QuickLinks -- Click here to rapidly navigate through this document

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D. C. 20549

FORM 10-K

Annual Report Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

For the fiscal year ended December 31, 2007

Commission file number 0-12422

MAINSOURCE FINANCIAL GROUP, INC.

(Exact name of registrant as specified in its charter)

Indiana

(State or other jurisdiction

of incorporation or organization) | | 35-1562245

(I.R.S. Employer

Identification No.) |

2105 North State Road 3 Bypass

Greensburg, Indiana 47240

(Address of principal executive offices) (Zip code) |

Registrant's telephone number, including area code:(812) 663-6734 |

Securities registered pursuant to Section 12(b) of the Act:

None |

Securities registered pursuant to Section 12(g) of the Act |

Common shares, no par value

(Title of Class) |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of "large accelerated filer", "accelerated filer", and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer o | | Accelerated filer ý | | Non-accelerated filer o

(Do not check if a smaller reporting company) | | Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No ý

The aggregate market value (not necessarily a reliable indication of the price at which more than a limited number of shares would trade) of the voting stock held by non-affiliates of the registrant was $314,516,912 as of June 30, 2007.

As of March 10, 2008, there were outstanding 18,570,139 common shares, without par value, of the registrant.

DOCUMENTS INCORPORATED BY REFERENCE

Documents

| | Part of Form 10-K

Into Which Incorporated

|

|---|

Definitive Proxy Statement for Annual

Meeting of Shareholders to be held

May 1, 2008 | | Part III (Items 10 through 14) |

FORM 10-K

TABLE OF CONTENTS

| PART I | | Page |

Item 1 |

|

Business |

|

3 |

| Item 1A | | Risk Factors | | 5 |

| Item 1B | | Unresolved Staff Comments | | 8 |

| Item 2 | | Properties | | 8 |

| Item 3 | | Legal Proceedings | | 8 |

| Item 4 | | Submission of Matters to a Vote of Security Holders | | 8 |

|

|

|

|

|

| PART II | | |

Item 5 |

|

Market For Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

|

9 |

| Item 6 | | Selected Financial Data | | 11 |

| Item 7 | | Management's Discussion and Analysis of Financial Condition and Results of Operations | | 12 |

| Item 7A | | Quantitative and Qualitative Disclosures About Market Risk | | 22 |

| Item 8 | | Financial Statements and Supplementary Data | | 23 |

| Item 9 | | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | | 48 |

| Item 9A | | Controls and Procedures | | 48 |

| Item 9B | | Other Information | | 48 |

|

|

|

|

|

| PART III | | |

Item 10 |

|

Directors, Executive Officers and Corporate Governance |

|

|

| Item 11 | | Executive Compensation | | |

| Item 12 | | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | | |

| Item 13 | | Certain Relationships and Related Transactions and Director Independence | | |

| Item 14 | | Principal Accounting Fees and Services | | |

|

|

|

|

|

| PART IV | | |

Item 15 |

|

Exhibits, Financial Statement Schedules |

|

49 |

Pursuant to General Instruction G, the information called for by Items 10–14 is omitted by MainSource Financial Group, Inc. since MainSource Financial Group, Inc. will file with the Commission a definitive proxy statement to shareholders pursuant to Regulation 14A not later than 120 days after the close of the fiscal year containing the information required by Items 10–14.

2

PART I.

ITEM 1. BUSINESS

(Dollars in thousands except per share data)

General

MainSource Financial Group, Inc. ("the Company") is a financial holding company based in Greensburg, Indiana. As of December 31, 2007, the Company owned three banking subsidiaries: MainSource Bank, MainSource Bank of Illinois, and MainSource Bank — Ohio (together "the Banks"). The Company also owns all of the outstanding stock of MainSource Bank — Hobart, although substantially all of the assets of that bank were transferred to MainSource Bank in May, 2007. The Company is a party to an agreement to sell the stock of MainSource Bank — Hobart to a third party, which sale is anticipated to be comsummated in the first quarter of 2008. Through its non-bank affiliates, the Company provides services incidental to the business of banking. Since its formation in 1982, the Company has acquired and established various institutions and financial services companies and may acquire additional financial institutions and financial services companies in the future. For further discussion of the business of the Company see Management's Discussion and Analysis in Part II, Item 7.

As of December 31, 2007, the Company operated 79 branch banking offices in Indiana, Illinois, and Ohio as well as eight insurance offices in Indiana. As of December 31, 2007, the Company had consolidated assets of $2,536,437, consolidated deposits of $1,901,829 and shareholders' equity of $264,102.

Through its Banks, the Company offers a broad range of financial services, including: accepting time and transaction deposits; making consumer, commercial, agribusiness and real estate mortgage loans; renting safe deposit facilities; providing general agency personal and business insurance services; providing personal and corporate trust services; and providing other corporate services such as letters of credit and repurchase agreements.

The lending activities of the Banks are separated into primarily the categories of commercial/agricultural, real estate and consumer. Loans are originated by the lending officers of the Banks subject to limitations set forth in lending policies. The Boards of Directors of each Bank review loans up to the Bank's legal lending limits, monitor concentrations of credit, problem and past due loans and charge-offs of uncollectible loans and formulate loan policy. The Banks maintain conservative loan policies and underwriting practices in order to address and manage loan risks. These policies and practices include granting loans on a sound and collectible basis, serving the legitimate needs of the community and the general market area while obtaining a balance between maximum yield and minimum risk, ensuring that primary and secondary sources of repayment are adequate in relation to the amount of the loan, developing and maintaining adequate diversification of the loan portfolio as a whole and of the loans within each category and developing and applying adequate collection policies.

Commercial loans include secured and unsecured loans, including real estate loans, to individuals and companies and to governmental units within the market area of the Banks for a myriad of business purposes.

Agricultural loans are generated in the Banks' markets. Most of the loans are real estate loans on farm properties. Loans are also made for agricultural production and such loans are generally reviewed annually.

Residential real estate lending has been the largest component of the loan portfolio for many years. All affiliate banks generate residential mortgages for their own portfolios. However, the Company elects to sell the majority of its fixed rate mortgages into the secondary market while maintaining the servicing of such loans. At December 31, 2007, the Company was servicing a $533 million residential real estate loan portfolio. By originating loans for sale in the secondary market, the Company can more fully satisfy customer demand for fixed rate residential mortgages and increase fee income, while reducing the risk of loss caused by rising interest rates.

The principal source of revenues for the Company is interest and fees on loans, which accounted for 69.1% of total revenues in 2007, 67.6% in 2006 and 63.7% in 2005.

The Company's investment securities portfolio is primarily comprised of U. S. Treasuries, federal agencies, state and municipal bonds, U. S. government sponsored entity's mortgage-backed securities and corporate securities. The Company has classified its entire investment portfolio as available for sale, with fair value changes reported separately in shareholders' equity. Funds invested in the investment portfolio generally represent funds not immediately required to meet loan demand. Income related to the Company's investment portfolio accounted for 14.2% of total revenues in 2007, 16.0% in 2006 and 18.3% in 2005. As of December 31, 2007, the Company had not identified any securities as being "high risk" as defined by the FFIEC Supervisory Policy Statement on Securities Activities.

The primary sources of funds for the Banks are deposits generated in local market areas. To attract and retain stable depositors, the Banks market various programs for demand, savings and time deposit accounts. These programs include interest and non-interest bearing demand and individual retirement accounts.

3

Currently, national retailing and manufacturing subsidiaries, brokerage and insurance firms and credit unions are fierce competitors within the financial services industry. Mergers between financial institutions within Indiana and neighboring states, which became permissible under the Interstate Banking and Branching Efficiency Act of 1994, have also added competitive pressure.

The Company's Banks are located in predominantly non-metropolitan areas and their business is centered in loans and deposits generated within markets considered largely rural in nature. In addition to competing vigorously with other banks, thrift institutions, credit unions and finance companies located within their service areas, we also compete, directly and indirectly, with all providers of financial services.

Employees

As of December 31, 2007, the Company and its subsidiaries had 805 full-time equivalent employees to whom it provides a variety of benefits and with whom it enjoys excellent relations. None of our employees are subject to collective bargaining agreements.

Regulation and Supervision of the Company

The Company is a financial holding company ("FHC") within the meaning of the Bank Holding Company Act of 1956, as amended ("Act"). This Act subjects FHC's to regulations of the Federal Reserve Board ("FRB") and restricts the business of FHC's to financial and related activities.

The Gramm-Leach-Bliley Financial Modernization Act of 1999 was enacted on November 12, 1999. The Modernization Act, which amended the Bank Holding Company Act, provides the following:

- •

- it allows bank holding companies that qualify as "financial holding companies" to engage in a broad range of financial and related activities;

- •

- it allows insurers and other financial services companies to acquire banks;

- •

- it removes various restrictions that applied to bank holding company ownership of securities firms and mutual fund advisory companies; and

- •

- it establishes the overall regulatory structure applicable to bank holding companies that also engage in insurance and securities operations.

