- BCE Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

-

Insider

- Institutional

- Shorts

-

6-K Filing

BCE (BCE) 6-KBCE files 2016 annual report on Form 40-F

Filed: 8 Mar 17, 12:00am

Exhibit 99.2

BCE INC. 2016 ANNUAL REPORT

OUR GOAL

For Bell to be recognized by

customers as Canada’s leading

communications company

| OUR STRATEGIC IMPERATIVES | |

| Invest in broadband networks and services | 8 |

| Accelerate wireless | 10 |

| Leverage wireline momentum | 12 |

| Expand media leadership | 14 |

| Improve customer service | 16 |

| Achieve a competitive cost structure | 18 |

| TABLE OF CONTENTS | |

| Financial and operational highlights | 2 |

| Letters to shareholders | 4 |

| Strategic imperatives | 8 |

| Community investment | 20 |

| Bell archives | 22 |

| Management’s discussion and analysis (MD&A) | 26 |

| Reports on internal control | 110 |

| Consolidated financial statements | 112 |

| Notes to consolidated financial statements | 118 |

BCE INC. 2016 ANNUAL REPORT

A commitment to lead broadband network investment

and innovation in Canada, and the consistent execution

of our competitive strategy, enabled Bell to grow

the business, achieve all financial objectives,

and extend our record of exceptional value creation

for shareholders.

| 2016 FINANCIAL PERFORMANCE | |||

| ACTUAL | TARGET | RESULT | |

| Revenue growth | 1.0% | 1%–3% | |

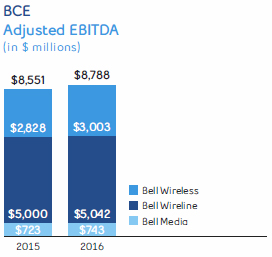

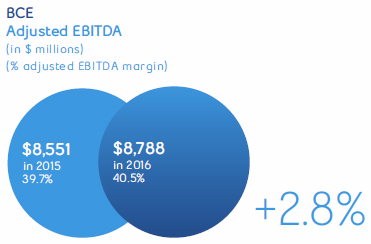

| Adjusted | 2.8% | 2%–4% | |

| EBITDA(3) growth | |||

| Capital intensity | 17.4% | ~17% | |

| Adjusted EPS(3) | $3.46 | $3.45–$3.55 | |

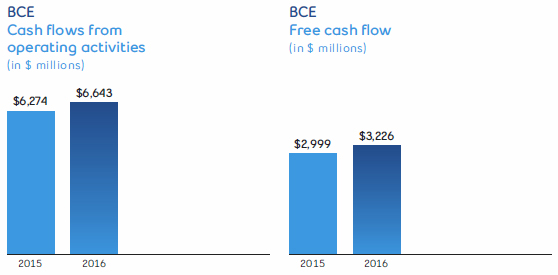

| Free cash flow(3) growth | 7.6% | 4%–12% | |

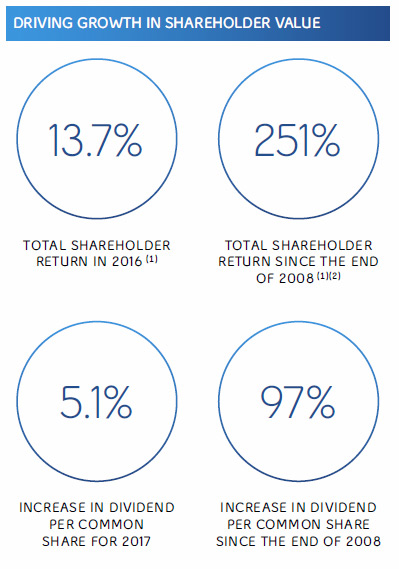

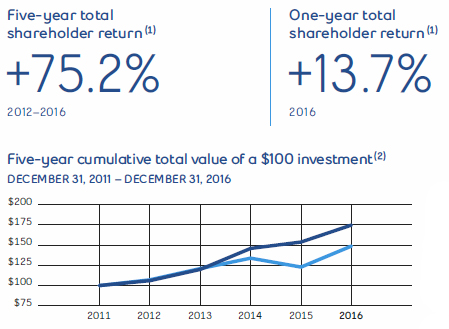

| COMPARATIVE TOTAL RETURN(1)(2) | ||

2016 | SINCE THE END OF 2008 | |

| BCE | 13.7% | 251% |

| S&P/TSX Composite Index | 21.1% | 116% |

| S&P/TSX Telecom Index | 18.3% | 181% |

| (1) | Assumes the reinvestment of dividends. |

| (2) | Total return since the end of 2008, the year Bell implemented its transformational strategy. |

| (3) | Adjusted EBITDA, adjusted EPS and free cash flow are non-GAAP financial measures and do not have any standardized meaning under International Financial Reporting Standards (IFRS). Therefore, they are unlikely to be comparable to similar measures presented by other issuers. For a full description of these measures, see section 10.2, Non-GAAP financial measures and key performance indicators (KPIs)on pp. 106 to 109 of the MD&A. |

1

BCE INC. 2016 ANNUAL REPORT

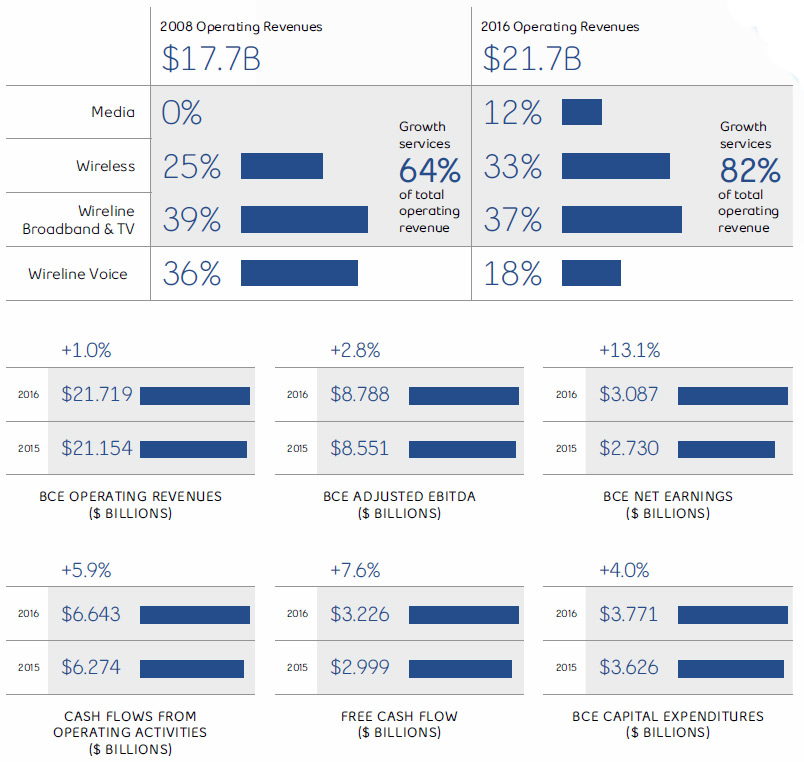

FINANCIAL AND OPERATIONAL HIGHLIGHTS

Leading network investments

drive Bell growth services

The enduring builder of Canada’s communications infrastructure since 1880, Bell is now investing in the next generation of high-capacity broadband networks that power the growth services of today: wireless, Internet, TV and media.

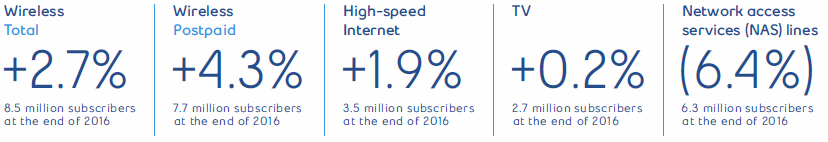

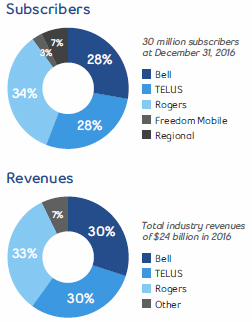

| BCE SUBSCRIBERS (MILLIONS)* | |||

| 2016 | 2015 | GROWTH | |

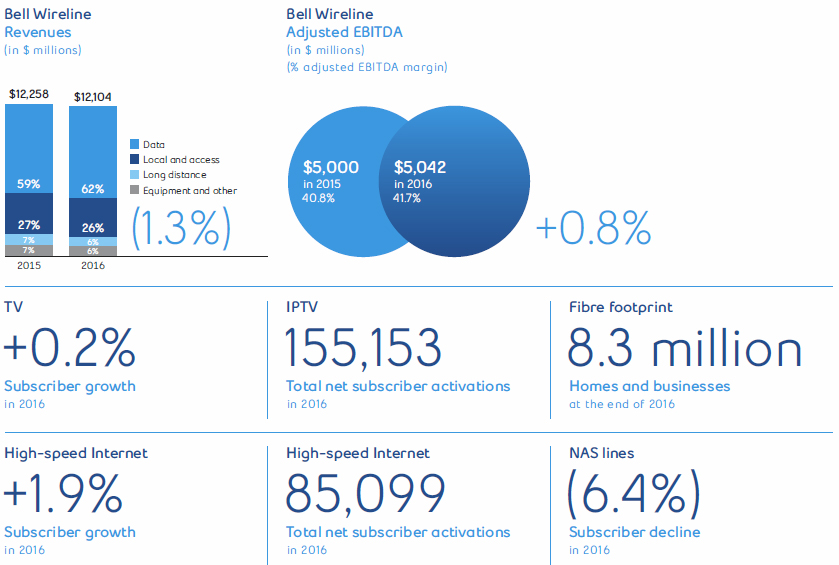

| Wireless | 8.5 | 8.2 | +2.7% |

| High-speed Internet | 3.5 | 3.4 | +1.9% |

| Television | 2.7 | 2.7 | +0.2% |

| Total growth services | 14.7 | 14.4 | +2.0% |

| Local telephone services | 6.3 | 6.7 | -6.4% |

| Total subscribers | 20.9 | 21.1 | -0.7% |

* Rounding in numbers may affect total figures presented.

