UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

____________________

Form 10-K

____________________

| |

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the fiscal year ended December 31, 2024 |

OR

| |

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the transition period from to |

Commission file No. 1-8491

HECLA MINING COMPANY

(Exact name of registrant as specified in its Charter)

| |

Delaware | 77–0664171 |

State or Other Jurisdiction of Incorporation or Organization | I.R.S. Employer Identification No. |

6500 N. Mineral Drive, Suite 200 Coeur d’Alene, Idaho | 83815-9408 |

Address of Principal Executive Offices | Zip Code |

208-769-4100

Registrant’s Telephone Number, Including Area Code

Securities registered pursuant to Section 12(b) of the Act:

| | | | |

Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

Common Stock, par value $0.25 per share | | HL | | New York Stock Exchange |

Series B Cumulative Convertible Preferred Stock, par value $0.25 per share | | HL-PB | | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☑ No __

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes __ No ☑

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months, and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No __

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☑ No __

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act:

| | | | | | |

Large accelerated filer |

| ☒ |

| Accelerated filer |

| ☐ |

Non-accelerated filer |

| ☐ |

| Smaller reporting company |

| ☐ |

Emerging growth company |

| ☐ |

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☑

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐

The aggregate market value of the registrant’s voting Common Stock held by non-affiliates was $2,979,623,680 as of June 30, 2024. There were 627,113,698 shares of the registrant’s Common Stock outstanding as of June 30, 2024, and 631,831,137 shares outstanding as of February 7, 2025.

Documents incorporated by reference herein:

To the extent herein specifically referenced in Part III, the information contained in the Proxy Statement for the 2025 Annual Meeting of Shareholders of the registrant, which will be filed with the Commission pursuant to Regulation 14A within 120 days of the end of the registrant’s 2024 fiscal year, is incorporated herein by reference. See Part III.

TABLE OF CONTENTS

Special Note on Forward-Looking Statements

Certain statements contained in this report (including information incorporated by reference) are “forward-looking statements” and are intended to be covered by the safe harbor provided for under Section 27A of the Securities Act of 1933, as amended (“Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (“Exchange Act”). Our forward-looking statements include our current expectations and projections about future production, results, performance, prospects and opportunities, including reserves and resources. We have tried to identify these forward-looking statements by using words such as “may,” “might,” “will,” “expect,” “anticipate,” “believe,” “could,” “intend,” “plan,” “estimate,” “project” and similar expressions. These forward-looking statements are based on information currently available to us and are expressed in good faith and believed to have a reasonable basis. However, our forward-looking statements are subject to a number of risks, uncertainties and other factors that could cause our actual production, results, performance, prospects or opportunities, including reserves and resources, to differ materially from those expressed in, or implied by, these forward-looking statements.

These risks, uncertainties and other factors include, but are not limited to, those set forth under Item 1A. Risk Factors and Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations. Given these risks and uncertainties, readers are cautioned not to place undue reliance on our forward-looking statements. Projections and other forward-looking statements included in this report have been prepared based on assumptions, which we believe to be reasonable, but not in accordance with United States generally accepted accounting principles (“GAAP”) or any guidelines of the Securities and Exchange Commission (“SEC”). Actual results may vary, perhaps materially. You are strongly cautioned not to place undue reliance on such projections and other forward-looking statements. All subsequent written and oral forward-looking statements attributable to Hecla Mining Company or to persons acting on our behalf are expressly qualified in their entirety by these cautionary statements. Except as required by federal securities laws, we disclaim any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Risk Factors Summary

The following is a summary of the principal risks that could adversely affect our business, operations and financial results. These risks are described in more detail under Item 1A. Risk Factors of this report.

Financial Risks

•A substantial or extended decline in metals prices would have a material adverse effect on us.

•An extended decline in metals prices, an increase in operating or capital costs or treatment charges, mine accidents or closures, increasing regulatory obligations, or our inability to convert resources or exploration targets to reserves may cause us to record write-downs, which could negatively impact our results of operations.

•We have a substantial amount of debt that could impair our financial health and prevent us from fulfilling our obligations under our existing and future indebtedness.

•We have net operating losses which could reoccur in the future. Our ability to recognize the benefits of deferred tax assets related to net operating loss carryforwards and other items is dependent upon future cash flows and taxable income.

•Our accounting and other estimates may be imprecise.

•Commodity and currency risk management activities could prevent us from realizing possible revenues or lower costs or expose us to losses.

•Tariffs could have a negative impact on us, including because we export products to countries that have or may impose retaliatory tariffs.

Operation, Climate, Development, Exploration and Acquisition Risks

•Natural disasters, public health crises, political crises, and other catastrophic events or other events outside of our control may materially and adversely affect our business or financial results.

•Our operations are subject to a range of risks related to climate change and transitioning the business to meet regulatory, societal and investor expectations for operating in a low-carbon economy

•Mining accidents or other adverse events at an operation could decrease our anticipated production or otherwise adversely affect our operations. Our operations may be adversely affected by risks and hazards associated with the mining industry that may not be fully covered by insurance.

•Efforts to expand the finite lives of our mines may not be successful or could result in significant demands on our liquidity, and our costs of development of new orebodies and other capital costs may be higher than estimated. Our mineral reserve and resource estimates may be imprecise.

•Our ability to market our metals production depends on the availability of smelters and/or refining facilities, and our operations and financial results may be affected by the disruptions or unavailability of such facilities. Shortages of critical parts and equipment may adversely affect our development projects.

•We derive a significant amount of revenue from a relatively small number of customers.

•Certain of our mines and exploration properties are located on land that is or may become subject to competing title claims and/or claims of cultural significance.

•We may be subject to a number of unanticipated risks related to inadequate infrastructure.

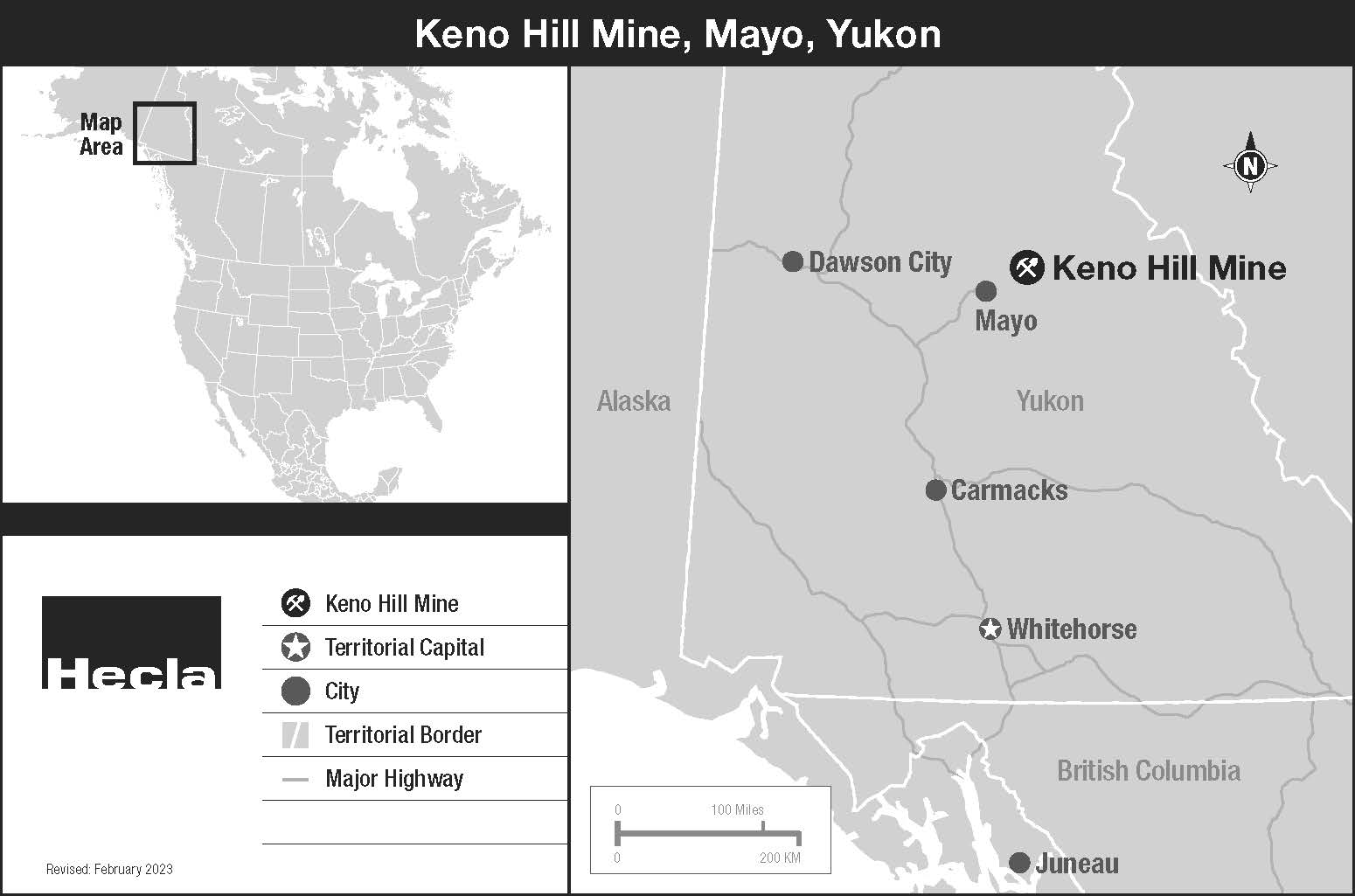

•We face inherent risks in acquisitions of other mining companies or properties that may adversely impact our growth strategy. The properties we have acquired or may acquire may not produce as expected, and we may be unable to accurately determine reserve potential or identify associated liabilities. We may be unable to successfully integrate the operations of the properties we acquire. We may not realize all of the anticipated benefits from our acquisitions. These risks continue to apply to our Keno

Hill unit which we acquired through our 2022 acquisition of Alexco Resource Corp. ("Alexco"), which has not yet achieved profitability.

