Exhibit 99.2

SVB Financial Group RBC Capital Markets

Financial Institutions Conference 2007

September 24-26, 2007

(Nasdaq: SIVB)

Principal Banking Subsidiary: Silicon Valley Bank

Member Federal Reserve System. Member FDIC

Safe Harbor Disclosure

This presentation contains projections or other forward-looking statements regarding management’s expectations about future events or the future financial performance of the company, and may include, without limitation, financial guidance for the company’s third fiscal quarter of 2007 and for the year 2007, as well as future economic, market and tax conditions. Forward-looking statements are statements that are not historical facts.

We wish to caution you that such statements are just predictions and actual events or results may differ materially, due to changes in economic, business and regulatory factors and trends. We also refer you to the documents the company files from time to time with the United States Securities and Exchange Commission, specifically the company’s latest Annual Report on Form 10-K for the year ended December 31, 2006, filed on March 1, 2007; and Form 10-Q for the three months ended June 30, 2007, filed on August 9, 2007. These documents contain and identify important risk factors that could cause the company’s actual results to differ materially from those contained in our projections or other forward-looking statements. All forward-looking statements included in this presentation are made only as of today’s date.

We Are Not Seeing a Material Impact from the Current Credit Situation

Credit and investment quality

We have no sub-prime mortgages in our loan or investment portfolios

The vast majority of mortgages in our investment portfolio are AAA-rated or agency-backed

Our exposure to asset-backed commercial paper is less than two percent of our investment portfolio and we are not currently reinvesting in those markets

Private equity

The majority of our loans to private equity firms go to cover capital calls rather than buyouts; these loans have very high credit quality

The segment of micro-cap private equity buyouts we finance is largely immune to the covenant and deal-size issues affecting leveraged lenders

We Have More Levers For Offsetting The Impact of Interest Rate Changes

The impact of the Federal Funds rate decrease (50 bps) will equate to approximately 5 to 6 cents per share* (or $2.2 million in after-tax net income) per quarter

Loans have continued to grow strongly

We are targeting noninterest expense growth of less than 6 percent in 2007 with our performance improvement initiatives

Noninterest income has grown strongly in the past four years and constitutes a growing share of our revenues

We announced authorization for $250 million in stock repurchases through July 2008, which will reduce our diluted share count

Settlement of our contingently convertible debt in June 2008 will further reduce our diluted share count

* | | Based on diluted share count as of June 30, 2007 |

Corporate Overview

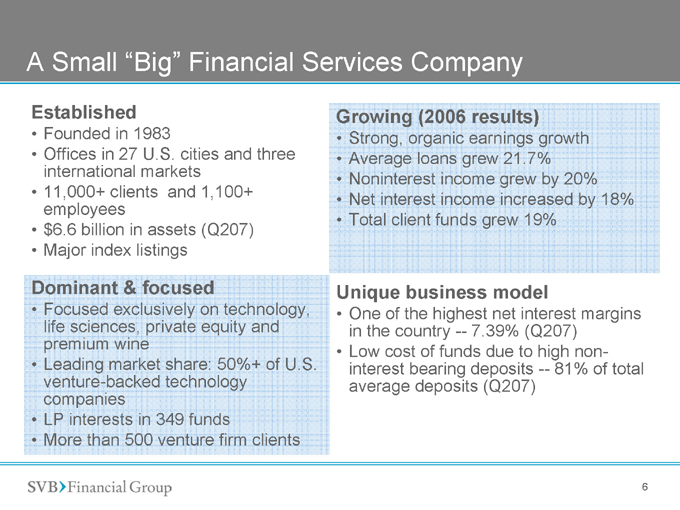

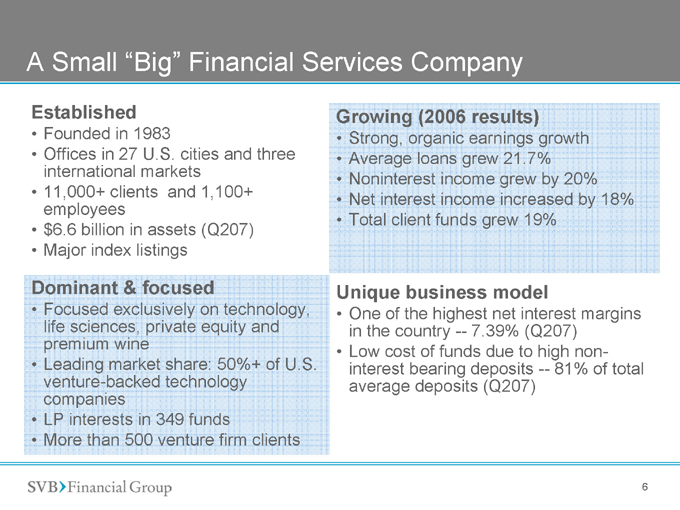

A Small “Big” Financial Services Company

Established

Founded in 1983

Offices in 27 U.S. cities and three international markets

11,000+ clients and 1,100+ employees

$6.6 billion in assets (Q207)

Major index listings

Dominant & focused

Focused exclusively on technology, life sciences, private equity and premium wine

Leading market share: 50%+ of U.S. venture-backed technology companies

LP interests in 349 funds

More than 500 venture firm clients

Growing (2006 results)

Strong, organic earnings growth

Average loans grew 21.7%

Noninterest income grew by 20%

Net interest income increased by 18%

Total client funds grew 19%

Unique business model

One of the highest net interest margins in the country 7.39% (Q207)

Low cost of funds due to high non-interest bearing deposits 81% of total average deposits (Q207)

