- WEBNF Dashboard

- Financials

- Filings

- Holdings

- Transcripts

-

ETFs

-

Insider

- Institutional

- Shorts

-

6-K Filing

Westpac Banking (WEBNF) 6-KCurrent report (foreign)

Filed: 4 May 20, 10:13am

EXHIBIT 1

Pillar 3 report Table of contents |

| Structure of Pillar 3 report | |

| Executive summary | 3 |

| Introduction | 6 |

| Risk appetite and risk types | 7 |

| Controlling and managing risk | 8 |

| Group structure | 14 |

| Capital overview | 16 |

| Leverage ratio | 21 |

| Credit risk management | 23 |

| Credit risk exposures | 33 |

| Credit risk mitigation | 57 |

| Counterparty credit risk | 59 |

| Securitisation | 62 |

| Market risk | 72 |

| Interest rate risk in the banking book | 76 |

| Operational risk | 78 |

| Equity risk | 80 |

| Funding and liquidity risk management | 82 |

| Liquidity coverage ratio | 83 |

| Net stable funding ratio | 84 |

| Appendices | |

| Appendix I – Regulatory capital reconciliation | 86 |

| Appendix II – Entities included in regulatory consolidation | 92 |

| Appendix III – Level 3 entities’ assets and liabilities | 95 |

| Appendix IV – Regulatory expected loss | 96 |

| Appendix V – APS330 quantitative requirements | 97 |

| Glossary | 100 |

| Disclosure regarding forward-looking statements | 105 |

In this report references to ‘Westpac’, ‘Westpac Group’, ‘the Group’, ‘we’, ‘us’ and ‘our’ are to Westpac Banking Corporation and its controlled entities (unless the context indicates otherwise).

In this report, unless otherwise stated or the context otherwise requires, references to '$', 'AUD' or 'A$' are to Australian dollars.

Any discrepancies between totals and sums of components in tables contained in this report are due to rounding.

In this report, unless otherwise stated, disclosures reflect the Australian Prudential Regulation Authority’s (APRA) implementation of Basel III.

Information contained in or accessible through the websites mentioned in this report does not form part of this report unless we specifically state that it is incorporated by reference and forms part of this report. All references in this report to websites are inactive textual references and are for information only.

| 2| Westpac Group March 2020 Pillar 3 report |  |

Pillar 3 report Executive summary |

Key capital ratios

| 31 March 2020 | 30 September 2019 | 31 March 2019 | |

| Level 2 Regulatory capital structure | |||

| Common equity Tier 1 capital after deductions $m | 47,982 | 45,752 | 44,680 |

| Risk weighted assets (RWA) $m | 443,905 | 428,794 | 419,819 |

| Common equity Tier 1 capital ratio % | 10.81 | 10.67 | 10.64 |

| Additional Tier 1 capital ratio % | 2.13 | 2.17 | 2.20 |

| Tier 1 capital ratio % | 12.94 | 12.84 | 12.84 |

| Tier 2 capital % | 3.35 | 2.79 | 1.78 |

| Total regulatory capital ratio % | 16.29 | 15.63 | 14.62 |

| APRA leverage ratio % | 5.66 | 5.68 | 5.72 |

| Level 1 Regulatory capital structure | |||

| Common equity Tier 1 capital after deductions ($m) | 48,482 | 46,380 | 43,850 |

| Risk weighted assets (RWA) ($m) | 437,137 | 422,475 | 409,231 |

| Level 1 Common equity Tier 1 capital ratio % | 11.09 | 10.98 | 10.72 |

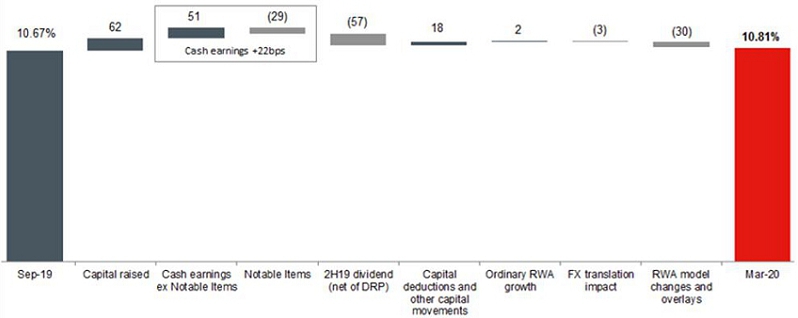

CET1 capital ratio movement for First Half 2020

Westpac’s CET1 capital ratio was 10.81% at 31 March 2020. The CET1 ratio was 14 basis points higher than 30 September 2019 reflecting the institutional placement and share purchase plan (which together raised $2.8 billion of capital) and earnings for the half, partially offset by payment of the final 2019 dividend and higher RWA.

Cash earnings for First Half 2020 were $993 million (22 basis point increase). Cash earnings included additional impairment charges of $1,107 million after tax in anticipation of credit losses that Westpac expects to incur from the COVID-19 pandemic. The net impact to the CET1 capital ratio of the increased impairment provisions related to COVID-19 is an 11 basis point decrease reflecting the impact to cash earnings, the reduction in regulatory expected loss deduction to nil and a higher deduction for deferred tax assets. Cash earnings were also impacted by Notable Items ($1,285 million after tax) relating to provisions and costs associated with the AUSTRAC proceedings and an increase in provisions for estimated customer refunds, payments, associated costs and litigation (29 basis point impact)1.

CET1 movement – First Half 2020

Key movements over the half were as follows:

| l | Capital raised totalling $2.8 billion over the half (62 basis point increase); |

| l | First Half 2020 cash earnings, including notable items (22 basis point increase); |

| l | The 2019 final dividend payment, net of the dividend reinvestment plan (DRP) share issuance (57 basis point decrease); |

| l | Capital deductions and other capital movements (18 basis point increase). This mainly reflects the impact of increased impairment provisions related to COVID-19, which reduced the regulatory expected loss deduction to nil (25 basis point increase) and a higher deduction for deferred tax assets (13 basis point decrease). Other capital items increased 6 basis points primarily driven by movements in fair value on economic hedges recognised in net profit; |

| 1 | Notable Items impacting cash earnings for First Half 2020 includes the provision for AUSTRAC and related matters, additional provisions for estimated customer refunds, payments and associated costs and litigation. |

| Westpac Group March 2020 Pillar 3 report |3 |

Pillar 3 report Executive summary |

| l | Ordinary RWA growth (before model changes, overlays and foreign currency translation) decreased slightly over the period (2 basis point increase); and |

| l | Foreign currency impacts from the appreciation of the NZ$ against the A$ (3 basis point decrease)1. |

RWA model changes and overlays increased RWA $12.3 billion leading to a 30 basis point decrease in the CET1 capital ratio. This was primarily driven by:

| l | Operational Risk capital overlay of $500 million imposed by APRA following AUSTRAC’s Statement of Claim (15 basis point decrease, $6.25 billion increase in RWA); |

| l | An increase in IRRBB capital from plans to implement a new IRRBB model more suited to low interest rates. Until the model is finalised and approved, Westpac will include an IRRBB capital overlay of $500 million (15 basis point decrease, $6.25 billion increase in RWA); |

| l | Adoption of AASB 16 Leases methodology from 1 October 2019 in other assets risk calculation (8 basis point decrease, $3.3 billion increase in RWA); and |

| l | Model changes for a segment of the Australian mortgage portfolio and also New Zealand mortgages (8 basis point increase, $3.5 billion decrease in RWA). |

Risk Weighted Assets (RWA)

| $m | 31 March 2020 | 30 September 2019 | 31 March 2019 |

| Risk weighted assets at Level 2 | |||

| Credit risk | 369,142 | 367,864 | 362,762 |

| Market risk | 8,396 | 9,350 | 8,338 |

| Operational risk | 54,093 | 47,680 | 38,641 |

| Interest rate risk in the banking book (IRRBB) | 5,305 | 530 | 7,076 |

| Other | 6,969 | 3,370 | 3,002 |

| Total RWA | 443,905 | 428,794 | 419,819 |

| Total Exposure at Default | 1,089,104 | 1,054,178 | 1,029,817 |

Total RWA increased $15.1 billion or 3.5% this half mainly driven by an increase in non-credit risk RWA.

The $1.3 billion increase in credit risk RWA included:

| l | A $1.1 billion increase in RWA from changes in asset quality within Australian mortgages including higher consumer delinquencies; |

| l | Lower lending primarily within retail products, which decreased RWA by $1.2 billion; |

| l | Model changes detailed above which reduced RWA by $3.5 billion; |

| l | Foreign currency translation impacts which increased RWA by $3.9 billion from the appreciation of the US$ and NZ$ against the A$ mainly impacting corporate and NZ mortgages; and |

| l | An increase in mark-to-market related credit risk and counterparty credit risk RWA of $1.0 billion mostly within corporate exposures. |

A $13.8 billion increase in non-credit RWA mostly from the impact of the capital overlays and the adoption of AASB 16 detailed above. These were partly offset by a $1.0 billion decrease in market risk RWA and a higher embedded gain from lower interest rates in IRRBB RWA.

