UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | | | | | |

| ¨ | | Preliminary Proxy Statement | | ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | | Definitive Proxy Statement | | |

| ¨ | | Definitive Additional Materials | | |

| ¨ | | Soliciting Material Pursuant to §240.14a-12 | | |

HERITAGE BANKSHARES, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

HERITAGE BANKSHARES, INC.

150 GRANBY STREET, NORFOLK, VA 23510

NOTICE OF 2008 ANNUAL MEETING OF SHAREHOLDERS

To be Held June 16, 2008

To Our Shareholders:

NOTICE is hereby given that the 2008 Annual Meeting of Shareholders of Heritage Bankshares, Inc. (the “Company”) will be held at the Courtyard by Marriott Hotel, 520 Plume Street, Norfolk, Virginia 23510, on Monday, June 16, 2008, at 10:00 A.M. local time, for the following purposes:

| | 1. | To elect to the Board of Directors of the Company five (5) “Class 2” directors to serve three-year terms until the 2011 Annual Meeting of Shareholders. |

| | 2. | To ratify the appointment of Elliott Davis LLC as the Company’s independent auditors for the year ending December 31, 2008. |

| | 3. | To transact such other business as may properly come before the meeting or any adjournment thereof. |

Only shareholders of record at the close of business on April 18, 2008 are entitled to notice of, and to vote at, the 2008 Annual Meeting of Shareholders or any adjournment thereof.

Your attention is directed to the Proxy Statement accompanying this notice for a more complete statement regarding matters proposed to be acted upon at the meeting.The Board of Directors unanimously recommends that shareholders vote FOR approval of each of the above items.

|

| By Order of the Board of Directors, |

|

/s/ MICHAEL S. IVES |

Michael S. Ives, President and Chief Executive Officer |

Dated in Norfolk, Virginia and mailed

the 29th day of April, 2008

TO ENSURE THAT YOUR SHARES ARE REPRESENTED AT THE ANNUAL MEETING, PLEASE FILL IN, DATE AND SIGN THE ENCLOSED PROXY AND RETURN IT PROMPTLY IN THE ENCLOSED ENVELOPE, REGARDLESS OF WHETHER YOU EXPECT TO ATTEND THE MEETING. THE ENCLOSED ENVELOPE REQUIRES NO POSTAGE IF MAILED IN THE UNITED STATES. IF FOR ANY REASON YOU DESIRE TO REVOKE YOUR PROXY, YOU MAY DO SO AT ANY TIME BEFORE IT IS VOTED BY CONTACTING THE SECRETARY OF THE COMPANY, IN PERSON OR IN WRITING, AT THE ADDRESS INDICATED ABOVE. IF YOU ATTEND THE MEETING, YOU MAY VOTE EITHER IN PERSON OR THROUGH YOUR PROXY.

HERITAGE BANKSHARES, INC.

PROXY STATEMENT

2008 ANNUAL MEETING OF SHAREHOLDERS

June 16, 2008

The solicitation of the enclosed Proxy is made by and on behalf of the Board of Directors of Heritage Bankshares, Inc. (the “Company”) to be used at the 2008 Annual Meeting of Shareholders (the “Annual Meeting”) to be held on June 16, 2008 at 10:00 a.m, or any adjournment thereof, at the Courtyard by Marriott Hotel, 520 Plume Street, Norfolk, Virginia 23510. The approximate mailing date of this Proxy Statement and the accompanying Proxy is April 29, 2008. The matters to be considered and acted upon at the Annual Meeting are (i) the election of certain members to the Board of Directors of the Company, and (ii) the ratification of Elliott Davis LLC as the Company’s independent auditors for the year ending December 31, 2008.

The Company is a one-bank holding company organized under the laws of the Commonwealth of Virginia. The Company’s wholly-owned subsidiary, Heritage Bank (the “Bank”), is a state banking corporation and a member of the Federal Reserve. The Bank currently operates five (5) full-service branches in Hampton Roads, Virginia.

Use and Revocation of Proxy

Anyone who gives a Proxy may still vote in person, if he or she so desires, and may revoke the Proxy at any time prior to the voting of such Proxy by contacting the Secretary of the Company, in person or in writing, or by filing a duly executed Proxy bearing a later date. All properly executed Proxies delivered pursuant to this solicitation will be voted at the Annual Meeting in accordance with instructions contained therein. If no instructions are given in a returned executed Proxy, the Proxy will be voted in favor of the two matters for consideration at the Annual Meeting, and in the discretion of the proxy holders as to any other matters which may properly come before the meeting. Proxies will extend to, and will be voted at, any properly adjourned session of the Annual Meeting, unless otherwise revoked.

Persons Making The Solicitation

The cost of the solicitation of proxies will be borne by the Company. Solicitations will be made only by mail, except that, if necessary, officers and regular employees of the Bank or the Company may make solicitations of proxies in person or by telephone. Banks, brokerage firms and other custodians, nominees and fiduciaries will be requested to forward the proxy soliciting material to the beneficial owners of the stock held of record by such persons, and the Company will, upon request, reimburse them for their reasonable charges and expenses in this regard.

Voting Shares and Vote Required

Only shareholders of record at the close of business on April 18, 2008, the record date fixed by the Board of Directors (the “Record Date”), will be entitled to vote at the Annual Meeting, or any adjournment thereof. As of the Record Date, the Company had issued and outstanding 2,278,652 shares of common stock of the Company, par value $5.00 per share (“Common Stock”). A majority of the outstanding shares of Common Stock must be represented at the Annual Meeting in person or by proxy in order to constitute a quorum for the transaction of business at the Annual Meeting. Each share of Common Stock is entitled to one vote on all matters to come before the Annual Meeting.

In the election of directors, if a quorum exists, those nominees receiving the greatest number of votes cast shall be elected even if such votes do not constitute a majority of the shares of Common Stock represented at the Annual Meeting in person or proxy. Elliott Davis LLC will be ratified as the Company’s independent auditors for the year ended December 31, 2008 if a quorum exists and the votes cast “for” ratification exceed the votes cast “against” ratification.

1

A shareholder who is present in person or by proxy at the Annual Meeting and who abstains from voting on any or all proposals will be included in the number of shareholders present at the Annual Meeting for the purpose of determining the presence of a quorum, but abstentions do not count as votes in favor of or against a given matter. Brokers who hold shares for the accounts of their clients may vote these shares either as directed by their clients or in their own discretion if permitted by the exchange or other organization of which they are members. Proxies that contain a broker vote on one or more proposals but no vote on others are referred to as “broker non-votes” with respect to the proposal(s) not voted upon. Broker non-votes are included in determining the presence of a quorum, but a broker non-vote does not count as a vote in favor of or against a particular proposal for which the broker has no discretionary voting authority. Accordingly, abstentions and broker non-votes will not affect the election of directors or the proposal to ratify Elliott Davis LLC as the Company’s independent auditors for the year ended December 31, 2008.

Approval of any other matter that may properly come before the Annual Meeting requires the affirmative vote of a majority of shares of Common Stock present in person or by proxy and entitled to vote on the matter, except to the extent otherwise required by law. Abstentions and broker non-votes will not be counted in determining the minimum number of votes required for approval and will, therefore, have the effect of negative votes.

2

PROPOSAL ONE ELECTION OF DIRECTORS

The Company’s Bylaws provide that the number of members of the Board of Directors shall be fifteen (15) persons, and further provide that the Board of Directors will be divided into three (3) classes, as nearly equal in number as possible. Each class serves for a term of three (3) years, and until their successors are elected and qualified.

At the Annual Meeting, five (5) directors comprising “Class 2” directors will be elected to serve until the 2011 Annual Meeting of Shareholders and until their successors are elected and qualified.