2

| BELL’S ONGOING TRANSFORMATION: 2008–2016 Advanced networks have transformed Bell into Canada’s broadband communications leader, now setting the pace in wireless, Internet, TV and media growth. Together, these high-demand growth services accounted for 82% of Bell revenue in 2016, up from 81% a year earlier and just 64% in 2008. |

For more information, please refer to section 7 of the MD&A –Selected Annual and Quarterly information, pp. 85 to 89.

3

BCE INC. 2016 ANNUAL REPORT

MESSAGE FROM THE CHAIR OF THE BOARD

Broadband leadership

driving growth today,

and into the future

As BCE reports on a year of strong operational and financial progress in 2016, it is clear that our industry landscape has evolved in new and challenging ways since the beginning of Bell’s broadband transformation 8 years ago.

New technologies, changing consumer tastes and growing competition in wireless, TV, Internet and media services are revolutionizing the ways we communicate with each other, and how companies large and small interact with their customers, partners and supply chains.

The demand for faster Internet access continues to accelerate and wireless usage grows by leaps and bounds, as consumers and business users take full advantage of broadband video across platforms, and the power of social media in personal, public and professional realms. The growth in online commerce is driving new business models in every part of the economy, while the emerging Internet of Things (IoT) is creating a machine-to-machine world of communication.

Bell’s next-generation networks lead the way

Bell is clearly ready to lead the way with a broadband growth and innovation strategy that has re-energized both our company and industry. Bell has the scale to deliver world-class communications networks and services across our vast country, and a skilled and seasoned team fully dedicated to delivering the benefits of our leadership strategy to all stakeholders.

Building on a legacy of technological leadership and service innovation since 1880, Bell’s advanced fibre and wireless networks continued to be the foundation of our success in 2016. And as we continue to outpace our competitors in capital investment in infrastructure, R&D and exclusive new services, our award-winning networks will continue to be the driver of our competitive leadership going forward as the world of digital communication continues to evolve.

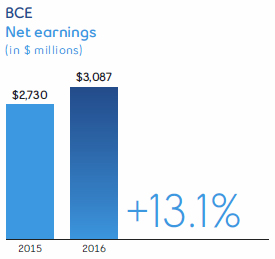

Financial strength, shareholder value

Bell achieved all its financial guidance targets in 2016, with solid revenue and adjusted EBITDA growth and strong free cash flow generation, all of which support Bell’s capital investment objectives and our ability to return value to you.

We announced a 5.1% increase in the BCE annualized common share dividend in February 2017, to $2.87 per share from the $2.73 announced the year before. This is the 13thsuch dividend increase since the end of 2008 and the 9thconsecutive year in which BCE has declared a dividend increase of at least 5%. Our objective

4

to deliver sustainable dividend growth is a core focus for our company. BCE’s total shareholder return of 251% since 2008 has outperformed competitive peers here and across North America and significantly outpaced the S&P/TSX Composite Index.

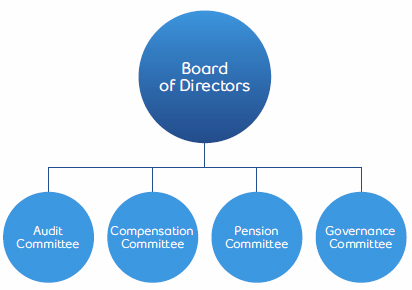

The highest levels of corporate governance and financial prudence underpin BCE’s capital markets strategy. Our healthy balance sheet is supported by investment-grade credit metrics and strong liquidity, and our defined benefit pension plans are well funded and attractively positioned should interest rates rise.

In 2016, we raised a combined total of $2.25 billion in gross proceeds from the issuance of 10-year and 5-year medium-term note (MTN) debentures, achieving the lowest-ever financing rate on any MTN issuance by Bell Canada and significantly reducing our after-tax cost of outstanding MTN debenture debt. We also made a voluntary $400 million contribution to BCE’s defined benefit pension plans, reducing our future pension obligations and enhancing our financial flexibility to invest in our broadband growth strategy.

Changes to your Board

I have been honoured to lead the BCE Board as Chair since April 2016, and am grateful for the support and insight of my predecessor, Thomas O’Neill, and my fellow Directors.

This includes Ronald Brenneman, a distinguished member of the Board who will be retiring at our Annual General Meeting. On behalf of the Board and all shareholders, I thank Ron for his wise counsel and dedication to our company as a Director since 2003, Chair of the Management Resources and Compensation Committee, and a member of the Pension Fund Committee.

I am also pleased to announce the nomination of Karen Sheriff to the Board. A highly successful leader who will add deep experience in the Canadian communications industry to our Board, Karen served as CEO of Bell Aliant and most recently Q9 Networks. Recognized numerous times as an exemplary executive and one of Canada’s most influential women leaders, Karen will be an outstanding addition to your Board.

On behalf of the Board and shareholders, I would like to thank our President and CEO George Cope and the Bell team for successfully navigating our complex and fast-changing sector with a winning strategy and unparalleled execution in the marketplace. We look forward to welcoming Manitoba Telecom Services (MTS) and implementing the Bell strategy in a province poised for growth and ready for the significant enhancement of its broadband communications infrastructure that Bell MTS will bring.

As Chair of the Board, it is my privilege to serve you as Bell moves forward as Canada’s broadband leader. We are committed to remaining at the forefront of communications innovation and growth, transforming our business to stay ahead while continuing to deliver for our shareholders, customers, employees and communities.

I am honoured to be part of the team writing the next chapters in Bell’s long and distinguished history. Thank you for your support.

Gordon M. Nixon

Chair of the Board

BCE Inc.

5

BCE INC. 2016 ANNUAL REPORT

MESSAGE FROM THE PRESIDENT & CEO

Bell in the vanguard

of Canada’s broadband

communications revolution

Bell continued to build on our position as Canada’s broadband communications leader in 2016. We are investing in the most advanced networks and service innovations to lead in the marketplace and ensure Canada’s competitiveness in a global digital economy, while delivering consistent dividend growth to you, the shareholders who have invested in Bell’s broadband strategy.

Each day and around the clock, the Bell team works to deliver world-class network performance, exclusive new products and an enhanced service experience to Canadians in every province and territory. In a highly competitive and fast changing communications sector, Bell continues to set the pace through our dedication to a clear goal – for Bell to be recognized by customers as Canada’s leading communications company.

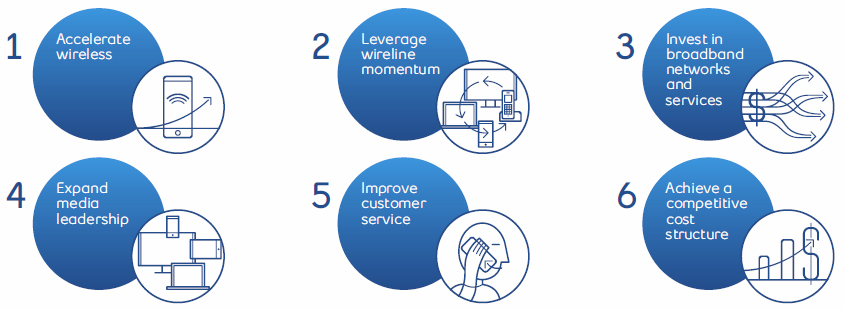

To achieve our goal, Bell executes a strategy focused on delivering the best wireless, TV, Internet and media growth services in the most timely and efficient manner possible, an approach framed by our 6 Strategic Imperatives:

| Invest in broadband networks and services Accelerate wireless Leverage wireline momentum Expand media leadership Improve customer service Achieve a competitive cost structure |

Ours is a strategy that reflects both the challenges of our dynamic industry and the clear opportunities for innovation and growth in Canadian communications. And the Bell team is delivering.

Innovation first with Bell

A growing Gigabit Internet footprint delivering the fastest access speeds to consumers and businesses, and an LTE wireless network ranked as the fastest in Canada and significantly faster than US networks. Exclusive Fibe TV features like Restart and Trending, and innovations like the first wireless Whole Home PVR, the Fibe TV app and Apple TV connectivity. Compelling Canadian content and the most-loved TV and radio channels. A network of all-Canadian data hosting centres able to take on global heavyweights like Microsoft and Google, further strengthened in 2016 with the addition of Q9 Networks.

These are the kinds of leading innovations delivered by Bell’s broadband investment strategy. In 2016, we achieved outstanding usage growth in Internet and wireless data, driven in large part by the surging use of video across our networks on multiple consumer and business platforms. Our significant lead in IPTV technology versus our cable competitors continued to propel our revolutionary Fibe TV service in the marketplace, while the popularity of Canada’s video streaming service, CraveTV from Bell Media, further accelerated.

Behind these millions of glowing screens lie the high-speed, high-capacity Bell networks that are on par with the best in the world. With access to the latest technology available from around the globe and a commitment to be in the vanguard of broadband product development in Canada, our capital expenditures in network infrastructure and R&D reached $3.77 billion in 2016. Bell is connecting communities at speeds never experienced before, fuelling Canadian innovation, and creating jobs in the digital economy.

Backed by continuous improvement in service and support, including high levels of satisfaction with our technician teams, Bell’s network leadership enabled us to outperform in the marketplace with unprecedented broadband growth. More than 240,000 net new Fibe TV and Internet customers and over 315,000 net postpaid wireless subscribers joined Bell in 2016.

Coupled with accelerating usage across our segments and a careful eye on operating costs, especially in slower-growth traditional lines of business, this leadership in the marketplace is enabling Bell to deliver the financial performance necessary to fuel our broadband infrastructure plans, return value to shareholders and invest in the community.

We look forward to rolling out our Fibe and LTE services in Manitoba now that our acquisition of MTS is set to close in March 2017 following the receipt of final federal regulatory approvals. It’s an acquisition that gains Bell more than 700,000 broadband wireless, Internet and IPTV customers in Manitoba, and we look forward to welcoming many more as Bell MTS delivers the best in broadband to a province poised for growth.

Bell MTS plans to invest $1 billion over the next 5 years to bring Gigabit Fibe Internet, Fibe TV and our award-winning LTE wireless network to major centres like Winnipeg and Brandon, to traffic corridors and small towns throughout the province, and to remote locations such as the burgeoning eco-tourism destination of Churchill, also known as the Polar Bear Capital of the World.

The Bell Let’s Talk initiative

Bell is renowned for our corporate responsibility leadership, including our commitments to environmental sustainability, diversity and community investment. Our high-profile mental health initiative Bell Let’s Talk continues to break new ground in the fight against the stigma around mental illness while supporting better care and access, new research and leadership in workplace mental health.

