5 Quarterly Financial Supplement Fourth quarter and fiscal 2023 results

TABLE OF CONTENTS PAGE Consolidated Statements of Income (Unaudited) 3 Consolidated Selected Key Metrics (Unaudited) 4 Segment Results Private Client Group (Unaudited) 6 Capital Markets (Unaudited) 7 Asset Management (Unaudited) 8 Bank (Unaudited) 9 Other (Unaudited) 10 Bank Segment Selected Key Metrics (Unaudited) 11 Reconciliation of non-GAAP financial measures to GAAP financial measures (Unaudited) 12 Footnotes 18 RAYMOND JAMES FINANCIAL, INC.

Three months ended % change from Twelve months ended $ in millions, except per share amounts September 30, 2022 December 31, 2022 March 31, 2023 June 30, 2023 September 30, 2023 September 30, 2022 June 30, 2023 September 30, 2022 September 30, 2023 % change Revenues: Asset management and related administrative fees $ 1,290 $ 1,242 $ 1,302 $ 1,373 $ 1,446 12 % 5 % $ 5,563 $ 5,363 (4) % Brokerage revenues: Securities commissions 357 352 369 356 382 7 % 7 % 1,589 1,459 (8) % Principal transactions 124 132 127 105 98 (21) % (7) % 527 462 (12) % Total brokerage revenues 481 484 496 461 480 — % 4 % 2,116 1,921 (9) % Account and service fees 266 289 258 264 314 18 % 19 % 833 1,125 35 % Investment banking 217 141 154 151 202 (7) % 34 % 1,100 648 (41) % Interest income 667 827 915 987 1,019 53 % 3 % 1,508 3,748 149 % Other 80 44 32 57 54 (33) % (5) % 188 187 (1) % Total revenues 3,001 3,027 3,157 3,293 3,515 17 % 7 % 11,308 12,992 15 % Interest expense (170) (241) (284) (386) (462) 172 % 20 % (305) (1,373) 350 % Net revenues 2,831 2,786 2,873 2,907 3,053 8 % 5 % 11,003 11,619 6 % Non-interest expenses: Compensation, commissions and benefits (1) 1,759 1,736 1,820 1,851 1,892 8 % 2 % 7,329 7,299 — % Non-compensation expenses: Communications and information processing 138 139 153 149 158 14 % 6 % 506 599 18 % Occupancy and equipment 66 66 68 68 69 5 % 1 % 252 271 8 % Business development 59 56 54 66 66 12 % — % 186 242 30 % Investment sub-advisory fees 36 34 36 40 41 14 % 3 % 152 151 (1) % Professional fees 38 32 38 35 40 5 % 14 % 131 145 11 % Bank loan provision for credit losses (2) 34 14 28 54 36 6 % (33) % 100 132 32 % Other (2) (3) (4) 85 57 119 158 166 95 % 5 % 325 500 54 % Total non-compensation expenses 456 398 496 570 576 26 % 1 % 1,652 2,040 23 % Total non-interest expenses 2,215 2,134 2,316 2,421 2,468 11 % 2 % 8,981 9,339 4 % Pre-tax income 616 652 557 486 585 (5) % 20 % 2,022 2,280 13 % Provision for income taxes 177 143 130 117 151 (15) % 29 % 513 541 5 % Net income 439 509 427 369 434 (1) % 18 % 1,509 1,739 15 % Preferred stock dividends 2 2 2 — 2 — % NM 4 6 50 % Net income available to common shareholders $ 437 $ 507 $ 425 $ 369 $ 432 (1) % 17 % $ 1,505 $ 1,733 15 % Earnings per common share – basic (5) $ 2.03 $ 2.36 $ 1.97 $ 1.75 $ 2.07 2 % 18 % $ 7.16 $ 8.16 14 % Earnings per common share – diluted (5) $ 1.98 $ 2.30 $ 1.93 $ 1.71 $ 2.02 2 % 18 % $ 6.98 $ 7.97 14 % Weighted-average common shares outstanding – basic 215.0 214.7 214.3 210.1 208.3 (3) % (1) % 209.9 211.8 1 % Weighted-average common and common equivalent shares outstanding – diluted 220.6 220.4 219.2 214.8 213.8 (3) % — % 215.3 216.9 1 % RAYMOND JAMES FINANCIAL, INC. Consolidated Statements of Income (Unaudited) Please refer to the footnotes at the end of this supplement for additional information. 3

As of % change from $ in millions, except per share amounts September 30, 2022 December 31, 2022 March 31, 2023 June 30, 2023 September 30, 2023 September 30, 2022 June 30, 2023 Total assets $ 80,951 $ 77,047 $ 79,180 $ 77,633 $ 78,360 (3) % 1 % Total common equity attributable to Raymond James Financial, Inc. $ 9,338 $ 9,736 $ 9,875 $ 9,870 $ 10,135 9 % 3 % Book value per share (6) $ 43.41 $ 45.28 $ 46.67 $ 47.34 $ 48.54 12 % 3 % Tangible book value per share (6) (7) $ 35.02 $ 36.87 $ 38.14 $ 38.71 $ 40.03 14 % 3 % Capital ratios: Tier 1 leverage 10.3 % 11.3 % 11.5 % 11.4 % 11.9 % (8) Tier 1 capital 19.2 % 20.3 % 20.1 % 20.6 % 21.4 % (8) Common equity tier 1 19.0 % 20.0 % 19.9 % 20.4 % 21.2 % (8) Total capital 20.4 % 21.6 % 21.4 % 22.0 % 22.8 % (8) Three months ended % change from Twelve months ended $ in millions September 30, 2022 December 31, 2022 March 31, 2023 June 30, 2023 September 30, 2023 September 30, 2022 June 30, 2023 September 30, 2022 September 30, 2023 % change Adjusted pre-tax income (7) $ 646 $ 649 $ 585 $ 526 $ 619 (4) % 18 % $ 2,169 $ 2,378 10 % Adjusted net income available to common shareholders (7) $ 459 $ 505 $ 446 $ 399 $ 457 — % 15 % $ 1,615 $ 1,806 12 % Adjusted earnings per common share – basic (5) (7) $ 2.13 $ 2.35 $ 2.07 $ 1.89 $ 2.19 3 % 16 % $ 7.68 $ 8.50 11 % Adjusted earnings per common share – diluted (5) (7) $ 2.08 $ 2.29 $ 2.03 $ 1.85 $ 2.13 2 % 15 % $ 7.49 $ 8.30 11 % Return on common equity (9) 18.7 % 21.3 % 17.3 % 14.9 % 17.3 % 17.0 % 17.7 % Adjusted return on common equity (7) (9) 19.6 % 21.2 % 18.2 % 16.1 % 18.3 % 18.2 % 18.4 % Adjusted return on tangible common equity (7) (9) 24.1 % 26.1 % 22.3 % 19.7 % 22.2 % 21.1 % 22.5 % Pre-tax margin (10) 21.8 % 23.4 % 19.4 % 16.7 % 19.2 % 18.4 % 19.6 % Adjusted pre-tax margin (7) (10) 22.8 % 23.3 % 20.4 % 18.1 % 20.3 % 19.7 % 20.5 % Total compensation ratio (11) 62.1 % 62.3 % 63.3 % 63.7 % 62.0 % 66.6 % 62.8 % Adjusted total compensation ratio (7) (11) 61.5 % 61.7 % 62.8 % 62.7 % 61.4 % 66.1 % 62.1 % Effective tax rate 28.7 % 21.9 % 23.3 % 24.1 % 25.8 % 25.4 % 23.7 % RAYMOND JAMES FINANCIAL, INC. Consolidated Selected Key Metrics (Unaudited) Please refer to the footnotes at the end of this supplement for additional information. 4

As of % change from September 30, 2022 December 31, 2022 March 31, 2023 June 30, 2023 September 30, 2023 September 30, 2022 June 30, 2023 Client asset metrics ($ in billions): Client assets under administration $ 1,093.1 $ 1,169.7 $ 1,224.4 $ 1,280.9 $ 1,256.5 15 % (2) % Private Client Group assets under administration $ 1,039.0 $ 1,114.3 $ 1,171.1 $ 1,227.0 $ 1,201.2 16 % (2) % Private Client Group assets in fee-based accounts $ 586.0 $ 633.1 $ 666.3 $ 697.0 $ 683.2 17 % (2) % Financial assets under management $ 173.8 $ 185.9 $ 194.4 $ 200.7 $ 196.4 13 % (2) % Net new assets metrics (12) ($ in millions) Three months ended Twelve months ended September 30, 2022 December 31, 2022 March 31, 2023 June 30, 2023 September 30, 2023 September 30, 2022 September 30, 2023 Domestic Private Client Group net new assets (13) $ 20,184 $ 23,226 $ 21,473 $ 14,386 $ 14,169 $ 95,041 $ 73,254 Domestic Private Client Group net new assets growth — annualized (13) 8.3 % 9.8 % 8.4 % 5.4 % 5.0 % 8.5 % 7.7 % Clients' domestic cash sweep and Enhanced Savings Program balances ($ in millions) As of % change from September 30, 2022 December 31, 2022 March 31, 2023 June 30, 2023 September 30, 2023 September 30, 2022 June 30, 2023 Raymond James Bank Deposit Program (“RJBDP”): (14) Bank segment (14) $ 38,705 $ 39,098 $ 37,682 $ 27,915 $ 25,355 (34) % (9) % Third-party banks 21,964 18,231 9,408 16,923 15,858 (28) % (6) % Subtotal RJBDP 60,669 57,329 47,090 44,838 41,213 (32) % (8) % Client Interest Program 6,445 3,053 2,385 1,915 1,620 (75) % (15) % Total clients’ domestic cash sweep balances 67,114 60,382 49,475 46,753 42,833 (36) % (8) % Enhanced Savings Program (15) — — 2,746 11,225 13,592 NM 21 % Total clients’ domestic cash sweep and Enhanced Savings Program balances $ 67,114 $ 60,382 $ 52,221 $ 57,978 $ 56,425 (16) % (3) % Three months ended Twelve months ended September 30, 2022 December 31, 2022 March 31, 2023 June 30, 2023 September 30, 2023 September 30, 2022 September 30, 2023 Average yield on RJBDP - third-party banks (16) 1.85 % 2.72 % 3.25 % 3.37 % 3.60 % 0.82 % 3.20 % As of % change from September 30, 2022 December 31, 2022 March 31, 2023 June 30, 2023 September 30, 2023 September 30, 2022 June 30, 2023 Private Client Group financial advisors: Employees 3,638 3,631 3,628 3,654 3,693 2 % 1 % Independent contractors (13) 5,043 5,068 5,098 5,050 5,019 — % (1) % Total advisors (13) 8,681 8,699 8,726 8,704 8,712 — % — % RAYMOND JAMES FINANCIAL, INC. Consolidated Selected Key Metrics (Unaudited) Please refer to the footnotes at the end of this supplement for additional information. 5

