Summary of Dodd-Frank Act Stress Test Results Under Supervisory Severely Adverse Scenario I. Introduction A. Background SVB Financial Group, a U.S. bank holding company (“SVBFG” or the “Company”), is disclosing the results of its 2014 company-run stress test as required by the Dodd-Frank Wall Street Reform and Consumer Protection Act (“Dodd-Frank Act”) and the regulations (“DFAST rules”) implemented by the Federal Reserve Board (“Federal Reserve”) thereunder. The DFAST rules require bank holding companies (“BHCs”) with more than $10 billion but less than $50 billion in total consolidated assets, such as SVBFG, to perform annual company-run stress tests to assess the potential impact of a minimum of three macroeconomic scenarios prescribed by the DFAST rules – “baseline”, “adverse” and “severely adverse” – on their consolidated losses, revenues, balance sheet (including risk-weighted assets) and capital. The stress tests are intended to assess the potential impact of hypothetical economic scenarios on the Company’s operations and capital over a defined planning horizon. The DFAST rules also require BHCs such as SVBFG to publicly disclose the results of their company-run stress tests under the hypothetical severely adverse economic scenario (“Supervisory Severely Adverse Scenario”). This scenario was released by the Federal Reserve on October 23, 2014, in the “2015 Supervisory Scenarios for Annual Stress Tests Required under the Dodd-Frank Act Stress Test (DFAST) Rules and the Capital Plan Rule.” The scenario portrays a hypothetical, severely adverse macroeconomic environment in a deep-rooted and prolonged recession in which the unemployment rate increases and asset prices, including equity prices and home prices, contract sharply. This summary of results contains: (i) a description of the types of risks included in the Supervisory Severely Adverse Scenario stress test; (ii) a summary description of the methodologies used in such stress test; (iii) estimates of certain financial results and pro forma capital ratios after applying such stress test; and (iv) explanations of the most significant causes for the changes in regulatory capital ratios. In addition, the DFAST rules require the Company to disclose the company-run stress test results under the Supervisory Severely Adverse Scenario for the Company’s principal banking subsidiary, Silicon Valley Bank (the “Bank”). The Bank is a California state-chartered Federal Reserve member bank that is also subject to annual stress test requirements under the DFAST rules. 1

B. Considerations Regarding the Results Disclosed In reviewing the results disclosed in this summary, the following should be considered: • The planning cycle of the stress test results set forth in this summary spans a nine quarter planning horizon, from the fourth quarter of 2014 through the fourth quarter of 2016 (“9Q Planning Horizon”). • The Supervisory Severely Adverse Scenario describes a hypothetical set of conditions designed to assess the strength of banking organizations and their resilience to severely adverse economic environments. The scenario is not a forecast of economic conditions and investors should not view or rely on the results disclosed herein as forecasts of actual financial results for SVBFG or the Bank. The Company’s future financial results and conditions may be influenced by actual economic and financial conditions and risks described in the Company’s Annual Report or periodic 10-K or 10-Q Securities and Exchange Commission filings as well as unforeseen factors. • The results of SVBFG’s stress test, including the impact on regulatory capital ratios, are driven by SVBFG’s capital composition and the overall mix of assets and off- balance sheet exposures. The majority of SVBFG’s risk assets are comprised of a high-quality investment securities portfolio that contributes a relatively small amount to its regulatory risk-weighted assets.1 As a result, changes in SVBFG’s regulatory capital caused by conditions under the Supervisory Severely Adverse Scenario tend to be driven by changes in loan volume, off-balance sheet exposures (such as unfunded commitments to lend), and changes in nonmarketable investments and warrant assets. • Excluding the impact from operational losses, SVBFG did not adjust noninterest expenses in response to the Supervisory Severely Adverse Scenario. Although SVBFG believes that it would be reasonable to assume lower variable incentive compensation expenses and more limited project-related expenses under a stress scenario is appropriate, SVBFG also believes that bearing the full impact of unadjusted baseline noninterest expenses would be an appropriate approach. 1 As of September 30, 2014, SVBFG’s fixed-income investment portfolio totaled $20.1 billion (the sum of the Company’s total held-to-maturity securities and total available-for-sale securities, as reported in the Company’s FR Y-9C Schedule HC-B as of the same date), which represented 56% of SVBFG’s total consolidated assets. For purposes of calculating regulatory capital ratios, SVBFG’s fixed-income investment portfolio had a composite regulatory risk-weight of approximately 9%. 2

II. Risks Included in SVBFG’s Company-Run Stress Test SVBFG’s stress test results specifically include the following four risk categories, which are incorporated primarily through quantitative models: • Credit Risk. Credit risk is the risk of loss resulting from the failure of a borrower or counterparty to meet its financial or contractual obligations to the Company and its subsidiaries. Under stressed economic conditions, the likelihood of credit losses may increase due to the failure of SVBFG’s borrowers and counterparties to meet their obligations. • Market/Liquidity Risk. Market risk is the risk of adverse fluctuations in the market value of financial instruments due to changes in market interest rates. Market risks include foreign currency exchange risk and equity price risk. Liquidity risk is the risk to current or anticipated earnings or capital arising from an inability to meet obligations when they come due. Increases in loan utilizations and/or deposit attrition, as well as decreases in the market value of investment securities, will likely coincide with severe economic stress. In such a case, SVBFG may experience reduced cash flows and credit availability, which may increase its reliance on higher cost funding sources. • Interest Rate Risk. Interest rate risk is the risk of loss arising from potential adverse changes in the value of SVBFG’s assets and liabilities resulting from changes in interest rates. Interest rate exposure may affect the carrying value of SVBFG’s assets that are held at or are subject to fair market valuation. SVBFG’s net interest income may also be negatively affected by interest rate differences between assets and liabilities. • Operational Risk. Operational risk is the risk of loss resulting from inadequate or failed internal processes or systems; human errors or misconduct; or external events. Operational losses result from, among other things, internal/external fraud; inadequate or inappropriate employment practices or workplace safety; failure to meet professional obligations involving clients, products or business practices; and business disruptions or systems failures. In addition, as part of the overall process for stress testing and setting internal capital limits, SVBFG considers other risks, which are generally assessed on a qualitative basis: • Model Risk. Model risk is the risk of adverse consequences arising from decisions based on incorrect or misused model outputs and reports. Model risk may result from flaws in model design, use of inadequate or incomplete data within models, or incorrect or inappropriate utilization of models. • Legal/Regulatory Risk. Legal/regulatory risk is the risk of loss or increased costs resulting from regulatory restrictions or requirements on SVBFG’s activities or the 3

conduct of its business. Legal/regulatory risk also is the risk of loss arising from violations of laws, rules or regulations, and includes exposure to orders, fines, penalties, and punitive damages resulting from litigation or regulatory actions. • Strategic/Reputation/Country Risk. Strategic risk is the risk of loss that may arise from adverse business decisions, poor implementation of business strategy or lack of responsiveness to changes in the banking industry and operating environment. Reputation risk is the risk to current or anticipated earnings, capital or enterprise value arising from negative public opinion. Country risk is the risk that a sovereign event or action alters the value or terms of contractual obligations of obligors, counterparties and issuers or adversely affects markets related to a particular country. III. Stress Test Methodology The overall stress testing process is overseen at the Board level by the Finance Committee of the Company’s Board of Directors and at the management level by the Company’s Asset/Liability management committee. Senior management is directly responsible for developing, implementing and monitoring the actual stress testing process. The stress testing process is formally managed by a working group consisting of representatives from the Company’s Credit, Risk Management, Finance, and Compliance functions. Internal Audit is also a participant in the process, as appropriate. The working group meets regularly to ensure that processes, assumptions, loss estimates, and controls are appropriately reviewed and assessed before being elevated to the Company’s Asset/Liability management committee. In turn, the Asset/Liability management committee reviews and challenges the preliminary stress test results before final presentation to the Finance Committee of the Company’s Board of Directors. The Company’s stress testing framework utilizes both quantitative and qualitative estimation methodologies to project capital levels through the 9Q Planning Horizon. Quantitative methodologies are based on statistical models developed by management, and qualitative methodologies are largely based on management’s subjective business judgment. In addition, macroeconomic variables associated with applied scenarios are incorporated into models as applicable. In addition to the impact of changes in interest rates, the supervisory macroeconomic variables that are most applicable to SVBFG are (i) the real U.S. gross domestic product, (ii) the U.S. unemployment rate, (iii) the yield on BBB-rated corporate bonds, and (iv) the Dow Jones Equity Market Index. In particular, the specific methodologies for estimating and modeling the key projections under the Supervisory Severely Adverse Scenario are discussed below: • Pre-Provision Net Revenue (“PPNR”). PPNR consists of: (i) net interest income and noninterest income; less (ii) noninterest expense. PPNR projections are based on projections of loan and deposit volumes, noninterest income and noninterest expense, as follows: 4

