Envision a Life Without Hesitation STAAR Surgical Investor Presentation NASDAQ: STAA | March 2023 Exhibit 99.1

All statements that are not statements of historical fact are forward-looking statements, including statements about any of the following: any financial projections (including sales), plans, strategies, and objectives of management for 2023 or prospects for achieving such plans, expectations for sales, revenue, margin, expenses or earnings, and any statements of assumptions underlying any of the foregoing, including those relating to financial performance in the first quarter and fiscal year 2023. Important factors that could cause actual results to differ materially from those indicated by such forward-looking statements include risks and uncertainties related to the COVID-19 pandemic and related public health measures, as well as the factors set forth in the Company’s Annual Report on Form 10-K for the year ended December 30, 2022 under the caption “Risk Factors,” which is on file with the Securities and Exchange Commission and available in the “Investor Information” section of the company’s website under the heading “SEC Filings.” We disclaim any intention or obligation to update or revise any financial projections or forward-looking statement due to new information or events. These statements are based on expectations and assumptions as of the date of this presentation and are subject to numerous risks and uncertainties, which could cause actual results to differ materially from those described in the forward-looking statements. The risks and uncertainties include the following: global economic conditions; the impact of the COVID-19 pandemic on markets; the discretion of regulatory agencies to approve or reject existing, new or improved products, or to require additional actions before approval, or to take enforcement action; international trade disputes; and the willingness of surgeons and patients to adopt a new or improved product and procedure. Forward Looking Statements 02

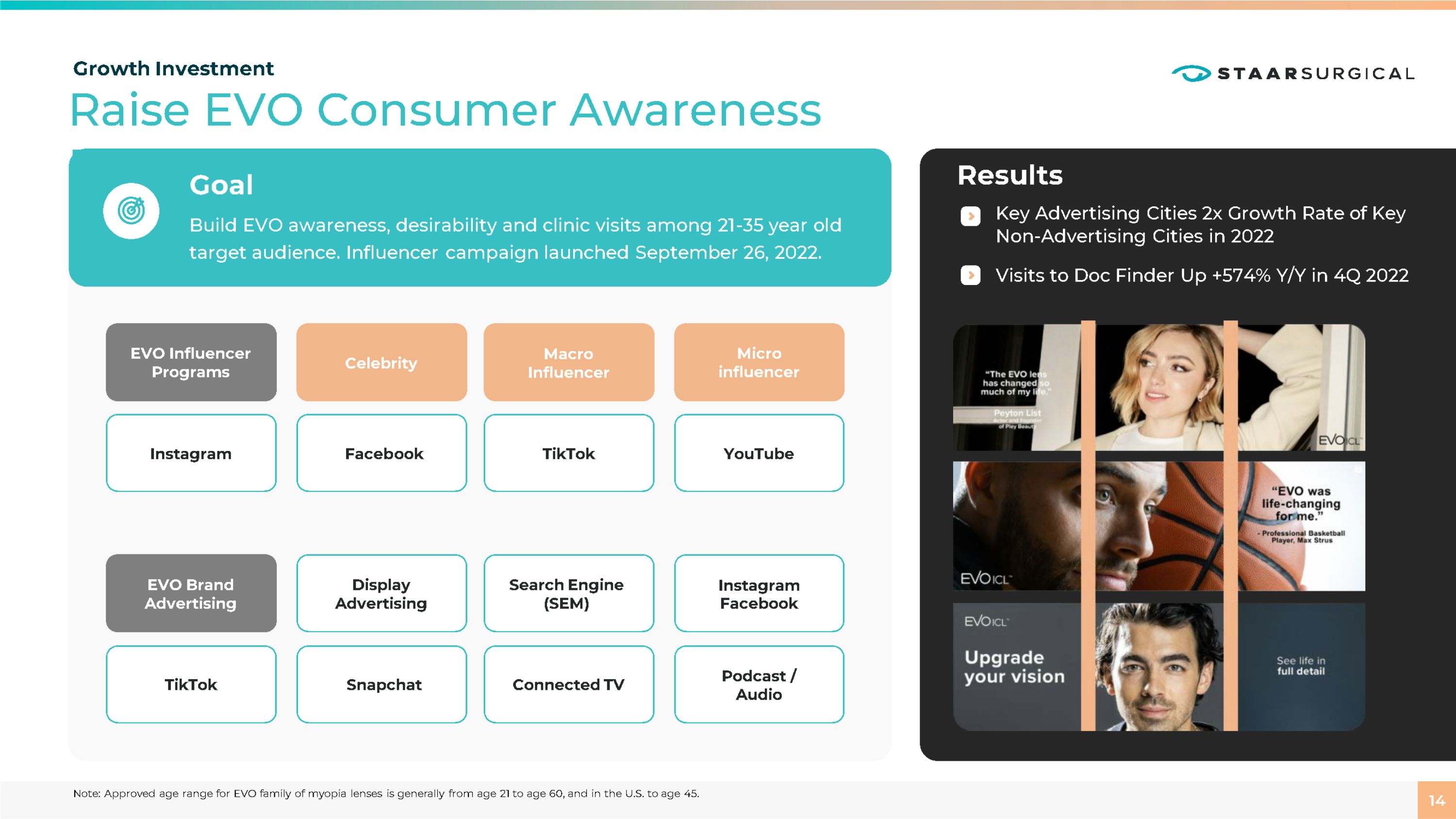

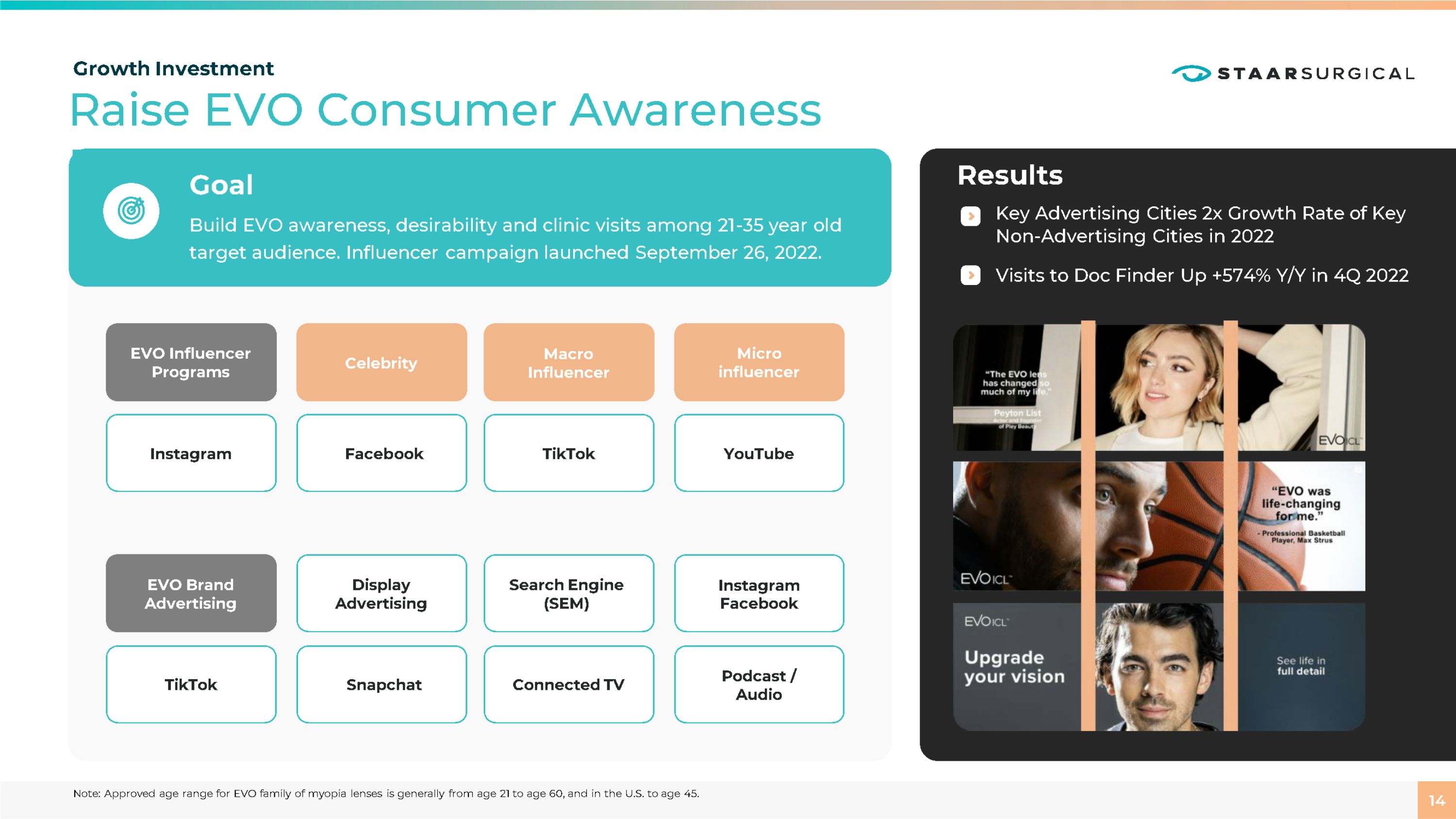

UPGRADE YOUR VISION 99% patient satisfaction* Become the standard of care for refractive vision correction, gaining broad-based surgeon acceptance of our family of EVO Implantable Collamer® Lenses (ICLs) as a primary procedure, and freeing patients from the hassles of glasses and contact lenses. Continue multi-year track record of industry leading growth, cash flow generation and GAAP profitability Financial Excellence Goal How? 01 02 03 Increase surgeon knowledge of EVO clinical outcomes and commercial benefits Raise consumer awareness of EVO Continue to tailor strategic agreements that address individual practice dynamics 03 * 99.4% of patients surveyed would elect EVO ICL again. Packer, The Implantable Collamer Lens with a central port: review of the literature, Clinical Ophthalmology, 2018.

04 Why Invest in STAAR Surgical? Multi-Year track record of 25%+ Y/Y sales growth Multi-Year track record of GAAP profitability Large and growing addressable market Wide competitive moat and negligible lens-based competition Gaining share and adding procedures to markets where we invest With 2022 EVO approval in U.S. (#2 market globally), increasing domestic growth investments Strong balance sheet Outlook for another strong year of growth in 2023, up +26% Y/Y Long history of EVO clinical safety and efficacy

05 Sustainability Elevated ESG stewardship to a strategic imperative Cross-functional team advancing our ESG goals Several projects completed or underway designed to reduce energy, waste and water Initial analysis of solar photovoltaic panel initiative indicates STAAR will reduce energy demand from the grid at our primary U.S. production facilities by nearly 40% Expanding philanthropy and volunteerism, e.g., Beyond Blindness and Salus University Project MyVision

