UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-3732

MFS VARIABLE INSURANCE TRUST II

(Exact name of registrant as specified in charter)

111 Huntington Avenue, Boston, Massachusetts 02199

(Address of principal executive offices) (Zip code)

Susan S. Newton

Massachusetts Financial Services Company

111 Huntington Avenue

Boston, Massachusetts 02199

(Name and address of agents for service)

Registrant’s telephone number, including area code: (617) 954-5000

Date of fiscal year end: December 31

Date of reporting period: June 30, 2013

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

SEMIANNUAL REPORT

June 30, 2013

MFS® TECHNOLOGY PORTFOLIO

MFS® Variable Insurance Trust II

TKS-SEM

MFS® TECHNOLOGY PORTFOLIO

CONTENTS

The report is prepared for the general information of contract owners. It is authorized for distribution to prospective investors only when preceded or accompanied by a current prospectus.

NOT FDIC INSURED Ÿ MAY LOSE VALUE Ÿ NO BANK OR CREDIT UNION GUARANTEE Ÿ NOT A DEPOSIT Ÿ NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY OR NCUA/NCUSIF

MFS Technology Portfolio

LETTER FROM THE CHAIRMAN AND CEO

Dear Contract Owners:

As the year progresses, the global economy continues to grind ahead slowly, held back by broad austerity measures. The U.S. economy remains a steadying force, driven by resilient consumers, who have taken the payroll tax increase and the sequestration’s early impact in stride. With U.S. housing and jobs showing steady expansion, domestic consumer-driven growth has offset weaker exports and the U.S. government’s spending constraints. In response to these developments, the U.S. Federal Reserve has begun to brace investors for an eventual shift in its monetary policy, causing global market tremors.

Japan has been another bright spot, with government and central bank stimulus policies leading to increased exports, a resurgent stock market and improved economic sentiment. After a six-month rally, Japan’s stocks slipped late in the second quarter, then picked up momentum on fresh signs that the country could soon break free of its chronic deflation. The major deterrent to global growth remains the eurozone, still in the grip of persistent recession. China has seen its pace of economic growth decelerate, a troubling turn for the country’s trading partners, who have come to rely on it as an engine for global growth.

As always, managing risk in the face of uncertainty remains a top priority for investors. At MFS®, our uniquely collaborative investment process employs integrated, global research and active risk management. Our global team of investment professionals shares ideas and evaluates opportunities across continents, investment disciplines and asset classes — all with a goal of building better insights, and ultimately better results, for our clients.

We are mindful of the many economic challenges investors face, and believe it is more important than ever to maintain a long-term view and employ time-tested principles, such as asset allocation and diversification. We remain confident that our unique approach can serve investors well as they work with their financial advisors to identify and pursue the most suitable opportunities.

Respectfully,

Robert J. Manning

Chairman and Chief Executive Officer

MFS Investment Management®

August 16, 2013

The opinions expressed in this letter are subject to change, may not be relied upon for investment advice, and no forecasts can be guaranteed.