•Issues we have faced at certain segments could require us to write-down the carrying value of associated long-lived assets. We could face similar issues at our other operations.

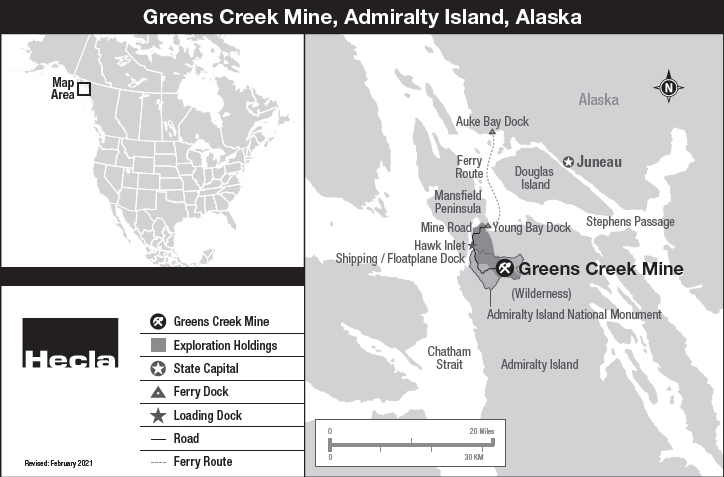

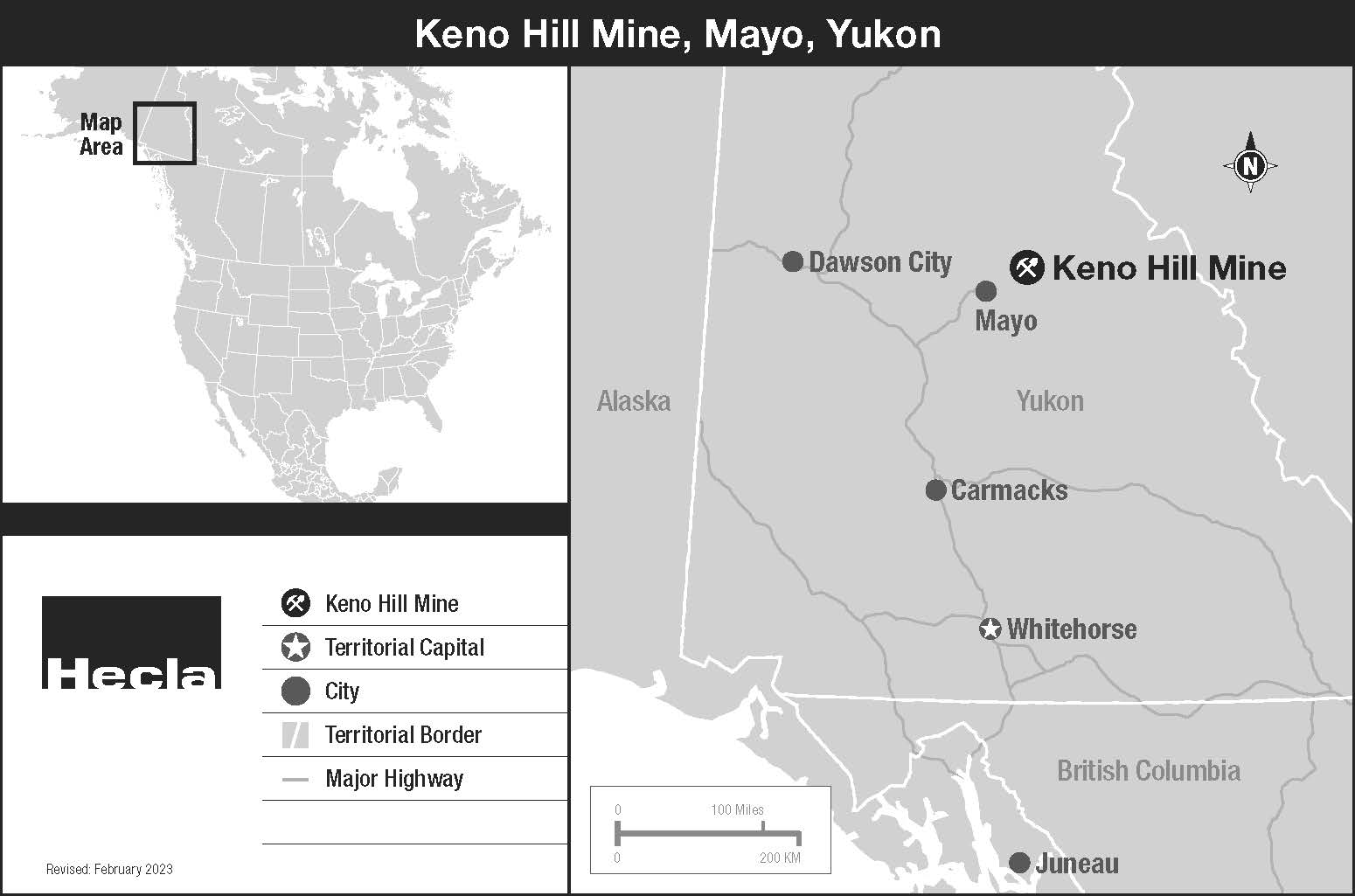

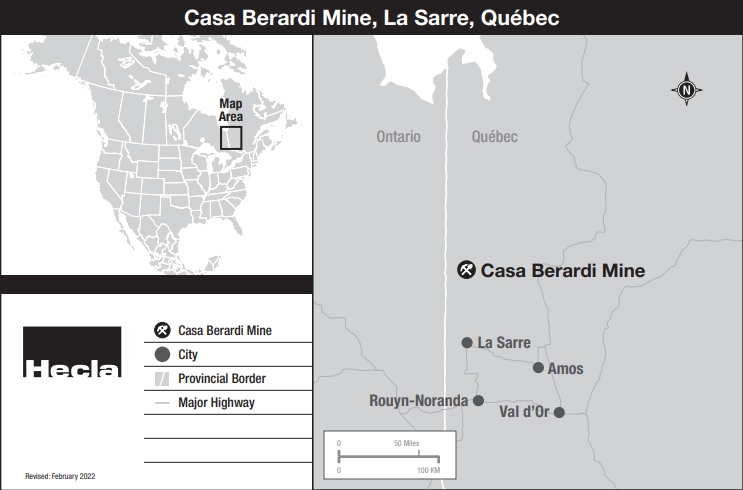

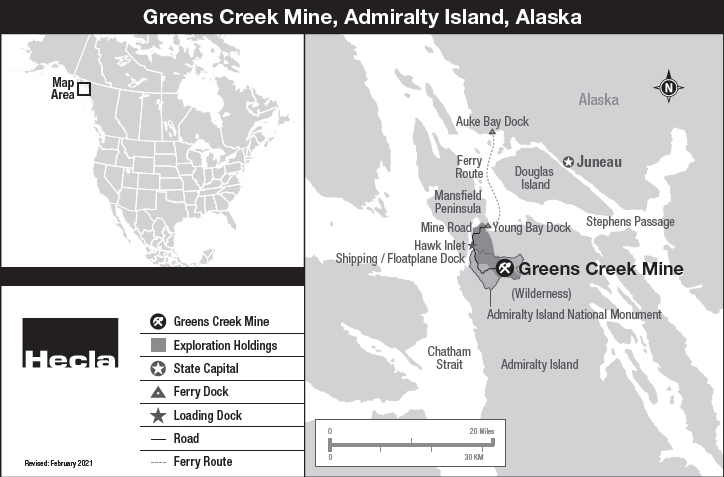

•We face risks relating to transporting our products from our mines, as well as transporting employees and materials at our Greens Creek, Casa Berardi and Keno Hill sites.

Legal, Regulatory and Compliance Risks

•Our operations are subject to complex, evolving and increasingly stringent environmental laws and regulations. Compliance with and litigation based on such laws and regulations, involves significant costs and can threaten existing operations or constrain expansion opportunities. Mine closure and reclamation regulations impose substantial costs on our operations and include requirements that we provide financial assurance supporting those obligations. These costs could significantly increase and we might not be able to provide financial assurance.