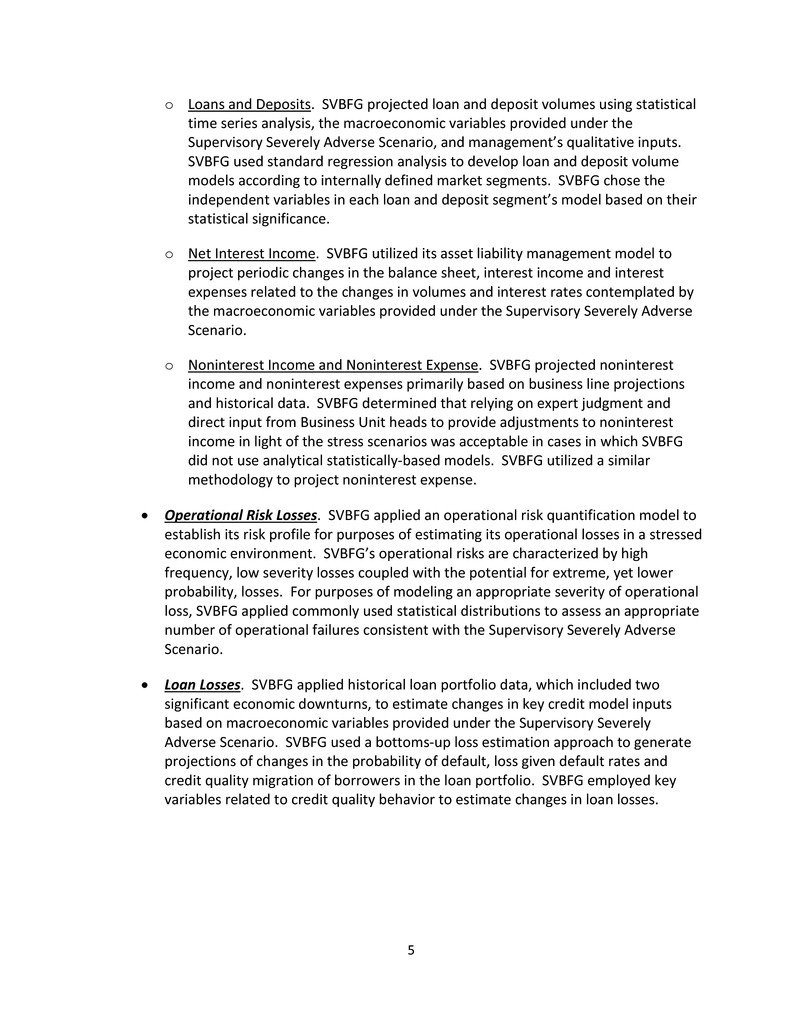

o Loans and Deposits. SVBFG projected loan and deposit volumes using statistical time series analysis, the macroeconomic variables provided under the Supervisory Severely Adverse Scenario, and management’s qualitative inputs. SVBFG used standard regression analysis to develop loan and deposit volume models according to internally defined market segments. SVBFG chose the independent variables in each loan and deposit segment’s model based on their statistical significance. o Net Interest Income. SVBFG utilized its asset liability management model to project periodic changes in the balance sheet, interest income and interest expenses related to the changes in volumes and interest rates contemplated by the macroeconomic variables provided under the Supervisory Severely Adverse Scenario. o Noninterest Income and Noninterest Expense. SVBFG projected noninterest income and noninterest expenses primarily based on business line projections and historical data. SVBFG determined that relying on expert judgment and direct input from Business Unit heads to provide adjustments to noninterest income in light of the stress scenarios was acceptable in cases in which SVBFG did not use analytical statistically-based models. SVBFG utilized a similar methodology to project noninterest expense. • Operational Risk Losses. SVBFG applied an operational risk quantification model to establish its risk profile for purposes of estimating its operational losses in a stressed economic environment. SVBFG’s operational risks are characterized by high frequency, low severity losses coupled with the potential for extreme, yet lower probability, losses. For purposes of modeling an appropriate severity of operational loss, SVBFG applied commonly used statistical distributions to assess an appropriate number of operational failures consistent with the Supervisory Severely Adverse Scenario. • Loan Losses. SVBFG applied historical loan portfolio data, which included two significant economic downturns, to estimate changes in key credit model inputs based on macroeconomic variables provided under the Supervisory Severely Adverse Scenario. SVBFG used a bottoms-up loss estimation approach to generate projections of changes in the probability of default, loss given default rates and credit quality migration of borrowers in the loan portfolio. SVBFG employed key variables related to credit quality behavior to estimate changes in loan losses. 5

