UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number

(Exact name of registrant as specified in charter)

680 Washington Boulevard, Suite 500, Stamford, Connecticut 06901

(Address of principal executive offices) (Zip code)

AMG Funds LLC

680 Washington Boulevard, Suite 500, Stamford, Connecticut 06901

(Name and address of agent for service)

Registrant's telephone number, including area code:

Date of reporting period:

January 01, 2024 - June 30, 2024

(Semi-Annual Shareholder Report)

Item 1. Reports to Shareholders

(a)

AMG GW&K ESG Bond Fund

Class N/MGFIX

SEMI-ANNUAL SHAREHOLDER REPORT | June 30, 2024

This semi-annual shareholder report contains important information about AMG GW&K ESG Bond Fund (the “Fund”) for the period of January 1, 2024 to June 30, 2024. You can find additional information about the Fund at https://wealth.amg.com/resources/order-literature. You can also request this information by contacting us at 800-548-4539.

Fund Expenses

What were the Fund costs for the last six months?

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

AMG GW&K ESG Bond Fund

(Class N/MGFIX) | $34 | 0.68% |

Key Fund Statistics (as of June 30, 2024)

| Fund net assets | $397,878,366% |

| Total number of portfolio holdings | $149% |

| Net advisory fees paid | $406,227% |

| Portfolio turnover rate as of the end of the reporting period | $18% |

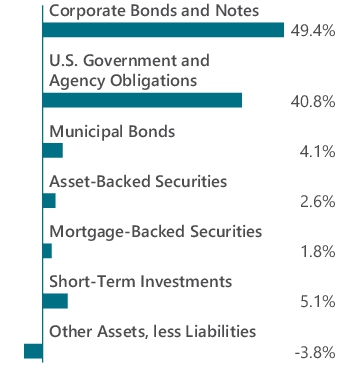

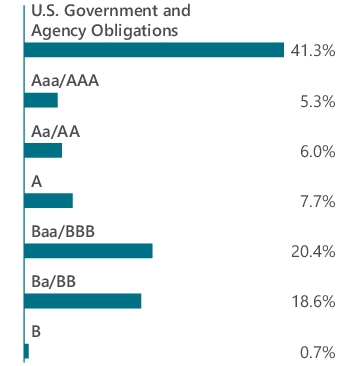

Graphical Representation of Holdings (as of June 30, 2024)

Top ten holdings and portfolio breakdown are shown as a percentage of net assets of the Fund and ratings are shown as a percentage of total long-term investments of the Fund.

| FHLMC, 3.000%, 04/01/51 | 3.2% |

| U.S. Treasury Bonds, 2.250%, 05/15/41 | 3.0% |

| FNMA, 3.500%, 08/01/49 | 2.2% |

| U.S. Treasury Bonds, 1.875%, 02/15/51 | 2.2% |

| U.S. Treasury Bonds, 3.125%, 05/15/48 | 2.2% |

| FNMA, 3.500%, 02/01/35 | 2.1% |

| FNMA, 3.500%, 02/01/47 | 1.8% |

| FHLMC, 3.500%, 02/01/50 | 1.8% |

| FHLMC, 4.500%, 12/01/48 | 1.7% |

| FNMA, 4.000%, 06/01/48 | 1.7% |

| Top Ten as a Group | 21.9% |

Availability of Additional Information

You can find additional information about the Fund such as the prospectus, financial information, fund holdings and proxy voting information at https://wealth.amg.com/resources/order-literature. You can also request this information by contacting us at 800.548.4539.

Householding

In order to reduce expenses, we will deliver a single copy of prospectuses, proxies, financial reports and other communication to shareholders with the same residential address, provided they have the same last name or we reasonably believe them to be members of the same family. Unless we are notified otherwise, we will continue to send recipients only one copy of these materials for as long as they remain a shareholder of the Fund. If you would like to receive individual mailings, please call 800.548.4539 and we will begin sending you separate copies of these materials within 30 days after receiving your request.

For additional information, please navigate to the additional material at https://wealth.amg.com/resources/order-literature.

AMG GW&K ESG Bond Fund

Class I/MGBIX

SEMI-ANNUAL SHAREHOLDER REPORT | June 30, 2024

This semi-annual shareholder report contains important information about AMG GW&K ESG Bond Fund (the “Fund”) for the period of January 1, 2024 to June 30, 2024. You can find additional information about the Fund at https://wealth.amg.com/resources/order-literature. You can also request this information by contacting us at 800-548-4539.

Fund Expenses

What were the Fund costs for the last six months?

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

AMG GW&K ESG Bond Fund

(Class I/MGBIX) | $24 | 0.48% |

Key Fund Statistics (as of June 30, 2024)

| Fund net assets | $397,878,366% |

| Total number of portfolio holdings | $149% |

| Net advisory fees paid | $406,227% |

| Portfolio turnover rate as of the end of the reporting period | $18% |

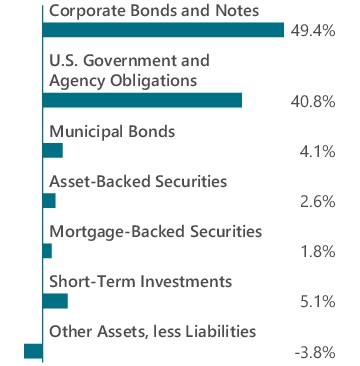

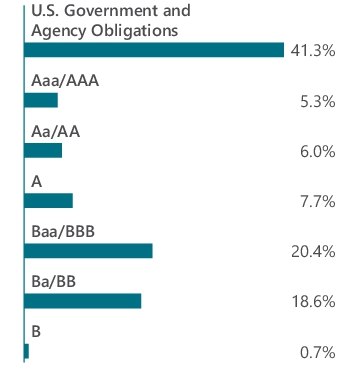

Graphical Representation of Holdings (as of June 30, 2024)

Top ten holdings and portfolio breakdown are shown as a percentage of net assets of the Fund and ratings are shown as a percentage of total long-term investments of the Fund.

| FHLMC, 3.000%, 04/01/51 | 3.2% |

| U.S. Treasury Bonds, 2.250%, 05/15/41 | 3.0% |

| FNMA, 3.500%, 08/01/49 | 2.2% |

| U.S. Treasury Bonds, 1.875%, 02/15/51 | 2.2% |

| U.S. Treasury Bonds, 3.125%, 05/15/48 | 2.2% |

| FNMA, 3.500%, 02/01/35 | 2.1% |

| FNMA, 3.500%, 02/01/47 | 1.8% |

| FHLMC, 3.500%, 02/01/50 | 1.8% |

| FHLMC, 4.500%, 12/01/48 | 1.7% |

| FNMA, 4.000%, 06/01/48 | 1.7% |

| Top Ten as a Group | 21.9% |

Availability of Additional Information

You can find additional information about the Fund such as the prospectus, financial information, fund holdings and proxy voting information at https://wealth.amg.com/resources/order-literature. You can also request this information by contacting us at 800.548.4539.

Householding

In order to reduce expenses, we will deliver a single copy of prospectuses, proxies, financial reports and other communication to shareholders with the same residential address, provided they have the same last name or we reasonably believe them to be members of the same family. Unless we are notified otherwise, we will continue to send recipients only one copy of these materials for as long as they remain a shareholder of the Fund. If you would like to receive individual mailings, please call 800.548.4539 and we will begin sending you separate copies of these materials within 30 days after receiving your request.

For additional information, please navigate to the additional material at https://wealth.amg.com/resources/order-literature.

AMG GW&K High Income Fund

Class N/MGGBX

SEMI-ANNUAL SHAREHOLDER REPORT | June 30, 2024

This semi-annual shareholder report contains important information about AMG GW&K High Income Fund (the “Fund”) for the period of January 1, 2024 to June 30, 2024. You can find additional information about the Fund at https://wealth.amg.com/resources/order-literature. You can also request this information by contacting us at 800-548-4539.

