2019 Annual Meeting MEMBER FDIC

Christine Toretti Chairperson MEMBER FDIC

Todd D. Brice Chief Executive Officer MEMBER FDIC

Forward Looking Statement and Risk Factors This presentation contains or incorporates statements that we believe are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements generally relate to our financial condition, results of operations, plans, objectives, outlook for earnings, revenues, expenses, capital and liquidity levels and ratios, asset levels, asset quality, financial position, and other matters regarding or affecting S&T and its future business and operations. Forward looking statements are typically identified by words or phrases such as “will likely result”, “expect”, “anticipate”, “estimate”, “forecast”, “project”, “intend”, “ believe”, “assume”, “strategy”, “trend”, “plan”, “outlook”, “outcome”, “continue”, “remain”, “potential”, “opportunity”, “believe”, “comfortable”, “current”, “position”, “maintain”, “sustain”, “seek”, “achieve” and variations of such words and similar expressions, or future or conditional verbs such as will, would, should, could or may. Although we believe the assumptions upon which these forward-looking statements are based are reasonable, any of these assumptions could prove to be inaccurate and the forward-looking statements based on these assumptions could be incorrect. The matters discussed in these forward-looking statements are subject to various risks, uncertainties and other factors that could cause actual results and trends to differ materially from those made, projected, or implied in or by the forward-looking statements depending on a variety of uncertainties or other factors including, but not limited to: credit losses; cyber-security concerns; rapid technological developments and changes; sensitivity to the interest rate environment including a prolonged period of low interest rates, a rapid increase in interest rates or a change in the shape of the yield curve; a change in spreads on interest-earning assets and interest-bearing liabilities; regulatory supervision and oversight; legislation affecting the financial services industry as a whole, and S&T, in particular; the outcome of pending and future litigation and governmental proceedings; increasing price and product/service competition; the ability to continue to introduce competitive new products and services on a timely, cost-effective basis; managing our internal growth and acquisitions; the possibility that the anticipated benefits from acquisitions cannot be fully realized in a timely manner or at all, or that integrating the acquired operations will be more difficult, disruptive or costly than anticipated; containing costs and expenses; reliance on significant customer relationships; general economic or business conditions; deterioration of the housing market and reduced demand for mortgages; deterioration in the overall macroeconomic conditions or the state of the banking industry that could warrant further analysis of the carrying value of goodwill and could result in an adjustment to its carrying value resulting in a non-cash charge to net income; re-emergence of turbulence in significant portions of the global financial and real estate markets that could impact our performance, both directly, by affecting our revenues and the value of our assets and liabilities, and indirectly, by affecting the economy generally and access to capital in the amounts, at the times and on the terms required to support our future businesses. Many of these factors, as well as other factors, are described in our filings with the SEC. Forward-looking statements are based on beliefs and assumptions using information available at the time the statements are made. We caution you not to unduly rely on forward-looking statements because the assumptions, beliefs, expectations and projections about future events may, and often do, differ materially from actual results. Any forward-looking statement speaks only as to the date on which it is made, and we undertake no obligation to update any forward-looking statement to reflect developments occurring after the statement is made. 4

Non-GAAP Financial Measures In addition to the results of operations presented in accordance with Generally Accepted Accounting Principles (GAAP), S&T management uses and this presentation contains or references certain non- GAAP financial measures, such as net interest income on a fully taxable equivalent basis. S&T believes these financial measures provide information useful to investors in understanding our operational performance and business and performance trends which facilitate comparisons with the performance of others in the financial services industry. Although S&T believes that these non-GAAP financial measures enhance investors’ understanding of S&T’s business and performance, these non-GAAP financial measures should not be considered an alternative to GAAP. The non-GAAP financial measures contained therein should be read in conjunction with the audited financial statements and analysis as presented in the Annual Report on Form 10-K as well as the unaudited financial statements and analyses as presented in the respective Quarterly Reports on Forms 10-Q for S&T Bancorp, Inc. and subsidiaries. 5

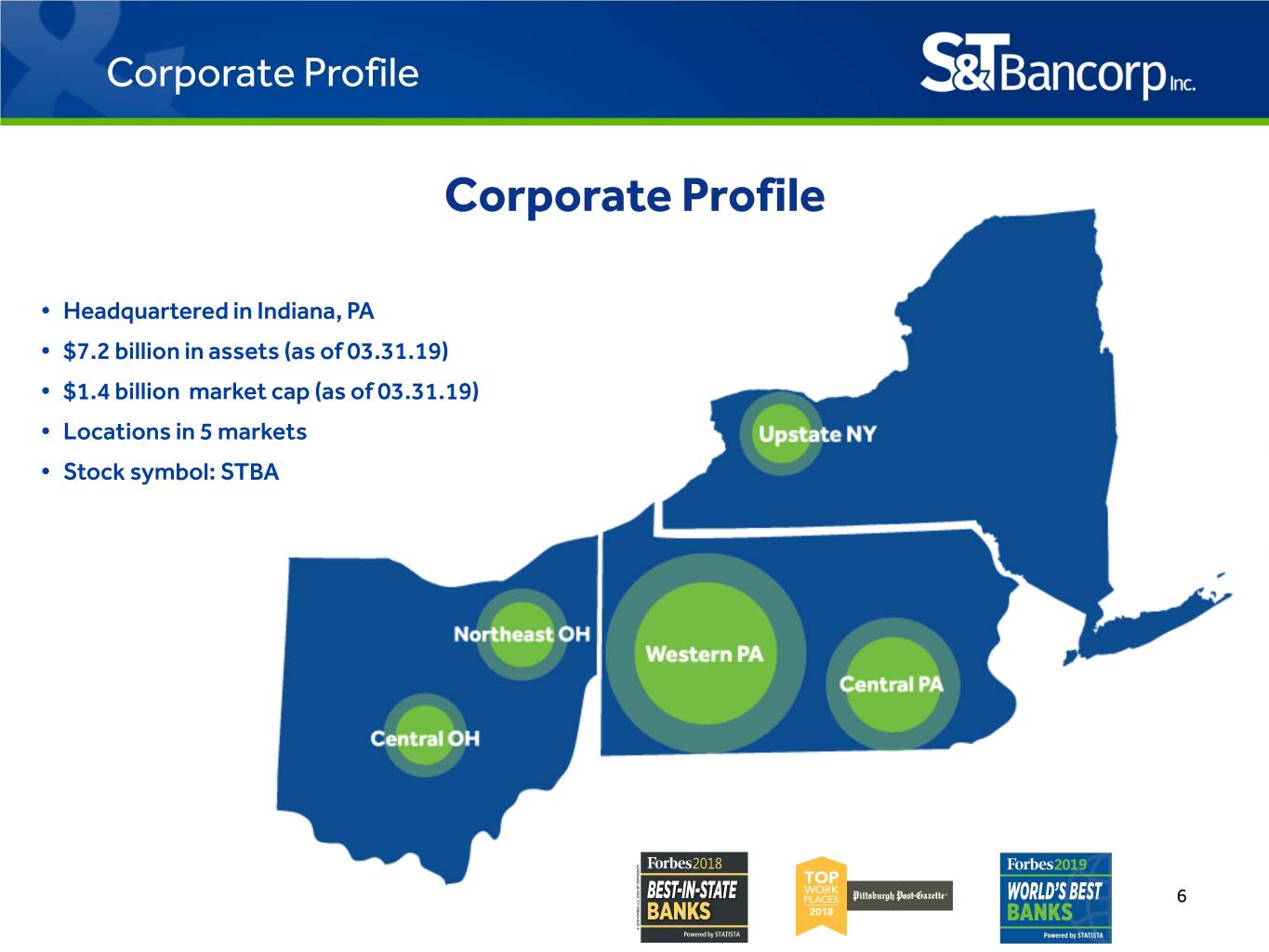

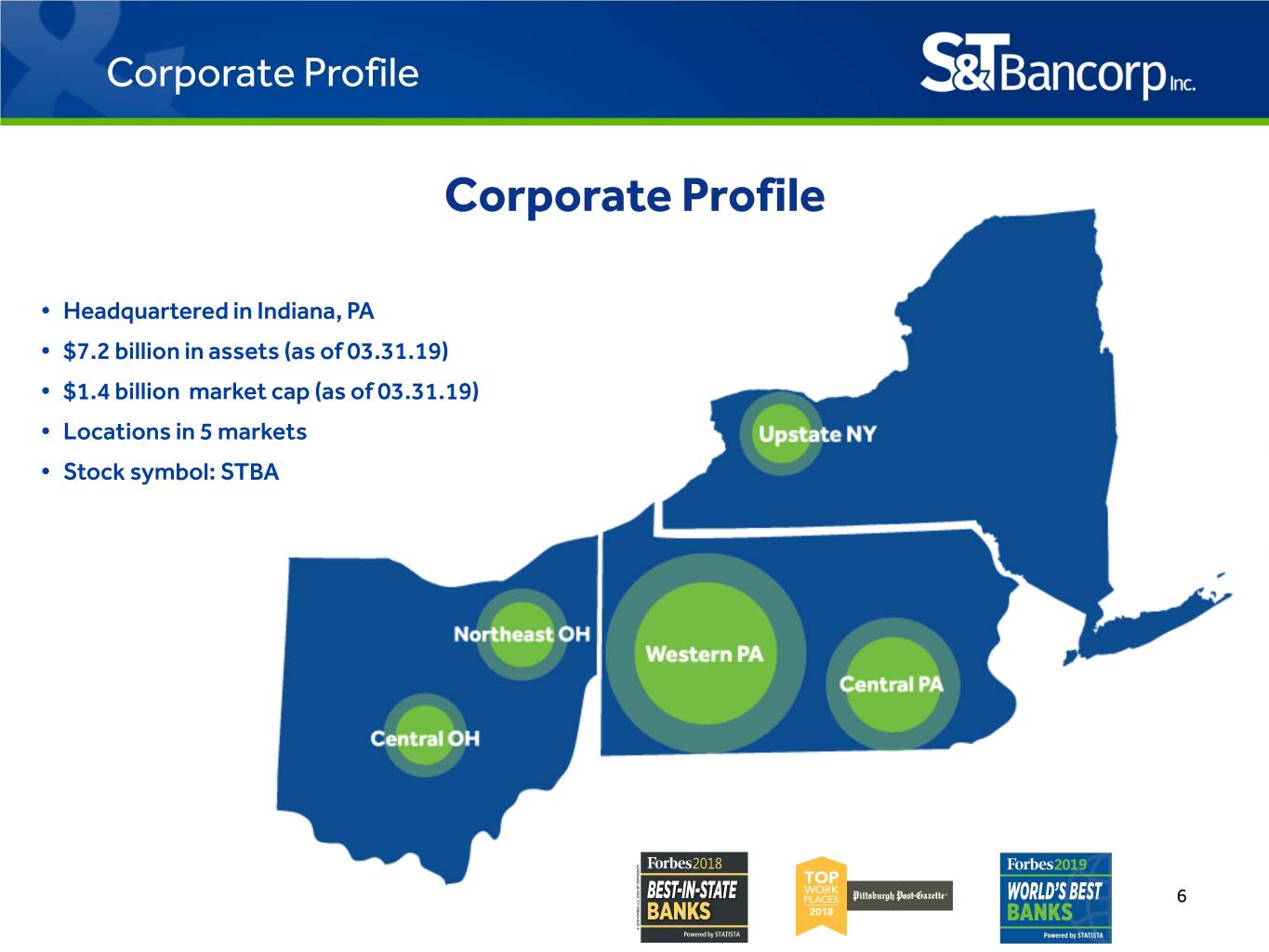

Corporate Profile Corporate Profile • Headquartered in Indiana, PA • $7.2 billion in assets (as of 03.31.19) • $1.4 billion market cap (as of 03.31.19) • Locations in 5 markets • Stock symbol: STBA 6

STBA Investment Thesis STBA Investment Thesis • Above peer performance • Demonstrated expense discipline and efficiency • Organic growth • Strategic and effective mergers and expansion • Stable markets with long-term oil and gas benefit • Sound asset quality 7