1

MFS Technology Portfolio

PORTFOLIO COMPOSITION

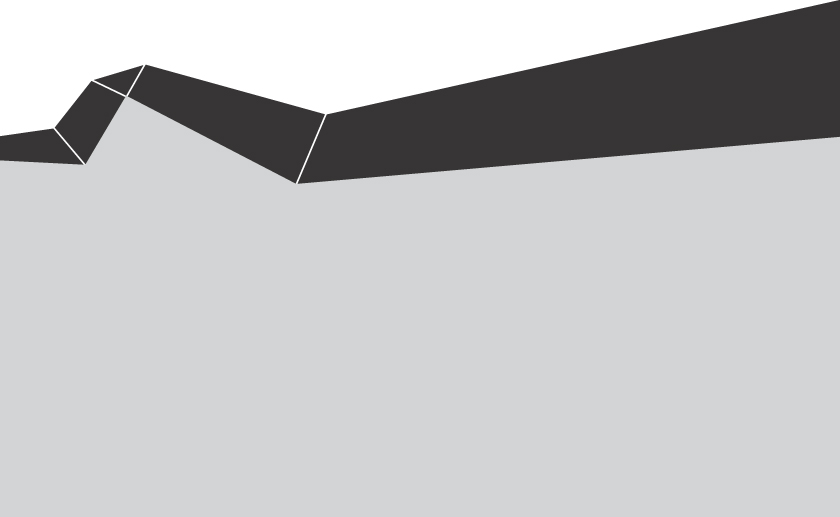

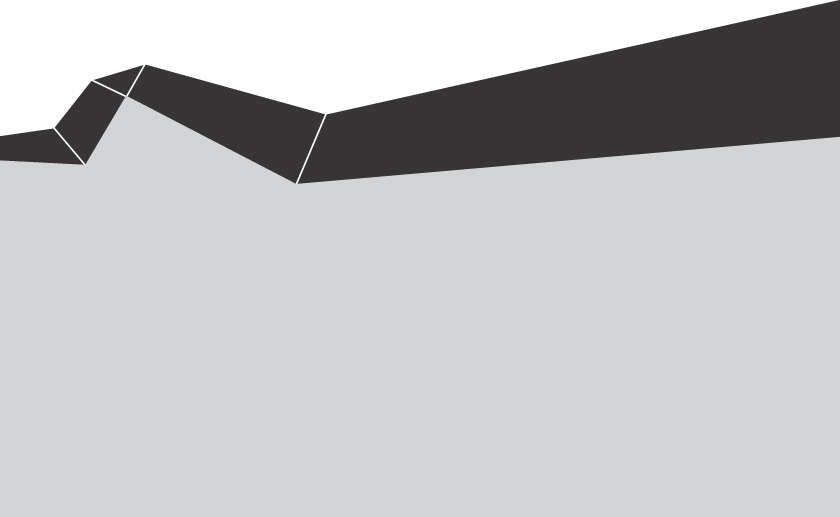

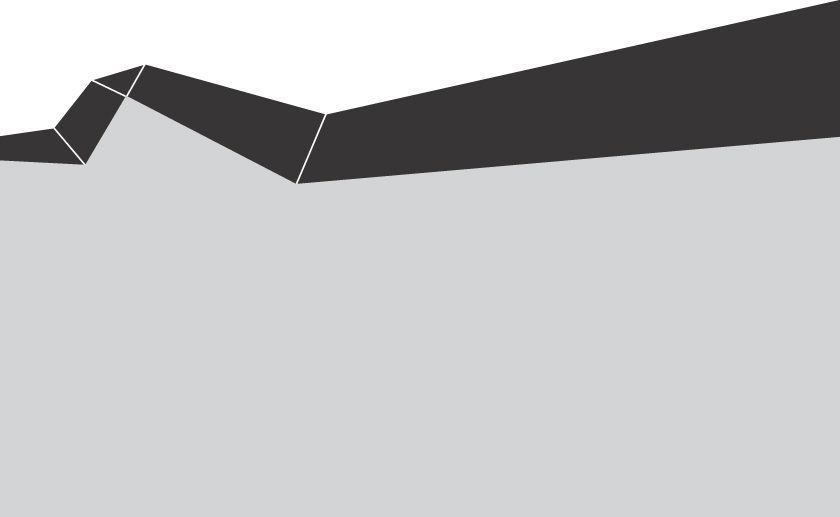

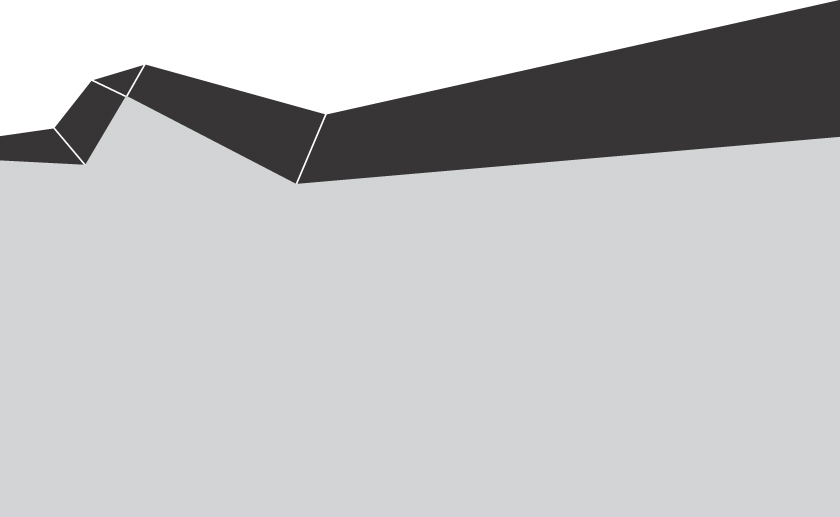

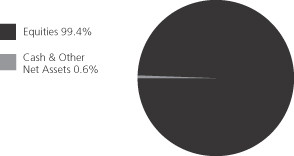

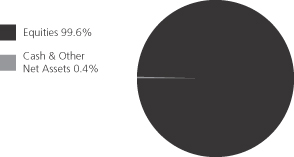

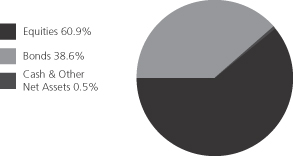

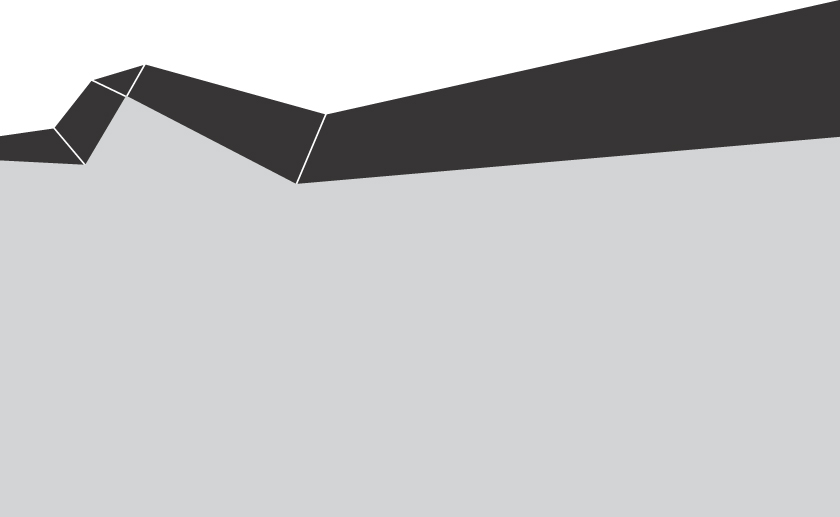

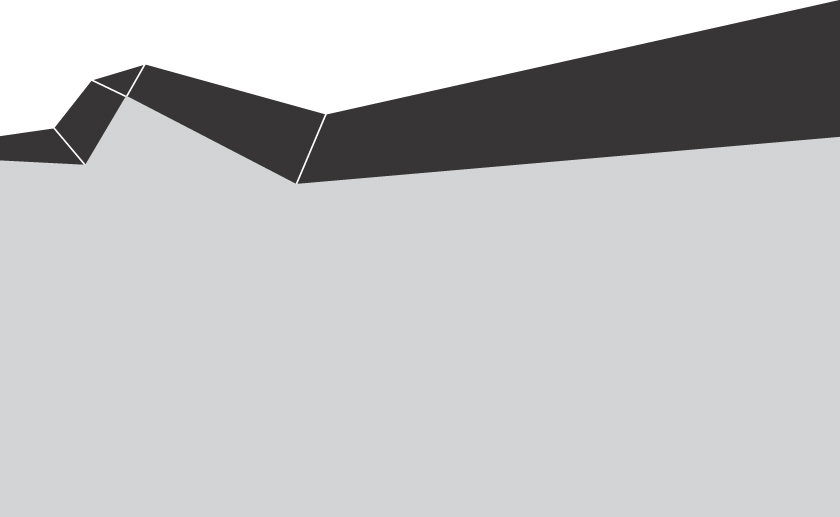

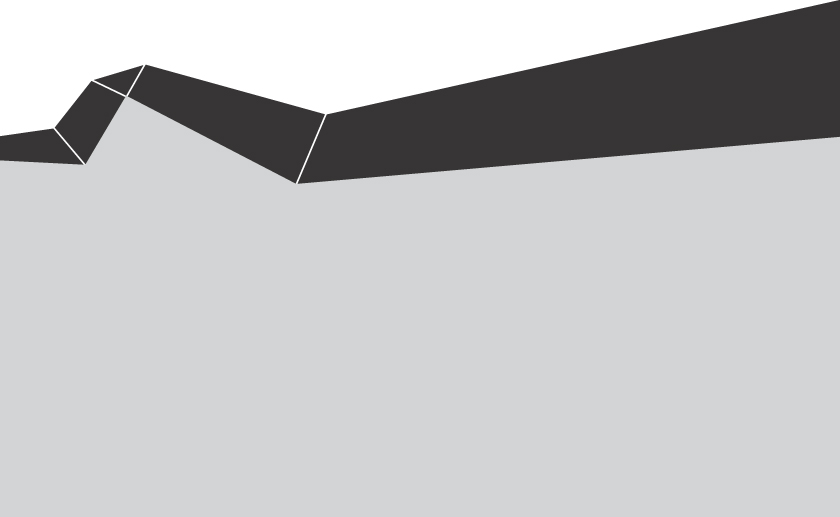

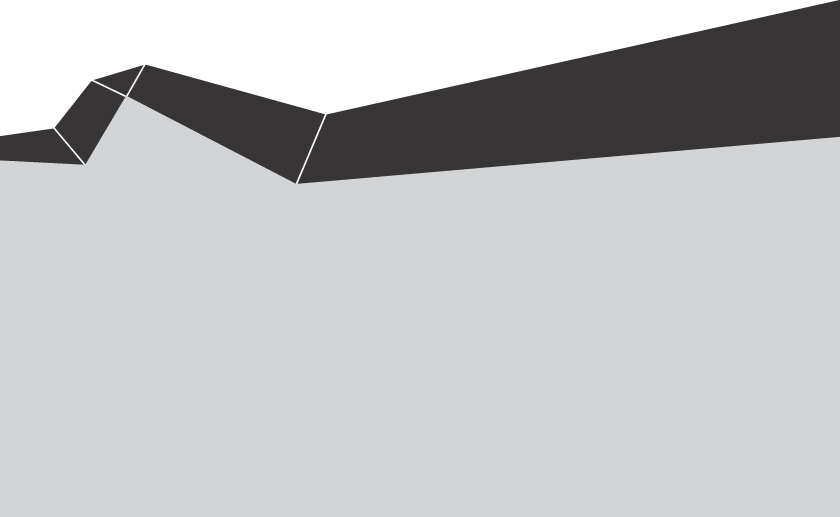

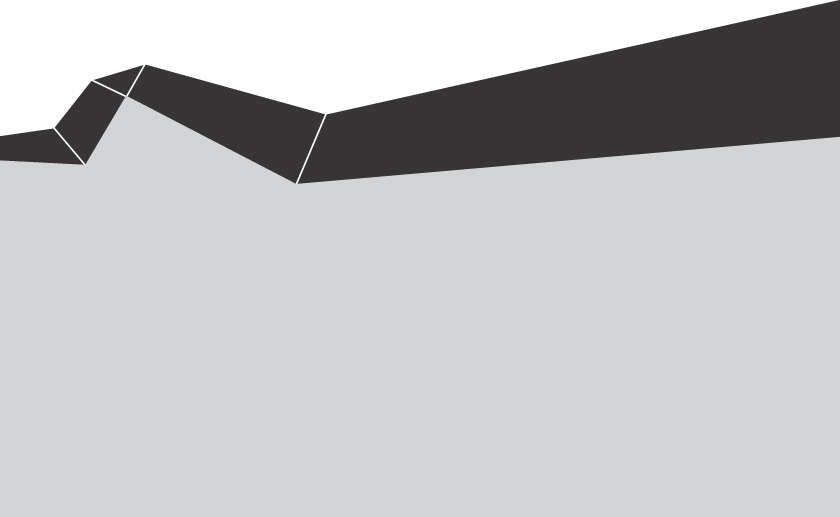

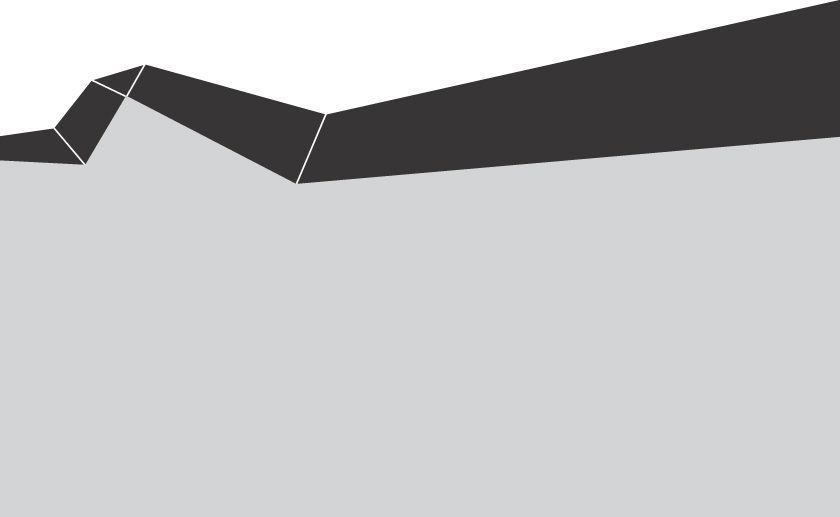

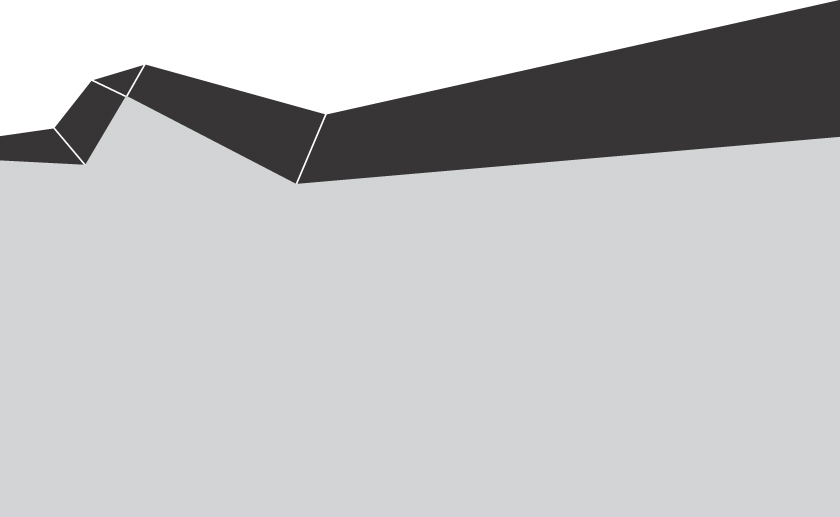

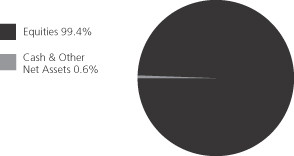

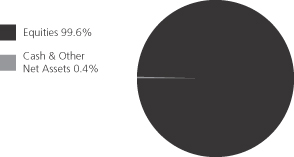

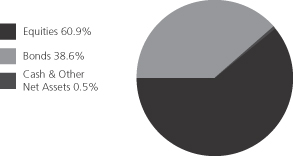

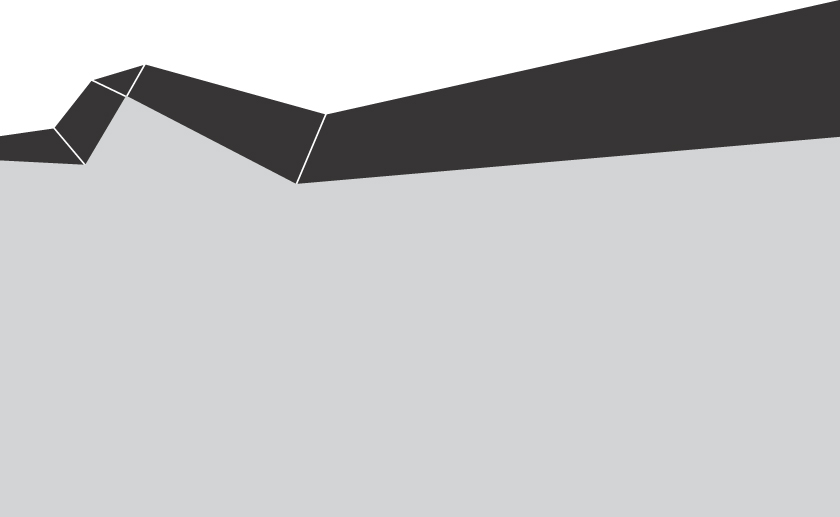

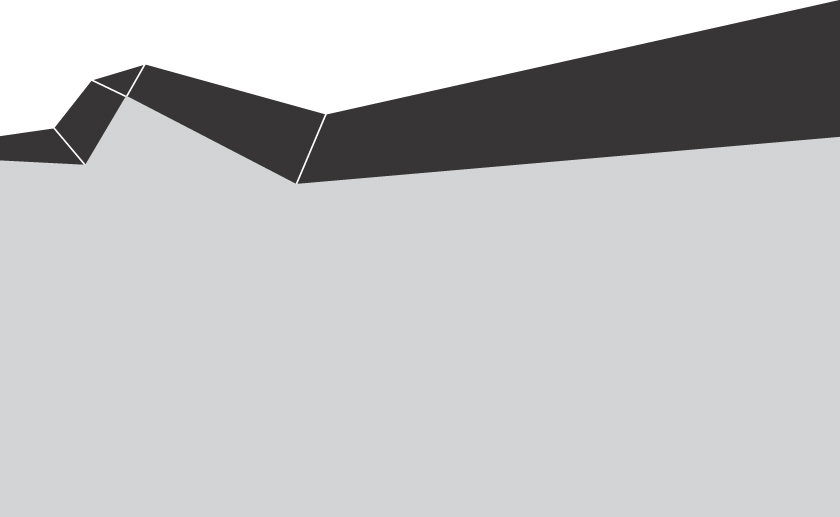

Portfolio structure (i)

| | | | |

| Top ten holdings (i) | | | | |

| Google, Inc., “A” | | | 10.1% | |

| Apple, Inc. | | | 6.5% | |

| Hewlett-Packard Co. | | | 6.0% | |

| Qualcomm, Inc. | | | 4.9% | |

| Amazon.com, Inc. | | | 4.5% | |

| Visa, Inc., “A” | | | 4.5% | |

| Oracle Corp. | | | 4.5% | |

| eBay, Inc. | | | 3.4% | |

| Microchip Technology, Inc. | | | 3.4% | |

| EMC Corp. | | | 3.4% | |

| | | | |

| Top five industries (i) | | | | |

Computer Software - Systems (s) | | | 20.6% | |

Internet | | | 18.1% | |

Computer Software | | | 12.5% | |

Electronics (s) | | | 12.0% | |

Other Banks & Diversified Financials | | | 7.9% | |

| (i) | For purposes of this presentation, the components include the market value of securities, less any securities sold short, and reflect the impact of the equivalent exposure of derivative positions. These amounts may be negative from time to time. Equivalent exposure is a calculated amount that translates the derivative position into a reasonable approximation of the amount of the underlying asset that the portfolio would have to hold at a given point in time to have the same price sensitivity that results from the portfolio’s ownership of the derivative contract. When dealing with derivatives, equivalent exposure is a more representative measure of the potential impact of a position on portfolio performance than market value. |

| (s) | Includes securities sold short. |

Percentages are based on net assets as of 6/30/13.

The portfolio is actively managed and current holdings may be different.

2

MFS Technology Portfolio

EXPENSE TABLE

Fund Expenses Borne by the Contract Holders During the Period,

January 1, 2013 through June 30, 2013

As a contract holder of the fund, you incur ongoing costs, including management fees; distribution and/or service (12b-1) fees; and other fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period January 1, 2013 through June 30, 2013.

