Use these links to rapidly review the document

TABLE OF CONTENTS

Table of Contents

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D. C. 20549

FORM 10-K

Annual Report Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

For the fiscal year ended December 31, 2012

Commission file number 0-12422

MAINSOURCE FINANCIAL GROUP, INC.

(Exact name of registrant as specified in its charter)

| | |

Indiana

(State or other jurisdiction

of incorporation or organization) | | 35-1562245

(I.R.S. Employer

Identification No.) |

2105 North State Road 3 Bypass

Greensburg, Indiana 47240

(Address of principal executive offices) (Zip code) |

Registrant's telephone number, including area code:(812) 663-6734 |

Securities registered pursuant to Section 12(b) of the Act: |

Title of each class

Common shares, no par value |

|

Name of each exchange on which registered

The NASDAQ Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act:

None |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the previous 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of "large accelerated filer", "accelerated filer", and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

| | | | | | |

| Large accelerated filero | | Accelerated filerý | | Non-accelerated filero | | Smaller reporting companyo |

| | | | | (Do not check if a smaller

reporting company) | | |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yeso Noý

The aggregate market value (not necessarily a reliable indication of the price at which more than a limited number of shares would trade) of the voting stock held by non-affiliates of the registrant was $239,915,062 as of June 30, 2012.

As of March 14, 2013, there were outstanding 20,326,725 common shares, without par value, of the registrant.

DOCUMENTS INCORPORATED BY REFERENCE

| | |

Documents | | Part of Form 10-K

Into Which Incorporated |

|---|

Definitive Proxy Statement for Annual

Meeting of Shareholders to be held

April 23, 2013 | | Part III (Items 10 through 14) |

1

Table of Contents

FORM 10-K

TABLE OF CONTENTS

Pursuant to General Instruction G, the information called for by Items 10-14 is omitted by MainSource Financial Group, Inc. since MainSource Financial Group, Inc. will file with the Commission a definitive proxy statement for its 2013 Annual Meeting of Shareholders pursuant to Regulation 14A not later than 120 days after the close of the fiscal year containing the information required by Items 10-14.

2

Table of Contents

PART I.

(Dollar amounts in thousands except per share data)

ITEM 1. BUSINESS

General

MainSource Financial Group, Inc. ("MainSource" or the "Company") is an Indiana corporation and bank holding company, within the meaning of the Bank Holding Company Act of 1956, as amended (the "BHC Act"), that has elected to become a financial holding company ("FHC"). The Company is based in Greensburg, Indiana. As of December 31, 2012, the Company operated one banking subsidiary: MainSource Bank ("the Bank"), an Indiana state chartered bank. Through its non-bank affiliates, the Company provides services incidental to the business of banking. Since its formation in 1982, the Company has acquired and established various institutions and financial services companies and may acquire additional financial institutions and financial services companies in the future. For further discussion of the business of the Company see Management's Discussion and Analysis in Part II, Item 7.

As of December 31, 2012, the Company operated 78 branch banking offices in Indiana, Illinois, Ohio and Kentucky. As of December 31, 2012, the Company had consolidated assets of $2,769,288, consolidated deposits of $2,185,054 and shareholders' equity of $323,751.

Through the Bank, the Company offers a broad range of financial services, including: accepting time and transaction deposits; making consumer, commercial, agribusiness and real estate mortgage loans; renting safe deposit facilities; providing personal and corporate trust services; and providing other corporate services such as letters of credit and repurchase agreements.

The lending activities of the Bank are separated into primarily the categories of commercial, commercial real estate, residential, and consumer. Loans are originated by the lending officers of the Bank subject to limitations set forth in lending policies. The Board of Directors of the Bank monitors concentrations of credit, problem and past due loans and charge-offs of uncollectible loans and approves loan policy. The Bank maintains conservative loan policies and underwriting practices in order to address and manage loan risks. These policies and practices include granting loans on a sound and collectible basis, serving the legitimate needs of the community and the general market area while obtaining a balance between maximum yield and minimum risk, ensuring that primary and secondary sources of repayment are adequate in relation to the amount of the loan, developing and maintaining adequate diversification of the loan portfolio as a whole and of the loans within each category and developing and applying adequate collection policies.

Commercial loans include secured and unsecured loans, including real estate loans, to individuals and companies and to governmental units predominantly within the market area of the Bank for a myriad of business purposes.

Agricultural loans are generated in the Bank's markets. Most of the loans are real estate loans on farm properties. Loans are also made for agricultural production and such loans are generally reviewed annually.

Residential real estate lending has been the largest component of the loan portfolio for many years. The Bank generates residential mortgages for its own portfolio. However, the Company elects to sell the majority of its fixed rate mortgages into the secondary market while maintaining the servicing of such loans. At December 31, 2012, the Company was servicing a $758 million residential real estate loan portfolio. By originating loans for sale in the secondary market, the Company can more fully satisfy customer demand for fixed rate residential mortgages and increase fee income, while reducing the risk of loss caused by rising interest rates.

The principal source of revenues for the Company is interest and fees on loans, which accounted for 55.0% of total revenues in 2012, 55.7% in 2011 and 59.8% in 2010. While the Company's chief decision makers monitor the revenue streams of the various Company products and services, the identifiable segments are not material and operations are managed and financial performance is evaluated on a Company-wide basis. Accordingly, all of the Company's financial service operations are considered by management to be aggregated in one reportable operating segment.

The Company's investment securities portfolio is primarily comprised of state and municipal bonds; U. S. government sponsored entity's mortgage-backed securities and collateralized mortgage obligations; and corporate securities. The Company has classified its entire investment portfolio as available for sale, with fair value changes reported separately in shareholders' equity. Funds invested in the investment portfolio generally represent funds not immediately required to meet loan demand. Income related to the Company's investment portfolio accounted for 16.2% of total revenues in 2012, 17.0% in 2011 and 16.6% in 2010. As of December 31, 2012, the Company had not identified any securities as being "high risk" as defined by the FFIEC Supervisory Policy Statement on Securities Activities.

The primary source of funds for the Bank is deposits generated in local market areas. To attract and retain stable depositors, the Bank markets various programs for demand, savings and time deposit accounts. These programs include interest and non-interest bearing demand and individual retirement accounts.

3

Table of Contents

Currently, national retailing and manufacturing subsidiaries, brokerage and insurance firms and credit unions are fierce competitors within the financial services industry. Mergers between financial institutions within Indiana and neighboring states, which became permissible under the Interstate Banking and Branching Efficiency Act of 1994, have also added competitive pressure.

The branches of the Bank are predominantly located in non-metropolitan areas and the Bank's business is centered in loans and deposits generated within markets considered largely rural in nature. In addition to competing vigorously with other banks, thrift institutions, credit unions and finance companies located within their service areas, we also compete, directly and indirectly, with all providers of financial services.

Employees

As of December 31, 2012, the Company and its subsidiaries had 808 full-time equivalent employees to whom they provide a variety of benefits and with whom they enjoy excellent relations. None of our employees are subject to collective bargaining agreements.

Regulation and Supervision

The Company is a financial holding company ("FHC") within the meaning of the Bank Holding Company Act of 1956, as amended. As a FHC, the Company is subject to regulation by the Federal Reserve Board ("FRB"). The Bank is an Indiana state chartered bank subject to supervision and regulation by the Federal Deposit Insurance Corporation ("FDIC") and the Indiana Department of Financial Institutions. The following is a discussion of material statutes and regulations affecting the Company and the Bank. The discussion is qualified in its entirety by reference to such statutes and regulations.