This report describes changes to the Fund that occurred during the reporting period.

Fund Expenses

What were the Fund costs for the last six months?

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

AMG GW&K High Income Fund

(Class N/MGGBX) | $41 | 0.82% |

Key Fund Statistics (as of June 30, 2024)

| Fund net assets | $6,686,315% |

| Total number of portfolio holdings | $1% |

| Net advisory fees paid | $0% |

| Portfolio turnover rate as of the end of the reporting period | $25% |

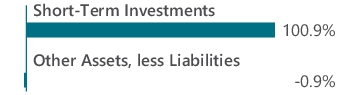

Graphical Representation of Holdings (as of June 30, 2024)

Top ten holdings and portfolio breakdown are shown as a percentage of net assets of the Fund.

| Dreyfus Institutional Preferred Government Money Market Fund, Institutional Shares, 5.270% | 100.9% |

| Top Ten as a Group | 100.9% |

Recent Fund Changes

This is a summary of certain changes to the Fund since January 1, 2024. For more complete information, you may review the Fund's prospectus at https://wealth.amg.com/resources/order-literature. The Fund's prospectus is also available without charge by calling 800.548.4539 or by sending an e-mail request to shareholderservices@amg.com.

The Board of Trustees of AMG Funds III has approved a plan to liquidate and terminate the Fund (the "Liquidation"), which is expected to occur on or about September 11, 2024 (the "Liquidation Date"). In conjunction with the Liquidation, the Fund sold its portfolio investments and invested the proceeds in cash and cash equivalents. Effective June 14, 2024, the Fund discontinued accruing 12b-1 Distribution fees through the Liquidation Date, and effective June 17, 2024, and through the Liquidation Date, the Investment Manager waived its management fee and will waive the right to recoup any prior reimbursed expenses under the Fund's Expense Limitation Agreement. Since immediately following the close of business on June 13, 2024, the Fund no longer accepts investments, except for investments made through existing asset allocation programs investing in the Fund, and shares purchased pursuant to automatic investment programs, such as automatic investments through 401(k) plans and reinvestments of any dividends and distributions.

Availability of Additional Information

You can find additional information about the Fund such as the prospectus, financial information, fund holdings and proxy voting information at https://wealth.amg.com/resources/order-literature. You can also request this information by contacting us at 800.548.4539.

Householding

In order to reduce expenses, we will deliver a single copy of prospectuses, proxies, financial reports and other communication to shareholders with the same residential address, provided they have the same last name or we reasonably believe them to be members of the same family. Unless we are notified otherwise, we will continue to send recipients only one copy of these materials for as long as they remain a shareholder of the Fund. If you would like to receive individual mailings, please call 800.548.4539 and we will begin sending you separate copies of these materials within 30 days after receiving your request.

For additional information, please navigate to the additional material at https://wealth.amg.com/resources/order-literature.

AMG GW&K High Income Fund

Class I/GWHIX

SEMI-ANNUAL SHAREHOLDER REPORT | June 30, 2024

This semi-annual shareholder report contains important information about AMG GW&K High Income Fund (the “Fund”) for the period of January 1, 2024 to June 30, 2024. You can find additional information about the Fund at https://wealth.amg.com/resources/order-literature. You can also request this information by contacting us at 800-548-4539.

This report describes changes to the Fund that occurred during the reporting period.

Fund Expenses

What were the Fund costs for the last six months?

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

AMG GW&K High Income Fund

(Class I/GWHIX) | $31 | 0.62% |

Key Fund Statistics (as of June 30, 2024)

| Fund net assets | $6,686,315% |

| Total number of portfolio holdings | $1% |

| Net advisory fees paid | $0% |

| Portfolio turnover rate as of the end of the reporting period | $25% |

Graphical Representation of Holdings (as of June 30, 2024)

Top ten holdings and portfolio breakdown are shown as a percentage of net assets of the Fund.

| Dreyfus Institutional Preferred Government Money Market Fund, Institutional Shares, 5.270% | 100.9% |

| Top Ten as a Group | 100.9% |

Recent Fund Changes

This is a summary of certain changes to the Fund since January 1, 2024. For more complete information, you may review the Fund's prospectus at https://wealth.amg.com/resources/order-literature. The Fund's prospectus is also available without charge by calling 800.548.4539 or by sending an e-mail request to shareholderservices@amg.com.

The Board of Trustees of AMG Funds III has approved a plan to liquidate and terminate the Fund (the "Liquidation"), which is expected to occur on or about September 11, 2024 (the "Liquidation Date"). In conjunction with the Liquidation, the Fund sold its portfolio investments and invested the proceeds in cash and cash equivalents. Effective June 14, 2024, the Fund discontinued accruing 12b-1 Distribution fees through the Liquidation Date, and effective June 17, 2024, and through the Liquidation Date, the Investment Manager waived its management fee and will waive the right to recoup any prior reimbursed expenses under the Fund's Expense Limitation Agreement. Since immediately following the close of business on June 13, 2024, the Fund no longer accepts investments, except for investments made through existing asset allocation programs investing in the Fund, and shares purchased pursuant to automatic investment programs, such as automatic investments through 401(k) plans and reinvestments of any dividends and distributions.

Availability of Additional Information

You can find additional information about the Fund such as the prospectus, financial information, fund holdings and proxy voting information at https://wealth.amg.com/resources/order-literature. You can also request this information by contacting us at 800.548.4539.

Householding

In order to reduce expenses, we will deliver a single copy of prospectuses, proxies, financial reports and other communication to shareholders with the same residential address, provided they have the same last name or we reasonably believe them to be members of the same family. Unless we are notified otherwise, we will continue to send recipients only one copy of these materials for as long as they remain a shareholder of the Fund. If you would like to receive individual mailings, please call 800.548.4539 and we will begin sending you separate copies of these materials within 30 days after receiving your request.

For additional information, please navigate to the additional material at https://wealth.amg.com/resources/order-literature.

AMG Veritas Asia Pacific Fund

Class N/MGSEX

SEMI-ANNUAL SHAREHOLDER REPORT | June 30, 2024

This semi-annual shareholder report contains important information about AMG Veritas Asia Pacific Fund (the “Fund”) for the period of January 1, 2024 to June 30, 2024. You can find additional information about the Fund at https://wealth.amg.com/resources/order-literature. You can also request this information by contacting us at 800-548-4539.

Fund Expenses

What were the Fund costs for the last six months?

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

AMG Veritas Asia Pacific Fund

(Class N/MGSEX) | $61 | 1.17% |

Key Fund Statistics (as of June 30, 2024)

