|

Exhibit 99.1

|

Todd Brice

President and Chief Executive Officer

Mark Kochvar

Chief Financial Officer

Full Year 2014

Forward Looking Statement and Risk Factor

This presentation contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements include, among others, statements regarding trends, strategies, plans, beliefs, intentions, expectations, goals and opportunities. Forward looking statements are typically identified by words or phrases such as believe, expect, anticipate, intend, estimate, assume, strategy, plan, outlook, outcome, continue, remain, trend and variations of such words and similar expressions, or future or conditional verbs such as will, would, should, could, may or similar expressions. Actual results and performance could differ materially from those anticipated by these forward-looking statements. Factors that could cause such a difference include, but are not limited to, general economic conditions, changes in interest rates, deposit flows, loan demand, asset quality, including real estate and other collateral values, and competition.

S&T cautions that these forward-looking statements are subject to numerous assumptions, risks and uncertainties, which change over time. These forward-looking statements speak only as of the date hereof, and S&T assumes no duty to update forward-looking statements. Subsequent written or oral statements attributable to S&T or persons acting on its behalf are expressly qualified in their entirety by the cautionary statements contained herein and those in S&T’s reports previously and subsequently filed with the Securities and Exchange Commission.

1

Non-GAAP Financial Measures

In addition to the results of operations presented in accordance with Generally Accepted Accounting Principles (GAAP), S&T management uses and this presentation contains or references certain non-GAAP financial measures, such as net interest income on a fully taxable equivalent basis. S&T believes these financial measures provide information useful to investors in understanding our operational performance and business and performance trends which facilitate comparisons with the performance of others in the financial services industry. Although S&T believes that these non-GAAP financial measures enhance investors’ understanding of S&T’s business and performance, these non-GAAP financial measures should not be considered an alternative to GAAP. The non-GAAP financial measures contained therein should be read in conjunction with the audited financial statements and analysis as presented in the Annual Report on Form 10-K as well as the unaudited financial statements and analyses as presented in the respective Quarterly Reports on Forms 10-Q for S&T Bancorp, Inc. and subsidiaries.

2

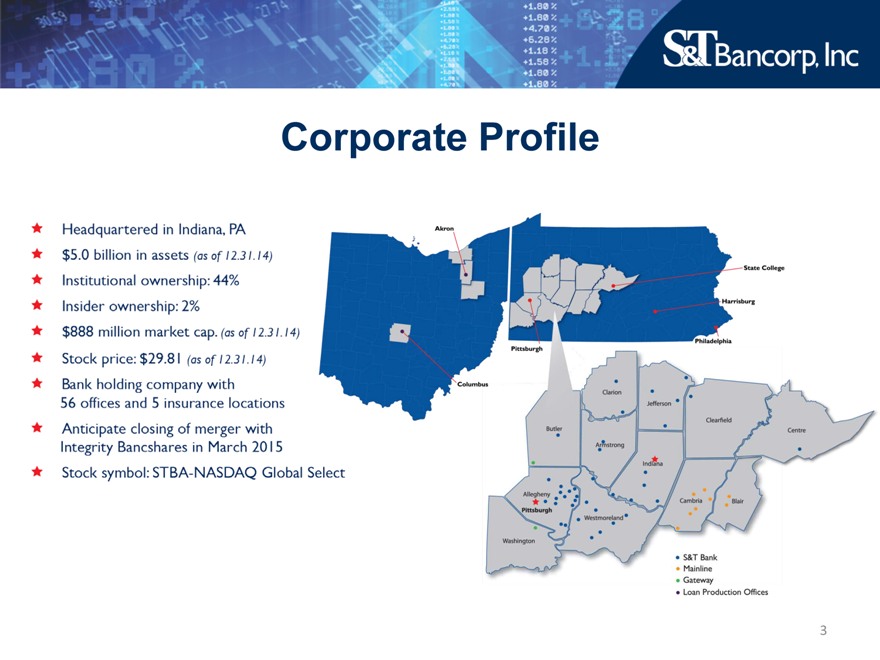

Corporate Profile

Headquartered in Indiana, PA

$5.0 billion in assets (as of 12.31.14)

Institutional ownership: 44%

Insider ownership:2%

$888 million market cap. (as of 12.31.14)

Stock price: $29.81 (as of 12.31.14)

Bank holding company with 56 offices and 5 insurance locations

Anticipate closing of merger with Intergrity Bancshares in March 2015

Stock symbol: STBA-NASDAQ Global Selected

Akron

Pittsburgh

Columbus

State College

Harrisburg

Philadelphia

Butler Clarion

Jefferson

Clearfield

Centre

Armstrong

Indiana

Cambria

Blair

Allegheny Pittsburgh

Washington

Westmoreland

S&T Bank Mainline Gateway Loan Production Offices

3

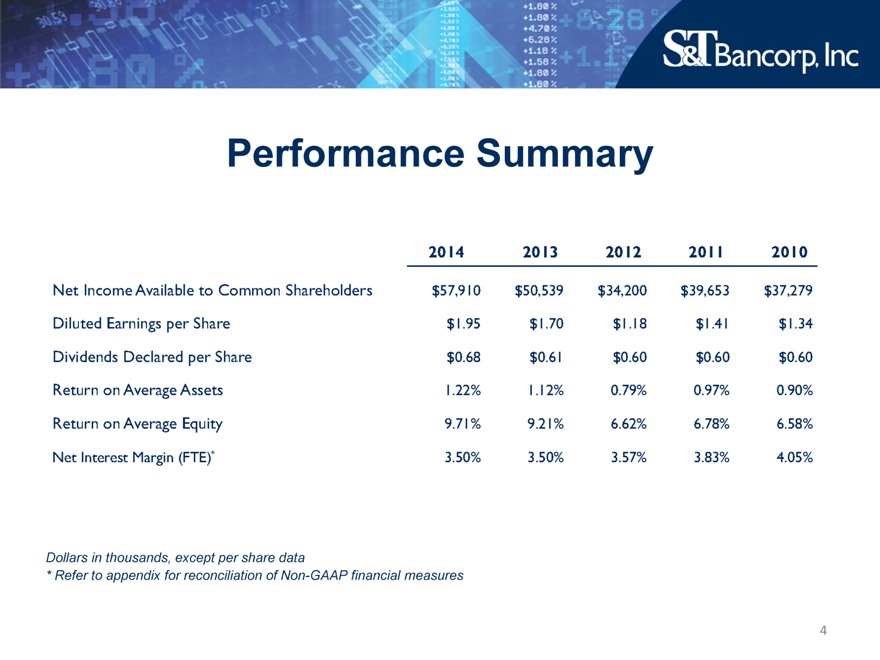

Performance Summary

2014 2013 2012 2011 2010

Net Income Available to Common Shareholders $57,910 $50,539 $34,200 $39,653 $37,279

