UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| [X] | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | For the fiscal year ended December 31, 2010 |

or

| [ ] | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number 1-7297

NICOR INC.

(Exact name of registrant as specified in its charter)

| Illinois | | 36-2855175 |

| (State of Incorporation) | | (I.R.S. Employer Identification No.) |

| | | |

| 1844 Ferry Road | | |

| Naperville, Illinois 60563-9600 | | (630) 305-9500 |

| (Address of principal executive offices) (Zip Code) | | (Registrant’s telephone number, including area code) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | | Name of each exchange on which registered |

| Common Stock, par value $2.50 per share | | New York Stock Exchange |

| | | Chicago Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [X] No [ ]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes [ ] No [X]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months, and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months. Yes [X] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [X]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer [X] | Accelerated filer [ ] |

| | |

| Non-accelerated filer [ ] | Smaller reporting company [ ] |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes [ ] No [X]

The aggregate market value of common stock (based on the June 30, 2010 closing price of $40.50) held by non-affiliates of the registrant was approximately $1.8 billion. As of February 16, 2011, there were 45,549,683 shares of common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the company’s 2010 Annual Meeting Definitive Proxy Statement, to be filed on or about April 26, 2011, are incorporated by reference into Part III.

Nicor Inc.

| |

| | | | |

| | Item No. | Description | Page No. |

| | | | |

| | | | ii |

| | | | |

| | | Part I | |

| | 1. | | 1 |

| | 1A. | | 7 |

| | 1B. | | 18 |

| | 2. | | 18 |

| | 3. | | 18 |

| | 4. | | 18 |

| | | | 19 |

| | | | |

| | | Part II | |

| | 5. | | 20 |

| | 6. | | 22 |

| | 7. | | 23 |

| | 7A. | | 45 |

| | 8. | | 47 |

| | 9. | | 87 |

| | 9A. | | 87 |

| | 9B. | | 88 |

| | | | |

| | | Part III | |

| | 10. | | 89 |

| | 11. | | 89 |

| | 12. | | 90 |

| | 13. | | 90 |

| | 14. | | 90 |

| | | | |

| | | Part IV | |

| | 15. | | 91 |

| | | | 93 |

| | | | 94 |

AGL Resources. AGL Resources, Inc., the company with whom Nicor entered into an Agreement and Plan of Merger on December 6, 2010.

ALJs. Administrative Law Judges.

ARO. Asset retirement obligation.

Base gas. The gas required in a storage reservoir to provide the pressure to cycle the normal working storage volume.

Central Valley. Central Valley Gas Storage, L.L.C., a wholly owned business that is developing a natural gas storage facility in the Sacramento River valley of north-central California.

Chicago Hub. A venture of Nicor Gas, which provides natural gas storage and transmission-related services to marketers and other gas distribution companies.

CPUC. California Public Utilities Commission, the agency that regulates utility services in California.

Degree day. The extent to which the daily average temperature falls below 65 degrees Fahrenheit. Normal weather for Nicor Gas’ service territory, for purposes of this report, is considered to be 5,600 degree days per year for 2010 and 2009 and 5,830 degree days per year for 2008.

EN Engineering. EN Engineering, L.L.C., a previously owned joint venture that provides engineering and consulting services. Nicor sold its ownership on March 31, 2009.

FERC. Federal Energy Regulatory Commission, the agency that regulates the interstate transportation of natural gas, oil and electricity.

Financial Reform Legislation. Dodd-Frank Wall Street Reform and Consumer Protection Act.

Health Care Act. Patient Protection and Affordable Care Act and the Health Care and Education Reconciliation Act of 2010.

Horizon Pipeline. Horizon Pipeline Company, L.L.C., a 50-percent-owned joint venture that operates an interstate regulated natural gas pipeline of approximately 70 miles, stretching from Joliet, Illinois to near the Wisconsin/Illinois border.

ICC. Illinois Commerce Commission, the agency that establishes the rules and regulations governing utility rates and services in Illinois.

IDR. Illinois Department of Revenue.

IRS. Internal Revenue Service.

Jobs Act. American Jobs Creation Act of 2004.

LIBOR. London Inter-bank Offered Rate.

LIFO. Last-in, first-out.

Mcf, MMcf, Bcf. Thousand cubic feet, million cubic feet, billion cubic feet.

Nicor. Nicor Inc., or the registrant.

Nicor Advanced Energy. Prairie Point Energy, L.L.C. (doing business as Nicor Advanced Energy), a wholly owned business that provides natural gas and related services on an unregulated basis to residential and small commercial customers.

Nicor Enerchange. Nicor Enerchange, L.L.C., a wholly owned business that engages in wholesale marketing of natural gas supply services primarily in the Midwest, administers the Chicago Hub for Nicor Gas, serves commercial and industrial customers in the northern Illinois market area, and manages Nicor Solutions’ and Nicor Advanced Energy’s product risks, including the purchase of natural gas supplies.

Nicor Gas. Northern Illinois Gas Company (doing business as Nicor Gas Company) is a regulated wholly owned public utility business and one of the nation’s largest distributors of natural gas.

Nicor Services. Nicor Energy Services Company, a wholly owned business that provides customer move connection services for utilities and product warranty contracts, heating, ventilation and air conditioning repair, maintenance and installation services and equipment to retail markets, including residential and small commercial customers.

Nicor Solutions. Nicor Solutions, L.L.C., a wholly owned business that offers residential and small commercial customers energy-related products that provide for natural gas cost stability and management of their utility bill.

NYMEX. New York Mercantile Exchange.

PBR. Performance-based rate, a regulatory plan which ended on January 1, 2003, that provided economic incentives based on natural gas cost performance.

PCBs. Polychlorinated Biphenyls.

PGA. Purchased Gas Adjustment, a rate rider that passes natural gas costs directly through to customers without markup, subject to ICC review.

Rider. A rate adjustment mechanism that is part of a utility’s tariff which authorizes it to provide specific services or assess specific charges.

Sawgrass Storage. Sawgrass Storage, L.L.C., a 50-percent-owned natural gas storage development joint venture with Mill Creek Gas Storage, L.L.C., an affiliate of Samson Contour Energy E&P, L.L.C., involving the proposed development of a depleted natural gas reservoir located near Monroe, Louisiana.

SEC. The United States Securities and Exchange Commission.

TEL. Tropic Equipment Leasing, Inc., a wholly owned subsidiary of Nicor, holds the company’s interest in Triton.

TEU. Twenty-foot equivalent unit, a measure of volume in containerized shipping equal to one 20-foot-long container.

Triton. Triton Container Investments L.L.C., a cargo container leasing company in which Nicor Inc. has an investment.

Tropical Shipping. A wholly owned business and a carrier of containerized freight in the Bahamas and the Caribbean region.

PART I

Nicor, an Illinois corporation formed in 1976, is a holding company. Gas distribution is Nicor’s primary business. Nicor’s major subsidiaries include Nicor Gas, one of the nation’s largest distributors of natural gas, and Tropical Shipping, a transporter of containerized freight in the Bahamas and the Caribbean region. Nicor also owns several energy-related ventures, including Nicor Services, Nicor Solutions and Nicor Advanced Energy, which provide energy-related products and services to retail markets, Nicor Enerchange, a wholesale natural gas marketing company, and Central Valley, which is developing a natural gas storage facility. As a consolidated group, Nicor had approximately 3,800 employees at year-end 2010.

Summary financial information for Nicor’s major businesses is included in Item 8 – Notes to the Consolidated Financial Statements – Note 14 – Business Segment and Geographic Information. The following sections describe Nicor’s plan of merger with AGL Resources, followed by descriptions of Nicor’s larger businesses. Certain terms used herein are defined in the glossary on pages ii and iii.

