U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

T ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2009

Commission file number 0-12183

BOVIE MEDICAL CORPORATION

(Exact name of registrant as specified in its charter)

| Delaware No. | | 11-2644611 |

| (State or other jurisdiction of incorporation or organization) | | (IRS Employer Identification No.) |

734 Walt Whitman Rd., Melville, New York 11747

(Address of principal executive offices)

(631) 421-5452

(Issuer's telephone number)

| | Title of each Class | Name of each Exchange on which registered |

| | Common Stock, $.001 Par Value | NYSE Amex Market |

Securities registered under Section 12(g) of the Exchange Act

None

Indicate by check mark if the Company is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes: £ No T

Indicate by check mark if the Company is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes: £ No T

Indicate by check mark whether the registrant (I) filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act of 1934 during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes T No £

Indicate by checkmark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. £

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a small reporting company. See definition of “large accelerated filer”, “accelerated filer” and “small reporting company” in Rule 12b-2 of the Exchange Act (Check one):

Large accelerated filer £ | Accelerated filer T | Non-accelerated filer £ | Small reporting company £ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

Yes £ No T

The aggregate market value of the voting stock held by non-affiliates computed by reference to the price at which the stock was sold, or the average bid and asked prices of such stock, as of March 1, 2010 was approximately $123,711,995

The number of shares of the registrant's $.001 par value common stock outstanding on the NYSE Amex exchange as of March 1, 2010 was 17,110,926

Company Symbol-BVX

Company SIC (Standard Industrial Code)-3841

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant’s definitive Proxy Statement relating to the Annual Meeting of Shareholders which was held on December 29, 2009 are incorporated by reference into Part I.

Bovie Medical Corporation 2009 Form 10-K Annual Report

Table of Contents

| Part I | | | Page |

| Item 1 | | | 1 |

| Item 1A | | | 7 |

| Item 1B | | | 13 |

| Item 2 | | | 13 |

| Item 3 | | | 13 |

| Item 4. | | | 13 |

| | | | |

| Part II | | | |

| Item 5. | | | 14 |

| Item 6. | | | 16 |

| Item 7 | | | 18 |

| Item 7A | | | 27 |

| Item 8 | | | 27 |

| Item 9 | | | 27 |

| Item 9A | | | 27 |

| Item 9B | | | 28 |

| | | | |

| Part III | | | |

| Item 10 | | | 28 |

| Item 11 | | | 33 |

| Item 12 | | | 40 |

| Item 13. | | | 42 |

| Item 14 | | | 43 |

| | | | 44 |

| | | | |

| Part IV | | | |

| Item 15 | | | |

BOVIE MEDICAL CORPORATION

Cautionary Notes Regarding “Forward-Looking” Statements

This report contains statements that we believe to be “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements give our current expectations or forecasts of future events. Forward-looking statements generally can be identified by the use of forward-looking terminology such as “may,” “will,” “expect,” “intend,” “estimate,” “anticipate,” “believe,” “project,” or “continue,” or similar words or the negative thereof. From time to time, we also may provide oral or written forward-looking statements in other materials we release to the public. Any or all of our forward-looking statements in this report and in any public statements we make could be materially different from actual results. They can be affected by assumptions we might make or by known or unknown risks or uncertainties. Consequently, we cannot guarantee any forward-looking statements. Investors are cautioned not to place undue reliance on any forward-looking statements. Investors should also understand that it is not possible to predict or identify all such factors and should not consider the risk factors discussed in Item 1A below to be a complete statement of all potential risks and uncertainties.

Part I

General

Bovie Medical Corporation (“Company” or “Bovie”) was incorporated in 1982, under the laws of the State of Delaware and has its principal executive office at 734 Walt Whitman Road, Melville, New York 11747.

We are actively engaged in the business of developing, manufacturing, and marketing medical products and devices with a strong emphasis in electrosurgical generators and electrosurgical disposables. We sell a broad range of products designed for doctor’s offices, surgi-centers and hospitals.

Significant Subsidiaries

Aaron Medical Industries, Inc. is a wholly owned Florida Corporation based in Clearwater, Florida. It is principally engaged in the business of marketing our medical products.

Bovie Canada ULC (a wholly owned subsidiary of BVX Holdings, LLC, which is wholly owned by Bovie), is an Alberta, Canada Corporation with its facility located in Windsor, Ontario. The principal function of this facility is product development and manufacturing focused mainly on endoscopic devices.

Industry

We believe the medical device industry will continue to have a long term growth outlook with surgical procedures performed increasing annually as a result of the aging “baby boomer” population. We also anticipate a continued increase in minimally invasive surgical procedures due to ongoing advancements in technology coupled with continued overall pressure to reduce healthcare costs via a reduction in patient trauma and recovery time. Expanding global markets will also continue to provide growth opportunities for the medical device industry.

Business Strategy

We manufacture and market products, both under private label and the Bovie brands (Aaron, IDS, ICON, and SEER), to distributors worldwide. Additionally, Bovie has original equipment manufacturing (OEM) agreements with other medical device manufacturers. These OEM and private label arrangements and our use of the Bovie brands allow us to gain greater market share for the distribution of our products.

During 2009 we continued to progress on the development and marketing of our new products and technologies. Management is encouraged by the continued positive acceptance of our new SEER tissue resection device (orders have already been received) and we have already established a direct and specialty sales team. Although entry for this product into the hospital market (liver resection) has been slower and more challenging than initially anticipated due to changes in hospital purchasing procedures and environments which now consist of several levels of approval boards, we remain optimistic on the sales potential for this and other related products.

In addition, although the challenging economic conditions and global recession have adversely impacted our capital equipment sales in 2009 (as evidenced by the downward trend in the sale of our generators), we are cautiously optimistic that this trend will show modest improvement starting in the second half of 2010 due to improved economic conditions and the anticipated introduction of new products.

We have continued the development of new products in 2009 and submitted 510K’s to the Food and Drug Administration (“FDA”) for the BOSS, laproscopy SEER, Seal-N-Cut, Icon VS, Icon GS (J-Plasma) and Resistick II (coated blades). The 510K’s for the laproscopy SEER and ICON GS/J-Plasma, and coated blades were received in 2009. Recently, we received FDA clearance to market Resistick II and the ICON VS generator.

In August 2009, we received clearance to market our J-Plasma technology (ICON GS). J-Plasma includes an improved, redesigned system with added features to increase efficiency for the surgeon, while reducing manufacturing costs. We are developing marketing strategies for J-Plasma, and believe the product will be versatile, with possible uses in a range of surgical specialties.

Cautery sales have trended up from 2007 to 2008 but remained flat in 2009.

Company Products

We group our products into three main categories: electrosurgery, cauteries, and other products. Information regarding sales by product categories and related percentages is included in the Management’s Discussion and Analysis of Financial Condition and Results of Operations section of this report (page 18) and is incorporated by reference herein.

Electrosurgery Products

Electrosurgery is our largest product line and includes desiccators, generators, electrodes, electrosurgical pencils and various ancillary disposable products. In addition, in 2009 we expanded into the saline enhanced electrosurgical market, which has a market estimated in excess of 1.3 million procedures and $500,000,000 in the United States annually and has only one other competitor. These electrosurgical products are used during surgical procedures in gynecology, urology, plastic surgery, dermatology, veterinary, and other surgical markets for the cutting and coagulation of tissue. It is estimated that 80% of all surgical procedures performed worldwide are accomplished by electrosurgery. Our electrosurgery products fall under two categories, monopolar or bipolar. Monopolar products require the use of a grounding pad attached to the patient for the return of the electrical current, while bipolar products consist of two electrodes; one for the inbound current and one for the return current and therefore do not require the use of a grounding pad.

Aaron 900 and Aaron 940

These products are low powered (30 and 40 watt) and high frequency desiccators. These units were designed primarily for dermatology and family practice physicians. The units are used mainly for removing small skin lesions and growths.