•We are required to obtain governmental permits and other approvals in order to conduct mining operations. We face substantial governmental regulation, including the Mine Safety and Health Act, various environmental laws and regulations and the 1872 Mining Law. Additionally, new federal, state, provincial, territorial and first nations laws, regulations and initiatives could impact our operations.

•We are currently involved in ongoing legal disputes. Legal challenges could prevent our projects in Montana from ever being developed. The titles to some of our properties may be defective or challenged.

•Our environmental and asset retirement obligations may exceed the provisions we have made.

Risks Relating to Our Common Stock and Our Indebtedness

•We may be unable to generate sufficient cash to service all of our debt and meet our other ongoing liquidity needs and may be forced to take other actions to satisfy our obligations, which may be unsuccessful.

•The price of our stock has a history of volatility and could decline in the future. We may not be able to pay common or preferred stock dividends in the future. The issuance of additional shares of our preferred or common stock in the future could adversely affect holders of common stock.

•Our existing stockholders are effectively subordinated to the holders of our 7.25% Senior Notes due February 15, 2028 (“Senior Notes”).

•The provisions in our certificate of incorporation, our by-laws and Delaware law could delay or deter tender offers or takeover attempts. The terms of our debt impose restrictions on our operations.

PART I

Item 1. Business

For information regarding the organization of our business segments and our significant customers, see Note 4 of Notes to Consolidated Financial Statements.

Information set forth in Items 1A and 2 below are incorporated by reference into this Item 1.

Introduction

Hecla Mining Company and its subsidiaries have provided precious and base metals to the U.S. and the world since 1891 (in this report, “we” or “our” or “us” refers to Hecla Mining Company and our affiliates and subsidiaries, unless the context requires otherwise). We discover, acquire and develop mines and other mineral interests and produce and market (i) concentrates containing silver, gold, lead, zinc and copper, (ii) carbon material containing silver and gold, and (iii) unrefined doré containing silver and gold. In doing so, we intend to manage our business activities in a safe, environmentally responsible and cost-effective manner.

The silver, zinc and precious metals concentrates and carbon material we produce are sold to custom smelters, metal traders and third-party processors, and the unrefined doré we produce is sold to refiners or further refined before sale of the metals to traders. We are organized and managed in four segments that encompass our operating mines and significant assets being Greens Creek, Lucky Friday, Keno Hill and Casa Berardi.

Our current business strategy is to focus our financial and human resources in the following areas:

•operating our properties safely, in an environmentally responsible and cost-effective manner;

•strengthen balance sheet to preserve our financial position in varying metals price and operational environments, improve capital allocation framework with a focus on Return On Invested Capital ("ROIC") and free cash flow generation;

•improving and optimizing operations at all sites, which includes incurring costs for new technologies and equipment, and implementing standardized systems and processes;

•optimize asset portfolio and identify growth opportunities;

•expanding our proven and probable reserves, mineral resources and production capacity at our properties;

•advancing the development and ramp up of the Keno Hill mine to profitability;

•seeking opportunities to acquire and invest in mining and exploration properties and companies;

•advancing permitting of the Libby Exploration project in Montana (50 miles from Lucky Friday);

•enhance ESG performance and risk management systems;

•build high-performing teams and strengthen organizational capabilities; and

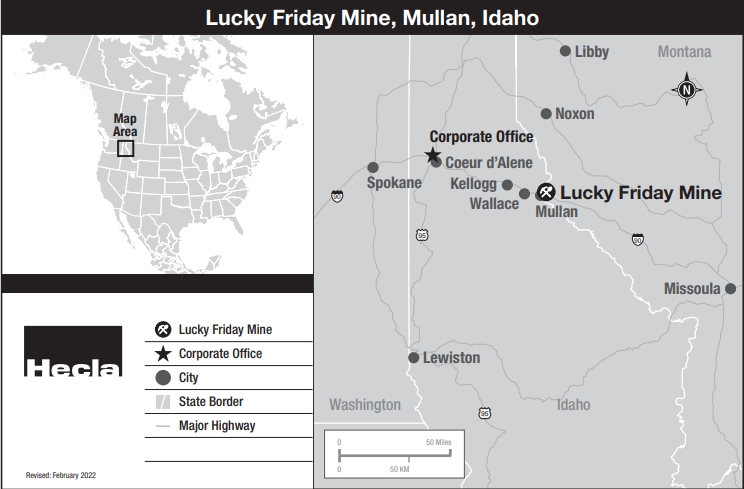

•maintaining and investing in exploration and pre-development projects in the vicinities of mining districts and projects we believe to be under-explored and under-invested: Greens Creek on Alaska's Admiralty Island located near Juneau; North Idaho's Silver Valley in the historic Coeur d'Alene Mining District; our projects located in two districts in Nevada; our projects in the Keno Hill mining district in the Yukon Territory, Canada; northwestern Montana; and the Republic Mining District in Washington state.

Metals Prices

Our operating results are substantially dependent upon the prices of silver, gold, lead and zinc, which can fluctuate widely. The volatility of such prices is illustrated in the following table, which sets forth our average realized prices and the high, low and average daily closing market prices for silver, gold, lead, zinc and copper over the last three years. The sources for the market prices are the London Market Fixing prices from the London Bullion Market Association for silver and gold and the Cash Official prices from the London Metals Exchange for lead, zinc and copper.

| | | | | | | | | | | | |

| | 2024 | | | 2023 | | | 2022 | |

Silver (per oz.): | | | | | | | | | |

Realized average | | $ | 28.58 | | | $ | 23.33 | | | $ | 21.53 | |

Market average | | $ | 28.24 | | | $ | 23.39 | | | $ | 21.75 | |

Market high | | $ | 34.51 | | | $ | 26.03 | | | $ | 26.36 | |

Market low | | $ | 22.09 | | | $ | 20.09 | | | $ | 17.81 | |

Gold (per oz.): | | | | | | | | | |

Realized average | | $ | 2,403 | | | $ | 1,939 | | | $ | 1,803 | |

Market average | | $ | 2,387 | | | $ | 1,943 | | | $ | 1,801 | |

Market high | | $ | 2,778 | | | $ | 2,049 | | | $ | 2,053 | |

Market low | | $ | 1,985 | | | $ | 1,811 | | | $ | 1,622 | |

Lead (per lb.): | | | | | | | | | |

Realized average | | $ | 0.97 | | | $ | 1.03 | | | $ | 1.01 | |

Market average | | $ | 0.94 | | | $ | 0.97 | | | $ | 0.98 | |

Market high | | $ | 1.04 | | | $ | 1.06 | | | $ | 1.15 | |

Market low | | $ | 0.86 | | | $ | 0.90 | | | $ | 0.80 | |

Zinc (per lb.): | | | | | | | | | |

Realized average | | $ | 1.37 | | | $ | 1.35 | | | $ | 1.41 | |

Market average | | $ | 1.26 | | | $ | 1.20 | | | $ | 1.58 | |

Market high | | $ | 1.47 | | | $ | 1.59 | | | $ | 2.05 | |

Market low | | $ | 1.04 | | | $ | 1.01 | | | $ | 1.23 | |

Copper (per lb.): | | | | | | | | | |

Realized average | | $ | 4.20 | | | NA | | | NA | |

Market average | | $ | 4.15 | | | NA | | | NA | |

Market high | | $ | 4.90 | | | NA | | | NA | |

Market low | | $ | 3.66 | | | NA | | | NA | |

The prices of the metals we produce are affected by numerous factors beyond our control. See Item 1A. Risk Factors – A substantial or extended decline in metals prices would have a material adverse effect on us for information on a number of the factors that can impact prices of the metals we produce. Our 2024 realized average prices for all metals we sold, except lead, were higher compared to 2023. In 2023, realized average prices for all metals we sold, except zinc, were higher compared to 2022. We are unable to predict fluctuations in prices for metals and have limited control over the timing of our concentrate shipments which also impacts our realized prices. However, we utilize financially-settled forward contracts for the metals we produce with the objective of managing the exposure to changes in prices of those metals contained in our concentrate shipments between the time of sale and final settlement. In addition, at times we utilize a similar program to manage the exposure to changes in prices of zinc and lead contained in our forecasted future concentrate shipments. See Note 10 of Notes to Consolidated Financial Statements for more information on our base and precious metal forward contract programs.

A comprehensive discussion of our financial results for the years ended December 31, 2024, 2023 and 2022, individual operation performance and other significant items can be found in Item 7. Management’s Discussion and Analysis of Consolidated Financial Condition and Results of Operations, as well as the Consolidated Financial Statements and Notes thereto.