PROPOSED MERGER WITH AGL RESOURCES

In December 2010, Nicor entered into an Agreement and Plan of Merger (the “Merger Agreement”) with AGL Resources. In accordance with the Merger Agreement, each share of Nicor common stock outstanding at the Effective Time (as defined in the Merger Agreement), other than shares to be cancelled, and Dissenting Shares (as defined in the Merger Agreement), will be converted into the right to receive consideration consisting of (i) $21.20 in cash and (ii) 0.8382 shares of AGL Resources common stock, subject to adjustment in certain circumstances.

The completion of the proposed merger is subject to various customary conditions, including, among others (i) shareholder approval by both companies, (ii) expiration or termination of any applicable waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, (iii) the SEC’s clearance of a registration statement registering AGL Resources common stock and (iv) receipt of all required regulatory approvals from, among others, the ICC.

The Merger Agreement contains certain termination rights for both Nicor and AGL Resources, and further provides for the payment of fees and expenses upon termination under specified circumstances. The proposed merger is expected to be completed in the second half of 2011. Except for specific references to the proposed merger, the disclosures contained in this report on Form 10-K relate solely to Nicor.

In January 2011, Nicor, Nicor Gas and AGL Resources filed a joint application with the ICC for approval of the proposed merger. The application did not request a rate increase and included a commitment to maintain the number of full-time equivalent employees involved in the operation of Nicor’s gas distribution subsidiary at a level comparable to current staffing for a period of three years following merger completion. The ICC has eleven months to act upon the application.

For additional information relating to the proposed merger please see Nicor’s Form 8-K filed on December 7, 2010 and the joint proxy statement / prospectus contained in the registration statement on Form S-4 filed by AGL Resources on February 4, 2011.

GAS DISTRIBUTION

General

Nicor Gas, a regulated natural gas distribution utility, serves 2.2 million customers in a service territory that encompasses most of the northern third of Illinois, excluding the city of Chicago. The company’s service territory is diverse, providing the company with a well-balanced mix of residential, commercial and industrial customers. Residential customers typically account for approximately 50 percent of natural gas deliveries, while commercial and industrial customers each typically account for approximately 25 percent. See Gas Distribution Statistics on page 31 for operating revenues, deliveries and number of customers by customer classification. Nicor Gas had approximately 2,200 employees at year-end 2010.

Nicor Gas maintains franchise agreements with most of the incorporated municipalities it serves, allowing it to construct, operate and maintain distribution facilities in those incorporated municipalities. Franchise agreement terms range up to 50 years. Currently, about one-third of the agreements will expire within five years.

Customers have the option of purchasing their own natural gas supplies, with delivery of the gas by Nicor Gas. The larger of these transportation customers also have options that include the use of Nicor Gas’ storage system and the ability to choose varying supply backup levels. The choice of transportation service as compared to natural gas sales service results in less revenue for Nicor Gas but has no direct impact on net operating results. Nicor Gas continues to deliver natural gas, maintain its distribution system and respond to emergencies.

Nicor Gas also operates the Chicago Hub, which provides natural gas storage and transmission-related services to marketers and other gas distribution companies. The Chicago area is a major market hub for natural gas, and demand exists for storage and transmission-related services by marketers, other gas distribution companies and electric power-generation facilities. Nicor Gas’ Chicago Hub addresses that demand. Chicago Hub revenues are passed directly through to customers as a credit to Nicor Gas’ PGA rider.

Sources of Natural Gas Supply

Nicor Gas purchases natural gas supplies in the open market by contracting with producers and marketers. It also purchases transportation and storage services from interstate pipelines that are regulated by the FERC. When firm pipeline services are temporarily not needed, Nicor Gas may release the services in the secondary market under FERC-mandated capacity release provisions, with proceeds reducing the cost of natural gas charged to customers.

Peak-use requirements are met through utilization of company-owned storage facilities, pipeline transportation capacity, purchased storage services and other supply sources, arranged by either Nicor Gas or its transportation customers. Nicor Gas has been able to obtain sufficient supplies of natural gas to meet customer requirements. The company believes natural gas supply and pipeline capacity will be sufficiently available to meet market demands in the foreseeable future.

Natural gas supply. Nicor Gas maintains a diversified portfolio of natural gas supply contracts. Supply purchases are diversified by supplier, producing region, quantity, credit limits and available transportation. Natural gas supply pricing is generally tied to published price indices so as to approximate current market prices. These supply contracts also may require the payment of fixed demand charges to ensure the availability of supplies on any given day. The company also purchases natural gas supplies on the spot market to fulfill its supply requirements or to take advantage of favorable short-term pricing.

As part of its purchasing practices, Nicor Gas maintains a price risk hedging strategy to reduce the risk of price volatility. A disciplined approach is used to systematically forward hedge a predetermined portion of forecasted monthly volumes.

As noted previously, transportation customers purchase their own natural gas supplies. About one-half of the natural gas that the company delivers is purchased by transportation customers directly from producers and marketers.

Pipeline transportation. The Nicor Gas distribution and storage system is directly connected to eight interstate pipelines. This provides the company with direct access to most of the major natural gas producing regions in North America. The company has long-term transportation contracts with nearly all of these interstate pipelines and generally has a right-of-first-refusal for contract extensions. The largest of these long-term transportation contracts is with Natural Gas Pipeline Company of America (“NGPL”) which provides approximately 70 percent of the firm transportation capacity. In addition, Nicor Gas enters into short-term winter-on ly transportation contracts and market-area transportation contracts that enhance Nicor Gas’ operational flexibility.

Storage. Nicor Gas owns and operates eight underground natural gas storage facilities. This storage system is one of the largest in the gas distribution industry. The storage reservoirs provide a total inventory capacity of about 150 Bcf, approximately 135 Bcf of which can be cycled on an annual basis. The system is designed to meet about 50 percent of the company’s estimated peak-day deliveries and approximately 40 percent of its normal winter deliveries. In addition to company-owned facilities, Nicor Gas has about 40 Bcf of purchased storage services under contracts with NGPL that expire in 2012 and 2013. This level of storage capability provides Nicor Gas with supply flexibility, improves the reliability of deliveries, and can mitigate the risk associated with seasonal price movements.

Competition/Demand

Nicor Gas is the largest natural gas distributor in Illinois and is regulated by the ICC. The company is the sole distributor of natural gas in essentially all of its service territory. In the commercial and industrial markets, the company’s natural gas services compete with other forms of energy, such as electricity, coal, propane and oil, based on such factors as price, service, reliability and environmental impact. In addition, the company has a tariff that allows negotiation with potential bypass customers. Nicor Gas also offers commercial and industrial customers alternatives in rates and service, increasing its ability to compete in these markets. Other significant factors that impact demand for natural gas include weather, conservation and economic condi tions.

Natural gas deliveries are temperature-sensitive and seasonal since about one-half of all deliveries are used for space heating. Typically, about three-quarters of the deliveries and revenues occur from October through March. Fluctuations in weather have the potential to significantly impact year-to-year comparisons of operating income and cash flow. It is estimated that a 100 degree day variation from normal weather impacts Nicor Gas’ distribution margin, net of income taxes, by approximately $1.3 million under the company’s current rate structure.

The effect of weather variations on Nicor Gas’ results is offset, in part, due to weather risks within the consolidated Nicor group related to the utility-bill management products marketed by Nicor Solutions and Nicor Advanced Energy. The amount of this offset has approximated 30 percent to 65 percent and will vary depending upon the time of year, weather patterns, the number of customers for these products and the market price for natural gas.

Nicor Gas’ large residential customer base provides for a relatively stable level of natural gas deliveries during weak economic conditions. The company’s industrial and commercial customer base is well diversified, lessening the impact of industry-specific economic swings. However, deliveries of natural

gas can be negatively affected by conservation, high natural gas prices and the use of alternative energy sources.