Additional Tier 1 and Tier 2 capital movement for First Half 2020

During the half, Westpac Issued US $1.5 billion of Tier 2 capital instruments (49 basis point increase) and redeemed CNY 1.25 billion of Tier 2 capital instruments (6 basis point decrease). The higher new issuance was in response to APRA’s increased total capital requirements to be met by 1 January 2024.

Exposure at Default

Exposure at default (EAD) increased $34.9 billion (or 3.3%) over the half, primarily due to higher sovereign exposures associated with increased levels of liquidity.

Leverage Ratio

The leverage ratio represents the amount of Tier 1 capital relative to exposure2. At 31 March 2020, Westpac’s leverage ratio was 5.66%, down 2 basis points since 30 September 2019.

| 1 | Reflecting the net impact of movements in the foreign currency translation reserve and RWA |

| 2 | As defined under Attachment D of APS110: Capital Adequacy. |

| 4| Westpac Group March 2020 Pillar 3 report |  |

Pillar 3 report Executive summary |

Liquidity Coverage Ratio (LCR)

Westpac’s LCR for 31 March 2020 calculated on a spot basis was 154% (31 December 2019: 130%). The inclusion of Westpac’s allowance of the Term Funding Facility (TFF) added 14 percentage points to the ratio. Other movements in the Group’s LCR reflect an increase in HQLA by $31.1 billion over the half, while net cash outflows (NCOs) increased by $10.2 billion. Westpac’s average LCR for the quarter was 140%1(31 December 2019: 132%).

Net Stable Funding Ratio (NSFR)

Westpac had an NSFR of 117%2at 31 March 2020 (31 December 2019: 112%). The inclusion of Westpac’s allowance of the TFF added 2 percentage points to the ratio. Other movements in the Group’s NSFR over the half mainly reflect a $21 billion increase in available stable funding, due to deposits (up $9 billion), wholesale funding (up $9 billion) and other (up $3 billion). Required stable funding increased by $2 billion excluding the impact of the TFF.

| 1 | Calculated as a simple average of the daily observations over the quarter. |

| 2 | Calculated as total available stable funding divided by total required stable funding as at end of the quarter. |

| Westpac Group March 2020 Pillar 3 report |5 |

Pillar 3 report Introduction |

Westpac Banking Corporation is an Authorised Deposit-taking Institution (ADI) subject to regulation by APRA. APRA has accredited Westpac to apply advanced models permitted by the Basel III global capital adequacy regime to the measurement of its regulatory capital requirements. Westpac uses the Advanced Internal Ratings-Based approach (Advanced IRB) for credit risk and the Advanced Measurement Approach (AMA) for operational risk.

In accordance with APS330 Public Disclosure, financial institutions that have received this accreditation, such as Westpac, are required to disclose prudential information about their risk management practices on a semi-annual basis. A subset of this information must be disclosed quarterly.

This report describes Westpac’s risk management practices and presents the prudential assessment of Westpac’s capital adequacy as at 31 March 2020.

In addition to this report, the regulatory disclosures section of the Westpac website1 contains the reporting requirements for:

| l | Capital instruments under Attachment B of APS330; and |

| l | The identification of potential Global-Systemically Important Banks (G-SIB) under Attachment H of APS330 (disclosed annually). |

Capital instruments disclosures are updated when:

| l | A new capital instrument is issued that will form part of regulatory capital; or |

| l | A capital instrument is redeemed, converted into CET1 capital, written off, or its terms and conditions are changed. |

| 1 | http://www.westpac.com.au/about-westpac/investor-centre/financial-information/regulatory-disclosures/ |

| 6| Westpac Group March 2020 Pillar 3 report |  |

Pillar 3 report Risk appetite and risk types |

Westpac’s appetite for risk is informed by our strategic objectives and business plans, regulatory rules and ratios, and the potential for adverse outcomes that result in material impacts on our customers, our staff, our reputation, our regulatory relationships and/or our financial position including the potential for capital and liquidity ratios to fall below target levels in stressed scenarios.

Westpac distinguishes between different types of financial and non-financial risk and takes an integrated approach toward identifying, assessing and managing risks. The annual review of Westpac’s Risk Management Framework, which includes the Risk Management Strategy and Risk Appetite Statement, together with the establishment and monitoring of key controls through supporting frameworks and policies all play vital roles.

Overview of key risk types

| l | governance – the risk that the right information does not get to the right people or governance fora in the right format and timeframe to empower decision making. It is driven by organisational structures and relationships including between the Board, management, its shareholders and other stakeholders, which leads to deficient decision making, poor accountability and ineffective structures and processes; |

| l | risk culture – the risk that our culture does not promote and reinforce behavioural expectations or structures to identify, understand, discuss and act on risks. This leads to ineffective risk management, poor risk awareness, risk-taking outside of risk appetite that is tolerated and a culture where key learnings are not integrated into Group-wide and customer outcomes, impeding continuous improvement; |

| l | strategic – the risks arising from key elements of the strategic objectives and business plans; |

| l | capital adequacy – the risk that the firm has an insufficient level or composition of capital to support its normal business activities and to meet its regulatory capital requirements under normal operating environments or stressed conditions (both actual and as defined for internal planning or regulatory testing purposes). This includes the risk from Westpac’s pension plans; |

| l | credit – the risk of financial loss where a customer or counterparty fails to meet their financial obligations to Westpac; |

| l | funding and liquidity – the risk that Westpac cannot meet its payment obligations or that it does not have the appropriate amount, tenor and composition of funding and liquidity to support its assets; |

| l | market – the risk of an adverse impact on earnings resulting from changes in market factors, such as foreign exchange rates, interest rates, commodity prices and equity prices. This includes interest rate risk in the banking book - the risk to interest income from a mismatch between the duration of assets and liabilities that arises in the normal course of business activities; |

| l | operational – the risk of loss resulting from inadequate or failed internal processes, people and systems or from external events. This definition includes legal and regulatory risk but excludes strategic risk; |

| l | conduct and compliance – the risk of failing to abide by compliance obligations required of us or otherwise failing to have behaviours and practices that deliver suitable, fair and clear outcomes for our customers and that support market integrity; |

| l | cyber – the potential for loss or harm to the business and stakeholders related to the use of technology; and |

| l | reputational - the risk that an action, inaction, transaction, investment or event will reduce trust in Westpac’s integrity and competence by clients, counterparties, investors regulators, employees or the public. |

| Westpac Group March 2020 Pillar 3 report |7 |

Pillar 3 report Controlling and managing risk |

We have adopted the Three Lines of Defence model to aid in holistic end-to-end management of risk, within which all employees play an active role. This necessitates co-operation between businesses and functions, such that there are no gaps in risk coverage. Effective risk management enables:

| l | accurate measurement of our risk profile and to balance risk and reward within our risk appetite, optimising financial growth opportunities and mitigating potential loss or damage; |

| l | protection of Westpac’s depositors, policyholders, and investors by maintaining a balance sheet with sound credit quality and buffers over regulatory minimums; |

| l | delivery of suitable, fair, clear and transparent outcomes for our customers that support market integrity; |

| l | embedment of adequate controls to guard against excessive risk or undue risk concentration; and |

| l | delivery of our regulatory and compliance obligations. |

The Board is responsible for approving Westpac’s risk management framework, Risk Management Strategy and Risk Appetite Statement and for monitoring the effectiveness of risk management by Westpac.

The Board has delegated to the Board Risk & Compliance Committee responsibility for establishing a view of the Group’s current and future risk position relative to its risk appetite and capital strength; review and approval of certain frameworks and policies for managing risk; and review and, where appropriate, approval of risks which may be beyond the approval discretion provided to management.

