Exhibit 99.1

STAAR Surgical Company NASDAQ: STAA Investor Presentation | February 28, 2019

Forward Looking Statements All statements in this presentation that are not statements of historical fact are forward - looking statements, including statements about any of the following: any financial projections, including those relating to the plans, strategies, and objectives of management for 2019 or prospects for achieving such plans, expectations for sales, revenue, or earnings, and any statements of assumptions underlying any of the foregoing. Important factors that could cause actual results to differ materially from those indicated by such forward - looking statements are set forth in the Company’s Annual Report on Form 10 - K for the year ended December 28, 2018 under the caption “Risk Factors,” which is on file with the Securities and Exchange Commission and available in the “Investor Information” section of the company’s website under the heading “SEC Filings.” We disclaim any intention or obligation to update or revise any financial projections or forward - looking statement due to new information or events. These statements are based on expectations and assumptions as of the date of this presentation and are subject to numerous risks and uncertainties, which could cause actual results to differ materially from those described in the forward - looking statements. The risks and uncertainties include the following: global economic conditions; the discretion of regulatory agencies to approve or reject existing, new or improved products, or to require additional actions before approval, or to take enforcement action; potential international trade disputes; and the willingness of surgeons and patients to adopt a new or improved product and procedure. The Visian ICL with CentraFLOW, now known as EVO Visian ICL, is not yet approved for sale in the United States. 2

» ICL Overview » Current Market Opportunity » Roadmap to Expanded Opportunity » Strong 2018 Financial Performance » 2019 Outlook is for Continued Strong Growth 3 Agenda

99.4% of Patients Would Elect STAAR’s Implantable Collamer Lens (ICL) Again* 4 We transform lives by providing visual freedom through premium lens - based surgical correction of refractive error. *Patient Registry Survey Data on File ICL Patients ICL Ambassadors

ICL™ Patient Testimonials “Upgradeable, Replaceable”… I feel like a big part of health is using what your body already has. Visian ICL is in line with that because it’s keeping your eye completely intact. My eye is still my eye. EVE TORRES GRACIE JIU JITSU INSTRUCTOR, FORMER WWE DIVA, MOM I had my first opportunity to put my Visian ICL eyes to the test recently in the Brazilian Rainforest, and it couldn’t have been more exciting to be able to spot rare species better than ever. 5 PHIL TORRES ENTOMOLOGIST, TV SHOW HOST