Products and Segments

Our segments are differentiated by geographic region located in North America. We produce silver, zinc, and precious metals flotation concentrates at Greens Creek and silver and zinc flotation concentrates at Lucky Friday, each of which we sell to custom smelters and metal traders. The flotation concentrates produced at Greens Creek and Lucky Friday contain payable silver, zinc and lead, and at Greens Creek they also contain payable gold and at times copper. At Greens Creek, we also produce gravity concentrate containing payable silver, gold and lead. Unrefined bullion (doré) is produced from the gravity concentrate by a third-party processor, and shipped to a refiner before sale of the metals to precious metal traders. Keno Hill is currently in ramp-up and producing silver and precious metal flotation concentrates, but at less than what we consider to be commercial production levels. We also produce unrefined gold and silver bullion bars (doré) and loaded carbon and precipitates at Casa Berardi, which are shipped to refiners before sale of the metals to precious metal traders. At times, we sell loaded carbon and precipitates directly to refiners. Payable metals are those included in our products which we are paid for by smelters, metal traders and refiners. Our segments as of December 31, 2024 included:

•Greens Creek located on Admiralty Island, near Juneau, Alaska - 100% owned and has been in production since 1989.

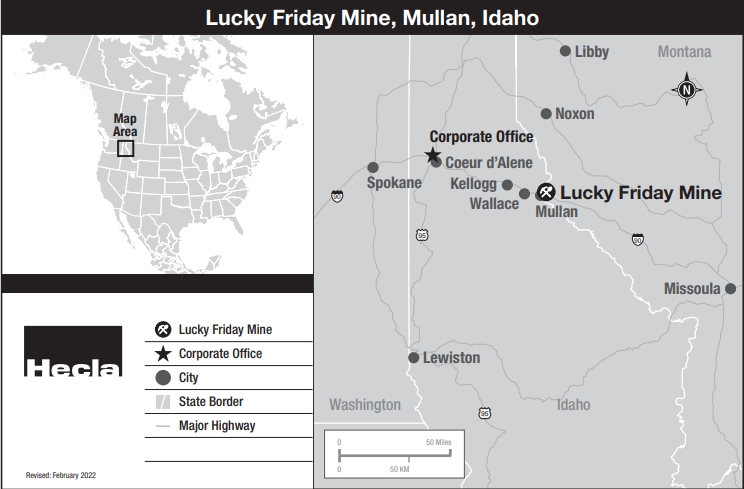

•Lucky Friday located in northern Idaho - 100% owned and has been a producing mine for us since 1958.

•Keno Hill located in the Keno Hill Silver District in Canada's Yukon Territory - 100% owned and was acquired as part of our acquisition of Alexco in September 2022. Production ramp-up commenced in June 2023.

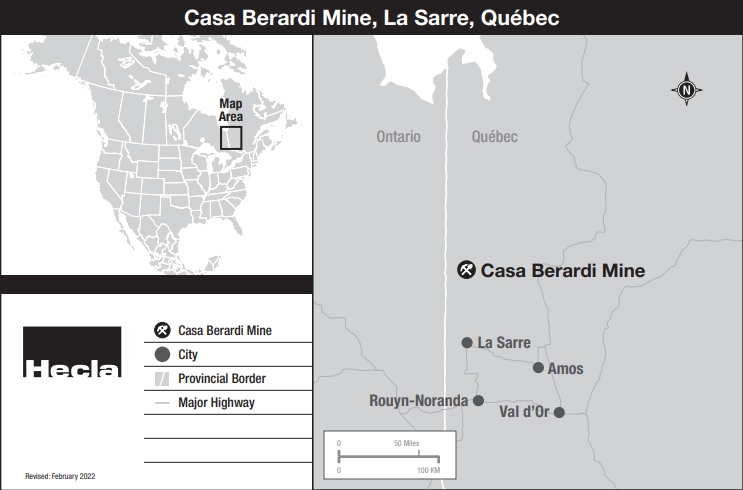

•Casa Berardi located in the Abitibi region of northwestern Quebec, Canada - 100% owned and has been in production since late 2006.

Effective January 2024, we revised our internal reporting provided to our Chief Operating Decision Maker, who is our President and Chief Executive Officer to no longer include any financial performance information for our Nevada assets ("Nevada"), reflecting the current status of Nevada being on care and maintenance. General corporate activities not associated with operating mines and their various exploration activities, idle properties and environmental remediation services in the Yukon, Canada, and the previously separately reported Nevada assets are presented as “Other". The presentation of the prior period information discussed in Item 7. Management’s Discussion and Analysis of Consolidated Financial Condition and Results of Operations, and Consolidated Financial Statements and Notes has been revised to reflect this change.

The contributions to our total metals sales by our significant operations in 2024 were 46.4% from Greens Creek, 23.1% from Casa Berardi, 22.3% from Lucky Friday and 8.2% from Keno Hill.

Governmental Regulation

The following is a summary of governmental regulation compliance areas which we believe are significant to our business and may have a material effect on our consolidated financial statements, earnings and/or competitive position.

Health and Safety

We are subject to the regulations of the Mine Safety and Health Administration (“MSHA”) in the United States, the Commission of Labor Standards, Pay Equity and Occupational Health and Safety in Quebec, Workers' Safety and Compensation Board in the Yukon and the Mexico Ministry of Economy and Mining, and work with these agencies to address issues outlined in any investigations and inspections and continue to evaluate our safety practices. We strive to achieve excellent mine safety and health performance, and attempt to implement reasonable best practices with respect to mine safety and emergency preparedness. Achieving and maintaining compliance with regulations is challenging and may increase our operating costs. See Human Capital - Health and Safety below and Item 1A. Risk Factors – We face substantial governmental regulation, including the Mine Safety and Health Act, various environmental laws and regulations and the 1872 Mining Law.

Environmental

Our operations are subject to various environmental laws and regulations at the federal and state/provincial/territorial level. Compliance with environmental regulations, and litigation based on environmental laws and regulations, involves significant costs and can threaten existing operations or constrain expansion opportunities. For example, since acquiring the Keno Hill mine in September 2022, the site has experienced permit exceedances involving the quality of water discharged into the environment. We are working to assess and improve the existing infrastructure and the environmental management system that was put in place by the previous owners. As part of this process, we have submitted plans to the Yukon Department of Energy, Mines and Resources to upgrade the water treatment plant at the Bermingham mine within our Keno Hill operations and in the interim have made other upgrades to water treatment at the site. See Note 16 of Notes to Consolidated Financial Statements.

Keno Hill is located at a site in the Yukon Territory where extensive historical mining activity occurred. The mining claims and rights that comprise our Keno Hill mine are owned by two of our indirect, wholly-owned subsidiaries, Alexco Keno Hill Mining Company and Elsa Reclamation & Development Company Ltd. (“ERDC”). ERDC and Alexco are parties to the Amended and Restated Subsidiary Agreement (“ARSA”) dated July 18, 2013, among them and Her Majesty the Queen in right of Canada (“Canada”) which addresses the pre-existing environmental condition and the environmental care and maintenance and reclamation of the historical Keno Hill site. Under the ARSA and related documents, ERDC, as a paid contractor for the Yukon Government, is responsible for the development and eventual implementation of the district wide reclamation and closure plan (“Reclamation Plan”) which addresses the historic environmental liabilities of the district from past mining activities pre-dating Hecla’s (and Alexco's) acquisition of the Keno Hill project, as well as for carrying out care and maintenance at various locations within the historical Keno Hill site until the Reclamation Plan is implemented. Hecla’s predecessor, Alexco, previously deposited CDN$10 million in a trust which funds ERDC’s maximum contribution toward implementing the Reclamation Plan, and agreed to a 1.5% net smelter royalty capped at CAD$4 million, of which approximately CAD$2.8 million has been paid or accrued for as of December 31, 2024. ERDC receives agreed-to commercial contractor rates when retained by Canada to provide environmental services in the historical Keno Hill site outside the scope of care and maintenance and closure and reclamation planning under the ARSA (in the latter case, for which ERDC receives an annual fee of CAD$900,000 from Canada, adjustable for material changes in scope). The potential liabilities associated with the pre-existing environmental conditions at Keno Hill are indemnified by Canada under the terms and conditions of the ARSA, subject to the requirement for ERDC to develop, permit, and implement the Reclamation Plan, or if Hecla and Canada agree to transfer portions of the historic area to active mining operations within the Keno Hill unit, then such indemnification ceases to the extent of such transferred area. Completing the Reclamation Plan is expected to take approximately 5 more years and is currently estimated to cost approximately CAD$348 million over that time, for which we expect ERDC to be reimbursed for all material costs incurred. However, we are at risk for any variance in timing between expending funds by ERDC and reimbursement by Canada, as well as for any disputed or otherwise non-reimbursed costs (for example if ERDC were to act outside of the scope of the ARSA). In addition, ERDC is responsible for sharing with Canada (i) under certain circumstances, care and maintenance costs pending implementation of the Reclamation Plan, (ii) detailed design and engineering costs to support the Reclamation Plan and (iii) under certain circumstances, post active reclamation costs (i.e. in the event Hecla has brought a historical area with pre-existing environmental conditions into active operations at the Keno Hill unit), which, in each case and in the aggregate, we do not anticipate will have a material impact on our financial results as a whole.