As described above, the election of each nominee requires the affirmative vote of a plurality of the votes cast by the shares entitled to vote. Proxies received will be voted “FOR” the election of such nominees unless marked to the contrary. A shareholder who desires to withhold voting of the proxy for one or all of the nominees may so indicate on his or her Proxy. The Nominating Committee nominated all of the nominees for election to the Board of Directors at the Annual Meeting, and all of the nominees currently serve as members of the Board and have consented to be named and have indicated their intent to serve if elected. However, in the event any nominee is not available for election, the Proxies will be voted for such person as shall be designated by the Board as a replacement.

The following table sets forth certain information as of the Record Date with respect to each nominee and incumbent director of the Company, including age, principal occupation and the year he or she first became a director. Unless otherwise indicated, the business experience and principal occupation shown for each nominee or incumbent director has existed five or more years.

| | | | | | |

Name | | Age | | Served as a Director Since | | Principal Occupation During Past Five Years |

Nominees for Election of “Class 2” Directors Whose Terms Will Expire in 2011 |

| | | |

Wendell C. Franklin | | 62 | | 2005 | | Senior Vice President of S.L. Nusbaum Realty Co., a commercial real estate leasing and brokerage firm, in Norfolk, Virginia. |

| | | |

F. Dudley Fulton | | 59 | | 1988 | | President and Chief Executive Officer of USI Midatlantic Insurance Services, Inc., an insurance and financial services company, in Norfolk, Virginia. |

| | | |

Ross C. Reeves | | 59 | | 1994 | | Attorney with Willcox & Savage, P.C., a law firm, in Norfolk, Virginia. |

| | | |

Howard M. Webb | | 71 | | 2005 | | Director of ColonialWebb Contractors Co., a mechanical contractor, in Norfolk, Virginia. Mr. Webb was Chief Executive Officer of Webb Technologies, Inc. from 1999 through 2004. |

| | | |

Barbara Zoby | | 55 | | 2005 | | President and Chief Executive Officer of Yukon Lumber Co., Inc., a specialty lumber firm, in Norfolk, Virginia. |

|

Incumbent “Class 3” Directors Whose Terms Will Expire in 2009 |

| | | |

Lisa F. Chandler | | 53 | | 1998 | | Executive Vice President of Nancy Chandler Associates, Inc., a residential real estate brokerage company, in Norfolk, Virginia. |

| | | |

Stephen A. Johnsen | | 62 | | 1984 | | Executive Vice President of Flagship—Brown & Brown, an insurance and financial services company, in Norfolk, Virginia. |

3

| | | | | | |

Name | | Age | | Served as a Director Since | | Principal Occupation During Past Five Years |

Thomas G. Johnson, III | | 38 | | 2002 | | Senior Vice President of S.L. Nusbaum Realty Co., a commercial real estate leasing and brokerage firm, in Norfolk, Virginia. |

| | | |

Charles R. Malbon, Jr. | | 58 | | 2005 | | President of Tank Lines, Inc., an oil distributor, in Virginia Beach, Virginia. |

| | | |

L. Allan Parrott, Jr. | | 42 | | 2002 | | President of Tidewater Fleet Supply, LLC, a wholesale auto parts distributor, in Chesapeake, Virginia. |

|

Incumbent “Class 1” Directors Whose Terms Will Expire in 2010 |

| | | |

James A. Cummings | | 65 | | 1992 | | President of Southern Atlantic Label Co., Inc., a manufacturer, in Chesapeake, Virginia. |

| | | |

Michael S. Ives | | 55 | | 2005 | | President and Chief Executive Officer of Heritage Bankshares, Inc. and Heritage Bank. Prior to joining the Company in February 2005, Mr. Ives was the Chief Executive Officer of the Hampton Roads Market of SouthTrust Bank; before that, Mr. Ives served as President and Chief Executive Officer of CENIT Bancorp, Inc. for approximately nine years. |

| | | |

David L. Kaufman | | 52 | | 2005 | | Senior Managing Director of Envest Holdings, L.L.C., a venture capital firm, in Norfolk, Virginia. |

| | | |

Peter M. Meredith, Jr. | | 56 | | 1992 | | Chairman and Chief Executive Officer of Meredith Construction Co., Inc., a general contractor, in Norfolk, Virginia.* |

| | | |

Harvey W. Roberts, III | | 63 | | 1993 | | Retired Certified Public Accountant. Prior to his retirement, Mr. Roberts was a principal in the accounting firm McPhillips, Roberts & Deans, PLC, in Norfolk, Virginia. |

| * | Mr. Meredith also has served as a Director of Waterside Capital Corporation (“Waterside”), a reporting company located in Norfolk, Virginia, since 1994. Mr. Meredith also previously served as Chairman of the Board of Waterside. |

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT YOU VOTEFOR THE PROPOSAL TO ELECT THE FIVE NOMINEES LISTED ABOVE AS “CLASS 2” DIRECTORS.

4

SECURITY OWNERSHIP

Security Ownership of Management

The following table sets forth for (1) each director-nominee, each director, and each named executive officer of the Company individually, and (2) all director-nominees, directors, and named executive officers of the Company as a group: (i) the number of shares of Common Stock of the Company beneficially owned on the Record Date and (ii) such person’s or group’s percentage ownership of outstanding shares of Common Stock of the Company on such date. All of the Company’s directors and named executive officers receive mail in their capacity as such at the Company’s principal executive office at 150 Granby Street, Norfolk, Virginia 23510.

| | | | | | |

Name of Beneficial Owner | | Amount and

Nature of

Beneficial

Ownership | | | Percent of

Class** | |

Directors: | | | | | | |

Lisa F. Chandler | | 8,509 | (1) | | * | |

James A. Cummings | | 29,256 | (2) | | 1.28 | % |

Wendell C. Franklin | | 39,595 | (3) | | 1.73 | % |

F. Dudley Fulton | | 20,300 | (4) | | * | |

Michael S. Ives | | 150,000 | (5) | | 6.31 | % |

David L. Kaufman | | 24,000 | (6) | | 1.05 | % |

Stephen A. Johnsen | | 30,590 | (7) | | 1.34 | % |

Thomas G. Johnson, III | | 14,400 | (8) | | * | |

Peter M. Meredith, Jr. | | 132,238 | (9) | | 5.79 | % |

Charles R. Malbon, Jr. | | 15,650 | (10) | | * | |

L. Allan Parrott, Jr. | | 23,000 | (11) | | 1.01 | % |

Ross C. Reeves | | 11,100 | (12) | | * | |

Harvey W. Roberts, III | | 60,184 | (13) | | 2.64 | % |

Howard M. Webb | | 8,225 | (14) | | * | |

Barbara Zoby | | 12,350 | (15) | | * | |

Non-Director Named Executive Officers: | | | | | | |

John O. Guthrie | | 28,500 | (16) | | 1.24 | % |

All Named Executive Officers and Directors as a group (16 persons) | | 607,897 | (17) | | 24.91 | % |

| * | Indicates less than one percent (1.0%) of the outstanding shares of Common Stock of the Company. |

| ** | Applicable percentages are based on 2,278,652 shares of Common Stock outstanding on the Record Date. Also includes shares of Common Stock subject to options that may be exercised within 60 days of the Record Date, including currently unvested options that would vest and be exercisable immediately in the event of a change in control of the Company. Such shares are deemed to be outstanding for the purposes of computing the percentage ownership of the applicable individual holding such options, but are not deemed outstanding for purposes of computing the percentage of any other person shown in the table. This table is based upon information supplied by officers, directors, and principal shareholders and (where applicable, if at all) Schedule 13Ds and 13Gs filed with the SEC. Unless indicated in the footnotes to this table and subject to community property laws where applicable, the Company believes that each of the shareholders named in this table has sole voting and investment power with respect to the shares indicated as beneficially owned. |

| (1) | Includes (a) 6,509 shares held in the name of the Lisa F Chandler Trust U/A dated 03/19/2001, and (b) 2,000 shares issuable upon exercise of options to purchase shares pursuant to the Company’s 1999 Stock Option Plan (“1999 Stock Option Plan”). |

| (2) | Includes 11,000 shares owned jointly with Mr. Cummings’ wife. |

| (3) | Includes 4,000 shares issuable upon exercise of options to purchase shares under the Heritage 2006 Equity Incentive Plan (the “2006 Incentive Plan”). |