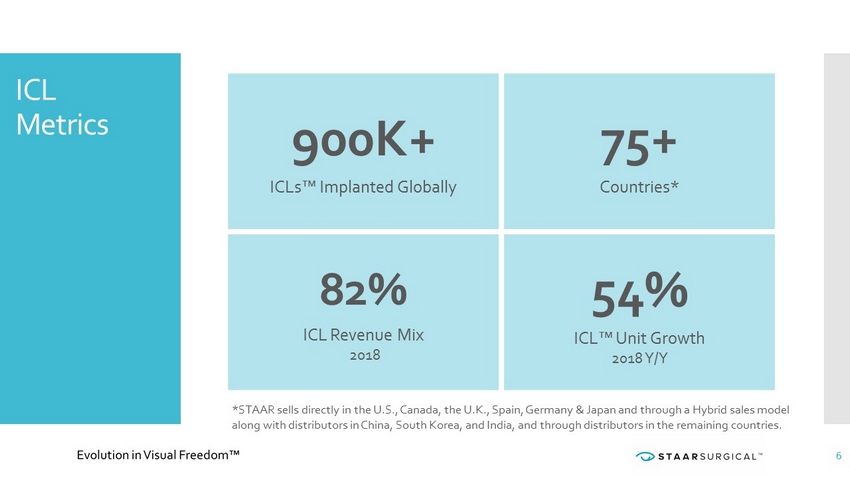

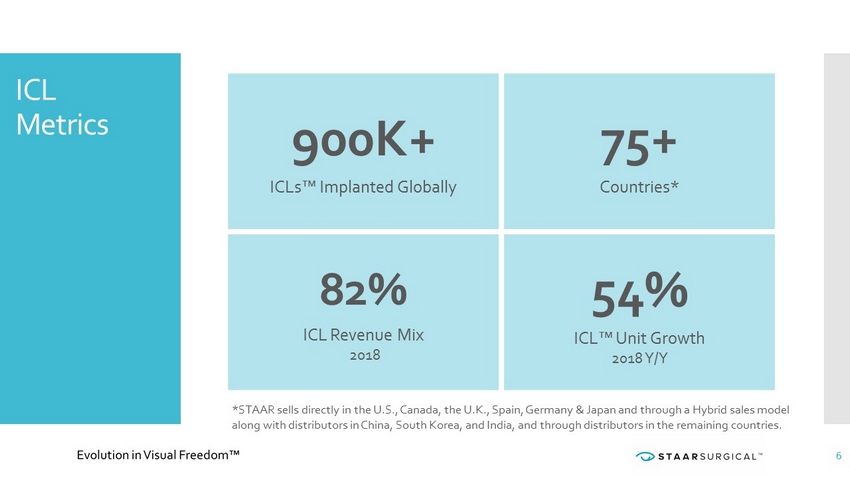

ICL Metrics *STAAR sells directly in the U.S., Canada, the U.K., Spain, Germany & Japan and through a Hybrid sales model along with distributors in China, South Korea, and India, and through distributors in the remaining countries. 900K+ ICLs™ Implanted Globally 75+ Countries* 82% ICL Revenue Mix 2018 54% ICL™ Unit Growth 2018 Y/Y 6

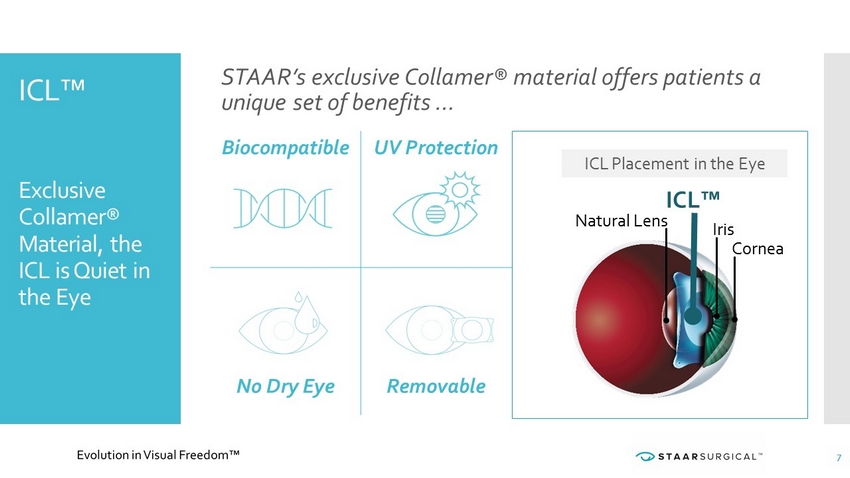

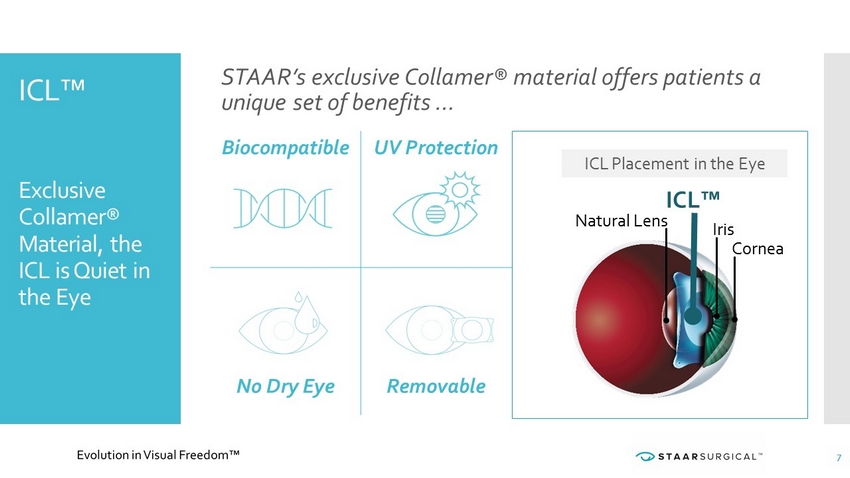

Biocompatible UV Protection No Dry Eye Removable ICL™ Exclusive Collamer® Material, the ICL is Quiet in the Eye Iris Cornea ICL™ Natural Lens 7 STAAR’s exclusive Collamer® material offers patients a unique set of benefits … ICL Placement in the Eye

EVO ICL™ Safety and Effectiveness Outcomes Reported in Literature 8 Stellar Safety and Effectiveness of STAAR’s EVO Lens 2018 Literature Review authored by Dr. Mark Packer is a review of 67 papers from 10 countries* Review covers over 6,000 Eyes of data with up to 5 years of Follow - Up Outstanding outcomes for Safety and Effectiveness Conclusion: “Improved safety and effectiveness across a broad range of refractive errors make EVO an attractive option for surgeons and patients”. *Published in Clinical Ophthalmology, December 2018