STBA Investment Thesis The Right Size • Big enough to: • Provide full complement of products and services • Access technology • Access capital markets • Attract talent • Expand – mergers and acquisitions/de novo • Small enough to: • Stay close to our customers • Understand our markets • Be responsive 8

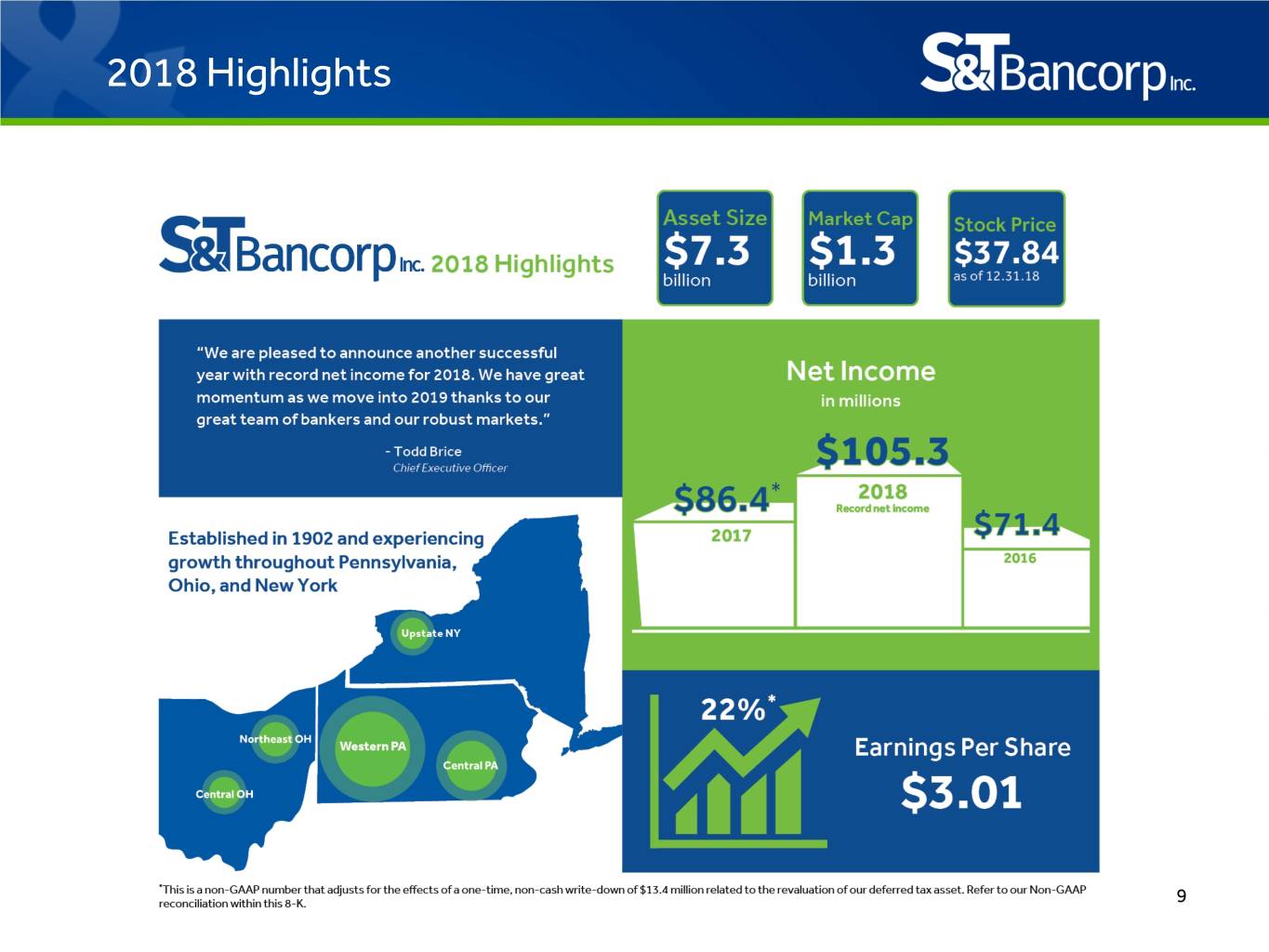

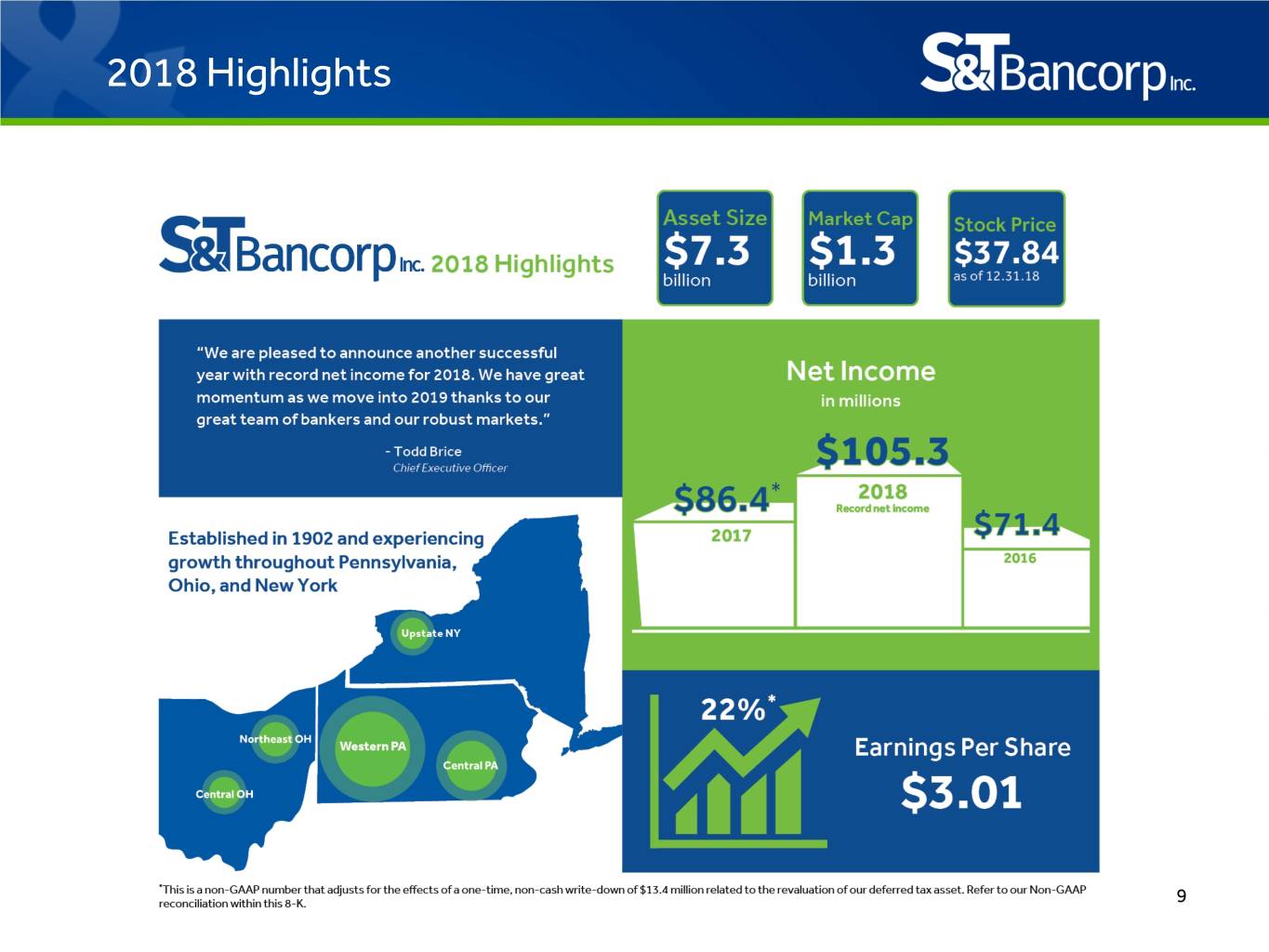

2018 Highlights 9

2018 Highlights 10

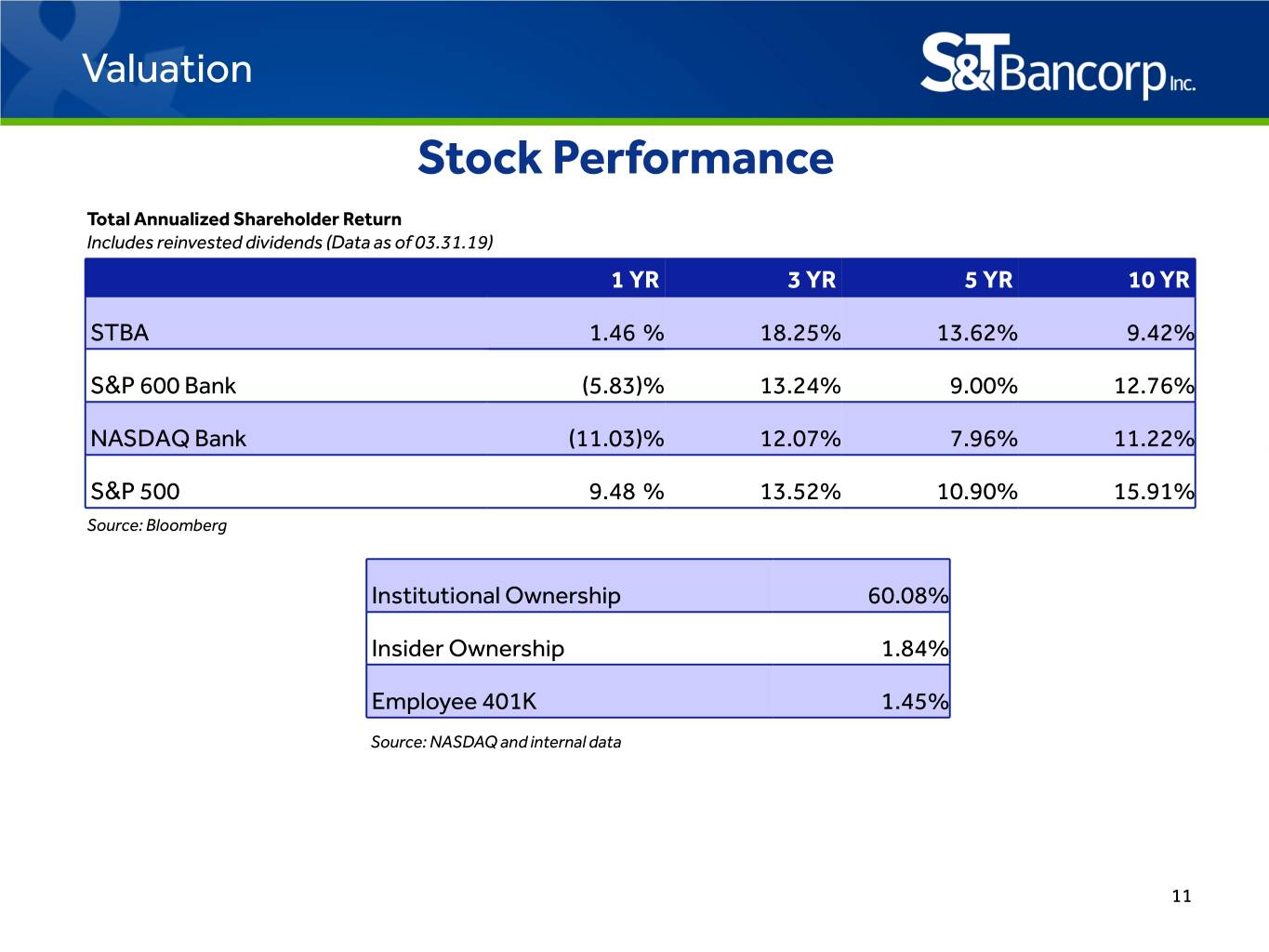

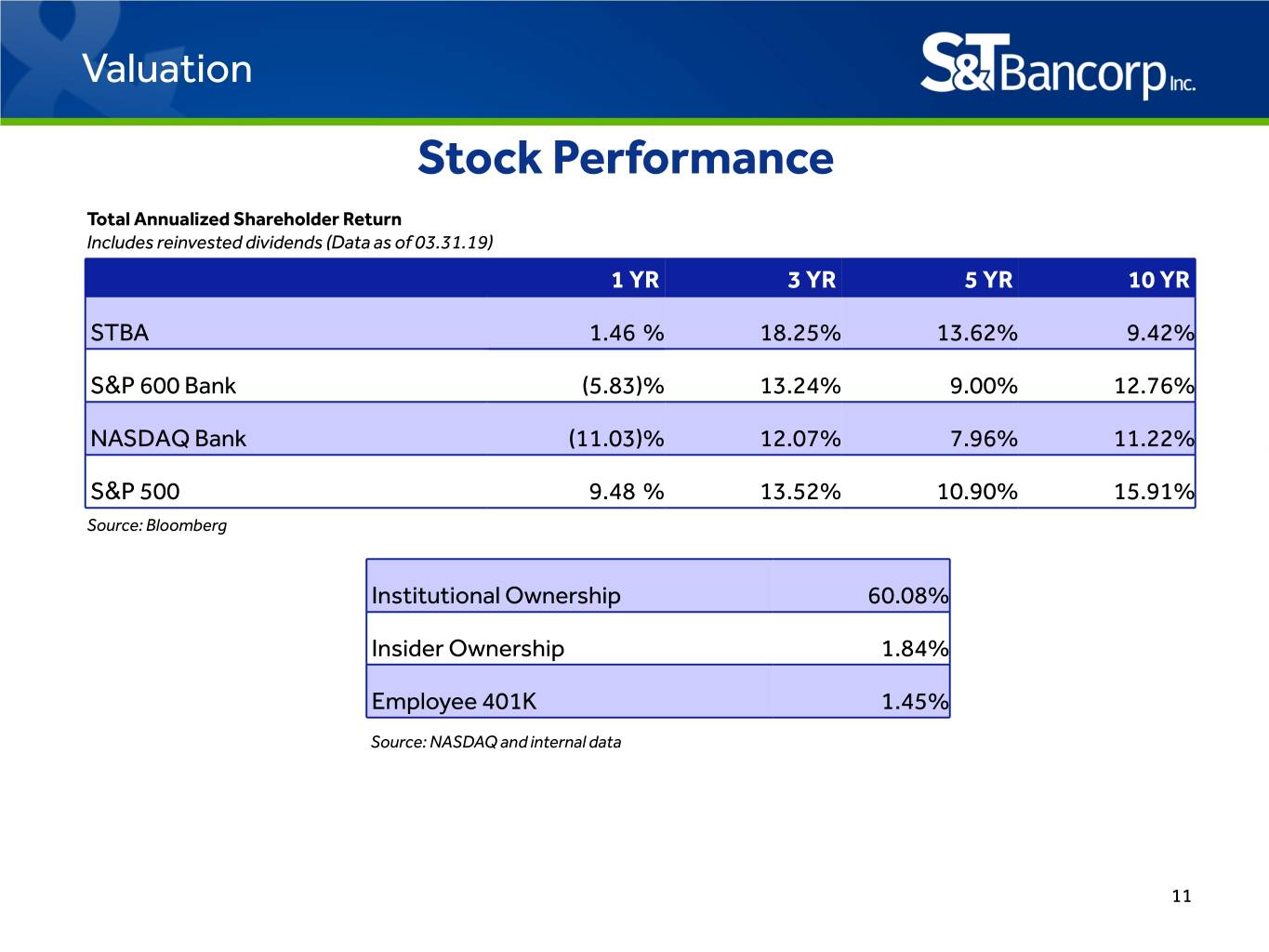

Valuation Stock Performance Total Annualized Shareholder Return Includes reinvested dividends (Data as of 03.31.19) 1 YR 3 YR 5 YR 10 YR STBA 1.46 % 18.25% 13.62% 9.42% S&P 600 Bank (5.83)% 13.24% 9.00% 12.76% NASDAQ Bank (11.03)% 12.07% 7.96% 11.22% S&P 500 9.48 % 13.52% 10.90% 15.91% Source: Bloomberg Institutional Ownership 60.08% Insider Ownership 1.84% Employee 401K 1.45% Source: NASDAQ and internal data 11

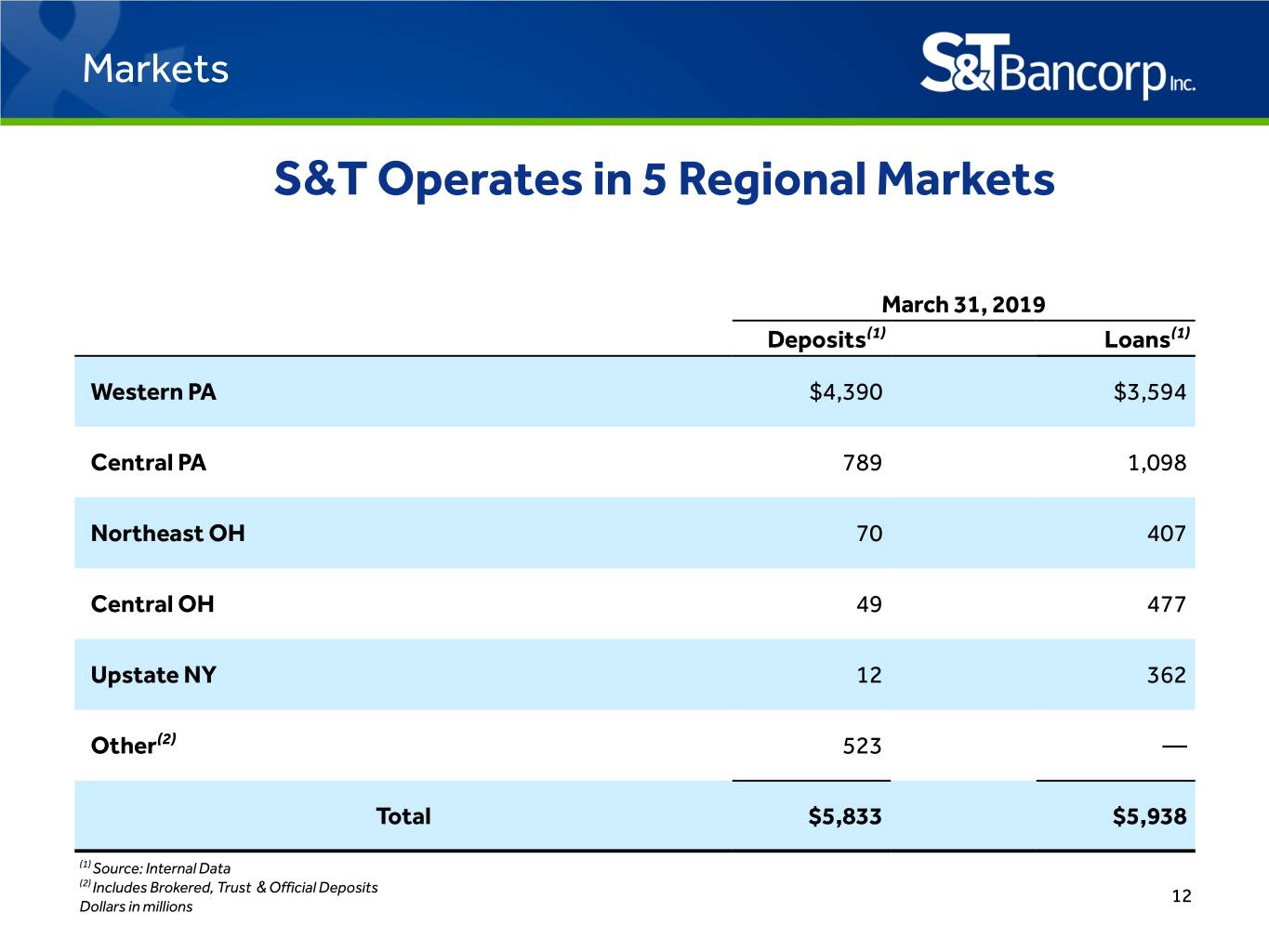

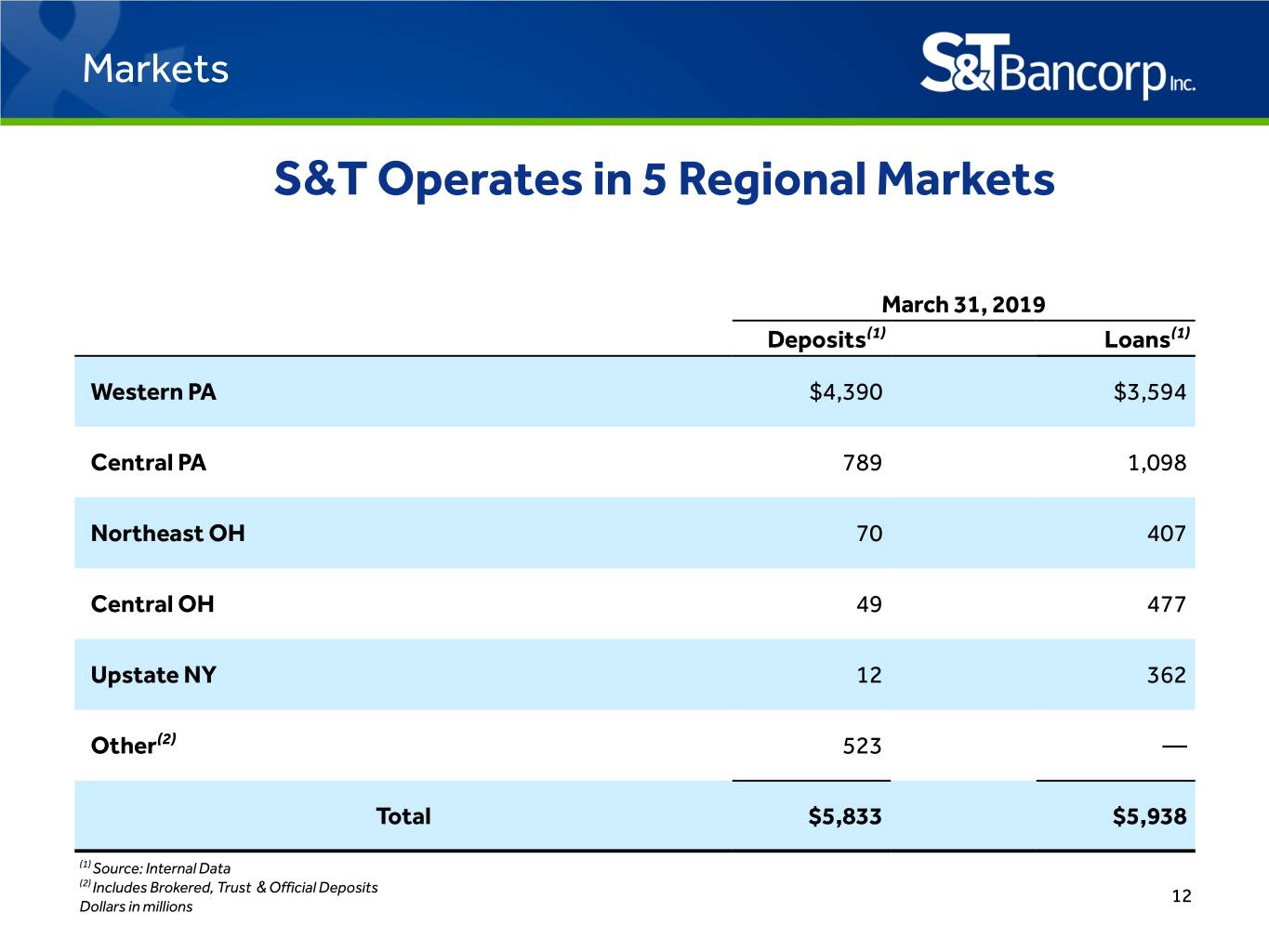

Markets S&T Operates in 5 Regional Markets March 31, 2019 Deposits(1) Loans(1) Western PA $4,390 $3,594 Central PA 789 1,098 Western NY Western NY Northeast OH 70 407 Northeast OH CentralNortheast OH OH 49 Central PA 477 Southwestern PA Central PA Southwestern PA Central OH Central OH Upstate NY 12 362 Other(2) 523 — Total $5,833 $5,938 (1) Source: Internal Data (2) Includes Brokered, Trust & Official Deposits 12 Dollars in millions