| Fund net assets | $88,229,688% |

| Total number of portfolio holdings | $46% |

| Net advisory fees paid | $228,065% |

| Portfolio turnover rate as of the end of the reporting period | $39% |

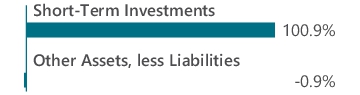

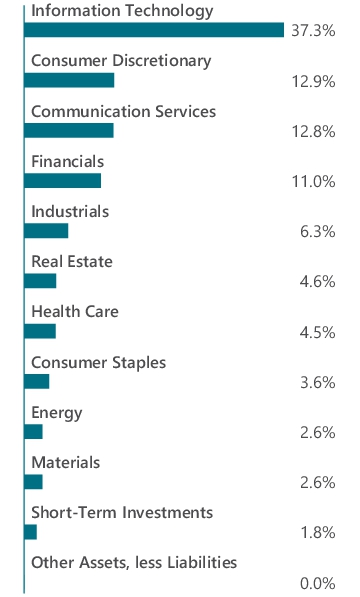

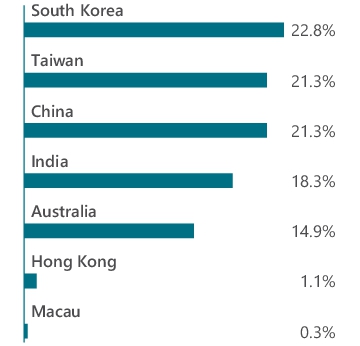

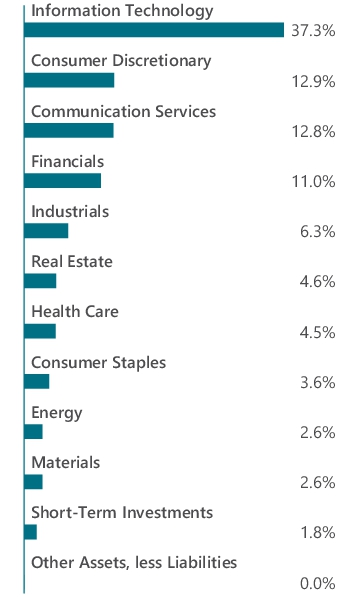

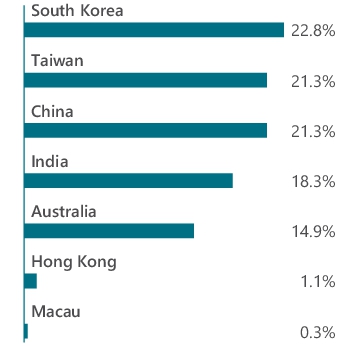

Graphical Representation of Holdings (as of June 30, 2024)

Top ten holdings and portfolio breakdown are shown as a percentage of net assets of the Fund and country allocation is shown as a percentage of total long-term investments of the Fund.

| Taiwan Semiconductor Manufacturing Co., Ltd. (Taiwan) | 17.0% |

| Tencent Holdings, Ltd. (China) | 7.8% |

| Samsung Electronics Co., Ltd. (South Korea) | 7.8% |

| Alibaba Group Holding, Ltd. (China) | 6.1% |

| Goodman Group (Australia) | 4.6% |

| HDFC Bank, Ltd., ADR (India) | 4.1% |

| SK Hynix, Inc. (South Korea) | 4.0% |

| REA Group, Ltd. (Australia) | 3.6% |

| Aristocrat Leisure, Ltd. (Australia) | 3.3% |

| Hanwha Aerospace Co., Ltd. (South Korea) | 2.6% |

| Top Ten as a Group | 60.9% |

Availability of Additional Information

You can find additional information about the Fund such as the prospectus, financial information, fund holdings and proxy voting information at https://wealth.amg.com/resources/order-literature. You can also request this information by contacting us at 800.548.4539.

Householding

In order to reduce expenses, we will deliver a single copy of prospectuses, proxies, financial reports and other communication to shareholders with the same residential address, provided they have the same last name or we reasonably believe them to be members of the same family. Unless we are notified otherwise, we will continue to send recipients only one copy of these materials for as long as they remain a shareholder of the Fund. If you would like to receive individual mailings, please call 800.548.4539 and we will begin sending you separate copies of these materials within 30 days after receiving your request.

For additional information, please navigate to the additional material at https://wealth.amg.com/resources/order-literature.

AMG Veritas Asia Pacific Fund

Class I/MSEIX

SEMI-ANNUAL SHAREHOLDER REPORT | June 30, 2024

This semi-annual shareholder report contains important information about AMG Veritas Asia Pacific Fund (the “Fund”) for the period of January 1, 2024 to June 30, 2024. You can find additional information about the Fund at https://wealth.amg.com/resources/order-literature. You can also request this information by contacting us at 800-548-4539.

Fund Expenses

What were the Fund costs for the last six months?

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

AMG Veritas Asia Pacific Fund

(Class I/MSEIX) | $48 | 0.93% |

Key Fund Statistics (as of June 30, 2024)

| Fund net assets | $88,229,688% |

| Total number of portfolio holdings | $46% |

| Net advisory fees paid | $228,065% |

| Portfolio turnover rate as of the end of the reporting period | $39% |

Graphical Representation of Holdings (as of June 30, 2024)

Top ten holdings and portfolio breakdown are shown as a percentage of net assets of the Fund and country allocation is shown as a percentage of total long-term investments of the Fund.

| Taiwan Semiconductor Manufacturing Co., Ltd. (Taiwan) | 17.0% |

| Tencent Holdings, Ltd. (China) | 7.8% |

| Samsung Electronics Co., Ltd. (South Korea) | 7.8% |

| Alibaba Group Holding, Ltd. (China) | 6.1% |

| Goodman Group (Australia) | 4.6% |

| HDFC Bank, Ltd., ADR (India) | 4.1% |

| SK Hynix, Inc. (South Korea) | 4.0% |

| REA Group, Ltd. (Australia) | 3.6% |

| Aristocrat Leisure, Ltd. (Australia) | 3.3% |

| Hanwha Aerospace Co., Ltd. (South Korea) | 2.6% |

| Top Ten as a Group | 60.9% |

Availability of Additional Information

You can find additional information about the Fund such as the prospectus, financial information, fund holdings and proxy voting information at https://wealth.amg.com/resources/order-literature. You can also request this information by contacting us at 800.548.4539.

Householding

In order to reduce expenses, we will deliver a single copy of prospectuses, proxies, financial reports and other communication to shareholders with the same residential address, provided they have the same last name or we reasonably believe them to be members of the same family. Unless we are notified otherwise, we will continue to send recipients only one copy of these materials for as long as they remain a shareholder of the Fund. If you would like to receive individual mailings, please call 800.548.4539 and we will begin sending you separate copies of these materials within 30 days after receiving your request.

For additional information, please navigate to the additional material at https://wealth.amg.com/resources/order-literature.

(b) Not applicable.

Item 2. CODE OF ETHICS

Not required in this filing.

Item 3. AUDIT COMMITTEE FINANCIAL EXPERT

Not required in this filing.

Item 4. PRINCIPAL ACCOUNTANT FEES AND SERVICES

Not required in this filing.

Item 5. AUDIT COMMITTEE OF LISTED REGISTRANTS

Not applicable.

Item 6. INVESTMENTS

The schedule of investments in securities of unaffiliated issuers as of the close of the reporting period is included in the financial statements filed under Item 7 hereof.

Item 7. FINANCIAL STATEMENTS AND FINANCIAL HIGHLIGHTS FOR OPEN-END MANAGEMENT INVESTMENT COMPANIES.

| | |

| | SEMI-ANNUAL REPORT |

| | | | | | |

| | | | AMG Funds June 30, 2024

AMG Veritas Asia Pacific Fund |

| | | |

| | | | | Class N: MGSEX | Class I: MSEIX |

| | | | |

| | | | | | | |

| | | | |

| | |

| wealth.amg.com | | | | 063024 SAR078 |

| | |

| | | AMG Funds Semi-Annual Report — June 30, 2024 (unaudited) |

Nothing contained herein is to be considered an offer, sale or solicitation of an offer to buy shares of any series of the AMG Funds Family of Funds. Such offering is made only by prospectus, which includes details as to offering price and other material information.