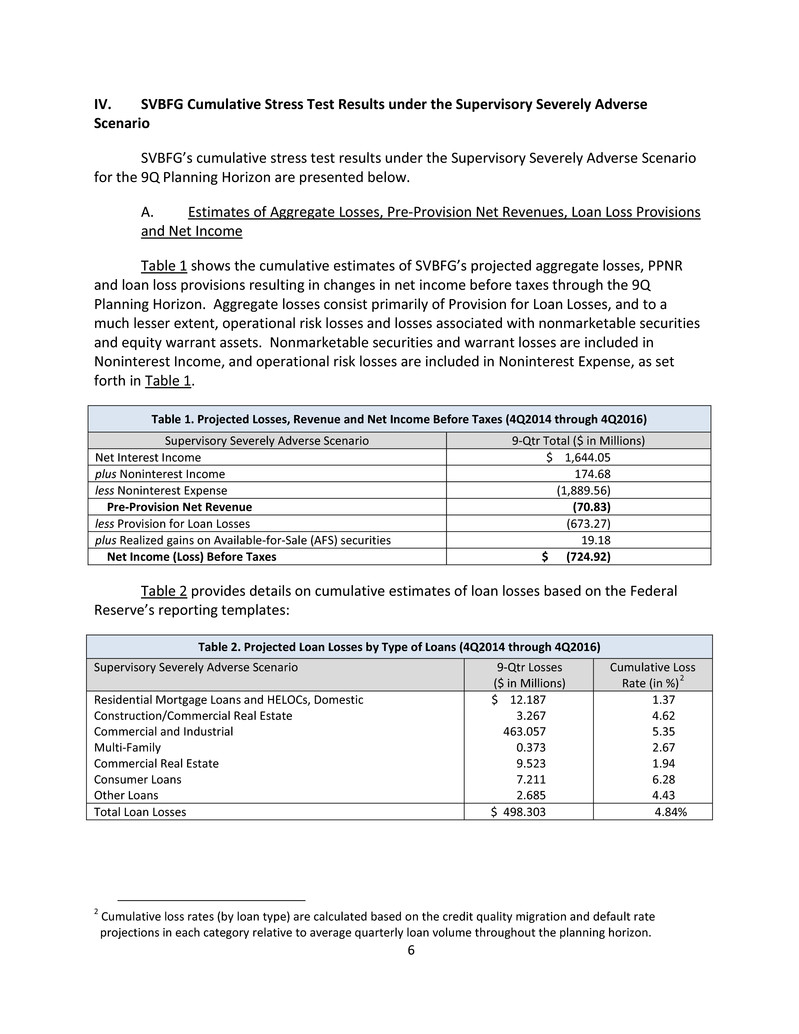

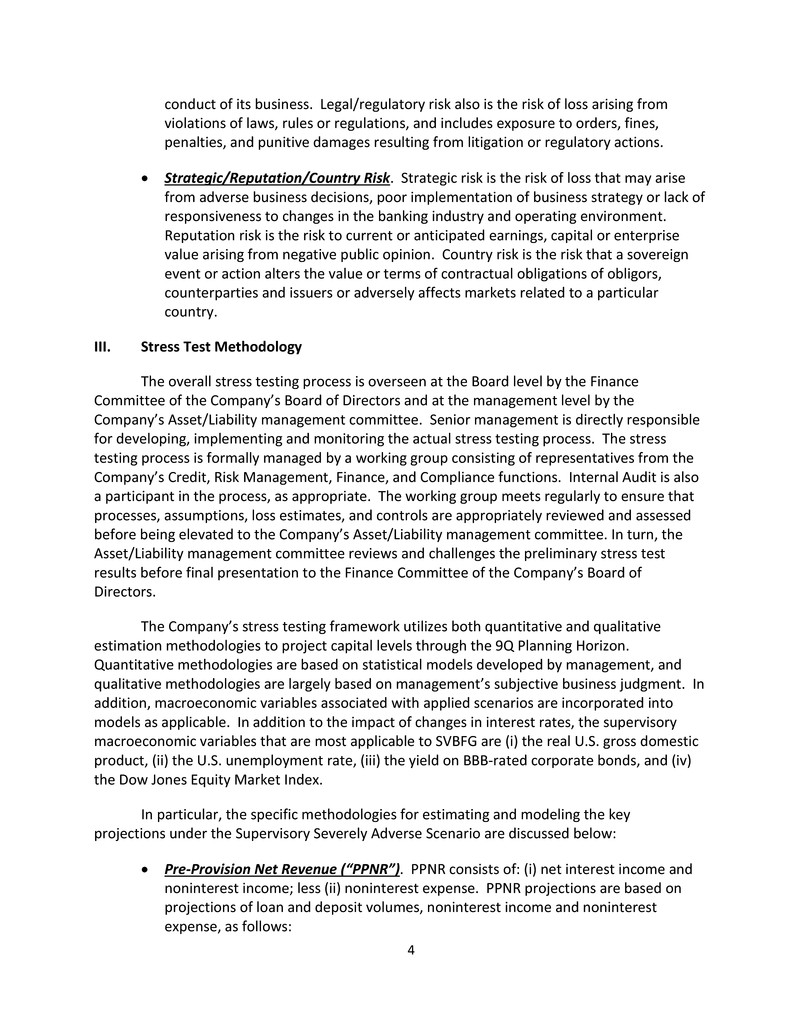

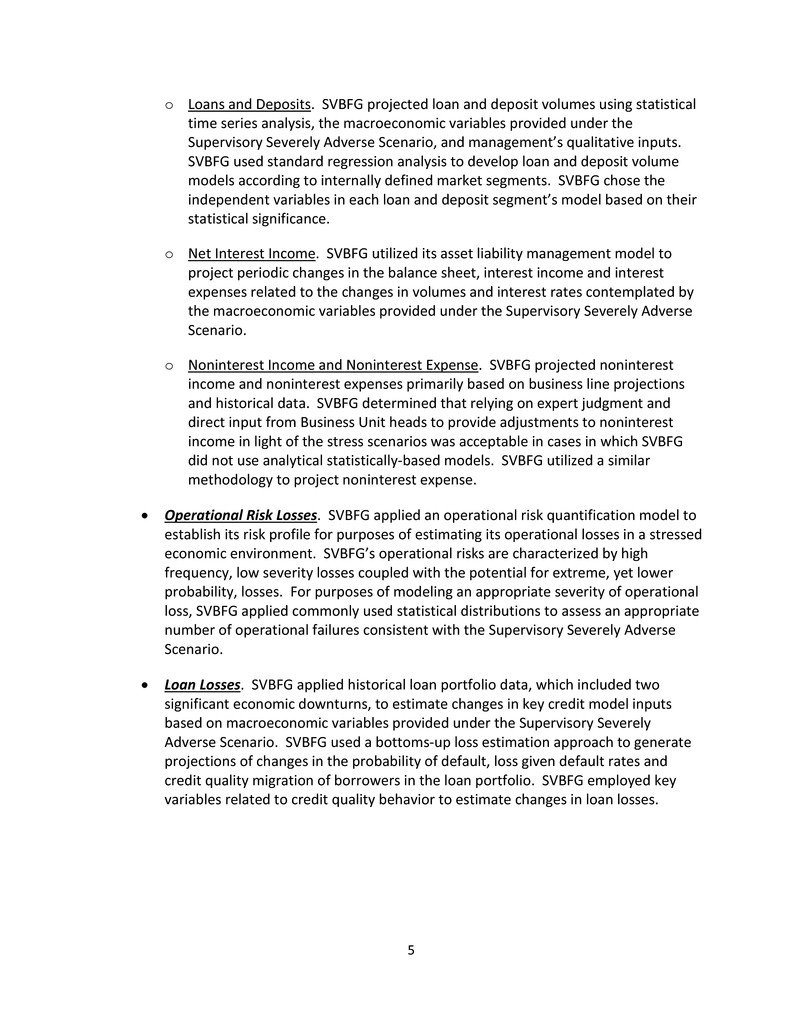

IV. SVBFG Cumulative Stress Test Results under the Supervisory Severely Adverse Scenario SVBFG’s cumulative stress test results under the Supervisory Severely Adverse Scenario for the 9Q Planning Horizon are presented below. A. Estimates of Aggregate Losses, Pre-Provision Net Revenues, Loan Loss Provisions and Net Income Table 1 shows the cumulative estimates of SVBFG’s projected aggregate losses, PPNR and loan loss provisions resulting in changes in net income before taxes through the 9Q Planning Horizon. Aggregate losses consist primarily of Provision for Loan Losses, and to a much lesser extent, operational risk losses and losses associated with nonmarketable securities and equity warrant assets. Nonmarketable securities and warrant losses are included in Noninterest Income, and operational risk losses are included in Noninterest Expense, as set forth in Table 1. Table 1. Projected Losses, Revenue and Net Income Before Taxes (4Q2014 through 4Q2016) Supervisory Severely Adverse Scenario 9-Qtr Total ($ in Millions) Net Interest Income $ 1,644.05 plus Noninterest Income 174.68 less Noninterest Expense (1,889.56) Pre-Provision Net Revenue (70.83) less Provision for Loan Losses (673.27) plus Realized gains on Available-for-Sale (AFS) securities 19.18 Net Income (Loss) Before Taxes $ (724.92) Table 2 provides details on cumulative estimates of loan losses based on the Federal Reserve’s reporting templates: Table 2. Projected Loan Losses by Type of Loans (4Q2014 through 4Q2016) Supervisory Severely Adverse Scenario 9-Qtr Losses ($ in Millions) Cumulative Loss Rate (in %)2 Residential Mortgage Loans and HELOCs, Domestic $ 12.187 1.37 Construction/Commercial Real Estate 3.267 4.62 Commercial and Industrial 463.057 5.35 Multi-Family 0.373 2.67 Commercial Real Estate 9.523 1.94 Consumer Loans 7.211 6.28 Other Loans 2.685 4.43 Total Loan Losses $ 498.303 4.84% 2 Cumulative loss rates (by loan type) are calculated based on the credit quality migration and default rate projections in each category relative to average quarterly loan volume throughout the planning horizon. 6