9 The Market Opportunity Myopia, Presbyopia and Growth

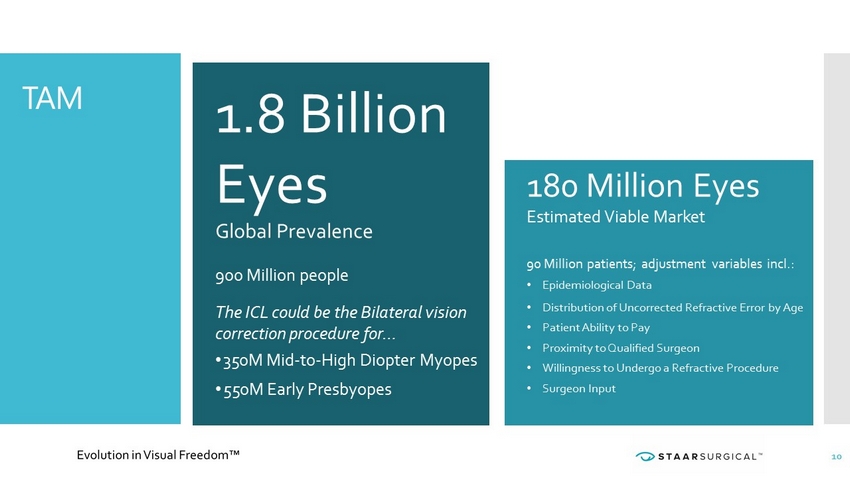

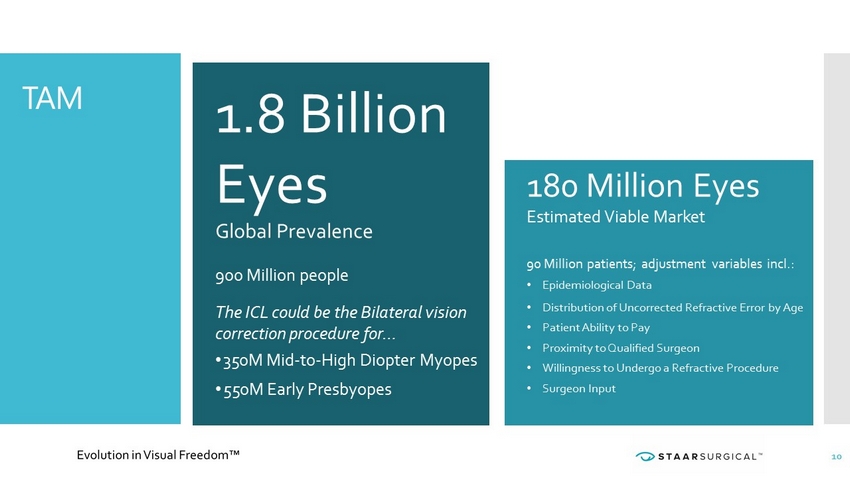

TAM 10 1.8 Billion Eyes Global Prevalence 900 Million people The ICL could be the Bilateral vision correction procedure for… • 350M Mid - to - High Diopter Myopes • 550M Early Presbyopes 180 Million Eyes Estimated Viable Market 90 Million patients; adjustment variables incl.: • Epidemiological Data • Distribution of Uncorrected Refractive Error by Age • Patient Ability to Pay • Proximity to Qualified Surgeon • Willingness to Undergo a Refractive Procedure • Surgeon Input