Our 7thBell Let’s Talk Day in January 2017 set all-new records for engagement across communications platforms in Canada and worldwide this year. New social media options helped to increase this year’s total messages of support to almost 132 million, further stimulating the national conversation about mental health while driving unprecedented new Bell funding for Canadian mental health programs.

Thank you

I would like to extend my thanks to Bell’s talented national team for their commitment to our customers, shareholders and communities, and to our Chair Gordon Nixon and the BCE Board of Directors for their invaluable support and guidance.

Thank you to our customers and shareholders for believing in Bell and the straightforward strategy of network, service and operational leadership that has transformed your company into Canada’s fastest growing broadband communications provider.

As we celebrate Canada’s 150thanniversary, and Bell’s role in our nation’s growth and prosperity as we mark our 137th, we will continue to focus on creating value for all stakeholders. We’re building a solid foundation for ongoing progress as we bring the next generation of communications to Canadians everywhere. We greatly appreciate your support.

George A. Cope

President and Chief Executive Officer

BCE Inc. and Bell Canada

7

BCE INC. 2016 ANNUAL REPORT

STRATEGIC IMPERATIVE

Invest in

broadband networks

and services

It’s all about the networks, the essential links that connect Canadians to each other and the world. Fast broadband fibre and wireless networks are the core of Bell’s leadership in the marketplace, enabling growing customer usage and satisfaction across our services.

On any given day, Bell networks will connect 39 million wireless calls, deliver 10 million hours of CTV programming, 2 million iHeartRadio streams, 213 million visits to Google, 13 million videos on YouTube, 79 million emails, 151 million text messages, and 35 million tweets.

On that same day, 96 of the 100 largest Canadian enterprises will rely on Bell’s networks for the fast, safe and secure communications they need to compete, including access to co-location and other managed and professional services through Bell’s industry-leading roster of 27 data centres.

To meet the astounding growth in demand for bandwidth, Bell is driving broadband network innovation and investment with capital expenditures of $3.77 billion in 2016, far more than any communications company in Canada and on par with major investors in Canada’s oil and gas sector.

Growth accelerates wherever Bell lays fibre, and we are quickly expanding our broadband Fibe network, including our Gigabit Fibe Internet footprint in Ontario, Québec, Atlantic Canada and, soon, Manitoba. We are bringing our 4G LTE and LTE Advanced (LTE-A) mobile networks to more Canadians across the country, increasing capacity to meet the growing demand for data and enabling speeds up to 335 Megabits per second (Mbps) with typical speeds up to 100 Mbps.

Bell is also implementing four-carrier spectrum aggregation that will enable mobile speeds in select areas of up to 560 Mbps (typically up to 166 Mbps), and laying the groundwork for the next generation of wireless connectivity as Bell partnered with Nokia in 2016 to complete the first trial of 5G mobile technology in Canada.

Independent testing highlights benefits of Bell networks

In wireless, independent analyst PCMag ranked Bell’s 4G LTE network the fastest in Canada and significantly faster than US carriers in 2016. Our national 4G LTE network reached 97% of Canadians by the end of the year.

Two reports by the CRTC in 2016 showed Bell’s rapidly expanding broadband fibre network stood out for delivering the highest-quality Internet service in the country.

Based on data collected from more than 3,000 Canadian Internet users, the reports confirmed that

8

Bell’s direct fibre links exceeded advertised Internet download speeds by a greater margin than other Canadian providers, and that Fibre to the Home (FTTH) services like Fibe offer the best browsing and streaming experience.

Bell’s broadband Fibe service is available now to 8.3 million homes and businesses, including 2.9 million direct fibre connections. By the end of 2017, approximately one-third of homes and businesses inside Bell’s wireline footprint will be capable of accessing Gigabit Fibe service, the fastest Internet available, with download speeds of 1 Gigabit per second and more.

Accelerating our investment momentum

With the acquisition of MTS approved to move forward in 2017, Bell plans to invest $1 billion in broadband network infrastructure projects throughout Manitoba over the next 5 years.

Bell’s investments will bring major wireline and wireless expansions to Winnipeg’s Innovation Alley; to the remote but burgeoning ecotourism destination of Churchill, the Polar Bear Capital of the World; continuous broadband wireless coverage along Highway 75 in southern Manitoba; and the expansion of mobile and wireline broadband networks in northern Manitoba, including along Highway 6 to Thompson, in Flin Flon and in 5 small indigenous communities.

As part of our network innovation strategy, we announced a partnership with AT&T and Orange in 2016 to develop software-driven networks that transcend the need for specialized hardware such as switches and routers. These networks of the future will accelerate the IoT and support emerging services such as virtual reality, self-driving vehicles, connected homes and smart cities.

9

BCE INC. 2016 ANNUAL REPORT

STRATEGIC IMPERATIVE

Accelerate wireless

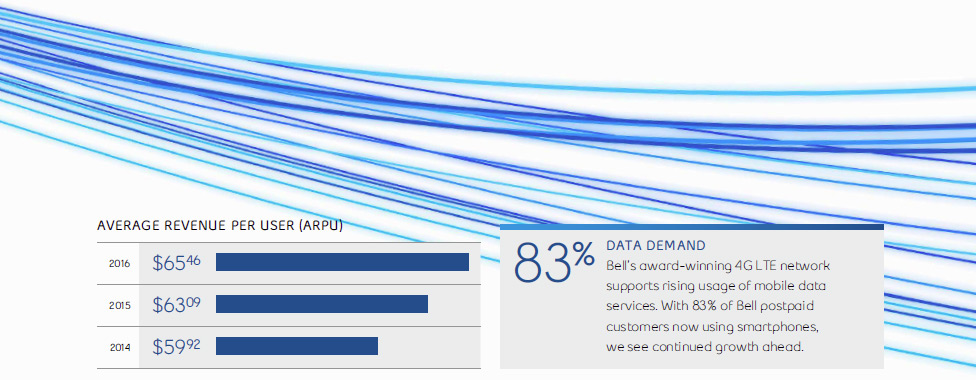

The fastest-ranked LTE network in the country took Bell wireless to the top of an intensely competitive mobile marketplace in 2016, leading the industry in net new postpaid customers, average revenue per customer, and growth in service revenue and adjusted EBITDA.

Top networks, product innovation and a focus on service are all critical to Bell’s leadership in the Canadian wireless marketplace. Distribution strength is also key to growth and Bell operates approximately 1,400 Bell-branded stores and The Source locations across every province and territory, significantly more than our competitors.

At Bell, Virgin Mobile and The Source stores, plus hundreds of WIRELESSWAVE, WIRELESS etc. and Tbooth wireless locations operated by Glentel, customers have their choice of the latest generation of smartphones from Apple, Samsung, HTC, ZTE, Motorola, Google, BlackBerry, Novatel, Sony, Sonim, LG and Alcatel. Our customers can also access a wide variety of tablets and other devices designed for data services, including machine-to-machine (M2M) communications for business applications.

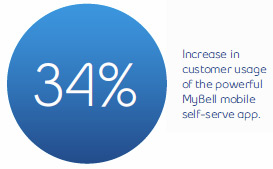

This sales and support network is backed up by a national customer care team enabled in 2016 by significant investments in IT support systems, training, simplified billing and our increasingly popular MyBell mobile self-serve app – which recorded more than 2.7 million transactions in 2016.

As the digital world becomes increasingly interconnected, our mobile customers are depending on their devices more than ever, and wherever they may travel.

In 2015, we introduced the popular Roam Better feature, which includes unlimited talk and text plus 100 MB of data per day for just $5 a day when in the US.

In 2016, we made Roam Better available for only $10 a day in 110 of the most popular destinations across Europe, the Caribbean, Bahamas, Bermuda, Mexico, Central and South America, Asia, Oceania, South Africa and the Middle East. Bell has our customers covered in more locations than any other Canadian competitor.

10

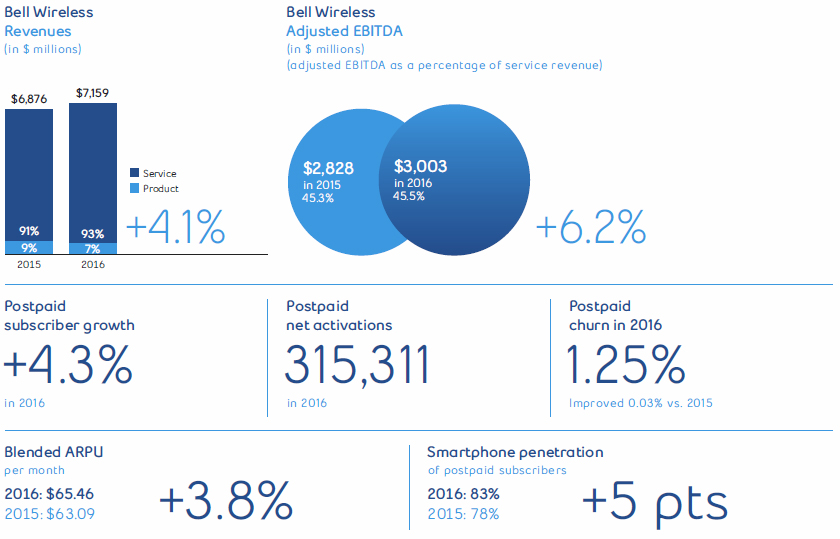

Bell Wireless delivered very strong financial results based on significant growth in new subscribers and ever-increasing mobile data usage as Canadians turn to their smartphones to manage their social interactions, finances, work and entertainment.

In 2016, we won the leading market share of net new postpaid subscribers among the top 3 competitors. For the full year, we added 315,311 net new postpaid customers, an 18.8% increase over the previous year. At the end of 2016, we served 7,690,727 postpaid customers, up 4.3% over 2015, and 8,468,872 including prepaid services.

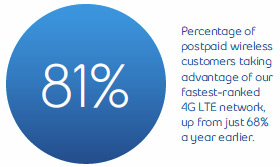

At year end, 83% of our postpaid subscribers were using smartphones, up from 78% at the start of the year. Similarly, 81% were taking advantage of the faster speeds of our expanding 4G LTE networks, up from just 68% a year earlier.

With the outstanding speeds of our 4G LTE and LTE-A networks, Bell customers can unlock the full potential of their smartphones.

