Revenues: Private Client Group $ 901,954 $ 866,432 $ 3,519,558 $ 3,289,503 Capital Markets 263,289 264,261 975,064 968,635 Asset Management 99,827 94,918 392,378 369,690 Raymond James Bank 110,398 95,547 425,988 360,317 Other (3) 10,505 5,148 66,967 42,203 Intersegment eliminations (18,990) (15,528) (71,791) (64,888) Total revenues $ 1,366,983 $ 1,310,778 $ 5,308,164 $ 4,965,460 Pre-tax income (loss) (excluding noncontrolling interests): Private Client Group $ 87,716 $ 100,180 $ 342,243 $ 330,278 Capital Markets 40,221 39,540 107,009 130,565 Asset Management 32,605 35,280 135,050 128,286 Raymond James Bank 65,093 64,057 278,721 242,834 Other (3) (18,819) (26,643) (64,849) (83,918) Pre-tax income (excluding noncontrolling interests) $ 206,816 $ 212,414 $ 798,174 $ 748,045 (1) During August and September 2015, we purchased 1,114,505 shares of our common stock in open market transactions, a total purchase price of $56.9 million, which reflects an average purchase price per share of $51.04. After the effect of these repurchases, approximately $93 million remains on the most recent Board of Directors authorization limit of $150 million for our securities repurchases. Refer to Part II, Item 5 in our Current Report on Form 10-K filed with the SEC on November 24, 2015 (available at www.sec.gov), for information regarding securities repurchase programs and authorization levels. The effect of the share repurchase on the weighted-average common shares outstanding for the diluted computation for the three and twelve months ended September 30, 2015, was to reduce the number of common shares outstanding by 434 thousand shares and 109 thousand shares, respectively. (2) Certain prior period amounts have been reclassified to conform to the current period’s presentation. (3) The Other segment includes the results of our principal capital and private equity activities as well as certain corporate overhead costs of RJF. CONDENSED CONSOLIDATED STATEMENTS OF INCOME (Unaudited – in 000s, Except per Share Amounts) CONSOLIDATED RESULTS BY SEGMENT (in 000s) Three Months Ended Twelve Months Ended September 30, 2015 September 30, 2014 September 30, 2015 September 30, 2014 Revenues: Securities commissions and fees $ 874,209 $ 840,165 $ 3,443,038 $ 3,241,525 Investment banking 94,894 115,019 323,660 340,821 Investment advisory fees 99,226 91,772 385,238 362,362 Interest 139,538 126,009 543,207 480,886 Account and service fees 120,923 111,524 457,913 407,707 Net trading profit 16,355 14,374 58,512 64,643 Other 21,838 11,915 96,596 67,516 Total revenues 1,366,983 1,310,778 5,308,164 4,965,460 Interest expense (26,000) (25,687) (107,954) (104,091) Net revenues 1,340,983 1,285,091 5,200,210 4,861,369 Non-interest expenses: Compensation, commissions and benefits 903,548 869,893 3,525,378 3,312,635 Communications and information processing 70,382 57,996 266,396 252,694 Occupancy and equipment costs 42,129 41,344 163,229 161,683 Clearance and floor brokerage 10,014 10,710 42,748 39,875 Business development 39,359 35,682 158,966 139,672 Investment sub-advisory fees 15,034 13,928 59,569 52,412 Bank loan loss provision 13,277 5,483 23,570 13,565 Other 46,105 44,851 183,642 172,885 Total non-interest expenses 1,139,848 1,079,887 4,423,498 4,145,421 Income including noncontrolling interests and before provision for income taxes 201,135 205,204 776,712 715,948 Provision for income taxes 77,630 76,048 296,034 267,797 Net income including noncontrolling interests 123,505 129,156 480,678 448,151 Net loss attributable to noncontrolling interests (5,681) (7,210) (21,462) (32,097) Net income attributable to Raymond James Financial, Inc. $ 129,186 $ 136,366 $ 502,140 $ 480,248 Net income per common share – diluted $ 0.88 $ 0.94 $ 3.43 $ 3.32 Weighted-average common and common equivalent shares outstanding – diluted 146,279 144,521 145,939 143,589 International Headquarters: The Raymond James Financial Center 880 Carillon Parkway // St. Petersburg, FL 33716 800.248.8863 // RaymondJames.com ©2015 Raymond James Financial Raymond James® is a registered trademark of Raymond James Financial, Inc. 15-Fin-Rep-0012 KM 10/15 Stock Traded: NEW YORK STOCK EXCHANGE