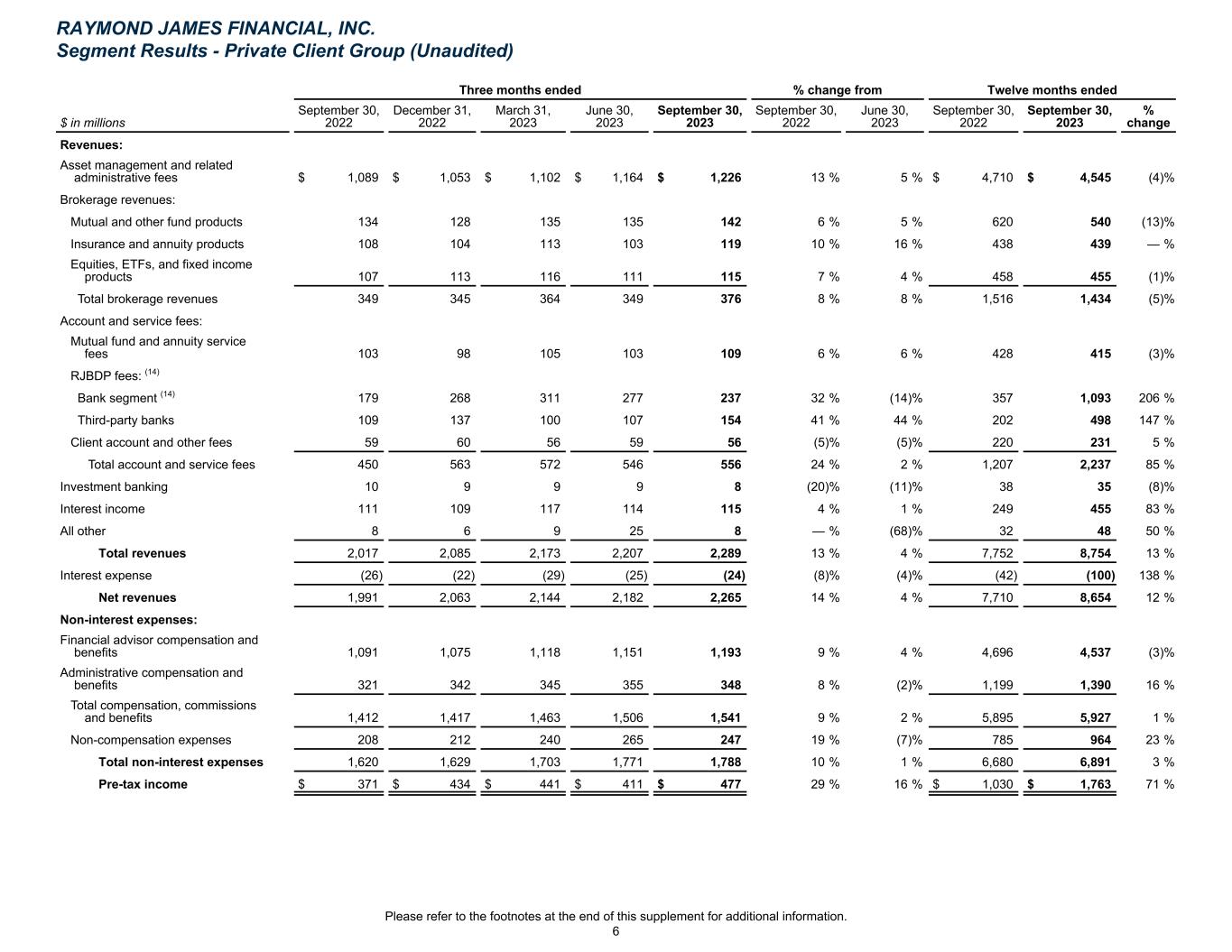

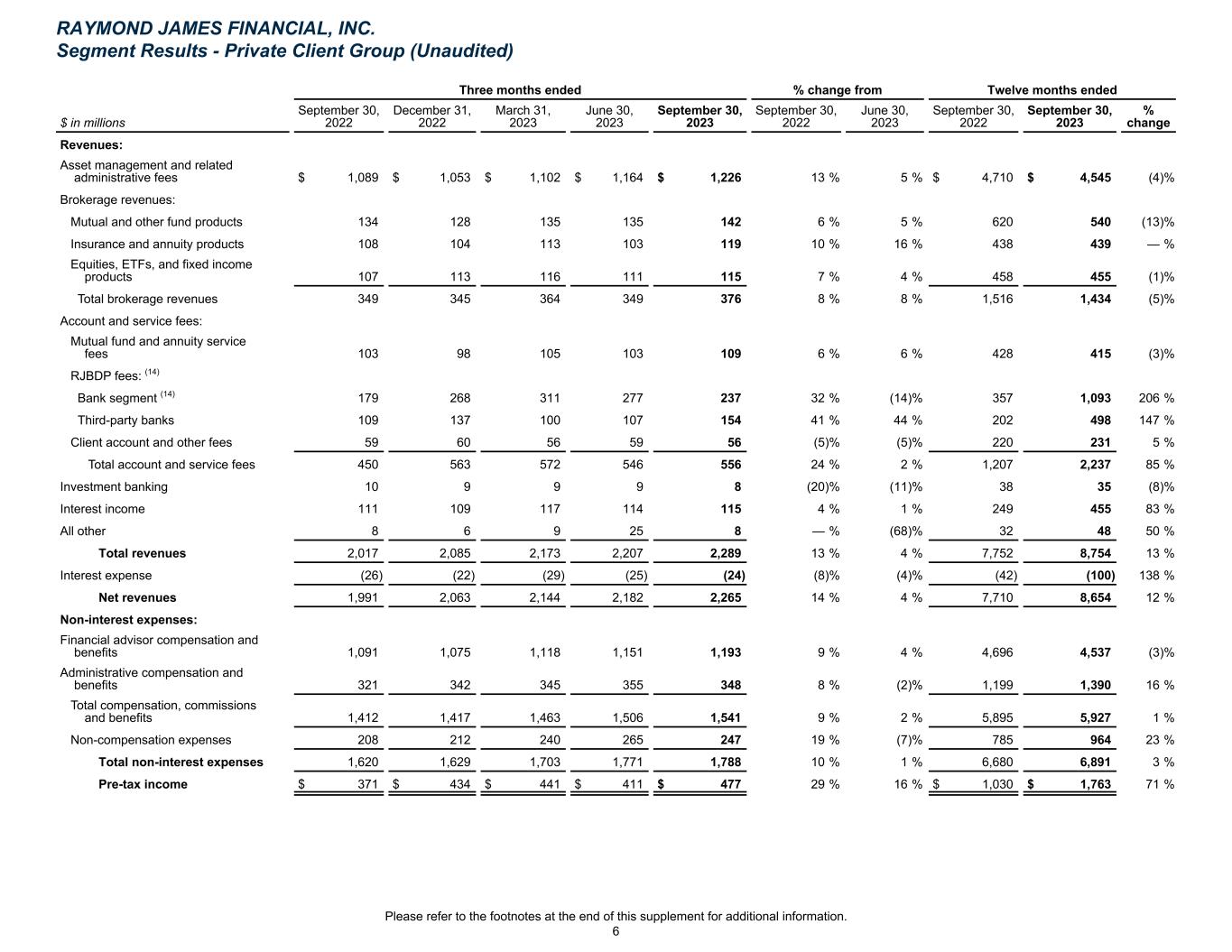

Three months ended % change from Twelve months ended $ in millions September 30, 2022 December 31, 2022 March 31, 2023 June 30, 2023 September 30, 2023 September 30, 2022 June 30, 2023 September 30, 2022 September 30, 2023 % change Revenues: Asset management and related administrative fees $ 1,089 $ 1,053 $ 1,102 $ 1,164 $ 1,226 13 % 5 % $ 4,710 $ 4,545 (4) % Brokerage revenues: Mutual and other fund products 134 128 135 135 142 6 % 5 % 620 540 (13) % Insurance and annuity products 108 104 113 103 119 10 % 16 % 438 439 — % Equities, ETFs, and fixed income products 107 113 116 111 115 7 % 4 % 458 455 (1) % Total brokerage revenues 349 345 364 349 376 8 % 8 % 1,516 1,434 (5) % Account and service fees: Mutual fund and annuity service fees 103 98 105 103 109 6 % 6 % 428 415 (3) % RJBDP fees: (14) Bank segment (14) 179 268 311 277 237 32 % (14) % 357 1,093 206 % Third-party banks 109 137 100 107 154 41 % 44 % 202 498 147 % Client account and other fees 59 60 56 59 56 (5) % (5) % 220 231 5 % Total account and service fees 450 563 572 546 556 24 % 2 % 1,207 2,237 85 % Investment banking 10 9 9 9 8 (20) % (11) % 38 35 (8) % Interest income 111 109 117 114 115 4 % 1 % 249 455 83 % All other 8 6 9 25 8 — % (68) % 32 48 50 % Total revenues 2,017 2,085 2,173 2,207 2,289 13 % 4 % 7,752 8,754 13 % Interest expense (26) (22) (29) (25) (24) (8) % (4) % (42) (100) 138 % Net revenues 1,991 2,063 2,144 2,182 2,265 14 % 4 % 7,710 8,654 12 % Non-interest expenses: Financial advisor compensation and benefits 1,091 1,075 1,118 1,151 1,193 9 % 4 % 4,696 4,537 (3) % Administrative compensation and benefits 321 342 345 355 348 8 % (2) % 1,199 1,390 16 % Total compensation, commissions and benefits 1,412 1,417 1,463 1,506 1,541 9 % 2 % 5,895 5,927 1 % Non-compensation expenses 208 212 240 265 247 19 % (7) % 785 964 23 % Total non-interest expenses 1,620 1,629 1,703 1,771 1,788 10 % 1 % 6,680 6,891 3 % Pre-tax income $ 371 $ 434 $ 441 $ 411 $ 477 29 % 16 % $ 1,030 $ 1,763 71 % RAYMOND JAMES FINANCIAL, INC. Segment Results - Private Client Group (Unaudited) Please refer to the footnotes at the end of this supplement for additional information. 6