| | |

| | | AMG Veritas Asia Pacific Fund Schedule of Portfolio Investments (unaudited) June 30, 2024 |

| | | | | | | | |

| | | Shares | | | Value | |

| | |

Common Stocks - 92.4% | | | | | | | | |

| | |

Communication Services - 12.8% | | | | | | | | |

| | |

NetEase, Inc. (China) | | | 60,000 | | | | $1,145,755 | |

| | |

REA Group, Ltd. (Australia) | | | 24,684 | | | | 3,223,107 | |

| | |

Tencent Holdings, Ltd. (China) | | | 145,939 | | | | 6,923,394 | |

| | |

Total Communication Services | | | | | | | 11,292,256 | |

| | |

Consumer Discretionary - 11.3% | | | | | | | | |

| | |

Alibaba Group Holding, Ltd. (China) | | | 595,250 | | | | 5,364,893 | |

| | |

Aristocrat Leisure, Ltd. (Australia) | | | 86,802 | | | | 2,874,495 | |

| | |

Li Auto, Inc., Class A (China)* | | | 25,000 | | | | 223,887 | |

| | |

Sands China, Ltd. (Macau)* | | | 142,100 | | | | 295,469 | |

| | |

Zomato, Ltd. (India)* | | | 510,263 | | | | 1,224,514 | |

| | |

Total Consumer Discretionary | | | | | | | 9,983,258 | |

| | |

Consumer Staples - 3.6% | | | | | | | | |

| | |

Kweichow Moutai Co., Ltd., Class A (China) | | | 4,000 | | | | 805,928 | |

| | |

Nestle India, Ltd. (India) | | | 29,350 | | | | 897,236 | |

| | |

Varun Beverages, Ltd. (India) | | | 74,582 | | | | 1,454,552 | |

| | |

Total Consumer Staples | | | | | | | 3,157,716 | |

| | |

Energy - 1.0% | | | | | | | | |

| | |

Reliance Industries, Ltd. (India) | | | 23,200 | | | | 869,690 | |

| | |

Financials - 11.0% | | | | | | | | |

| | |

HDFC Bank, Ltd., ADR (India) | | | 55,817 | | | | 3,590,708 | |

| | |

Hong Kong Exchanges & Clearing, Ltd. (Hong Kong) | | | 31,150 | | | | 996,898 | |

| | |

ICICI Bank, Ltd., Sponsored ADR (India) | | | 15,424 | | | | 444,366 | |

| | |

KB Financial Group, Inc. (South Korea) | | | 38,326 | | | | 2,179,988 | |

| | |

Samsung Fire & Marine Insurance Co., Ltd. (South Korea) | | | 4,574 | | | | 1,286,612 | |

| | |

Samsung Life Insurance Co., Ltd. (South Korea) | | | 19,498 | | | | 1,247,104 | |

| | |

Total Financials | | | | | | | 9,745,676 | |

| | |

Health Care - 3.5% | | | | | | | | |

| | |

CSL, Ltd. (Australia) | | | 5,938 | | | | 1,164,425 | |

| | |

CSPC Pharmaceutical Group, Ltd. (China) | | | 818,000 | | | | 651,447 | |

| | |

Innovent Biologics, Inc. (China)*,1 | | | 100,000 | | | | 470,717 | |

| | |

Shenzhen Mindray Bio-Medical Electronics Co., Ltd., Class A (China) | | | 19,700 | | | | 788,164 | |

| | |

Total Health Care | | | | | | | 3,074,753 | |

| | |

Industrials - 6.3% | | | | | | | | |

| | |

Contemporary Amperex Technology Co., Ltd., Class A (China) | | | 39,900 | | | | 988,382 | |

| | |

Hanwha Aerospace Co., Ltd. (South Korea) | | | 12,722 | | | | 2,294,391 | |

| | |

Samsung C&T Corp. (South Korea) | | | 11,897 | | | | 1,220,931 | |

| | | | | | | | |

| | | Shares | | | Value | |

| | |

Shenzhen Inovance Technology Co., Ltd., Class A (China) | | | 149,500 | | | | $1,054,280 | |

| | |

Total Industrials | | | | | | | 5,557,984 | |

| | |

Information Technology - 35.7% | | | | | | | | |

| | |

ASMedia Technology, Inc. (Taiwan) | | | 6,000 | | | | 412,332 | |

| | |

ASPEED Technology, Inc. (Taiwan) | | | 3,000 | | | | 445,172 | |

| | |

Chroma ATE, Inc. (Taiwan) | | | 81,000 | | | | 791,991 | |

| | |

Delta Electronics, Inc. (Taiwan) | | | 44,000 | | | | 524,810 | |

| | |

Hon Hai Precision Industry Co., Ltd. (Taiwan) | | | 195,000 | | | | 1,283,865 | |

| | |

Infosys, Ltd., Sponsored ADR (India)2 | | | 120,000 | | | | 2,234,400 | |

| | |

Samsung Electronics Co., Ltd. (South Korea) | | | 116,495 | | | | 6,856,176 | |

| | |

Samsung SDI Co., Ltd. (South Korea) | | | 1,700 | | | | 434,096 | |

| | |

SK Hynix, Inc. (South Korea)* | | | 20,750 | | | | 3,521,454 | |

| | |

Taiwan Semiconductor Manufacturing Co., Ltd. (Taiwan) | | | 506,400 | | | | 15,003,429 | |

| | |

Total Information Technology | | | | | | | 31,507,725 | |

| | |

Materials - 2.6% | | | | | | | | |

| | |

LG Chem, Ltd. (South Korea) | | | 2,957 | | | | 736,869 | |

| | |

Rio Tinto, Ltd. (Australia) | | | 19,500 | | | | 1,544,632 | |

| | |

Total Materials | | | | | | | 2,281,501 | |

| | |

Real Estate - 4.6% | | | | | | | | |

| | |

Goodman Group, REIT (Australia) | | | 176,341 | | | | 4,068,168 | |

| | |

Total Common Stocks

(Cost $75,845,336) | | | | | | | 81,538,727 | |

| | |

Participation Notes - 5.8% | | | | | | | | |

| | |

Consumer Discretionary - 1.6% | | | | | | | | |

| | |

Zomato, Ltd. (CLSA Ltd.), 07/22/26 (India) | | | 579,936 | | | | 1,391,713 | |

| | |

Energy - 1.6% | | | | | | | | |

| | |

Reliance Industries Ltd. (CLSA Ltd.), 06/30/25 (India) | | | 36,895 | | | | 1,383,069 | |

| | |

Health Care - 1.0% | | | | | | | | |

| | |

Apollo Hospitals Enterprise, Ltd. (CLSA Ltd.), 06/30/27 (India) | | | 12,580 | | | | 931,475 | |

| | |

Information Technology - 1.6% | | | | | | | | |

| | |

Tata Consultancy Services, Ltd. (CLSA Ltd.), 02/25/25 (India) | | | 30,365 | | | | 1,418,448 | |

| | |

Total Participation Notes

(Cost $4,007,828) | | | | | | | 5,124,705 | |

The accompanying notes are an integral part of these financial statements.

2

| | |

| | | AMG Veritas Asia Pacific Fund Schedule of Portfolio Investments (continued) |

| | | |

| | | |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| | |

Short-Term Investments - 1.8% | | | | | | | | |

| |

Joint Repurchase Agreements - 1.1%3 | | | | | |

| | |

Bethesda Securities LLC, dated 06/28/24, due 07/01/24, 5.450% total to be received $951,616 (collateralized by various U.S. Government Agency Obligations, 2.500% - 6.070%, 10/01/27 - 01/01/57, totaling $970,208) | | | $951,184 | | | | $951,184 | |

| | |

| | | Shares | | | | |

| |

Other Investment Companies - 0.7% | | | | | |

| | |

Dreyfus Government Cash Management Fund, Institutional Shares, 5.19%4 | | | 256,535 | | | | 256,535 | |

| | | | | | | | |

| | | Shares | | | Value | |

| | |

Dreyfus Institutional Preferred Government Money Market Fund, Institutional Shares, 5.27%4 | | | 384,802 | | | | $384,802 | |

| | |

Total Other Investment Companies | | | | | | | 641,337 | |

| | |

Total Short-Term Investments

(Cost $1,592,521) | | | | | | | 1,592,521 | |

| | |

Total Investments - 100.0%

(Cost $81,445,685) | | | | | | | 88,255,953 | |

| | |

Other Assets, less Liabilities - (0.0)%# | | | | | | | (26,265 | ) |

| | |

Net Assets - 100.0% | | | | | | | $88,229,688 | |

| | | | | | | | |

| * | Non-income producing security. |

| 1 | Security exempt from registration under Rule 144A of the Securities Act of 1933. This security may be resold in transactions exempt from registration, normally to qualified institutional buyers. At June 30, 2024, the value of this security amounted to $470,717 or 0.5% of net assets. |

| 2 | Some of this security, amounting to $2,212,056 or 2.5% of net assets, was out on loan to various borrowers and are collateralized by cash and various U.S. Treasury Obligations. See Note 4 of Notes to Financial Statements. |

| 3 | Cash collateral received for securities lending activity was invested in these joint repurchase agreements. |

| 4 | Yield shown represents the June 30, 2024, seven day average yield, which refers to the sum of the previous seven days’ dividends paid, expressed as an annual percentage. |

ADR American Depositary Receipt

REIT Real Estate Investment Trust

The accompanying notes are an integral part of these financial statements.

