Table of Contents

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

____________________

Form 10-K

____________________

☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | For the fiscal year ended December 31, 2019 |

OR

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | For the transition period from to |

Commission file No. 1-8491

HECLA MINING COMPANY

(Exact name of registrant as specified in its Charter)

Delaware | 77-0664171 |

State or Other Jurisdiction of Incorporation or Organization | I.R.S. Employer Identification No. |

| | |

6500 N. Mineral Drive, Suite 200 Coeur d’Alene, Idaho | 83815-9408 |

Address of Principal Executive Offices | Zip Code |

208-769-4100

Registrant’s Telephone Number, Including Area Code

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Common Stock, par value $0.25 per share | HL | New York Stock Exchange |

Series B Cumulative Convertible Preferred Stock, par value $0.25 per share | HL-PB | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months, and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act:

| Large accelerated filer ☒ | Accelerated filer ☐ |

| Non-accelerated filer ☐ | Smaller reporting company ☐ |

| Emerging growth company ☐ | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The aggregate market value of the registrant’s voting Common Stock held by non-affiliates was $868,456,633 as of June 30, 2019. There were 488,870,345 shares of the registrant’s Common Stock outstanding as of June 30, 2019, and 495,540,493 shares outstanding as of February 6, 2020.

Documents incorporated by reference herein:

To the extent herein specifically referenced in Part III, the information contained in the Proxy Statement for the 2020 Annual Meeting of Shareholders of the registrant, which will be filed with the Commission pursuant to Regulation 14A within 120 days of the end of the registrant’s 2019 fiscal year, is incorporated herein by reference. See Part III.

TABLE OF CONTENTS

Special Note on Forward-Looking Statements | 1 |

PART I | 1 |

Item 1. Business | 1 |

Introduction | 1 |

Products and Segments | 5 |

Licenses, Permits and Claims/Concessions | 6 |

Physical Assets | 6 |

Employees | 6 |

Available Information | 6 |

Item 1A. Risk Factors | 7 |

Item 1B. Unresolved Staff Comments | 32 |

Item 2. Properties | 32 |

The Greens Creek Unit | 32 |

The Lucky Friday Unit | 37 |

The Casa Berardi Unit | 40 |

The San Sebastian Unit | 45 |

The Nevada Operations Unit | 48 |

Item 3. Legal Proceedings | 57 |

Item 4. Mine Safety Disclosures | 57 |

PART II | 58 |

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 58 |

Item 6. Selected Financial Data | 60 |

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations | 61 |

Overview | 61 |

Results of Operations | 63 |

The Greens Creek Segment | 66 |

The Lucky Friday Segment | 69 |

The Casa Berardi Segment | 71 |

The San Sebastian Segment | 73 |

The Nevada Operations Segment | 75 |

Corporate Matters | 78 |

Reconciliation of Cost of Sales and Other Direct Production Costs and Depreciation, Depletion and Amortization (GAAP) to Cash Cost, Before By-product Credits and Cash Cost, After By-product Credits (non-GAAP) and All-In Sustaining Cost, Before By-product Credits and All-In Sustaining Cost, After By-product Credits (non-GAAP) | 79 |

Reconciliation of Net Income (Loss) (GAAP) to Earnings Before Interest, Taxes, Depreciation, and Amortization (non-GAAP) | 87 |

Financial Liquidity and Capital Resources | 87 |

Contractual Obligations and Contingent Liabilities and Commitments | 90 |

Off-Balance Sheet Arrangements | 91 |

Critical Accounting Estimates | 91 |

New Accounting Pronouncements | 93 |

Forward-Looking Statements | 94 |

Item 7A. Quantitative and Qualitative Disclosures About Market Risk | 94 |

Provisional Sales | 95 |

Commodity-Price Risk Management | 95 |

Foreign Currency | 96 |

Special Note on Forward-Looking Statements

Certain statements contained in this report (including information incorporated by reference) are “forward-looking statements” and are intended to be covered by the safe harbor provided for under Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended ("Exchange Act"). Our forward-looking statements include our current expectations and projections about future production, results, performance, prospects and opportunities, including reserves and other mineralization. We have tried to identify these forward-looking statements by using words such as “may,” “might,” “will,” “expect,” “anticipate,” “believe,” “could,” “intend,” “plan,” “estimate,” "project" and similar expressions. These forward-looking statements are based on information currently available to us and are expressed in good faith and believed to have a reasonable basis. However, our forward-looking statements are subject to a number of risks, uncertainties and other factors that could cause our actual production, results, performance, prospects or opportunities, including reserves and mineralization, to differ materially from those expressed in, or implied by, these forward-looking statements.

These risks, uncertainties and other factors include, but are not limited to, those set forth under Item 1A. Risk Factors and Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations. Given these risks and uncertainties, readers are cautioned not to place undue reliance on our forward-looking statements. Projections and other forward-looking statements included in this report have been prepared based on assumptions, which we believe to be reasonable, but not in accordance with United States generally accepted accounting principles (“GAAP”) or any guidelines of the Securities and Exchange Commission (“SEC”). Actual results may vary, perhaps materially. You are strongly cautioned not to place undue reliance on such projections and other forward-looking statements. All subsequent written and oral forward-looking statements attributable to Hecla Mining Company or to persons acting on our behalf are expressly qualified in their entirety by these cautionary statements. Except as required by federal securities laws, we disclaim any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

PART I

Item 1. Business

For information regarding the organization of our business segments and our significant customers, see Note 11 of Notes to Consolidated Financial Statements.

Information set forth in Items 1A and 2 are incorporated by reference into this Item 1.

Introduction

Hecla Mining Company and our subsidiaries have provided precious and base metals to the U.S. and worldwide since 1891 (in this report, “we” or “our” or “us” refers to Hecla Mining Company and our affiliates and subsidiaries, unless the context requires otherwise). We discover, acquire and develop mines and other mineral interests and produce and market concentrates, carbon material and doré containing silver, gold, lead and zinc. In doing so, we intend to manage our business activities in a safe, environmentally responsible and cost-effective manner.

We produce lead, zinc and bulk concentrates and carbon material, which we sell to custom smelters, metal traders and third-party processors, and unrefined doré containing gold and silver, which is sold to refiners or further refined before sale of the metals to traders. We are organized and managed in five segments that encompass our operating units: the Greens Creek, Lucky Friday, Casa Berardi, San Sebastian and Nevada Operations units.