Risk management governance structure as at 31 March 2020

| Board | l | approves our risk management framework, Risk Management Strategy and Risk Appetite Statement; and |

| l | makes an annual declaration to APRA on risk management. | |

| Board Risk & Compliance Committee (BRCC) | l | assists the Board to consider and approve the Westpac’s overall risk framework for managing financial and non-financial risks; |

| l | reviews and recommends the Westpac Group Risk Management Framework, Risk Management Strategy and Risk Appetite Statement to the Board for approval on an annual basis; | |

| l | reviews and monitors Westpac’s risk profile and controls consistent with the Westpac Risk Appetite Statement; | |

| l | reviews and approves material frameworks, and policies for managing risk; | |

| l | reviews and approves the limits and conditions that apply to credit risk approval authority delegated to the CEO, CFO, CRO and any other officers of Westpac to whom the Board has delegated credit approval authority; | |

| l | monitors changes anticipated for the economic and business environment including consideration of emerging risks, and other factors considered relevant to our risk profile and risk appetite; | |

| l | assists the Board to make its annual declaration to APRA on risk management under APRA prudential standard CPS220 Risk Management; | |

| l | reviews and where appropriate approves risks beyond the approval discretion provided to management; and | |

| l | assists the Board to oversee compliance management within Westpac. | |

| From the perspective of specific types of risk, the Board Risk & Compliance Committee’s role includes: | ||

| l | credit risk – approving key policies and limits supporting the Credit Risk Management Framework, and monitoring the risk profile, performance and management of our credit portfolio; | |

| l | liquidity risk – approving key policies and limits supporting the Liquidity Risk Management Framework, including our annual funding strategy, recovery and resolution plans and monitoring the liquidity position and requirements; | |

| 8| Westpac Group March 2020 Pillar 3 report |  |

Pillar 3 report Controlling and managing risk |

Risk management governance structure (continued)

| l | market risk – approving key policies and limits supporting the Market Risk Management Framework and monitoring the market risk profile; | |

| l | operational risk – approving key policies supporting the Operational Risk Management Framework, and monitoring the performance of operational risk management and controls; | |

| l | conduct risk – reviewing and approving the Westpac Group Conduct Framework and reviewing and monitoring the performance of conduct risk management and controls; | |

| l | reputation risk – reviewing and approving the Reputation Risk Management Framework, and reviewing and monitoring the performance of reputation risk management and controls; and | |

| l | compliance risk – reviewing and approving the Westpac Group Compliance Management Framework and Financial Crime Risk Management Framework, supporting policies and standards and monitoring the performance of compliance and financial crime risk management and controls. | |

| The Board Risk & Compliance Committee also: | ||

| l | oversees and approves the Internal Capital Adequacy Assessment Process and in doing so reviews the outcomes of Westpac’s stress testing, sets the target capital ranges for regulatory capital and reviews and monitors capital levels for consistency with Westpac’s risk appetite; | |

| l | provides relevant periodic assurances and reports (as appropriate) to the Board Audit Committee; | |

| l | reviews and approves other risk management frameworks1 and the monitoring of performance under those frameworks (as appropriate); | |

| l | forms a view on Westpac’s risk culture and oversees the identification of, and steps taken to address, any desirable changes to risk culture and periodically reports to the Board; | |

| l | refers to the Board or any other Board Committees relevant matters that come to the attention of the Board Risk & Compliance; and | |

| l | in its capacity as the Westpac Group’s US Risk Committee, oversees the key risks, risk management framework and policies of Westpac’s US operations. | |

| Board Committees with a Risk Focus | Board Audit Committee (BAC) | |

| l | oversees the integrity of financial statements and financial reporting systems and matters relating to taxation risks. | |

| Board Financial Crime Committee (BFC) | ||

| l | oversees the implementation of Westpac’s Financial Crime Strategic Plan, the program of work established to support this Plan and the appointment of external experts to conduct independent reviews. | |

| Board Remuneration Committee (BRC) | ||

| l | oversees remuneration policies and practices of Westpac, in the context that these policies and practices reflect Westpac’s risk management framework, including making recommendations to the Board for the adjustment of variable components of remuneration for relevant employees including as a result of risk or compliance failures. | |

| Board Technology Committee (BTC) | ||

| l | oversees the implementation of Westpac’s technology strategy, including risks associated with major technology programs. | |

| 1 | Additional frameworks include the Equity Risk Management Framework, Related Entity Risk Management Framework, and Insurance Risk Management Framework. |

| Westpac Group March 2020 Pillar 3 report |9 |

Pillar 3 report Controlling and managing risk |

Risk management governance structure (continued)

| Executive Team | Westpac Executive Team (ET) | |

| l | executes the Board-approved strategy; | |

| l | delivers Westpac’s various strategic and performance goals within the approved risk appetite; | |

| l | approves position statements that guide Westpac’s response to sustainability issues; and | |

| l | monitors key risks within each business unit, capital adequacy and Westpac’s reputation. | |

| Executive risk committees | Westpac Group Executive Risk Committee (RISKCO) | |

| l | leads the management and oversight of material risks across Westpac within the context of the risk appetite approved by the Board; | |

| l | monitors the effectiveness of the Risk Management Framework and the execution of the Risk Management Strategy; | |

| l | monitors and reviews Westpac’s risk profile for all identified material risks; | |

| l | shapes and promotes a strong risk culture; and | |

| l | identifies emerging risks and allocates responsibility for assessing impacts and implementing appropriate actions to address these. | |

| Westpac Group Asset & Liability Committee (ALCO) | ||

| l | leads the optimisation of funding and liquidity risk-reward across Westpac; | |

| l | reviews the level and quality of capital to ensure that it is commensurate with Westpac’s risk profile, business strategy and risk appetite; | |

| l | oversees the Liquidity Risk Management Framework and key policies; | |

| l | oversees the funding and liquidity risk profile and balance sheet risk profile; and | |

| l | identifies emerging funding and liquidity risks and appropriate actions to address these. | |

| Westpac Group Credit Risk Committee (CREDCO) | ||

| l | reviews and oversees the Credit Risk Management Framework and key supporting policies; | |

| l | oversees Westpac’s credit risk profile; and | |

| l | identifies emerging credit risks, allocates responsibility for assessing impacts, and responds as appropriate. | |

| Westpac Group Market Risk Committee (MARCO) | ||

| l | reviews and monitors the Market Risk, and Insurance Risk Management Frameworks and key market risk management policies; | |

| l | reviews policies and limits for managing traded and non-traded market risk; and | |

| l | reviews and monitors the market risk, equity risk and insurance risk profile. | |

| Westpac Group Operational Risk Committee (OPCO) | ||

| l | reviews and monitors the Operational Risk Management Framework and the Compliance and Conduct Risk Management Framework, and reviews and approves key supporting policies; | |

| l | monitors Westpac’s operational risk profile; and | |

| l | identifies emerging operational, compliance and conduct risks, and appropriate actions to address these. | |

| 10| Westpac Group March 2020 Pillar 3 report |  |

Pillar 3 report Controlling and managing risk |

Risk management governance structure (continued)

| Westpac Group Remuneration Oversight Committee (ROC) | ||

| l | supporting the CEO, BRC and the Board by reviewing and approving remuneration frameworks, guidelines and short term variable reward plans underpinning the Board-approved Westpac Group Remuneration Policy from a Human Resources, Risk (including Compliance), Finance and Legal perspective and in line with external requirements; | |

| l | assisting the BRC and the Board in fulfilling its responsibility to oversee remuneration policies and practices of Westpac in the context that these policies and practices fairly and responsibly reward individuals having regard to customer and shareholder interests, long term financial soundness and prudent risk management; | |

| l | recommending to the CEO for recommendation to the BRC remuneration arrangements for Responsible Persons, risk and financial control employees, Material Risk Takers and other individuals whose activities may impact the financial soundness of Westpac below the Group Executive level; and | |

| l | recommending to the CEO for recommendation to the BRC the criteria and rationale for determining the total quantum of Westpac’s variable reward pool. | |

| Prudential Reporting and Compliance Committee | ||

| l | oversees from a Group-wide perspective, Westpac’s compliance with prudential requirements and regulatory reporting; | |

| l | oversees the effective management of prudential compliance breaches, incidents or issues including remediation actions; and | |

| l | monitors and reviews ongoing prudential governance activities, including changes to prudential standards. | |

| Reputation Risk Committee | ||

| l | reviews issues with material reputation risk that arise in the operations of Westpac’s business to mitigate reputation risk and detrimental customer impacts. | |

| Westpac Group Financial Crime Risk Committee | ||

| l | oversees Anti-Money Laundering and Counter-Terrorism Financing, Anti-Bribery and Corruption, Sanctions and Tax Transparency within the context of the risk appetite approved by the Board; | |

| l | reviews and monitors the Financial Crime Risk Management Framework, key supporting policies, programs and standards; | |

| l | review and track key Regulator (AUSTRAC) commitments and communications; | |

| l | monitors and oversees Westpac’s financial crime risk profile; and | |

| l | identifies emerging financial crime risks, and appropriate actions to address these. | |

| Westpac Group March 2020 Pillar 3 report |11 |

Pillar 3 report Controlling and managing risk |

Risk management governance structure (continued)

| Risk function | Risk Function | |

| l | promotes a strong risk culture; | |

| l | owns the design and content of the Risk Management Framework; | |

| l | defines the structure and coverage of risk appetite; | |

| l | defines the annual risk strategy to execute the Risk Management Framework ensuring the management of risks is in alignment with risk appetite and business strategy; | |

| l | establishes risk policies, procedures and limits; | |

| l | measures and reports on risk levels; and | |

| l | provides oversight of and direction on the management of risks. | |

| Independent internal review | Group Audit | |

| l | reviews the adequacy and effectiveness of management controls over risk. | |

Divisional business units and Functions | Business Units and Functions | |

| l | responsible for identifying, evaluating and managing the risks that they originate within approved risk appetite and policies; and | |

| l | establish and maintain appropriate risk management and compliance controls, resources and self-assessment processes. | |

| 12| Westpac Group March 2020 Pillar 3 report |  |

Pillar 3 report Controlling and managing risk |

Roles and responsibilities

Our Three Lines of Defence approach is designed on a functional basis and covers all employees within Westpac.