Mark Kochvar Chief Financial Officer MEMBER FDIC

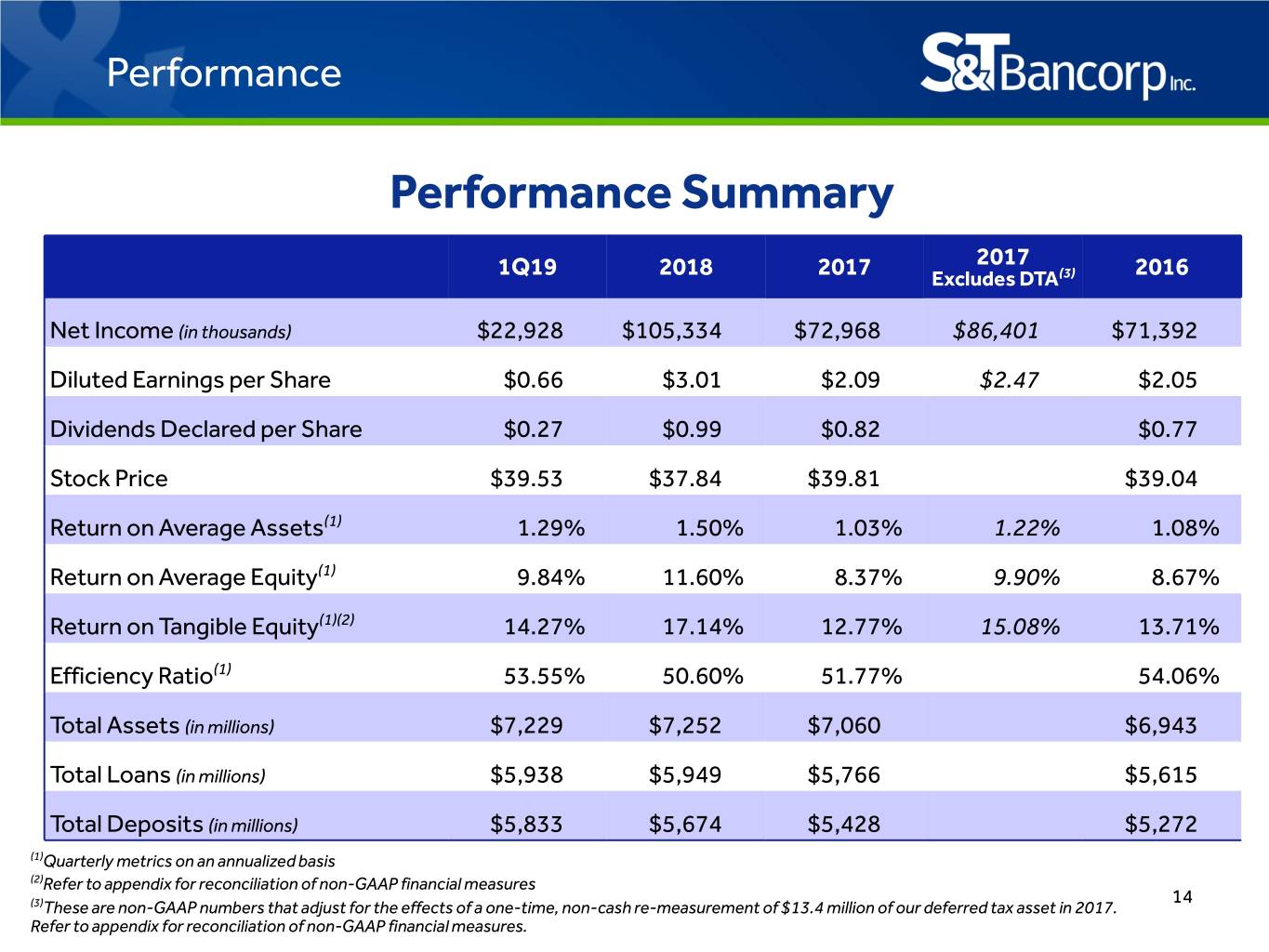

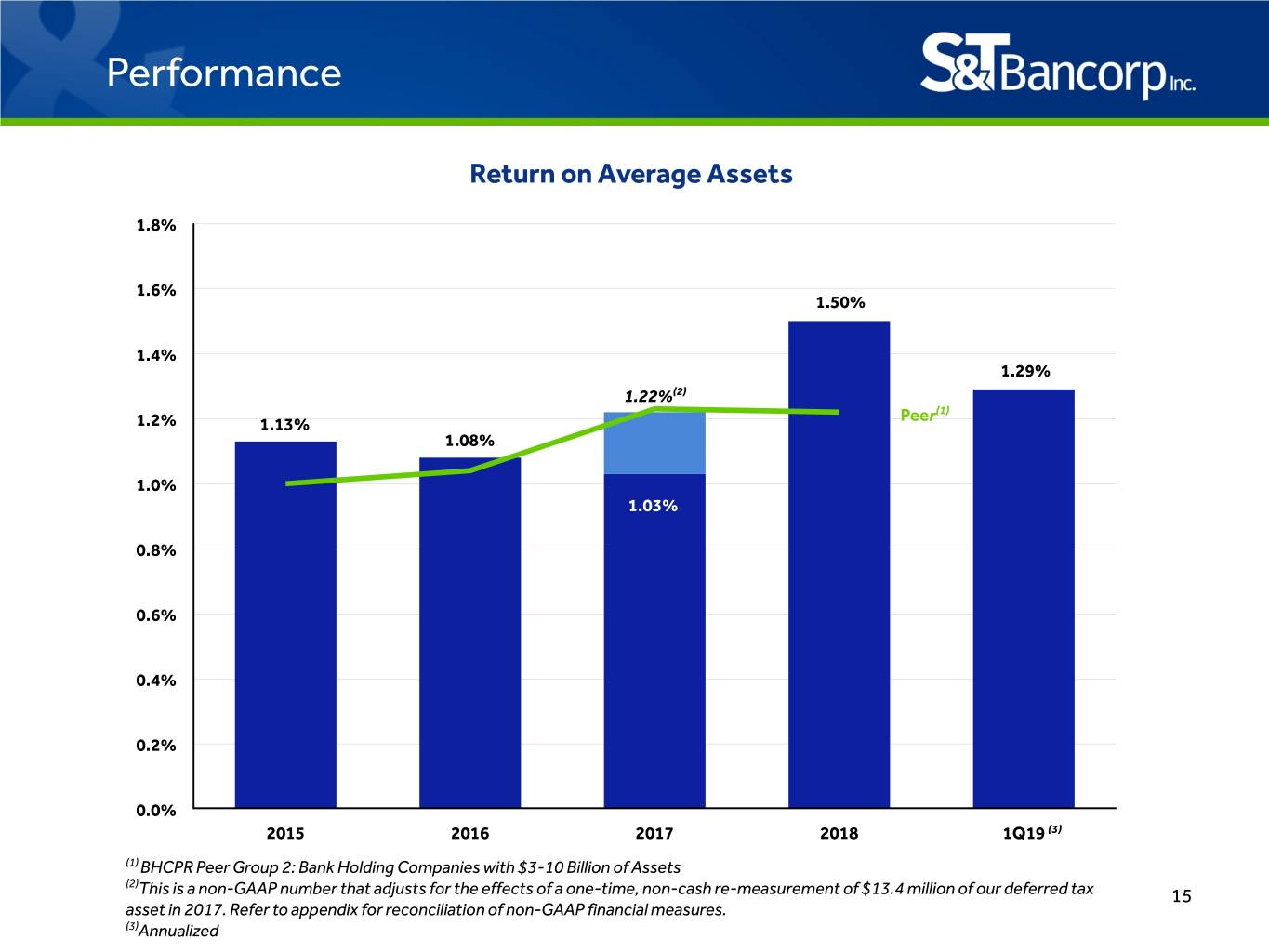

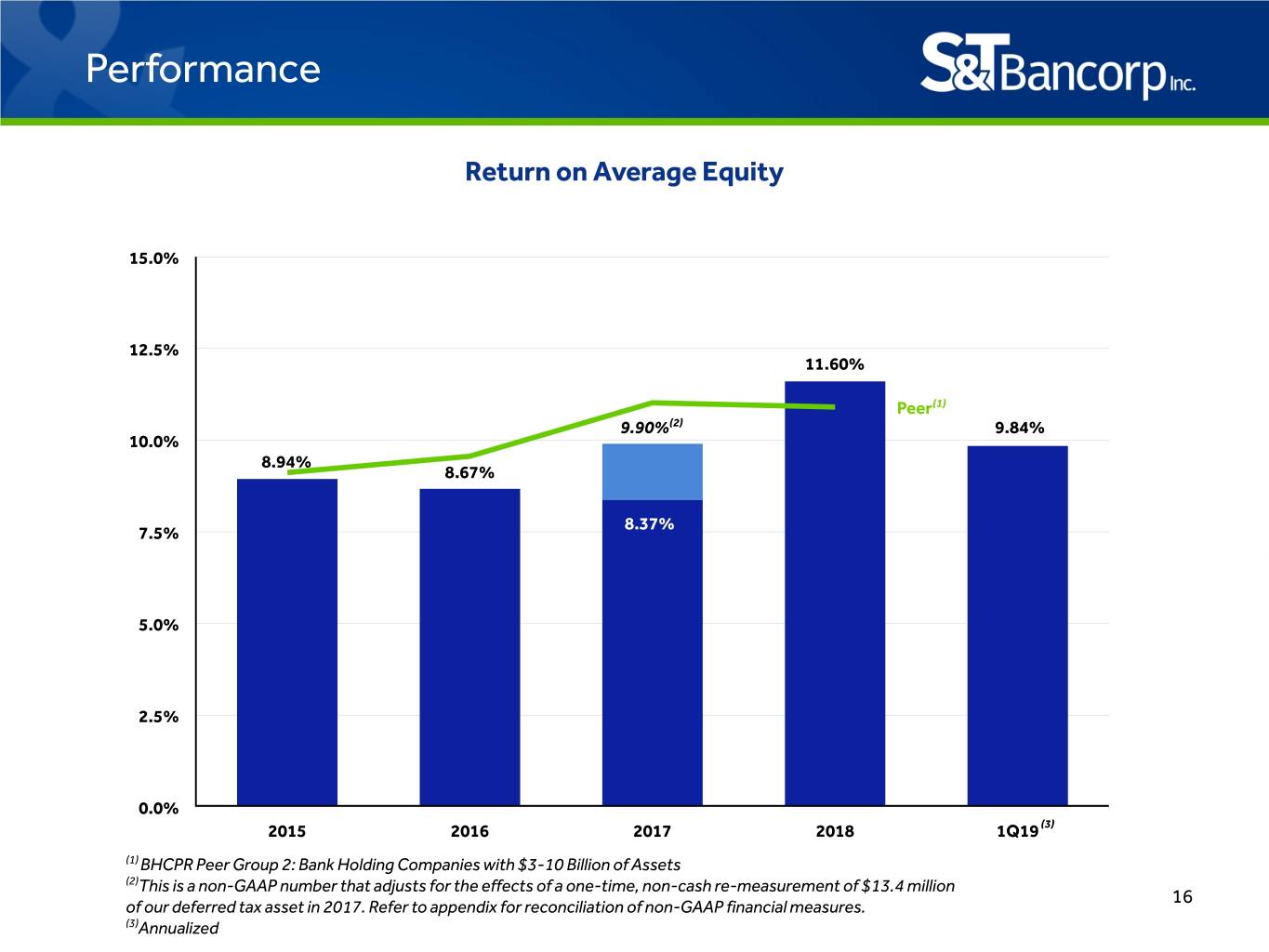

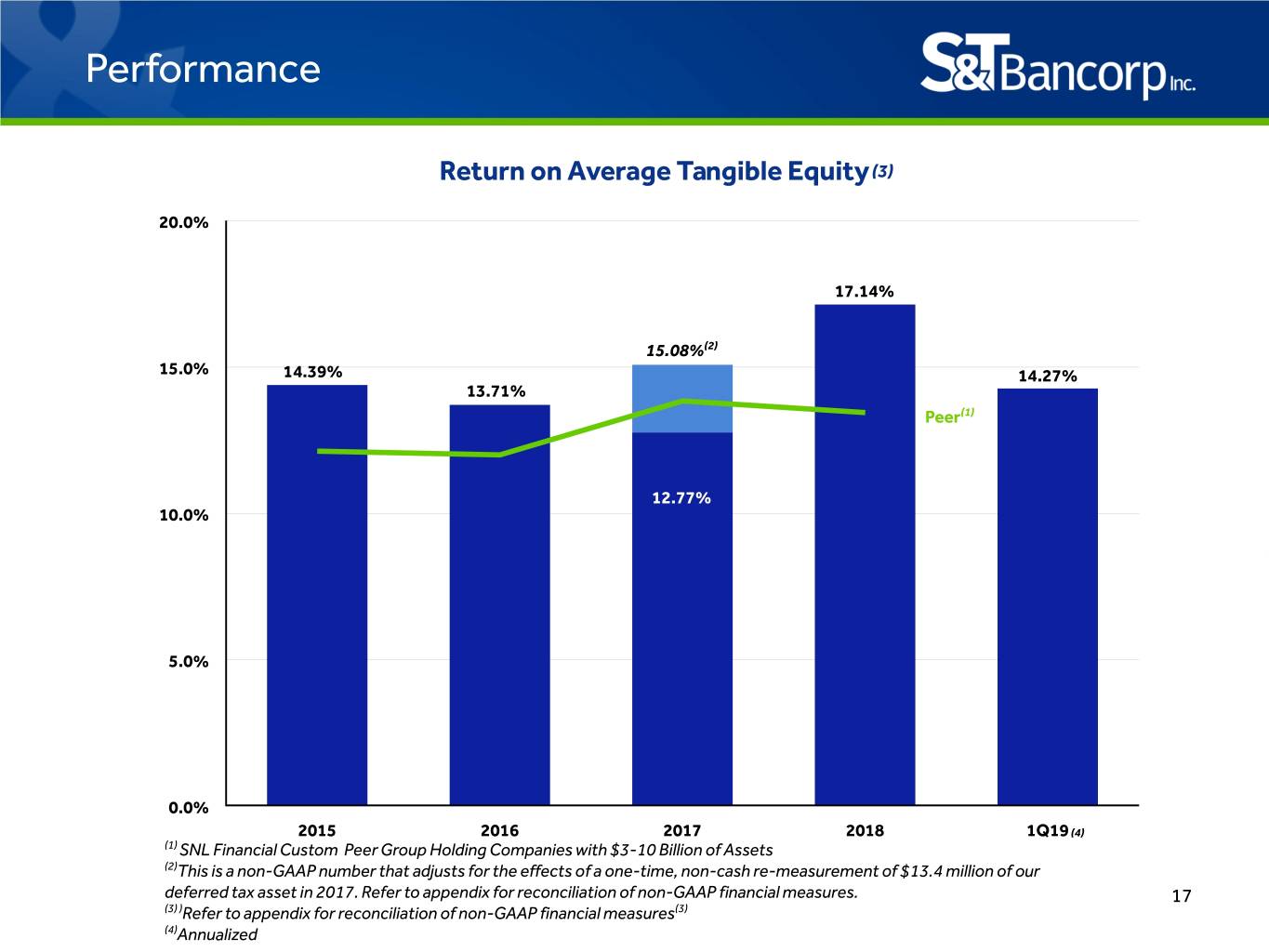

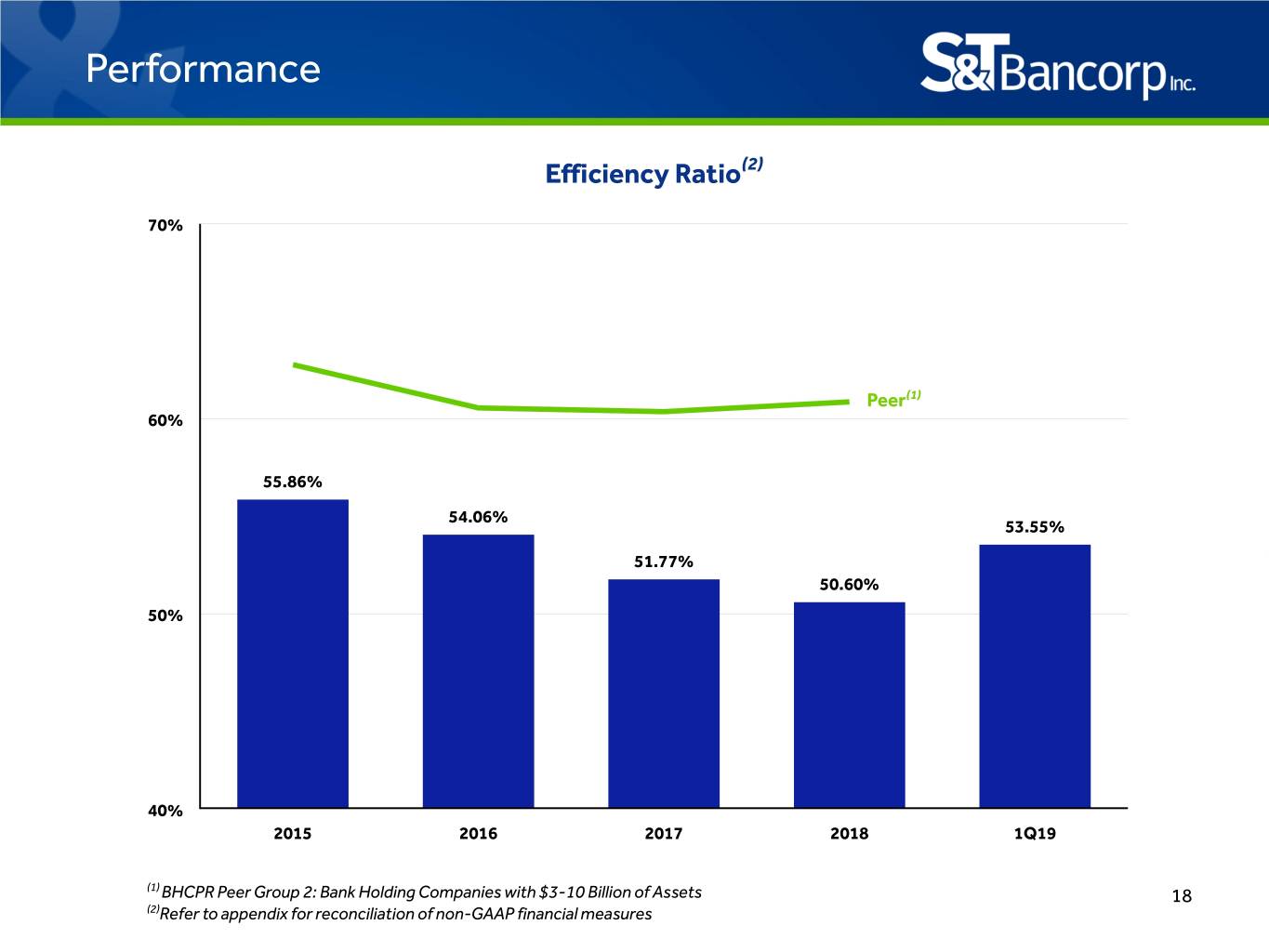

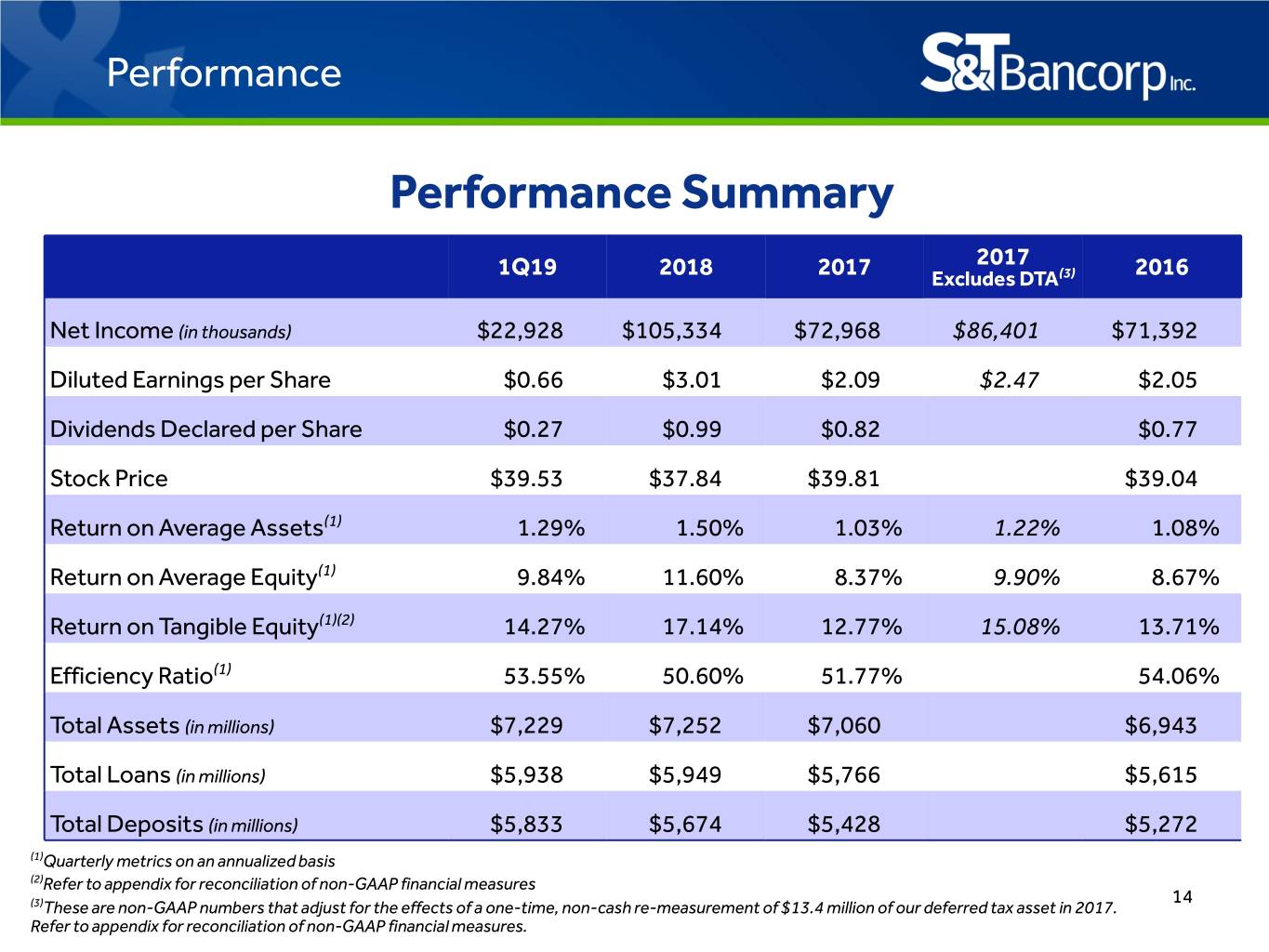

Performance Performance Summary 2017 1Q19 2018 2017 Excludes DTA(3) 2016 Net Income (in thousands) $22,928 $105,334 $72,968 $86,401 $71,392 Diluted Earnings per Share $0.66 $3.01 $2.09 $2.47 $2.05 Dividends Declared per Share $0.27 $0.99 $0.82 $0.77 Stock Price $39.53 $37.84 $39.81 $39.04 Return on Average Assets(1) 1.29% 1.50% 1.03% 1.22% 1.08% Return on Average Equity(1) 9.84% 11.60% 8.37% 9.90% 8.67% Return on Tangible Equity(1)(2) 14.27% 17.14% 12.77% 15.08% 13.71% Efficiency Ratio(1) 53.55% 50.60% 51.77% 54.06% Total Assets (in millions) $7,229 $7,252 $7,060 $6,943 Total Loans (in millions) $5,938 $5,949 $5,766 $5,615 Total Deposits (in millions) $5,833 $5,674 $5,428 $5,272 (1)Quarterly metrics on an annualized basis (2)Refer to appendix for reconciliation of non-GAAP financial measures 14 (3)These are non-GAAP numbers that adjust for the effects of a one-time, non-cash re-measurement of $13.4 million of our deferred tax asset in 2017. Refer to appendix for reconciliation of non-GAAP financial measures.