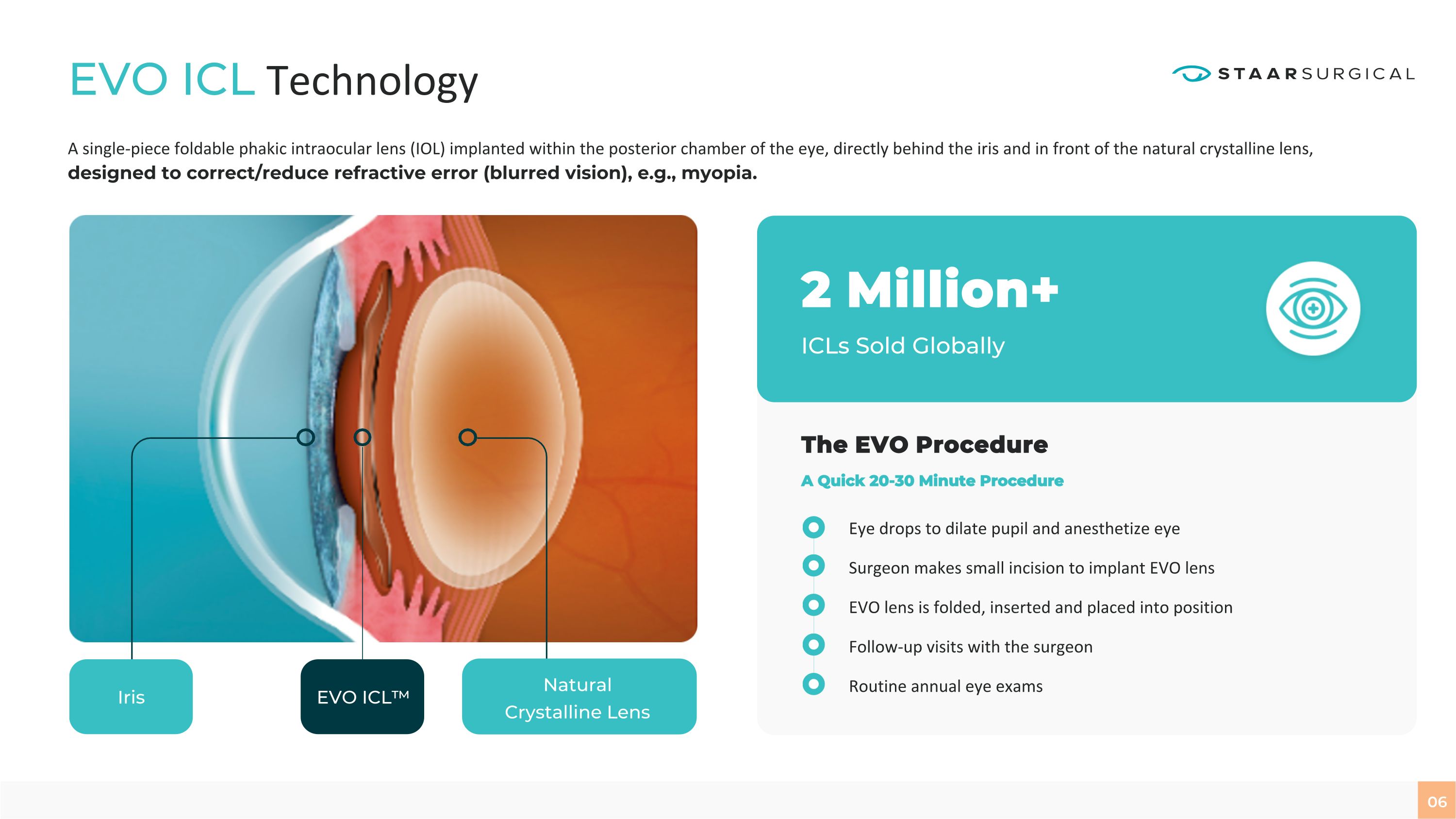

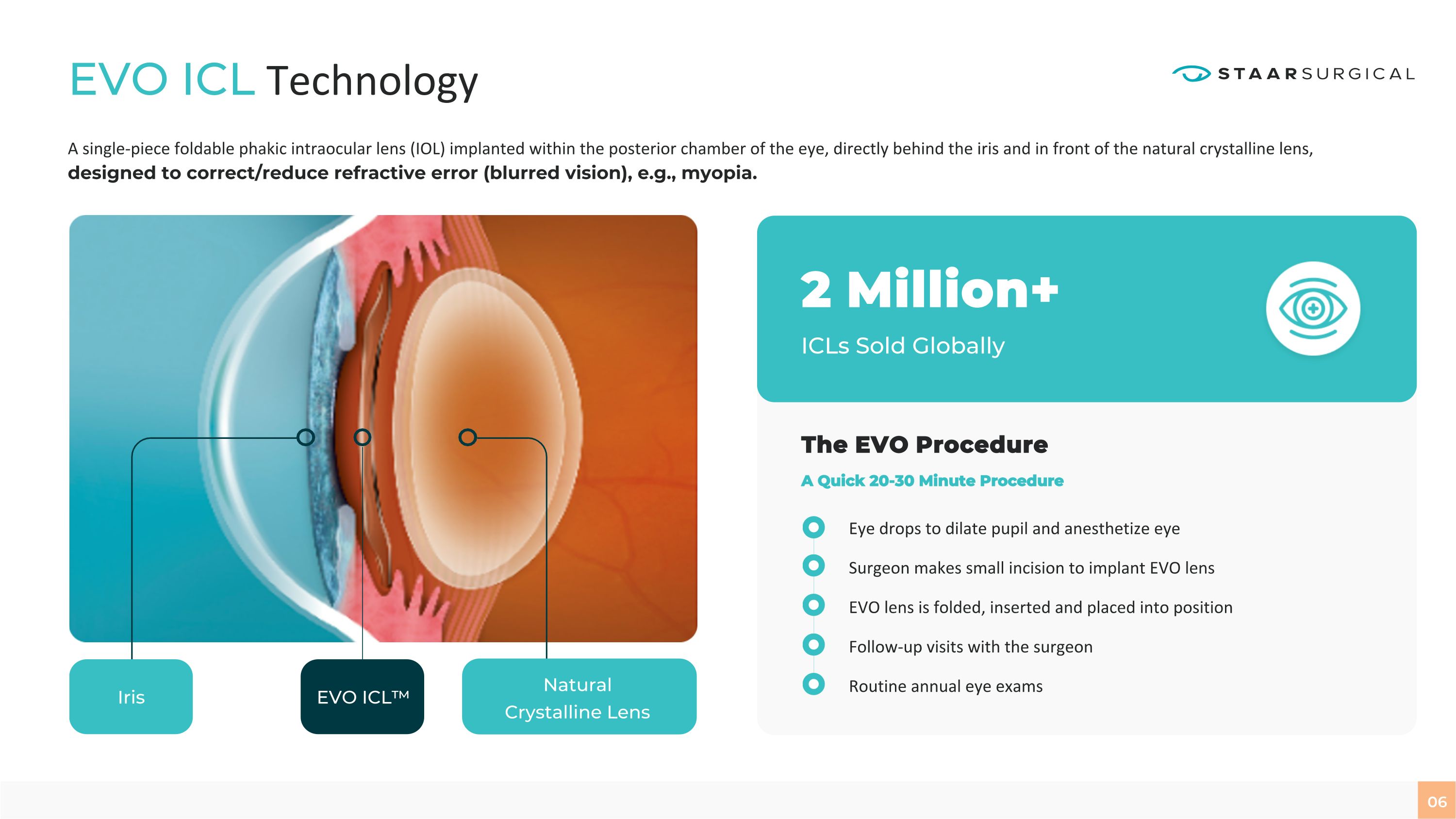

06 EVO ICL Technology Natural

Crystalline Lens EVO ICL™ Iris A single-piece foldable phakic intraocular lens (IOL) implanted within the posterior chamber of the eye, directly behind the iris and in front of the natural crystalline lens, designed to correct/reduce refractive error (blurred vision), e.g., myopia. Eye drops to dilate pupil and anesthetize eye Surgeon makes small incision to implant EVO lens EVO lens is folded, inserted and placed into position Follow-up visits with the surgeon Routine annual eye exams ICLs Sold Globally 2 Million+ The EVO Procedure A Quick 20-30 Minute Procedure

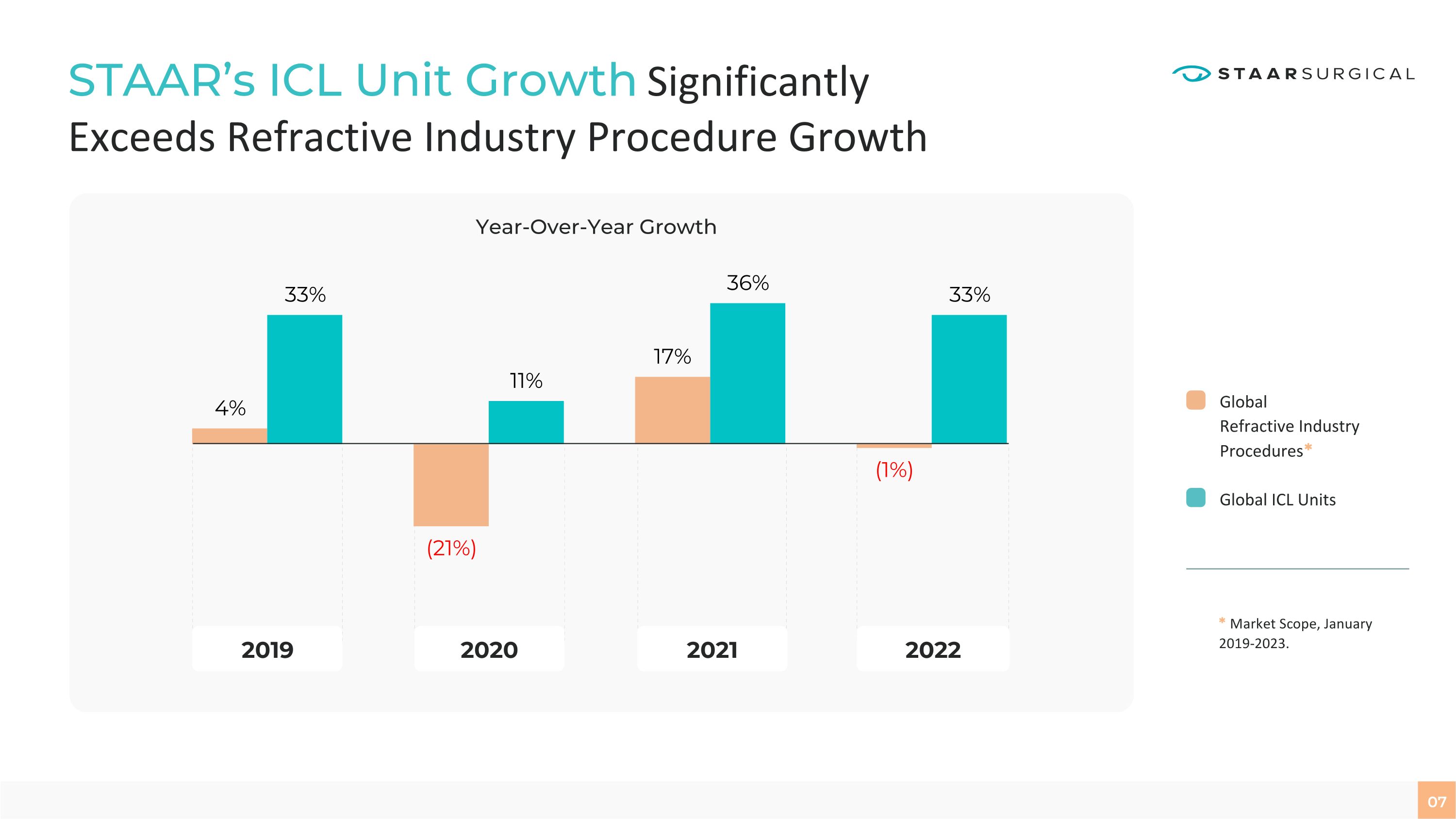

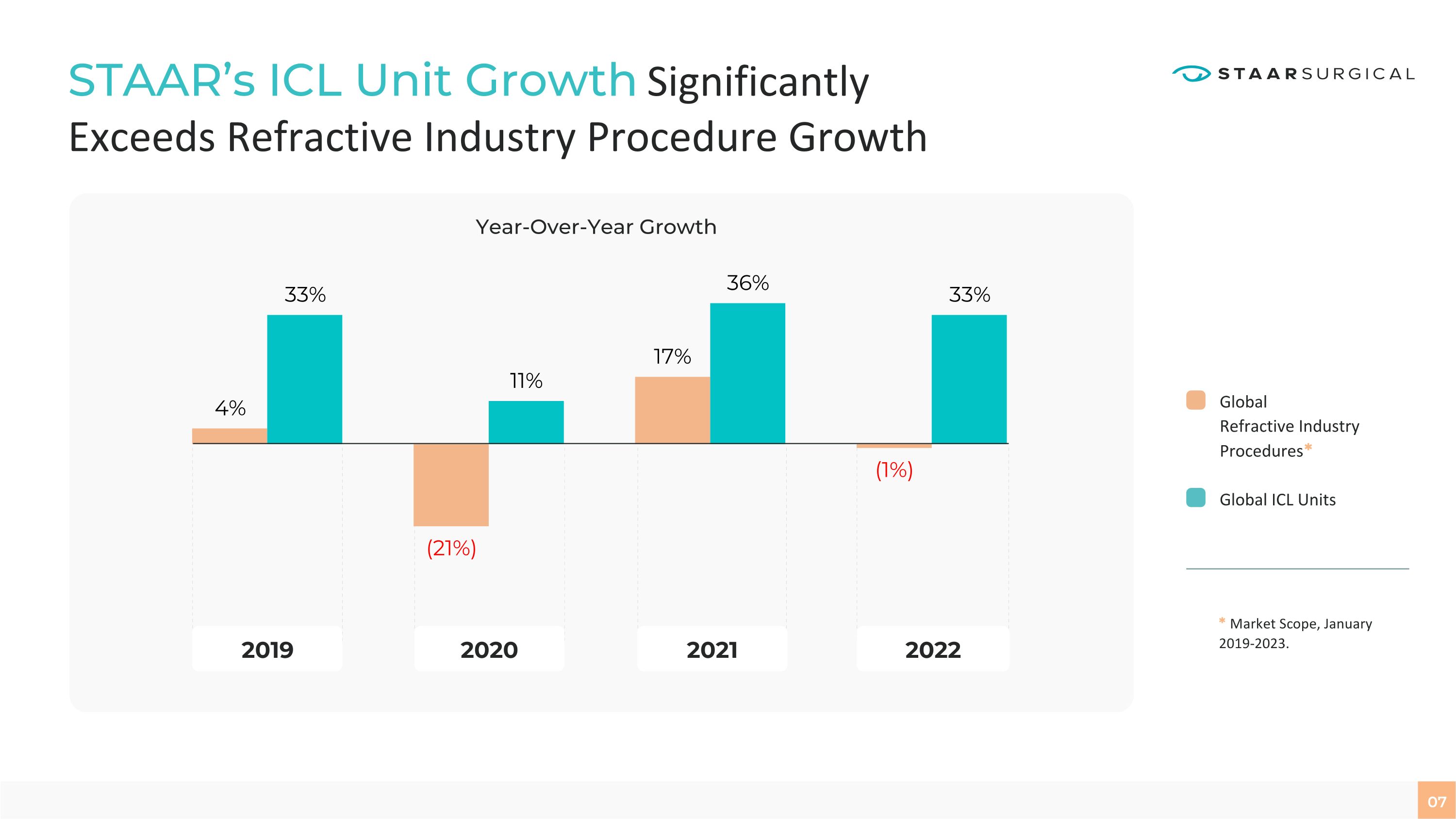

07 2019 2020 2021 2022 Global Refractive Industry Procedures* Global ICL Units * Market Scope, January 2019-2023. STAAR’s ICL Unit Growth Significantly