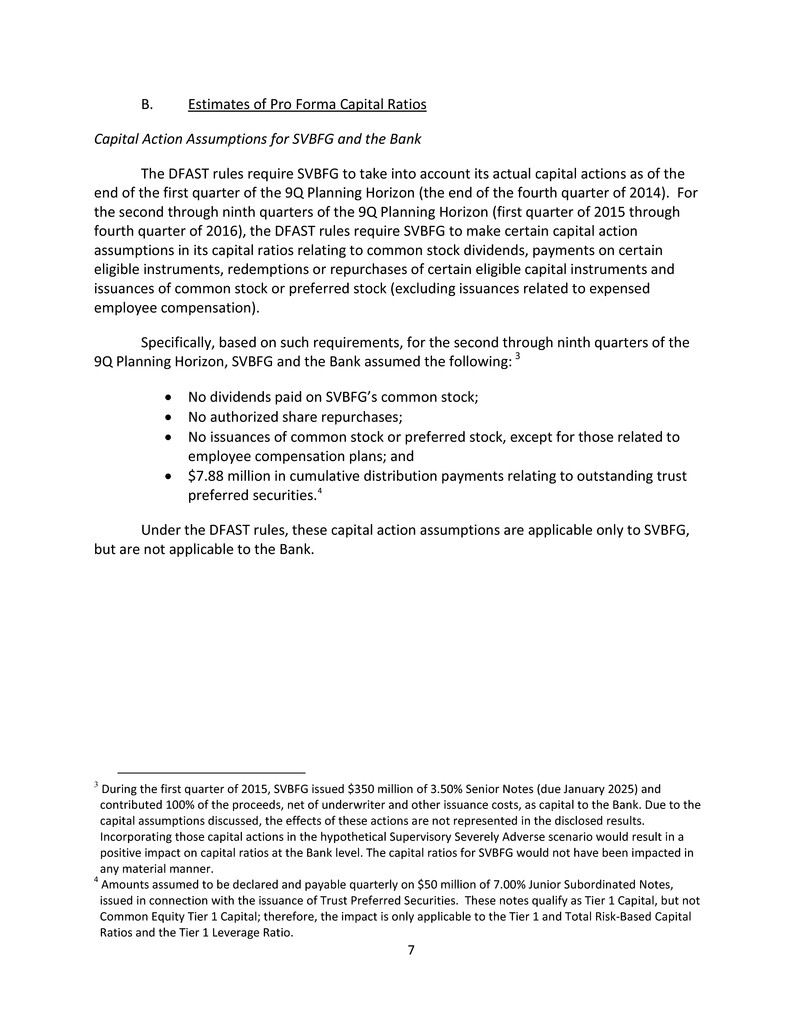

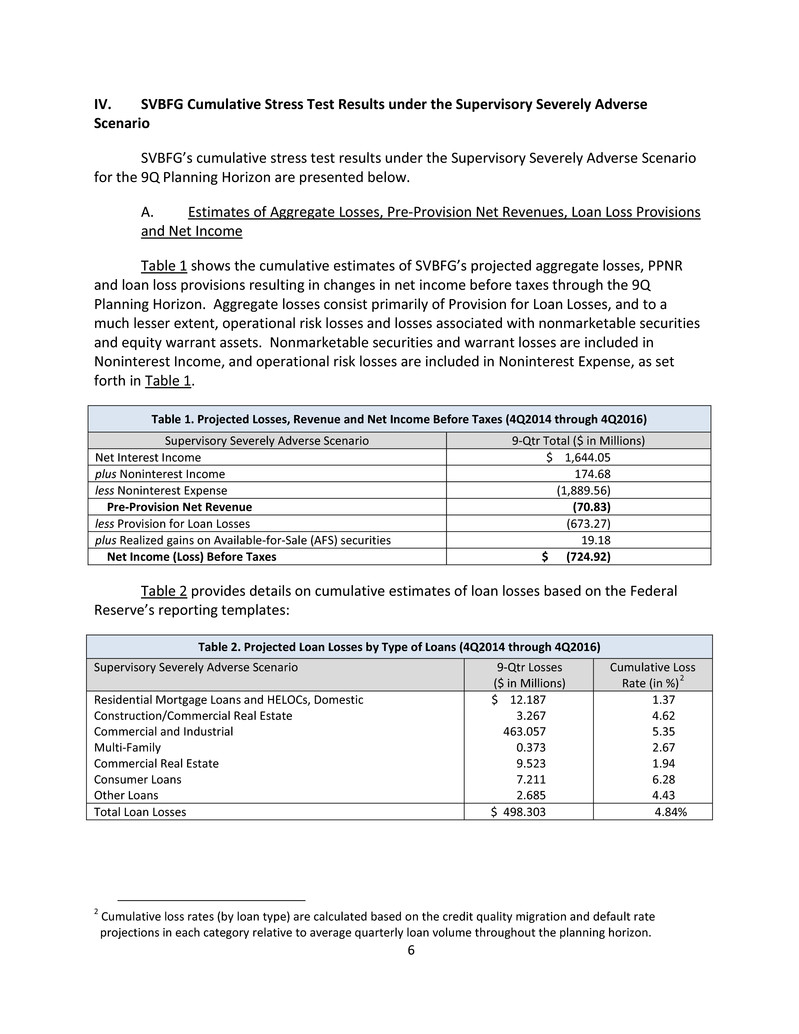

B. Estimates of Pro Forma Capital Ratios Capital Action Assumptions for SVBFG and the Bank The DFAST rules require SVBFG to take into account its actual capital actions as of the end of the first quarter of the 9Q Planning Horizon (the end of the fourth quarter of 2014). For the second through ninth quarters of the 9Q Planning Horizon (first quarter of 2015 through fourth quarter of 2016), the DFAST rules require SVBFG to make certain capital action assumptions in its capital ratios relating to common stock dividends, payments on certain eligible instruments, redemptions or repurchases of certain eligible capital instruments and issuances of common stock or preferred stock (excluding issuances related to expensed employee compensation). Specifically, based on such requirements, for the second through ninth quarters of the 9Q Planning Horizon, SVBFG and the Bank assumed the following: 3 • No dividends paid on SVBFG’s common stock; • No authorized share repurchases; • No issuances of common stock or preferred stock, except for those related to employee compensation plans; and • $7.88 million in cumulative distribution payments relating to outstanding trust preferred securities.4 Under the DFAST rules, these capital action assumptions are applicable only to SVBFG, but are not applicable to the Bank. 3 During the first quarter of 2015, SVBFG issued $350 million of 3.50% Senior Notes (due January 2025) and contributed 100% of the proceeds, net of underwriter and other issuance costs, as capital to the Bank. Due to the capital assumptions discussed, the effects of these actions are not represented in the disclosed results. Incorporating those capital actions in the hypothetical Supervisory Severely Adverse scenario would result in a positive impact on capital ratios at the Bank level. The capital ratios for SVBFG would not have been impacted in any material manner. 4 Amounts assumed to be declared and payable quarterly on $50 million of 7.00% Junior Subordinated Notes, issued in connection with the issuance of Trust Preferred Securities. These notes qualify as Tier 1 Capital, but not Common Equity Tier 1 Capital; therefore, the impact is only applicable to the Tier 1 and Total Risk-Based Capital Ratios and the Tier 1 Leverage Ratio. 7