The Company initially qualified as a financial holding company in December, 2004. Thus the Company is authorized to operate as a financial holding company and is eligible to engage in, or acquire companies engaged in, the broader range of activities that are permitted by the Modernization Act. These activities include those that are determined to be "financial in nature," including insurance underwriting, securities underwriting and dealing, and making merchant banking investments in commercial and financial companies. If any of our banking subsidiaries ceases to be "well capitalized" or "well managed" under applicable regulatory standards, the Federal Reserve Board may, among other things, place limitations on our ability to conduct these broader financial activities or, if the deficiencies persist, require us to divest the banking subsidiary. In addition, if any of our banking subsidiaries receives a rating of less than satisfactory under the Community Reinvestment Act of 1977 ("CRA"), we would be prohibited from engaging in any additional activities other than those permissible for bank holding companies that are not financial holding companies. Our banking subsidiaries currently meet these capital, management and CRA requirements.

Acquisitions by the Company of banks and savings associations are subject to federal and state regulation. Any acquisition by the Company of more than five percent of the voting stock of any bank requires prior approval of the FRB, the FDIC and, if applicable, state regulators. Acquisition of savings associations is also subject to the approval of the OTS and acquisition of national banks is subject to the approval of the OCC.

Indiana law permits FHCs to acquire bank holding companies and banks out of state on a reciprocal basis, subject to certain limitations. Under current law, the Company may acquire banks, and may be acquired by bank holding companies, located in any state in the United States that permits reciprocal entry by Indiana FHCs. Under the Act, FHCs may acquire savings associations without geographic restrictions.

A FHC and its subsidiaries are prohibited from engaging in certain tying arrangements in connection with the extension of credit, lease or sale of property, or the provision of any property or service.

The Company is under the jurisdiction of the Securities and Exchange Commission ("SEC") and state securities commission for matters relating to the offering and sale of its securities. The Company is subject to the SEC's rules and regulations relating to, among other things, periodic reporting, reporting to shareholders, proxy solicitation and insider trading.

The Company's liquidity is principally derived from dividends paid on the common stock of its subsidiaries. The payment of these dividends is subject to certain regulatory restrictions.

4

Under bank holding company policy, the Company is expected to act as a source of financial strength to, and commit resources to support, its affiliates. As a result of such policy, the Company may be required to commit resources to its affiliate banks in circumstances where it might not otherwise do so.

Certain regulations define relevant capital measures for five capital categories. A "well capitalized" institution is one that has a total risk-based capital ratio of at least 10%, a Tier 1 risk-based capital ratio of at least 8%, a leverage ratio of at least 5% and is not subject to regulatory direction to maintain a specific level for any capital measure. An "adequately capitalized" institution is one that has ratios greater than 8%, 4% and 4%. An institution is "undercapitalized" if its respective ratios are less than 8%, 4% and 4%. "Significantly undercapitalized" institutions have ratios of less than 6%, 3% and 3%. An institution is deemed to be "critically undercapitalized" if it has a ratio of tangible equity to total assets that is 2% or less. Institutions with capital ratios at levels of "undercapitalized" or lower are subject to various limitations that, in most situations, will reduce the competitiveness of the institution.

Regulation and Supervision of the Subsidiary Banks

The Company's affiliate banks are supervised, regulated and examined by their respective state regulatory banking agencies and the Federal Deposit Insurance Corporation ("FDIC"). A cease-and-desist order may be issued against the banks, if the respective agency finds that the activities of the bank represent an unsafe and unsound banking practice or violation of law.

The deposits of the Company's banking subsidiaries are insured to the maximum extent permitted by law by the Deposit Insurance Fund ("DIF") of the FDIC, which was created in 2006 as the result of the merger of the Bank Insurance Fund and the Savings Association Insurance Fund in accordance with the Federal Deposit Insurance Reform Act of 2005 (the "FDI" Act). The FDI Act provided for several additional changes to the deposit insurance system, including adjusting the deposit insurance limits (currently $100,000 for most accounts) every 5 years beginning in 2011 based on an inflation index, increasing the insurance limit for retirement accounts from $100,000 to $250,000, and allocating an aggregate of $4.7 billion of one-time credits to banks to offset the insurance premiums charged to such banks by the FDIC.

Branching by banks in Indiana is subject to the jurisdiction, and requires the prior approval, of the bank's primary federal regulatory authority and, if the branching bank is a state bank, of the Indiana Department of Financial Institutions ("DFI"). Under Indiana law, banks may branch anywhere in the state.

The Company is a legal entity separate and distinct from its subsidiary Banks. There are various legal limitations on the extent to which the Banks can supply funds to the Company. The principal source of the Company's funds consists of dividends from its subsidiary Banks. State and Federal law restricts the amount of dividends that may be paid by banks. In addition, the Banks are subject to certain restrictions on extensions of credit to the Company, on investments in the stock or other securities of the Company and in taking such stock or securities as collateral for loans.

Capital Requirements

The Company and its subsidiary Banks must meet certain minimum capital requirements mandated by each of their state or federal regulators. These regulatory agencies require BHCs and banks to maintain certain minimum ratios of primary capital to total assets and total capital to total assets. The FRB requires BHCs to maintain a minimum Tier 1 leverage ratio of 3 percent capital to total assets; however, for all but the most highly rated institutions which do not anticipate significant growth, the minimum Tier 1 leverage ratio is 3 percent plus an additional cushion of 100 to 200 basis points. As of December 31, 2007, the Company's leverage ratio of capital to total assets was 7.1%. The FRB and FDIC each have approved the imposition of "risk-adjusted" capital ratios on BHCs and financial institutions. The Company's Tier 1 Capital to Risk-Weighted Assets Ratio was 10.0% and its Total Capital to Risk-Weighted Assets Ratio was 10.8% at December 31, 2007. The Company's Banks had capital to asset ratios and risk- adjusted capital ratios at December 31, 2007, in excess of the applicable minimum regulatory requirements.

ITEM 1A. RISK FACTORS

In addition to the other information contained in this report, the following risks may affect us. If any of these risks actually occur, our business, financial condition or results of operations may suffer. As a result, the price of our common shares could decline.

Like most banking organizations, our business is highly susceptible to credit risk.

As a lender, we are exposed to the risk that our customers will be unable to repay their loans according to their terms and that the collateral securing the payment of their loans (if any) may not be sufficient to assure repayment. Credit losses could have a material adverse effect on our operating results.

As of December 31, 2007, our total loan portfolio was approximately $1.7 billion or 67% of our total assets. Three major components of the loan portfolio are loans principally secured by real estate, approximately $1.3 billion or 78% of total loans, other commercial loans, approximately $214 million or 13% of total loans, and consumer loans, approximately $127 million or 9% of total loans. Our credit risk with respect to our consumer installment loan portfolio and commercial loan portfolio relates principally to the

5

general creditworthiness of individuals and businesses within our local market area. Our credit risk with respect to our residential and commercial real estate mortgage and construction loan portfolio relates principally to the general creditworthiness of individuals and businesses and the value of real estate serving as security for the repayment of the loans. A related risk in connection with loans secured by commercial real estate is the effect of unknown or unexpected environmental contamination, which could make the real estate effectively unmarketable or otherwise significantly reduce its value as security.

Our allowance for loan losses may not be sufficient to cover actual loan losses, which could adversely affect our earnings.

We maintain an allowance for loan losses at a level estimated to be sufficient to cover probable incurred loan losses in our loan portfolio. Additional loan losses will likely occur in the future and may occur at a rate greater than we have experienced to date. In determining the size of the allowance, our management makes various assumptions and judgments about the collectibility of our loan portfolio, including the diversification by industry of our commercial loan portfolio, the effect of changes in the local real estate market on collateral values, the results of recent regulatory examinations, the effects on the loan portfolio of current economic indicators and their probable impact on borrowers, the amount of charge-offs for the period, the amount of nonperforming loans and related collateral security, and the evaluation of our loan portfolio by an external loan review. If our assumptions and judgments prove to be incorrect, our current allowance may not be sufficient and adjustments may be necessary to allow for different economic conditions or adverse developments in our loan portfolio. Federal and state regulators also periodically review our allowance for loan losses and may require us to increase our provision for loan losses or recognize further loan charge-offs, based on judgments different than those of our management. Any increase in our allowance for loan losses or loan charge-offs could have an adverse effect on our operating results and financial condition.

We rely heavily on our management and other key personnel, and the loss of any of them may adversely affect our operations.

