2019 FIRST QUARTER for the future

Dear Fellow Shareholders, Despite the challenging market environment during the banking revenues. The segment’s pre-tax income of $12 provision during the quarter, the bank’s credit metrics quarter, Raymond James generated record quarterly net million was negatively impacted by the aforementioned $15 remain satisfactory, with criticized loans as a percent of revenues of $1.93 billion and net income of $249 million, million loss associated with the sale of certain of our total loans of 1.13% declining from 1.32% in December 2017 or $1.69 per diluted share, for the fiscal first quarter European operations. Compared to the prior year’s fiscal and 1.18% in September 2018. ended December 31, 2018. Quarterly net revenues first quarter, revenues increased due to higher M&A revenues During the quarter, we announced a leadership change in increased 12% over the prior year’s fiscal first quarter, and, to a lesser extent, equity underwriting fees. The Global Equities and Investment Banking, with co-president driven by higher asset management and related sequential decline in the segment’s net revenues was Jim Bunn becoming president and assuming full leadership administrative fees, higher net interest income and primarily due to lower M&A and tax credit fund revenues, of the business after Jeff Trocin, as part of a planned increased investment banking revenues. Quarterly net which both set records in the preceding quarter. Fixed succession, stepped down as co-president of the business. income of $249 million was negatively impacted by a $15 income brokerage revenues continued to be challenged Jeff remains active with the firm and has been appointed million loss associated with the sale of our operations given the flat yield curve and lower levels of client activity. vice chairman, Raymond James Financial. I thank Jeff for related to the research, sales and trading of European The Asset Management segment produced record quarterly successfully leading our equities business over the past 22 equities, but still improved a substantial 109% over the net revenues of $174 million, up 15% over the prior year’s fiscal years, and for continuing to help the firm in his new prior year’s fiscal first quarter, which included a $117 first quarter and 1% over the preceding quarter. Quarterly capacity. We also announced the appointment of Robert M. million loss related to the Tax Cuts and Jobs Act. pre-tax income of $64 million improved 12% compared to the (Bob) Dutkowsky to the board of directors and its Audit and Annualized return on equity for the quarter was 15.9%. prior year’s fiscal first quarter and was essentially flat with the Risk Committee. Given Bob’s extensive experience in the The Private Client Group (PCG), Asset Management and preceding quarter. Financial assets under management ended technology industry, including as former chief executive Raymond James Bank segments generated record net December at $126.5 billion, down 3% compared to December officer of a number of public companies, we are confident revenues during the quarter. PCG’s record quarterly net 2017 and 10% compared to the preceding quarter. Net inflows that he will serve our board and shareholders well. revenues of $1.36 billion grew 10% over the prior year’s of assets into managed programs were more than offset by Additionally, after nearly 12 years of service, Bob Saltzman fiscal first quarter and 4% over the preceding quarter. the significant decline in the equity markets during the retired from the board of directors on Feb. 28. I am deeply Record PCG quarterly pre-tax income of $164 million quarter, as well as net outflows for Carillon Tower Advisers. grateful for all he has contributed over the years and our increased 6% over the prior year’s fiscal first quarter and best wishes for good health, happiness and prosperity, and Raymond James Bank generated record quarterly net 25% over the preceding quarter. PCG’s record results were continued success in his future endeavors. revenues of $203 million and pre-tax income of $110 million. largely attributable to starting the quarter with higher Revenues grew 23% over the prior year’s fiscal first quarter, We earned several notable awards, recognitions and assets in fee-based accounts, as these accounts are lifted by loan growth and the year-over-year expansion of the accolades during the fiscal first quarter. In PCG, four primarily billed based on balances at the beginning of the net interest margin (NIM). The bank’s NIM increased to 3.25% Raymond James-affiliated advisors were named to Barron’s quarter, and higher fees earned on balances in the for the quarter, up 17 basis points over the prior year’s fiscal list of Top 100 Independent Wealth Advisors, and 13 Raymond James Bank Deposit Program (RJBDP). An first quarter, helped by higher short-term interest rates, but Raymond James-affiliated managers were named to On increase in the internal servicing fee paid by Raymond down two basis points compared to the preceding quarter, Wall Street’s list of Top 75 Branch Managers. Additionally, James Bank and higher short-term interest rates drove the largely due to a higher concentration in lower-yielding cash 12 Raymond James-affiliated advisors were named to increased RJBDP fees. Financial advisor growth was balances. Net loans at Raymond James Bank ended the Working Mother magazine’s Top Wealth Adviser Moms list, essentially flat in the quarter as a number of planned quarter at a record $19.9 billion, an increase of $2.2 billion, or and Raymond James Financial Services advisor Lynn retirements, where we typically retain the vast majority of 12%, over December 2017 and $369 million, or 2%, over Phillips-Gaines was named to InvestmentNews’ Women to client assets, as well as advisors leaving the business September 2018, reflecting broad-based growth across all Watch. In our Financial Institutions Division, 27 Raymond offset the addition of new advisors. Regrettable attrition loan categories. Pre-tax income declined 4% compared to James-affiliated advisors were named to Bank Investment remains very low, and interest from prospective advisors the prior year’s fiscal first quarter, as solid revenue growth Consultant’s list of Top 100 Advisors. is strong across all of our affiliation options. was offset by an increase in the internal servicing fee paid to Raymond James Investment Banking was recognized with The Capital Markets segment generated quarterly net the PCG segment related to RJBDP accounts, as well as a three “Deal of the Year” awards from the M&A Advisor: revenues of $253 million, which grew 17% over the prior higher loan loss provision. The higher loan loss provision was Information Technology (over $100MM), Industrials (over year’s fiscal first quarter but declined 8% compared to the primarily driven by loan growth and certain credit $100MM) and Private Equity ($250MM-$500MM). preceding quarter, bolstered by record investment downgrades during the quarter. Despite the uptick in the

