T H I R D Q U A R T E R2017 the HUMAN connection

Dear Fellow Shareholders, Modest economic expansion and strong corporate earnings contributed to continued stock market appreciation during the June quarter. These market gains, along with higher short-term interest rates and consistent growth of our core business drivers, helped us generate record financial results for the fiscal third quarter ending June 30, 2017. Record quarterly net revenues of $1.62 billion increased 20% over the prior year’s fiscal third quarter and 4% over the preceding quarter. Record quarterly net income of $183.4 million, or $1.24 per diluted share, increased 46% over the prior year’s fiscal third quarter and 63% over the preceding quarter, which was negatively impacted by $100 million of legal expense associated with the previously announced legal settlement, as described in detail in our last quarterly letter to shareholders. We ended the fiscal third quarter with records for client assets under administration of $664.4 billion, Private Client Group financial advisors of 7,285, financial assets under administration of $91.0 billion, and net loans at Raymond James Bank of $16.6 billion. For the first nine months of fiscal 2017, net revenues of $4.68 billion increased 19% compared to the first nine months of fiscal 2016. The attractive revenue growth during the first three quarters of fiscal 2017 was largely attributable to the net addition of Private Client Group financial advisors, equity market appreciation, strong investment banking results, and the significant benefit from higher short-term interest rates on both net interest income and account and service fees. During the same period, net income of $442.7 million increased a substantial 24% despite being negatively impacted by $130 million of legal expenses associated with the aforementioned settlement. The annualized return on equity for the third quarter of fiscal 2017 was 13.8%, which we consider to be a satisfactory result, particularly when compared to the lower returns generated by many other firms in our industry with much higher levels of leverage and significantly lower capital ratios. On June 30, our shareholders’ equity was $5.4 billion, or $37.46 of book value per share, reflecting 15% growth over shareholders’ equity in June of last year. The record quarterly results were lifted by revenue growth in all of the core operating segments. The Private Client Group segment, Asset Management segment, and Raymond James Bank generated record quarterly net revenues in the quarter. Moreover, the Private Client Group and Asset Management segments also generated record quarterly pre-tax income. Quarterly net revenues in the Private Client Group segment of $1.13 billion improved 25% over the prior year’s fiscal third quarter and 4% over the preceding quarter. Quarterly pre-tax income in the Private Client Group segment of $128 million increased a noteworthy 56% over the prior year’s fiscal third quarter. Record quarterly results in the segment were primarily attributable to larger balances in fee-based accounts, which ended the quarter at 44% of the segment’s total client assets, and higher short-term interest rates. The growth of client assets was driven by net recruiting of financial advisors, the successful acquisitions of Alex. Brown and 3Macs and market appreciation. The Capital Markets segment generated quarterly net revenues of $258.9 million, which were up 3% over the prior year’s fiscal third quarter and 1% over the preceding quarter. Quarterly pre-tax income in the segment of $34.6 million was up 6% over the prior year’s fiscal third quarter, but down 16% compared to the preceding quarter. Investment banking revenues during the quarter were lifted by M&A and advisory fees, but were partially offset by weakness in tax credit funds syndication fees due to uncertainty surrounding corporate tax reform. Relatively low levels of market volatility during the quarter hurt both institutional equity and fixed income commissions, with the latter