Bank Holding Company Act of 1956, as amended

Generally, the BHC Act governs the acquisition and control of banks and nonbanking companies by bank holding companies. A bank holding company is subject to regulation by and is required to register with the FRB under the BHC Act. The BHC Act requires a bank holding company to file an annual report of its operations and such additional information as the FRB may require. The FRB has issued regulations under the BHC Act requiring a bank holding company to serve as a source of financial and managerial strength to its subsidiary banks. It is the policy of the FRB that, pursuant to this requirement, a bank holding company should stand ready to use its resources to provide adequate capital funds to its subsidiary banks during periods of financial stress or adversity.

The acquisition of 5% or more of the voting shares of any bank or bank holding company generally requires the prior approval of the FRB and is subject to applicable federal and state law, including the Riegle-Neal Interstate Banking and Branching Efficiency Act of 1994 ("Riegle-Neal") for interstate transactions. The FRB evaluates acquisition applications based on, among other things, competitive factors, supervisory factors, adequacy of financial and managerial resources, and banking and community needs considerations.

The BHC Act also prohibits, with certain exceptions, a bank holding company from acquiring direct or indirect ownership or control of more than 5% of the voting shares of any "nonbanking" company unless the nonbanking activities are found by the FRB to be "so closely related to banking…as to be a proper incident thereto." Under current regulations of the FRB, a bank holding company and its nonbank subsidiaries are permitted, among other activities, to engage in such banking-related business ventures as consumer finance, equipment leasing, data processing, mortgage banking, financial and investment advice, and securities brokerage services. The BHC Act does not place territorial restrictions on the activities of a bank holding company or its nonbank subsidiaries.

Federal law prohibits acquisition of "control" of a bank or bank holding company without prior notice to certain federal bank regulators. "Control" is defined in certain cases as the acquisition of as little as 10% of the outstanding shares of any class of voting stock. Furthermore, under certain circumstances, a bank holding company may not be able to purchase its own stock, where the gross consideration will equal 10% or more of the company's net worth, without obtaining approval of the FRB. Under the Federal Reserve Act, banks and their affiliates are subject to certain requirements and restrictions when dealing with each other (affiliate transactions include transactions between a bank and its bank holding company).

The Gramm-Leach-Bliley Financial Modernization Act of 1999 (the "Modernization Act") was enacted on November 12, 1999. The Modernization Act, which amended the BHC Act, provides the following:

- •

- it allows bank holding companies that qualify as "financial holding companies" to engage in a broad range of financial and related activities;

- •

- it allows insurers and other financial services companies to acquire banks;

4

Table of Contents

- •

- it removes various restrictions that applied to bank holding company ownership of securities firms and mutual fund advisory companies; and

- •

- it establishes the overall regulatory structure applicable to bank holding companies that also engage in insurance and securities operations.

The Company initially qualified as a financial holding company in December, 2004. Thus the Company is authorized to operate as a financial holding company and is eligible to engage in, or acquire companies engaged in, the broader range of activities that are permitted by the Modernization Act. These activities include those that are determined to be "financial in nature," including insurance underwriting, securities underwriting and dealing, and making merchant banking investments in commercial and financial companies. If a banking subsidiary ceases to be "well capitalized" or "well managed" under applicable regulatory standards, the FRB may, among other things, place limitations on our ability to conduct these broader financial activities or, if the deficiencies persist, require us to divest the banking subsidiary. In addition, if a banking subsidiary receives a rating of less than satisfactory under the Community Reinvestment Act of 1977 ("CRA"), we would be prohibited from engaging in any additional activities other than those permissible for bank holding companies that are not financial holding companies.

In 1970, Congress enacted the Currency and Foreign Transactions Reporting Act, commonly known as the Bank Secrecy Act (the "BSA"). The BSA requires financial institutions to maintain records of certain customers and currency transactions and to report certain domestic and foreign currency transactions, which may have a high degree of usefulness in criminal, tax, or regulatory investigations or proceedings. Under this law, financial institutions are required to develop a BSA compliance program.

In 2001, the President signed into law comprehensive anti-terrorism legislation known as the USA Patriot Act. Title III of the USA Patriot Act requires financial institutions, including the Company and the Bank, to help prevent and detect international money laundering and the financing of terrorism and prosecute those involved in such activities. The Department of the Treasury has adopted additional requirements to further implement Title III.

Under these regulations, a mechanism has been established for law enforcement officials to communicate names of suspected terrorists and money launderers to financial institutions to enable financial institutions to promptly locate accounts and transactions involving those suspects. Financial institutions receiving names of suspects must search their account and transaction records for potential matches and report positive results to the U.S. Department of the Treasury Financial Crimes Enforcement Network ("FinCEN"). Each financial institution must designate a point of contact to receive information requests. These regulations outline how financial institutions can share information concerning suspected terrorist and money laundering activity with other financial institutions under the protection of a statutory safe harbor if each financial institution notifies FinCEN of its intent to share information. The Department of the Treasury has also adopted regulations intended to prevent money laundering and terrorist financing through correspondent accounts maintained by U.S. financial institutions on behalf of foreign banks. Financial institutions are required to take reasonable steps to ensure that they are not providing banking services directly or indirectly to foreign shell banks. In addition, banks must have procedures in place to verify the identity of the persons with whom they deal.

The Federal Deposit Insurance Corporation Improvement Act of 1991 ("FDICIA") requires, among other things, federal bank regulatory authorities to take "prompt corrective action" with respect to banks which do not meet minimum capital requirements. For these purposes, FDICIA establishes five capital tiers: well capitalized, adequately capitalized, undercapitalized, significantly undercapitalized and critically undercapitalized. The FDIC has adopted regulations to implement the prompt corrective action provisions of FDICIA.

"Undercapitalized" banks are subject to growth limitations and are required to submit a capital restoration plan. A bank's compliance with such plan is required to be guaranteed by the bank's parent holding company. If an "undercapitalized" bank fails to submit an acceptable plan, it is treated as if it is significantly undercapitalized. "Significantly undercapitalized" banks are subject to one or more restrictions, including an order by the FDIC to sell sufficient voting stock to become adequately capitalized, requirements to reduce total assets and cease receipt of deposits from correspondent banks, and restrictions on compensation of executive officers. "Critically undercapitalized" institutions may not, beginning 60 days after becoming "critically undercapitalized," make any payment of principal or interest on certain subordinated debt or extend credit for a highly leveraged transaction or enter into any transaction outside the ordinary course of business. In addition, "critically undercapitalized" institutions are subject to appointment of a receiver or conservator.

A "well capitalized" institution is one that has a total risk-based capital ratio of at least 10%, a Tier 1 risk-based capital ratio of at least 6%, a leverage ratio of at least 5% and is not subject to regulatory direction to maintain a specific level for any capital measure. An "adequately capitalized" institution is one that has ratios greater than 8%, 4% and 4%. An institution is "undercapitalized" if its respective ratios are less than 8%, 4% and 4%. "Significantly undercapitalized" institutions have ratios of

5

Table of Contents

less than 6%, 3% and 3%. An institution is deemed to be "critically undercapitalized" if it has a ratio of tangible equity to total assets that is 2% or less.

The Sarbanes-Oxley Act of 2002 (the "Sarbanes-Oxley Act") represents a comprehensive revision of laws affecting corporate governance, accounting obligations and corporate reporting. Among other requirements, the Sarbanes-Oxley Act established: (i) requirements for audit committees of public companies, including independence and expertise standards; (ii) additional responsibilities regarding financial statements for the chief executive officers and chief financial officers of reporting companies; (iii) standards for auditors and regulation of audits; (iv) increased disclosure and reporting obligations for reporting companies regarding various matters relating to corporate governance, and (v) new and increased civil and criminal penalties for violation of the securities laws.