Three months ended % change from Twelve months ended $ in millions September 30, 2022 December 31, 2022 March 31, 2023 June 30, 2023 September 30, 2023 September 30, 2022 June 30, 2023 September 30, 2022 September 30, 2023 % change Revenues: Brokerage revenues: Fixed income $ 96 $ 100 $ 96 $ 78 $ 71 (26) % (9) % $ 448 $ 345 (23) % Equity 30 34 34 32 30 — % (6) % 142 130 (8) % Total brokerage revenues 126 134 130 110 101 (20) % (8) % 590 475 (19) % Investment banking: Merger & acquisition and advisory 152 102 87 88 141 (7) % 60 % 709 418 (41) % Equity underwriting 25 15 29 25 16 (36) % (36) % 210 85 (60) % Debt underwriting 30 16 29 28 37 23 % 32 % 143 110 (23) % Total investment banking 207 133 145 141 194 (6) % 38 % 1,062 613 (42) % Interest income 20 23 21 21 23 15 % 10 % 36 88 144 % Affordable housing investments business revenues 56 24 23 21 41 (27) % 95 % 127 109 (14) % All other 9 4 3 4 3 (67) % (25) % 21 14 (33) % Total revenues 418 318 322 297 362 (13) % 22 % 1,836 1,299 (29) % Interest expense (19) (23) (20) (21) (21) 11 % — % (27) (85) 215 % Net revenues 399 295 302 276 341 (15) % 24 % 1,809 1,214 (33) % Non-interest expenses: Compensation, commissions and benefits 238 213 231 220 238 — % 8 % 1,065 902 (15) % Non-compensation expenses 95 98 105 90 110 16 % 22 % 329 403 22 % Total non-interest expenses 333 311 336 310 348 5 % 12 % 1,394 1,305 (6) % Pre-tax income/(loss) $ 66 $ (16) $ (34) $ (34) $ (7) NM 79 % $ 415 $ (91) NM RAYMOND JAMES FINANCIAL, INC. Segment Results - Capital Markets (Unaudited) Please refer to the footnotes at the end of this supplement for additional information. 7

Three months ended % change from Twelve months ended $ in millions September 30, 2022 December 31, 2022 March 31, 2023 June 30, 2023 September 30, 2023 September 30, 2022 June 30, 2023 September 30, 2022 September 30, 2023 % change Revenues: Asset management and related administrative fees: Managed programs $ 140 $ 134 $ 140 $ 146 $ 153 9 % 5 % $ 585 $ 573 (2) % Administration and other 69 63 66 71 73 6 % 3 % 297 273 (8) % Total asset management and related administrative fees 209 197 206 217 226 8 % 4 % 882 846 (4) % Account and service fees 5 5 6 5 5 — % — % 22 21 (5) % All other 2 5 4 4 5 150 % 25 % 10 18 80 % Net revenues 216 207 216 226 236 9 % 4 % 914 885 (3) % Non-interest expenses: Compensation, commissions and benefits 52 47 52 51 48 (8) % (6) % 194 198 2 % Non-compensation expenses 81 80 82 86 88 9 % 2 % 334 336 1 % Total non-interest expenses 133 127 134 137 136 2 % (1) % 528 534 1 % Pre-tax income $ 83 $ 80 $ 82 $ 89 $ 100 20 % 12 % $ 386 $ 351 (9) % RAYMOND JAMES FINANCIAL, INC. Segment Results - Asset Management (Unaudited) Please refer to the footnotes at the end of this supplement for additional information. 8

Three months ended % change from Twelve months ended $ in millions September 30, 2022 December 31, 2022 March 31, 2023 June 30, 2023 September 30, 2023 September 30, 2022 June 30, 2023 September 30, 2022 September 30, 2023 % change Revenues: Interest income $ 527 $ 676 $ 749 $ 826 $ 847 61 % 3 % $ 1,209 $ 3,098 156 % Interest expense (110) (185) (219) (329) (408) 271 % 24 % (156) (1,141) 631 % Net interest income 417 491 530 497 439 5 % (12) % 1,053 1,957 86 % All other 11 17 10 17 12 9 % (29) % 31 56 81 % Net revenues 428 508 540 514 451 5 % (12) % 1,084 2,013 86 % Non-interest expenses: Compensation and benefits 36 40 48 48 41 14 % (15) % 84 177 111 % Non-compensation expenses: Bank loan provision for credit losses 34 14 28 54 36 6 % (33) % 100 132 32 % RJBDP fees to Private Client Group (14) 179 268 311 277 237 32 % (14) % 357 1,093 206 % All other 56 50 62 69 59 5 % (14) % 161 240 49 % Total non-compensation expenses 269 332 401 400 332 23 % (17) % 618 1,465 137 % Total non-interest expenses 305 372 449 448 373 22 % (17) % 702 1,642 134 % Pre-tax income $ 123 $ 136 $ 91 $ 66 $ 78 (37) % 18 % $ 382 $ 371 (3) % RAYMOND JAMES FINANCIAL, INC. Segment Results - Bank (Unaudited) Please refer to the footnotes at the end of this supplement for additional information. 9