Stock Symbol: RJF Raymond James Financial, Inc. (NYSE: RJF) is a leading diversified financial services company providing private client group, capital markets, asset management, banking and other services to individuals, corporations and municipalities. The company has approximately 6,600 financial advisors serving in excess of 2.7 million client accounts in more than 2,700 locations throughout the United States, Canada and overseas. Total client assets are approximately $480 billion. Public since 1983, the firm has been listed on the New York Stock Exchange since 1986 under the symbol RJF.Additional information is available at www.raymondjames.com. FORWARD LOOKING STATEMENTS Certain statements made in this report may constitute “forward- looking statements” under the Private Securities Litigation Reform Act of 1995. Forward-looking statements include information concerning future strategic objectives, business prospects, anticipated savings, financial results (including expenses, earnings, liquidity, cash flow and capital expenditures), industry or market conditions, demand for and pricing of our products, acquisitions and divestitures, anticipated results of litigation and regulatory developments or general economic conditions. In addition, words such as “believes,” “expects,” “anticipates,” “intends,” “plans,” “estimates,” “projects,” “forecasts,” and future or conditional verbs such as “will,” “may,” “could,” “should,” and “would,” as well as any other statement that necessarily depends on future events, are intended to identify forward-looking statements. Forward-looking statements are not guarantees, and they involve risks, uncertainties and assumptions. Although we make such statements based on assumptions that we believe to be reasonable, there can be no assurance that actual results will not differ materially from those expressed in the forward-looking statements. We caution investors not to rely unduly on any forward-looking statements and urge you to carefully consider the risks described in our filings with the Securities and Exchange Commission (the “SEC”) from time to time, including our most recent Annual Report on Form 10-K and subsequent Forms 10-Q, which are available on www.raymondjames. com and the SEC’s website at www.sec.gov. We expressly disclaim any obligation to update any forward-looking statement in the event it later turns out to be inaccurate, whether as a result of new information, future events, or otherwise. About Raymond James Financial, Inc. FOURTH QUARTER 2015 (2) (2) (2) (2) (1) (1)

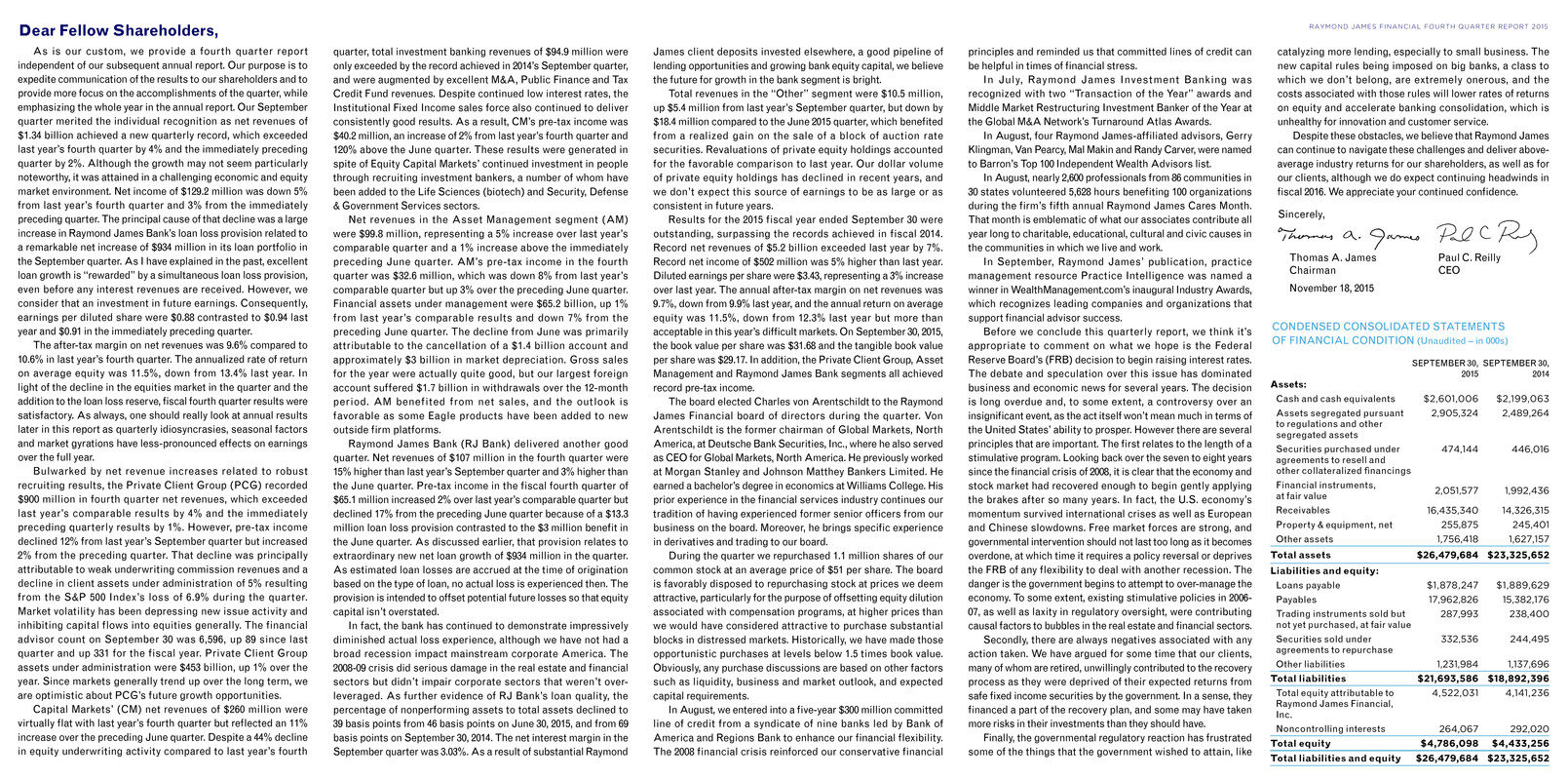

Dear Fellow Shareholders, As is our custom, we provide a fourth quarter report independent of our subsequent annual report. Our purpose is to expedite communication of the results to our shareholders and to provide more focus on the accomplishments of the quarter, while emphasizing the whole year in the annual report. Our September quarter merited the individual recognition as net revenues of $1.34 billion achieved a new quarterly record, which exceeded last year’s fourth quarter by 4% and the immediately preceding quarter by 2%. Although the growth may not seem particularly noteworthy, it was attained in a challenging economic and equity market environment. Net income of $129.2 million was down 5% from last year’s fourth quarter and 3% from the immediately preceding quarter. The principal cause of that decline was a large increase in Raymond James Bank’s loan loss provision related to a remarkable net increase of $934 million in its loan portfolio in the September quarter. As I have explained in the past, excellent loan growth is “rewarded” by a simultaneous loan loss provision, even before any interest revenues are received. However, we consider that an investment in future earnings. Consequently, earnings per diluted share were $0.88 contrasted to $0.94 last year and $0.91 in the immediately preceding quarter. The after-tax margin on net revenues was 9.6% compared to 10.6% in last year’s fourth quarter. The annualized rate of return on average equity was 11.5%, down from 13.4% last year. In light of the decline in the equities market in the quarter