Regulation

Nicor Gas is regulated by the ICC, which governs utility rates and services in Illinois. Those ICC orders and regulations that may significantly affect business performance include the following:

| · | Base rates, which are set by the ICC, are designed to allow the company an opportunity to recover its costs and earn a fair return for investors. On March 25, 2009, the ICC issued an order approving an increase in Nicor Gas’ base revenues of approximately $69 million, a rate of return on rate base of 7.58 percent and a rate of return on equity of 10.17 percent. On October 7, 2009, the ICC increased the annual base revenues approved for Nicor Gas in the March 25, 2009 order by approximately $11 million as a result of a rehearing decision and increased the rate of return on rate base to 8.09 percent. Therefore, the total annual base revenue increase resulting from these ICC orders is approximately $80 million. For additional information about the rate proceeding, see Item 7 – Ma nagement’s Discussion and Analysis of Financial Condition and Results of Operations and Item 8 – Notes to the Consolidated Financial Statements – Note 18 – Regulatory Proceedings. |

| · | The company’s ICC-approved tariffs provide that the cost of natural gas purchased for customers will be fully charged to customers without markup. Therefore, the company does not profit from the sale of natural gas. Rather, the company earns income from fixed monthly charges and from variable transportation charges for delivering natural gas to customers. Annually, the ICC initiates a review of the company’s natural gas purchasing practices for prudence, and may disallow the pass-through of costs considered imprudent. The annual prudence reviews for calendar years 1999-2010 are open for review. |

| · | The company has ICC-approved tariffs that provide for the pass-through of prudently incurred environmental costs related to the remediation of former manufactured gas plant sites. Manufactured gas plants were used in the 1800’s and early to mid 1900’s to produce manufactured gas from coal, creating a coal tar byproduct. Current environmental laws may require the cleanup of coal tar at certain of these sites. As of December 31, 2010, the company had recorded a liability in connection with these matters of $28.7 million. These costs are subject to annual ICC review. For additional information on the company’s obligation for manufactured gas plants, see Item 8 – Notes to the Consolidated Financial Statements – Note 20 – Contingencies – Man ufactured Gas Plant Sites. |

| · | On February 2, 2010, the ICC approved a bad debt rider which provides for the recovery from (or refund to) customers of the difference between Nicor Gas’ actual bad debt experience on an annual basis and the benchmark bad debt expense included in its base rates for the respective year. For additional information about the bad debt rider, see Item 7 – Management’s Discussion and Analysis of Financial Condition and Results of Operations and Item 8 – Notes to the Consolidated Financial Statements – Note 18 – Regulatory Proceedings. |

| · | As part of the rate order issued in 2009, the ICC approved an energy efficiency rider to fund the costs of energy savings programs. Pursuant to an Illinois law enacted in 2009 that requires local gas distribution utilities to establish plans to achieve specified energy savings goals beginning in June 2011, Nicor Gas filed an application with the ICC seeking approval of a new energy efficiency plan on September 29, 2010. The law provides utilities with a rider to collect the costs of the plan from customers. Under its proposed plan, the company estimates that it would bill nearly $100 million to customers under the rider, over a three year period commencing June 1, 2011, to fund the costs of various energy savings programs identified in the com pany’s filing. This new energy efficiency plan rider will replace the rider currently in effect. The costs under these riders are subject to annual ICC review. |

| · | On July 1, 2009, Nicor Gas filed a petition seeking re-approval from the ICC of the operating agreement that governs many inter-company transactions between Nicor Gas and its affiliates. The petition was filed pursuant to a requirement contained in the ICC order approving the company’s most recent general rate increase and requested that the operating agreement be re-approved without change. For additional information regarding this proceeding, see Item 7 – Management’s Discussion and Analysis of Financial Condition and Results of Operations. |

| · | On January 18, 2011, AGL Resources, Nicor and Nicor Gas filed a joint application with the ICC seeking approval of the merger of AGL Resources and Nicor and other approvals relating to the merger. For additional information regarding this proceeding, see Item 7 – Management’s Discussion and Analysis of Financial Condition and Results of Operations. |

Nicor Gas enters into various service agreements with Nicor and its affiliates. Nicor Gas, to the extent required, obtains ICC approvals for these agreements.

The ICC has other rules that impact the operations of utilities in Illinois.

A PBR plan for natural gas costs went into effect in 2000 and was terminated by the company effective January 1, 2003. Under the PBR plan, Nicor Gas’ total natural gas supply costs were compared to a market-sensitive benchmark. Savings and losses relative to the benchmark were determined annually and shared equally with sales customers. The results of the PBR plan are currently under ICC review. Additional information on the plan and the ICC review are presented in Item 8 – Notes to the Consolidated Financial Statements – Note 20 – Contingencies – PBR Plan.

Gas distribution, transmission and storage system, and other properties

The gas distribution, transmission and storage system includes approximately 34,000 miles of steel, plastic and cast iron main; approximately 2.0 million steel, plastic/aluminum composite, plastic and copper services connecting the mains to customers’ premises; and eight underground storage fields. Other properties include buildings, land, motor vehicles, meters, regulators, compressors, construction equipment, tools, communication and computer equipment, software and office equipment.

Most of the company’s distribution and transmission property, and underground storage fields are located on property owned by others and used by the company through easements, permits or licenses. The company owns most of the buildings housing its administrative offices and the land on which they sit.

Substantially all gas distribution properties are subject to the lien of the indenture securing Nicor Gas’ First Mortgage Bonds.

Additional information about Nicor Gas’ business is presented in Item 1A – Risk Factors, Item 7 – Management’s Discussion and Analysis of Financial Condition and Results of Operations and Item 8 – Notes to the Consolidated Financial Statements.

SHIPPING

Tropical Shipping is a transporter of containerized freight in the Bahamas and the Caribbean, a region which has historically been characterized by modest market growth and intense competition. The company is a major carrier of exports from the east coast of the United States and Canada to these regions. The company’s shipments consist primarily of southbound cargo such as building materials, food and other necessities for developers, manufacturers and residents in the Caribbean and the Bahamas, as well as tourist-related shipments intended for use in hotels and resorts, and on cruise ships. The balance of Tropical Shipping’s cargo consists primarily of interisland shipments and northbound ship ments of apparel and agricultural products. Other related services such as inland transportation and cargo insurance are also provided by Tropical Shipping or other Nicor subsidiaries.

At December 31, 2010, Tropical Shipping’s operating fleet consisted of 11 owned vessels and 3 chartered vessels with a container capacity totaling approximately 4,970 TEUs. In addition to the vessels, the company owns and/or leases containers, container-handling equipment, chassis and other equipment. Real property, more than half of which is leased, includes office buildings, cargo handling facilities and warehouses located in the United States, Canada and some of the ports served.

Additional information about Tropical Shipping’s business is presented in Item 1A – Risk Factors, Item 7 – Management’s Discussion and Analysis of Financial Condition and Results of Operations and Item 8 – Notes to the Consolidated Financial Statements.

OTHER ENERGY VENTURES

Nicor owns several energy-related ventures, including three companies marketing energy-related products and services and a wholesale natural gas marketing company. Nicor is also developing natural gas storage facilities and owns an interest in an interstate natural gas pipeline.