Mine closure and reclamation regulations impose substantial costs on our operations and include requirements that we provide financial assurance supporting those obligations. We currently have $213.6 million of financial assurances, primarily in the form of surety bonds, for reclamation company-wide. We anticipate approximately $7.3 million in expenditures in 2025 for environmental permit compliance and idle property management. We also plan to invest approximately $3.5 million for on-going reclamation work at the former Troy Mine in Montana. The projected remaining cost for reclamation at the site is included in our accrued reclamation and closure costs liability. See Item 1A. Risk Factors – We face substantial governmental regulation, including the Mine Safety and Health Act, various environmental laws and regulations and the 1872 Mining Law; Our operations are subject to complex, evolving and increasingly stringent environmental laws and regulations; Compliance with environmental regulations, and litigation based on such regulations, involves significant costs and can threaten existing operations or constrain expansion opportunities; Mine closure and reclamation obligations impose substantial costs on our operations; Our environmental and asset retirement obligations may exceed the provisions we have made; and New federal and state laws, regulations and initiatives could impact our operations.

Licenses, Permits and Claims/Concessions

We are required to obtain various licenses and permits to operate our mines and conduct exploration and reclamation activities. See Item 1A. Risk Factors – We are required to obtain governmental permits and other approvals in order to conduct mining operations. We can only engage in exploration at our exploration sites such as the Hollister and Hatter Graben (Nevada) and Libby Exploration (Montana) projects if we are successful in obtaining necessary permits. Similarly, mining at our planned open pits at Casa Berardi requires permits we have not yet received. At the Libby Exploration project (formerly known as Montanore), in February 2022, we submitted a new Plan of Operations to the United States Forest Service limited to underground exploration and evaluation activities that is currently under an Environmental Assessment review (“EA”) under the National Environmental Policy Act (“NEPA”). Upon

successful completion of the EA process, and if subsequent data collection and analysis activities suggest development of a mine is feasible, then it is anticipated that a new Plan of Operations for the construction and development of a mine at the Libby Exploration site would be submitted for approval. See Item 1A. Risk Factors – We are required to obtain governmental permits and other approvals in order to conduct mining operations and Legal challenges could prevent our projects in Montana from ever being developed.

In addition, our operations and exploration activities in Canada are conducted pursuant to claims granted by the host government, and are subject to claims renewal and minimum work commitment requirements, which are subject to certain political risks associated with foreign operations. See Item 1A. Risk Factors – Our foreign activities are subject to additional inherent risks, Our operations and properties in Canada expose us to additional political risks and Certain of our mines and exploration properties are located on land that is or may become subject to traditional territory, title claims and/or claims of cultural significance, and such claims and the attendant obligations of the federal government to those tribal communities and stakeholders may affect our current and future operations.

Taxes and Royalties

We are subject to various taxes and government royalties in the jurisdictions where we operate, including those specific to mining activities. These include: federal income taxes; state/provincial income taxes; county/city and bureau property taxes and sales and use tax in the U.S.; goods and services tax in Canada; value added tax in Mexico; mining-specific taxes in Alaska, Idaho, Nevada, Quebec and the Yukon; and mining royalties in Alaska, Nevada and Canada. Accrual and payment of taxes and accounting for deferred taxes can involve significant estimates and assumptions and can have a material impact on our consolidated financial statements. Tax rates and the calculations of taxes can change significantly and are influenced by changes in political administrations and other factors. See Item 1A. Risk Factors – Our accounting and other estimates may be imprecise; Our ability to recognize the benefits of deferred tax assets related to net operating loss carryforwards and other items is dependent on future cash flows generating taxable income; Our foreign activities are subject to additional inherent risks; and We face substantial governmental regulation, including the Mine Safety and Health Act, various environmental laws and regulations and the 1872 Mining Law. Also, see Note 7 of Notes to Consolidated Financial Statements for more information on income and mining taxes.

Physical Assets

Our business is capital intensive and requires ongoing capital investment for the replacement, modernization and expansion of equipment and facilities and to develop new mineral reserves. At December 31, 2024, the book value of our properties, plants, equipment and mine development, net of accumulated depreciation, was approximately $2.7 billion. For more information see Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations. We maintain insurance policies against property loss and business interruption. However, such insurance contains exclusions and limitations on coverage, and there can be no assurance that claims would be paid under such insurance policies in connection with a particular event. When we do experience insurable losses – such as with the fire at the Lucky Friday in August and September of 2023 – it can take a long period of time before we receive any or all insurance proceeds. See Item 1A. Risk Factors – Our operations may be adversely affected by risks and hazards associated with the mining industry that may not be fully covered by insurance.

Human Capital

As of December 31, 2024, we had approximately 1,830 employees, of which approximately 1,070 were employed in the United States, 750 in Canada, and 10 in Mexico. The vast majority of our employees are full-time. Approximately 260 of our employees at the Lucky Friday were covered by a collective bargaining agreement.

The attraction, development and retention of people is critical to delivering our business strategy. Key areas of focus for us include:

Health and Safety

The safety and health of our employees is of paramount importance. Our goal is to achieve world-class safety and health performance by promoting a deeply rooted value-based culture of safety and utilizing technology and innovation to continually improve the safety at our operations. We know that employees' and contractors' safety awareness is fundamental to making our workplace as safe as possible. Therefore, we invest in training and workforce development programs that focus on safety first. All employees and contractors receive training that complies with or exceeds the applicable safety and health regulations as set by the governing body in the jurisdiction in which each operation is located. As part of our commitment to safety, we track a variety of safety performance indicators, including injuries, near misses, observations, and equipment damages. Our goal is to reduce safety incidents. Our All Injury Frequency Rate (“AIFR”) is calculated as the number of incidents in the period multiplied by 200,000 hours and divided by the number of hours worked in the period. Company-wide, our AIFR was 1.86 for 2024.

Compensation and Benefits

We are among the largest private-sector employers in the communities in which we operate providing a compensation and benefits package that attracts, motivates, and retains employees. In addition to competitive base wages, and incentive compensation, we offer retirement benefits, health insurance plans and paid time off.

Retention and Employee Development

We are committed to hiring talented people, developing effective leaders, providing an inclusive workplace and retaining a large portion of the workforce for long periods of time. The mining workforce of the future, like most industries, will see a continual change in the jobs and skill sets required as we adopt new technologies and make our workplace safer and more efficient. We are also committed to helping employees update their skills. For example, in conjunction with a trade school in Val-d’Or, Quebec, the leadership at our Casa Berardi mine has developed a customized training program for new and existing supervisors to develop their skills in the areas of leadership, communications, roles and responsibilities, and health and safety. In addition, we have long supported the Pathways to Mining Careers program, a career training partnership with the University of Alaska Southeast in Juneau. We also offer a reimbursement program to assist with educational expenses for employees who are interested in furthering their education. Advanced education can improve job performance and increase advancement opportunities for the employee, while providing flexibility to our company by increasing the employee’s knowledge base and skill set.

Annual employee surveys are conducted to gauge employee concerns and morale. The results of the surveys, and any responsive measures, are shared with our Board of Directors. Strategic talent reviews and succession planning reviews are conducted periodically across all business areas, and our training programs are adapted accordingly. The Chief Executive Officer (“CEO”), senior level company leadership and the Board of Directors periodically review our top talent. Creating more opportunities for women and indigenous people are among our priorities for employee development. We also strive to maintain an inclusive workplace and provide periodic training to employees to help meet that goal. Our employees are required to abide by our Code of Conduct, which is provided to employees upon being hired and thereafter annually, and is available on our website, to promote the conduct of our business in a consistently legal and ethical manner. Among other provisions, the Code of Conduct reflects our policy and practice not to discriminate against any employee because of race, color, religion, national origin, sex, sexual orientation, gender identity or expression, age, or physical or other disability. We expect our leaders to set the example by being positive role models and good mentors for our employees.

Our Senior Vice President - Chief Administrative Officer is responsible for developing and executing our human capital strategy. The position is an executive-level position to reflect the priority we place on utilizing our human capital resources to meet our business strategy.

Available Information

Hecla Mining Company is a Delaware corporation. Our current holding company structure dates from the incorporation of Hecla Mining Company in 2006 and the renaming of our subsidiary (previously Hecla Mining Company) as Hecla Limited. Our principal executive offices are located at 6500 N. Mineral Drive, Suite 200, Coeur d’Alene, Idaho 83815-9408. Our telephone number is (208) 769-4100. Our web site address is www.hecla.com. Information on our web site is not incorporated into this Annual Report on Form 10-K. We file our annual, quarterly and current reports and any amendments to these reports with the SEC, copies of which are available on our website or from the SEC free of charge (www.sec.gov). Our restated certificate of incorporation, bylaws, charters of our audit, compensation, and governance and social responsibility committees, as well as our Code of Ethics for the Chief Executive Officer and Senior Financial Officers and our Code of Conduct, are also available on our website. In addition, any amendments to our Code of Ethics or waivers granted to our directors and executive officers will be posted on our website. Each of these documents may be periodically revised, so you are encouraged to visit our website for any updated terms. We will provide copies of these materials to stockholders upon request using the above-listed contact information, directed to the attention of Investor Relations, or via e-mail request sent to hmc-info@hecla.com.