Actual Expenses

The first line for each share class in the following table provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line for each share class in the following table provides information about hypothetical account values and hypothetical expenses based on the fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight the fund’s ongoing costs only and do not take into account the fees and expenses imposed under the variable contracts through which your investment in the fund is made. Therefore, the second line for each share class in the table is useful in comparing ongoing costs associated with an investment in vehicles (such as the fund) which fund benefits under variable annuity and variable life insurance contracts and to qualified pension and retirement plans only, and will not help you determine the relative total costs of investing in the fund through variable annuity and variable life insurance contracts. If the fees and expenses imposed under the variable contracts were included, your costs would have been higher.

| | | | | | | | | | | | | | | | | | |

| Share Class | | | | Annualized

Expense Ratio | | | Beginning

Account Value

1/01/13 | | | Ending

Account Value

6/30/13 | | | Expenses Paid

During Period (p)

1/01/13-6/30/13 | |

| Initial Class | | Actual | | | 1.08% | | | | $1,000.00 | | | | $1,085.75 | | | | $5.59 | |

| | Hypothetical (h) | | | 1.08% | | | | $1,000.00 | | | | $1,019.44 | | | | $5.41 | |

| Service Class | | Actual | | | 1.33% | | | | $1,000.00 | | | | $1,084.53 | | | | $6.87 | |

| | Hypothetical (h) | | | 1.33% | | | | $1,000.00 | | | | $1,018.20 | | | | $6.66 | |

| (h) | 5% class return per year before expenses. |

| (p) | Expenses paid are equal to each class’s annualized expense ratio, as shown above, multiplied by the average account value over the period, multiplied by the number of days in the period, divided by the number of days in the year. |

Expenses Impacting Table

Expense ratios include 0.11% of investment related expenses from short sale dividend and interest expenses that are outside of the expense limitation arrangement (See Note 3 of the Notes to Financial Statements).

3

MFS Technology Portfolio

PORTFOLIO OF INVESTMENTS – 6/30/13 (unaudited)

The Portfolio of Investments is a complete list of all securities owned by your fund. It is categorized by broad-based asset classes.

| | | | | | | | |

| Issuer | | Shares/Par | | | Value ($) | |

| | | | | | | | |

| COMMON STOCKS – 99.3% | | | | | | | | |

| Broadcasting – 4.3% | | | | | | | | |

| Discovery Communications, Inc., “C” (a) | | | 3,540 | | | $ | 246,596 | |

| News Corp., “A” | | | 30,820 | | | | 1,004,732 | |

| Time Warner, Inc. | | | 7,140 | | | | 412,835 | |

| Viacom, Inc., “B” | | | 3,030 | | | | 206,191 | |

| Walt Disney Co. | | | 7,000 | | | | 442,050 | |

| | | | | | | | |

| | | | | | $ | 2,312,404 | |

| | | | | | | | |

| Brokerage & Asset Managers – 0.3% | | | | | | | | |

| IntercontinentalExchange, Inc. (a) | | | 1,050 | | | $ | 186,648 | |

| | | | | | | | |

| Business Services – 5.0% | | | | | | | | |

| Accenture PLC, “A” | | | 14,000 | | | $ | 1,007,440 | |

| Cognizant Technology Solutions Corp., “A” (a) | | | 7,510 | | | | 470,201 | |

| Fidelity National Information Services, Inc. | | | 14,870 | | | | 637,031 | |

| FleetCor Technologies, Inc. (a) | | | 4,370 | | | | 355,281 | |

| QIWI PLC, ADR | | | 7,740 | | | | 179,568 | |

| | | | | | | | |

| | | | | | $ | 2,649,521 | |

| | | | | | | | |

| Computer Software – 12.5% | | | | | | | | |

| Autodesk, Inc. (a) | | | 13,160 | | | $ | 446,650 | |

| CDW Corp. (a) | | | 23,260 | | | | 433,101 | |

| Citrix Systems, Inc. (a) | | | 9,100 | | | | 549,003 | |

| Microsoft Corp. | | | 13,830 | | | | 477,550 | |

| Oracle Corp. (s) | | | 77,950 | | | | 2,394,624 | |

| Qlik Technologies, Inc. (a) | | | 14,750 | | | | 416,983 | |

| Salesforce.com, Inc. (a) | | | 29,000 | | | | 1,107,220 | |

| Symantec Corp. | | | 22,150 | | | | 497,710 | |

| TIBCO Software, Inc. (a) | | | 16,400 | | | | 350,960 | |

| | | | | | | | |

| | | | | | $ | 6,673,801 | |

| | | | | | | | |

| Computer Software – Systems – 20.9% | | | | | |

| Apple, Inc. (s) | | | 8,815 | | | $ | 3,491,445 | |

| EMC Corp. | | | 76,770 | | | | 1,813,307 | |

| FleetMatics Group PLC (a) | | | 9,700 | | | | 322,331 | |

| Guidewire Software, Inc. (a) | | | 12,510 | | | | 526,046 | |

| Hewlett-Packard Co. | | | 129,710 | | | | 3,216,808 | |

| International Business Machines Corp. | | | 2,519 | | | | 481,406 | |

| Model N, Inc. (a) | | | 10,180 | | | | 237,805 | |

| Qualys, Inc. (a) | | | 10,010 | | | | 161,361 | |

| Splunk, Inc. (a) | | | 5,990 | | | | 277,696 | |

| SS&C Technologies Holdings, Inc. (a) | | | 9,740 | | | | 320,446 | |

| Vantiv, Inc., “A” (a) | | | 11,900 | | | | 328,440 | |

| | | | | | | | |

| | | | | | $ | 11,177,091 | |

| | | | | | | | |

| Consumer Services – 3.5% | | | | | | | | |

| Grand Canyon Education, Inc. (a) | | | 2,870 | | | $ | 92,500 | |

| Priceline.com, Inc. (a) | | | 2,172 | | | | 1,796,526 | |

| | | | | | | | |

| | | | | | $ | 1,889,026 | |

| | | | | | | | |

| Electrical Equipment – 1.6% | | | | | | | | |

| Amphenol Corp., “A” | | | 9,450 | | | $ | 736,533 | |

| W.W. Grainger, Inc. | | | 510 | | | | 128,612 | |

| | | | | | | | |

| | | | | | $ | 865,145 | |

| | | | | | | | |

| | | | | | | | |

| Issuer | | Shares/Par | | | Value ($) | |

| | | | | | | | |

| COMMON STOCKS – continued | |

| Electronics – 12.8% | | | | | | | | |

| Aeroflex Holding Corp. (a) | | | 51,220 | | | $ | 404,126 | |

| Altera Corp. | | | 33,640 | | | | 1,109,784 | |

| Freescale Semiconductor Ltd. (a) | | | 29,690 | | | | 402,300 | |

| JDS Uniphase Corp. (a) | | | 100,320 | | | | 1,442,602 | |

| Linear Technology Corp. | | | 9,800 | | | | 361,032 | |

| Mellanox Technologies Ltd. (a) | | | 7,020 | | | | 347,490 | |

| Microchip Technology, Inc. | | | 49,350 | | | | 1,838,287 | |

| NXP Semiconductors N.V. (a) | | | 20,860 | | | | 646,243 | |

| Ultratech, Inc. (a) | | | 4,090 | | | | 150,185 | |

| Veeco Instruments, Inc. (a) | | | 4,330 | | | | 153,369 | |

| | | | | | | | |

| | | | | | $ | 6,855,418 | |

| | | | | | | | |

| Entertainment – 0.7% | | | | | | | | |

| AMC Networks, Inc., “A” (a) | | | 5,410 | | | $ | 353,868 | |

| | | | | | | | |

| Internet – 18.1% | | | | | | | | |

| ChannelAdvisor Corp. (a) | | | 11,220 | | | $ | 176,491 | |

| eBay, Inc. (a) | | | 35,620 | | | | 1,842,266 | |

| Facebook, Inc., “A “ (a) | | | 31,460 | | | | 782,096 | |

| Google, Inc., “A” (a)(s) | | | 6,132 | | | | 5,398,429 | |

| LinkedIn Corp., “A” (a) | | | 1,801 | | | | 321,118 | |

| Rackspace Hosting, Inc. (a) | | | 2,300 | | | | 87,147 | |

| Yahoo!, Inc. (a) | | | 42,490 | | | | 1,066,924 | |

| | | | | | | | |

| | | | | | $ | 9,674,471 | |

| | | | | | | | |

| Network & Telecom – 7.2% | | | | | | | | |

| Finisar Corp. (a) | | | 49,900 | | | $ | 845,805 | |

| Juniper Networks, Inc. (a) | | | 18,640 | | | | 359,938 | |

| Qualcomm, Inc. | | | 43,000 | | | | 2,626,440 | |

| | | | | | | | |

| | | | | | $ | 3,832,183 | |

| | | | | | | | |

| Other Banks & Diversified Financials – 7.9% | | | | | |

| MasterCard, Inc., “A” | | | 3,135 | | | $ | 1,801,058 | |

| Visa, Inc., “A” | | | 13,203 | | | | 2,412,848 | |

| | | | | | | | |

| | | | | | $ | 4,213,906 | |

| | | | | | | | |

| Specialty Stores – 4.5% | | | | | | | | |

| Amazon.com, Inc. (a) | | | 8,701 | | | $ | 2,416,181 | |

| | | | | | | | |

Total Common Stocks

(Identified Cost, $47,495,227) | | | | | | $ | 53,099,663 | |

| | | | | | | | |

|

| MONEY MARKET FUNDS – 1.7% | |

| MFS Institutional Money Market Portfolio, 0.11%, at Cost and Net Asset Value (v) | | | 892,779 | | | $ | 892,779 | |

| | | | | | | | |

Total Investments

(Identified Cost, $48,388,006) | | | | | | $ | 53,992,442 | |

| | | | | | | | |

| Issuer/Expiration Date/Strike Price | | Number of

Contracts | | | | |

|

| CALL OPTIONS WRITTEN – 0.0% | |

| Business Services – 0.0% | | | | | | | | |

| Accenture PLC – July 2013 @ $72.5 | | | (19 | ) | | $ | (2,565 | ) |

| Accenture PLC – July 2013 @ $75 | | | (39 | ) | | | (1,755 | ) |

| | | | | | | | |

| | | | | | $ | (4,320 | ) |

| | | | | | | | |

4

MFS Technology Portfolio

Portfolio of Investments (unaudited) – continued

| | | | | | | | |

| Issuer/Expiration Date/Strike Price | | Number of

Contracts | | | Value ($) | |

| | | | | | | | |

| CALL OPTIONS WRITTEN – continued | | | | | |

| Computer Software – Systems – 0.0% | |

| Apple Inc. – July 2013 @ 470 | | | (12 | ) | | $ | (204 | ) |

| | | | | | | | |

Total Call Options Written

(Premium Received, $6,216) | | | | | | $ | (4,524 | ) |

| | | | | | | | |

| |

| PUT OPTIONS WRITTEN – (0.1)% | | | | | |

| Computer Software – Systems – 0.0% | |

| Synaptics Inc. – July 2013 @ $37 (a) | | | (54 | ) | | $ | (4,050 | ) |

| | | | | | | | |

| Network & Telecom – (0.1)% | | | | | | | | |

| Research In Motion Ltd. – July 2013 @ $13 (a) | | | (141 | ) | | $ | (37,083 | ) |

| | | | | | | | |

Total Put Options Written

(Premium Received, $11,725) | | | | | | $ | (41,133 | ) |

| | | | | | | | |

| Issuer | | Shares/Par | | | | |

|

| SECURITIES SOLD SHORT – (3.0)% | |

| Business Services – (1.2)% | | | | | | | | |

| FactSet Research Systems, Inc. | | | (6,600 | ) | | $ | (672,804 | ) |

| | | | | | | | |

| Computer Software – Systems – (0.4)% | | | | | |

| Synaptics Inc. | | | (5,400 | ) | | $ | (208,224 | ) |

| | | | | | | | |

| Electronics – (0.9)% | | | | | | | | |

| Texas Instruments, Inc. | | | (10,300 | ) | | $ | (359,161 | ) |

| Xilinx, Inc. | | | (2,700 | ) | | | (106,947 | ) |

| | | | | | | | |

| | | | | | $ | (466,108 | ) |

| | | | | | | | |

| | | | | | | | |

| Issuer | |

Shares/Par | | | Value ($) | |

| | | | | | | | |

| SECURITIES SOLD SHORT – continued | |

| Network & Telecom – (0.5)% | | | | | | | | |

| Research In Motion Ltd. | | | (25,600 | ) | | $ | (268,032 | ) |

| | | | | | | | |

Total Securities Sold Short

(Proceeds Received, $1,645,577) | | | | | | $ | (1,615,168 | ) |

| | | | | | | | |

OTHER ASSETS, LESS

LIABILITIES – 2.1% | | | | | | | 1,126,384 | |

| | | | | | | | |

| Net Assets – 100.0% | | | | | | $ | 53,458,001 | |

| | | | | | | | |

| (a) | | Non-income producing security. |

| (s) | | Security or a portion of the security was pledged to cover collateral requirements for securities sold short and certain derivative transactions. |

| (v) | | Underlying affiliated fund that is available only to investment companies managed by MFS. The rate quoted for the MFS Institutional Money Market Portfolio is the annualized seven-day yield of the fund at period end. |

At June 30, 2013, the fund had cash collateral of $1,274,118 and other liquid securities with an aggregate value of $1,090,732 to cover any commitments for securities sold short and certain derivative contracts. Cash collateral is comprised of “Deposits with brokers” in the Statement of Assets and Liabilities.