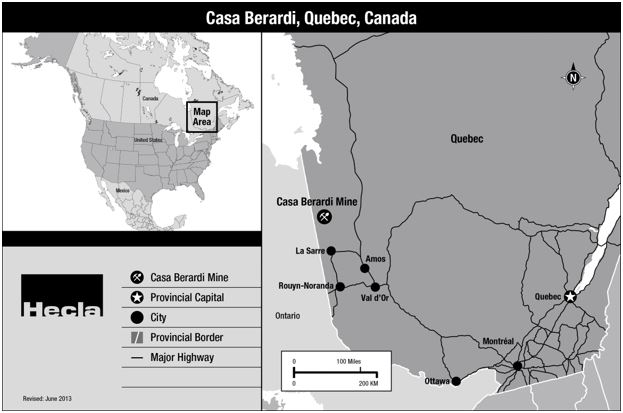

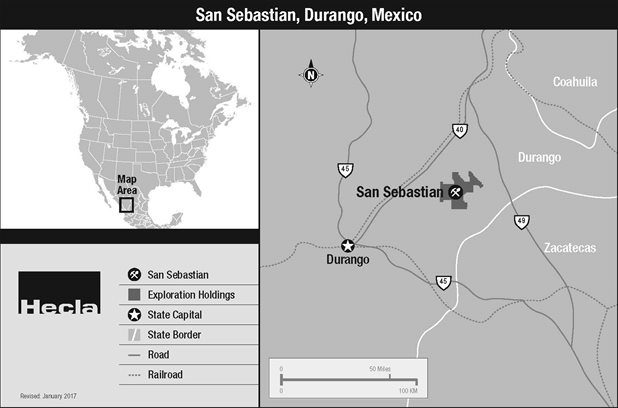

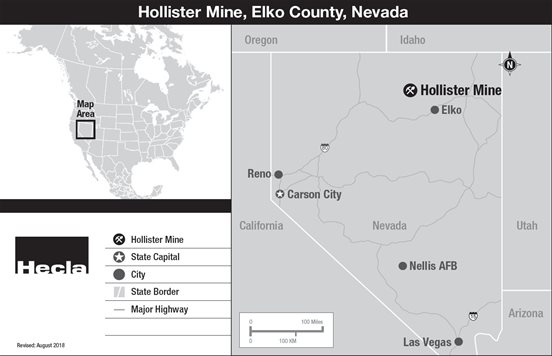

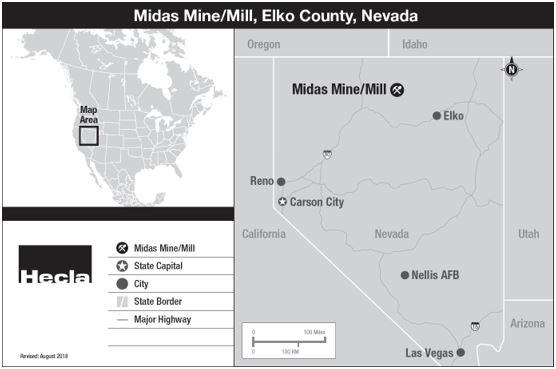

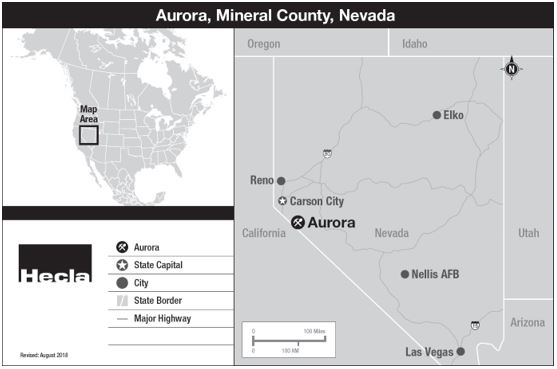

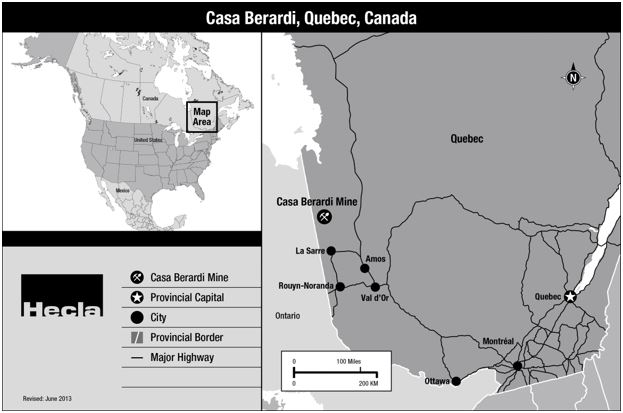

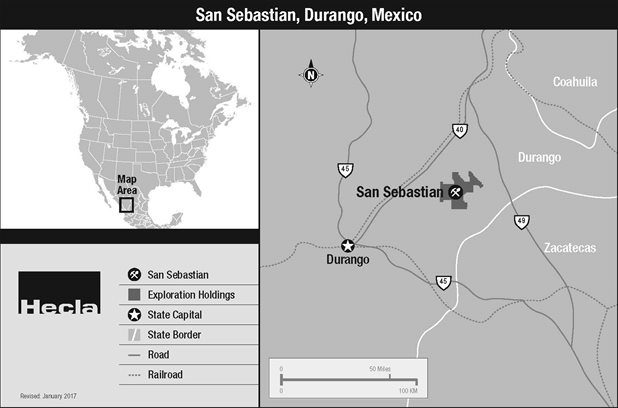

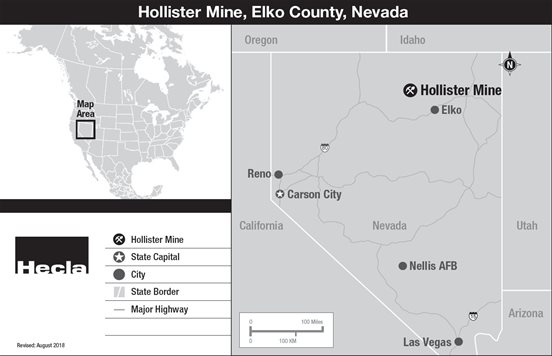

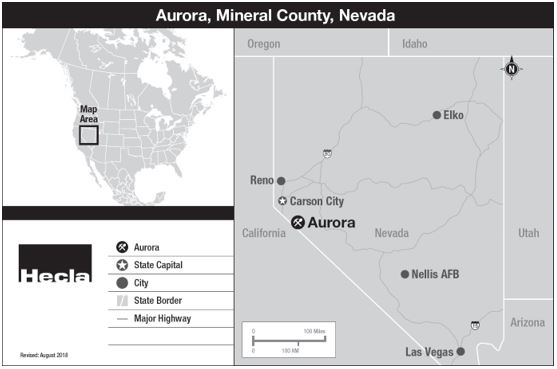

The map below shows the locations of our operating units and our exploration and pre-development projects, as well as our corporate offices located in Coeur d’Alene, Idaho, Vancouver, British Columbia and Val d'Or, Quebec.

Our current business strategy is to focus our financial and human resources in the following areas:

| | • | Operating our properties safely, in an environmentally responsible manner, and cost-effectively. |

| | • | Maintaining and investing in exploration and pre-development projects in the vicinities of seven mining districts and projects we believe to be under-explored or under-invested: our Greens Creek unit on Alaska's Admiralty Island located near Juneau; North Idaho's Silver Valley in the historic Coeur d'Alene Mining District; the silver-producing district near Durango, Mexico; the Abitibi region of northwestern Quebec, Canada; our projects in northern Nevada; the Rock Creek and Montanore projects in northwestern Montana; and the Creede district of southwestern Colorado. |

| | • | Refinancing our $506.5 million in 6.875% Senior Notes due May 1, 2021 ("Senior Notes") (see Note 6 Notes to Consolidated Financial Statements for more information). |

| | • | Continuing to optimize and improve operations at each of our units, which includes incurring costs for new technologies and equipment that may not result in measurable benefits. |

| | • | Expanding our proven and probable reserves and production capacity at our units. |

| | • | Conducting our business with financial stewardship to preserve our financial position in varying metals price environments. |

| | • | Advancing permitting of the Rock Creek and Montanore projects. |

| | • | Continuing to seek opportunities to acquire and invest in mining and exploration properties and companies. |

Below is a summary of net (loss) income for each of the last five years (in thousands):

| | | Year Ended December 31, | |

| | | 2019 | | | 2018 | | | 2017 | | | 2016 | | | 2015 | |

Net (loss) income | | $ | (99,557 | ) | | $ | (26,563 | ) | | $ | (28,520 | ) | | $ | 61,569 | | | $ | (94,738 | ) |

Our financial results over the last five years have been impacted by:

| | • | Changes in our sales of products due to fluctuations in metals prices and the amount of metals we sell. Our sales of products for the last five years were as follows (in thousands): |

| | | Year Ended December 31, | |

| | | 2019 | | | 2018 | | | 2017 | | | 2016 | | | 2015 | |

Sales of products | | $ | 673,266 | | | $ | 567,137 | | | $ | 577,775 | | | $ | 645,957 | | | $ | 443,567 | |

| | • | The average high and low daily closing market prices for silver, gold, lead and zinc for each of the last five years are below. The sources for the prices are the London Market Fixing prices from the London Bullion Market Association for silver and gold and the Cash Official prices from the London Metals Exchange for lead and zinc. |

| | | 2019 | | | 2018 | | | 2017 | | | 2016 | | | 2015 | |

Silver (per oz.): | | | | | | | | | | | | | | | | | | | | |

Average | | $ | 16.20 | | | $ | 15.71 | | | $ | 17.05 | | | $ | 17.10 | | | $ | 15.70 | |

High | | $ | 19.31 | | | $ | 17.52 | | | $ | 18.56 | | | $ | 20.71 | | | $ | 18.23 | |

Low | | $ | 14.38 | | | $ | 13.97 | | | $ | 15.22 | | | $ | 13.58 | | | $ | 13.71 | |

Gold (per oz.): | | | | | | | | | | | | | | | | | | | | |

Average | | $ | 1,392 | | | $ | 1,269 | | | $ | 1,257 | | | $ | 1,248 | | | $ | 1,160 | |