We are and will continue to be dependent upon the services of our management team. The loss of any of our senior managers could have an adverse effect on our growth and performance because of their skills, knowledge of the markets in which we operate and years of industry experience and the difficulty of promptly finding qualified replacement personnel. The loss of key personnel in a particular market could have an adverse effect on our performance in that market because it may be difficult to find qualified replacement personnel who are already located in or would be willing to relocate to a non-metropolitan market. Recently, our former President and Chief Executive Officer resigned and was replaced by an interim President and CEO, Robert E. Hoptry. We are currently conducting a search for a permanent President and CEO. This transition may be a distraction to senior management, business operations, and customers.

Significant interest rate volatility could reduce our profitability.

Our results of operations are affected principally by net interest income, which is the difference between interest earned on loans and investments and interest expense paid on deposits and other borrowings. We cannot predict or control changes in interest rates. National, regional and local economic conditions and the policies of regulatory authorities, including monetary policies of the Board of Governors of the Federal Reserve System, affect market interest rates. While we have instituted policies and procedures designed to manage the risks from changes in market interest rates, at any given time our assets and liabilities will likely be affected differently by a given change in interest rates, principally because we do not match the maturities of our loans and investments precisely with our deposits and other funding sources. Changes in interest rates may also affect the level of voluntary prepayments on our loans and the level of financing or refinancing by customers. As of December 31, 2007, we had a negative interest rate gap of 36% of interest earning assets in the one-year time frame. Although this is within our internal policy limits, our earnings will be adversely affected in periods of rising interest rates because, during such periods, the interest expense paid on deposits and borrowings will generally increase more rapidly than the interest income earned on loans and investments. If such an interest rate increase occurred gradually, we would use our established procedures to attempt to mitigate the effects over time. However, if such an interest rate increase occurred rapidly, or interest rates exhibited volatile increases and decreases, we might be unable to mitigate the effects, and our net interest income could suffer significant adverse effects. While management intends to continue to take measures to mitigate interest rate risk, we cannot assure you that such measures will be entirely effective in minimizing our exposure to the risk of rapid changes in interest rates.

The geographic concentration of our markets makes our business highly susceptible to local economic conditions.

Unlike larger banking organizations that are more geographically diversified, our operations are currently concentrated in 30 counties in Indiana, three counties in Illinois, and two counties in Ohio. As a result of this geographic concentration in three fairly contiguous markets, our financial results depend largely upon economic conditions in these market areas. A deterioration in economic conditions in one or all of these markets could result in one or more of the following:

- •

- an increase in loan delinquencies;

- •

- an increase in problem assets and foreclosures;

- •

- a decrease in the demand for our products and services; and

6

- •

- a decrease in the value of collateral for loans, especially real estate, in turn reducing customers' borrowing power, the value of assets associated with problem loans and collateral coverage.

If we do not adjust to rapid changes in the financial services industry, our financial performance may suffer.

We face substantial competition for deposit, credit and trust relationships, as well as other sources of funding in the communities we serve. Competing providers include other banks, thrifts and trust companies, insurance companies, mortgage banking operations, credit unions, finance companies, money market funds and other financial and nonfinancial companies which may offer products functionally equivalent to those offered by our banks. Competing providers may have greater financial resources than we do and offer services within and outside the market areas we serve. In addition to this challenge of attracting and retaining customers for traditional banking services, our competitors now include securities dealers, brokers, mortgage bankers, investment advisors and finance and insurance companies who seek to offer one-stop financial services to their customers that may include services that banks have not been able or allowed to offer to their customers in the past. The increasingly competitive environment is primarily a result of changes in regulation, changes in technology and product delivery systems and the accelerating pace of consolidation among financial service providers. If we are unable to adjust both to increased competition for traditional banking services and changing customer needs and preferences, it could adversely affect our financial performance and your investment in our common stock.

Our historical growth and financial performance trends may not continue if our acquisition strategy is not successful.

Growth in asset size and earnings through acquisitions is an important part of our business strategy. As consolidation of the banking industry continues, the competition for suitable acquisition candidates may increase. We compete with other banking companies for acquisition opportunities, and many of these competitors have greater financial resources and acquisition experience than we do and may be able to pay more for an acquisition than we are able or willing to pay. We also may need additional debt or equity financing in the future to fund acquisitions. We may not be able to obtain additional financing or, if available, it may not be in amounts and on terms acceptable to us. We may use our common stock as the consideration for an acquisition or we may issue additional common stock and use the proceeds for the acquisition. Our issuance of additional securities will dilute your equity interest in us and may have a dilutive effect on our earnings per share. If we are unable to locate suitable acquisition candidates willing to sell on terms acceptable to us, or we are otherwise unable to obtain additional debt or equity financing necessary for us to continue our acquisition strategy, we would be required to find other methods to grow our business and we may not grow at the same rate we have in the past, or at all.

Acquisitions entail risks which could negatively affect our operations.

Acquisitions involve numerous risks, including:

- •

- exposure to asset quality problems of the acquired institution;

- •

- maintaining adequate regulatory capital;

- •

- diversion of management's attention from other business concerns;

- •

- risks and expenses of entering new geographic markets;

- •

- potential significant loss of depositors or loan customers from the acquired institution; and

- •

- exposure to undisclosed or unknown liabilities of an acquired institution.

Any of these acquisition risks could result in unexpected losses or expenses and thereby reduce the expected benefits of the acquisition.

Unanticipated costs related to our acquisition strategy could reduce MainSource's future earnings per share.

MainSource believes it has reasonably estimated the likely costs of integrating the operations of the banks it acquires into MainSource and the incremental costs of operating such banks as a part of the MainSource family. However, it is possible that unexpected transaction costs such as taxes, fees or professional expenses or unexpected future operating expenses, such as increased personnel costs or increased taxes, as well as other types of unanticipated adverse developments, could have a material adverse effect on the results of operations and financial condition of MainSource. If unexpected costs are incurred, acquisitions could have a dilutive effect on MainSource's earnings per share. In other words, if MainSource incurs such unexpected costs and expenses as a result of its acquisitions, MainSource believes that the earnings per share of MainSource common stock could be less than they would have been if those acquisitions had not been completed.

7

MainSource may be unable to successfully integrate the operations of the banks it has acquired and may acquire in the future and retain employees of such banks.

MainSource's acquisition strategy involves the integration of the banks MainSource has acquired and may acquire in the future as MainSource subsidiary banks. The difficulties of integrating the operations of such banks with MainSource and its other subsidiary banks include:

- •

- coordinating geographically separated organizations;

- •

- integrating personnel with diverse business backgrounds;

- •

- combining different corporate cultures; and

- •

- retaining key employees.

The process of integrating operations could cause an interruption of, or loss of momentum in, the activities of one or more of MainSource, its subsidiary banks and the banks MainSource has acquired and may acquire in the future and the loss of key personnel. The integration of such banks as MainSource subsidiary banks requires the experience and expertise of certain key employees of such banks who are expected to be retained by MainSource. We cannot be sure, however, that MainSource will be successful in retaining these employees for the time period necessary to successfully integrate such banks' operations as subsidiary banks of MainSource. The diversion of management's attention and any delays or difficulties encountered in connection with the mergers, along with the integration of the banks as MainSource subsidiary banks, could have an adverse effect on the business and results of operation of MainSource.

Changes in governmental regulation and legislation could limit our future performance and growth.

We are subject to extensive state and federal regulation, supervision and legislation that govern almost all aspects of our operations, as well as any acquisitions we may propose to make. Any change in applicable federal or state laws or regulations could have a substantial impact on us, our subsidiary banks and our operations. While we cannot predict what effect any presently contemplated or future changes in the laws or regulations or their interpretations would have on us, these changes could reduce the value of your investment.

Our strategy to minimize Indiana state taxes on our investment portfolio may be unsuccessful.

Since 2002, our Indiana state financial institutions taxes have been reduced by our use of subsidiaries we formed in the State of Nevada to hold a significant portion of our investment portfolio. Nevada has no state or local income tax, and we take the position that none of this income is subject to the Indiana financial institutions tax. For the year ended December 31, 2007, our net savings in Indiana tax from this arrangement (after federal tax) was approximately $900,000. Management believes that this arrangement is permitted under Indiana law, and Indiana tax authorities have not challenged our tax returns in this regard. If we were not permitted to realize state tax savings from this arrangement, it would cause our net income after taxes to be lower in the future, and if Indiana tax authorities challenged our arrangement and were successful in assessing additional taxes, interest and penalties for prior years, we might be forced to take a special charge to our earnings in the amount of the assessment.

ITEM 1B. UNRESOLVED STAFF COMMENTS.

None.