The following abbreviations are used in this report and are defined:

| ADR | | American Depositary Receipt |

| PLC | | Public Limited Company |

See Notes to Financial Statements

5

MFS Technology Portfolio

FINANCIAL STATEMENTS | STATEMENT OF ASSETS AND LIABILITIES (unaudited)

This statement represents your fund’s balance sheet, which details the assets and liabilities comprising the total value of the fund.

| | | | | | | | |

At 6/30/13 | | | | | | | | |

Assets | | | | | | | | |

Investments – | | | | | | | | |

Non-affiliated issuers, at value (identified cost, $47,495,227) | | | $53,099,663 | | | | | |

Underlying affiliated funds, at cost and value | | | 892,779 | | | | | |

Total investments, at value (identified cost, $48,388,006) | | | $53,992,442 | | | | | |

Deposits with brokers | | | 1,274,118 | | | | | |

Receivables for | | | | | | | | |

Investments sold | | | 459,907 | | | | | |

Fund shares sold | | | 158,507 | | | | | |

Dividends | | | 28,607 | | | | | |

Other assets | | | 387 | | | | | |

Total assets | | | | | | | $55,913,968 | |

Liabilities | | | | | | | | |

Payables for | | | | | | | | |

Securities sold short, at value (proceeds received, $1,645,577) | | | $1,615,168 | | | | | |

Investments purchased | | | 747,316 | | | | | |

Fund shares reacquired | | | 6,245 | | | | | |

Written options outstanding, at value (premiums received, $17,941) | | | 45,657 | | | | | |

Payable to affiliates | | | | | | | | |

Investment adviser | | | 4,548 | | | | | |

Shareholder servicing costs | | | 81 | | | | | |

Distribution and/or service fees | | | 1,106 | | | | | |

Payable for independent Trustees’ compensation | | | 243 | | | | | |

Accrued expenses and other liabilities | | | 35,603 | | | | | |

Total liabilities | | | | | | | $2,455,967 | |

Net assets | | | | | | | $53,458,001 | |

Net assets consist of | | | | | | | | |

Paid-in capital | | | $46,988,875 | | | | | |

Unrealized appreciation (depreciation) on investments | | | 5,607,129 | | | | | |

Accumulated net realized gain (loss) on investments and foreign currency | | | 952,972 | | | | | |

Accumulated net investment loss | | | (90,975 | ) | | | | |

Net assets | | | | | | | $53,458,001 | |

Shares of beneficial interest outstanding | | | | | | | 6,363,030 | |

| | | | | | | | | | | | |

| | | Net assets | | | Shares

outstanding | | | Net asset value

per share | |

Initial Class | | | $12,925,285 | | | | 1,500,490 | | | | $8.61 | |

Service Class | | | 40,532,716 | | | | 4,862,540 | | | | 8.34 | |

See Notes to Financial Statements

6

MFS Technology Portfolio

FINANCIAL STATEMENTS | STATEMENT OF OPERATIONS (unaudited)

This statement describes how much your fund earned in investment income and accrued in expenses. It also describes any gains and/or losses generated by fund operations.

| | | | | | | | |

Six months ended 6/30/13 | | | | | | | | |

Net Investment loss | | | | | | | | |

Income | | | | | | | | |

Dividends | | | $213,722 | | | | | |

Interest | | | 4,708 | | | | | |

Dividends from underlying affiliated funds | | | 195 | | | | | |

Total investment income | | | | | | | $218,625 | |

Expenses | | | | | | | | |

Management fee | | | $183,788 | | | | | |

Distribution and/or service fees | | | 45,067 | | | | | |

Shareholder servicing costs | | | 2,550 | | | | | |

Administrative services fee | | | 8,726 | | | | | |

Independent Trustees’ compensation | | | 663 | | | | | |

Custodian fee | | | 7,111 | | | | | |

Shareholder communications | | | 2,532 | | | | | |

Audit and tax fees | | | 26,127 | | | | | |

Legal fees | | | 378 | | | | | |

Dividend and interest expense on securities sold short | | | 27,351 | | | | | |

Miscellaneous | | | 5,470 | | | | | |

Total expenses | | | | | | | $309,763 | |

Fees paid indirectly | | | (2 | ) | | | | |

Reduction of expenses by investment adviser | | | (161 | ) | | | | |

Net expenses | | | | | | | $309,600 | |

Net investment loss | | | | | | | $(90,975 | ) |

Realized and unrealized gain (loss) on investments and foreign currency | | | | | | | | |

Realized gain (loss) (identified cost basis) | | | | | | | | |

Investments | | | $1,050,575 | | | | | |

Written options | | | 198,388 | | | | | |

Securities sold short | | | (202,996 | ) | | | | |

Foreign currency | | | 98 | | | | | |

Net realized gain (loss) on investments and foreign currency | | | | | | | $1,046,065 | |

Change in unrealized appreciation (depreciation) | | | | | | | | |

Investments | | | $2,853,307 | | | | | |

Written options | | | (27,716 | ) | | | | |

Securities sold short | | | 142,980 | | | | | |

Net unrealized gain (loss) on investments | | | | | | | $2,968,571 | |

Net realized and unrealized gain (loss) on investments | | | | | | | $4,014,636 | |

Change in net assets from operations | | | | | | | $3,923,661 | |

See Notes to Financial Statements

7

MFS Technology Portfolio

FINANCIAL STATEMENTS | STATEMENTS OF CHANGES IN NET ASSETS

These statements describe the increases and/or decreases in net assets resulting from operations, any distributions, and any shareholder transactions.

| | | | | | | | |

| |

| Six months ended

6/30/13

(unaudited |

) | |

| Year ended

12/31/12 |

|

Change in net assets | | | | | | | | |

| From operations | | | | | | | | |

Net investment loss | | | $(90,975 | ) | | | $(251,579 | ) |

Net realized gain (loss) on investments and foreign currency | | | 1,046,065 | | | | 2,152,568 | |

Net unrealized gain (loss) on investments | | | 2,968,571 | | | | 2,434,213 | |

Change in net assets from operations | | | $3,923,661 | | | | $4,335,202 | |

Change in net assets from fund share transactions | | | $4,504,921 | | | | $11,415,026 | |

Total change in net assets | | | $8,428,582 | | | | $15,750,228 | |

Net assets | | | | | | | | |

At beginning of period | | | 45,029,419 | | | | 29,279,191 | |

At end of period (including accumulated net investment loss of $90,975 and

$0, respectively) | | | $53,458,001 | | | | $45,029,419 | |

See Notes to Financial Statements

8

MFS Technology Portfolio

FINANCIAL STATEMENTS | FINANCIAL HIGHLIGHTS

The financial highlights table is intended to help you understand the fund’s financial performance for the semiannual period and the past 5 fiscal years. Certain information reflects financial results for a single fund share. The total returns in the table represent the rate by which an investor would have earned (or lost) on an investment in the fund share class (assuming reinvestment of all distributions) held for the entire period.

| | | | | | | | | | | | | | | | | | | | | | | | |

| Initial Class | | Six months

ended

6/30/13 | | | Years ended 12/31 | |

| | | | 2012 | | | 2011 | | | 2010 | | | 2009 | | | 2008 | |

| | | (unaudited) | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | | $7.93 | | | | $6.92 | | | | $6.84 | | | | $5.67 | | | | $3.21 | | | | $6.54 | |

| Income (loss) from investment operations | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss) (d) | | | $(0.01 | ) | | | $(0.04 | ) | | | $(0.05 | ) | | | $ (0.00 | )(w) | | | $ (0.00 | )(w) | | | $(0.00 | )(w) |

Net realized and unrealized gain (loss) on investments and foreign currency | | | 0.69 | | | | 1.05 | | | | 0.13 | | | | 1.17 | | | | 2.46 | | | | (3.33 | ) |

Total from investment operations | | | $0.68 | | | | $1.01 | | | | $0.08 | | | | $1.17 | | | | $2.46 | | | | $(3.33 | ) |

Net asset value, end of period (x) | | | $8.61 | | | | $7.93 | | | | $6.92 | | | | $6.84 | | | | $5.67 | | | | $3.21 | |

Total return (%) (k)(r)(s)(x) | | | 8.58 | (n) | | | 14.60 | | | | 1.17 | | | | 20.63 | | | | 76.64 | | | | (50.92 | ) |

Ratios (%) (to average net assets) and Supplemental data: | | | | | | | | | | | | | | | | | | | | | | | | |

Expenses before expense reductions (f) | | | 1.08 | (a) | | | 1.18 | | | | 1.28 | | | | 1.38 | | | | 1.60 | | | | 1.39 | |

Expenses after expense reductions (f) | | | 1.08 | (a) | | | 1.13 | | | | 1.08 | | | | 1.07 | | | | 1.04 | | | | 1.02 | |

Net investment loss | | | (0.20 | )(a) | | | (0.51 | ) | | | (0.77 | ) | | | (0.07 | ) | | | (0.05 | ) | | | (0.00 | )(w) |

Portfolio turnover | | | 31 | (n) | | | 62 | | | | 90 | | | | 140 | | | | 227 | | | | 244 | |

Net assets at end of period (000 omitted) | | | $12,925 | | | | $13,019 | | | | $14,598 | | | | $15,844 | | | | $14,542 | | | | $8,051 | |

| Supplemental Ratios (%): | | | | | | | | | | | | | | | | | | | | | | | | |

Ratio of expenses to average net assets after expense

reductions excluding short sale dividend and

interest expense (f) | | | 0.97 | (a) | | | 1.00 | | | | 1.00 | | | | 1.00 | | | | 1.00 | | | | 1.00 | |

| | |

| Service Class | | Six months

ended 6/30/13 | | | Years ended 12/31 | |

| | | | 2012 | | | 2011 | | | 2010 | | | 2009 | | | 2008 | |

| | | (unaudited) | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | | $7.69 | | | | $6.73 | | | | $6.66 | | | | $5.54 | | | | $3.14 | | | | $6.42 | |

| Income (loss) from investment operations | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss) (d) | | | $(0.02 | ) | | | $(0.06 | ) | | | $(0.08 | ) | | | $ (0.00 | )(w) | | | $(0.01 | ) | | | $(0.02 | ) |

Net realized and unrealized gain (loss) on investments and foreign currency | | | 0.67 | | | | 1.02 | | | | 0.15 | | | | 1.12 | | | | 2.41 | | | | (3.26 | ) |

Total from investment operations | | | $0.65 | | | | $0.96 | | | | $0.07 | | | | $1.12 | | | �� | $2.40 | | | | $(3.28 | ) |

Net asset value, end of period (x) | | | $8.34 | | | | $7.69 | | | | $6.73 | | | | $6.66 | | | | $5.54 | | | | $3.14 | |

Total return (%) (k)(r)(s)(x) | | | 8.45 | (n) | | | 14.26 | | | | 1.05 | | | | 20.22 | | | | 76.43 | | | | (51.09 | ) |