and the addition to the loan loss reserve, fiscal fourth quarter results were satisfactory. As always, one should really look at annual results later in this report as quarterly idiosyncrasies, seasonal factors and market gyrations have less-pronounced effects on earnings over the full year. Bulwarked by net revenue increases related to robust recruiting results, the Private Client Group (PCG) recorded $900 million in fourth quarter net revenues, which exceeded last year’s comparable results by 4% and the immediately preceding quarterly results by 1%. However, pre-tax income declined 12% from last year’s September quarter but increased 2% from the preceding quarter. That decline was principally attributable to weak underwriting commission revenues and a decline in client assets under administration of 5% resulting from the S&P 500 Index’s loss of 6.9% during the quarter. Market volatility has been depressing new issue activity and inhibiting capital flows into equities generally. The financial advisor count on September 30 was 6,596, up 89 since last quarter and up 331 for the fiscal year. Private Client Group assets under administration were $453 billion, up 1% over the year. Since markets generally trend up over the long term, we are optimistic about PCG’s future growth opportunities. Capital Markets’ (CM) net revenues of $260 million were virtually flat with last year’s fourth quarter but reflected an 11% increase over the preceding June quarter. Despite a 44% decline in equity underwriting activity compared to last year’s fourth quarter, total investment banking revenues of $94.9 million were only exceeded by the record achieved in 2014’s September quarter, and were augmented by excellent M&A, Public Finance and Tax Credit Fund revenues. Despite continued low interest rates, the Institutional Fixed Income sales force also continued to deliver consistently good results. As a result, CM’s pre-tax income was $40.2 million, an increase of 2% from last year’s fourth quarter and 120% above the June quarter. These results were generated in spite of Equity Capital Markets’ continued investment in people through recruiting investment bankers, a number of whom have been added to the Life Sciences (biotech) and Security, Defense & Government Services sectors. Net revenues in the Asset Management segment (AM) were $99.8 million, representing a 5% increase over last year’s comparable quarter and a 1% increase above the immediately preceding June quarter. AM’s pre-tax income in the fourth quarter was $32.6 million, which was down 8% from last year’s comparable quarter but up 3% over the preceding June quarter. Financial assets under management were $65.2 billion, up 1% from last year’s comparable results and down 7% from the preceding June quarter. The decline from June was primarily attributable to the cancellation of a $1.4 billion account and approximately $3 billion in market depreciation. Gross sales for the year were actually quite good, but our largest foreign account suffered $1.7 billion in withdrawals over the 12-month period. AM benefited from net sales, and the outlook is favorable as some Eagle products have been added to new outside firm platforms. Raymond James Bank (RJ Bank) delivered another good quarter. Net revenues of $107 million in the fourth quarter were 15% higher than last year’s September quarter and 3% higher than the June quarter. Pre-tax income in the fiscal fourth quarter of $65.1 million increased 2% over last year’s comparable quarter but declined 17% from the preceding June quarter because of a $13.3 million loan loss provision contrasted to the $3 million benefit in the June quarter. As discussed earlier, that provision relates to extraordinary new net loan growth of $934 million in the quarter. As estimated loan losses are accrued at the time of origination based on the type of loan, no actual loss is experienced then. The provision is intended to offset potential future losses so that equity capital isn’t overstated. In fact, the bank has continued to demonstrate impressively diminished actual loss experience, although we have not had a broad recession impact mainstream corporate