Exceeds Refractive Industry Procedure Growth Year-Over-Year Growth

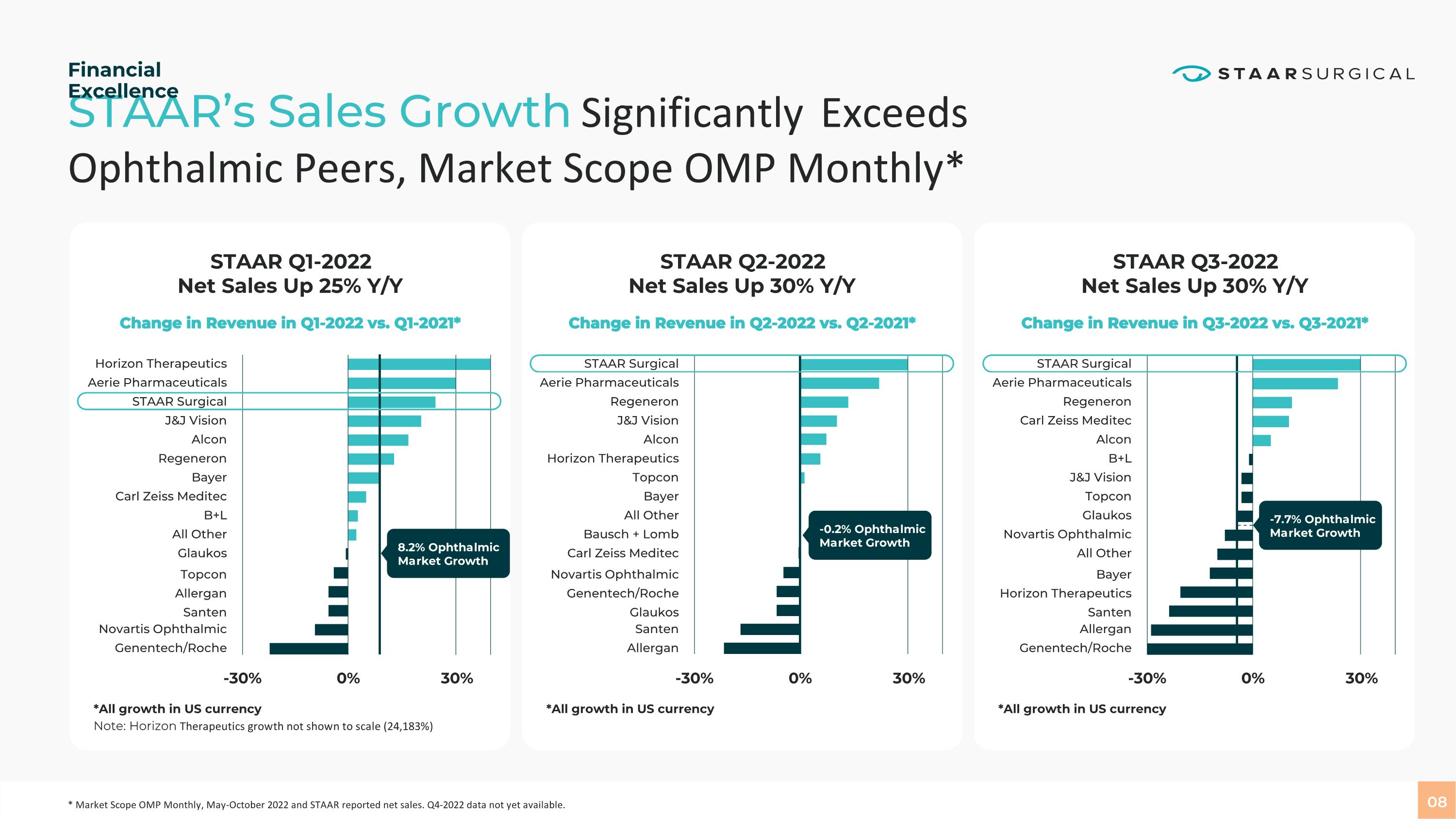

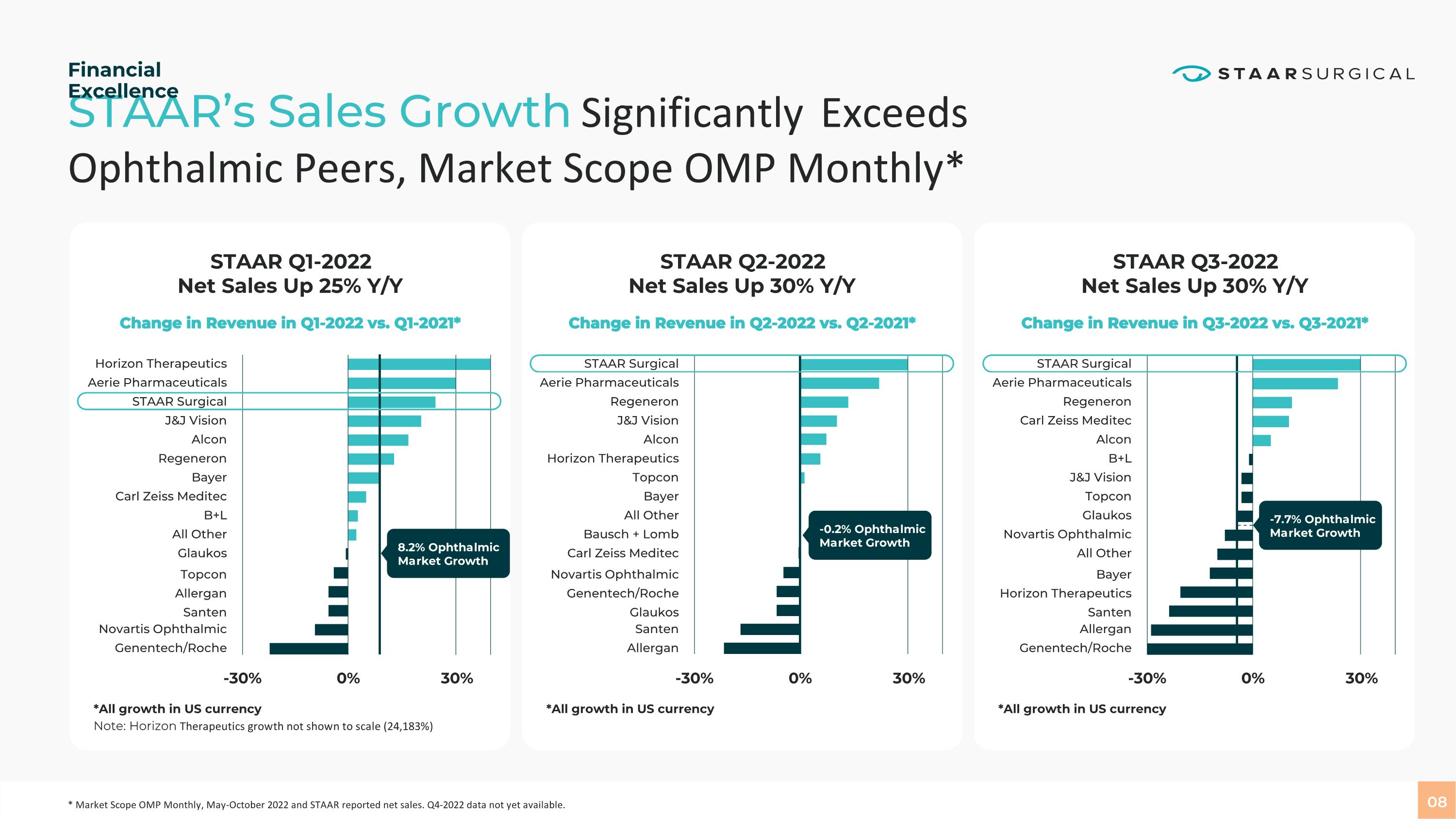

08 STAAR’s Sales Growth Significantly Exceeds Ophthalmic Peers, Market Scope OMP Monthly* Financial Excellence STAAR Q1-2022 Net Sales Up 25% Y/Y STAAR Q2-2022 Net Sales Up 30% Y/Y STAAR Q3-2022 Net Sales Up 30% Y/Y Change in Revenue in Q1-2022 vs. Q1-2021* Horizon Therapeutics Aerie Pharmaceuticals STAAR Surgical J&J Vision Alcon Regeneron Bayer Carl Zeiss Meditec B+L All Other Glaukos Topcon Allergan Santen Novartis Ophthalmic Genentech/Roche STAAR Surgical Aerie Pharmaceuticals Regeneron J&J Vision Alcon Horizon Therapeutics Topcon Bayer All Other Bausch + Lomb Carl Zeiss Meditec Novartis Ophthalmic Genentech/Roche Glaukos Santen Allergan STAAR Surgical Aerie Pharmaceuticals Regeneron Carl Zeiss Meditec Alcon B+L J&J Vision Topcon Glaukos Novartis Ophthalmic All Other Bayer Horizon Therapeutics Santen Allergan Genentech/Roche Change in Revenue in Q2-2022 vs. Q2-2021* Change in Revenue in Q3-2022 vs. Q3-2021* -30% 0% 30% -30% 0% 30% -30% 0% 30% *All growth in US currency Note: Horizon Therapeutics growth not shown to scale (24,183%) *All growth in US currency *All growth in US currency 8.2% Ophthalmic Market Growth -0.2% Ophthalmic Market Growth -7.7% Ophthalmic�Market Growth * Market Scope OMP Monthly, May-October 2022 and STAAR reported net sales. Q4-2022 data not yet available.

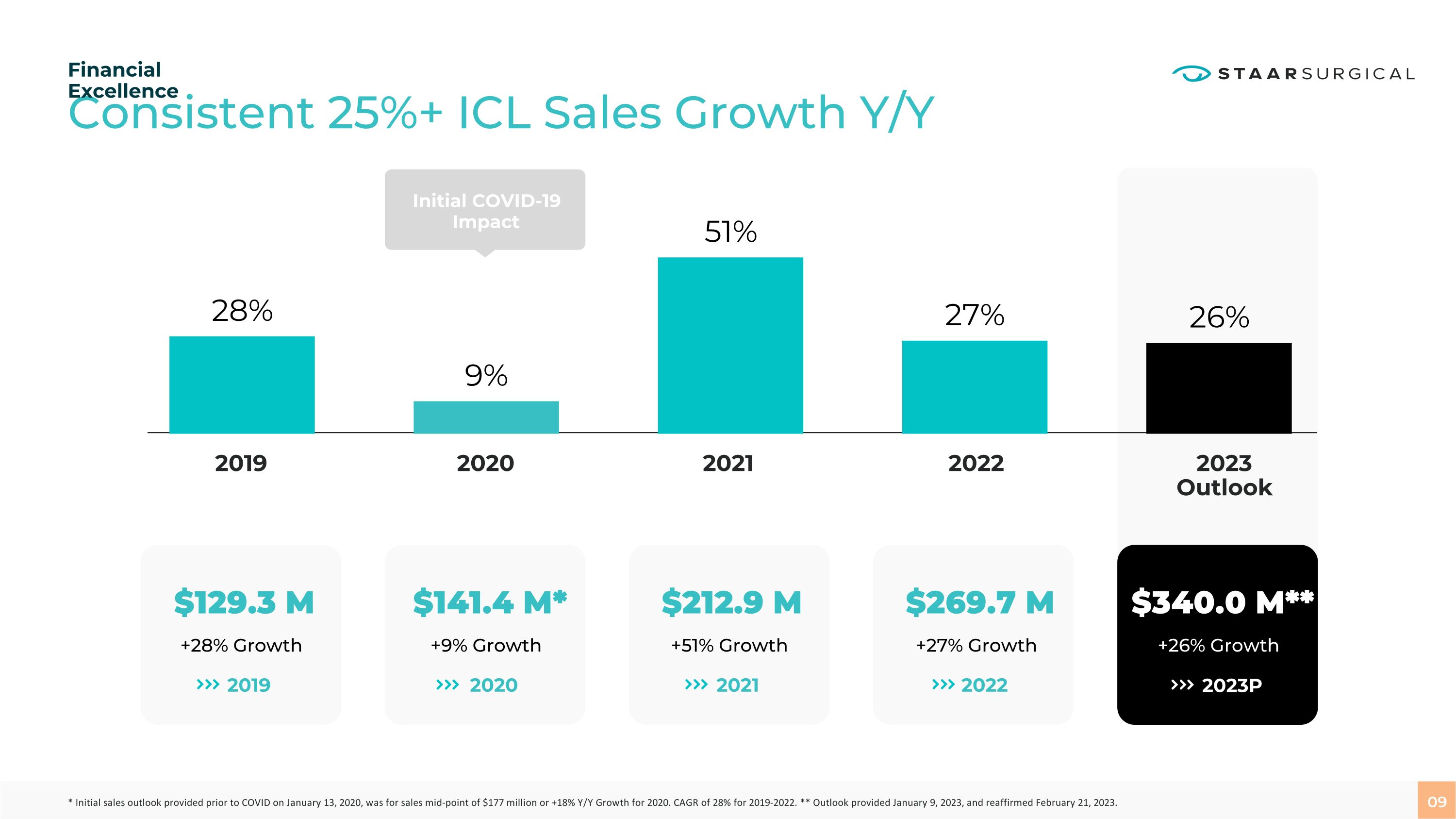

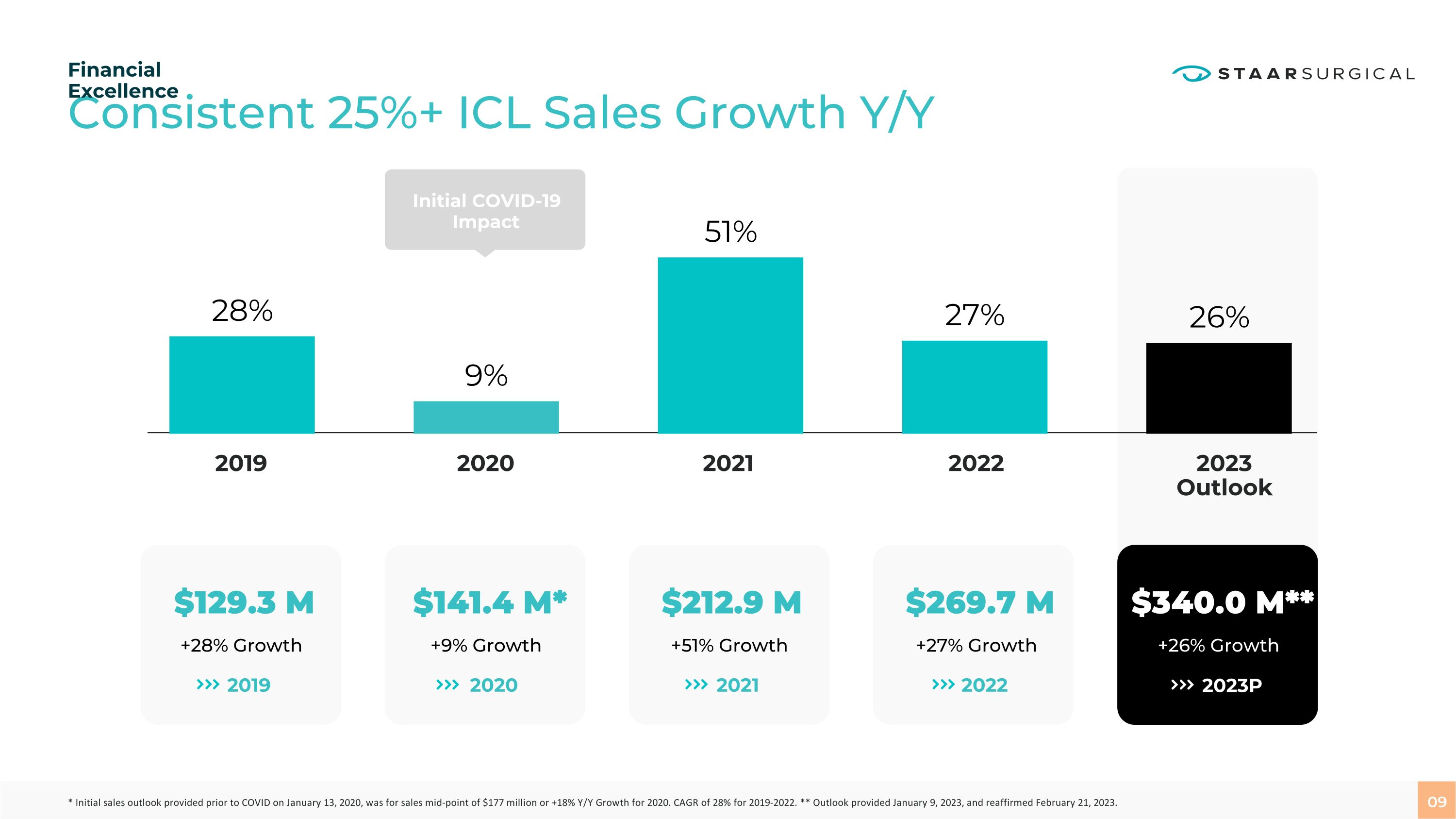

2019 2020 2021 2022 2023

Outlook +28% Growth $129.3 M 2019 +51% Growth $212.9 M 2021 +27% Growth $269.7 M 2022 +9% Growth $141.4 M* 2020 +26% Growth $340.0 M** 2023P Initial COVID-19 Impact 09 Consistent 25%+ ICL Sales Growth Y/Y Financial Excellence * Initial sales outlook provided prior to COVID on January 13, 2020, was for sales mid-point of $177 million or +18% Y/Y Growth for 2020. CAGR of 28% for 2019-2022. ** Outlook provided January 9, 2023, and reaffirmed February 21, 2023.