| (4) | Shares are pledged as security. |

5

| (5) | Includes (a) 30,000 options issued under the 1999 Stock Option Plan pursuant to Mr. Ives’ Employment Agreement dated February 7, 2005, as amended, and (b) 70,000 shares issuable upon exercise of options to purchase shares pursuant to the 2006 Incentive Plan. |

| (6) | Includes 4,000 shares issuable upon exercise of options to purchase shares pursuant to the 2006 Incentive Plan. |

| (7) | Includes 3,300 shares owned jointly with Mr. Johnsen’s wife. |

| (8) | Includes (a) 2,000 shares issuable upon exercise of options to purchase shares pursuant to the 1999 Stock Option Plan, and (b) 2,000 shares issuable upon exercise of options to purchase shares pursuant to the 2006 Incentive Plan. |

| (9) | Includes (a) 21,920 shares held in the name of Meredith Realty Company, L.L.C., (b) 27,616 shares held in the name of Pomar Holding, L.L.C., (c) 6,000 shares held in the name of Meredith Realty Associates, (d) 14,706 shares owned by Mr. Meredith’s children and (e) 4,000 shares issuable upon exercise of options to purchase shares pursuant to the 1999 Stock Option Plan. |

| (10) | Includes 4,000 shares issuable upon exercise of options to purchase shares pursuant to the 2006 Incentive Plan. |

| (11) | Includes (a) 800 shares held in trust for the benefit of Mr. Parrott’s children, and (b) 2,000 shares issuable upon exercise of options to purchase shares pursuant to the 2006 Incentive Plan. |

| (12) | Includes (a) 750 shares owned by Mr. Reeves’ wife and (b) 4,000 shares issuable upon exercise of options to purchase shares pursuant to the 1999 Stock Option Plan. |

| (13) | Includes (a) 34,560 shares owned by Mr. Roberts’ wife, (b) 6,000 shares owned jointly with Mr. Roberts’ wife and (c) 4,000 shares issuable upon exercise of options to purchase shares pursuant to the 1999 Stock Option Plan. |

| (14) | Includes 4,000 shares issuable upon exercise of options to purchase shares pursuant to the 2006 Incentive Plan. |

| (15) | Includes 4,000 shares issuable upon exercise of options to purchase shares pursuant to the 2006 Incentive Plan. |

| (16) | Includes 22,000 shares issuable upon exercise of options to purchase shares pursuant to the 2006 Incentive Plan. |

| (17) | Includes (a) 46,000 shares issuable to all named executive officers and directors as a group upon exercise of options to purchase shares pursuant to the 1999 Stock Option Plan and (b) 116,000 shares issuable to all named executive officers and directors as a group upon exercise of options to purchase shares pursuant to the 2006 Incentive Plan. |

Security Ownership of Certain Beneficial Owners

Based on currently available information, as of the Record Date, there is no beneficial owner of 5.0% or more of the outstanding Common Stock of the Company except as otherwise noted above under “Security Ownership of Management”.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires the Company’s directors, executive officers and persons who beneficially own greater than ten percent (10%) of the Common Stock of the Company (the “Reporting Persons”) to file reports relating to their ownership and changes in ownership of Common Stock with the Securities and Exchange Commission (the “SEC”). Reporting Persons are required by SEC regulations to furnish to the Company copies of all Section 16(a) reports.

Based solely on its review of copies of such reports furnished to the Company, the Company believes that all reporting requirements under Section 16(a) were complied with during the fiscal year ended December 31, 2007, except as follows:

| | • | | John O. Guthrie filed one late Form 4 related to one transaction that was not timely reported. |

6

CORPORATE GOVERNANCE AND THE BOARD OF DIRECTORS

General

The Company’s Board of Directors has primary responsibility for the determination of corporate policies and the overall financial condition of the Company. The Board appoints a chief executive and other officers who are responsible for conducting business on a day-to-day basis under the Board’s guidance. In turn, the management of the Company provides the Board of Directors with a regular and detailed flow of information relating to the Company’s overall condition and financial performance.

Executive Officers of Heritage Bankshares, Inc. and Heritage Bank

Michael S. Ives, 55, has served as the President and Chief Executive Officer of the Company and the Bank, and as a Company director, since February 7, 2005. Prior to that time, Mr. Ives was the Chief Executive Officer for the Hampton Roads Market of SouthTrust Bank. Mr. Ives joined SouthTrust Bank in August 2001, following the acquisition by SouthTrust Corporation of CENIT Bancorp, Inc. (“CENIT”). Prior to its acquisition by SouthTrust Corporation in August 2001, Mr. Ives had served as President and Chief Executive Officer of CENIT since 1992.

John O. Guthrie, 58, has served as the Chief Financial Officer of the Company and the Bank since February 14, 2005. Mr. Guthrie served as Chief Financial Officer of CENIT, a position he held from 1992 to August 2001, until CENIT was acquired by SouthTrust Corporation in August 2001. After briefly holding a position with SouthTrust Bank following the CENIT acquisition, Mr. Guthrie was employed as an investment advisor with Legg Mason in Norfolk, Virginia, from approximately November 2002 to January 2004. Mr. Guthrie also served as the Chief Financial Officer for Geeks On Call America, a technology company in Norfolk, Virginia, for several months in 2004.

Independence of Directors

We apply the definition of independent director as defined by Rule 4200(a)(15) of the National Association of Securities Dealers, Inc. (“NASD”) listing standards. In accordance with this guidance, all of the directors of the Company would be considered independent with the exception of Michael S. Ives, our President and Chief Executive Officer. Further, other than Mr. Ives (who serves on the Company’s Executive Committee), all of the members of the Board Committees of the Company are considered independent under NASD Rule 4200(a)(15).

Shareholder Communications with the Company’s Board of Directors

The Board of Directors has not established a written policy regarding communications with shareholders. A formal policy has not been adopted because directors have periodic contact with shareholders through business, personal, and community-based activities. Although not prescribed in a policy, shareholders may communicate with the Board through written communications addressed to the Company’s executive office at 150 Granby Street, Norfolk, Virginia 23510. Personal correspondence from a shareholder directed to an individual board member will be referred, unopened, to that member. Personal correspondence marked “confidential” from a shareholder not directed to a particular board member will be referred, unopened, to the Chairman of the Board.

Board Meetings; Meeting Attendance; Committees

The business of the Company is managed under the direction of the Board of Directors. The Board generally meets once a month and met twelve (12) times in 2007. All directors attended at least 75% of the total meetings of the Board of Directors, except that Stephen A. Johnsen and Thomas G. Johnson, III each attended only 66.7% of the Board meetings. All committee members attended at least 75% of the meetings of the various committees on which they are members during the period in which they served, except that Stephen A. Johnsen did not attend the one Compensation Committee meeting held during 2007.

7

The Board does not have a policy regarding attendance at annual shareholders’ meetings; however, all Board members are strongly encouraged to attend such meetings, and ten (10) Board members attended the 2007 Annual Meeting of Shareholders held on June 21, 2007.

The Board of Directors has four (4) standing committees: Audit Committee, Compensation Committee, Nominating Committee and Executive Committee, as well as other ad hoc committees. All committee meetings are scheduled by the committee chairpersons as deemed necessary. Certain information regarding the members and duties of the various management committees is detailed below.

Audit Committee

The Audit Committee consists of F. Dudley Fulton (Chairman), Lisa F. Chandler, James A. Cummings, L. Allan Parrott, Jr., Harvey W. Roberts, III, and Barbara Zoby. The Board of Directors has determined that Mr. Fulton is the “audit committee financial expert” as defined in Item 407(d)(5) of Regulation S-K, and Mr. Fulton is independent under the guidelines used by the Company as noted above. The Audit Committee is responsible for the appointment, compensation and oversight of the work of the independent auditor of the Company. It also must pre-approve all audit and non-audit services provided by the independent auditor. Further, while management has the primary responsibility for the consolidated financial statements and the financial reporting process, the Committee reviews the Company’s financial reporting process, including internal control over financial reporting, on behalf of the Board of Directors. The Committee acts as the intermediary between the Company and the independent auditor and reviews the reports of the independent auditor. The Audit Committee has adopted a formal written charter, which is attached as Appendix A to this Proxy Statement. The Audit Committee held four (4) meetings in 2007.

