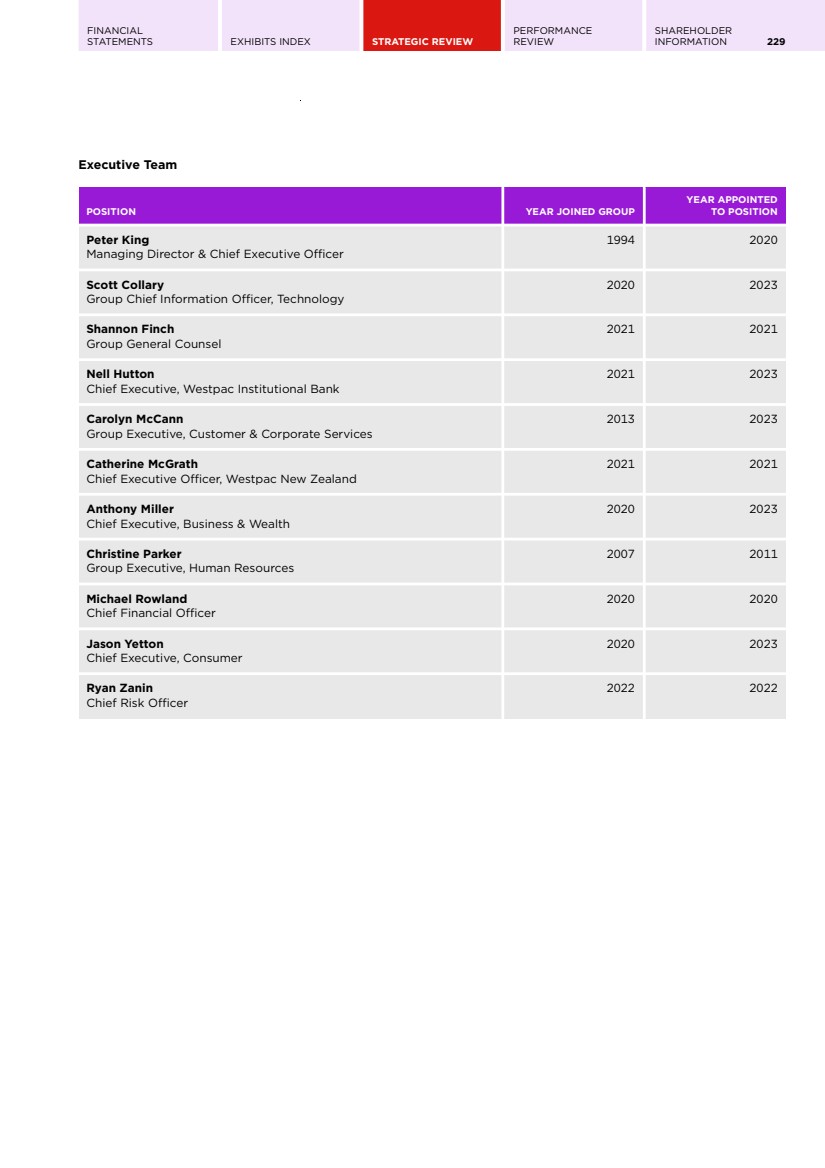

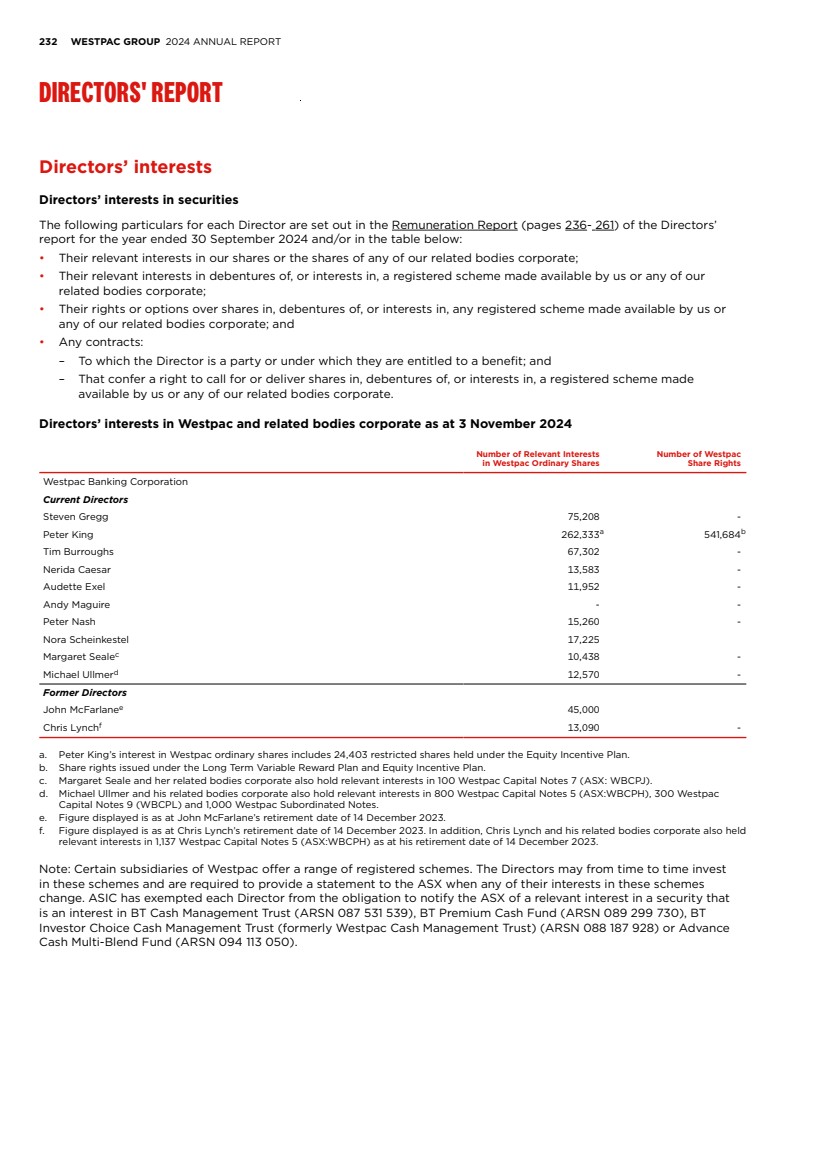

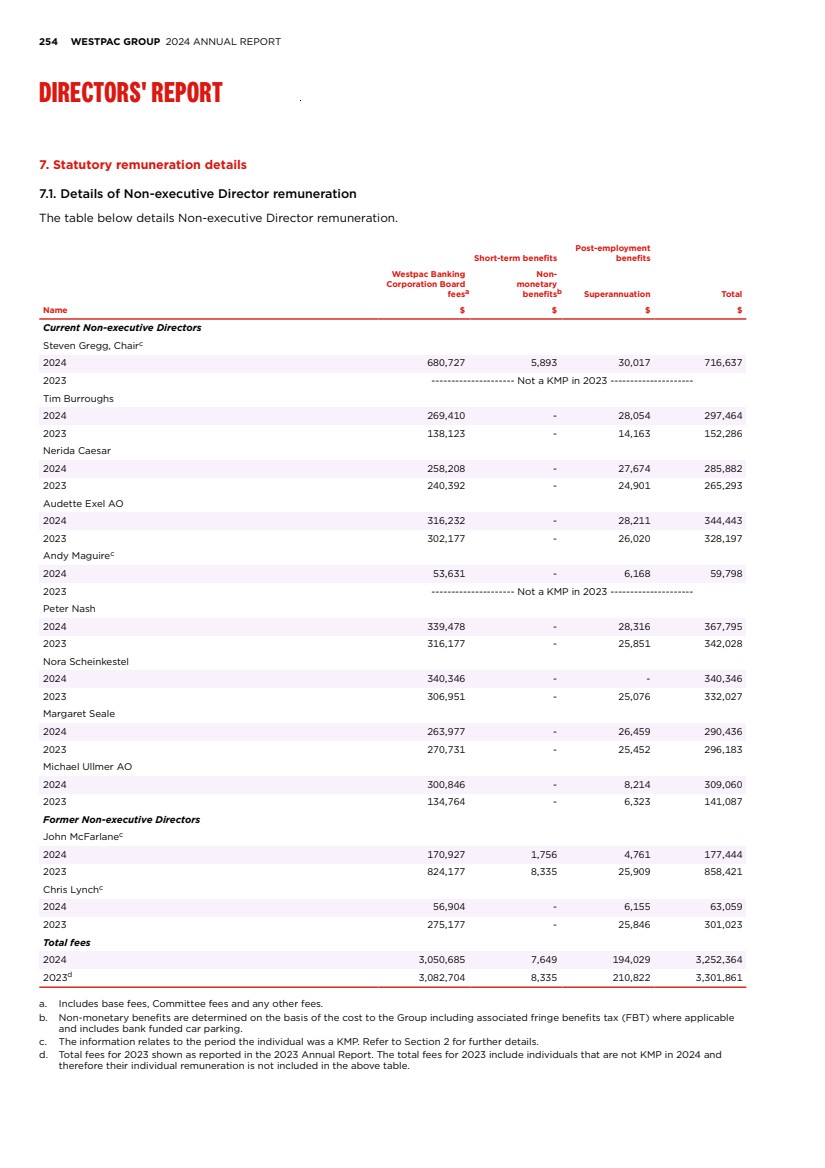

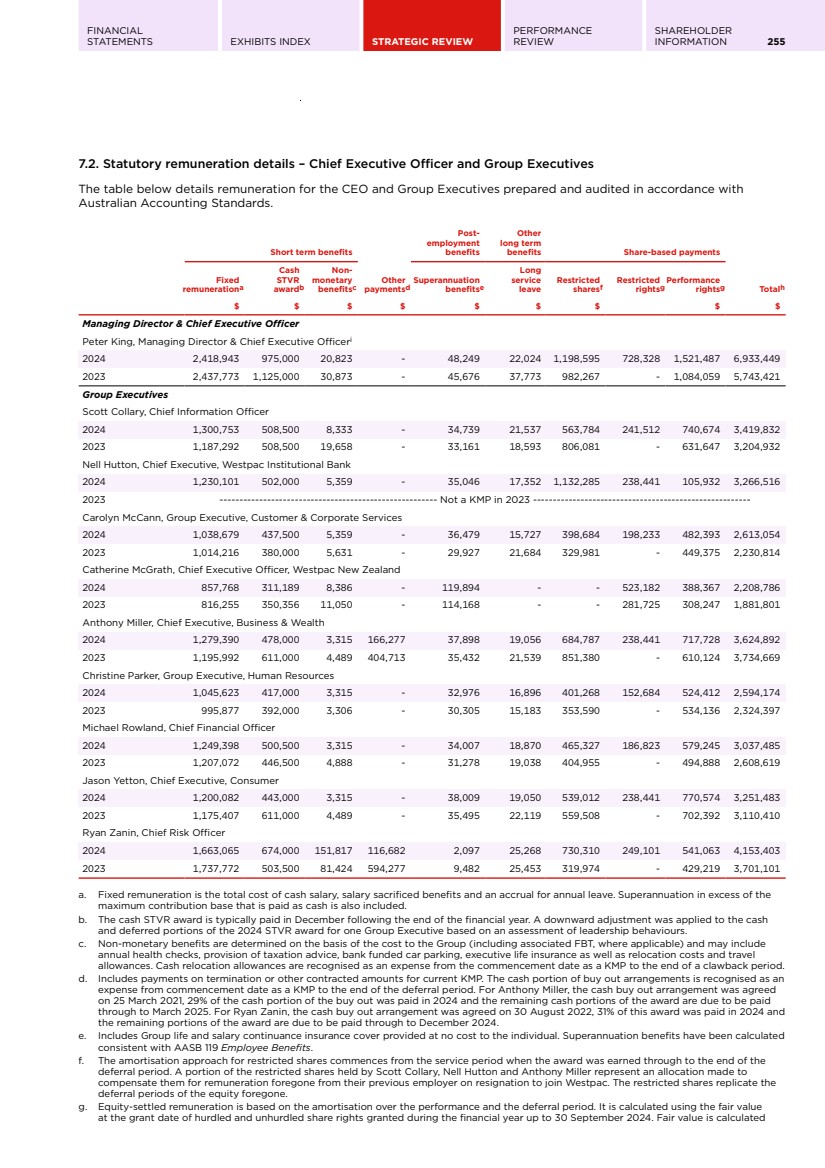

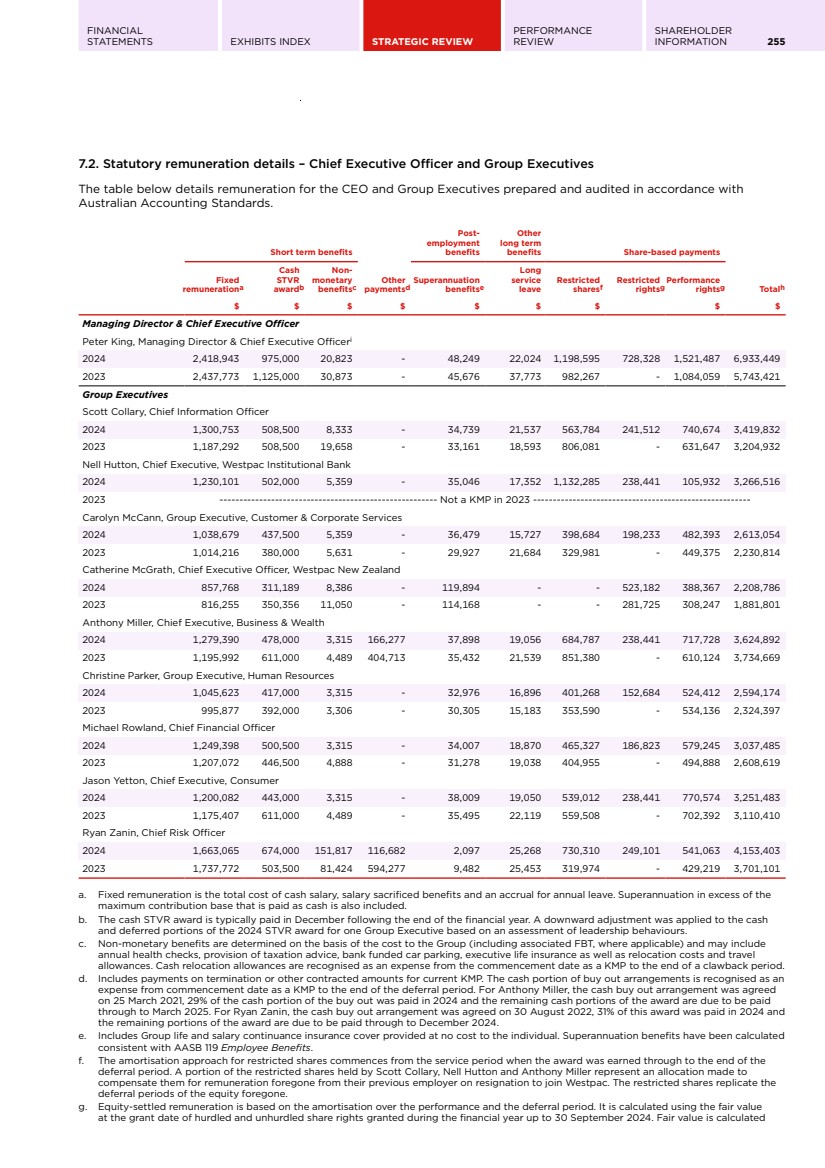

| FINANCIAL STATEMENTS EXHIBITS INDEX STRATEGIC REVIEW PERFORMANCE REVIEW SHAREHOLDER INFORMATION 255 7.2. Statutory remuneration details – Chief Executive Officer and Group Executives The table below details remuneration for the CEO and Group Executives prepared and audited in accordance with Australian Accounting Standards. Short term benefits Post-employment benefits Other long term benefits Share-based payments Fixed remunerationa Cash STVR awardb Non-monetary benefitsc Other paymentsd Superannuation benefitse Long service leave Restricted sharesf Restricted rightsg Performance rightsg Totalh $ $ $ $ $ $ $ $ $ Managing Director & Chief Executive Officer Peter King, Managing Director & Chief Executive Officeri 2024 2,418,943 975,000 20,823 - 48,249 22,024 1,198,595 728,328 1,521,487 6,933,449 2023 2,437,773 1,125,000 30,873 - 45,676 37,773 982,267 - 1,084,059 