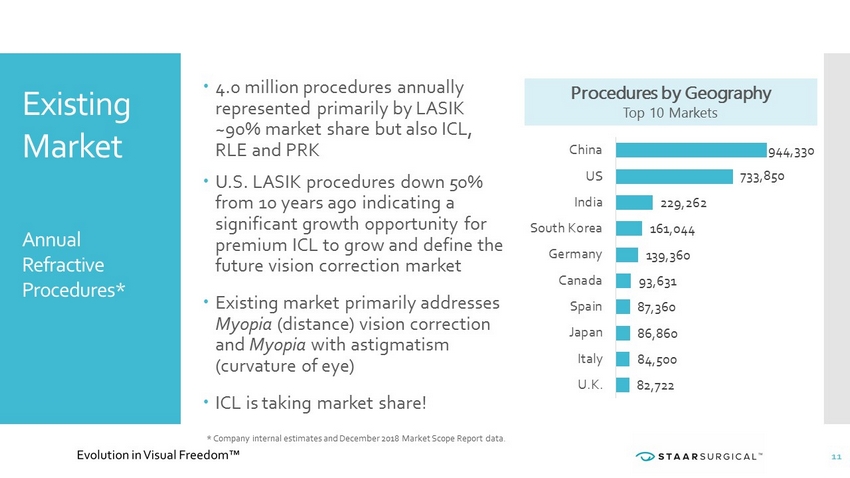

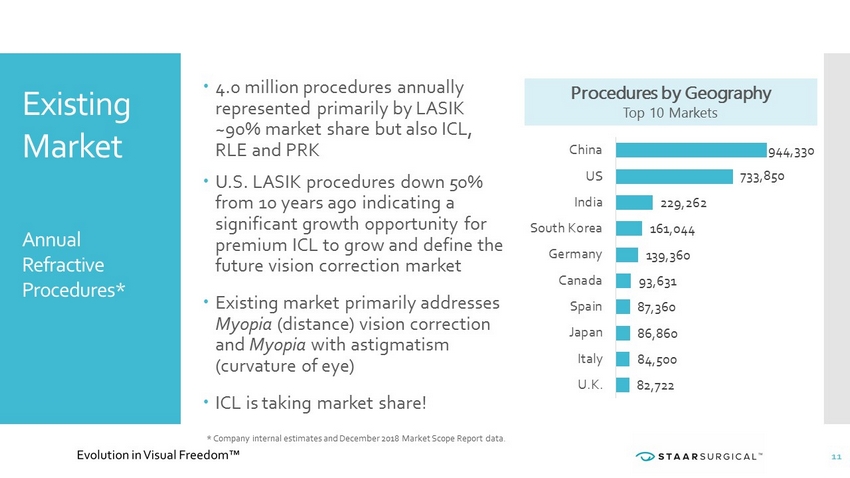

Existing Market Annual Refractive Procedures* Procedures by Geography Top 10 Markets 82,722 84,500 86,860 87,360 93,631 139,360 161,044 229,262 733,850 944,330 U.K. Italy Japan Spain Canada Germany South Korea India US China 4.0 million procedures annually represented primarily by LASIK ~90% market share but also ICL, RLE and PRK U.S. LASIK procedures down 50% from 10 years ago indicating a significant growth opportunity for premium ICL to grow and define the future vision correction market Existing market primarily addresses Myopia (distance) vision correction and Myopia with astigmatism (curvature of eye) ICL is taking market share! 11 * Company internal estimates and December 2018 Market Scope Report data.

Myopia An Inability to Focus at Distance due to Genetic and/or Environmental Factors • More screen use and near vision work • Less time spent outdoors • Positive correlation between education level and myopia • ICL™ Label Approved Use is - 3 to - 20 diopters of vision correction *“Ophthalmology 2016;123:1036 - 1042 © 2016 by the American Academy of Ophthalmology;” Myopia incidence was estimated at 1.4B people globally at time of study growing to 4.8B people by 2050 or predicted 50% of global pop. Singapore Health Board 12 Predicted to Impact 50% of Global Population by 2050…

Myopia STAAR’s Market Position & Growth Opportunity • STAAR is a market leader providing a premium refractive surgical solution and patient experience for High Myopes • Moving down the diopter curve to Mid Myopes represents a significant opportunity for STAAR; Mid Myopia market opportunity estimated at ~ 5x High - Myopia • EVO ICL™ (central port for eye’s aqueous flow) creates one step surgical procedure and suggests significant opportunity for the U.S. • EVO ICL globally available outside the U.S. with over 500,000 sold. 13 Types of Myopia High - 10 to - 20 Mid - 6 to - 10 Low - 1 to - 6

Presbyopia An Inability to Focus on Near Objects due to an Age Related Loss of Lens Accommodation • Current refractive options for presbyopia are Monocular/LASIK/RLE • ICL could be a more desirable solution to patients seeking Visual Freedom • ICL Not laser/equipment dependent; no large capital investment required • ICL Bilateral placement - no emmetropia qualifier • ICL targets each eye for desired correction Impacts 1.7 Billion People Globally… Reading Glasses 14

Presbyopia 15 • STAAR aims to become a market leading refractive surgical solution and patient experience for the 550 million Early Presbyopes, ages 45 to 55 • Multi - site European clinical trial for EVO ICL with EDOF (Presby Lens) currently underway • Initially targeting CE Mark approval (31+ countries)