Diluted Earnings per Share $1.95 $1.70 $1.18 $1.41 $1.34

Dividends Declared per share $0.68 $0.61 $0.60 $0.60 $0.60

Return on Average Assets 1.22% 1.12% 0.79% 0.97% 0.90%

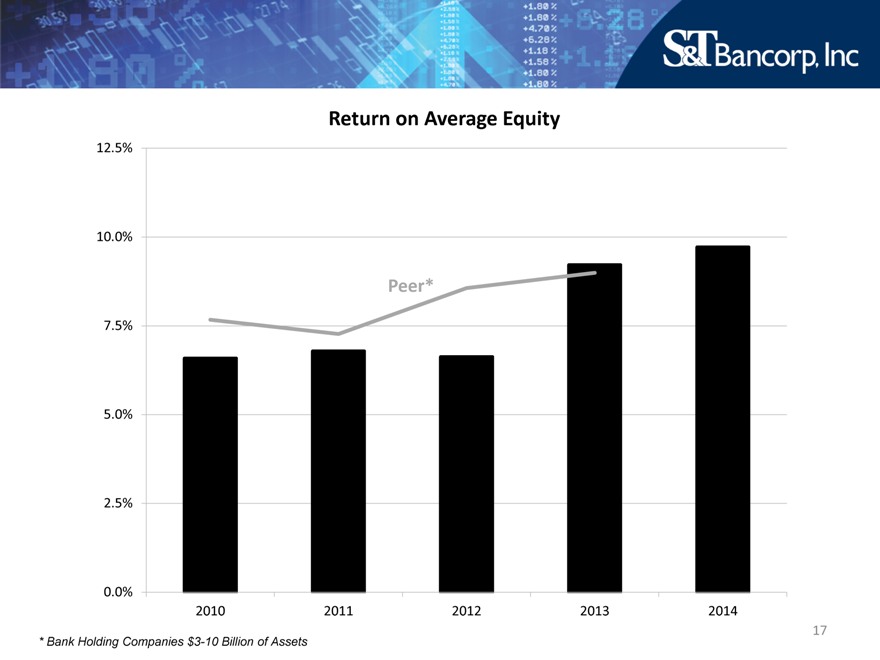

Return on Average Equity 9.71% 9.21% 6.62% 6.78% 6.58%

Net interest Margin (FTE)* 3.50% 3.50% 3.57% 3.83% 4.05 %

Dollars in thousands, except per share data

* Refer to appendix for reconciliation of Non-GAAP financial measures

4

STBA Investment Thesis

Stable Western PA economy

Long-term Marcellus Shale benefit

Strategic & effective acquisitions/expansions

Loan growth

Excellent asset quality

Demonstrated expense discipline and efficiency

Historically high performer

5

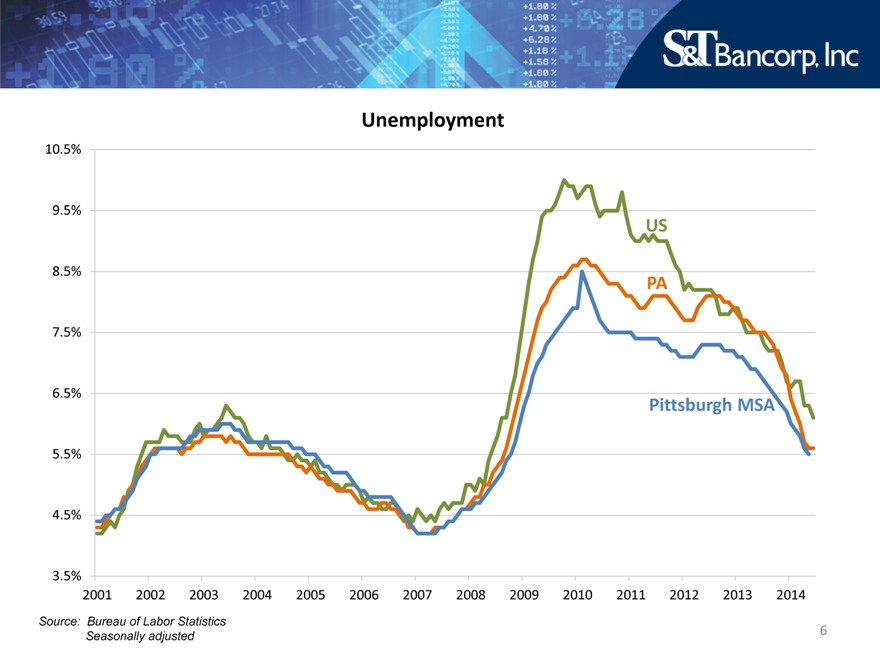

Unemployment

10.5%

9.5%

US

8.5% PA

7.5%

6.5% Pittsburgh MSA

5.5%

4.5%

3.5%

2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014

Source: Bureau of Labor Statistics Seasonally adjusted

6

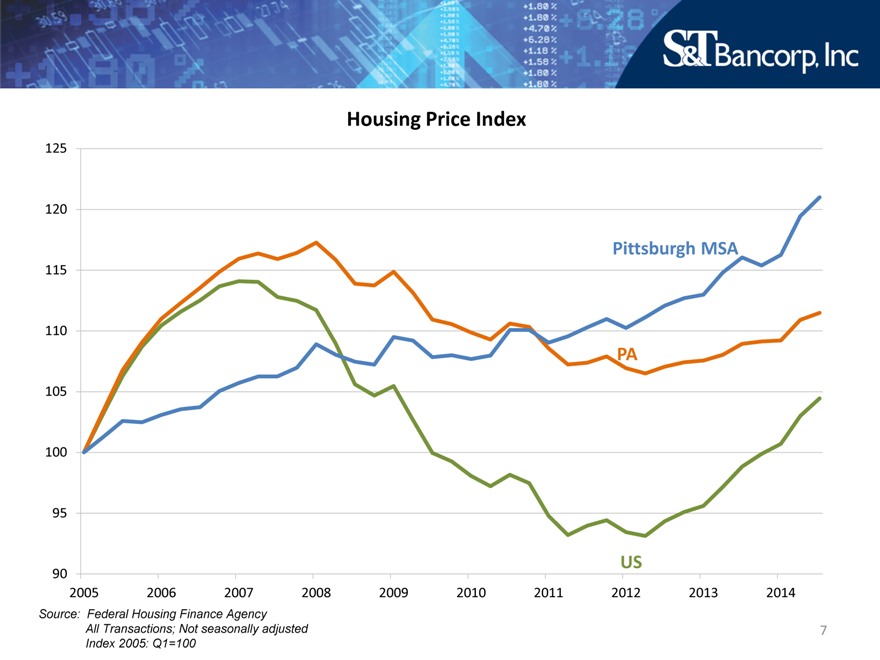

Housing Price Index

125

120

Pittsburgh MSA

115

110

PA

105

100

95

90 US

2005 2006 2007 2008 2009 2010 2011 2012 2013 2014

Source: Federal Housing Finance Agency All Transactions; Not seasonally adjusted Index 2005: Q1=100

