Exhibit 99.1

Certain Financial Information

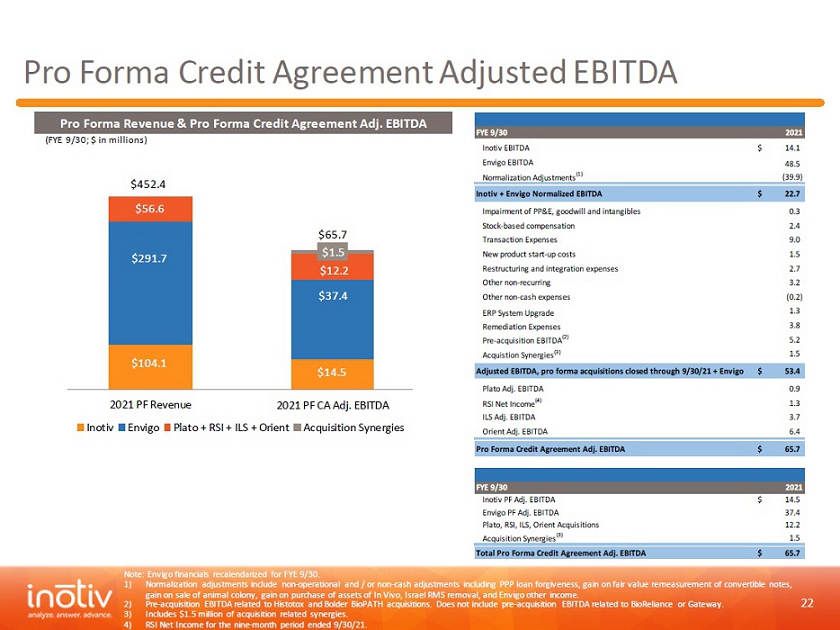

In January 2022, Inotiv, Inc. (the “Company”) conducted a confidentially marketed syndication of secured debt to its existing lenders. As part of the marketing effort, the Company disclosed to the lenders certain financial information regarding the Company and certain of its recent acquisition targets that has not been previously disclosed. That information included historical revenues and Adjusted EBITDA information for the Company and for the acquisition targets for the 12-month period ended September 30, 2021 (the “LTM Period”). The acquisition targets included Envigo RMS Holding Corp. (“Envigo”), Plato BioPharma, LLC (“Plato”), Robinson Services, Inc. (“RSI”), Integrated Laboratory Services, Inc. (“ILS”) and Orient BioResource Center, Inc. (“Orient”) Pro forma financial information giving effect to the acquisition of Envigo and the associated financing was included as Exhibit 99.2 to the Company’s Current Report on Form 8-K filed with the SEC on December 23, 2021 (the “Envigo Pro Forma Information”). The Adjusted EBITDA information provided to the lenders is set forth in the slide attached hereto. In addition, in order to enable investors and shareholders to better evaluate the information provided to the lenders, the Company is providing the following GAAP information for the LTM Period for each of the entities included in the pro forma calculation (amounts in thousands).

| | | Twelve Months Ended September 30, 2021 | |

| Entity | | Net Revenue | | | Net Income | |

| Inotiv | | $ | 89,605 | | | $ | 10,895 | |

| Envigo | | | 291,700 | | | | 12,670 | |

| Plato | | | 6,596 | | | | 1,234 | |

| RSI | | | 2,469 | | | | 1,265 | |

| ILS | | | 20,425 | | | | 3,072 | |

| Orient | | | 27,085 | | | | 5,961 | |

| Total | | $ | 452,387 | | | $ | 35,097 | |

As noted in the Envigo Pro Forma Information, after giving effect to the acquisitions of Bolder BioPATH, Inc. and HistoTox Laboratories, Inc., which occurred in April and May 2021, the Company’s pro forma net revenue for the LTM Period was $104,112 thousand and its pro forma income from continuing operations for the LTM Period was $13,608 thousand.