The First Line of Defence – Business and support: manages the risks they originate

The First Line proactively identifies, evaluates, owns and manages the risks in their business/domain. It also ensures that business activities are within approved risk appetite and policies. This accountability cannot be abrogated. The First Line of defence is accountable for ‘self-certification’. In managing its risk, the First Line is required to establish and maintain appropriate governance structures, controls, resources and self-assessment processes, including issue identification, recording and escalation procedures.

The Second Line of Defence – Risk: provides oversight, insight and control of First Line activities

The Second Line sets frameworks, controls (including policies and limits), and standards for use across the Westpac. They can require remediation or cessation of activity where these are not adhered to. Their approach will be risk-based and proportionate. The Second Line reviews and challenges First Line activities and decisions that may materially affect Westpac’s risk position, and independently evaluate the effectiveness of First Line’s controls, monitoring, compliance, and monitors progress towards mitigating risks. In addition, the Second Line provides insight to the First Line, assisting in developing, maintaining and enhancing the business’ approach to risk management. The Second Line understands and reports on the aggregated risk profile of the Group to ensure end-to-end oversight of risk and can accept risks outside of the business’ risk appetite.

The Third Line of Defence – Audit: provides independent audit

The Third Line is an independent assurance function that evaluates and opines on the adequacy and effectiveness of both First and Second Line risk management approaches and tracks remediation progress, with the aim of providing the Board, and senior executives, with comfort that Westpac’s governance, risk management and internal controls are operating effectively.

| Westpac Group March 2020 Pillar 3 report |13 |

Pillar 3 report GroupStructure |

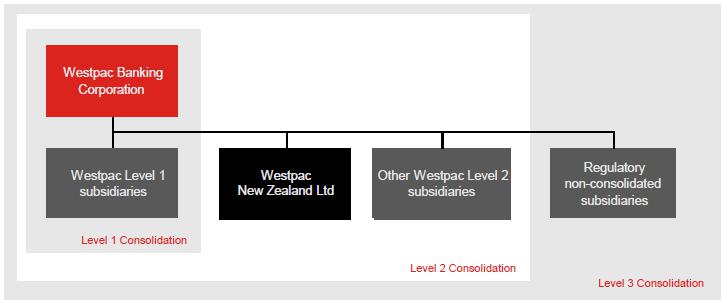

Westpac seeks to ensure that it is adequately capitalised at all times. APRA applies a tiered approach to measuring Westpac’s capital adequacy1by assessing financial strength at three levels:

| l | Level 1, comprising Westpac Banking Corporation and its subsidiary entities that have been approved by APRA as being part of a single 'Extended Licensed Entity' (ELE) for the purposes of measuring capital adequacy; |

| l | Level 2, the consolidation of Westpac Banking Corporation and all its subsidiary entities except those entities specifically excluded by APRA regulations. The head of the Level 2 group is Westpac Banking Corporation; and |

| l | Level 3, the consolidation of Westpac Banking Corporation and all its subsidiary entities. |

Unless otherwise specified, all quantitative disclosures in this report refer to the prudential assessment of Westpac’s financial strength on a Level 2 basis2.

The Westpac Group

The following diagram shows the Level 3 conglomerate group and illustrates the different tiers of regulatory consolidation.

Accounting consolidation3

The consolidated financial statements incorporate the assets and liabilities of all subsidiaries (including structured entities) controlled by Westpac. Westpac and its subsidiaries are referred to collectively as the ‘Group’. The effects of all transactions between entities in the Group are eliminated. Control exists when the parent entity is exposed to, or has rights to, variable returns from its involvement with an entity, and has the ability to affect those returns through its power over that entity. Subsidiaries are fully consolidated from the date on which control commences and they are no longer consolidated from the date that control ceases.

Group entities excluded from the regulatory consolidation at Level 2

Regulatory consolidation at Level 2 covers the global operations of Westpac and its subsidiary entities, including other controlled banking, securities and financial entities, except for those entities involved in the following business activities:

| l | insurance; |

| l | acting as manager, responsible entity, approved trustee, trustee or similar role in relation to funds management; |

| l | non-financial (commercial) operations; or |

| l | special purpose entities to which assets have been transferred in accordance with the requirements of APS120 Securitisation. |

Retained earnings and equity investments in subsidiary entities excluded from the consolidation at Level 2 are deducted from capital, with the exception of securitisation special purpose entities.

| 1 | APS110 Capital Adequacy outlines the overall framework adopted by APRA for the purpose of assessing the capital adequacy of an ADI. |

| 2 | Impaired assets and provisions held in Level 3 entities are excluded from the tables in this report. |

| 3 | Refer to Note 31 of Westpac’s 2019 Annual Report for further details. |

| 14| Westpac Group March 2020 Pillar 3 report |  |

Pillar 3 report Group Structure |

Subsidiary banking entities

Westpac New Zealand Limited (WNZL), a wholly owned subsidiary entity, is a registered bank incorporated in New Zealand and regulated by the Reserve Bank of New Zealand (RBNZ). WNZL uses the Advanced IRB approach for credit risk and the AMA for operational risk. Other subsidiary banking entities in the Group include Westpac Bank-PNG-Limited and Westpac Europe Limited. For the purposes of determining Westpac’s capital adequacy subsidiary banking entities are consolidated at Level 2.

Restrictions and major impediments on the transfer of funds or regulatory capital within the Group

Minimum capital (‘thin capitalisation’) rules

Tax legislation in most jurisdictions in which the Group operates prescribes minimum levels of capital that must be retained in that jurisdiction to avoid a portion of the interest costs incurred in the jurisdiction ceasing to be tax deductible. Capital for these purposes includes both contributed capital and non-distributed retained earnings. Westpac seeks to maintain sufficient capital/retained earnings to comply with these rules.

Tax costs associated with repatriation

Repatriation of retained earnings (and capital) may result in tax being payable in either the jurisdiction from which the repatriation occurs or Australia on receipt of the relevant amounts. This cost would reduce the amount actually repatriated.

Intra-group exposure limits

Exposures to related entities are managed within the prudential limits prescribed by APRA in APS222 Associations with Related Entities1. Westpac has an internal limit structure and approval process governing credit exposures to related entities. This limit structure and approval process, combined with APRA’s prudential limits, is designed to reduce the potential for unacceptable contagion risk.

Prudential regulation of subsidiary entities

Certain subsidiary banking, insurance and trustee entities are subject to local prudential regulation in their own right, including capital adequacy requirements and investment or intra-group exposure limits. Westpac seeks to ensure that its subsidiary entities are adequately capitalised and adhere to regulatory requirements at all times. There are no capital deficiencies in subsidiary entities excluded from the regulatory consolidation at Level 2.

On 4 November 2019, the RBNZ advised it would change WNZL’s conditions of registration to remove the 2% overlay applying to its minimum capital requirements from 31 December 2019. This overlay had been in place since 31 December 2017 following the RBNZ’s review of WNZL’s compliance with the RBNZ’s ‘Capital Adequacy Framework’ (Internal Models Based Approach) (BS2B).

On 2 April 2020, a decision was made by the RBNZ to freeze the distribution of dividends on ordinary shares by all banks in New Zealand during the period of economic uncertainty caused by COVID-19.

| 1 | For the purposes of APS222, subsidiaries controlled by Westpac, other than subsidiaries that form part of the ELE, represent ‘related entities’. Prudential and internal limits apply to intra-group exposures between the ELE and related entities, both on an individual and aggregate basis. |

| Westpac Group March 2020 Pillar 3 report |15 |

Pillar 3 report Capital overview |

Capital Structure

This table shows Westpac’s capital resources under APS111 Capital Adequacy: Measurement of Capital.