Ratios (%) (to average net assets)

and Supplemental data: | | | | | | | | | | | | | | | | | | | | | | | | |

Expenses before expense reductions (f) | | | 1.33 | (a) | | | 1.48 | | | | 1.53 | | | | 1.63 | | | | 1.85 | | | | 1.62 | |

Expenses after expense reductions (f) | | | 1.33 | (a) | | | 1.42 | | | | 1.33 | | | | 1.32 | | | | 1.29 | | | | 1.27 | |

Net investment loss | | | (0.43 | )(a) | | | (0.74 | ) | | | (1.13 | ) | | | (0.04 | ) | | | (0.32 | ) | | | (0.29 | ) |

Portfolio turnover | | | 31 | (n) | | | 62 | | | | 90 | | | | 140 | | | | 227 | | | | 244 | |

Net assets at end of period (000 omitted) | | | $40,533 | | | | $32,010 | | | | $14,681 | | | | $5,652 | | | | $1,776 | | | | $990 | |

| Supplemental Ratios (%): | | | | | | | | | | | | | | | | | | | | | | | | |

Ratio of expenses to average net assets after expense

reductions excluding short sale dividend and

interest expense (f) | | | 1.22 | (a) | | | 1.25 | | | | 1.25 | | | | 1.25 | | | | 1.25 | | | | 1.25 | |

See Notes to Financial Statements

9

MFS Technology Portfolio

Financial Highlights – continued

| (d) | | Per share data is based on average shares outstanding. |

| (f) | | Ratios do not reflect reductions from fees paid indirectly, if applicable. |

| (k) | | The total return does not reflect expenses that apply to separate accounts. Inclusion of these charges would reduce the total return figures for all periods shown. |

| (r) | | Certain expenses have been reduced without which performance would have been lower. |

| (s) | | From time to time the fund may receive proceeds from litigation settlements, without which performance would be lower. Excluding the effect of the proceeds received from a non-recurring litigation settlement against Nortel Networks Corp., the total returns for the year ended December 31, 2008 would have been lower by approximately 0.58%. |

| (w) | | Per share amount was less than $0.01 and total return or ratio was less than 0.01%, as applicable. |

| (x) | | The net asset values per share and total returns have been calculated on net assets which include adjustments made in accordance with U.S. generally accepted accounting principles required at period end for financial reporting purposes. |

See Notes to Financial Statements

10

MFS Technology Portfolio

NOTES TO FINANCIAL STATEMENTS (unaudited)

| (1) | | Business and Organization |

MFS Technology Portfolio (the fund) is a series of MFS Variable Insurance Trust II (the trust). The trust is organized as a Massachusetts business trust and is registered under the Investment Company Act of 1940, as amended, as an open-end management investment company. The shareholders of each series of the trust are separate accounts of insurance companies, which offer variable annuity and/or life insurance products, and qualified retirement and pension plans.

| (2) | | Significant Accounting Policies |

General – The preparation of financial statements in conformity with U.S. generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates. In the preparation of these financial statements, management has evaluated subsequent events occurring after the date of the fund’s Statement of Assets and Liabilities through the date that the financial statements were issued. The fund invests primarily in securities of issuers in the technology industry. Issuers in a single industry can react similarly to market, economic, political and regulatory conditions and developments.

In this reporting period, the fund adopted the disclosure provisions of the Financial Accounting Standards Board (FASB) Accounting Standards Update 2011-11 (“ASU 2011-11”), Balance Sheet (Topic 210) – Disclosures about Offsetting Assets and Liabilities along with the related scope clarification provisions of FASB Accounting Standards Update 2013-01 (“ASU 2013-01”) entitled Balance Sheet (Topic 210) – Clarifying the Scope of Disclosures about Offsetting Assets and Liabilities. ASU 2011-11 is intended to enhance disclosures on the offsetting of financial assets and liabilities by requiring entities to disclose both gross and net information about financial instruments and transactions that are either offset in the statement of financial position or subject to a Master Netting Agreement or similar arrangement. ASU 2013-01 limits the scope of ASU 2011-11’s disclosure requirements on offsetting to financial assets and financial liabilities related to derivatives, repurchase and reverse repurchase agreements, and securities lending and securities borrowing transactions. The disclosures required by ASU 2011-11, to the extent applicable to the fund, have been included in the fund’s Significant Accounting Policies note under the captions for each of the fund’s in-scope financial instruments and transactions.

In June 2013, FASB issued Accounting Standards Update 2013-08 Financial Services – Investment Companies (Topic 946) – Amendments to the Scope, Measurement, and Disclosure Requirements (“ASU 2013-08”) which is effective for interim and annual reporting periods in fiscal years that begin after December 15, 2013. ASU 2013-08 sets forth a methodology for determining whether an entity should be characterized as an investment company and prescribes fair value accounting for an investment company’s non-controlling ownership interest in another investment company. FASB has determined that a fund registered under the Investment Company Act of 1940 automatically meets ASU 2013-08’s criteria for an investment company. Although still evaluating the potential impacts of ASU 2013-08 to the fund, management expects that the impact of the fund’s adoption will be limited to additional financial statement disclosures.

Investment Valuations – Equity securities, including restricted equity securities, are generally valued at the last sale or official closing price as provided by a third-party pricing service on the market or exchange on which they are primarily traded. Equity securities, for which there were no sales reported that day, are generally valued at the last quoted daily bid quotation as provided by a third-party pricing service on the market or exchange on which such securities are primarily traded. Equity securities held short, for which there were no sales reported for that day, are generally valued at the last quoted daily ask quotation as provided by a third-party pricing service on the market or exchange on which such securities are primarily traded. Short-term instruments with a maturity at issuance of 60 days or less generally are valued at amortized cost, which approximates market value. Exchange-traded options are generally valued at the last sale or official closing price as provided by a third-party pricing service on the exchange on which such options are primarily traded. Exchange-traded options for which there were no sales reported that day are generally valued at the last daily bid quotation as provided by a third-party pricing service on the exchange on which such options are primarily traded. Options not traded on an exchange are generally valued at a broker/dealer bid quotation. Foreign currency options are generally valued at valuations provided by a third-party pricing service. Open-end investment companies are generally valued at net asset value per share. Securities and other assets generally valued on the basis of information from a third-party pricing service may also be valued at a broker/dealer bid quotation. Values obtained from third-party pricing services can utilize both transaction data and market information such as yield, quality, coupon rate, maturity, type of issue, trading characteristics, and other market data. The values of foreign securities and other assets and liabilities expressed in foreign currencies are converted to U.S. dollars using the mean of bid and asked prices for rates provided by a third-party pricing service.

The Board of Trustees has delegated primary responsibility for determining or causing to be determined the value of the fund’s investments (including any fair valuation) to the adviser pursuant to valuation policies and procedures approved by the Board. If the adviser determines that reliable market quotations are not readily available, investments are valued at fair value as determined in good faith by the adviser in accordance with such procedures under the oversight of the Board of Trustees. Under the fund’s valuation policies and procedures, market quotations are not considered to be readily available for most types of debt instruments and floating rate loans and many types of derivatives. These investments are generally valued at fair value based on information from

11

MFS Technology Portfolio

Notes to Financial Statements (unaudited) – continued

third-party pricing services. In addition, investments may be valued at fair value if the adviser determines that an investment’s value has been materially affected by events occurring after the close of the exchange or market on which the investment is principally traded (such as foreign exchange or market) and prior to the determination of the fund’s net asset value, or after the halting of trading of a specific security where trading does not resume prior to the close of the exchange or market on which the security is principally traded. Events that occur on a frequent basis after foreign markets close (such as developments in foreign markets and significant movements in the U.S. markets) and prior to the determination of the fund’s net asset value may be deemed to have a material effect on the value of securities traded in foreign markets. Accordingly, the fund’s foreign equity securities may often be valued at fair value. The adviser generally relies on third-party pricing services or other information (such as the correlation with price movements of similar securities in the same or other markets; the type, cost and investment characteristics of the security; the business and financial condition of the issuer; and trading and other market data) to assist in determining whether to fair value and at what value to fair value an investment. The value of an investment for purposes of calculating the fund’s net asset value can differ depending on the source and method used to determine value. When fair valuation is used, the value of an investment used to determine the fund’s net asset value may differ from quoted or published prices for the same investment. There can be no assurance that the fund could obtain the fair value assigned to an investment if it were to sell the investment at the same time at which the fund determines its net asset value per share.

Various inputs are used in determining the value of the fund’s assets or liabilities. These inputs are categorized into three broad levels. In certain cases, the inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, an investment’s level within the fair value hierarchy is based on the lowest level of input that is significant to the fair value measurement. The fund’s assessment of the significance of a particular input to the fair value measurement in its entirety requires judgment, and considers factors specific to the investment. Level 1 includes unadjusted quoted prices in active markets for identical assets or liabilities. Level 2 includes other significant observable market-based inputs (including quoted prices for similar securities, interest rates, prepayment speed, and credit risk). Level 3 includes unobservable inputs, which may include the adviser’s own assumptions in determining the fair value of investments. Other financial instruments are derivative instruments not reflected in total investments, such as written options. The following is a summary of the levels used as of June 30, 2013 in valuing the fund’s assets or liabilities:

| | | | | | | | | | | | | | | | |

| Investments at Value | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Equity Securities | | | $53,099,663 | | | | $— | | | | $— | | | | $53,099,663 | |

| Mutual Funds | | | 892,779 | | | | — | | | | — | | | | 892,779 | |

| Total Investments | | | $53,992,442 | | | | $— | | | | $— | | | | $53,992,442 | |

| Short Sales | | | $(1,615,168 | ) | | | $— | | | | $— | | | | $(1,615,168 | ) |

| | | | |

| Other Financial Instruments | | | | | | | | | | | | |

| Written Options | | | $(45,657 | ) | | | $— | | | | $— | | | | $(45,657 | ) |

For further information regarding security characteristics, see the Portfolio of Investments.

Foreign Currency Translation – Purchases and sales of foreign investments, income, and expenses are converted into U.S. dollars based upon currency exchange rates prevailing on the respective dates of such transactions or on the reporting date for foreign denominated receivables and payables. Gains and losses attributable to foreign currency exchange rates on sales of securities are recorded for financial statement purposes as net realized gains and losses on investments. Gains and losses attributable to foreign exchange rate movements on receivables, payables, income and expenses are recorded for financial statement purposes as foreign currency transaction gains and losses. That portion of both realized and unrealized gains and losses on investments that results from fluctuations in foreign currency exchange rates is not separately disclosed.

Derivatives – The fund uses derivatives for different purposes, primarily to increase or decrease exposure to a particular market or segment of the market, or security, to increase or decrease interest rate or currency exposure, or as alternatives to direct investments. Derivatives are used for hedging or non-hedging purposes. While hedging can reduce or eliminate losses, it can also reduce or eliminate gains. When the fund uses derivatives as an investment to increase market exposure, or for hedging purposes, gains and losses from derivative instruments may be substantially greater than the derivative’s original cost.

The derivative instruments used by the fund were written options and purchased options. The fund’s period end derivatives, as presented in the Portfolio of Investments, generally are indicative of the volume of its derivative activity during the period.

The following table presents, by major type of derivative contract, the fair value, on a gross basis, of the asset and liability components of derivatives held by the fund at June 30, 2013 as reported in the Statement of Assets and Liabilities:

| | | | | | | | | | |

| | | | | Fair Value | |

| Risk | | Derivative Contracts | | Asset Derivatives | | | Liability Derivatives | |

| Equity | | Written Equity Options | | | $— | | | | $(45,657 | ) |

12

MFS Technology Portfolio

Notes to Financial Statements (unaudited) – continued

The following table presents, by major type of derivative contract, the realized gain (loss) on derivatives held by the fund for the six months ended June 30, 2013 as reported in the Statement of Operations:

| | | | | | | | |

| Risk | | Investments (Purchased Options) | | | Written Options | |

| Equity | | | $(338,842 | ) | | | $198,388 | |

The following table presents, by major type of derivative contract, the change in unrealized appreciation (depreciation) on derivatives held by the fund for the six months ended June 30, 2013 as reported in the Statement of Operations:

| | | | | | | | |

| Risk | | Investments (Purchased Options) | | | Written Options | |

| Equity | | | $72,084 | | | | $(27,716 | ) |

Derivative counterparty credit risk is managed through formal evaluation of the creditworthiness of all potential counterparties. On certain, but not all, over-the-counter derivatives, the fund attempts to reduce its exposure to counterparty credit risk whenever possible by entering into an International Swaps and Derivatives Association (ISDA) Master Agreement on a bilateral basis with each of the counterparties with whom it undertakes a significant volume of transactions. The ISDA Master Agreement gives each party to the agreement the right to terminate all transactions traded under such agreement if there is a certain deterioration in the credit quality of the other party. Upon an event of default or a termination of the ISDA Master Agreement, the non-defaulting party has the right to close out all transactions traded under such agreement and to net amounts owed under each transaction to one net amount payable by one party to the other. This right to close out and net payments across all transactions traded under the ISDA Master Agreement could result in a reduction of the fund’s credit risk to such counterparty equal to any amounts payable by the fund under the applicable transactions, if any.