Nicor Services, Nicor Solutions and Nicor Advanced Energy are businesses that provide energy-related products and services to retail markets, including residential and small commercial customers. Nicor Services operates primarily in northern Illinois and provides warranty and maintenance contracts, as well as repair and installation services of heating, air conditioning and indoor air-quality equipment, and customer move connection services for utilities. In conjunction with national expansion efforts, Nicor Services began doing business under the Nicor National brand in 2009. Nicor Solutions offers its residential and small commercial customers, primarily in the Nicor Gas service territory, energy-related products that provide for natural gas price stability and management of their utili ty bill. These products mitigate and/or eliminate the risks to customers of colder than normal weather and/or changes in natural gas prices. Nicor Advanced Energy is certified by the ICC as an Alternate Gas Supplier, authorizing it to be a non-utility marketer of natural gas for residential and small commercial customers. Nicor Advanced Energy presently operates in northern Illinois, offering customers an alternative to the utility as its natural gas supplier.

Nicor Enerchange is a business that engages in wholesale marketing of natural gas supply services primarily in the Midwest, administers the Chicago Hub for Nicor Gas, serves commercial and industrial customers in the northern Illinois market area, and manages Nicor Solutions’ and Nicor Advanced Energy’s product risks, including the purchases of natural gas supplies.

Central Valley is developing an underground natural gas storage facility in the Sacramento River valley of north-central California and plans to provide approximately 11 Bcf of working natural gas capacity, offering flexible, high-deliverability multi-cycle services and interconnection to a regional pipeline. In October 2010, the CPUC approved Central Valley’s Certificate of Public Convenience and Necessity to construct and operate the storage facility. Central Valley plans to initiate construction activity during the first quarter of 2011 and expects completion during the fourth quarter of 2011, with firm storage services commencing in early 2012. Nicor is also participating in a natural gas storage development joint venture known as Sawgrass Storage. In 2010, Sawg rass Storage initiated the pre-filing process with the FERC.

Horizon Pipeline, a 50-percent-owned joint venture with NGPL, operates a natural gas pipeline of approximately 70 miles, stretching from Joliet, Illinois to near the Wisconsin/Illinois border. Nicor Gas has contracted for approximately 80 percent of Horizon Pipeline’s capacity under an agreement expiring in 2012 at rates that have been accepted by the FERC.

EN Engineering, a previously-owned joint venture between Nicor and A. Epstein & Sons International, is an engineering and consulting firm that specializes in the design, installation and maintenance of natural gas, petroleum and liquid pipeline facilities. EN Engineering provides engineering and corrosion services to Nicor Gas. Nicor sold its ownership on March 31, 2009.

Additional information about Nicor’s other energy ventures is presented in Item 1A – Risk Factors, Item 7 – Management’s Discussion and Analysis of Financial Condition and Results of Operations and Item 8 – Notes to the Consolidated Financial Statements.

CORPORATE

Nicor has various equity investments, the largest of which is Triton, a cargo container leasing business. Additional information on Nicor’s equity investments are presented in Item 8 – Notes to the Consolidated Financial Statements – Note 15 – Equity Investment Income, Net.

AVAILABLE INFORMATION

Nicor files various reports with the SEC. These reports include the annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13 (a) of the Securities Exchange Act of 1934. Nicor makes all of these reports available without charge to the public on the investor section of the company’s Internet site at www.nicor.com as soon as reasonably practicable after Nicor files them with, or furnishes them to, the SEC.

The following factors are the most significant factors that can impact year-to-year comparisons and may affect the future performance of the company’s businesses. New risks may emerge and management cannot predict those risks or estimate the extent to which they may affect the company’s financial performance.

The risks described below should be carefully considered in addition to the other cautionary statements and risks described elsewhere, and the other information contained in this report and in Nicor’s other filings with the SEC, including its subsequent reports on Forms 10-Q and 8-K. The risks and uncertainties described below are not the only risks Nicor faces although they are the most significant risks. See Item 7 – Management’s Discussion and Analysis of Financial Condition and Results of Operations, Item 7A – Quantitative and Qualitative Disclosures About Market Risk, and Item 8 – Notes to the Consolidated Financial Statements for further discussion of these and other risks Nicor faces. Additionally, see the joint proxy / prospectus contained in the regi stration statement on Form S-4 filed by AGL Resources on February 4, 2011.

Regulation of Nicor Gas, including changes in the regulatory environment in general, may adversely affect the company’s results of operations, cash flows and financial condition.

Nicor Gas is regulated by the ICC, which has general regulatory power over practically all phases of the public utility business in Illinois, including rates and charges, issuance of securities, services and facilities, system of accounts, investments, safety standards, transactions with affiliated interests and other matters.

Nicor Gas is permitted by the ICC’s PGA regulation to adjust the charge to its sales customers on a monthly basis to recover the company’s prudently incurred actual costs to acquire the natural gas it delivers to them. The company’s gas costs are subject to subsequent prudence reviews by the ICC for which the company makes annual filings. The annual prudence reviews for calendar years 1999-2010 are open for review and any disallowance of costs in those proceedings could adversely affect Nicor Gas’ results of operations, cash flows and financial condition.

Additionally, Nicor Gas is permitted by ICC regulations to periodically adjust the charge to its customers to recover the company’s prudently incurred actual costs associated with environmental remediation at

former manufactured gas plant sites, franchise payments to municipalities, energy efficiency programs and, as approved in February 2010, bad debt expense. These charges are subject to subsequent prudence reviews by the ICC and any disallowance of costs by the ICC could adversely affect Nicor Gas’ results of operations, cash flows and financial condition.

Most of Nicor Gas’ other charges are changed only through a rate case proceeding with the ICC. The charges established in a rate case proceeding are based on an approved level of operating costs and investment in utility property and are designed to allow the company an opportunity to recover those costs and to earn a fair return on that investment based upon an estimated volume of annual natural gas deliveries. To the extent Nicor Gas’ actual costs to provide utility service are higher than the levels approved by the ICC, or its actual natural gas deliveries are less than the annual volume estimated by the ICC, Nicor Gas’ results of operations, cash flows and financial condition could be adversely affected until such time as it files for and obtains ICC approval for new charges th rough a rate case proceeding.

Nicor Gas is subject to rules and regulations pertaining to the integrity of its distribution system and environmental compliance. The company’s results of operations, cash flows and financial condition could be adversely affected by any additional laws or regulations that are enacted that require significant increases in the amount of expenditures for system integrity and environmental compliance.

The ICC has other rules that impact the operations of utilities in Illinois. Changes in these rules could impact the company’s results of operations, cash flows and financial condition.

Nicor Gas enters into various service agreements with Nicor and its affiliates. Nicor Gas obtains the required ICC approvals for these agreements. The company’s results of operations, cash flows and financial condition could be adversely affected if, as a result of a change in law or action by the ICC, new restrictions are imposed that limit or prohibit certain service agreements between Nicor Gas and its affiliates.

A change in the ICC’s approved rate mechanism for recovery of environmental remediation costs at former manufactured gas plant sites, or adverse decisions with respect to the prudence of costs actually incurred, could adversely affect the company’s results of operations, cash flows and financial condition.

Current environmental laws may require the cleanup of coal tar at certain former manufactured gas plant sites for which the company may in part be responsible. Management believes that any such costs that are not recoverable from other entities or from insurance carriers are recoverable through rates for utility services under an ICC-approved mechanism for the recovery of prudently incurred costs. A change in this rate recovery mechanism, however, or a decision by the ICC that some or all of these costs were not prudently incurred, could adversely affect the company’s results of operations, cash flows and financial condition.

An adverse decision in the proceeding concerning Nicor Gas’ PBR plan could result in a refund obligation which could adversely affect the company’s results of operations, cash flows and financial condition.

In 2000, Nicor Gas instituted a PBR plan for natural gas costs. Under the PBR plan, Nicor Gas’ total gas supply costs were compared to a market-sensitive benchmark. Savings and losses relative to the benchmark were determined annually and shared equally with sales customers. The PBR plan was terminated effective January 1, 2003. There are allegations that Nicor Gas acted improperly in connection with the PBR plan, and the ICC is reviewing these allegations in a pending proceeding. An adverse decision in this proceeding could result in a refund to ratepayers or other obligations which could adversely affect the company’s results of operations, cash flows and financial condition.