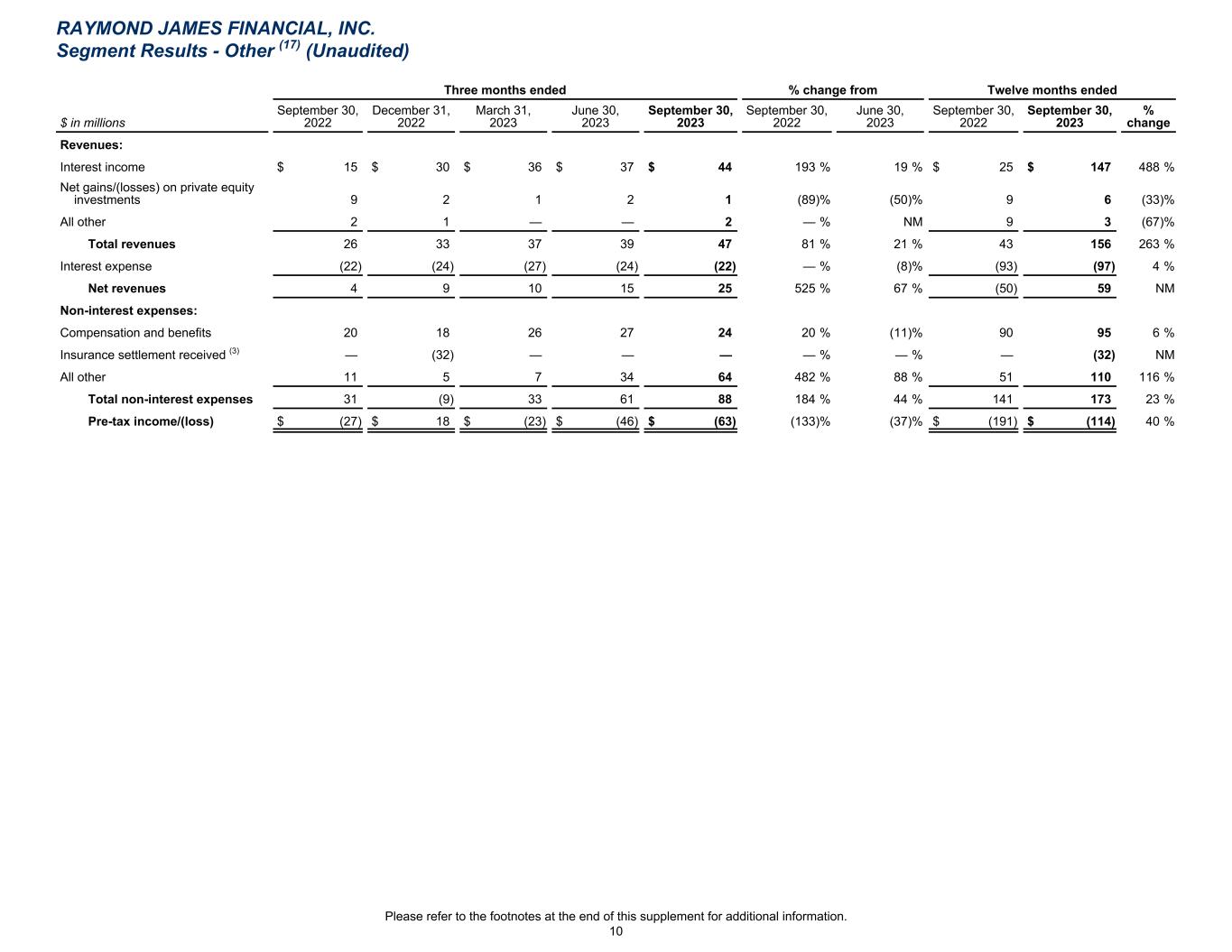

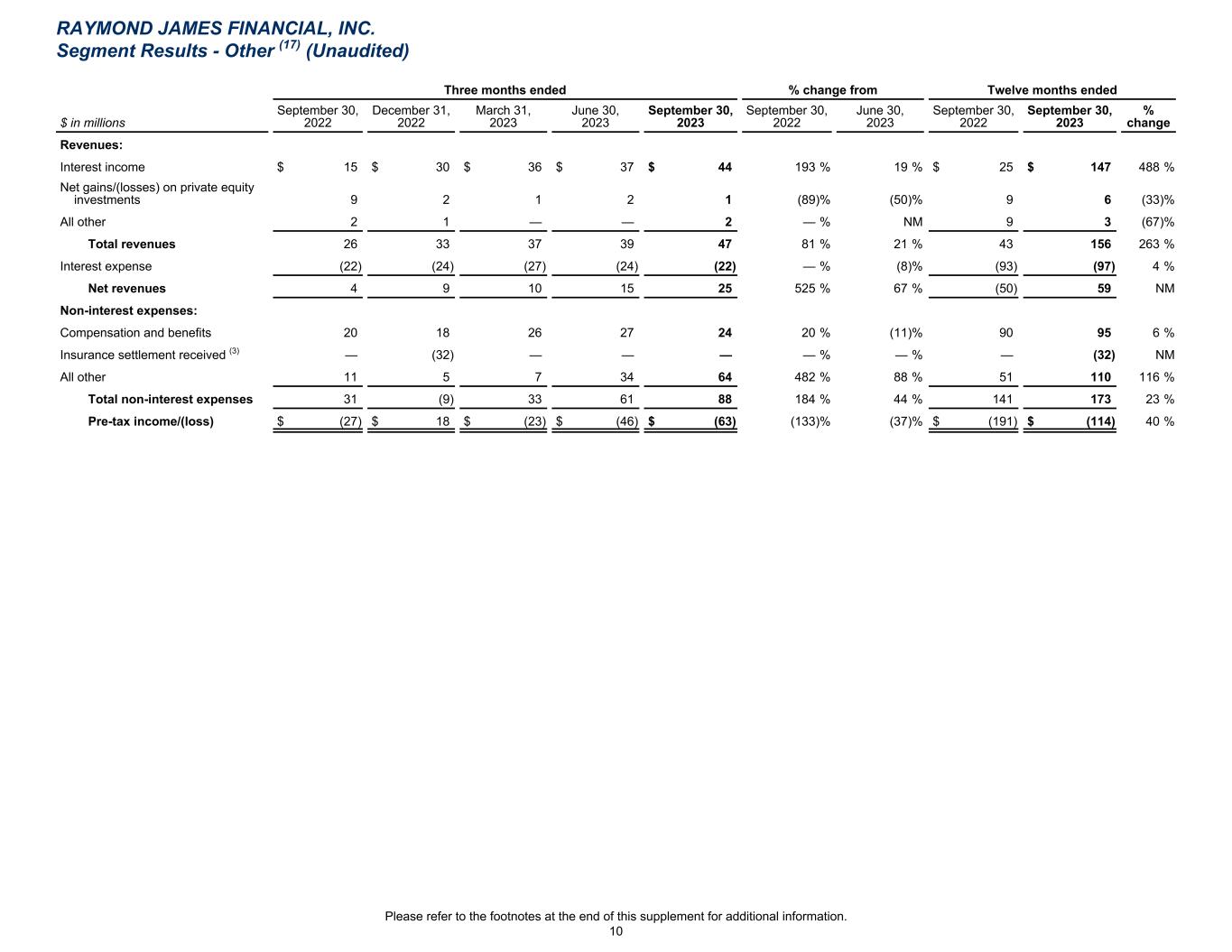

Three months ended % change from Twelve months ended $ in millions September 30, 2022 December 31, 2022 March 31, 2023 June 30, 2023 September 30, 2023 September 30, 2022 June 30, 2023 September 30, 2022 September 30, 2023 % change Revenues: Interest income $ 15 $ 30 $ 36 $ 37 $ 44 193 % 19 % $ 25 $ 147 488 % Net gains/(losses) on private equity investments 9 2 1 2 1 (89) % (50) % 9 6 (33) % All other 2 1 — — 2 — % NM 9 3 (67) % Total revenues 26 33 37 39 47 81 % 21 % 43 156 263 % Interest expense (22) (24) (27) (24) (22) — % (8) % (93) (97) 4 % Net revenues 4 9 10 15 25 525 % 67 % (50) 59 NM Non-interest expenses: Compensation and benefits 20 18 26 27 24 20 % (11) % 90 95 6 % Insurance settlement received (3) — (32) — — — — % — % — (32) NM All other 11 5 7 34 64 482 % 88 % 51 110 116 % Total non-interest expenses 31 (9) 33 61 88 184 % 44 % 141 173 23 % Pre-tax income/(loss) $ (27) $ 18 $ (23) $ (46) $ (63) (133) % (37) % $ (191) $ (114) 40 % RAYMOND JAMES FINANCIAL, INC. Segment Results - Other (17) (Unaudited) Please refer to the footnotes at the end of this supplement for additional information. 10

Our Bank segment includes Raymond James Bank and TriState Capital Bank. Bank Segment As of % change from $ in millions September 30, 2022 December 31, 2022 March 31, 2023 June 30, 2023 September 30, 2023 September 30, 2022 June 30, 2023 Total assets $ 56,737 $ 57,623 $ 60,400 $ 59,506 $ 60,041 6 % 1 % Bank loans, net: Raymond James Bank $ 31,109 $ 31,690 $ 31,425 $ 30,834 $ 30,906 (1) % — % TriState Capital Bank 12,130 12,376 12,258 12,511 12,869 6 % 3 % Total bank loans, net $ 43,239 $ 44,066 $ 43,683 $ 43,345 $ 43,775 1 % 1 % Bank loan allowance for credit losses $ 396 $ 408 $ 415 $ 456 $ 474 20 % 4 % Bank loan allowance for credit losses as a % of total loans held for investment 0.91 % 0.92 % 0.94 % 1.04 % 1.07 % Bank loan allowance for credit losses on corporate loans as a % of corporate loans held for investment (18) 1.73 % 1.64 % 1.67 % 1.90 % 2.03 % Total nonperforming assets $ 74 $ 61 $ 99 $ 127 $ 128 73 % 1 % Nonperforming assets as a % of total assets 0.13 % 0.11 % 0.16 % 0.21 % 0.21 % Total criticized loans $ 496 $ 447 $ 403 $ 411 $ 518 4 % 26 % Criticized loans as a % of loans held for investment 1.14 % 1.01 % 0.92 % 0.94 % 1.17 % Total bank deposits $ 51,357 $ 51,979 $ 54,229 $ 53,768 $ 54,199 6 % 1 % As of % change from $ in millions September 30, 2022 December 31, 2022 March 31, 2023 June 30, 2023 September 30, 2023 September 30, 2022 June 30, 2023 Securities-based loans (19) $ 15,297 $ 14,885 $ 14,227 $ 14,227 $ 14,606 (5) % 3 % Commercial and industrial loans 11,173 11,405 11,259 10,663 10,406 (7) % (2) % Commercial real estate loans 6,549 6,929 7,054 7,091 7,221 10 % 2 % Real estate investment trust loans 1,592 1,680 1,717 1,715 1,668 5 % (3) % Residential mortgage loans 7,386 7,818 8,079 8,422 8,662 17 % 3 % Tax-exempt loans 1,501 1,667 1,643 1,548 1,541 3 % — % Total loans held for investment 43,498 44,384 43,979 43,666 44,104 1 % 1 % Held for sale loans 137 90 119 135 145 6 % 7 % Total loans held for sale and investment 43,635 44,474 44,098 43,801 44,249 1 % 1 % Allowance for credit losses (396) (408) (415) (456) (474) 20 % 4 % Bank loans, net $ 43,239 $ 44,066 $ 43,683 $ 43,345 $ 43,775 1 % 1 % Three months ended % change from Twelve months ended $ in millions September 30, 2022 December 31, 2022 March 31, 2023 June 30, 2023 September 30, 2023 September 30, 2022 June 30, 2023 September 30, 2022 September 30, 2023 % change Bank loan provision for credit losses $ 34 $ 14 $ 28 $ 54 $ 36 6 % (33) % $ 100 $ 132 32 % Net charge-offs $ 14 $ 2 $ 20 $ 15 $ 17 21 % 13 % $ 26 $ 54 108 % Net interest margin (net yield on interest-earning assets) 2.91 % 3.36 % 3.63 % 3.26 % 2.87 % 2.39 % 3.28 % RAYMOND JAMES FINANCIAL, INC. Bank Segment Selected Key Metrics (Unaudited) Please refer to the footnotes at the end of this supplement for additional information. 11

