- HL Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Hecla Mining (HL) DEF 14ADefinitive proxy

Filed: 12 Apr 22, 6:05am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE 14A

(RULE 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Pursuant to Section 240.14a-11(c) or Section 240.14a-12 | |

Hecla Mining Company

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 | |||

MESSAGE FROM YOUR BOARD OF DIRECTORS

| Board of Directors

From left (back): Charles B. Stanley, Ted Crumley, George R. Johnson, Phillips S. Baker, Jr., and Terry V. Rogers

From left (front): Catherine J. Boggs, Alice Wong, and Stephen F. Ralbovsky

| |||||

Hecla’s Board of Directors believes strong governance strengthens the Company’s policies and performance and will distinguish Hecla as a respected precious metals producer. Operating transparently and with integrity has helped the Company earn the trust of our shareholders, credibility within the communities where we operate, and dedication from our employees. | ||||||

Dear Fellow Shareholder:

As your Board of Directors, we are pleased to report that, in a year filled with uncertainty, Hecla had a record year both operationally and financially. Hecla was able to accomplish this due to our dedicated employees who were not only able to maintain the continuity of the business in the face of COVID-19 and the myriad of related challenges, but also able to achieve significant milestones, and to do so safely and innovatively.

Performance and Innovation in a Challenging Environment

Despite the challenging environment, Hecla performed well in 2021. Highlights include:

• Produced 12.9 million silver ounces and 201,327 gold ounces, meeting production and cost guidance. • Second highest reserves for both silver and gold in Company history. • Developed the Underhand Closed Bench mining method at Lucky Friday, which contributed to the 75% increase in silver production and showed improvements in managing seismicity. • In 2021, the Hecla Charitable Foundation donated more than $464,000 toward education, youth activities, community programs, and health services activities in communities in which we operate. | • Strong safety performance with an all-injury frequency rate of 1.45, 40% below the U.S. national average. • Returned $20.7 million, or 19%, of free cash flow to our shareholders through dividends. • Second highest cash flow from operations of $220.3 million and free cash flow of $111.3 million.1 • 2nd best performing stock in our peer group from 2019-2021. |

Our People

For over 130 years, our people have been our most valuable asset. As of December 31, 2021, Hecla employed approximately 1,650 people. The vast majority of Hecla’s employees are full-time, and approximately 15% are covered by a collective bargaining agreement. Since we are often among the largest private-sector employers in the communities in which we operate, it is important that we fairly compensate our employees. For many decades we have offered competitive wages and among the highest valued benefits where we operate. In addition to competitive base wages, we offer retirement benefits, health insurance benefits, incentive plans, and paid time off. We believe our retirement benefits, which include both defined benefit and defined contribution plans for U.S.-based employees, set us apart from many other employers.

Creating greater gender diversity in a predominantly male industry is among the priorities of Hecla in the coming years. Management is working to increase the representation of women, local and indigenous people (where applicable) and other diverse people throughout Hecla’s workforce.

Health and Safety

The safety and health of our employees is of paramount importance. Hecla invests in effective ways to operate our mines more safely. Our goal is to achieve world-class safety and health performance by promoting a deeply rooted value-based culture of safety and utilizing technology and innovation to continually improve the safety at Hecla’s operations. Hecla invests in our people with training and workforce development programs that focus on safety first. All employees receive training that complies with or exceeds applicable safety and health regulations as set by the applicable governing body where each operation is located. As part of Hecla’s commitment to safety, we track a variety of safety performance indicators, including injuries, near misses, observations, and equipment damages. Company-wide, Hecla’s all injury frequency rate dropped by 76% from 2012 to 2021.

| 1 | A non-GAAP measurement. See Appendix A for reconciliation to GAAP. |

2022 Proxy Statement i

Message from Your Board of Directors

Approach to Sustainability and Advancing on Environmental, Social and Governance (“ESG”)

Hecla is proud to produce the essential metals that shape everyday life, and we take seriously our mandate to ensure that the process of extracting those metals has a positive impact on the daily lives of our communities. Our work provides large economic and social benefits to rural communities, yet our geographic and environmental footprint is small. In 2021, we reduced our greenhouse gas emissions by 43.7% from our 2019 baseline level and have offset 76,550 tonnes of emissions through purchasing and retiring carbon credits, achieving a net zero carbon emissions level.

Active Board Refreshment

Since 2016, 50% of the Board of Directors has changed as we have welcomed four new directors, including two women. This year we will say goodbye to Terry V. Rogers and Ted Crumley, who will retire after the Annual Meeting. With their departure, our average tenure will decrease from 12 years to 9 years. While we will miss Mr. Rogers and Mr. Crumley, and their wealth of contributions and experience, we look forward to the opportunity to further refresh the Board of Directors. As demonstrated by recent additions, we remain committed to recruiting additional independent directors who will expand our Board of Director’s skillsets, perspectives, and capabilities, with the objective of having a Board of Directors with expansive and diverse experience, a deep understanding of the challenges and opportunities associated with our business, and a focus on value and sustainability for the benefit of all stakeholders.

Annual Meeting

For the past two years in response to the pandemic, we held our annual meetings virtually. This year, we will take a hybrid approach by having a live meeting, as well as a virtually alternative meeting via a live audio webcast.

As your Board of Directors, we want to thank you for your continued confidence in Hecla. We appreciate the opportunity to serve Hecla on your behalf as we continue to navigate through these unprecedented times but with excitement for what the future holds for the largest U.S. silver producer.

Ted Crumley

Chairman

Stephen F. Ralbovsky

Director

Terry V. Rogers

Director

Charles B. Stanley

Director

George R. Johnson

Director

Alice Wong

Director

Phillips S. Baker, Jr.

Chief Executive Officer, President and Director

Catherine J. Boggs

Director

ii www.hecla-mining.com

PROXY STATEMENT

ANNUAL MEETING OF SHAREHOLDERS

MAY 26, 2022

| iv | ||||

| 1 | ||||

| 1 | ||||

| 1 | ||||

| 1 | ||||

| 2 | ||||

| 2 | ||||

| 2 | ||||

| 2 | ||||

| 3 | ||||

| 3 | ||||

| 3 | ||||

| 4 | ||||

| 5 | ||||

| 6 | ||||

| 6 | ||||

| 8 | ||||

| 8 | ||||

| 8 | ||||

| 8 | ||||

| 9 | ||||

| 9 | ||||

| 9 | ||||

| 10 | ||||

Majority Voting for Directors and Director Resignation Policy | 13 | |||

| 13 | ||||

| 13 | ||||

| 13 | ||||

| 16 | ||||

| 16 | ||||

Board and Committee Independence; Audit Committee Financial Expert | 19 | |||

| 19 | ||||

| 19 | ||||

| 20 | ||||

| 20 | ||||

| 20 | ||||

| 21 | ||||

| 22 | ||||

| 22 | ||||

Current Class III Nominees for Election to the Board – Term Ending at the 2022 Annual Meeting | 23 | |||

Continuing Class I Members of the Board – Term Ending at the 2023 Annual Meeting | 24 | |||