The deposits of the Bank are insured to the maximum extent permitted by law by the Deposit Insurance Fund ("DIF") of the FDIC, which was created in 2006 as the result of the merger of the Bank Insurance Fund and the Savings Association Insurance Fund in accordance with the Federal Deposit Insurance Reform Act of 2005 (the "FDI Act"). The FDIC maintains the DIF by assessing depository institutions an insurance premium. Pursuant to the Dodd-Frank Act, the FDIC is required to set a DIF reserve ratio of 1.35% of estimated insured deposits and is required to achieve this ratio by September 30, 2020. Also, the Dodd-Frank Act has eliminated the 1.50% ceiling on the reserve ratio and provides that the FDIC is no longer required to refund amounts in the DIF that exceed 1.50% of insured deposits.

Under the FDIC's risk-based assessment system, insured institutions are required to pay deposit insurance premiums based on the risk that each institution poses to the DIF. An institution's risk to the DIF is measured by its regulatory capital levels, supervisory evaluations, and certain other factors. An institution's assessment rate depends upon the risk category to which it is assigned. As noted above, pursuant to the Dodd-Frank Act, the FDIC will calculate an institution's assessment level based on its total average consolidated assets during the assessment period less average tangible equity (i.e., Tier 1 capital) as opposed to an institution's deposit level which was the previous basis for calculating insurance assessments. Pursuant to the Dodd-Frank Act, institutions will be placed into one of four risk categories for purposes of determining the institution's actual assessment rate. The FDIC will determine the risk category based on the institution's capital position (well capitalized, adequately capitalized, or undercapitalized) and supervisory condition (based on exam reports and related information provided by the institution's primary federal regulator).

The Company is a legal entity separate and distinct from the Bank. There are various legal limitations on the extent to which the Bank can supply funds to the Company. The principal source of the Company's funds consists of dividends from the Bank. State and Federal law restricts the amount of dividends that may be paid by banks. In addition, the Bank is subject to certain restrictions on extensions of credit to the Company, on investments in the stock or other securities of the Company and in taking such stock or securities as collateral for loans.

The Community Reinvestment Act requires that the federal banking regulators evaluate the records of a financial institution in meeting the credit needs of its local community, including low and moderate income neighborhoods. These factors are also considered in evaluating mergers, acquisitions, and applications to open a branch or facility. Failure to adequately meet these criteria could result in the imposition of additional requirements and limitations on the Bank.

As discussed above, the Company and the Bank must meet certain minimum capital requirements mandated by each of their state or federal regulators. These regulatory agencies require BHCs and banks to maintain certain minimum ratios of primary capital to total assets and total capital to total assets. The FRB requires BHCs to maintain a minimum Tier 1 leverage ratio of 3% capital to total assets; however, for all but the most highly rated institutions which do not anticipate significant growth, the minimum Tier 1 leverage ratio is 3% plus an additional cushion of 100 to 200 basis points. As of December 31, 2012, the Company's leverage ratio of capital to total assets was 10.4%. The FRB and FDIC each have approved the imposition of "risk-adjusted" capital ratios on BHCs and financial institutions. The Company's Tier 1 Capital to Risk-Weighted Assets Ratio was 16.5% and its Total Capital to Risk-Weighted Assets Ratio was 17.8% at December 31, 2012. The Bank had capital to asset ratios and risk- adjusted capital ratios at December 31, 2012, in excess of the applicable minimum regulatory requirements.

6

Table of Contents

In October 2008, the Emergency Economic Stabilization Act of 2008 ("EESA") was enacted. The EESA authorized Treasury to purchase from financial institutions and their holding companies up to $700 billion in mortgage loans, mortgage- related securities and certain other financial instruments, including debt and equity securities issued by financial institutions and their holding companies in a troubled asset relief program ("TARP"). The purpose of TARP was to restore confidence and stability to the U.S. banking system and to encourage financial institutions to increase their lending to customers and to each other. EESA also increased the amount of deposit insurance provided by the FDIC.

The U.S. Department of the Treasury ("Treasury"), working with the Federal Reserve Board, established late in 2008 the TARP Capital Purchase Program ("CPP"), which was intended to stabilize the financial services industry. One of the components of the CPP included a $250 billion voluntary capital purchase program for certain qualified and healthy banking institutions. Pursuant to the CPP, Treasury purchased from the Company 57,000 shares of $1,000 par value senior perpetual preferred securities at a price of $57 million equal to approximately 3.0% of the Company's then risk-weighted assets. Such preferred shares pay a dividend of 5% for the first five years and will increase to 9% thereafter. In connection with the Company's participation in the CPP, Treasury also received a warrant for the purchase of common stock in the amount of 571,906 shares at a strike price of $14.95 per share. The warrant expires on January 16, 2019. During 2012, Treasury auctioned off the Company's preferred shares to third parties. The Company was successful in repurchasing some of these shares and on two separate occasions during 2012, repurchased some additional shares from third parties. As of December 31, 2012, 15,100 shares of Series A preferred stock remained outstanding. See Note 2 in the Consolidated Financial Statements for further discussion of the preferred shares.

On February 17, 2009, President Barack Obama signed the American Recovery and Reinvestment Act of 2009 ("ARRA"), more commonly known as the economic stimulus or economic recovery package. ARRA included a wide variety of programs intended to stimulate the economy and provide for extensive infrastructure, energy, health and education needs. In addition, ARRA imposed new executive compensation and corporate governance limits on current and future participants in the CPP, including the Company, which are in addition to those previously announced by Treasury. These limits remain in place until the participant has redeemed the preferred stock sold to Treasury, which is now permitted under ARRA without penalty and without the need to raise new capital, subject to Treasury's consultation with the recipient's appropriate federal regulator. On June 10, 2009, Treasury released an interim final rule, effective June 15, 2009, that provided guidance on the compensation and governance standards for participants in the CPP, and promulgated regulations to implement the restrictions and standards set forth in ARRA. Among other things, Treasury's final rule and ARRA significantly expanded the executive compensation restrictions previously imposed by EESA. As of April 3, 2012, the date the U.S. Treasury no longer held any shares of the Company's preferred stock issued under the CPP, the Company was no longer subject to the ARRA or EESA restrictions.

On July 21, 2010, President Obama signed into law the sweeping financial regulatory reform act entitled the "Dodd-Frank Wall Street Reform and Consumer Protection Act" (Dodd-Frank Act). The Dodd-Frank Act implements far-reaching changes to the regulation of the financial services industry, including provisions that, among other things will:

- •

- centralize responsibility for consumer financial protection by creating a new agency (the Consumer Financial Protection Bureau) responsible for implementing, examining and enforcing compliance with federal consumer financial laws with broad rulemaking, supervision and enforcement authority for a wide range of consumer protection laws that would apply to all banks and thrifts; smaller financial institutions, including the Company, will be subject to the supervision and enforcement of their primary federal banking regulator with respect to the federal consumer financial protection laws;

- •

- require the FDIC to seek to make its capital requirements for banks countercyclical so that the amount of capital required to be maintained increases in times of economic expansion and decreases in times of economic contraction;

- •

- change the assessment base for federal deposit insurance from the amount of insured deposits to consolidated assets less tangible capital;

- •

- implement corporate governance revisions, including with regard to executive compensation and proxy access by stockholders, that apply to all public companies, not just financial institutions;

- •

- make permanent the $250,000 limit for federal deposit insurance and increase the cash limit of Securities Investor Protection Corporation protection from $100,000 to $250,000, and provide unlimited federal deposit insurance until January 1, 2013, for non-interest bearing demand transaction accounts at all insured depository institutions;

- •

- repeal the federal prohibitions on the payment of interest on demand deposits, thereby permitting depository institutions to pay interest on business transaction and other accounts starting July 2011; and

7

Table of Contents

- •

- increase the authority of the Federal Reserve to examine the Company and its non-bank subsidiaries.

