|

Exhibit 99.1

|

Exhibit 99.1

2015 ANALYSTAND INVESTOR DAY

MAY 21, 2015

SAFE HARBOR STATEMENT

Forward-Looking Statements

The Private Securities Litigation Reform Act of 1995 provides a safe harbor for certain forward-looking statements. The company’s Annual Report, as well as the Report on Form 10-K, its

Quarterly Reports on Form 10-Q and other filings with the Securities and Exchange Commission, the company’s press releases and oral statements made with the approval of an authorized executive officer, contain forward-looking statements that reflect the company’s current views with respect to future events and financial performance. These forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from historical results or those anticipated. The words “aim,” “believe,” “expect,” “anticipate,” “intend,” “estimate” and other expressions that indicate future events and trends identify forward-looking statements including statements related to our fiscal 2016 outlook, business strategy, expected inventory reductions, product introductions and demand. Actual future results and trends may differ materially from historical results or those anticipated depending on a variety of factors, including, but not limited to those set forth in the company’s Annual Report on Form 10-K for the year ended March 31, 2014, under heading “Item 1A. Risk Factors.” The company does not undertake any obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

TODAY’S AGENDA1

INTRODUCTIONS

4 | | 2020 VISION & STRATEGIC PLAN |

BREAK

CHRIS EPERJESY BACKGROUND

13 YEARS AS PUBLIC COMPANY CFO

CFO at Twin Disc, Inc.

International acquisitions

Global manufacturing & supply chain experience

25 YEARS OF INTERNATIONAL BUSINESS

DaimlerChrysler – USA, Belgium & Germany

PwC – USA & Germany

GUIDING PRINCIPLES

Finance enables profitable growth

Processes matter

Talent and its development are critical to succeed

Investors need to be kept informed

Chris Eperjesy

FINANCIAL

PERSPECTIVE

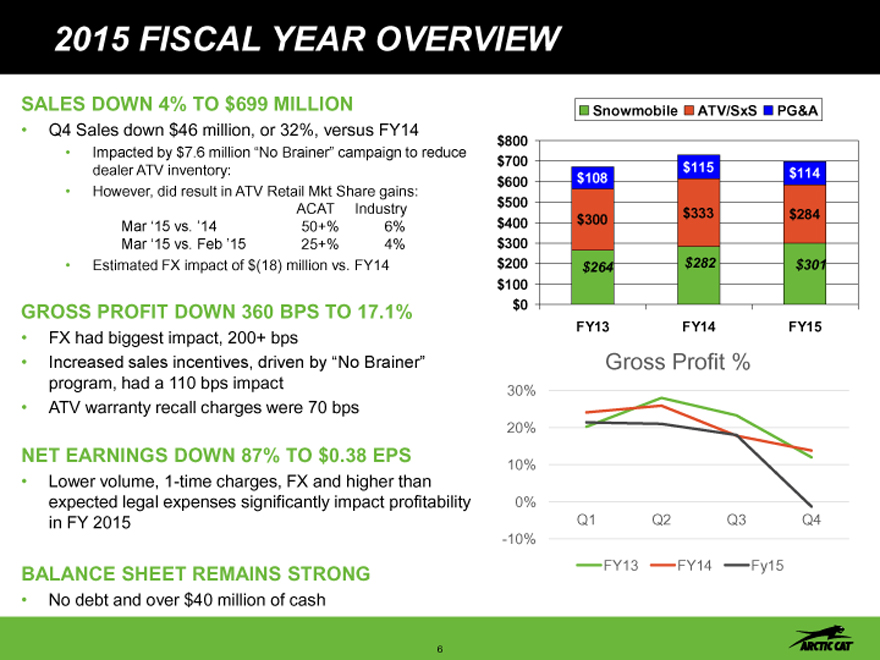

2015 FISCAL YEAR OVERVIEW

SALES DOWN 4% TO $699 MILLION

Q4 Sales down $46 million, or 32%, versus FY14

Impacted by $7.6 million “No Brainer” campaign to reduce dealer ATV inventory:

However, did result in ATV Retail Mkt Share gains:

ACAT Industry

Mar ‘15 vs. ’14 50+% 6%

Mar ‘15 vs. Feb ’15 25+% 4%

Estimated FX impact of $(18) million vs. FY14

GROSS PROFIT DOWN 360 BPS TO 17.1%

FX had biggest impact, 200+ bps

Increased sales incentives, driven by “No Brainer” program, had a 110 bps impact

ATV warranty recall charges were 70 bps

NET EARNINGS DOWN 87% TO $0.38 EPS

Lower volume, 1-time charges, FX and higher than expected legal expenses significantly impact profitability in FY 2015

BALANCE SHEET REMAINS STRONG

No debt and over $40 million of cash

Snowmobile ATV/SxS PG&A

$800

$700

$600 $108 $115 $114

$500

$400 $300 $333 $284

$300

$200 $264 $282 $301

$100

$0

FY13 FY14 FY15

Gross Profit %

30%

20%

10%

0%

Q1 Q2 Q3 Q4

-10%

FY13 FY14 Fy15

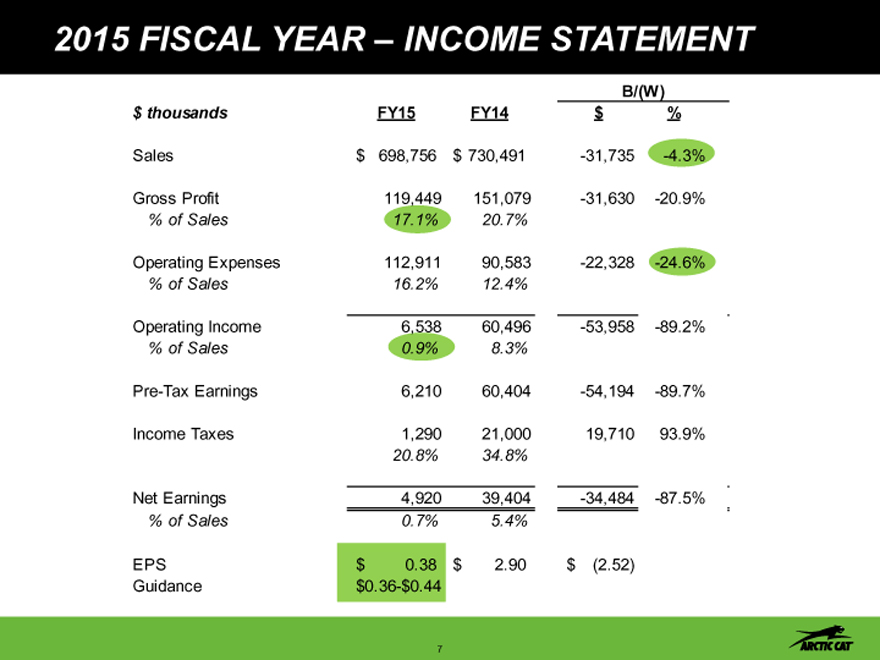

2015 FISCAL YEAR – INCOME STATEMENT

B/(W)

$ thousands FY15 FY14 $ %

Sales $ 698,756 $ 730,491 -31,735 -4.3%

Gross Profit 119,449 151,079 -31,630 -20.9%

% of Sales 17.1% 20.7%

Operating Expenses 112,911 90,583 -22,328 -24.6%

% of Sales 16.2% 12.4%

Operating Income 6,538 60,496 -53,958 -89.2%

% of Sales 0.9% 8.3%

Pre-Tax Earnings 6,210 60,404 -54,194 -89.7%

Income Taxes 1,290 21,000 19,710 93.9%

20.8% 34.8%

Net Earnings 4,920 39,404 -34,484 -87.5%

% of Sales 0.7% 5.4%

EPS $ 0.38 $ 2.90 $ (2.52)