| 31 March | 30 September | 31 March | |

| $m | 2020 | 2019 | 2019 |

| Common equity Tier 1 capital | |||

| Paid up ordinary capital | 40,503 | 37,508 | 36,351 |

| Treasury shares | (619) | (575) | (571) |

| Equity based remuneration | 1,645 | 1,548 | 1,527 |

| Foreign currency translation reserve | 59 | (199) | (331) |

| Accumulated other comprehensive income | (190) | (68) | 15 |

| Non-controlling interests - other | 61 | 58 | 54 |

| Retained earnings | 25,985 | 27,188 | 26,949 |

| Less retained earnings in life and general insurance, funds management and securitisation entities | (1,326) | (1,407) | (1,289) |

| Deferred fees | 229 | 267 | 234 |

| Total common equity Tier 1 capital | 66,347 | 64,320 | 62,939 |

| Deductions from common equity Tier 1 capital | |||

| Goodwill (excluding funds management entities) | (8,673) | (8,648) | (8,665) |

| Deferred tax assets | (2,610) | (2,034) | (1,710) |

| Goodwill in life and general insurance, funds management and securitisation entities | (935) | (940) | (941) |

| Capitalised expenditure | (1,656) | (1,719) | (1,778) |

| Capitalised software | (2,029) | (2,019) | (1,881) |

| Investments in subsidiaries not consolidated for regulatory purposes | (1,633) | (1,540) | (1,522) |

| Regulatory expected loss in excess of eligible provisions1 | - | (1,106) | (1,148) |

| Defined benefit superannuation fund surplus | (80) | (73) | (66) |

| Equity investments | (327) | (425) | (482) |

| Regulatory adjustments to fair value positions | (407) | (63) | (65) |

| Other Tier 1 deductions | (15) | (1) | (1) |

| Total deductions from common equity Tier 1 capital | (18,365) | (18,568) | (18,259) |

| Total common equity Tier 1 capital after deductions | 47,982 | 45,752 | 44,680 |

| Additional Tier 1 capital | |||

| Basel III complying instruments | 9,473 | 9,299 | 9,216 |

| Total Additional Tier 1 capital | 9,473 | 9,299 | 9,216 |

| Net Tier 1 regulatory capital | 57,455 | 55,051 | 53,896 |

| Tier 2 capital | |||

| Basel III complying instruments | 14,455 | 11,645 | 7,143 |

| Basel III transitional instruments | 567 | 519 | 495 |

| Eligible general reserve for credit loss | 79 | 62 | 66 |

| Total Tier 2 capital | 15,101 | 12,226 | 7,704 |

| Deductions from Tier 2 capital | |||

| Investments in subsidiaries not consolidated for regulatory purposes | (140) | (140) | (140) |

| Holdings of own and other financial institutions Tier 2 capital instruments | (102) | (115) | (103) |

| Total deductions from Tier 2 capital | (242) | (255) | (243) |

| Net Tier 2 regulatory capital | 14,859 | 11,971 | 7,461 |

| Total regulatory capital | 72,314 | 67,022 | 61,357 |

| 1 | An explanation of the relationship between this deduction, regulatory expected loss and provisions for impairment charges is contained in Appendix IV. |

| 16| Westpac Group March 2020 Pillar 3 report |  |

Pillar 3 report Capital overview |

APRA announcements on capital

As part of its response to the current economic environment following COVID-19, APRA has adjusted its expectations for bank capital. On 19 March 2020 APRA announced that during the period of disruption caused by COVID-19 APRA would not be concerned if banks were not meeting its 10.5% “unquestionably strong” benchmark for CET1. Banks may use their current capital buffers provided they remain above the current regulatory requirement (currently at least 8.0% for domestic systemically important banks (D-SIBs)1). APRA has also indicated that they do not envisage reinstating the “unquestionably strong” benchmarks for at least 12 months. Accordingly, Westpac has updated its capital management strategy which is set out below.

APRA has also deferred implementation of the Basel III capital reforms by one year to January 2023 and announced amendments to the calculation of RWA for COVID-19 relief packages which allow for payment deferrals. These COVID-19 packages have not impacted RWA at 31 March 2020 due to the timing of these packages being offered, however may impact future periods.

Further details of APRA’s regulatory changes are set out in the Significant Developments section of the 2020 Half Year Financial Results.

Capital management strategy

Westpac’s approach to capital management seeks to ensure that it is adequately capitalised as an ADI. Westpac evaluates its approach to capital management through an Internal Capital Adequacy Assessment Process (ICAAP), the key features of which include:

| l | the development of a capital management strategy, including consideration of regulatory minimums, capital buffers and contingency plans; |

| l | consideration of both regulatory and economic capital requirements; |

| l | a stress testing framework that challenges the capital measures, coverage and requirements including the impact of adverse economic scenarios; and |

| l | consideration of the perspectives of external stakeholders including rating agencies as well as equity and debt investors. |

During the period of disruption caused by COVID-19, Westpac will seek to operate with the following principles in relation to capital:

| l | prioritise maintaining capital strength; |

| l | in line with APRA guidance, utilise some of the “unquestionably strong” buffer and seek to maintain a buffer above the regulatory minimum; |

| l | retain capital to absorb further downside on credit quality and acknowledge a high degree of uncertainty regarding the length and depth of this stress; and |

| l | allow for capital flexibility to support lending to customers. |

These principles take into consideration:

| l | current regulatory capital minimums and the capital conservation buffer (CCB), which together are the Total CET1 Requirement. In line with the above, the Total CET1 Requirement for Westpac is at least 8.0%, based upon an industry minimum CET1 requirement of 4.5% plus a capital buffer of at least 3.5% applicable to D-SIBs1,2; |

| l | stress testing to calibrate an appropriate buffer against a downturn; and |

| l | quarterly volatility of capital ratios due to the half yearly cycle of ordinary dividend payments. |

Westpac will revise its target capital levels once the medium to longer term impacts of COVID-19 are clearer, taking into account APRA’s expectations for the timing of any capital rebuilding required and the finalisation of APRA’s review of the capital adequacy framework.

| 1 | Noting that APRA may apply higher CET1 requirements for an individual ADI. |

| 2 | If an ADI’s CET1 ratio falls below the Total CET1 Requirement (at least 8%), they face restrictions on the distribution of earnings, such as dividends, distribution payments on AT1 capital instruments and discretionary staff bonuses. |

| Westpac Group March 2020 Pillar 3 report |17 |

Pillar 3 report Capital overview |

Westpac’s capital adequacy ratios

| % | 31 March 2020 | 30 September 2019 | 31 March 2019 |

| The Westpac Group at Level 2 | |||

| Common equity Tier 1 capital ratio | 10.8 | 10.7 | 10.6 |

| Additional Tier 1 capital | 2.1 | 2.2 | 2.2 |

| Tier 1 capital ratio | 12.9 | 12.8 | 12.8 |

| Tier 2 capital | 3.4 | 2.8 | 1.8 |

| Total regulatory capital ratio | 16.3 | 15.6 | 14.6 |

| The Westpac Group at Level 1 | |||

| Common equity Tier 1 capital ratio | 11.1 | 11.0 | 10.7 |

| Additional Tier 1 capital | 2.2 | 2.2 | 2.3 |

| Tier 1 capital ratio | 13.3 | 13.2 | 13.0 |

| Tier 2 capital | 3.4 | 2.9 | 1.8 |

| Total regulatory capital ratio | 16.7 | 16.1 | 14.8 |

Westpac New Zealand Limited’s capital adequacy ratios

| % | 31 March 2020 | 30 September 2019 | 31 March 2019 |

| Westpac New Zealand Limited | |||

| Common equity Tier 1 capital ratio | 11.4 | 11.3 | 11.7 |

| Additional Tier 1 capital | 2.7 | 2.6 | 2.8 |

| Tier 1 capital ratio | 14.1 | 13.9 | 14.5 |

| Tier 2 capital | 1.8 | 2.0 | 2.0 |

| Total regulatory capital ratio | 15.9 | 15.9 | 16.5 |

| 18| Westpac Group March 2020 Pillar 3 report |  |

Pillar 3 report Capital overview |

Capital requirements

This table shows risk weighted assets and associated capital requirements1 for each risk type included in the regulatory assessment of Westpac’s capital adequacy. Westpac’s approach to managing these risks, and more detailed disclosures on the prudential assessment of capital requirements, are presented in the following sections of this report.

| 31 March 2020 | IRB | Standardised | Total Risk | Total Capital |

| $m | Approach | Approach2 | Weighted Assets | Required1 |

| Credit risk | ||||

| Corporate | 78,288 | 1,087 | 79,375 | 6,350 |

| Business lending | 34,493 | 993 | 35,486 | 2,839 |

| Sovereign | 2,192 | 1,354 | 3,546 | 284 |

| Bank | 6,956 | 51 | 7,007 | 561 |

| Residential mortgages | 131,424 | 4,714 | 136,138 | 10,891 |

| Australian credit cards | 4,837 | - | 4,837 | 387 |

| Other retail | 11,594 | 805 | 12,399 | 992 |

| Small business | 16,812 | - | 16,812 | 1,345 |

| Specialised lending | 56,004 | 503 | 56,507 | 4,521 |

| Securitisation | 5,747 | - | 5,747 | 460 |

| Mark-to-market related credit risk3 | - | 11,289 | 11,289 | 903 |

| Total | 348,347 | 20,795 | 369,142 | 29,533 |

| Market risk | 8,396 | 672 | ||

| Operational risk | 54,093 | 4,327 | ||

| Interest rate risk in the banking book | 5,305 | 424 | ||

| Other assets4 | 6,969 | 558 | ||

| Total | 443,905 | 35,514 | ||

| 30 September 2019 | IRB | Standardised | Total Risk | Total Capital |

| $m | Approach | Approach2 | Weighted Assets | Required1 |

| Credit risk | ||||

| Corporate | 74,807 | 1,166 | 75,973 | 6,078 |

| Business lending | 35,470 | 950 | 36,420 | 2,914 |

| Sovereign | 2,068 | 1,069 | 3,137 | 251 |

| Bank | 8,339 | 46 | 8,385 | 671 |

| Residential mortgages | 131,629 | 5,010 | 136,639 | 10,931 |

| Australian credit cards | 5,089 | - | 5,089 | 407 |

| Other retail | 12,395 | 894 | 13,289 | 1,063 |

| Small business | 16,090 | - | 16,090 | 1,287 |

| Specialised lending | 55,262 | 518 | 55,780 | 4,462 |

| Securitisation | 5,749 | - | 5,749 | 460 |

| Mark-to-market related credit risk3 | - | 11,313 | 11,313 | 905 |

| Total | 346,898 | 20,966 | 367,864 | 29,429 |

| Market risk | 9,350 | 748 | ||

| Operational risk | 47,680 | 3,814 | ||

| Interest rate risk in the banking book | 530 | 42 | ||

| Other assets4 | 3,370 | 270 | ||

| Total | 428,794 | 34,303 |

| 1 | Total capital required is calculated as 8% of total risk weighted assets. |