The Dodd-Frank Act includes certain provisions concerning the capital regulations of the United States banking regulators, which are often referred to as the "Collins Amendment." These provisions are intended to subject bank holding companies to the same capital requirements as their bank subsidiaries and to eliminate or significantly reduce the use of hybrid capital instruments, especially trust preferred securities, as regulatory capital. Under the Collins Amendment, trust preferred securities issued by a company, such as the Company, with total consolidated assets of less than $15 billion before May 19, 2010 and treated as regulatory capital are grandfathered, but any such securities issued later are not eligible as regulatory capital. The banking regulators must develop regulations setting minimum risk-based and leverage capital requirements for holding companies and banks on a consolidated basis that are no less stringent than the generally applicable requirements in effect for depository institutions under prompt corrective action regulations. The banking regulators also must seek to make capital standards countercyclical so that the required levels of capital increase in times of economic expansion and decrease in times of economic contraction.

Many aspects of the act are subject to rulemaking and will take effect over several years, making it difficult to anticipate the overall financial impact on the Company, its customers or the financial industry more generally. Provisions in the legislation that affect deposit insurance assessments and payment of interest on demand deposits could increase the costs associated with deposits as well as place limitations on certain revenues those deposits may generate.

Regulations issued under the Secure and Fair Enforcement for Mortgage Licensing Act of 2008 (the "S.A.F.E. Act") require residential mortgage loan originators who are employees of institutions regulated by the foregoing agencies, including national banks, to meet the registration requirements of the S.A.F.E. Act. The S.A.F.E. Act requires residential mortgage loan originators who are employees of regulated financial institutions to be registered with the Nationwide Mortgage Licensing System and Registry, a database created by the Conference of State Bank Supervisors and the American Association of Residential Mortgage Regulators to support the licensing of mortgage loan originators by the states. Employees of regulated financial institutions are generally prohibited from originating residential mortgage loans unless they are registered.

In December 2010, the Basel Committee released its final framework for strengthening international capital and liquidity regulation, officially identified by the Basel Committee as "Basel III". In June 2012, the Federal Reserve Board, OCC, and FDIC (collectively, the "Agencies") each issued Notices of Proposed Rulemaking ("NPRs") that would revise and replace the Agencies' current capital rules to align with the BASEL III capital standards and meet certain requirements of the Dodd-Frank Act. The comment period for the NPRs ended October 22, 2012, and comments received by such deadline are currently being evaluated by the Agencies.

The standards set forth in the NPRs, when implemented by the Agencies and fully phased-in, will require bank holding companies and their bank subsidiaries to maintain substantially more capital, with a greater emphasis on common equity.

As set forth in the NPRs, the new capital rules would, among other things:

- •

- Narrow the types of instruments that can be included in Tier 1 Capital (including removing trust preferred securities from such definition);

- •

- Introduce a new Common Equity Tier 1 Capital Ratio of 6.5% (to be well-capitalized);

- •

- Increase the Tier 1 Capital Ratio from 4% to 6%; and

- •

- Introduce a capital conservation buffer of an additional 2.5% of common equity to risk-weighted assets.

The timing for the Agencies' adoption and implementation of final rules to implement the Basel III/Dodd-Frank Act capital framework is uncertain. Accordingly, the regulations ultimately applicable to the Company and the Bank may be substantially different from the Basel III final framework as published in December 2010 (and updated in 2011) or the NPRs. The requirements to maintain higher levels of capital or to maintain higher levels of liquid assets could adversely impact the Company's financial results.

In addition to the specific legislation described above, various additional legislation is currently being considered by Congress. This legislation may change banking statutes and the Company's operating environment in substantial and unpredictable ways and may increase reporting requirements and governance. If enacted, such legislation could increase or decrease the cost of doing business, limit or expand permissible activities, or affect the competitive balance among banks, savings associations, credit unions, and other financial institutions. The Company cannot predict whether any potential legislation will be enacted and, if enacted, the effect that it, or any implementing regulations, would have on its business, results of operations, or financial condition.

8

Table of Contents

ITEM 1A. RISK FACTORS

In addition to the other information contained in this report, the following risks may affect us. If any of these risks actually occur, our business, financial condition or results of operations may suffer. As a result, the price of our common shares could decline.

Risks Related to the Company's Business

Difficult conditions in the capital markets and the economy generally have affected and may continue to materially adversely affect our business and results of operations.

From 2007 through 2009, the U.S. economy was in recession. Business activity across a wide range of industries and regions in the U.S. was greatly reduced. Although economic conditions have begun to improve, certain sectors, such as real estate, remain weak and unemployment remains high. Local governments and many businesses are still in serious difficulty due to lower consumer spending and the lack of liquidity in the credit markets.

Market conditions also led to the failure or merger of several prominent financial institutions and numerous regional and community-based financial institutions. These failures, as well as projected future failures, have had a significant negative impact on the capitalization level of the deposit insurance fund of the FDIC, which, in turn, has led to a significant increase in deposit insurance premiums paid by financial institutions.

The Company's financial performance generally, and in particular the ability of borrowers to pay interest on and repay principal of outstanding loans and the value of collateral securing those loans, as well as demand for loans and other products and services that the Company offers, is highly dependent upon the business environment in the markets where the Company operates and in the United States as a whole. A favorable business environment is generally characterized by, among other factors, economic growth, efficient capital markets, low inflation, low unemployment, high business and investor confidence, and strong business earnings. Unfavorable or uncertain economic and market conditions can be caused by declines in economic growth, business activity or investor or business confidence; limitations on the availability or increases in the cost of credit and capital; increases in inflation or interest rates; high unemployment, natural disasters, or a combination of these or other factors.

During 2011 and 2012, the business environment continued to be adverse for many households and businesses in the United States and worldwide. While economic conditions in the United States and worldwide have begun to improve, there can be no assurance that this improvement will continue. Such conditions have affected, and could continue to adversely affect, the credit quality of the Company's loans, results of operations and financial condition.

Recently enacted and potential further financial regulatory reforms could have a significant impact on our business, financial condition and results of operations.

On July 21, 2010, President Obama signed the Dodd-Frank Wall Street Reform and Consumer Protection Act (the "Dodd-Frank Act") into law. The Dodd-Frank Act is expected to have a broad impact on the financial services industry, including significant regulatory and compliance changes. Many of the requirements called for in the Dodd-Frank Act will be implemented over time and most will be subject to implementing regulations over the course of several years. Given the uncertainty associated with the manner in which the provisions of the Dodd-Frank Act will be implemented by the various regulatory agencies and through regulations, the full extent of the impact such requirements will have on our operations is unclear. The changes resulting from the Dodd-Frank Act may impact the profitability of business activities, require changes to certain business practices, impose more stringent capital, liquidity and leverage requirements or otherwise adversely affect our business. In particular, the potential impact of the Dodd-Frank Act on our operations and activities, both currently and prospectively, include, among others:

- •

- a reduction in the ability to generate or originate revenue-producing assets as a result of compliance with heightened capital standards;

- •

- increased cost of operations due to greater regulatory oversight, supervision and examination of banks and bank holding companies, and higher deposit insurance premiums;

- •

- the limitation on the ability to raise new capital through the use of trust preferred securities, as any new issuances of these securities will no longer be included as Tier 1 capital going forward;

- •

- a potential reduction in fee income due to limits on interchange fees applicable to larger institutions which could effectively reduce the fees we can charge; and

- •

- the limitation on the ability to expand consumer product and service offerings due to anticipated stricter consumer protection laws and regulations.

Further, we may be required to invest significant management attention and resources to evaluate and make any changes necessary to comply with new statutory and regulatory requirements under the Dodd-Frank Act, which may negatively impact results of operations and financial condition.

9

Table of Contents

We cannot predict whether there will be additional proposed laws or reforms that would affect the U.S. financial system or financial institutions, whether or when such changes may be adopted, how such changes may be interpreted and enforced or how such changes may affect us. However, the costs of complying with any additional laws or regulations could have a material adverse effect on our financial condition and results of operations.

