Note 1 — Organization

VALIC Company I (the “Series”), a Maryland Corporation, is registered with the Securities and Exchange Commission (the “SEC”) under the Investment Company Act of 1940, as amended (the “1940 Act”) as an open-end management investment company. The Series is currently comprised of 36 funds (each, a “Fund,” and collectively, the “Funds”). The Variable Annuity Life Insurance Company (“VALIC” or the “Adviser”), an indirect wholly owned subsidiary of Corebridge Financial, Inc. (“Corebridge”), serves as investment adviser for all the Funds of the Series. For purposes of the Investment Advisers Act and the Investment Company Act, American International Group, Inc.’s (“AIG”) share ownership of Corebridge, the publicly-traded parent company of VALIC, and the rights granted to AIG by Corebridge as part of a separation agreement between AIG and Corebridge, provide AIG with control over Corebridge’s corporate and business activities.

Shares of the Funds are issued and redeemed in connection with investments in and payments under variable annuity contracts and variable life policies (collectively, the “Variable Contracts”) offered by life insurance companies affiliated with the Adviser (the “Life Companies”), and are also offered to certain employer-ponsored retirement plans and individual retirement accounts and certain affiliated mutual funds. All shares may be purchased or redeemed at net asset value without any sales or redemption charges.

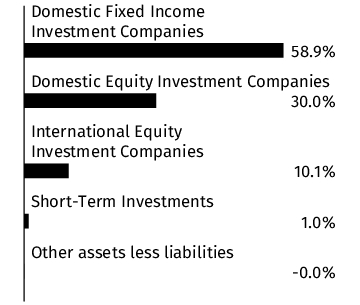

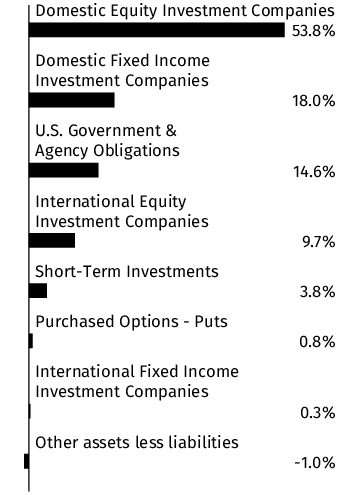

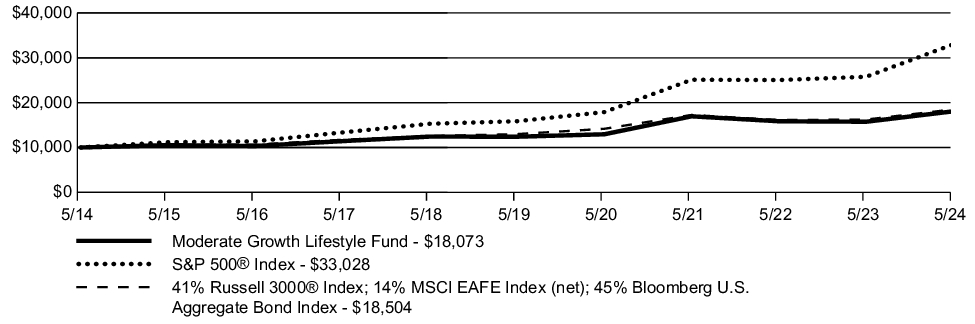

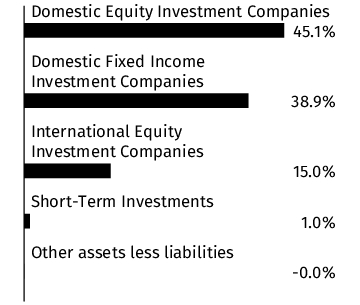

The Aggressive Growth Lifestyle Fund, Conservative Growth Lifestyle Fund and Moderate Growth Lifestyle Fund (the “Lifestyle Funds”) are structured as fund-of-funds and invest in affiliated mutual funds (the “Underlying Funds”). The Dynamic Allocation Fund invests, under normal conditions, approximately 70% to 90% of its assets in Underlying Funds.