| 2 | Westpac’s Standardised risk weighted assets are categorised based on their equivalent IRB categories. |

| 3 | Mark-to-market related credit risk is measured under the standardised approach. It is also known as Credit Valuation Adjustment (CVA) risk. |

| 4 | Other assets include cash items, unsettled transactions, fixed assets and other non-interest earning assets. |

| Westpac Group March 2020 Pillar 3 report |19 |

Pillar 3 report Capital overview |

| 31 March 2019 | IRB | Standardised | Total Risk | Total Capital |

| $m | Approach | Approach2 | Weighted Assets | Required1 |

| Credit risk | ||||

| Corporate | 73,551 | 1,737 | 75,288 | 6,023 |

| Business lending | 35,294 | 982 | 36,276 | 2,902 |

| Sovereign | 1,653 | 1,042 | 2,695 | 216 |

| Bank | 7,066 | 31 | 7,097 | 568 |

| Residential mortgages | 132,133 | 5,273 | 137,406 | 10,992 |

| Australian credit cards | 5,910 | - | 5,910 | 473 |

| Other retail | 13,082 | 944 | 14,026 | 1,122 |

| Small business | 16,092 | - | 16,092 | 1,287 |

| Specialised lending | 54,833 | 446 | 55,279 | 4,422 |

| Securitisation | 5,583 | - | 5,583 | 447 |

| Mark-to-market related credit risk3 | - | 7,110 | 7,110 | 569 |

| Total | 345,197 | 17,565 | 362,762 | 29,021 |

| Market risk | 8,338 | 667 | ||

| Operational risk | 38,641 | 3,091 | ||

| Interest rate risk in the banking book | 7,076 | 566 | ||

| Other assets4 | 3,002 | 240 | ||

| Total | 419,819 | 33,585 |

| 1 | Total capital required is calculated as 8% of total risk weighted assets. |

| 2 | Westpac’s Standardised risk weighted assets are categorised based on their equivalent IRB categories. |

| 3 | Mark-to-market related credit risk is measured under the standardised approach. It is also known as Credit Valuation Adjustment (CVA) risk. |

| 4 | Other assets include cash items, unsettled transactions, fixed assets and other non-interest earning assets. |

| 20| Westpac Group March 2020 Pillar 3 report |  |

Pillar 3 report Leverage ratio |

Leverage ratio

The following table summarises Westpac’s leverage ratio. This has been determined using APRA’s definition of the leverage ratio as specified in APS110 Capital Adequacy.

| $ billion | 31 March 2020 | 31 December 2019 | 30 September 2019 | 30 June 2019 |

| Tier 1 Capital | 57.5 | 56.8 | 55.1 | 53.7 |

| Total Exposures | 1,014.2 | 948.7 | 968.8 | 946.7 |

| Leverage ratio | 5.7% | 6.0% | 5.7% | 5.7% |

Leverage ratio disclosure

| $m | 31 March 2020 | |

| On-balance sheet exposures | ||

| 1 | On-balance sheet items (excluding derivatives and securities financing transactions (SFTs), but including collateral) | 904,651 |

| 2 | (Asset amounts deducted in determining Tier 1 capital) | (18,790) |

| 3 | Total on-balance sheet exposures (excluding derivatives and SFTs) (sum of rows 1 and 2) | 885,861 |

| Derivative exposures | ||

| 4 | Replacement cost associated with all derivatives transactions (i.e. net of eligible cash variation margin) | 12,339 |

| 5 | Add-on amounts for potential future credit exposure (PFCE) associated with all derivatives transactions | 19,137 |

| 6 | Gross-up for derivatives collateral provided where deducted from the balance sheet assets pursuant to the Australian Accounting Standards | 5,927 |

| 7 | (Deductions of receivables assets for cash variation margin provided in derivatives transactions) | (8,313) |

| 8 | (Exempted central counterparty (CCP) leg of client-cleared trade exposures) | |

| 9 | Adjusted effective notional amount of written credit derivatives | 4,852 |

| 10 | (Adjusted effective notional offsets and add-on deductions for written credit derivatives) | (4,832) |

| 11 | Total derivative exposures (sum of rows 4 to 10) | 29,111 |

| SFT exposures | ||

| 12 | Gross SFT assets (with no recognition of netting), after adjusting for sales accounting transactions | 20,571 |

| 13 | (Netted amounts of cash payables and cash receivables of gross SFT assets) | |

| 14 | Counterparty credit risk exposure for SFT assets | 4,858 |

| 15 | Agent transaction exposures | |

| 16 | Total SFT exposures (sum of rows 12 to 15) | 25,429 |

| Other off-balance sheet exposures | ||

| 17 | Off-balance sheet exposure at gross notional amount | 197,768 |

| 18 | (Adjustments for conversion to credit equivalent amounts) | (123,956) |

| 19 | Other off-balance sheet exposures (sum of rows 17 and 18) | 73,811 |

| Capital and total exposures | ||

| 20 | Tier 1 Capital | 57,455 |

| 21 | Total exposures (sum of rows 3, 11, 16 and 19) | 1,014,212 |

| Leverage ratio % | ||

| 22 | Leverage ratio | 5.7% |

| Westpac Group March 2020 Pillar 3 report |21 |

Pillar 3 report Leverage ratio |

Summary comparison of accounting assets versus leverage ratio exposure measure

| $m | 31 March 2020 | |

| 1 | Total consolidated assets as per published financial statements | 967,662 |

| 2 | Adjustment for investments in banking, financial, insurance or commercial entities that are consolidated for accounting purposes but outside the scope of regulatory consolidation | (2,648) |

| 3 | Adjustment for assets held on the balance sheet in a fiduciary capacity pursuant to the Australian Accounting Standards but excluded from the leverage ratio exposure measure | - |

| 4 | Adjustments for derivative financial instruments | (27,550) |

| 5 | Adjustment for SFTs (i.e. repos and similar secured lending) | 20,347 |

| 6 | Adjustment for off-balance sheet exposures (i.e. conversion to credit equivalent amounts of off-balance sheet exposures) | 73,811 |

| 7 | Other adjustments | (17,410) |

| 8 | Leverage ratio exposure | 1,014,212 |

| 22| Westpac Group March 2020 Pillar 3 report |  |

Pillar 3 report Credit risk management |

Credit risk is the potential for financial loss where a customer or counterparty fails to meet their financial obligations to Westpac. Westpac maintains a credit risk management framework and a number of supporting policies, processes and controls governing the assessment, approval and management of customer and counterparty credit risk. These incorporate the assignment of risk grades, the quantification of loss estimates in the event of default, and the segmentation of credit exposures.

Structure and organisation

The Chief Risk Officer (CRO) is responsible for the effectiveness of overall risk management throughout Westpac, including credit risk. The Group Chief Credit Officer is responsible for the effectiveness of credit risk management, including credit approval decisioning beyond business authority level and appointing our most senior authorised credit officers. Authorised credit officers have delegated authority to approve credit risk exposures, including customer risk grades, other credit parameters and their ongoing review. Our largest exposures are approved by our most experienced authorised credit officers. Line business management is responsible for managing credit risks originated in their business and for managing risk adjusted returns from their business credit portfolios, within the approved risk appetite, risk management framework and policies.

Credit risk management framework and policies

Westpac maintains a credit risk management framework and supporting policies that are designed to clearly define roles and responsibilities, acceptable practices, limits and key controls.

The Credit Risk Management Framework describes the principles, methodologies, systems, roles and responsibilities, reports and controls that exist for managing credit risk in Westpac. The Credit Risk Rating System policy describes the credit risk rating system philosophy, design, key features and uses of rating outcomes.