This has propelled wireless data use – up 37% in 2016 – for everything from texting, gaming and Web browsing to watching live programming on more than 40 channels offered by Bell Mobile TV.

As recently as 5 years ago, Bell’s blended ARPU (combining both prepaid and postpaid customers) was approximately $5 a month lower than that of our nearest large competitor. By the end of 2016, we were generating higher usage and consequently more revenue per subscriber than either of our largest competitors.

Overall in 2016, Bell’s wireless revenue growth of 4.1% and adjusted EBITDA growth of 6.2%, even in the face of intense competitive discounting and promotional efforts, led the Canadian industry.

As wireless continues to be the primary driver of growth in communications in Canada and globally, Bell is staying well ahead with ongoing network development and innovation.

For example, we successfully tested 5G wireless technology with Nokia in 2016, a first in Canada, achieving speeds more than 6 times faster than those available today. Expected to be commercially available in 4 to 6 years, 5G provides more capacity for mobile broadcast video and IoT applications, including connected vehicles and city-wide IoT solutions.

11

BCE INC. 2016 ANNUAL REPORT

STRATEGIC IMPERATIVE

Leverage

wireline

momentum

Bell continues to provide Canadians with the newest TV and Internet innovations and the exclusive business services that make Bell #1 in broadband wireline communications in Canada.

Fibe TV remained Canada’s fastest-growing TV service in 2016 as more subscribers embraced the unmatched quality and exclusive services of the country’s best television experience, enhancing Bell’s lead as Canada’s #1 television provider.

Bell continued to unveil more of the exclusive television features that have made Fibe TV so popular, including the availability of the powerful Fibe TV app on Apple TV.

Bell continued to prove itself as an innovator on a global scale by announcing the world’s first fully wireless IPTV service with Fibe TV. The Fibe Wireless 4K personal video recorder (PVR) enables faster install times and gives customers the flexibility to place their TVs anywhere in the home without extra wires or cables.

Offering the largest recording capacity despite its small size, the Fibe Wireless 4K PVR offers up to 150 hours of 4K recording capacity, integrated 4K Netflix, and is ready for high dynamic range (HDR), the next evolution in broadcast technology. Customers also gained the opportunity to Own with Fibe, enabling them to purchase On Demand movies and enjoy them as many times as they want on Fibe.

Available to TV subscribers across the country and to any Canadian with an Internet connection, Bell Media’s unique CraveTV streaming service surpassed 1 million subscribers in 2016. Offering original Canadian content like the hit comedy series LETTERKENNY and thousands of hours of critically acclaimed programming from HBO, SHOWTIME and more of the biggest names in entertainment, CraveTV was growing as fast by the end of 2016 as it did after its launch in December 2014.

12

In 2016, the Internet outpaced TV to become the #1 connection for Canadians, with 50% of users streaming video at least once a day. To support fast-growing Internet usage and an explosion in the number of connected devices, Bell’s broadband fibre footprint expanded to reach approximately 8.3 million homes and businesses in 2016, providing the fastest broadband speeds and reliable technology necessary to support customer demands and the needs of Canada’s growing digital economy.

With 2016 Internet net additions of 85,099, Bell continues to lead the way in Internet services with 3,476,562 high-speed subscribers, the most of any provider in Canada.

Bell continued to provide unique value to Internet customers with the Home Hub 3000 residential gateway, Canada’s most powerful home Wi-Fi service with 12 antennas and exclusive tri-band technology, supporting multiple devices simultaneously and total throughput of up to 1 Gigabit. The average number of connected devices per home has more than doubled since 2013 and data usage by Bell Internet customers continues to climb – by 30% in 2016.

Virgin Mobile also introduced Home Internet in Ontario and Québec as a competitively priced high-speed option for youth and value-oriented customers, providing download speeds up to 25 Mbps and upload speeds up to 10 Mbps.

Canada’s business communications leader

2016 brought the expansion of Bell Total Connect to the small business sector, reflecting Bell’s commitment to enable the success of Canadian entrepreneurs and innovators.

Small businesses in Québec and Ontario can now benefit from the full suite of next-generation business communications services used by the largest enterprises, including seamless switching between mobile devices and desk phones, making it easy to work remotely and still maintain your business identity for outgoing calls.

Bell Business Markets closed 2016 with all 7 major Canadian banks running critical communications services on Bell’s unparalleled networks.

We also expanded Canada’s largest network of data centres by acquiring all remaining equity in Q9 Networks, further enabling Bell Business Markets’ leadership in data hosting services and cloud solutions.

Bell became the first Canadian provider to offer businesses access to Microsoft Azure ExpressRoute through Bell’s secure cloud connection, providing faster access, better reliability and unmatched security to enterprise customers.

Bell also entered an exclusive partnership with IBM as the only Canadian carrier to offer IBM MobileFirst for iOS apps, boosting the efficiency and productivity of mobile iOS devices for business users.

13

BCE INC. 2016 ANNUAL REPORT

STRATEGIC IMPERATIVE

Expand

media

leadership

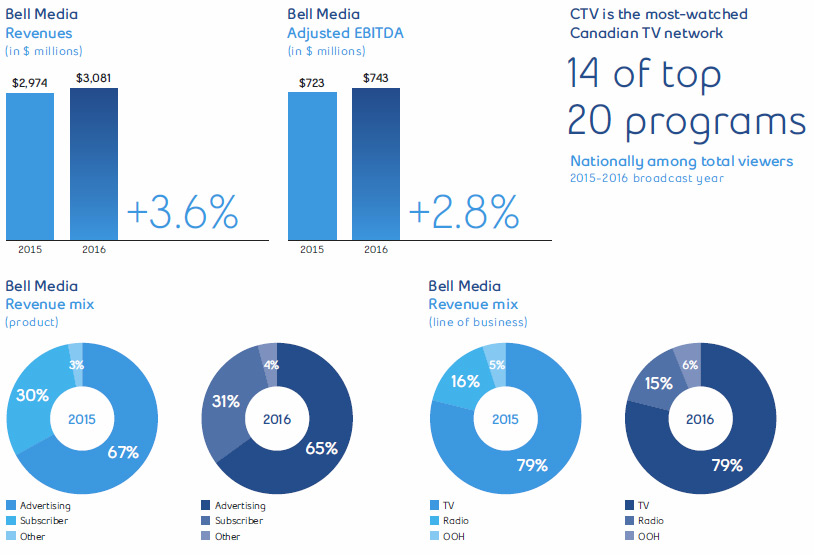

Bell Media is leveraging the scale of its cross-country media assets, innovation in emerging media platforms, and the best content from Canada and around the world to break new ground in multimedia communications.

The largest media company in Canada and an important part of communities nationwide, Bell Media operates the country’s widest range of broadcasting and other media assets: Canada’s largest private TV broadcaster with 30 conventional stations including CTV, the most-watched network in the country; 34 specialty and pay TV channels; 105 radio stations in 54 markets across the nation, tuned in by 17.1 million listeners for 77 million hours a week; the leading Canadian digital media properties, including TSN.ca and CTV.ca; and Astral Out of Home, with more than 30,000 advertising faces in strategic locations across Canada.

For the 13thstraight fall season, CTV was the #1 network among total viewers and all key adult demographics with 10 of the top 20 programs, more than all other competing networks combined, and Canada’s top newscast: CTV National News with Lisa LaFlamme.

Bell Media’s specialty and pay TV properties were reaching 83% of English specialty and pay TV viewers in the average week at year end, with 12 of the top 20 programs among key adult viewers. TSN, Discovery (the top entertainment specialty channel in primetime), Space and Bravo all ranked in the top 10 English-language specialty channels. Bell Media also launched Gusto in 2016, its first food and lifestyle specialty channel featuring an exclusive portfolio of original Canadian programming.

Committed to delivering the pay TV programming Canadians want the most, Bell Media became the sole provider of HBO Canada in 2016 and expanded the reach of The Movie Network (TMN) pay TV service nationally. We also partnered with 20thCentury Fox to deliver first-run theatrical movies for TMN subscribers, and with Warner Brothers to stream many of the year’s most-popular shows on CraveTV.

With a strong Québec presence, we also remain the leader in French-language specialty and pay TV, reaching 78% of all French-language TV viewers in the average week. We operate 5 of the top 10 French specialty and pay channels among key viewers: the RDS sports network, Canal D, Super Écran, Canal Vie and Z.

Sports programming continues to outperform across Bell Media’s conventional and specialty TV, radio and digital platforms. In the last quarter of 2016, total primetime viewership for TSN was up 11% over last year as more viewers tuned in Toronto Raptors, NFL and CFL games. The Major League Soccer (MLS) playoffs featuring Toronto FC produced the 3 most-watched MLS games in Canadian TV history, with 1.3 million viewers for the final game. TSN extended its broadcast deal with MLS in 2016 for another 5 years.

The annual IIHF World Junior Championship is a traditional Canadian favourite on TSN and RDS, and 17.2 million individual Canadians – nearly 50% of the population – tuned in to watch coverage during the international hockey tournament’s 11 days.

14

As with many segments of Canada’s communications industry, the media landscape is changing dramatically as evolving technologies enable consumers to explore new viewing and listening options.

Bell Media has embraced the innovation opportunity with Canada’s fast-growing video streaming service, CraveTV, and our TV Everywhere options, including CTV GO, TSN GO, RDS GO, Discovery GO and TMN GO, providing live and on-demand television content on smartphones, tablets and computers.

CraveTV’s mix of much-loved shows from major studios and original Canadian content such as the hugely popular LETTERKENNY series is continuing to accelerate growth of the streaming service. Initially launched through multiple TV providers in 2014, CraveTV became available to all Canadians with an Internet connection in 2016, driving the subscriber base to more than one million during the year. We also made CraveTV available as an app for Apple TV viewers.

iHeartRadio Canada

In October 2016, Bell Media brought the highly successful iHeartRadio brand to Canada. Our digital iHeartRadio Canada service offers instant access to all of Bell Media’s 105 radio stations across the country.

The free iHeartRadio Canada digital app adds more than 100 exclusive streaming channels featuring every musical genre as well as news/talk, sports and comedy offerings. By year end, the iOS and Android apps had been downloaded more than 600,000 times.