Growth Opportunities Current and Potential Future Drivers of Growth • ICL capturing vision correction (refractive surgery) market share drives base business growth • ICL Premium and Primary product positioning supported by clinical data and industry - leading patient satisfaction • Myopia • Moving down the diopter curve expands STAAR’s Myopia market opportunity • EVO in the U.S. represents game - changing market opportunity for the ICL • Presbyopia • EVO with EDOF (Presby Lens) in CE Mark Countries • The only bilateral intraocular custom solution for Presby treatment • ICL advantages supported by clinical studies and strategic cooperation agreements with committed growth create barriers to entry 16

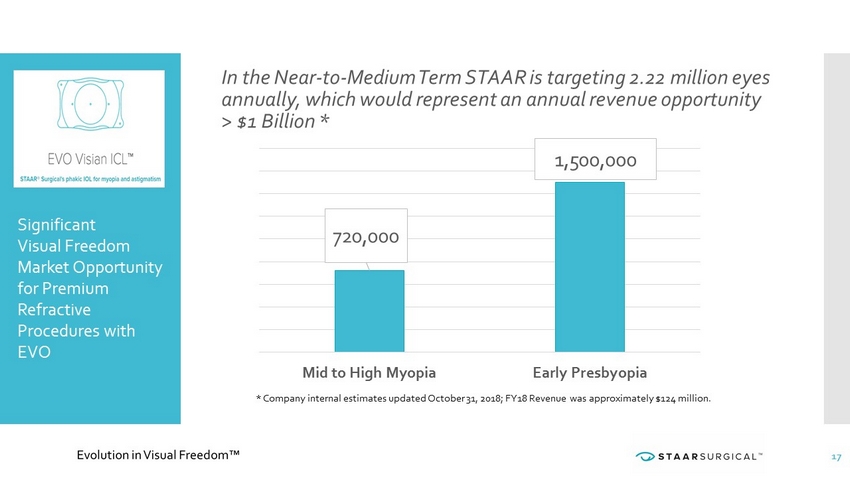

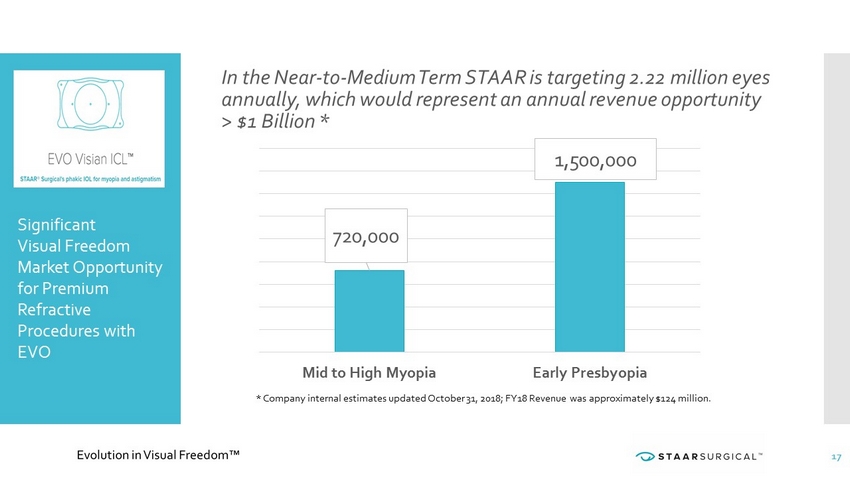

720,000 1,500,000 Mid to High Myopia Early Presbyopia 17 * Company internal estimates updated October 31, 2018; FY18 Revenue was approximately $124 million. In the Near - to - Medium Term STAAR is targeting 2.22 million eyes annually, which would represent an annual revenue opportunity > $1 Billion * Significant Visual Freedom Market Opportunity for Premium Refractive Procedures with EVO