Non-GAAP to GAAP Reconciliation

This information contains financial measures that are not calculated in accordance with generally accepted accounting principles in the United States (GAAP), including Adjusted EBITDA for the twelve months ended September 30, 2021. Adjusted EBITDA as reported herein refers to a financial performance measure that excludes from net income (loss) income statement line items interest expense and income taxes (benefit) expense, as well as non-cash charges for depreciation and amortization, stock-based compensation expense, PPP loan forgiveness, gain on fair value remeasurement of convertible notes, gain on forgiveness of debt, gains on sale of animal colony, non-recurring acquisition and integration costs, and other items reflected in the Non-GAAP to GAAP reconciliations listed in the table below.

The Company believes that these non-GAAP measures provide useful information to investors. Among other things, they may help investors evaluate the Company’s ongoing operations. They can assist in making meaningful period-over-period comparisons and in identifying operating trends that would otherwise be masked or distorted by the items subject to the adjustments. Management uses these non-GAAP measures internally to evaluate the performance of the business, including to allocate resources. Investors should consider these non-GAAP measures as supplemental and in addition to, not as a substitute for or superior to, measures of financial performance prepared in accordance with GAAP.

Management has chosen to provide this supplemental information to investors, analysts, and other interested parties to enable them to perform additional analyses of our results and to illustrate our results giving effect to the non-GAAP adjustments shown in the reconciliation. Management strongly encourages investors to review the Company’s consolidated financial statements and publicly filed reports in their entirety and cautions investors that the non-GAAP measures used by the Company may differ from similar measures used by other companies, even when similar terms are used to identify such measures.

| Inotiv Net Income | | | | | | 10,895 | |

| Interest expense, net | | | | | | 1,683 | |

| Income tax expense | | | | | | (4,776 | ) |

| Depreciation & Amortization | | | | | | 6,268 | |

| Inotiv EBITDA | | | | | | 14,070 | |

| | | | | | | | |

| Envigo Net Income | | | | | | 12,670 | |

| Interest expense, net | | | | | | 8,424 | |

| Income Tax Expense (Benefit) | | | | | | 17,127 | |

| Depreciation & Amortization | | | | | | 10,325 | |

| Envigo EBITDA | | | | | | 48,546 | |

| | | | | | | | |

| Inotiv + Envigo Adjustments | | | | | | | |

| PPP Loan Forgiveness Inotiv | | | | | | (4,851 | ) |

| Gain on Fair Value Remeasurement of Convertible Notes | | | | | | (8,362 | ) |

| Gain on Sale of Animal Colony | | | | | | (12,386 | ) |

| Israel RMS Removal | | | | | | (2,040 | ) |

| Envigo Other Income | | | | | | (736 | ) |

| PPP Loan Forgiveness Envigo | | | | | | (11,516 | ) |

| Normalization Adjustments | | | | | | (39,891 | ) |

| | | | | | | | |

| Inotiv + Envigo Normalized EBITDA | | | | | | 22,725 | |

| | | | | | | | |

| Impairment of PP&E, goodwill and intangibles | | | | | | 300 | |

| Inotiv Stock-based compensation | | 1,787 | | | | | |

| Envigo Stock-based compensation | | 574 | | | | | |

| Stock-based compensation | | | | | | 2,361 | |

| Inotiv Acquisition & Integration Expenses | | 5,377 | | | | | |

| Envigo Transaction Expenses | | 3,656 | | | | | |

| Transaction Expenses | | | | | | 9,033 | |

| Start-up costs for new service offerings | | | | | | 1,478 | |

| Envigo Integration costs | | 174 | | | | | |

| Envigo Restructuring Expenses | | 2,562 | | | | | |

| Restructuring and integration expenses | | | | | | 2,736 | |

| Envigo Sponsor Management Fees | | 2,256 | | | | | |

| Envigo Other Adjustments | | 954 | | | | | |

| Other non-recurring | | | | | | 3,210 | |

| Envigo Inventory step-up amortization | | 114 | | | | | |

| Envigo normalized bad debt | | (142 | ) | | | | |

| Inotiv UK Lease Liability / other | | (179 | ) | | | | |

| Other non-cash expenses | | | | | | (207 | ) |

| ERP System Upgrade | | | | | | 1,329 | |

| Remediation Expenses | | | | | | 3,787 | |

| HistoTox (Apr-21) | | 2,086 | | | | | |

| Boulder BioPath (Apr-21) | | 3,093 | | | | | |

| Pre-acquisition EBITDA | | | | | | 5,180 | |

| Acquisition Synergies | | | | | | 1,500 | |

| Adjusted EBITDA, pro forma acquisitions closed through 9/30/21 + Envigo | | | | | | 53,432 | |