Please see “Audit Committee Report” below.

Compensation Committee

The Compensation Committee consists of Ross C. Reeves (Chairman), Wendell C. Franklin, Thomas G. Johnson, III, Stephen A. Johnsen and David L. Kaufman. (Peter M. Meredith, Jr., as Chairman of the Board, also serves as anex officiomember of the Committee.) The Compensation Committee has not yet adopted a charter, but plans to do so in the future. The Compensation Committee is responsible for overseeing the compensation structure of the Company. The Compensation Committee also reviews the performance and establishes the compensation of the Company’s President and Chief Executive Officer and approves the compensation of the Company’s other executive officers upon recommendation of the President and Chief Executive Officer. In addition, the Compensation Committee administers the Heritage 2006 Equity Incentive Plan. The Compensation Committee may not delegate its authority to other persons. The Compensation Committee held one (1) meeting in 2007.

Nominating Committee

The Nominating Committee consists of Peter M. Meredith, Jr. (Chairman), Stephen A. Johnsen, Charles R. Malbon, Jr., Ross C. Reeves, Harvey W. Roberts, III and Howard M. Webb. The function of this committee is to identify and present nominees for membership on the Board of Directors. The Nominating Committee did not meet in 2007, in light of the fact that all nominees for election to the Board of Directors at the 2007 Annual Meeting of Shareholders were incumbent directors.

The Nominating Committee has not yet adopted a charter, but plans to do so in the future. The Board of Directors relies on the discretion of the Nominating Committee members to identify potential nominees from sources that they deem appropriate. The Nominating Committee has not formulated specific criteria for nominees, but it considers qualifications that include, but are not limited to, capability, ability to serve, conflicts of interest, ability to refer desirable business to the Company and the Bank, willingness and ability to make

8

equity investments in the Company and other relevant factors. The Nominating Committee also emphasizes character, ethics, judgment, financial literacy, business acumen, and community involvement among other criteria it may consider. In addition, directors and director nominees are subject to various laws and regulations pertaining to financial holding companies, including a minimum stock ownership requirement.

The Nominating Committee utilizes a variety of resources in identifying nominees, including recommendations of individuals who serve the Company and the Bank on advisory boards, management, other Board members, and other business or community leaders. The Nominating Committee may consider recommendations from shareholders that comply with applicable requirements under the Company’s Bylaws, including that each notice of a recommendation must set forth, (i) as to each person whom such shareholder proposes to nominate for election or re-election as a director, all information relating to such person that is required to be disclosed in solicitations of proxies for election of directors, or is otherwise required, under applicable law (including such person’s written consent to being named in the proxy statement as a nominee and to serving as a director if elected); (ii) as to each person whom such shareholder proposes to nominate for election or re-election as a director, all information, certifications, reports and submissions required by the Federal Reserve Board, Virginia Bureau of Financial Institutions or any other regulatory agency with supervisory authority over the Company or the Bank with respect to the designation of a new director of a holding company or financial institution regulated by such a regulatory agency; and (iii) as to the shareholder giving the notice, his or her name and address and the number of shares beneficially owned by such shareholder. The Company has not paid a third party to assist in identifying, evaluating, or otherwise assisting in the nomination process.

Executive Committee

The Executive Committee consists of Peter M. Meredith, Jr. (Chairman), Michael S. Ives, Stephen A. Johnsen, Charles R. Malbon, Jr., Ross C. Reeves, Harvey W. Roberts, III and Howard M. Webb. When the Board of Directors is not in session, the Executive Committee is authorized to exercise all powers vested in the Board, subject to certain matters reserved for Board action in the Company’s Bylaws. The Executive Committee did not meet in 2007.

9

Audit Committee Report

The Audit Committee has reviewed and discussed the Company’s audited consolidated financial statements with management and the Company’s independent accountants. The Committee has discussed with the independent accountants matters required to be discussed by Statement on Auditing Standards No. 61, as amended (AICPA,Professional Standards, Vol. 1, section 380), as adopted by the Public Company Accounting Oversight Board in Rule 3200T. In addition, the Committee has discussed with the independent accountants the independent accountants’ independence from the Company, the Bank and its management, including the matters in the written disclosures and the letter received from the independent accountants as required by the Independence Standards Board Standards No. 1 (Independence Discussions with Audit Committees), as adopted by the Public Company Accounting Oversight Board in Rule 3600T. The Committee discussed with the Company’s internal and independent auditors the overall scope and specific plans for their respective audits.

The Audit Committee meets with the internal and independent auditors, with and without management present, to discuss the results of their examinations, the evaluations of the Company’s internal controls, and the overall quality of the Company’s financial reporting. The meetings also are designed to facilitate any private communications with the Committee desired by the internal auditors or independent accountants. In reliance on the reviews and discussions referred to above, the Committee recommended to the Board of Directors, and the Board has approved, that the applicable audited financial statements of the Company be included in the Company’s Annual Report on Form 10-KSB for the fiscal year ended December 31, 2007 for filing with the Securities and Exchange Commission. This report is provided by the following directors who constitute the Audit Committee as of the date hereof.

F. Dudley Fulton, Chairman

Lisa F. Chandler

James A. Cummings

L. Allan Parrott, Jr.

Harvey W. Roberts, III

Barbara Zoby

10

Certain Relationships and Related Transactions

Loans to Officers and Directors

Certain directors and officers of the Company and the Bank, members of their immediate families, and corporations, partnerships and other entities with which such persons are associated, are customers of the Bank. As such, some of these persons engaged in transactions with the Bank in the ordinary course of business during 2007, and will have additional transactions with the Bank in the future. All loans extended and commitments to lend by the Bank to such persons were made in the ordinary course of business, were made upon substantially the same terms, including interest rates and collateral, as those prevailing at the time for comparable transactions with persons not related to the Company, and do not involve more than the normal risk of collectability or present other unfavorable features. None of such loans are classified as nonaccrual, past-due, restructured or potential problem, and all such loans are current as to principal and interest. As of December 31, 2007, the amount of loans from the Bank to certain officers (vice president and above) and all directors of the Company and the Bank, and entities in which they are associated, was approximately $12.8 million, which amount includes loans for which certain related parties are partial guarantors.

Other Transactions and Relationships

The Bank currently occupies 11,119 square feet of a building located at 1450 South Military Highway in Chesapeake, Virginia for its operations center. The building previously was owned by IBV Partners, L.P., a Virginia limited partnership (“IBV Partners”), which has as its sole general partner IBV Real Estate Holdings, Inc., a wholly-owned subsidiary of the Company. Certain directors of the Company and the Bank own certain of the limited partnership interests in IBV Partners. During 2007 and prior years, the Company was a party to a lease with IBV Partners for the Bank’s operations center. The facility that housed the operations center was sold by IBV Partners in August 2007 to an unrelated party, and the Company now leases the facility from the unrelated party. Total rent expense paid by the Bank in respect of the IBV Partners lease was $72,996 during 2007. The Bank also had a loan receivable from IBV Partners, which was secured by the building and improvements that included the Bank’s operations center. This loan was satisfied upon the sale of the building, so there was no balance on this loan at December 31, 2007.

In December 2006, the Bank contracted with Meredith Construction Co., Inc. (“Meredith Construction”), of which Peter M. Meredith, Jr. is Chairman and Chief Executive Officer, as general contractor to build, for a maximum price of $1.4 million (which includes a fee of approximately $127,000 to Meredith Construction), the Bank’s new retail banking office on its site on Lynnhaven Parkway in Virginia Beach. Mr. Meredith is a director and Chairman of the Board of the Company. Meredith Construction utilized ColonialWebb Contractors Co. (“ColonialWebb”), of which Howard M. Webb is a director, as the heating and air conditioning subcontractor related to construction of the Lynnhaven office for a price of $82,454. Mr. Webb is a director of the Company.

