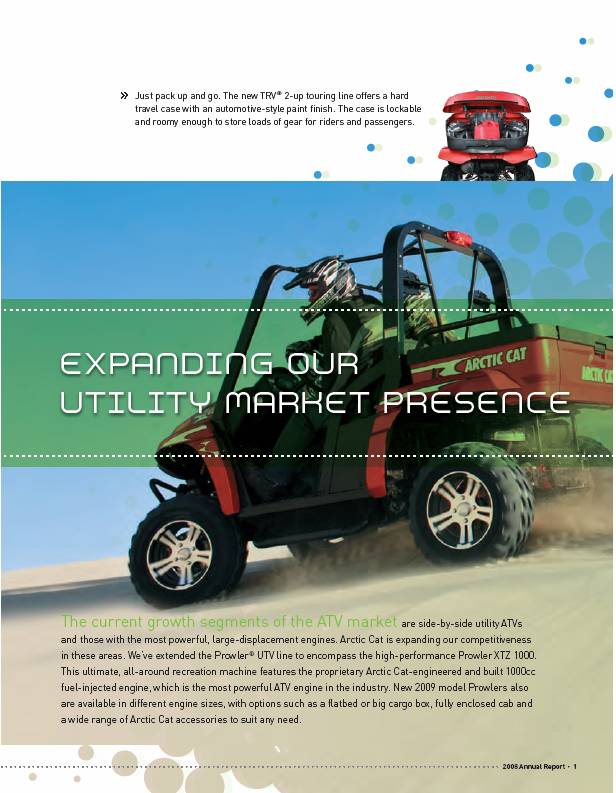

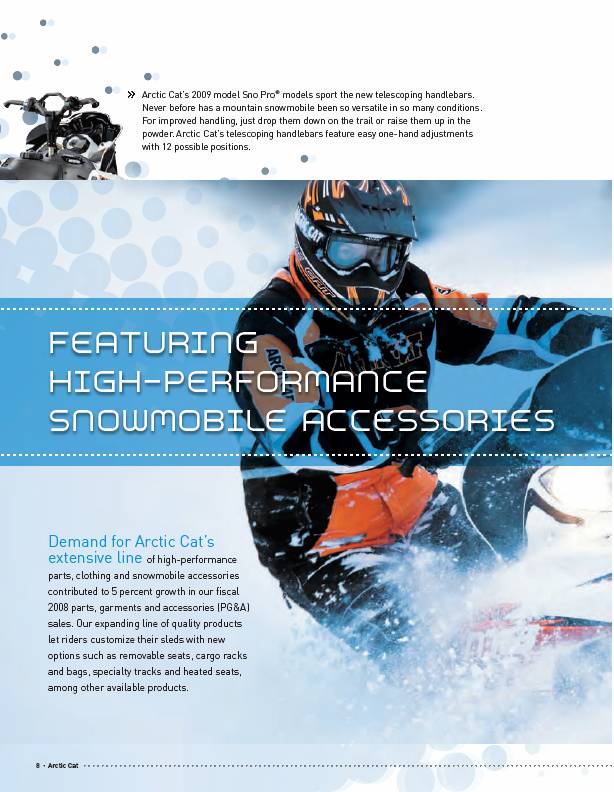

| | While the overall weak economy led to lower retail sales in nearly every recreational vehicle category, North American industry retail snowmobile sales grew in fiscal 2008. As we predicted last year, pent-up demand led to increased snowmobile sales after some of the earliest and best snow conditions we have seen in the past 10 years. The rideable snow drove customers, who had delayed their purchases, to buy new sleds this year. As a result of lower inventories and improved dealer sentiment, we expect growth in snowmobile sales to dealers of approximately 20 percent in fiscal 2009. We also are seeing similar enthusiasm from our snowmobile customers, resulting in a 70 percent increase in orders with downpayments compared to last year. This enthusiasm is driven by our exciting new snowmobiles and the good snow conditions that most riders experienced this past winter. One of the highlights of our new 2009 line-up is a 177 horsepower turbocharged four-stroke engine, which is offered in several 2009 models. This is the largest horsepower engine in the snowmobile industry and currently exceeds 2012 EPA emissions standards. In addition, our mountain machines continue to be among the lightest and most powerful, and our utility line of snowmobiles, particularly important in the Canadian market, has been completely redesigned on our F3 chassis. Consolidating the number of chassis platforms helps reduce design and manufacturing costs and improve margins, while offering customers exciting new, best-in-class products. We are encouraged to see the generally high level of enthusiasm for our snowmobile business from dealers and customers. Targeting Growing ATV Segments Arctic Cat’s fiscal 2008 ATV sales were $350.3 million compared with $431.5 million last fiscal year. Contributing to the lower ATV revenues was a decline in industrywide ATV retail sales, which led us to cut our ATV production by 25 percent. The poor performance of the overall ATV market, and our ATV business, surprised us. Industrywide retail sales significantly declined throughout our fiscal year, but particularly in the last five months. Uncharacteristically, Arctic Cat’s retail sales declined at a similar rate to the overall industry. This is the first year, since we entered the ATV business more than 10 years ago, that we did not outperform the industry and gain market share. I am confident that there is nothing fundamentally wrong with the ATV industry or Arctic Cat’s ATV business that a strengthening economy and rising consumer confidence won’t help. We are seeing delayed discretionary purchases by our core ATV customers, those in the lower- to middleincome range, as they cope with rising food and gas prices. In contrast, customers with higher annual household incomes