Continuing Class II Members of the Board – Term Ending at the 2024 Annual Meeting | 25 | |||

| 26 | ||||

| 26 | ||||

| 26 | ||||

| 26 | ||||

| 27 | ||||

| 27 | ||||

Non-Management Director Stock Ownership Guidelines | 27 | |||

| 29 | ||||

| 29 | ||||

| 30 | ||||

| 30 | ||||

| 30 | ||||

PROPOSAL 3 - APPROVAL, ON AN ADVISORY BASIS, OF OUR EXECUTIVE COMPENSATION | 32 | |||

| 33 | ||||

| 34 | ||||

| 35 | ||||

| 36 | ||||

| 37 | ||||

The Compensation Committee Process and the Role of Management and Human Resources Department | 38 | |||

| 39 | ||||

| 41 | ||||

| 43 | ||||

| 52 | ||||

| 53 | ||||

| 53 | ||||

| 54 | ||||

| 55 | ||||

| 56 | ||||

| 56 | ||||

| 57 | ||||

| 57 | ||||

| 60 | ||||

| 62 | ||||

| 63 | ||||

| 64 | ||||

| 65 | ||||

| 65 | ||||

| 66 | ||||

Summary of Potential Payments Upon Termination or Change in Control | 67 | |||

| 71 | ||||

| 72 | ||||

| 74 | ||||

| 74 | ||||

| 74 | ||||

| 74 | ||||

Shareholder proposals to be included in next year’s Proxy Statement | 75 | |||

Security Ownership of Certain Beneficial Owners and Management | 75 | |||

| 78 | ||||

| A-1 | ||||

2022 Proxy Statement iii

NOTICE OF 2022 ANNUAL MEETING OF SHAREHOLDERS

To the Shareholders of Hecla Mining Company:

NOTICE IS HEREBY GIVEN that due to the public health impact of COVID-19, and to support the varying levels of comfort regarding in person gatherings, this year’s Annual Meeting of Shareholders (“Annual Meeting”) of Hecla Mining Company (“we,” “our,” “us,” “Hecla,” or the “Company”) will be held on Thursday, May 26, 2022, at 8:30 a.m. PDT in a hybrid (virtual and in person) meeting format. The Annual Meeting will be held in person at the Elks Lodge #331, 419 Cedar St., Wallace, Idaho, and virtually, via www.virtualshareholdermeeting.com/HL2022, on Thursday, May 26, 2022, at 8:30 a.m. PDT. During the meeting, shareholders will be asked to:

| Proposal 1 – | Elect two Class III Directors; | |

| Proposal 2 – | Ratify the Appointment of BDO USA, LLP as our Independent Registered Public Accounting Firm for 2022; and | |

| Proposal 3 – | Approve, on an advisory basis, named executive officer compensation. | |

Shareholders will also transact such other business as may be brought properly before the meeting and all adjournments or postponements thereof.

Whether you plan to attend the Annual Meeting, or any postponement or adjournment thereof, you are urged to submit your proxy as soon as possible so that your shares can be voted at the meeting in accordance with your instructions. To participate and vote your shares during the meeting, please see Attending the Virtual Meeting or Attending the Meeting in Person on page 78 for additional information.

The Board of Directors (“Board”) has fixed the close of business on March 28, 2022, as the record date for the determination of shareholders entitled to notice of, and to vote at, the Annual Meeting and at any adjournment or postponement thereof (“Record Date”). A list of the shareholders of record entitled to vote at the Annual Meeting will be available for review by any shareholder, for any purpose related to the meeting, between 7:00 a.m. and 4:30 p.m. PDT at Hecla Mining Company, 6500 N. Mineral Dr., Suite 200, Coeur d’Alene, Idaho 83815, for ten days prior to the meeting and on the day of the meeting. The list will also be available to shareholders at www.virtualshareholdermeeting.com/HL2022 during the Annual Meeting.

PLEASE REVIEW THE PROXY STATEMENT AND VOTE IN ONE OF FOUR WAYS:

| VIA THE INTERNET Visit www.proxyvote.com Follow instructions provided on your proxy card or voting instruction form |

|

| BY MAIL Sign, date and return your proxy card or voting instruction form | ||||

| BY TELEPHONE Call the telephone number on your proxy card, |

| IN PERSON Vote at the meeting by completing a ballot | |||||

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting to be held on May 26, 2022. This Proxy Statement and our 2021 Annual Report are available at www.hecla-mining.com, and at www.proxyvote.com.

We are mailing our “Notice of Internet Availability of Proxy Materials” to shareholders on or about April 12, 2022, which contains instructions on how to access our Proxy Statement and 2021 Annual Report (“Proxy Materials”) online. We are also mailing a full set of our Proxy Materials to shareholders who previously requested paper copies of the materials. Our Proxy Materials can also be viewed on our website at www.hecla-mining.com under “Investors” and then selecting “Annual Meeting,” or at www.proxyvote.com.

By Order of the Board of Directors

Michael B. White

Corporate Secretary

April 12, 2022

2022 Proxy Statement iv

This summary highlights information contained elsewhere in this Proxy Statement. It does not contain all the information you should consider. You should read the entire Proxy Statement carefully before voting. For more complete information regarding the Company’s 2021 performance, please review our Annual Report on Form 10-K.

Agenda and Voting Recommendations

Proposal 1

Election of Directors

Board Vote Recommendation FOR

Page 22 | Proposal 2

Ratify the Appointment of

Board Vote Recommendation FOR

Page 29 | Proposal 3

Advisory Vote on Executive Compensation

Board Vote Recommendation FOR

Page 32 |

Environmental | Social | Governance | ||

• Scope 1 and Scope 2 greenhouse gas emissions reduced 44% from 2019 baseline level to 76,550 tonnes CO2e. • Retired equivalent tonnage of United Nations Certified Emissions Reduction credits to be net zero (on Scope 1 and Scope 2 emissions) in 2021. • In 2021, 99% of our electricity used at our mines was line power. Of that, 70% was generated from renewable hydropower. | • Women comprise 10% of Hecla’s workforce, and 21% of managerial positions. • 80% of our workforce is local to our operations. • In 2021, the Hecla Charitable Foundation donated more than $464,000 toward education, youth activities, community programs, and health services activities in communities in which we operate. • In 2021 at our Casa Berardi Mine, two five-year contracts were awarded to Construction Kiwetin for maintenance and transportation services and will employ 25 First Nation workers annually over the life of the contracts. | • Four of eight directors joined the Board after 2016, including one in 2021. • 1 director retired in 2021, and 2 directors will retire after the 2022 Annual Meeting, dropping average Board tenure from 12 years to nine years. • 25% of our directors are women. • We will have a new Chairperson for the first time in 16 years. • Our Chairman of the Board is independent of our Chief Executive Officer. • Directors who receive more “Against” votes than “For” votes must tender their resignation to the Board for consideration. | ||

Operational Highlights • 2nd highest reserves for both gold and silver in the Company’s 130-year history. • Developed the Underhand Closed Bench mining method at our Lucky Friday Mine, which contributed to the 75% increase in silver production at the Lucky Friday Mine and helped to manage seismicity. • Strong safety performance with an all-injury frequency rate of 1.45, 40% below the U.S. national average; 58% reduction from 2016 to 2021. | Financial Highlights • Record sales of $807.5 million with net income of $35.1 million. • Record Adjusted EBITDA of $278.8 million.2 • Cash flow from operations of $220.3 million, and free cash flow of $111.3 million3 which is the second highest in Hecla’s history. • Returned $20.7 million, or 19%, of free cash flow to our common and preferred shareholders through dividends. • 2nd best performing stock in our peer group from 2019-2021, based on total shareholder return. | |||

| 2 | A non-GAAP measurement. See Appendix A for a reconciliation to GAAP. |

| 3 | A non-GAAP measurement. See Appendix A for a reconciliation to GAAP. |

2022 Proxy Statement 1

We view engagement with our shareholders as a critical part of our corporate governance and social responsibility profile. Among other benefits, proactive engagement with our shareholders helps us to understand expectations for our performance, maintain transparency, and shape corporate governance and compensation policies. Over the last several years we have undertaken significant shareholder outreach efforts to elicit and understand the concerns of our shareholders and other stakeholders. Participants include management of the Company, including our Senior Vice President – Chief Administrative Officer (“Sr. Vice President and CAO”), Senior Vice President and Chief Financial Officer (“Sr. Vice President and CFO), Vice President – General Counsel, Vice President – Corporate Development & Sustainability, and Assistant Secretary. If requested by a stakeholder, our chairpersons of each committee of the Board are available to join our engagements.