High | | $ | 1,546 | | | $ | 1,355 | | | $ | 1,346 | | | $ | 1,366 | | | $ | 1,296 | |

Low | | $ | 1,270 | | | $ | 1,178 | | | $ | 1,151 | | | $ | 1,077 | | | $ | 1,049 | |

Lead (per lb.): | | | | | | | | | | | | | | | | | | | | |

Average | | $ | 0.91 | | | $ | 1.02 | | | $ | 1.05 | | | $ | 0.85 | | | $ | 0.81 | |

High | | $ | 1.03 | | | $ | 1.22 | | | $ | 1.17 | | | $ | 1.12 | | | $ | 0.97 | |

Low | | $ | 0.80 | | | $ | 0.85 | | | $ | 0.91 | | | $ | 0.72 | | | $ | 0.70 | |

Zinc (per lb.): | | | | | | | | | | | | | | | | | | | | |

Average | | $ | 1.16 | | | $ | 1.33 | | | $ | 1.31 | | | $ | 0.95 | | | $ | 0.88 | |

High | | $ | 1.37 | | | $ | 1.64 | | | $ | 1.53 | | | $ | 1.32 | | | $ | 1.09 | |

Low | | $ | 1.00 | | | $ | 1.04 | | | $ | 1.10 | | | $ | 0.66 | | | $ | 0.66 | |

See Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations – Results of Operations for a summary of our average realized and market prices for each of the three years ended December 31, 2019, 2018 and 2017. Our results of operations are significantly impacted by fluctuations in the prices of silver, gold, lead and zinc, which are affected by numerous factors beyond our control. See Item 1A. Risk Factors – Financial Risks – A substantial or extended decline in metals prices would have a material adverse effect on us for information on a number of the factors that can impact prices of the metals we produce. Our average realized prices for silver and gold were higher, while the average realized prices for zinc and lead were lower, in 2019 compared to 2018. Our average realized prices for silver, zinc and lead were lower, with the average realized price for gold slightly higher, in 2018 compared to 2017. Market metal price trends are a significant factor in our operating and financial performance. We are unable to predict fluctuations in prices for metals and have limited control over the timing of our concentrate shipments which impacts our realized prices. However, we utilize financially-settled forward contracts for the metals we produce with the objective of managing the exposure to changes in prices of those metals contained in our concentrate shipments between the time of sale and final settlement. In addition, at times we utilize a similar program to manage the exposure to changes in prices of zinc and lead (but not silver and gold) contained in our forecasted future concentrate shipments. In June 2019, we also began utilizing financially-settled put option contracts to manage the exposure of our forecasted future gold and silver sales to potential declines in market prices for those metals. See Note 10 of Notes to Consolidated Financial Statements for more information on our base and precious metal forward and put option contract programs.

| | • | The following table illustrates our metal quantities produced and sold for the last five years: |

| | | | Year Ended December 31, | |

| | | | 2019 | | | 2018 | | | 2017 | | | 2016 | | | 2015 | |

Silver - | Ounces produced | | | 12,605,234 | | | | 10,369,503 | | | | 12,484,844 | | | | 17,177,317 | | | | 11,591,602 | |

| | Payable ounces sold | | | 11,548,373 | | | | 9,254,385 | | | | 11,308,958 | | | | 15,997,087 | | | | 10,171,896 | |

Gold - | Ounces produced | | | 272,873 | | | | 262,103 | | | | 232,684 | | | | 233,929 | | | | 189,327 | |

| | Payable ounces sold | | | 275,060 | | | | 247,528 | | | | 219,929 | | | | 222,105 | | | | 178,400 | |

Lead - | Tons produced | | | 24,210 | | | | 20,091 | | | | 22,733 | | | | 42,472 | | | | 39,965 | |

| | Payable tons sold | | | 19,746 | | | | 16,214 | | | | 17,960 | | | | 37,519 | | | | 33,409 | |

Zinc - | Tons produced | | | 58,857 | | | | 56,023 | | | | 55,107 | | | | 68,516 | | | | 70,073 | |

| | Payable tons sold | | | 39,381 | | | | 39,273 | | | | 39,335 | | | | 49,802 | | | | 49,831 | |

| | • | Cost of sales and other direct production costs of $450.3 million in 2019, $354.0 million in 2018, $304.7 million in 2017, $338.3 million in 2016 and $292.4 million in 2015. Cost of sales and other direct production costs in 2019 and 2018 were impacted by the addition of our Nevada Operations unit through the acquisition of Klondex in July 2018. Cost of sales and other direct production costs in 2019, 2018, 2017 and 2016 were impacted by commencement of sales at our San Sebastian unit in the first quarter of 2016. Cost of sales and other direct production costs in 2019, 2018 and 2017 were also impacted by suspension of full production at Lucky Friday as a result of a strike, as discussed further below. See Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations – Results of Operations for more information. |

| | • | Suspension-related cash costs at our Lucky Friday unit of $7.8 million, $14.6 million and $17.1 million in 2019, 2018 and 2017, respectively. These costs, along with $4.3 million, $5.0 million and $4.2 million in non-cash depreciation, depletion and amortization at Lucky Friday for 2019, 2018 and 2017, respectively, are included in a separate line item on our consolidated statements of operations and comprehensive loss (income) for those periods. Suspension-related costs for 2018 also included $1.1 million related to curtailment of production at the Midas mine. The suspension-related costs at Lucky Friday are a result of a strike by unionized employees that started in mid-March 2017 and ended in early January 2020 (see the Employees section below for more information). |

| | • | Exploration and pre-development expenditures totaling $19.1 million, $40.6 million, $29.0 million, $17.9 million and $22.0 million for the years ended December 31, 2019, 2018, 2017, 2016 and 2015, respectively. |

| | • | Provision for closed operations and environmental matters of $4.7 million, $6.1 million, $6.7 million, $5.7 million and $12.2 million for the years ended December 31, 2019, 2018, 2017, 2016, and 2015, respectively. |

| | • | Net loss of $4.0 million in 2019, a net gain of $40.3 million in 2018, a net loss of $21.3 million in 2017, and net gains of $4.4 million in 2016 and $8.3 million in 2015 on base metal forward and precious metal put option contracts. These gains and losses are related to financially-settled forward contracts on forecasted zinc and lead production as part of a risk management program initiated in 2010. The net loss in 2019 also includes losses on financially-settled put option contracts on forecasted gold and silver sales, a program initiated in June 2019. See Note 10 of Notes to Consolidated Financial Statements for more information on our derivatives contracts. |

| | • | Our acquisition of Aurizon Mines Ltd. ("Aurizon") in June 2013 was partially funded by the issuance of our Senior Notes in April 2013 for net proceeds of $490.0 million. In 2019, 2018, 2017, 2016 and 2015 we recorded interest expense related to the Senior Notes, including amortization of issuance costs, of $36.3 million, $36.3 million, $35.3 million, $20.1 million, and $22.7 million, respectively. The interest expense for 2017, 2016 and 2015 was recorded net of $0.9 million, $16.2 million and $13.5 million, respectively, in capitalized interest primarily related to the #4 Shaft project at Lucky Friday which was completed in early 2017. |

| | • | Our acquisition of Klondex for $413.9 million in July 2018. We recognized expenses related to the acquisition of $10.0 million in 2018. See Note 15 of Notes to Consolidated Financial Statements for more information. |

| | • | Our acquisition of Mines Management for $52.1 million in September 2016. We recognized expenses related to the acquisition of $2.7 million in 2016. |

| | • | Our acquisition of Revett for $20.1 million in June 2015. We recognized expenses related to the acquisition of $2.2 million in 2015. |

| | • | Foreign exchange loss in 2019 of $8.2 million, a gain in 2018 of $10.3 million, losses in 2017 and 2016 of $9.7 million and $2.7 million, respectively, and a gain in 2015 of $24.2 million, primarily due to increased exposure to exchange fluctuations between the U.S. dollar and Canadian dollar as a result of our acquisition of Aurizon. |

| | • | Income tax benefits of $24.1 million and $6.7 million in 2019 and 2018, respectively, and income tax provisions of $21.0 million, $28.1 million and $57.0 million in 2017, 2016 and 2015, respectively. See Note 5 of Notes to Consolidated Financial Statements for more information. |

| | • | An increase in the number of shares of our common stock outstanding, which impacts our income (loss) per common share. |

A comprehensive discussion of our financial results for the years ended December 31, 2019, 2018 and 2017, individual operating unit performance, general corporate expenses and other significant items can be found in Item 7. Management’s Discussion and Analysis of Consolidated Financial Condition and Results of Operations, as well as the Consolidated Financial Statements and Notes thereto.