5,743,421 Group Executives Scott Collary, Chief Information Officer 2024 1,300,753 508,500 8,333 - 34,739 21,537 563,784 241,512 740,674 3,419,832 2023 1,187,292 508,500 19,658 - 33,161 18,593 806,081 - 631,647 3,204,932 Nell Hutton, Chief Executive, Westpac Institutional Bank 2024 1,230,101 502,000 5,359 - 35,046 17,352 1,132,285 238,441 105,932 3,266,516 2023 ------------------------------------------------------- Not a KMP in 2023 ------------------------------------------------------- Carolyn McCann, Group Executive, Customer & Corporate Services 2024 1,038,679 437,500 5,359 - 36,479 15,727 398,684 198,233 482,393 2,613,054 2023 1,014,216 380,000 5,631 - 29,927 21,684 329,981 - 449,375 2,230,814 Catherine McGrath, Chief Executive Officer, Westpac New Zealand 2024 857,768 311,189 8,386 - 119,894 - - 523,182 388,367 2,208,786 2023 816,255 350,356 11,050 - 114,168 - - 281,725 308,247 1,881,801 Anthony Miller, Chief Executive, Business & Wealth 2024 1,279,390 478,000 3,315 166,277 37,898 19,056 684,787 238,441 717,728 3,624,892 2023 1,195,992 611,000 4,489 404,713 35,432 