In November and December 2021, we sought engagement with 30 of our largest shareholders and three shareholders responded. We also spoke with one proxy advisory firm. All others who responded said they did not need to meet with us to discuss any matters. In 2021, management also conducted approximately 18 presentations for analysts and investors, held approximately 105 one-on-one and group meetings with investors, and hosted four quarterly conference calls with investors and analysts allowing for questions and answers with management. In addition, the Company responded to questions from investors and analysts by telephone and email throughout the year.

In 2021, our Say-on-Pay proposal received 97% support. During our shareholder outreach this year, there were no significant discussions with, or concerns expressed by shareholders, about our executive compensation program.

Additional topics discussed with shareholders and proxy advisory firms focused on net zero carbon emission levels, and our gap and materiality analysis to reporting frameworks (Sustainability Accounting Standards Board – metals and mining standards, Task Force on Climate-Related Financial Disclosures, and Global Reporting Initiative, as well as our Canadian operations benchmarking against the Towards Sustainability Mining protocols). See Sustainability on the following page.

In our 2021 and 2022 shareholder outreach, we discussed board diversity and refreshment. We added two new directors in 2016, one new director in 2017, and one new director in 2021, thereby reducing the average tenure of the Board. We also have two directors who will not stand for re-election at the Annual Meeting due to mandatory retirement, thus allowing us the opportunity to further refresh the Board.

We also discussed three of our corporate governance features that may have an anti-takeover effect on the Company: (i) the inability of shareholders to call special meetings; (ii) our classified Board structure; and (iii) supermajority voting provisions in our Restated Certificate of Incorporation and Bylaws. In prior years we have proposed amendments to our Restated Certificate of Incorporation and Bylaws to revise these three provisions, but the voting results have never been close to sufficient to implement change. The required vote is 80% of outstanding shares voted in favor of any such change, and we have never obtained higher than 56% of outstanding shares voted in favor. The shareholders and proxy advisory firms unanimously told us that due to the repeated failure of proposals to change these provisions at past Annual Meetings, and the desire to improve the format and readability of our Proxy Statement and the resources involved in printing and mailing a lengthier Proxy Statement, they would not object if we did not include these proposals at our Annual Meeting.

The Board will continue to assess evolving best practices in corporate governance matters, including the subjects of the prior proposals discussed above. In future years, we may again include one or more of these proposals on the agenda for an annual meeting. Furthermore, the Board will continue to consider any formal proposals and other feedback that we receive from shareholders. And, we will continue our shareholder outreach efforts so that we can understand and appropriately react to the evolving viewpoints of our shareholders on corporate governance and other matters.

2 www.hecla-mining.com

We are committed to meeting the highest standards of environmental stewardship across our operations, respecting human rights in all our business practices, and prioritizing the health, safety and well-being of our workforce and host communities where we operate. We recognize that the long-term success of the Company and sustainable value creation are dependent on integrating into our business strategies, the ESG performance factors that are most important to our stakeholders and business. Thus, we measure our ESG performance against the following benchmarks:

| • | the Sustainability Accounting Standards Board (“SASB”) – metals and mining standards; |

| • | relevant aspects of the Task Force on Climate-Related Financial Disclosures, Global Reporting Initiative; and |

| • | protocols of Towards Sustainable Mining (for our Canadian operations). |

We have also prioritized the United Nations Foundation Sustainable Development Goals that most directly align with our business, corporate strategy, and material sustainability issues.

On our website at www.hecla-mining.com, you can find Hecla’s ESG reporting and data and view our SASB-compliant 2020 Sustainability Report. We expect our 2021 Sustainability Report to be available on our website prior to the Annual Meeting. Governance is discussed in the next section of this Proxy Statement, so this section primarily focuses on the 2021 highlights around the areas of environment, safety and health, human capital management, and community engagement.

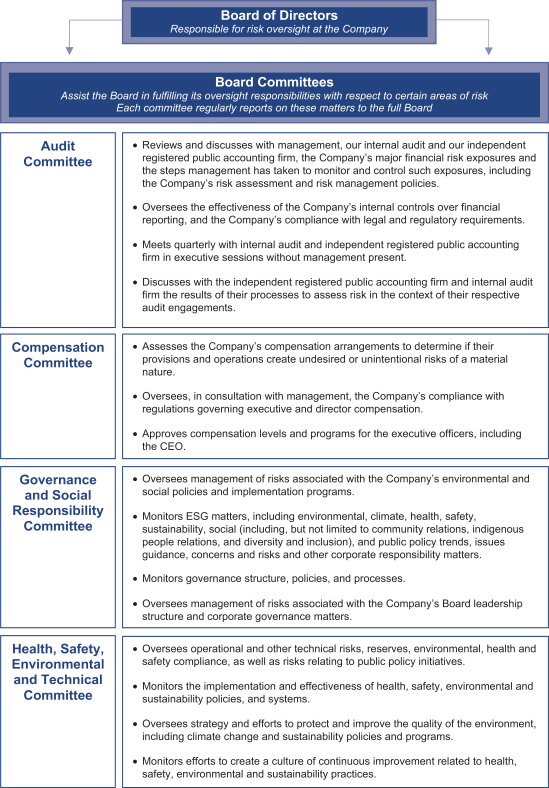

Board Oversight and Management of Sustainability

Two committees of the Board provide ESG oversight. The Health, Safety, Environmental and Technical Committee of Hecla’s Board is tasked with overseeing ESG risks, strategic plans, and progress on issues that may potentially adversely impact Hecla’s operations, activities, plans, strategies, or reputation. The focus is primarily on internal matters and the technical requirements of ESG matters. The Governance and Social Responsibility Committee (“Governance Committee”) is tasked with reviewing and making recommendations to the Board for ESG matters. The focus is primarily on policy and external matters. Each committee relies on the activities of the other.

At the executive level, the Senior Vice President and Chief Operating Officer (“Sr. Vice President and COO”), and the Vice President – Corporate Development and Sustainability report directly to our Chief Executive Officer (“CEO”) and are responsible for implementing the Company’s ESG programs. At our operations, the Vice President – General Manager, and other employees ensure continuous improvement toward sustainability goals.

As the largest silver producer in the United States, Hecla is proud to supply an essential metal used in critically important markets including renewable energy technology, medical products, and military defense technology. At the same time, we recognize the importance of responsible mining to ensure that our important work is also having a positive impact on the environments where we live and work. At each of our sites, we implement programs to reduce freshwater and energy consumption, reduce our carbon footprint, maintain local water quality backed by rigorous testing and monitoring, and reclaim the land once mining is complete.

We are committed to minimizing the environmental impact of our operations through continuous improvement of our processes. We set reduction targets for greenhouse gas (“GHG”) emissions and energy use, and we also capture and track environmental data to benchmark our operations against industry standards to ensure accountability and transparency in our progress against our goals.

Sustainability Targets

| ✓ | 30% reduction of combined GHG emissions (Scope 1 and Scope 2) from our 2019 baseline emissions of 135,301 tonnes CO2e by 2030, while maintaining a net zero (Scope 1 and Scope 2) carbon footprint through the purchase of carbon emission reduction credits; |

| ✓ | Utilize cleaner energy sources and increase the proportion of renewable energy in the Company’s energy mix, while committing to a 5% reduction in energy intensity in our operations from 2020 baseline levels; and |

| ✓ | Continually improve our climate change disclosure by incorporating climate-related risks and opportunities into our risk management and strategic planning processes aligned with the Task Force on Climate-Related Financial Disclosures framework. |

2022 Proxy Statement 3

Sustainability

Environmental Policies, Management System, and Training

Hecla’s Environmental Policy states our commitment to complying with all applicable federal, state/provincial, and local environmental laws and regulations that govern our facilities and going beyond them when minimal compliance does not meet Hecla’s values. Employees and contractors are also expected to comply with all applicable internal policies, programs, standards, and procedures as outlined in our Code of Conduct, and we conduct structured environmental reviews and audits to assess compliance at least annually.