Products and Segments

Our segments are differentiated by geographic region. We produce zinc, lead and bulk flotation concentrates at our Greens Creek unit and lead and zinc flotation concentrates at our Lucky Friday unit, each of which we sell to custom smelters and metal traders on contract. The flotation concentrates produced at our Greens Creek and Lucky Friday units contain payable silver, zinc and lead, and at Greens Creek they also contain payable gold. At Greens Creek, we also produce gravity concentrate containing silver, gold and lead. Unrefined bullion (doré) is produced from the gravity concentrate by a third-party processor, and shipped to a refiner before sale of the metals to precious metal traders. We also produce unrefined gold and silver bullion bars (doré), loaded carbon and precipitates at our Casa Berardi, San Sebastian and Nevada Operations units, which are shipped to refiners before sale of the metals to precious metal traders. At times, we sell loaded carbon and precipitates directly to refiners. Payable metals are those included in our products which we are paid for by smelters, metal traders and refiners. Our segments as of December 31, 2019 included:

| | • | The Greens Creek unit located on Admiralty Island, near Juneau, Alaska. Greens Creek is 100% owned and has been in production since 1989, with a temporary care and maintenance period from April 1993 through July 1996. |

| | • | The Lucky Friday unit located in northern Idaho. Lucky Friday is 100% owned and has been a producing mine for us since 1958. As discussed below in the Employees section, unionized employees at Lucky Friday were on strike from mid-March 2017 until early January 2020, resulting in limited production during that time. We expect re-staffing of the mine, which has commenced, to be completed in stages, with a return to full production by the end of 2020. |

| | • | The Casa Berardi unit located in the Abitibi region of northwestern Quebec, Canada. Casa Berardi is 100% owned and was acquired on June 1, 2013 with the purchase of all issued and outstanding common shares of Aurizon. Aurizon had operated and produced from the Casa Berardi mine since late 2006 and began various mine enhancements in an effort to improve operational efficiency, including a shaft deepening project completed in 2014 and a new paste fill facility completed in 2013. In addition to ongoing production from the underground mine, production from the East Mine Crown Pillar ("EMCP") surface mine commenced in July 2016. The addition of surface production and enhancements to the processing facility resulted in increased ore throughput and gold production. We expect to recommence underground mining in the East Mine, which was the original production area, by the end of 2020. |

| | • | The San Sebastian unit located in the state of Durango, Mexico. San Sebastian is 100% owned, and had previously produced for us from underground mines between 2001 and 2005. Near-surface exploration discoveries in the vicinity of the past producing area led to the decision in the third quarter of 2015 to develop shallow open pit mines there. Production commenced from the open pits in the fourth quarter of 2015. Continued exploration resulted in the decision to develop a new underground ramp and rehabilitate the historical underground access. The underground development commenced in the first quarter of 2017, and underground ore production began in January 2018. During 2019, we commenced mining and processing of a bulk sample of underground sulfide material. Testing of the bulk sample is part of an ongoing evaluation which we believe will allow us to determine the viability of extending underground production there. We have also continued to advance additional surface exploration targets near our current operations. |

| | • | The Nevada Operations unit located in northern Nevada. Nevada Operations is 100% owned and was acquired on July 20, 2018 with the purchase of all of the issued and outstanding common shares of Klondex. Nevada Operations consists of three land packages in northern Nevada totaling approximately 110 square miles and containing operating or previously-operating mines with a history of high-grade gold production: Fire Creek, Hollister and Midas. We believe these properties to be prospective and under-explored. The acquisition included the Midas mill and, in the Walker Lane district, the Aurora mine and mill. Klondex had owned Fire Creek since 1975, Midas since 2014, and Hollister and Aurora since 2016. As discussed in Item 7. Management’s Discussion and Analysis of Consolidated Financial Condition and Results of Operations - The Nevada Operations Segment, in the second quarter of 2019, we ceased development to access new production areas at our Nevada operations until completion of studies and test work for hydrology, mining and milling, resulting in, among other changes, an anticipated suspension of production in mid-2020. |

The contributions to our consolidated sales by our operating units in 2019 were 44.5% from Greens Creek, 28.7% from Casa Berardi, 8.3% from San Sebastian, 16.0% from Nevada Operations and 2.5% from Lucky Friday.

See the Introduction section above for information on our metals production and sales for the years ended December 31, 2019, 2018, 2017, 2016 and 2015.

Licenses, Permits and Claims/Concessions

We are required to obtain various licenses and permits to operate our mines and conduct exploration and reclamation activities. See Item 1A. Risk Factors - Legal, Regulatory and Market Risks - We are required to obtain governmental permits and other approvals in order to conduct mining operations. The El Toro area at San Sebastian, the Rock Creek and Montanore projects, and our planned open pits at Casa Berardi can only be developed if we are successful in obtaining the necessary permits. See Item 1A. Risk Factors - Legal, Regulatory and Market Risks - We are required to obtain governmental permits and other approvals in order to conduct mining operations and Legal challenges could prevent the Rock Creek or Montanore projects from ever being developed. In addition, our operations and exploration activities at our Casa Berardi and San Sebastian units are conducted pursuant to claims or concessions granted by the host government, and otherwise are subject to claims renewal and minimum work commitment requirements, which are subject to certain political risks associated with foreign operations. See Item 1A. Risk Factors - Operation, Development, Exploration and Acquisition Risks - Our foreign activities are subject to additional inherent risks.

Physical Assets

Our business is capital intensive and requires ongoing capital investment for the replacement, modernization and expansion of equipment and facilities and to develop new ore reserves. At December 31, 2019, the book value of our properties, plants, equipment and mineral interests, net of accumulated depreciation, was approximately $2.4 billion. For more information see Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations. We maintain insurance policies against property loss and business interruption. However, such insurance contains exclusions and limitations on coverage, and there can be no assurance that claims would be paid under such insurance policies in connection with a particular event. See Item 1A. Risk Factors - Operation, Development, Exploration and Acquisition Risks - Our operations may be adversely affected by risks and hazards associated with the mining industry that may not be fully covered by insurance.

Employees

As of December 31, 2019, we employed 1,622 people, including the unionized employees at Lucky Friday who until recently were on strike, as discussed below. With the potential exception of some of the employees recently on strike, we believe relations with our employees are generally good.

Many of the employees at our Lucky Friday unit are represented by a union. The previous collective bargaining agreement with the unionized employees expired on April 30, 2016. After voting against our new contract offer at the time, the unionized employees went on strike on March 13, 2017. They remained on strike until January 7, 2020, when the union ratified a new collective bargaining agreement. The new collective bargaining agreement expires on January 6, 2023.

Available Information

Hecla Mining Company is a Delaware corporation. Our current holding company structure dates from the incorporation of Hecla Mining Company in 2006 and the renaming of our subsidiary (previously Hecla Mining Company) as Hecla Limited. Our principal executive offices are located at 6500 N. Mineral Drive, Suite 200, Coeur d’Alene, Idaho 83815-9408. Our telephone number is (208) 769-4100. Our web site address is www.hecla-mining.com. We file our annual, quarterly and current reports and any amendments to these reports with the SEC, copies of which are available on our website or from the SEC free of charge (www.sec.gov or 800-SEC-0330). Our restated certificate of incorporation, bylaws, charters of our audit, compensation, and corporate governance and directors nominating committees, as well as our Code of Ethics for the Chief Executive Officer and Senior Financial Officers and our Code of Conduct, are also available on our website. In addition, any amendments to our Code of Ethics or waivers granted to our directors and executive officers will be posted on our website. Each of these documents may be periodically revised, so you are encouraged to visit our website for any updated terms. We will provide copies of these materials to stockholders upon request using the above-listed contact information, directed to the attention of Investor Relations, or via e-mail request sent to hmc-info@hecla-mining.com.