Aaron 950

Bovie has developed a high frequency desiccator with cut capacity for outpatient surgical procedures. These generators allow physicians to change the power settings with one action. They were designed mainly for use in doctors’ offices and are utilized in a variety of specialties including dermatology, gynecology, family and general practice, urology, plastic surgery and ophthalmology.

Aaron 1250U

We have also developed a 120-watt multipurpose electrosurgery generator. The unit features monopolar and bipolar functions with pad sensing. This generator was recently redesigned to allow one unit to work with a line voltage ranging from 100 – 240 VAC whereas previously there was a need for three different versions.

Aaron 2250 / 3250 and IDS 200 / 300 / 400

Given the market interest in more powerful electrosurgical generators, we have developed 200-watt, 300-watt, and 400-watt multipurpose digital electrosurgery generators designed for the rapidly expanding surgi-center market and the hospital market. The digital hardware allows very high parallel data processing throughout the operation. All data is sampled and processed digitally. For the first time in electrosurgery, through digital technology, we are able to measure tissue impedance in real time (5,000 times a second). These units have been designed based on a digital feedback system. Bovie is using dedicated digital hardware instead of a general purpose controller for processing data. As the impedance varies, the power is adjusted to deliver a consistent clinical effect. The IDS 200 / Aaron 2250 have the capability to do m ost procedures performed today in the surgi-center or outpatient settings and was introduced in 2003. Although 200 watts is more than enough power to do most procedures in the operating room, 300 watts is considered the standard and believed to be what most hospitals and surgi-centers will require. Therefore, we developed the IDS 300/ Aaron 3250. The Bovie IDS 400 is a 400 watt generator designed primarily for sale in the overseas markets. These units feature both monopolar and bipolar functions, have pad and tissue sensing, plus nine blended cutting settings.

ICON GI and ICON GP

The ICON product lines are innovative, custom designed specialty electrosurgical generators that incorporate an easy to use touch-screen interface which provides the user flexibility in achieving a desired effect through different digitally built-in modes. In addition, the ICON product line was designed to improve safety and convenience by requiring the use of only split pads with digital technology to protect against pad burns. It features specialized error messaging to prevent misinterpretation and allows for quicker troubleshooting, and has specialized audible alerts to indicate improper cable connections. The ICON line represents a new foundation platform that can be readily expanded thereby reducing the development time and cost for future new specialized generators and also allowing the user to easily upgrade existing units. The ICON GI is designed for the gastrointestinal (“GI”) niche market, while the ICON GP is designed for a more general purpose market like hospital operating rooms, surgery centers, etc.

SEER line

The SEER line consists of conductive sintered steel as an electrode for radio frequency (RF) coupled with sterile saline used in cutting and coagulation, intended to lower blood loss, quicken procedure times and provide cost savings for hospitals. Initial fields of therapy for the technology include liver, pancreatic and kidney tumor therapies.

Cauteries

Battery Operated Cauteries

Battery operated cauteries constitute our second largest product line. Cauteries were originally designed for precise hemostasis (to stop bleeding) in ophthalmology. The current use of cauteries has been substantially expanded to include sculpting woven grafts in bypass surgery, vasectomies, evacuation of subungual hematoma (smashed fingernail) and for arresting bleeding in many types of surgery. Battery operated cauteries are primarily sterile one-time use products. Bovie manufactures one of the broadest lines of cauteries in the world, including but not limited to, a line of replaceable battery and tip cauteries, which are popular in overseas markets.

Other Products

Battery Operated Medical Lights

We manufacture a variety of specialty lighting instruments for use in ophthalmology as well as specialty lighting instruments for general surgery, hip replacement surgery and for the placement of endotracheal tubes in emergency and surgical procedures. We also manufacture and market physicians’ office use penlights.

Nerve Locator Stimulator

Bovie manufactures a nerve locator stimulator primarily used for identifying motor nerves in hand and facial reconstructive surgery. This instrument is a self-contained, battery-operated unit, used for single surgical procedures.

Research and Development and New Products

Our research and development activities are an essential component of our efforts to develop new innovative products for introduction in the marketplace. New and improved products play a critical role in the Company’s sales growth. The Company continues to place emphasis on the development of proprietary products and product improvements to complement and expand its existing product lines. We maintain close working relationships with physicians and medical personnel in hospitals and universities who assist in product research and areas of development. Our research and development activities are primarily developed internally. Information regarding the Company’s research and development costs for each of the past three years is included on page 22 in the Management’s Discussion and Analysis of Financial Condition and R esults of Operations section of this report and Footnote 2 of the Notes to Consolidated Financial Statements and is incorporated by reference herein.

BOSS product lines

The BOSS product line expands on the premise of the SEER patent in using conductive sintered steel as an electrode for radio frequency (RF) coupled with sterile saline but uses dual electrodes. This product is used in cutting and coagulation and is intended to lower blood loss, quicken procedure times and provide cost savings for hospitals. The BOSS is designed mainly for the orthopedic market which has a worldwide market size expected to total approximately $500 million in 2010. We recently filed for 510K FDA approval to market the BOSS which is anticipated to go into production in 2010.

Aaron 1450

The Aaron 1450-RF is a high frequency generator designed for surgery in the doctor office setting. This unit operates at 4 MHz, eight times higher frequency than a standard electrosurgical generator which operates at approximately 500 KHz. This unit is intended to be the first in a family of 4MHz generators initially designed for several office based specialties. The 1450-RF has been designed to include universal power control which allows the unit to be used in any power setting world wide.

Seal-N-Cut Handle and Accessories (formerly Polarian)

The Seal-N-Cut is a new disposable endoscopic surgical handle that supports a plurality of electrical and mechanical modes. This technologically advanced endoscopic device will target the growing vessel and tissue sealing and cutting market. We have recently filed for 510K FDA approval to market the Seal-N-Cut.

We acquired assets related to this product line in October 2006 from Lican Developments LTD (Lican), an Ontario, Canada Corporation. As a result of the asset acquisition, Steve Livneh became President of Bovie Canada. The assets acquired included proprietary patent pending technologies, working prototypes in various stages of development and production equipment.

ICON VS

This generator expands further on our ICON platform which incorporates a flexible and simple user interface and allows for customization of the output modes for a variety of electrosurgical applications. This product, like the ICON GI and GP, its predecessor generators, is designed and being developed to add safety features and improve convenience in performing general purpose procedures and includes a vessel sealing component. This generator will also be used with our Seal-N-Cut handle and accessories. We have recently received 510K FDA clearance to market the ICON VS.

ICON GS (J-Plasma)

Our J-Plasma technology is the foundation for the ICON GS plasma system, which utilizes a gas ionization process producing a stable thin focused beam of ionized gas that can be controlled in a wide range of temperatures and intensities, providing the surgeon greater precision, minimal invasiveness and an absence of conductive currents during surgery. The development of this new gas system generator also includes the design of a new proprietary handpiece. We have received 510K FDA approval to market the ICON GS.

Prior to our acquiring the J-Plasma technology, Soring, a German company, had licensed the same technology. The license agreement was terminated but Soring has filed its own patent possibly using the J-Plasma technology as its basis. Management of Bovie believes Soring may be infringing on our patent and as a result, there is no assurance that there will not be future litigation involving Soring or the possible loss of our competitive advantage.

MEG Handle and Accessories

These innovative modular forceps are ergonomically designed to provide surgeons added comfort and improved safety while reducing per-procedure costs. The modular forceps offer a unique and simpler assembly process for laparoscopic procedures and are the first modular design for the arthroscopy market.

We launched our first generation of the MEG line in 2009. However, after receiving various sources of feedback requesting further abilities to be incorporated in the design, we have temporarily suspended the manufacture of the first generation MEG line in an effort to provide our customers with the features they requested in our second generation MEG design.