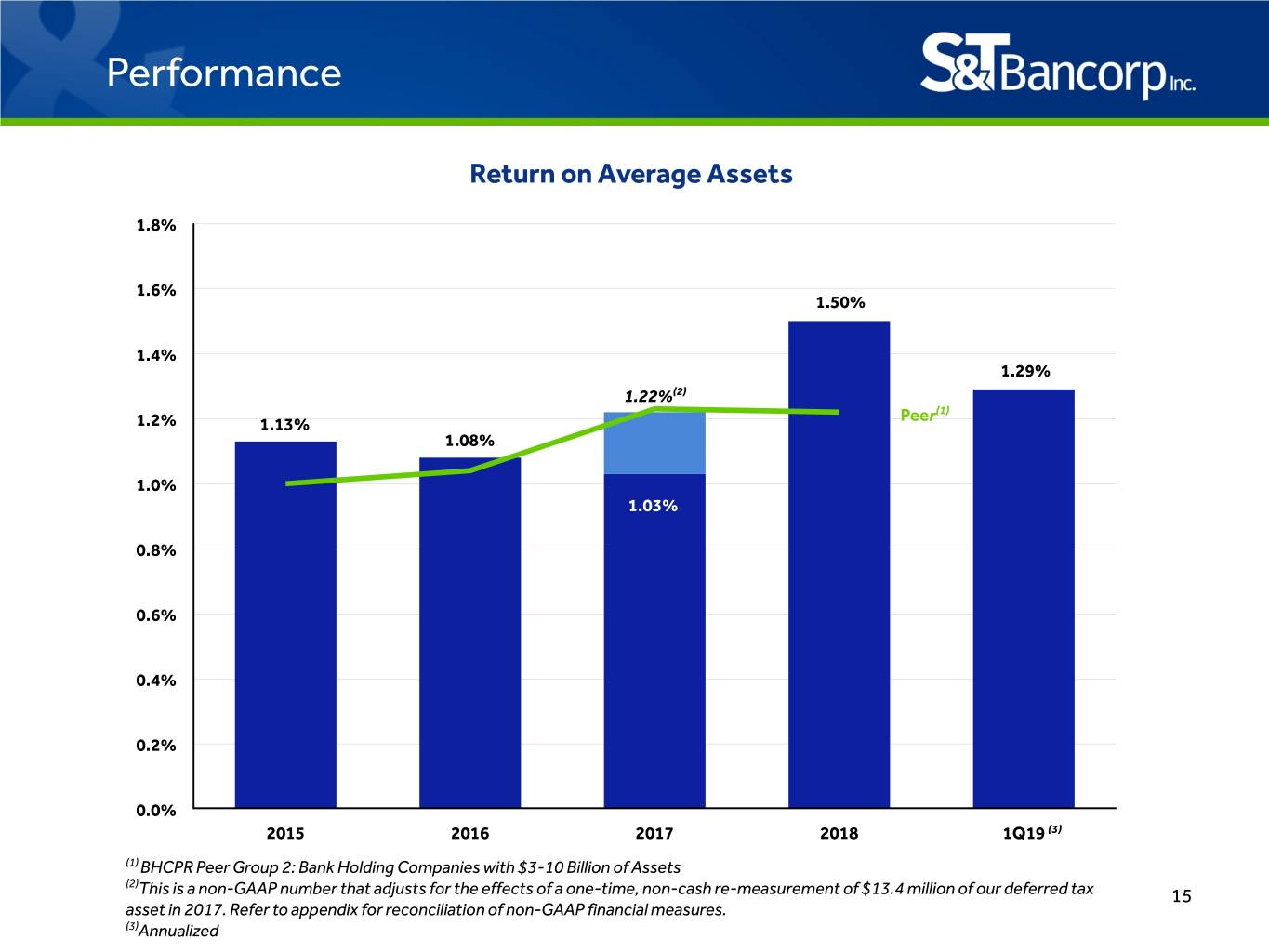

Performance Return on Average Assets 1.8% 1.6% 1.50% 1.4% 1.29% 1.22%(2) Peer(1) 1.2% 1.13% 1.08% 1.0% 1.03% 0.8% 0.6% 0.4% 0.2% 0.0% 2015 2016 2017 2018 1Q19 (3) (1) BHCPR Peer Group 2: Bank Holding Companies with $3-10 Billion of Assets (2) This is a non-GAAP number that adjusts for the effects of a one-time, non-cash re-measurement of $13.4 million of our deferred tax 15 asset in 2017. Refer to appendix for reconciliation of non-GAAP financial measures. (3)Annualized

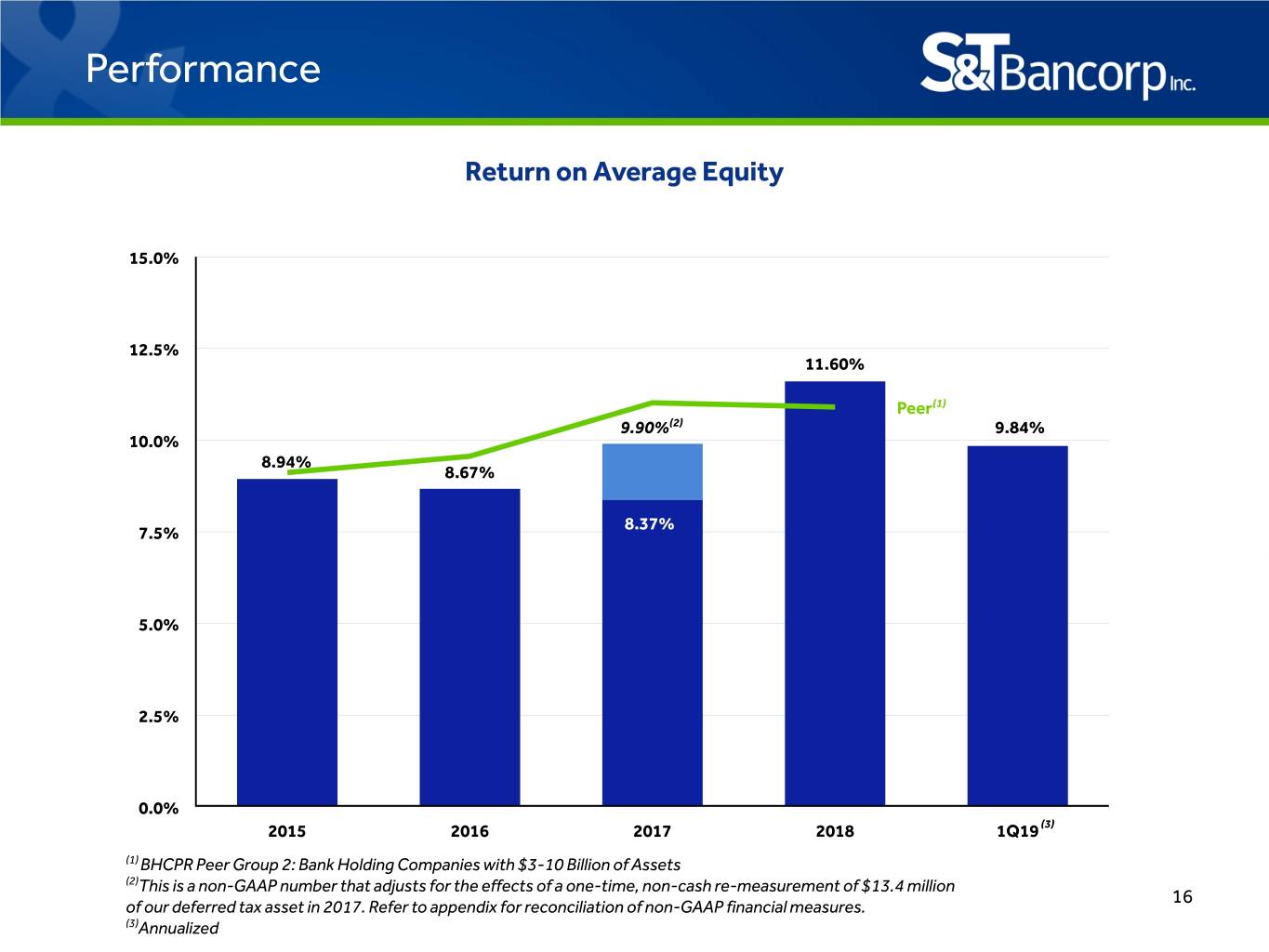

Performance Return on Average Equity 15.0% 12.5% 11.60% Peer(1) 9.90%(2) 9.84% 10.0% 8.94% 8.67% 8.37% 7.5% 5.0% 2.5% 0.0% 2015 2016 2017 2018 1Q19 (3) (1) BHCPR Peer Group 2: Bank Holding Companies with $3-10 Billion of Assets (2)This is a non-GAAP number that adjusts for the effects of a one-time, non-cash re-measurement of $13.4 million 16 of our deferred tax asset in 2017. Refer to appendix for reconciliation of non-GAAP financial measures. (3)Annualized

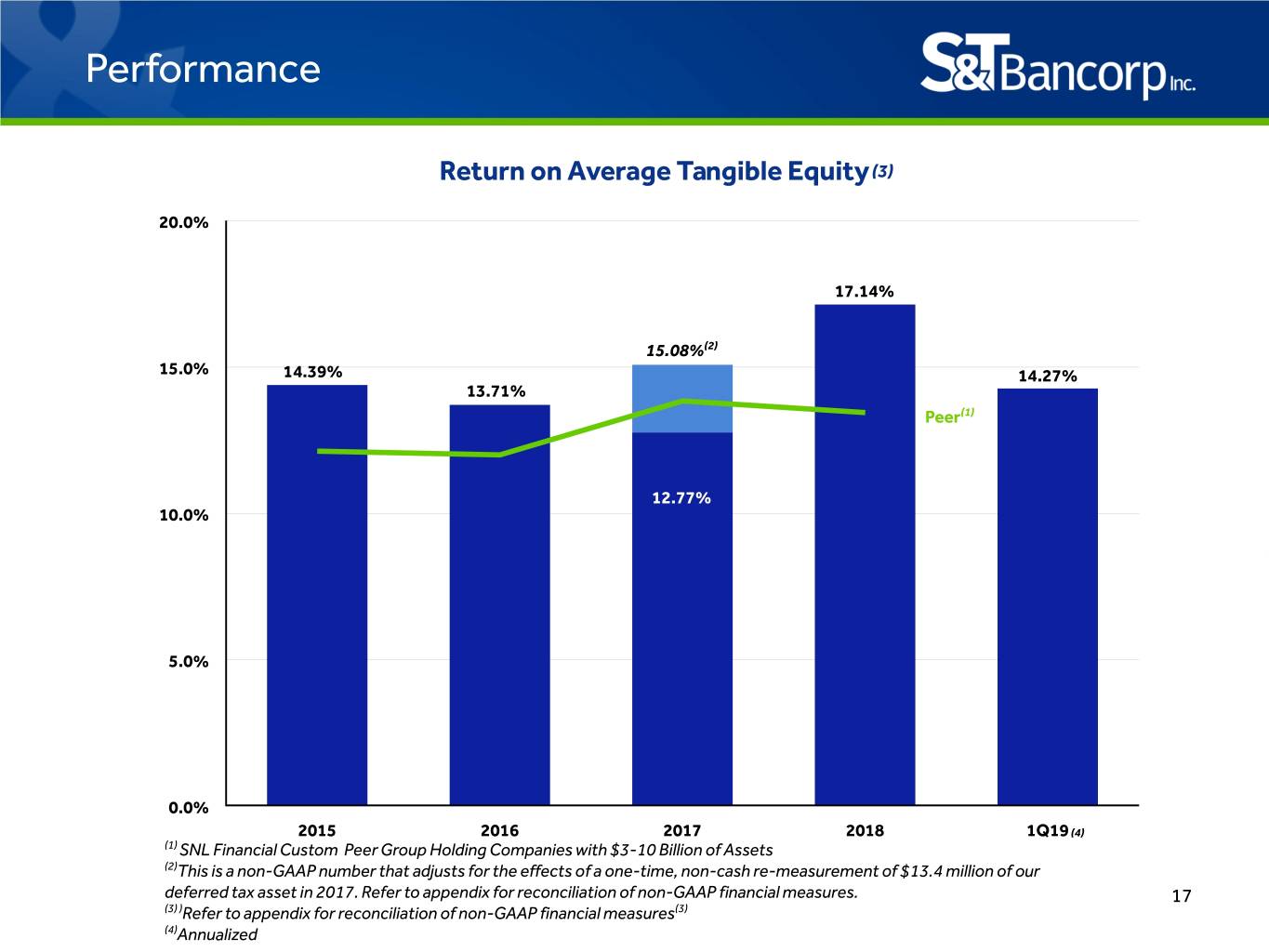

Performance Return on Average Tangible Equity(3) 20.0% 17.14% 15.08%(2) 15.0% 14.39% 14.27% 13.71% Peer(1) 12.77% 10.0% 5.0% 0.0% 2015 2016 2017 2018 1Q19 (4) (1) SNL Financial Custom Peer Group Holding Companies with $3-10 Billion of Assets (2)This is a non-GAAP number that adjusts for the effects of a one-time, non-cash re-measurement of $13.4 million of our deferred tax asset in 2017. Refer to appendix for reconciliation of non-GAAP financial measures. 17 (3) )Refer to appendix for reconciliation of non-GAAP financial measures(3) (4)Annualized