also being negatively impacted by a flattening yield curve. The Asset Management segment produced record quarterly net revenues of $125.7 million, up 24% over the prior year’s fiscal third quarter and 8% over the preceding quarter. The segment’s record quarterly pre-tax income of $43.3 million improved 33% compared to the prior year’s fiscal third quarter and 14% compared to the preceding quarter. Quarterly results in the segment were bolstered by record financial assets under management and increased utilization of fee-based accounts in the Private Client Group, which has accelerated in response to the Department of Labor fiduciary rule. Raymond James Bank generated record quarterly net revenues of $150.5 million, increasing 19% over the prior year’s fiscal third quarter and 6% over the preceding quarter. Quarterly pre-tax income of $100 million rose 12% over the prior year’s fiscal third quarter and 9% over the preceding quarter. Growth in the bank’s quarterly net revenues and pre-tax income was largely attributable to higher balances of both loans and

agency-backed securities and an improvement in the bank’s net interest margin due to higher short-term interest rates. The credit quality of the loan portfolio remained satisfactory, as total nonperforming assets declined to 23 basis points of the bank’s total assets, comparing favorably to 52 basis points in the prior year’s fiscal third quarter and 27 basis points in the preceding quarter. We also earned several notable awards, recognitions and accolades during the third quarter: • In May, S&P Global Ratings upgraded our credit rating to BBB+. Moody’s Investors Service also recently upgraded our rating to Baa1. These upgrades, which resulted in Raymond James having the same credit ratings as many of the largest firms in our industry, reflect our conservative, client-focused values. • Raymond James was recognized by the Bank Insurance and Securities Association with the Technology Innovation Award for the fifth consecutive year. In April 2017, three Raymond James-affiliated advisors were named to the Barron’s 2017 list of the Top 100 Financial Advisors. In May 2017, nine Raymond James-affiliated program managers were named to Bank Investment Consultant’s list of the Top 25 Program Managers. In June 2017, five Raymond James advisors were named to the Barron’s list of the Top 100 Women Financial Advisors, six Raymond James branch managers were named to On Wall Street’s list of the Top 100 Branch Managers, and two Raymond James professionals were named to Investment News’ annual 40 Under 40 list. • In the Capital Markets segment, the investment banking team earned two deal-of-the-year awards at the annual M&A Advisor Turnaround Awards, and our equity research analysts received 16 awards in the 2017 Thomson Reuters Analyst Awards. • During the quarter, we also strengthened our liquidity position by extending the five-year, $300 million revolving credit facility and closing on a registered underwritten public offering of $500 million in aggregate principal amount of the reopened 4.95% Senior Notes due 2046. Looking forward, we are entering the fourth quarter with several tailwinds. The Private Client Group is starting the fourth quarter with assets in fee-based accounts 6% higher than the preceding quarter. The increase in short-term interest rates in June is expected to generate a benefit to the firm’s pre-tax income of approximately $15 million per quarter, the majority of which will be reflected in the Private Client Group segment. In the Capital Markets segment, we are encouraged by the backlog for investment banking, although our outlook for Fixed Income remains cautious given the flattening yield curve. In Asset Management, we are still on track to close on the acquisition of Scout Investments and Reams Asset Management by the end of the calendar year. Raymond James Bank should continue to benefit from the growth of its loan balances and securities portfolio. In summary, all of our businesses are positioned very well, with