Collateral and margin requirements differ by type of derivative. Margin requirements are set by the broker or clearing house for cleared derivatives (i.e., futures contracts, cleared swaps, and exchange-traded options) while collateral terms are contract specific for over-the-counter traded derivatives (i.e., forward foreign currency exchange contracts, uncleared swap agreements, and over-the-counter options). For derivatives traded under an ISDA Master Agreement, the collateral requirements are netted across all transactions traded under such agreement and one amount is posted from one party to the other to collateralize such obligations. Cash that has been segregated to cover the fund’s collateral or margin obligations under derivative contracts, if any, will be reported separately in the Statement of Assets and Liabilities as “Deposits with brokers.” Securities pledged as collateral or margin for the same purpose, if any, is noted in the Portfolio of Investments.

The fund’s accounting policy with respect to balance sheet offsetting is that, absent an event of default by the counterparty or a termination of the agreement, the ISDA Master Agreement does not result in an offset of reported amounts of financial assets and financial liabilities in the Statement of Assets and Liabilities across transactions between the fund and the applicable counterparty.

Written Options – In exchange for a premium, the fund wrote call options on securities that it anticipated the price would decline and also wrote put options on securities that it anticipated the price would increase. At the time the option was written, the fund believed the premium received exceeded the potential loss that could result from adverse price changes in the options’ underlying securities. In a written option, the fund as the option writer grants the buyer the right to purchase from, or sell to, the fund a specified number of shares or units of a particular security, currency or index at a specified price within a specified period of time.

The premium received is initially recorded as a liability in the Statement of Assets and Liabilities. The option is subsequently marked-to-market daily with the difference between the premium received and the market value of the written option being recorded as unrealized appreciation or depreciation. When a written option expires, the fund realizes a gain equal to the amount of the premium received. The difference between the premium received and the amount paid on effecting a closing transaction is considered a realized gain or loss. When a written call option is exercised, the premium received is offset against the proceeds to determine the realized gain or loss. When a written put option is exercised, the premium reduces the cost basis of the security purchased by the fund.

At the initiation of the written option contract, for exchange traded options, the fund is required to deposit securities or cash as collateral with the custodian for the benefit of the broker. For over-the-counter options, the fund may post collateral subject to the terms of an ISDA Master Agreement as generally described above if the market value of the options contract moves against it. The fund, as writer of an option, may have no control over whether the underlying securities may be sold (call) or purchased (put) and, as a result, bears the market risk of an unfavorable change in the price of the securities underlying the written option. Losses from writing options can exceed the premium received and can exceed the potential loss from an ordinary buy and sell transaction. Although the fund’s market risk may be significant, the maximum counterparty credit risk to the fund is equal to the market value of any collateral posted to the broker. For over-the-counter options, this risk is mitigated in cases where there is an ISDA Master Agreement between the fund and the counterparty providing for netting as described above.

13

MFS Technology Portfolio

Notes to Financial Statements (unaudited) – continued

The following table represents the written option activity in the fund during the six months ended June 30, 2013:

| | | | | | | | |

| | | Number of contracts | | | Premiums

received | |

| Outstanding, beginning of period | | | — | | | | $— | |

| Options written | | | 7,469 | | | | 317,198 | |

| Options closed | | | (868 | ) | | | (61,981 | ) |

| Options exercised | | | (1,701 | ) | | | (68,496 | ) |

| Options expired | | | (4,635 | ) | | | (168,780 | ) |

| Outstanding, end of period | | | 265 | | | | $17,941 | |

Purchased Options – The fund purchased call and put options for a premium. Purchased call and put options entitle the holder to buy and sell a specified number of shares or units of a particular security, currency or index at a specified price at a specified date or within a specified period of time. Purchasing call options may hedge against an anticipated increase in the dollar cost of securities or currency to be acquired or increase the fund’s exposure to an underlying instrument. Purchasing put options may hedge against an anticipated decline in the value of portfolio securities or currency or decrease the fund’s exposure to an underlying instrument.

The premium paid is initially recorded as an investment in the Statement of Assets and Liabilities. That investment is subsequently marked-to-market daily with the difference between the premium paid and the market value of the purchased option being recorded as unrealized appreciation or depreciation. Premiums paid for purchased call and put options which have expired are treated as realized losses on investments in the Statement of Operations. Upon the exercise or closing of a purchased call option, the premium paid is added to the cost of the security or financial instrument purchased. Upon the exercise or closing of a purchased put option, the premium paid is offset against the proceeds on the sale of the underlying security or financial instrument in order to determine the realized gain or loss on investments.

Whether or not the option is exercised, the fund’s maximum risk of loss from purchasing an option is the amount of premium paid. All option contracts involve credit risk if the counterparty to the option contract fails to perform. For over-the-counter options, this risk is mitigated in cases where there is an ISDA Master Agreement between the fund and the counterparty providing for netting as described above and for posting of collateral by the counterparty to the fund to cover the fund’s exposure to the counterparty under such ISDA Master Agreement.

Short Sales – The fund entered into short sales whereby it sells a security it does not own in anticipation of a decline in the value of that security. The fund will realize a gain if the security price decreases and a loss if the security price increases between the date of the short sale and the date on which the fund replaces the borrowed security. Losses from short sales can exceed the proceeds of the security sold; and they can also exceed the potential loss from an ordinary buy and sell transaction. The amount of any premium, dividends, or interest the fund may be required to pay in connection with a short sale will be recognized as a fund expense. During the six months ended June 30, 2013, this expense amounted to $27,351. The fund segregates cash or marketable securities in an amount that, when combined with the amount of proceeds from the short sale deposited with the broker, at least equals the current market value of the security sold short.

Indemnifications – Under the fund’s organizational documents, its officers and Trustees may be indemnified against certain liabilities and expenses arising out of the performance of their duties to the fund. Additionally, in the normal course of business, the fund enters into agreements with service providers that may contain indemnification clauses. The fund’s maximum exposure under these agreements is unknown as this would involve future claims that may be made against the fund that have not yet occurred.

Investment Transactions and Income – Investment transactions are recorded on the trade date. Interest income is recorded on the accrual basis. Dividends received in cash are recorded on the ex-dividend date. Certain dividends from foreign securities will be recorded when the fund is informed of the dividend if such information is obtained subsequent to the ex-dividend date. Dividend and interest payments received in additional securities are recorded on the ex-dividend or ex-interest date in an amount equal to the value of the security on such date.

The fund may receive proceeds from litigation settlements. Any proceeds received from litigation involving portfolio holdings are reflected in the Statement of Operations in realized gain/loss if the security has been disposed of by the fund or in unrealized gain/loss if the security is still held by the fund. Any other proceeds from litigation not related to portfolio holdings are reflected as other income in the Statement of Operations.

Fees Paid Indirectly – The fund’s custody fee may be reduced according to an arrangement that measures the value of cash deposited with the custodian by the fund. This amount, for the six months ended June 30, 2013, is shown as a reduction of total expenses in the Statement of Operations.

Tax Matters and Distributions – The fund intends to qualify as a regulated investment company, as defined under Subchapter M of the Internal Revenue Code, and to distribute all of its taxable income, including realized capital gains. As a result, no provision for federal income tax is required. The fund’s federal tax returns, when filed, will remain subject to examination by the Internal Revenue Service for a three year period.

14

MFS Technology Portfolio

Notes to Financial Statements (unaudited) – continued

Distributions to shareholders are recorded on the ex-dividend date. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from U.S. generally accepted accounting principles. Certain capital accounts in the financial statements are periodically adjusted for permanent differences in order to reflect their tax character. These adjustments have no impact on net assets or net asset value per share. Temporary differences which arise from recognizing certain items of income, expense, gain or loss in different periods for financial statement and tax purposes will reverse at some time in the future. Distributions in excess of net investment income or net realized gains are temporary overdistributions for financial statement purposes resulting from differences in the recognition or classification of income or distributions for financial statement and tax purposes.

Book/tax differences primarily relate to net operating losses, wash sale loss deferrals, and straddle loss deferrals.

The fund declared no distributions for the year ended December 31, 2012.

The federal tax cost and the tax basis components of distributable earnings were as follows:

| | | | |

| As of 6/30/13 | | | | |

| Cost of investments | | | $48,437,144 | |

| Gross appreciation | | | 7,434,477 | |

| Gross depreciation | | | (1,879,179 | ) |

| Net unrealized appreciation (depreciation) | | | $5,555,298 | |

| |

| As of 12/31/12 | | | | |

| Undistributed long-term capital gain | | | 56,254 | |

| Other temporary differences | | | (212,780 | ) |

| Net unrealized appreciation (depreciation) | | | 2,701,991 | |

The aggregate cost above includes prior fiscal year end tax adjustments, if applicable.

Multiple Classes of Shares of Beneficial Interest – The fund offers multiple classes of shares, which differ in their respective distribution and service fees. The fund’s income, realized and unrealized gain (loss), and common expenses are allocated to shareholders based on the daily net assets of each class. Dividends are declared separately for each class. Differences in per share dividend rates are generally due to differences in separate class expenses.

| (3) | | Transactions with Affiliates |

Investment Adviser – The fund has an investment advisory agreement with MFS to provide overall investment management and related administrative services and facilities to the fund.

The management fee is computed daily and paid monthly at the following annual rates:

| | | | |

| First $1 billion of average daily net assets | | | 0.75% | |

| Average daily net assets in excess of $1 billion | | | 0.70% | |

Effective April 1, 2013, MFS has agreed in writing to reduce its management fee by a specified amount if certain MFS mutual fund assets exceed thresholds agreed to by MFS and the fund’s Board of Trustees. For the period April 1, 2013 through June 30, 2013, this management fee reduction amounted to $69, which is shown as a reduction of total expenses in the Statement of Operations. The management fee incurred for the six months ended June 30, 2013 was equivalent to an annual effective rate of 0.75% of the fund’s average daily net assets.

The investment adviser has agreed in writing to pay a portion of the fund’s total annual operating expenses, exclusive of interest, taxes, extraordinary expenses, brokerage and transaction costs, and investment-related expenses (such as short sale dividend and interest expenses incurred in connection with the fund’s investment activity), such that total annual operating expenses do not exceed 1.00% of average daily net assets for the Initial Class shares and 1.25% of average daily net assets for the Service Class shares. This written agreement will continue until modified by the fund’s Board of Trustees, but such agreement will continue at least until April 30, 2015. For the six months ended June 30, 2013, the fund’s actual operating expenses did not exceed the limit and therefore, the investment adviser did not pay any portion of the fund’s expenses related to this agreement.

Distributor – MFS Fund Distributors, Inc. (MFD), a wholly-owned subsidiary of MFS, is the distributor of shares of the fund. The Trustees have adopted a distribution plan for the Service Class shares pursuant to Rule 12b-1 under the Investment Company Act of 1940.

The fund’s distribution plan provides that the fund will pay MFD distribution and/or service fees equal to 0.25% per annum of its average daily net assets attributable to Service Class shares as partial consideration for services performed and expenses incurred by MFD and financial intermediaries (including participating insurance companies that invest in the fund to fund variable annuity and variable life insurance contracts, sponsors of qualified retirement and pension plans that invest in the fund, and affiliates of these

15

MFS Technology Portfolio

Notes to Financial Statements (unaudited) – continued

participating insurance companies and plan sponsors) in connection with the sale and distribution of the Service Class shares. MFD may subsequently pay all, or a portion, of the distribution and/or service fees to financial intermediaries.