We routinely post important information for investors on our web site, www.hecla.com, in the “Investors” section. We also may use our web site as a means of disclosing material, non-public information and for complying with our disclosure obligations under Regulation FD. Accordingly, investors should monitor the Investors section of our web site, in addition to following our press releases, SEC filings, public conference calls, presentations and webcasts. The information contained on, or that may be accessed through, our web site is not incorporated by reference into, and is not a part of, this document.

Item 1A. Risk Factors

The following risks and uncertainties, together with the other information set forth in this report, should be carefully considered by those who invest in our securities. Any of the following material risk factors could adversely affect our business, financial condition or operating results and could decrease the value of our common or preferred stock or other outstanding securities. These are not all of the risks we face, and other factors not presently known to us or that we currently believe are immaterial may also affect our business if they occur.

Financial Risks

A substantial or extended decline in metals prices would have a material adverse effect on us.

Our revenue is derived primarily from the sale of concentrates and doré containing silver, gold, lead, zinc and copper and, as a result, our earnings are directly related to the prices of these metals. Silver, gold, lead, zinc and copper prices fluctuate widely and are affected by numerous factors, including:

•relative exchange rates of the U.S. dollar;

•global and regional demand and production;

•inflation, recession or increased or reduced economic activity; and

•other political, regulatory and economic conditions.

These factors are largely beyond our control and are difficult to predict. If the market prices for these metals fall below our production or development costs for a sustained period of time, we will experience losses and may have to discontinue exploration, development or operations, and we may also incur asset write-downs at one or more of our properties. See Item 1. Business - Introduction for information on the average, high, and low daily closing prices for silver, gold, lead, zinc and copper for the last three years. On February 7, 2025, the closing prices for silver, gold, lead, zinc and copper were $31.78 per ounce, $2,860.10 per ounce, $0.90 per pound, $1.28 per pound, and$ 4.16 per pound, respectively.

An extended decline in metals prices, an increase in operating or capital costs or treatment charges, mine accidents or closures, increasing regulatory obligations, or our inability to convert resources or exploration targets to reserves may cause us to record write-downs, which could negatively impact our results of operations.

When events or changes in circumstances indicate the carrying value of our long-lived assets may not be recoverable, (a "triggering event") we review the recoverability of the carrying value by estimating the future undiscounted cash flows expected to result from the use and eventual disposition of the asset. Impairment must be recognized when the carrying value of the asset exceeds these cash flows. Recognizing impairment write-downs could negatively impact our results of operations. Metals price estimates are a key component used in the evaluation of the carrying values of our assets, as the evaluation involves comparing carrying values to the probability weighted estimated undiscounted cash flows resulting from operating plans using various metals price scenarios. Our estimates of undiscounted cash flows for our long-lived assets also include an estimate of the market value of the resources and exploration targets beyond the current operating plans.

We determined no impairments was required for a triggering event identified during 2024. For more discussion, see the below risk factors, “We may not realize all of the anticipated benefits from our acquisitions, including our 2022 acquisition of Alexco" and “Issues we have faced at certain segments could require us to write-down the carrying value of associated long-lived assets. We could face similar issues at our other operations. Such write-downs may adversely affect our results of operations and financial condition.” If the prices of the metals we produce decline for an extended period of time, if we fail to control production or capital costs, if regulatory issues increase costs or decrease production, or if we do not realize the mineable mineral reserves, resources or exploration targets at our mining properties, we may be required to recognize asset write-downs in the future. In addition, the perceived market value of the resources and exploration targets of our properties is dependent upon prevailing metals prices as well as our ability to discover economic ore. A decline in metals prices for an extended period of time or our inability to convert resources or exploration targets to reserves could significantly reduce our estimates of the value of the resources or exploration targets at our properties and result in asset write-downs.

We have a substantial amount of debt that could impair our financial health and prevent us from fulfilling our obligations under our existing and future indebtedness.

As of December 31, 2024, we had total indebtedness of approximately $558.7 million, primarily in the form of our Senior Notes and borrowings under our amended revolving credit agreement. Our level of debt, debt service obligations and covenant requirements may have adverse effects on our business, financial condition, cash flows or results of operations, including:

•making it more difficult for us to satisfy our obligations with respect to the Senior Notes;

•reducing the amount of funds available to finance our operations, capital expenditures and other activities;

•increasing our vulnerability to economic downturns and industry conditions;

•limiting our flexibility in responding to changing business and economic conditions;

•jeopardizing our ability to execute our business plans;

•placing us at a disadvantage when compared to our competitors that have less debt;

•increasing our cost of borrowing; and

•limiting our ability to borrow additional funds.

We and our subsidiaries may incur substantial additional indebtedness in the future. Although the indenture governing our Senior Notes contains restrictions on the incurrence of additional indebtedness, these restrictions are subject to a number of significant qualifications and exceptions and, under certain circumstances, the amount of additional indebtedness that could be incurred in compliance with these restrictions could be substantial. In May 2024, we entered into an amended revolving credit agreement (the "Credit Agreement") which increased borrowing capacity to $225 million. Like the indenture, the credit agreement governing the revolving credit facility also has restrictions on the incurrence of additional indebtedness but with a number of significant qualifications and exceptions. If new debt is added to our and our subsidiaries’ existing debt levels, the risks associated with such debt that we currently face would increase. In addition, the indenture governing the Senior Notes does not prevent us from incurring additional indebtedness under the indenture.

We have had losses that could reoccur in the future.

We have experienced volatility in our net income (loss) reported in the last three years, as shown in our Consolidated Statement of Operations and Comprehensive Income (Loss), including net income of $35.8 million in 2024, net losses of $84.2 million and $37.3 million in 2023 and 2022, respectively. A comparison of operating results over the past three years can be found in Results of Operations in Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Many of the factors affecting our operating results are beyond our control, including, but not limited to, the volatility of metals prices; smelter terms; rock and soil conditions; seismic events; cybersecurity attacks; availability of hydroelectric power; diesel fuel prices; interest rates; foreign exchange rates; global or regional political or economic policies; inflation; availability and cost of labor; economic developments and crises; governmental regulations; continuity of orebodies; ore grades; recoveries; performance of equipment; uninsured losses; price speculation by certain investors; and purchases and sales by central banks and other holders and producers of gold and silver in response to these factors. We cannot assure you that we will not experience net losses in the future.

Our accounting and other estimates may be imprecise.

Preparing consolidated financial statements requires management to make estimates and assumptions that affect the reported amounts and related disclosure of assets, liabilities, revenue and expenses at the date of the consolidated financial statements and reporting periods. The more significant areas requiring the use of management assumptions and estimates relate to:

•mineral reserves, resources, and exploration targets that are the basis for future income and cash flow estimates and units-of-production depreciation, depletion and amortization calculations;

•future ore grades, throughput and recoveries;

•future capital and operating costs;

•environmental, reclamation and closure obligations;

•permitting and other regulatory considerations;

•valuation of business combinations;

•future foreign exchange rates, inflation rates and applicable tax rates;

•reserves for contingencies and litigation; and

•deferred tax asset valuation allowance.

Future estimates and actual results may differ materially from these estimates as a result of using different assumptions or conditions. For additional information, see Critical Accounting Estimates in Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations, Note 2 of Notes to Consolidated Financial Statements, and the risk factors set forth below: “Our costs of extending existing reserves or development of new orebodies and other capital costs may be higher and provide less return than we estimated,” “Our mineral reserve and resource estimates may be imprecise,” “We are currently involved in ongoing legal disputes that may materially adversely affect us,” and “Our environmental and asset retirement obligations may exceed the provisions we have made.”

Commodity and currency risk management activities could prevent us from realizing possible revenues or lower costs or expose us to losses.

We periodically engage in risk management activities to manage the exposure to changes in prices of silver, gold, lead and zinc contained in our concentrate shipments between the time of sale and final settlement and manage the exposure to changes in the prices of lead and zinc contained in our forecasted future shipments. Such activities are utilized in an attempt to partially insulate our operating results from changes in prices for those metals. However, such activities may prevent us from realizing revenues in the event that the market price of a metal exceeds the price stated in a forward contract, and may also result in significant mark-to-market fair value adjustments, which may have a material adverse impact on our reported financial results. In addition, we are exposed to credit risk with our counterparties, and we may experience losses if a counterparty fails to purchase under a contract when the contract price exceeds the spot price of a commodity.

We also use financially-settled forward contract programs to manage exposure to fluctuations in the exchange rates between the U.S. dollar (“USD”) and the Canadian dollar (“CAD”) and the impact on our future operating costs denominated in CAD. We use a similar program related to future development costs denominated in CAD. As with our metals derivatives, when utilized, such activities may prevent us from realizing possible lower costs on a USD-basis in the event that the USD strengthens relative to the CAD compared to the exchange rates stated in the forward contracts, and also expose us to counterparty credit risk.