Guidance $0.36-$0.44

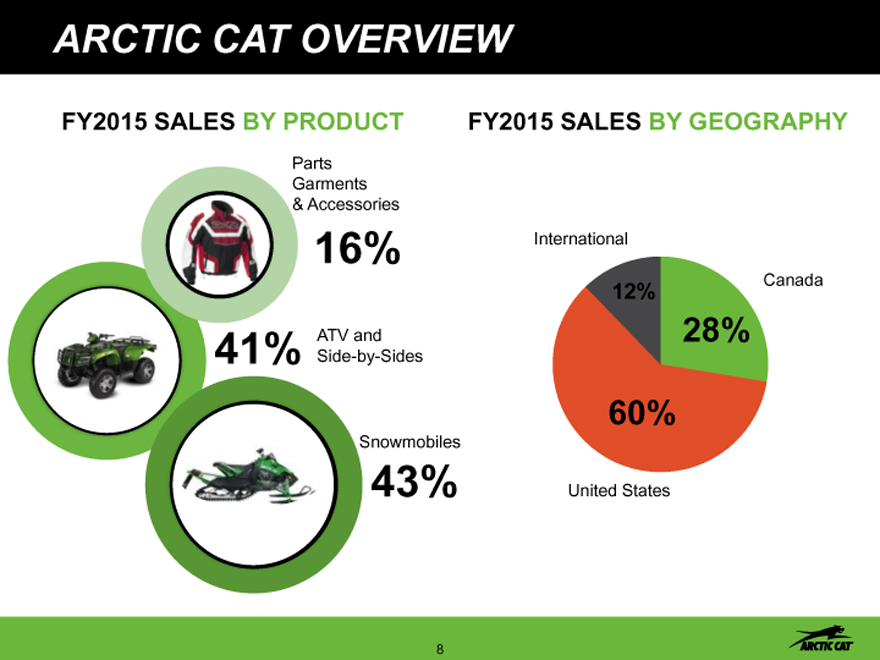

ARCTIC CAT OVERVIEW

FY2015 SALES BY PRODUCT

FY2015 SALES BY GEOGRAPHY

Parts Garments

& Accessories

16%

ATV and

41% Side-by-Sides

Snowmobiles

43%

International

12% Canada

28%

60%

United States

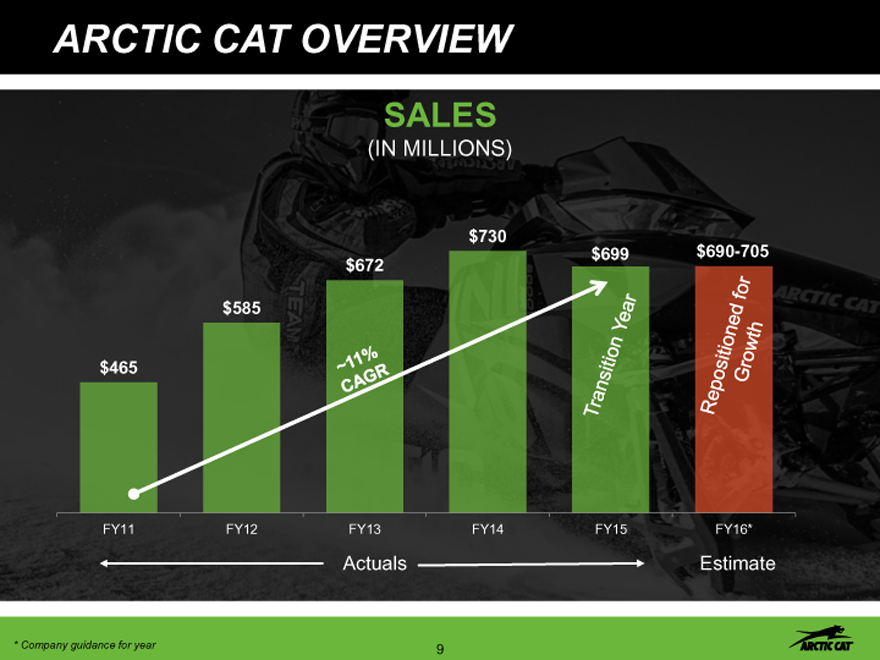

ARCTIC CAT OVERVIEW

SALES

(IN MILLIONS)