3

| | |

| | | AMG Veritas Asia Pacific Fund Schedule of Portfolio Investments (continued) |

| | | |

| | | |

The following table summarizes the inputs used to value the Fund’s investments by the fair value hierarchy levels as of June 30, 2024:

| | | | | | | | | | | | | | | | |

| | | Level 1 | | | Level 21 | | | Level 3 | | | Total | |

Investments in Securities | | | | | | | | | | | | | | | | |

| | | | |

Common Stocks | | | | | | | | | | | | | | | | |

| | | | |

Information Technology | | | $2,234,400 | | | | $29,273,325 | | | | — | | | | $31,507,725 | |

| | | | |

Communication Services | | | — | | | | 11,292,256 | | | | — | | | | 11,292,256 | |

| | | | |

Consumer Discretionary | | | — | | | | 9,983,258 | | | | — | | | | 9,983,258 | |

| | | | |

Financials | | | 4,035,074 | | | | 5,710,602 | | | | — | | | | 9,745,676 | |

| | | | |

Industrials | | | — | | | | 5,557,984 | | | | — | | | | 5,557,984 | |

| | | | |

Real Estate | | | — | | | | 4,068,168 | | | | — | | | | 4,068,168 | |

| | | | |

Consumer Staples | | | — | | | | 3,157,716 | | | | — | | | | 3,157,716 | |

| | | | |

Health Care | | | — | | | | 3,074,753 | | | | — | | | | 3,074,753 | |

| | | | |

Materials | | | — | | | | 2,281,501 | | | | — | | | | 2,281,501 | |

| | | | |

Energy | | | — | | | | 869,690 | | | | — | | | | 869,690 | |

| | | | |

Participation Notes† | | | — | | | | 5,124,705 | | | | — | | | | 5,124,705 | |

| | | | |

Short-Term Investments | | | | | | | | | | | | | | | | |

| | | | |

Joint Repurchase Agreements | | | — | | | | 951,184 | | | | — | | | | 951,184 | |

| | | | |

Other Investment Companies | | | 641,337 | | | | — | | | | — | | | | 641,337 | |

| | | | | | | | | | | | | | | | |

| | | | |

Total Investments in Securities | | | $6,910,811 | | | | $81,345,142 | | | | — | | | | $88,255,953 | |

| | | | | | | | | | | | | | | | |

| † | All participation notes held in the Fund are Level 2 securities. For a detailed breakout of participation notes by major industry classification, please refer to the Fund’s Schedule of Portfolio Investments. |

| 1 | An external pricing service is used to reflect any impact on security value due to market movements between the time the Fund valued such foreign securities and the earlier closing of foreign markets. |

For the six months ended June 30, 2024, there were no transfers in or out of Level 3.

The accompanying notes are an integral part of these financial statements.

4

| | |

| | | Statement of Assets and Liabilities (unaudited) June 30, 2024 |

| | | |

| | | |

| | | | |

| | | AMG Veritas

Asia

Pacific Fund |

| |

Assets: | | | | |

| |

Investments at value1 (including securities on loan valued at $2,212,056) | | | $88,255,953 | |

| |

Foreign currency2 | | | 450,933 | |

| |

Receivable for investments sold | | | 1,400,014 | |

| |

Dividend and interest receivables | | | 350,479 | |

| |

Securities lending income receivable | | | 413 | |

| |

Receivable for Fund shares sold | | | 3,217 | |

| |

Receivable from affiliate | | | 12,962 | |

| |

Prepaid expenses and other assets | | | 16,112 | |

| |

Total assets | | | 90,490,083 | |

| |

Liabilities: | | | | |

| |

Payable upon return of securities loaned | | | 951,184 | |

| |

Payable for investments purchased | | | 911,488 | |

| |

Payable for Fund shares repurchased | | | 10,550 | |

| |

Payable for foreign capital gains tax | | | 270,268 | |

| |

Accrued expenses: | | | | |

| |

Investment advisory and management fees | | | 50,347 | |

| |

Administrative fees | | | 10,637 | |

| |

Shareholder service fees | | | 15,554 | |

| |

Other | | | 40,367 | |

| |

Total liabilities | | | 2,260,395 | |

| |

Commitments and Contingencies (Notes 2 & 6) | | | | |

| |

Net Assets | | | $88,229,688 | |

| |

1 Investments at cost | | | $81,445,685 | |

| |

2 Foreign currency at cost | | | $449,292 | |

The accompanying notes are an integral part of these financial statements.

5

| | |

| | | Statement of Assets and Liabilities (continued) |

| | | |

| | | |

| | | | |

| | | AMG Veritas

Asia

Pacific Fund |

| |

Net Assets Represent: | | | | |

| |

Paid-in capital | | | $133,635,203 | |

| |

Total distributable loss | | | (45,405,515 | ) |

| |

Net Assets | | | $88,229,688 | |

| |

Class N: | | | | |

| |

Net Assets | | | $80,995,987 | |

| |

Shares outstanding | | | 1,310,588 | |

| |

Net asset value, offering and redemption price per share | | | $61.80 | |

| |

Class I: | | | | |

| |

Net Assets | | | $7,233,701 | |

| |

Shares outstanding | | | 106,621 | |

| |

Net asset value, offering and redemption price per share | | | $67.84 | |

The accompanying notes are an integral part of these financial statements.

6

| | |

| | | Statement of Operations (unaudited) For the six months ended June 30, 2024 |

| | | |

| | | |

| | | | |

| | | AMG Veritas

Asia

Pacific Fund |

| |

Investment Income: | | | | |

| |

Dividend income | | | $843,785 | |

| |

Interest income | | | 2,451 | |

| |

Securities lending income | | | 1,303 | |

| |

Foreign withholding tax | | | (78,251 | ) |

| |

Total investment income | | | 769,288 | |

| |

Expenses: | | | | |

| |

Investment advisory and management fees | | | 299,629 | |

| |

Administrative fees | | | 63,302 | |

| |

Shareholder servicing fees - Class N | | | 94,689 | |

| |

Custodian fees | | | 26,604 | |

| |

Professional fees | | | 21,282 | |

| |

Registration fees | | | 16,827 | |

| |

Reports to shareholders | | | 11,648 | |

| |

Transfer agent fees | | | 7,978 | |

| |

Trustee fees and expenses | | | 3,245 | |

| |

Miscellaneous | | | 13,521 | |

| |

Total expenses before offsets | | | 558,725 | |

| |

Expense reimbursements | | | (71,564 | ) |

| |

Net expenses | | | 487,161 | |

| | | | |

| |

Net investment income | | | 282,127 | |

| |

Net Realized and Unrealized Gain: | | | | |

| |

Net realized loss on investments | | | (7,166,147 | )1 |

| |

Net realized loss on foreign currency transactions | | | (32,323 | ) |

| |

Net change in unrealized appreciation/depreciation on investments | | | 14,566,278 | 2 |

| |

Net change in unrealized appreciation/depreciation on foreign currency translations | | | (1,914 | ) |

| |

Net realized and unrealized gain | | | 7,365,894 | |

| | | | |

| |

Net increase in net assets resulting from operations | | | $7,648,021 | |

| 1 | Net of foreign capital gains tax of $141,814. |

| 2 | Net of change in accrued foreign capital gains tax of $(115,349). |

The accompanying notes are an integral part of these financial statements.