We have always been focused on giving back to our sequential basis. Furthermore, the fiscal second communities, and I am particularly proud of our significant quarter is typically negatively impacted by a reset in efforts during the quarter. Between advisor and associate payroll taxes, a lower number of days during the contributions, and our company match, Raymond James quarter, and elevated costs associated with year-end raised nearly $6.25 million for communities across the mailings. However, we are also entering the quarter country through the United Way – our most effective with the benefit of higher short-term interest rates campaign yet. Through the Tampa Bay Heart Walk, and a sequential increase in client cash balances, Raymond James associates raised nearly $350,000 for the which should lift net interest income and related fees. American Heart Association. Raymond James was a Longer term, we believe we remain well-positioned to finalist in the Corporate Philanthropy Award category, and continue delivering superior returns for our seven other Raymond James-affiliated advisors received shareholders. Thank you for your confidence in honorable mentions. Raymond James. In support of advancing diversity and inclusion in the Sincerely, workplace, I signed the CEO Action for Diversity and Inclusion pledge. Raymond James has always welcomed associates of all backgrounds, not only because it is the Paul C. Reilly right thing to do, but also because a more diverse Chairman, CEO workforce makes us a better and more competitive firm. March 6, 2019 In summary, we are pleased with our strong results during the first fiscal quarter despite the challenging market environment. We acted opportunistically when Certain statements made in this letter may constitute “forward- the equity markets declined during the quarter by looking statements” under the Private Securities Litigation Reform repurchasing 6.1 million shares of common stock for $458 Act of 1995. Forward-looking statements include information concerning future strategic objectives, business prospects, million, an average cost of approximately $75.70 per anticipated savings, financial results (including expenses, share. As of December 31, 2018, we had $255 million earnings, liquidity, cash flow and capital expenditures), industry remaining of the $500 million authorization approved by or market conditions, demand for and pricing of our products, acquisitions and divestitures, anticipated results of litigation the board of directors in late November. and regulatory developments or general economic conditions. In In addition to returning capital to shareholders through addition, words such as “expects,” and future or conditional verbs such as “will” and “should,” as well as any other statement that dividends and share repurchases, our primary objective necessarily depends on future events, are intended to identify remains utilizing our capital to grow the company, both forward-looking statements. Forward-looking statements are not guarantees, and they involve risks, uncertainties and organically and through selective acquisitions. For assumptions. Although we make such statements based on example, we recently announced the acquisition of Silver assumptions that we believe to be reasonable, there can be Lane Advisors to complement and expand our investment no assurance that actual results will not differ materially from those expressed in the forward-looking statements. We caution banking advisory business. I am excited to welcome the investors not to rely unduly on any forward-looking statements Silver Lane Advisors team to the Raymond James family. and urge you to carefully consider the risks described in our filings We believe our strong levels of capital and liquidity position with the Securities and Exchange Commission (the “SEC”) from time to time, including our most recent Annual Report on Form us well for changing market environments. 10-K and subsequent Quarterly Reports on Form 10-Q, which Due to the decline in the equity markets during the fiscal are available at www.raymondjames.com and the SEC’s website at www.sec.gov. We expressly disclaim any obligation to update first quarter, we are entering the fiscal second quarter any forward-looking statement in the event it later turns out to be with assets in fee-based accounts down 8% on a inaccurate, whether as a result of new information, future events, or otherwise.