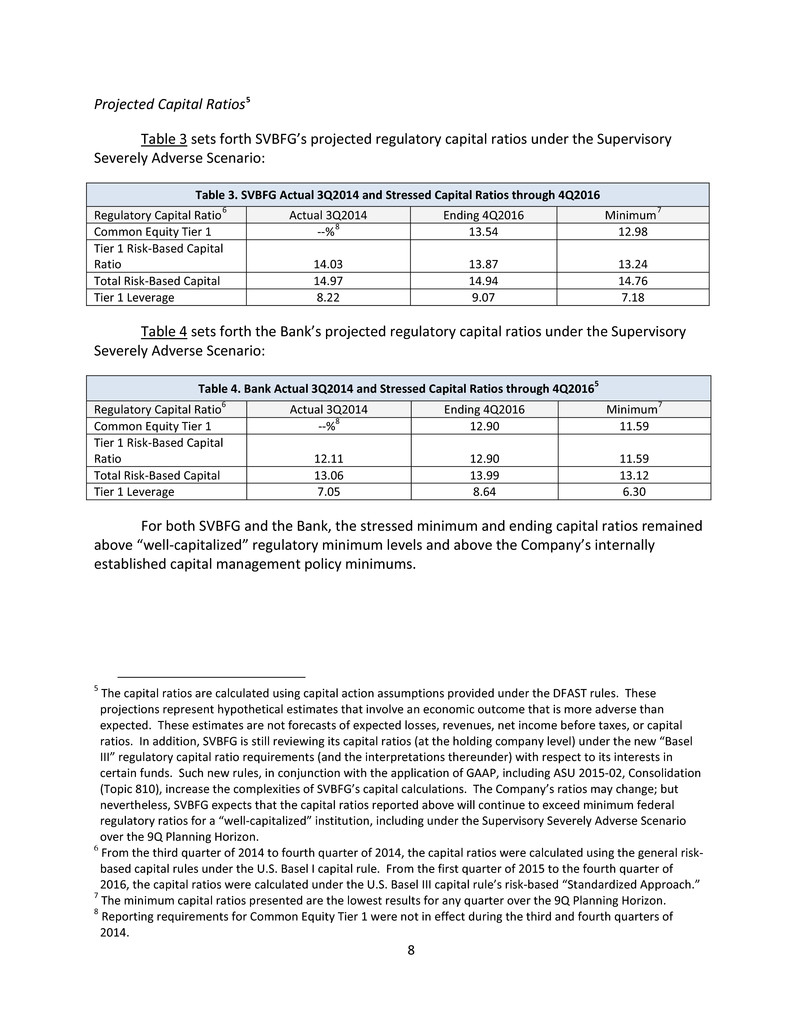

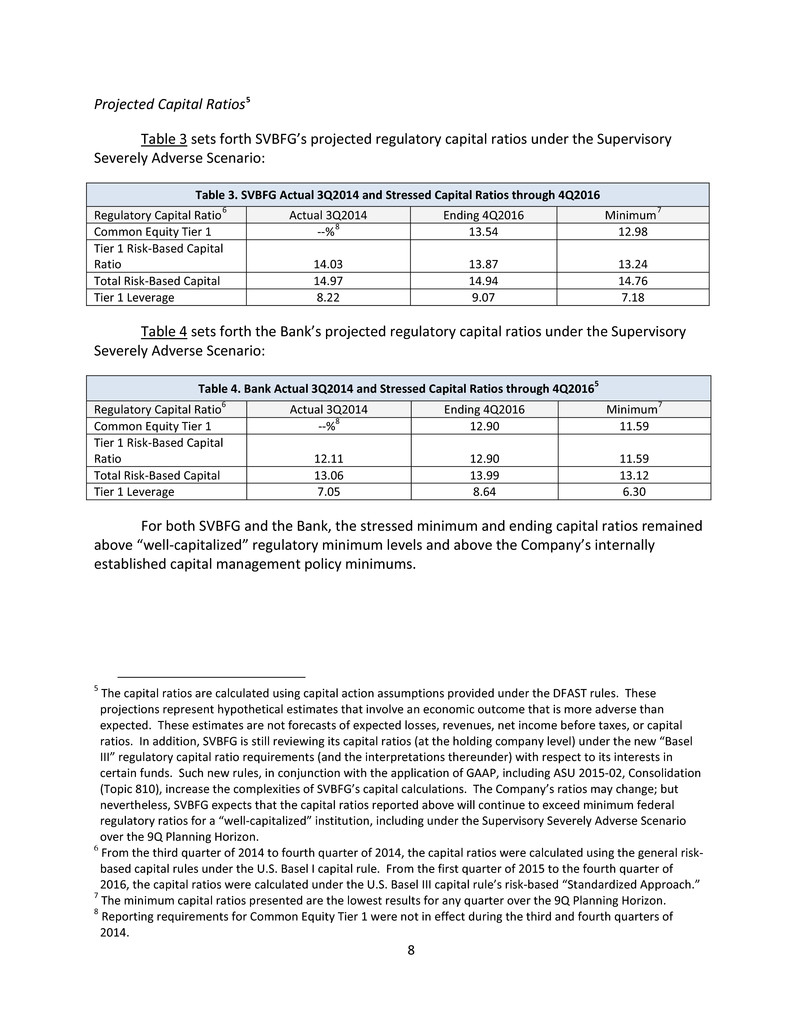

Projected Capital Ratios5 Table 3 sets forth SVBFG’s projected regulatory capital ratios under the Supervisory Severely Adverse Scenario: Table 3. SVBFG Actual 3Q2014 and Stressed Capital Ratios through 4Q2016 Regulatory Capital Ratio6 Actual 3Q2014 Ending 4Q2016 Minimum7 Common Equity Tier 1 --%8 13.54 12.98 Tier 1 Risk-Based Capital Ratio 14.03 13.87 13.24 Total Risk-Based Capital 14.97 14.94 14.76 Tier 1 Leverage 8.22 9.07 7.18 Table 4 sets forth the Bank’s projected regulatory capital ratios under the Supervisory Severely Adverse Scenario: Table 4. Bank Actual 3Q2014 and Stressed Capital Ratios through 4Q20165 Regulatory Capital Ratio6 Actual 3Q2014 Ending 4Q2016 Minimum7 Common Equity Tier 1 --%8 12.90 11.59 Tier 1 Risk-Based Capital Ratio 12.11 12.90 11.59 Total Risk-Based Capital 13.06 13.99 13.12 Tier 1 Leverage 7.05 8.64 6.30 For both SVBFG and the Bank, the stressed minimum and ending capital ratios remained above “well-capitalized” regulatory minimum levels and above the Company’s internally established capital management policy minimums. 5 The capital ratios are calculated using capital action assumptions provided under the DFAST rules. These projections represent hypothetical estimates that involve an economic outcome that is more adverse than expected. These estimates are not forecasts of expected losses, revenues, net income before taxes, or capital ratios. In addition, SVBFG is still reviewing its capital ratios (at the holding company level) under the new “Basel III” regulatory capital ratio requirements (and the interpretations thereunder) with respect to its interests in certain funds. Such new rules, in conjunction with the application of GAAP, including ASU 2015-02, Consolidation (Topic 810), increase the complexities of SVBFG’s capital calculations. The Company’s ratios may change; but nevertheless, SVBFG expects that the capital ratios reported above will continue to exceed minimum federal regulatory ratios for a “well-capitalized” institution, including under the Supervisory Severely Adverse Scenario over the 9Q Planning Horizon. 6 From the third quarter of 2014 to fourth quarter of 2014, the capital ratios were calculated using the general risk- based capital rules under the U.S. Basel I capital rule. From the first quarter of 2015 to the fourth quarter of 2016, the capital ratios were calculated under the U.S. Basel III capital rule’s risk-based “Standardized Approach.” 7 The minimum capital ratios presented are the lowest results for any quarter over the 9Q Planning Horizon. 8 Reporting requirements for Common Equity Tier 1 were not in effect during the third and fourth quarters of 2014. 8

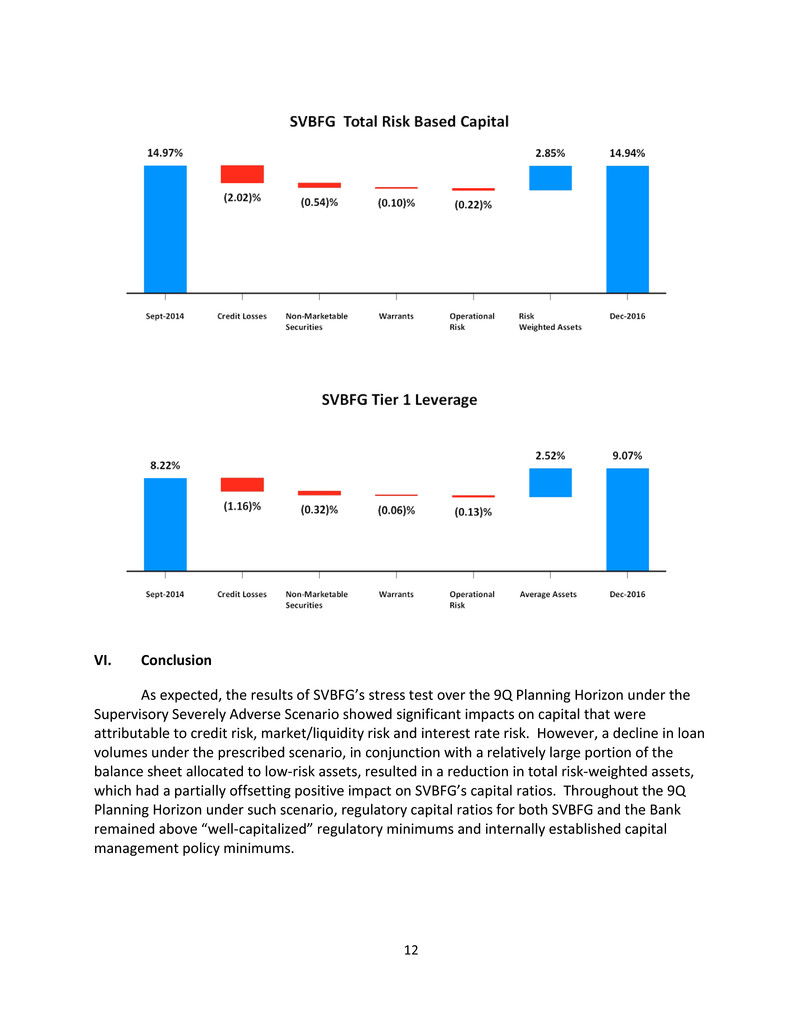

V. Key Drivers of Changes to Capital Ratios Changes to SVBFG’s capital ratios under the Supervisory Severely Adverse Scenario are driven primarily by credit losses and decreases in PPNR (including nonmarketable securities losses, warrant losses and operational risk losses). Changes in risk-weighted assets, driven primarily by loan volumes and the persistent low level of interest rates, also contributed significantly to changes in SVBFG’s capital ratios. Substantially all of SVBFG’s total consolidated risk-weighted assets are held at the Bank, SVBFG’s primary operating subsidiary.9 Changes in risk-weighted assets are the primary driver of changes in the capital ratios. Additionally, most of SVBFG’s total consolidated equity capital is held at the Bank.10 With the exception of losses on nonmarketable securities and warrants, which are held at the parent company level and thus only impact SVBFG, due to consolidation of the Bank into SVBFG for capital purposes, the key drivers of changes to the Bank’s capital ratios are generally the same as those at the SVBFG parent company level. Credit Losses. Under the Supervisory Severely Adverse Scenario, the elevated unemployment rate and declining consumer price index (CPI) that characterize a deep-rooted and prolonged recession result in an increase in nonperforming loans, which drives up credit loss rates. SVBFG’s Commercial and Industrial (“C&I”) loans contribute the largest nominal impact on capital with $463.1 million in cumulative losses over the 9Q Planning Horizon. Similarly, losses from C&I loans also produce among the highest default rates (5.35% based on average quarterly balances) across SVBFG’s loan categories under the Supervisory Severely Adverse Scenario. In aggregate, credit losses flow directly through retained earnings (a component of equity) and create the largest negative impact on SVBFG’s capital ratios. Decreases in Pre-Provision Net Revenues. The decrease in PPNR relative to the base case estimate is significant under the Supervisory Severely Adverse Scenario. Net interest income and noninterest income totaling $1,818.7 million is more than offset by $1,889.6 million in noninterest expenses. The result is a net negative impact on capital of $(70.8) million coming from PPNR during the 9Q Planning Horizon. Specifically, negative impacts on PPNR include lower net interest income driven primarily by lower interest income from decreasing loan volumes. Market interest rates under the Supervisory Severely Adverse Scenario also remain near or below recent historical low levels resulting in further margin compression on earning assets and, ultimately, lower net interest income. Other negative adjustments to PPNR include lower returns on nonmarketable securities and equity warrants. The Dow Jones Equity Market Index declines nearly 60% during the first 4- quarters of the 9Q Planning Horizon under the Supervisory Severely Adverse Scenario. The result is a material negative impact on the market value of these nonmarketable securities and warrants assets. Because they only are held at the parent level, nonmarketable investment 9 As of September 30, 2014, 98% of SVBFG’s total consolidated risk-weighted assets were held at the Bank level. 10 As of September 30, 2014, 85% of SVBFG’s total consolidated equity capital was held at the Bank level. 9