We acquired the MEG patent-pending technology in January 2006 from Henvil Corp. Ltd. (“Henvil”) and Steve Livneh, its principal owner. Pursuant to this agreement, commencing with the year following the first sale or commercial delivery of the Product, Bovie will pay to Henvil’s principal, Steve Livneh, an initial minimum royalty of the greater of $35,000 per year or 3% of adjusted gross sales received from the sale of the instruments for a period of four years. Thereafter, Mr. Livneh will be paid a royalty equal to 2.5% of adjusted gross sales for the life of the patents established for the technology.

Suture Cutter

The Suture Cutter was not well accepted by the doctors who tried the device on patients for a variety of reasons. Obstacles consisted of resistance to the higher price verses current method of suture removal, the requirement to change standard procedures related to suture removal procedures, and partial concerns related to the heating element. Based on this feedback, we are evaluating the potential of this product but feel with a modification in design and an introduction to classes at both the teaching university and at medical trade shows that this still could become an accepted method of technique in a niche market. The investment in this product line has been minimal to date.

Resistick II

Resistick II is coating applied to stainless steel which resists eschar (scab or scar tissue caused by burning) during surgery. The coated electrodes continue the expansion of the Bovie line of electrosurgical disposables. the Company has received 510(k) clearance from the Food and Drug Administration (FDA) to market its line of coated blades, needles and ball electrodes used for cutting and coagulating soft tissues during surgical procedures

Sales & Marketing

The majority of the Company’s products are marketed through medical distributors, which distribute to more than 6,000 hospitals and to doctors and other health-care facilities. New distributors are contacted through responses to our advertising in international and domestic medical journals and domestic or international trade shows. International sales represented 16% of total revenues in 2009 as compared with 17% in 2008 and 15% in 2007. The Company’s products are sold in more than 150 countries through local dealers which are coordinated by sales and marketing personnel at the Clearwater, Florida facility.

Our business is generally not seasonal in nature.

Competition

The Company competes with numerous manufacturers and distributors of medical supplies and devices, many of which are large and well established.

We sell our products and compete in various ways including by private labeling some of our products for major distributors under their label, and selling the majority of our other products through distributors. Private labeling allows us to increase our position in the marketplace and thereby compete from two different approaches, our Aaron or Bovie label, and our customers’ private label. Our private label customers distribute our products under their name through their internal sales force. Selling the majority of our other products through distribution increases our sales potential and helps level the playing field in regards to our larger competitors as most of the companies we compete with sell direct. Domestically, we believe, we have a substantial market share in the field of electrosurgical generator manufacturing which c onsists of our Company label and OEM units. We sell our products and compete with other manufacturers in various ways.

Our main competitors are Conmed, Valleylab (a division of Covidien) and Erbe Electromedizine, in the electrosurgery market, Xomed (a division of Medtronics), in the battery operated cautery market, Salient Surgical Technologies (formerly Tissuelink) in the saline enhanced sintered steel market and Ethicon and U.S. Surgical in the endoscopic instrumentation market. We believe our competitive position did not change in 2009.

Intellectual Property

We rely on our intellectual property that we have acquired over recent years including patents, trade secrets, technical innovations, and various licensing agreements to provide our future growth and build our competitive position. We own 20 outstanding patents and trademarks with some of our earlier patents currently having diminished useful lives. We also have filed several U.S. and international patent applications pending for various new products. As we continue to expand our intellectual property portfolio we believe it is critical for our Company to continue to invest in filing patent applications to protect our technology, inventions, and improvements, however we can give no assurance that competitors will not infringe on our patent rights or otherwise create similar or non-infringi ng competing products that are technically patentable in their own right.

Manufacturing and Suppliers

We are committed to producing products of the highest quality and technical advancements. Bovie manufactures the majority of its products on its premises in Clearwater, Florida which is certified under the ISO international quality standards and may be subject to continuing regulation and routine inspections by the FDA to determine compliance with regulations in our quality system, medical device reporting, and FDA restrictions on promoting products for unapproved or off-label uses. In addition, we are also subject to regulations under the Occupational Safety and Health Act, the Environmental Protection Act and other federal, state and local regulations.

Customers

We sell the majority of our current products through major distributors which include Allegiance (a Cardinal Company), IMCO, McKesson Medical Surgical, Inc., Medline, NDC (Abco, Cida and Starline), Owens & Minor, and Physician Sales & Service. In addition we have a major OEM customer, Arthrex, Inc. for which we manufacture products on a private label basis, pursuant to an agreement. On August 31, 2007 we amended and extended this manufacturing agreement for an additional three year period. The main change to the amended manufacturing agreement is the elimination of the provision that required Arthrex to exclusively purchase the products from us as well as the elimination of the provision that required us not to compete in the same Arthrex markets with said products. This amended Arthrex Agreement has termination date s of December 6, 2010 and March 2011 for the generators. In fiscal 2009, Arthrex orders represented approximately 22% of our total revenues. As such, should Arthrex determine to reduce or cease placement of orders for the products, our business will likely be adversely affected.

Backlog

The dollar value of unshipped factory orders is not material.

Employees

Bovie has 163 full time employees consisting of 4 executive officers, 21 supervisory personnel, 11 sales personnel, and 127 technical support, administrative, and production employees. None of our current employees are covered by any collective bargaining agreement and we have never experienced a work stoppage. We consider our employee relations to be good.

In addition to risks and uncertainties in the ordinary course of business, important risk factors that may affect us are discussed below.

Risks Relating to Our Business

Current challenges in the credit and capital markets may adversely affect our business and financial condition.

The current global economic crisis described below should also be considered when reviewing each of the subsequent paragraphs setting forth the various aspects of our business, operations, and products.

The recent global economic and financial market crisis has caused, among other things, a general tightening in the credit and capital markets, lower levels of liquidity, increases in the rates of default and bankruptcy, and lower consumer and business spending. Although the ultimate outcome of these events cannot be predicted, they may have a material adverse effect on the Company and our ability to raise capital or borrow money in the credit markets and potentially to draw on our revolving credit facility or otherwise obtain financing. Similarly, current or potential customers and suppliers may no longer be in business, may be unable to fund purchases or may decide to reduce purchases, all of which could lead to reduced demand for our products, reduced gross margins, and increased customer payment delays or defaults. Furthe r, suppliers may not be able to supply us with needed raw materials on a timely basis, may increase prices or go out of business, which could result in our inability to meet customer demand in a timely manner or affect our gross margins. We are also limited in our ability to reduce costs to offset the results of a prolonged or severe economic downturn given certain fixed costs associated with our operations.

We do a substantial amount of business with certain original equipment manufacturers (“OEM”) which as a group have produced substantial revenues for our Company. Loss of business from a major OEM customer will likely adversely affect our business.

Bovie manufactures the majority of its products on its premises in Clearwater, Florida. Labor-intensive sub-assemblies and labor-intensive products may be out-sourced to our specification. Although we sell through distributors, we market our products through national trade journal advertising, direct mail, distributor sales representatives and trade shows, under the Bovie name, the Bovie/Aaron name and private label. Major distributors include Allegiance (a Cardinal Company), IMCO, McKesson Medical Surgical, Inc., Medline, NDC (Abco, Cida and Starline), Owens & Minor, and Physician Sales & Service. If any of these distributor relationships are terminated or not replaced, our revenue from the territories served by these distributors could be adversely affected.

We have a major OEM customer, Arthrex, Inc. for which we manufacture products on a private label basis, pursuant to an agreement. On August 31, 2007, we amended and extended this manufacturing agreement for an additional three year period. The amended terms continue to provide that we will be reimbursed for our expenses in developing any changes or modifications to products according to Arthrex’s specifications, and that Arthrex continues to own the intellectual property. In addition, general provisions for product warranties, insurance, termination, and confidentiality remain the same. The main change to the amended manufacturing agreement is the elimination of the provision that required Arthrex to exclusively purchase the products from us as well as the elimination of the provision that required us to forego competi ng in the same Arthrex markets with said products. This amended Arthrex Agreement has termination dates of December 6, 2010 and March 2011 for the generators. In fiscal 2009, Arthrex orders represented approximately 22% of our total revenues. As such, should Arthrex determine to reduce or cease placement of orders for the products, or decline to extend or review its agreements with us, our business will likely be materially and adversely affected.