| | | | | | | | |

| Plato Net Income | | | | | | 1,234 | |

| Interest Expense | | | | | | 12 | |

| Tax | | | | | | 101 | |

| Depreciation | | | | | | 17 | |

| Amortization | | | | | | 1 | |

| PPP Loan Forgiveness | | | | | | (460 | ) |

| Plato Adjusted EBITDA | | | | | | 905 | |

| | | | | | | | |

| RSI Net Income | | | | | | 1,265 | |

| | | | | | | | |

| ILS Net Income | | | | | | 3,072 | |

| Interest expense, net | | | | | | 31 | |

| Depreciation & Amortization | | | | | | 554 | |

| ILS EBITDA | | | | | | 3,657 | |

| | | | | | | | |

| Orient Net Income | | | | | | 5,961 | |

| Depreciation & Amortization | | | | | | 343 | |

| PPP Loan Forgiveness | | | | | | (650 | ) |

| Legal fees for DOJ investigation | | | | | | 640 | |

| Net loss on disposition of fixed assets | | | | | | 117 | |

| Orient Adjusted EBITDA | | | | | | 6,412 | |

| | | | | | | | |

| Pro Forma Credit Agreement Adjusted EBITDA | | | | | | 65,671 | |

| | | | | | | | |

| Inotiv Net Income | | | | | | 10,895 | |

| Interest expense, net | | | | | | 1,683 | |

| Income tax expense | | | | | | (4,776 | ) |

| Depreciation & Amortization | | | | | | 6,268 | |

| PPP Loan Forgiveness | | | | | | (4,851 | ) |

| Stock-Based Compensation | | | | | | 1,787 | |

| UK Lease Liability / Other | | | | | | (179 | ) |

| Acquisition & Integration Costs | | | | | | 5,377 | |

| Start-up costs for new service offerings | | | | | | 1,478 | |

| Gain on fair value remeasurement of convertible notes | | | | | | (8,362 | ) |

| HistoTox (Apr-21) | | | | | | 2,086 | |

| Boulder BioPath (Apr-21) | | | | | | 3,093 | |

| Inotiv Pro Forma Adjusted EBITDA | | | | | | 14,500 | |

| | | | | | | | |

| Envigo Net Income | | | | | | 12,670 | |

| Interest expense, net | | | | | | 8,424 | |

| Income Tax Expense (Benefit) | | | | | | 17,127 | |

| Depreciation & Amortization | | | | | | 10,325 | |

| Loss on Disposition of Assets | | | | | | 764 | |

| Impairment of Property, Plant and Equipment, Goodwill and Intangible Assets | | | | | | 300 | |