$730

$699 $690-705

$672

$585

$465

FY11 FY12 FY13 FY14 FY15 FY16*

Actuals Estimate

* | | Company guidance for year |

9

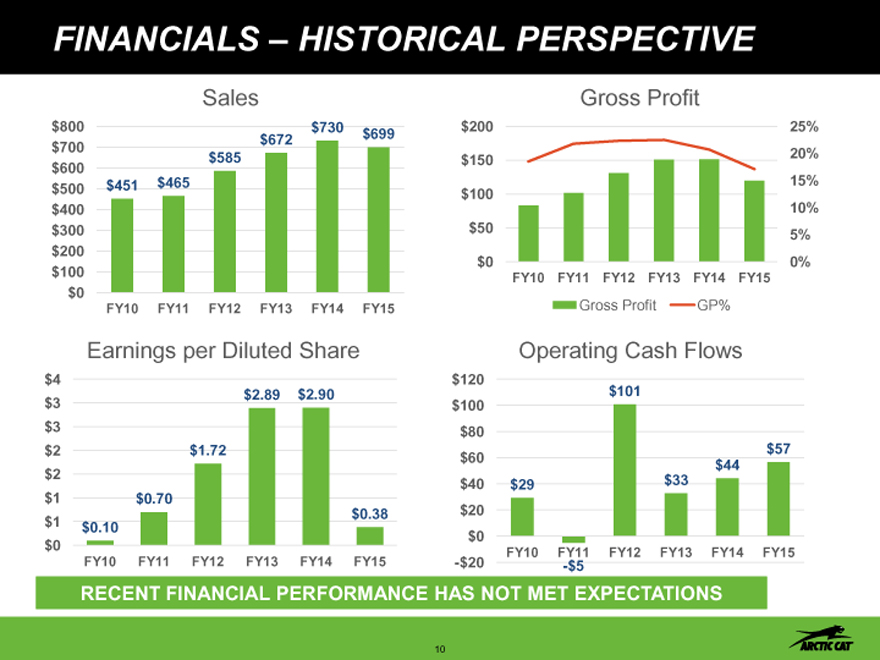

FINANCIALS – HISTORICAL PERSPECTIVE

Sales

$800 $730

$700 $672 $699

$585

$600

$500 $451 $465

$400

$300

$200

$100

$0

FY10 FY11 FY12 FY13 FY14 FY15

Gross Profit

$200 25%

$150 20%

15%

$100

10%

$50 5%

$0 0%

FY10 FY11 FY12 FY13 FY14 FY15

Gross Profit GP%

Earnings per Diluted Share

$ 4

$ 3 $ 2.89 $ 2.90

$ 3

$ 2 $ 1.72

$ 2

$ 1 $ 0.70

$ 0.38

$ 1 $ 0.10

$ 0

FY10 FY11 FY12 FY13 FY14 FY15

Operating Cash Flows

$120

$101

$100

$80

$57

$60 $44

$40 $29 $33

$20

$0

FY10 FY11 FY12 FY13 FY14 FY15

-$20 -$5

RECENT FINANCIAL PERFORMANCE HAS NOT MET EXPECTATIONS

10

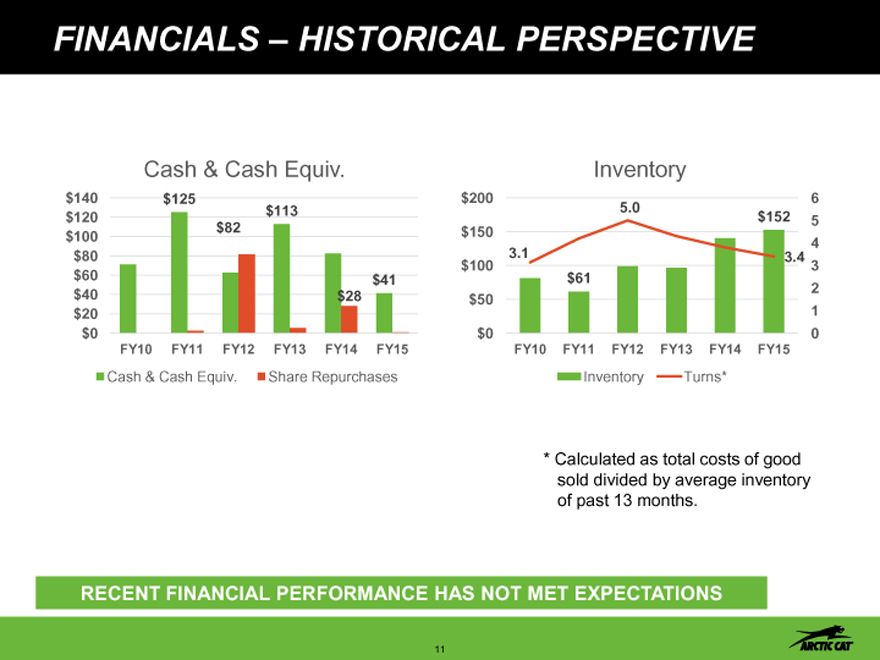

FINANCIALS – HISTORICAL PERSPECTIVE

Cash & Cash Equiv.

$140 $125

$120 $113

$100 $82

$80

$60 $41

$40 $28

$20

$0

FY10 FY11 FY12 FY13 FY14 FY15

Cash & Cash Equiv. Share Repurchases

Inventory

$200 6

5.0

$152 5

$150

3.1 3.4

$100 3

$61

$50

$0 0

FY10 FY11 FY12 FY13 FY14 FY15

Inventory Turns*

Calculated as total costs of good sold divided by average inventory of past 13 months.

RECENT FINANCIAL PERFORMANCE HAS NOT MET EXPECTATIONS

11

FY16

GUIDANCE

12

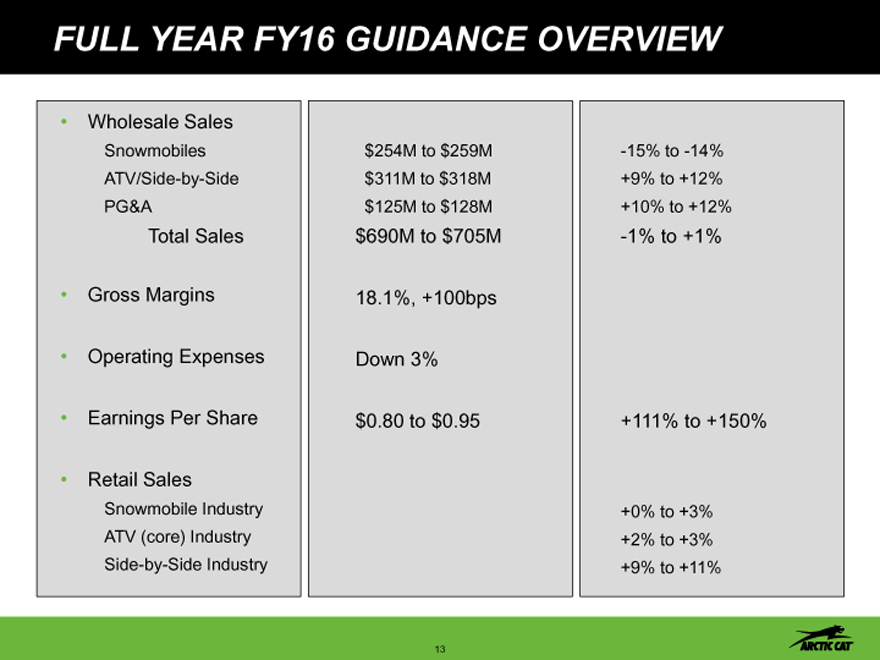

FULL YEAR FY16 GUIDANCE OVERVIEW

Wholesale Sales

Snowmobiles ATV/Side-by-Side PG&A

Total Sales Gross Margins Operating Expenses Earnings Per Share

Retail Sales

Snowmobile Industry ATV (core) Industry Side-by-Side Industry

$254M to $259M $311M to $318M $125M to $128M $690M to $705M

18.1%, +100bps Down 3% $0.80 to $0.95

-15% to -14%

+9% to +12%

+10% to +12%

-1% to +1%

+111% to +150%

+0% to +3%

+2% to +3%

+9% to +11%

13

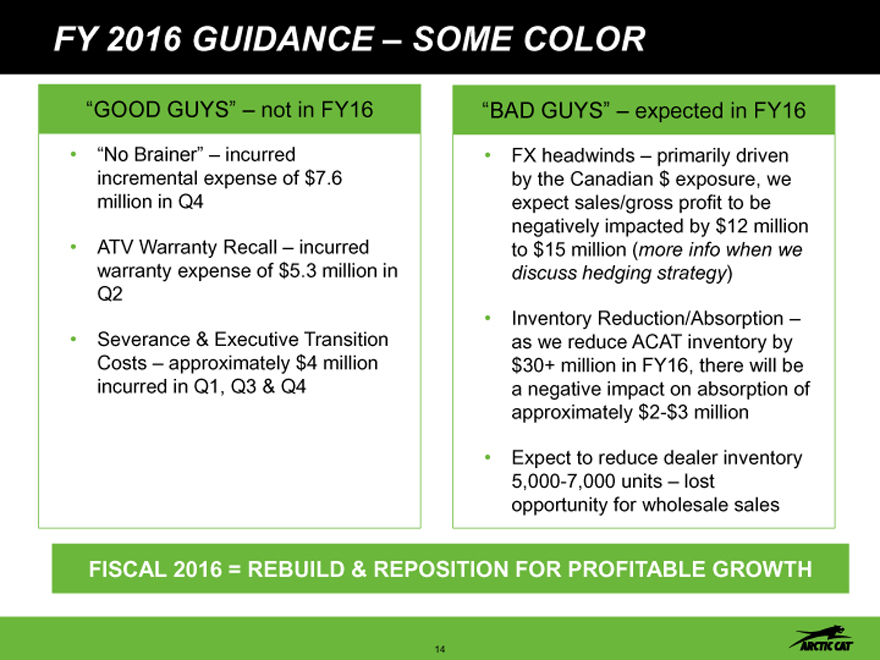

FY 2016 GUIDANCE – SOME COLOR

“GOOD GUYS” – not in FY16

“No Brainer” – incurred incremental expense of $7.6 million in Q4

ATV Warranty Recall – incurred warranty expense of $5.3 million in Q2

Severance & Executive Transition Costs – approximately $4 million incurred in Q1, Q3 & Q4