We are also dependent on other OEM customers who have no legal obligation to purchase products. Should the collaborative customer fail to give us purchase orders for the product after development, our future business and value of related assets could be negatively affected. Furthermore, no assurance can be given that a collaborative customer will give sufficient high priority to our products. Finally, disagreements or disputes may arise between Bovie and its contractual customers, which could adversely affect production of our products.

We rely on certain suppliers and manufacturers for raw materials and other products and are vulnerable to fluctuations in the availability and price of such products and services.

Fluctuations in the price, availability, and quality of the raw materials we use in our manufacturing could have a negative effect on our cost of sales and our ability to meet the demands of our customers. Inability to meet the demands of our customers could result in the loss of future sales. In addition, the costs to manufacture our products depends in part on the market prices of the raw materials used to produce the them. We may not be able to pass along to our customers all or a portion of our higher costs of raw materials due to competitive and marketing pressures, which could decrease our earnings.

We also have informal collaborative arrangements with three foreign suppliers under which we request the development of certain items and components and we purchase them pursuant to purchase orders. Our purchase order commitments are never more than one year in duration and are supported by orders from our customers.

If we are unable to protect our patents or other proprietary rights, or if we infringe on the patents or other proprietary rights of others, our competitiveness and business prospects may be materially damaged.

We own 20 outstanding patents and trademarks with some of our earlier patents currently having diminished useful lives. We also have several U.S. and international patent applications pending for various new products. We can give no assurance that competitors will not infringe on our patent rights or otherwise create similar or non-infringing competing products that are technically patentable in their own right.

We have recently filed new patent applications for various new products including a scanning cannula, modular laparoscopic and endoscopic instruments, the output stage to our generator platform, our ICON product line and a Plasma Stream patent application relating to the plasma technology.

Divestitures of some of our operations or product lines may materially and adversely affect our business and results of operations.

We periodically evaluate the performance of all of operations and although we have not to date, we may sell, consolidate, or close a portion of our business or product lines. Any divestitures may result in significant write-offs, including those related to goodwill and other intangible assets, which could have a material adverse effect on our business and results of operations. Divestitures could involve additional risks, including difficulties in the separation of operations, services, products and personnel, the diversion of management’s attention from other business concerns, the disruption of our business and the potential loss of key employees. We may not be successful in managing these or any other significant risks that we encounter in divesting a business or product line.

Although we carry liability insurance, due to the nature of our products and their use by professionals, we may, from time to time, be subject to litigation from persons who sustain injury during medical procedures in hospitals, physician’s offices or in clinics and defending such litigations is expensive, disruptive, time consuming and could adversely affect our business.

The manufacture and sale of medical products entail significant risks of product liability claims. Bovie currently maintains product liability insurance with combined coverage limits of $10 million on a claims made basis. There is no assurance that this coverage will be adequate to protect us from any possible liabilities we might incur in connection with the sale or testing of our products. In addition, we may need increased product liability coverage as products are commercialized. This insurance is expensive and in the future may not be available on acceptable terms, if at all.

Our business is subject to the potential for defects or failures associated with our products which could lead to recalls or safety alerts and negative publicity.

Manufacturing flaws, component failures, design defects, off-label uses or inadequate disclosure of product-related information could result in an unsafe condition or the injury or death of a patient. These problems could lead to a recall of, or issuance of a safety alert relating to, our products and result in significant costs and negative publicity. Due to the strong name recognition of our brands, an adverse event involving one of our products could result in reduced market acceptance and demand for all products within that brand, and could harm our reputation and our ability to market our products in the future. In some circumstances, adverse events arising from or associated with the design, manufacture or marketing of our products could result in the suspension or delay of our current regulatory reviews of our applications for n ew product approvals. We also may undertake voluntarily to recall products or temporarily shut down production lines based on internal safety and quality monitoring and testing data. Any of the foregoing problems could disrupt our business and have a material adverse effect on our business, results of operations, financial condition and cash flows.

Our manufacturing facilities are located in Clearwater, Florida and could be affected due to multiple risks from fire, hurricanes and the like.

Our manufacturing facilities are located in Clearwater, Florida and could be affected by multiple weather risks, most notably hurricanes (one of which previously caused damage to the roof of one of our buildings as well as some of our furniture and equipment). The damage was mildly disruptive to operations. Although we carry casualty insurance and business interruption insurance, future possible disruptions of operations due to hurricanes or other weather risks could affect our ability to meet our commitments to our customers and impair important business relationships, the loss of which could adversely affect our operations and profitability.

Risks Related to Our Industry

The medical device industry is highly competitive and we may be unable to compete effectively.

The medical device industry is highly competitive. Many competitors in this industry are well established, do a substantially greater amount of business, and have greater financial resources and facilities than we do.

Domestically, we believe we rank third in the number of units sold in the field of electrosurgical generator manufacturing and we sell our products and compete with other manufacturers in various ways. In addition to advertising, attending trade shows and supporting our distribution channels, we strive to enhance product quality, improve user friendliness and expand product exposure.

We also compete by private labeling our products for major distributors under their label. This allows us to increase our position in the marketplace and thereby compete from two different approaches, our Aaron or Bovie label, and our customers’ private label. Our private label customers distribute our products under their name through their internal sales force. We believe our main competitors do not private label their products.

Lastly, at this time we sell the majority of our products through distributors. Many of the companies we compete with sell direct, thus competing directly with distributors they sometimes use.

Our main competitors are Conmed, Valleylab (a division of Covidien) and Erbe Electromedizine, in the electrosurgery market, Xomed (a division of Medtronics), in the battery operated cautery market, Salient Surgical Technologies (formerly Tissuelink) in the saline enhanced sintered steel market and Ethicon and U.S. Surgical in the endoscopic instrumentation market. We believe our competitive position did not materially change in 2009.

Our industry is highly regulated by the U.S. Food and Drug Administration and internationally including other governmental, state and federal agencies which have substantial authority to establish criteria which must be complied with in order for us to continue in operation.

United States

The Company’s products and research and development activities are subject to regulation by the FDA and other regulatory bodies. FDA regulations govern, among other things, the following activities:

| · | Pre-market clearance or approval. |

| · | Advertising and promotion. |

| · | Product traceability, and |

In the United States, medical devices are classified on the basis of control deemed necessary to reasonably ensure the safety and effectiveness of the device. Class I devices are subject to general controls. These controls include registration and listing, labeling, pre-market notification and adherence to the FDA Quality System Regulation. Class II devices are subject to general and special controls. Special controls include performance standards, post market surveillance, patient registries and FDA guidelines. Class III devices are those which must receive pre-market approval by the FDA to ensure their safety and effectiveness. Currently, we only manufacture Class I and Class II devices. Pre-market notification clearance must be obtained for some Class I and most Class II devices when the FDA does not require pre-market ap proval. All Bovie products have been cleared by the Pre-market notification process. To date, the FDA has not failed to clear any devices we have submitted.

A pre-market approval application is required for most Class III devices. A pre-market approval application must be supported by valid scientific evidence to demonstrate the safety and effectiveness of the device. The pre-market approval application typically includes:

| · | Results of bench and laboratory tests, animal studies, and clinical studies |

| · | A complete description of the device and its components |

| · | A detailed description of the methods, facilities and controls used to manufacture the device, and proposed labeling. |

The pre-market approval process can be expensive, uncertain and lengthy. A number of devices for which pre-market approval has been sought by other companies have never been approved for marketing.

International Regulation

To market products in the European Union, our products must bear the “CE” mark. Manufacturers of medical devices bearing the CE mark have gone through a conformity assessment process that assures that products are manufactured in compliance with a recognized quality system and to comply with the European Medical Devices Directive.