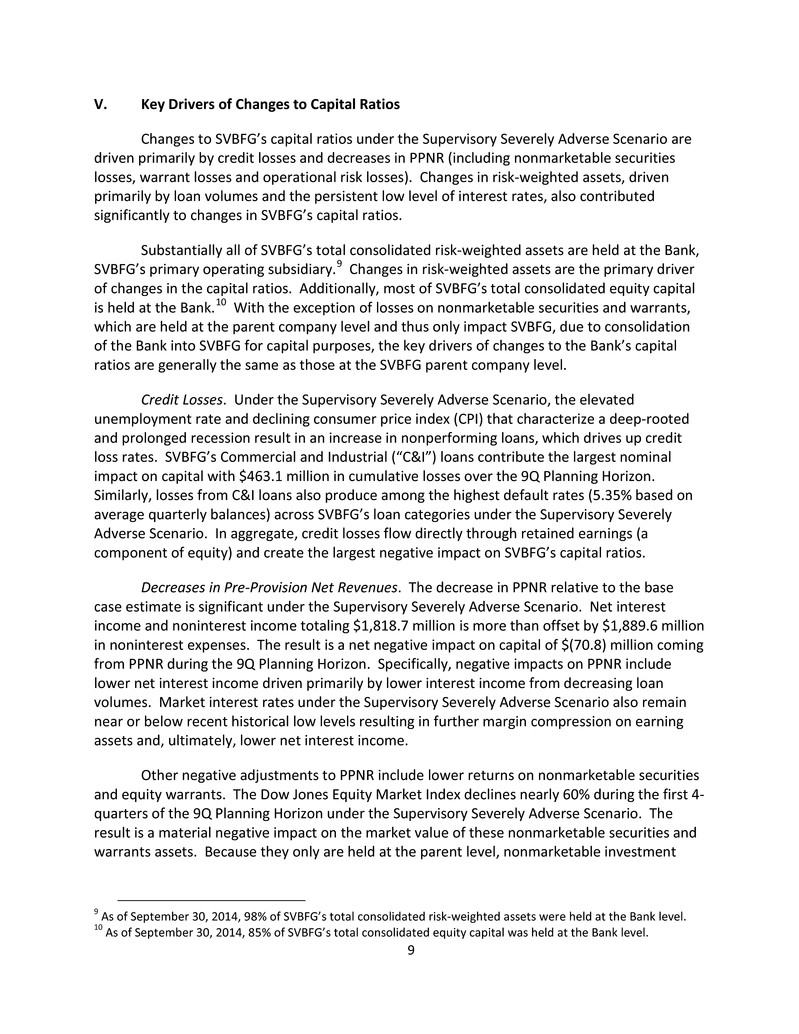

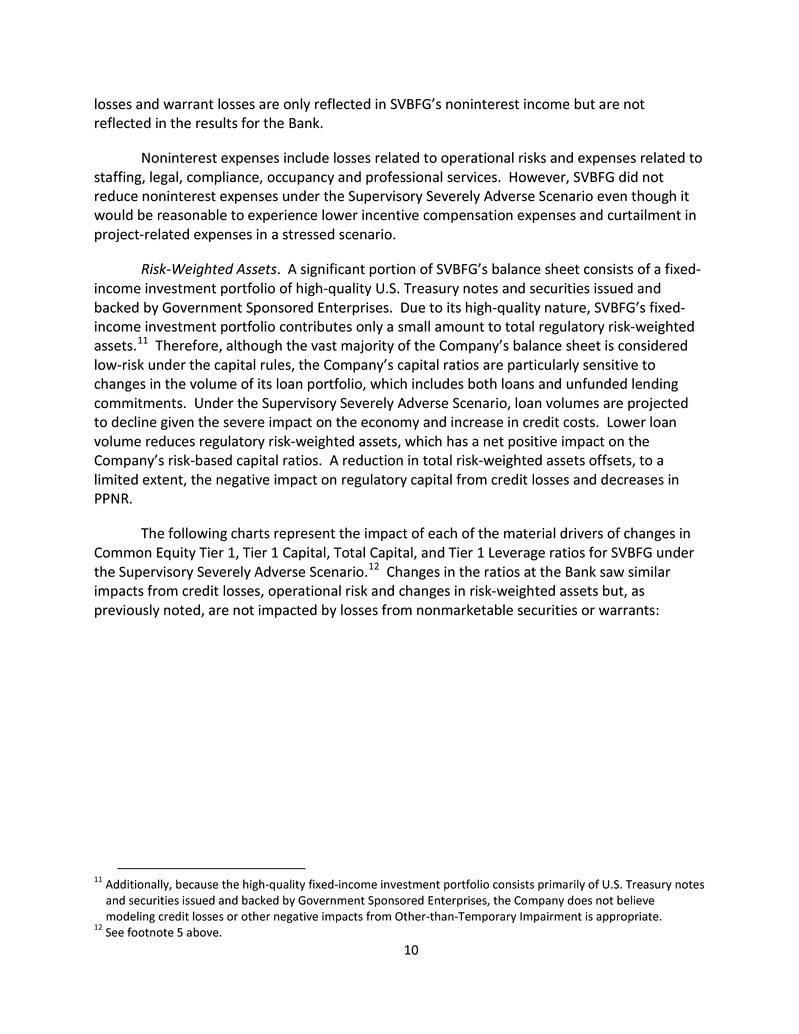

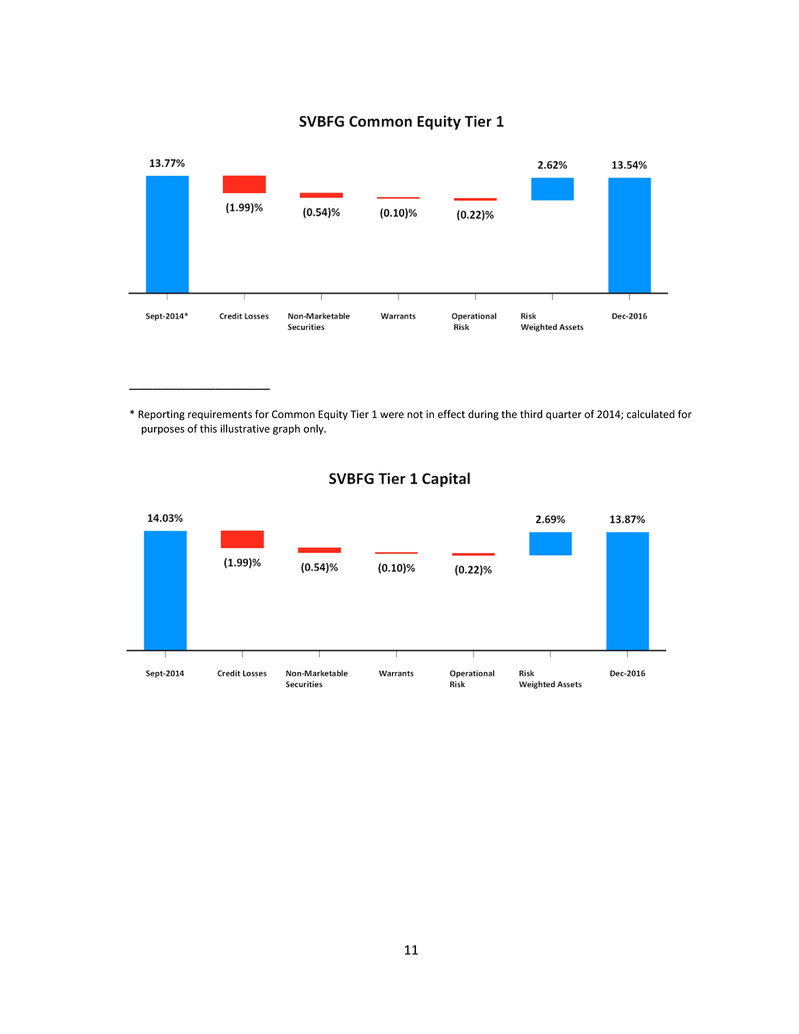

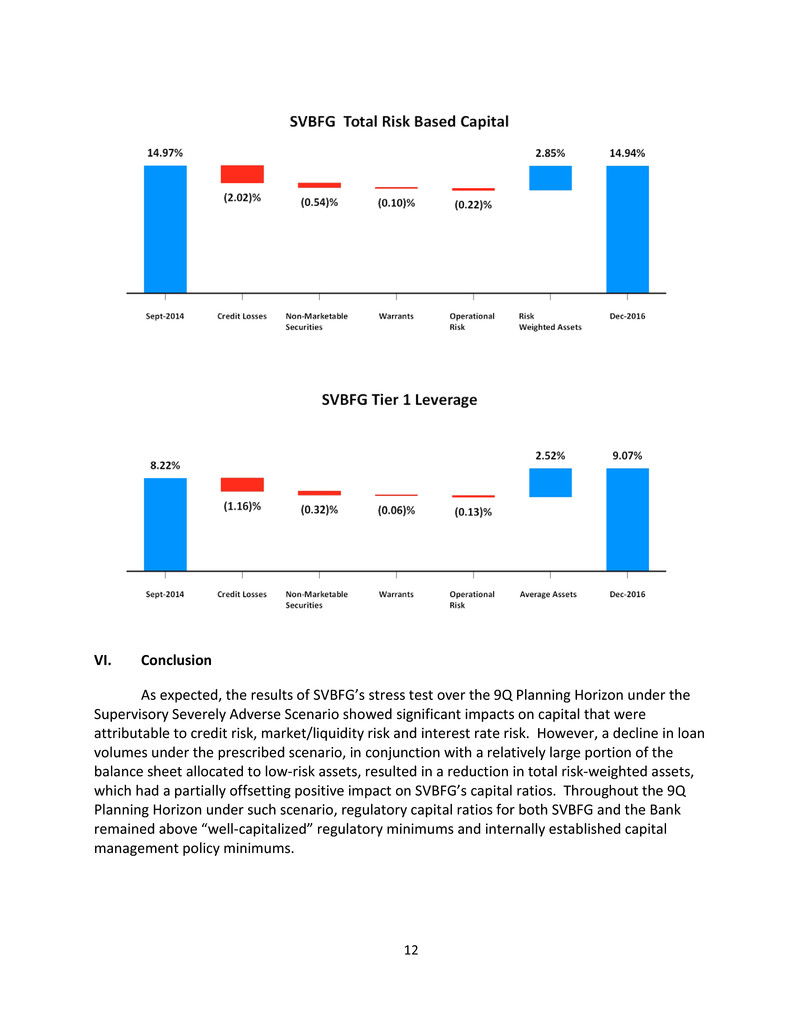

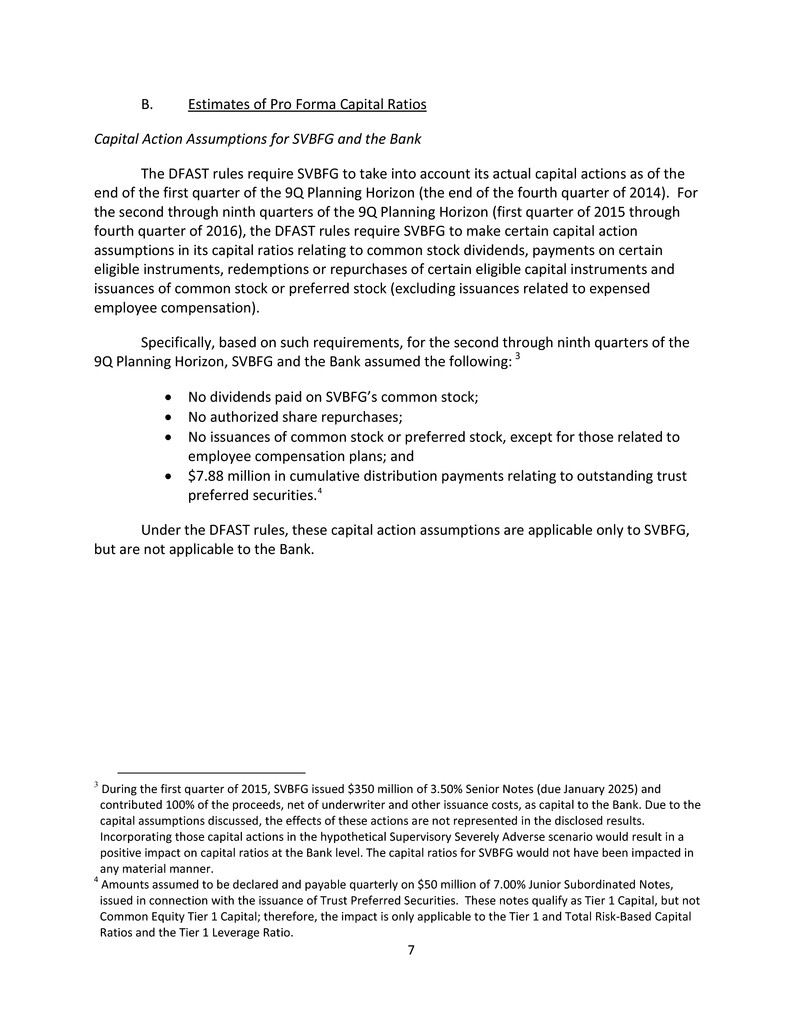

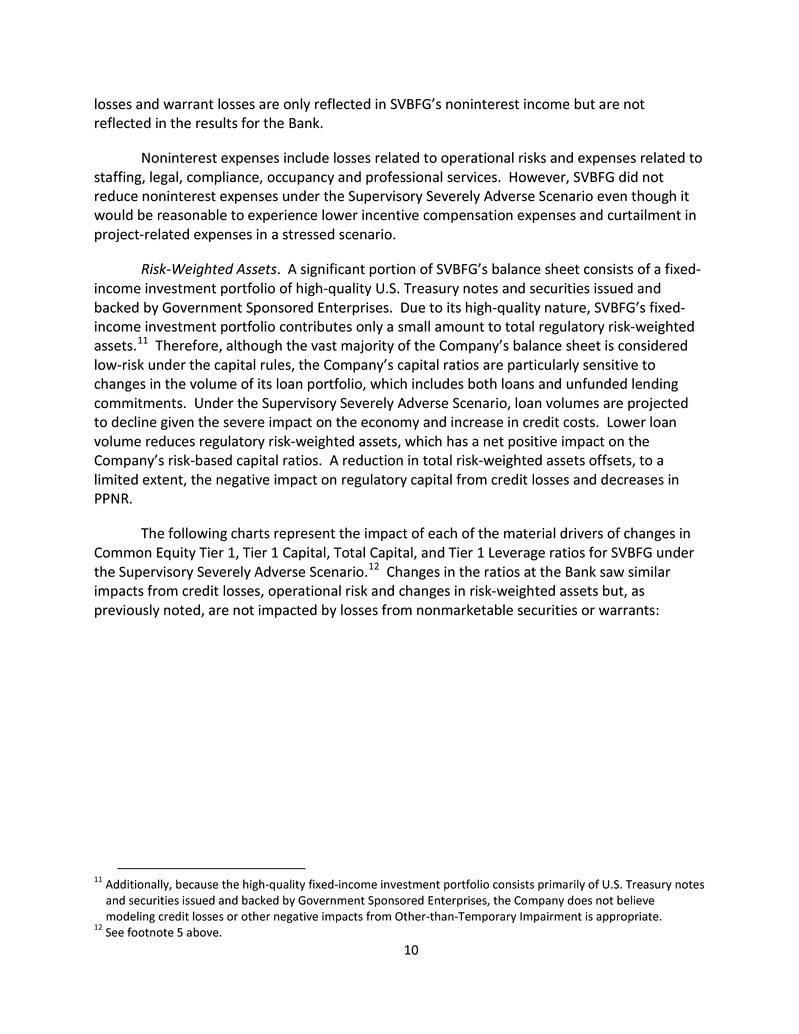

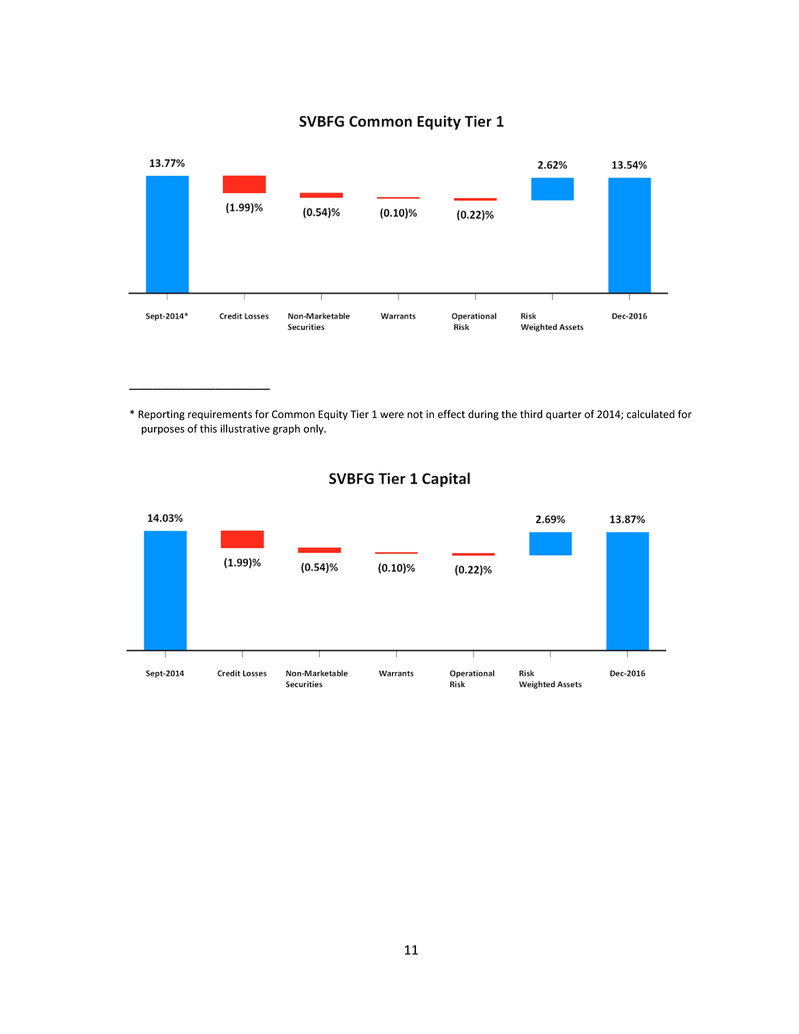

losses and warrant losses are only reflected in SVBFG’s noninterest income but are not reflected in the results for the Bank. Noninterest expenses include losses related to operational risks and expenses related to staffing, legal, compliance, occupancy and professional services. However, SVBFG did not reduce noninterest expenses under the Supervisory Severely Adverse Scenario even though it would be reasonable to experience lower incentive compensation expenses and curtailment in project-related expenses in a stressed scenario. Risk-Weighted Assets. A significant portion of SVBFG’s balance sheet consists of a fixed- income investment portfolio of high-quality U.S. Treasury notes and securities issued and backed by Government Sponsored Enterprises. Due to its high-quality nature, SVBFG’s fixed- income investment portfolio contributes only a small amount to total regulatory risk-weighted assets.11 Therefore, although the vast majority of the Company’s balance sheet is considered low-risk under the capital rules, the Company’s capital ratios are particularly sensitive to changes in the volume of its loan portfolio, which includes both loans and unfunded lending commitments. Under the Supervisory Severely Adverse Scenario, loan volumes are projected to decline given the severe impact on the economy and increase in credit costs. Lower loan volume reduces regulatory risk-weighted assets, which has a net positive impact on the Company’s risk-based capital ratios. A reduction in total risk-weighted assets offsets, to a limited extent, the negative impact on regulatory capital from credit losses and decreases in PPNR. The following charts represent the impact of each of the material drivers of changes in Common Equity Tier 1, Tier 1 Capital, Total Capital, and Tier 1 Leverage ratios for SVBFG under the Supervisory Severely Adverse Scenario.12 Changes in the ratios at the Bank saw similar impacts from credit losses, operational risk and changes in risk-weighted assets but, as previously noted, are not impacted by losses from nonmarketable securities or warrants: 11 Additionally, because the high-quality fixed-income investment portfolio consists primarily of U.S. Treasury notes and securities issued and backed by Government Sponsored Enterprises, the Company does not believe modeling credit losses or other negative impacts from Other-than-Temporary Impairment is appropriate. 12 See footnote 5 above. 10