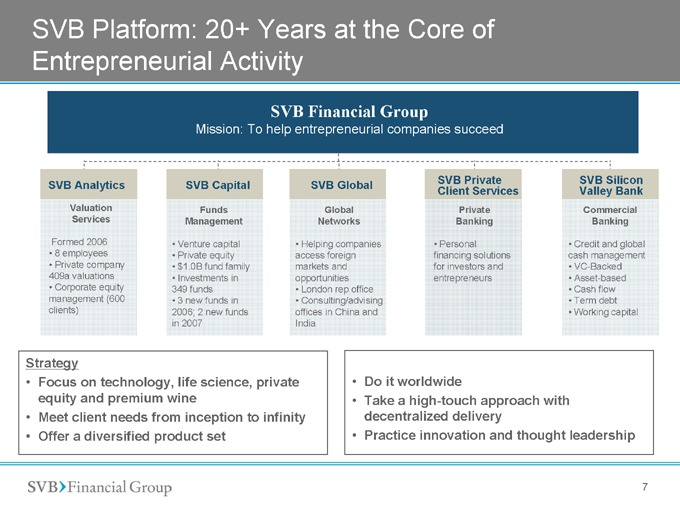

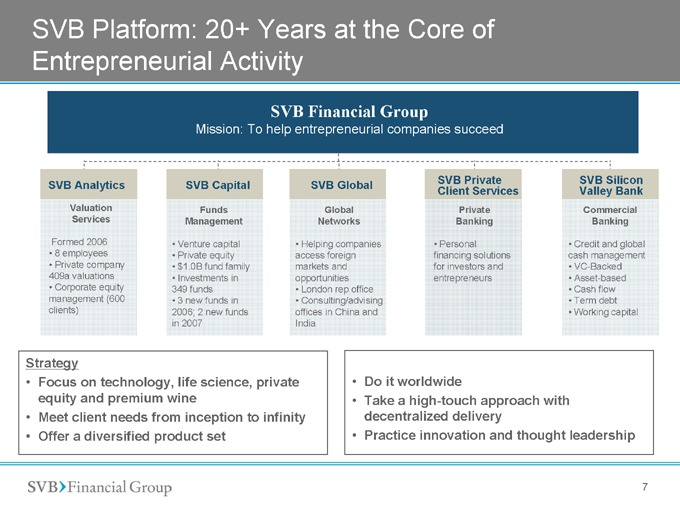

SVB Platform: 20+ Years at the Core of Entrepreneurial Activity

SVB Financial Group

Mission: To help entrepreneurial companies succeed

SVB Analytics

Valuation Services

Formed 2006

Private company 409a valuations

Corporate equity management (600 clients)

SVB Capital

Funds Management

Venture capital

Private equity

$1.0B fund family

Investments in 349 funds

3 | | new funds in 2006; 2 new funds in 2007 |

SVB Global

Global Networks

Helping companies access foreign markets and opportunities

London rep office

Consulting/advising offices in China and India

SVB Private Client Services

Private Banking

Personal financing solutions for investors and entrepreneurs

SVB Silicon

Valley Bank

Commercial

Banking

Credit and global

cash management

VC-Backed

Asset-based

Cash flow

Term debt

Working capital

Strategy

Focus on technology, life science, private equity and premium wine

Meet client needs from inception to infinity

Offer a diversified product set

Do it worldwide

Take a high-touch approach with decentralized delivery

Practice innovation and thought leadership

Long-Term Goals

10 – 20% growth in EPS over the long term

20% ROE in the long term

Cutting our expense growth in half (10% ®5%)

Optimizing our capital base

Growing deposits on the balance sheet

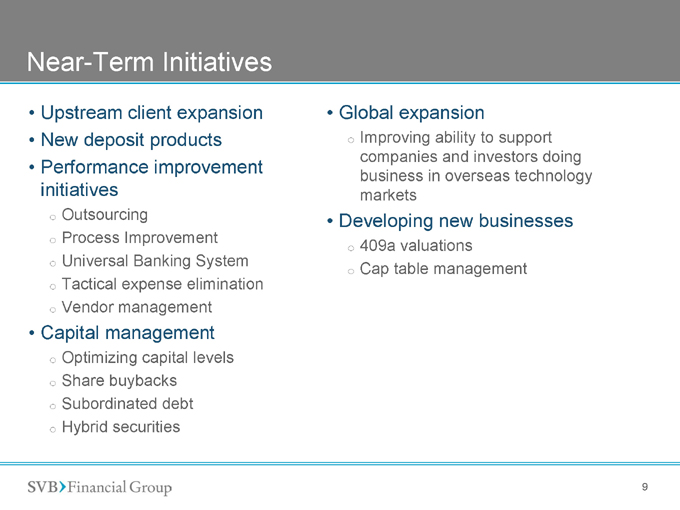

Near-Term Initiatives

Upstream client expansion

New deposit products

Performance improvement initiatives

Outsourcing

Process Improvement

Universal Banking System

Tactical expense elimination

Vendor management

Capital management

Optimizing capital levels

Share buybacks

Subordinated debt

Hybrid securities

Global expansion

Improving ability to support companies and investors doing business in overseas technology markets

