- WEBNF Dashboard

- Financials

- Filings

- Holdings

- Transcripts

-

ETFs

-

Insider

- Institutional

- Shorts

-

6-K Filing

Westpac Banking (WEBNF) 6-KCurrent report (foreign)

Filed: 26 Apr 21, 6:04am

Exhibit 1

| ASX Release 26 APRIL 2021 Level 18, 275 Kent Street Sydney, NSW, 2000 Items affecting Westpac’s First Half 2021 Westpac today announced that its cash earnings in 1H21 will be reduced by $282m (after tax) due to notable items. Statutory net profit will also be reduced by these items. The notable items after tax include: additional provisions for customer refunds, payments, associated costs, and litigation provisions of $220m; write-down of capitalised software and other intangibles of $115m; costs associated with ending the Group’s relationship with IOOF, $56m; write-down of goodwill related to Lenders Mortgage Insurance of $84m; and an accounting loss on sale in Westpac Pacific along with transaction costs and payments associated with divestments, $113m. These losses were partly offset by: a net gain on the revaluation of the Group’s investment in Coinbase Inc. of $288m, a gain on sale of the Group’s holding in Zip Co Ltd, $18m. Of the $282m in notable items, $212m were announced in our 1Q21 Market Update with the remaining net cash earnings impact of $70m (after tax) occurring in 2Q21. Details of notable items in First Half 2021 are in Appendix 1 and a summary of line item impacts is in Appendix 2. Change in software capitalisation policy Westpac has also changed its software capitalisation policy, increasing the threshold before a project is capitalised to $20m (previously $1m). This policy has been applied from 1 October 2020 and will see the Group expense a higher portion of its investment spending from First Half 2021. The higher expense is not treated as a notable item. This change had no impact to the carrying value of capitalised software at 30 September 2020. |

| Additional information to be included in Westpac’s 2021 Interim Financial Results Following agreements to sell certain businesses within the Specialist Businesses division, Westpac is releasing details of businesses under the “held for sale” designation. The businesses include: Vendor Finance; Westpac General Insurance; Westpac Lenders Mortgage Insurance; and Westpac Pacific, As a result of this presentation change we will provide the following disclosures in our 2021 Interim Financial Results: the Group’s Consolidated balance sheet will include a separate “Held for sale” line item in both assets and liabilities which will include the sum of items relating to these businesses. Tables for Loans, Deposits, Provisions for ECL and Fair values of financial assets and liabilities will also be impacted. net interest income associated with these businesses will also be disclosed in separate line items and this will impact the Average balance sheet; and separate disclosures in section 3.5 Specialist Businesses will outline the cash earnings contribution of the businesses currently held for sale. The held for sale classification is only effective from First Half 2021 and therefore prior periods are not presented on a held for sale basis. The Group will continue with its existing segment reporting in its 2021 Interim Financial Results consistent with information provided internally to Westpac’s key decision makers. Accordingly, the presentation of results will not be affected by the decision to bring together the leadership of its Consumer and Business divisions into a new Consumer & Business Banking division. We are scheduled to announce our First Half 2021 results on Monday, 3 May 2021. For further information: David LordingAndrew Bowden Group Head of Media RelationsHead of Investor Relations 0419 683 4110438 284 863 This document has been authorised for release by Tim Hartin, General Manager & Company Secretary. |

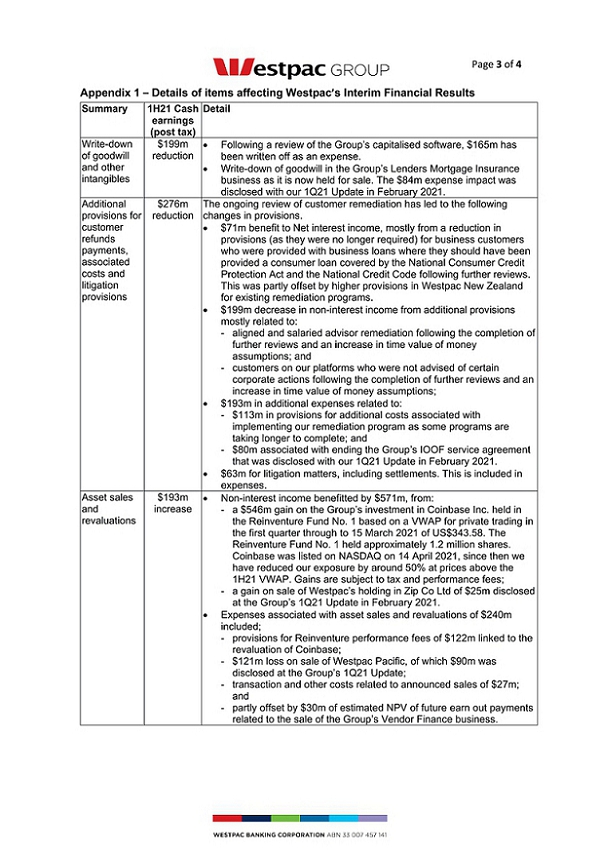

| Appendix 1 – Details of items affecting Westpac’s Interim Financial Results |

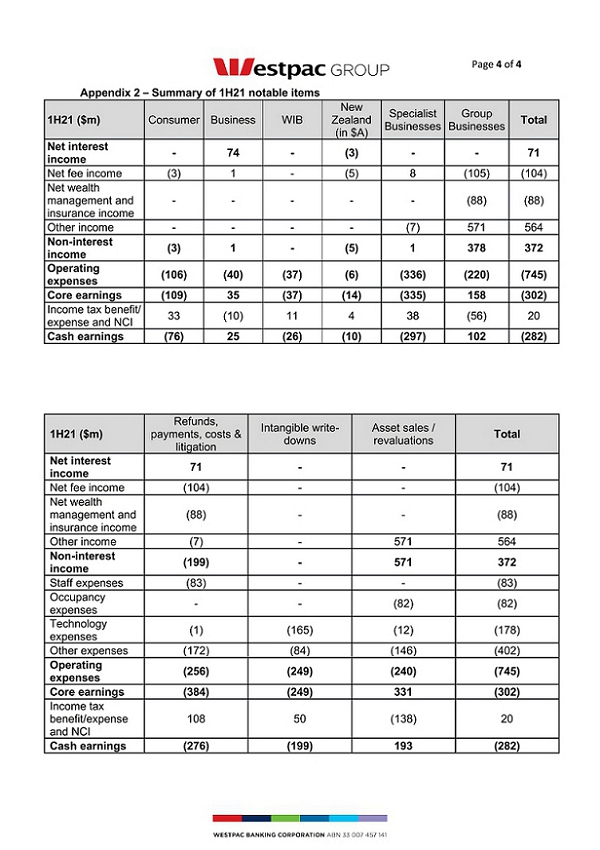

| Appendix 2 – Summary of 1H21 notable items |