We utilize our Environmental Management System (“EMS”) to provide consistency in our environmental programs company-wide and promote a culture of environmental awareness, innovation, and accountability across all our operations. The EMS is a 13-element program that promotes continuous improvement around issues including obligation registers, management of change, air quality, water and waste management, energy management, training, and reporting. The EMS program, which is benchmarked against ISO-14001 and complements Canada’s Towards Sustainable Mining program, is reviewed annually through internal audits and third-party reviews.

As part of our environmental management programs, we are committed to ensuring that our employees receive training to raise awareness of environmental issues and our processes to reduce environmental impact. In 2021, site workers company-wide received more than 1,500 hours of environmental training, focusing on job-specific environmental awareness, hazardous material management, spill response, and reporting.

Climate Change and Net Zero Targets

Hecla recognizes that the impacts of climate change are expected to create greater potential risks for our operations, including risks posed by increased frequency of droughts and more extreme weather events such as intense rainfalls. Potential risks to our operations include higher volumes of mine contact water requiring storage and treatment, increased requirements for stormwater diversion and associated water management systems, and reduced availability of freshwater. As part of our enterprise risk management processes, we are committed to incorporating climate-related risks and opportunities into our risk management and strategic planning processes aligned with the Task Force on Climate-Related Financial Disclosures framework.

At least every three years, we conduct structured high-level risk assessments (“HLRAs”) that include climate change considerations and appropriate materiality re-assessments. From these assessments, we develop site-specific management action plans that are assigned to the site management team for resolution. Each key risk identified in the HLRA response action plan is matched with an appropriate performance metric against which progress can be measured. Management and relevant employees meet quarterly with the Health, Safety, Environmental and Technical Committee of our Board to present project updates, including results from HLRAs and progress on material HLRA action plans.

Hecla is committed to reducing our carbon footprint. To demonstrate our commitment, we have set targets for reductions in Scope 1 and Scope 2 GHG emissions. Company-wide, we achieved a 44% reduction in Scope 1 and Scope 2 GHG emissions (76,550 tonnes CO2e) from 2019 (135,952 tonnes CO2e) and have seen the GHG Intensity score (Total Metric Tonnes GHG Emissions / Total Revenues US$M) reduced by 53% from 201.92 to 94.8 from 2019. We achieved a carbon neutral or net zero emissions level in 2021 for our Scope 1 and Scope 2 emissions by purchasing and retiring an equivalent emission tonnage of Certified Emission Reduction credits associated with the Tatay Hydroelectric Project in Cambodia.

4 www.hecla-mining.com

Sustainability

|

Environmental Highlights

|

Climate Change:

| • | 44% reduction in Scope 1 and Scope 2 GHG emissions from our 2019 baseline levels. |

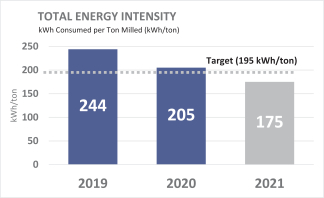

Total Energy Intensity:

| • | We continue to reduce our energy intensity, exceeding our multi-year 5% energy intensity reduction goal. |

Integrated Environmental Working Groups:

| • | Each of our sites has a Tailings, Waste and Water Working Group that considers, among other aspects, climate change-related impacts that could affect site operations which are then integrated into design of mine facility infrastructure. |

Renewable Energy:

| • | In 2021, 99% of our electricity used at our mines was line power. Of that, 70% was generated from renewable hydropower. |

Closure:

| • | Hecla continued reclamation at the Troy Mine by finalizing demolition of the office, maintenance, crushing, and milling facilities which were all located on U.S. Forest Service administered public land. Reclamation work completed resulted in release of nearly $8 million in financial assurance by the state. |

| • | At our San Sebastian Mine site, we progressed our open pit closure by placing over 3,800,000 tons of waste rock back into the open pits. We partnered with a local contractor for completion of this work. |

Hecla’s commitment to the safety and health of our workforce has been an essential part of our corporate culture for over 130 years and has enabled us to build the highest reputation for safety with our employees, our communities, and within the industry. We work to operate our mines safely by promoting a deeply rooted value-based culture, leveraging mining expertise developed over the Company’s long history, and innovating new practices that improve safety while increasing productivity. As an example, 2021 saw the development of the Underhand Closed Bench (“UCB”) mining method at the Lucky Friday Mine. The UCB method has improved our ability to manage seismicity at the mine.

|

Safety and Health Highlights

|

All-Injury Frequency Rate of 1.45, 40% lower than U.S. National Average:

Zero Fatalities:

| • | In 2021, we had zero employee or contractor fatalities. |

Decrease in Non-compliance Violations:

| • | We had 93 total non-compliance violations in 2021, representing a 54% reduction since 2020. |

| • | In 2021, Hecla’s Casa Berardi Mine received the John T. Ryan Safety Trophy for the Quebec-Maritime Provinces Region for outstanding safety performance. The annual award is given by the Canadian Institute of Mining, Metallurgy and Petroleum to the mine with the lowest reportable injury frequency. |

2022 Proxy Statement 5

Sustainability

Hecla’s human capital management is dedicated to investing continuously in the technology, training, systems, and programs that help protect and support our people. We also strive to have our workforce mirror the local demographic diversity, including but not limited to gender, ethnicity and local indigenous people (where applicable). As of December 31, 2021, Hecla employed approximately 1,650 people, of which approximately 950 were employed in the United States, 650 in Canada, and 50 in Mexico. The vast majority of Hecla’s employees are full-time, and approximately 15% of the employees are covered by a collective bargaining agreement. Creating greater gender diversity in a predominantly male industry is among the priorities of Hecla in the coming years. Management is working to increase the representation of women, local and indigenous people (where applicable) and other diverse people throughout Hecla’s workforce.

At the executive level, the Sr. Vice President and CAO reports directly to the CEO and is responsible for implementing the Company’s human capital management program. The position is an executive-level position to reflect the priority we place on utilizing our human capital resources to meet our business strategy. At the local level, each operating site has a human resource professional whose primary role is to manage the Company’s human capital management program at their respective site.

|

Human Capital Management Highlights

|

Gender Diversity:

| • | 10% of our workforce are women and 21% hold managerial positions. |

Hiring Local:

| • | 80% of our workforce is local to our operations. |

Hiring First Nations:

| • | The number of First Nations persons hired from the Abitibiwinni (Pikogan) community by Hecla Quebec has more than quadrupled since 2018 from six to an average of 25 who worked at our Casa Berardi Mine in 2021. |

Protecting Human Rights:

| • | We conduct business in jurisdictions where human rights laws are respected and promoted and strive to conduct our business in a manner consistent with the United Nations Universal Declaration of Human Rights and the United Nations Guiding Principles on Business and Human Rights. |

Over our 130-year history, Hecla has always been a strong partner in the communities where we operate. Through the continued growth of our responsible mining operations, we provide significant social and economic benefits to our local communities. We are the largest private-sector employer and taxpayer in Juneau, Alaska, near our Greens Creek Mine and in Wallace/Mullan, Idaho, near our Lucky Friday Mine.

We engage with stakeholders at all our sites during every stage of the mining life cycle to become a community partner and deepen our understanding of local concerns and issues. We communicate information through a variety of methods including community meetings, local and social media, and flyers, with all materials available in the local language with translation provided if necessary. We disclose the results of environmental, economic, and social impact assessments and partner with local stakeholders to mitigate any environmental and social impacts. We also work with local stakeholders to identify opportunities for the Hecla Charitable Foundation to provide support for community initiatives.