Developing new businesses

409a valuations

Cap table management

9

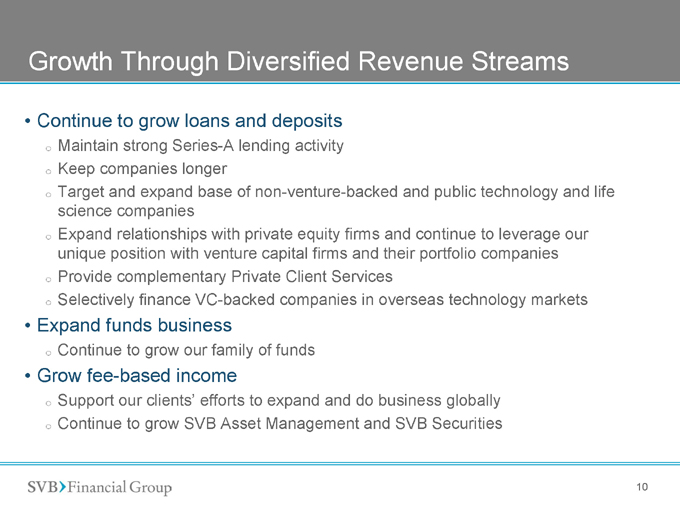

Growth Through Diversified Revenue Streams

Continue to grow loans and deposits

Maintain strong Series-A lending activity

Keep companies longer

Target and expand base of non-venture-backed and public technology and life science companies

Expand relationships with private equity firms and continue to leverage our unique position with venture capital firms and their portfolio companies

Provide complementary Private Client Services

Selectively finance VC-backed companies in overseas technology markets

Expand funds business

Continue to grow our family of funds

Grow fee-based income

Support our clients’ efforts to expand and do business globally

Continue to grow SVB Asset Management and SVB Securities

10

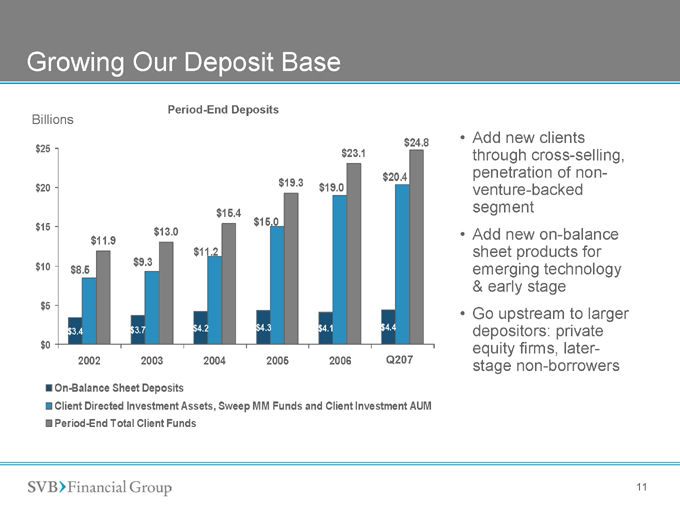

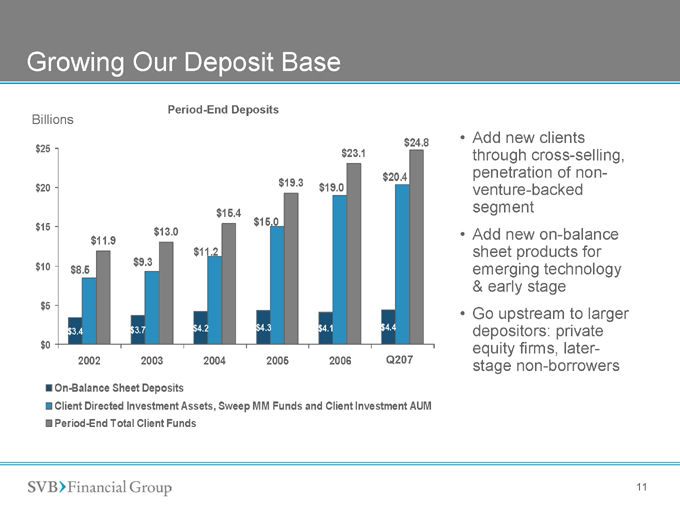

Growing Our Deposit Base

Period-End Deposits

Billions

$24.8

$25 $23.1 $20.4 $19.3 $19.0 $20

$15.4 $15.0

$15 $13.0 $11.9 $11.2

$10 $9.3 $8.5

$5

$3.4 $3.7 $4.2 $4.3 $4.1 $4.4 $0

2002 2003 2004 2005 2006 Q207

On-Balance Sheet Deposits

Client Directed Investment Assets, Sweep MM Funds and Client Investment AUM Period-End Total Client Funds

Add new clients through cross-selling, penetration of non-venture-backed segment

Add new on-balance sheet products for emerging technology & early stage

Go upstream to larger depositors: private equity firms, later-stage non-borrowers