In May 2007, the Bank again contracted with Meredith Construction as general contractor to build, for a maximum price of $2.3 million (which includes a fee of approximately $208,000 to Meredith Construction), the Bank’s new retail banking office on its site on Laskin Road in Virginia Beach. Meredith Construction plans to utilize ColonialWebb as the heating and air conditioning subcontractor related to construction of the Laskin office for a price of $193,245.

The Bank also contracted in May 2007 with Meredith Construction as general contractor to renovate, for a maximum price of $106,000 (which includes a fee of approximately $13,875 to Meredith Construction), the Bank’s retail banking office on its site on North Military Highway in Norfolk.

The Company retained the law firm of Willcox & Savage, P.C. in 2007 in connection with certain legal matters, and expects to continue to do so in the future. Ross C. Reeves, a director of the Company, is an attorney with Willcox & Savage, P.C. The Company paid fees to the firm of $137,024 during 2007.

11

Code of Ethics

The Company has adopted a Code of Ethics that applies to its Principal Executive Officer and Principal Financial Officer. The Code of Ethics summarizes the legal, ethical and regulatory standards that such individuals must follow and is a reminder to all of the Company’s directors and executive officers of the seriousness of that commitment. As adopted, the Code of Ethics sets forth written standards that are designed, among other things, to deter wrongdoing and to promote:

| | • | | honest and ethical conduct, including the ethical handling of actual or apparent conflicts of interest between personal and professional relationships; |

| | • | | full, fair, accurate, timely and understandable disclosure in reports and documents the Company files with or submits to the SEC and in other public communications made by the Company; |

| | • | | compliance with applicable governmental laws, rules and regulations; |

| | • | | the prompt internal reporting of violations of the Code of Ethics to an appropriate person or persons identified in the Code of Ethics; and |

| | • | | accountability for adherence to the Code of Ethics. |

A copy of the Company’s Code of Ethics may be obtained by any person, without charge, by accessing the Company’s web site at:http://www.heritagebankva.com/CorporateNews/CodeOfEthics.aspx.

Director Compensation

The table below presents information related to the compensation of the Company’s nonemployee directors for the fiscal year ended December 31, 2007.

Director Compensation for the Fiscal Year Ended December 31, 2007

| | | | | | | | | | | |

Name | | Fees

Earned or

Paid in

Cash ($)

(1) | | Option

Awards ($)

(2) | | Nonqualified

Deferred

Compensation

Earnings ($) | | | All Other

Compensation

($) (4) | | Total ($) |

James A. Cummings | | 6,250 | | — | | — | | | 400 | | 6,650 |

David L. Kaufman | | 5,150 | | — | | — | | | — | | 5,150 |

Peter M. Meredith, Jr. | | 5,500 | | — | | — | | | 400 | | 5,900 |

Harvey W. Roberts, III | | 6,350 | | — | | — | | | 300 | | 6,650 |

Wendell C. Franklin | | 5,150 | | — | | — | | | 500 | | 5,650 |

F. Dudley Fulton | | 5,750 | | — | | — | | | 300 | | 6,050 |

Ross C. Reeves | | 5,400 | | — | | — | | | 300 | | 5,700 |

Howard M. Webb | | 4,000 | | — | | — | | | 500 | | 4,500 |

Barbara Zoby | | 6,900 | | — | | — | | | 750 | | 7,650 |

Lisa F. Chandler | | 6,250 | | — | | — | | | 300 | | 6,550 |

Stephen A. Johnsen | | 4,150 | | — | | (3 | ) | | 200 | | 4,350 |

Thomas G. Johnson, III | | 4,300 | | — | | — | | | 200 | | 4,500 |

Charles R. Malbon, Jr. | | 6,000 | | — | | — | | | 1,000 | | 7,000 |

L. Allan Parrott, Jr. | | 5,600 | | — | | — | | | — | | 5,600 |

| (1) | Directors of the Company and directors of the Bank receive $500 for each Board of Directors meeting attended and $150 for each committee meeting attended. Committee Chairs receive $200 for each committee meeting chaired. |

| (2) | In 2006 the Company adopted the Heritage 2006 Equity Incentive Plan (“2006 Incentive Plan”), which authorizes the grant by the Board of Directors of stock options, stock appreciation rights, restricted stock |

12

| | and certain other equity awards to officers and nonemployee directors of the Company and the Bank. In connection with the adoption of the 2006 Incentive Plan, the Board of Directors terminated the Company’s ability to issue new awards under both its 1987 Stock Option Plan and its 1999 Stock Option Plan. For a discussion of the assumptions made in the valuation of option awards, please see “Stock Compensation Plans” under Note 10 of the Notes to Consolidated Financial Statements in the Company’s Annual Report on Form 10-KSB for the year ended December 31, 2007. No options were granted to nonemployee directors under the 2006 Incentive Plan during 2007. |

| (3) | Stephen A. Johnsen and the Bank entered into a deferred compensation arrangement in 1985 pursuant to which Mr. Johnsen deferred $12,000 of his director’s fees. The agreement provides for the Bank to pay Mr. Johnsen a retirement benefit of $3,355 per month for 120 months beginning on April 1 following his attainment of age 70. The agreement further provides that if Mr. Johnsen dies before his retirement benefit begins, the Bank will pay his designated beneficiary $1,976 per month for 120 months thereafter. Similar arrangements were made for the other outside directors of the Company serving in 1985 and for a number of years thereafter. Over the years, all of the participants in the arrangement except Mr. Johnsen have retired from Board service. The Company is the owner and beneficiary of an insurance policy on the life of Mr. Johnsen with a total death benefit of $189,289 at December 31, 2007. Compensation expense in 2007 related to Mr. Johnsen’s deferred compensation arrangement was $10,611. |

| (4) | Directors of the Company receive $100 for each Company “Advisory Board” meeting attended. |

13

EXECUTIVE COMPENSATION

The summary compensation table below presents information related to the compensation the Company’s Principal Executive Officer and other Named Executive Officers during the fiscal years ended December 31, 2007 and 2006:

Summary Compensation Table for the Fiscal Years Ended December 31, 2007 and 2006

| | | | | | | | | | | | | | |

Name and Principal Position | | Year | | Salary

($) | | Bonus

($) | | Option

Awards

($) (1) | | Non-Equity

Incentive Plan

Compensation

($) | | All Other

Compensation

($) (2) | | Total

($) |

Michael S. Ives | | 2007 | | 200,000 | | — | | — | | — | | 19,134 | | 219,134 |

President & Chief Executive Officer | | 2006 | | 200,000 | | — | | 295,400 | | — | | 20,401 | | 515,801 |

John O. Guthrie | | 2007 | | 127,300 | | — | | 7,080 | | — | | 7,397 | | 141,777 |

Executive Vice President & Chief Financial Officer | | 2006 | | 123,600 | | — | | 75,600 | | — | | 9,263 | | 208,463 |

| (1) | For a discussion of the assumptions made in the valuation of option awards, please see “Stock Compensation Plans” under Note 10 of the Notes to Consolidated Financial Statements in the Company’s Annual Report on Form 10-KSB for the year ended December 31, 2007. Please also see the narrative discussion regarding stock options that follows this table. |

| (2) | Includes, in the case of Mr. Ives, (a) $12,360 and $13,970 contributed to the Bank’s 401(k) Plan by the Bank in 2007 and 2006, respectively; (b) $6,000 in automobile allowance in each of 2007 and 2006; and (c) $774 and $431 representing taxable compensation related to group life insurance in 2007 and 2006, respectively. |

| | Includes, in the case of Mr. Guthrie, (a) $7,002 and $8,871 contributed to the Bank’s 401(k) Plan by the Bank in 2007 and 2006, respectively; and (b) $395 and $392 representing taxable compensation related to group life insurance in 2007 and 2006, respectively. |

Stock Option Grants in Last Fiscal Year

In 2006 the Company adopted the Heritage 2006 Equity Incentive Plan (“2006 Incentive Plan”), which authorizes the grant by the Board of Directors of stock options, stock appreciation rights, restricted stock and certain other equity awards to officers and nonemployee directors of the Company and the Bank. In connection with the adoption of the 2006 Incentive Plan, the Board of Directors terminated the Company’s ability to issue new awards under both its 1987 Stock Option Plan and its 1999 Stock Option Plan.