6 www.hecla-mining.com

Sustainability

|

Community Engagement Highlights

|

Supplier Code of Conduct:

| • | The Company has a Supplier Code of Conduct that sets out the minimum standards of conduct expected from all suppliers wishing to do business with, or on behalf of, Hecla and its subsidiaries. |

Indigenous Relations:

| • | In 2021 at our Casa Berardi Mine, two five-year contracts were awarded to Construction Kiwetin for maintenance and transportation services, resulting in the employment of 25 First Nations workers annually over the life of the contracts. A contract for clearing land for exploration drilling was given to Cooperative de solidarite de Pikogan, which will employ a minimum of two workers for a three-month period. |

Supporting Communities through the Hecla Charitable Foundation:

| • | In 2021, the Hecla Charitable Foundation donated more than $464,000 toward education, youth activities, community programs, and health services activities in communities in which we operate. |

Engaging with Stakeholders:

| • | Our Greens Creek Mine was named the Alaska Chamber’s Large Business of the Year in 2021. |

Building a Skilled Workforce:

| • | In 2020, our Greens Creek Mine renewed a partnership with the University of Alaska Southeast (UAS) Center for Mine Training with a gift of $315,000 for scholarship assistance over the next three years. This makes over $1.2 million invested by the Company in this program over the past 10 years. |

2022 Proxy Statement 7

We are committed to effective corporate governance that reflects our values and supports our strategic and financial objectives and performance. Our corporate governance practices are generally reflected in our Bylaws, Corporate Governance Guidelines, Code of Conduct, Whistleblower Policy, and committee charters.

Electronic Access to Corporate Governance Documents

Our corporate governance documents are available on our website at www.hecla-mining.com by selecting the tab entitled “Investors” and then selecting the tab entitled “Governance and Ethics.” These include:

| • | Bylaws |

| • | Restated Certificate of Incorporation |

| • | Corporate Governance Guidelines |

| • | Whistleblower Policy |

| • | Code of Conduct |

| • | Code of Ethics: CEO and Senior Financial Officers |

| • | Supplier Code of Conduct |

| • | Human Rights Statement |

| • | Charters of the Audit, Compensation, Governance and Social Responsibility, and Health, Safety, Environmental and Technical Committees of the Board |

Shareholders may also request a free copy of these documents from: Investor Relations, Hecla Mining Company, 6500 N. Mineral Drive, Suite 200, Coeur d’Alene, Idaho 83815-9408; (208) 769-4100.

Corporate Governance Guidelines and Code of Conduct

The Board has adopted Corporate Governance Guidelines and a Code of Conduct in accordance with the U.S. Securities and Exchange Commission (“SEC”) and the New York Stock Exchange (“NYSE”) corporate governance standards. The Corporate Governance Guidelines were adopted by the Board to ensure that the Board is independent from management, that the Board adequately performs its function as the overseer of management, and to help ensure that the interests of the Board and management align with the interests of our shareholders.

We believe that operating with honesty and integrity has earned trust from our shareholders, credibility within our communities and dedication from our employees. Our directors, officers and employees are required to abide by our Code of Conduct to promote the conduct of our business in a consistently legal and ethical manner. Our Code of Conduct covers many topics, including conflicts of interest, confidentiality, fair dealing, proper use of the Company’s assets, and compliance with laws, rules and regulations. In addition to the Code of Conduct for directors, officers and employees, our CEO and Sr. Vice President and CFO are also bound by a separate Code of Ethics.

The Governance Committee has adopted procedures to receive, retain, and react to complaints received regarding possible violations of the Code of Conduct, and to allow for the confidential and anonymous submission by employees of concerns regarding possible violations of the Code of Conduct. Our employees may submit any concerns regarding apparent violations of the Code of Conduct to their supervisor, our Vice President and General Counsel, the Chair of the Governance Committee, or through our anonymous telephone hotline.

We have a Whistleblower Policy adopted by our Audit Committee that encourages our employees, suppliers, contractors, shareholders, customers, or other stakeholders (collectively, “stakeholders”) to report to appropriate Company representatives, without fear of retaliation, any information relating to possible fraud or questionable accounting, internal controls, or auditing matters. Stakeholders may confidentially submit any concerns to the Company’s Vice President and General Counsel, or through an anonymous telephone hotline or a special website. The goal of this policy is to discourage illegal activity and business conduct that damages Hecla’s reputation, business interests, and our relationship with stakeholders.

In 2021, we did not receive any complaints under our Whistleblower Policy.

8 www.hecla-mining.com

Corporate Governance

Stakeholders wishing to communicate with our Chairman of the Board (“Chairman”) or with the independent directors as a group may do so by delivering or mailing the communication in writing to: Chairman of the Board, c/o Corporate Secretary, Hecla Mining Company, 6500 N. Mineral Drive, Suite 200, Coeur d’Alene, Idaho 83815-9408. Concerns relating to accounting, internal controls or auditing matters are immediately brought to the attention of our internal auditor and handled in accordance with procedures established by the Audit Committee with respect to such matters. From time to time, the Board may change the process by which stakeholders may communicate with the Board or its members. Please refer to our website at www.hecla-mining.com, selecting the tab entitled “Investors” and then the tab entitled “Governance and Ethics,” for any changes in this process.

Currently, the positions of CEO and Chairman are held by separate persons. The Board believes this structure is optimal for the Company at this time because it allows the CEO to focus on leading the Company’s business and operations, and the Chairman to serve as a sounding board and advisor to the CEO, and to lead the activities of the Board. The Board has also determined that having this structure ensures a greater role for the independent directors in the oversight of the Company, and it enhances the Board’s independence and, we believe, senior management’s accountability to the Board.

In the future, if the individual elected as Chairman also were to be the CEO, the independent directors would elect a Lead Independent Director for a one-year term. This would help ensure continued robust independent leadership of the Board.

Currently, our Chairman chairs meetings of the Board, as well as the executive sessions with independent members of the Board. The Chairman’s duties include:

| • | chairing annual shareholder meetings; |

| • | overseeing the preparation of agendas for Board meetings; |

| • | preparing for executive sessions of the Board and providing feedback to the CEO; |

| • | staying current on developments to determine when it may be appropriate to alert the Board to significant pending developments; and |

| • | serving as a liaison between independent directors and the CEO with respect to sensitive issues. |

Executive sessions of independent directors are included on the agenda for every regularly scheduled Board meeting. During 2021, executive sessions were held at each regularly scheduled Board meeting. The executive sessions are chaired by the Chairman. Our independent directors meet in executive sessions without management present unless the independent directors request their attendance. For the foregoing reasons, we have determined that our leadership structure is appropriate in the context of our specific circumstances.

In accordance with our Corporate Governance Guidelines, the Governance Committee reviews annually the composition and size of the Board, recognizing the importance of refreshment to maintain a balance of tenure, diversity, skill sets and experience on our Board. Our Board currently consists of eight members, seven of whom the Board has affirmatively determined are independent. There are three Class III directors whose terms will expire at the Annual Meeting: Ted Crumley, Terry V. Rogers, and Charles B. Stanley. Messrs. Crumley and Rogers have reached the mandatory retirement age and will not stand for re-election. Due to these retirements, the Board will reduce its size from eight members to six members at the Annual Meeting.

Since 2016, we have recruited four new Board members. These four additions to our Board are consistent with our objective to have a Board with expansive and diverse experience, a deep understanding of the challenges and opportunities associated with our business and a focus on value and sustainability for the benefit of all stakeholders. With the upcoming retirement of Messrs. Crumley and Rogers, our director recruitment efforts are ongoing and further additions to the Board are anticipated within the next year.

2022 Proxy Statement 9

Corporate Governance

Identifying and Evaluating Nominees for Director

Director Selection Process

| 1 | Candidate Recommendations |  | 2 | Governance Committee |  | 3 | Board of Directors |  | 4 | Shareholders

| ||||||||||||||||

| From shareholders, management, directors, and search firms | • Evaluates the Board’s needs and screens and interviews candidates • Reviews qualifications and expertise, tenure, regulatory requirements, and diversity • Recommends nominees | Discusses, analyzes independence, and selects nominees for election | Vote on nominees at annual meeting | |||||||||||||||||||||||

The Governance Committee uses a variety of methods for identifying and evaluating nominees for director. The Governance Committee is responsible for ensuring that the composition of the Board accurately addresses the needs of our business. In the event vacancies are anticipated, or arise, the Governance Committee considers various potential candidates for director. Candidates may come to the attention of the Governance Committee through current Board members, professional search firms, shareholders, or other persons. Consideration of new director nominee candidates typically involves a series of internal discussions, review of information concerning candidates and interviews with selected candidates. The Governance Committee then determines the best qualified candidates based on the established criteria and recommends those candidates to the Board for election.