We have included the Chief Executive Officer (CEO) and Chief Financial Officer (CFO) certifications regarding our public disclosure required by Section 302 of the Sarbanes-Oxley Act of 2002 as Exhibits 31.1 and 31.2 to this report. Additionally, we filed with the New York Stock Exchange (“NYSE”) the CEO’s certification regarding our compliance with the NYSE’s Corporate Governance Listing Standards (“Listing Standards”) pursuant to Section 303A.12(a) of the Listing Standards, which certification was dated May 28, 2019, and indicated that the CEO was not aware of any violations of the Listing Standards.

Item 1A. Risk Factors

The following risks and uncertainties, together with the other information set forth in this report, should be carefully considered by those who invest in our securities. Any of the following risks could materially adversely affect our business, financial condition or operating results and could decrease the value of our common or preferred stock or other outstanding securities.

Financial Risks

We have a substantial amount of debt that could impair our financial health and prevent us from fulfilling our obligations under our existing and future indebtedness.

As of December 31, 2019, we had total indebtedness of approximately $517.4 million, primarily in the form of our Senior Notes due May 1, 2021. Our level of debt and our debt service obligations may have adverse effects on our business, financial condition, cash flows or results of operations, including:

| | • | making it more difficult for us to satisfy our obligations with respect to the Senior Notes; |

| | • | reducing the amount of funds available to finance our operations, capital expenditures and other activities; |

| | • | increasing our vulnerability to economic downturns and industry conditions; |

| | • | limiting our flexibility in responding to changing business and economic conditions; |

| | • | jeopardizing our ability to execute our business plans; |

| | • | placing us at a disadvantage when compared to our competitors that have less debt; |

| | • | increasing our cost of borrowing; and |

| | • | limiting our ability to borrow additional funds. |

We and our subsidiaries may incur substantial additional indebtedness in the future. Although the indenture governing our Senior Notes contains restrictions on the incurrence of additional indebtedness, these restrictions are subject to a number of significant qualifications and exceptions and, under certain circumstances, the amount of additional indebtedness that could be incurred in compliance with these restrictions could be substantial. In July 2018, we entered into our $250 million senior credit facility, which as of the date of this report allows us to draw up to $150 million on a revolving basis. Like the indenture, the credit agreement governing the revolving credit facility also has restrictions on the incurrence of additional indebtedness but with a number of significant qualifications and exceptions. If new debt is added to our and our subsidiaries’ existing debt levels, the risks associated with such debt that we currently face would increase. In addition, the indenture governing the Senior Notes does not prevent us from incurring additional indebtedness under the indenture.

There is no assurance that our internal and external sources of liquidity will at all times be sufficient for our cash requirements.

We must have sufficient sources of liquidity to make scheduled payments or to refinance or repay when due our debt obligations and to fund our planned capital expenditures, operating expenses and other ongoing liquidity needs. The principal sources of our liquidity are funds generated from operating activities, available cash and cash equivalents, and borrowings under our revolving credit facility. As of December 31, 2019, we held cash and cash equivalents of $62.5 million and had no outstanding borrowings on our revolving credit facility. In 2019, we periodically borrowed under our $250 million revolving credit facility in order to meet our working capital requirements, and in 2020 we anticipate also borrowing under our credit facility. Our ability to borrow under the credit facility is limited by the size of our lenders’ commitments and our ability to comply with covenants, including certain financial ratios. We cannot guarantee that we will be able to meet such covenants, and therefore borrowings under the credit facility may not be available to us.

Our ability to achieve our business and cash flow plans is based on a number of assumptions which involve significant judgments and estimates of future performance and credit availability, which cannot at all times be assured. Accordingly, we cannot assure you cash flows from operations and other internal and external sources of liquidity will at all times be sufficient for our cash requirements, including for us to (1) pay the principal, premium, if any, and interest on our indebtedness, including the Senior Notes which are due May 1, 2021, or (2) to fund our other liquidity needs. If necessary, we may need to consider actions and steps to improve our cash position and mitigate any potential liquidity shortfall, such as modifying our business plan and planned expenditures, pursuing additional financing to the extent available, selling assets, reducing capital expenditures, restructuring or refinancing our Senior Notes and other potential actions to reduce costs. There can be no assurance that any of these actions would be successful, sufficient or available on favorable terms. Any inability to generate or obtain sufficient levels of liquidity to meet our cash requirements at the level and times needed could have a material adverse impact on our business and financial position.

Our ability to obtain any additional financing or any refinancing of our debt, if needed at any time, depends upon many factors, including our existing level of indebtedness and restrictions in our debt facilities, historical business performance, financial projections, the value and sufficiency of collateral, prospects and creditworthiness, external economic conditions and general liquidity in the credit and capital markets. Any additional financing or refinancing could also be extended only at higher costs and require us to satisfy more restrictive covenants, which could further limit or restrict our business and results of operations, or be dilutive to our stockholders. The terms of existing or future debt instruments and the indenture governing our Senior Notes may restrict us from adopting some of these alternatives. In addition, any failure to make payments of interest and principal on our outstanding indebtedness on a timely basis would likely result in a reduction of our credit rating, which could harm our ability to incur additional indebtedness. These alternative measures may not be successful and may not permit us to meet our scheduled debt service obligations.

In addition, we conduct substantially all of our operations through our subsidiaries, certain of which are not guarantors of our indebtedness. Accordingly, repayment of our indebtedness is dependent on the generation of cash flow by our subsidiaries and their ability to make such cash available to us, by dividend, debt repayment or otherwise. Unless they are guarantors of our indebtedness, our subsidiaries do not have any obligation to pay amounts due with respect to our indebtedness or to make funds available for that purpose. Our subsidiaries may not be able to, or may not be permitted to, make distributions to enable us to make payments in respect of our indebtedness. Each subsidiary is a distinct legal entity, and under certain circumstances, legal and contractual restrictions may limit our ability to obtain cash from our subsidiaries. While the credit agreement governing our revolving credit facility and the indenture governing our Senior Notes limit the ability of our subsidiaries to incur consensual restrictions on their ability to pay dividends or make other intercompany payments to us, these limitations are subject to qualifications and exceptions. In the event that we do not receive distributions from our subsidiaries, we may be unable to make required principal and interest payments on our indebtedness.

See Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations - Financial Liquidity and Capital Resources. Also, for more information on risks relating to our debt, see the risk factors below under “Risks Relating to Our Common Stock and Our Indebtedness.”

A substantial or extended decline in metals prices would have a material adverse effect on us.

Our revenue is derived primarily from the sale of concentrates and doré containing silver, gold, lead and zinc and, as a result, our earnings are directly related to the prices of these metals. Silver, gold, lead and zinc prices fluctuate widely and are affected by numerous factors, including:

| | • | relative exchange rates of the U.S. dollar; |

| | • | global and regional demand and production; |

| | • | inflation, recession or increased or reduced economic activity; and |

| | • | other political, regulatory and economic conditions. |

These factors are largely beyond our control and are difficult to predict. If the market prices for these metals fall below our production, exploration or development costs for a sustained period of time, we will experience losses and may have to discontinue exploration, development or operations, or incur asset write-downs at one or more of our properties. See Item 1. Business - Introduction for information on the average, high, and low daily closing prices for silver, gold, lead and zinc for the last five years. On February 6, 2020, the closing prices for silver, gold, lead and zinc were $17.62 per ounce, $1,553 per ounce, $0.84 per pound and $1.00 per pound, respectively.

We have had losses that could reoccur in the future.

We have experienced volatility in our net (loss) income reported in the last five years, as shown in Item 6. Selected Financial Data, including net losses of $99.6 million in 2019, $26.6 million in 2018, $28.5 million in 2017 and $94.7 million in 2015. A comparison of operating results over the past three years can be found in Results of Operations in Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Many of the factors affecting our operating results are beyond our control, including, but not limited to, the volatility of metals prices; smelter terms; rock and soil conditions; seismic events; availability of hydroelectric power; diesel fuel prices; interest rates; foreign exchange rates; global or regional political or economic policies; inflation; availability and cost of labor; economic developments and crises; governmental regulations; continuity of orebodies; ore grades; recoveries; performance of equipment; price speculation by certain investors; and purchases and sales by central banks and other holders and producers of gold and silver in response to these factors. We cannot foresee whether our operations will continue to generate sufficient revenue in order for us to generate net cash from operating activities. We cannot assure you that we will not experience net losses in the future.

An extended decline in metals prices, an increase in operating or capital costs, mine accidents or closures, increasing regulatory obligations, or our inability to convert exploration potential to reserves may cause us to record write-downs, which could negatively impact our results of operations.