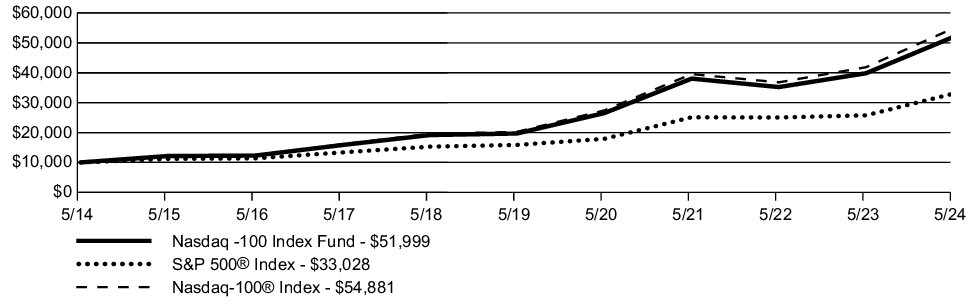

Each Fund is diversified with the exception of Growth Fund, International Government Bond Fund, Nasdaq-100® Index Fund, Science & Technology Fund and Systematic Growth Fund, which are non-diversified as defined by the 1940 Act.

Indemnifications: The Funds' organizational documents provide current and former officers and directors with a limited indemnification against liabilities arising out of the performance of their duties to the Funds. In addition, pursuant to Indemnification Agreements between the Funds and each of the current (and certain former) directors who is not an “interested person,” as defined in Section 2(a)(19) of the 1940 Act, of the Funds (collectively, the “Disinterested Directors”), the Funds provide the Disinterested Directors with a limited indemnification against liabilities arising out of the performance of their duties to the Funds, whether such liabilities are asserted during or after their service as directors. In addition, in the normal course of business the Funds enter into contracts that contain the obligation to indemnify others. The Funds' maximum exposure under these arrangements is unknown. Currently, however, the Funds expect the risk of loss to be remote.

Note 2 — Significant Accounting Policies

The preparation of financial statements in accordance with U.S. generally accepted accounting principles (“GAAP”) requires management to make estimates and assumptions that affect the reported amounts and disclosures in the financial statements. Actual results could differ from those estimates and those differences could be significant. The Funds are considered investment companies under U.S. GAAP and follow the accounting and reporting guidance applicable to investment companies. The following is a summary of significant accounting policies consistently followed by the Series, in the preparation of its financial statements:

Security Valuation: In accordance with the authoritative guidance on fair value measurements and disclosures under GAAP, the Funds disclose the fair value of their investments in a hierarchy that prioritizes the inputs to valuation techniques used to measure the fair value. In accordance with GAAP, fair value is defined as the price that the Funds would receive upon selling an asset or transferring a liability in a timely transaction to an independent third party in the principal or most advantageous market. GAAP establishes a three-tier hierarchy to provide more transparency around the inputs used to measure fair value and to establish classification of fair value measurements for disclosure purposes. Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk. Inputs may be observable or unobservable. Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability developed based on market data obtained from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability developed based on the best information available in the circumstances. The three-tiers are as follows:

Level 1 — Unadjusted quoted prices in active markets for identical securities

Level 2 — Other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, referenced indices, quoted prices in inactive markets, adjusted quoted prices in active markets, adjusted quoted prices on foreign equity securities that were adjusted in accordance with pricing procedures adopted by the Board of Directors (the “Board”), etc.)

Level 3 — Significant unobservable inputs (includes inputs that reflect the Funds’ own assumptions about the assumptions market participants would use in pricing the security, developed based on the best information available under the circumstances)

Changes in valuation techniques may result in transfers in or out of an investment’s assigned Level within the hierarchy. The methodology used for valuing investments is not necessarily an indication of the risk associated with investing in those investments and the determination of the significance of a particular input to the fair value measurement in its entirety requires judgment and consideration of factors specific to each security.

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is recently issued and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3.

The summary of the Funds’ assets and liabilities classified in the fair value hierarchy as of May 31, 2024, is reported on a schedule at the end of each Fund’s Portfolio of Investments.

Stocks are generally valued based upon closing sales prices reported on recognized securities exchanges on which the securities are principally traded and are generally categorized as Level 1. Stocks listed on the NASDAQ are valued using the NASDAQ Official Closing Price (“NOCP”). Generally, the NOCP will be the last sale price unless the