ITEM 2. PROPERTIES

As of December 31, 2007, the Company leased space from one of its subsidiaries for use as its corporate headquarters. The Company's subsidiaries own, or lease, all of the facilities from which they conduct business. All leases are comparable to other leases in the respective market areas and do not contain provisions materially detrimental to the Company or its subsidiaries. As of December 31, 2007 the Company had 79 banking locations of which MainSource Bank had 67, MainSource Bank of Illinois had seven, and MainSource Bank — Ohio had five. In addition, the Company operates eight insurance offices in Indiana. At December 31, 2007, the Company had approximately $40 million invested in premises and equipment.

ITEM 3. LEGAL PROCEEDINGS

The Company and its subsidiaries may be parties (both plaintiff and defendant) to ordinary litigation incidental to the conduct of business. Management is presently not aware of any material pending or contemplated legal proceedings.

ITEM 4. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS

No matters were submitted during the fourth quarter of 2007 to a vote of security holders, through the solicitation of proxies or otherwise.

8

PART II

ITEM 5. MARKET FOR THE REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER'S PURCHASES OF EQUITY SECURITIES

Market Information

The Company's Common Stock is traded on the NASDAQ Stock Market under the symbol MSFG. The Common Stock was held by approximately 4,000 shareholders at March 10, 2008. The quarterly high and low closing prices for the Company's common stock as reported by NASDAQ and quarterly cash dividends declared and paid are set forth in the tables below. All per share data is retroactively restated for all stock dividends and splits.

The range of known per share prices by calendar quarter, based on actual transactions, excluding commissions, is shown below.

| Market Prices

|

|---|

2007

| Q1

| | Q2

| | Q3

| | Q4

|

|---|

|

|---|

| High | $ | 17.53 | | $ | 17.50 | | $ | 19.01 | | $ | 18.09 |

| Low | $ | 15.42 | | $ | 16.15 | | $ | 15.03 | | $ | 14.36 |

2006

|

Q1

|

|

Q2

|

|

Q3

|

|

Q4

|

|---|

|

|---|

| High | $ | 18.52 | | $ | 18.13 | | $ | 16.93 | | $ | 17.88 |

| Low | $ | 17.05 | | $ | 15.57 | | $ | 15.30 | | $ | 16.05 |

|

Cash Dividends

|

|---|

2007

| Q1

| | Q2

| | Q3

| | Q4

|

|---|

|

|---|

| | $ | 0.135 | | $ | 0.140 | | $ | 0.140 | | $ | 0.140 |

2006

|

Q1

|

|

Q2

|

|

Q3

|

|

Q4

|

|---|

|

|---|

| | $ | 0.129 | | $ | 0.133 | | $ | 0.133 | | $ | 0.133 |

Equity Compensation Plan Information

The following table sets forth information regarding securities authorized for issuance under the Company's equity compensation plans as of December 31, 2007:

Plan category

| Number of securities to be issued upon exercise of outstanding options, warrants and rights

(a)

| | Weighted-average exercise price of outstanding options, warrants and rights

(b)

| | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a))

(c)

|

|---|

|

|---|

| Equity compensation plans approved by security holders | 275,837 | | $ | 18.07 | | 574,945 |

| Equity compensation plans not approved by security holders | — | | | — | | — |

| |

| |

| |

|

| Total | 275,837 | | $ | 18.07 | | 574,945 |

9

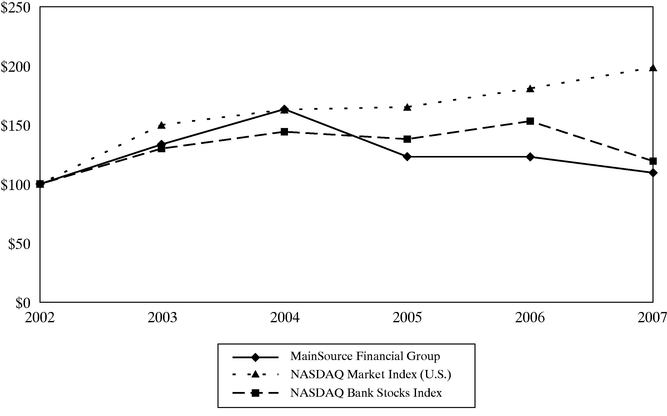

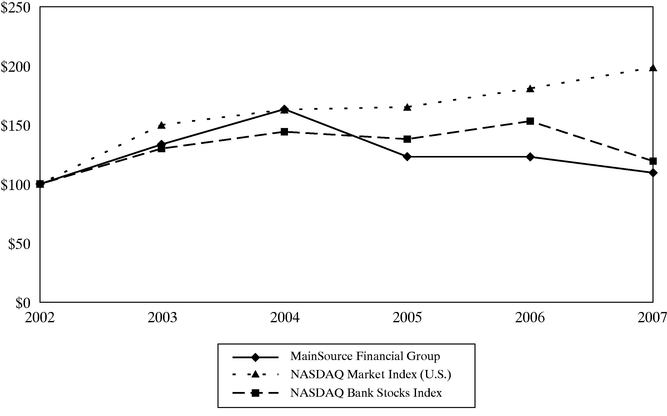

Stock Performance Graph

The following performance graph compares the performance of our common shares to the performance of the NASDAQ Market Index (U.S.) and the NASDAQ Bank Stocks Index for the 60 months ended December 31, 2007. The graph assumes an investment of $100 in each of the Company's common shares, the NASDAQ Market Index (U.S.) and the NASDAQ Bank Stocks Index on December 21, 2002.

| 12/31/02

| | 12/31/03

| | 12/31/04

| | 12/31/05

| | 12/31/06

| | 12/31/07

|

|---|

|

|---|

| MainSource Financial Group | 100.00 | | 133.45 | | 163.27 | | 123.12 | | 122.94 | | 109.50 |

| NASDAQ MARKET INDEX (U.S.) | 100.00 | | 150.01 | | 162.89 | | 165.13 | | 180.85 | | 198.60 |

| NASDAQ Bank Stocks Index | 100.00 | | 129.93 | | 144.21 | | 137.97 | | 153.15 | | 119.35 |

Purchases of Equity Securities

The activity in the Company's Stock Repurchase Program for the fourth quarter of 2007 was as follows:

Period

| Total Number of Shares (or Units) Purchased

| | Average Price Paid Per Share (or Unit)

| | Total Number of Shares (or Units) Purchased as Part of Publicly Announced Plans or Programs

| | Maximum Number (or Approximate Dollar Value) of Shares (or Units) That May Yet Be Purchased Under the Plans or Programs(1)

|

|---|

|

|---|

| October 2007 | 148 | | $ | 17.02 | | 148 | | 378,886 |

| November 2007 | 66,032 | | $ | 15.70 | | 66,032 | | 312,854 |

| December 2007 | 110 | | $ | 16.00 | | 110 | | 312,744 |

- (1)

- On March 22, 2007, the Company announced that its Board of Directors had approved a stock repurchase program effective April 1, 2007, for the purchase of up to 2.5% of its outstanding common shares, or approximately 500,000 shares. The program expires on March 31, 2008, unless completed sooner or otherwise extended.

10

ITEM 6. SELECTED FINANCIAL DATA

Selected Financial Data

(Dollar amounts in thousands except per share data)

| 2007

| | 2006

| | 2005

| | 2004

| | 2003

| |

|---|

| |

|---|

| Results of Operations | | | | | | | | | | | | | | | |

| | Net interest income | $ | 74,397 | | $ | 68,268 | | $ | 53,648 | | $ | 50,002 | | $ | 44,232 | |

| | Provision for loan losses | | 5,745 | | | 1,819 | | | 1,040 | | | 600 | | | 1,325 | |

| | Noninterest income | | 28,126 | | | 23,039 | | | 17,332 | | | 19,544 | | | 19,443 | |

| | Noninterest expense | | 68,020 | | | 59,642 | | | 48,576 | | | 45,880 | | | 40,448 | |

| | Income before income tax | | 28,758 | | | 29,846 | | | 21,364 | | | 23,066 | | | 21,902 | |

| | Income tax | | 6,888 | | | 7,605 | | | 5,172 | | | 6,273 | | | 6,597 | |

| | Net income | | 21,870 | | | 22,241 | | | 16,192 | | | 16,793 | | | 15,305 | |

| | Dividends paid on common stock | | 10,392 | | | 8,944 | | | 6,514 | | | 5,421 | | | 4,873 | |

Per Common Share* |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| | Earnings per share (basic) | $ | 1.17 | | $ | 1.30 | | $ | 1.23 | | $ | 1.41 | | $ | 1.31 | |

| | Earnings per share (diluted) | | 1.17 | | | 1.29 | | | 1.23 | | | 1.41 | | | 1.31 | |

| | Dividends paid | | 0.555 | | | 0.529 | | | 0.495 | | | 0.453 | | | 0.415 | |

| | Book value — end of period | | 14.22 | | | 13.50 | | | 11.39 | | | 10.17 | | | 9.02 | |

| | Market price — end of period | | 15.56 | | | 16.94 | | | 17.00 | | | 22.74 | | | 18.55 | |