When events or changes in circumstances indicate the carrying value of our long-lived assets may not be recoverable, we review the recoverability of the carrying value by estimating the future undiscounted cash flows expected to result from the use and eventual disposition of the asset. Impairment must be recognized when the carrying value of the asset exceeds these cash flows. Recognizing impairment write-downs could negatively impact our results of operations. Metal price estimates are a key component used in the evaluation of the carrying values of our assets, as the evaluation involves comparing carrying values to the average estimated undiscounted cash flows resulting from operating plans using various metals price scenarios. Our estimates of undiscounted cash flows for our long-lived assets also include an estimate of the market value of the exploration potential beyond the current operating plans.

In the second quarter of 2019, we determined that a review of our Nevada operations and resulting plans to curtail development and limit near term production there represented a change in circumstances indicating the carrying value of our long-lived assets in Nevada may not be recoverable. However, our review for recoverability as of June 30, 2019 determined our estimates of undiscounted cash flows, including the estimated value of mineral interests, exceeded the carrying values for our Nevada assets reviewed at that time. Subsequent events or changes in circumstances during the remainder of 2019 did not indicate the carrying value of our long-lived assets in Nevada or at our other operating, pre-development or exploration properties were not recoverable. For more discussion, see Note 15 of Notes to Consolidated Financial Statements and the below risk factors, “We may not realize all of the anticipated benefits from our acquisitions, including our acquisition of Klondex” and “The issues we have faced and continue to face at our Nevada Operations unit could require us to write-down the associated long-lived assets. We could face similar issues at our other operations. Such write-downs may adversely affect our results of operations and financial condition.” If the prices of silver, gold, zinc and lead decline for an extended period of time, if we fail to control production or capital costs, if regulatory issues increase costs or decrease production, or if we do not realize the mineable ore reserves or exploration potential at our mining properties, we may be required to recognize asset write-downs in the future. In addition, the perceived market value of the exploration potential of our properties is dependent upon prevailing metals prices as well as our ability to discover economic ore. A decline in metals prices for an extended period of time or our inability to convert exploration potential to reserves could significantly reduce our estimates of the value of the exploration potential at our properties and result in asset write-downs.

Global financial events or developments impacting major industrial or developing countries may have an impact on our business and financial condition in ways that we currently cannot predict.

The 2008 credit crisis and related turmoil in the global financial system and ensuing recession had an impact on our business and financial position, and similar events in the future could also impact us. The re-emergence of a financial crisis or recession or reduced economic activity in the United States, China, India and other industrialized or developing countries, or disruption of key sectors of the economy such as oil and gas, may have a significant effect on our results of operations or limit our ability to raise capital through credit and equity markets. The prices of the metals that we produce are affected by a number of factors, and it is unknown how these factors may be impacted by a global financial event or developments impacting major industrial or developing countries.

Recently enacted tariffs, other potential changes to tariff and import/export regulations, and ongoing trade disputes between the United States and other jurisdictions may have a negative effect on global economic conditions and our business, financial results and financial condition.

In 2018, the United States imposed and enacted tariffs on certain items. Since their enactment, there have been ongoing discussions and activities regarding changes to other U.S. trade policies and treaties. In response, a number of markets, including China, into which we have in the past and may in the future sell our products, have implemented tariffs on U.S. imports, or are threatening to impose tariffs on U.S. imports or to take other measures in response to these U.S. actions. These developments may have a material adverse effect on global economic conditions and the stability of global financial markets, and they may significantly reduce global trade and, in particular, trade between China and the United States. Any of these factors could depress economic activity, restrict our access to customers and have a material adverse effect on our business, financial condition and results of operations. In addition, any actions by foreign markets to implement further trade policy changes, including limiting foreign investment or trade, increasing regulatory scrutiny or taking other actions which impact U.S. companies’ ability to obtain necessary licenses or approvals could negatively impact our business.

In September 2018, in response to tariffs on Chinese goods implemented by the United States, China imposed a 5% tariff on lead concentrates and a 10% tariff on silver concentrates, both of which are products we produce and from time to time ship to China. We sold no lead or silver concentrates to China in 2019. While to date the direct impact of tariffs has been immaterial on our sales and treatment charges, they may also have an impact on our sales and treatment charges outside of China.

These tariffs are relatively recent and are subject to a number of uncertainties as they are implemented, including future adjustments and changes in the countries excluded from such tariffs. The ultimate reaction of other countries, and businesses in those countries, and the impact of these tariffs or other actions on the United States, China, the global economy and our business, financial condition and results of operations, cannot be predicted at this time, nor can we predict the impact of any other developments with respect to global trade.

Commodity and currency risk management activities could prevent us from realizing possible revenues or lower costs or expose us to losses.

We periodically enter into risk management activities such as financially-settled forward sales contracts to manage the exposure to changes in prices of silver, gold, lead and zinc contained in our concentrate shipments between the time of sale and final settlement. We also utilize such programs to manage the exposure to changes in the prices of lead and zinc contained in our forecasted future shipments. Such activities are utilized in an attempt to partially insulate our operating results from changes in prices for those metals. However, such activities may prevent us from realizing revenues in the event that the market price of a metal exceeds the price stated in a forward sale contract, and may also result in significant mark-to-market fair value adjustments, which may have a material adverse impact on our reported financial results. In addition, we are exposed to credit risk with our counterparties, and we may experience losses if a counterparty fails to purchase under a contract when the contract price exceeds the spot price of a commodity.

In 2016, we also initiated financially-settled forward contract programs to manage exposure to fluctuations in the exchange rates between the U.S. dollar (“USD”) and the Canadian dollar (“CAD”) and the Mexican peso (“MXN”) and the impact on our future operating costs denominated in CAD and MXN. As with our metals derivatives, such activities may prevent us from realizing possible lower costs on a USD-basis in the event that the USD strengthens relative to the CAD or MXN compared to the exchange rates stated in the forward contracts, and also expose us to counterparty credit risk.

See Note 10 of Notes to Consolidated Financial Statements for more information on these forward contract programs.

Our profitability could be affected by the prices of other commodities.

Our profitability is sensitive to the costs of commodities such as fuel (in particular as used at Greens Creek to generate electricity when hydropower is unavailable), steel, and cement. While the recent prices for such commodities have been stable or in decline, prices have been historically volatile, and material increases in commodity costs could have a significant effect on our results of operations.

Our accounting and other estimates may be imprecise.

Preparing financial statements requires management to make estimates and assumptions that affect the reported amounts and related disclosure of assets, liabilities, revenue and expenses at the date of the consolidated financial statements and reporting periods. The more significant areas requiring the use of management assumptions and estimates relate to:

| | • | mineral reserves, mineralized material, and other resources that are the basis for future income and cash flow estimates and units-of-production depreciation, depletion and amortization calculations; |

| | • | future ore grades, throughput and recoveries; |

| | • | future capital and operating costs; |

| | • | environmental, reclamation and closure obligations; |

| | • | permitting and other regulatory considerations; |

| | • | valuation of business combinations; |

| | • | future foreign exchange rates, inflation rates and applicable tax rates; |

| | • | reserves for contingencies and litigation; and |

| | • | deferred tax asset valuation allowance. |

Future estimates and actual results may differ materially from these estimates as a result of using different assumptions or conditions. For additional information, see Critical Accounting Estimates in Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations, Note 1 of Notes to Consolidated Financial Statements, and the risk factors set forth below: “Our costs of development of new orebodies and other capital costs may be higher and provide less return than we estimated,” “Our ore reserve estimates may be imprecise,” “We are currently involved in ongoing legal disputes that may materially adversely affect us,” and “Our environmental and asset retirement obligations may exceed the provisions we have made.”

Our ability to recognize the benefits of deferred tax assets related to net operating loss carryforwards and other items is dependent on future cash flows and taxable income.