Concentration risk policies cover individual counterparties, specific industries (e.g. property) and individual countries. In addition, we have policies covering risk appetite statements, environmental, social and governance (ESG) risk, credit risks and the delegation of credit approval authorities.

At the divisional level, credit manuals embed the Group’s framework requirements for application in line businesses. These manuals include policies covering the origination, evaluation, approval, documentation, settlement and on-going management of credit risks, and sector policies to guide the extension of credit where industry-specific guidelines are considered necessary.

Credit approval limits govern the extension of credit and represent the formal delegation of credit approval authority to responsible individuals throughout the organisation.

| Westpac Group March 2020 Pillar 3 report |23 |

Pillar 3 report Credit risk management |

Approach

Westpac adopts two approaches to managing credit risk depending upon the nature of the customer and the product.

Transaction-managed approach

For larger customers, Westpac evaluates credit requests by undertaking detailed individual customer and transaction risk analysis (the ‘transaction-managed’ approach). Such customers are assigned a customer risk grade (CRG) representing Westpac’s estimate of their probability of default (PD). Each facility is assigned a loss given default (LGD). The Westpac credit risk rating system has 20 risk grades for non-defaulted customers and 10 risk grades for defaulted customers. Non-defaulted CRGs down to the level of normally acceptable risk (i.e. D grade – see table below) are mapped to Moody’s and Standard & Poor’s (S&P) external senior ranking unsecured ratings. This mapping allows Westpac to integrate the rating agencies’ default history with internal historical data when calculating PDs.

The final assignment of CRGs and LGDs is approved by authorised credit approvers with appropriate delegated approval authority. All material credit exposures are approved by authorised Credit Officers who are part of the risk management stream and operate independently of the areas originating the credit risk proposals. Authorised Credit Officer decisions are subject to reviews to ensure consistent quality and confirm compliance with approval authority. Separate teams are responsible for maintaining accurate and timely recording of all credit risk approvals and changes to customer and facility data. These teams also operate independently of both the areas originating the credit risk proposals and the credit risk approvers. Appropriate segregation of functions is one of the key requirements of our credit risk management framework.

Mapping of Westpac risk grades

The table below shows the current alignment between Westpac’s internal CRGs and the corresponding external rating. Note that only high-level CRG groupings are shown.

Westpac customer risk grade | Standard & Poor’s rating | Moody’s rating |

| A | AAA to AA– | Aaa to Aa3 |

| B | A+ to A– | A1 to A3 |

| C | BBB+ to BBB– | Baa1 to Baa3 |

| D | BB+ to B+ | Ba1 to B1 |

| Westpac Rating | ||

| E | Watchlist | |

| F | Special mention | |

| G | Substandard/default | |

| H | Default | |

For Specialised Lending Westpac maps exposures to the appropriate supervisory slot based on an assessment that takes into account borrower strength and security quality, as required by APS 113.

Program-managed approach

High-volume retail customer credit portfolios with homogenous credit risk characteristics are managed on a statistical basis according to pre-determined objective criteria (the ‘program-managed’ approach). Program-managed exposure to a consumer customer may exceed $1 million. Business customer exposures may be program managed for exposure up to $3 million. Quantitative scorecards are used to assign application and behavioural scores to enable risk-based decision making within these portfolios. The scorecard outcomes and decisions are regularly monitored and validated against subsequent customer performance and scorecards are recalibrated or rebuilt when required. For capital estimation and other purposes, risk-based customer segments are created based upon modelled expected PD, Exposure At Default (EAD) and LGD. Accounts are then assigned to respective segments based on customer and account characteristics. Each segment is assigned a quantified measure of its PD, LGD and EAD.

For both transaction-managed and program-managed approaches, CRGs, PDs and LGDs are reviewed at least annually.

| 24| Westpac Group March 2020 Pillar 3 report |  |

Pillar 3 report Credit risk management |

Mapping of Basel categories to Westpac portfolios

APS113 Capital Adequacy: Internal Ratings-Based Approach to Credit Risk, states that under the Advanced IRB approach to credit risk, an ADI must categorise banking book exposures into six broad IRB asset classes and apply the prescribed treatment for those classes to each credit exposure within them for the purposes of deriving its regulatory capital requirement. Standardised and Securitised portfolios are subject to treatment under APS112 Capital Adequacy: Standardised Approach to Credit Risk and APS120 Securitisation respectively.

| APS Asset Class | Sub-asset class | Westpac category | Segmentation criteria |

| Corporate | Corporate | Corporate | All transaction-managed customers not elsewhere classified where annual turnover exceeds $50 million1. |

| SME Corporate | Business Lending | All transaction-managed customers not elsewhere classified where annual turnover is $50 million or less. | |

| Project Finance | Specialised Lending-Project Finance | Applied to transaction-managed customers where the primary source of debt service, security and repayment is derived from the revenue generated by a completed project (e.g. infrastructure such as toll roads or railways). | |

| Income-producing Real Estate | Specialised Lending- Property Finance | Applied to transaction-managed customers where the primary source of debt service, security and repayment is derived from either the sale of a property development or income produced by one or more investment properties2. | |

| Sovereign | Sovereign | Applied to transaction-managed exposures backed by governments. | |

| Bank | Bank | Applied to transaction-managed exposures to deposit-taking institutions and foreign equivalents. | |

| Residential Mortgage | Residential Mortgages | Exposures secured by residential mortgages not elsewhere classified. | |

| Qualifying Revolving Retail | Australian Credit Cards | Program-managed credit cards with low volatility in loss rates. The New Zealand cards portfolio is not eligible for Qualifying Revolving Retail treatment and is classified in Other Retail. | |

| Other Retail | Small Business | Program-managed business lending exposures under $1 million where complex products are not utilised by the customer. | |

| Other Retail | All other program-managed lending to retail customers, including New Zealand credit cards. |

1 Includes all NZ agribusiness loans, regardless of turnover.

2 Excludes large diversified property groups and property trusts, which appear in the Corporate asset class.

| Westpac Group March 2020 Pillar 3 report |25 |

Pillar 3 report Credit risk management |

Mapping of Credit risk approach to Basel categories and exposure types

| Approach | APS asset class | Types of exposures |

| Transaction-Managed Portfolios | Corporate

Sovereign

Bank

| Direct lending

Contingent lending

Derivative counterparty

Asset warehousing

Underwriting

Secondary market trading

Foreign exchange settlement

Other intra-day settlement obligations |

| Program-Managed Portfolios | Residential mortgage | Mortgages

Equity access loans |

| Qualifying revolving retail | Australian credit cards | |

| Other retail | Personal loans

Overdrafts

New Zealand credit cards

Auto and equipment finance

Business development loans

Business overdrafts

Other term products |

Internal ratings process for transaction-managed portfolios

The process for assigning and approving individual customer PDs and facility LGDs involves:

| l | Business unit representatives recommend the CRG and facility LGDs under the guidance of criteria set out in established credit policies. Each CRG is associated with an estimated PD; |

| l | Authorised credit officers evaluate the recommendations and approve the final CRG and facility LGDs. Authorised credit officers may override line business unit recommendations; |

| l | An expert judgement decisioning process is employed to evaluate CRG and the outputs of various risk grading models are used as one of several inputs into that process; and |

| l | Authorised credit officers’ decisions are subject to reviews to ensure consistent quality and confirm compliance with approval authority. |

For on-going exposures to transaction-managed customers, risk grades and facility LGDs are required to be reviewed at least annually, but also whenever material changes occur.

No material deviations from the reference definition of default are permitted.

Internal ratings process for program-managed portfolios

The process for assigning PDs, LGDs and EADs to the program-managed portfolio involves dividing the portfolio into a number of pools per product. These pools are created by analysing risk characteristics that have historically predicted that an account is likely to go into default or loss.

No material deviations from the reference definition of default are permitted.

Internal credit risk ratings system

In addition to using the credit risk estimates as the basis for regulatory capital purposes, they are also used for the purposes described below:

Economic capital - Economic capital includes both credit and non-credit components. Economic credit capital is calculated using a framework that considers estimates of PD, LGD, EAD, total committed exposure and loan tenor, as well as measures of portfolio composition not reflected in regulatory capital formulae.

Provisioning - Credit provisions are held by Westpac to cover expected credit losses in the loan portfolio. Provisioning includes both individual and collective components. Individual provisions are calculated on impaired loans taking into account management’s best estimate of the present value of future cashflows.

| 26| Westpac Group March 2020 Pillar 3 report |  |

Pillar 3 report Credit risk management |

Collective provisions are established on a portfolio basis using a framework that considers PD, LGD, EAD, total committed exposure, level of arrears, recent past experience and forward looking macro-economic forecasts.

Risk-adjusted performance measurement- Business performance is measured using allocated capital, which incorporates charges for economic capital and regulatory capital, including credit capital and capital for other risk types.

Pricing - Westpac prices loans to produce an acceptable return on the capital allocated to the loan. Returns include interest income and fees after expected credit losses and other costs.