18 Financial Overview Recent Results, Outlook and Growth Drivers

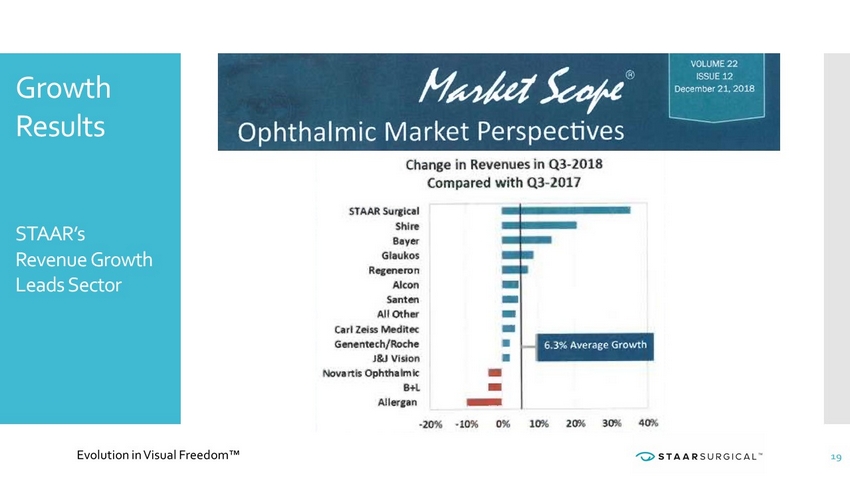

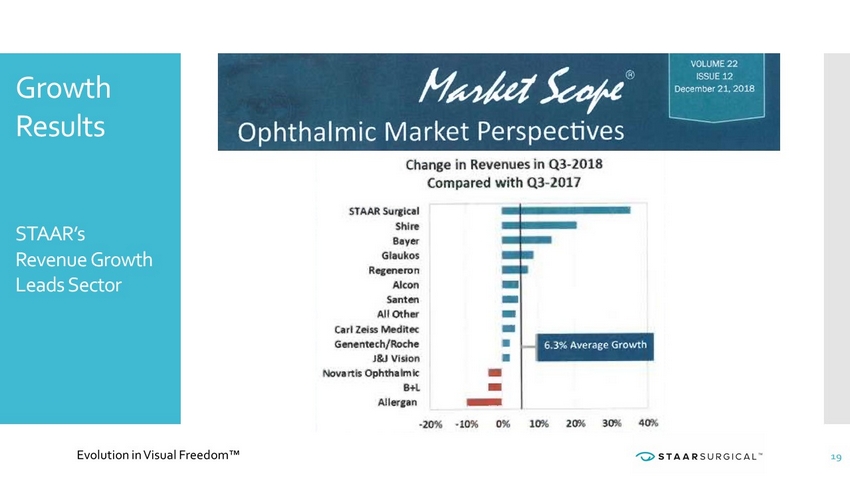

Growth Results STAAR’s Revenue Growth Leads Sector 19

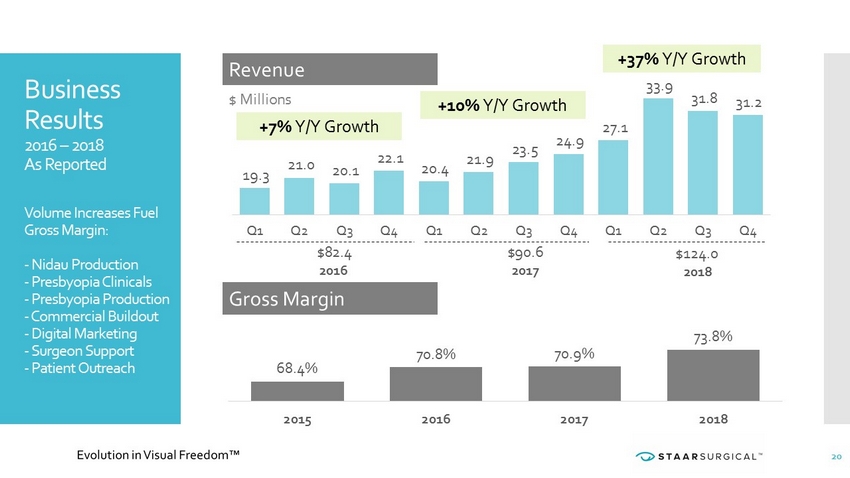

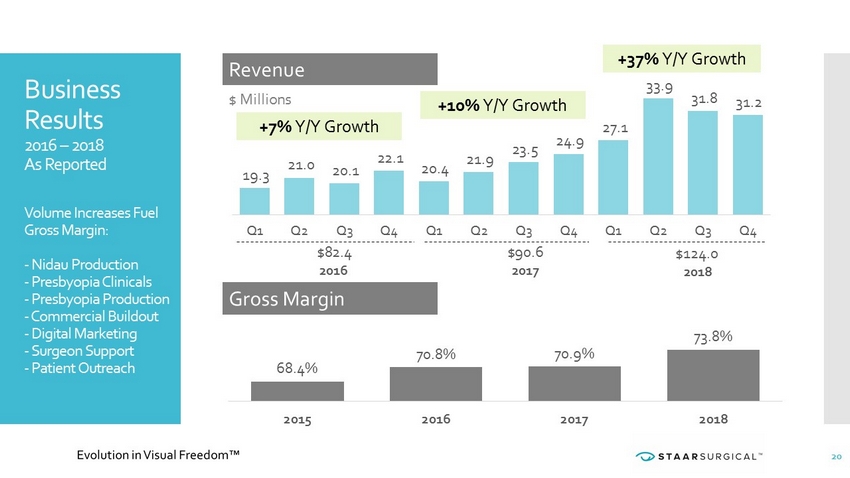

19.3 21.0 20.1 22.1 20.4 21.9 23.5 24.9 27.1 33.9 31.8 31.2 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 68.4% 70.8% 70.9% 73.8% 2015 2016 2017 2018 $82.4 2016 $90.6 2017 $ Millions Revenue Gross Margin $124.0 2018 20 Business Results 2016 – 2018 As Reported Volume Increases Fuel Gross Margin: - Nidau Production - Presbyopia Clinicals - Presbyopia Production - Commercial Buildout - Digital Marketing - Surgeon Support - Patient Outreach +7% Y/Y Growth +10% Y/Y Growth +37% Y/Y Growth