At Year End |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| | Total assets | $ | 2,536,437 | | $ | 2,429,773 | | $ | 1,645,605 | | $ | 1,549,379 | | $ | 1,442,729 | |

| | Investment securities | | 489,739 | | | 485,259 | | | 450,814 | | | 428,686 | | | 425,542 | |

| | Loans, excluding held for sale | | 1,693,678 | | | 1,574,384 | | | 957,995 | | | 929,005 | | | 855,471 | |

| | Allowance for loan losses | | 14,331 | | | 12,792 | | | 10,441 | | | 11,698 | | | 11,509 | |

| | Total deposits | | 1,901,829 | | | 1,859,689 | | | 1,352,697 | | | 1,226,367 | | | 1,191,310 | |

| | Notes payable | | — | | | — | | | — | | | 9,100 | | | 12,500 | |

| | Federal Home Loan Bank advances | | 257,099 | | | 208,443 | | | 41,547 | | | 90,981 | | | 62,751 | |

| | Subordinated debentures | | 41,239 | | | 41,239 | | | 29,898 | | | 29,898 | | | 29,898 | |

| | Shareholders' equity | | 264,102 | | | 253,247 | | | 161,069 | | | 123,320 | | | 105,424 | |

Financial Ratios |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| | Return on average assets | | 0.90 | % | | 1.06 | % | | 1.04 | % | | 1.13 | % | | 1.14 | % |

| | Return on average common shareholders' equity | | 8.49 | | | 10.39 | | | 11.27 | | | 14.70 | | | 15.07 | |

| | Allowance for loan losses to total loans (year end, excluding held for sale) | | 0.85 | | | 0.81 | | | 1.09 | | | 1.26 | | | 1.35 | |

| | Allowance for loan losses to total non-performing loans (year end) | | 69.93 | | | 73.18 | | | 102.19 | | | 83.31 | | | 77.65 | |

| | Shareholders' equity to total assets (year end) | | 10.41 | | | 10.42 | | | 9.79 | | | 7.96 | | | 7.31 | |

| | Average equity to average total assets | | 10.57 | | | 10.13 | | | 9.18 | | | 7.95 | | | 7.57 | |

| | Dividend payout ratio | | 47.52 | | | 40.21 | | | 40.23 | | | 32.28 | | | 31.84 | |

- *

- Adjusted for stock split and dividends

11

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Management's Discussion and Analysis

(Dollar amounts in thousands except per share data)

Forward-Looking Statements

Except for historical information contained herein, the discussion in this Annual Report includes certain forward-looking statements based upon management expectations. Actual results and experience could differ materially from the anticipated results or other expectations expressed in the Company's forward-looking statements. Factors which could cause future results to differ from these expectations include the following: general economic conditions; legislative and regulatory initiatives; monetary and fiscal policies of the federal government; deposit flows; the cost of funds; general market rates of interest; interest rates on competing investments; demand for loan products; demand for financial services; changes in accounting policies or guidelines; changes in the quality or composition of the Company's loan and investment portfolios; the Company's ability to integrate acquisitions, the impact of our continuing acquisition strategy, and other factors, including the risk factors set forth in Item 1A of this Annual Report on Form 10-K and in other reports we file from time to time with the Securities and Exchange Commission.

Overview

MainSource Financial Group, Inc. ("MainSource or Company") is a financial holding company whose principal activity is the ownership and management of its three wholly owned subsidiary banks ("Banks"): MainSource Bank headquartered in Greensburg, Indiana, MainSource Bank of Illinois headquartered in Kankakee, Illinois, and MainSource Bank — Ohio headquartered in Troy, Ohio. The banks operate under state charters and are subject to regulation by their respective state regulatory agencies and the Federal Deposit Insurance Corporation. Non-banking subsidiaries include MainSource Insurance, LLC and MainSource Title, LLC. Both of these subsidiaries are subject to regulation by the Indiana Department of Insurance. The Company also owns all of the outstanding stock of MainSource Bank — Hobart, although substantially all of the assets of that bank were transferred to MainSource Bank in May, 2007.

Business Strategy

The Company operates under the broad tenets of a long-term strategic plan ("Plan") designed to improve the Company's financial performance, expand its competitive position and enhance long-term shareholder value. The Plan is premised on the belief of the Company's Board of Directors that it can best promote long-term shareholder interests by pursuing strategies which will continue to preserve its community-focused philosophy. The dynamics of the Plan assure continually evolving goals, with the enhancement of shareholder value being the constant, overriding objective. The extent of the Company's success will depend upon how well it anticipates and responds to competitive changes within its markets, the interest rate environment and other external forces.

The Company continued its history of external growth through acquisitions during 2006 by acquiring three whole bank institutions and purchasing five branches from an in-market competitor. In March, 2006, the Company acquired 100% of the outstanding shares of Union Community Bancorp ("Union"). In May, 2006, the Company acquired 100% of the outstanding shares of HFS Bank, F.S.B. ("HFS"). In June, 2006, the Company acquired 100% of the outstanding shares of Peoples Ohio Financial Corporation ("Peoples"). In August, 2006, the Company purchased five branches from First Financial Bank. In total, these acquisitions added approximately $598 million in loans and $490 million in deposits.

In February, 2008, the Company announced the execution of a definitive agreement to acquire 1st Independence Financial Group, Inc. headquartered in Louisville, Kentucky. As of December 31, 2007, 1st Independence had approximately $350 million in assets, $280 million in loans, and $255 million in deposits. The agreement provides that 1st Independence's shareholders will receive $5.475 in cash and .881036 shares of MainSource common stock for each share of 1st Independence stock owned. The transaction value is estimated at $37 million. The consideration to be paid to 1st Independence's shareholders may be adjusted at closing based on the value of 1st Independence's consolidated tangible shareholders' equity, subject to certain adjustments, as well as the closing price of the Company's common stock prior to closing. The transaction, which is expected to close in the third quarter of 2008, is subject to various regulatory approvals and the approval of 1st Independence's shareholders. The Company is continuously reviewing other acquisition targets including branches, whole banks, and other financial service related entities focusing on the four-state Midwest region of Indiana, Illinois, Kentucky, and Ohio.

12

Results of Operations

Net income was $21,870 in 2007, $22,241 in 2006, and $16,192 in 2005. Earnings per common share on a fully diluted basis were $1.17 in 2007, $1.29 in 2006, and $1.23 in 2005. The decrease from 2006 to 2007 in overall net income and earnings per share was primarily attributable to three factors: the decrease in the Company's net interest margin, the increase in the Company's loan loss provision expense, and the expenses incurred for the data processing system conversions of the Hobart and Crawfordsville affiliates. Key measures of the operating performance of the Company are return on average assets, return on average shareholders' equity, and efficiency ratio. The Company's return on average assets was 0.90% for 2007 compared to 1.06% for 2006 and return on average shareholders' equity was 8.5% in 2007 compared to 10.4% in 2006. The Company's efficiency ratio, which measures the non-interest expenses of the Company as a percentage of its net interest income (on a fully taxable equivalent basis) and its non-interest income, was 64.4% in 2007 compared to 63.6% in 2006.

13

Net Interest Income

Net interest income and net interest margin are influenced by the volume and yield or cost of earning assets and interest-bearing liabilities. Tax equivalent net interest income of $77,603 in 2007 increased from $71,345 in 2006. Net interest margin, on a fully-taxable equivalent basis, was 3.60% for 2007 compared to 3.81% for the same period a year ago. Due to the relatively flat nature of the yield curve for most of 2007, the Company's cost of funds increased steadily throughout the year and outpaced the increase in the yield on earning assets. Partially offsetting this trend was a favorable shift in the Company's volume and mix of earning assets as lower-yielding residential real estate loans were replaced by higher-yielding commercial loans.

The following table summarizes net interest income (on a tax-equivalent basis) for each of the past three years.