Each device that bears a CE mark has an associated technical file that includes a description of the following:

| · | Description of the device and its components, |

| . | A summary of how the device complies with the essential requirements of the medical devices directive, |

| · | Safety (risk assessment) and performance of the device, |

| · | Clinical evaluations with respect to the device, |

| · | Methods, facilities and quality controls used to manufacture the device, and |

| · | Proposed labeling for the device. |

Manufacturing and distribution of a device is subject to ongoing surveillance by the appropriate regulatory body to ensure continued compliance with quality system and reporting requirements.

We began CE marking of devices for sale in the European Union in 1999. In addition to the requirement to CE mark, each member country of the European Union maintains the right to impose additional regulatory requirements.

Outside of the European Union, regulations vary significantly from country to country. The time required to obtain approval to market products may be longer or shorter than that required in the United States or the European Union. Certain European countries outside of the European Union do recognize and give effect to the CE mark certification. We are permitted to market and sell our products in those countries.

If we are unable to successfully introduce new products or fail to keep pace with advances in technology, our business, financial condition and results of operations could be adversely affected. In addition, our research and development efforts rely upon investments and alliances, and we cannot guarantee that any previous or future investments or alliances will be successful.

Our research and development activities are an essential component of our efforts to develop new innovative products for introduction in the marketplace. New and improved products play a critical role in our sales growth. We continue to place emphasis on the development of proprietary products and product improvements to complement and expand its existing product lines. We maintain close working relationships with physicians and medical personnel in hospitals and universities who assist in product research and areas of development. Our research and development activities are primarily conducted internally and are expensed as incurred. These expenses include direct expenses for wages, materials and services associated with the development of our products net of any reimbursements from customers. Research and development expenses do not include any portion of general and administrative expenses. The Company has two complementary facilities that both contribute to a centralized research and development focus. Our Clearwater, FL facility has been our flagship research and design location, followed later by our addition of the Canadian facility in October 2006. Currently both facilities are working synergistically developing our new products the ICON GP/VS and ICON GS, as well as the accompanying Endoscopic Modular Instruments, the Polarian handle and accessories. We expect to make future investments to enable us to develop new technologies and products to further our strategic objectives and strengthen our existing business. However, we cannot guarantee that any of our previous or future investments will be successful.

The amount expended by us on research and development of our products during the years 2009, 2008 and 2007, totaled approximately $2.1, $2.1, and $1.6 million respectively. During the past three years, we invested in the J-Plasma technology, currently used in one of our new products under development, the ICON GS plasma system. In addition, we invested in the BOSS and other saline enhanced electrosurgical devices, Endoscopic Modular Instruments, and accompanying new generators. We have not incurred any direct costs relating to environmental regulations or requirements. For 2010, we expect our expenditures for research and development activities to remain around the same level as 2009.

Our international operations subject us to foreign currency fluctuations and other risks associated with operating in foreign countries.

We operate internationally and enter into transactions denominated in foreign currencies (most notably the Canadian dollar and the Euro). To date, we have not hedged our exposure to changes in foreign currency exchange rates, and as a result, we are subject to foreign currency transaction and translation gains and losses. We purchase goods and services in U.S. and Canadian dollars and have recently begun to invoice certain product sales in Euros. Foreign exchange risk is managed primarily by satisfying foreign denominated expenditures with cash flows or assets denominated in the same currency. We charged currency value fluctuations to our accumulated other comprehensive account which amounts were not material for 2009.

Our operations are subject to certain proposed healthcare reform legislative proposals that could be enacted into law, our business, financial condition, results of operations and cash flows could be significantly and adversely affected.

In 2009, both the U.S. Senate and House of Representatives released various draft proposals related to healthcare reform legislation which could include provisions that would impose a fee or excise tax on certain medical devices. These proposals may apply to some or all of our medical device and supply products. Many details of the proposals remain uncertain, and any healthcare reform legislation must still be enacted by both Houses of Congress and signed by the President. If any of these medical device proposals is enacted into law, our results of operations could be materially and adversely affected.

Our operations may experience higher costs to produce our products as a result of changes in prices for oil, gas and other commodities.

We use some plastics and other petroleum-based materials along with precious metals contained in electronic components as raw materials in many of our products. Prices of oil and gas also significantly affect our costs for freight and utilities. Oil, gas and precious metal prices are volatile and may increase, resulting in higher costs to produce and distribute our products. Due to the highly competitive nature of the healthcare industry and the cost-containment efforts of our customers we may be unable to pass along cost increases through higher prices. If we are unable to fully recover these costs through price increases or offset through other cost reductions, our results of operations could be materially and adversely affected.

Risks related to climate change

Our manufacturing facilities (Clearwater and Canada) do not produce hazardous materials or emissions that would adversely impact the environment. We do however, have air conditioning units and consume electricity which could be impacted by climate change in the form of increased rates. We do not however believe the increase in expense from the rate increases, as a percentage of sales, would be material in the near term.

The effect on the Company’s business and operations related to physical changes in the planet caused by climate change such as increased storms (hurricanes) could result in impaired production of products or damages to property, plant and equipment. We do however maintain a backup generator at our Clearwater facility and a disaster recovery plan in place to help mitigate this risk.

ITEM 1B. Unresolved Staff Comments

There are no outstanding unresolved comments from the staff of the Securities and Exchange Commission.

Bovie currently maintains the following locations:

| | · | Our executive office at 734 Walt Whitman Road, Melville, New York which is leased for approximately $1,500 per month. |

| | · | A 60,000 square foot facility which consists of office, warehousing, manufacturing and research space located at 5115 Ulmerton Rd., Clearwater, FL which was acquired on September 11, 2008, renovated, and occupied during June 2009. Monthly principal and interest payments are approximately $24,000 per month. |

| | · | A 28,000 square foot manufacturing facility at 7100 30th Ave N., St Petersburg, Florida which we own. |

| | · | A research and manufacturing facility at 4056 North Services Rd. E., Windsor, Canada which is leased for approximately $4,200 per month through December 2010. |

| | · | A research and manufacturing facility at 3200 Tyrone Blvd., St. Petersburg, Florida which is leased for approximately $13,000 per month under a lease that expires in September 2013. |

The Company currently has the facility at 7100 30th Ave. N., St. Petersburg listed with a broker for sale along with a sublease listed with the same broker for its facility at 3200 Tyrone Blvd., St. Petersburg.

ITEM 3. Legal Proceedings

In 2008, Erbe USA, Inc. (“Erbe”) filed a civil action in the U.S. District Court for the Northern District of Georgia, Atlanta Division, against Bovie and a former employee, seeking equitable relief and unspecified damages. The complaint essentially alleges that the employee, among other things, breached his employment agreement with Erbe by wrongfully taking Erbe’s confidential information and trade secrets for use in his new employment position, with the assistance of Bovie. In a mutual effort to resolve the dispute, on November 4, 2009, Bovie and Erbe signed a full and final settlement agreement and mutual general release of all claims. We continue to deny Erbe’s claims and allegations. Given that both parties desire to end the litigation and mit igate ongoing legal costs, however, we agreed to pay Erbe $160,000 as part of the terms of the settlement. We also agreed not to use or disclose, and to destroy, any information that Erbe alleged constituted trade secrets and confidential business information related to Erbe. Additional terms of the settlement include a two-year period in which we agreed not to solicit (a) Erbe’s current employees and (b) a limited number of dealers and independent representatives who currently market Erbe products (see Note 12. Commitments and Contingency).