On December 19, 2007, the Board of Directors granted an option with respect to 2,000 shares of Common Stock to John O. Guthrie, Chief Financial Officer of the Company and the Bank. The option granted to Mr. Guthrie becomes exercisable at the rate of 20% commencing on December 31, 2008 and continuing on each subsequent December 31 until December 31, 2012.

The options granted under the 2006 Incentive Plan, including those granted to Mr. Guthrie in 2007, will become exercisable earlier upon a change in control (as defined in the 2006 Incentive Plan) of the Company. The options may also become exercisable earlier upon the optionee’s disability or death, and termination without cause or resignation for good reason. No option may be exercised after ten (10) years from the date of grant.

14

Outstanding Equity Awards at 2007 Fiscal Year-End

| | | | | | | | | | | | |

Name | | No. of Securities

Underlying

Unexercised

Options

(#) Unexercisable | | | No. of Securities

Underlying

Unexercised

Options

(#) Exercisable | | | Equity

Incentive Plan

Awards; No.

of Securities

Underlying

Unexercised

Unearned

Options (#) | | Option Exercise

Price ($) | | Option Expiration

Date |

Michael S. Ives | | — | | | 30,000 | (1) | | — | | 19.79 | | February 7, 2015 |

President & Chief Executive Officer | | 42,000 | (2) | | 28,000 | (2) | | — | | 15.56 | | July 25, 2016 |

| | | | | |

John O. Guthrie | | 16,000 | (3) | | 4,000 | (3) | | — | | 16.65 | | October 24, 2016 |

Executive Vice President & Chief Financial Officer | | 2,000 | (4) | | — | | | | | 12.12 | | December 18, 2017 |

| (1) | These stock options were granted to Mr. Ives in 2005 under his Employment Agreement and were immediately exercisable. Please refer to the narrative discussion under “Employment Agreements” below for additional information. |

| (2) | These stock options were granted to Mr. Ives in 2006 under the 2006 Incentive Plan and are exercisable at the rate of 20% per year commencing December 31, 2006, subject to accelerated vesting in certain circumstances. Please refer to the narrative discussion under “Employment Agreements” below for additional information. |

| (3) | These stock options were granted to Mr. Guthrie in 2006 under the 2006 Incentive Plan and are exercisable at the rate of 20% per year commencing December 31, 2007, subject to accelerated vesting in certain circumstances. |

| (4) | These stock options were granted to Mr. Guthrie in 2007 under the 2006 Incentive Plan and are exercisable at the rate of 20% per year commencing December 31, 2008, subject to accelerated vesting in certain circumstances. Please refer to the narrative discussion under “Stock Option Grants in Last Fiscal Year” above for additional information. |

Agreements with Named Executive Officers

The Company and Michael S. Ives, the Company’s President and Chief Executive Officer, entered into an Employment Agreement dated February 7, 2005. The Employment Agreement provided for (i) an initial term beginning on February 7, 2005 and ending on December 31, 2009; (ii) an initial annual salary of $200,000, subject to annual review, plus the opportunity to earn annual incentive bonuses; (iii) an employment inducement grant of a fully-vested option to purchase 30,000 shares of Company common stock; (iv) a commitment to grant to Mr. Ives the option to acquire 50,000 additional shares of Company common stock under a future amended stock option plan; and (v) a $500 monthly automobile allowance and payment of certain club membership dues.

Effective as of June 30, 2006, the Company and Mr. Ives amended his Employment Agreement. Pursuant to the Amendment, (i) Mr. Ives’ annual salary was continued at the 2005 level of $200,000 per year, eliminating certain incentive bonuses and the potential repricing of Mr. Ives’ option for 30,000 shares of Company stock provided for in the original Employment Agreement; and (ii) the Company committed to grant Mr. Ives the option to acquire 70,000 shares of Company common stock under the 2006 Incentive Plan, with such options generally vesting in equal installments over five years commencing on December 31, 2006, subject to accelerated vesting in certain circumstances and continued vesting if Mr. Ives retires after attaining age 55 (the Company’s commitment to grant the 70,000 options under the 2006 Incentive Plan pursuant to the Amendment superseded the Company’s commitment under the original Employment Agreement to grant Mr. Ives 50,000 incentive options, as those options were never granted). Under an Amendment to Mr. Ives’ Employment Agreement

15

effective as of December 20, 2006, if Mr. Ives retires after attaining age 55, the option granted under the 2006 Incentive Plan will continue to vest in accordance with the five-year schedule described above only if the Board of Directors, in its sole discretion, approves Mr. Ives’ early retirement from the Company.

Mr. Ives’ Employment Agreement also provides for certain payments to Mr. Ives in the following events of termination of his employment: (i) Mr. Ives will continue to receive his base salary for the remainder of the term of his agreement following his termination by the Company without “cause” (as defined in the agreement), except for termination without cause following a “change of control” (as defined in the agreement), together with payment for all accrued and unused vacation and sick leave; (ii) Mr. Ives will continue to receive his base salary for the remainder of the term of his agreement following his termination for “good reason” (as defined in the agreement), except for termination for good reason within 12 months after a “change in control”; (iii) if within 12 months after a change of control Mr. Ives’ employment is terminated without cause or Mr. Ives resigns, Mr. Ives will receive a lump-sum payment equal to the greater of (a) his base salary payable over the remainder of the term of his agreement or (b) 2.99 times his average annual compensation (includable in gross income for federal tax purposes) over the five years prior to the change of control, together with payment for all accrued and unused vacation and sick leave and an additional “gross-up” payment to compensate Mr. Ives for any excise tax payable on such severance payments; and (iv) in the event of Mr. Ives’ death, Mr. Ives’ estate will receive one month’s base salary together with payment for all accrued and unused vacation and sick leave.

The Company and John O. Guthrie, the Company’s Chief Financial Officer, entered into an Employment Agreement dated June 9, 2006. The Employment Agreement (i) has an initial term beginning on May 1, 2005 and ending on April 30, 2007, which in 2007 automatically renewed for an additional two-year term continuing through April 30, 2009; and (ii) provides for an initial annual salary of $120,000, which is subject to at least annual review and was increased to $127,300 as of January 1, 2007.

Mr. Guthrie’s Employment Agreement also provides for certain payments to Mr. Guthrie in the following events of termination of his employment: (i) Mr. Guthrie will continue to receive his base salary for 12 months following his termination by the Company without “cause” (as defined in the agreement), except for termination without cause following a “change of control” (as defined in the agreement), together with payment for all accrued and unused vacation and sick leave; (ii) Mr. Guthrie will continue to receive his base salary for 12 months following his termination for “good reason” (as defined in the agreement), except for termination for good reason following a “change in control”; (iii) following a change of control, the term of Mr. Guthrie’s agreement will automatically be extended for two additional years, and if during the term of the agreement (as extended) Mr. Guthrie’s employment is terminated without cause or Mr. Guthrie resigns, Mr. Guthrie will receive a lump-sum payment equal to eighteen (18) months’ base salary then in effect (or, if greater, in effect immediately prior to the change of control), together with payment for all accrued and unused vacation and sick leave; and (iv) in the event of Mr. Guthrie’s death, Mr. Guthrie’s estate will receive one month’s base salary together with payment for all accrued and unused vacation and sick leave.