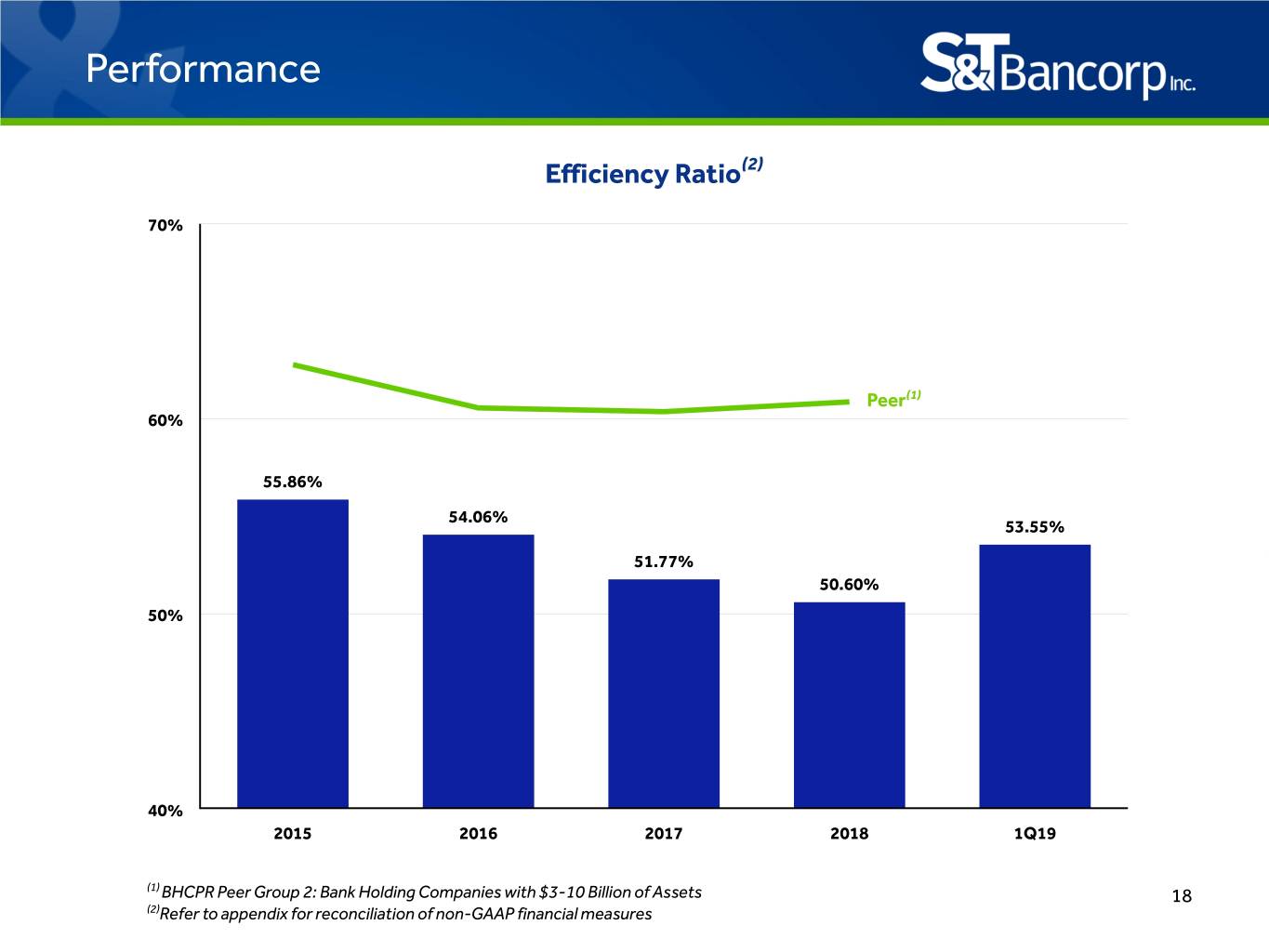

Performance Efficiency Ratio(2) 70% Peer(1) 60% 55.86% 54.06% 53.55% 51.77% 50.60% 50% 40% 2015 2016 2017 2018 1Q19 (1) BHCPR Peer Group 2: Bank Holding Companies with $3-10 Billion of Assets 18 (2)Refer to appendix for reconciliation of non-GAAP financial measures