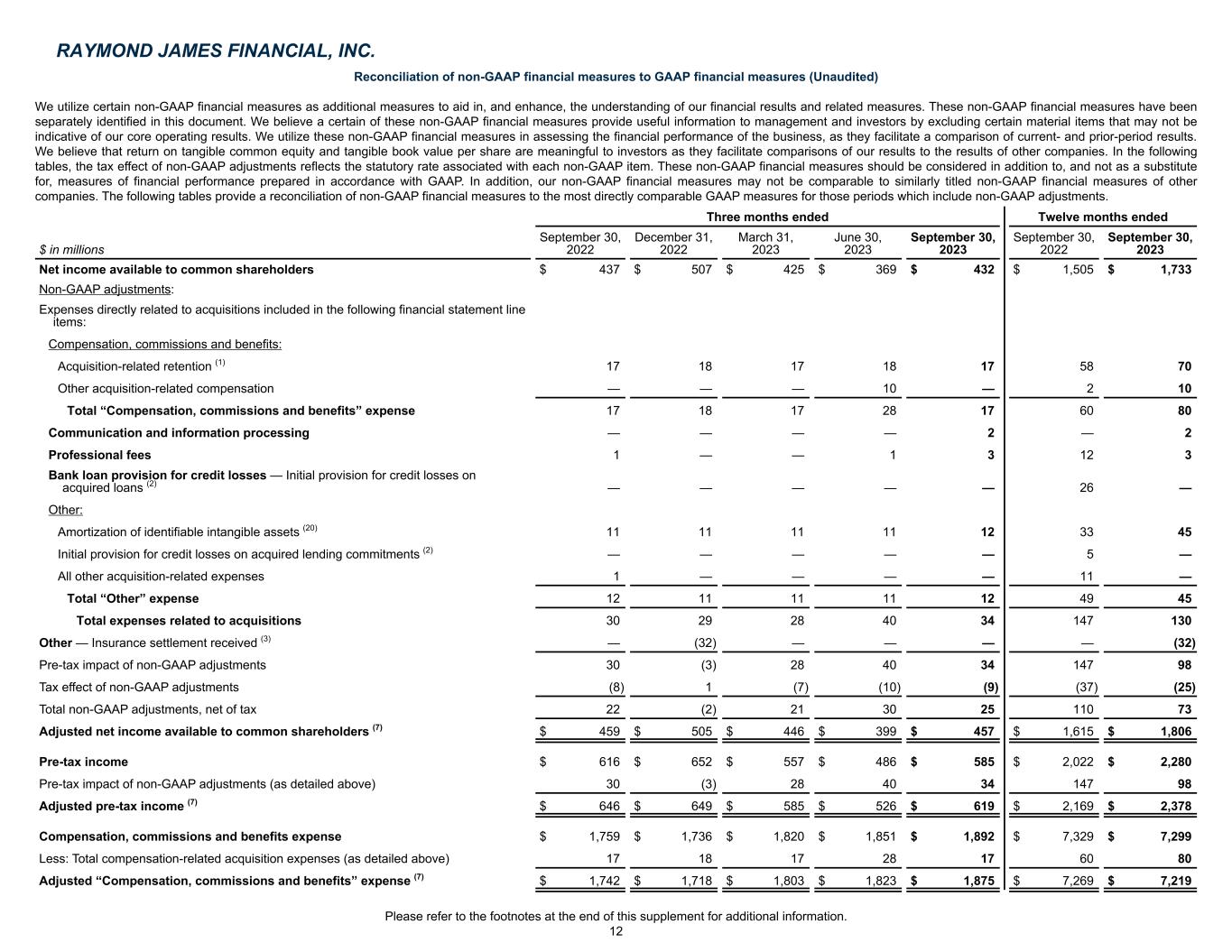

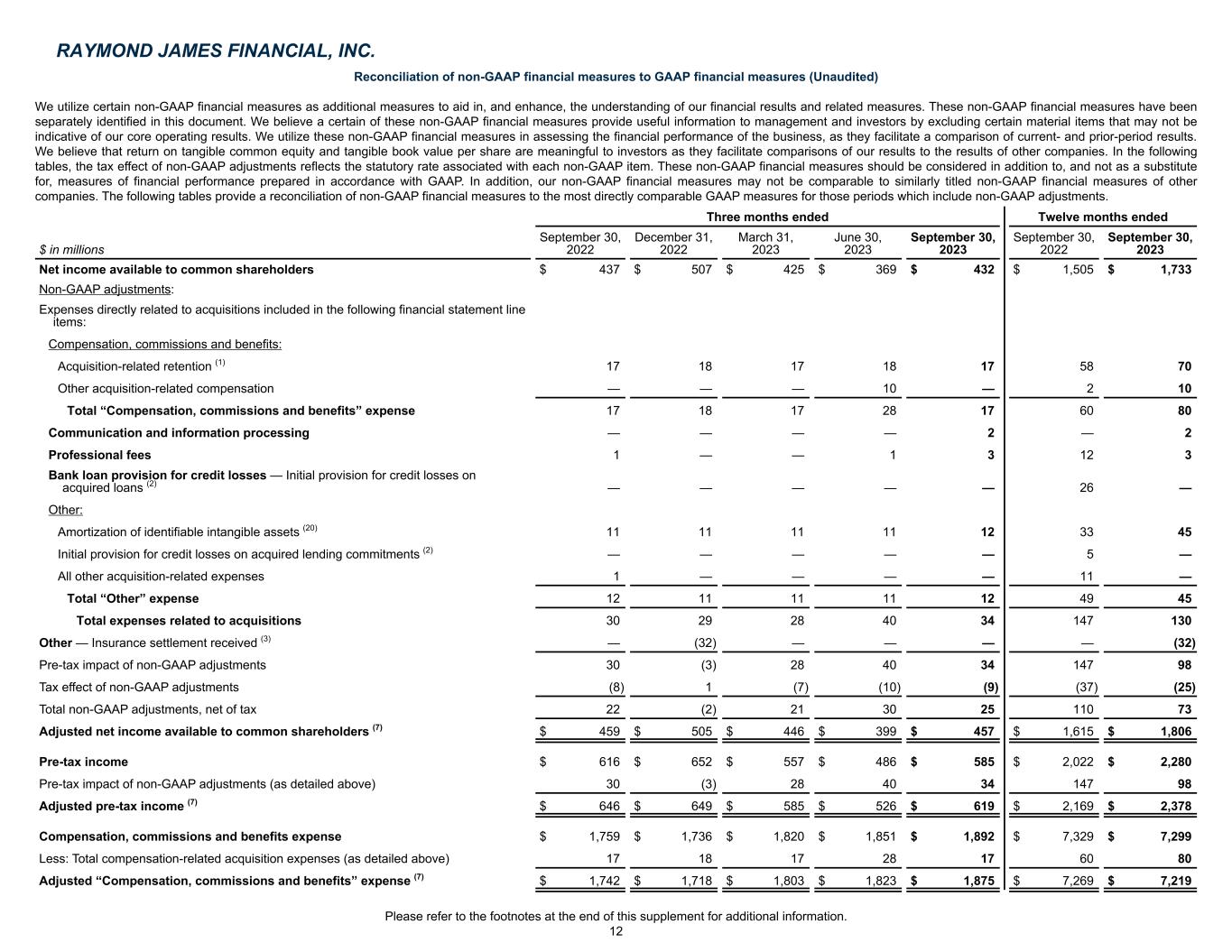

Reconciliation of non-GAAP financial measures to GAAP financial measures (Unaudited) We utilize certain non-GAAP financial measures as additional measures to aid in, and enhance, the understanding of our financial results and related measures. These non-GAAP financial measures have been separately identified in this document. We believe a certain of these non-GAAP financial measures provide useful information to management and investors by excluding certain material items that may not be indicative of our core operating results. We utilize these non-GAAP financial measures in assessing the financial performance of the business, as they facilitate a comparison of current- and prior-period results. We believe that return on tangible common equity and tangible book value per share are meaningful to investors as they facilitate comparisons of our results to the results of other companies. In the following tables, the tax effect of non-GAAP adjustments reflects the statutory rate associated with each non-GAAP item. These non-GAAP financial measures should be considered in addition to, and not as a substitute for, measures of financial performance prepared in accordance with GAAP. In addition, our non-GAAP financial measures may not be comparable to similarly titled non-GAAP financial measures of other companies. The following tables provide a reconciliation of non-GAAP financial measures to the most directly comparable GAAP measures for those periods which include non-GAAP adjustments. Three months ended Twelve months ended $ in millions September 30, 2022 December 31, 2022 March 31, 2023 June 30, 2023 September 30, 2023 September 30, 2022 September 30, 2023 Net income available to common shareholders $ 437 $ 507 $ 425 $ 369 $ 432 $ 1,505 $ 1,733 Non-GAAP adjustments: Expenses directly related to acquisitions included in the following financial statement line items: Compensation, commissions and benefits: Acquisition-related retention (1) 17 18 17 18 17 58 70 Other acquisition-related compensation — — — 10 — 2 10 Total “Compensation, commissions and benefits” expense 17 18 17 28 17 60 80 Communication and information processing — — — — 2 — 2 Professional fees 1 — — 1 3 12 3 Bank loan provision for credit losses — Initial provision for credit losses on acquired loans (2) — — — — — 26 — Other: Amortization of identifiable intangible assets (20) 11 11 11 11 12 33 45 Initial provision for credit losses on acquired lending commitments (2) — — — — — 5 — All other acquisition-related expenses 1 — — — — 11 — Total “Other” expense 12 11 11 11 12 49 45 Total expenses related to acquisitions 30 29 28 40 34 147 130 Other — Insurance settlement received (3) — (32) — — — — (32) Pre-tax impact of non-GAAP adjustments 30 (3) 28 40 34 147 98 Tax effect of non-GAAP adjustments (8) 1 (7) (10) (9) (37) (25) Total non-GAAP adjustments, net of tax 22 (2) 21 30 25 110 73 Adjusted net income available to common shareholders (7) $ 459 $ 505 $ 446 $ 399 $ 457 $ 1,615 $ 1,806 Pre-tax income $ 616 $ 652 $ 557 $ 486 $ 585 $ 2,022 $ 2,280 Pre-tax impact of non-GAAP adjustments (as detailed above) 30 (3) 28 40 34 147 98 Adjusted pre-tax income (7) $ 646 $ 649 $ 585 $ 526 $ 619 $ 2,169 $ 2,378 Compensation, commissions and benefits expense $ 1,759 $ 1,736 $ 1,820 $ 1,851 $ 1,892 $ 7,329 $ 7,299 Less: Total compensation-related acquisition expenses (as detailed above) 17 18 17 28 17 60 80 Adjusted “Compensation, commissions and benefits” expense (7) $ 1,742 $ 1,718 $ 1,803 $ 1,823 $ 1,875 $ 7,269 $ 7,219 RAYMOND JAMES FINANCIAL, INC. Please refer to the footnotes at the end of this supplement for additional information. 12