11

Financial Highlights

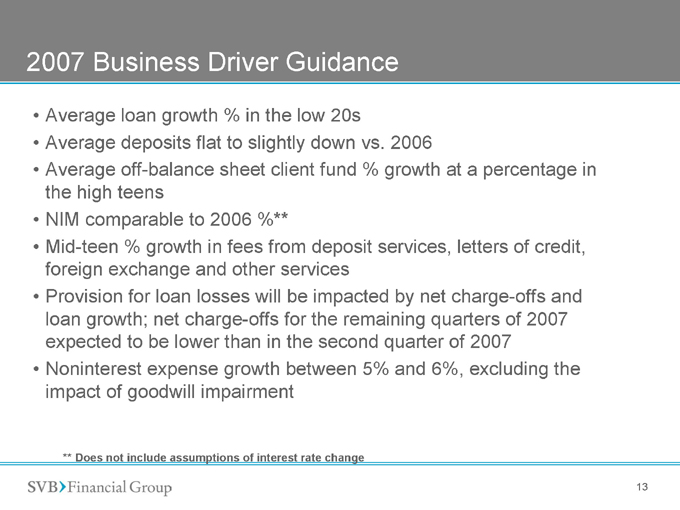

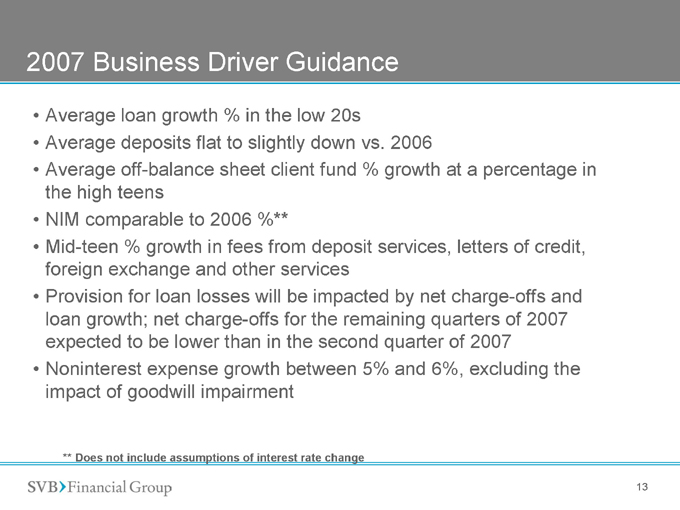

2007 Business Driver Guidance

Average loan growth % in the low 20s

Average deposits flat to slightly down vs. 2006

Average off-balance sheet client fund % growth at a percentage in the high teens NIM comparable to 2006 %**

Mid-teen % growth in fees from deposit services, letters of credit, foreign exchange and other services

Provision for loan losses will be impacted by net charge-offs and loan growth; net charge-offs for the remaining quarters of 2007 expected to be lower than in the second quarter of 2007

Noninterest expense growth between 5% and 6%, excluding the impact of goodwill impairment

** Does not include assumptions of interest rate change

13

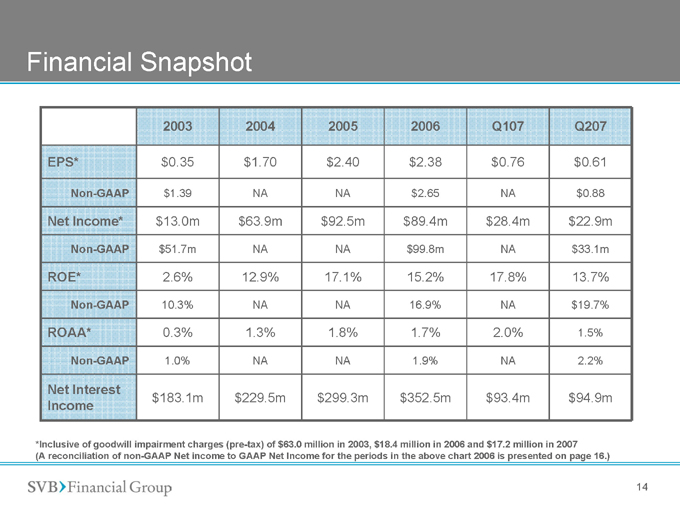

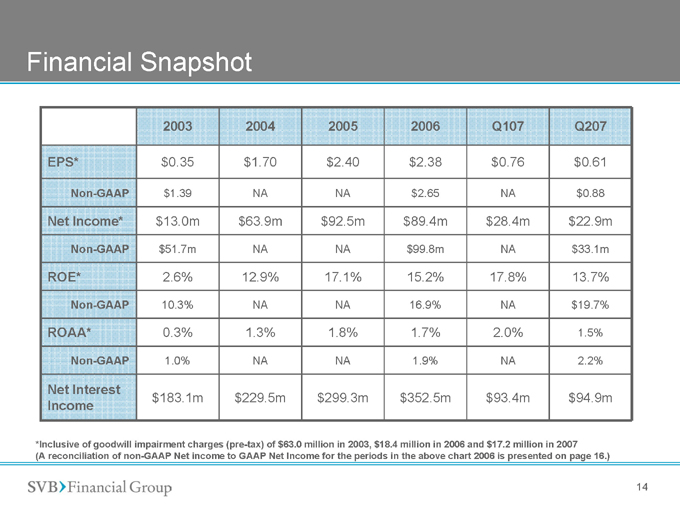

Financial Snapshot

2003 2004 2005 2006 Q107 Q207

EPS* $0.35 $1.70 $2.40 $2.38 $0.76 $0.61

Non-GAAP $1.39 NA NA $2.65 NA $0.88

Net Income* $13.0m $63.9m $92.5m $89.4m $28.4m $22.9m

Non-GAAP $51.7m NA NA $99.8m NA $33.1m

ROE* 2.6% 12.9% 17.1% 15.2% 17.8% 13.7%

Non-GAAP 10.3% NA NA 16.9% NA $19.7%

ROAA* 0.3% 1.3% 1.8% 1.7% 2.0% 1.5%

Non-GAAP 1.0% NA NA 1.9% NA 2.2%

Net Interest

$183.1m $229.5m $299.3m $352.5m $93.4m $94.9m

Income

*Inclusive of goodwill impairment charges (pre-tax) of $63.0 million in 2003, $18.4 million in 2006 and $17.2 million in 2007 (A reconciliation of non-GAAP Net income to GAAP Net Income for the periods in the above chart 2006 is presented on page 16.)