Astral Out of Home expansion

Astral Out of Home continued to expand its reach in 2016, beginning with the acquisition in January of Métromédia, which specializes in outdoor and digital advertising in Montréal subway stations, on city buses and in parking lots. The Astral team also won the exclusive rights to digital advertising at Toronto Pearson Airport, giving Bell a significant presence in 6 of Canada’s largest international airports.

And in early 2017, Bell Media acquired Cieslok Media, a Canadian heavyweight in large-format outdoor advertising with 120 high-profile displays – including the country’s biggest multimedia billboards at Yonge-Dundas Square in Toronto.

Bell Media excellence recognized

Bell Media’s commitment to excellence in programming earned Bell Media and its partners 37 Canadian Screen Awards, alongside Bell Media’s role in 19 film category wins.

Our ongoing leadership in creating and developing original Canadian content was reflected in awards for CTV National News with Lisa LaFlamme (best national news), CTV Vancouver (best local news), 19-2 (best drama), The Amazing Race Canada (best reality/competition series), Degrassi (best children’s or youth series) and The Marilyn Denis Show (best talk).

TSN received more awards than any sports broadcaster, including best live sports event for the FIFA Women’s World Cup.

15

BCE INC. 2016 ANNUAL REPORT

STRATEGIC IMPERATIVE

Improve

customer

service

Bell is transforming the service experience by simplifying the way we interact with our customers across a full range of communications services.

With close to 21 million customer connections – more than any other communications company in Canada – our strategy to improve satisfaction includes investing $850 million since 2012 in better tools and training for our call centre representatives and field technicians, improving our online self-serve tools and processes, and helping to ensure customers are connected faster.

Simplifying the customer experience

We appreciate that every customer’s time is valuable. That’s why Bell developed innovative new tools like Manage Your Appointment in 2016 that not only lets customers confirm their service call, but also provides key information including the technician’s name and approximate arrival time. In addition, technicians can now access a customer’s account history directly on their mobile device, further reducing the time it takes to connect to our services.

In 2016 Bell technicians arrived right on time for 97% of appointments, helping to drive a record 95% customer satisfaction rate. Our investments in service, along with process improvements in installation, mean we can reach customers faster with most service appointments now scheduled within 2 days of placing an order.

Business customers also benefited from service enhancements. By improving dispatch processes, we were able to deliver same day service for small businesses 73% of the time by the end of 2016, a 98% improvement since 2014. Because it’s crucial for our business customers to get up and running quickly, Bell has dedicated pages on Bell.ca for small business and enterprise clients, connecting customers directly to one of Bell’s specially trained business experts.

A simpler self-serve experience

As Canadians increasingly manage their services and pay their bills over a mobile device, our enhanced self-serve options give our customers more control over their accounts than ever before.

Users of the MyBell app can access a redesigned and simplified bill any time, track their data use, pay a bill or change account features, including travel add-ons like Roam Better.

For Mobility customers, Bell revamped our entire welcome strategy from the time of sale to beyond the first bill in order to make sure customers have the easiest way to get the right information at the right time.

16

This covers everything from an in-store checklist to the Bell Mobility Interactive tour – a customized video for new wireless customers explaining their first bill, how to check usage, and how to add new features.

These innovations are generating positive results. Transactions on our MyBell app increased 34% compared to last year while the volume of calls to our service centres fell by 4 million.

This not only reduces the costs of serving a growing customer base, it also enables our representatives to spend more time with the customers who call in.

A further measure of our progress is a reduction of complaints lodged with the federal Commissioner for Complaints for Telecommunications Services (CCTS). After a steady decline in complaints in each of the last 3 years, in 2016, complaints to CCTS about Bell fell 18%.

Meeting the needs of all our customers

Bell has taken steps over the past several years to make it easier for Canadians with physical, speech, cognitive, hearing, and vision-related challenges to access our advanced communications products and services. In 2016, we upgraded our Accessibility Services Centre on Bell.ca, with improved navigation when using screen readers and keyboards. The site meets internationally recognized Web Content Accessibility Guidelines and also features a new mobile device selector, making it easier to find devices with specific accessibility features such as hearing aid compatibility and screen magnification.

There’s also the Mobile Accessibility app, a screen reader app to assist low-vision and blind users that’s complimentary for all Bell Mobility customers with an Android device. To support Canadians who are deaf or hard of hearing, Bell introduced a dedicated wireless rate plan that eliminates unnecessary voice minutes.

Bell has invested approximately $25 million in accessibility initiatives such as Text with 9-1-1 service, enabling customers with speech or hearing impairment to communicate with emergency services, and Video Relay Service (VRS), which facilitates real-time sign-language interpretation of telephone conversations.

Expanding our reach

Bell is continuing to expand and enhance our network of retail outlets which includes about 1,400 Bell-branded stores and The Source locations across the country, plus several hundred locations of Glentel, 50% owned by Bell, operating under such brands as WIRELESSWAVE and WAVE SANS FIL.

With highly trained front-line retail staff and ongoing enhancements to store design, including a recent upgrade to the accessories section at Bell’s flagship store at the Toronto Eaton Centre, our retail customer experience is unparalleled.

Improving customer service is critical to achieving Bell’s goal of being recognized by customers as Canada’s leading communications company. Our results show that customers are embracing our online self-serve and mobile apps, making fewer calls to our service centres and are more satisfied than ever before. We’re committed to building on our strong service momentum in 2017.

17

BCE INC. 2016 ANNUAL REPORT

STRATEGIC IMPERATIVE

Achieve a

competitive

cost structure

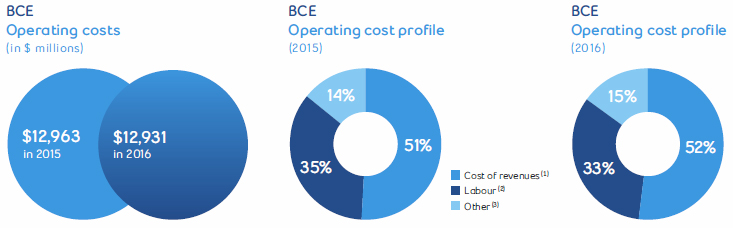

Focused on achieving best-in-class operating efficiencies, Bell puts a high priority on controlling costs in order to enhance our ability to invest in growth-generating infrastructure and innovation, and maximize value to our customers in a competitive marketplace.

With a close eye on any discretionary spending, we minimize business travel whenever possible by employing the same teleconferencing and videoconferencing productivity tools we offer to other companies. It’s a strategy that helps improve productivity as team members reduce time on the road between Bell’s many locations across the country and gain time in the office and at home.

In 2016, we continued to find savings from the integration of Bell Aliant and from adjusting our workforce as our business evolves, expanding in high-growth broadband services and reducing in declining traditional lines of business.

Our wireline segment reduced costs by 2.7% in 2016, supporting the second straight year of growth in adjusted EBITDA and continued improvement in Bell’s North American-leading wireline EBITDA margin.

Customer operations also delivered significant productivity savings. By investing heavily in online and mobile customer self-serve options, we have reduced higher-cost calls to our service centres significantly, by 4 million in 2016.

We have also invested in productivity technology for our installation and service technicians, enabling significant gains in their ability to get the job done right on the first visit – cutting truck rolls by 100,000 in 2016 while achieving record customer satisfaction scores. The new Appointment Manager tool has reduced the number of times our technicians find no one home at the appointed time by 27%.

In 2016 we significantly reduced our cost of borrowing, obtaining the lowest-ever financing rate on MTN debentures that will be used to repay debt and fund investments.

Everyone at Bell is involved in driving a more competitive cost structure at our company, reducing waste and expenses while maximizing productivity and strategic investment. It’s a critical imperative as Bell leads the way in investing in Canada’s broadband communications future.

18

CORPORATE RESPONSIBILITY

Bell’s corporate responsibility focus considers the community, environmental and broad economic impact of all our business operations. We work to safeguard privacy, foster a diverse workplace and ensure environmental sustainability, participating in respected Canadian and international bodies that benchmark our performance against peer companies here and around the world.

This includes community investment leadership with Bell Let’s Talk and other initiatives such as United Way Centraide and the Canadian Centre for Child Protection. Our employees and retirees also contributed $2.2 million in charitable gifts through the Bell Employee Giving Program and more than 336,000 hours of personal volunteer time.

Bell was again recognized as Canada’s top communications company in corporate sustainability and environmental performance in Newsweek’s 2016 international ranking of the world’s Top Green Companies.

Bell was named one of the Top 50 Socially Responsible Corporations by Maclean’s and L’Actualité, and one of the Best 50 Corporate Citizens in Canada by Corporate Knights. Workforce diversity was a key factor in Bell being recognized as one of Canada’s Top 100 Employers in 2016.

To learn more about these initiatives, please see the Bell Corporate Responsibility Report at BCE.ca.

19

BCE INC. 2016 ANNUAL REPORT

COMMUNITY INVESTMENT

Bell Let’s Talk:

Record engagement in

Canada’s mental health cause

Bell Let’s Talk fights the stigma around mental illness while funding mental healthcare, research and workplace initiatives across Canada.

Bell’s initiative is having a direct and positive impact on perceptions of mental illness, reflected in recent data from Nielsen outlining that most Canadians are more aware of mental health issues than 6 years ago and think that progress is being made.

Significantly, 82% of Canadians (and 88% of young people) believe attitudes towards mental illness have changed for the better, up from 70% last year. At the same time, 72% (76% of young people) believe stigma has been reduced, up from just 57% the year before.

Canadians everywhere join the fight against the stigma

Reducing the stigma around mental illness is critical to making progress in mental health, because too many who struggle won’t seek the help they need because of fear or embarrassment. Bell Let’s Talk Day has played a key role in growing both awareness and action by sparking a renewed cross-Canada mental health conversation each year.

Bell Let’s Talk Day 2017 on January 25 achieved all-new records for engagement in the national mental health discussion – 131,705,010 social media interactions and texts, mobile calls and long distance calls by Bell customers.

Because Bell donates 5 cents for each interaction on Bell Let’s Talk Day at no extra charge to participants, our funding for Canadian mental health grew by $6,585,250.50. Added to the results of the previous 6 Bell Let’s Talk Days plus Bell’s original $50-million anchor donation, Bell’s total funding commitment is now $86,504,429.05 – well on the way to our target of at least $100 million in 2020.