Credit approval- For transaction-managed facilities, approval authorities are tiered based on the CRG, with lower limits applicable for customers with a higher PD. Program-managed facilities are approved on the basis of application scorecard outcomes and product based approval authorities.

Control mechanisms for the credit risk rating system include:

| l | Westpac’s credit risk rating system is reviewed annually to confirm that the rating criteria and procedures are appropriate given the current portfolio and external conditions; |

| l | All models materially impacting the risk rating process are periodically reviewed in accordance with Westpac’s model risk policy; |

| l | Specific credit risk estimates (including PD, LGD and EAD levels) are overseen, reviewed annually and supported by the Credit Risk Estimates Committee (a sub-committee of CREDCO) for approval by General Manager, Risk Analytics and Insights; |

| l | Credit Risk Assurance undertake an independent annual end-to-end technical and operational review of the overall process; and |

| l | CREDCO, RISKCO and BRCC monitor the risk profile, performance and management of Westpac’s credit portfolio and the development and review of key credit risk policies. |

Risk reporting

A comprehensive report on Westpac's credit risk portfolio is provided to CREDCO, RISKCO and BRCC quarterly. It details the current level of impairment losses, stressed exposures, delinquency trends, provisions, impaired assets and key performance metrics. It also reports on portfolio concentrations and large exposures.

Credit risk and asset quality are also reported to the Board each month, including details of impairment losses, stressed exposures, delinquency trends and key performance metrics.

Response to COVID-19

Westpac remains focused on supporting customers. In response to the current COVID-19 pandemic Westpac has introduced a range of support packages such as lowering interest rates on certain products, waiving certain fees and providing impacted customers with an option to defer their repayments for between 3 and 6 months. In accordance with guidance from APRA outlined below, customers approved for these deferrals will not be recorded in traditional stress metrics while part of these packages but will be closely monitored, particularly once the deferral period changes.

APRA has announced that it is providing a specific capital treatment for loans granted repayment deferrals of up to six months. Where a borrower who has been meeting their repayment obligations until recently chooses to take up the offer not to make repayments as part of a COVID-19 support package, a bank need not treat the period of the repayment holiday as a period of arrears. Similarly, loans that have been granted a repayment deferral as part of a COVID-19 support package need not be regarded as restructured. Westpac expects to apply this treatment.

However, APRA has advised that if there is objective evidence that an individual borrower on a repayment deferral is unlikely to pay its modified credit obligations in full, the loan should be regarded as impaired if not fully secured, and should also be considered as restructured.

| Westpac Group March 2020 Pillar 3 report |27 |

Pillar 3 report Credit risk management |

Summary credit risk disclosure

| Regulatory | |||||||

| Expected | Specific | Actual | |||||

| Risk | Regulatory | Loss for | Provisions | Losses for | |||

| 31 March 2020 | Exposure | Weighted | Expected | non-defaulted | Impaired | for Impaired | the 6 months |

| $m | at Default | Assets | Loss1 | exposures | Loans | Loans | ended |

| Corporate | 146,529 | 78,288 | 787 | 547 | 363 | 232 | (4) |

| Business lending | 54,428 | 34,493 | 669 | 413 | 347 | 195 | 35 |

| Sovereign | 127,064 | 2,192 | 2 | 2 | - | - | - |

| Bank | 26,633 | 6,956 | 9 | 9 | - | - | - |

| Residential mortgages | 553,866 | 131,424 | 1,788 | 1,229 | 404 | 114 | 67 |

| Australian credit cards | 18,601 | 4,837 | 314 | 238 | 123 | 92 | 164 |

| Other retail | 15,223 | 11,594 | 601 | 419 | 312 | 218 | 135 |

| Small business | 33,181 | 16,812 | 557 | 378 | 501 | 183 | 39 |

| Specialised Lending | 65,866 | 56,004 | 813 | 583 | 52 | 26 | 1 |

| Securitisation | 28,097 | 5,747 | - | - | - | - | - |

| Standardised2 | 19,616 | 20,795 | - | - | 52 | 19 | - |

| Total | 1,089,104 | 369,142 | 5,540 | 3,818 | 2,154 | 1,079 | 437 |

| Regulatory | |||||||

| Expected | Specific | Actual | |||||

| Risk | Regulatory | Loss for | Provisions | Losses for | |||

| 30 September 2019 | Exposure | Weighted | Expected | non-defaulted | Impaired | for Impaired | the 12 months |

| $m | at Default | Assets | Loss1 | exposures | Loans | Loans | ended |

| Corporate | 139,173 | 74,807 | 523 | 473 | 135 | 50 | 30 |

| Business lending | 54,570 | 35,470 | 635 | 431 | 316 | 168 | 54 |

| Sovereign | 90,960 | 2,068 | 2 | 2 | - | - | - |

| Bank | 28,761 | 8,339 | 10 | 10 | - | - | - |

| Residential mortgages | 559,018 | 131,629 | 1,642 | 1,088 | 414 | 127 | 111 |

| Australian credit cards | 17,541 | 5,089 | 328 | 248 | 121 | 80 | 340 |

| Other retail | 15,951 | 12,395 | 582 | 417 | 283 | 165 | 354 |

| Small business | 33,365 | 16,090 | 512 | 351 | 367 | 152 | 78 |

| Specialised Lending | 65,553 | 55,262 | 748 | 557 | 69 | 29 | 13 |

| Securitisation | 26,774 | 5,749 | - | - | - | - | - |

| Standardised2 | 22,512 | 20,966 | - | - | 58 | 21 | 2 |

| Total | 1,054,178 | 367,864 | 4,982 | 3,577 | 1,763 | 792 | 982 |

| Regulatory | |||||||

| Expected | Specific | Actual | |||||

| Risk | Regulatory | Loss for | Provisions | Losses for | |||

| 31 March 2019 | Exposure | Weighted | Expected | non-defaulted | Impaired | for Impaired | the 6 months |

| $m | at Default | Assets | Loss1 | exposures | Loans | Loans | ended |

| Corporate | 135,502 | 73,551 | 561 | 468 | 176 | 79 | (3) |

| Business lending | 54,299 | 35,294 | 642 | 424 | 279 | 161 | 23 |

| Sovereign | 79,572 | 1,653 | 2 | 1 | - | - | - |

| Bank | 25,471 | 7,066 | 8 | 8 | - | - | - |

| Residential mortgages | 558,161 | 132,133 | 1,649 | 1,106 | 391 | 126 | 52 |

| Australian credit cards | 18,850 | 5,910 | 363 | 292 | 101 | 63 | 150 |

| Other retail | 16,583 | 13,082 | 640 | 459 | 297 | 173 | 162 |

| Small business | 33,280 | 16,092 | 497 | 345 | 374 | 148 | 33 |

| Specialised Lending | 64,781 | 54,833 | 798 | 562 | 118 | 44 | 10 |

| Securitisation | 25,929 | 5,583 | - | - | - | - | - |

| Standardised2 | 17,389 | 17,565 | - | - | 13 | 6 | 1 |

| Total | 1,029,817 | 362,762 | 5,160 | 3,665 | 1,749 | 800 | 428 |

1 Includes regulatory expected losses for defaulted and non-defaulted exposures.

2 Includes mark-to-market related credit risk.

| 28| Westpac Group March 2020 Pillar 3 report |  |

Pillar 3 report Credit risk management |

Loan impairment provisions

Expected credit losses (ECL) are a estimate of the cash shortfalls expected to result from defaults over the relevant timeframe. They are determined by evaluating a range of possible outcomes and taking into account the time value of money, past events, current conditions and forecasts of future economic conditions. Westpac calculates provisions for ECL based on a three stage approach:

| l | Stage 1: 12 months ECL (performing) - For financial assets where there has been no significant increase in credit risk since origination, a provision for 12 months ECL is recognised. |

| l | Stage 2: Lifetime ECL (performing) - For financial assets where there has been a significant increase in credit risk since origination and where the asset is still performing, a provision for lifetime ECL is recognised. |

Determining when a financial asset has experienced a significant increase in credit risk is primarily based on changes in internal risk grades since origination of the financial asset. An internal risk grade assessed using both quantitative and qualitative factors. The number of notches (changes) in the internal risk grade that Westpac uses to represent a significant increase in credit risk is determined on a sliding scale where the number of notches will generally be greater for a financial asset with a lower credit risk compared to a financial asset with a higher credit risk.

| l | Stage 3: Lifetime ECL (non-performing) -For financial assets that are non-performing a provision for lifetime ECL is recognised. Indicators include a breach of contract with Westpac such as a default on interest or principal payments, a borrower experiencing significant financial difficulties. |

Collective and individual assessment -Financial assets that are in stages 1 and 2 are assessed on a collective basis as are financial assets in stage 3 below specified exposure thresholds. Those financial assets in stage 3 above the specified exposure thresholds are assessed on an individual basis.