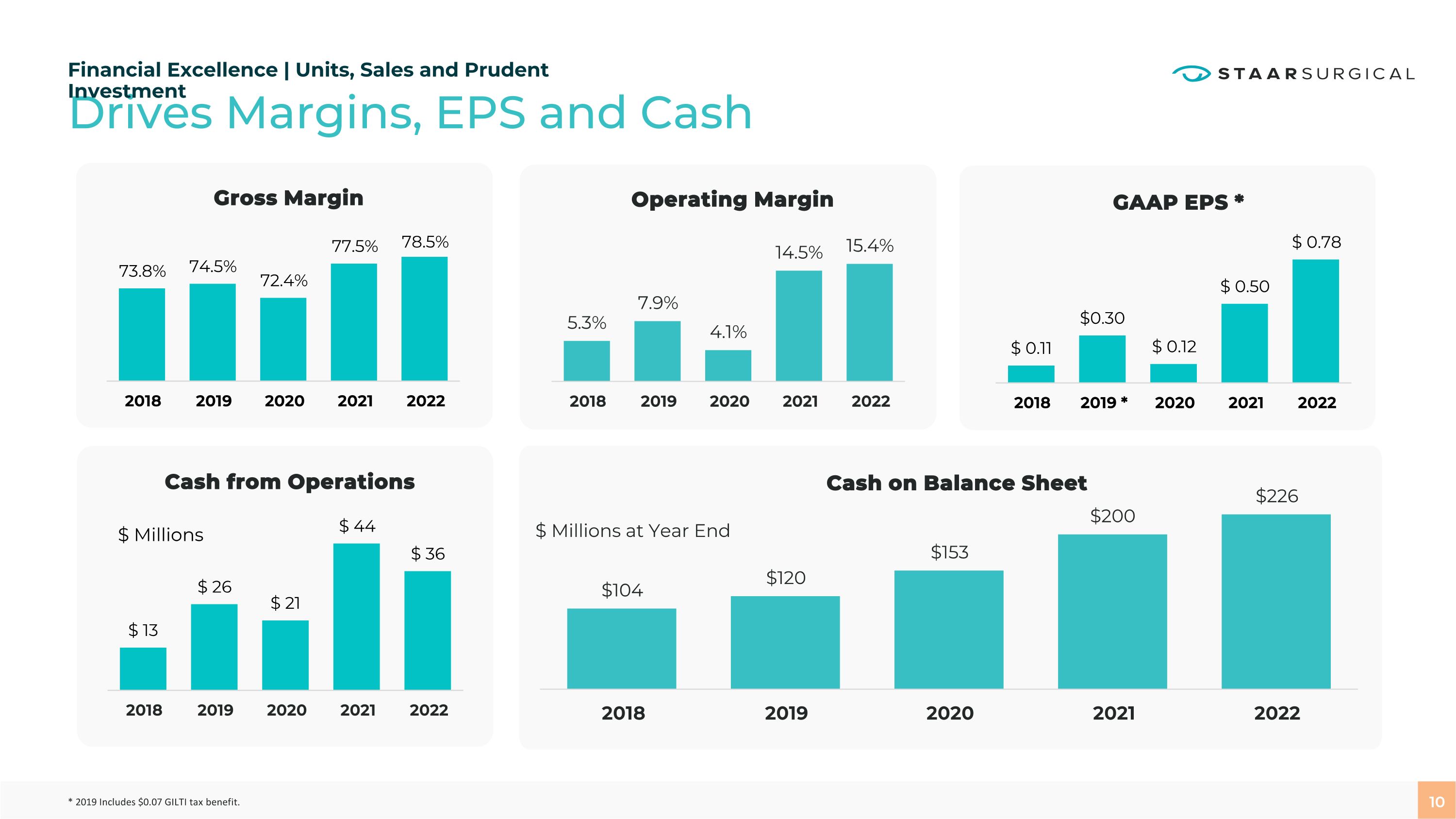

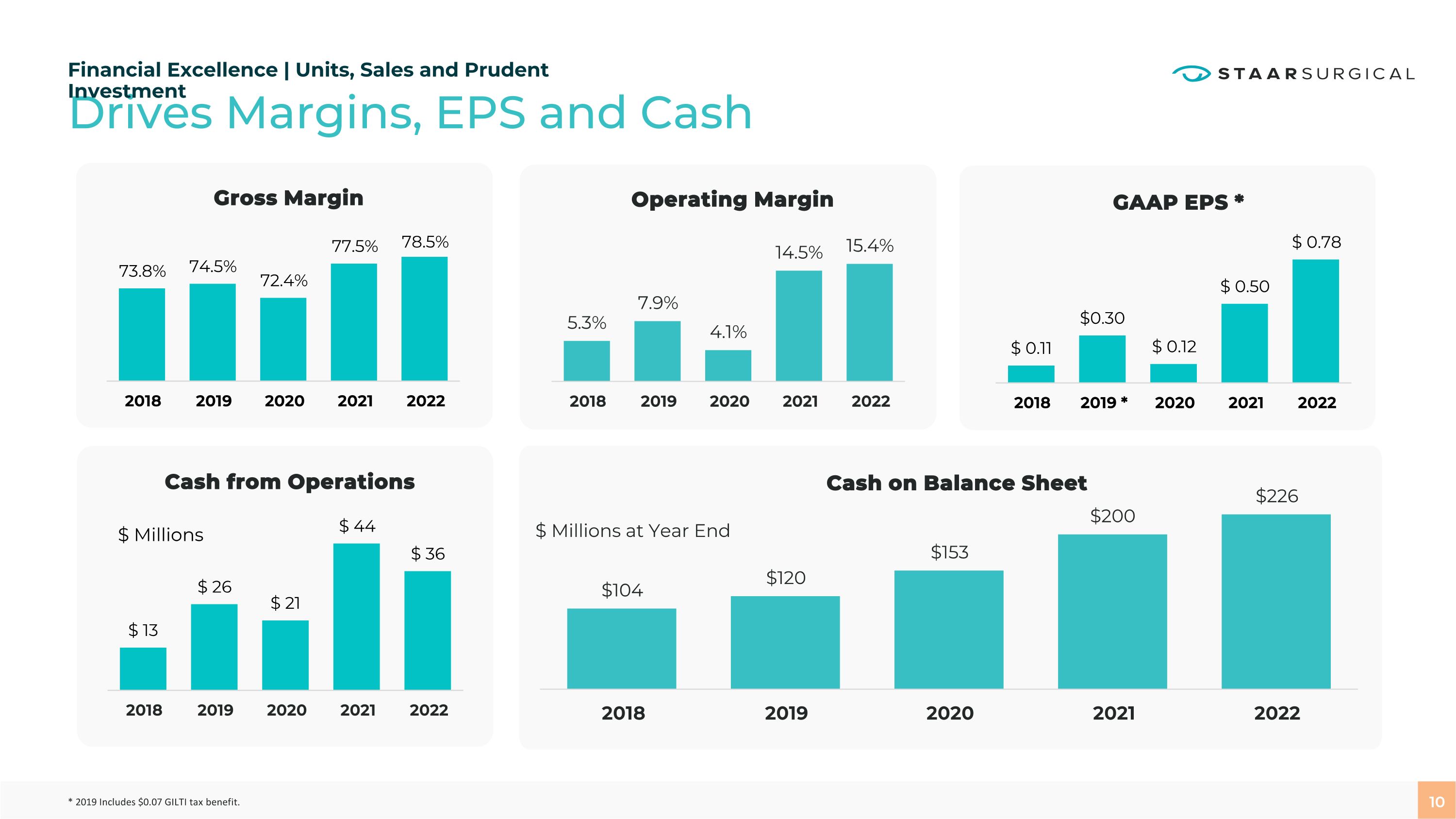

10 Drives Margins, EPS and Cash Financial Excellence | Units, Sales and Prudent Investment * 2019 Includes $0.07 GILTI tax benefit. Cash on Balance Sheet $ Millions Gross Margin GAAP EPS * Cash from Operations $ Millions at Year End Operating Margin

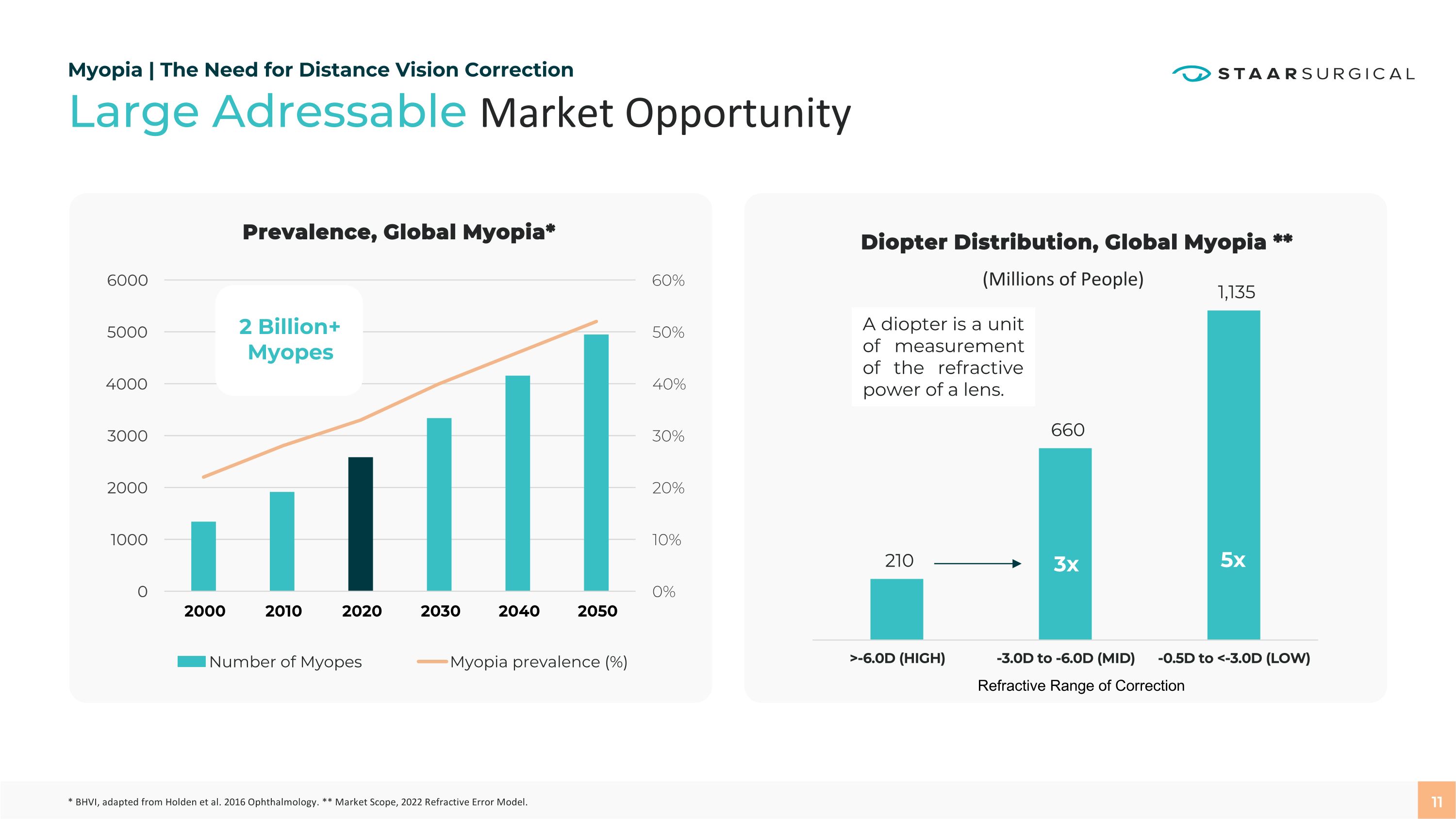

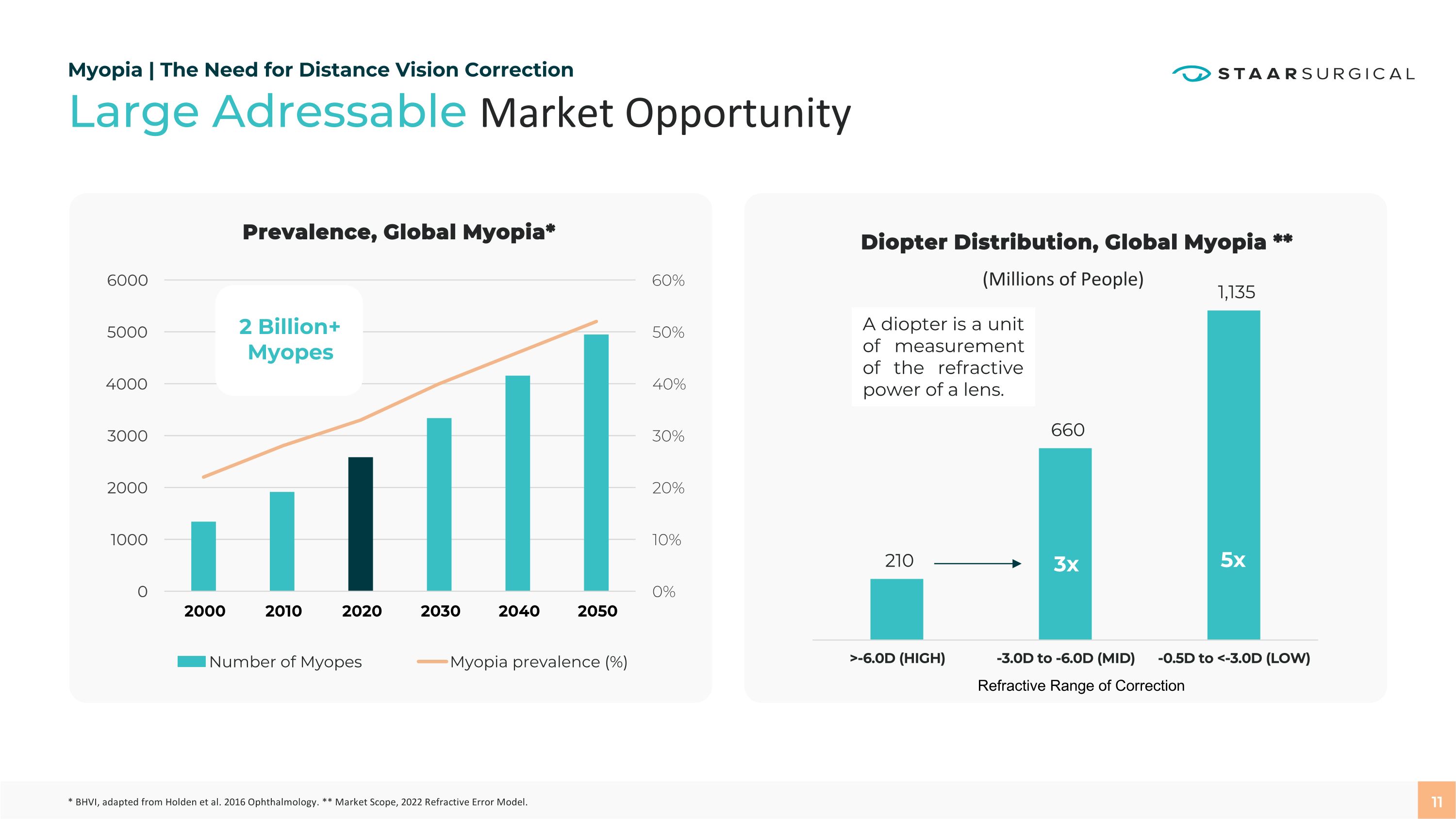

Large Adressable Market Opportunity Myopia | The Need for Distance Vision Correction 11 * BHVI, adapted from Holden et al. 2016 Ophthalmology. ** Market Scope, 2022 Refractive Error Model. Prevalence, Global Myopia* Diopter Distribution, Global Myopia ** (Millions of People) 2 Billion+ Myopes 3x 5x A diopter is a unit of measurement of the refractive power of a lens. Refractive Range of Correction