Social media interaction on Bell Let’s Talk Day almost tripled in 2017 thanks to the addition of Snapchat and Instagram support, on top of Twitter and Facebook. #BellLetsTalk was once again the top Twitter trend in Canada and worldwide, and the new Bell Let’s Talk Snapchat geofilter was the social media platform’s most-used filter ever in Canada for one day.

Again on Bell Let’s Talk Day, political leaders, royalty, sports heroes, corporations and competitors, entertainers and other celebrities embraced the cause, driving unprecedented social media engagement from millions of fans in Canada and around the world.

More than 20,000 student-athletes at 54 universities helped lead the Bell Let’s Talk Day conversation on campuses, and more than 100 university sports games across the country were part of the campaign.

Student-athletes also led the charge on Canada’s largest-ever Thunderclap, the social media crowdspeaking platform that allows a single message to be shared en masse. With 5,479 people registered and a social reach of 6,003,469, the Bell Let’s Talk Day Thunderclap was the biggest ever for mental health worldwide.

20

The Bell Let’s Talk team thanks the hundreds of Canadian corporations, hospitals and universities, governments, the Canadian Armed Forces, professional sports teams and associations, community and mental health partners, chambers of commerce, and schools, colleges and universities that joined the conversation on Bell Let’s Talk Day through events, promotions and advertising, social media, newsletters and websites.

Bell Let’s Talk funding at work

While Bell Let’s Talk Day is the highest-profile part of the initiative, Bell’s funding helps move Canada’s mental health forward every day of the year.

Bell Let’s Talk has supported hundreds of organizations in every region of the country since 2010, which have in turn provided direct mental health assistance to at least 1.5 million Canadians.

This includes front-line organizations supporting mental health at the community level. The Bell Let’s Talk Community Fund announced grants of $5,000 to $25,000 for 72 more community groups all around Canada in 2016, bringing the total number of groups supported by the Fund since it was launched in 2011 to 345.

Bell extended its $1 million partnership with the True Patriot Love Foundation in 2016 for another 4 years, supporting mental health services for Canadian Armed Forces members, their families and veterans.

Bell Let’s Talk supports research projects and improved access to care at major healthcare institutions and universities. In 2016, Bell donated $1 million to renew the Bell Canada Mental Health and Anti-Stigma Research Chair at Queen’s University, including the re-appointment of Dr. Heather Stuart, inaugural holder of the world’s first anti-stigma research chair, for another 5 years.

A new $250,000 donation to McGill University’s Montréal Neurological Institute and Hospital is funding the development of online resources focused on the mental health needs of multicultural communities.

Funding from Bell Let’s Talk is accelerating government support for mental health initiatives. A $1 million gift to Strongest Families Institute is being matched by all 4 Atlantic provinces to improve mental health services for about 2,000 children.

A $300,000 Bell Let’s Talk donation to improve access to care at 2 health foundations in Québec’s Lanaudière region is being matched by the government of Québec.

As part of its multi-year, $1 million fund for Canada’s Northern territories, Bell Let’s Talk has also committed $250,000 for a counter-suicide safeTALK program to be delivered by Nunavut’s Embrace Life Council.

Bell Let’s Talk is supporting the integration of mental health training in standard and emergency first aid courses with a $150,000 donation to St. John Ambulance. Available nationally next year, the courses will be offered in workplaces, hospitals, schools and communities and teach participants what to do in an emergency, including how to recognize high-risk situations and when to escalate a mental health situation to professionals.

21

BCE INC. 2016 ANNUAL REPORT

BELL ARCHIVES

Celebrating Canada 150

and Bell’s role in our

nation’s development

Canada was barely a teenager, just 13 years old, when Bell Canada was founded in 1880 in Montréal. Ever since, the growth of the country and our company has been entwined as Bell’s networks, communications services and media properties have woven Canadians and their stories together.

As Canada marks 150 years of Confederation, and Montréal celebrates its own 375thanniversary, we took a look through Bell’s archives for some interesting history…

First coast-to-coast radio broadcast

To mark the 1927 Diamond Jubilee of Confederation, Bell led the engineering for the first-ever coast-to-coast radio broadcast, from Halifax to Vancouver. This involved connecting 23 radio stations nationally as well as the installation of loudspeakers in stadiums, parks and other public places so that people without radios could listen in to the broadcast by Prime Minister William Lyon Mackenzie King and hear the inaugural ringing of the Peace Tower Carillion on Parliament Hill.

The radio stations involved included 2 that are part of Bell Media’s network of 105 news, sports and music radio properties nationwide: CFRB, now Bell Media’s Newstalk 1010 in Toronto, and CKOC in Hamilton, Ontario, Canada’s oldest continuously operating radio station and now TSN Hamilton 1150.

Bell helps Expo 67 welcome the world

Canada marked its Centennial 40 years later, and Bell was the lead player in the creation of one of the most popular attractions at Expo 67: the Telephone Association of Canada pavilion. Crowds waited in long lines to see the ground breaking Circle-Vision 360° film called Canada 67, and try “picturephones” to see who they were talking to.

Canada 150

Bell is sponsoring celebrations in the nation’s capital as our broadband networks and media properties provide unprecedented access to Canada 150 festivities across multiple platforms and screens.

Bell is powering the Ottawa 2017 travelling kiosk and experiential mobile app, and creating a special multimedia experience in the capital city’s underground LRT system. Bell Media’s national reach ensures Canadians everywhere can join in the nation’s big birthday party.

Bell’s Annual General Meeting of Shareholders will also take place on April 26 at Ottawa’s National Gallery of Canada to mark Canada 150.

22

Bell Media will also employ its television, radio, outdoor and digital properties to promote the country’s anniversary throughout the year – which includes Canada In A Day, a CTV special this summer that was created entirely from videos made by people nationwide in a single day.

Showcasing Bell history

To highlight Bell’s important role in Montréal as the city celebrates its 375thanniversary in 2017, we’re mounting a year-long exhibition of our history at the Pointe-à-Callière Montréal Archaeology and History Complex.

Detailing the impact of Alexander Graham Bell’s invention on our country’s growth and cultural development,Hello Montréal!features 250 artifacts from the Bell archives presented in a fun and compelling way for people of all ages.

23

| Table of contents |

| Management’s discussion and analysis | 26 | ||

| 1 | Overview | 27 | |

| 1.1 | Introduction | 27 | |

| 1.2 | About BCE | 29 | |

| 1.3 | Key corporate developments | 33 | |

| 1.4 | Capital markets strategy | 34 | |

| 1.5 | Corporate governance and risk management | 36 | |

| 2 | Strategic imperatives | 39 | |

| 2.1 | Accelerate wireless | 39 | |

| 2.2 | Leverage wireline momentum | 39 | |

| 2.3 | Invest in broadband networks and services | 40 | |

| 2.4 | Expand media leadership | 41 | |

| 2.5 | Improve customer service | 42 | |

| 2.6 | Achieve a competitive cost structure | 42 | |

| 3 | Performance targets, outlook, assumptions and risks | 43 | |

| 3.1 | 2016 performance vs. guidance targets | 43 | |

| 3.2 | Business outlook and assumptions | 43 | |

| 3.3 | Principal business risks | 44 | |

| 4 | Consolidated financial analysis | 46 | |

| 4.1 | Introduction | 46 | |

| 4.2 | Customer connections | 47 | |

| 4.3 | Operating revenues | 48 | |

| 4.4 | Operating costs | 49 | |

| 4.5 | Net earnings | 50 | |

| 4.6 | Adjusted EBITDA | 50 | |

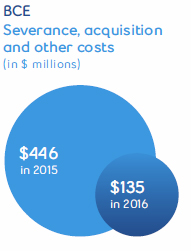

| 4.7 | Severance, acquisition and other costs | 51 | |

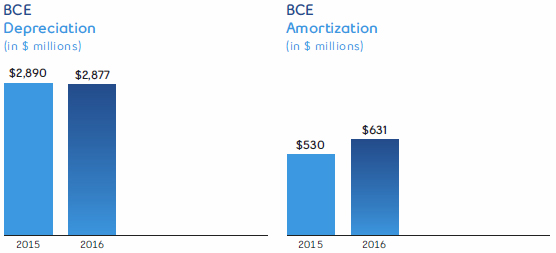

| 4.8 | Depreciation and amortization | 51 | |

| 4.9 | Finance costs | 52 | |

| 4.10 | Other income (expense) | 52 | |

| 4.11 | Income taxes | 53 | |

| 4.12 | Net earnings attributable to common shareholders and EPS | 53 | |

| 4.13 | Capital expenditures | 54 | |

| 4.14 | Cash flows | 54 | |

| 5 | Business segment analysis | 55 | |

| 5.1 | Bell Wireless | 55 | |

| 5.2 | Bell Wireline | 62 | |

| 5.3 | Bell Media | 70 | |

| 6 | Financial and capital management | 76 | |

| 6.1 | Net debt | 76 | |

| 6.2 | Outstanding share data | 76 | |

| 6.3 | Cash flows | 77 | |

| 6.4 | Post-employment benefit plans | 79 | |

| 6.5 | Financial risk management | 79 | |

| 6.6 | Credit ratings | 82 | |

| 6.7 | Liquidity | 82 | |

| 7 | Selected annual and quarterly information | 85 | |

| 7.1 | Annual financial information | 85 | |

| 7.2 | Quarterly financial information | 87 | |

| 8 | Regulatory environment | 90 | |

| 9 | Business risks | 95 | |

| 10 | Financial measures, accounting policies and controls | 102 | |

| 10.1 | Our accounting policies | 102 | |

| 10.2 | Non-GAAP financial measures and key performance indicators (KPIs) | 106 | |