14

Non-GAAP Analysis

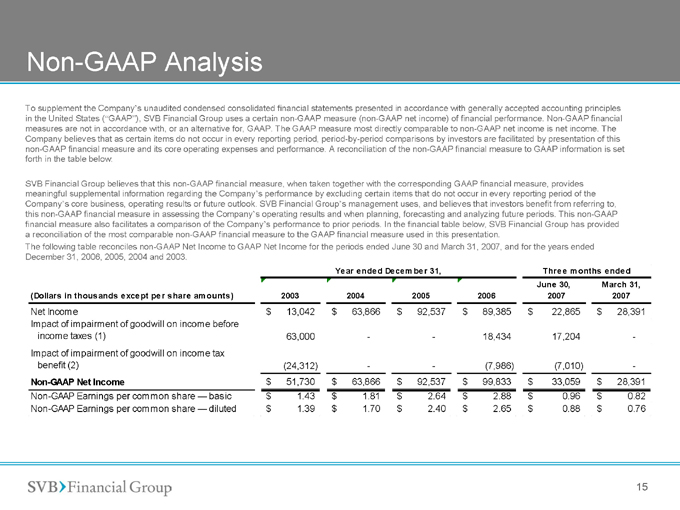

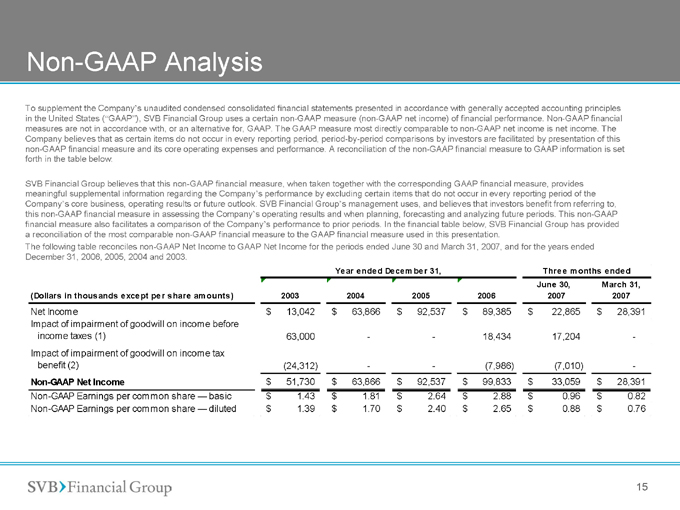

To supplement the Company’s unaudited condensed consolidated financial statements presented in accordance with generally accepted accounting principles in the United States (���GAAP”), SVB Financial Group uses a certain non-GAAP measure (non-GAAP net income) of financial performance. Non-GAAP financial measures are not in accordance with, or an alternative for, GAAP. The GAAP measure most directly comparable to non-GAAP net income is net income. The Company believes that as certain items do not occur in every reporting period, period-by-period comparisons by investors are facilitated by presentation of this non-GAAP financial measure and its core operating expenses and performance. A reconciliation of the non-GAAP financial measure to GAAP information is set forth in the table below.

SVB Financial Group believes that this non-GAAP financial measure, when taken together with the corresponding GAAP financial measure, provides meaningful supplemental information regarding the Company’s performance by excluding certain items that do not occur in every reporting period of the Company’s core business, operating results or future outlook. SVB Financial Group’s management uses, and believes that investors benefit from referring to, this non-GAAP financial measure in assessing the Company’s operating results and when planning, forecasting and analyzing future periods. This non-GAAP financial measure also facilitates a comparison of the Company’s performance to prior periods. In the financial table below, SVB Financial Group has provided a reconciliation of the most comparable non-GAAP financial measure to the GAAP financial measure used in this presentation.

The following table reconciles non-GAAP Net Income to GAAP Net Income for the periods ended June 30 and March 31, 2007, and for the years ended December 31, 2006, 2005, 2004 and 2003.