7

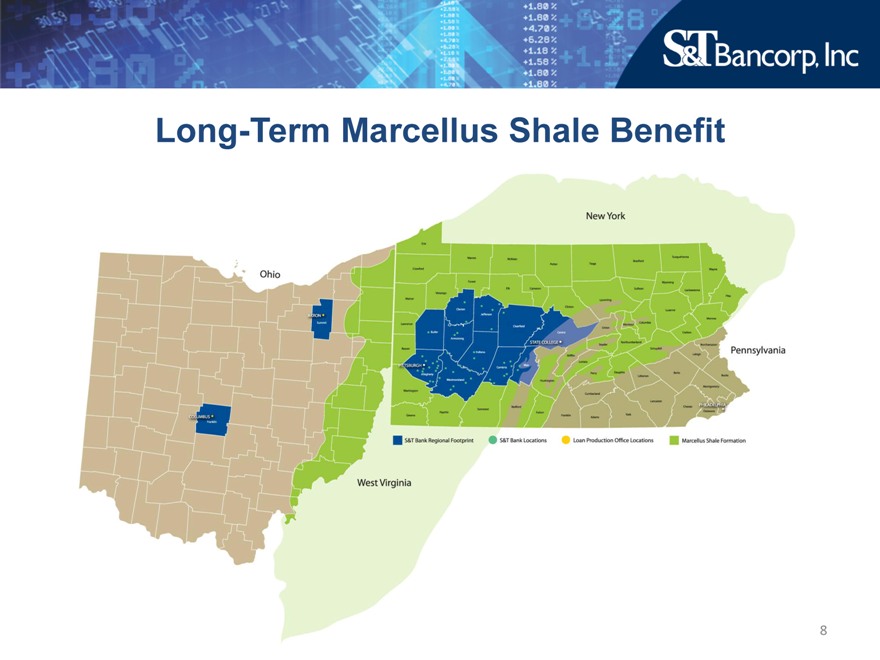

Long-Term Marcellus Shale Benefit

Ohio New York

West Virginia

8

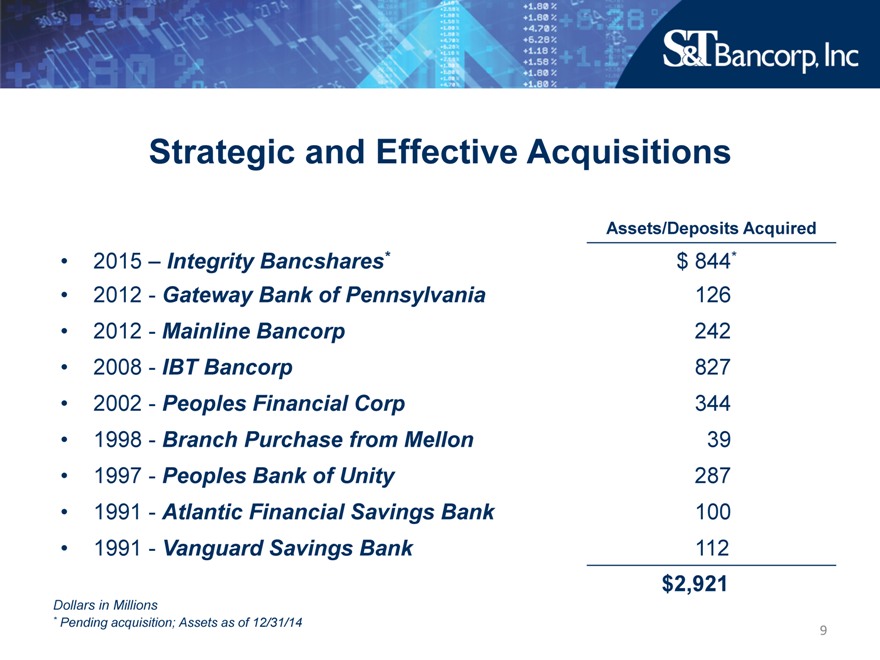

Strategic and Effective Acquisitions

Assets/Deposits Acquired

2015 – Integrity Bancshares* $ 844*

2012 —Gateway Bank of Pennsylvania 126

2012 —Mainline Bancorp 242

2008 —IBT Bancorp 827

2002 —Peoples Financial Corp 344

1998 —Branch Purchase from Mellon 39

1997 —Peoples Bank of Unity 287

1991 —Atlantic Financial Savings Bank 100

1991 —Vanguard Savings Bank 112

$2,921

Dollars in Millions

* Pending acquisition; Assets as of 12/31/14

9

Strategic and Effective Expansions

2012 – Loan production office opened in northeast Ohio, August 2012

2014 – Loan production office opened in central Ohio, January 2014

2014 – Hired seven bankers in State College, PA and branch opened in June, 2014

2015 – Hired banker in Rochester, NY, January 2015

10

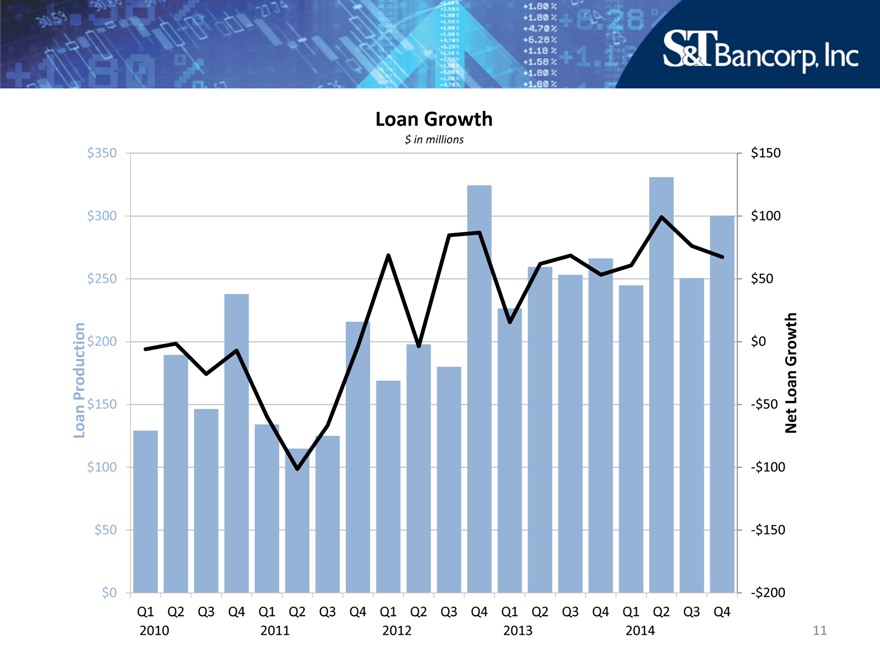

Loan Growth

$ in millions

$350 $150

$300 $100

$250 $50

Production $200 $0 Growth

$150 -$50 Loan

Loan Net

$100 -$100

$50 -$150

$0 -$200

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4

2010 2011 2012 2013 2014

11

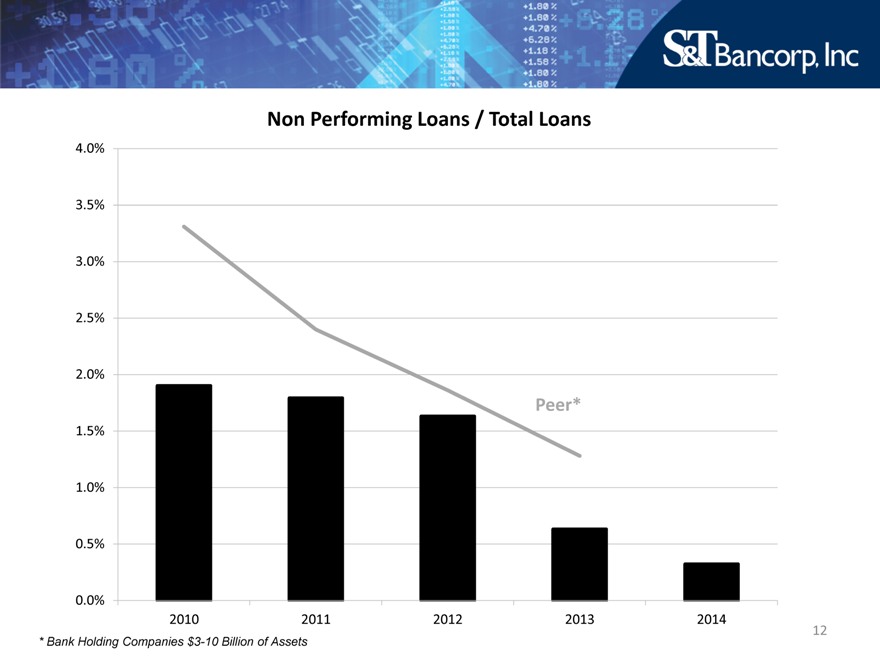

Non Performing Loans / Total Loans

4.0%

3.5%

3.0%

2.5%

2.0%

Peer*

1.5%

1.0%

0.5%