| 10.3 | Effectiveness of internal controls | 109 | |

| Reports on internal control | 110 | |

| Management’s report on internal control over financial reporting | 110 | |

| Report of independent registered public accounting firm | 111 | |

| Consolidated financial statements | 112 | |

| Management’s responsibility for financial reporting | 112 | |

| Report of independent registered public accounting firm | 113 | |

| Consolidated income statements | 114 | |

| Consolidated statements of comprehensive income | 114 | |

| Consolidated statements of financial position | 115 | |

| Consolidated statements of changes in equity | 116 | |

| Consolidated statements of cash flows | 117 | |

| Notes to consolidated financial statements | 118 | |

| Note 1 | Corporate information | 118 |

| Note 2 | Significant accounting policies | 118 |

| Note 3 | Business acquisitions and dispositions | 127 |

| Note 4 | Segmented information | 129 |

| Note 5 | Operating costs | 131 |

| Note 6 | Severance, acquisition and other costs | 131 |

| Note 7 | Interest expense | 132 |

| Note 8 | Other income (expense) | 132 |

| Note 9 | Income taxes | 133 |

| Note 10 | Earnings per share | 134 |

| Note 11 | Trade and other receivables | 135 |

| Note 12 | Inventory | 135 |

| Note 13 | Property, plant and equipment | 135 |

| Note 14 | Intangible assets | 137 |

| Note 15 | Investments in associates and joint ventures | 138 |

| Note 16 | Other non-current assets | 138 |

| Note 17 | Goodwill | 138 |

| Note 18 | Trade payables and other liabilities | 139 |

| Note 19 | Debt due within one year | 139 |

| Note 20 | Long-term debt | 140 |

| Note 21 | Provisions | 141 |

| Note 22 | Post-employment benefit plans | 142 |

| Note 23 | Other non-current liabilities | 146 |

| Note 24 | Financial and capital management | 146 |

| Note 25 | Share capital | 150 |

| Note 26 | Share-based payments | 151 |

| Note 27 | Commitments and contingencies | 154 |

| Note 28 | Related party transactions | 154 |

| Note 29 | Significant partly-owned subsidiaries | 155 |

| Board of directors | 156 | |

| Executives | 157 | |

| Investor information | 158 | |

BCE Inc. 2016 ANNUAL REPORT 25 | |||

MD&A | |||

| Management’s discussion and analysis |

In this management’s discussion and analysis of financial condition and results of operations (MD&A),we,us,our,BCE andthe companymean, as the context may require, either BCE Inc. or, collectively, BCE Inc., Bell Canada, their subsidiaries, joint arrangements and associates.Bellmeans, as the context may require, either Bell Canada or, collectively, Bell Canada, its subsidiaries, joint arrangements and associates.

All amounts in this MD&A are in millions of Canadian dollars, except where noted. Please refer to section 10.2,Non-GAAP financial measures and key performance indicators (KPIs)on pages 106 to 109 for a list of defined non-GAAP financial measures and key performance indicators.

Please refer to BCE’s audited consolidated financial statements for the year ended December 31, 2016 when reading this MD&A.

In preparing this MD&A, we have taken into account information available to us up to March 2, 2017, the date of this MD&A, unless otherwise stated.

You will find additional information relating to BCE, including BCE’s audited consolidated financial statements for the year ended December 31, 2016, BCE’s annual information form for the year ended December 31, 2016, dated March 2, 2017 (BCE 2016 AIF) and recent financial reports, on BCE’s website atBCE.ca, on SEDAR atsedar.comand on EDGAR atsec.gov.

This MD&A comments on our business operations, performance, financial position and other matters for the two years ended December 31, 2016 and 2015.

| CAUTION REGARDING FORWARD-LOOKING STATEMENTS |

BCE’s 2016 annual report, including this MD&A and, in particular, but without limitation, section 1.3,Key corporate developments, section 1.4, Capital markets strategy, section 2,Strategic imperatives, section 3.2,Business outlook and assumptions, section 5,Business segment analysisand section 6.7,Liquidityof this MD&A, contains forward-looking statements. These forward-looking statements include, but are not limited to, statements relating to BCE’s 2017 annualized common share dividend and common share dividend payout policy, the expected improvement of BCE’s net debt leverage ratio and return thereof within BCE’s target range, the sources of liquidity we expect to use to meet our anticipated 2017 cash requirements, our expected 2017 post-employment benefit plans funding, our network deployment and capital investment plans, the expected timing and completion of the proposed acquisition of Manitoba Telecom Services Inc. (MTS) and of the proposed divestitures to TELUS Corporation through one or more of its subsidiaries (collectively, the TELUS Group) and Xplornet Communications Inc. (Xplornet) of certain assets, certain synergies and other benefits expected to result from the proposed acquisition of MTS, and BCE’s business outlook, objectives, plans and strategic priorities. Forward-looking statements also include any other statements that do not refer to historical facts. A statement we make is forward-looking when it uses what we know and expect today to make a statement about the future. Forward-looking statements are typically identified by the wordsassumption,goal,guidance,objective,outlook,project,strategy,targetand other similar expressions or future or conditional verbs such asaim,anticipate,believe,could,expect,intend,may,plan,seek,should,striveandwill. All such forward-looking statements are made pursuant to the safe harbour provisions of applicable Canadian securities laws and of the United StatesPrivate Securities Litigation Reform Act of 1995.

Unless otherwise indicated by us, forward-looking statements in BCE’s 2016 annual report, including in this MD&A, describe our expectations as at March 2, 2017 and, accordingly, are subject to change after that date. Except as may be required by Canadian securities laws, we do not undertake any obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Forward-looking statements, by their very nature, are subject to inherent risks and uncertainties and are based on several assumptions, both general and specific, which give rise to the possibility that actual results or events could differ materially from our expectations expressed in, or implied by, such forward-looking statements and that our business outlook, objectives, plans and strategic priorities may not be achieved. As a result, we cannot guarantee that any forward-looking statement will materialize and we caution you against relying on any of these forward-looking statements. Forward-looking statements are presented in BCE’s 2016 annual report, including in this MD&A, for the purpose of assisting investors and others in understanding our objectives, strategic priorities and business outlook as well as our anticipated operating environment. Readers are cautioned, however, that such information may not be appropriate for other purposes.

We have made certain economic, market and operational assumptions in preparing the forward-looking statements contained in BCE’s 2016 annual report and, in particular, but without limitation, the forward-looking statements contained in the previously-mentioned sections of this MD&A. These assumptions include, without limitation, the assumptions described in the various sections of this MD&A entitledBusiness outlook and assumptions, which sections are incorporated by reference in this cautionary statement. We believe that our assumptions were reasonable at March 2, 2017. If our assumptions turn out to be inaccurate, our actual results could be materially different from what we expect.

Important risk factors including, without limitation, regulatory, competitive, economic, financial, operational, technological and other risks that could cause actual results or events to differ materially from those expressed in, or implied by, the previously-mentioned forward-looking statements and other forward-looking statements contained in BCE’s 2016 annual report, and in particular in this MD&A, include, but are not limited to, the risks described or referred to in section 9,Business risks, which section is incorporated by reference in this cautionary statement.

We caution readers that the risks described in the previously-mentioned section and in other sections of this MD&A are not the only ones that could affect us. Additional risks and uncertainties not currently known to us or that we currently deem to be immaterial may also have a material adverse effect on our financial position, financial performance, cash flows, business or reputation. Except as otherwise indicated by us, forward-looking statements do not reflect the potential impact of any special items or of any dispositions, monetizations, mergers, acquisitions, other business combinations or other transactions that may be announced or that may occur after March 2, 2017. The financial impact of these transactions and special items can be complex and depends on facts particular to each of them. We therefore cannot describe the expected impact in a meaningful way, or in the same way we present known risks affecting our business.

| 26 BCE Inc. 2016 ANNUAL REPORT | |||

| 1 | Overview | MD&A | |

| 1 Overview |

| 1.1 Introduction |

At a glance

BCE is Canada’s largest communications company, providing residential, business and wholesale customers with a wide range of solutions for all their communications needs. BCE’s shares are publicly traded on the Toronto Stock Exchange and on the New York Stock Exchange (TSX, NYSE: BCE).

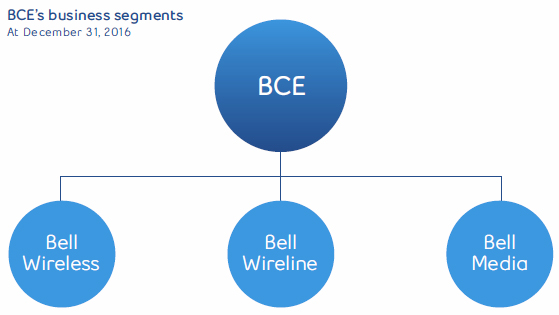

Our results are reported in three segments: Bell Wireless, Bell Wireline and Bell Media.

Bell Wireless provides wireless voice and data communications products and services to our residential, small and medium-sized business and large enterprise customers across Canada.

Bell Wireline provides data, including Internet access and Internet protocol television (IPTV), local telephone, long distance, as well as other communications services and products to our residential, small and medium-sized business and large enterprise customers, primarily in Ontario, Québec and the Atlantic provinces, while satellite television (TV) service and connectivity to business customers are available nationally across Canada. In addition, this segment includes our wholesale business, which buys and sells local telephone, long distance, data and other services from or to resellers and other carriers.

Bell Media provides conventional, specialty and pay TV, digital media, radio broadcasting services and out-of-home (OOH) advertising services to customers nationally across Canada.

BCE is Canada’s

largest communications company

We also hold investments in a number of other assets, including:

BCE Inc. 2016 ANNUAL REPORT 27 | |||

| 1 | Overview | MD&A | |

| BCE consolidated results |

| BCE customer connections |

| Our goal |

Our goal is to be recognized by customers as Canada’s leading communications company. Our primary business objectives are to grow our subscribers profitably and to maximize revenues, operating profit, free cash flow and return on invested capital by further enhancing our position as the foremost provider in Canada of comprehensive communications services to residential, business and wholesale customers and as Canada’s premier content creation company. We seek to take advantage of opportunities to leverage our networks, infrastructure, sales channels, and brand and marketing resources across our various lines of business to create value for both our customers and other stakeholders.

Our strategy is centred on our disciplined focus and execution of six strategic imperatives. The six strategic imperatives that underlie BCE’s business plan are:

| (1) | Adjusted EBITDA, adjusted net earnings and free cash flow are non-GAAP financial measures and do not have any standardized meaning under International Financial Reporting Standards (IFRS). Therefore, they are unlikely to be comparable to similar measures presented by other issuers. See section 10.2,Non-GAAP financial measures and key performance indicators (KPIs) – Adjusted EBITDA and adjusted EBITDA margin, Adjusted net earnings and adjusted EPSandFree cash flow and dividend payout ratiofor more details, including reconciliations to the most comparable IFRS financial measure. |

| 28 BCE Inc. 2016 ANNUAL REPORT | |||

| 1 | Overview | MD&A | |

| 1.2 About BCE |

We report the results of our operations in three segments: Bell Wireless, Bell Wireline and Bell Media. We describe our product lines by segment below, to provide further insight into our operations.

| Our products and services |

Bell Wireless

SEGMENT DESCRIPTION

|

OUR NETWORKS AND REACH

We hold licensed national wireless spectrum, with holdings across various spectrum bands, totalling more than 4,500 million Megahertz (Mhz) per Population (MHz-pop), corresponding to a weighted-average of approximately 135 MHz-pop of spectrum across Canada.