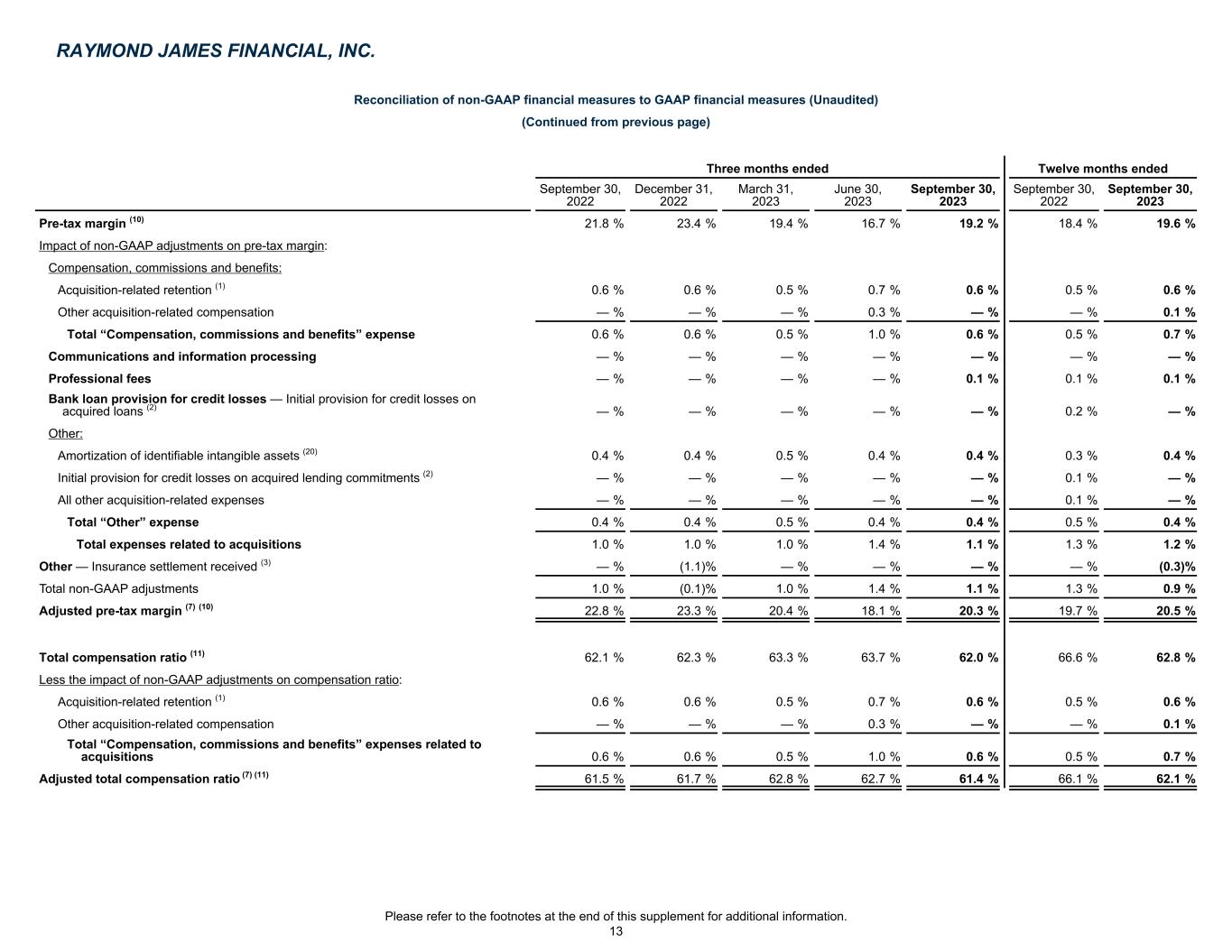

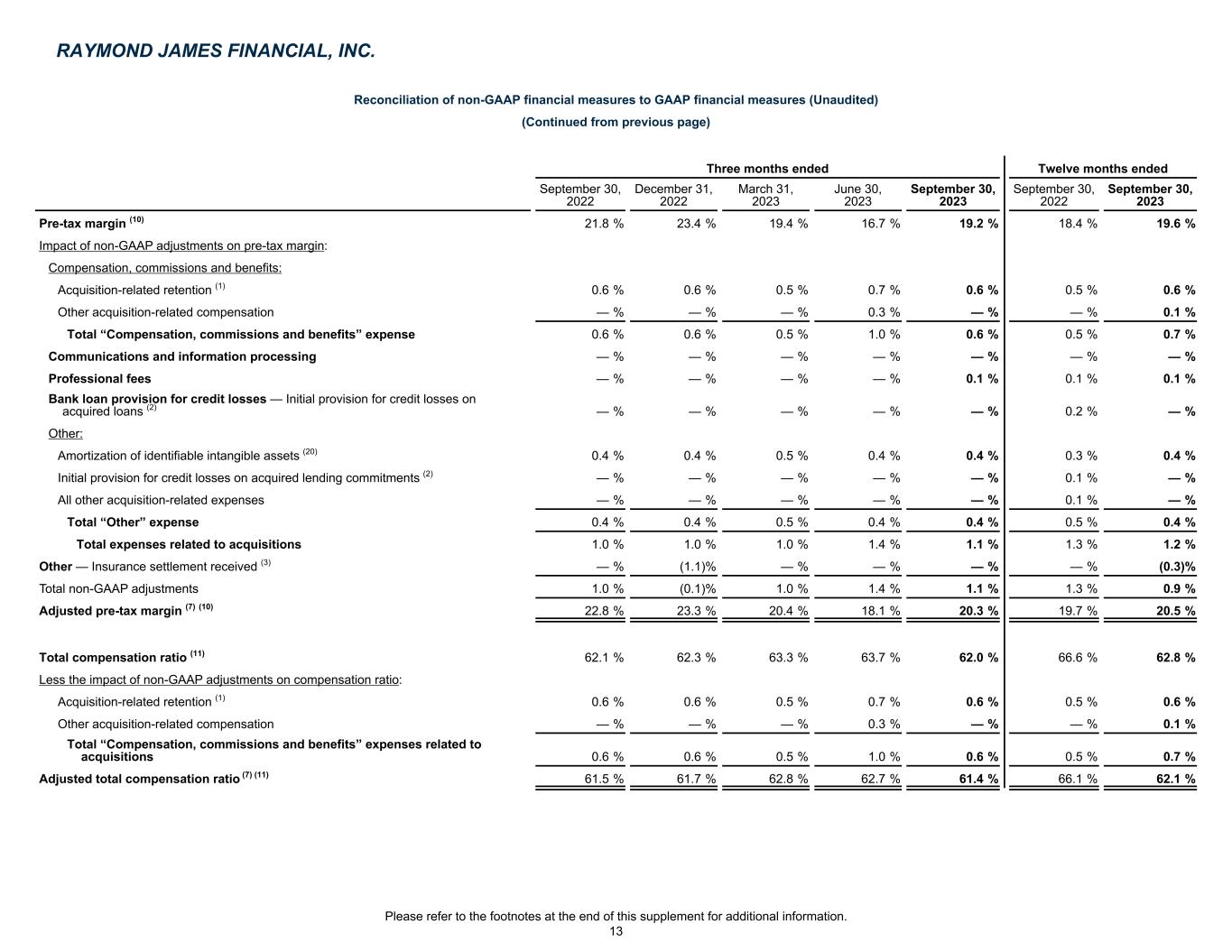

Reconciliation of non-GAAP financial measures to GAAP financial measures (Unaudited) (Continued from previous page) Three months ended Twelve months ended September 30, 2022 December 31, 2022 March 31, 2023 June 30, 2023 September 30, 2023 September 30, 2022 September 30, 2023 Pre-tax margin (10) 21.8 % 23.4 % 19.4 % 16.7 % 19.2 % 18.4 % 19.6 % Impact of non-GAAP adjustments on pre-tax margin: Compensation, commissions and benefits: Acquisition-related retention (1) 0.6 % 0.6 % 0.5 % 0.7 % 0.6 % 0.5 % 0.6 % Other acquisition-related compensation — % — % — % 0.3 % — % — % 0.1 % Total “Compensation, commissions and benefits” expense 0.6 % 0.6 % 0.5 % 1.0 % 0.6 % 0.5 % 0.7 % Communications and information processing — % — % — % — % — % — % — % Professional fees — % — % — % — % 0.1 % 0.1 % 0.1 % Bank loan provision for credit losses — Initial provision for credit losses on acquired loans (2) — % — % — % — % — % 0.2 % — % Other: Amortization of identifiable intangible assets (20) 0.4 % 0.4 % 0.5 % 0.4 % 0.4 % 0.3 % 0.4 % Initial provision for credit losses on acquired lending commitments (2) — % — % — % — % — % 0.1 % — % All other acquisition-related expenses — % — % — % — % — % 0.1 % — % Total “Other” expense 0.4 % 0.4 % 0.5 % 0.4 % 0.4 % 0.5 % 0.4 % Total expenses related to acquisitions 1.0 % 1.0 % 1.0 % 1.4 % 1.1 % 1.3 % 1.2 % Other — Insurance settlement received (3) — % (1.1) % — % — % — % — % (0.3) % Total non-GAAP adjustments 1.0 % (0.1) % 1.0 % 1.4 % 1.1 % 1.3 % 0.9 % Adjusted pre-tax margin (7) (10) 22.8 % 23.3 % 20.4 % 18.1 % 20.3 % 19.7 % 20.5 % Total compensation ratio (11) 62.1 % 62.3 % 63.3 % 63.7 % 62.0 % 66.6 % 62.8 % Less the impact of non-GAAP adjustments on compensation ratio: Acquisition-related retention (1) 0.6 % 0.6 % 0.5 % 0.7 % 0.6 % 0.5 % 0.6 % Other acquisition-related compensation — % — % — % 0.3 % — % — % 0.1 % Total “Compensation, commissions and benefits” expenses related to acquisitions 0.6 % 0.6 % 0.5 % 1.0 % 0.6 % 0.5 % 0.7 % Adjusted total compensation ratio (7) (11) 61.5 % 61.7 % 62.8 % 62.7 % 61.4 % 66.1 % 62.1 % RAYMOND JAMES FINANCIAL, INC. Please refer to the footnotes at the end of this supplement for additional information. 13