Average Balance Sheet and Net Interest Analysis (Taxable Equivalent Basis)*

| 2007

| | 2006

| | 2005

| |

|---|

|

| |

|---|

Assets

| Average Balance

| | Interest

| | Average Rate

| | Average Balance

| | Interest

| | Average Rate

| | Average Balance

| | Interest

| | Average Rate

| |

|---|

|

| |

|---|

| Short-term investments | $ | 2,601 | | $ | 131 | | 5.04 | % | $ | 4,210 | | $ | 141 | | 3.35 | % | $ | 4,010 | | $ | 71 | | 1.77 | % |

| Federal funds sold and money market accounts | | 10,458 | | | 575 | | 5.50 | | | 8,249 | | | 394 | | 4.78 | | | 4,889 | | | 197 | | 4.03 | |

| Securities | | | | | | | | | | | | | | | | | | | | | | | | |

| | Taxable | | 401,006 | | | 19,661 | | 4.90 | | | 382,912 | | | 18,176 | | 4.75 | | | 359,116 | | | 13,819 | | 3.85 | |

| | Non-taxable* | | 121,737 | | | 7,621 | | 6.26 | | | 121,257 | | | 7,540 | | 6.22 | | | 105,251 | | | 6,251 | | 5.94 | |

| |

| | | | | | | | | | | | | | | | | | | | | | |

| | | Total securities | | 522,743 | | | 27,282 | | 5.22 | | | 504,169 | | | 25,716 | | 5.10 | | | 464,367 | | | 20,070 | | 4.32 | |

| Loans** | | | | | | | | | | | | | | | | | | | | | | | | |

| | Commercial | | 770,269 | | | 55,243 | | 7.17 | | | 594,294 | | | 43,128 | | 7.26 | | | 490,832 | | | 33,056 | | 6.73 | |

| | Residential real estate | | 556,136 | | | 41,625 | | 7.48 | | | 488,477 | | | 33,362 | | 6.83 | | | 225,358 | | | 14,083 | | 6.25 | |

| | Consumer | | 290,930 | | | 23,177 | | 7.97 | | | 270,885 | | | 21,067 | | 7.78 | | | 219,281 | | | 15,555 | | 7.09 | |

| |

| |

| | | Total loans | | 1,617,335 | | | 120,045 | | 7.42 | | | 1,353,656 | | | 97,557 | | 7.21 | | | 935,471 | | | 62,694 | | 6.70 | |

| |

| |

| | | Total earning assets | | 2,153,137 | | | 148,033 | | 6.88 | | | 1,870,284 | | | 123,808 | | 6.62 | | | 1,408,737 | | | 83,032 | | 5.89 | |

| |

| |

Cash and due from banks |

|

56,498 |

|

|

|

|

|

|

|

58,562 |

|

|

|

|

|

|

|

47,595 |

|

|

|

|

|

|

| Unrealized gains (losses) on securities | | (4,634 | ) | | | | | | | (7,643 | ) | | | | | | | (2,601 | ) | | | | | |

| Allowance for loan losses | | (13,296 | ) | | | | | | | (12,667 | ) | | | | | | | (11,754 | ) | | | | | |

| Premises and equipment,net | | 39,829 | | | | | | | | 35,926 | | | | | | | | 26,291 | | | | | | |

| Intangible assets | | 136,189 | | | | | | | | 103,008 | | | | | | | | 50,845 | | | | | | |

| Accrued interest receivable and other assets | | 70,789 | | | | | | | | 55,580 | | | | | | | | 44,905 | | | | | | |

| |

| | | | | | |

| | | | | | |

| | | | | | |

| | | Total assets | $ | 2,438,512 | | | | | | | $ | 2,103,050 | | | | | | | $ | 1,564,018 | | | | | | |

| |

| | | | | | |

| | | | | | |

| | | | | | |

Liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| | Interest-bearing deposits DDA, savings, and money market accounts | $ | 776,693 | | $ | 14,853 | | 1.91 | | $ | 711,111 | | $ | 11,130 | | 1.57 | | $ | 616,398 | | $ | 6,916 | | 1.12 | |

| | Certificates of deposit | | 864,074 | | | 38,820 | | 4.49 | | | 731,603 | | | 28,152 | | 3.85 | | | 483,457 | | | 13,183 | | 2.73 | |

| |

| |

| | | Total interest-bearing deposits | | 1,640,767 | | | 53,673 | | 3.27 | | | 1,442,714 | | | 39,282 | | 2.72 | | | 1,099,855 | | | 20,099 | | 1.83 | |

| Short-term borrowings | | 48,943 | | | 1,856 | | 3.79 | | | 33,586 | | | 1,332 | | 3.97 | | | 38,720 | | | 975 | | 2.52 | |

| Subordinated debentures | | 41,239 | | | 3,333 | | 8.08 | | | 31,750 | | | 2,475 | | 7.80 | | | 29,898 | | | 1,938 | | 6.48 | |

| Notes payable and FHLB borrowings | | 236,706 | | | 11,568 | | 4.89 | | | 189,171 | | | 9,374 | | 4.96 | | | 95,525 | | | 3,815 | | 3.99 | |

| |

| |

| | | Total interest-bearing liabilities | | 1,967,655 | | | 70,430 | | 3.58 | | | 1,697,221 | | | 52,463 | | 3.09 | | | 1,263,998 | | | 26,827 | | 2.12 | |

| Demand deposits | | 190,162 | | | | | | | | 174,218 | | | | | | | | 144,647 | | | | | | |

| Other liabilities | | 23,062 | | | | | | | | 17,622 | | | | | | | | 11,737 | | | | | | |

| |

| | | | | | |

| | | | | | |

| | | | | | |

| Total liabilities | | 2,180,879 | | | | | | | | 1,889,061 | | | | | | | | 1,420,382 | | | | | | |

| Shareholders' equity | | 257,633 | | | | | | | | 213,989 | | | | | | | | 143,636 | | | | | | |

| |

| | | | | | |

| | | | | | |

| | | | | | |

| Total liabilities and shareholders' equity | $ | 2,438,512 | | | 70,430 | | 3.27 | *** | $ | 2,103,050 | | | 52,463 | | 2.81 | *** | $ | 1,564,018 | | | 26,827 | | 1.90 | *** |

| |

| |

| |

| |

| |

| |

| |

| Net interest income | | | | $ | 77,603 | | 3.60 | **** | | | | $ | 71,345 | | 3.81 | **** | | | | $ | 56,205 | | 3.99 | **** |

| | | | |

| | | | |

| | | | |

| |

| Conversion of tax exempt income to a fully taxable equivalent basis using a marginal rate of 35% | | | | $ | 3,206 | | | | | | | $ | 3,077 | | | | | | | $ | 2,557 | | | |

| | | | |

| | | | | | |

| | | | | | |

| | | |

- *

- Adjusted to reflect income related to securities and loans exempt from Federal income taxes.

- **

- Nonaccruing loans have been included in the average balances.

- ***

- Total interest expense divided by total earning assets.

- ****

- Net interest income divided by total earning assets.

14

The following table sets forth for the periods indicated a summary of the changes in interest income and interest expense resulting from changes in volume and changes in rates.

Volume/Rate Analysis of Changes in Net Interest Income

(Tax Equivalent Basis)

| 2007 OVER 2006

| | 2006 OVER 2005

|

|---|

| Volume

| | Rate

| | Total

| | Volume

| | Rate

| | Total

|

|---|

|

|---|

| Interest income | | | | | | | | | | | | | | | | | |

| | Loans | $ | 19,645 | | $ | 2,843 | | $ | 22,488 | | $ | 30,092 | | $ | 4,771 | | $ | 34,863 |

| | Securities | | 961 | | | 605 | | | 1,566 | | | 2,024 | | | 3,622 | | | 5,646 |

| | Federal funds sold and money market funds | | 117 | | | 64 | | | 181 | | | 166 | | | 31 | | | 197 |

| | Short-term investments | | (81 | ) | | 71 | | | (10 | ) | | (1 | ) | | 71 | | | 70 |

| |

| |

|

| | | Total interest income | | 20,643 | | | 3,582 | | | 24,225 | | | 32,281 | | | 8,495 | | | 40,776 |

| |

| |

|

Interest expense |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| | Interest-bearing DDA, savings, and money market accounts | $ | 1,305 | | $ | 2,418 | | $ | 3,723 | | $ | 1,440 | | $ | 2,774 | | $ | 4,214 |

| | Certificates of deposit | | 5,986 | | | 4,682 | | | 10,668 | | | 9,554 | | | 5,415 | | | 14,969 |

| | Borrowings | | 2,911 | | | (193 | ) | | 2,718 | | | 4,428 | | | 1,488 | | | 5,916 |

| | Subordinated debentures | | 769 | | | 89 | | | 858 | | | 142 | | | 395 | | | 537 |

| |

| |

|

| | | Total interest expense | | 10,971 | | | 6,996 | | | 17,967 | | | 15,564 | | | 10,072 | | | 25,636 |

| |

| |

|

| Change in net interest income | $ | 9,672 | | $ | (3,414 | ) | | 6,258 | | $ | 16,717 | | $ | (1,577 | ) | | 15,140 |

| |

| | | | |

| | | |

| Change in tax equivalent adjustment | | | | | | | | 129 | | | | | | | | | 520 |

| | | | | | | |

| | | | | | | |

|

| Change in net interest income before tax equivalent adjustment | | | | | | | $ | 6,129 | | | | | | | | $ | 14,620 |

| | | | | | | |

| | | | | | | |

|

Provision for Loan Losses

The Company expensed $5,745 in provision for loan losses in 2007. This level of provision allowed the Company to maintain an adequate allowance for loan losses. This topic is discussed in detail under the heading "Loans, Credit Risk and the Allowance and Provision for Loan Losses".