While the Governance Committee and our Board prioritize maintaining a board that is comprised of directors with a diverse set of skills, backgrounds, experiences, and perspectives, they also recognize the importance of balancing these qualifications with the overall tenure of directors in their long-term approach to board refreshment. The fresh viewpoints and philosophies newer directors bring, coupled with the valuable experience and institutional knowledge the longer-tenured directors possess, benefits the Board and its overall contribution to the Company.

The Board has appointed four highly qualified directors since 2016 who bring insight to areas such as mining, international business, acquisitions, operations, legal, risk management, geology, engineering, finance, and tax. To supplement our newer directors, our longer-tenured directors have extensive knowledge of our operations and have the perspective of overseeing our business activities through economic cycles and across differing competitive environments.

We hold the view that the continuing service of qualified incumbents promotes stability and continuity in the boardroom, contributing to the Board’s ability to work as a collective body, while giving us the benefit of familiarity and insight into our affairs that our directors have accumulated during their tenure. Recent additions to the Board provide new perspectives and diversity, while directors who have served for a number of years bring experience, continuity, institutional knowledge, and insight into the Company’s business and industry. Directors with relevant business and leadership experience provide the Board with a useful perspective on business strategy and significant risks, and an understanding of the challenges facing the business. Accordingly, the process for identifying nominees reflects our practice of re-nominating incumbent directors who (i) continue to satisfy the Governance Committee’s criteria for membership on the Board, (ii) the Governance Committee believes continue to make important contributions to the Board, and (iii) consent to continue their service on the Board. Directors should also be able to commit the requisite time for preparation and attendance at regularly scheduled Board and committee meetings, as well as be able to participate in other matters necessary to ensure good corporate governance is practiced.

The Governance Committee reviews annually with the Board the composition of the Board as a whole and recommends, if necessary, measures to be taken so that the Board reflects the appropriate balance of knowledge, experience, skills, expertise, and diversity required for the Board as a whole and contains at least the minimum number of independent directors required by applicable laws and regulations. Board members should possess such attributes and experience as are necessary for the Board as a whole and contain a broad range of personal

10 www.hecla-mining.com

Corporate Governance

characteristics, including diversity of backgrounds, management skills, mining, accounting, finance, and business experience. Summarized below is a description of why each core competency is important for service on Hecla’s Board.

Knowledge, Skills and Experience |  |  |  |  |  |  |  |  | ||||||||

Audit Committee Financial Expert | ∎ | |||||||||||||||

Board Service on Public Companies We value individuals who understand public company reporting responsibilities and have experience with the issues commonly faced by public companies. Five of our directors have served on boards of other public companies. | ∎ | ∎ | ∎ | ∎ | ∎ | |||||||||||

CEO Experience These skills are important to gain a practical understanding of organizations and drivers of individual growth and development. Seven of our directors have had some experience in the administration of a multijurisdictional company. Two of our directors have experience as a chief executive officer. | ∎ | ∎ | ||||||||||||||

Corporate Governance Experience with governance principals and policies. All our directors have had experience in corporate governance. | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ||||||||

Environmental and Social Responsibility Experience with environmental and social responsibility initiatives, including sustainability, diversity, and inclusion. Six of our directors have experience in environmental and social responsibility. | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ||||||||||

Finance We believe that an understanding of finance and financial reporting processes is important for our directors to monitor and assess the Company’s operating and strategic performance and to ensure accurate financial reporting and robust controls. It is important to have experience in capital markets, corporate finance, accounting, and financial reporting and several of our director’s satisfy the “accounting or related financial management experience” criteria set forth in the NYSE listing standards. Three of the eight directors satisfy the “audit committee financial expert” criteria set forth in regulations of the SEC, but only one of those directors sits on the Audit Committee. All of our directors have financial knowledge and are financially literate. | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ||||||||

Geology, Mining and Engineering It is important that some of our directors have experience in open-pit and underground mines, as well as knowing the science and technology of extracting minerals, exploration, geology, metallurgy, and geotechnical engineering experience. Two of our directors have experience managing mining operations. Three of our directors have experience in geology, mining, and/or engineering. | ∎ | ∎ | ∎ | |||||||||||||

Industry Experience Having experience in our industry or a similar industry contributes to a deeper understanding of our business strategy, operations, key performance indicators and competitive environment. All of our directors have experience in mining or a similar industry. | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ||||||||

Industry Association Participation Experience in organizations that support companies and employers in the mining industry and protect their rights. Three of our directors have chaired an industry organization. Seven of our directors have a long and highly regarded reputation in the industry. | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | |||||||||

International Business With operations in Mexico and Canada and prospects for further expansion, international experience helps us understand opportunities and challenges. All of our directors have had international business experience. | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ||||||||

Senior Leadership Experience serving as CEO or a senior business executive, as well as hands-on leadership experience in core management areas, such as strategic and operational planning, financial reporting, compliance, risk management and leadership development, provides a practical understanding of how organizations like Hecla function. All of our directors have senior business leadership experience. | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ||||||||

Legal and Compliance Hecla is subject to a broad array of government regulations. Mining is impacted by changes in law or regulation in areas such as safety, environmental and disclosure. Several of our directors have experience in regulated industries, providing them with insight and perspective in working constructively and proactively with governments and agencies. Three of our directors have formal legal education and understand the legal risks and obligations of the Company. | ∎ | ∎ | ∎ |

2022 Proxy Statement 11

Corporate Governance

Knowledge, Skills and Experience |  |  |  |  |  |  |  |  | ||||||||

Reputation in the Industry | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ||||||||

Risk Management Considering the Board’s role in risk oversight, we seek directors who can contribute to the identification, assessment and prioritization of risks facing the Company. All of our directors have experience with our business to understand key areas of risk. | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ||||||||

Strategic Planning, Business Development, Business Operations Experience defining and driving strategic direction and growth and managing the operations of a business or large organization. All of our directors have experience in setting and managing the strategic direction of a business. | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ||||||||

Demographics | ||||||||||||||||

Race/Ethnicity | ||||||||||||||||

Asian/Pacific Islander | ∎ | |||||||||||||||

White/Caucasian | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | |||||||||

Gender | ||||||||||||||||

Male | ∎ | ∎ | ∎ | ∎ | ∎ | ∎ | ||||||||||

Female | ∎ | ∎ | ||||||||||||||

Board Tenure | ||||||||||||||||

Years – Average Tenure is 12 years. After Annual Meeting and retirement of Messrs. Crumley and Rogers, average tenure will be 9 years. | 21 | 5 | 27 | 6 | 6 | 15 | 15 | 1 |

In general, and as more fully outlined in our Bylaws and Corporate Governance Guidelines, in evaluating director candidates for election to our Board, the Governance Committee will: (i) consider if the candidate satisfies the minimum qualifications for director candidates as set forth in the Corporate Governance Guidelines; (ii) consider factors that are in the best interests of the Company and its shareholders, including the knowledge, experience, integrity and judgment of each candidate; (iii) consider the contribution of each candidate to the diversity of backgrounds, experience and competencies which the Board desires to have represented, with such diversity being considered among the other desirable attributes of the Board; (iv) assess the performance of an incumbent director during the preceding term; (v) consider each candidate’s ability to devote sufficient time and effort to his or her duties as a director; (vi) consider a candidate’s independence and willingness to consider all strategic proposals; (vii) consider any other criteria established by the Board and any core competencies or technical expertise necessary to manage and direct the affairs and business of the Company, including, when applicable, to enhance the ability of committees of the Board to fulfill their duties; and (viii) determine whether there exists any special, countervailing considerations against nomination of the candidate.