Nicor Gas relies on direct connections to eight interstate pipelines and extensive underground storage capacity. If these pipelines or storage facilities were unable to deliver natural gas for any reason it could impair Nicor Gas’ ability to meet its customers’ full requirements which could adversely affect the company’s results of operations, cash flows and financial condition.

Nicor Gas meets its customers’ peak day, seasonal and annual gas requirements through deliveries of natural gas transported on interstate pipelines, with which it or its natural gas suppliers have contracts, and through withdrawals of natural gas from storage fields it owns or leases. Nicor Gas contracts with multiple pipelines for transportation services. If a pipeline were to fail to perform transportation or storage service, including as a result of war, acts or threats of terrorism, mechanical problems or natural disaster, on a peak day or other day with high volume gas requirements, Nicor Gas’ ability to meet all of its customers’ natural gas requirements may be impaired unless or until alternative arrangements for delivery of supply were put in place. Likewise, if a storage field owned by Nicor Gas, or a principal Nicor Gas-owned transmission or distribution pipeline used to deliver natural gas to the market, were to be out of service for any reason, including as a result of war, acts or threats of terrorism, mechanical problems or natural disaster, this could impair Nicor Gas’ ability to meet its customers’ full requirements which could adversely affect the company’s results of operations, cash flows and financial condition.

Fluctuations in weather, conservation, economic conditions and use of alternative fuel sources have the potential to adversely affect the company’s results of operations, cash flows and financial condition.

When weather conditions are milder than normal, Nicor Gas has historically delivered less natural gas, and consequently may earn less income. Nicor Gas’ natural gas deliveries are temperature-sensitive and seasonal since about one-half of all deliveries are used for space heating. Typically, about three-quarters of the deliveries and revenues occur from October through March. Mild weather in the future could adversely affect the company’s results of operations, cash flows and financial condition. In addition, factors including, but not limited to, conservation, economic conditions and the use of alternative fuel sources could also result in lower customer demand.

Conversely, results from products sold by Nicor Solutions and Nicor Advanced Energy generally benefit from milder than normal weather. Nicor Solutions and Nicor Advanced Energy offer utility-bill management products that mitigate and/or eliminate the risks to customers of variations in weather. Benefits or costs related to these products resulting from variances from normal weather are recorded primarily at the corporate level as a result of an agreement between the parent company and certain of its subsidiaries. To the extent weather is colder than normal in the future, Nicor Solutions and Nicor Advanced Energy’s results of operations, cash flows and financial condition could be adversely affected.

Conservation could adversely affect the company's results of operations, cash flows and financial condition.

As a result of recent legislative and regulatory initiatives, the company has put into place programs to promote additional energy efficiency by its customers. Funding for such programs is being recovered through a cost recovery rider. However, the adverse impact of lower deliveries and resulting reduced margin could adversely affect the company's results of operations, cash flows and financial condition until such time as it files for and obtains ICC approval for new charges through a rate case proceeding.

Possible legislation or regulation intended to address concerns about climate change could adversely affect the company’s results of operations, cash flows and financial condition.

Future laws may mandate reductions in greenhouse gas emissions by the company and its customers in an effort to address concerns about the possible effect of those emissions on the climate. If enacted, such laws could require the company to reduce emissions and to incur compliance costs that could adversely affect the company’s results of operations, cash flows and financial condition.

Natural gas commodity price changes may affect the operating costs and competitive positions of the company’s businesses which could adversely affect its results of operations, cash flows and financial condition.

Nicor’s energy-related businesses are sensitive to changes in natural gas prices. Natural gas prices historically have been volatile and may continue to be volatile in the future. Prices for natural gas are subject to a variety of factors that are beyond Nicor’s control. These factors include, but are not limited to, the level of consumer demand for, and the supply of, natural gas, processing, gathering and transportation availability, the level of imports of, and the price of foreign natural gas, legislatively mandated gas supply purchase obligations, the price and availability of alternative fuel sources, weather conditions, natural disasters and political conditions or hostilities in natural gas producing regions.

Any changes in natural gas prices could affect the prices Nicor’s energy-related businesses charge, operating costs and the competitive position of products and services. In accordance with the ICC’s PGA regulations, Nicor Gas adjusts its gas cost charges to sales customers on a monthly basis to account for changes in the price of natural gas. However, changes in natural gas prices can also impact certain operating and financing costs that can only be reflected in Nicor Gas’ charges to customers if approved by the ICC in a rate case. Increases in natural gas prices can also have an adverse effect on natural gas distribution margin because such increases can result in lower customer demand.

Nicor’s other energy businesses are also subject to natural gas commodity price risk, arising primarily from fixed-price purchase and sale agreements, natural gas inventories and utility-bill management arrangements. Derivative instruments such as futures, options, forwards and swaps may be used to hedge these risks.

Nicor’s use of derivative instruments could adversely affect the company’s results of operations, cash flows and financial condition.

Nicor uses derivative instruments, including futures, options, forwards and swaps, either traded on exchanges or executed over-the-counter with natural gas merchants as well as financial institutions, to hedge natural gas price risk. Fluctuating natural gas prices cause earnings and financing costs of Nicor to be impacted. The use of derivative instruments that are not perfectly matched to the exposure could adversely affect the company’s results of operations, cash flows and financial condition. Also, when Nicor’s derivative instruments either do not qualify for hedge accounting treatment or for which hedge accounting is not elected, the company’s results of operations, cash flows and financial condition could be adversely affected.

Nicor is subject to margin requirements in connection with the use of derivative financial instruments and these requirements could escalate if prices move adversely.

Adverse decisions in lawsuits seeking a variety of damages allegedly caused by mercury spillage could adversely affect the company’s results of operations, cash flows and financial condition.

Nicor Gas has incurred, and expects to continue to incur, costs related to its historical use of mercury in various kinds of equipment. Nicor Gas remains a defendant in several private lawsuits, all in the Circuit Court of Cook County, Illinois, seeking a variety of unquantified damages (including bodily injury and property damages) allegedly caused by mercury spillage resulting from the removal of mercury-containing regulators. Potential liabilities relating to these claims have been assumed by a contractor’s insurer subject to certain limitations. Adverse decisions regarding these claims, if not fully covered by such insurance, could adversely affect the company’s results of operations, cash flows and financial condition.

Transporting and storing natural gas involves numerous risks that may result in accidents and other operating risks and costs that could adversely affect the company’s results of operations, cash flows and financial condition.

Nicor Gas’ activities involve a variety of inherent hazards and operating risks, such as leaks, accidents and mechanical problems, which could cause substantial financial losses. In addition, these risks could result in loss of human life, significant damage to property, environmental pollution and impairment of Nicor Gas’ operations, which in turn could lead to substantial losses. In accordance with customary industry practice, Nicor Gas maintains insurance against some, but not all, of these risks and losses. The location of pipelines and storage facilities near populated areas, including residential areas, commercial business centers and industrial sites, could increase the level of damages resulting from these risks. The occurrence of any of these events if not fully covered by insurance could adversely affect the company’s results of operations, cash flows and financial condition.

A significant decline in the market value of investments held within the pension trust maintained by Nicor Gas adversely affects the company’s results of operations, cash flows and financial condition.

Nicor Gas sponsors a defined benefit pension plan and, over the years, has made contributions to a trust to fund future benefit obligations of the pension plan participants. A significant decline in the market value of investments held in the trust of the pension plan unfavorably impacts the benefit costs associated with the pension plan and could adversely affect Nicor Gas’ liquidity if additional contributions to the trust are required. These impacts, either individually or in aggregate, may adversely affect the company’s results of operations, cash flows and financial condition.