0.0%

2010 2011 2012 2013 2014

* Bank Holding Companies $3-10 Billion of Assets

12

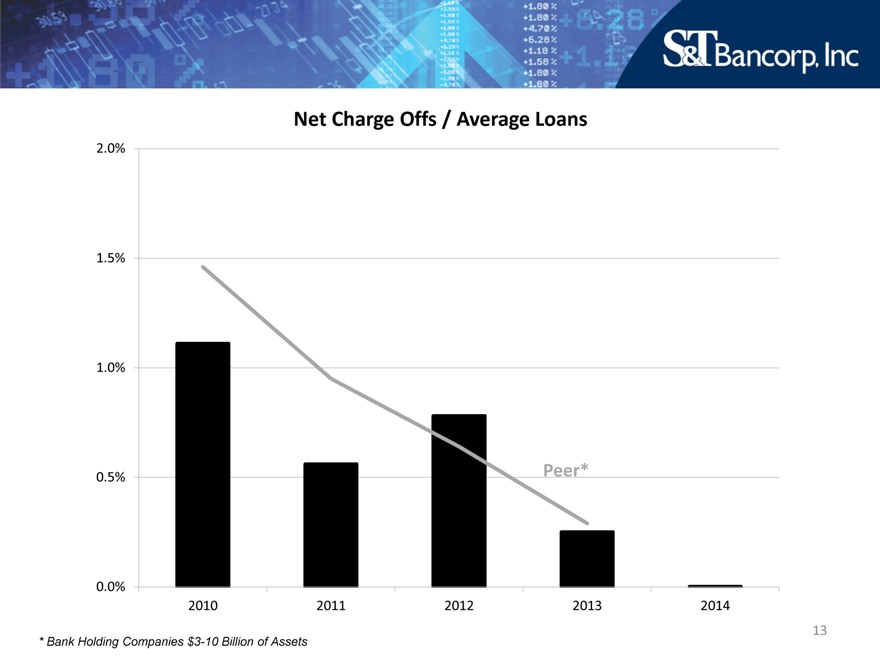

Net Charge Offs / Average Loans

2.0%

1.5%

1.0%

0.5% Peer*

0.0%

2010 2011 2012 2013 2014

13

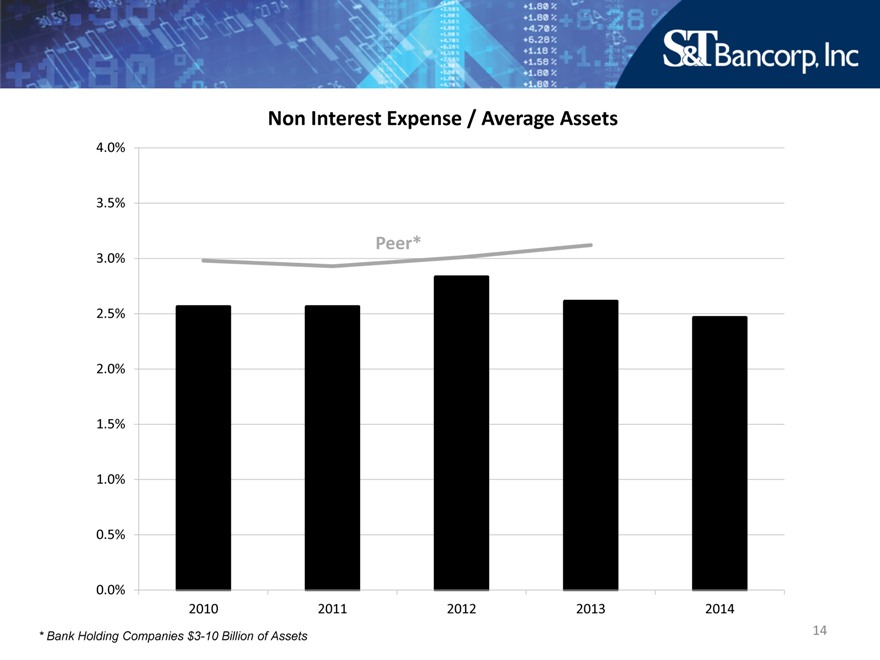

Non Interest Expense / Average Assets

4.0%

3.5%

Peer*

3.0%

2.5%

2.0%

1.5%

1.0%

0.5%

0.0%

2010 2011 2012 2013 2014

* Bank Holding Companies $3-10 Billion of Assets

14

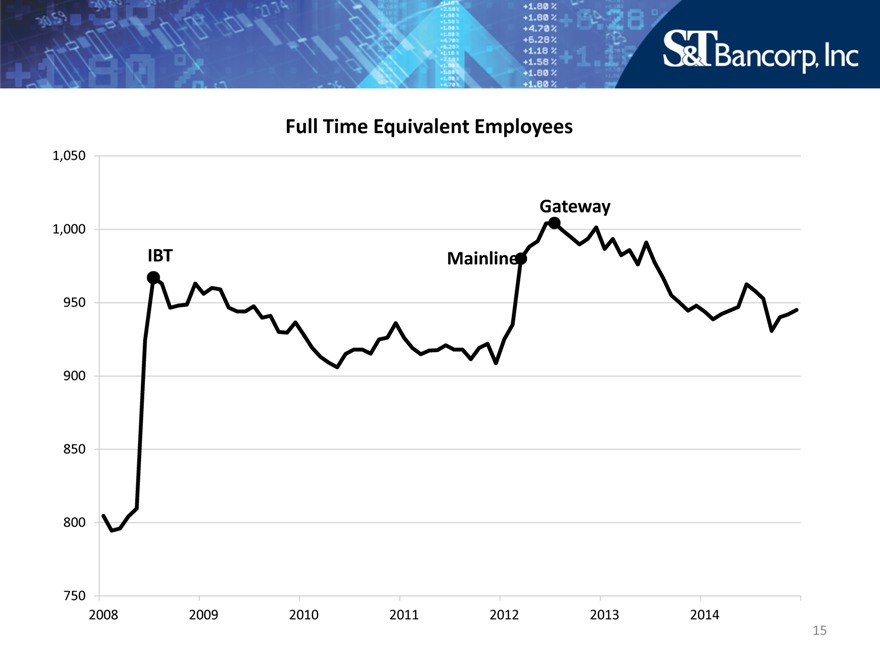

Full Time Equivalent Employees

1,050

Gateway

1,000

IBT Mainline

950

900

850

800

750

2008 2009 2010 2011 2012 2013 2014

15

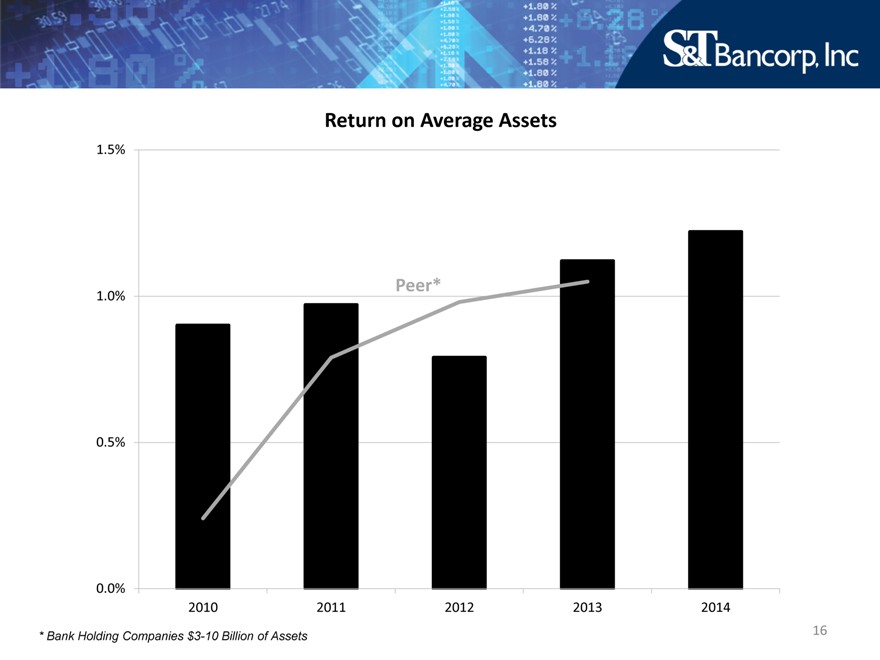

Return on Average Assets

1.5%

1.0% Peer*

0.5%

0.0%

2010 2011 2012 2013 2014

* Bank Holding Companies $3-10 Billion of Assets

16

Return on Average Equity

12.5%

10.0%

Peer*

7.5%

5.0%

2.5%

0.0%

2010 2011 2012 2013 2014

* Bank Holding Companies $3-10 Billion of Assets

17

4 Lines of Business

Commercial Banking Retail Banking

Wealth Management Insurance

18

Commercial Banking

39 commercial bankers

16 business bankers

Privately held companies with sales up to $150 million

Northeast Ohio loan production office, August, 2012

Central Ohio loan production office, January, 2014

State College, PA branch, June 2014