America. The 2008-09 crisis did serious damage in the real estate and financial sectors but didn’t impair corporate sectors that weren’t over- leveraged. As further evidence of RJ Bank’s loan quality, the percentage of nonperforming assets to total assets declined to 39 basis points from 46 basis points on June 30, 2015, and from 69 basis points on September 30, 2014. The net interest margin in the September quarter was 3.03%. As a result of substantial Raymond SEPTEMBER 30, 2015 SEPTEMBER 30, 2014 Assets: Cash and cash equivalents $2,601,006 $2,199,063 Assets segregated pursuant to regulations and other segregated assets 2,905,324 2,489,264 Securities purchased under agreements to resell and other collateralized financings 474,144 446,016 Financial instruments, at fair value 2,051,577 1,992,436 Receivables 16,435,340 14,326,315 Property & equipment, net 255,875 245,401 Other assets 1,756,418 1,627,157 Total assets $26,479,684 $23,325,652 Liabilities and equity: Loans payable $1,878,247 $1,889,629 Payables 17,962,826 15,382,176 Trading instruments sold but not yet purchased, at fair value 287,993 238,400 Securities sold under agreements to repurchase 332,536 244,495 Other liabilities 1,231,984 1,137,696 Total liabilities $21,693,586 $18,892,396 Total equity attributable to Raymond James Financial, Inc. 4,522,031 4,141,236 Noncontrolling interests 264,067 292,020 Total equity $4,786,098 $4,433,256 Total liabilities and equity $26,479,684 $23,325,652 CONDENSED CONSOLIDATED STATEMENTS OF FINANCIAL CONDITION (Unaudited – in 000s) RAYMOND JAMES FINANCIAL FOURTH QUARTER REPORT 2015 Sincerely, Thomas A. James Paul C. Reilly Chairman CEO November 18, 2015 James client deposits invested elsewhere, a good pipeline of lending opportunities and growing bank equity capital, we believe the future for growth in the bank segment is bright. Total revenues in the “Other” segment were $10.5 million, up $5.4 million from last year’s September quarter, but down by $18.4 million compared to the June 2015 quarter, which benefited from a realized gain on the sale of a block of auction rate securities. Revaluations of private equity holdings accounted for the favorable comparison to last year. Our dollar volume of private equity holdings has declined in recent years, and we don’t expect this source of earnings to be as large or as consistent in future years. Results for the 2015 fiscal year ended September 30 were outstanding, surpassing the records achieved in fiscal 2014. Record net revenues of $5.2 billion exceeded last year by 7%. Record net income of $502 million was 5% higher than last year. Diluted earnings per share were $3.43, representing a 3% increase over last year. The annual after-tax margin on net revenues was 9.7%, down from 9.9% last year, and the annual return on average equity was 11.5%, down from 12.3% last year but more than acceptable in this year’s difficult markets. On September 30, 2015, the book value per share was $31.68 and the tangible book value per share was $29.17. In addition, the Private Client Group, Asset Management and Raymond James Bank segments all achieved record pre-tax income. The board elected Charles von Arentschildt to the Raymond James Financial board of directors during the quarter. Von Arentschildt is the former chairman of Global Markets, North America, at Deutsche Bank Securities, Inc., where he also served as CEO for Global Markets, North America. He previously worked at Morgan Stanley and Johnson Matthey Bankers Limited. He earned a bachelor’s degree in economics at Williams College. His prior experience in the financial services industry continues our tradition of having experienced former senior officers from our business on the board. Moreover, he brings specific experience in derivatives and trading to our board. During the quarter we repurchased 1.1 million shares of our common stock at an average price of $51 per share. The board is favorably disposed to repurchasing stock at prices we deem attractive, particularly for the purpose of offsetting equity dilution associated with compensation programs, at higher prices than we would have considered attractive to purchase