Year ended December 31, Three months ended

June 30, 2007 March 31, 2007

(Dollars in thousands except per share amounts) 2003 2004 2005 2006

Net Income $13,042 $63,866 $92,537 $89,385 $22,865 $28,391

Impact of impairment of goodwill on income before

income taxes (1) 63,000 —— 18,434 17,204 —

Impact of impairment of goodwill on income tax

benefit (2) (24,312) —— (7,986) (7,010) —

Non-GAAP Net Income $51,730 $63,866 $92,537 $99,833 $33,059 $28,391

Non-GAAP Earnings per common share — basic $1.43 $1.81 $2.64 $2.88 $0.96 $0.82

Non-GAAP Earnings per common share — diluted $1.39 $1.70 $2.40 $2.65 $0.88 $0.76

15

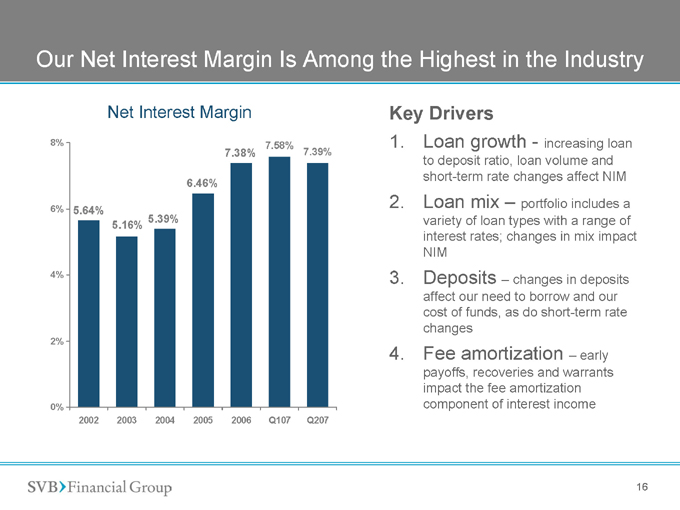

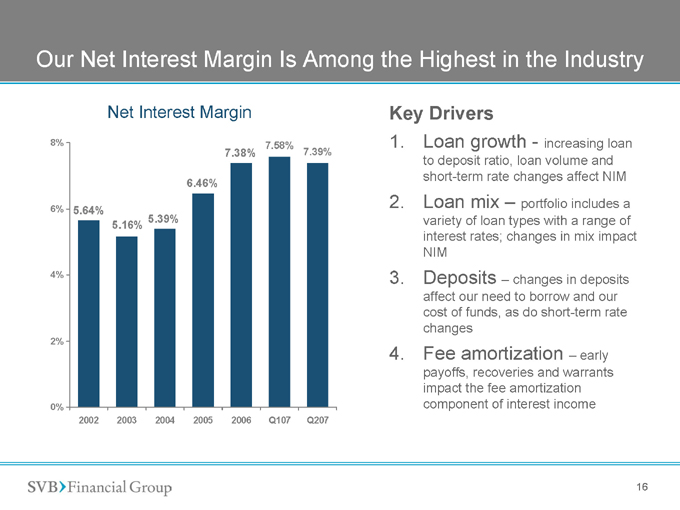

Our Net Interest Margin Is Among the Highest in the Industry

Key Drivers

1. Loan growth—increasing loan to deposit ratio, loan volume and short-term rate changes affect NIM

2. Loan mix – portfolio includes a variety of loan types with a range of interest rates; changes in mix impact NIM

3. Deposits – changes in deposits affect our need to borrow and our cost of funds, as do short-term rate changes

4. Fee amortization – early

payoffs, recoveries and warrants impact the fee amortization component of interest income