7

| | |

| | | Statements of Changes in Net Assets For the six months ended June 30, 2024 (unaudited) and the fiscal year ended December 31, 2023 |

| | | |

| | | |

| | | | | | | | | | | | |

| | | AMG Veritas

Asia Pacific Fund |

| | | |

| | | June 30, 2024 | | | | December 31, 2023 |

| | | |

Increase (Decrease) in Net Assets Resulting From Operations: | | | | | | | | | | | | |

| | | |

Net investment income | | | $282,127 | | | | | | | | $149,439 | |

| | | |

Net realized loss on investments | | | (7,198,470 | ) | | | | | | | (15,082,837 | ) |

| | | |

Net change in unrealized appreciation/depreciation on investments | | | 14,564,364 | | | | | | | | 9,845,574 | |

| | | | | | | | | | | | |

| | | |

Net increase (decrease) in net assets resulting from operations | | | 7,648,021 | | | | | | | | (5,087,824 | ) |

| | | |

Distributions to Shareholders: | | | | | | | | | | | | |

| | | |

Class N | | | — | | | | | | | | (93,333 | ) |

| | | |

Class I | | | — | | | | | | | | (25,321 | ) |

| | | | | | | | | | | | |

| | | |

Total distributions to shareholders | | | — | | | | | | | | (118,654 | ) |

| | | |

Capital Share Transactions:1 | | | | | | | | | | | | |

| | | |

Net decrease from capital share transactions | | | (7,246,082 | ) | | | | | | | (19,983,339 | ) |

| | | | | | | | | | | | |

| | | |

Total increase (decrease) in net assets | | | 401,939 | | | | | | | | (25,189,817 | ) |

| | | |

Net Assets: | | | | | | | | | | | | |

| | | |

Beginning of period | | | 87,827,749 | | | | | | | | 113,017,566 | |

| | | | | | | | | | | | |

| | | |

End of period | | | $88,229,688 | | | | | | | | $87,827,749 | |

1 See Note 1(g) of the Notes to Financial Statements.

The accompanying notes are an integral part of these financial statements.

8

| | |

| | | AMG Veritas Asia Pacific Fund Financial Highlights For a share outstanding throughout each fiscal period |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | For the six months ended June 30, 2024 (unaudited) | | For the fiscal years ended December 31, |

| Class N | | 2023 | | 2022 | | 2021 | | 2020 | | 2019 |

| | | | | | |

Net Asset Value, Beginning of Period | | | | $56.49 | | | | | $59.41 | | | | | $82.42 | | | | | $147.58 | | | | | $111.15 | | | | | $114.95 | |

| | | | | | |

Income (loss) from Investment Operations: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net investment income (loss)1,2 | | | | 0.18 | | | | | 0.07 | | | | | (0.05 | ) | | | | (0.67 | ) | | | | (1.03 | ) | | | | (1.03 | ) |

| | | | | | |

Net realized and unrealized gain (loss) on investments | | | | 5.13 | | | | | (2.93 | ) | | | | (22.96 | ) | | | | 4.55 | | | | | 43.88 | | | | | 30.19 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Total income (loss) from investment operations | | | | 5.31 | | | | | (2.86 | ) | | | | (23.01 | ) | | | | 3.88 | | | | | 42.85 | | | | | 29.16 | |

| | | | | | |

Less Distributions to Shareholders from: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net investment income | | | | — | | | | | (0.06 | ) | | | | — | | | | | — | | | | | — | | | | | — | |

| | | | | | |

Net realized gain on investments | | | | — | | | | | — | | | | | — | | | | | (56.87 | ) | | | | (6.42 | ) | | | | (32.96 | ) |

| | | | | | |

Paid in capital | | | | — | | | | | — | | | | | — | | | | | (12.17 | ) | | | | — | | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Total distributions to shareholders | | | | — | | | | | (0.06 | ) | | | | — | | | | | (69.04 | ) | | | | (6.42 | ) | | | | (32.96 | ) |

| | | | | | |

Net Asset Value, End of Period | | | | $61.80 | | | | | $56.49 | | | | | $59.41 | | | | | $82.42 | | | | | $147.58 | | | | | $111.15 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Total Return2,3 | | | | 9.40 | %4 | | | | (4.82 | )% | | | | (27.91 | )% | | | | 3.16 | % | | | | 38.74 | % | | | | 25.69 | % |

| | | | | | |

Ratio of net expenses to average net assets | | | | 1.17 | %5 | | | | 1.17 | % | | | | 1.18 | % | | | | 1.27 | %6 | | | | 1.36 | %6 | | | | 1.36 | %6 |

| | | | | | |

Ratio of gross expenses to average net assets7 | | | | 1.34 | %5 | | | | 1.29 | % | | | | 1.29 | % | | | | 1.31 | % | | | | 1.42 | % | | | | 1.42 | % |

| | | | | | |

Ratio of net investment income (loss) to average net assets2 | | | | 0.65 | %5 | | | | 0.13 | % | | | | (0.07 | )% | | | | (0.69 | )% | | | | (0.89 | )% | | | | (0.76 | )% |

| | | | | | |

Portfolio turnover | | | | 39 | %4 | | | | 44 | % | | | | 54 | % | | | | 222 | % | | | | 100 | % | | | | 96 | % |

| | | | | | |

Net assets end of period (000’s) omitted | | | | $80,996 | | | | | $80,640 | | | | | $100,679 | | | | | $166,168 | | | | | $204,794 | | | | | $171,801 | |

| | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

9

| | |

| | | AMG Veritas Asia Pacific Fund Financial Highlights For a share outstanding throughout each fiscal period |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | For the six months ended June 30, 2024 (unaudited) | | For the fiscal years ended December 31, |

| Class I | | 2023 | | 2022 | | 2021 | | 2020 | | 2019 |

| | | | | | |

Net Asset Value, Beginning of Period | | | | $61.94 | | | | | $65.15 | | | | | $90.15 | | | | | $154.81 | | | | | $116.08 | | | | | $118.57 | |

| | | | | | |

Income (loss) from Investment Operations: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net investment income (loss)1,2 | | | | 0.28 | | | | | 0.24 | | | | | 0.13 | | | | | (0.48 | ) | | | | (0.77 | ) | | | | (0.72 | ) |

| | | | | | |

Net realized and unrealized gain (loss) on investments | | | | 5.62 | | | | | (3.23 | ) | | | | (25.13 | ) | | | | 4.86 | | | | | 45.92 | | | | | 31.19 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Total income (loss) from investment operations | | | | 5.90 | | | | | (2.99 | ) | | | | (25.00 | ) | | | | 4.38 | | | | | 45.15 | | | | | 30.47 | |

| | | | | | |

Less Distributions to Shareholders from: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net investment income | | | | — | | | | | (0.22 | ) | | | | — | | | | | — | | | | | — | | | | | — | |

| | | | | | |

Net realized gain on investments | | | | — | | | | | — | | | | | — | | | | | (56.87 | ) | | | | (6.42 | ) | | | | (32.96 | ) |

| | | | | | |

Paid in capital | | | | — | | | | | — | | | | | — | | | | | (12.17 | ) | | | | — | | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Total distributions to shareholders | | | | — | | | | | (0.22 | ) | | | | — | | | | | (69.04 | ) | | | | (6.42 | ) | | | | (32.96 | ) |

| | | | | | |

Net Asset Value, End of Period | | | | $67.84 | | | | | $61.94 | | | | | $65.15 | | | | | $90.15 | | | | | $154.81 | | | | | $116.08 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Total Return2,3 | | | | 9.54 | %4 | | | | (4.58 | )% | | | | (27.73 | )% | | | | 3.43 | % | | | | 39.08 | % | | | | 26.02 | % |