__________________ * Reporting requirements for Common Equity Tier 1 were not in effect during the third quarter of 2014; calculated for purposes of this illustrative graph only. 11

VI. Conclusion As expected, the results of SVBFG’s stress test over the 9Q Planning Horizon under the Supervisory Severely Adverse Scenario showed significant impacts on capital that were attributable to credit risk, market/liquidity risk and interest rate risk. However, a decline in loan volumes under the prescribed scenario, in conjunction with a relatively large portion of the balance sheet allocated to low-risk assets, resulted in a reduction in total risk-weighted assets, which had a partially offsetting positive impact on SVBFG’s capital ratios. Throughout the 9Q Planning Horizon under such scenario, regulatory capital ratios for both SVBFG and the Bank remained above “well-capitalized” regulatory minimums and internally established capital management policy minimums. 12

VII. Forward-Looking Statements Disclaimer This disclosure contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are subject to known and unknown risks and uncertainties, many of which may be beyond SVBFG’s control. Forward- looking statements are statements that are not historical facts, such as forecasts of SVBFG’s future financial results and condition, expectations for SVBFG’s operations and business, and SVBFG’s underlying assumptions of such forecasts and expectations. In addition, forward- looking statements generally can be identified by the use of such words as “becoming,” “may,” “will,” “should,” “could,” “would,” “predict,” “potential,” “continue,” “anticipate,” “believe,” “estimate,” “seek,” “expect,” “plan,” “intend,” the negative of such words or comparable terminology. In this disclosure, SVBFG makes forward-looking statements discussing management’s expectations under hypothetical scenarios about, among other things, economic conditions; opportunities in the market; the outlook on SVBFG’s clients' performance; SVBFG’s financial, credit, and business performance, including potential investment gains; loan growth, loan mix and loan yields; expense levels; and financial results (and