Shareholder Servicing Agent – MFS Service Center, Inc. (MFSC), a wholly-owned subsidiary of MFS, receives a fee from the fund for its services as shareholder servicing agent. For the six months ended June 30, 2013, the fee was $2,537, which equated to 0.0103% annually of the fund’s average daily net assets. MFSC also receives payment from the fund for out-of-pocket expenses paid by MFSC on behalf of the fund. For the six months ended June 30, 2013, these costs amounted to $13.

Administrator – MFS provides certain financial, legal, shareholder communications, compliance, and other administrative services to the fund. Under an administrative services agreement, the fund partially reimburses MFS the costs incurred to provide these services. The fund is charged an annual fixed amount of $17,500 plus a fee based on average daily net assets. The administrative services fee incurred for the six months ended June 30, 2013 was equivalent to an annual effective rate of 0.0356% of the fund’s average daily net assets.

Trustees’ and Officers’ Compensation – The fund pays compensation to independent Trustees in the form of a retainer, attendance fees, and additional compensation to Board and Committee chairpersons. The fund does not pay compensation directly to Trustees or officers of the fund who are also officers of the investment adviser, all of whom receive remuneration for their services to the fund from MFS. Certain officers and Trustees of the fund are officers or directors of MFS, MFD, and MFSC.

Other – This fund and certain other funds managed by MFS (the funds) have entered into services agreements (the Agreements) which provide for payment of fees by the funds to Tarantino LLC and Griffin Compliance LLC in return for the provision of services of an Independent Chief Compliance Officer (ICCO) and Assistant ICCO, respectively, for the funds. The ICCO and Assistant ICCO are officers of the funds and the sole members of Tarantino LLC and Griffin Compliance LLC, respectively. The funds can terminate the Agreements with Tarantino LLC and Griffin Compliance LLC at any time under the terms of the Agreements. For the six months ended June 30, 2013, the aggregate fees paid by the fund to Tarantino LLC and Griffin Compliance LLC were $181 and are included in “Miscellaneous” expense in the Statement of Operations. MFS has agreed to reimburse the fund for a portion of the payments made by the fund in the amount of $92, which is shown as a reduction of total expenses in the Statement of Operations. Additionally, MFS has agreed to bear all expenses associated with office space, other administrative support, and supplies provided to the ICCO and Assistant ICCO.

The fund invests in the MFS Institutional Money Market Portfolio which is managed by MFS and seeks current income consistent with preservation of capital and liquidity. Income earned on this investment is included in “Dividends from underlying affiliated funds” in the Statement of Operations. This money market fund does not pay a management fee to MFS.

Purchases and sales of investments, other than purchased option transactions, short sales, and short-term obligations, aggregated $19,972,105 and $15,176,113, respectively.

| (5) | | Shares of Beneficial Interest |

The fund’s Declaration of Trust permits the Trustees to issue an unlimited number of full and fractional shares of beneficial interest. Transactions in fund shares were as follows:

| | | | | | | | | | | | | | | | |

| | | Six months ended 6/30/13 | | | Year ended 12/31/12 | |

| | | Shares | | | Amount | | | Shares | | | Amount | |

| Shares sold | | | | | | | | | | | | | | | | |

Initial Class | | | 35,676 | | | | $303,500 | | | | 183,167 | | | | $1,425,060 | |

Service Class | | | 912,926 | | | | 7,412,390 | | | | 2,570,116 | | | | 19,344,946 | |

| | | 948,602 | | | | $7,715,890 | | | | 2,753,283 | | | | $20,770,006 | |

| Shares reacquired | | | | | | | | | | | | | | | | |

Initial Class | | | (176,392 | ) | | | $(1,469,717 | ) | | | (650,110 | ) | | | $(4,988,560 | ) |

Service Class | | | (215,178 | ) | | | (1,741,252 | ) | | | (586,332 | ) | | | (4,366,420 | ) |

| | | (391,570 | ) | | | $(3,210,969 | ) | | | (1,236,442 | ) | | | $(9,354,980 | ) |

| Net change | | | | | | | | | | | | | | | | |

Initial Class | | | (140,716 | ) | | | $(1,166,217 | ) | | | (466,943 | ) | | | $(3,563,500 | ) |

Service Class | | | 697,748 | | | | 5,671,138 | | | | 1,983,784 | | | | 14,978,526 | |

| | | 557,032 | | | | $4,504,921 | | | | 1,516,841 | | | | $11,415,026 | |

The fund and certain other funds managed by MFS participate in a $1.1 billion unsecured committed line of credit, subject to a $1 billion sublimit, provided by a syndication of banks under a credit agreement. Borrowings may be made for temporary financing needs. Interest is charged to each fund, based on its borrowings, generally at a rate equal to the higher of the Federal Reserve funds

16

MFS Technology Portfolio

Notes to Financial Statements (unaudited) – continued

rate or one month LIBOR plus an agreed upon spread. A commitment fee, based on the average daily, unused portion of the committed line of credit, is allocated among the participating funds at the end of each calendar quarter. In addition, the fund and other funds managed by MFS have established unsecured uncommitted borrowing arrangements with certain banks for temporary financing needs. Interest is charged to each fund, based on its borrowings, at a rate equal to the Federal Reserve funds rate plus an agreed upon spread. For the six months ended June 30, 2013, the fund’s commitment fee and interest expense were $119 and $0, respectively, and are included in “Miscellaneous” expense in the Statement of Operations.

| (7) | | Transactions in Underlying Affiliated Funds – Affiliated Issuers |

An affiliated issuer may be considered one in which the fund owns 5% or more of the outstanding voting securities, or a company which is under common control. For the purposes of this report, the fund assumes the following to be an affiliated issuer:

| | | | | | | | | | | | | | | | |

| Underlying Affiliated Fund | | Beginning Shares/Par Amount | | | Acquisitions Shares/Par Amount | | | Dispositions Shares/Par Amount | | | Ending Shares/Par Amount | |

| MFS Institutional Money Market Portfolio | | | 391,077 | | | | 7,430,186 | | | | (6,928,484 | ) | | | 892,779 | |

| | | | |

| Underlying Affiliated Fund | | Realized Gain (Loss) | | | Capital Gain

Distributions | | | Dividend Income | | | Ending Value | |

| MFS Institutional Money Market Portfolio | | | $— | | | | $— | | | | $195 | | | | $892,779 | |

17

MFS Technology Portfolio

BOARD REVIEW OF INVESTMENT ADVISORY AGREEMENT

A discussion regarding the Board’s most recent review and renewal of the fund’s Investment Advisory Agreement with MFS will be available on or about November 1, 2013 by clicking on the fund’s name under “Variable Insurance Portfolios — VIT II” in the “Products” section of the MFS Web site (mfs.com).

PROXY VOTING POLICIES AND INFORMATION

A general description of the MFS funds’ proxy voting policies and procedures is available without charge, upon request, by calling 1-800-225-2606, by visiting the Proxy Voting section of mfs.com or by visiting the SEC’s Web site at http://www.sec.gov.

Information regarding how the fund voted proxies relating to portfolio securities during the most recent twelve-month period ended June 30 is available without charge by visiting the Proxy Voting section of mfs.com or by visiting the SEC’s Web site at http://www.sec.gov.

QUARTERLY PORTFOLIO DISCLOSURE

The fund will file a complete schedule of portfolio holdings with the Securities and Exchange Commission (the Commission) for the first and third quarters of each fiscal year on Form N-Q. The fund’s Form N-Q is available on the EDGAR database on the Commission’s Internet Web site at http://www.sec.gov, and may be reviewed and copied at the:

Public Reference Room

Securities and Exchange Commission

100 F Street, NE, Room 1580

Washington, D.C. 20549

Information on the operation of the Public Reference Room may be obtained by calling the Commission at 1-800-SEC-0330. Copies of the fund’s Form N-Q also may be obtained, upon payment of a duplicating fee, by electronic request at the following e-mail address: publicinfo@sec.gov or by writing the Public Reference Section at the above address.

FURTHER INFORMATION

From time to time, MFS may post important information about the fund or the MFS funds on the MFS web site (mfs.com). This information is available by visiting the “News & Commentary” section of mfs.com or by clicking on the fund’s name under “Variable Insurance Portfolios — VIT II” in the “Products” section of mfs.com.

18

SEMIANNUAL REPORT

June 30, 2013

MFS® INTERNATIONAL VALUE PORTFOLIO

MFS® Variable Insurance Trust II

FCG-SEM

MFS® INTERNATIONAL VALUE PORTFOLIO

CONTENTS

The report is prepared for the general information of contract owners. It is authorized for distribution to prospective investors only when preceded or accompanied by a current prospectus.

NOT FDIC INSURED Ÿ MAY LOSE VALUE Ÿ NO BANK OR CREDIT UNION GUARANTEE Ÿ NOT A DEPOSIT Ÿ NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY OR NCUA/NCUSIF

MFS International Value Portfolio

LETTER FROM THE CHAIRMAN AND CEO

Dear Contract Owners:

As the year progresses, the global economy continues to grind ahead slowly, held back by broad austerity measures. The U.S. economy remains a steadying force, driven by resilient consumers, who have taken the payroll tax increase and the sequestration’s early impact in stride. With U.S. housing and jobs showing steady expansion, domestic consumer-driven growth has offset weaker exports and the U.S. government’s spending constraints. In response to these developments, the U.S. Federal Reserve has begun to brace investors for an eventual shift in its monetary policy, causing global market tremors.

Japan has been another bright spot, with government and central bank stimulus policies leading to increased exports, a resurgent stock market and improved economic sentiment. After a six-month rally, Japan’s stocks slipped late in the second quarter, then picked up momentum on fresh signs that the country could soon break free of its chronic deflation. The major deterrent to global growth remains the eurozone, still in the grip of persistent recession. China has seen its pace of economic growth decelerate, a troubling turn for the country’s trading partners, who have come to rely on it as an engine for global growth.

As always, managing risk in the face of uncertainty remains a top priority for investors. At MFS®, our uniquely collaborative investment process employs integrated, global research and active risk management. Our global team of investment professionals shares ideas and evaluates opportunities across continents, investment disciplines and asset classes — all with a goal of building better insights, and ultimately better results, for our clients.

We are mindful of the many economic challenges investors face, and believe it is more important than ever to maintain a long-term view and employ time-tested principles, such as asset allocation and diversification. We remain confident that our unique approach can serve investors well as they work with their financial advisors to identify and pursue the most suitable opportunities.

Respectfully,

Robert J. Manning

Chairman and Chief Executive Officer

MFS Investment Management®

August 16, 2013

The opinions expressed in this letter are subject to change, may not be relied upon for investment advice, and no forecasts can be guaranteed.