21,539 851,380 - 610,124 3,734,669 Christine Parker, Group Executive, Human Resources 2024 1,045,623 417,000 3,315 - 32,976 16,896 401,268 152,684 524,412 2,594,174 2023 995,877 392,000 3,306 - 30,305 15,183 353,590 - 534,136 2,324,397 Michael Rowland, Chief Financial Officer 2024 1,249,398 500,500 3,315 - 34,007 18,870 465,327 186,823 579,245 3,037,485 2023 1,207,072 446,500 4,888 - 31,278 19,038 404,955 - 494,888 2,608,619 Jason Yetton, Chief Executive, Consumer 2024 1,200,082 443,000 3,315 - 38,009 19,050 539,012 238,441 770,574 3,251,483 2023 1,175,407 611,000 4,489 - 35,495 22,119 559,508 - 702,392 3,110,410 Ryan Zanin, Chief Risk Officer 2024 1,663,065 674,000 151,817 116,682 2,097 25,268 730,310 249,101 541,063 4,153,403 2023 1,737,772 503,500 81,424 594,277 9,482 25,453 319,974 - 429,219 3,701,101 a. Fixed remuneration is the total cost of cash salary, salary sacrificed benefits and an accrual for annual leave. Superannuation in excess of the maximum contribution base that is paid as cash is also included. b. The cash STVR award is typically paid in December following