| Gain on Sale of Animal Colony | | | | | | (12,386 | ) |

| Gain on Extinguishment of Debt | | | | | | (633 | ) |

| PPP Loan Forgiveness | | | | | | (11,516 | ) |

| Transaction Expenses | | | | | | 3,656 | |

| Foreign Exchange Losses (Gains) | | | | | | 417 | |

| Non-cash Stock Compensation Expense | | | | | | 574 | |

| Pension Expense | | | | | | 259 | |

| Sponsor Management Fees and Expenses | | | | | | 2,256 | |

| Inventory Step-up Amortization | | | | | | 114 | |

| Integration Expenses | | | | | | 174 | |

| COVID-19 Expenses | | | | | | 362 | |

| Restructuring Expenses | | | | | | 2,084 | |

| ERP System Upgrade | | | | | | 1,329 | |

| Remediation Expenses | | | | | | 3,787 | |

| Haslett/Boyertown Estimated Savings from Restructuring | | | | | | 397 | |

| Bresso Restructuring | | | | | | 81 | |

| Consolidated VIE Removal | | | | | | 600 | |

| Israel RMS Removal | | | | | | (2,040 | ) |

| Other Income | | | | | | (736 | ) |

| Normalized Bad Debt | | | | | | (142 | ) |

| Board of Directors | | | | | | 500 | |

| Unrecorded Audit Adjustments | | | | | | (1,315 | ) |

| Envigo Pro Forma Adjusted EBITDA | | | | | | 37,432 | |

| | | | | | | | |

| Plato Net Income | | | | | | 1,234 | |

| Interest Expense | | | | | | 12 | |

| Tax | | | | | | 101 | |

| Depreciation | | | | | | 17 | |

| Amortization | | | | | | 1 | |

| PPP Loan Forgiveness | | | | | | (460 | ) |

| RSI Net Income | | | | | | 1,265 | |

| ILS Net Income | | | | | | 3,072 | |

| Interest expense, net | | | | | | 31 | |

| Depreciation & Amortization | | | | | | 554 | |

| Orient Net Income | | | | | | 5,961 | |

| Depreciation & Amortization | | | | | | 343 | |

| PPP Loan Forgiveness | | | | | | (650 | ) |

| Legal fees for DOJ investigation | | | | | | 640 | |

| Net loss on disposition of fixed assets | | | | | | 117 | |

| Plato, RSI, ILS, Orient Acquisitions | | | | | | 12,239 | |

| | | | | | | | |

| Acquisition Synergies | | | | | | 1,500 | |

| | | | | | | | |

| Total Pro Forma Credit Agreement Adjusted EBITDA | | | | | | 65,671 | |

Pro Forma Credit Agreement Adjusted EBITDA Pro Forma Revenue & Pro Forma Credit Agreement Adj. EBITDA (FYE 9/30; $ in millions) $452.4 $56.6 $65.7 $291.7 $1.5 $12.2 $37.4 $104.1 $14.5 2021 PF Revenue 2021 PF CA Adj. EBITDA Inotiv Envigo Plato + RSI + ILS + Orient Acquisition Synergies Note: Envigo financials recalendarized for FYE 9/30. FYE 9/30 2021 Inotiv EBITDA $ 14.1 Envigo EBITDA 48.5 Normalization Adjustments(1) (39.9) Inotiv + Envigo Normalized EBITDA $ 22.7 Impairment of PP&E, goodwill and intangibles 0.3 Stock-based compensation 2.4 Transaction Expenses 9.0 New product start-up costs 1.5 Restructuring and integration expenses 2.7 Other non-recurring 3.2 Other non-cash expenses (0.2) ERP System Upgrade 1.3 Remediation Expenses 3.8 Pre-acquisition EBITDA(2) 5.2 Acquistion Synergies(3) 1.5 Adjusted EBITDA, pro forma acquisitions closed through 9/30/21 + Envigo $ 53.4 Plato Adj. EBITDA 0.9 RSI Net Income(4) 1.3 ILS Adj. EBITDA 3.7 Orient Adj. EBITDA 6.4 Pro Forma Credit Agreement Adj. EBITDA $ 65.7 FYE 9/30 2021 Inotiv PF Adj. EBITDA $ 14.5 Envigo PF Adj. EBITDA 37.4 Plato, RSI, ILS, Orient Acquisitions 12.2 Acquisition Synergies(3) 1.5 Total Pro Forma Credit Agreement Adj. EBITDA $ 65.7 1) Normalization adjustments include non-operational and / or non-cash adjustments including PPP loan forgiveness, gain on fair value remeasurement of convertible notes, gain on sale of animal colony, gain on purchase of assets of In Vivo, Israel RMS removal, and Envigo other income. 22 2) Pre-acquisition EBITDA related to Histotox and Bolder BioPATH acquisitions. Does not include pre-acquisition EBITDA related to BioReliance or Gateway. 3) Includes $1.5 million of acquisition related synergies. 4) RSI Net Income for the nine-month period ended 9/30/21.