We recognize the expected future tax benefit from deferred tax assets when the tax benefit is considered to be more likely than not of being realized. Otherwise, a valuation allowance is applied against deferred tax assets, reducing the value of such assets. Assessing the recoverability of deferred tax assets requires management to make significant estimates related to expectations of future taxable income. Estimates of future taxable income are based on forecasted income from operations and the application of existing tax laws in each jurisdiction. Metal price and production estimates are key components used in the determination of our ability to realize the expected future benefit of our deferred tax assets. To the extent that future taxable income differs significantly from estimates as a result of a decline in metals prices or other factors, our ability to realize the deferred tax assets could be impacted. Additionally, significant future issuances of common stock or common stock equivalents, or changes in the direct or indirect ownership of our common stock or common stock equivalents, could limit our ability to utilize our net operating loss carryforwards pursuant to Section 382 of the Internal Revenue Code. Future changes in tax law or changes in ownership structure could limit our ability to utilize our recorded tax assets. Due to the changes to tax laws under the Tax Cuts and Jobs Act enacted in December 2017, we determined it is more likely than not we will not realize the net deferred tax assets in the “Hecla U.S. tax group,” our U.S. consolidated tax group which is exclusive of our U.S. consolidated tax group located in Nevada (“Nevada U.S. tax group”). We currently do not have valuation allowances for certain amounts related to the Nevada U.S. tax group and certain foreign deferred tax assets, and our deferred tax assets as of December 31, 2019 were $215.1 million, net of $86.6 million in valuation allowances. See Note 5 of Notes to Consolidated Financial Statements for further discussion of our deferred tax assets.

Returns for investments in pension plans and pension plan funding requirements are uncertain.

We maintain defined benefit pension plans for most U.S. employees, which provide for defined benefit payments after retirement for those employees. Canadian and Mexican employees participate in public retirement systems for those countries and are not eligible to participate in the defined benefit pension plans that we maintain for U.S. employees. The ability of the pension plans maintained for U.S. employees to provide the specified benefits depends on our funding of the plans and returns on investments made by the plans. Returns, if any, on investments are subject to fluctuations based on investment choices and market conditions. In addition, we have a supplemental executive retirement plan which is unfunded. A sustained period of low returns or losses on investments, or future benefit obligations that exceed our estimates, could require us to fund the pension plans to a greater extent than anticipated. See Note 8 of Notes to Consolidated Financial Statements for more information on our pension plans.

Operation, Development, Exploration and Acquisition Risks

Mining accidents or other adverse events at an operation could decrease our anticipated production or otherwise adversely affect our operations.

Production may be reduced below our historical or estimated levels for many reasons, including, but not limited to, mining accidents; unfavorable ground or shaft conditions; work stoppages or slow-downs; lower than expected ore grades; unexpected regulatory actions; if the metallurgical characteristics of ore are less economic than anticipated; or because our equipment or facilities fail to operate properly or as expected. Our mines are subject to risks relating to ground instability, including, but not limited to, pit wall failure, crown pillar collapse, stope failure or the breach or failure of a tailings impoundment. Both the Lucky Friday and Casa Berardi mines have a history of ground instability underground and related incidents. The occurrence of an event such as those described above could result in loss of life or temporary or permanent cessation of operations, any of which could have a material adverse effect on our financial condition and results of operations. Other closures or impacts on operations or production may occur at any of our mines at any time, whether related to accidents, changes in conditions, changes to regulatory policy, or as precautionary measures.

In addition, our operations are typically in remote locations, where conditions can be inhospitable, including with respect to weather, surface conditions, interactions with wildlife or otherwise in or near dangerous conditions. In the past we have had employees, contractors, or employees of contractors get injured, sometimes fatally, while working in such challenging locations. An accident or injury to a person at or near one of our operations could have a material adverse effect on our financial condition and results of operations.

Our operations may be adversely affected by risks and hazards associated with the mining industry that may not be fully covered by insurance.

Our business is capital intensive, requiring ongoing investment for the replacement, modernization or expansion of equipment and facilities. Our mining and milling operations are subject to risks of process upsets and equipment malfunctions. Equipment and supplies may from time to time be unavailable on a timely basis. Our business is subject to a number of other risks and hazards including:

| | • | unusual or unexpected geologic formations; |

| | • | rock bursts, ground falls, pit wall failures, or tailings impoundment breaches or failures; |

| | • | underground fires or floods; |

| | • | unanticipated hydrologic conditions, including flooding and periodic interruptions due to inclement or hazardous weather conditions; |

| | • | political and country risks; |

| | • | civil unrest or terrorism; |

| | • | disruption, damage or failure of technology systems related to operation of equipment and other aspects of our mine operations; |

| | • | labor disputes or strikes; and |

| | • | our operating mines have tailing ponds which could fail or leak as a result of seismic activity, unusual weather or for other reasons. |

Such risks could result in:

| | • | personal injury or fatalities; |

| | • | damage to or destruction of mineral properties or producing facilities; |

| | • | environmental damage and financial penalties; |

| | • | delays in exploration, development or mining; |

| | • | inability to meet our financial obligations; |

| | • | asset impairment charges; |

| | • | temporary or permanent closure of facilities. |

We maintain insurance to protect against losses that may result from some of these risks, such as property loss and business interruption, in amounts we believe to be reasonably consistent with our historical experience, industry practice and circumstances surrounding each identified risk. Such insurance, however, contains exclusions and limitations on coverage, particularly with respect to environmental liability, political risk and seismic events. We cannot assure you that claims would be paid under such insurance policies in connection with a particular event. Insurance specific to environmental risks is generally either unavailable or, we believe, too expensive for us, and we therefore do not maintain environmental insurance. Occurrence of events for which we are not insured may have an adverse effect on our business.

Our costs of development of new orebodies and other capital costs may be higher and provide less return than we estimated.

Capitalized development projects may cost more and provide less return than we estimate. If we are unable to realize a return on these investments, we may incur a related asset write-down that could adversely affect our financial results or condition.

Our ability to sustain or increase our current level of metals production partly depends on our ability to develop new orebodies and/or expand existing mining operations. Before we can begin a development project, we must first determine whether it is economically feasible to do so. This determination is based on estimates of several factors, including:

| | • | expected ore grades and recovery rates of metals from the ore; |

| | • | facility and equipment costs; |

| | • | availability of adequate staffing; |

| | • | availability of affordable sources of power and adequacy of water supply; |

| | • | exploration and drilling success; |

| | • | capital and operating costs of a development project; |

| | • | environmental and closure, permitting and other regulatory considerations and costs; |

| | • | adequate access to the site, including competing land uses (such as agriculture); |

| | • | foreign currency fluctuation and inflation rates; and |

| | • | availability and cost of financing. |

Many of these estimates are based on geological and other interpretive data, which may be imprecise. As a result, actual operating and capital costs and returns from a development project may differ substantially from our estimates, and, as such, it may not be economically feasible to continue with a development project.

Our ore reserve estimates may be imprecise.

Our ore reserve figures and costs are primarily estimates and are not guarantees that we will recover the indicated quantities of these metals. You are cautioned not to place undue reliance on estimates of reserves (or mineralized material or other resource estimates). Reserves are estimates made by our professional technical personnel of the amount of metals that they believe could be economically and legally extracted or produced at the time of the reserve determination. No assurance can be given that the estimated amount of metal or the indicated level of recovery of these metals will be realized. Reserve estimation is an interpretive process based upon available data and various assumptions. Our reserve estimates may change based on actual production experience. Further, reserves are valued based on estimates of costs and metals prices, which may not be consistent among our properties or across the industry. The economic value of ore reserves may be adversely affected by:

| | • | declines in the market price of the various metals we mine; |

| | • | increased production or capital costs; |

| | • | reduction in the grade or tonnage of the deposit; |

| | • | increase in the dilution of the ore; |

| | • | future foreign currency rates, inflation rates and applicable tax rates; |

| | • | reduced metal recovery; and |

| | • | changes in environmental, permitting or other regulatory requirements. |

Short-term operating factors relating to our ore reserves, such as the need to sequentially develop orebodies and the processing of new or different ore grades, may adversely affect our cash flow.

If the prices of metals that we produce decline substantially below the levels used to calculate reserves for an extended period, we could experience:

| | • | delays in new project development; |

| | • | write-downs of asset values; and |

Additionally, the term “mineralized material” does not indicate proven and probable reserves as defined by the Securities and Exchange Commission (“SEC”) or our standards. Estimates of mineralized material are subject to further exploration and development, and are, therefore, subject to considerable uncertainty. Despite our history of converting mineralized material to reserves through additional drilling and study work, we cannot be certain that any part or parts of the mineralized material deposit will ever be confirmed or converted into reserves as defined by the SEC or that mineralized material can be economically or legally extracted.

Efforts to expand the finite lives of our mines may not be successful or could result in significant demands on our liquidity, which could hinder our growth.