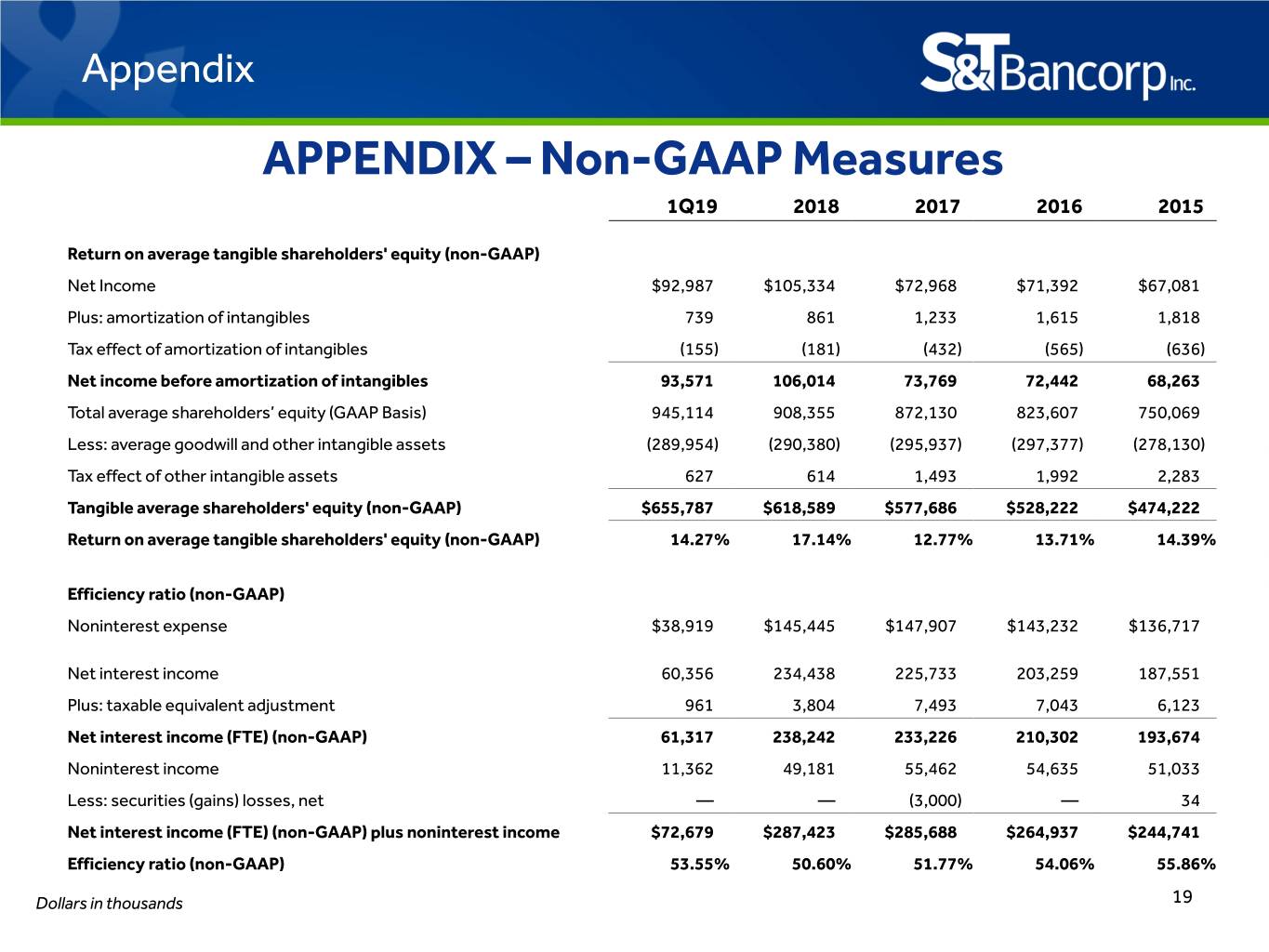

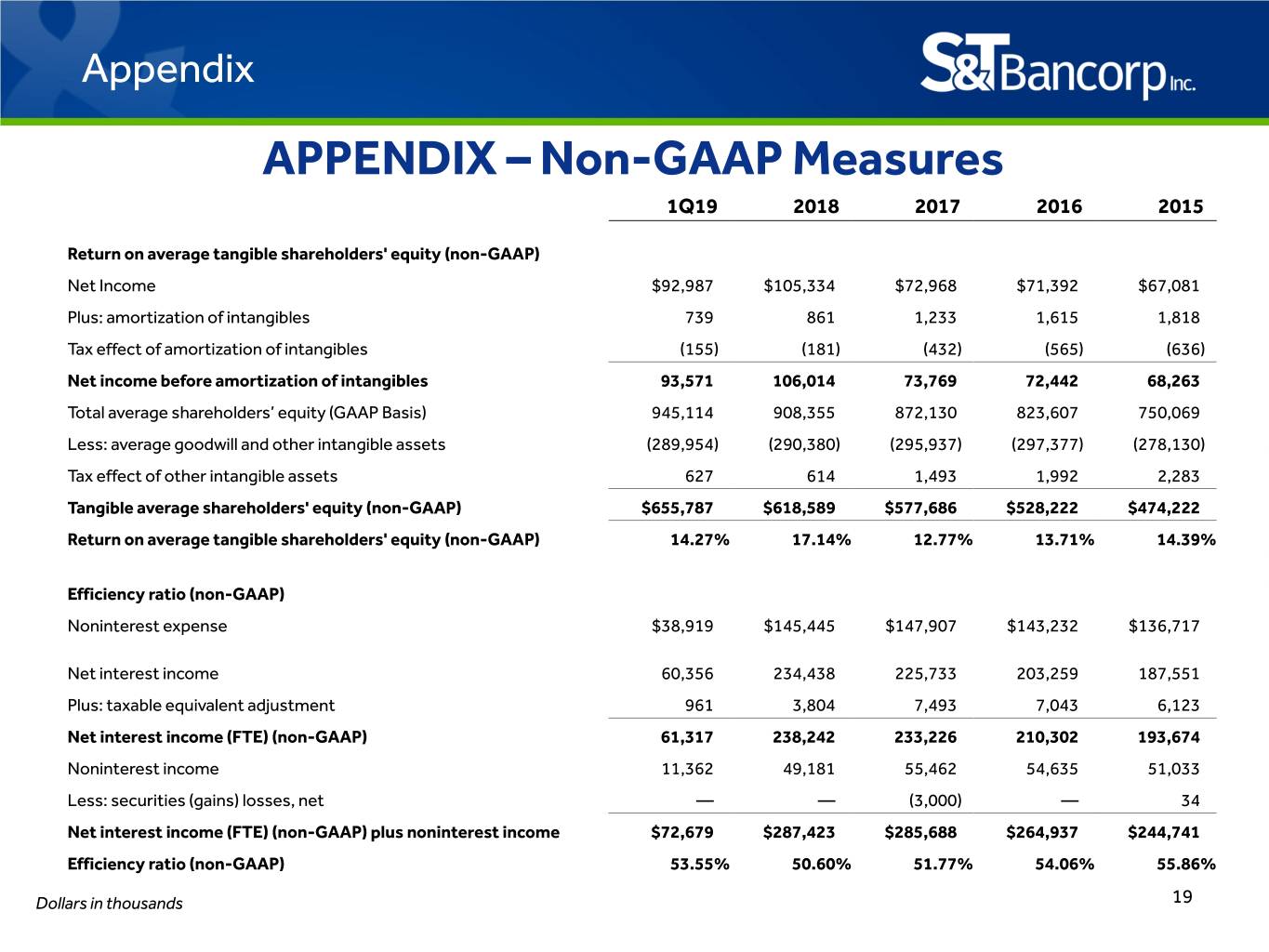

Appendix APPENDIX – Non-GAAP Measures 1Q19 2018 2017 2016 2015 Return on average tangible shareholders' equity (non-GAAP) Net Income $92,987 $105,334 $72,968 $71,392 $67,081 Plus: amortization of intangibles 739 861 1,233 1,615 1,818 Tax effect of amortization of intangibles (155) (181) (432) (565) (636) Net income before amortization of intangibles 93,571 106,014 73,769 72,442 68,263 Total average shareholders’ equity (GAAP Basis) 945,114 908,355 872,130 823,607 750,069 Less: average goodwill and other intangible assets (289,954) (290,380) (295,937) (297,377) (278,130) Tax effect of other intangible assets 627 614 1,493 1,992 2,283 Tangible average shareholders' equity (non-GAAP) $655,787 $618,589 $577,686 $528,222 $474,222 Return on average tangible shareholders' equity (non-GAAP) 14.27% 17.14% 12.77% 13.71% 14.39% Efficiency ratio (non-GAAP) Noninterest expense $38,919 $145,445 $147,907 $143,232 $136,717 Net interest income 60,356 234,438 225,733 203,259 187,551 Plus: taxable equivalent adjustment 961 3,804 7,493 7,043 6,123 Net interest income (FTE) (non-GAAP) 61,317 238,242 233,226 210,302 193,674 Noninterest income 11,362 49,181 55,462 54,635 51,033 Less: securities (gains) losses, net — — (3,000) — 34 Net interest income (FTE) (non-GAAP) plus noninterest income $72,679 $287,423 $285,688 $264,937 $244,741 Efficiency ratio (non-GAAP) 53.55% 50.60% 51.77% 54.06% 55.86% Dollars in thousands 19

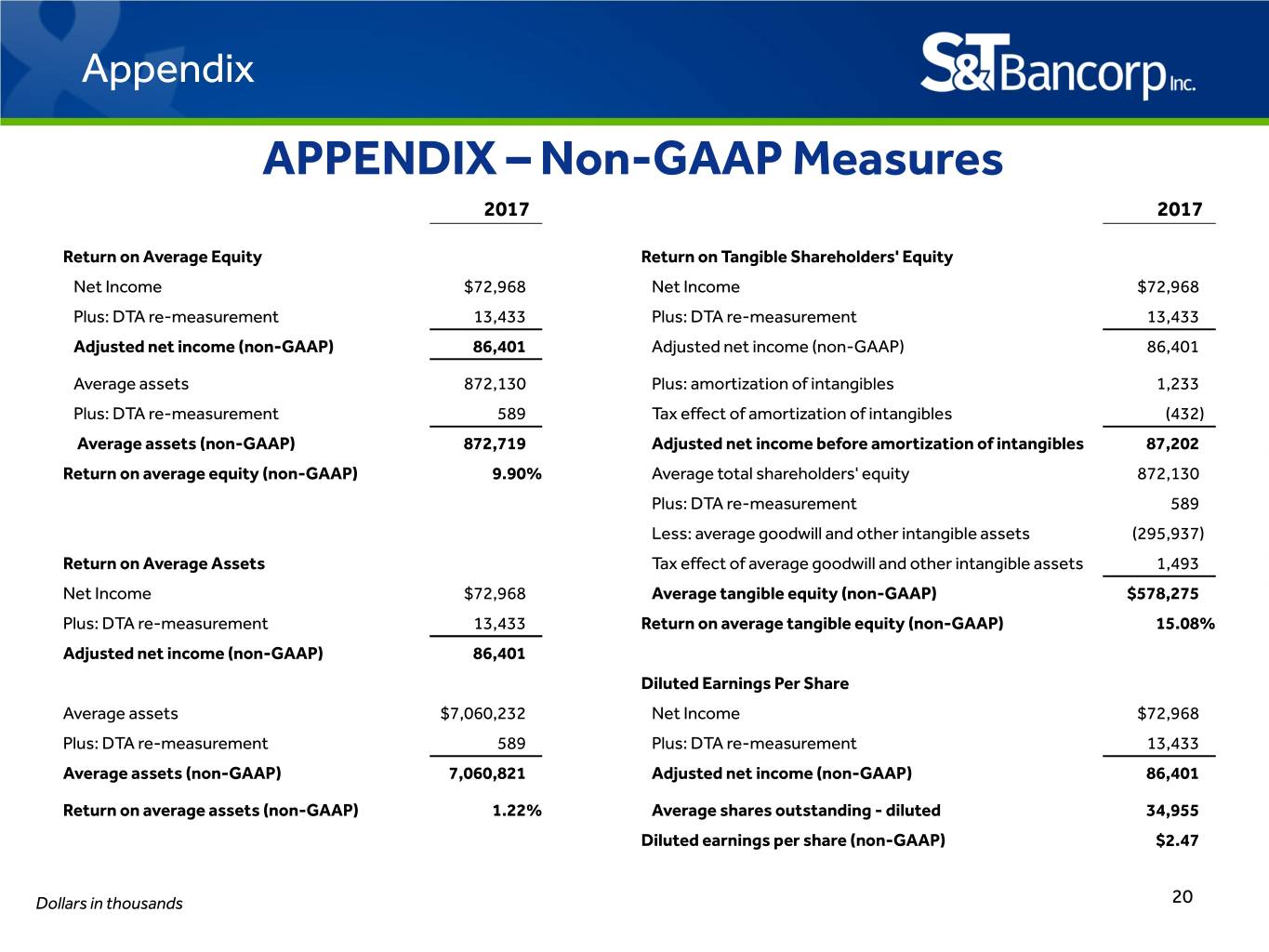

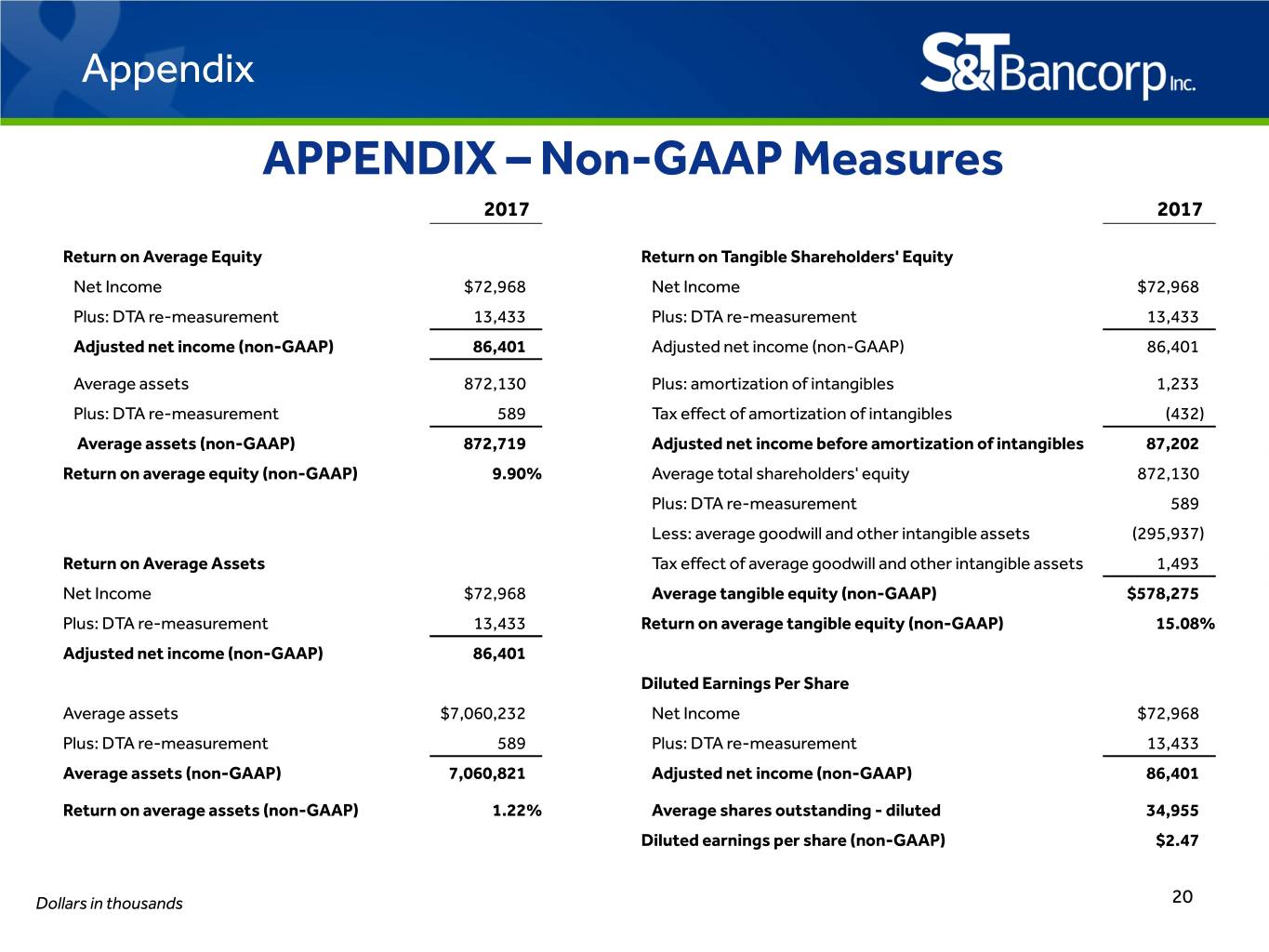

Appendix APPENDIX – Non-GAAP Measures 2017 2017 Return on Average Equity Return on Tangible Shareholders' Equity Net Income $72,968 Net Income $72,968 Plus: DTA re-measurement 13,433 Plus: DTA re-measurement 13,433 Adjusted net income (non-GAAP) 86,401 Adjusted net income (non-GAAP) 86,401 Average assets 872,130 Plus: amortization of intangibles 1,233 Plus: DTA re-measurement 589 Tax effect of amortization of intangibles (432) Average assets (non-GAAP) 872,719 Adjusted net income before amortization of intangibles 87,202 Return on average equity (non-GAAP) 9.90% Average total shareholders' equity 872,130 Plus: DTA re-measurement 589 Less: average goodwill and other intangible assets (295,937) Return on Average Assets Tax effect of average goodwill and other intangible assets 1,493 Net Income $72,968 Average tangible equity (non-GAAP) $578,275 Plus: DTA re-measurement 13,433 Return on average tangible equity (non-GAAP) 15.08% Adjusted net income (non-GAAP) 86,401 Diluted Earnings Per Share Average assets $7,060,232 Net Income $72,968 Plus: DTA re-measurement 589 Plus: DTA re-measurement 13,433 Average assets (non-GAAP) 7,060,821 Adjusted net income (non-GAAP) 86,401 Return on average assets (non-GAAP) 1.22% Average shares outstanding - diluted 34,955 Diluted earnings per share (non-GAAP) $2.47 Dollars in thousands 20

2019 Annual Meeting MEMBER FDIC