1

MFS International Value Portfolio

PORTFOLIO COMPOSITION

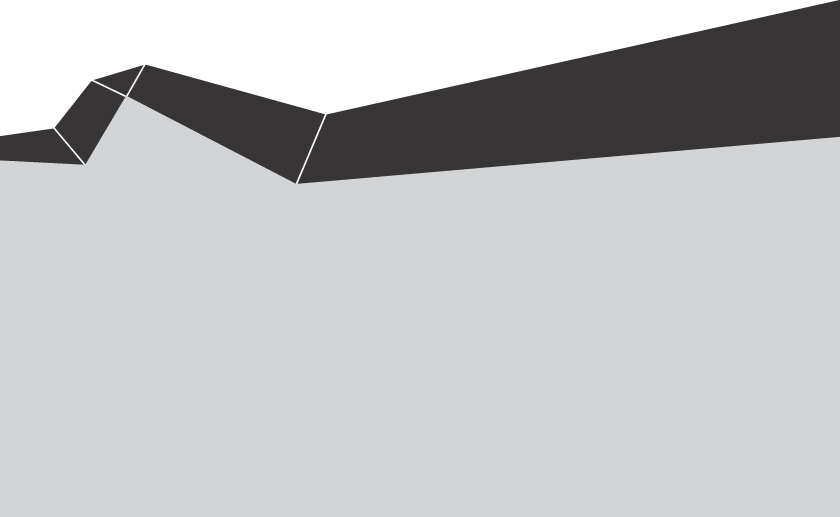

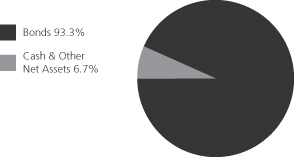

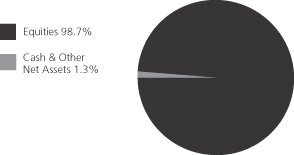

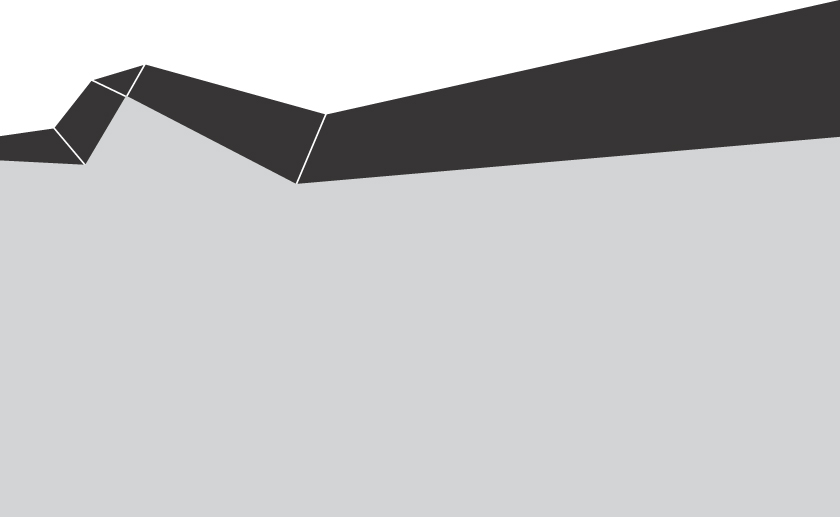

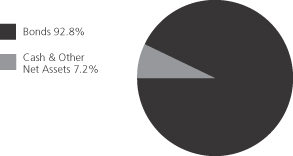

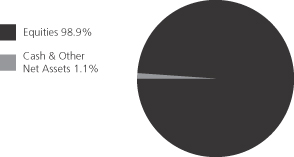

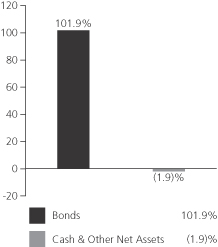

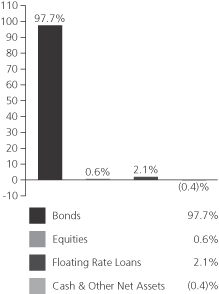

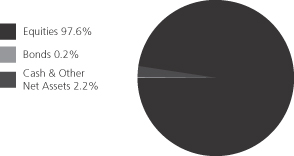

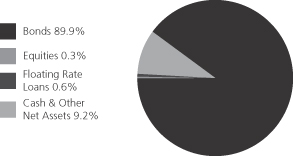

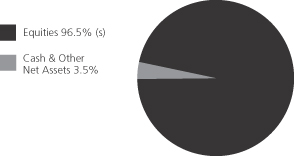

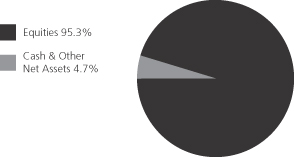

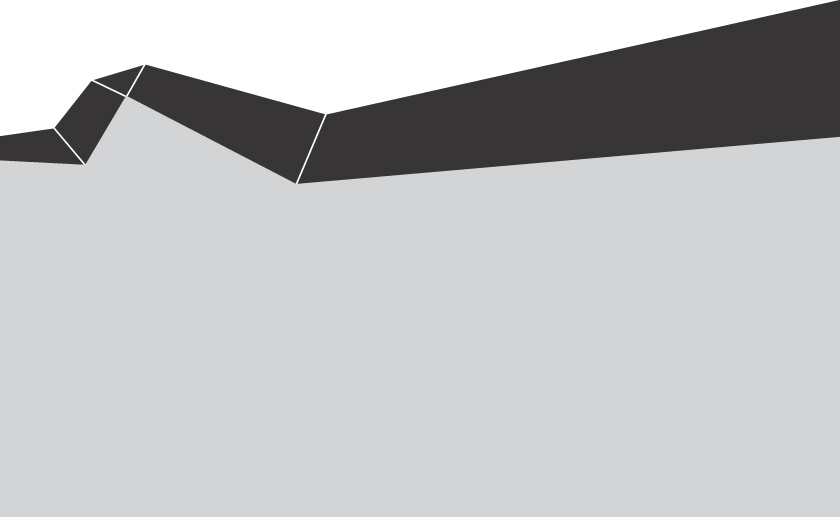

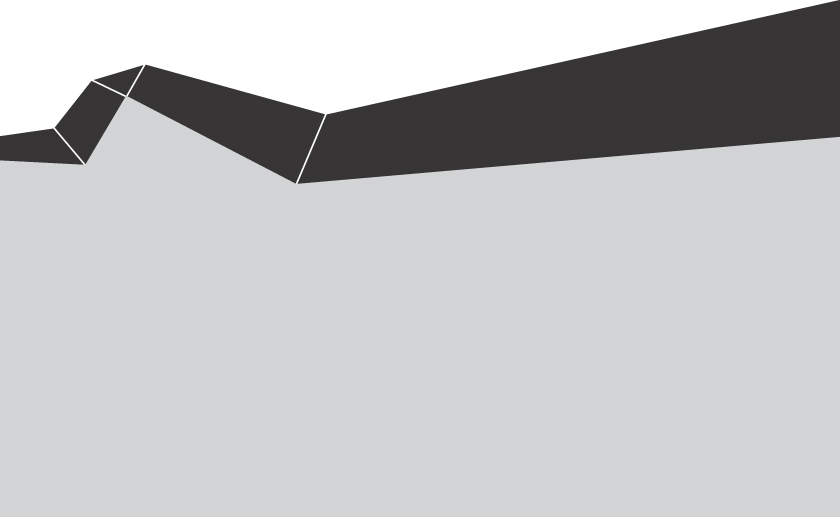

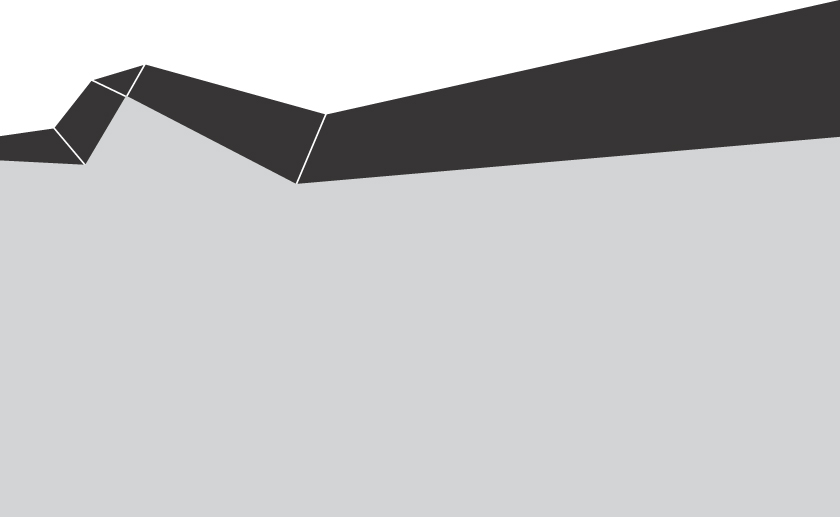

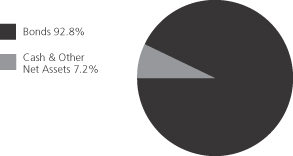

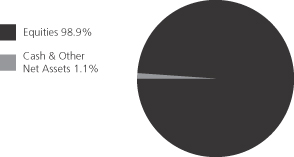

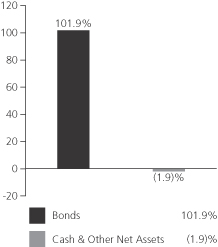

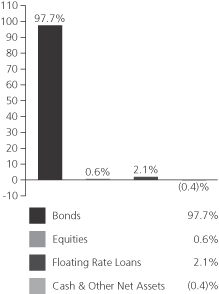

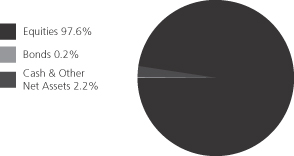

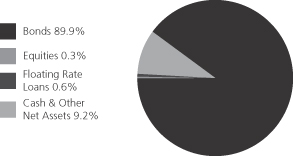

Portfolio structure (i)

| | | | |

| Top ten holdings | | | | |

| KDDI Corp. | | | 4.5% | |

| Groupe Danone | | | 3.7% | |

| GlaxoSmithKline PLC | | | 3.2% | |

| Kao Corp. | | | 3.0% | |

| Roche Holding AG | | | 2.8% | |

| Nestle S.A. | | | 2.5% | |

| Japan Tobacco, Inc. | | | 2.4% | |

| HSBC Holdings PLC | | | 2.4% | |

| Royal Dutch Shell PLC, “A” | | | 2.3% | |

| Reckitt Benckiser Group PLC | | | 2.2% | |

| |

| Equity sectors | | | | |

| Consumer Staples | | | 20.5% | |

| Financial Services | | | 18.0% | |

| Health Care | | | 11.6% | |

| Utilities & Communications | | | 9.7% | |

| Technology | | | 8.5% | |

| Special Products & Services | | | 7.3% | |

| Industrial Goods & Services | | | 4.4% | |

| Energy | | | 4.3% | |

| Leisure | | | 3.4% | |

| Basic Materials | | | 2.4% | |

| Transportation | | | 1.9% | |

| Retailing | | | 1.8% | |

| Autos & Housing | | | 1.5% | |

| | | | |

| Issuer country weightings (i)(x) | | | | |

| Japan | | | 28.6% | |

| United Kingdom | | | 24.9% | |

| Switzerland | | | 12.1% | |

| Germany | | | 8.3% | |

| France | | | 6.1% | |

| United States | | | 4.7% | |

| Netherlands | | | 3.8% | |

| Sweden | | | 1.8% | |

| Spain | | | 1.7% | |

| Other Countries | | | 8.0% | |

| |

| Currency exposure weightings (i)(y) | | | | |

| British Pound Sterling | | | 24.9% | |

| Japanese Yen | | | 24.4% | |

| Euro | | | 23.3% | |

| Swiss Franc | | | 12.1% | |

| United States Dollar | | | 7.8% | |

| Swedish Krona | | | 1.8% | |

| Taiwan Dollar | | | 1.4% | |

| Danish Krone | | | 1.3% | |

| Norwegian Krone | | | 1.1% | |

| Other Currencies | | | 1.9% | |

| (i) | For purposes of this presentation, the components include the market value of securities, less any securities sold short, and reflect the impact of the equivalent exposure of derivative positions. These amounts may be negative from time to time. Equivalent exposure is a calculated amount that translates the derivative position into a reasonable approximation of the amount of the underlying asset that the portfolio would have to hold at a given point in time to have the same price sensitivity that results from the portfolio’s ownership of the derivative contract. When dealing with derivatives, equivalent exposure is a more representative measure of the potential impact of a position on portfolio performance than market value. |

| (x) | Represents the portfolio’s exposure to issuer countries as a percentage of a portfolio’s net assets. |

| (y) | Represents the portfolio’s exposure to a particular currency as a percentage of a portfolio’s net assets. |

Percentages are based on net assets as of 6/30/13.

The portfolio is actively managed and current holdings may be different.

2

MFS International Value Portfolio

EXPENSE TABLE

Fund Expenses Borne by the Contract Holders During the Period,

January 1, 2013 through June 30, 2013

As a contract holder of the fund, you incur ongoing costs, including management fees; distribution and/or service (12b-1) fees; and other fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period January 1, 2013 through June 30, 2013.

Actual Expenses

The first line for each share class in the following table provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line for each share class in the following table provides information about hypothetical account values and hypothetical expenses based on the fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.