Director Qualifications, Evaluation, and Nomination

The Governance Committee believes nominees for election to the Board should also possess certain minimum qualifications and attributes. The nominee must: (i) exhibit strong personal integrity, character and ethics, and a commitment to ethical business and accounting practices; (ii) not be involved in ongoing litigation with the Company or be employed by an entity engaged in such litigation; and (iii) not be the subject of any ongoing criminal investigations in the jurisdiction of the United States, any state, or internationally, including investigations for fraud or financial misconduct.

In connection with the director nominees who are up for election at the Annual Meeting, the Governance Committee also considered the nominee’s role in: (i) overseeing the Company’s efforts in complying with its SEC disclosure requirements; (ii) assisting in improving the Company’s internal controls and disclosure controls; (iii) assisting with the development of the strategic plan of the Company; and (iv) working with management to implement the Company’s strategic goals and plans. Directors are expected to exemplify high standards of personal and professional integrity and to constructively challenge management through their active participation and questioning. Our Bylaws and Corporate Governance Guidelines provide that a director will not be nominated for re-election after their 75th birthday.

12 www.hecla-mining.com

Corporate Governance

In addition to fulfilling the above criteria, each nominee for election to the Board at the upcoming Annual Meeting brings a strong and unique background and set of skills to the Board, giving the Board competence and experience in a wide variety of areas, including corporate governance, executive management, legal, accounting, finance, mining, exploration, and board service. The Governance Committee has reviewed the nominees’ overall service to the Company during their terms, including the number of meetings attended, level of participation and quality of performance.

Majority Voting for Directors and Director Resignation Policy

In February 2017, the Governance Committee recommended and the Board approved amendments to the Corporate Governance Guidelines to include a director resignation policy. The policy provides that any director who is not elected by a majority of votes cast shall tender his or her resignation to the Governance Committee. The Governance Committee will recommend to the Board whether to accept or reject the resignation offer, or whether another action should be taken. In determining whether to recommend that the Board accept any resignation offer, the Governance Committee will consider all factors believed relevant by it. The Board will act on the Governance Committee’s recommendation within 90 days following certification of the election results. In deciding whether to accept the resignation offer, the Board will consider the factors considered by the Governance Committee and any additional information and factors that the Board finds relevant. If the Board accepts a director’s resignation offer pursuant to this process, the Governance Committee will recommend to the Board and the Board will thereafter determine whether to fill such vacancy or reduce the size of the Board. Any director who tenders their resignation pursuant to this provision will not participate in the proceedings of either the Governance Committee or the Board with respect to their own resignation offer. If a director’s resignation is not accepted by the Board, the director shall continue to serve until the next annual meeting of shareholders or until their successor is duly elected and qualified, or their earlier resignation or removal.

The Company’s Corporate Governance Guidelines provide the Board should include individuals with a diverse range of experiences to give the Board depth and breadth in the mix of skills represented. The Board seeks to include diversity in professional experience, skills, industry background, race/ethnicity, national origin, and gender, as well as the ability of directors (and candidates for director) to devote sufficient time to performing their duties in an effective manner.

Size of the Board of Directors

Our Bylaws require the Board to have not less than five nor more than nine members. The size of the Board may be increased or decreased within that range from time-to-time by resolution approved by the affirmative vote of a majority of the Board. On February 26, 2021, the Board increased the size of the Board from eight members to nine members due to the appointment of a new Class I director (Ms. Alice Wong). On May 19, 2021, the Board decreased the size of the Board from nine members to eight members due to the retirement of Mr. George R. Nethercutt, Jr.

The retirement of Messrs. Rogers and Crumley will cause an imbalance in the number of directors on the Board’s three classes of directors. The Company’s Bylaws and Restated Certificate of Incorporation provide that the number of directors in each class of directors shall be as nearly equal in number as possible. In order to maintain balance among the classes, Alice Wong will stand for election at the Annual Meeting as a Class III director, together with Charles B. Stanley, each with a term to expire at the 2025 annual meeting of shareholders. Immediately following the Annual Meeting, the size of the Board will be reduced to six.

Board’s Role in Oversight of Strategy and Risk Management

Our Board is engaged and involved in overseeing our strategy and takes an active role in risk oversight.

| • | The Board oversees the strategic direction of the Company, and in doing so considers the potential rewards and risks of our business opportunities and challenges, and monitors the development and management of risks that impact our strategic goals. |

| • | The Board as a whole is responsible for risk oversight at the Company, with reviews of certain areas conducted by the relevant Board committees that regularly report to the full Board. |

2022 Proxy Statement 13

Corporate Governance

| • | In its risk oversight role, the Board reviews, evaluates and discusses with appropriate members of management whether the risk management processes designed and implemented by management are adequate in identifying, assessing, managing, and mitigating material risks facing the Company, including financial, operational, social, and environmental risks. |

The Board believes that full and open communication between senior management and the directors is essential to effective risk oversight. Our Chairman regularly meets with our CEO on a variety of matters, including business strategies, opportunities, key challenges, and risks facing the Company, as well as management’s risk mitigation strategies. Senior management attends all regularly scheduled Board meetings where they conduct presentations on various matters involving our operations and are available to address any questions or concerns raised by the Board on risk management-related or other matters. Following consideration of the information presented by management, the Board provides feedback and makes recommendations, as needed, which is designed to help minimize the Company’s risk exposure. To the extent any risks identified by each standing committee of the Board are material or otherwise merit discussion by the whole Board, the respective committee chair will raise such risks at the next scheduled meeting of the Board, or sooner if merited.

For the foregoing reasons, we have determined that our risk oversight is appropriate in the context of our specific circumstances, risk management efforts, and the Board’s administration of its oversight function. The chart below provides an overview of the allocation of risk management responsibilities among the Board committees.

14 www.hecla-mining.com

Corporate Governance

2022 Proxy Statement 15

Corporate Governance

The Compensation Committee is responsible for overseeing the Company’s succession planning process for our CEO and other key senior executives and annually reviews the Company’s succession plans for all key senior executives with input from the CEO and Sr. Vice President – CAO. The criteria used when assessing the qualifications of potential CEO successors include, among others, strategic vision and leadership, operational experience, financial management, executive officer leadership development, ability to motivate employees, and an ability to develop an effective working relationship with the Board.

Emergency Succession Plan

| • | Our Corporate Governance Guidelines provide that in the event of the death, resignation, removal or incapacitation of the President and CEO, the Chairman will act as the President and CEO until a successor is duly elected. |

| • | They also provide that in the event of the death, resignation, removal or incapacitation of our Chairman, the President and CEO will act as Chairman until a successor is duly elected. |

| • | In the event of an unexpected executive departure, the emergency succession plan allows for a smooth transfer of responsibilities to an individual who may or may not be permanently appointed to the new role. |

| • | In the event of a senior executive’s departure, both internal and external candidates may be considered for permanent appointment to such role. |

Long-term Succession Plan

| • | The long-term succession plan is intended to develop a pipeline of qualified talent for key roles. |

| • | The planning process includes a discussion of internal succession candidates, assessment of relevant skills and planning for professional development where necessary. Multiple internal succession candidates may be identified for an individual role and provided with relevant growth opportunities. The Board gains insight through direct exposure to internal succession candidates from their presentations to the Board, work with individual directors or Board committees, and participation in Board activities. |

| • | The Company’s short- and long-term business strategy will be considered when evaluating internal succession candidates and their skills. |

Committees of the Board and Committee Assignments

The Board has six standing committees: Audit; Compensation; Governance and Social Responsibility; Health, Safety, Environmental and Technical; Executive; and Non-Executive Stock Award. Information regarding these committees is provided below. Except for the Executive Committee and Non-Executive Stock Award Committee, all committees are composed entirely of independent directors. The members of each committee are identified below, along with the number of meetings held in 2021.