Non-interest Income and Expense

|

| |

| |

| | Percent Change

|

|---|

| 2007

| | 2006

| | 2005

| | 07/06

| | 06/05

|

|---|

|

|---|

| Non-interest income | | | | | | | | | | | | |

| | Insurance commissions | $ | 1,864 | | $ | 1,821 | | $ | 1,991 | | 2.4% | | -8.5% |

| | Mortgage banking | | 2,921 | | | 2,279 | | | 2,693 | | 28.2% | | -15.4% |

| | Trust and investment product fees | | 1,569 | | | 1,187 | | | 1,119 | | 32.2% | | 6.1% |

| | Service charges on deposit accounts | | 13,312 | | | 9,491 | | | 7,510 | | 40.3% | | 26.4% |

| | Net realized gains/(losses) on securities sales | | 114 | | | 145 | | | (2,179 | ) | -21.4% | | -106.7% |

| | Increase in cash surrender value of life insurance | | 1,535 | | | 1,255 | | | 891 | | 22.3% | | 40.9% |

| | Interchange income | | 3,159 | | | 2,617 | | | 1,926 | | 20.7% | | 35.9% |

| | Other | | 3,652 | | | 4,244 | | | 3,381 | | -13.9% | | 25.5% |

| |

| | | | |

| | | Total non-interest income | $ | 28,126 | | $ | 23,039 | | $ | 17,332 | | 22.1% | | 32.9% |

| |

| | | | |

Non-interest expense |

|

|

|

|

|

|

|

|

|

|

|

|

| | Salaries and employee benefits | $ | 38,063 | | $ | 33,073 | | $ | 27,121 | | 15.1% | | 21.9% |

| | Net occupancy | | 5,347 | | | 4,755 | | | 3,542 | | 12.5% | | 34.2% |

| | Equipment | | 5,788 | | | 5,361 | | | 4,123 | | 8.0% | | 30.0% |

| | Intangibles amortization | | 2,666 | | | 2,236 | | | 1,306 | | 19.2% | | 71.2% |

| | Telecommunications | | 1,924 | | | 1,916 | | | 1,664 | | 0.4% | | 15.1% |

| | Stationery, printing, and supplies | | 1,475 | | | 1,408 | | | 984 | | 4.8% | | 43.1% |

| | Other | | 12,757 | | | 10,893 | | | 9,836 | | 17.1% | | 10.7% |

| |

| | | | |

| | | Total non-interest expense | $ | 68,020 | | $ | 59,642 | | $ | 48,576 | | 14.0% | | 22.8% |

| |

| | | | |

15

Non-interest Income

Non-interest income was $28,126 for 2007 compared to $23,039 for the same period in 2006. The acquisitions closed in 2006 were the primary driver of this increase as the Company realized the full-year effect in 2007. Non-interest income as a percent of non-interest expense was 41.3% for 2007 compared to 38.6% for 2006.

Total non-interest income was $23,039 for 2006 compared to $17,332 for 2005, an increase of $5,707 and 32.9% The primary drivers of the increase in non-interest income were the acquisitions of the three whole banks in 2006 and the change in securities gains and losses year over year. In total, the acquisitions accounted for approximately $2,175 of non-interest income with approximately half of this income related to service charges on deposit accounts. In 2005, the Company incurred net losses on securities sales of $2,179 compared to net gains on securities sales of $145 in 2006. The securities losses incurred in 2005 were primarily related to the portfolio restructuring that took place at the end of 2005. This restructuring involved the sale of $85 million in under-performing securities and resulted in a pre-tax loss of $2.7 million.

Non-interest Expense

Total non-interest expense was $68,020 in 2007 compared to $59,642 in 2006, an increase of $8,378 and 14.0%. The full-year effect of the 2006 acquisitions was the primary driver of this increase and added approximately $6 million of expenses to 2007. In addition, the Company incurred approximately $900 of expenses related to the data processing system conversions of its Hobart and Crawfordsville, Indiana affiliates.

Total non-interest expense was $59,642 in 2006 compared to $48,576 in 2005, an increase of $11,066 and 22.8%. The primary driver of the increase in non-interest expense was the acquisitions of the three whole banks in 2006. As a result of the 2006 bank acquisitions, the Company added 18 offices to its branch network bringing its total to 80 at the end of 2006. In total, the acquisitions accounted for approximately $9,700 of non-interest expense in 2006 with approximately half of this expense related to salaries and employee benefits. Excluding acquisition-related activity, the Company's non-interest expense would have been approximately $49,950 in 2006, an increase of 2.8%.

Income Taxes

The effective tax rate was 24.0% in 2007, 25.5% in 2006, and 24.2% in 2005. The decrease in the Company's effective tax rate from 2006 to 2007 was primarily attributable to the purchase of a new markets tax credit investment in 2007. The Company and its subsidiaries file consolidated income tax returns.

Balance Sheet

At December 31, 2007, total assets were $2,536,437 compared to $2,429,773 at December 31, 2006, an increase of $107 million. The increase was primarily attributable to the organic growth in the Company's loan portfolio, which grew by $119 million.

Loans, Credit Risk and the Allowance and Provision for Loan Losses

Loans remain the Company's largest concentration of assets and continue to represent the greatest potential risk. The loan underwriting standards observed by the Company's subsidiaries are viewed by management as a means of controlling problem loans and the resulting charge-offs.

The Company's conservative loan underwriting standards have historically resulted in higher loan quality and generally lower levels of net charge-offs than peer group averages. The Company also believes credit risks may be elevated if undue concentrations of loans in specific industry segments and to out-of-area borrowers are incurred. Accordingly, the Company's Board of Directors regularly monitors such concentrations to determine compliance with its loan concentration policy. The Company believes it has no undue concentrations of loans.

Total loans (excluding those held for sale) increased by $119 million from year-end 2006. The increase in commercial loans (including commercial real estate and construction and development loans) was the primary driver of this increase. In total, commercial loans grew by $133 million, or approximately 20%. Residential real estate loans continue to represent the largest portion of the total loan portfolio. With the acquisition of the three thrift institutions in 2006 and their corresponding large residential real estate portfolios, such loans represented 46% of total loans at December 31, 2007 compared to 50% of total loans at the end of 2006.

The following table details the Company's loan portfolio by type of loan.

16

Loan Portfolio

| December 31

|

|---|

| 2007

| | 2006

| | 2005

| | 2004

| | 2003

|

|---|

|

|---|

| Types of loans | | | | | | | | | | | | | | |

| Commercial and industrial | $ | 214,393 | | $ | 173,557 | | $ | 149,074 | | $ | 154,717 | | $ | 158,271 |

| Agricultural production financing | | 29,812 | | | 25,588 | | | 23,871 | | | 22,647 | | | 25,897 |

| Farm real estate | | 42,185 | | | 46,051 | | | 38,833 | | | 38,281 | | | 37,107 |

| Commercial real estate mortgage | | 376,759 | | | 326,284 | | | 202,047 | | | 213,359 | | | 183,938 |

| Residential real estate mortgage | | 780,102 | | | 790,962 | | | 368,953 | | | 353,515 | | | 315,848 |

| Construction and development | | 123,611 | | | 82,261 | | | 51,736 | | | 38,056 | | | 34,686 |

| Consumer | | 126,816 | | | 129,681 | | | 123,481 | | | 108,430 | | | 99,724 |

| |

|

| | Total loans | $ | 1,693,678 | | $ | 1,574,384 | | $ | 957,995 | | $ | 929,005 | | $ | 855,471 |

| |

|

The following table indicates the amounts of loans (excluding residential and commercial mortgages and consumer loans) outstanding as of December 31, 2007 which, based on remaining scheduled repayments of principal, are due in the periods indicated.

Maturities and Sensitivity to Changes in Interest Rates of Commercial and Construction Loans

| Due: Within 1 Year

| | 1–5 Years

| | Over 5 years

| | Total

|

|---|

|

|---|

| Loan Type | | | | | | | | | | | |

| | Commercial and industrial | $ | 112,559 | | $ | 47,874 | | $ | 53,960 | | $ | 214,393 |

| | Agricultural production financing | | 23,274 | | | 4,417 | | | 2,121 | | | 29,812 |

| | Construction and development | | 91,800 | | | 21,613 | | | 10,198 | | | 123,611 |

| | |

|

| | | Totals | $ | 227,633 | | $ | 73,904 | | $ | 66,279 | | $ | 367,816 |

| | |

|

| | | Percent | | 62% | | | 20% | | | 18% | | | 100% |

| | |

|

Rate Sensitivity |

|

|

|

|

|

|

|

|

|

|

|

| | Fixed Rate | $ | 28,303 | | $ | 33,220 | | $ | 28,817 | | $ | 90,340 |

| | Variable Rate | | 249,735 | | | 27,617 | | | 124 | | | 277,476 |

| | |

|

| | | Totals | $ | 278,038 | | $ | 60,837 | | $ | 28,941 | | $ | 367,816 |

| | |

|

The Company regards its ability to identify and correct loan quality problems as one of its greatest strengths. Loans are placed on "non-accrual" status when, in management's judgment, the collateral value and/or the borrower's financial condition does not justify accruing interest. As a general rule, commercial and real estate loans are reclassified to nonaccrual status at or before becoming 90 days past due. Interest previously recorded is reversed and charged against current income. Subsequent interest payments collected on nonaccrual loans are thereafter applied as a reduction of the loan's principal balance. Non-performing loans were $20,493 as of December 31, 2007 compared to $17,481 as of December 31, 2006 and represented 1.21% of total loans at December 31, 2007 versus 1.11% one year ago.