“BAD GUYS” – expected in FY16

FX headwinds – primarily driven by the Canadian $ exposure, we expect sales/gross profit to be negatively impacted by $12 million to $15 million (more info when we discuss hedging strategy)

Inventory Reduction/Absorption – as we reduce ACAT inventory by $30+ million in FY16, there will be a negative impact on absorption of approximately $2-$3 million

Expect to reduce dealer inventory 5,000-7,000 units – lost opportunity for wholesale sales

FISCAL 2016 = REBUILD & REPOSITION FOR PROFITABLE GROWTH

14

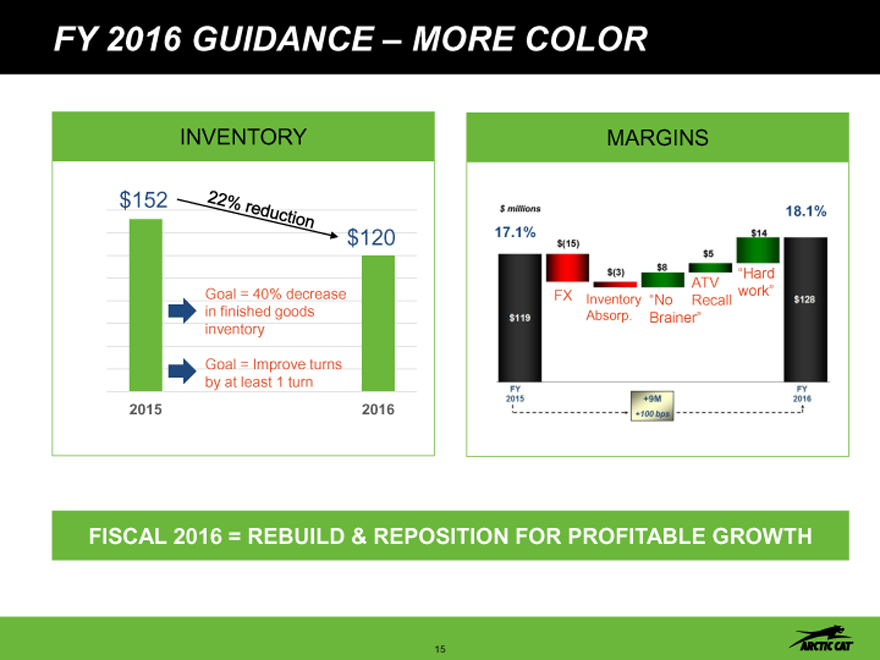

FY 2016 GUIDANCE – MORE COLOR

INVENTORY

$152

$120

Goal = 40% decrease

in finished goods

inventory

Goal = Improve turns

by at least 1 turn

2015 2016

MARGINS

18.1%

17.1%

ATV “Hard

FX Inventory “No Recall work”

Absorp. Brainer”

FISCAL 2016 = REBUILD & REPOSITION FOR PROFITABLE GROWTH

15

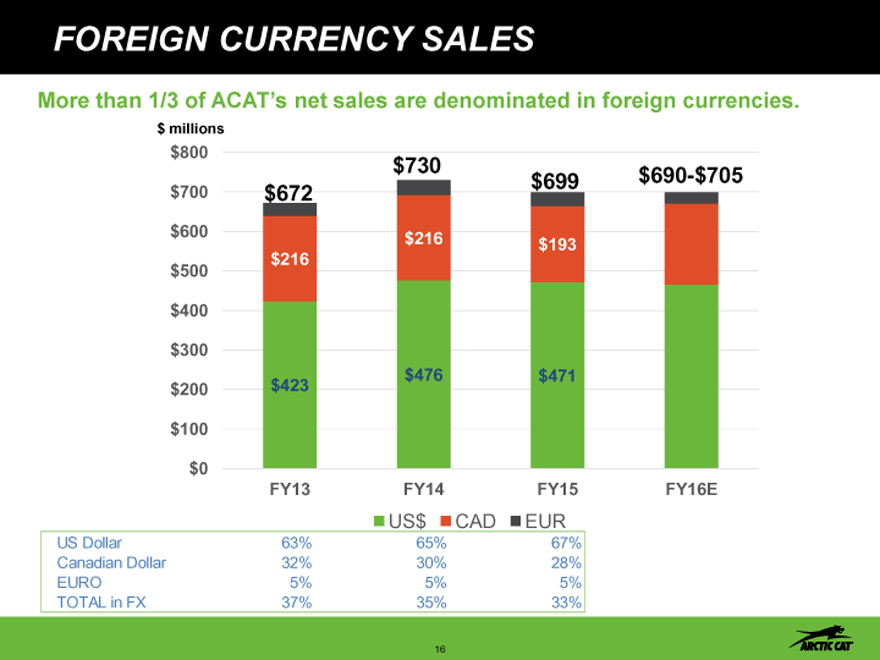

FOREIGN CURRENCY SALES

More than 1/3 of ACAT’s net sales are denominated in foreign currencies.