the components of such results) for certain quarters in, and for the 9Q Planning Horizon which spans the period between the fourth quarter of 2014 through the fourth quarter of 2016. Although SVBFG believes that the expectations reflected in SVBFG’s forward-looking statements are reasonable, SVBFG has based these expectations on its current beliefs as well as its assumptions, and such expectations may not prove to be correct. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside SVBFG’s control. SVBFG’s actual results of operations and financial performance could differ significantly from those expressed in or implied by SVBFG’s management’s forward-looking statements. Important factors that could cause SVBFG’s actual results and financial condition to differ from the expectations stated in the forward-looking statements include, among others: (i) deterioration, weaker than expected improvement, or other changes in the state of the economy or the markets in which SVBFG conducts business or are served by SVBFG (including the levels of IPOs and M&A activities); (ii) changes in the volume and credit quality of SVBFG’s loans; (iii) the impact of changes in interest rates or market levels or factors affecting or affected by them, especially on SVBFG’s loan and fixed-income investment portfolios; (iv) changes in SVBFG’s deposit levels; (v) changes in the performance or equity valuations of funds or companies in which SVBFG has invested or holds derivative instruments or equity warrant assets; (vi) variations from SVBFG’s expectations as to factors impacting SVBFG’s cost structure; (vii) changes in SVBFG’s assessment of the creditworthiness or liquidity of SVBFG’s clients or unanticipated effects of credit concentration risks which create or exacerbate deterioration of such creditworthiness or liquidity; (viii) accounting changes, as required by GAAP; and (ix) regulatory or legal changes or their impact on SVBFG, including the impact of the Volcker Rule. For additional information about these and other factors, please refer to SVBFG’s public reports filed with the U.S. Securities and Exchange Commission, including under the caption “Risk Factors” in SVBFG’s most recent Annual Report filed on Form 10-K. The forward-looking 13

statements included in this disclosure are made only as of the date of this disclosure. SVBFG does not intend, and undertakes no obligation, to update these forward-looking statements. * * * * * 14