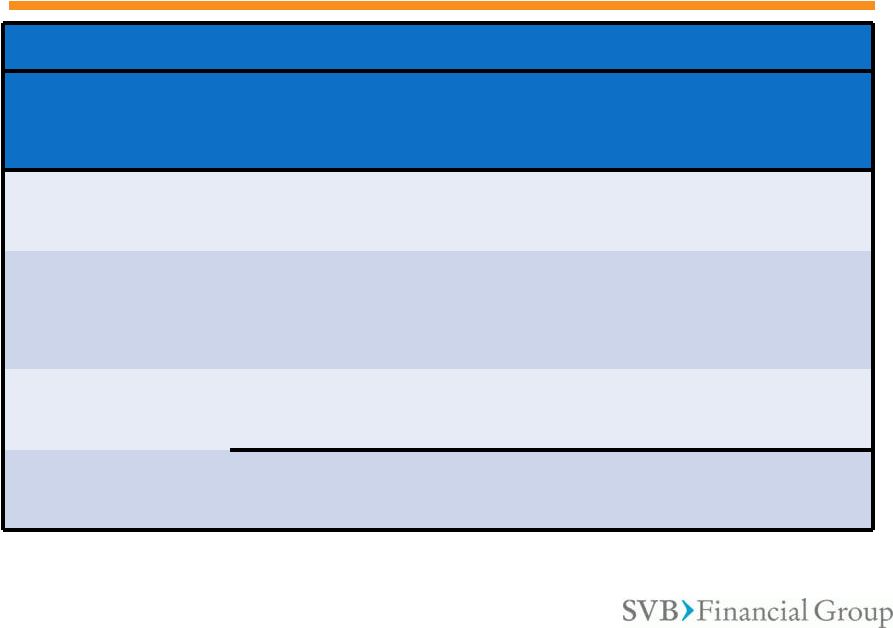

Non-GAAP Non-Interest Expense Reconciliation 43 Appendix – Non-GAAP Reconciliations Three months ended Year ended Non-GAAP operating efficiency ratio, net of noncontrolling interests (dollars in thousands, except ratios) March 31, December 31, March 31, December 31, December 31, 2011 2010 2010 2010 2009 GAAP noninterest expense $ 117,435 $ 115,891 $ 98,576 $ 422,818 $ 343,866 Less: amounts attributable to noncontrolling interests 3,481 3,298 3,231 12,348 12,451 Less: impairment of goodwill - - - - 4,092 Non-GAAP noninterest expense, net of noncontrolling interests $ 113,954 $ 112,593 $ 95,345 $ 410,470 $ 327,323 GAAP taxable equivalent net interest income $ 120,806 $ 105,025 $ 101,362 $ 420,186 $ 384,354 Less: income (losses) attributable to noncontrolling interests 7 8 (7) 28 (18) Non-GAAP taxable equivalent net interest income, net of noncontrolling interests 120,799 105,017 101,369 420,158 384,372 Non-GAAP noninterest income, net of noncontrolling interests 46,392 52,079 35,382 168,645 122,644 Non-GAAP taxable equivalent revenue, net of noncontrolling interests $ 167,191 $ 157,096 $ 136,751 $ 588,803 $ 507,016 Non-GAAP operating efficiency ratio (1) 68.16 % 71.67 % 69.72 % 69.71 % 64.56 % (1) The non-GAAP operating efficiency ratio is calculated by dividing non-GAAP noninterest expense, net of noncontrolling interests by non-GAAP taxable equivalent revenue, net of noncontrolling interests. For additional GAAP to Non-GAAP reconciliation information, please refer to our regularly filed Forms 10-Q and 10-K, as well as our quarterly earnings releases. |