- HL Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

Hecla Mining (HL) 8-KOther events

Filed: 11 May 04, 12:00am

| NEWS RELEASE | Exhibit 99 |

FOR IMMEDIATE RELEASE

May 10, 2004

COEUR D’ALENE, IDAHO — Hecla Mining Company (HL:NYSE) today announced plans to develop the Mina Isidora gold mine on the Block B lease in eastern Venezuela’s El Callao gold district. Production is expected as early as the end of 2005. Full commercial production of about 360 tonnes per day is expected to be achieved in the second quarter of 2006. Annual production rates of between 75,000 to 115,000 ounces of gold at cash costs between $150 to $185 per ounce are estimated for the first five years of full production, with the current mine plan running to 2012. Relatively little capital is needed to develop the mine, because construction of a processing mill will not be necessary. The ore will be trucked about 70 miles south to Hecla’s La Camorra mill.

Hecla’s Board of Directors gave the go-ahead Friday to the approximately $30 million development plan. The identified resource at the Mina Isidora deposit has grown steadily since drilling commenced. At December 2003, reported proven and probable reserves at Mina Isidora were 327,303 ounces of gold. A new resource block model based on definition drilling in the fourth quarter of 2003 and the first quarter of 2004 has increased proven and probable reserves by 29%, to 421,234 ounces. The total estimated mineable resource at Mina Isidora has increased from year-end 2003 to 932,000 tons at a grade of 0.59 ounce of gold per ton. (See attached Mina Isidora schematic.)

Data from a total of 121 drill holes ranging in ore grades up to 10 ounces of gold per ton have been used to develop the Mina Isidora mine plan. However, for resource estimation, individual samples were capped at approximately 3 ounces of gold per ton. Numerous targets have been established where there is additional potential in several areas along the same geologic structure, where drill holes have intersected ore-grade material.

A life-of-mine plan has been developed, using ramp access from the Valle Norte portal site. The orebody has a shallow dip, between 42 to 47 degrees. The life-of-mine ore grades are expected to run in the range of 20.3 grams of gold per tonne. At a gold price of $360 per ounce, the return on investment is projected at about 26%.

Permission has been granted from the various country authorities to move forward with development of Mina Isidora. The majority of capital will be spent on underground development and equipment, with funds also being used for surface facilities, housing, and road and power line construction.

The deposit occurs in quartz veins hosted in volcanic and intrusive rocks. The mineralized system is open, down-plunge to the southwest. The historic workings of the old Chile Mine are up-plunge to the northeast of the deposit. The El Callao mining district is one of the prolific gold-producing districts located in greenstone belts that are seen in other parts of the world such as the rich Timmins district in Canada and others in South Africa and Australia.

Hecla Mining Company President and Chief Executive Officer Phillips S. Baker, Jr., said, “We acquired this property in late 2002. At that time, it had nothing but exploration targets. By 2005, we expect it will be a 100,000-ounce per year gold mine. This is another example of Hecla’s ability to take a project from exploration to production in very short time frames. There

6500 N Mineral Drive, Suite 200 • Coeur d’Alene, Idaho 83815-9408 • 208/769-4100 • FAX 208/769-7612

are a couple of reasons for this. First, we are the largest gold miner in Venezuela, which means we get exposure to prime opportunities. Second, the quality of the geology in Venezuela’s gold mining districts is phenomenal, and we have an excellent land position in both the El Callao district as well as the El Dorado gold district, where our La Camorra gold mine is located. Mina Isidora is just the first of many new projects we expect to be able to develop here.”

San Sebastian

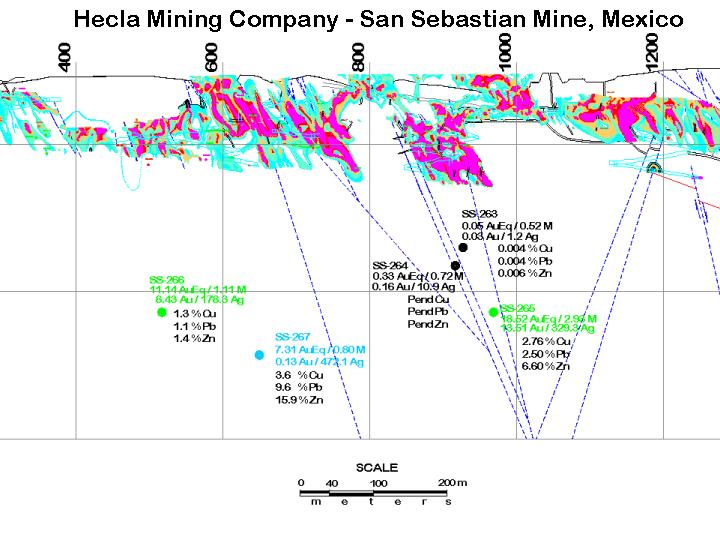

In central Mexico, Hecla has made significant progress in characterizing the mineralization and defining exploration targets on its large land position near Durango, where the San Sebastian silver mine is located in one of the world’s most prolific and historic silver belts. A detailed geological study of both the Francine and Don Sergio deposits has been completed. Hecla has also carried out extensive geological, geochemical and geophysical surveys in the area. The result of all this work is now being compiled and interpreted, and a number of new exploration targets are being identified.