ITEM 4. Submission of Matters to a Vote of Security Holders

Reserved

PART II

ITEM 5. Market for Registrant’s Common Equity and Related Stockholder Matters

Bovie’s common stock currently is traded on the NYSE Amex exchange and previously was traded on the American Stock Exchange from November 5, 2003. The table shows the reported high and low bid prices for the common stock during each quarter of the last eight respective quarters. These prices do not represent actual transactions and do not include retail markups, markdowns or commissions.

| 2009 | | High | | | Low | |

| | | | | | | |

4th Quarter | | $ | 9.11 | | | $ | 7.17 | |

3rd Quarter | | | 10.00 | | | | 7.04 | |

2nd Quarter | | | 9.69 | | | | 6.24 | |

1st Quarter | | | 7.60 | | | | 5.75 | |

| | | | | | | | | |

| 2008 | | High | | | Low | |

| | | | | | | |

4th Quarter | | $ | 7.57 | | | $ | 3.90 | |

3rd Quarter | | | 8.05 | | | | 6.51 | |

2nd Quarter | | | 9.27 | | | | 6.27 | |

1st Quarter | | | 6.69 | | | | 5.50 | |

On March 1, 2010, the closing bid for Bovie’s Common Stock as reported by the NYSE Amex exchange was $7.23 per share. As of March 1, 2010, the total number of shareholders of Bovie’s Common Stock was approximately 3,500, of which approximately 2,800 are estimated to be shareholders whose shares are held in the name of their broker, stock depository or the escrow agent holding shares for the benefit of Bovie Medical Corporation shareholders and the balance are shareholders who keep their shares registered in their own name.

Recent Sales of Unregistered Equity Securities

None

Issuer Purchases of Equity Securities

| | | Number of Securities to be Issued Upon Exercise of Outstanding Options, Warrants and Rights | | | Weighted-Average Exercise Price of Outstanding Options, Warrants and Rights | | | Number of Securities Remaining Available for Future Issuance Under Equity Compensation Plans (excluding securities reflected in column (a)) | |

| | | (a) | | | (b) | | | (c) | |

| Equity compensation plans approved by security holders | | | 1,621,525 | | | $ | 3.69 | | | | 148,875 | |

| Equity compensation plans not approved by security holders | | | 120,000 | (1) | | | 3.87 | | | | — | |

| | | | | | | | | | | | | |

| TOTAL | | | 1,741,525 | | | $ | 3.61 | | | | 148,875 | |

(1) Includes an issuance on January 11, 2006 for 100,000 restricted stock options to Henvil Corporation related to the acquisition of the MEG technology and 20,000 restricted stock options granted to Howard Stallard pursuant to an employment agreement dated October 1, 2006 related to the Lican Development asset purchase agreement.

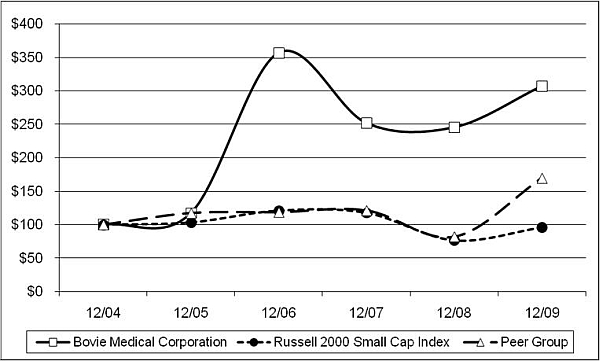

Performance Graph

The following graph shows a comparison of the cumulative total stockholder return for our common stock, the Russell 2000 Small Cap Index, and a peer group that we believe in good faith is an appropriate basis for comparison. The comparison for each of the periods assumes that $100 was invested on December 31, 2004 in our common stock, the Russell 2000 Small Cap Index, and the stocks in the peer group, and that all dividends were reinvested. The results shown in the graph below are not necessarily indicative of future performance.

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN*

Among Bovie Medical Corporation, Russell 2000 Small Cap Index,

And a Peer Group

* $100 invested on 12/31/2004 in stock or index, including reinvesting of any dividends. Fiscal year ended December 31.

| | | Cumulative Total Return | | | | |

| | | | 12/04 | | | | 12/05 | | | | 12/06 | | | | 12/07 | | | | 12/08 | | | | 12/09 | |

| Bovie Medical Corporation | | | 100.00 | | | | 117.32 | | | | 357.09 | | | | 251.97 | | | | 245.67 | | | | 307.48 | |

| Russell 2000 Small Cap Index | | | 100.00 | | | | 103.32 | | | | 120.89 | | | | 117.57 | | | | 76.65 | | | | 95.98 | |

| Peer Group | | | 100.00 | | | | 117.44 | | | | 118.70 | | | | 121.32 | | | | 82.00 | | | | 169.90 | |

This peer group consists of five companies, Atrion Corp. (ATRI), Alpha Pro Tech Ltd. (APT), Endologix (ELGX), Utah Medical Products (UTMD), and Trinity Biotech plc. (TRIB). These companies were chosen using the following criteria: a listing on either the NYSE or Nasdaq Exchange, they were in the medical supply industry, they had similar market capitalization, and similar sales volume and number of employees.

This information shall not be deemed to be ''soliciting material’’ or to be ''filed’’ with the Commission or subject to Regulation 14A (17 CFR 240.14a-1-240.14a-104), other than as provided in Item 201(e) of Regulation S-K, or subject to the liabilities of section 18 of the Exchange Act (15 U.S.C. 78r).

We have never declared or paid any cash dividends on our common stock and we do not intend to pay cash dividends in the foreseeable future. We currently expect to retain any future earnings to fund the operation and expansion of our business.

ITEM 6. Selected Financial Data

The following selected consolidated financial data (presented in thousands, except per share amounts and employee data) are derived from our consolidated financial statements. This data should be read in conjunction with the consolidated financial statements and notes thereto, and with Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Year Ended December 31,

(in thousands, except per share amounts)

| | | 2009 | | | 2008 | | | 2007 | | | 2006 | | | 2005 | |

| | | | | | | | | (As restated) | | | | | | | |

| Sales, net | | $ | 26,953 | | | $ | 28,097 | | | $ | 28,779 | | | $ | 26,676 | | | $ | 20,211 | |

| Cost of sales | | | 15,098 | | | | 16,248 | | | | 17,464 | | | | 16,075 | | | | 12,649 | |

| | | | | | | | | | | | | | | | | | | | | |

| Gross Profit | | | 11,855 | | | | 11,849 | | | | 11,315 | | | | 10,601 | | | | 7,562 | |

| | | | | | | | | | | | | | | | | | | | | |

| Gain on cancellation of agreement | | | -- | | | | 1,496 | | | | -- | | | | -- | | | | -- | |

| | | | | | | | | | | | | | | | | | | | | |

| Other costs: | | | | | | | | | | | | | | | | | | | | |

| Research and development | | | 2,083 | | | | 2,061 | | | | 1,643 | | | | 1,048 | | | | 986 | |

| Professional services | | | 1,398 | | | | 991 | | | | 738 | | | | 520 | | | | 447 | |

| Salaries and related costs | | | 3,003 | | | | 3,017 | | | | 2,805 | | | | 2,558 | | | | 2,011 | |

| Selling, general and administration | | | 4,656 | | | | 4,489 | | | | 4,023 | | | | 3,712 | | | | 3,553 | |

| Development cost - joint venture | | | -- | | | | -- | | | | -- | | | | 139 | | | | 161 | |

| | | | | | | | | | | | | | | | | | | | | |

| Total other costs | | | 11,140 | | | | 10,558 | | | | 9,209 | | | | 7,977 | | | | 7,158 | |

| | | | | | | | | | | | | | | | | | | | | |

| Income from operations | | | 715 | | | | 2,787 | | | | 2,106 | | | | 2,624 | | | | 404 | |

| | | | | | | | | | | | | | | | | | | | | |

| Other income and (expense): | | | | | | | | | | | | | | | | | | | | |

| Interest income | | | 24 | | | | 49 | | | | 143 | | | | 103 | | | | 47 | |

| Minority interest | | | -- | | | | -- | | | | 5 | | | | 20 | | | | 10 | |

| Interest expense | | | (76 | ) | | | (59 | ) | | | (3 | ) | | | (16 | ) | | | (23 | ) |

| Total other income (expense) - net | | | (52 | ) | | | (10 | ) | | | 145 | | | | 107 | | | | 34 | |

| | | | | | | | | | | | | | | | | | | | | |

| Income before income taxes | | | 663 | | | | 2,777 | | | | 2,251 | | | | 2,731 | | | | 438 | |