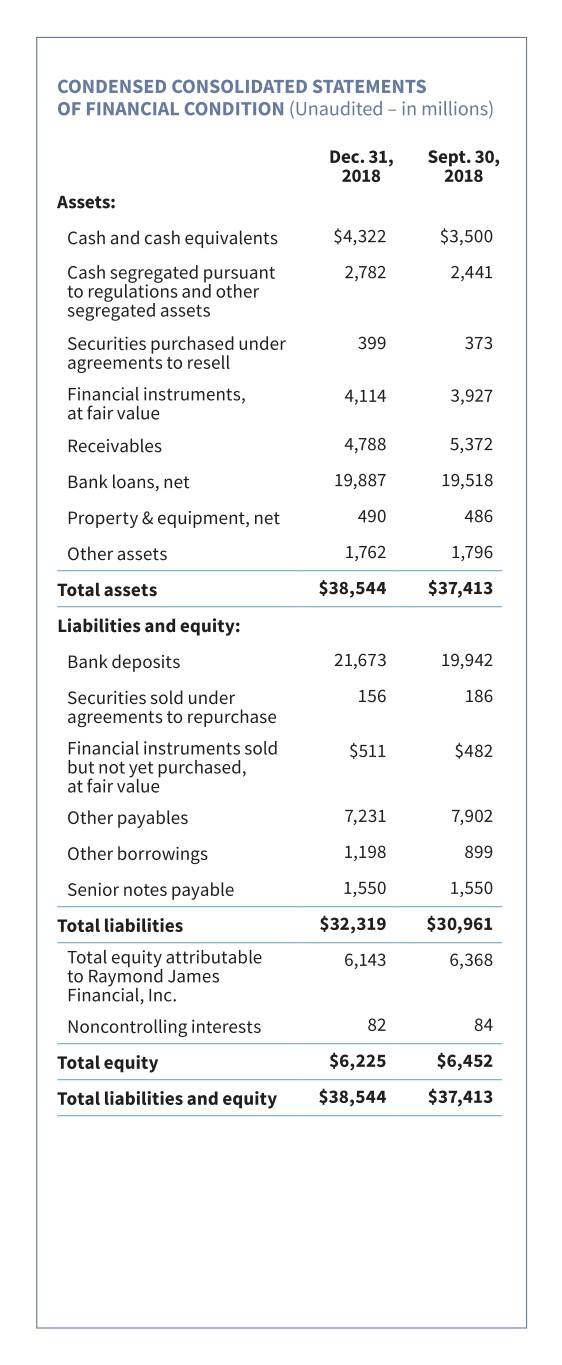

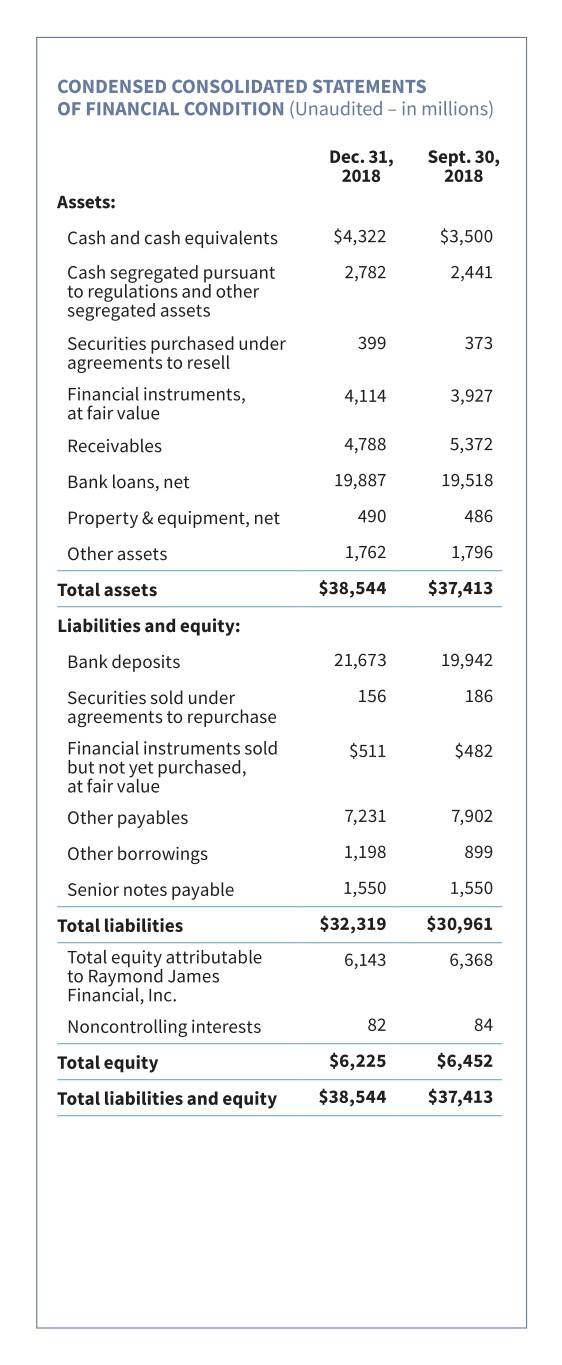

CONDENSED CONSOLIDATED STATEMENTS OF FINANCIAL CONDITION (Unaudited – in millions) Dec. 31, Sept. 30, 2018 2018 Assets: Cash and cash equivalents $4,322 $3,500 Cash segregated pursuant 2,782 2,441 to regulations and other segregated assets Securities purchased under 399 373 agreements to resell Financial instruments, 4,114 3,927 at fair value Receivables 4,788 5,372 Bank loans, net 19,887 19,518 Property & equipment, net 490 486 Other assets 1,762 1,796 Total assets $38,544 $37,413 Liabilities and equity: Bank deposits 21,673 19,942 Securities sold under 156 186 agreements to repurchase Financial instruments sold $511 $482 but not yet purchased, at fair value Other payables 7,231 7,902 Other borrowings 1,198 899 Senior notes payable 1,550 1,550 Total liabilities $32,319 $30,961 Total equity attributable 6,143 6,368 to Raymond James Financial, Inc. Noncontrolling interests 82 84 Total equity $6,225 $6,452 Total liabilities and equity $38,544 $37,413

CONDENSED CONSOLIDATED STATEMENTS OF INCOME (Unaudited - in millions, except per share amounts) Three Months Ended Dec. 31, Dec. 31, 2018 2017 Revenues: Asset management and related administrative fees $ 865 $ 729 Brokerage revenues: Securities commissions 388 416 Principal transactions 76 97 Total brokerage revenues 464 513 Account and service fees 185 171 Investment banking 137 88 Interest income 316 232 Other 37 33 Total revenues 2,004 1,766 Interest expense (73) (40) Net revenues 1,931 1,726 Non-interest expenses: Compensation, commissions and benefits 1,265 1,153 Communications and information processing 92 80 Occupancy and equipment costs 51 50 Business development 43 34 Investment sub-advisory fees 24 22 Professional fees 22 12 Bank loan loss provision 16 1 Acquisition and disposition-related expenses 15 4 Other 73 59 Total non-interest expenses 1,601 1,415 Income including noncontrolling interests and before provision for income