The following table details the Company's non-performing loans as of December 31 for the years indicated.

Non-performing Loans

| 2007

| | 2006

| | 2005

| | 2004

| | 2003

|

|---|

|

|---|

| Nonaccruing loans | $ | 18,800 | | $ | 16,021 | | $ | 9,984 | | $ | 13,611 | | $ | 14,626 |

| Accruing loans contractually past due 90 days or more | | 1,693 | | | 1,460 | | | 233 | | | 431 | | | 196 |

| |

|

| | Total | $ | 20,493 | | $ | 17,481 | | $ | 10,217 | | $ | 14,042 | | $ | 14,822 |

| |

|

| | % of total loans | | 1.21% | | | 1.11% | | | 1.07% | | | 1.51% | | | 1.73% |

The provision for loan losses was $5,745 in 2007, $1,819 in 2006, and $1,040 in 2005. The increase in the Company's provision in 2007 was primarily due to the increase in non-performing loans and the increase in net charge-offs during 2007. In addition, the Company allocated additional reserve dollars in the fourth quarter of 2007 to cover its potential exposure in its $50 million land development loan portfolio. Net charge-offs were $4,206 in 2007 compared to $3,363 in 2006 and $3,299 in 2005. As a percentage of average loans, net charge-offs equaled .26%, .25%, and .35% in 2007, 2006 and 2005, respectively.

17

Summary of the Allowance for Loan Losses

| 2007

| | 2006

| | 2005

| | 2004

| | 2003

|

|---|

|

|---|

| Balance at January 1 | $ | 12,792 | | $ | 10,441 | | $ | 11,698 | | $ | 11,509 | | $ | 9,517 |

| Chargeoffs | | | | | | | | | | | | | | |

| | Commercial | | 1,642 | | | 1,653 | | | 1,164 | | | 1,069 | | | 588 |

| | Commercial real estate mortgage | | 136 | | | — | | | 594 | | | 43 | | | — |

| | Residential real estate mortgage | | 446 | | | 412 | | | 869 | | | 534 | | | 555 |

| | Consumer | | 3,134 | | | 1,834 | | | 956 | | | 886 | | | 777 |

| |

|

| | | Total Chargeoffs | | 5,358 | | | 3,899 | | | 3,583 | | | 2,532 | | | 1,920 |

| |

|

| Recoveries | | | | | | | | | | | | | | |

| | Commercial | | 258 | | | 65 | | | 46 | | | 123 | | | 160 |

| | Commercial real estate mortgage | | — | | | — | | | — | | | 2 | | | 43 |

| | Residential real estate mortgage | | 26 | | | 66 | | | 35 | | | 43 | | | 54 |

| | Consumer | | 868 | | | 405 | | | 203 | | | 178 | | | 252 |

| |

|

| | | Total Recoveries | | 1,152 | | | 536 | | | 284 | | | 346 | | | 509 |

| |

|

| Net Chargeoffs | | 4,206 | | | 3,363 | | | 3,299 | | | 2,186 | | | 1,411 |

| Addition resulting from acquisition | | — | | | 3,895 | | | 1,002 | | | 1,775 | | | 2,078 |

| Provision for loan losses | | 5,745 | | | 1,819 | | | 1,040 | | | 600 | | | 1,325 |

| |

|

| Balance at December 31 | $ | 14,331 | | $ | 12,792 | | $ | 10,441 | | $ | 11,698 | | $ | 11,509 |

| |

|

| Net Chargeoffs to average loans | | 0.26% | | | 0.25% | | | 0.35% | | | 0.24% | | | 0.18% |

| Provision for loan losses to average loans | | 0.36% | | | 0.13% | | | 0.11% | | | 0.07% | | | 0.17% |

| Allowance to total loans at year end | | 0.85% | | | 0.81% | | | 1.09% | | | 1.26% | | | 1.35% |

| |

|

Allocation of the Allowance for Loan Losses

| 2007

| | 2006

| | 2005

| | 2004

| | 2003

| |

|---|

December 31

| Amount

| | Percent of loans to total loans

| | Amount

| | Percent of loans to total loans

| | Amount

| | Percent of loans to total loans

| | Amount

| | Percent of loans to total loans

| | Amount

| | Percent of loans to total loans

| |

|---|

| |

|---|

| Real estate | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Residential | $ | 2,652 | | 46 | % | $ | 2,514 | | 50 | % | $ | 1,018 | | 39 | % | $ | 1,123 | | 38 | % | $ | 1,230 | | 37 | % |

| | Farm real estate | | 251 | | 3 | | | 247 | | 3 | | | 625 | | 4 | | | 681 | | 4 | | | 704 | | 4 | |

| | Commercial | | 4,386 | | 22 | | | 4,045 | | 21 | | | 3,233 | | 21 | | | 3,997 | | 23 | | | 3,907 | | 21 | |

| | Construction and development | | 1,085 | | 7 | | | 359 | | 5 | | | 763 | | 5 | | | 648 | | 4 | | | 658 | | 4 | |

| |

| |

| | | Total real estate | | 8,374 | | 78 | | | 7,165 | | 79 | | | 5,639 | | 69 | | | 6,449 | | 69 | | | 6,499 | | 66 | |

| |

| |

| Commercial | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Agribusiness | | 167 | | 2 | | | 138 | | 2 | | | 412 | | 3 | | | 464 | | 3 | | | 491 | | 3 | |

| | Other commercial | | 2,593 | | 13 | | | 2,189 | | 11 | | | 2,440 | | 16 | | | 2,831 | | 17 | | | 3,003 | | 19 | |

| |

| |

| | | Total Commercial | | 2,760 | | 15 | | | 2,327 | | 13 | | | 2,852 | | 19 | | | 3,295 | | 20 | | | 3,494 | | 22 | |

| |

| |

| Consumer | | 3,114 | | 7 | | | 2,053 | | 8 | | | 1,435 | | 12 | | | 1,581 | | 11 | | | 1,053 | | 12 | |

| Unallocated | | 83 | | | | | 1,247 | | | | | 515 | | | | | 373 | | | | | 463 | | | |

| |

| |

| | | Total | $ | 14,331 | | 100 | % | $ | 12,792 | | 100 | % | $ | 10,441 | | 100 | % | $ | 11,698 | | 100 | % | $ | 11,509 | | 100 | % |

| |

| |

The unallocated portion of the Company's allowance for loan losses increased significantly in 2006 as a result of the three whole bank acquisitions and those banks' differing approaches to computing the allowance. During 2007, the acquired entities' loans were subject to the Company's loan review process and fully integrated into the Company's allowance for loan losses allocation methodology. As a result of this process, the allowance dollars were allocated to the appropriate loan categories and the unallocated portion decreased.

Management maintains a list of loans warranting either the assignment of a specific reserve amount or other special administrative attention. This watch list, together with a listing of all classified loans, nonaccrual loans and delinquent loans, is reviewed monthly by the Board of Directors of each banking subsidiary. Additionally, the Company evaluates its consumer and

18

residential real estate loan pools for probable losses incurred based on historical trends, adjusted by current delinquency and non-performing loan levels.

The ability to absorb loan losses promptly when problems are identified is invaluable to a banking organization. Most often, losses incurred as a result of prompt, aggressive collection actions are much lower than losses incurred after prolonged legal proceedings. Accordingly, the Company observes the practice of quickly initiating stringent collection efforts in the early stages of loan delinquency.

The adequacy of the allowance for loan losses in each subsidiary is reviewed at least quarterly. The determination of the provision amount in any period is based upon management's continuing review and evaluation of loan loss experience, changes in the composition of the loan portfolio, classified loans including non-accrual and impaired loans, current economic conditions, the amount of loans presently outstanding, and the amount and composition of loan growth. The Company's allowance for loan losses was $14,331, or 0.85% of total loans, at December 31, 2007 compared to $12,792, or 0.81% of total loans, at the end of 2006.