Net Interest Margin

8%

7.38% 7.58% 7.39%

6.46%

6% 5.64%

5.39% 5.16%

4%

2%

0%

2002 2003 2004 2005 2006 Q107 Q207

16

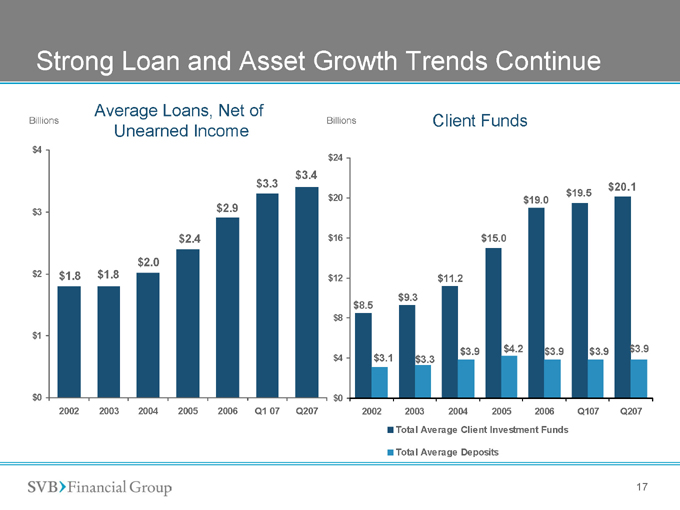

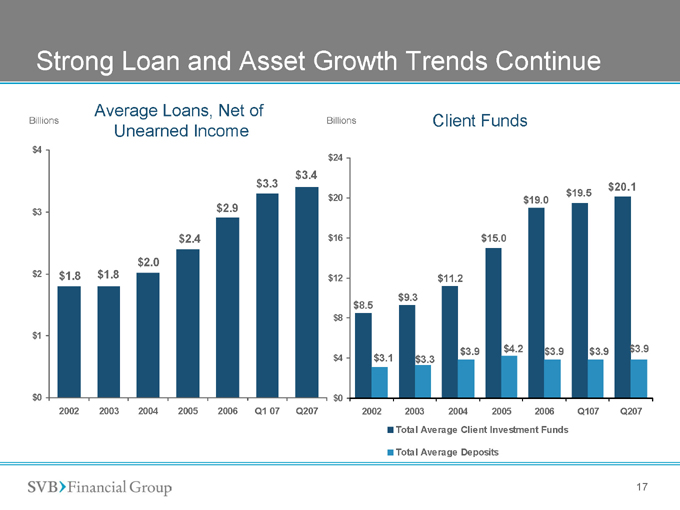

Strong Loan and Asset Growth Trends Continue

Average Loans, Net of

Billions Billions

Unearned Income

$4 $24

$3.4 $3.3

$20

$3 $2.9 $2.4 $16

$2.0

$2 $1.8 $1.8 $12

$8 $1

$4

$0 $0 2002 2003 2004 2005 2006 Q107 Q207

Client Funds $20.1 $19.5 $19.0

$15.0

$11.2 $9.3 $8.5

$3.9 $4.2 $3.9 $3.9 $3.9 $3.1 $3.3

2002 2003 2004 2005 2006 Q107 Q207 Total Average Client Investment Funds

Total Average Deposits

17

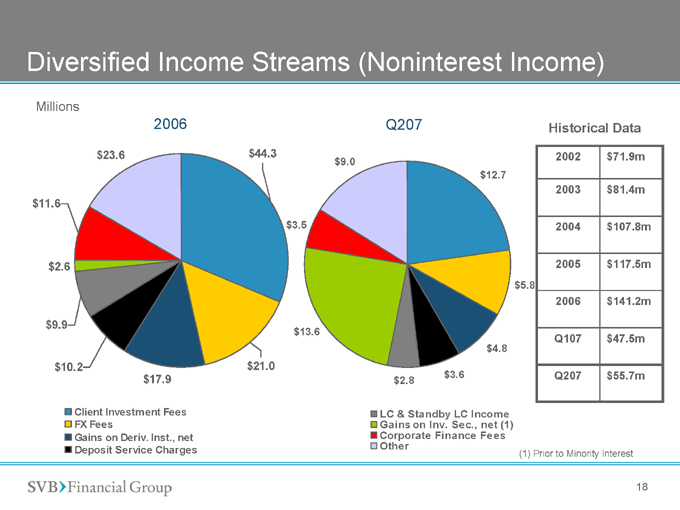

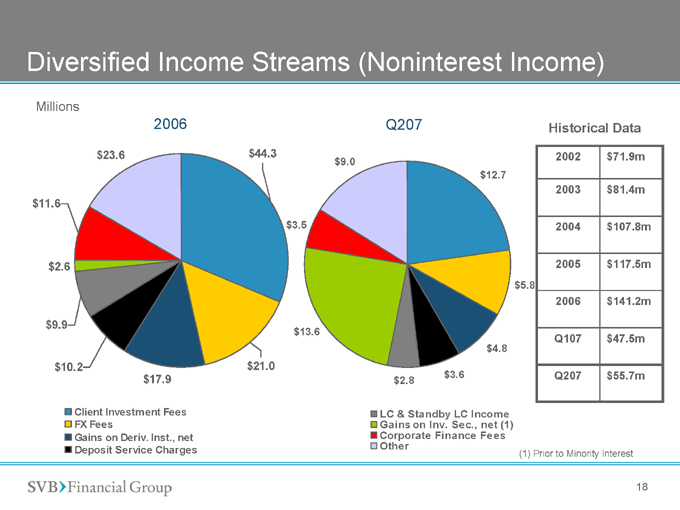

Diversified Income Streams (Noninterest Income)

Millions

2006

Q207

Historical Data

2002 $71.9m

2003 $81.4m

2004 $107.8m

2005 $117.5m

2006 $141.2m

Q107 $47.5m

Q207 $55.7m

Client Investment Fees FX Fees Gains on Deriv. Inst., net Deposit Service Charges

LC & Standby LC Income Gains on Inv. Sec., net (1) Corporate Finance Fees Other

(1) | | Prior to Minority Interest |

$23.6 $44.3 $9.0 $12.7

$11.6 $3.5

$2.6 $5.8

$9.9 $13.6 $4.8 $10.2 $21.0 $17.9 $3.6 $2.8

18

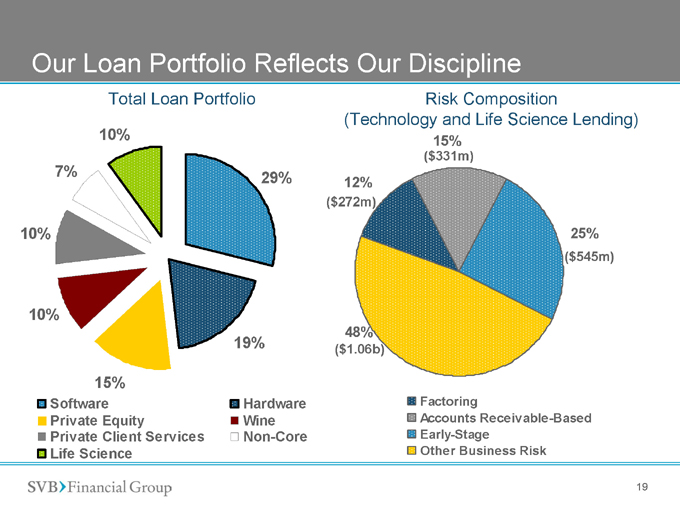

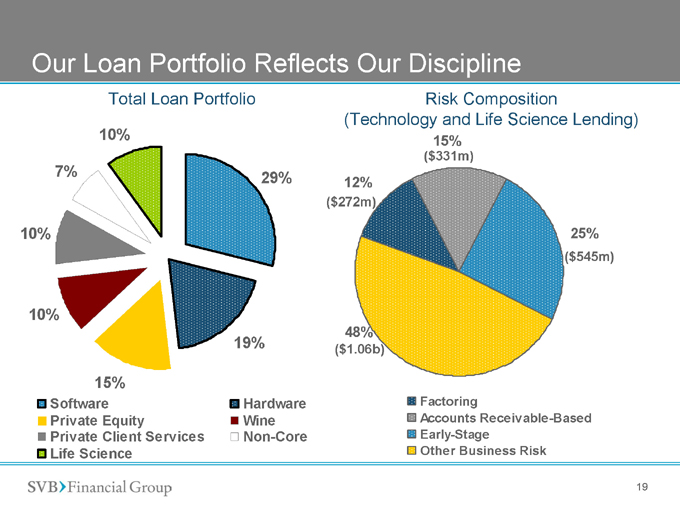

Our Loan Portfolio Reflects Our Discipline

Total Loan Portfolio

10%

7% 29% 10%

10%

19%

15%

Risk Composition

(Technology and Life Science Lending)

15%

($331m)

12%

($272m)

25%

($545m)

48%

($1.06b)