See Note 10 of Notes to Consolidated Financial Statements for more information on these forward contract programs.

Our ability to recognize the benefits of deferred tax assets related to net operating loss carryforwards and other items is dependent on future cash flows generating taxable income.

We recognize the expected future tax benefit from deferred tax assets when the tax benefit is considered to be more likely than not of being realized. Otherwise, a valuation allowance is applied against deferred tax assets, reducing the value of such assets. Assessing the recoverability of deferred tax assets requires management to make significant estimates related to expectations of future taxable income. Estimates of future taxable income are based on forecasted income from operations and the application of existing tax laws in each jurisdiction. Metal prices, reserves, production and cost estimates are key components to determine the expected future benefit of our deferred tax assets. To the extent that future taxable income differs significantly from estimates as a result of a decline in metals prices or other factors, our ability to realize the deferred tax assets could be impacted. Additionally, significant future issuances of common stock or common stock equivalents, or changes in the direct or indirect ownership of our common stock or common stock

equivalents, could limit our ability to utilize our net operating loss carryforwards pursuant to Section 382 of the Internal Revenue Code. Future changes in tax law or changes in ownership structure could limit our ability to utilize our recorded tax assets. Our deferred tax assets as of December 31, 2024 were $252.7 million, net of $115.1 million in valuation allowances. See Note 7 of Notes to Consolidated Financial Statements for further discussion of our deferred tax assets.

Returns for investments in pension plans and pension plan funding requirements are uncertain.

We maintain defined benefit pension plans for most U.S. employees, which provide for defined benefit payments after retirement for those employees. Canadian and Mexican employees participate in public retirement systems for those countries and are not eligible to participate in the defined benefit pension plans that we maintain for U.S. employees. The ability of the pension plans maintained for U.S. employees to provide the specified benefits depends on our funding of the plans and returns on investments made by the plans. Returns, if any, on investments are subject to fluctuations based on investment choices and market conditions. In addition, we have a supplemental excess retirement plan which was funded as of December 31, 2024. A sustained period of low returns or losses on investments, or future benefit obligations that exceed our estimates, could require us to fund the pension plans to a greater extent than anticipated. See Note 6 of Notes to Consolidated Financial Statements for more information on our pension plans.

Operation, Climate, Development, Exploration and Acquisition Risks

Natural disasters, public health crises, political crises, and other catastrophic events or other events outside of our control may materially and adversely affect our business or financial results.

If any of our facilities or the facilities of our suppliers, third-party service providers, or customers is affected by natural disasters, such as earthquakes, floods, fires, power shortages or outages, public health crises (such as pandemics and epidemics), political crises (such as terrorism, war, political instability or other conflict), or other events outside of our control, our operations or financial results could suffer. Any of these events could materially and adversely impact us in a number of ways, including through decreased production, increased costs, decreased demand for our products due to reduced economic activity or other factors, or the failure by counterparties to perform under contracts or similar arrangements. For example, the COVID-19 pandemic impacted our operations and financial results between 2020 and 2022.

Our operations are subject to a range of risks related to climate change and transitioning the business to meet regulatory, societal and investor expectations for operating in a low-carbon economy.

Climate change is expected to create more extreme weather patterns that can increase frequency or severity of forest fires (such as our Casa Berardi unit experienced in summer 2023) and droughts and sudden heavy rainfall (such as our Greens Creek unit has periodically experienced). These latter two events require careful water management. Potential key material physical risks to Hecla from climate change include, but are not limited to:

•increased volumes of mine contact water requiring storage and treatment;

•increased design requirements for stormwater diversion and associated water management systems;

•reduced freshwater availability due to potential drought conditions;

•damage to roads and other infrastructure at our sites due to extreme weather events including intense rainfalls and related events such as landslides; and

•unpermitted or otherwise non-compliant discharge of wastewater due to an increased frequency of extreme weather events exceeding the design capacity of existing tailings storage facilities and other stormwater management infrastructure.

Such events can temporarily slow or halt operations due to physical damage to assets, unavailability of power, reduced worker productivity for safety protocols on site related to extreme weather events, and difficulties transporting workers, materials or supplies to or from sites. Additional financial impacts could include increased capital or operating costs to (i) increase water storage and treatment capacity, (ii) obtain or develop maintenance and monitoring technologies, (iii) increase resiliency of facilities and (iv) establish supplier climate resiliency and contingency plans. The occurrence of weather and climate events have in the past and could in the future cause us to incur unplanned costs, which may be material, to address or prevent resulting damage. See the below Risk Factors “We may be subject to a number of unanticipated risks related to inadequate infrastructure” and “Our operations may be adversely affected by risks and hazards associated with the mining industry that may not be fully covered by insurance."

In addition, we have identified opportunities and potential risks for Hecla as we shift toward a low-carbon economy. Technologies that support decarbonization include renewable energy sources, electric vehicles, and energy storage, all of which require the metals we produce. However, renewable energies currently may not have the same reliability as conventional energy sources. Thus, as we transition toward renewable energy sources, we could experience a possible curtailment of our energy supply, and these new energy sources may cost more in the future than our current supplies, which could negatively impact our financial performance. Further, transitioning to a lower-carbon economy will require significant investment and may entail extensive policy, legal, technology, and market changes to address mitigation and adaptation requirements related to climate change. Depending on the nature, speed, focus and jurisdiction of these changes, transition risks may pose varying levels of financial and reputational risk to our business.

Policy and regulatory risk related to actual and proposed changes in climate and water-related laws, regulations and taxes developed to regulate the transition to a low-carbon economy may result in increased costs for our operations, third-party smelters and refiners and our suppliers, including increased energy, capital equipment, environmental monitoring and reporting and other costs to comply with such regulations. Regulatory uncertainty may cause higher costs and lower economic returns than originally estimated for new development projects and operations, including closure reclamation and remediation obligations.

The development and deployment of technological improvements or innovations will be required to support the transition to a low-carbon economy, which could result in write-offs and early retirement of existing assets, increased costs to adopt and deploy new practices and processing including planning and design for mines, development of alternative power sources, site level efficiencies and other capital investments.

A failure to meet our climate strategy commitments and/or societal or investor expectations could also result in damage to our reputation, decreased investor confidence and challenges in maintaining positive community relations, which can pose additional obstacles to our ability to conduct our operations and develop our projects, which may result in a material adverse impact on our business, financial position, results of operations and growth prospects.

Mining accidents or other adverse events at an operation could decrease our anticipated production or otherwise adversely affect our operations.

Production may be reduced below our historical or estimated levels for many reasons, including, but not limited to, mining accidents; unfavorable ground or shaft conditions; extreme weather events; fire, influx of water or other insured and uninsured events; work stoppages or slow-downs; lower than expected ore grades; cybersecurity attacks; unexpected regulatory actions; if the metallurgical characteristics of ore are less economic than anticipated; or because our equipment or facilities fail to operate properly or as expected. Our mines are subject to risks relating to ground instability, including, but not limited to, pit wall failure, crown pillar collapse, seismic events, backfill and stope failure or the breach or failure of a tailings or other impoundment. Both the Lucky Friday and Casa Berardi mines have a history of ground instability underground and related incidents which in the past have resulted in loss of production at these facilities and some of the other effects described below. The occurrence of an event such as those described above could result in loss of life or temporary or permanent cessation of operations, any of which could have a material adverse effect on our financial condition and results of operations. Other closures or impacts on operations or production may occur at any of our mines at any time, whether related to accidents, changes in conditions, changes to regulatory policy, or as precautionary measures. See “Our operations are subject to complex, evolving and increasingly stringent environmental laws and regulations. Compliance with environmental regulations, and litigation based on such regulations, involves significant costs and can threaten existing operations or constrain expansion opportunities.”

In addition, our operations are typically in remote locations, where conditions can be inhospitable, including with respect to weather, surface conditions, interactions with wildlife or otherwise in or near dangerous conditions. In the past we have had employees, contractors, or employees of contractors get injured, sometimes fatally, while working in such challenging locations. An accident or injury to a person at or near one of our operations could have a material adverse effect on our financial condition and results of operations.

At the Lucky Friday mine we are mining ever deeper deposits and have been utilizing our patented Underhand Closed Bench (“UCB”) mining method. See Item 2. Properties - Lucky Friday for a description of the UCB method. We started testing the UCB method in 2020 and it was used for approximately 86%, 87% and 88% of the tons mined at Lucky Friday in 2024, 2023 and 2022, respectively. The UCB method has not been used at other mines. Although we believe the testing has resulted in better management of the Lucky Friday mine’s seismicity, which increases as we mine deeper, we cannot predict unknown hazards that the UCB method or our deeper mining activities might cause.

Our operations may be adversely affected by risks and hazards associated with the mining industry that may not be fully covered by insurance.