$ millions

$800

$730 $699 $690-$705

$700 $672

$600

$216 $193

$216

$500

$400

$300

$200 $423 $476 $471

$100

$0

FY13 FY14 FY15 FY16E

US$ CAD EUR

US Dollar 63% 65% 67%

Canadian Dollar 32% 30% 28%

EURO 5% 5% 5%

TOTAL in FX 37% 35% 33%

16

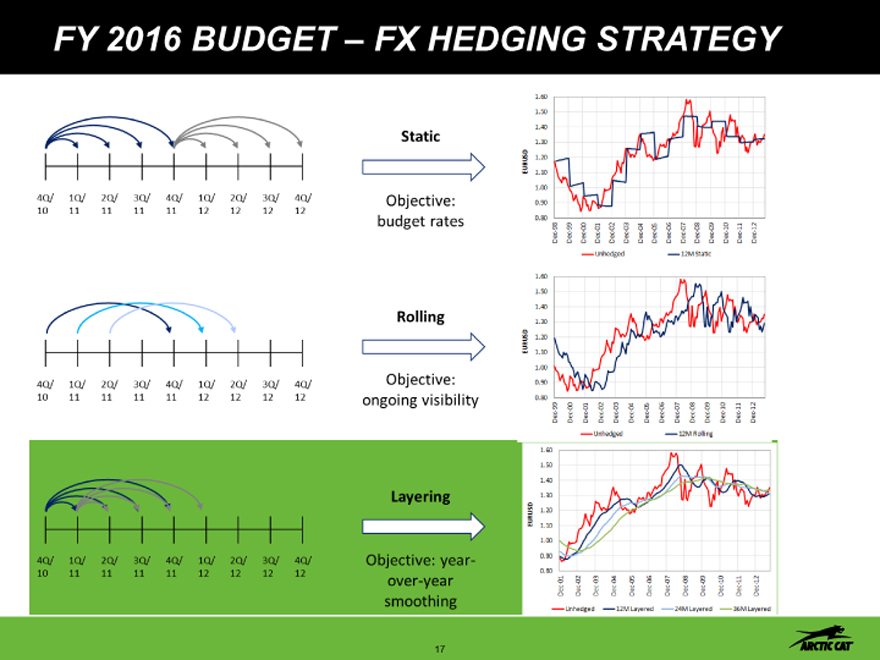

FY 2016 BUDGET – FX HEDGING STRATEGY

17

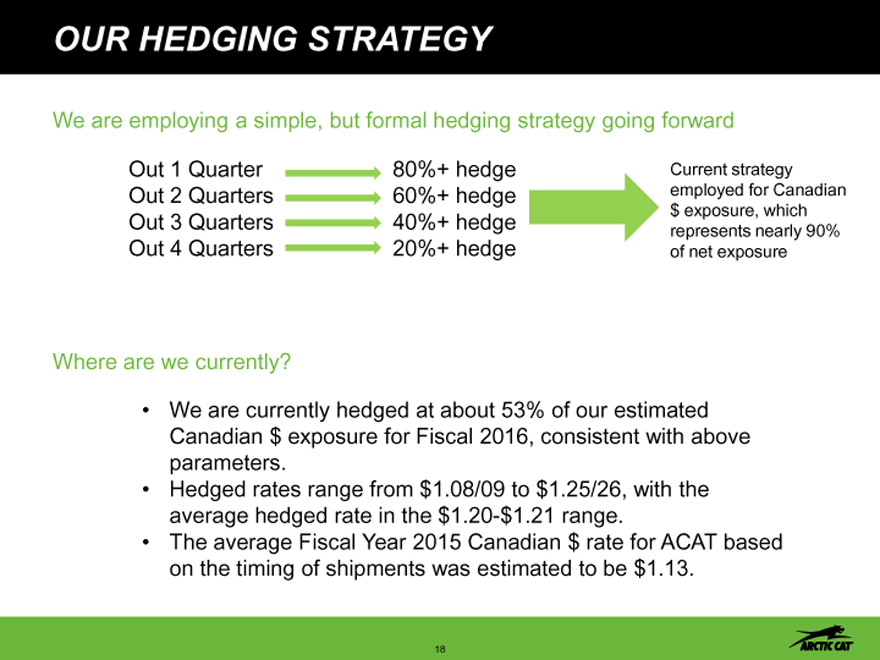

OUR HEDGING STRATEGY

We are employing a simple, but formal hedging strategy going forward

Out 1 Quarter 80%+ hedge Current strategy

Out 2 Quarters 60%+ hedge employed for Canadian

$ exposure, which

Out 3 Quarters 40%+ hedge represents nearly 90%

Out 4 Quarters 20%+ hedge of net exposure

Where are we currently

We are currently hedged at about 53% of our estimated Canadian $ exposure for Fiscal 2016, consistent with above parameters.

Hedged rates range from $1.08/09 to $1.25/26, with the average hedged rate in the $1.20-$1.21 range.

The average Fiscal Year 2015 Canadian $ rate for ACAT based on the timing of shipments was estimated to be $1.13.