The vast majority of our cell towers are connected by fibre, the latest in network infrastructure technology, for a more reliable connection.

We have deployed and operate a number of leading nationwide wireless broadband networks compatible with global standards that deliver high-quality and reliable voice and high-speed data services to virtually all of the Canadian population.

OUR PRODUCTS AND SERVICES

BCE Inc. 2016 ANNUAL REPORT 29 | |||

| 1 | Overview | MD&A | |

Bell Wireline

SEGMENT DESCRIPTION

|

OUR NETWORKS AND REACH

OUR PRODUCTS AND SERVICES

RESIDENTIAL

BUSINESS

| 30 BCE Inc. 2016 ANNUAL REPORT | |||

| 1 | Overview | MD&A | |

Bell Media

SEGMENT DESCRIPTION

|

OUR ASSETS AND REACH

TV

RADIO

OOH ADVERTISING

DIGITAL MEDIA

BROADCAST RIGHTS

OTHER ASSETS

OUR PRODUCTS AND SERVICES

BCE Inc. 2016 ANNUAL REPORT 31 | |||

| 1 | Overview | MD&A | |

Other BCE investments

BCE also holds investments in a number of other assets, including:

|

| Our people |

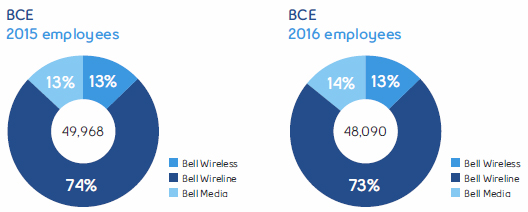

EMPLOYEES

At the end of 2016, our team included 48,090 employees dedicated to driving shareholder return and improving customer service.

The total number of BCE employees at the end of 2016 decreased by 1,878 employees compared to the end of 2015, due primarily to workforce reductions across our Bell Wireline and Bell Wireless segments attributable to normal attrition, retirements and productivity improvements.

Approximately 44% of total BCE employees are represented by labour unions.

BELL CODE OF BUSINESS CONDUCT

The ethical business conduct of our people is core to the integrity with which we operate our business. The Bell Code of Business Conduct sets out specific expectations and accountabilities, providing employees with practical guidelines to conduct business in an ethical manner. Our commitment to the Code of Business Conduct is renewed by employees each year in an ongoing effort to ensure that all employees are aware of, and adhere to, Bell’s standards of conduct.

| 32 BCE Inc. 2016 ANNUAL REPORT | |||

| 1 | Overview | MD&A | |

| 1.3 Key corporate developments |

MTS acquisition expected to close on March 17

On February 15, 2017, Innovation, Science and Economic Development Canada (ISED) and the Competition Bureau approved BCE’s $3.9 billion acquisition of MTS originally announced on May 2, 2016. The combined companies’ Manitoba operations will be known as Bell MTS. These approvals, together with the Canadian Radio-television and Telecommunications Commission’s (CRTC) approval on December 20, 2016, under theBroadcasting Act, of the transfer of the broadcasting distribution undertaking (BDU) licence held by MTS to BCE, completed all regulatory approvals required to close the transaction. MTS shareholders approved BCE’s acquisition of MTS at a special shareholders meeting held on June 23, 2016 and the Manitoba Court of Queen’s Bench issued a final order approving the acquisition on June 29, 2016. Subject to certain closing conditions and termination rights, this transaction is expected to close on March 17, 2017.

The transaction will be completed through a plan of arrangement under which BCE will acquire all of the issued and outstanding common shares of MTS for $40 per share, which will be paid 55% through the issuance of BCE common shares and 45% in cash. The cash component will be funded through debt financing (Refer to section 6.7,Liquidity, for more details) and BCE will issue approximately 28 million common shares for the equity portion of the transaction. If the transaction does not close under certain circumstances BCE may be liable to pay a break fee of $200 million to MTS.

The acquisition of MTS, which is expected to be accretive to BCE’s revenue, adjusted EBITDA and free cash flow, will allow us to reach more Canadians through the expansion of our wireless and wireline broadband networks while supporting our goal of being recognized by customers as Canada’s leading communications company.

As part of a consent agreement with the Competition Bureau, BCE has agreed to divest approximately one-quarter of MTS’ postpaid wireless subscribers and 13 retail locations to the TELUS Group for total proceeds of approximately $300 million, subject to final adjustments. Subject to certain closing conditions and termination rights, this transaction is expected to close on April 1, 2017. The $75 million break fee that was payable by BCE to the TELUS Group if the transaction with the TELUS Group did not close under certain circumstances is no longer applicable given the receipt of all regulatory approvals.

As part of the previously mentioned consent agreement, BCE has also agreed to transfer to Xplornet a total of 40 MHz of 700 MHz, Advanced Wireless Services-1 (AWS-1) and 2500 MHz wireless spectrum currently held by MTS, which has also been approved by ISED; 24,700 wireless customers once Xplornet launches its mobile wireless service; and five retail outlets in Winnipeg and one in Brandon. Xplornet will receive transitional remedy network access from Bell MTS in urban areas of Manitoba for three years and other operational benefits as Xplornet builds out its own wireless network in Manitoba. Subject to certain closing conditions and termination rights, this transaction is expected to close on March 17, 2017.

| Acquisition of Q9 Networks Inc. (Q9) |

On October 3, 2016, BCE acquired all equity it did not already own in Q9, a Toronto-based data centre operator providing outsourced hosting and other data solutions to Canadian business and government customers. Q9 had previously been acquired in October 2012 by an investor group comprised of BCE, Ontario Teachers’ Pension Plan Board, Providence Equity Partners LLC and funds managed by Madison Dearborn Partners LLC. BCE held a 35.4% stake in Q9 and has acquired the remaining 64.6% equity interest from its fellow investors. The transaction was valued at approximately $680 million, including Q9 net debt but excluding BCE’s prior ownership interest. The acquisition supports BCE’s ability to compete against domestic and international providers in the growing outsourced data services sector.

| Recognition of Bell’s environmental leadership |

United States magazine Newsweek once again recognized Bell’s environmental leadership by naming it on its annual list of the top green companies in the world. Bell placed 110th on the newsmagazine’s 2016 list of 500 publicly traded international companies and is the only Canadian communications provider on the list. Bell ranked sixth out of the 16 Canadian companies recognized for 2016. The first telecommunications company in Canada to achieve the highest level certification for its environmental management system (ISO 14001), Bell continuously seeks to reduce the environmental impact of its operations across its networks, Information Technology (IT) infrastructure, buildings and service fleet. In 2016, we made progress in a number of areas, reducing electricity by about 26 gigawatt hours and generating about 450,000 kilowatt hours (kWh) of renewable energy from solar and wind power sources. We also reduced fuel consumption by about 3 million litres due in part to our investment in more than 1,000 new fuel-efficient replacement vehicles and the continuous efforts of team members to reduce idling.

BCE Inc. 2016 ANNUAL REPORT 33 | |||

| 1 | Overview | MD&A | |

| 1.4 Capital markets strategy |

We seek to deliver sustainable shareholder returns through consistent dividend growth. That objective is underpinned by continued growth in free cash flow, a healthy level of ongoing capital investment in the business, a strong balance sheet and an investment-grade credit profile.

| Dividend growth and payout policy |

On February 2, 2017, we announced a 5.1%, or 14 cent, increase in the annualized dividend payable on BCE’s common shares for 2017 to $2.87 per share from $2.73 per share in 2016, starting with the quarterly dividend payable on April 15, 2017. This represents BCE’s 13th increase to its annual common share dividend, representing a 97% increase, since the fourth quarter of 2008.

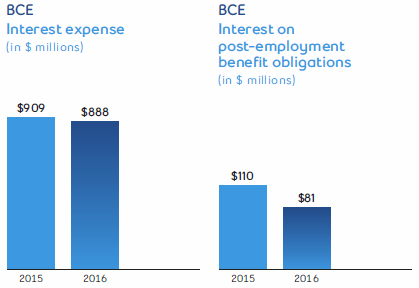

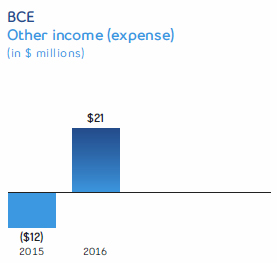

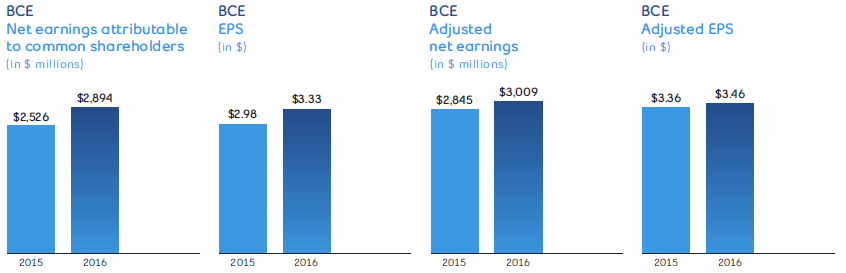

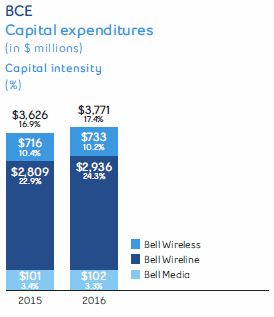

The dividend increase for 2017 is consistent with BCE’s common share dividend policy of a target payout between 65% and 75% of free cash flow. Our objective is to seek to achieve dividend growth while maintaining our dividend payout ratio(1) within the target range and balancing our strategic business priorities. BCE’s dividend payout policy and the declaration of dividends are subject to the discretion of the BCE board of directors (BCE Board or Board) and, consequently, there can be no guarantee that BCE’s dividend policy will be maintained or that dividends will be increased or declared.