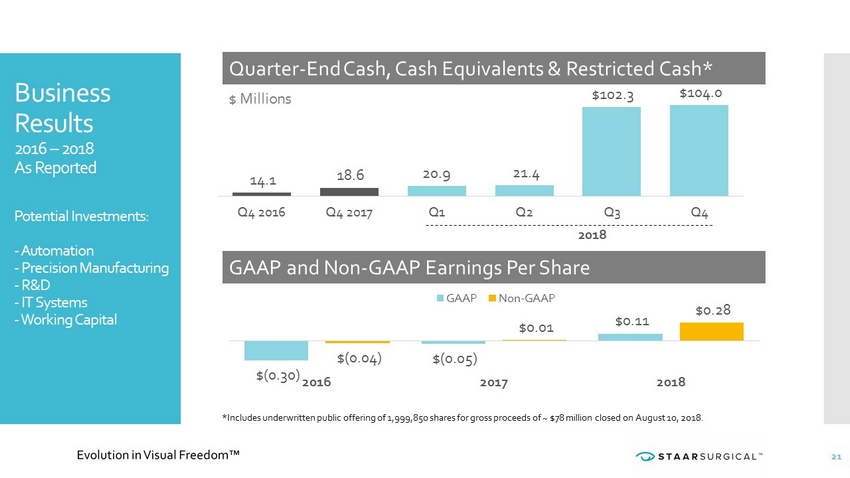

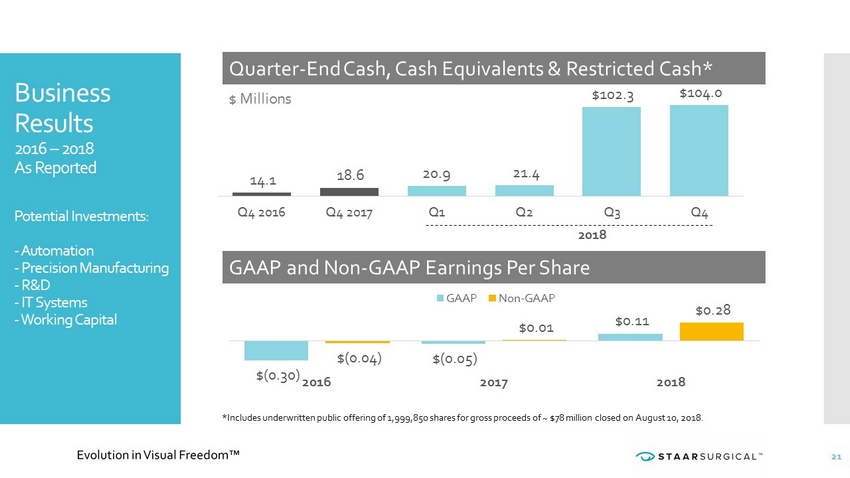

2018 Business Results 2016 – 2018 As Reported Potential Investments: - Automation - Precision Manufacturing - R&D - IT Systems - Working Capital Quarter - End Cash, Cash Equivalents & Restricted Cash* GAAP and Non - GAAP Earnings Per Share 14.1 18.6 20.9 21.4 $102.3 $104.0 Q4 2016 Q4 2017 Q1 Q2 Q3 Q4 $ Millions $(0.30) $(0.05) $0.11 $(0.04) $0.01 $0.28 2016 2017 2018 GAAP Non-GAAP *Includes underwritten public offering of 1,999,850 shares for gross proceeds of ~ $78 million closed on August 10, 2018. 21