18

OUTLOOK

19

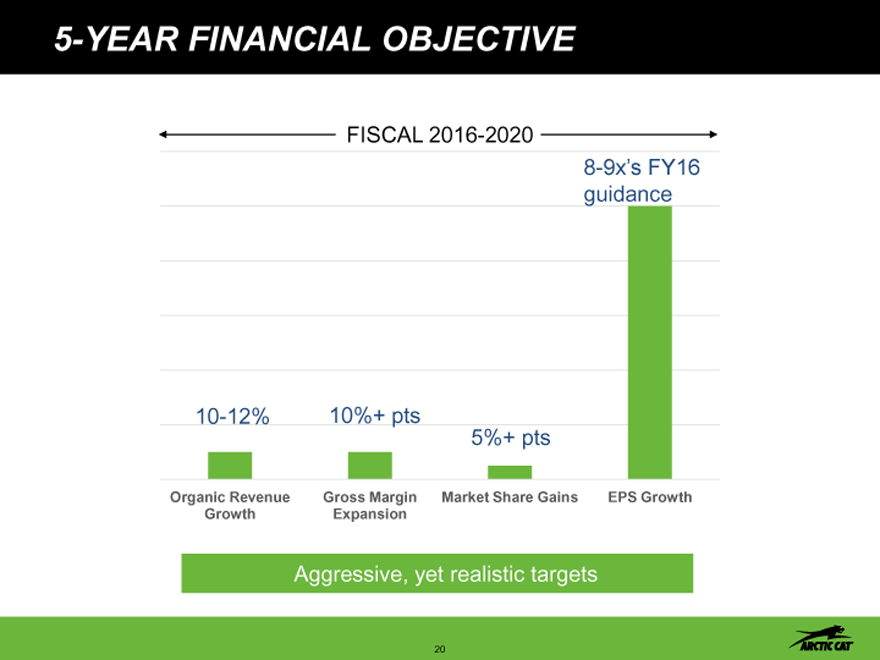

5-YEAR FINANCIAL OBJECTIVE

FISCAL 2016-2020

8-9x’s FY16

guidance

10-12% 10%+ pts

5%+ pts

Organic Revenue Gross Margin Market Share Gains EPS Growth

Growth Expansion

Aggressive, yet realistic targets

20

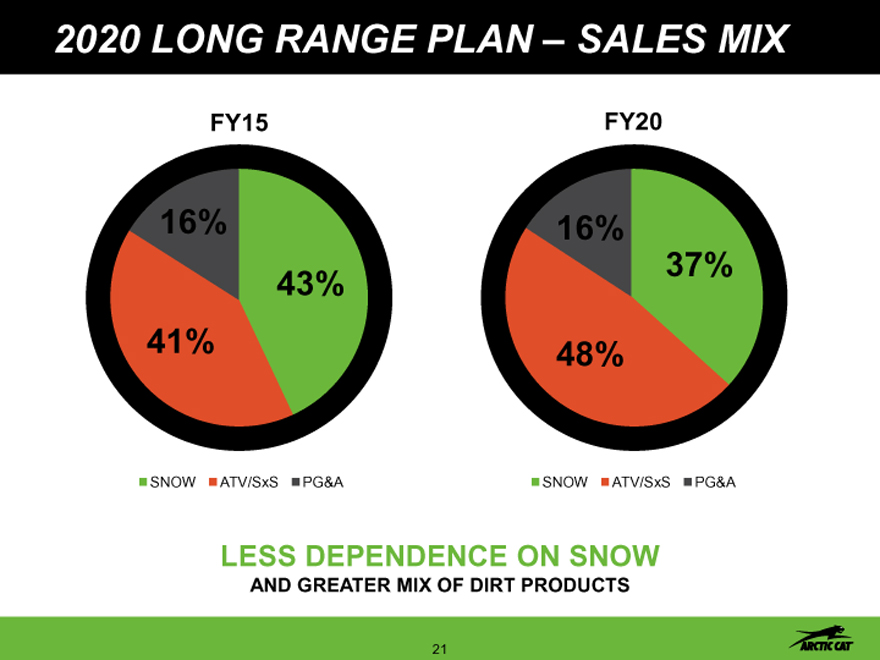

2020 LONG RANGE PLAN – SALES MIX

FY15

16%

43%

41%

SNOW ATV/SxS PG&A

FY20

16%

37%

48%

SNOW ATV/SxS PG&A

LESS DEPENDENCE ON SNOW

AND GREATER MIX OF DIRT PRODUCTS

21

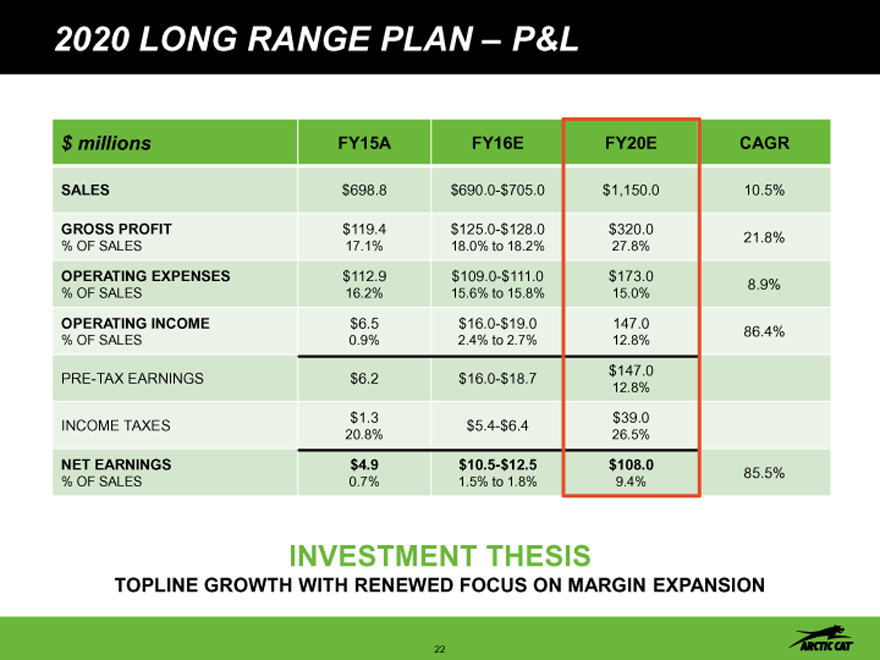

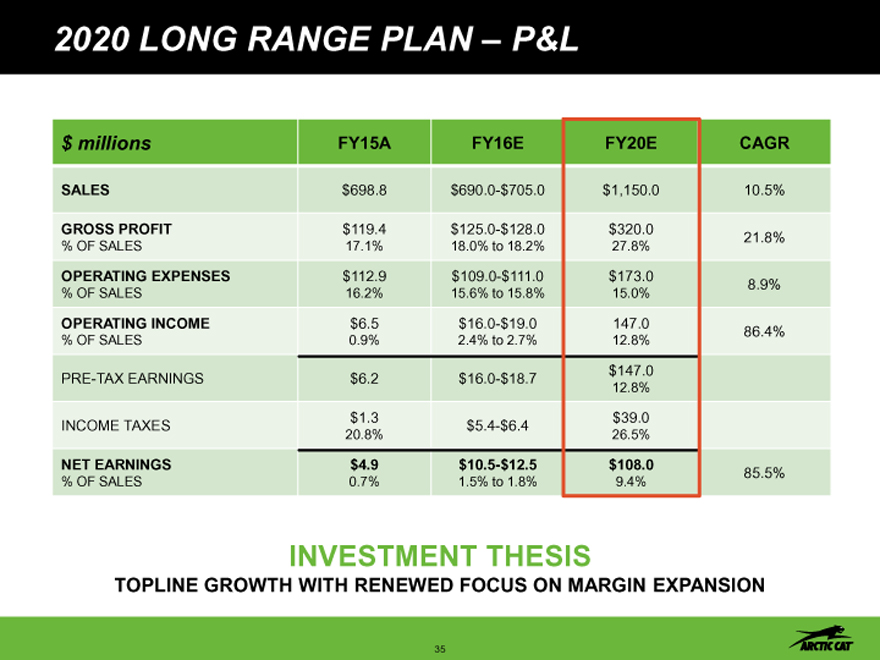

2020 LONG RANGE PLAN – P&L

$ millions FY15A FY16E FY20E CAGR

SALES $698.8 $690.0-$705.0 $1,150.0 10.5%

GROSS PROFIT $119.4 $125.0-$128.0 $320.0 21.8%

% OF SALES 17.1% 18.0% to 18.2% 27.8%

OPERATING EXPENSES $112.9 $109.0-$111.0 $173.0 8.9%

% OF SALES 16.2% 15.6% to 15.8% 15.0%

OPERATING INCOME $6.5 $16.0-$19.0 147.0 86.4%

% OF SALES 0.9% 2.4% to 2.7% 12.8%

PRE-TAX EARNINGS $6.2 $16.0-$18.7 $147.0

12.8%

$1.3 $39.0

INCOME TAXES $5.4-$6.4

20.8% 26.5%

NET EARNINGS $4.9 $10.5-$12.5 $108.0 85.5%

% OF SALES 0.7% 1.5% to 1.8% 9.4%

INVESTMENT THESIS

TOPLINE GROWTH WITH RENEWED FOCUS ON MARGIN EXPANSION

22

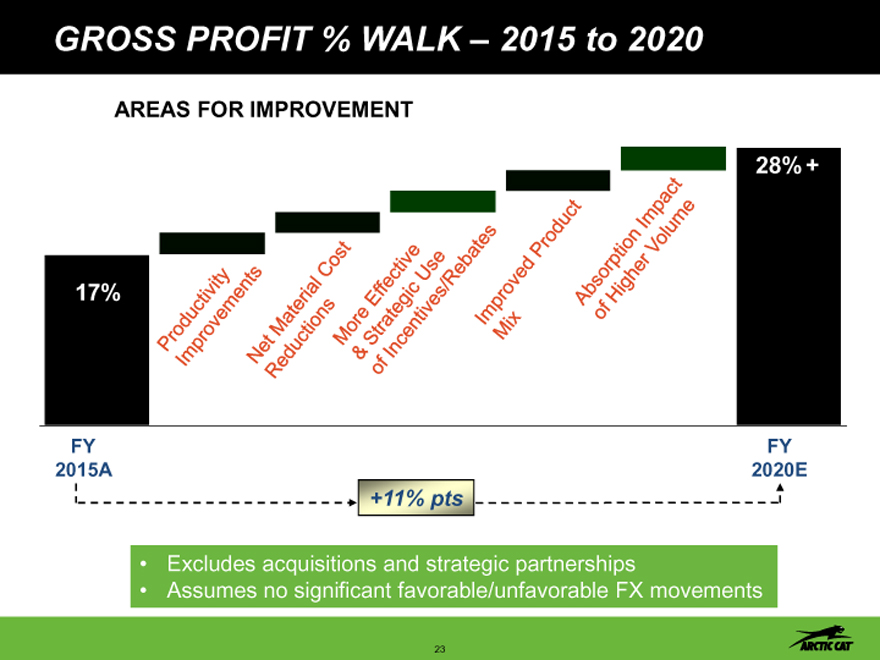

GROSS PROFIT % WALK – 2015 to 2020

AREAS FOR IMPROVEMENT

28% +

17%

FY FY

2015A 2020E

+11% pts

Excludes acquisitions and strategic partnerships

Assumes no significant favorable/unfavorable FX movements

23

ARCTIC CAT OVERVIEW

24

CHRIS METZ BACKGROUND

13 YEARS AT BLACK & DECKER, INC.

Assistant product manager to president