Hired banker in Rochester, NY, January 2015

19

Retail Banking

Competitive, relationship driven

Robust suite of deposit and loan products

Over 110,000 households

56 branches; average size of $66.1 million

Technology driven with over 87,000 online banking and over 29,000 mobile banking customers

20

Wealth Management

$2.0 billion AUM

3 divisions

– S&T Trust

– S&T Financial Services

– RIA/Stewart Capital

Annual revenue of $11.3 million

Stewart Capital Mid-Cap Fund (SCMFX) with $95 million in assets; Top 14% performance in 2014

21

S&T-Evergreen Insurance

Full service agency

– Commercial P&C (75%)

– Group life and health (13%)

– Personal lines (12%)

Annual revenue of $5.2 million

Focus on increasing penetration of S&T customer base

22

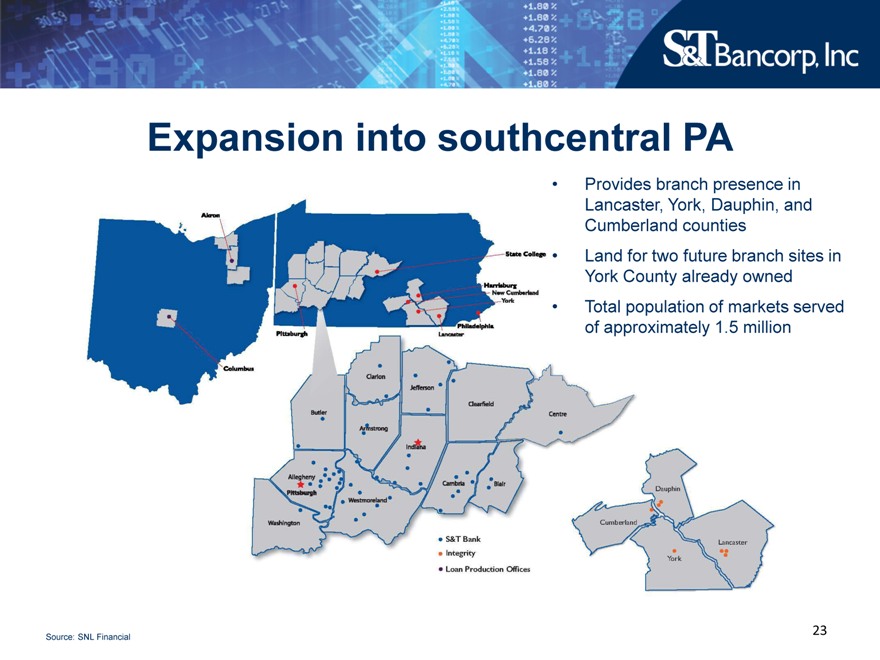

Expansion into southcentral PA

Provides branch presence in Lancaster, York, Dauphin, and Cumberland counties Land for two future branch sites in York County already owned Total population of markets served of approximately 1.5 million

Source: SNL Financial

23

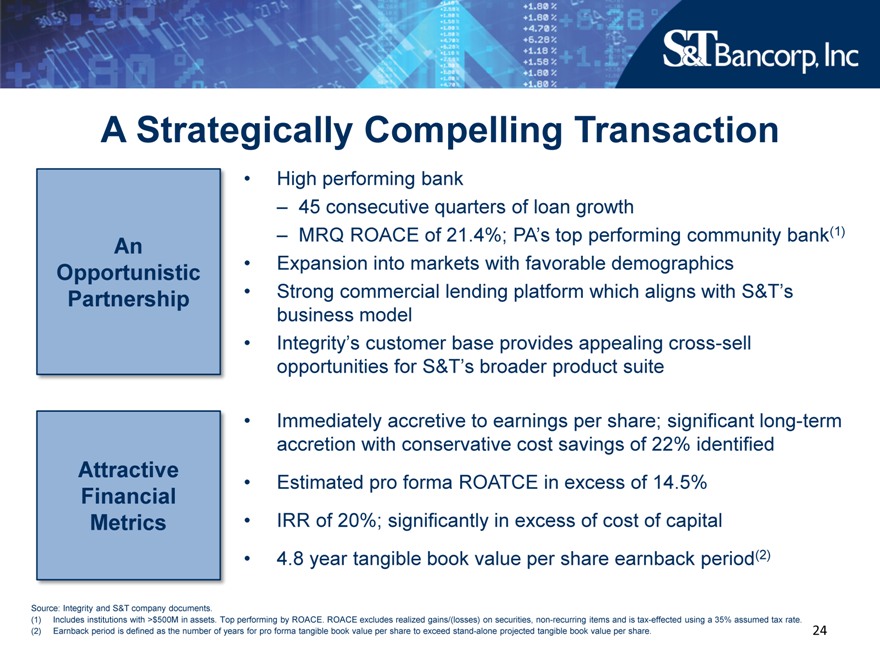

A Strategically Compelling Transaction

An Opportunistic Partnership

Attractive Financial Metrics

High performing bank

– 45 consecutive quarters of loan growth

– MRQ ROACE of 21.4%; PA’s top performing community bank(1)