An inability to access financial markets could affect the execution of Nicor’s business plan and could adversely affect the company’s results of operations, cash flows and financial condition.

Nicor relies on access to both short- and long-term capital markets as a significant source of liquidity for capital and operating requirements not satisfied by the cash flows from its operations. Management believes that Nicor and its subsidiaries will maintain sufficient access to these financial markets based upon current credit ratings. However, certain disruptions outside of Nicor’s control or events of default under its debt agreements may increase its cost of borrowing or restrict its ability to access one or more financial markets. Such disruptions could include an economic downturn, the bankruptcy of an unrelated energy company or downgrades to Nicor’s credit ratings. Furthermore, Nicor’s ability to incur indebtedness or issue debt securities is restr icted by the covenants set forth in the Merger Agreement. Restrictions on Nicor’s ability to access financial markets may affect its ability to execute its business plan as scheduled and could adversely affect the company’s results of operations, cash flows and financial condition.

Changes in the rules and regulations of certain regulatory agencies could adversely affect the results of operations, cash flows and financial condition of Tropical Shipping.

Tropical Shipping is subject to the International Ship and Port-facility Security Code and is also subject to the United States Maritime Transportation Security Act, both of which require extensive security assessments, plans and procedures. Tropical Shipping is also subject to the regulations of both the Federal Maritime Commission, and the Surface Transportation Board, other federal agencies as well as local laws, where applicable. Additional costs that could result from changes in the rules and regulations of these regulatory agencies would adversely affect the results of operations, cash flows and financial condition of Tropical Shipping.

Tropical Shipping’s business is dependent on general economic conditions. Changes or downturns in the economy could adversely affect the results of operations, cash flows and financial condition of Tropical Shipping.

Tropical Shipping’s business consists primarily of the shipment of building materials, food and other necessities from the United States and Canada to developers, manufacturers and residents in the Bahamas and the Caribbean region, as well as tourist-related shipments intended for use in hotels and resorts, and on cruise ships. As a result, Tropical Shipping’s results of operations, cash flows and financial condition can be significantly affected by adverse general economic conditions in the United States, Bahamas, Caribbean region and Canada. Also, a shift in buying patterns that results in such goods being sourced directly from other parts of the world, including China and India, rather than the United States and Canada, could significantly affect Tropical Shipping’s results of o perations, cash flows and financial condition.

The occurrence of hurricanes, storms and other natural disasters in Tropical Shipping’s area of operations could adversely affect its results of operations, cash flows and financial condition.

Tropical Shipping’s operations are affected by weather conditions in Florida, Canada, the Bahamas and Caribbean regions. During hurricane season in the summer and fall, Tropical Shipping may be subject to revenue loss, higher operating expenses, business interruptions, delays, and ship, equipment and facilities damage which could adversely affect Tropical Shipping’s results of operations, cash flows and financial condition.

Nicor has credit risk that could adversely affect the company’s results of operations, cash flows and financial condition.

Nicor extends credit to its counterparties. Despite what the company believes to be prudent credit policies and the maintenance of netting arrangements, the company is exposed to the risk that it may not be able to collect amounts owed to it. If counterparties fail to perform and any collateral the company has secured is inadequate, it could adversely affect the company’s results of operations, cash flows and financial condition.

The company is involved in legal or administrative proceedings before various courts and governmental bodies that could adversely affect the company’s results of operations, cash flows and financial condition.

The company is involved in legal or administrative proceedings before various courts and governmental bodies with respect to general claims, rates, taxes, environmental issues, billing, credit and collection matters, intersegment services, gas cost prudence reviews and other matters. Adverse decisions regarding these matters, to the extent they require the company to make payments in excess of amounts provided for in its financial statements, could adversely affect the company’s results of operations, cash flows and financial condition.

Changes in taxation could adversely affect the company’s results of operations, cash flows and financial condition.

Various tax and fee increases may occur in locations in which the company operates. For example, the Illinois corporate income tax rate was increased effective January 1, 2011. The company cannot predict whether other legislation or regulation will be introduced, the form of any legislation or regulation, or whether any such legislation or regulation will be passed by the legislatures or other governmental bodies. New taxes or an increase in tax rates would increase tax expense and could adversely affect the company’s results of operations, cash flows and financial condition.

Changes in the laws and regulations regarding the sale and marketing of products and services offered by Nicor’s other energy ventures could adversely affect the results of operations, cash flows and financial condition of Nicor.

Nicor’s other energy ventures provide various energy-related products and services. These include sales of natural gas and utility-bill management services to residential and small commercial customers, the sale, repair, maintenance and warranty of heating, air conditioning and indoor air quality equipment and wholesale natural gas supply services. The sale and marketing of these products and services by Nicor’s other energy ventures are subject to various state and federal laws and regulations. Changes in these laws and regulations could impose additional costs on, or restrict or prohibit certain activities by, Nicor’s other energy ventures which could adversely affect the results of ope rations, cash flows and financial condition of Nicor.

Risks Related to the Proposed Merger with AGL Resources

The merger may not be completed, which could adversely affect Nicor’s business operations and stock price.

To complete the merger, AGL Resources shareholders must approve the issuance of shares of AGL Resources common stock as contemplated by the Merger Agreement and the amendment to AGL Resources’ amended and restated articles of incorporation to increase the number of directors that may serve on AGL Resources’ board of directors, and Nicor shareholders must approve the Merger Agreement. In addition, each of AGL Resources and Nicor must also make certain filings with and obtain certain other approvals and consents from various federal and state governmental and regulatory authorities.

AGL Resources and Nicor have not obtained all regulatory clearances, consents and approvals required to complete the merger. Governmental or regulatory agencies could still seek to block or challenge the merger or could impose restrictions they deem necessary or desirable in the public interest as a condition to approving the merger. If these approvals are not received, or they are not received on terms that satisfy the conditions set forth in the Merger Agreement, then neither AGL Resources nor Nicor will be obligated to complete the merger.

In addition, the Merger Agreement contains other customary closing conditions, which may not be satisfied or waived. If AGL Resources and Nicor are unable to complete the merger, Nicor would be subject to a number of risks, including the following:

| · | Nicor would not realize the anticipated benefits of the merger, including increased operating efficiencies; |

| · | the attention of Nicor’s management may have been diverted to the merger rather than to its own operations and the pursuit of other opportunities that could have been beneficial to Nicor; |

| · | the potential loss of key personnel during the pendency of the merger as employees may experience uncertainty about their future roles with the combined company; |

| · | Nicor will have been subject to certain restrictions on the conduct of its business, which may prevent it from making certain acquisitions or dispositions or pursuing certain business opportunities while the merger is pending; and |

| · | the trading price of Nicor common stock may decline to the extent that the current market price reflects a market assumption that the merger will be completed. |

Nicor is required to pay AGL Resources a termination fee and the reimbursement of merger-related out-of-pocket expenses if Nicor terminates the Merger Agreement under certain circumstances specified in the Merger Agreement.

The occurrence of any of these events individually or in combination could have a material adverse effect on Nicor’s results of operations or the trading price of Nicor common stock.

Nicor is subject to contractual restrictions in the Merger Agreement that may hinder its operations pending the merger.

The Merger Agreement restricts Nicor, without AGL Resources’ consent, from making certain acquisitions and taking other specified actions until the merger occurs or the Merger Agreement terminates. These restrictions may prevent Nicor from pursuing otherwise attractive business opportunities and making other changes to its business prior to completion of the merger or termination of the Merger Agreement.

The value of shares of AGL Resources common stock to be received by Nicor shareholders in the merger will fluctuate.