U.S. and Europe

DEWALT story

10 YEARS AT SUN CAPITAL PARTNERS, INC.

$500M to $10B under management

#1 private equity firm in turn-around space

JOINED ARCTIC CAT IN DECEMBER 2014 GUIDING PRINCIPLES

Teams win … invest for success

Leadership matters … drive execution

Culture is critical … create passion for winning

Credibility is built one quarter at a time … drive accountability and results

Chris Metz

25

REASONS FOR JOINING ARCTIC CAT

MARKET UNDERPERFORMER OPPORTUNITY

ICONIC LEADING WITH FUNDAMENTAL

BRAND PRODUCTS STRENGTHS TO WIN

PERFECT MATCH

PRODUCT STRONG GLOBAL UNDER- OUTDOOR/

IS A HERO LEADERSHIP BUSINESS PERFORMER SPORTS

SPACE

26

55 YEAR HERITAGE

1962 First front-mounted engine snowmobile “Tin Lizzie”

1966 ACAT Panther First slide-rail rear suspension and rubber track

1978 El Tigre Fastest Snowmobile

1985 Breakthrough A-Arm front suspension

1993 One Millionth ACAT Snowmobile built

1995 First ATV with biggest engine displacement and highest ground

clearance

2003 Introduce industry first 4-stroke snowmobile engine – low emissions, quiet

2005 ACAT builds first Turbocharged Snowmobile T660 Turbo

2007 ACAT begins production of engines in St. Cloud, MN

2011 ACAT introduces first pure performance ROV – The Wildcat with 5 Link

Rear Suspension and 18 inches of rear travel

2014 ACAT introduces industry first Trail Ready 50 inch ROV Wildcat Trail

27

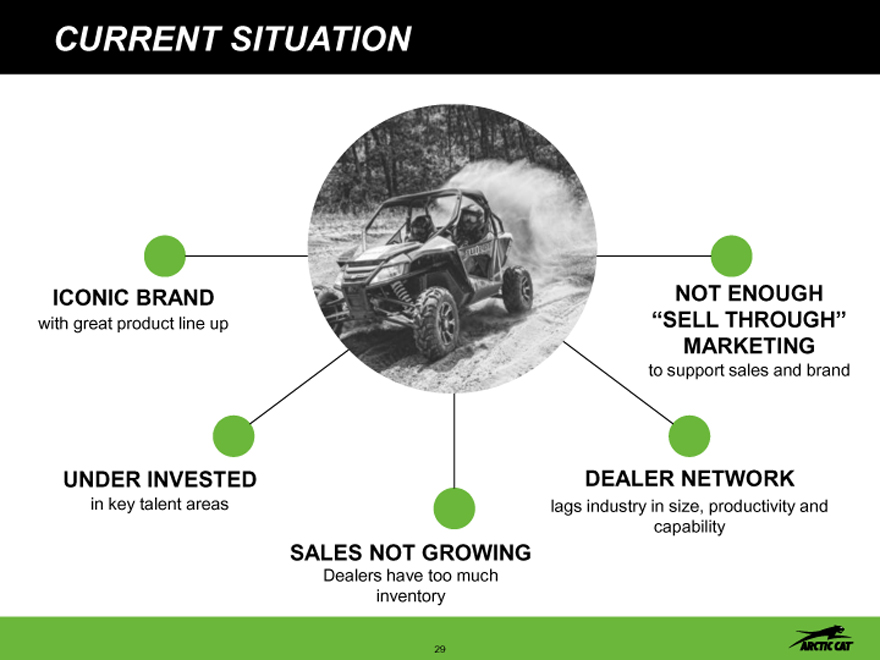

CURRENT SITUATION

28

CURRENT SITUATION

ICONIC BRAND NOT ENOUGH

with great product line up “SELL THROUGH”