| | | | | | |

Ratio of net expenses to average net assets | | | | 0.93 | %5 | | | | 0.93 | % | | | | 0.93 | % | | | | 1.02 | %6 | | | | 1.11 | %6 | | | | 1.11 | %6 |

| | | | | | |

Ratio of gross expenses to average net assets7 | | | | 1.10 | %5 | | | | 1.05 | % | | | | 1.04 | % | | | | 1.06 | % | | | | 1.17 | % | | | | 1.17 | % |

| | | | | | |

Ratio of net investment income (loss) to average net assets2 | | | | 0.89 | %5 | | | | 0.37 | % | | | | 0.18 | % | | | | (0.44 | )% | | | | (0.64 | )% | | | | (0.51 | )% |

| | | | | | |

Portfolio turnover | | | | 39 | %4 | | | | 44 | % | | | | 54 | % | | | | 222 | % | | | | 100 | % | | | | 96 | % |

| | | | | | |

Net assets end of period (000’s) omitted | | | | $7,234 | | | | | $7,188 | | | | | $12,339 | | | | | $22,066 | | | | | $44,593 | | | | | $38,093 | |

| | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 1 | Per share numbers have been calculated using average shares. |

| 2 | Total returns and net investment income (loss) would have been lower had certain expenses not been offset. |

| 3 | The total return is calculated using the published Net Asset Value as of period end. |

| 6 | Includes reduction from broker recapture amounting to less than 0.01% for the fiscal years ended December 31, 2021, 2020 and 2019, respectively. |

| 7 | Excludes the impact of expense reimbursement or fee waivers and expense reductions such as brokerage credits, but includes expense repayments and non-reimbursable expenses, if any, such as interest, taxes, and extraordinary expenses. (See Note 1(c) and 2 in the Notes to Financial Statements.) |

10

| | |

| | | Notes to Financial Statements (unaudited) June 30, 2024 |

| | | |

| | | |

1. ORGANIZATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

AMG Funds III (the “Trust”) is an open-end management investment company, organized as a Massachusetts business trust, and registered under the Investment Company Act of 1940, as amended (the “1940 Act”). Currently, the Trust consists of a number of different funds, each having distinct investment management objectives, strategies, risks, and policies. Included in this report is AMG Veritas Asia Pacific Fund (the “Fund”).

The Fund offers Class N and Class I shares. Each class represents an interest in the same assets of the Fund. Although all share classes generally have identical voting rights, each share class votes separately when required by law. Different share classes may have different net asset values per share to the extent the share classes pay different distribution amounts and/or the expenses of such share classes differ. Each share class has its own expense structure. Please refer to a current prospectus for additional information on each share class.

The Fund is non-diversified.

The Fund’s financial statements are prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”), including accounting and reporting guidance pursuant to Accounting Standards Codification Topic 946 applicable to investment companies. U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and expenses during the reporting period. Actual results could differ from those estimates and such differences could be material. The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements:

a. VALUATION OF INVESTMENTS

Equity securities traded on a national securities exchange or reported on the NASDAQ national market system (“NMS”) are valued at the last quoted sales price on the primary exchange or, if applicable, the NASDAQ official closing price or the official closing price of the relevant exchange or, lacking any sales, at the last quoted bid price. Equity securities held by the Fund that are traded in the over-the-counter market (other than NMS securities) are valued at the bid price. Foreign equity securities (securities principally traded in markets other than U.S. markets) held by the Fund are valued at the official closing price on the primary exchange or, for markets that either do not offer an official closing price or where the official closing price may not be representative of the overall market, the last quoted sale price.

Fixed income securities purchased with a remaining maturity of 60 days or less are valued at amortized cost, provided that the amortized cost value is approximately the same as the fair value of the security valued without the use of amortized cost. Investments in other open-end registered investment companies are valued at their end of day net asset value per share.

Participation notes (“P-Notes”) are valued using the underlying equity security’s official closing price on the primary exchange or, for markets that either do not offer an official closing price or where the official closing price may not be representative of the overall market, the last quoted sale price.

The Fund’s portfolio investments are generally valued based on independent market quotations or prices or, if none, “evaluative” or other market based

valuations provided by third party pricing services. Pursuant to Rule 2a-5 under the 1940 Act, the Fund’s Board of Trustees (the “Board”) designated AMG Funds LLC (the “Investment Manager”) as the Fund’s Valuation Designee to perform the Fund’s fair value determinations. Such determinations are subject to Board oversight and certain reporting and other requirements intended to ensure that the Board receives the information it needs to oversee the Investment Manager’s fair value determinations.

Under certain circumstances, the value of certain Fund portfolio investments may be based on an evaluation of fair value, pursuant to procedures established by the Investment Manager and under the general supervision of the Board. The Fund may use the fair value of a portfolio investment to calculate its net asset value (“NAV”) in the event that the market quotation, price or market based valuation for the portfolio investment is not readily available or otherwise not determinable pursuant to the Fund’s valuation procedures, if the Investment Manager believes the quotation, price or market based valuation to be unreliable, or in certain other circumstances. When determining the fair value of an investment, the Investment Manager seeks to determine the price that the Fund might reasonably expect to receive from current sale of that portfolio investment in an arms-length transaction. Fair value determinations shall be based upon consideration of all available facts and information, including, but not limited to (i) attributes specific to the investment; (ii) fundamental and analytical data relating to the investment; and (iii) the value of other comparable securities or relevant financial instruments, including derivative securities, traded on other markets or among dealers.

The values assigned to fair value portfolio investments are based on available information and do not necessarily represent amounts that might ultimately be realized in the future, since such amounts depend on future developments inherent in long-term investments. Because of the inherent uncertainty of valuation, those estimated values may differ significantly from the values that would have been used had a ready market for the investments existed, and the differences could be material. The Board will be presented with quarterly reports, as of the most recent quarter end, summarizing all fair value activity, material fair value matters that occurred during the quarter, and all outstanding securities fair valued by the Fund. Additionally, the Board will be presented with an annual report that assesses the adequacy and effectiveness of the Investment Manager’s process for determining the fair value of the Fund’s investments.

With respect to foreign equity securities and certain foreign fixed income securities, securities held in the Fund that can be fair valued by the applicable fair value pricing service are fair valued on each business day provided that each individual price exceeds a pre-established confidence level.

U.S. GAAP defines fair value as the price that a fund would receive to sell an asset or pay to transfer a liability in an orderly transaction between market participants at the measurement date. U.S. GAAP also establishes a framework for measuring fair value, and a three level hierarchy for fair value measurements based upon the transparency of inputs to the valuation of an asset or liability. Inputs may be observable or unobservable and refer broadly to the assumptions that market participants would use in pricing the asset or liability. Observable inputs reflect the assumptions market participants would use in pricing the asset or liability based on market data obtained from sources independent of the Fund. Unobservable inputs reflect the Fund’s own assumptions about the assumptions that market participants would use in pricing the asset or liability developed based on the best information available in the circumstances. Each investment is assigned a level based upon the observability of the inputs which are significant to the overall valuation.

