Free signup for more

- Track your favorite companies

- Receive email alerts for new filings

- Personalized dashboard of news and more

- Access all data and search results

Filing tables

Filing exhibits

STBA similar filings

- 26 Jan 16 S&T Bancorp, Inc. Announces Fourth Quarter and Full Year 2015 Results

- 2 Nov 15 Regulation FD Disclosure

- 20 Oct 15 S&T Bancorp, Inc. Announces Third Quarter 2015 Results and Declares Increased Quarterly Dividend

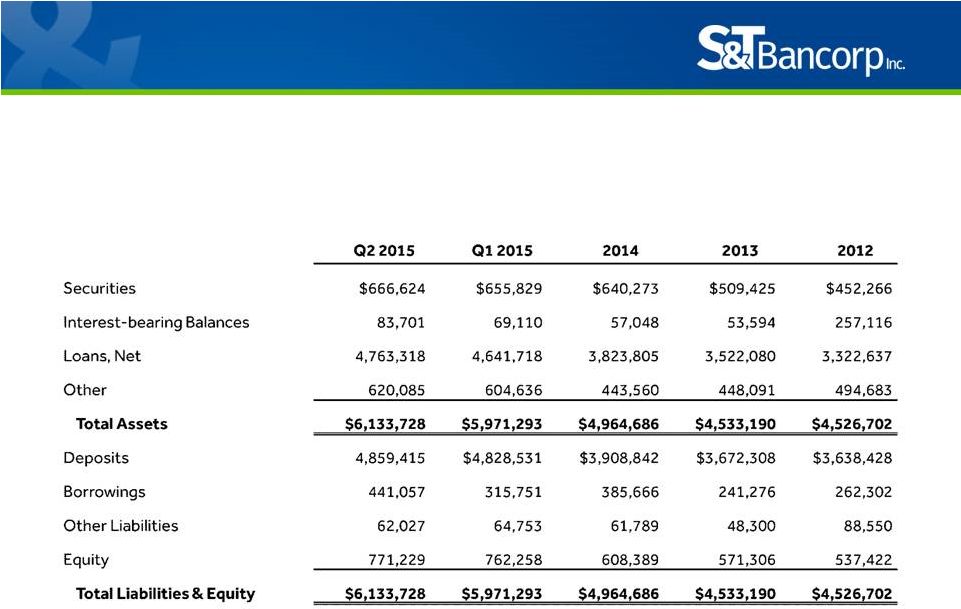

- 27 Jul 15 Stock Price $29.59 Market Cap (in $ millions) $1,030 Dividend Yield (annualized) 2.43% Price/Earnings (LTM) 15.5

- 21 Jul 15 S&T Bancorp, Inc. Announces Second Quarter 2015 Results and Declares Quarterly Dividend

- 21 May 15 Submission of Matters to a Vote of Security Holders

- 20 May 15 Regulation FD Disclosure

Filing view

External links