Factoring

Accounts Receivable-Based Early-Stage Other Business Risk

Software

Private Equity Hardware Wine Private Client Services Non-Core Life Science

19

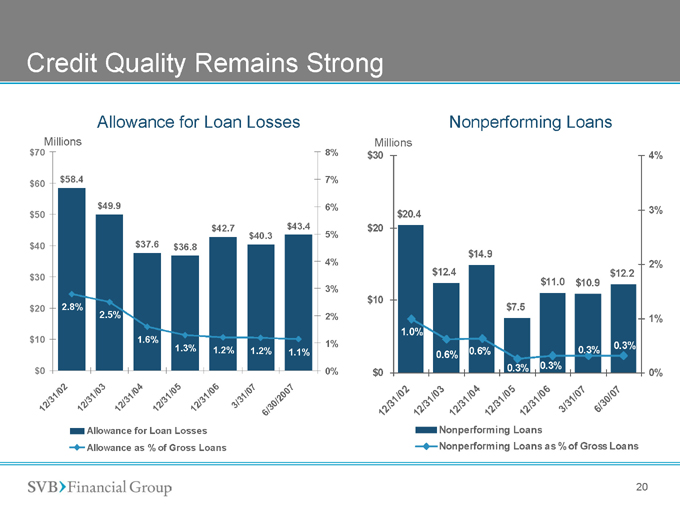

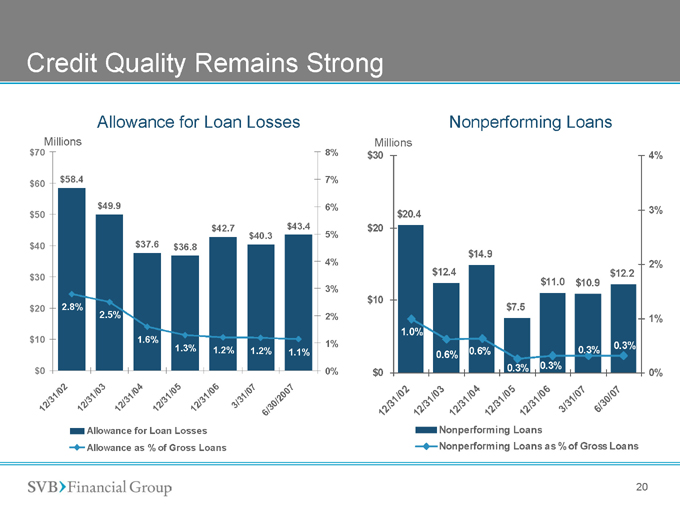

Credit Quality Remains Strong

Allowance for Loan Losses

Millions

$70 8%

$58.4 7% $60

$49.9 6% $50 $42.7 $43.4 $40.3 5%

$40 $37.6 $36.8

4% $30 3%

$20 2.8%

2.5% 2%

$10 1.6% 1% 1.3% 1.2% 1.2% 1.1%

$0 0%

12/31/02

12/31/03

12/31/04

12/31/05

12/31/06

3/30/07

6/30/07

Nonperforming Loans

Millions

$30 4%

$20.4 3% $20

$14.9

2% $12.4 $12.2 $11.0 $10.9 $10 $7.5 1% 1.0% 0.3% 0.6% 0.3% 0.6% 0.3% 0.3%

$0 0%

12/31/02

12/31/03

12/31/04

12/31/05

12/31/06

3/30/07

6/30/07

Allowance for Loan Losses Allowance as % of Gross Loans

Nonperforming Loans

Nonperforming Loans as % of Gross Loans

20

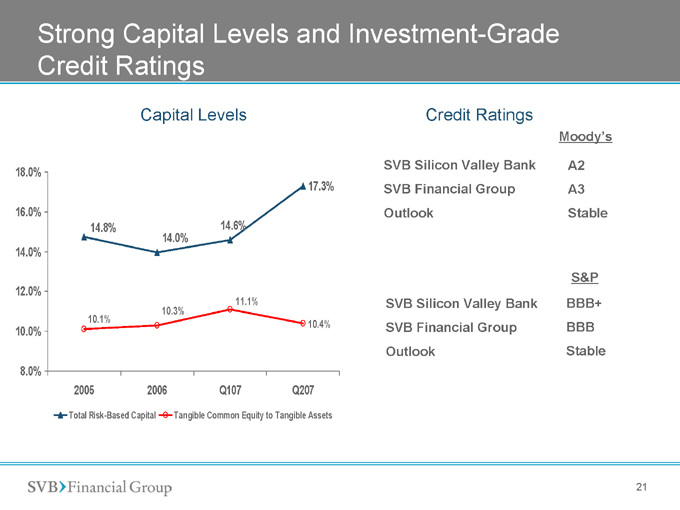

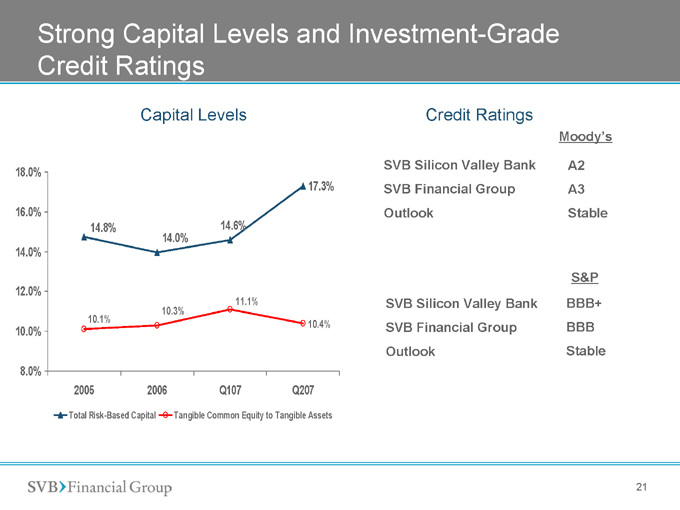

Strong Capital Levels and Investment-Grade Credit Ratings

Capital Levels

Credit Ratings

SVB Silicon Valley Bank SVB Financial Group Outlook

SVB Silicon Valley Bank SVB Financial Group Outlook

Moody’s

A2 A3 Stable

S&P

BBB+ BBB Stable

Total Risk-Based Capital Tangible Common Equity to Tangible Assets

18.0%

17.3%

16.0%

14.8% 14.6% 14.0% 14.0%

12.0%

11.1% 10.3% 10.1%

10.4%

10.0%

8.0%

2005 2006 Q107 Q207

21

In Summary

Strong performance

Continued growth

Solid shareholder returns

Solid credit and investment quality

No direct sub-prime exposure in loan or investment portfolios

Strong liquidity

Prospects for continued growth and multiple levers for driving efficiency and performance

Diversified income streams

Capital management

Performance improvement initiatives

22