seem less affected by the economy and continue to have ample disposable income, as demonstrated by growing demand for our largest and most expensive units. Our Prowler UTV side-by-side continues to sell better than the prior year and retail sales of large displacement ATVs, such as our new Thundercat 1000, also show retail strength. However, we don’t expect core ATV retail sales to pick up until the overall economy strengthens. For fiscal 2009, we expect ATV revenues to be flat to slightly higher, based on increased Prowler and international sales, and a richer model mix. Growing PG&A Business Sales of parts, garments and accessories rose 5 percent to $109.4 million, up from $103.9 million last year, fueled by snowmobile and ATV parts, garments and accessories. We are optimistic that we will continue to grow PG&A sales, with additional focus and attention under our new leadership for this business. The dealer enthusiasm that we have seen for our snowmobile units is equally evident in the PG&A business, where pre-season orders are up significantly over last year. New products, greater retail activity and lower inventories are generating increased orders. Looking Ahead to a Profitable Year We anticipate that Arctic Cat will return to profitability in fiscal 2009. We are focused on achieving growth by offering innovative products that drive market share gains, and lowering costs through strategic sourcing and further leveraging our efficiency. For the fiscal year ending March 31, 2009, we expect net sales to grow between 5 percent and 8 percent, and be in the range of $650 million to $674 million. Full-year diluted earnings per share are anticipated to be in the range of $0.18 to $0.28. Although recreational vehicles continue to experience a tough retail market, we believe our current dealer inventory levels will enable growth in sales to dealers in fiscal 2009. We anticipate that our growth will come from increased North American and international snowmobile revenues, flat to slightly higher ATV revenues, based on increased Prowler utility vehicle and international ATV sales, as well as a more profitable ATV product mix. We also expect continued growth in the PG&A business. In addition, we plan to further leverage our efficiency. We aim to save approximately $5 million to $6 million in fiscal 2009 through our strategic sourcing initiatives, although we believe that these savings will be partially offset by higher commodity prices. Although our markets will remain challenging in fiscal 2009, we are better positioned to attain modest growth and profitability in the year ahead, due to the strategic actions we’ve undertaken. Thank you to our employees, customers and shareholders for your continued support and interest in Arctic Cat. Sincerely, Christopher A. Twomey Chairman and Chief Executive Officer 32008 Annual R |