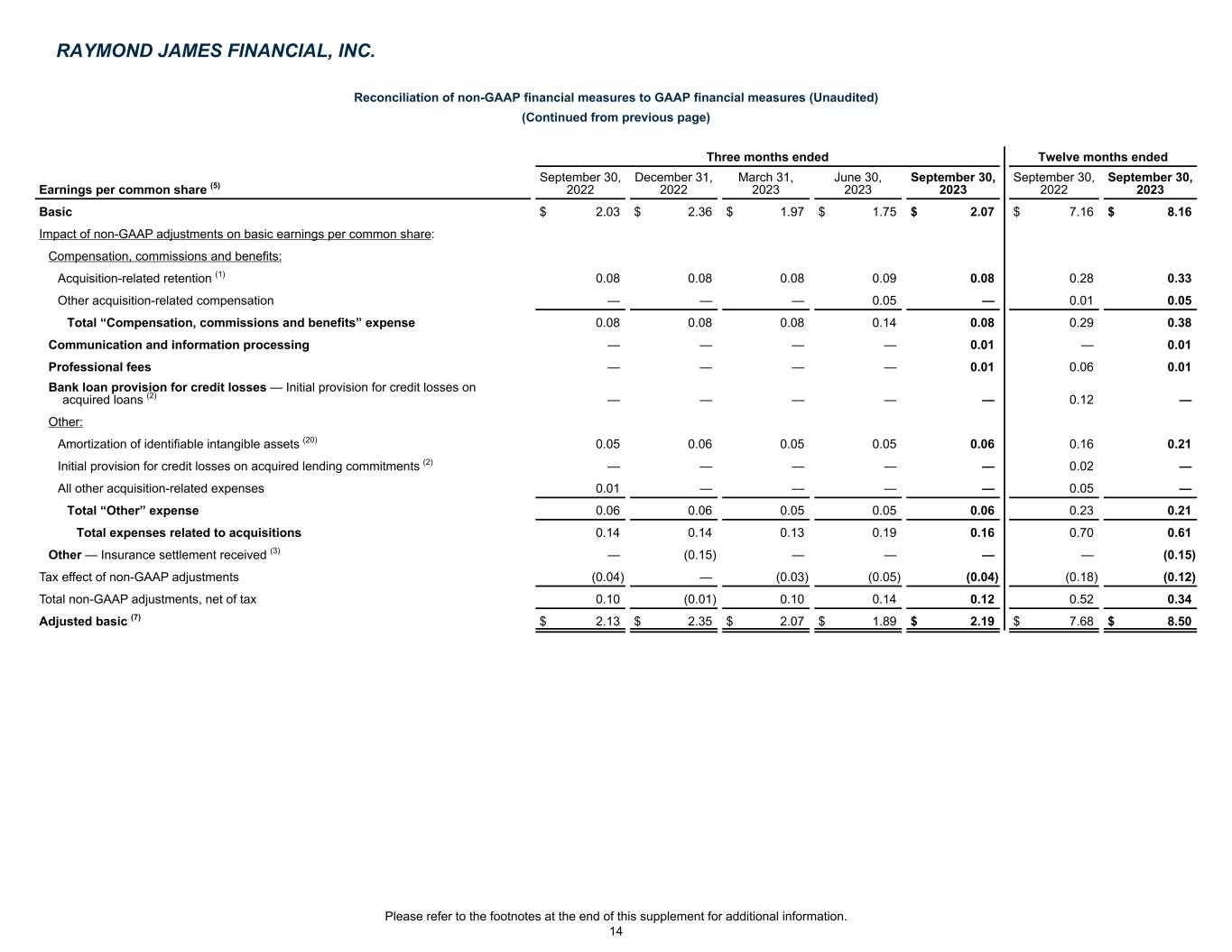

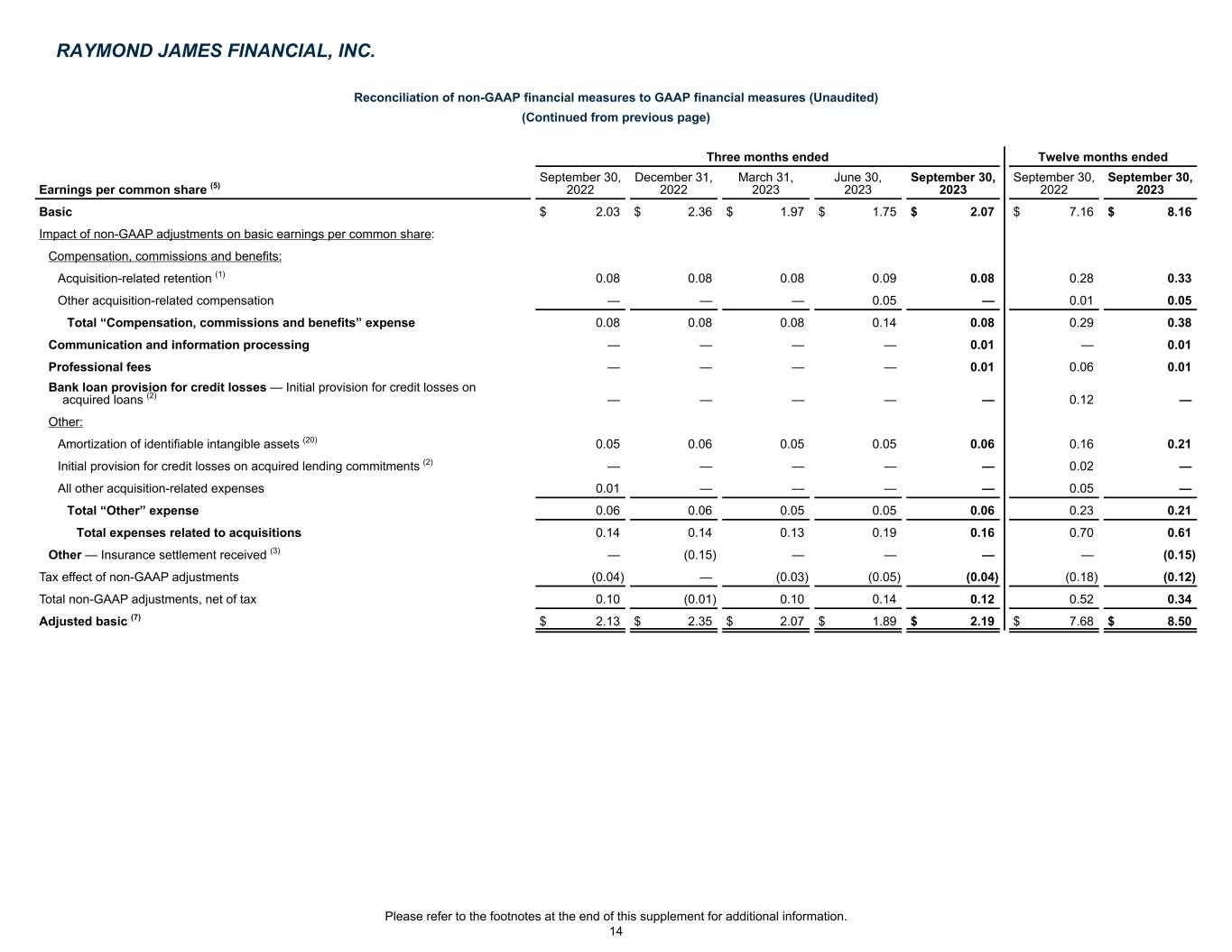

Reconciliation of non-GAAP financial measures to GAAP financial measures (Unaudited) (Continued from previous page) Three months ended Twelve months ended Earnings per common share (5) September 30, 2022 December 31, 2022 March 31, 2023 June 30, 2023 September 30, 2023 September 30, 2022 September 30, 2023 Basic $ 2.03 $ 2.36 $ 1.97 $ 1.75 $ 2.07 $ 7.16 $ 8.16 Impact of non-GAAP adjustments on basic earnings per common share: Compensation, commissions and benefits: Acquisition-related retention (1) 0.08 0.08 0.08 0.09 0.08 0.28 0.33 Other acquisition-related compensation — — — 0.05 — 0.01 0.05 Total “Compensation, commissions and benefits” expense 0.08 0.08 0.08 0.14 0.08 0.29 0.38 Communication and information processing — — — — 0.01 — 0.01 Professional fees — — — — 0.01 0.06 0.01 Bank loan provision for credit losses — Initial provision for credit losses on acquired loans (2) — — — — — 0.12 — Other: Amortization of identifiable intangible assets (20) 0.05 0.06 0.05 0.05 0.06 0.16 0.21 Initial provision for credit losses on acquired lending commitments (2) — — — — — 0.02 — All other acquisition-related expenses 0.01 — — — — 0.05 — Total “Other” expense 0.06 0.06 0.05 0.05 0.06 0.23 0.21 Total expenses related to acquisitions 0.14 0.14 0.13 0.19 0.16 0.70 0.61 Other — Insurance settlement received (3) — (0.15) — — — — (0.15) Tax effect of non-GAAP adjustments (0.04) — (0.03) (0.05) (0.04) (0.18) (0.12) Total non-GAAP adjustments, net of tax 0.10 (0.01) 0.10 0.14 0.12 0.52 0.34 Adjusted basic (7) $ 2.13 $ 2.35 $ 2.07 $ 1.89 $ 2.19 $ 7.68 $ 8.50 RAYMOND JAMES FINANCIAL, INC. Please refer to the footnotes at the end of this supplement for additional information. 14

Reconciliation of non-GAAP financial measures to GAAP financial measures (Unaudited) (Continued from previous page) Three months ended Twelve months ended Earnings per common share (5) September 30, 2022 December 31, 2022 March 31, 2023 June 30, 2023 September 30, 2023 September 30, 2022 September 30, 2023 Diluted $ 1.98 $ 2.30 $ 1.93 $ 1.71 $ 2.02 $ 6.98 $ 7.97 Impact of non-GAAP adjustments on diluted earnings per common share: Compensation, commissions and benefits: Compensation, commissions and benefits — Acquisition-related retention (1) 0.08 0.08 0.08 0.09 0.08 0.27 0.32 Other acquisition-related compensation — — — 0.05 — 0.01 0.05 Total “Compensation, commissions and benefits” expense 0.08 0.08 0.08 0.14 0.08 0.28 0.37 Communications and information processing — — — — 0.01 — 0.01 Professional fees — — — — 0.01 0.06 0.01 Bank loan provision for credit losses — Initial provision for credit losses on acquired loans (2) — — — — — 0.12 — Other: Amortization of identifiable intangible assets (20) 0.05 0.06 0.05 0.05 0.05 0.15 0.21 Initial provision for credit losses on acquired lending commitments (2) — — — — — 0.02 — All other acquisition-related expenses 0.01 — — — — 0.05 — Total “Other” expense 0.06 0.06 0.05 0.05 0.05 0.22 0.21 Total expenses related to acquisitions 0.14 0.14 0.13 0.19 0.15 0.68 0.60 Other — Insurance settlement received (3) — (0.15) — — — — (0.15) Tax effect of non-GAAP adjustments (0.04) — (0.03) (0.05) (0.04) (0.17) (0.12) Total non-GAAP adjustments, net of tax 0.10 (0.01) 0.10 0.14 0.11 0.51 0.33 Adjusted diluted (7) $ 2.08 $ 2.29 $ 2.03 $ 1.85 $ 2.13 $ 7.49 $ 8.30 Book value per share As of $ in millions, except per share amounts September 30, 2022 December 31, 2022 March 31, 2023 June 30, 2023 September 30, 2023 Total common equity attributable to Raymond James Financial, Inc. $ 9,338 $ 9,736 $ 9,875 $ 9,870 $ 10,135 Less non-GAAP adjustments: Goodwill and identifiable intangible assets, net 1,931 1,938 1,932 1,928 1,907 Deferred tax liabilities related to goodwill and identifiable intangible assets, net (126) (129) (128) (129) (131) Tangible common equity attributable to Raymond James Financial, Inc. (7) $ 7,533 $ 7,927 $ 8,071 $ 8,071 $ 8,359 Common shares outstanding 215.1 215.0 211.6 208.5 208.8 Book value per share (6) $ 43.41 $ 45.28 $ 46.67 $ 47.34 $ 48.54 Tangible book value per share (6) (7) $ 35.02 $ 36.87 $ 38.14 $ 38.71 $ 40.03 RAYMOND JAMES FINANCIAL, INC. Please refer to the footnotes at the end of this supplement for additional information. 15

Reconciliation of non-GAAP financial measures to GAAP financial measures (Unaudited) (Continued from previous page) Return on common equity Three months ended Twelve months ended $ in millions September 30, 2022 December 31, 2022 March 31, 2023 June 30, 2023 September 30, 2023 September 30, 2022 September 30, 2023 Average common equity (21) $ 9,367 $ 9,537 $ 9,806 $ 9,873 $ 10,003 $ 8,836 $ 9,791 Impact of non-GAAP adjustments on average common equity: Compensation, commissions and benefits: Acquisition-related retention (1) 9 9 9 9 9 27 35 Other acquisition-related compensation — — — 4 — 1 4 Total “Compensation, commissions and benefits” expense 9 9 9 13 9 28 39 Communications and information processing — — — — 1 — 1 Professional fees 1 — — 1 2 6 1 Bank loan provision for credit losses — Initial provision for credit losses on acquired loans (2) — — — — — 10 — Other: Amortization of identifiable intangible assets (20) 5 5 6 6 6 16 22 Initial provision for credit losses on acquired lending commitments (2) — — — — — 2 — All other acquisition-related expenses — — — — — 6 — Total “Other” expense 5 5 6 6 6 24 22 Total expenses related to acquisitions 15 14 15 20 18 68 63 Other — Insurance settlement received (3) — (16) — — — — (26) Tax effect of non-GAAP adjustments (4) 1 (4) (5) (5) (17) (9) Total non-GAAP adjustments, net of tax 11 (1) 11 15 13 51 28 Adjusted average common equity (7) (21) $ 9,378 $ 9,536 $ 9,817 $ 9,888 $ 10,016 $ 8,887 $ 9,819 RAYMOND JAMES FINANCIAL, INC. Please refer to the footnotes at the end of this supplement for additional information. 16

Reconciliation of non-GAAP financial measures to GAAP financial measures (Unaudited) (Continued from previous page) Return on tangible common equity Three months ended Twelve months ended $ in millions September 30, 2022 December 31, 2022 March 31, 2023 June 30, 2023 September 30, 2023 September 30, 2022 September 30, 2023 Average common equity (21) $ 9,367 $ 9,537 $ 9,806 $ 9,873 $ 10,003 $ 8,836 $ 9,791 Less: Average goodwill and identifiable intangible assets, net 1,871 1,935 1,936 1,930 1,918 1,322 1,928 Average deferred tax liabilities related to goodwill and identifiable intangible assets, net (127) (128) (129) (128) (130) (94) (129) Average tangible common equity (7) (21) $ 7,623 $ 7,730 $ 7,999 $ 8,071 $ 8,215 $ 7,608 $ 7,992 Impact of non-GAAP adjustments on average tangible common equity: Compensation, commissions and benefits: Acquisition-related retention (1) 9 9 9 9 9 27 35 Other acquisition-related compensation — — — 4 — 1 4 Total “Compensation, commissions and benefits” expense 9 9 9 13 9 28 39 Communications and information processing — — — — 1 — 1 Professional fees 1 — — 1 2 6 1 Bank loan provision for credit losses — Initial provision for credit losses on acquired loans (2) — — — — — 10 — Other: Amortization of identifiable intangible assets (20) 5 5 6 6 6 16 22 Initial provision for credit losses on acquired lending commitments (2) — — — — — 2 — All other acquisition-related expenses — — — — — 6 — Total “Other” expense 5 5 6 6 6 24 22 Total expenses related to acquisitions 15 14 15 20 18 68 63 Other — Insurance settlement received (3) — (16) — — — — (26) Tax effect of non-GAAP adjustments (4) 1 (4) (5) (5) (17) (9) Total non-GAAP adjustments, net of tax 11 (1) 11 15 13 51 28 Adjusted average tangible common equity (7) (21) $ 7,634 $ 7,729 $ 8,010 $ 8,086 $ 8,228 $ 7,659 $ 8,020 Return on common equity (9) 18.7 % 21.3 % 17.3 % 14.9 % 17.3 % 17.0 % 17.7 % Adjusted return on common equity (7) (9) 19.6 % 21.2 % 18.2 % 16.1 % 18.3 % 18.2 % 18.4 % Return on tangible common equity (7) (9) 22.9 % 26.2 % 21.3 % 18.3 % 21.0 % 19.8 % 21.7 % Adjusted return on tangible common equity (7) (9) 24.1 % 26.1 % 22.3 % 19.7 % 22.2 % 21.1 % 22.5 % RAYMOND JAMES FINANCIAL, INC. Please refer to the footnotes at the end of this supplement for additional information. 17