The new Basel III capital rules proposed in August 2012 by the Federal Reserve and the FDIC to implement the Basel III capital guidelines may adversely affect the Company's and the Bank's capital adequacy and the costs of conducting its business.

If adopted and effective in their current form, many of these proposals will be applicable to the Company and the Bank, and will include several significant changes, including changes to the definition of "capital" for regulatory purposes, the types and minimum levels of capital required under the prompt corrective action rules and for other regulatory purposes and the risk-weighting of various assets. In addition, among other things, for bank holding companies with under $15 billion in assets, trust preferred securities will be phased out as Tier 1 capital over 10 years. Based on the current components and levels of our capital and assets, we believe that we would be in compliance with the requirements in the proposed rules if they were currently in effect. There is no assurance that the Basel III proposals will be adopted in their current form, what changes may be made prior to adoption, or when the final rules will be effective. Until the proposals are finalized and the timing of implementation of the new rules is determined, some uncertainty will exist with respect to the impact of the rules on us and the banking industry generally.

Like most banking organizations, a significant portion of our assets consists of loans, which if not repaid could result in losses to the Company.

As a lender, we are exposed to the risk that our customers will be unable to repay their loans according to their terms and that the collateral securing the payment of their loans (if any) may not be sufficient to assure repayment. Credit losses could have a material adverse effect on our operating results.

As of December 31, 2012, our total loan portfolio was approximately $1,553,383 or 56% of our total assets. Three major components of the loan portfolio are loans principally secured by real estate, approximately $1,345,354 or 87% of total loans; other commercial loans, approximately $159,734 or 10% of total loans; and consumer loans, approximately $48,295 or 3% of total loans. Our credit risk with respect to our consumer installment loan portfolio and commercial loan portfolio relates principally to the general creditworthiness of individuals and businesses within our local market area. Our credit risk with respect to our residential and commercial real estate mortgage and construction loan portfolio relates principally to the general creditworthiness of individuals and businesses and the value of real estate serving as security for the repayment of the loans. A related risk in connection with loans secured by commercial real estate is the effect of unknown or unexpected environmental contamination, which could make the real estate effectively unmarketable or otherwise significantly reduce its value as security. Continued or worsening declines in the economy could cause additional credit issues, particularly within our residential and commercial real estate mortgage and construction loan portfolio.

Our allowance for loan losses may not be sufficient to cover actual loan losses, which could adversely affect our earnings.

We maintain an allowance for loan losses at a level estimated by management to be sufficient to cover probable incurred loan losses in our loan portfolio. Loan losses will likely occur in the future and may occur at a rate greater than we have experienced to date. In determining the size of the allowance, our management makes various assumptions and judgments about the collectability of our loan portfolio, including the diversification by industry of our commercial loan portfolio, the effect of changes in the local real estate markets on collateral values, the results of recent regulatory examinations, the effects on the loan portfolio of current economic indicators and their probable impact on borrowers, the amount of charge-offs for the period, the amount of nonperforming loans and related collateral security, and the evaluation of our loan portfolio by an external loan review. If our assumptions and judgments prove to be incorrect, our current allowance may not be sufficient and adjustments may be necessary to allow for different economic conditions or adverse developments in our loan portfolio. Additionally, continuing deterioration in economic conditions affecting borrowers, new information regarding existing loans, identification of additional problem loans and other factors, both within and outside the Company's control, may require an increase in the allowance for loan losses. Federal and state regulators also periodically review our allowance for loan losses and may require us to increase our provision for loan losses or recognize further loan charge-offs, based on judgments different than those of our management. Any increase in our allowance for loan losses or loan charge-offs could have an adverse effect on our operating results and financial condition. There can be no assurance that our monitoring procedures and policies will reduce certain lending risks or that our allowance for loan losses will be adequate to cover actual losses.

If we foreclose on collateral property, we may be subject to the increased costs associated with ownership of real property, resulting in reduced revenues and earnings.

We may have to foreclose on collateral property to protect our investment and may thereafter own and operate such property, in which case we will be exposed to the risks inherent in the ownership of real estate. The amount that we, as a mortgagee, may realize

10

Table of Contents

after a default is dependent upon factors outside of our control, including, but not limited to: (i) general or local economic conditions; (ii) neighborhood values; (iii) interest rates; (iv) real estate tax rates; (v) operating expenses of the mortgaged properties; (vi) environmental remediation liabilities; (vii) ability to obtain and maintain adequate occupancy of the properties; (viii) zoning laws; (ix) governmental rules, regulations and fiscal policies; and (x) acts of God. Certain expenditures associated with the ownership of real estate, principally real estate taxes, insurance, and maintenance costs, may adversely affect the income from the real estate. Therefore, the cost of operating real property may exceed the income earned from such property, and we may have to advance funds in order to protect our investment, or we may be required to dispose of the real property at a loss. The foregoing expenditures and costs could adversely affect our ability to generate revenues, resulting in reduced levels of profitability.

Significant interest rate volatility could reduce our profitability.

Our results of operations are affected principally by net interest income, which is the difference between interest earned on loans and investments and interest expense paid on deposits and other borrowings. We cannot predict or control changes in interest rates. National, regional and local economic conditions and the policies of regulatory authorities, including monetary policies of the Board of Governors of the Federal Reserve System, affect market interest rates. While we have instituted policies and procedures designed to manage the risks from changes in market interest rates, at any given time our assets and liabilities will likely be affected differently by a given change in interest rates, principally because we do not match the maturities of our loans and investments precisely with our deposits and other funding sources. Changes in interest rates may also affect the level of voluntary prepayments on our loans and the level of financing or refinancing by customers. As of December 31, 2012, we had a negative interest rate gap of approximately 20% of interest earning assets in the one-year time frame. Although this is within our internal policy limits, our earnings will be adversely affected in periods of rising interest rates because, during such periods, the interest expense paid on deposits and borrowings will generally increase more rapidly than the interest income earned on loans and investments. If such an interest rate increase occurred gradually, we would use our established procedures to attempt to mitigate the effects over time. However, if such an interest rate increase occurred rapidly, or interest rates exhibited volatile increases and decreases, we might be unable to mitigate the effects, and our net interest income could suffer significant adverse effects. While management intends to continue to take measures to mitigate interest rate risk, we cannot assure you that such measures will be entirely effective in minimizing our exposure to the risk of rapid changes in interest rates.

The repeal of Regulation Q may increase competition for deposits and increase our interest expense.

On July 18, 2011, the Board of Governors of the Federal Reserve System published a final rule repealing Regulation Q, which prohibits the payment of interest on demand deposits by institutions that are member banks of the Federal Reserve System. The rule implements Section 627 of the Dodd-Frank Wall Street Reform and Consumer Protection Act signed by President Obama on July 21, 2010, which repealed Section 19(i) of the Federal Reserve Act in its entirety effective July 21, 2011. As a result, banks and thrifts may now offer interest-bearing demand deposit accounts to commercial customers, which were previously forbidden under Regulation Q. The repeal of Regulation Q may cause increased competition from other financial institutions for these deposits. If the Bank decides to pay interest on demand accounts, it would expect interest expense to increase.

We may be required to pay significantly higher Federal Deposit Insurance Corporation (FDIC) premiums in the future.

Insured institution failures during the past several years, as well as deterioration in banking and economic conditions, have significantly increased FDIC loss provisions, resulting in a decline in the designated reserve ratio to historical lows. The FDIC expects the higher rate of insured institution failures to continue for the next few years compared to the past; thus, the reserve ratio may continue to decline. In addition the Dodd-Frank Act permanently implemented FDIC insurance coverage for all deposit accounts up to $250,000 and revised the insurance premium assessment base from all domestic deposits to the average of total assets less tangible equity. The minimum reserve ratio of the deposit insurance fund has been increased from 1.15% to 1.35%, with the increase to be covered by assessments on insured institutions with assets over $10 billion until the new reserve ratio is reached.