Stock Option and Employee Benefit Plans

Stock Option Plans. The Company maintains the Heritage Bankshares, Inc. 1987 and 1999 Stock Option Plans (“Old Stock Option Plans”) for the benefit of employees and nonemployee directors. Of the 480,000 shares authorized for option grants under the Old Stock Option Plans, 440,000 shares were authorized for grants to employees and 40,000 shares were authorized for grants to nonemployee directors. Concurrently with its approval of the New Plan (described below), the Board of Directors terminated the Company’s ability to issue new awards under the Old Stock Option Plans.

In 2006 the Company adopted the Heritage 2006 Equity Incentive Plan (“New Plan”), which authorizes the grant of stock options, stock appreciation rights, restricted stock and certain other equity awards with respect to the Company’s common stock. The maximum number of shares of the Company’s common stock that may be issued under the New Plan is 250,000. The shares issued may be authorized but unissued shares, treasury shares

16

or shares purchased by the Company on the open market or from private sources for use under the New Plan. The Board of Directors may approve the grant of nonstatutory stock options and options qualifying as incentive stock options. The option price of either a nonstatutory stock option or an incentive stock option will be the fair market value of the Company’s common stock on the date of grant. “Fair market value” is defined under the New Plan generally as the weighted average (based on daily trading volume) during the thirty (30) day period next preceding the date of grant of the “last sale” prices of a share of the Company’s common stock on the five (5) days nearest preceding the date of grant on which at least 300 shares were traded. Please see above for additional information regarding stock option grants in 2007 to the Chief Financial Officer of the Company.

Deferred Compensation Plan.In 1985, the Company entered into a deferred compensation and retirement arrangement with certain directors and subsequently with one officer. The Company’s policy is to accrue the present value of estimated amounts to be paid under the contracts over the required service period to the date the participant is fully eligible to receive the benefit. At December 31, 2007 and 2006, other liabilities included $707,059 and $743,296, respectively, related to the deferred compensation plans. Compensation expense related to this plan was $36,919 and $40,907 for the years ended December 31, 2007 and 2006, respectively.

Employee Stock Ownership Plan. The Board of Directors adopted an Employees’ Stock Ownership Plan (the “ESOP”) effective January 1, 1998. The ESOP covers substantially all employees after they have met eligibility requirements, and funds contributed to the plan are used to purchase outstanding common stock. Dividends received by the ESOP are used for administrative expenses of the plan. At December 31, 2007, the ESOP owned 10,271 shares. Stock purchases for the year ended December 31, 2007 totaled 786 shares, while no shares were distributed to terminated employees. At December 31, 2007, the fair market value of the total shares held by the ESOP totaled $114,522.

401k Retirement Program. Effective January 1, 1993, the Board of Directors adopted a Retirement Program (the “401K Plan”). Eligible employees who have completed the required months of service are eligible to participate in and make contributions to the 401K Plan. The Company makes employer matching contributions. The Company expensed $134,673 and $168,583 for the years ended December 31, 2007 and 2006, respectively.

17

PROPOSAL TWO

RATIFICATION OF APPOINTMENT OF INDEPENDENT AUDITORS

The Company’s Audit Committee has appointed, and the Board of Directors has ratified the appointment of, Elliott Davis LLC as the independent registered public accounting firm to audit the Company’s consolidated financial statements for the year ending December 31, 2008, and the Board of Directors desires that such appointment be ratified by the Company’s shareholders at the Annual Meeting. A representative of Elliott Davis LLC is expected to be present at the Annual Meeting, will be available to respond to appropriate questions, and will have the opportunity to make a statement if he or she desires.

Although the Company’s bylaws do not require the submission of the selection of independent registered public accountants to the shareholders for approval, the Board of Directors believes it is appropriate to give shareholders the opportunity to ratify the decision of the Audit Committee. Neither the Audit Committee nor the Board will be bound by the shareholders’ vote at the meeting, but if the shareholders fail to ratify the independent registered public accountants selected by the Audit Committee, the Audit Committee may reconsider its selection.

Fees of Independent Auditors

The following table shows the fees for professional services provided to the Company by its independent registered public accountants (Elliott Davis LLC, except where specifically noted below) for the fiscal years ended December 31, 2007 and December 31, 2006, respectively:

| | | | | | |

| | | Year Ended December 31 |

| | | 2007 | | 2006 |

Audit Fees | | $ | 51,421 | | $ | 49,437 |

Audit-Related Fees | | | — | | | 3,795 |

Tax Fees | | | — | | | — |

All Other Fees | | | 9,059 | | | 30,407 |

| | | | | | |

Total Fees | | $ | 60,480 | | $ | 83,639 |

| | | | | | |

Audit Fees. These are fees billed for professional services rendered by the independent registered public accounting firm for audits of the Company’s consolidated financial statements, for reviews of the financial statements included in the Company’s 10-Q filings, and for services that are normally provided in connection with statutory and regulatory filings or engagements for the relevant fiscal years.

Audit-Related Fees. These are fees that are billed by the independent registered public accounting firm for assurance and related services that were reasonably related to the performance of the audit or review of the Company’s financial statements and are not reported under Audit Fees. The Audit-Related Fees for 2006 consist of fees for services provided by the Company’s former independent public accounting firm, Witt Mares, PLC, for audit consent and transition services in connection with the fiscal year ended December 31, 2006.

Tax Fees. These are fees billed for professional services rendered by the independent registered public accounting firm for tax compliance, tax advice and tax planning.

All Other Fees. These are fees billed for products and services provided by the independent registered public accounting firm, other than for services reported above. The fees were billed for accounting consultation services provided in connection with interpretations of various accounting pronouncements as to their possible impact on the Company, as well as other accounting consultation services. All Other Fees for 2006 include fees for accounting consultation services provided by Larrowe and Company, P.L.C. (“Larrowe”) in 2006, prior to its November 2006 combination with Elliott Davis LLC, provided by Larrowe prior to the Company’s engaging

18

Elliott Davis LLC as its independent registered public accounting firm in November 2006 for the fiscal year ended December 31, 2006.

Audit Committee Administration Pre-Approval Policies and Procedures.

The Audit Committee is responsible for the appointment, compensation and oversight of the work performed by the Company’s independent accountants. Generally, services are pre-approved by the Audit Committee through its annual review of the engagement letter. Subsequently, as the need for additional services arise, detailed information regarding the specific audit, audit-related, tax and permissible non-audit services are submitted to the Audit Committee for its review and approval prior to the provision of such services. In the event that the Audit Committee cannot meet prior to the provision of such services, the Audit Committee has delegated to its Chair the authority to pre-approve such services. All such pre-approvals are then reported to the Audit Committee at its next meeting. All audit related services, tax services and other services in 2007 and 2006 were pre-approved by the Audit Committee, which concluded that the provision of such services by Elliott Davis in 2007 and 2006 were compatible with the maintenance of that firm’s independence in the conduct of its auditing functions.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT YOU VOTEFOR THE PROPOSAL TO RATIFY ELLIOTT DAVIS LLC AS THE COMPANY’S INDEPENDENT AUDITOR FOR THE YEAR ENDING DECEMBER 31, 2008.

SUBMISSION OF PROPOSALS 2009

Any shareholder who wishes to submit a proposal for consideration at the 2009 Annual Meeting of Shareholders, and who wishes to have such proposal included in the Company’s Proxy Statement, must comply with SEC Rule 14a-8 and must submit the proposal in writing no later than December 31, 2008. Additionally, any such shareholder proposals or notifications must comply in all respects with the Company’s Bylaws. All such proposals or notifications shall be delivered to the Company’s executive offices at 150 Granby Street, Norfolk, Virginia 23510, Attn: Michael S. Ives, President and Chief Executive Officer.

OTHER MATTERS

The Board of Directors does not intend to present, and knows of no one who intends to present, to the meeting any matter for action by shareholders other than as set forth herein. However, the enclosed Proxy confers discretionary authority with respect to transaction of any other business that may properly come before the meeting, and it is the intention of the persons named in the Proxy to vote in accordance with their judgment on any such matter.