One of the targets generated as a result of the study led to the recent drilling to test potential deep feeder zones beneath the Francine Vein. Three of the first five holes drilled contained ore-grade intercepts over mineable widths, and all five holes contained mineralized vein material. The holes tested two potential feeder zones approximately 500 meters apart along strike and approximately 150-200 meters below the Francine deposit. The intercepts contain abundant base metal sulphides in addition to the precious metal values, indicating a significant change in the nature of the mineralization. Additional drilling is underway to follow up on the new intercepts, and additional drilling will also be required to test the other two potential feeders zones that have been identified. (See attached San Sebastian long section.)

Baker noted, “We have only been in this district for four years, and we’ve just begun to scratch the surface of the potential here. There are no guarantees that the deep Francine drilling will result in an economic orebody, but our first holes are ore grade and are consistent with our geologic model. We are going to follow up on this very quickly. Plus, we now have a dozen new drilling targets on this 190-square-mile land position. As we prioritize, some targets will take time to explore, but we are clearly in a mineralized system that is even better than we thought.”

Noche Buena

Hecla’s Board of Directors also approved a plan on Friday to spend $3.4 million dollars to conduct additional resource definition drilling and to complete a feasibility study for the Noche Buena project, located in northern Sonora, Mexico. Hecla conducted extensive work on the project through 1999 when low gold prices caused the company to place the project on standby. Recent improvement in the gold price has resulted in re-evaluation of this deposit, which could increase gold production for Hecla in Mexico. Of the $3.4 million approved for expenditure, $1.8 million will be spent on resource delineation drilling, including approximately 9,100 meters of diamond drilling in 61 holes.

The drill program is expected to be completed by the end of the second quarter of 2005. Positive results will allow Hecla to decide whether to proceed with construction of this low-grade, heap-leach operation. Successful drilling results would improve Hecla’s resource position, and a subsequent development decision would significantly increase Hecla’s gold production. A feasibility study would be conducted following a successful drilling program. Mining grades, annual production rates and the mine plan would be determined during the feasibility work. Hecla currently has an indicated and inferred resource at Noche Buena of about 11.7 million tons at a gold grade of 0.03 ounce per ton, and there is a potential to double that resource in the future, with the deposit open to the northeast.

In addition to the Mina Isidora deposit in Hecla’s Bock B lease in eastern Venezuela, several further exploration targets have been identified in the area. Drilling has commenced around the old Laguna mine, with ore-grade material encountered in two of the eight holes.

6500 N Mineral Drive, Suite 200 • Coeur d’Alene, Idaho 83815-9408 • 208/769-4100 • FAX 208/769-7612

Exploration drilling is ongoing on several other targets in Block B. Geologic studies, including surface mapping, geophysics and geochemistry, are being conducted to identify additional exploration prospects.

Target identification continued for the El Dorado district exploration program during the first quarter. Hecla’s operating gold mine, La Camorra, is located in this district. The objective is to conduct exploration on Hecla’s land position surrounding the mine with a goal of locating additional resources that could supply ore to the La Camorra mill. Previous work has identified several veins in the area.

In other action, the Board of Directors announced that to conserve cash for exploration, development and acquisition opportunities, it has elected to defer the July 1, 2004, quarterly payment of dividends to the holders of Hecla Series B Cumulative Convertible Preferred Stock.

At Hecla’s Annual Meeting of Shareholders, both proposals received approval from shareholders concerning election of directors and amendment to the existing 1995 Stock Incentive Plan. The three directors reelected to the board were Ted Crumley, Charles L. McAlpine and Jorge E. Ordoñez C.

Hecla Mining Company, headquartered in Coeur d’Alene, Idaho, mines and processes silver and gold in the United States, Venezuela and Mexico. A 113-year-old company, Hecla has long been well known in the mining world and financial markets as a quality silver and gold producer. Hecla’s common and preferred shares are traded on the New York Stock Exchange under the symbols HL and HL-PrB.

Statements made which are not historical facts, such as anticipated payments, litigation outcome, production, sales of assets, exploration results and plans, costs, prices or sales performance are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, and involve a number of risks and uncertainties that could cause actual results to differ materially from those projected, anticipated, expected or implied. These risks and uncertainties include, but are not limited to, metals price volatility, volatility of metals production, exploration risks and results, project development risks and ability to raise financing. Refer to the company’s Form 10-Q and 10-K reports for a more detailed discussion of factors that may impact expected future results. The company undertakes no obligation and has no intention of updating forward-looking statements.

Cautionary Note to Investors — The United States Securities and Exchange Commission permits mining companies, in their filings with the SEC, to disclose only those mineral deposits that a company can economically and legally extract or produce. We use certain terms in this news release, such as “resource,” “mineralized material” and “indicated and inferred resource” that the SEC guidelines strictly prohibit us from including in our filing with the SEC. U.S. investors are urged to consider closely the disclosure in our Form 10-K. You can review and obtain copies of these filings from the SEC’s website at http://www.sec.gov/edgar.shtml.

Contact: Vicki Veltkamp, vice president — investor and public relations, 208/769-4144

Hecla’s Home Page can be accessed on the Internet at:http://www.hecla-mining.com

6500 N Mineral Drive, Suite 200 • Coeur d’Alene, Idaho 83815-9408 • 208/769-4100 • FAX 208/769-7612

6500 N Mineral Drive, Suite 200 • Coeur d’Alene, Idaho 83815-9408 • 208/769-4100 • FAX 208/769-7612

6500 N Mineral Drive, Suite 200 • Coeur d’Alene, Idaho 83815-9408 • 208/769-4100 • FAX 208/769-7612