Expansion into markets with favorable demographics

Strong commercial lending platform which aligns with S&T’s business model

Integrity’s customer base provides appealing cross-sell opportunities for S&T’s broader product suite

Immediately accretive to earnings per share; significant long-term accretion with conservative cost savings of 22% identified

Estimated pro forma ROATCE in excess of 14.5%

IRR of 20%; significantly in excess of cost of capital

4.8 year tangible book value per share earnback period(2)

Source: Integrity and S&T company documents.

(1) Includes institutions with >$500M in assets. Top performing by ROACE. ROACE excludes realized gains/(losses) on securities, non-recurring items and is tax-effected using a 35% assumed tax rate. (2) Earnback period is defined as the number of years for pro forma tangible book value per share to exceed stand-alone projected tangible book value per share.

24

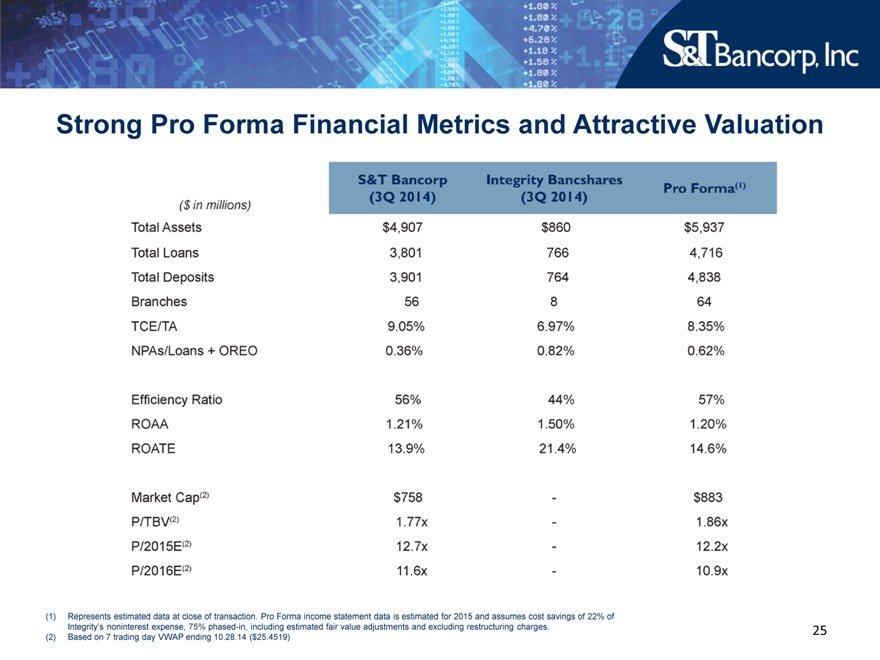

Strong Pro Forma Financial Metrics and Attractive Valuation

($ in millions) S&T Bancorp Integrity Bancshares

(3Q 2014) (3Q 2014) Pro Forma (1)

Total Assets $4,907 $860 $5,937

Total loans 3,801 766 4,716

Total Deposits 3,901 764 4,838

Branches 56 8 64

TCE/TA 9.05% 6.97% 8.35%

NPAs/Loans + OREO 0.36% 0.82% 0.62%

Efficiency Ratio 56% 44% 57%

ROAA 1.21% 1.50% 1.20%

ROATE 13.9% 21.4% 14.6%

Market Cap(2) $758 — $883

P/TBV(2) 1.77x — 1.86x

P/2015E(2) 12.7x — 12.2x

P2016E(2) 11.6x — 10.9x

(1) Represents estimated data at close of transaction. Pro Forma income statement data is estimated for 2015 and assumes cost savings of 22% of Integrity’s noninterest expense, 75% phased-in, including estimated fair value adjustments and excluding restructuring charges.

(2) Based on 7 trading day VWAP ending 10.28.14 ($25.4519)

25

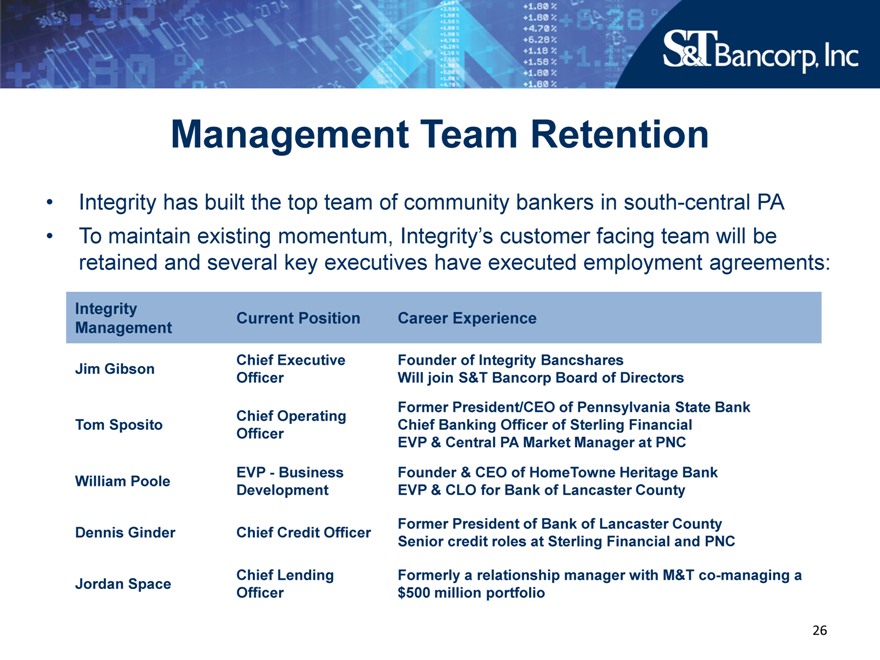

Management Team Retention

Integrity has built the top team of community bankers in south-central PA

To maintain existing momentum, Integrity’s customer facing team will be retained and several key executives have executed employment agreements:

Integrity Current Position Career Experience

Management

Chief Executive Founder of Integrity Bancshares

Jim Gibson Officer Will join S&T Bancorp Board of Directors

Chief Operating Former President/CEO of Pennsylvania State Bank

Tom Sposito Chief Banking Officer of Sterling Financial

Officer EVP & Central PA Market Manager at PNC

William Poole EVP—Business Founder & CEO of HomeTowne Heritage Bank

Development EVP & CLO for Bank of Lancaster County

Dennis Ginder Chief Credit Officer Former President of Bank of Lancaster County

Senior credit roles at Sterling Financial and PNC

Jordan Space Chief Lending Formerly a relationship manager with M&T co-managing a

Officer $500 million portfolio

26

The Right Size

Big enough to:

– Provide full complement of products and services

– Access technology

– Access capital markets

– Attract talent

– Expand – mergers and acquisitions/de novo

Small enough to:

– Stay close to our customers

– Understand our markets

– Be responsive

27

Income Statement

2014 2013 2012 2011 2010

Net Interest Income $148,042 $139,193 $135,227 $137,346 $145,846

Noninterest Income 46,338 51,527 51,912 44,057 47,210

Total Revenue 194,380 190,720 187,139 181,403 $193,056

Noninterest Expense 117,240 117,392 122,863 103,908 105,633

Provision for Loan Losses 1,715 8,311 22,815 15,609 29,511

Net Income Before Taxes 75,425 65,017 41,461 61,886 57,912

Taxes 17,515 14,478 7,261 14,622 14,432

Net Income 57,910 50,539 34,200 47,264 43,480

Preferred Stock Dividends and Discount Amortization — — — 7,611 6,201

Net Income Available to Common Shareholders $57,910 $50,539 $34,200 $39,653 $37,279

Diluted Earnings per Share $1.95 $1.70 $1.18 $1.41 $1.34

Dollars in thousands, except per share data

28

Balance Sheet

2014 2013 2012 2011 2010

Securities $640,273 $509,425 $452,266 $356,371 $286,887

Interest-bearing Balances 57,048 53,594 257,116 208,854 61,260

Loans, Net 3,823,805 3,522,080 3,322,637 3,083,768 3,312,540

Other 443,560 448,091 494,683 471,001 453,652

Total Assets $4,964,686 $4,533,190 $4,526,702 $4,119,994 $4,114,339

Deposits $3,908,842 $3,672,308 $3,638,428 $3,335,859 $3,317,524

Borrowings 385,666 241,276 262,302 227,863 160,637

Other Liabilities 61,789 48,300 88,550 65,746 57,513

Equity 608,389 571,306 537,422 490,526 578,665

Total Liabilities & Equity $4,964,686 $4,533,190 $4,526,702 $4,119,994 $4,114,339