substantial blocks in distressed markets. Historically, we have made those opportunistic purchases at levels below 1.5 times book value. Obviously, any purchase discussions are based on other factors such as liquidity, business and market outlook, and expected capital requirements. In August, we entered into a five-year $300 million committed line of credit from a syndicate of nine banks led by Bank of America and Regions Bank to enhance our financial flexibility. The 2008 financial crisis reinforced our conservative financial principles and reminded us that committed lines of credit can be helpful in times of financial stress. In July, Raymond James Investment Banking was recognized with two “Transaction of the Year” awards and Middle Market Restructuring Investment Banker of the Year at the Global M&A Network’s Turnaround Atlas Awards. In August, four Raymond James-affiliated advisors, Gerry Klingman, Van Pearcy, Mal Makin and Randy Carver, were named to Barron’s Top 100 Independent Wealth Advisors list. In August, nearly 2,600 professionals from 86 communities in 30 states volunteered 5,628 hours benefiting 100 organizations during the firm’s fifth annual Raymond James Cares Month. That month is emblematic of what our associates contribute all year long to charitable, educational, cultural and civic causes in the communities in which we live and work. In September, Raymond James’ publication, practice management resource Practice Intelligence was named a winner in WealthManagement.com’s inaugural Industry Awards, which recognizes leading companies and organizations that support financial advisor success. Before we conclude this quarterly report, we think it’s appropriate to comment on what we hope is the Federal Reserve Board’s (FRB) decision to begin raising interest rates. The debate and speculation over this issue has dominated business and economic news for several years. The decision is long overdue and, to some extent, a controversy over an insignificant event, as the act itself won’t mean much in terms of the United States’ ability to prosper. However there are several principles that are important. The first relates to the length of a stimulative program. Looking back over the seven to eight years since the financial crisis of 2008, it is clear that the economy and stock market had recovered enough to begin gently applying the brakes after so many years. In fact, the U.S. economy’s momentum survived international crises as well as European and Chinese slowdowns. Free market forces are strong, and governmental intervention should not last too long as it becomes overdone, at which time it requires a policy reversal or deprives the FRB of any flexibility to deal with another recession. The danger is the government begins to attempt to over-manage the economy. To some extent, existing stimulative policies in 2006- 07, as well as laxity in regulatory oversight, were contributing causal factors to bubbles in the real estate and financial sectors. Secondly, there are always negatives associated with any action taken. We have argued for some time that our clients, many of whom are retired, unwillingly contributed to the recovery process as they were deprived of their expected returns from safe fixed income securities by the government. In a sense, they financed a part of the recovery plan, and some may have taken more risks in their investments than they should have. Finally, the governmental regulatory reaction has frustrated some of the things that the government wished to attain, like catalyzing more lending, especially to small business. The new capital rules being imposed on big banks, a class to which we don’t belong, are extremely onerous, and the costs associated with those rules will lower rates of returns on equity and accelerate banking consolidation, which is unhealthy for innovation and customer service. Despite these obstacles, we believe that Raymond James can continue to navigate these challenges and deliver above- average industry returns for our shareholders, as well as for our clients, although we do expect continuing headwinds in fiscal 2016. We appreciate your continued confidence.