In the merger, each share of Nicor common stock outstanding immediately prior to completion of the merger (other than shares of Nicor common stock owned by AGL Resources, Nicor or any of their respective subsidiaries and shares of Nicor common stock held by Nicor shareholders who have perfected their dissenters’ rights) will be converted into the right to receive $21.20 in cash and 0.8382 shares of AGL Resources common stock, subject to adjustment in certain circumstances. The exchange ratio will not be adjusted to reflect stock price changes prior to the completion of the merger.

The market prices of AGL Resources common stock and Nicor common stock immediately prior to the effective time of the completion of the merger may vary significantly from their market prices on the date of the Merger Agreement, the date of this Annual Report on Form 10-K and at the date of the special meeting of the shareholders of Nicor that is called to vote to approve the Merger Agreement. These variations may be the result of various factors, including, without limitation:

| · | changes in the business, operations or prospects of AGL Resources and/or Nicor; |

| · | speculation regarding the likelihood that the merger will be completed and the timing of the completion; |

| · | general market and economic conditions; and |

| · | regulatory developments and/or litigation. |

The merger may not be completed until a significant period of time has passed after the Nicor shareholder approval is received. At the time of the Nicor special meeting, Nicor shareholders will not know the exact market value of the AGL Resources common stock that will be received as a result of the merger.

The actual market value of shares of AGL Resources common stock, when received by Nicor shareholders, will depend on the market value of those shares on that date. This market value may be significantly less or significantly more than the value used to determine the number of shares to be issued pursuant to the merger, as that determination was made at the time the Merger Agreement was entered into by the parties. Neither AGL Resources nor Nicor is permitted to terminate the Merger Agreement solely because of a change in the market price for AGL Resources common stock or Nicor common stock.

The merger is subject to receipt of consent or approval from governmental entities that could delay or prevent the completion of the merger or that could cause abandonment of the merger.

To complete the merger, AGL Resources and Nicor need to obtain approvals or consents from, or make filings with, a number of United States federal and state public utility, antitrust and other regulatory authorities, including, among others, the Federal Trade Commission, the Department of Justice, the ICC and the CPUC.

While Nicor believes that they will receive the required statutory approvals and other clearances for the merger, there can be no assurance as to the timing of these approvals and clearances. If such approvals and clearances are received, they may impose terms that do not satisfy the conditions set forth in the Merger Agreement, which could permit AGL Resources or Nicor to terminate the Merger Agreement. A substantial delay in obtaining the required authorizations, approvals or consents or the imposition of unfavorable terms, conditions or restrictions contained in such authorizations, approvals or consents could prevent the consummation of the merger.

Governmental authorities could seek to block or challenge the merger as they deem necessary or desirable in the public interest.

The special meeting at which the Nicor shareholders will vote on the approval of the merger contemplated by the Merger Agreement may take place before all such approvals have been obtained and, in certain cases where they have not been obtained, before the terms of any conditions to obtain such approvals that may be imposed are known. As a result, if shareholder approval of the transactions contemplated by the Merger Agreement is obtained at such meeting, Nicor may make decisions after the special meeting to waive a condition or approve certain actions required to obtain necessary approvals without seeking further shareholder approval.

Nicor will be subject to various uncertainties while the merger is pending that may cause disruption and may make it more difficult to maintain relationships with employees, suppliers or customers.

Uncertainty about the effect of the merger on employees, suppliers and customers may have an adverse effect on Nicor. Although Nicor intends to take steps designed to reduce any adverse effects, these uncertainties may impair Nicor’s abilities to attract, retain and motivate key personnel until the merger is completed and for a period of time thereafter, and could cause customers, suppliers and others that deal with Nicor to seek to change or terminate existing business relationships with Nicor or not enter into new relationships or transactions.

Employee retention and recruitment may be challenging prior to the completion of the merger, as employees and prospective employees may experience uncertainty about their future roles with the combined company. If, despite Nicor’s retention and recruiting efforts, key employees depart or fail to continue employment with Nicor because of issues relating to the uncertainty and difficulty of integration or a desire not to remain with the combined company, Nicor’s financial results could be adversely affected.

Pending shareholder suits could delay or prevent the closing of the merger or otherwise adversely impact the business and operations of Nicor.

Nicor, its board of directors, AGL Resources, one or both of AGL Resources’ acquisition subsidiaries and, in one instance, Nicor’s Executive Vice President and Chief Financial Officer, have been named as defendants in five putative class action lawsuits brought by purported Nicor shareholders challenging Nicor’s proposed merger with AGL Resources. The shareholder actions variously allege, among other things, that the Nicor board of directors breached its fiduciary duties to Nicor and its shareholders by (i) approving the sale of Nicor to AGL Resources at an inadequate purchase price (and thus failing to maximize value to Nicor shareholders); (ii) conducting an inadequate sale process by agreeing to preclusive deal protection provisions in the Merger Agreement; and (iii) failing to disclose ma terial information regarding the proposed merger to Nicor shareholders. The complaints also allege that AGL Resources and Nicor aided and abetted these alleged breaches of fiduciary duty. The shareholder actions seek, among other things, declaratory and injunctive relief, including orders enjoining the defendants from consummating the proposed merger and, in certain circumstances, damages. No assurances can be given as to the outcome of these lawsuits, including the costs associated with defending these lawsuits or any other liabilities or costs the parties may incur in connection with the litigation or settlement of these

lawsuits. Furthermore, one of the conditions to closing the merger is that there are no injunctions issued by any court preventing the completion of the transactions. No assurance can be given that these lawsuits will not result in such an injunction being issued which could prevent or delay the closing of the transactions contemplated by the Merger Agreement.

Nicor will incur significant transaction, merger-related and restructuring costs in connection with the merger.

Nicor expects to incur costs associated with combining its operations with those of AGL Resources, as well as transaction fees and other costs related to the merger. These costs will be expensed as incurred.

The Merger Agreement contains provisions that limit Nicor’s ability to pursue alternatives to the merger, which could discourage a potential acquirer of Nicor from making an alternative transaction proposal and, in certain circumstances, could require Nicor to pay AGL Resources a termination fee of $67 million.

Under the Merger Agreement, Nicor is restricted, subject to limited exceptions, from entering into alternative transactions. Unless and until the Merger Agreement is terminated, subject to specified exceptions, Nicor and its subsidiaries are restricted from initiating, soliciting, seeking, inducing or intentionally encouraging or facilitating any inquiries or the making of any proposal or offer for a competing acquisition proposal with any person. Furthermore, Nicor and its subsidiaries are subject to limitations on their ability to participate in any discussions or negotiations, or to furnish any information to any person that has made an acquisition proposal with respect to Nicor or to approve, endorse or recommend any such acquisition proposal for Nicor. Additionally, under the Merger Agreement, in the event of a potential change of recommendation by the board of directors of Nicor with respect to the merger-related proposals, Nicor must provide AGL Resources with five business days prior notice and, if requested, negotiate in good faith an adjustment to the terms and conditions of the Merger Agreement prior to changing its recommendation.

Nicor may terminate the Merger Agreement and enter into an agreement with respect to a superior proposal only if specified conditions have been satisfied, including compliance with the non-solicitation provisions of the Merger Agreement. In addition, under the Merger Agreement, Nicor may be required to pay AGL Resources a termination fee of $67 million if the Merger Agreement is terminated under certain circumstances related to an alternative acquisition proposal. These provisions could discourage a third party that may have an interest in acquiring all or a significant part of Nicor from considering or proposing that acquisition, even if such third party were prepared to pay consideration with a higher per share cash or market value than the value of the merger consideration proposed to be received or realized in the merger, or might result in a potential competing acquirer proposing to pay a lower price than it would otherwise have proposed to pay because of the added expense of the termination fee that may become payable in certain circumstances.