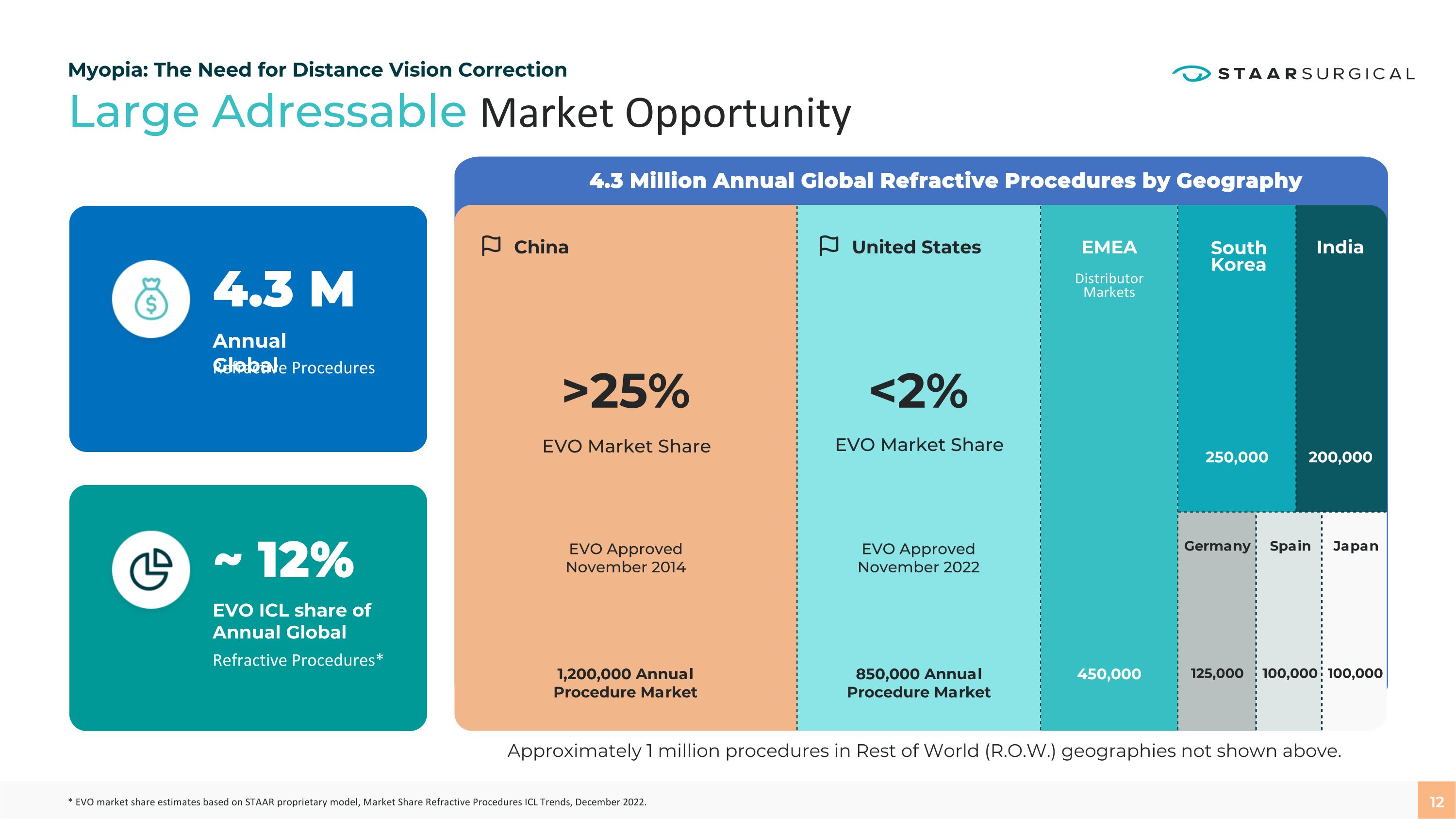

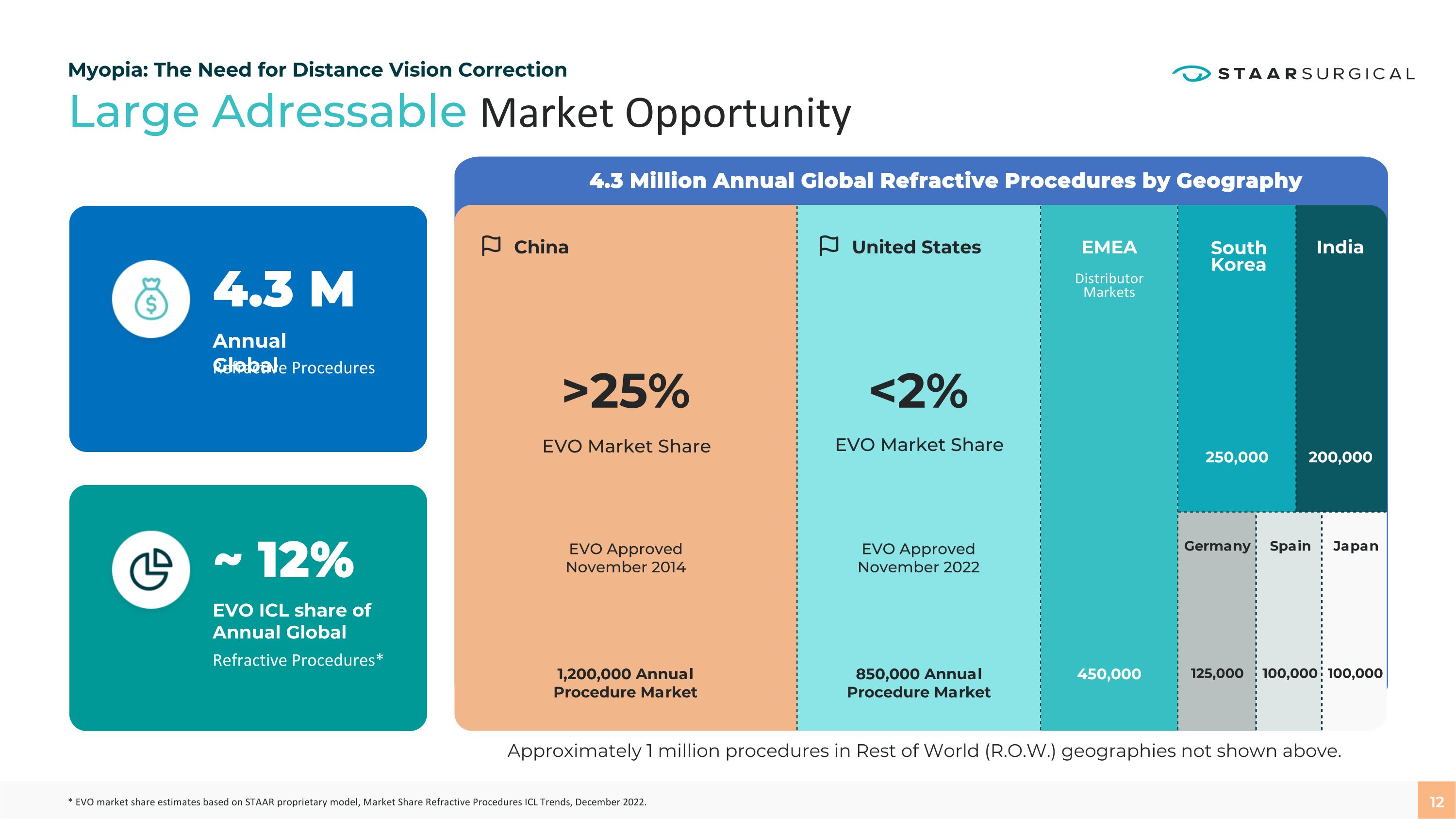

12 4.3 M ~ 12% Annual Global EVO ICL share of Annual Global Refractive Procedures EVO Market Share EVO Market Share EVO Approved

November 2022 1,200,000 Annual Procedure Market 850,000 Annual Procedure Market 450,000 125,000 100,000 100,000 250,000 200,000 Refractive Procedures* 4.3 Million Annual Global Refractive Procedures by Geography China >25% <2% United States EMEA South Korea India Germany Spain Japan Distributor Markets Approximately 1 million procedures in Rest of World (R.O.W.) geographies not shown above. EVO Approved

November 2014 Large Adressable Market Opportunity Myopia: The Need for Distance Vision Correction * EVO market share estimates based on STAAR proprietary model, Market Share Refractive Procedures ICL Trends, December 2022.

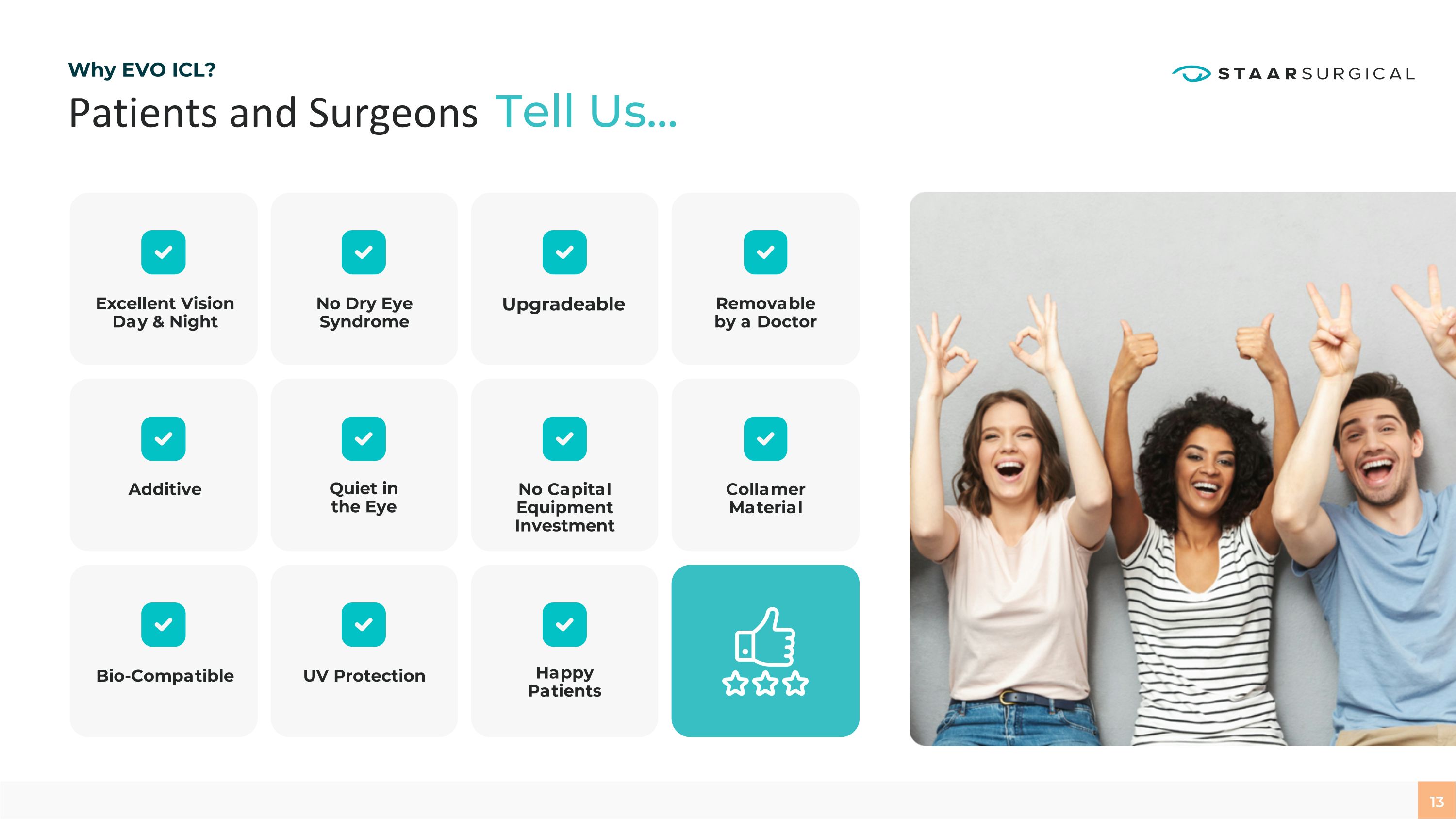

13 Patients and Surgeons Tell Us… Why EVO ICL? Excellent Vision Day & Night Additive Bio-Compatible No Capital Equipment Investment Upgradeable Happy