| | | | | | | | | | | | | | | | | | | | | |

| Benefit (provision) for income taxes | | | (67 | ) | | | (945 | ) | | | 1,550 | | | | (48 | ) | | | (32 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Net income | | $ | 596 | | | $ | 1,832 | | | $ | 3,801 | | | $ | 2,683 | | | $ | 406 | |

| | | | | | | | | | | | | | | | | | | | | |

| Earnings per common share: | | | | | | | | | | | | | | | | | | | | |

| Basic | | $ | 0.04 | | | $ | 0.11 | | | $ | 0.25 | | | $ | 0.19 | | | $ | 0.03 | |

| Diluted | | $ | 0.03 | | | $ | 0.11 | | | $ | 0.22 | | | $ | 0.16 | | | $ | 0.03 | |

| | | | | | | | | | | | | | | | | | | | | |

| Balance Sheet Information: | | | | | | | | | | | | | | | | | | | | |

| Cash and cash equivalents | | $ | 2,155 | | | $ | 2,565 | | | $ | 3,535 | | | $ | 2,953 | | | $ | 1,295 | |

| Working capital | | $ | 10,741 | | | $ | 9,943 | | | $ | 10,071 | | | $ | 7,955 | | | $ | 5,501 | |

| Total assets | | $ | 27,584 | | | $ | 26,725 | | | $ | 20,213 | | | $ | 16,686 | | | $ | 11,771 | |

| Long-term debt | | $ | 3,958 | | | $ | 4,143 | | | $ | 318 | | | $ | 368 | | | $ | 0 | |

| Stockholders’ equity | | $ | 21,153 | | | $ | 20,128 | | | $ | 18,192 | | | $ | 14,060 | | | $ | 9,802 | |

ITEM 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Our future results of operations and the other forward-looking statements contained herein, particularly the statements regarding growth in the medical products industry, capital spending, research and development, and marketing and general and administrative expenses, involve a number of risks and uncertainties. In addition to the factors discussed above, there are other factors that could cause actual results to differ materially, such as business conditions and the general state of the economy; competitive factors including rival manufacturers’ availability of components at reasonable prices; risk of nonpayment of accounts receivable; risks associated with foreign operations; and litigation involving intellectual property and consumer issues.

We believe that we have the product mix, facilities, personnel, competitive edge, operating cash flows and financial resources for business success in the immediate future (1 year) and distant future (after 1 year), but future revenues, costs, margins, product mix and profits are all subject to the influence of a number of factors, as discussed above.

The following discussion should be read in conjunction with the Selected Financial Data and the Consolidated Financial Statements and Notes.

Executive Level Overview

We are a medical device company engaged in the manufacturing and marketing of electrosurgical devices. Our medical products include a wide range of devices including electrosurgical generators and accessories, cauteries, medical lighting, nerve locators and other products.

We internally divide our operations into three product lines. Electrosurgical products, battery operated cauteries and other products. The electrosurgical line sells electrosurgical products which include desiccators, generators, electrodes, electrosurgical pencils and various ancillary disposable products. These products are used in surgery for the cutting and coagulation of tissue. Battery operated cauteries are used for precise hemostasis (to stop bleeding) in ophthalmology and in other fields. Our other revenues are derived from nerve locators, disposable and reusable penlights, medical lighting, license fees, development fees and other miscellaneous income.

Most of the Company’s products are marketed through medical distributors, which distribute to more than 6,000 hospitals, and to doctors and other health-care facilities. New distributors are contacted through responses to our advertising in international and domestic medical journals and domestic or international trade shows. International sales represented 16% of total revenues in 2009 as compared with 17% in 2008 and 15% in 2007. The Company’s products are sold in more than 150 countries through local dealers which are coordinated by sales and marketing personnel at the Clearwater, Florida facility. Our business is generally not seasonal in nature.

Outlook for 2010

During 2009 we continued to make progress on the development and marketing of our new products and technologies. We are encouraged by the continued positive acceptance of our new SEER tissue resection device (orders have already been received) and we have already established a direct and specialty sales team for this product. Although entry for this product into the hospital market (liver resection) has been slower and more challenging than initially anticipated due to changes in hospital purchasing procedures and environments which now consist of several levels of approval boards, we remain optimistic on the sales potential for this and other related products.

In addition, although the challenging economic conditions and global recession have adversely impacted our capital equipment sales in 2009 (as evidenced by the downward trend in the sale of our generators), we are cautiously optimistic that this trend will show modest improvement starting in the second half of 2010 due to improved economic conditions and the anticipated introduction of new products.

We have continued the development of new products in 2009 and submitted 510K’s to the Food and Drug Administration (“FDA”) for the BOSS, laproscopy SEER, Seal-N-Cut, Icon VS, Icon GS (J-Plasma) and Resistick II (coated blades). The 510K’s for the laproscopy SEER and ICON GS/J-Plasma, and coated blades were received in 2009. Recently, we received FDA clearance to market Resistick II and the ICON VS generator.

In August 2009, we received clearance to market our J-Plasma technology (ICON GS). J-Plasma includes an improved, redesigned system with added features to increase efficiency for the surgeon, while reducing manufacturing costs. We are developing marketing strategies for J-Plasma, and believe the product will be versatile, with possible uses in a range of surgical specialties.

In today’s economic environment, marked by historic uncertainty, forecasting has become increasingly more difficult. We have and will always, take a conservative approach. Every effort has been made to provide an outlook based on our experience and knowledge; however, variations beyond our ability to predict or control often impact forecasting which may result in a change in this outlook. We strongly encourage investors to visit our website: www.boviemedical.com to view the most current news and to review our filings with the Securities and Exchange Commission.

Results of Operations –

Sales

| | | 2009 vs. 2008 | | | 2008 vs. 2007 | |

| Sales by Product Line (in thousands) | | 2009 | | | 2008 | | | Percent change | | | 2008 | | | 2007 | | | Percent change | |

| Electrosurgical | | $ | 18,576 | | | | 19,535 | | | | (4.9 | )% | | $ | 19,535 | | | | 20,284 | | | | (3.7 | )% |

| Cauteries | | | 6,252 | | | | 6,265 | | | | (0.2 | )% | | | 6,265 | | | | 6,131 | | | | 2.2 | % |

| Other | | | 2,125 | | | | 2,296 | | | | (7.5 | )% | | | 2,296 | | | | 2,364 | | | | (2.9 | )% |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Total | | $ | 26,953 | | | | 28,096 | | | | (4.1 | )% | | $ | 28,096 | | | | 28,779 | | | | (2.4 | )% |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Sales by Domestic and International (in thousands) | | | | | | | | | | | | | | | | | | | | | | | | |

| Domestic | | $ | 22,506 | | | | 23,176 | | | | (2.9 | )% | | $ | 23,176 | | | | 24,474 | | | | (5.3 | )% |

| International | | | 4,447 | | | | 4,920 | | | | (9.6 | )% | | | 4,920 | | | | 4,305 | | | | 14.3 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Total | | $ | 26,953 | | | | 28,096 | | | | (4.1 | )% | | $ | 28,096 | | | | 28,779 | | | | (2.4 | )% |

Sales for the year ended 2009 decreased approximately $1.1 million or 4.1% compared to the same period in 2008. This decrease was due to the following reasons:

| | · | sales of generators were down approximately $930,000 or 7.2% due to lower capital expenditures by hospitals and doctor offices in the current economy; |

| | · | sales of other products were down approximately $170,000 or 7.4%. This consisted of a $41,000 reduction in royalty income due to royalty contracts ending in 2008; a $50,000 reduction in the sales of penlights; $74,000 reduction in medical lighting sales; and a $5,000 reduction in miscellaneous other products. These decreases are mainly the result of distributors electing to reduce their inventories in the current economy. |

Sales for the year ended 2008 decreased approximately $683,000 or 2.4% compared to the same period in 2007. This decrease was due to the following reasons:

| | · | sales of generators were down approximately $940,000 or 26% due to a reduction in the sales to OEM customers. |

The decrease in generator sales was offset by:

| | · | an increase in sales of cauteries of approximately $130,000 due to increased demand; |

| | · | new products sales of SEER, MEG, and plasma probes of approximately $62,000; and |

| | · | an increase in sales of disposable electrosurgical accessories of approximately $65,000. |

Our ten largest customers accounted for approximately 71.5%, 70%, and 71% of net revenues for 2009, 2008, and 2007 respectively. In 2009, 2008 and 2007, Arthrex was our only customer that accounted for over 10% of total revenues (22%, 20%, and 21% of our revenues for each such year). Arthrex sales of generators and accessories increased by approximately $245,000, or 4.3% to approximately $6.0 million for the year ended December 31, 2009 from approximately $5.7 million for the year ended December 31, 2008.