19

2007 ANNUAL REPORT

The Company’s Form 10-KSB for the year ended December 31, 2007 accompanies this Proxy Statement. The Form 10-KSB does not form any part of the material for the solicitation of proxy.

|

| By Order of the Board of Directors, |

|

/s/ MICHAEL S. IVES |

Michael S. Ives, President and Chief Executive Officer |

Dated in Norfolk, Virginia and mailed

the 29th day of April, 2008

YOU ARE CORDIALLY INVITED TO ATTEND THE ANNUAL MEETING IN PERSON. WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING, YOU ARE REQUESTED TO SIGN, DATE AND PROMPTLY RETURN THE ACCOMPANYING PROXY CARD IN THE ENCLOSED

POSTAGE-PAID ENVELOPE.

20

APPENDIX A

HERITAGE BANKSHARES, INC.

AUDIT COMMITTEE CHARTER

Organization

There shall be a committee of the board of directors to be known as the audit committee. The audit committee shall be composed of directors who are independent of the management of the corporation and are free of any relationship that, in the opinion of the board of directors, would interfere with their exercise of independent judgment as a committee member.

Statement of Policy

The audit committee shall provide assistance to the corporate directors in fulfilling their responsibility to the shareholders, potential shareholders, and investment community relating to corporate accounting, reporting practices of the corporation, and the quality and integrity of the financial reports of the corporation. In so doing, it is the responsibility of the audit committee to maintain free and open means of communication between the directors, the independent auditors, the internal auditors, and the financial management of the corporation.

Responsibilities

In carrying out its responsibilities, the audit committee believes its policies and procedures should remain flexible, in order to best react to changing conditions and to ensure to the directors and shareholders that the corporate accounting and reporting practices of the corporation are in accordance with all requirements and are of the highest quality.

In carrying out these responsibilities, the audit committee will:

| | • | | Review and recommend to the directors the independent auditors to be selected to audit the financial statements of the corporation and its divisions and subsidiaries. |

| | • | | Meet with the independent auditors and financial management of the corporation to review the scope of the proposed audit for the current year and the audit procedures to be utilized, and at the conclusion thereof review such audit including any comments or recommendations of the independent auditors. |

| | • | | Review with the independent auditors, the company’s internal auditor, and financial and accounting personnel, the adequacy and effectiveness of the accounting and financial controls of the corporation, and elicit any recommendations for the improvement of such internal control procedures or particular areas where new or more detailed controls or procedures are desirable. Particular emphasis should be given to the adequacy of such internal controls to expose any payments, transactions, or procedures that might be deemed illegal or otherwise improper. Further, the committee periodically should review company policy statements to determine their adherence to the code of conduct. |

| | • | | Review the internal audit function of the corporation including the independence and authority of its reporting obligations, the proposed audit plans for the coming year, and the coordination of such plans with the independent auditors. |

| | • | | Receive prior to each meeting a summary of findings from completed internal audits and a progress report on the proposed internal audit plan, with explanations for any deviations from the original plan. |

| | • | | Review the financial statements contained in the annual report to shareholders with management and the independent auditors to determine that the independent auditors are satisfied with the disclosure and content of the financial statements to be presented to the shareholders. Any changes in accounting principles should be reviewed. |

A-1

| | • | | Provide sufficient opportunity for the internal and independent auditors to meet with the members of the audit committee without members of management present. Among the items to be discussed in these meetings are the independent auditors’ evaluation of the corporation’s financial, accounting, and auditing personnel, and the cooperation that the independent auditors received during the course of the audit. |

| | • | | Submit the minutes of all meetings of the audit committee to, or discuss the matters discussed at each committee meeting with, the board of directors. |

| | • | | Investigate any matter brought to its attention within the scope of its duties, with the power to retain outside counsel for this purpose if in its judgment, that is appropriate. |

A-2

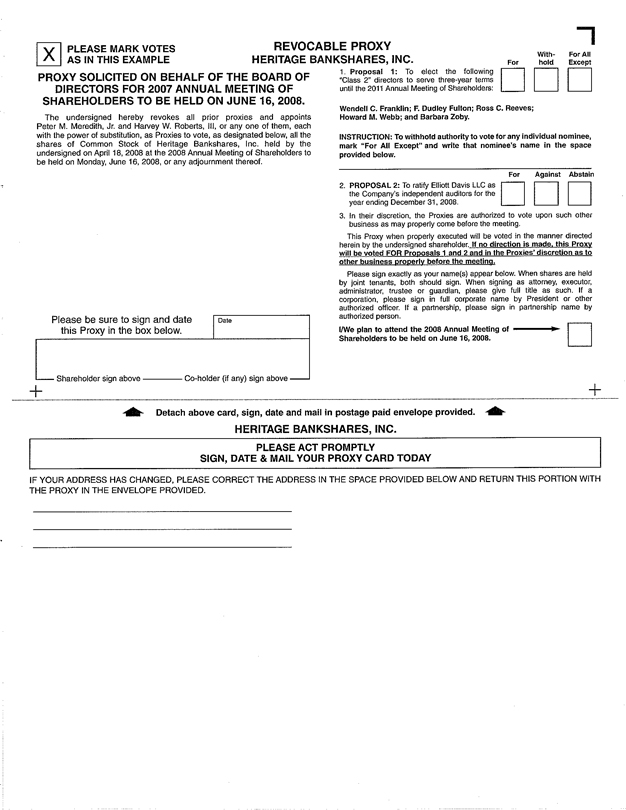

PLEASE MARK VOTES

AS IN THIS EXAMPLE

REVOCABLE PROXY

HERITAGE BANKSHARES, INC.

PROXY SOLICITED ON BEHALF OF THE BOARD OF

DIRECTORS FOR 2007 ANNUAL MEETING OF

SHAREHOLDERS TO BE HELD ON JUNE 16, 2008.

The undersigned hereby revokes all prior proxies and appoints

Peter M. Meredith, Jr. and Harvey W. Roberts, III, or any one of them, each

with the power of substitution, as Proxies to vote, as designated below, all the

shares of Common Stock of Heritage Bankshares, Inc. held by the

undersigned on April 18, 2008 at the 2008 Annual Meeting of Shareholders to

be held on Monday, June 16, 2008, or any adjournment thereof.

1.Proposal 1: To elect the following “Class 2” directors to serve three-year terms

until the 2011 Annual Meeting of Shareholders:

For

With-hold

For All Except

Wendell C. Franklin; F. Dudley Fulton; Ross C. Reeves;

Howard M. Webb; and Barbara Zoby.

INSTRUCTION: To withhold authority to vote for any individual nominee,

mark “For All Except” and write that nominee’s name in the space

provided below.

2. PROPOSAl 2: To ratify Elliott Davis LLC as

the Company’s independent auditors for the

year ending December 31, 2008.

For

Against

Abstain

3. In their discretion, the Proxies are authorized to vote upon such other business as may properly come before the meeting.

This Proxy when properly executed will be voted in the manner directed herein by the undersigned shareholder. If no direction is made, this Proxy wilt be voted FOR Proposals 1 and 2 and in the Proxies’ discretion as to other business properly before the meeting.

Please sign exactly as your name(s) appear below. When shares are held

by joint tenants, both should sign. When signing as attorney, executor,

administrator, trustee or guardian, please give full title as such, If a

corporation, please sign in full corporate name by President or other

authorized officer If a partnership, please sign in partnership name by

authorized person.

I/We plan to attend the 2008 Annual Meeting of

Shareholders to be held on June 16, 2008.

Please be sure to sign and date

this Proxy in the box below.

Date

Shareholder sign above

Co-holder (if any) sign above

Detach above card, sign, date and mail in postage paid envelope provided.

HERITAGE BANKSHARES, INC.

PLEASE ACT PROMPTLY

SIGN, DATE & MAIL YOUR PROXY CARD TODAY

IF YOUR ADDRESS HAS CHANGED, PLEASE CORRECT THE ADDRESS IN THE SPACE PROVIDED BELOW AND RETURN THIS PORTION WITH

THE PROXY IN THE ENVELOPE PROVIDED.