As a result of these restrictions, Nicor may not be able to enter into an agreement with respect to a more favorable alternative transaction without incurring a potentially significant liability to AGL Resources.

AGL Resources’ inability to obtain the financing necessary to complete the transaction could delay or prevent the completion of the merger.

AGL Resources intends to finance the cash portion of the merger consideration with debt financing. To this end, AGL Capital Corporation (a subsidiary of AGL Resources), entered into a bridge facility pursuant to which, subject to certain conditions and limitations, the lenders agree to provide loans to AGL Capital Corporation in an aggregate principal amount of $1.05 billion. AGL Resources and/or AGL Capital Corporation may issue debt securities, preferred stock, common equity, or other securities, bank loans, or other debt financings in lieu of all or a portion of the drawing under the bridge facility.

Under the terms of the Merger Agreement, if all of the conditions to closing are satisfied and the proceeds of the financing or alternative financing necessary to complete the transaction are not available, the Merger Agreement may be terminated by either party, so long as such party is not in material breach of its representations, warranties or covenants in the Merger Agreement that was a proximate cause of the financing failure. In such event, AGL Resources is required to pay Nicor a financing failure fee of $115 million.

The availability of funds under the bridge facility is subject to certain conditions including, among others, the absence of a material adverse effect on AGL Resources or Nicor, pro forma compliance with a consolidated total debt to total capitalization ratio of 70 percent, the ability of AGL Capital Corporation to achieve certain minimum credit ratings and the ability of AGL Capital Corporation to achieve a certain liquidity level at closing. If AGL Resources is unable to timely obtain the financing because one of the conditions to the financing fails to be satisfied, the closing of the merger could be significantly delayed or may not occur at all.

The opinion rendered to the board of directors of Nicor by its financial advisor was based on the financial analyses it performed, which considered factors such as market and other conditions then in effect, and financial forecasts and other information made available to it, as of the date of its opinion. As a result, this opinion does not reflect changes in events or circumstances after the date of the opinion.

The opinion rendered to the board of directors of Nicor by Nicor’s financial advisor was provided in connection with, and at the time of, the board of directors’ evaluation of the merger. The opinion was necessarily based on the financial analyses performed, which considered market and other conditions then in effect, and financial forecasts and other information made available to the financial advisor, as of the date of its opinion, which may have changed after the date of the opinion. The opinion did not speak as of the time that the merger would be completed or as of any date other than the date of such opinion.

None.

Information concerning Nicor and its major subsidiaries’ properties is included in Item 1 – Business, and is incorporated herein by reference. These properties are suitable, adequate and utilized in the company’s operations.

Illinois Attorney General Subpoena. On February 8, 2010, the Office of the Attorney General for the State of Illinois (“IOAG”) issued a subpoena to Nicor to provide documents in connection with an IOAG investigation pursuant to the Illinois Whistleblower Reward and Protection Act. On November 30, 2010, the IOAG issued Nicor an amended request for information. According to the subpoena, the IOAG investigation relates to billing practices used with certain customer accounts involving government funds. While the company believes its billing practices comply with ICC requirements, the company is unable to predict the outcome of this matter or reasonably estima te its potential exposure, if any, and has not recorded a liability associated with this matter.

Also see Item 7 – Management’s Discussion and Analysis of Financial Condition and Results of Operations – Other Matters and Item 8 – Notes to the Consolidated Financial Statements – Note 1 – Proposed Merger with AGL Resources and Note 20 – Contingencies, which are incorporated herein by reference.

| Name | | Age | | Position and Business Experience during past five years |

| | | | | |

| Russ M. Strobel | | 58 | | Chairman, Nicor and Nicor Gas (since 2005); Chief Executive Officer, Nicor (since 2005); Chief Executive Officer, Nicor Gas (since 2003); President, Nicor and Nicor Gas (since 2002). |

| | | | | |

| Richard L. Hawley | | 61 | | Executive Vice President and Chief Financial Officer, Nicor and Nicor Gas (since 2003). |

| | | | | |

| Rocco J. D’Alessandro | | 52 | | Executive Vice President Operations, Nicor Gas (since 2006); Senior Vice President Operations, Nicor Gas (2002-2006). |

| | | | | |

| Daniel R. Dodge | | 57 | | Executive Vice President Diversified Ventures, Nicor (since 2007); Senior Vice President Diversified Ventures and Corporate Planning, Nicor and Nicor Gas (2002-2007). |

| | | | | |

| Claudia J. Colalillo | | 61 | | Senior Vice President Human Resources and Corporate Communications, Nicor (since 2002) and Nicor Gas (since 2006); Senior Vice President Human Resources and Customer Care, Nicor Gas (2002-2006). |

| | | | | |

| Paul C. Gracey, Jr. | | 51 | | Senior Vice President, General Counsel and Secretary, Nicor and Nicor Gas (since 2006); Vice President, General Counsel and Secretary, Nicor and Nicor Gas (2002-2006). |

| | | | | |

Gerald P. O’Connor | | 59 | | Senior Vice President Finance and Strategic Planning, Nicor and Nicor Gas (since 2007); Senior Vice President Finance and Treasurer, Nicor and Nicor Gas (2007); Vice President Administration and Finance, Nicor and Nicor Gas (2004-2006). |

| | | | | |

| Karen K. Pepping | | 46 | | Vice President and Controller, Nicor and Nicor Gas (since 2006); Assistant Vice President and Controller, Nicor and Nicor Gas (2005-2006). |

| | | | | |

| Douglas M. Ruschau | | 52 | | Vice President and Treasurer, Nicor and Nicor Gas (since 2007); Vice President Finance and Treasurer, Peoples Energy Corporation (2002-2007). |

| | | | | |

| Rick Murrell | | 64 | | Chairman, Tropical Shipping and Construction Company Limited (since 2006); President, Tropical Shipping and Construction Company Limited (2006 – January 2011). |

PART II

| Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

Nicor common stock is listed on the New York and Chicago Stock Exchanges. At February 16, 2011, there were approximately 16,700 common stockholders of record and the closing stock price was $52.51.

| | | | Stock price | | | Dividends | |

| Quarter | | | High | | | Low | | | Declared | |

| | | | | | | | | | | |

| 2010 | | | | | | | | | | |

| First | | | $ | 43.75 | | | $ | 37.99 | | | $ | .465 | |

| Second | | | | 44.70 | | | | 38.63 | | | | .465 | |

| Third | | | | 46.27 | | | | 39.54 | | | | .465 | |

| Fourth | | | | 50.81 | | | | 42.98 | | | | .465 | |

| | | | | | | | | | | | | | |

| 2009 | | | | | | | | | | | | | |

| First | | | $ | 36.34 | | | $ | 27.50 | | | $ | .465 | |

| Second | | | | 35.37 | | | | 30.28 | | | | .465 | |

| Third | | | | 38.08 | | | | 32.83 | | | | .465 | |

| Fourth | | | | 43.39 | | | | 34.96 | | | | .465 | |

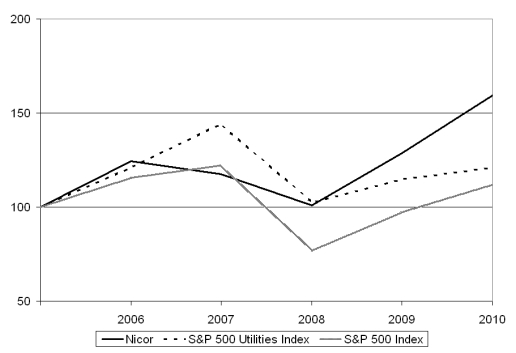

| | | | | | | | | | | | | | |