Footnotes (1) Includes acquisition-related compensation expenses primarily arising from equity and cash-based retention awards issued in conjunction with acquisitions in prior years. Such retention awards are generally contingent upon the post-closing continuation of service of certain associates who joined the firm as part of such acquisitions and are expensed over the requisite service period. (2) Our results for the twelve months ended September 30, 2022 included an initial provision for credit losses on loans and lending commitments acquired as part of our acquisition of TriState Capital Holdings, Inc. amounting to $26 million (included in “Bank loan provision for credit losses”) and $5 million (included in “Other” expense), respectively. These provisions were required under U.S. generally accepted accounting principles to be recorded in earnings in the reporting period following the acquisition date. (3) The three months ended December 31, 2022 and twelve months ended September 30, 2023 included the favorable impact of a $32 million insurance settlement received during the period related to a previously settled legal matter. This item has been reflected as an offset to Other expenses within our Other segment. In the computation of our non-GAAP financial measures, we have reversed the favorable impact of this item on adjusted pre-tax income and adjusted net income available to common shareholders. See the schedules on the previous pages for a reconciliation of non-GAAP financial measures to the most directly comparable GAAP measures and for more information on these measures. (4) Results for fiscal 2023 included elevated provisions for legal and regulatory matters, while provisions for legal and regulatory matters did not have a significant impact on our results for the three and twelve months ended September 30, 2022. (5) Earnings per common share is computed by dividing net income available to common shareholders (less allocation of earnings and dividends to participating securities) by weighted-average common shares outstanding (basic or diluted as applicable) for each respective period or, in the case of adjusted earnings per common share, computed by dividing adjusted net income available to common shareholders (less allocation of earnings and dividends to participating securities) by weighted-average common shares outstanding (basic or diluted as applicable) for each respective period. The allocations of earnings and dividends to participating securities were $1 million for each of the three months ended September 30, 2022, December 31, 2022, June 30, 2023, and September 30, 2023, $2 million for the three months ended March 31, 2023, $3 million for the twelve months ended September 30, 2022, and $5 million for the twelve months ended September 30, 2023. (6) Book value per share is computed by dividing total common equity attributable to Raymond James Financial, Inc. by the number of common shares outstanding at the end of each respective period or, in the case of tangible book value per share, computed by dividing tangible common equity by the number of common shares outstanding at the end of each respective period. (7) These are non-GAAP financial measures. See the schedules on the previous pages for a reconciliation of non-GAAP financial measures to the most directly comparable GAAP measures and for more information on these measures. (8) Estimated. (9) Return on common equity is computed by dividing annualized net income available to common shareholders by average common equity for each respective period or, in the case of return on tangible common equity, computed by dividing annualized net income available to common shareholders by average tangible common equity for each respective period. Adjusted return on common equity is computed by dividing annualized adjusted net income available to common shareholders by adjusted average common equity for each respective period, or in the case of adjusted return on tangible common equity, computed by dividing annualized adjusted net income available to common shareholders by adjusted average tangible common equity for each respective period. Tangible common equity is defined as total common equity attributable to Raymond James Financial, Inc. less goodwill and intangible assets, net of related deferred taxes. (10) Pre-tax margin is computed by dividing pre-tax income by net revenues for each respective period or, in the case of adjusted pre-tax margin, computed by dividing adjusted pre-tax income by net revenues for each respective period. (11) Total compensation ratio is computed by dividing compensation, commissions and benefits expense by net revenues for each respective period or, in the case of adjusted total compensation ratio, computed by dividing adjusted compensation, commissions and benefits expense by net revenues for each respective period. (12) Domestic Private Client Group net new assets represents domestic Private Client Group client inflows, including dividends and interest, less domestic Private Client Group client outflows, including commissions, advisory fees, and other fees. The Domestic Private Client Group net new asset growth — annualized percentage is based on the beginning Domestic Private Client Group assets under administration balance for the indicated period. (13) These metrics include the impact of the departure of approximately 60 financial advisors and approximately $5 billion of assets under administration, representing the portion of advisors previously associated through a single relationship in the firm’s independent contractors division whose affiliation with the firm ended in the fiscal third quarter of 2023. (14) We earn fees from RJBDP, a multi-bank sweep program in which clients’ cash deposits in their brokerage accounts are swept into interest-bearing deposit accounts at Raymond James Bank and TriState Capital Bank, which are included in our Bank segment, as well as various third-party banks. RJBDP balances swept to our Bank segment are reflected in Bank deposits on our Consolidated Statement of Financial Condition. Fees earned by the Private Client Group segment on deposits held by our Bank segment are eliminated in consolidation. (15) In March 2023, we launched our Enhanced Savings Program, in which Private Client Group clients may deposit cash in a high-yield Raymond James Bank account. These balances are reflected in Bank deposits on our Consolidated Statement of Financial Condition. (16) Average yield on RJBDP - third-party banks is computed by dividing annualized RJBDP fees - third-party banks, which are net of the interest expense paid to clients by the third-party banks, by the average daily RJBDP balances at third-party banks. (17) The Other segment includes interest income on certain corporate cash balances, the results of our private equity investments, which predominantly consist of investments in third-party funds, certain other corporate investing activity, and certain corporate overhead costs of RJF that are not allocated to other segments including the interest costs on our public debt, certain provisions for legal and regulatory matters, and certain acquisition-related expenses. (18) Corporate loans included commercial and industrial loans, commercial real estate loans, and real estate investment trust loans. RAYMOND JAMES FINANCIAL, INC. 18

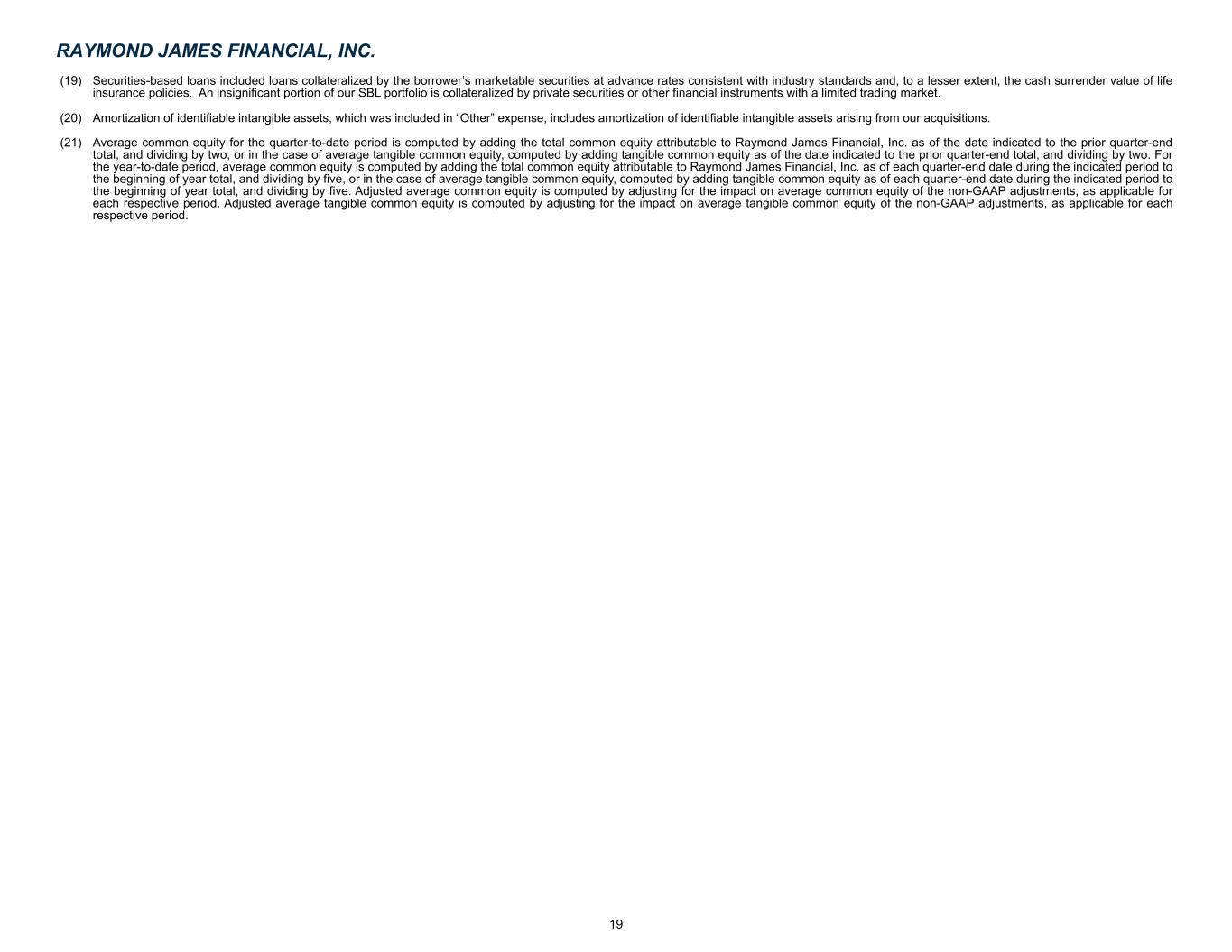

(19) Securities-based loans included loans collateralized by the borrower’s marketable securities at advance rates consistent with industry standards and, to a lesser extent, the cash surrender value of life insurance policies. An insignificant portion of our SBL portfolio is collateralized by private securities or other financial instruments with a limited trading market. (20) Amortization of identifiable intangible assets, which was included in “Other” expense, includes amortization of identifiable intangible assets arising from our acquisitions. (21) Average common equity for the quarter-to-date period is computed by adding the total common equity attributable to Raymond James Financial, Inc. as of the date indicated to the prior quarter-end total, and dividing by two, or in the case of average tangible common equity, computed by adding tangible common equity as of the date indicated to the prior quarter-end total, and dividing by two. For the year-to-date period, average common equity is computed by adding the total common equity attributable to Raymond James Financial, Inc. as of each quarter-end date during the indicated period to the beginning of year total, and dividing by five, or in the case of average tangible common equity, computed by adding tangible common equity as of each quarter-end date during the indicated period to the beginning of year total, and dividing by five. Adjusted average common equity is computed by adjusting for the impact on average common equity of the non-GAAP adjustments, as applicable for each respective period. Adjusted average tangible common equity is computed by adjusting for the impact on average tangible common equity of the non-GAAP adjustments, as applicable for each respective period. RAYMOND JAMES FINANCIAL, INC. 19