One of the risks we face is that mines are depleting assets. Thus, in order to maintain or increase production we must continually replace depleted ore reserves by locating and developing additional ore. Our ability to expand or replace ore reserves primarily depends on the success of our exploration programs. Mineral exploration, particularly for silver and gold, is highly speculative and expensive. It involves many risks and is often non-productive. Even if we believe we have found a valuable mineral deposit, it may be several years before production from that deposit is possible. During that time, it may become no longer feasible to produce those minerals for economic, regulatory, political or other reasons. As a result of high costs and other uncertainties, we may not be able to expand or replace our existing ore reserves as they are depleted, which would adversely affect our business and financial position in the future.

Our ability to market our metals production depends on the availability of smelters and/or refining facilities and our operations and financial results may be affected by disruptions or closures or the unavailability of smelters and/or refining facilities for other reasons.

We sell our metals products to smelters and metal traders. Our doré bars are sent to refiners for further processing before being sold to metal traders. Access to refiners and smelters on economical terms is critical to our ability to sell our products to buyers and generate revenues. If smelters or refiners are unavailable or unwilling to accept our products, or we are otherwise unable to sell our products to customers on acceptable commercial and legal terms, our operations and financial results could be adversely affected. See Note 11 of Notes to Consolidated Financial Statements for more information on the distribution of our sales and our significant customers.

We derive a significant amount of revenue from a relatively small number of customers and occasionally enter into concentrate spot market sales with metal traders.

For the fiscal year ended December 31, 2019, the four largest customers accounted for approximately 24%, 23%, 17% and 8%, respectively, of our total revenues. Given our operations produce unique qualities of concentrates, which a limited number of smelters can process effectively, we enter into long-term benchmark contracts for a majority of our total concentrates production. We expose lower portions of our concentrates production to spot market sales to metal traders to benefit from favorable spot market sales terms from time to time. Our results of operations, financial condition and cash flows could be materially adversely affected if one or more of our long-term customers were to decide to interrupt or curtail their activities, terminate their contracts with us or fail to renew existing contracts. Additionally, if spot market conditions deteriorate rapidly, we could have difficulty selling a portion of our concentrates, and metal traders could refuse to perform under existing contracts, which could also result in materially adverse effects on our results of operations, financial conditions and cash flows. See Note 11 of Notes to Consolidated Financial Statements for more information on the distribution of our sales and our significant customers.

Our business depends on availability of skilled miners and good relations with employees.

We are dependent upon the ability and experience of our executive officers, managers, employees, contractors and their employees, and other personnel, and we cannot assure you that we will be able to retain such employees or contractors. We compete with other companies both in and outside the mining industry in recruiting and retaining qualified employees and contractors knowledgeable about the mining business. From time to time, we have encountered, and may in the future encounter, difficulty recruiting skilled mining personnel at acceptable wage and benefit levels in a competitive labor market, and may be required to utilize contractors, which can be more costly. Temporary or extended lay-offs due to mine closures may exacerbate such issues and result in vacancies or the need to hire less skilled or efficient employees or contractors. The loss of skilled employees or contractors or our inability to attract and retain additional highly skilled employees and contractors could have an adverse effect on our business and future operations.

We or our contractors may experience labor disputes, work stoppages or other disruptions in production that could adversely affect our business and results of operations. The Lucky Friday mine is our only operation where some of our employees are subject to a collective bargaining agreement, and the previous agreement expired on April 30, 2016. After voting against our new contract offer at the time, the unionized employees went on strike on March 13, 2017. They remained on strike until January 7, 2020, when the union ratified a new collective bargaining agreement. Production at Lucky Friday was suspended from the start of the strike until July 2017, when limited production resumed by salaried personnel. Cash suspension costs during the strike totaled $7.8 million in 2019 and are combined with non-cash depreciation expense of $4.3 million in 2019 and reported in a separate line item on our consolidated statements of operations. Although we expect that many of the unionized employees will return to work throughout 2020 and that ultimately Lucky Friday will return to full production, we cannot predict how smooth the reintegration process will be, and there may be disruptions, delays or additional or extraordinary costs incurred during the process of reintegrating the employees and hiring new employees. Any such delays, disruptions or increased costs could adversely affect our financial condition and results of operations.

Shortages of critical parts and equipment may adversely affect our operations and development projects.

Hecla has been impacted, from time to time, by increased demand for critical resources such as input commodities, drilling equipment, trucks, shovels and tires. These shortages have, at times, impacted the efficiency of our operations, and resulted in cost increases and delays in construction of projects; thereby impacting operating costs, capital expenditures and production and construction schedules.

Our information technology systems may be vulnerable to disruption which could place our systems at risk from data loss, operational failure, or compromise of confidential information.

We rely on various information technology systems and on third party developers and contractors in connection with operations, including production, equipment operation and financial support systems. While we regularly monitor the security of our systems, they remain vulnerable to disruption, damage or failure from a variety of sources, including errors by employees or contractors, computer viruses, cyber-attacks including phishing, ransomware and similar malware, misappropriation of data by outside parties, and various other threats. Techniques used to obtain unauthorized access to or sabotage our systems are under continuous and rapid evolution, and we may be unable to detect efforts to disrupt our data and systems in advance. Breaches and unauthorized access carry the potential to cause losses of assets or production, operational delays, equipment failure that could cause other risks to be realized, inaccurate recordkeeping, or disclosure of confidential information, any of which could result in financial losses and regulatory or legal exposure, and could have a material adverse effect on our cash flows, financial condition or results of operations.

Our foreign activities are subject to additional inherent risks.

We currently have foreign operations in Mexico and Canada, and we expect to continue to conduct operations there and possibly other international locations in the future. Because we conduct operations internationally, we are subject to political, social, legal and economic risks such as:

| | • | the effects of local political, labor and economic developments and unrest; |

| | • | significant or abrupt changes in the applicable regulatory or legal climate; |

| | • | significant changes to regulations or laws or the interpretation or enforcement of them, including with respect to tax and profit-sharing matters arising out of the use of outsourced labor and other services at our San Sebastian operation in Mexico; |

| | • | exchange controls and export restrictions; |

| | • | expropriation or nationalization of assets with inadequate compensation; |

| | • | unfavorable currency fluctuations, particularly in the exchange rate between the U.S. dollar and the Canadian dollar and Mexican Peso; |

| | • | repatriation restrictions; |

| | • | invalidation and unavailability of governmental orders, permits or agreements; |

| | • | property ownership disputes; |

| | • | renegotiation or nullification of existing concessions, licenses, permits and contracts; |

| | • | criminal activity, corruption, demands for improper payments, expropriation, and uncertain legal enforcement and physical security; |

| | • | failure to maintain compliance with corruption and transparency statutes, including the U.S. Foreign Corrupt Practices Act; |

| | • | disadvantages of competing against companies from countries that are not subject to U.S. laws and regulations; |

| | • | fuel or other commodity shortages; |

| | • | laws or policies of foreign countries and the United States affecting trade, investment and taxation; |

| | • | opposition to our presence, operations, properties or plans by governmental or non-governmental organizations or civic groups; |

| | • | civil disturbances, war and terrorist actions; and |

The occurrence of any one or combination of these events, many of which are beyond our control, could materially adversely affect our financial condition or results of operations.

Our operations and properties in Canada expose us to additional political risks.

Our properties in Canada, particularly in Quebec, may be of particular interest or sensitivity to one or more interest groups, including aboriginal groups (which are generally referred to as “First Nations”). We have mineral projects in Quebec and British Columbia that are or may be in areas with a First Nations presence. It is our practice to work closely with and consult with First Nations in areas in which our projects are located or which could be impacted by our activities. However, there is no assurance that relationships with such groups will be positive. Accordingly, it is possible that our production, exploration or development activities on these properties could be interrupted or otherwise adversely affected in the future by political uncertainty, native land claims entitlements, expropriations of property, changes in applicable law, governmental policies and policies of relevant interest groups, including those of First Nations. Any changes in law or relations or shifts in political conditions may be beyond our control, or we may enter into agreements with First Nations, all of which may adversely affect our business and operations and if significant, may result in the impairment or loss of mineral concessions or other mineral rights, or may make it impossible to continue our mineral production, exploration or development activities in the applicable area, any of which could have an adverse effect on our financial conditions and results of operations.