almost all of our key operating metrics starting the fiscal fourth quarter at record levels. Thank you for your continued confidence in Raymond James Financial. Certain statements made in this letter may constitute “forward-looking statements” under the Private Securities Litigation Reform Act of 1995. Forward-looking statements include information concerning future strategic objectives, business prospects, anticipated savings, financial results (including expenses, earnings, liquidity, cash flow and capital expenditures), industry or market conditions, demand for and pricing of our products, acquisitions and divestitures, anticipated results of litigation and regulatory developments or general economic conditions. In addition, words such as “expects,” and future or conditional verbs such as “will” and “should,” as well as any other statement that necessarily depends on future events, are intended to identify forward- looking statements. Forward-looking statements are not guarantees, and they involve risks, uncertainties and assumptions. Although we make such statements based on assumptions that we believe to be reasonable, there can be no assurance that actual results will not differ materially from those expressed in the forward-looking statements. We caution investors not to rely unduly on any forward-looking statements and urge you to carefully consider the risks described in our filings with the Securities and Exchange Commission (the “SEC”) from time to time, including our most recent Annual Report on Form 10-K and subsequent Quarterly Reports on Form 10-Q, which are available at www.raymondjames.com and the SEC’s website at www.sec.gov. We expressly disclaim any obligation to update any forward-looking statement in the event it later turns out to be inaccurate, whether as a result of new information, future events, or otherwise. Sincerely, Paul C. Reilly Chairman, CEO August 14, 2017

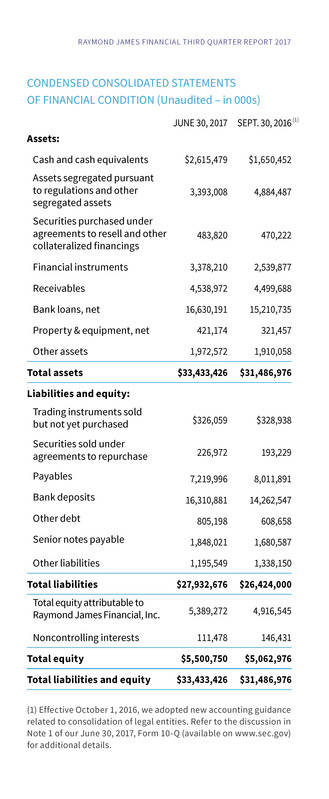

R AYMOND JAMES FINANCIAL THIRD QUARTER REPORT 2017 (1) Effective October 1, 2016, we adopted new accounting guidance related to consolidation of legal entities. Refer to the discussion in Note 1 of our June 30, 2017, Form 10-Q (available on www.sec.gov) for additional details. JUNE 30, 2017 SEPT. 30, 2016 Assets: Cash and cash equivalents $2,615,479 $1,650,452 Assets segregated pursuant to regulations and other segregated assets 3,393,008 4,884,487 Securities purchased under agreements to resell and other collateralized financings 483,820 470,222 Financial instruments 3,378,210 2,539,877 Receivables 4,538,972 4,499,688 Bank loans, net 16,630,191 15,210,735 Property & equipment, net 421,174 321,457 Other assets 1,972,572 1,910,058 Total assets $33,433,426 $31,486,976 Liabilities and equity: Trading instruments sold but not yet purchased $326,059 $328,938 Securities sold under agreements to repurchase 226,972 193,229 Payables 7,219,996 8,011,891 Bank deposits 16,310,881 14,262,547 Other debt 805,198 608,658 Senior notes payable 1,848,021 1,680,587 Other liabilities 1,195,549 1,338,150 Total liabilities $27,932,676 $26,424,000 Total equity attributable to Raymond James Financial, Inc. 5,389,272 4,916,545 Noncontrolling interests 111,478 146,431 Total equity $5,500,750 $5,062,976 Total liabilities and equity $33,433,426 $31,486,976 CONDENSED CONSOLIDATED STATEMENTS OF FINANCIAL CONDITION (Unaudited – in 000s) (1)

(1) As a result of our October 1, 2016, adoption of the new consolidation guidance, we deconsolidated a number of tax credit fund VIEs that had been previously consolidated. Certain prior period amounts have been revised from those reported in the prior periods to conform to the current presentation. There was no net impact on our Condensed Consolidated Statements of Income and Comprehensive Income for the prior period as the net change in revenues, interest and other expenses were offset by the impact of the deconsolidation on the net income/(loss) attributable to noncontrolling interests. See our Quarterly Report on Form 10-Q for the