MARKETING

to support sales and brand

UNDER INVESTED DEALER NETWORK

in key talent areas lags industry in size, productivity and

capability

SALES NOT GROWING

Dealers have too much

inventory

29

CURRENT SITUATION

PASSIONATE CULTURE DELIVERING NO

but need to drive accountability MATERIAL

PRODUCTIVITY

NEED BETTER PROCESS ONE SINGLE PLANT

for reliable, consistent performance not in a low cost region

30

APPROACH

STRONG LEADERSHIP

FOCUSED ON KEY

STRATEGIES

ACT QUICKLY AND DECISIVELY

MANIACALLY DRIVE EXECUTION

EMBRACE ACCOUNTABILITY

31

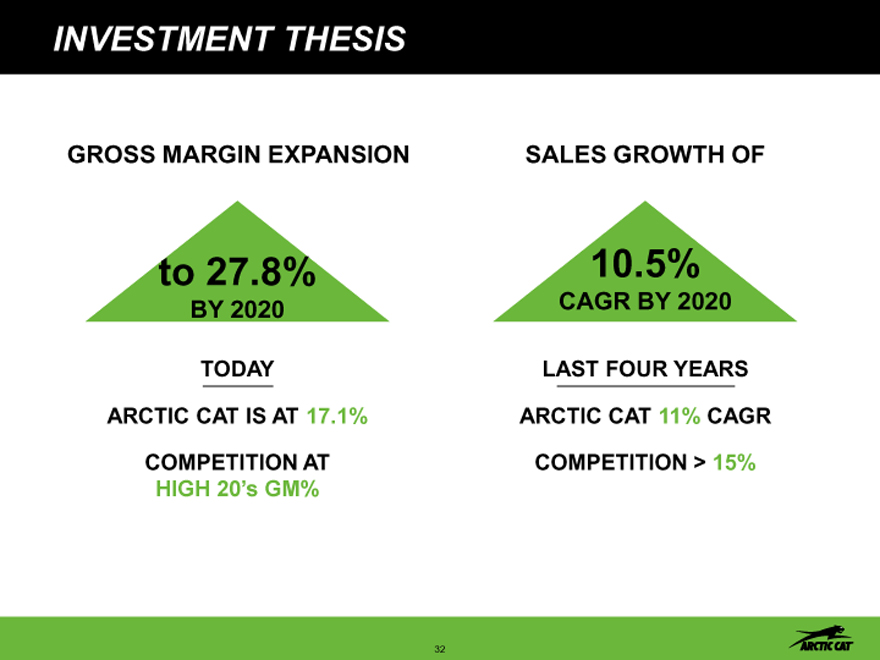

INVESTMENT THESIS

GROSS MARGIN EXPANSION

SALES GROWTH OF

to 27.8%

BY 2020

TODAY

ARCTIC CAT IS AT 17.1%

COMPETITION AT

HIGH 20’s GM%

10.5%

CAGR BY 2020

LAST FOUR YEARS

ARCTIC CAT 11% CAGR

COMPETITION > 15%

32

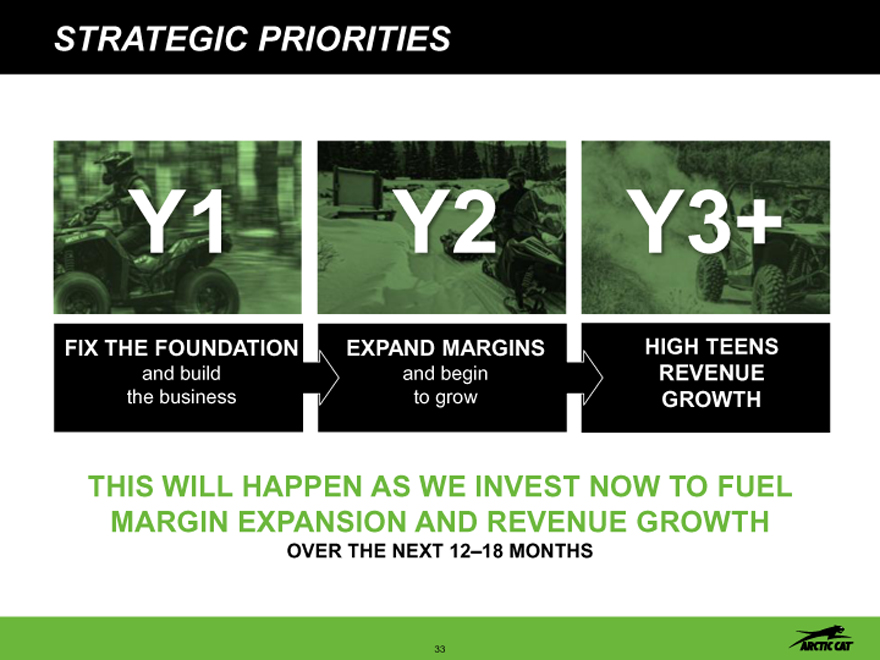

STRATEGIC PRIORITIES

Y1

Y2

Y3+

FIX THE FOUNDATION

EXPAND MARGINS

HIGH TEENS

and build

and begin

REVENUE

the business

to grow

GROWTH

THIS WILL HAPPEN AS WE INVEST NOW TO FUEL MARGIN EXPANSION AND REVENUE GROWTH

OVER THE NEXT 12–18 MONTHS

33

GUIDING PRINCIPLES

INVEST

for success, best team wins

CREATE

a winning culture

DRIVE

maniacal execution

DEMAND

and expect results — accountability

34

2020 LONG RANGE PLAN – P&L

$ millions

FY15A

FY16E

FY20E

CAGR

SALES

$698.8

$690.0-$705.0

$1,150.0

10.5%

GROSS PROFIT

$119.4

$125.0-$128.0

$320.0

21.8%

% OF SALES

17.1%

18.0% to 18.2%

27.8%

OPERATING EXPENSES

$112.9

$109.0-$111.0

$173.0

8.9%

% OF SALES

16.2%

15.6% to 15.8%

15.0%

OPERATING INCOME

$6.5

$16.0-$19.0

147.0

86.4%

% OF SALES

0.9%

2.4% to 2.7%

12.8%

PRE-TAX EARNINGS

$6.2

$16.0-$18.7

$147.0

12.8%

$1.3

$39.0

INCOME TAXES

$5.4-$6.4

20.8%

26.5%

NET EARNINGS

$4.9

$10.5-$12.5

$108.0

85.5%

% OF SALES

0.7%

1.5% to 1.8%

9.4%

INVESTMENT THESIS

TOPLINE GROWTH WITH RENEWED FOCUS ON MARGIN EXPANSION

35

VISION

Deliver the ultimate experience for riders, workers and outdoor enthusiasts around the world by driving passion and performance in every product and service we provide

36

BRAND PROMISE

Create the ultimate

off-road riding experience

37

STRATEGIC PLAN

38

KEY STRATEGIES

DRAMATICALLY

RAMP UP

PURSUE OEM

CREATE BRAND

IMPROVE OUR

END-USER

PARTNERSHIPS &

MARKETING

DEALER

FOCUSED NEW

BOLT-ON

POWERHOUSE

NETWORK

PRODUCTS

ACQUISITIONS

39

KEY ENABLERS

PROCESS EXCELLENCE & EXECUTION

PROFIT IMPROVEMENT

PEOPLE AND CULTURE

40

ENABLER … PROCESS EXCELLENCE

Develop and implement clearly defined, documented and communicated processes across all functions to deliver consistent and reliable performance

41

ENABLER … PROCESS EXCELLENCE

Stage gate new product development Change management Lean productivity SAP

Strategic deployment

Weekly, monthly and quarterly reporting

Operating model

42

ENABLER … PROFIT IMPROVEMENT

Develop repeatable productivity methodology to deliver 5% gross productivity to expand gross margins and deliver

10% operating income

43

ENABLER … PROFIT IMPROVEMENT

Supplier cost down

Value engineering

In bound/out bound freight

Currency hedging

Lower rebate incentives with greater amount of current inventory

Lower effective tax rate

44

ENABLER … PEOPLE AND CULTURE

Top grade or recruit “A” talent in critical leadership and management positions supported by strategies and goals that are aligned and appraisals that are honest

45

ENABLER … PEOPLE AND CULTURE

Goal setting

Appraisals

Investing in talent

Minneapolis headquarters

46

KEY STRATEGY … IMPROVE DEALER NETWORK

Develop top quartile performing dealer network, in terms of size, productivity and capabilities in every key region in North America

47

KEY STRATEGY … IMPROVE DEALER NETWORK

Rank and top grade

Set expectations, measure results, drive accountability

Dealer development … existing and new

Training

Dramatically reduce non-current inventory

Sell-through programming Sell-through brand marketing Ensure appropriate resources

48

KEY STRATEGY … RAMP UP NEW PRODUCTS

Develop end-user focused SBUs that deliver industry leading “Hero” new products that are innovative, potentially breakthrough, and yield 25%+ gross margins

49

KEY STRATEGY … RAMP UP NEW PRODUCTS

Launch exciting “HERO” products for

MY 2017 (introduced August 2016)

Build product management functions focused on end-user

Develop 10 year multi-generational product and technology roadmap for ATVs, ROVs and snowmobiles

Unveil well thought out accessories with all new products

Use new stage gate process to drive faster and higher quality new products

Continue to develop existing and new OEM partnerships

50

KEY STRATEGY … OEM & BOLT-ON ACQUISITIONS

Leverage internal resources to pursue meaningful partnerships

Partnerships will leverage others’ channels of distribution strengths and geographic footprint

Acquisition into current space or near adjacencies

Acquisitions that are financially compelling

No Acquisitions Included in 2020 Vision

51

KEY STRATEGY … BRAND MARKETING

Create brand marketing powerhouse that delivers passionate and exciting experiences at all customer touch points to drive double-digit retail sales growth every year

52

KEY STRATEGY … BRAND MARKETING

Advertising

Invest in team

Experiential marketing

Event field marketing

Digital

Training

53

CULTURAL BEHAVIORS

PASSION FOR WINNING

INNOVATION

ATTITUDE

ACHIEVE COMMITMENTS

HIGH ENERGY

STRAIGHT TALK

RISK TAKING

RAISE THE BAR

54

RECENT PROGRESS — PAST FIVE MONTHS

NEW

ACCELERATED

MANAGEMENT

DEALER ATV

MOTORFIST

TEAM

INVENTORY

ACQUISITION

CEO, CFO,

REDUCTION

CMO, VP

SALES

NEW

TORO

STRATEGIC

OPERATING

PARTNERSHIP

PLAN

MODEL

DEVELOPED

IMPLEMENTED

55

RECENT TRENDS

SNOW

2015 RETAIL +9% vs. INDUSTRY +8%

2016 SNOWMOBILE SHOW NEW PRODUCT WELL RECEIVED

SPRING SELLING UP 10% VS. LAST YEAR

ATV/ROV

“NO BRAINER” PROMOTION IS

WORKING

56

ATV RETAIL YOY GROWTH

ATV/ROV

Arctic Cat

Industry

ATVs

ATVs

February 2015

30%

Down low

single digits

March 2015

50%

Up mid

single digits

April 2015

50%

Down low

single digits

ARCTIC CAT ROV YTD 20% VERSUS INDUSTRY UP LOW

DOUBLE DIGITS

57

RECENT TRENDS

SNOW ATV/ROV

2016 SNOWMOBILE SHOW “NO BRAINER” PROMOTION IS

NEW PRODUCTS WELL RECEIVED WORKING SPRING SELLING UP 10% VS. LAST YEAR

PG&A

MOTORFIST ADDED 125 ARCTIC CAT DEALERS TO BASE OF 291 FOR CURRENT TOTAL OF 416 DEALERS

58

INVESTMENT MERITS

59

INVESTMENT MERITS

STRONG

ICONIC

NEW

INNOVATIVE

BALANCE

BRAND

LEADERSHIP

PRODUCTS

SHEET

TARGETING

EXPANDING

$1.15+ BILLION

GROSS

IN SALES

MARGINS

BY 2020

TO 27%+

BY 2020

60

BREAK

FOLLOWED BY

Q&A

61