We are generally unable to control the amount of premiums that we are required to pay for FDIC insurance. If there are additional bank or financial institution failures, we may be required to pay even higher FDIC premiums than the recently increased levels. Additionally, the FDIC may make material changes to the calculation of the prepaid assessment from the current proposal. Any future changes in the calculation or assessment of FDIC insurance premiums may have a material adverse effect on our results of operations, financial condition and our ability to continue to pay dividends on our common shares at the current rate or at all.

Future growth or operating results may require the Company to raise additional capital but that capital may not be available or it may be dilutive.

The Company is required by federal and state regulatory authorities to maintain adequate levels of capital to support its operations. To the extent the Company's future operating results erode capital or the Company elects to expand through loan growth or acquisition it may be required to raise capital. The Company's ability to raise capital will depend on conditions in the capital markets, which are outside of its control, and on the Company's financial performance. Accordingly, the Company cannot be assured

11

Table of Contents

of its ability to raise capital if needed or on favorable terms. If the Company cannot raise additional capital when needed, it will be subject to increased regulatory supervision and the imposition of restrictions on its growth and business. These could negatively impact the Company's ability to operate or further expand its operations through acquisitions or the establishment of additional branches and may result in increases in operating expenses and reductions in revenues that could have a material adverse effect on its financial condition and results of operations.

We rely heavily on our management and other key personnel, and the loss of any of them may adversely affect our operations.

We are and will continue to be dependent upon the services of our management team. The loss of any of our senior managers could have an adverse effect on our growth and performance because of their skills, knowledge of the markets in which we operate and years of industry experience and the difficulty of promptly finding qualified replacement personnel. The loss of key personnel in a particular market could have an adverse effect on our performance in that market because it may be difficult to find qualified replacement personnel who are already located in or would be willing to relocate to a non-metropolitan market. Additionally, recent proposed regulations issued by banking regulators regarding executive compensation may impact our ability to compensate executives and, as a result, to attract and retain qualified personnel.

The geographic concentration of our markets makes our business highly susceptible to local economic conditions.

Unlike larger banking organizations that are more geographically diversified, our operations are currently concentrated in 31 counties in Indiana, three counties in Illinois, two counties in Ohio, and three counties in Kentucky. As a result of this geographic concentration in four fairly contiguous markets, our financial results depend largely upon economic conditions in these market areas. A deterioration in economic conditions in one or all of these markets could result in one or more of the following:

- •

- an increase in loan delinquencies;

- •

- an increase in problem assets and foreclosures;

- •

- a decrease in the demand for our products and services; or

- •

- a decrease in the value of collateral for loans, especially real estate, in turn reducing customers' borrowing power, the value of assets associated with problem loans and collateral coverage.

If we do not adjust to rapid changes in the financial services industry, our financial performance may suffer.

We face substantial competition for deposit, credit and trust relationships, as well as other sources of funding in the communities we serve. Competing providers include other banks, thrifts and trust companies, insurance companies, mortgage banking operations, credit unions, finance companies, money market funds and other financial and nonfinancial companies which may offer products functionally equivalent to those offered by our banks. Competing providers may have greater financial resources than we do and offer services within and outside the market areas we serve. In addition to this challenge of attracting and retaining customers for traditional banking services, our competitors now include securities dealers, brokers, mortgage bankers, investment advisors and finance and insurance companies who seek to offer one-stop financial services to their customers that may include services that banks have not been able or allowed to offer to their customers in the past. The increasingly competitive environment is primarily a result of changes in regulation, changes in technology and product delivery systems and the accelerating pace of consolidation among financial service providers. If we are unable to adjust both to increased competition for traditional banking services and changing customer needs and preferences, it could adversely affect our financial performance and your investment in our common stock.

Acquisitions entail risks which could negatively affect our operations.

Acquisitions involve numerous risks, including:

- •

- exposure to asset quality problems of the acquired institution;

- •

- maintaining adequate regulatory capital;

- •

- diversion of management's attention from other business concerns;

- •

- risks and expenses of entering new geographic markets;

- •

- potential significant loss of depositors or loan customers from the acquired institution; or

- •

- exposure to undisclosed or unknown liabilities of an acquired institution.

Any of these acquisition risks could result in unexpected losses or expenses and thereby reduce the expected benefits of the acquisition.

12

Table of Contents

Unanticipated costs related to our acquisitions could reduce MainSource's future earnings per share.

MainSource believes it has reasonably estimated the likely costs of integrating the operations of the banks it acquires into MainSource and the incremental costs of operating such banks as a part of the MainSource family. However, it is possible that unexpected transaction costs such as taxes, fees or professional expenses or unexpected future operating expenses, such as increased personnel costs or increased taxes, as well as other types of unanticipated adverse developments, could have a material adverse effect on the results of operations and financial condition of MainSource. If unexpected costs are incurred, acquisitions could have a dilutive effect on MainSource's earnings per share. Current accounting guidance requires expensing of acquisition costs. In prior years, these costs could be capitalized. In other words, if MainSource incurs such unexpected costs and expenses as a result of its acquisitions, MainSource believes that the earnings per share of MainSource common stock could be less than they would have been if those acquisitions had not been completed.

MainSource may be unable to successfully integrate the operations of the banks it has acquired and may acquire in the future and retain employees of such banks.

MainSource's acquisition strategy involves the integration of the banks MainSource has acquired and may acquire in the future as MainSource subsidiary banks. The difficulties of integrating the operations of such banks with MainSource and its other subsidiary banks include:

- •

- coordinating geographically separated organizations;

- •

- integrating personnel with diverse business backgrounds;

- •

- combining different corporate cultures; or

- •

- retaining key employees.

The process of integrating operations could cause an interruption of, or loss of momentum in, the activities of one or more of MainSource, its subsidiary banks and the banks MainSource has acquired and may acquire in the future and the loss of key personnel. The integration of such banks as MainSource subsidiary banks requires the experience and expertise of certain key employees of such banks who are expected to be retained by MainSource. We cannot be sure, however, that MainSource will be successful in retaining these employees for the time period necessary to successfully integrate such banks' operations as subsidiary banks of MainSource. The diversion of management's attention and any delays or difficulties encountered in connection with the mergers, along with the integration of the banks as MainSource subsidiary banks, could have an adverse effect on the business and results of operation of MainSource.

The Company may be subject to future goodwill impairment charges

During 2009, the Company recorded $80,310 in goodwill impairment charges in the second and fourth quarters. No goodwill impairment charges were recorded in 2010, 2011, or 2012. While the Company does not currently anticipate that there will be additional impairment charges required in the future, it can make no guarantees that none will be taken. If more impairment is recorded, it will have a negative impact on future earnings.

Risks Relating to the Banking Industry

Changes in governmental regulation and legislation could limit our future performance and growth.

We are subject to extensive state and federal regulation, supervision and legislation that govern almost all aspects of our operations, as well as any acquisitions we may propose to make. Any change in applicable federal or state laws or regulations could have a substantial impact on us, our subsidiary banks and our operations. While we cannot predict what effect any presently contemplated or future changes in the laws or regulations or their interpretations would have on us, these changes could reduce the value of your investment.

Changes in regulation or oversight may have a material adverse impact on our operations.