quarter ended June 30, 2017 (available at www.sec.gov), for more information. (2) The Other segment includes the results of our principal capital and private equity activities, as well as certain corporate overhead costs of Raymond James Financial, Inc., including the interest costs on our public debt, and the acquisition and integration costs associated with certain acquisitions. (3) Excludes noncontrolling interests. CONDENSED CONSOLIDATED STATEMENTS OF INCOME (Unaudited – in 000s, Except per Share Amounts) Three Months Ended Nine Months Ended June 30, 2017 June 30, 2016 June 30, 2017 June 30, 2016 Revenues: Securities commissions and fees $ 1,017,908 $ 871,764 $ 2,994,405 $ 2,574,756 Investment banking 104,191 72,714 267,993 198,971 Investment advisory and related administrative fees 117,378 96,343 335,901 288,816 Interest 204,224 163,810 579,550 467,920 Account and service fees 174,084 129,334 485,856 373,685 Net trading profit 23,404 29,795 59,770 66,379 Other 21,918 23,237 68,714 58,437 Total revenues 1,663,107 1,386,997 4,792,189 4,028,964 Interest expense (38,560) (28,033) (111,203) (83,841) Net revenues 1,624,547 1,358,964 4,680,986 3,945,123 Non-interest expenses: Compensation, commissions and benefits 1,082,382 908,884 3,124,563 2,663,219 Communications and information processing 77,819 71,717 226,047 212,337 Occupancy and equipment costs 46,507 40,825 140,057 123,505 Clearance and floor brokerage 12,296 10,214 36,053 30,727 Business development 39,305 36,488 116,186 112,529 Investment sub-advisory fees 20,133 15,030 57,206 43,866 Bank loan loss provision 6,209 3,452 13,097 26,991 Acquisition-related expenses 3,366 13,445 17,118 21,332 Other 59,589 54,055 304,900 141,582 Total non-interest expenses 1,347,606 1,154,110 4,035,227 3,376,088 Income including noncontrolling interests and before provision for income taxes 276,941 204,854 645,759 569,035 Provision for income taxes 91,590 72,261 204,160 206,541 Net income including noncontrolling interests 185,351 132,593 441,599 362,494 Net income/(loss) attributable to noncontrolling interests 1,927 7,089 (1,147) 4,814 Net income attributable to Raymond James Financial, Inc. $ 183,424 $ 125,504 $ 442,746 $ 357,680 Earnings per common share – diluted $ 1.24 $ 0.87 $ 3.02 $ 2.47 Weighted-average common and common equivalent shares outstanding – diluted 147,103 143,952 146,347 144,618 (1) (1) Net revenues: Private Client Group $ 1,127,285 $ 900,527 $ 3,252,551 $ 2,653,130 Capital Markets 258,909 252,054 748,096 715,881 Asset Management 125,664 100,940 356,226 297,978 RJ Bank 150,487 126,584 429,873 360,240 Other (2) (7,251) 28 (24,912) (24,379) Intersegment eliminations (30,547) (21,169) (80,848) (57,727) Total net revenues $ 1,624,547 $ 1,358,964 $ 4,680,986 $ 3,945,123 Pre-tax income/(loss): (3) Private Client Group $ 127,951 $ 81,911 $ 230,681 $ 234,283 Capital Markets 34,607 32,769 97,302 86,024 Asset Management 43,270 32,507 122,976 96,996 RJ Bank 99,990 88,930 296,022 239,929 Other (2) (30,804) (38,352) (100,075) (93,011) Pre-tax income $ 275,014 $ 197,765 $ 646,906 $ 564,221 CONSOLIDATED RESULTS BY SEGMENT (unaudited – in 000s) (1) (1)

International Headquarters: The Raymond James Financial Center 880 Carillon Parkway // St. Petersburg, FL 33716 800.248.8863 // raymondjames.com © 2017 Raymond James Financial Raymond James® is a registered trademark of Raymond James Financial, Inc. 17-Fin-Rep-0054 KM 8/17 Stock Traded: NEW YORK STOCK EXCHANGE Stock Symbol: RJF corporate profile Raymond James Financial, Inc. (NYSE: RJF) is a leading diversified financial services company providing private client group, capital markets, asset management, banking and other services to individuals, corporations and municipalities. The company has approximately 7,300 financial advisors in 3,000 locations throughout the United States, Canada and overseas. Total client assets are $664 billion. Public since 1983, the firm is listed on the New York Stock Exchange under the symbol RJF. Additional information is available at www.raymondjames.com.