16 www.hecla-mining.com

Corporate Governance

| Audit Committee | ||

Meetings in 2021: 6 | Primary Responsibilities

• assist the Board in fulfilling its oversight responsibilities; • review the integrity of our financial statements; • review the independent auditor’s qualifications and independence; • review the performance of our internal auditor and the independent auditor; • review our compliance with laws and regulations, including disclosure controls and procedures; • review financial risks; • oversee the performance of the Company’s independent registered public accounting firm and internal audit firm; • review the qualifications and independence of the Company’s independent registered public accounting firm; and • oversee the effectiveness of the Company’s internal control over financial reporting.

See Report of the Audit Committee on page 30 for additional information. | |

2021 Meeting Attendance: 100% | ||

Current Committee Members

Stephen F. Ralbovsky, Chair ∎ George R. Johnson Catherine J. Boggs Alice Wong

∎ = Financial Expert

All members of the Audit Committee are financially literate

No members on the Audit Committee serve on the audit committee of any other public companies

Committee consists of four independent directors | ||

| Compensation Committee | ||

Meetings in 2021: 5 | Primary Responsibilities

• discharge the Board’s responsibilities relating to compensation of the Company’s executive officers; • approve the design of our compensation program; • approve compensation levels and programs for the executive officers, including the CEO; • administer the Company’s cash-based and equity- based incentive compensation plans; and • administer our stock-based plans.

See The Compensation Committee Process and Role of Management and Human Resources Department on page 38 for more information.

| |

2021 Meeting Attendance: 100% | ||

Current Committee Members

Terry V. Rogers, Chair* Ted Crumley* Charles B. Stanley Catherine J. Boggs

Committee consists of four independent directors | ||

2022 Proxy Statement 17

Corporate Governance

Governance and Social Responsibility Committee | ||

Meetings in 2021: 4 | Primary Responsibilities

• periodically review our Corporate Governance Guidelines, Code of Conduct, and other corporate procedures to ensure compliance with laws and regulations; • review any director candidates, including those nominated or recommended by shareholders; • identify individuals qualified to become directors consistent with criteria approved by the Board; • recommend to the Board the director nominees for the next annual meeting of shareholders, any special meeting of shareholders, or to fill any vacancy on the Board; • review the appropriateness of the size of the Board relative to its various responsibilities; • recommend committee assignments and committee chairpersons for the standing committees for consideration by the Board; • recommend policies, programs, practices, metrics, performance indicators and progress concerning ESG matters to the Board; and • recommend to the Board any action on ESG and related matters that may be required or considered advisable.

See Sustainability and Corporate Governance on pages 3 and 8 for more information. | |

2021 Meeting Attendance: 100% | ||

Current Committee Members

Catherine J. Boggs, Chair Stephen F. Ralbovsky George R. Johnson

Committee consists of three independent directors | ||

Health, Safety, Environmental and Technical Committee | ||

Meetings in 2021: 4 | Primary Responsibilities

• review operational and exploration performance; • review operational, reserve, and other technical risks; • review and monitor health, safety, and environmental policies; • review the implementation and effectiveness of compliance systems; • review the effectiveness of health, safety and environmental policies, systems, and monitoring processes; • review audit results and updates from management with respect to health, safety, and environmental performance; • review emerging health, safety and environmental trends in legislation and proposed regulations affecting the Company; • review the technical activities of the Company; and • make recommendations to the Board concerning the advisability of proceeding with the exploration, development, acquisition, or divestiture of mineral properties and/or operations. | |

2021 Meeting Attendance: 100% | ||

Current Committee Members

George R. Johnson, Chair Terry V. Rogers* Charles B. Stanley Alice Wong | ||

Executive Committee | ||

Meetings in 2021: None | Primary Responsibilities

• empowered with the same authority as the Board in the management of our business, except for certain matters enumerated in our Bylaws and Delaware law, that are specifically reserved to the whole Board. | |

2021 Meeting Attendance: N/A | ||

Current Committee Members

Phillips S. Baker, Jr., Chair Ted Crumley* Terry V. Rogers* | ||

18 www.hecla-mining.com

Corporate Governance

Non-Executive Stock Award Committee | ||

Meetings in 2021: None | Primary Responsibilities

• empowered with the authority to make awards under the Hecla Mining Company 2010 Stock Incentive Plan to employees of the Company or any of its direct and indirect subsidiaries who are not executive officers of the Company or otherwise subject to the requirements of Section 16 of the Securities Exchange Act of 1934, as amended. | |

2021 Meeting Attendance: N/A | ||

Current Committee Members

Phillips S. Baker, Jr., Chair | ||

| * | As previously disclosed, Messrs. Crumley and Rogers will retire as directors effective as of the date of our Annual Meeting. |

Board and Committee Independence; Audit Committee Financial Expert

Our Corporate Governance Guidelines provide that the Board will have a majority of directors who meet the criteria for independence as defined in the NYSE rules. Based on information solicited from each director, and upon the advice and recommendation of the Governance Committee, our Board annually determines the independence of each of our directors in connection with the nomination process. Further, in connection with the appointment of any new director to the Board during the year, our Board makes the same determination. In making its recommendation to the Board, the Governance Committee, with assistance from the Company’s Corporate Secretary, evaluates responses to a questionnaire completed by each director regarding relationships and possible conflicts of interest between such director, the Company, management, the independent registered public accounting firm, and the internal audit firm. In its review of director independence, the Governance Committee considers the commercial, industrial, banking, consulting, legal, accounting, charitable, and familial relationships any director may have with the Company, management, the independent registered public accounting firm, and the internal audit firm.

Our Board has affirmatively determined that all current directors (other than Mr. Baker) have no material relationship with the Company and are independent according to the NYSE listing standards. The Board also has determined that each of the members of the Audit, Compensation, and Governance Committees have no material relationship with the Company and satisfies the independence criteria (including the enhanced qualifications with respect to members of the Audit Committee and Compensation Committee) set forth in the applicable NYSE listing standards and SEC rules. In addition, the Board has determined that Mr. Stephen F. Ralbovsky qualifies as an “Audit Committee financial expert,” as such term is defined by the rules of the SEC.

Directors are expected to immediately inform the Board of any material change in their circumstances or relationships that may impact their independence.

Compensation Committee Procedures

The Compensation Committee has the sole authority to set compensation for our executive officers, including annual compensation amounts and Short-term Incentive Plan and Long-term Incentive Plan criteria, evaluate the performance of our executive officers, and make awards to our executive officers under our stock incentive plans. The Compensation Committee also reviews, approves, and recommends to the Board any proposed plan or arrangement providing for incentive, retirement or other compensation to our executive officers and oversees our assessment of whether our compensation practices are likely to expose the Company to material risks. In addition, the Compensation Committee annually recommends to the Board the slate of officers for the Company, periodically reviews the functions of our officers, and makes recommendations to the Board concerning those functions.

2021 Board Meetings and Attendance

During 2021, there were four meetings of the Board. Directors are expected to make every effort to attend the Annual Meeting, all Board meetings, and the meetings of the committees on which they serve. All members of the Board attended last year’s Annual Meeting of Shareholders, which was held in May 2021. In 2021, each director attended 100% of the Board meetings and the committee meetings in which they are a member.

2022 Proxy Statement 19

Corporate Governance

Director Orientation and Continuing Education

New directors undergo a comprehensive orientation program that introduces them to the Company, including our business operations, strategy, financial position, key members of management and governance structure. Directors also are encouraged to enroll in director education programs. Directors have contact with leaders throughout the organization and visit our mine sites, where they tour the facilities and interact directly with the personnel responsible for our day-to-day operations. These activities collectively help to ensure that new directors become, and existing directors remain, knowledgeable about the most important issues affecting our Company and our business.

Board and Committee Self-Evaluation Process