permits, us to incur secured debt up to specified limits. As a result, the notes and the guarantees will be effectively subordinated to our and our guarantors’ future secured indebtedness with respect to the collateral that secures such indebtedness, including any borrowings under our senior credit facility. Upon a default in payment on, or the acceleration of, any of our secured indebtedness, or in the event of bankruptcy, insolvency, liquidation, dissolution, reorganization or other insolvency proceeding involving us or such guarantor, the proceeds from the sale of collateral securing any secured indebtedness will be available to pay obligations on the notes only after such secured indebtedness has been paid in full. As a result, the holders of the notes may receive less, ratably, than the holders of secured debt in the event of a bankruptcy, insolvency, liquidation, dissolution, reorganization or other insolvency proceeding involving us or such guarantor.

Any draw-downs on our senior credit facility would be secured debt. With the exception of the $33.6 million in letters of credit outstanding, we did not have a balance drawn on the senior credit facility as of December 31, 2019.

Our subsidiaries that provide, or will provide, guarantees of the notes will be automatically released from those guarantees upon the occurrence of certain events.

Our subsidiaries that provide, or will provide, guarantees of the notes will be automatically released from those guarantees upon the occurrence of certain events, including the following:

| | • | | the release or discharge of such guarantor’s obligations or guarantee under all Credit Facilities (as defined in “Description of the Notes”) and its guarantee of any other indebtedness of ours in excess of $10 million in aggregate principal amount; |

| | • | | the sale or other disposition, including the sale of substantially all the assets, of that guarantor; or |

| | • | | the discharge of our obligations under the indenture that will govern the notes. |

If any subsidiary guarantee is released, no holder of the notes will have a claim as a creditor against that subsidiary, and the indebtedness and other liabilities, including trade payables and preferred stock, if any, whether secured or unsecured, of that subsidiary will be structurally senior to the claim of any holders of the notes. See “Description of the Notes — Note Guarantees.”

We may be unable to generate sufficient cash to service all of our indebtedness, including the notes, and meet our other ongoing liquidity needs and may be forced to take other actions to satisfy our obligations under our indebtedness, which may be unsuccessful.

Our ability to make scheduled payments or to refinance our debt obligations, including the notes, and to fund our planned capital expenditures and other ongoing liquidity needs depends on our financial and operating performance, which is subject to prevailing economic and competitive conditions and to certain financial, business and other factors beyond our control. We cannot assure you that our business will generate sufficient cash flow from operations or that borrowings will be available to us to pay the principal, premium, if any, and interest on our indebtedness or to fund our other liquidity needs. We may need to refinance all or a portion of our debt, including the notes, on or before maturity. We may be unable to refinance any of our debt on commercially reasonable terms or at all.

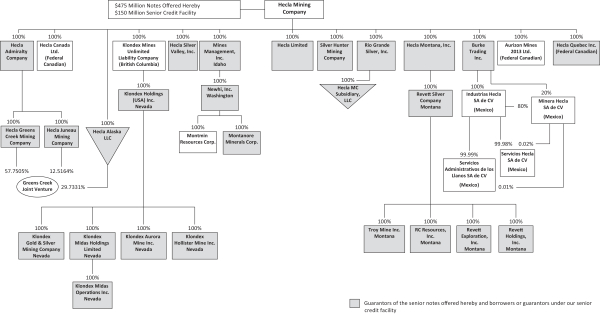

In addition, we conduct substantially all of our operations through our subsidiaries, certain of which will not be guarantors of the notes or our other indebtedness. Accordingly, repayment of our indebtedness, including the notes, is dependent on the generation of cash flow by our subsidiaries and their ability to make such cash available to us, by dividend, debt repayment or otherwise. Unless they are guarantors of the notes or our other indebtedness, our subsidiaries do not have any obligation to pay amounts due on the notes or our other indebtedness or to make funds available for that purpose. Our subsidiaries may not be able to, or may not be permitted to, make distributions to enable us to make payments in respect of our indebtedness, including the notes. Each subsidiary is a distinct legal entity and, under certain circumstances, legal and contractual restrictions

S-18