the end of the financial year. A downward adjustment was applied to the cash and deferred portions of the 2024 STVR award for one Group Executive based on an assessment of leadership behaviours. c. Non-monetary benefits are determined on the basis of the cost to the Group (including associated FBT, where applicable) and may include annual health checks, provision of taxation advice, bank funded car parking, executive life insurance as well as relocation costs and travel allowances. Cash relocation allowances are recognised as an expense from the commencement date as a KMP to the end of a clawback period. d. Includes payments on termination or other contracted amounts for current KMP. The cash portion of buy out arrangements is recognised as an expense from commencement date as a KMP to the end of the deferral period. For Anthony Miller, the cash buy out arrangement was agreed on 25 March 2021, 29% of the cash portion of the buy out was paid in 2024 and the remaining cash portions of the award are due to be paid through to March 2025. For Ryan Zanin, the cash buy out arrangement was agreed on 30 August 2022, 31% of this award was paid in 2024 and the remaining portions of the award are due to be paid through to December 2024. e. Includes Group life and salary continuance insurance cover provided at no cost to the individual. Superannuation benefits have been calculated consistent with AASB 119 Employee Benefits. f. The amortisation approach for restricted shares commences from the service period when the award was earned through to the end of the deferral period. A portion of the restricted shares held by Scott Collary, Nell Hutton and Anthony Miller represent an allocation made to compensate them for remuneration foregone from their previous employer on resignation to join Westpac. The restricted shares replicate the deferral periods of the equity foregone. g. Equity-settled remuneration is based on the amortisation over the performance and the deferral period. It is calculated using the fair value at the grant date of hurdled and unhurdled share rights granted during the financial year up to 30 September 2024. Fair value is calculated |