Gross Profit

| | | Years ended December 31, | |

| (in thousands) | | 2009 | | | 2008 | | | Percent change 08’vs 09’ | | | 2007 | | | Percent change 07’vs.08 | |

| Cost of sales | | $ | 15,099 | | | $ | 16,248 | | | | (7.1 | )% | | $ | 17,464 | | | | (7.0 | )% |

| Cost of sales as a percentage of revenue | | | 56.0 | % | | | 57.8 | % | | | | | | | 60.7 | % | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| Gross profit | | $ | 11,855 | | | $ | 11,849 | | | | 0.1 | % | | $ | 11, 316 | | | | 4.7 | % |

| Gross profit as a percentage of revenue | | | 44.0 | % | | | 42.2 | % | | | | | | | 39.3 | % | | | | |

In relation to the $1.1 million reduction in sales, the 1.8% increase in gross profit as a percentage of sales in the year ended 2009 compared to the same period for 2008 was primarily a result of:

| | · | approximately $308,000 increase in capitalized manufacturing overhead; |

| | · | approximately $105,000 reduction in annual bonuses; |

| | · | approximately $108,000 reduction of our company match to our employees’ 401(k) contributions; |

| | · | an additional decrease in direct and indirect labor costs amounting to approximately $101,000; and |

| | · | approximately a $476,000 reduction in direct material cost as a result of the $1.1 million reduction in sales. |

In relation to the $683,000 reduction in sales, the 2.9% increase in gross profit as a percentage of sales in the year ended 2008 compared to the same period for 2007 was primarily a result of:

| | · | material cost reductions of approximately $170,000 from a decrease in shipping costs and a $460,000 decrease in component costs related to an OEM customer; |

| | · | approximately $116,000 reduction in manufacturing overhead costs; |

| | · | an additional decrease in direct and indirect labor costs amounting to approximately $63,000; |

| | · | certain portions of the workforce in our Canadian facility were reallocated from manufacturing to research and development activities amounting to approximately $175,000 to expand the development of our new products; and |

| | · | approximately a $216,000 reduction in direct material cost as a result of the $683,000 reduction in sales. |

Gain on Cancellation of Agreement

| | | Year ended December 31, | |

| (in thousands) | | 2009 | | | 2008 | | | Percent change 08’vs 09’ | | | 2007 | | | Percent change 07’vs.08 | |

| Gain on cancellation of agreement | | | -- | | | $ | 1,496 | | | | -- | | | | -- | | | | -- | |

| Gain as a percentage of revenue | | | -- | | | | 5.3 | % | | | -- | | | | -- | | | | -- | |

During the year ended 2008, we recognized a one time gain from a cancellation of a contract with Boston Scientific Corporation of approximately $1.5 million. We had no such activity in 2009 or 2007. For an explanation of this gain, please see Note 15 in our consolidated financial statements..

Research and development

| | | Year ended December 31, | |

| (in thousands) | | 2009 | | | 2008 | | | Percent change 08’vs 09’ | | | 2007 | | | Percent change 07’vs.08 | |

| Research and Development expense | | $ | 2,083 | | | $ | 2,061 | | | | 1.1 | % | | $ | 1,643 | | | | 25.4 | % |

| R&D expense as a percentage of revenue | | | 7.7 | % | | | 7.3 | % | | | | | | | 5.7 | % | | | | |

The 1.1% increase in R&D expenses in the year ended 2009 compared to the same period for 2008 was primarily a result of:

| | · | increased costs of approximately $120,000 related to continued development of the Boss and other related sintered steel product line; |

| | · | increase in costs of approximately $22,000 related to the end stage development of the ICON GS (J-Plasma). |

These increases were offset by:

| | · | a decrease in the R&D costs related to our Canadian facility in the amount of approximately $120,000 which was the result of a reduction of the labor force and other related overhead costs. |

The 25.4% increase in R&D expenses in the year ended 2008 compared to the same period for 2007 was primarily a result of:

| | · | certain portions of the workforce in our Canadian facility were reallocated from manufacturing to research and development activities amounting to approximately $175,000 to expand the development of our new products; |

| | · | increases in development costs of the Seal-N-Cut product line, including additional R&D labor, amounting to approximately $243,000; |

Professional services

| | | Year ended December 31, | |

| (in thousands) | | 2009 | | | 2008 | | | Percent change 08’vs 09’ | | | 2007 | | | Percent change 07’vs.08 | |

| Professional services expense | | $ | 1,398 | | | $ | 991 | | | | 41.1 | % | | $ | 738 | | | | 34.3 | % |

| Professional services as a percentage of revenue | | | 5.2 | % | | | 3.5 | % | | | | | | | 2.6 | % | | | | |

The 41.1% increase in professional services costs in the year ended 2009 compared to the same period for 2008 was primarily a result of:

| | · | legal fees related to the Erbe lawsuit increased approximately $339,000; |

| | · | legal fees related to Security and Exchange Commission filings and correspondence increased by approximately $57,000; and |

| | · | audit and accounting costs increased by $51,000 which were related to additional tax related issues and Sarbanes-Oxley compliance and related testing. |

These increases were offset by:

| | · | A decrease of approximately $30,000 in legal fees attributable to patent costs incurred by our Canadian facility for the Seal-N-Cut and other developing products. |

The 34.3% increase in professional services costs in the year ended 2008 compared to the same period for 2007 was primarily a result of:

| | · | legal fees related to the Erbe lawsuit increased approximately $212,000; |

| | · | audit and accounting costs increased by $41,000 which were primarily related to Sarbanes-Oxley compliance and related testing. |

Salaries and related costs

| | | Year ended December 31, | |

| (in thousands) | | 2009 | | | 2008 | | | Percent change 08’vs 09’ | | | 2007 | | | Percent change 07’vs.08 | |

| Salaries and related expenses | | $ | 3,003 | | | $ | 3,016 | | | | (0.5 | )% | | $ | 2,805 | | | | 7.5 | % |

| Salaries & related expenses as a percentage of revenue | | | 11.1 | % | | | 10.7 | % | | | | | | | 9.7 | % | | | | |

The 0.5% decrease in salaries and related costs in the year ended 2009 compared to the same period for 2008 was primarily a result of:

| | · | management’s cost cutting plan implemented in 2009 which resulted in a decrease of approximately $94,000 related to the suspension of employee bonuses, salary increases, and vacation cash out ability. In addition, we had a decrease of approximately $52,000 related to the suspension of the company’s 401(k) match; |

| | · | a decrease in the administrative labor force located at our Canadian facility amounting to approximately $18,000; |

| | · | a reduction in the amount of employee stock option expense booked in the amount of approximately $29,000; and |

| | · | a reduction in other employee benefits by approximately $31,000. |

These decreases were offset by:

| | · | adding additional sales force employees related to our SEER and MEG product lines of approximately $179,000; and |

| | · | an increase in employee health insurance costs of approximately $32,000. |

The 7.5% increase in salaries and related costs in the year ended 2008 compared to the same period for 2007 was primarily a result of:

| | · | annual salary increases which amounted to approximately $168,000; |

| | · | addition of administrative personnel in our Canadian facility of approximately $22,000; and |