Dollars in thousands

29

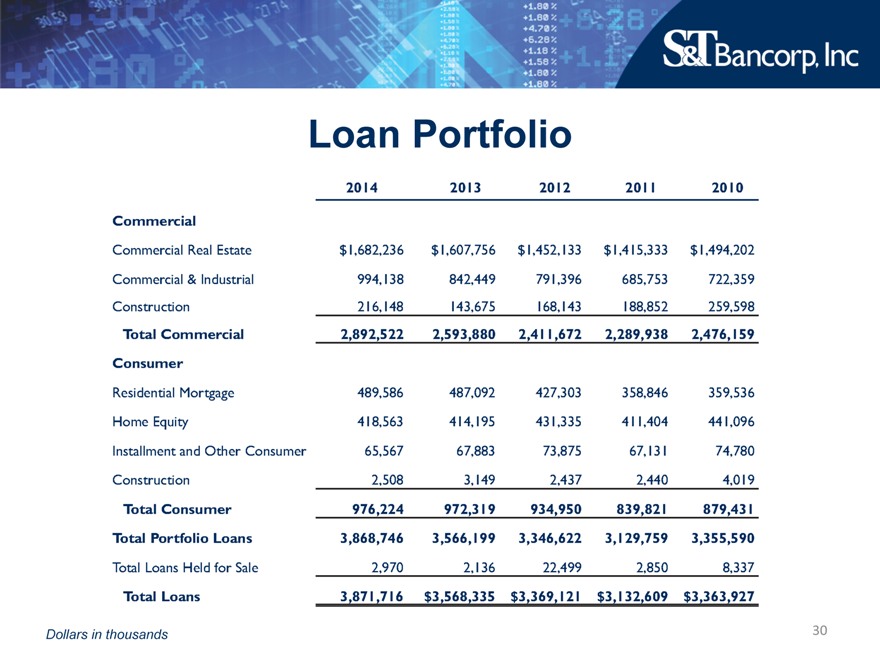

Loan Portfolio

2014 2013 2012 2011 2010

Commercial

Commercial Real Estate $1,682,236 $1,607,756 $1,452,133 $1,415,333 $1,494,202

Commercial & Industrial 994,138 842,449 791,396 685,753 722,359

Construction 216,148 143,675 168,143 188,852 259,598

Total Commercial 2,892,522 2,593,880 2,411,672 2,289,938 2,476,159

Consumer

Residential Mortgage 489,586 487,092 427,303 358,846 359,536

Home Equity 418,563 414,195 431,335 411,404 441,096

Installment and Other Consumer 65,567 67,883 73,875 67,131 74,780

Construction 2,508 3,149 2,437 2,440 4,019

Total Consumer 976,224 972,319 934,950 839,821 879,431

Total Portfolio Loans 3,868,746 3,566,199 3,346,622 3,129,759 3,355,590

Total Loans Held for Sale 2,970 2,136 22,499 2,850 8,337

Total Loans 3,871,716 $3,568,335 $3,369,121 $3,132,609 $3,363,927

Dollars in thousands

30

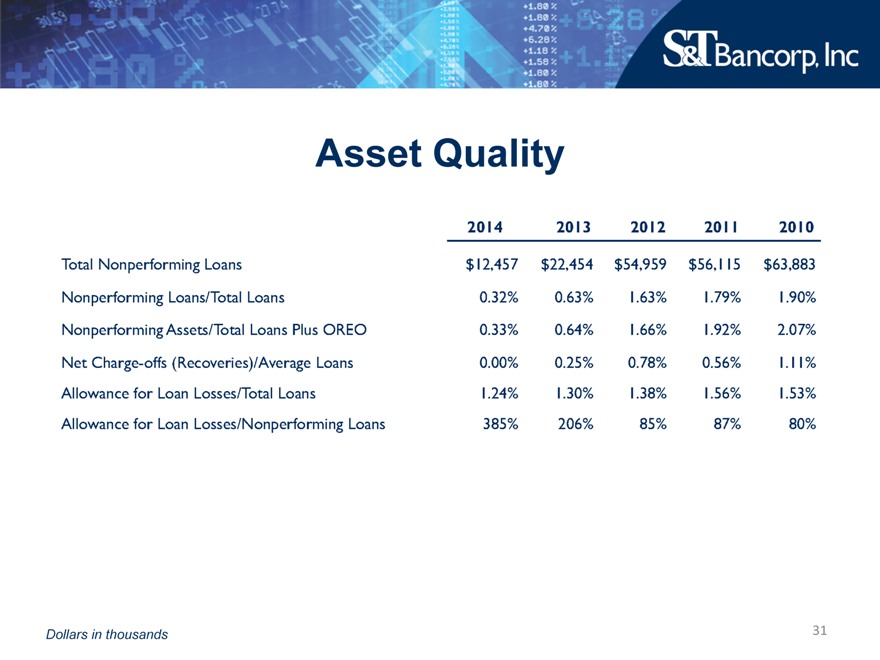

Asset Quality

2014 2013 2012 2011 2010

Total Nonperforming Loans $12,457 $22,454 $54,959 $56,115 $63,883

Nonperforming Loans/Total Loans 0.32% 0.63% 1.63% 1.79% 1.90%

Nonperforming Assets/Total Loans Plus OREO 0.33% 0.64% 1.66% 1.92% 2.07%

Net Charge-offs (Recoveries)/Average Loans 0.00% 0.25% 0.78% 0.56% 1.11%

Allowance for Loan Losses/Total Loans 1.24% 1.30% 1.38% 1.56% 1.53%

Allowance for Loan Losses/Nonperforming Loans 385% 206% 85% 87% 80%

Dollars in thousands

31

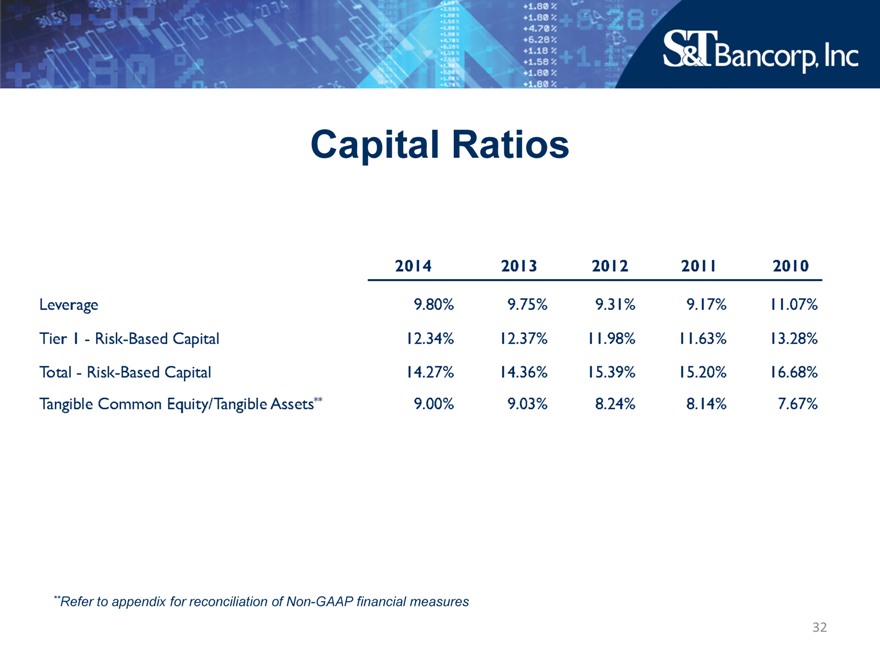

Capital Ratios

2014 2013 2012 2011 2010

Leverage 9.80% 9.75% 9.31% 9.17% 11.07%

Tier I – Risk-Based Capital 12.34% 12.37% 11.98% 11.63% 13.28%

Total – Risk-Based Capital 14.27% 14.36% 15.39% 15.20% 16.68%

Tangible Common Equity/Tangible Assets** 9.00% 9.03% 8.24% 8.14% 7.67%

**Refer to appendix for reconciliation of Non-GAAP financial measures

32

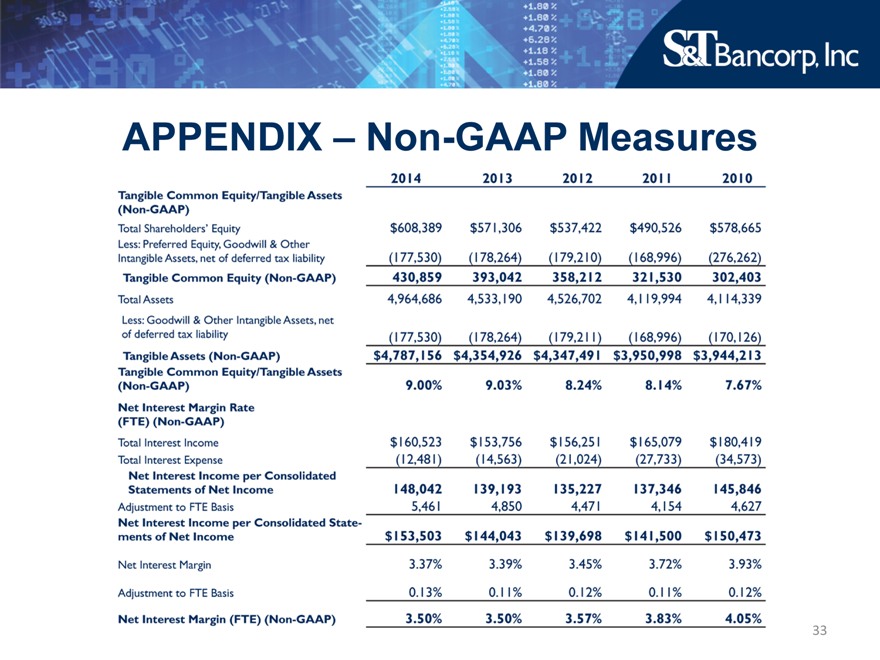

APPENDIX – Non-GAAP Measures

2014 2013 2012 2011 2010

Tangible Common Equity/Tangible Assets

(Non-GAAP)

Total Shareholders’ Equity $608,389 $571,306 $537,422 $490,526 $578,665

Less: Preferred Equity, Goodwill & Other

Intangible Assets, net of deferred tax liability (177,530) (178,264) (179,210) (168,996) (276,262)

Tangible Common Equity (Non-GAAP) 430,859 393,042 358,212 321,530 302,403

Total Assets 4,964,686 4,533,190 4,526,702 4,119,994 4,114,339

Less: Goodwill & Other Intangible Assets, net

of deferred tax liability (177,530) (178,264) (179,211) (168,996) (170,126)

Tangible Assets (Non-GAAP) $4,787,156 $4,354,926 $4,347,491 $3,950,998 $3,944,213

Tangible Common Equity/Tangible Assets

(Non-GAAP) 9.00% 9.03% 8.24% 8.14% 7.67%

Net Interest Margin Rate

(FTE) (Non-GAAP)

Total Interest Income $160,523 $153,756 $156,251 $165,079 $180,419

Total Interest Expense (12,481) (14,563) (21,024) (27,733) (34,573)

Net Interest Income per Consolidated

Statements of Net Income 148,042 139,193 135,227 137,346 145,846

Adjustment of FTE Basis 5,461 4,850 4,471 4,154 4,627

Net Interest Income per Consolidated State-

ments of Net Income $153,503 $144,043 $139,698 $141,500 $150,473

Net Interest Margin 3.37% 3.39% 3.45% 3.72% 3.93%

Adjustment to FTE Basis 0.13% 0.11% 0.12% 0.11% 0.12%

Net Interest Margin (FTE) (Non-GAAP) 3.50% 3.50% 3.57% 3.83% 4.05%

33

S&T Bancorp, Inc