Patients Quiet in

the Eye Collamer Material No Dry Eye Syndrome UV Protection Removable

by a Doctor

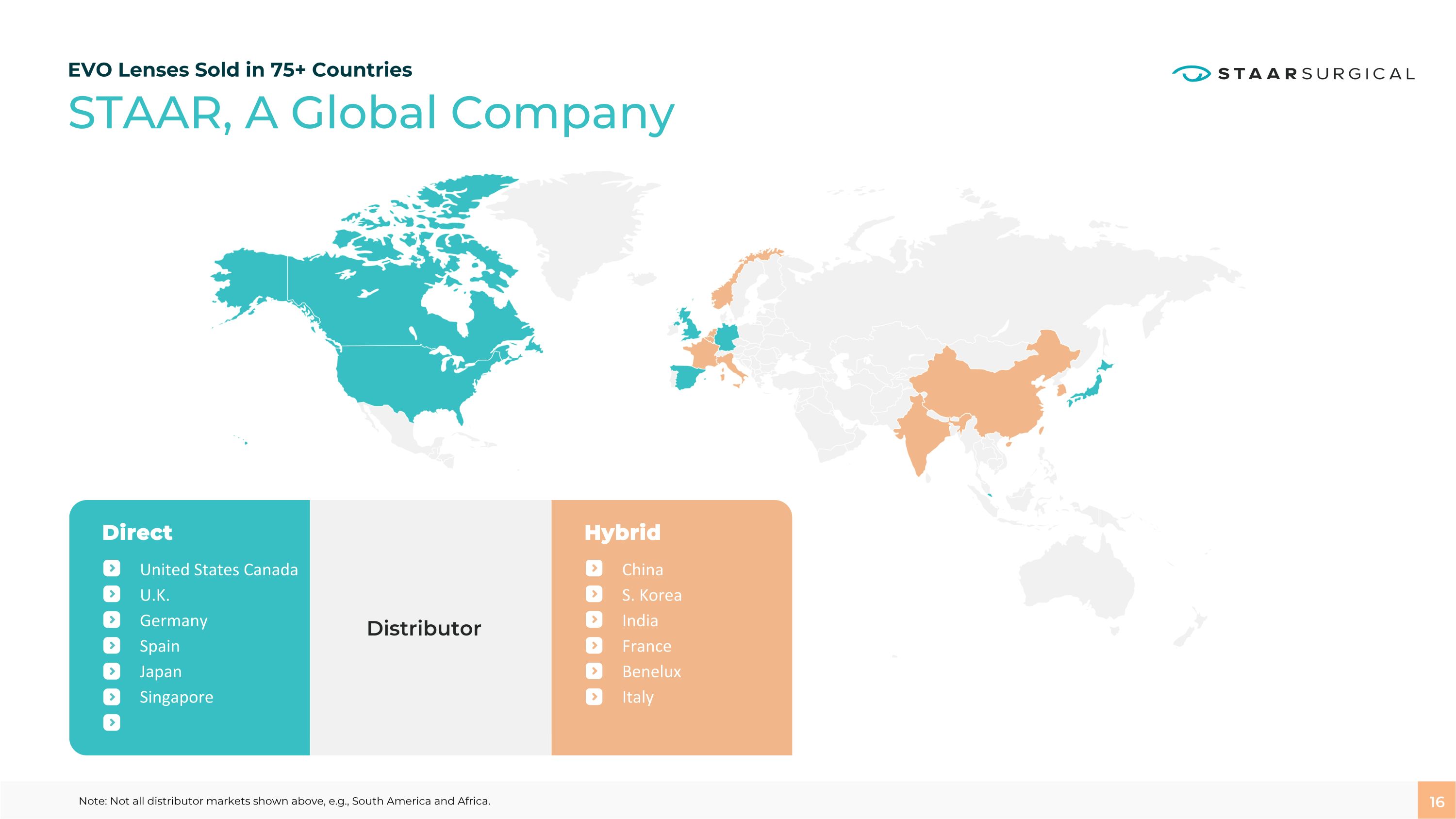

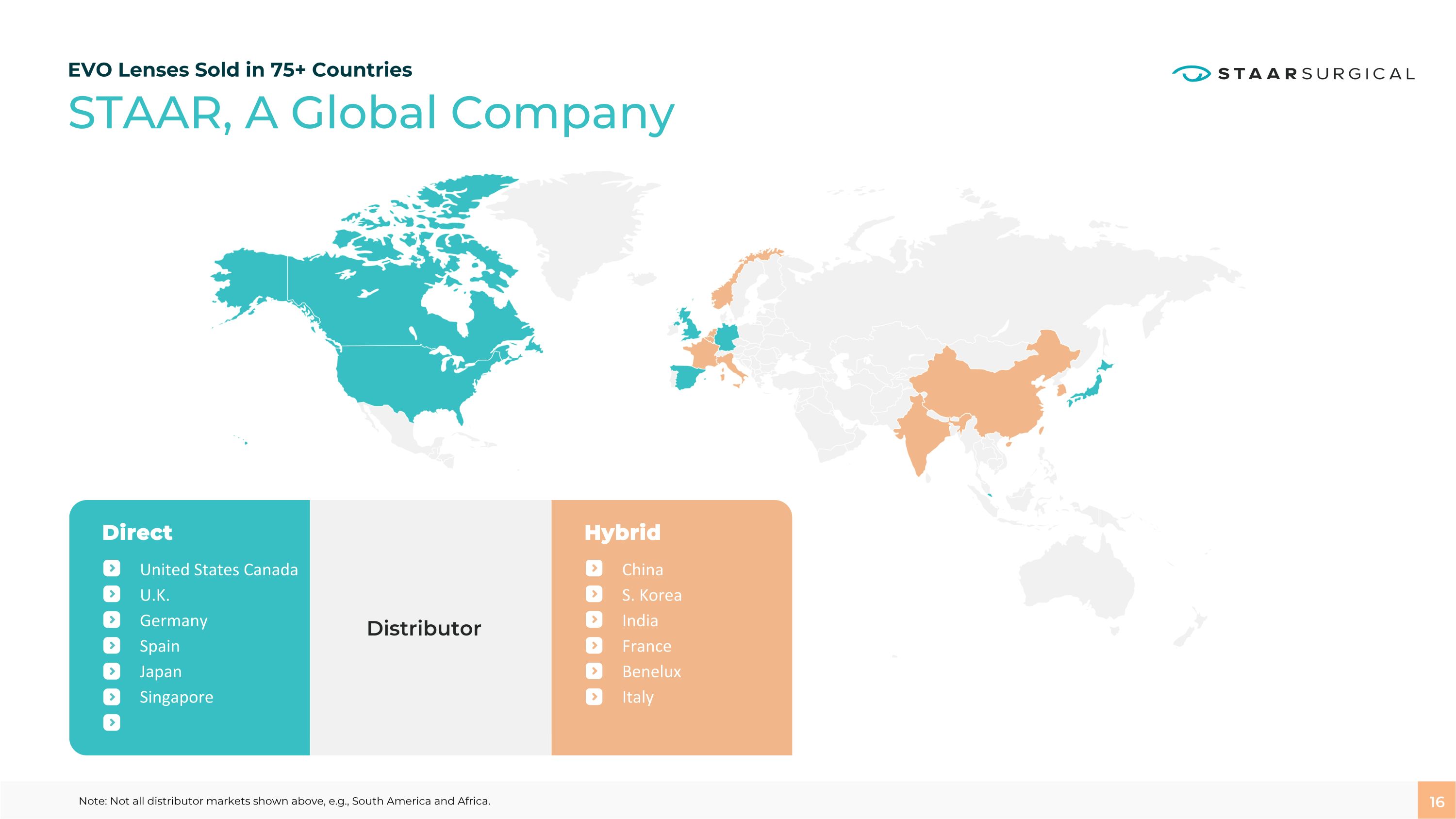

16 Direct Hybrid Distributor United States Canada

U.K.

Germany

Spain

Japan

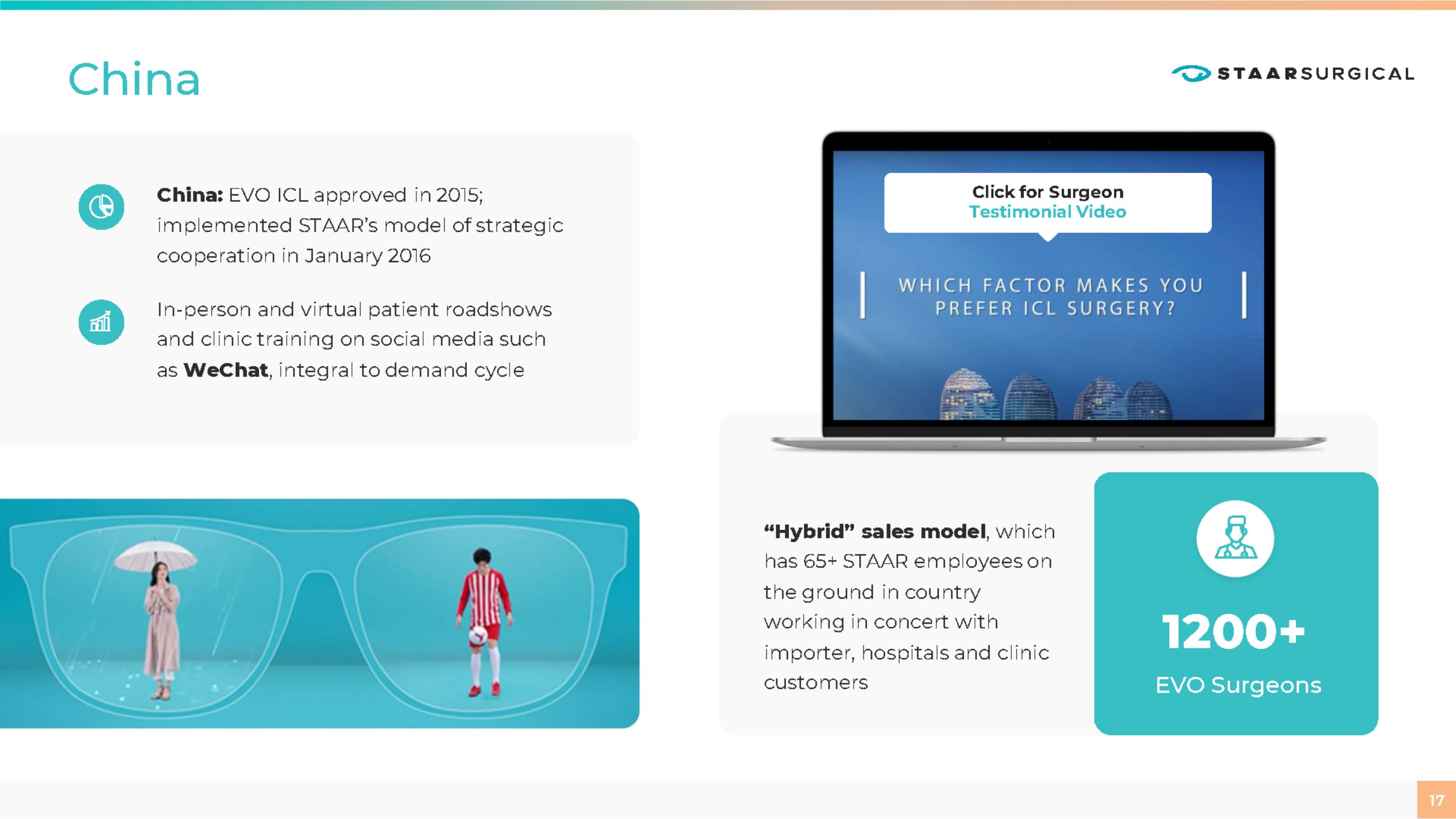

Singapore China

S. Korea

India

France

Benelux

Italy STAAR, A Global Company EVO Lenses Sold in 75+ Countries Note: Not all distributor markets shown above, e.g., South America and Africa.

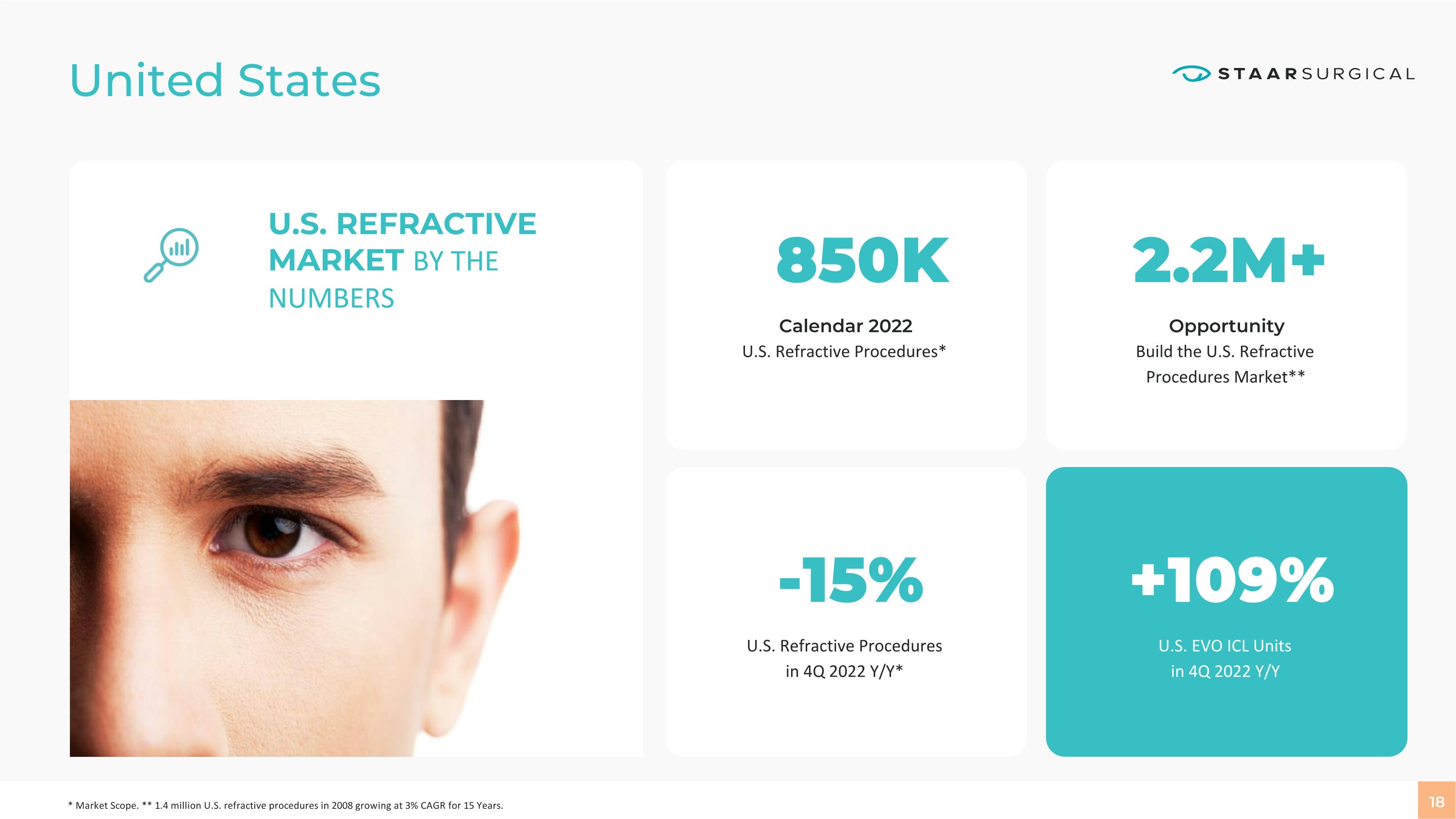

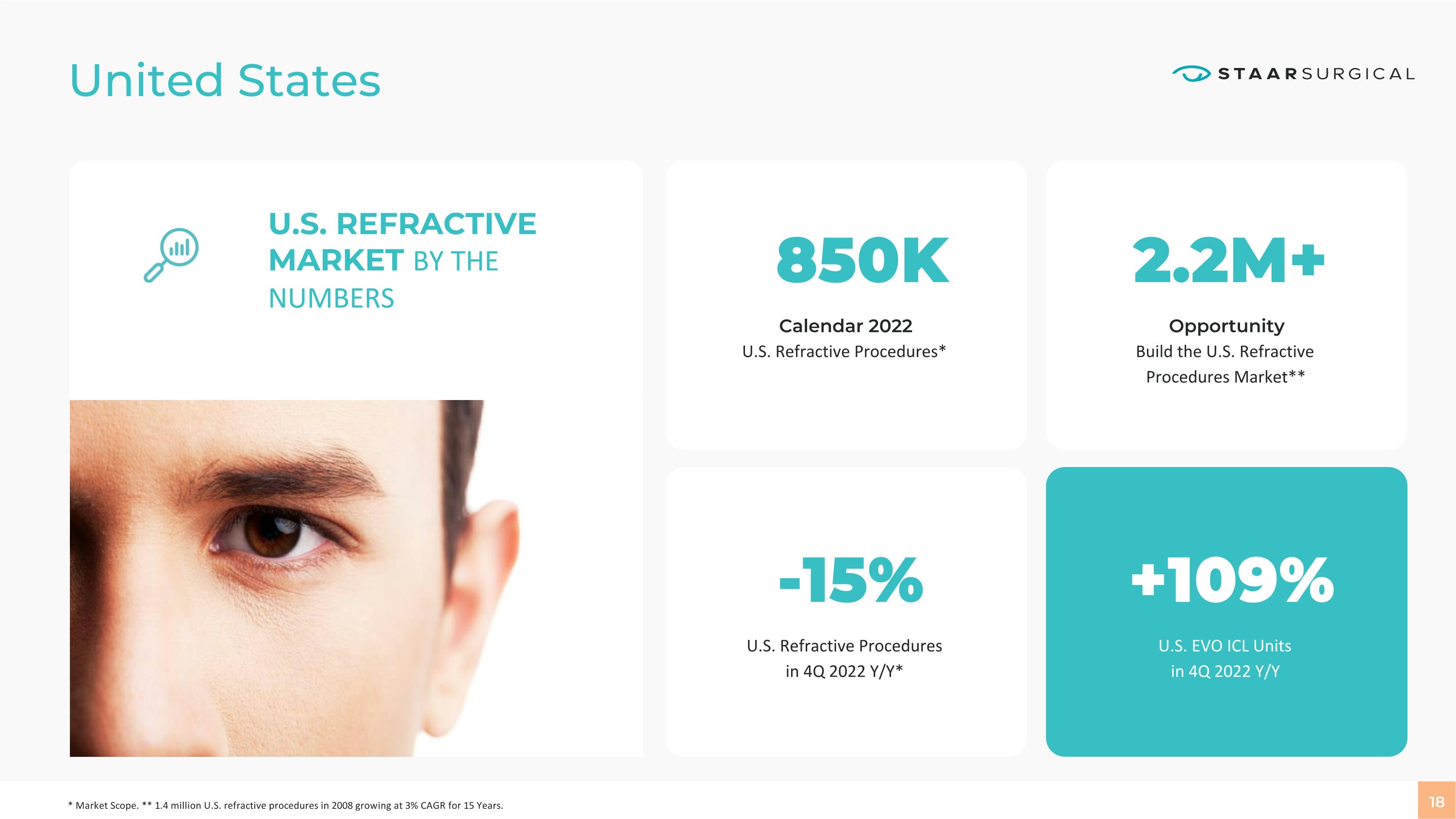

18 United States U.S. Refractive Procedures

in 4Q 2022 Y/Y* U.S. EVO ICL Units

in 4Q 2022 Y/Y -15% +109% Calendar 2022 U.S. Refractive Procedures* Opportunity Build the U.S. Refractive Procedures Market** 850K 2.2M+ * Market Scope. ** 1.4 million U.S. refractive procedures in 2008 growing at 3% CAGR for 15 Years. U.S. REFRACTIVE MARKET BY THE NUMBERS