Our business is capital intensive, requiring ongoing investment for the replacement, modernization or expansion of equipment and facilities. Our mining and milling operations are subject to risks of process disruptions and equipment malfunctions. Equipment and supplies may from time to time be unavailable on a timely basis. Our business is subject to a number of other risks and hazards including:

•unusual or unexpected geologic formations;

•rock bursts, ground falls, pit wall failures, or tailings or other impoundment breaches or failures;

•road and bridge failures;

•underground floods or fires (such as we experienced in August 2023 when there was a fire deep within the #2 shaft at our Lucky Friday unit which caused production there to stop for approximately 5 months, before production resumed in January 2024);

•unanticipated hydrologic conditions, including lack of precipitation, flooding, rapid snow melt and associated runoff, and periodic interruptions due to inclement or hazardous weather conditions;

•civil unrest or terrorism;

•changes in interpretation or enforcement of regulatory and permitting requirements;

•disruption, damage or failure of power, technology or other systems related to operation of equipment and other aspects of our mine operations;

•labor disputes or strikes; and

•tailing ponds and other impoundments and dams which in the past have failed and could again fail or leak as a result of design or construction flaws, seismic activity, unusual weather or for other reasons.

Such risks could result in:

•personal injury or fatalities;

•damage to or destruction of mineral properties or producing facilities;

•environmental damage and financial penalties;

•delays in exploration, development or mining;

•inability to meet our financial obligations;

•asset impairment charges;

•temporary or permanent closure of facilities.

We maintain insurance to protect against losses that may result from some of these risks, such as property loss and business interruption, in amounts we believe to be reasonably consistent with our historical experience, industry practice and circumstances surrounding each identified risk. Such insurance, however, contains exclusions and limitations on coverage, particularly with respect to environmental liability, political risk and seismic events. We cannot assure you that claims would be paid under such insurance policies in connection with a particular event. Insurance specific to environmental risks is generally either unavailable or, we believe, cost prohibitive, and we therefore we maintain limited environmental insurance. Occurrence of events for which we are not insured may have an adverse effect on our business.

Our costs of extending existing reserves or development of new orebodies and other capital costs may be higher and provide less return than we estimated.

Capitalized development projects may cost more and provide less return than we estimate. If we are unable to realize a return on these investments, we may incur a related asset write-down that could adversely affect our financial results or condition.

Our ability to sustain or increase our current level of metals production partly depends on our ability to develop new orebodies and/or expand existing mining operations. Before we can begin a development project, we must first determine whether it is economically feasible to do so. This determination is based on estimates of several factors, including:

•mineral reserves and resources;

•expected ore grades and recovery rates of metals from the ore;

•facility and equipment costs;

•availability of adequate staffing;

•availability of affordable sources of power and adequacy of water supply;

•exploration and drilling success;

•capital and operating costs of a development project;

•environmental and closure, permitting and other regulatory considerations and costs;

•adequate access to the site, including competing land uses (such as agriculture);

•current and potential tariffs;

•foreign currency fluctuation and inflation rates; and

•availability and cost of financing.

Many of these estimates are based on geological and other interpretive data, which may be imprecise. As a result, actual operating and capital costs and returns from a development project may differ substantially from our estimates, and, as such, it may not be economically feasible to continue with a development project.

Our mineral reserve and resource estimates may be imprecise.

Our mineral reserve figures are primarily estimates and are not guarantees that we will recover the indicated quantities of these metals. You are cautioned not to place undue reliance on estimates of reserves (or resource estimates or exploration targets). Reserves are estimates made by our professional technical personnel of the amount of metals that they believe could be economically and legally extracted or produced at the time of the reserve determination. No assurance can be given that the estimated amount of metal or the indicated level of recovery of these metals will be realized. Reserve and resource estimation is an interpretive process based upon available data and various assumptions. Our reserve and resource estimates may change. Reserves are valued based on estimates of costs and metals prices, which may not be consistent among our properties or across the industry. The estimated quantities and economic value of mineral reserves may be adversely affected by:

•declines in the market price of the various metals we mine;

•increased production or capital costs;

•reduction in the grade or tonnage of the deposit;

•increase in the dilution of the ore;

•future foreign currency rates, inflation rates and applicable tax rates;

•current and future tariffs;

•reduced metal recovery; and

•changes in environmental, permitting or other regulatory requirements.

Furthermore, short-term operating factors relating to our mineral reserves, such as the need to sequentially develop orebodies and the processing of new or different ore grades, may adversely affect our cash flow.

If the prices of metals that we produce decline substantially below the levels used to calculate reserves for an extended period, we could experience:

•delays in new project development;

•reductions in reserves and resources;

•write-downs of asset values;

•temporary suspension of mining activities; and

Additionally, reserve estimates are subject to further development and preproduction drilling, resource estimates and exploration targets are subject to further exploration and development, and are, therefore, subject to considerable uncertainty. Despite our history of converting resources and exploration targets to reserves through additional drilling and study work, we cannot be certain that any part or parts of resources or exploration targets will ever be confirmed or converted into reserves as defined by the SEC.

Efforts to expand the finite lives of our mines may not be successful or could result in significant demands on our liquidity, which could hinder our growth.

One of the risks we face is that mines are depleting assets. Thus, in order to maintain or increase production we must continually replace depleted mineral reserves by locating and developing additional ore. Our ability to expand or replace mineral reserves primarily depends on the success of our exploration programs. Mineral exploration, particularly for silver and gold, is highly speculative and expensive. It involves many risks and is often non-productive. Even if we believe we have found a valuable mineral deposit, it may be several years before production from that deposit is possible. During that time, it may become no longer feasible to produce those minerals for economic, regulatory, political or other reasons. As a result of high costs and other uncertainties, we may not be able to expand or replace our existing mineral reserves as they are depleted, which would adversely affect our business and financial position in the future.

Our ability to market our metals production depends on the availability of smelters and/or refining facilities and our operations and financial results may be affected by disruptions or closures or the unavailability of smelters and/or refining facilities for other reasons.

We sell our metals products to smelters and metal traders. Our doré bars are sent to refiners for further processing before being sold to metal traders. Access to refiners and smelters on terms which are economic is critical to sell our products to buyers and generate revenues. If smelters or refiners are unavailable or unwilling to accept our products, or we are otherwise unable to sell our products to customers on acceptable commercial and legal terms, our operations and financial results could be adversely affected. See Note 4 of Notes to Consolidated Financial Statements for more information on the distribution of our sales and our significant customers.

We derive a significant amount of revenue from a relatively small number of customers and occasionally enter into concentrate spot market sales with metal traders.

For the fiscal year ended December 31, 2024, our three largest customers accounted for approximately 28%, 19% and 17%, respectively, of our total revenues. Given our operations produce unique qualities of concentrates, which a limited number of smelters can process effectively, we enter into long-term benchmark contracts for a majority of our total concentrates production. We expose lesser portions of our concentrates production to spot market sales to metal traders to benefit from favorable spot market sales terms from time to time. Our results of operations, financial condition and cash flows could be materially adversely affected if one or more of our long-term customers were to decide to interrupt or curtail their activities, terminate their contracts with us or fail to renew existing contracts. Additionally, if spot market conditions deteriorate rapidly, we could have difficulty selling a portion of our concentrates, and metal traders could refuse to perform under existing contracts, which could also result in materially adverse effects on our results of operations, financial conditions and cash flows. See Note 4 of Notes to Consolidated Financial Statements for more information on the distribution of our sales and our significant customers.

Shortages of critical parts and equipment may adversely affect our operations and development projects.

We have been impacted, from time to time, by increased demand for critical resources such as input commodities, drilling equipment, trucks, shovels and tires. These shortages have, at times, impacted the efficiency of our operations, and resulted in cost increases and delays in construction of projects; thereby impacting operating costs, capital expenditures and production and construction schedules.

Our foreign activities are subject to additional inherent risks.

We currently have operations in Canada (and limited activities in Mexico), and we expect to continue to conduct operations there and possibly other international locations in the future. Because we conduct operations internationally, we are subject to political, social, legal and economic risks such as:

•the effects of local political, labor and economic developments and unrest;

•significant or abrupt changes in the applicable regulatory or legal climate;

•significant changes to regulations or laws or the interpretation or enforcement of them;

•exchange controls and export restrictions;

•expropriation or nationalization of assets with inadequate compensation;

•unfavorable currency fluctuations, particularly in the exchange rate between the U.S. dollar and the Canadian dollar and Mexican Peso;

•repatriation restrictions;

•invalidation and unavailability of governmental orders, permits or agreements;

•property ownership disputes;

•renegotiation or nullification of existing concessions, licenses, permits and contracts;

•criminal activity, corruption, demands for improper payments, expropriation, and uncertain legal enforcement and physical security;

•failure to maintain compliance with corruption and transparency statutes, including the U.S. Foreign Corrupt Practices Act;

•disadvantages of competing against companies from countries that are not subject to U.S. laws and regulations;

•fuel or other commodity shortages;