taxes 330 311 Provision for income taxes 83 192 Net income including noncontrolling interests 247 119 Net loss attributable to noncontrolling interests (2) — Net income attributable to Raymond James Financial, Inc. $ 249 $ 119 Earnings per common share – diluted $ 1.69 $ 0.80 Weighted-average common and common equivalent shares outstanding – diluted 147.3 148.3 CONSOLIDATED RESULTS BY SEGMENT (unaudited - in millions) Net revenues: Private Client Group $ 1,356 $ 1,233 Capital Markets 253 217 Asset Management 174 151 RJ Bank 203 165 Other (1) 2 (3) Intersegment eliminations (57) (37) Total net revenues $ 1,931 $ 1,726 Pre-tax income/(loss) (excluding noncontrolling interests): Private Client Group $ 164 $ 155 Capital Markets 12 5 Asset Management 64 57 RJ Bank 110 114 Other (1) (18) (20) Pre-tax income (excluding noncontrolling interests) $ 332 $ 311 (1) �The Other segment includes the results of our private equity activities, as well as certain corporate overhead costs of RJF, including the interest costs on our public debt, and the acquisition and integration costs associated with certain acquisitions.

corporate profile Raymond James Financial, Inc. (NYSE: RJF) is a leading diversified financial services company providing private client group, capital markets, asset management, banking and other services to individuals, corporations and municipalities. The company has approximately 7,800 financial advisors throughout the United States, Canada and overseas. Total client assets are $725 billion. Public since 1983, the firm is listed on the New York Stock Exchange under the symbol RJF. Additional information is available at raymondjames.com. Stock Traded: NEW YORK STOCK EXCHANGE Stock Symbol: RJF International Headquarters: The Raymond James Financial Center 880 Carillon Parkway // St. Petersburg, FL 33716 800.248.8863 // raymondjames.com © 2019 Raymond James Financial Raymond James® is a registered trademark of Raymond James Financial, Inc. 19-Fin-Rep-0092 EG 3/19