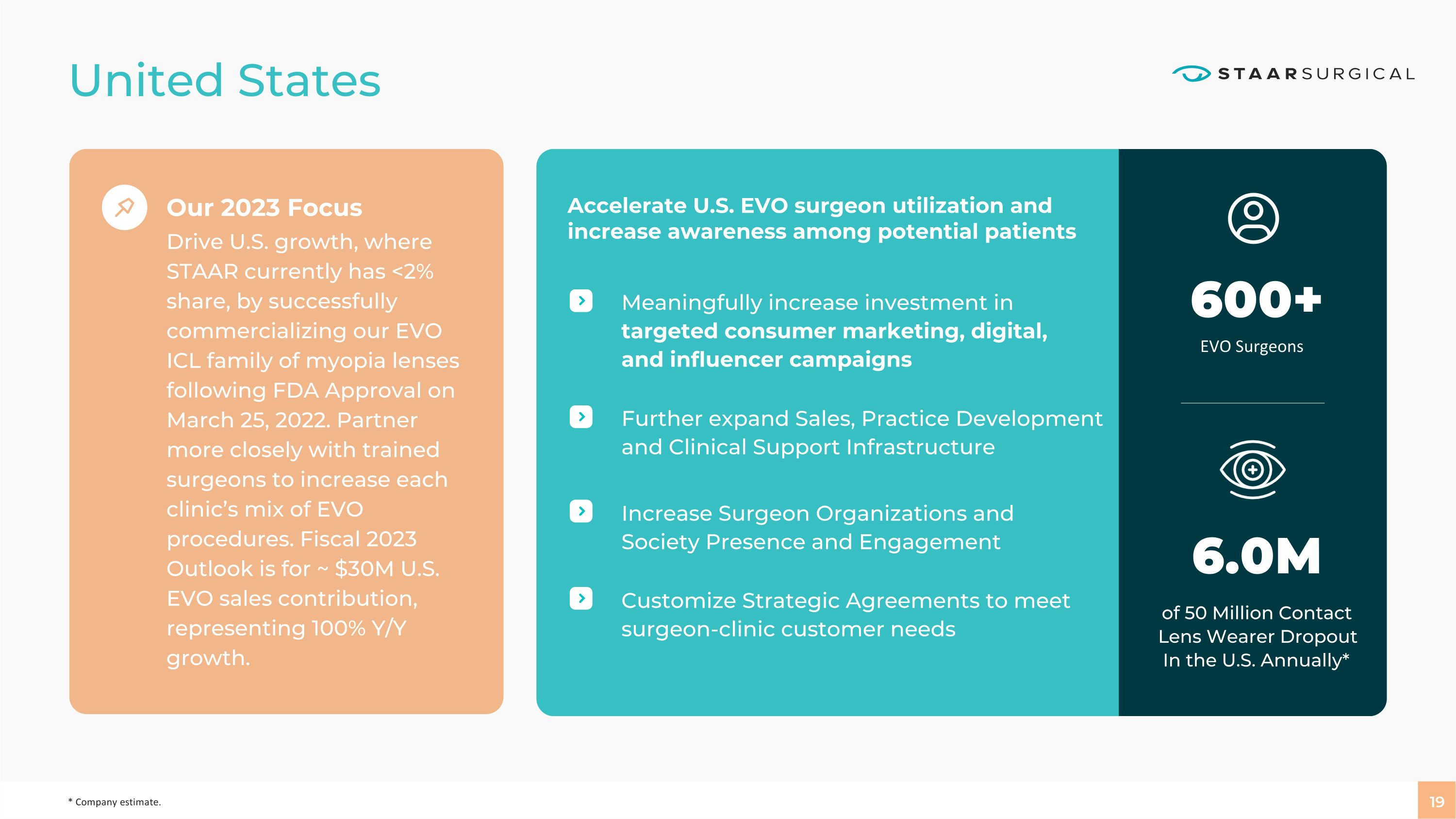

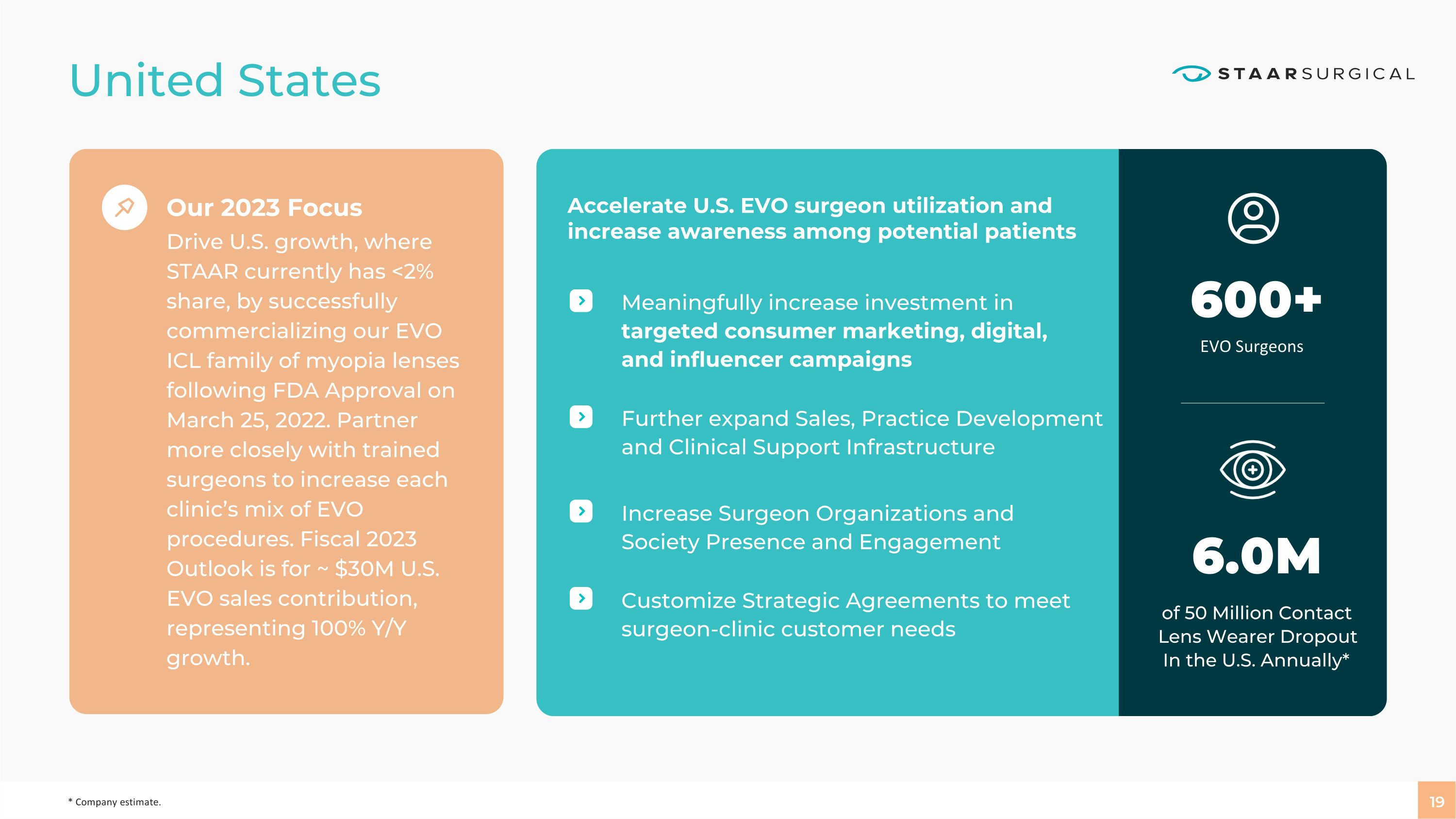

19 United States Drive U.S. growth, where STAAR currently has <2% share, by successfully commercializing our EVO ICL family of myopia lenses following FDA Approval on March 25, 2022. Partner more closely with trained surgeons to increase each clinic’s mix of EVO procedures. Fiscal 2023 Outlook is for ~ $30M U.S. EVO sales contribution, representing 100% Y/Y growth. Meaningfully increase investment in targeted consumer marketing, digital, and influencer campaigns Further expand Sales, Practice Development and Clinical Support Infrastructure Increase Surgeon Organizations and Society Presence and Engagement Customize Strategic Agreements to meet surgeon-clinic customer needs Our 2023 Focus Accelerate U.S. EVO surgeon utilization and increase awareness among potential patients EVO Surgeons of 50 Million Contact Lens Wearer Dropout

In the U.S. Annually* 600+ 6.0M * Company estimate.

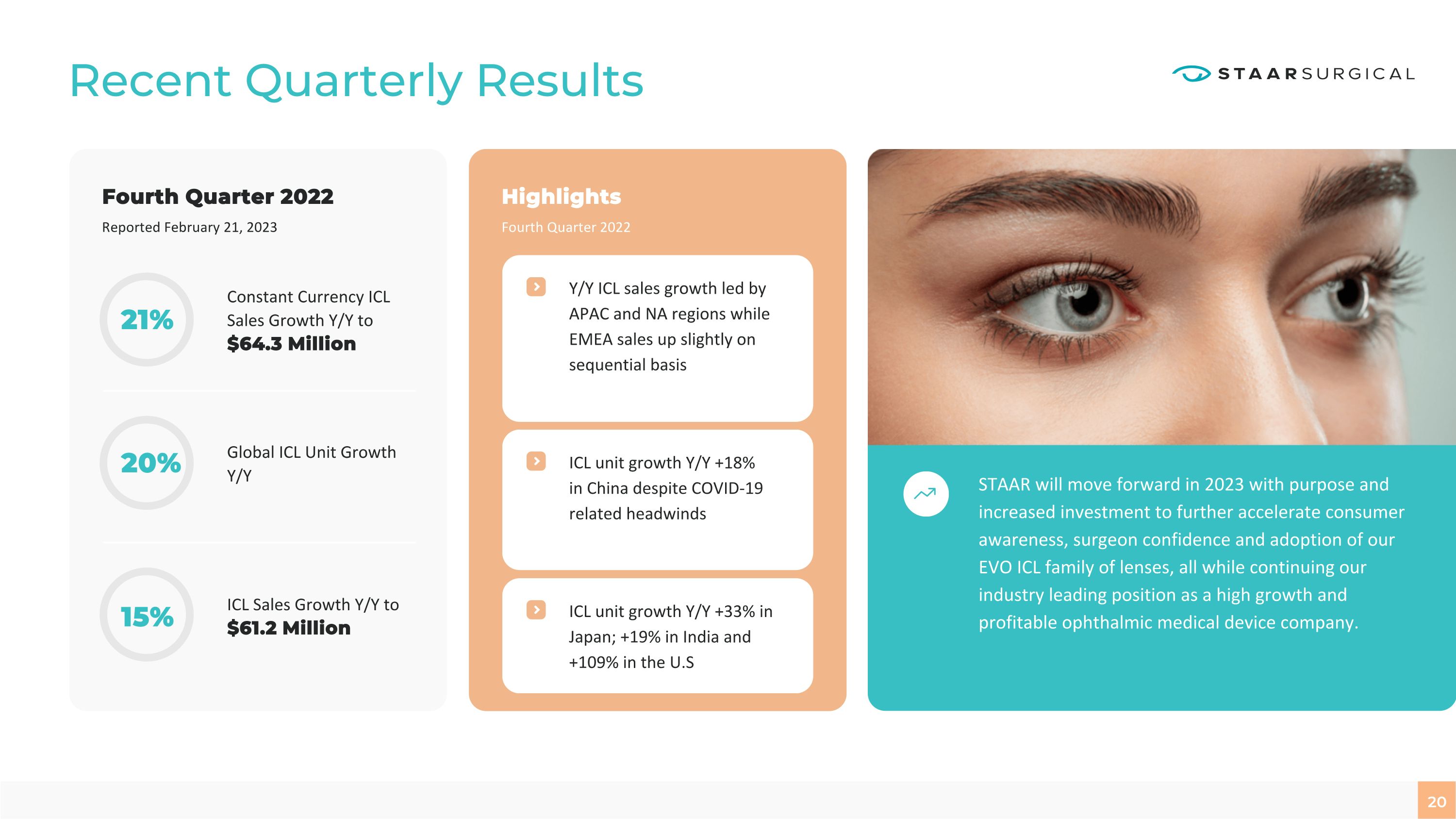

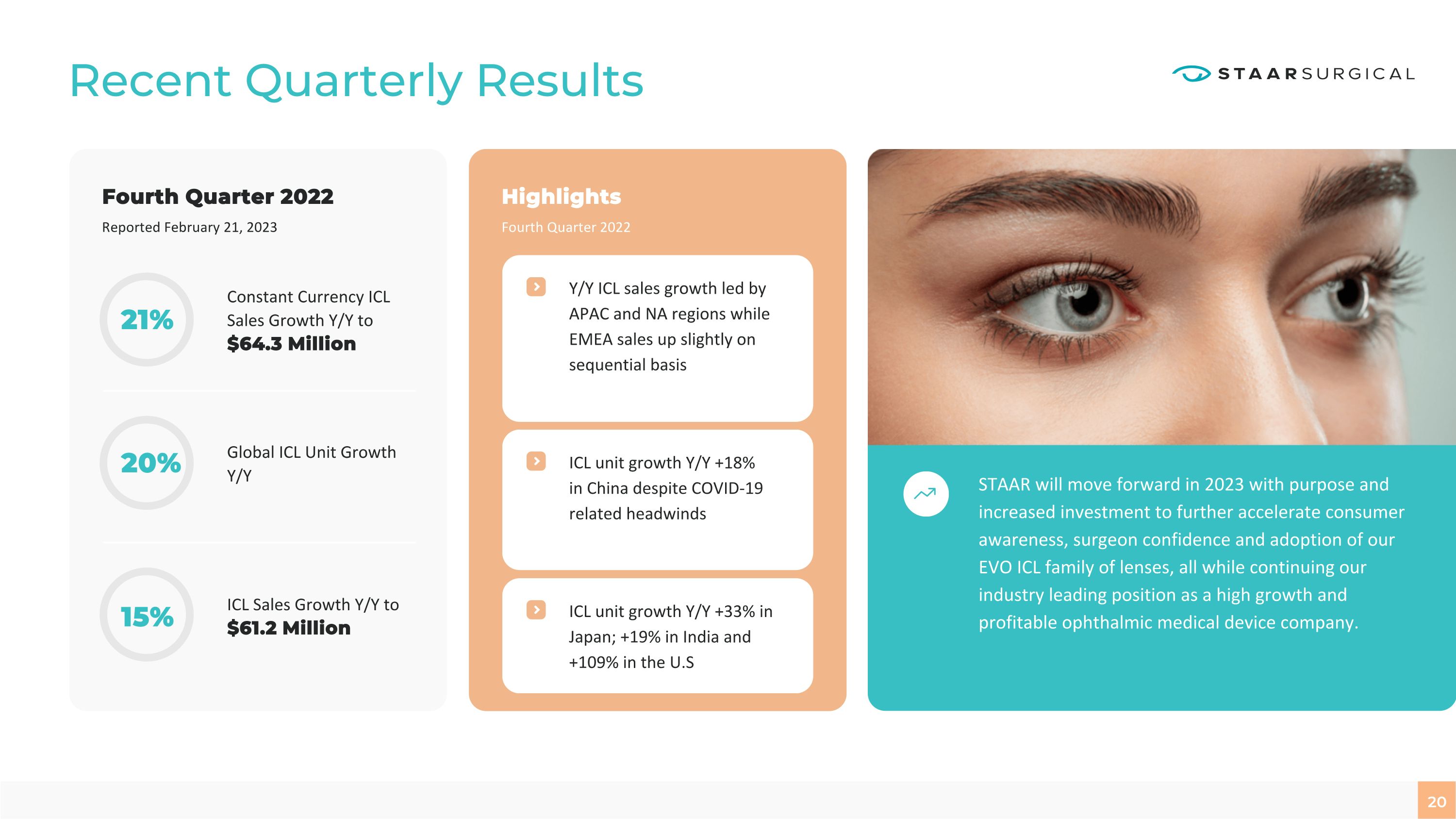

20 Recent Quarterly Results Reported February 21, 2023 Fourth Quarter 2022 Fourth Quarter 2022 21% 20% 15% Highlights Constant Currency ICL Sales Growth Y/Y to $64.3 Million Global ICL Unit Growth Y/Y ICL Sales Growth Y/Y to $61.2 Million Y/Y ICL sales growth led by APAC and NA regions while EMEA sales up slightly on sequential basis ICL unit growth Y/Y +18% in China despite COVID-19 related headwinds ICL unit growth Y/Y +33% in Japan; +19% in India and +109% in the U.S STAAR will move forward in 2023 with purpose and increased investment to further accelerate consumer awareness, surgeon confidence and adoption of our EVO ICL family of lenses, all while continuing our industry leading position as a high growth and profitable ophthalmic medical device company.