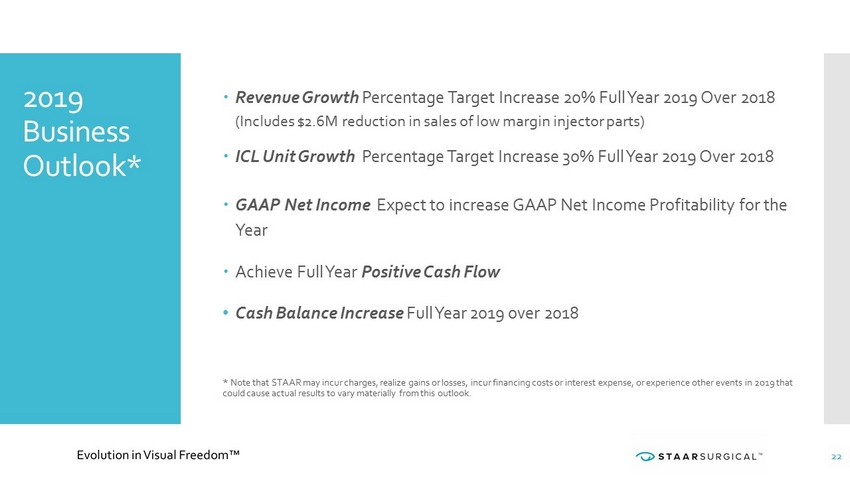

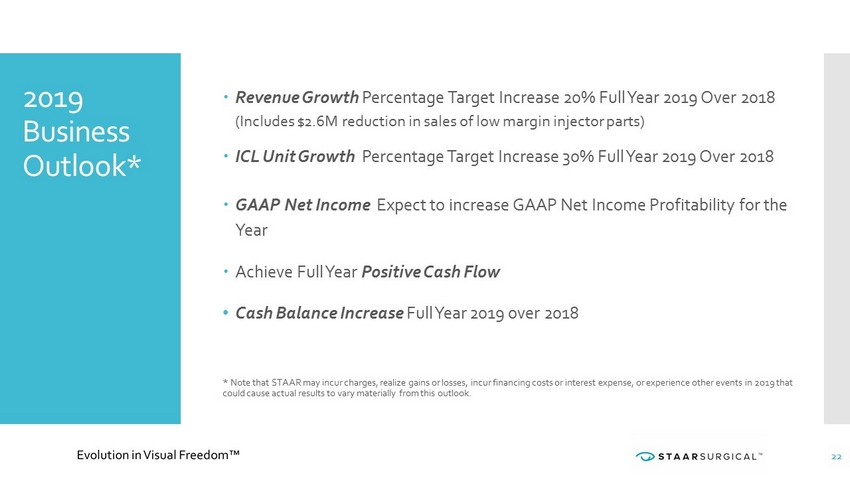

2019 Business Outlook* Revenue Growth Percentage Target Increase 20% Full Year 2019 Over 2018 (Includes $2.6M reduction in sales of low margin injector parts) ICL Unit Growth Percentage Target Increase 30% Full Year 2019 Over 2018 GAAP Net Income Expect to increase GAAP Net Income Profitability for the Year Achieve Full Year Positive Cash Flow • Cash Balance Increase Full Year 2019 over 2018 * Note that STAAR may incur charges, realize gains or losses, incur financing costs or interest expense, or experience other ev ent s in 2019 that could cause actual results to vary materially from this outlook. 22

Growth Drivers 2019 » Continued market penetration in China where share has increased 5x in less than three years » U.S. market returns to growth with introduction of the Toric ICL for astigmatism in Q4’18 » EU market upside with potential Presbyopia approval 23 » Continued market share gains in Mid - to - lower diopter ( - 6 to - 10) lenses » Increasing investment in DTC marketing and patient education » Strategic cooperation agreements and alliances w/ global partners at contracted unit volumes and price

STAAR Surgical Company 2018 - 2020 24 Millions of Eyes “Millions of Eyes” Global Opportunity – Myopia and Presbyopia Revenue Growth 20% Annual Revenue Growth Goal Profitability Targets Targeting Achievement of Sustained Profitability Margin Expansion Gross Margin Improvement & Cash Generation Growth Continues Product Expansion EVO ICL Product Family Expansion – Myopia and Presbyopia EDOF Global Partners Growing Global Partners – Strategic Agreements Secure Base We Believe There is Substantial Growth Opportunity…

STAAR Surgical Company NASDAQ: STAA Investor Presentation | February 28, 2019