We are subject to extensive regulation, supervision and examination by the Indiana Department of Financial Institutions, the Federal Deposit Insurance Corporation, the Board of Governors of the Federal Reserve System, the Securities and Exchange Commission and other regulatory bodies. Such regulation and supervision governs the activities in which we may engage. Regulatory authorities have extensive discretion in their supervisory and enforcement activities, including the imposition of restrictions on our operations, investigations and limitations related to our securities, the classification of our assets and determination of the level of our allowance for loan losses. In light of the current conditions in the U.S. financial markets and economy, Congress and regulators have increased their focus on the regulation of the financial services industry. Any change in such regulation and oversight, whether in the form of regulatory policy, regulations, legislation or supervisory action, may have a material adverse impact on our business, financial condition or results of operations.

13

Table of Contents

Risks Related to the Company's Stock

We may not be able to pay dividends in the future in accordance with past practice.

The Company has traditionally paid a quarterly dividend to common stockholders. The Company is a separate legal entity from the Bank and receives substantially all of its revenue and cash flow from dividends paid by the Bank to the Company. Indiana state law and agreements between the Bank and its federal and state regulators may limit the amount of dividends that the Bank may pay to the Company. In the event that the Bank is unable to pay dividends to the Company for an extended period of time, the Company may not be able to service its debt obligations or pay dividends on its common stock. Additionally, any payment of dividends in the future will depend, in large part, on the Bank's earnings, capital requirements, financial condition and other factors considered relevant by the Company's Board of Directors. Starting in the second quarter of 2009 and continuing to the second quarter of 2012, the Company reduced the amount of cash dividends paid. This reduction was made to preserve capital levels at the Company. Beginning in the third quarter of 2012, the Company raised the dividend to $.03/share, and in the first quarter of 2013 it raised the dividend to $.06/share.

The price of the Company's common stock may be volatile, which may result in losses for investors.

General market price declines or market volatility in the future could adversely affect the price of the Company's common stock. In addition, the following factors may cause the market price for shares of the Company's common stock to fluctuate:

- •

- announcements of developments related to the Company's business;

- •

- fluctuations in the Company's results of operations;

- •

- sales or purchases of substantial amounts of the Company's securities in the marketplace;

- •

- general conditions in the Company's banking niche or the worldwide economy;

- •

- a shortfall or excess in revenues or earnings compared to securities analysts' expectations;

- •

- changes in analysts' recommendations or projections; and

- •

- the Company's announcement of new acquisitions or other projects.

The Company's charter documents and federal regulations may inhibit a takeover, prevent a transaction that may favor or otherwise limit the Company's growth opportunities, which could cause the market price of the Company's common stock to decline.

Certain provisions of the Company's charter documents and federal regulations could have the effect of making it more difficult for a third party to acquire, or of discouraging a third party from attempting to acquire, control of the Company. In addition, the Company must obtain approval from regulatory authorities before acquiring control of any other company.

ITEM 1B. UNRESOLVED STAFF COMMENTS.

None.

ITEM 2. PROPERTIES

As of December 31, 2012, the Company leased an office building located in Greensburg, Indiana, from one of its subsidiaries for use as its corporate headquarters. The Company's subsidiaries own, or lease, all of the facilities from which they conduct business. All leases are comparable to other leases in the respective market areas and do not contain provisions materially detrimental to the Company or its subsidiaries. As of December 31, 2012 the Company had 78 banking locations. At December 31, 2012, the Company had approximately $54,101 invested in premises and equipment.

ITEM 3. LEGAL PROCEEDINGS

The Company and its subsidiaries may be parties (both plaintiff and defendant) to ordinary litigation incidental to the conduct of business. Management is presently not aware of any material pending or contemplated legal proceedings.

ITEM 4. MINE SAFETY DISCLOSURES

Not applicable.

14

Table of Contents

PART II

ITEM 5. MARKET FOR THE REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER'S PURCHASES OF EQUITY SECURITIES

Market Information

The Company's Common Stock is traded on the NASDAQ Stock Market under the symbol MSFG. The Common Stock was held by approximately 4,500 shareholders at March 12, 2013. The quarterly high and low closing prices for the Company's common stock as reported by NASDAQ and quarterly cash dividends declared and paid are set forth in the tables below. All per share data is retroactively restated for all stock dividends and splits.

The range of known per share prices by calendar quarter, based on actual transactions, excluding commissions, is shown below.

| | | | | | | | | | | | | |

| | Market Prices | |

|---|

2012

| | Q1

| | Q2

| | Q3

| | Q4

| |

|---|

| | |

|---|

High | | $ | 12.12 | | $ | 12.05 | | $ | 13.00 | | $ | 12.97 | |

Low | | $ | 8.84 | | $ | 10.80 | | $ | 11.27 | | $ | 11.50 | |

2011

|

|

Q1

|

|

Q2

|

|

Q3

|

|

Q4

|

|

|---|

| | |

|---|

High | | $ | 10.60 | | $ | 10.05 | | $ | 9.24 | | $ | 9.89 | |

Low | | $ | 8.74 | | $ | 6.98 | | $ | 7.46 | | $ | 7.66 | |

| |

Cash Dividends | |

|---|

2012

| | Q1

| | Q2

| | Q3

| | Q4

| |

|---|

| | |

|---|

| | $ | 0.01 | | $ | 0.01 | | $ | 0.03 | | $ | 0.03 | |

2011

|

|

Q1

|

|

Q2

|

|

Q3

|

|

Q4

|

|

|---|

| | |

|---|

| | $ | 0.01 | | $ | 0.01 | | $ | 0.01 | | $ | 0.01 | |

In the first quarter of 2013 the Board of Directors voted to raise the quarterly dividend to $.06/share. It is expected that the Company will continue to consider the Company's results of operations, capital levels and other external factors beyond management's control in making the decision to maintain or further raise the dividend.

Issuer Purchases of Equity Securities

The Company purchased the following equity securities of the Company during the quarter ended December 31, 2012:

| | | | | | | | | | | | | |

Period

| | Total Number

of Shares (or

Units) Purchased

(1)

| | Average Price Paid Per

Share (or Unit) (1)

| | Total Number of Shares

(or Units) Purchased as

Part of Publicly

Announced Plans or

Programs

| | Maximum Number (or

Approximate Dollar Value)

of Shares (or Units) That

May Yet Be Purchased

Under the Plans or Programs

| |

|---|

| | |

October 2012 | | | — | | | — | | | — | | | 0 | |

November 2012 | | | — | | | — | | | — | | | 0 | |

December 2012 | | | 19,050 | | $ | 993.54 | | | — | | | 0 | |

| | | | |

Total: | | | 19,050 | | $ | 993.54 | | | — | | | 0 | |

- (1)

- On December 5, 2012, the Company purchased 19,050 shares of Fixed Rate Cumulative Perpetual Preferred Stock, Series A, of the Company in a privately negotiated transaction at a price of $993.54/share.

15

Table of Contents

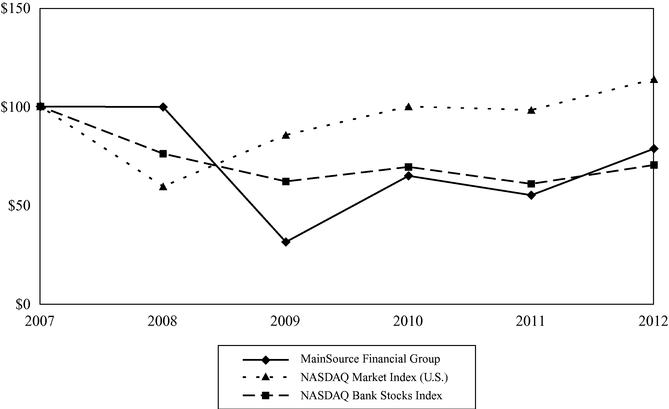

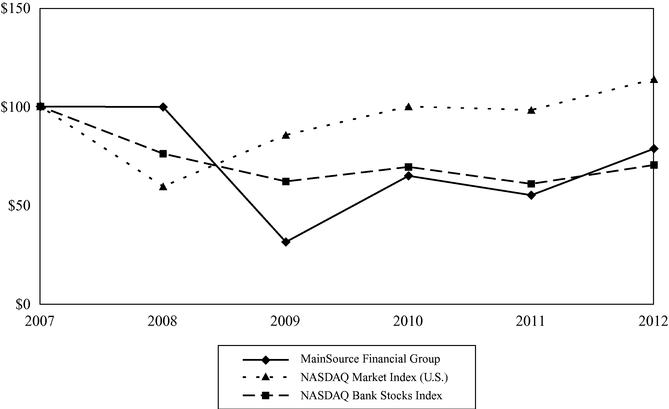

Stock Performance Graph

The following performance graph compares the performance of our common shares to the performance of the NASDAQ Market Index (U.S.) and the NASDAQ Bank Stocks Index for the 60 months ended December 31, 2012. The graph assumes an investment of $100 in each of the Company's common shares, the NASDAQ Market Index (U.S.) and the NASDAQ Bank Stocks Index on December 31, 2007.