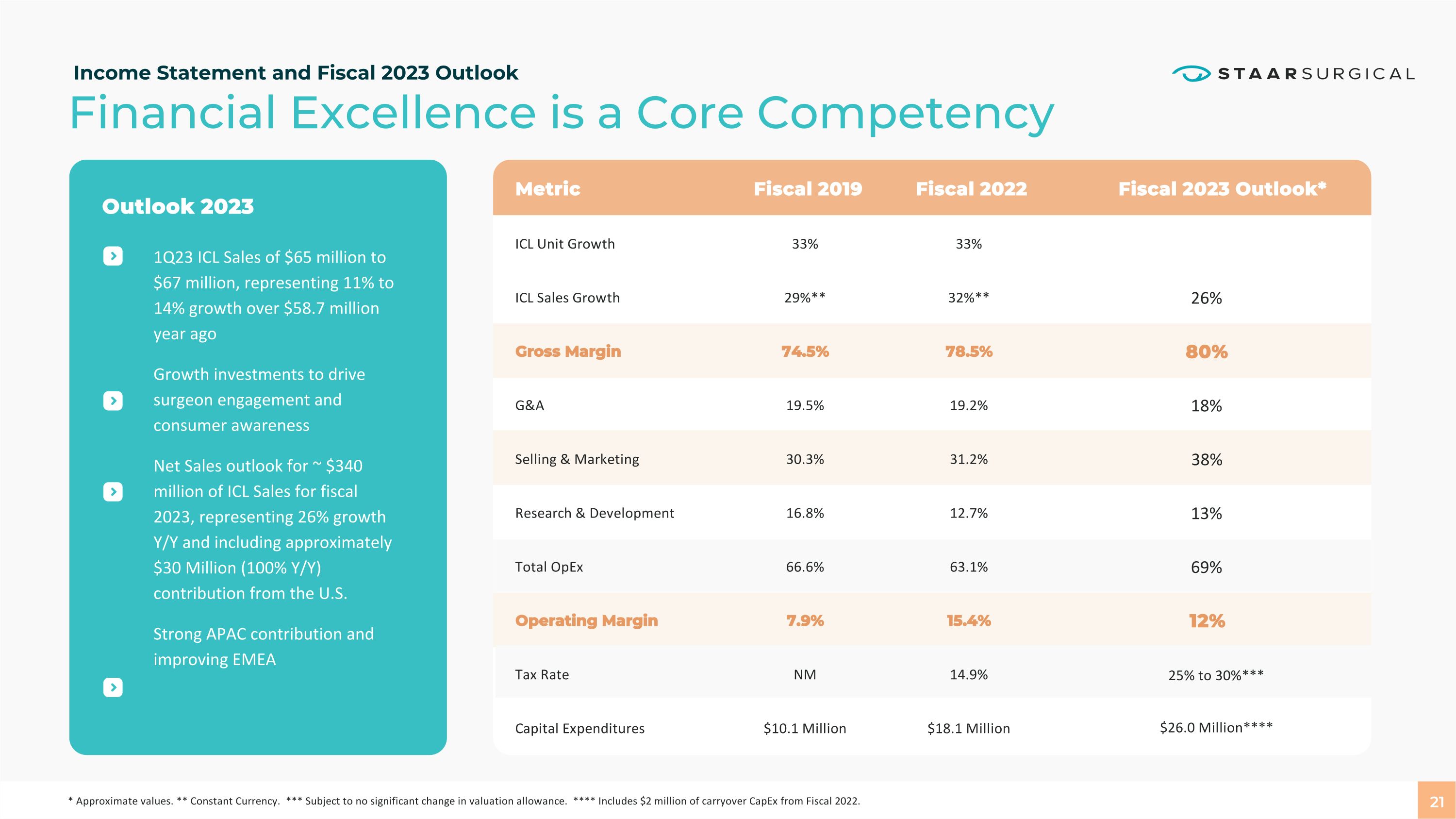

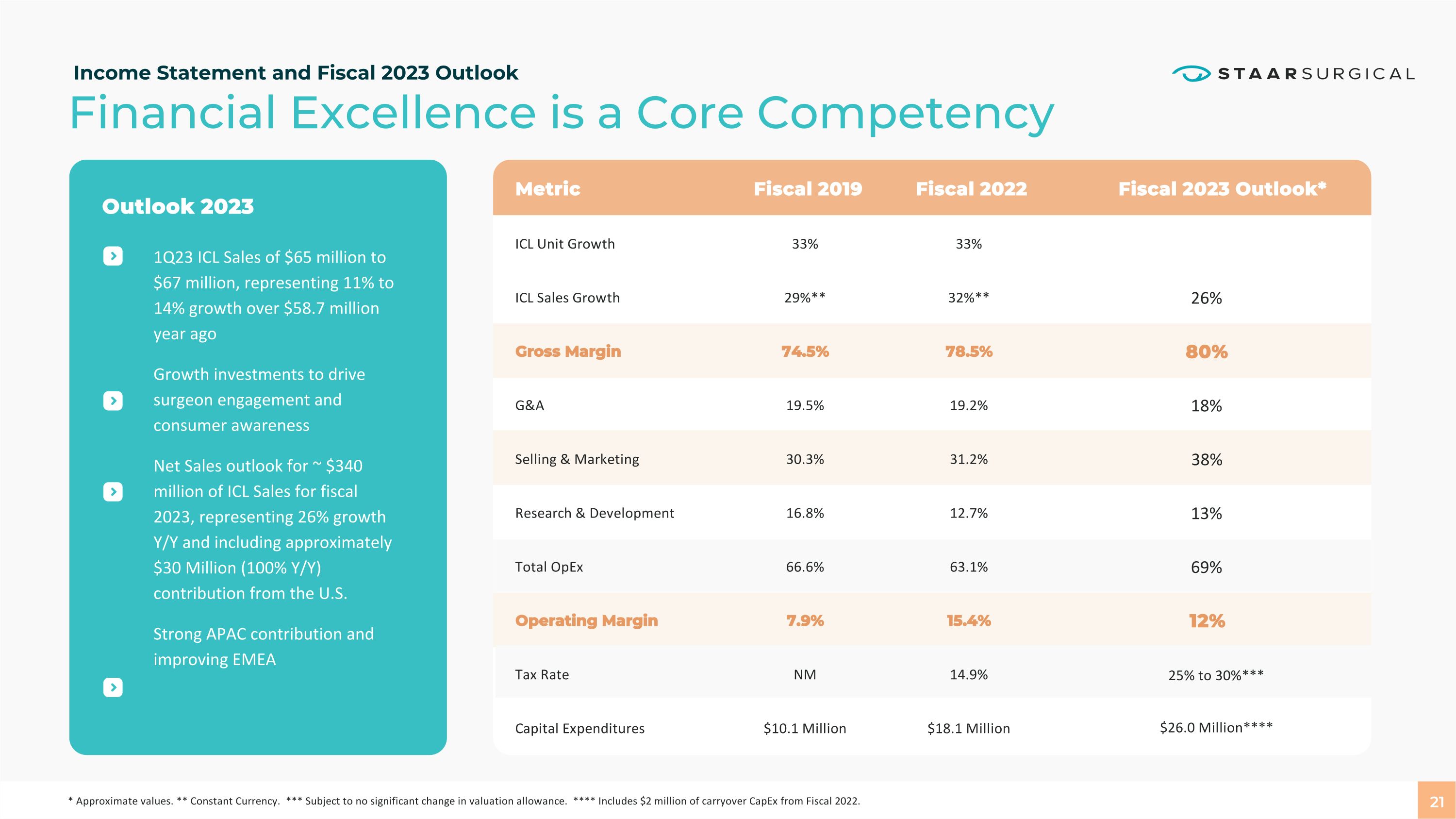

21 Financial Excellence is a Core Competency Income Statement and Fiscal 2023 Outlook Outlook 2023 1Q23 ICL Sales of $65 million to $67 million, representing 11% to 14% growth over $58.7 million year ago

Growth investments to drive surgeon engagement and consumer awareness

Net Sales outlook for ~ $340 million of ICL Sales for fiscal 2023, representing 26% growth Y/Y and including approximately $30 Million (100% Y/Y) contribution from the U.S.

Strong APAC contribution and improving EMEA * Approximate values. ** Constant Currency. *** Subject to no significant change in valuation allowance. **** Includes $2 million of carryover CapEx from Fiscal 2022. ICL Unit Growth 33% 33% 32%** 29%** 19.2% 26% 31.2% 19.5% 12.7% 18% 63.1% 30.3% 14.9% 38% $18.1 Million 16.8% 15.4% 13% 78.5% 66.6% 69% NM 25% to 30%*** $10.1 Million $26.0 Million**** 7.9% 12% 74.5% 80% ICL Sales Growth Gross Margin G&A Selling & Marketing Research & Development Total OpEx Operating Margin Tax Rate Capital Expenditures Metric Fiscal 2019 Fiscal 2022 Fiscal 2023 Outlook*

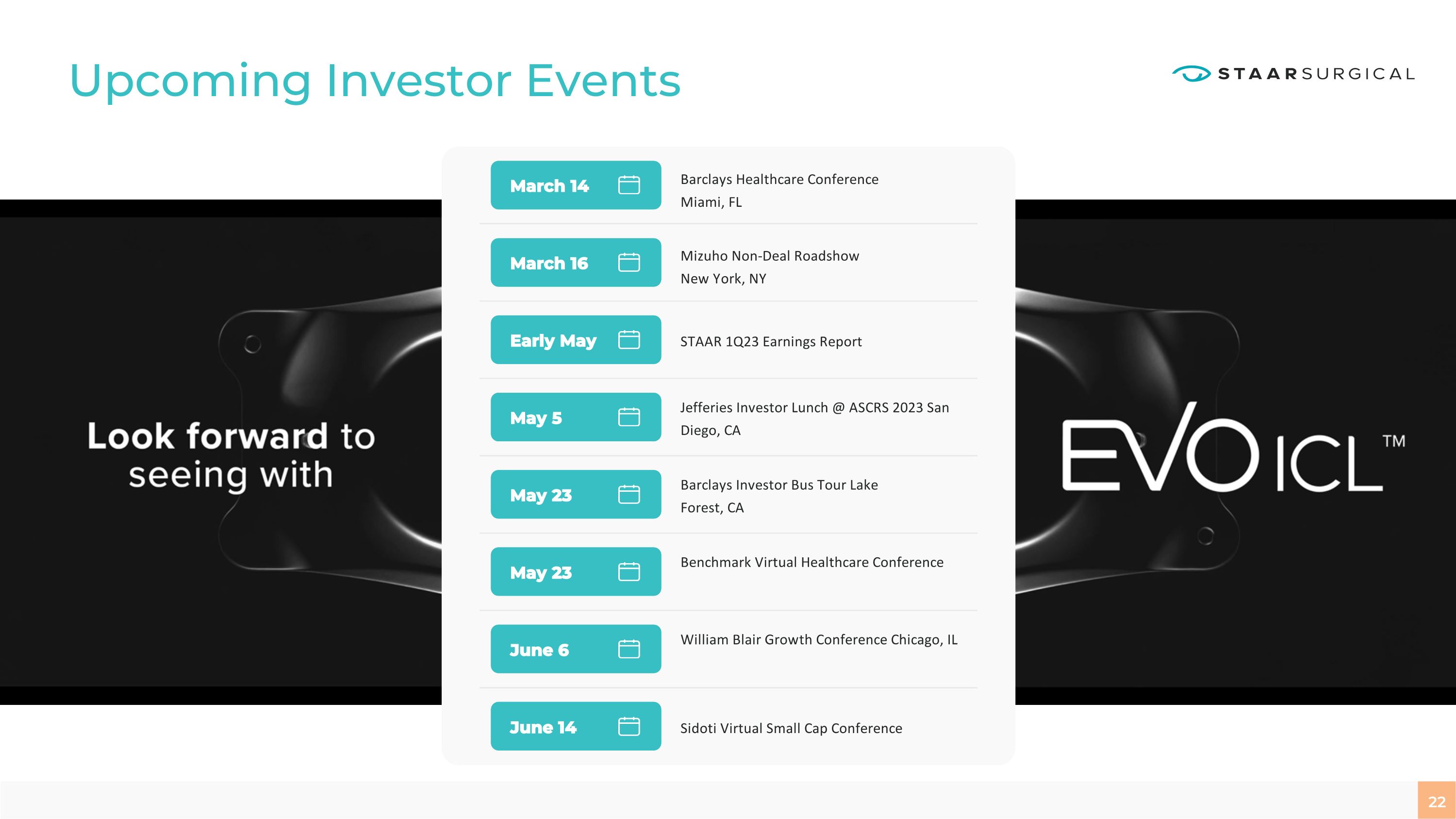

22 Upcoming Investor Events Barclays Healthcare Conference Miami, FL STAAR 1Q23 Earnings Report Mizuho Non-Deal Roadshow New York, NY Jefferies Investor Lunch @ ASCRS 2023 San Diego, CA Barclays Investor Bus Tour Lake Forest, CA William Blair Growth Conference Chicago, IL Benchmark Virtual Healthcare Conference Sidoti Virtual Small Cap Conference Early May March 14 March 16 May 5 June 6 May 23 May 23 June 14

Envision a Life Without Hesitation NASDAQ: STAA www.staar.com www.evoicl.com