| | | | | | | | | | | | | | | | | | | |

| | 12/31/07

| | 12/31/08

| | 12/31/09

| | 12/31/10

| | 12/31/11

| | 12/31/12

| |

|---|

| | |

MainSource Financial Group | | | 100.00 | | | 99.75 | | | 31.27 | | | 64.83 | | | 55.02 | | | 78.60 | |

NASDAQ MARKET INDEX (U.S.) | | | 100.00 | | | 59.46 | | | 85.55 | | | 100.03 | | | 98.22 | | | 113.85 | |

NASDAQ Bank Stocks Index | | | 100.00 | | | 76.08 | | | 62.00 | | | 69.36 | | | 60.76 | | | 70.34 | |

16

Table of Contents

ITEM 6. SELECTED FINANCIAL DATA

Selected Financial Data

(Dollar amounts in thousands except per share data)

| | | | | | | | | | | | | | | | |

| | 2012

| | 2011

| | 2010

| | 2009

| | 2008

| |

|---|

| | |

Results of Operations | | | | | | | | | | | | | | | | |

Net interest income | | $ | 94,082 | | $ | 99,848 | | $ | 101,252 | | $ | 98,008 | | $ | 87,525 | |

Provision for loan losses | | | 9,850 | | | 17,800 | | | 35,250 | | | 46,310 | | | 20,918 | |

Noninterest income | | | 43,891 | | | 45,308 | | | 41,291 | | | 40,050 | | | 29,697 | |

Noninterest expense, excluding goodwill impairment | | | 94,838 | | | 99,805 | | | 92,252 | | | 87,222 | | | 72,773 | |

Goodwill impairment | | | — | | | — | | | — | | | 80,310 | | | — | |

Income (loss) before income tax | | | 33,285 | | | 27,551 | | | 15,041 | | | (75,784 | ) | | 23,531 | |

Income tax (benefit) | | | 6,027 | | | 3,738 | | | 239 | | | (11,645 | ) | | 4,379 | |

Net income (loss) | | | 27,258 | | | 23,813 | | | 14,802 | | | (64,139 | ) | | 19,152 | |

Preferred dividends and accretion | | | 2,110 | | | 3,054 | | | 3,054 | | | 2,919 | | | — | |

Net income (loss) available to common shareholders | | | 26,505 | | | 20,759 | | | 11,748 | | | (67,058 | ) | | 19,152 | |

Dividends paid on common stock | | | 1,623 | | | 807 | | | 805 | | | 5,135 | | | 11,133 | |

Per Common Share* | | | | | | | | | | | | | | | | |

Earnings (loss) per share (basic) | | $ | 1.31 | | $ | 1.03 | | $ | 0.58 | | $ | (3.33 | ) | $ | 1.00 | |

Earnings (loss) per share (diluted) | | | 1.30 | | | 1.03 | | | 0.58 | | | (3.33 | ) | | 1.00 | |

Dividends paid | | | 0.08 | | | 0.04 | | | 0.04 | | | 0.26 | | | 0.58 | |

Book value — end of period | | | 15.21 | | | 13.87 | | | 12.24 | | | 11.84 | | | 14.90 | |

Tangible book value — end of period | | | 11.72 | | | 10.45 | | | 8.71 | | | 8.16 | | | 7.43 | |

Market price — end of period | | | 12.67 | | | 8.83 | | | 10.41 | | | 4.78 | | | 15.50 | |

At Year End | | | | | | | | | | | | | | | | |

Total assets | | $ | 2,769,288 | | $ | 2,754,180 | | $ | 2,769,312 | | $ | 2,906,530 | | $ | 2,899,835 | |

Securities | | | 902,341 | | | 876,090 | | | 806,071 | | | 714,607 | | | 513,310 | |

Loans, excluding held for sale | | | 1,553,383 | | | 1,534,379 | | | 1,680,971 | | | 1,885,447 | | | 1,995,601 | |

Allowance for loan losses | | | 32,227 | | | 39,889 | | | 42,605 | | | 46,648 | | | 34,583 | |

Total deposits | | | 2,185,054 | | | 2,159,900 | | | 2,211,564 | | | 2,270,650 | | | 2,009,324 | |

Federal Home Loan Bank advances | | | 141,052 | | | 151,427 | | | 152,065 | | | 222,265 | | | 433,167 | |

Subordinated debentures | | | 50,418 | | | 50,267 | | | 50,117 | | | 49,966 | | | 49,816 | |

Shareholders' equity | | | 323,751 | | | 336,553 | | | 302,570 | | | 294,462 | | | 299,949 | |

Financial Ratios | | | | | | | | | | | | | | | | |

Return on average assets | | | 0.99 | % | | 0.85 | % | | 0.51 | % | | (2.19 | )% | | 0.73 | % |

Return on average common shareholders' equity | | | 8.15 | | | 7.44 | | | 4.86 | | | (22.61 | ) | | 6.90 | |

Allowance for loan losses to total loans (year end, excluding held for sale) | | | 2.07 | | | 2.60 | | | 2.53 | | | 2.47 | | | 1.73 | |

Allowance for loan losses to total non-performing loans (year end) | | | 63.04 | | | 61.18 | | | 46.55 | | | 50.60 | | | 58.31 | |

Shareholders' equity to total assets (year end) | | | 11.69 | | | 12.22 | | | 10.93 | | | 10.13 | | | 10.34 | |

Average equity to average total assets | | | 12.12 | | | 11.46 | | | 10.59 | | | 11.59 | | | 10.57 | |

Dividend payout ratio | | | 6.12 | | | 3.89 | | | 6.85 | | | NM | | | 58.13 | |

- *

- Adjusted for stock split and dividends

- NM

- Not meaningful

17

Table of Contents

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Management's Discussion and Analysis

(Dollar amounts in thousands except per share data)

Forward-Looking Statements

Except for historical information contained herein, the discussion in this Annual Report includes certain forward-looking statements based upon management expectations. Actual results and experience could differ materially from the anticipated results or other expectations expressed in the Company's forward-looking statements. The Company disclaims any intent or obligation to update such forward looking statements. Factors which could cause future results to differ from these expectations include the following: general economic conditions; legislative and regulatory initiatives; monetary and fiscal policies of the federal government; deposit flows; the cost of funds; general market rates of interest; interest rates on competing investments; demand for loan products; demand for financial services; changes in accounting policies or guidelines; changes in the quality or composition of the Company's loan and investment portfolios; the Company's ability to integrate acquisitions, and other factors, including the risk factors set forth in Item 1A of this Annual Report on Form 10-K and in other reports we file from time to time with the Securities and Exchange Commission. The Company intends the forward looking statements set forth herein to be covered by the safe harbor provisions for forward looking statements contained in the Private Securities Litigation Reform Act of 1995.

Overview