11

| | |

| | | Notes to Financial Statements (continued) |

| | | |

| | | |

The three-tier hierarchy of inputs is summarized below:

Level 1 – inputs are quoted prices in active markets for identical investments (e.g., equity securities, open-end investment companies)

Level 2 – other observable inputs (including, but not limited to: quoted prices for similar assets or liabilities in markets that are active, quoted prices for identical or similar assets or liabilities in markets that are not active, inputs other than quoted prices that are observable for the assets or liabilities (such as interest rates, yield curves, volatilities, prepayment speeds, loss severities, credit risks and default rates) or other market corroborated inputs) (e.g., debt securities, government securities, foreign currency exchange contracts, P-Notes, foreign securities utilizing international fair value pricing, fair valued securities with observable inputs)

Level 3 – inputs are significant unobservable inputs (including the Fund’s own assumptions used to determine the fair value of investments) (e.g., fair valued securities with unobservable inputs)

Changes in inputs or methodologies used for valuing investments may result in a transfer in or out of levels within the fair value hierarchy. The inputs or methodologies used for valuing investments may not necessarily be an indication of the risk associated with investing in those investments.

b. SECURITY TRANSACTIONS

Security transactions are accounted for as of trade date. Realized gains and losses on securities sold are determined on the basis of identified cost.

c. INVESTMENT INCOME AND EXPENSES

Dividend income is recorded on the ex-dividend date. Dividends from foreign securities are recorded on the ex-dividend date, and if after the fact, as soon as the Fund becomes aware of the ex-dividend date, except for Korean securities where dividends are recorded on confirmation date. Interest income, which includes amortization of premium and accretion of discount on debt securities, is accrued as earned. Dividend and interest income on foreign securities is recorded gross of any withholding tax. Non-cash dividends included in dividend income, if any, are reported at the fair market value of the securities received. Other income and expenses are recorded on an accrual basis. Expenses that cannot be directly attributed to the Fund are apportioned among the funds in the Trust and other trusts or funds within the AMG Funds Family of Funds (collectively, the “AMG Funds Family”) based upon their relative average net assets or number of shareholders. Investment income, realized and unrealized capital gains and losses, the common expenses of the Fund, and certain fund level expense reductions, if any, are allocated on a pro-rata basis to each class based on the relative net assets of each class to the total net assets of the Fund.

d. DIVIDENDS AND DISTRIBUTIONS

Fund distributions resulting from either net investment income or realized net capital gains, if any, will normally be declared and paid at least annually in

December. Distributions to shareholders are recorded on the ex-dividend date. Distributions are determined in accordance with federal income tax regulations, which may differ from net investment income and net realized capital gains for financial statement purposes (U.S. GAAP). Differences may be permanent or temporary. Permanent differences are reclassified among capital accounts in the financial statements to reflect their tax character. Permanent book and tax basis differences, if any, relating to shareholder distributions will result in reclassifications to paid-in capital. Temporary differences arise when certain items of income, expense and gain or loss are recognized in different periods for financial statement and tax purposes; these differences will reverse at some time in the future. There were no permanent differences. Temporary differences are primarily due to wash sale loss deferrals and cost adjustments on dividend income received from spinoffs.

At June 30, 2024, the aggregate cost for federal income tax purposes approximates the aggregate cost for book purposes. The approximate cost of investments and the aggregate gross unrealized appreciation and depreciation for federal income tax purposes were as follows:

| | | | | | | | | | | | |

| Cost | | Appreciation | | | Depreciation | | | Net Appreciation | |

| | | |

| $81,445,685 | | | $13,144,310 | | | | $(6,334,042 | ) | | | $6,810,268 | |

e. FEDERAL TAXES

The Fund currently qualifies as an investment company and intends to comply with the requirements under Subchapter M of the Internal Revenue Code of 1986, as amended (the “Code”), and to distribute substantially all of its taxable income and gains to its shareholders and to meet certain diversification and income requirements with respect to investment companies. The Investment Manager has analyzed the Fund’s tax positions taken on federal income tax returns for all open tax years (generally, the three prior taxable years), and has concluded that no provision for federal income tax is required in the Fund’s financial statements. Additionally, the Investment Manager is not aware of any tax position for which it is reasonably possible that the total amounts of unrecognized tax benefit/detriment will change materially in the next twelve months.

Furthermore, based on the Fund’s understanding of the tax rules and rates related to income, gains and transactions for the foreign jurisdictions in which it invests, the Fund will provide for foreign taxes, and where appropriate, deferred foreign taxes.

f. CAPITAL LOSS CARRYOVERS AND DEFERRALS

As of December 31, 2023, the Fund had capital loss carryovers for federal income tax purposes as shown in the following chart. These amounts may be used to offset future realized capital gains indefinitely, and retain their character as short-term and/or long-term.

| | | | | | | | | | |

Short-Term | | | | Long-Term | | | | | Total |

| | | | |

$21,979,638 | | | | | $22,136,011 | | | | | $44,115,649 |

g. CAPITAL STOCK

The Trust’s Declaration of Trust authorizes for the Fund the issuance of an unlimited number of shares of beneficial interest, without par value. The Fund records sales and repurchases of its capital stock on the trade date.

12

| | |

| | | Notes to Financial Statements (continued) |

| | | |

| | | |

For the six months ended June 30, 2024 (unaudited) and the fiscal year ended December 31, 2023, the capital stock transactions by class for the Fund were as follows:

| | | | | | | | | | | | | | | | |

| | | June 30, 2024 | | | December 31, 2023 | |

| | | | |

| | | Shares | | | Amount | | | Shares | | | Amount | |

| | | | |

Class N: | | | | | | | | | | | | | | | | |

| | | | |

Shares sold | | | 5,022 | | | | $287,585 | | | | 13,202 | | | | $769,999 | |

| | | | |

Shares issued in reinvestment of distributions | | | — | | | | — | | | | 1,666 | | | | 90,774 | |

| | | | |

Shares redeemed | | | (121,966) | | | | (6,933,545) | | | | (281,875) | | | | (16,206,613) | |

| | | | | | | | | | | | | | | | |

| | | | |

Net decrease | | | (116,944) | | | | $(6,645,960) | | | | (267,007) | | | | $(15,345,840) | |

| | | | | | | | | | | | | | | | |

| | | | |

Class I: | | | | | | | | | | | | | | | | |

| | | | |

Shares sold | | | 10,416 | | | | $654,923 | | | | 20,098 | | | | $1,294,720 | |

| | | | |

Shares issued in reinvestment of distributions | | | — | | | | — | | | | 413 | | | | 24,694 | |

| | | | |

Shares redeemed | | | (19,844) | | | | (1,255,045) | | | | (93,867) | | | | (5,956,913) | |

| | | | | | | | | | | | | | | | |

| | | | |

Net decrease | | | (9,428) | | | | $(600,122) | | | | (73,356) | | | | $(4,637,499) | |

| | | | | | | | | | | | | | | | |

h. REPURCHASE AGREEMENTS AND JOINT REPURCHASE AGREEMENTS

The Fund may enter into third-party and bilateral repurchase agreements for temporary cash management purposes and for reinvestment of cash collateral on securities lending transactions under the securities lending program offered by The Bank of New York Mellon (“BNYM”) (the “Securities Lending Program”) (collectively, “Repurchase Agreements”). The value of the underlying collateral, including accrued interest, must equal or exceed the value of the Repurchase Agreements during the term of the agreement. For joint repurchase agreements, the Fund participates on a pro rata basis with other clients of BNYM in its share of the underlying collateral under such joint repurchase agreements and in its share of proceeds from any repurchase or other disposition of the underlying collateral. The underlying collateral for all Repurchase Agreements is held by the Fund’s custodian or at the Federal Reserve Bank. If the seller defaults and the value of the collateral declines, or if bankruptcy proceedings commence with respect to the seller of the security, realization of the collateral by the Fund may be delayed or limited. Pursuant to the Securities Lending Program, the Fund is indemnified for such losses by BNYM on joint repurchase agreements.

At June 30, 2024, the market value of Repurchase Agreements outstanding for Veritas Asia Pacific Fund was $951,184.

i. FOREIGN CURRENCY TRANSLATION

The books and records of the Fund are maintained in U.S. Dollars. The value of investments, assets and liabilities denominated in currencies other than U.S. Dollars are translated into U.S. Dollars based upon current foreign exchange rates. Purchases and sales of foreign investments, income and expenses are converted into U.S. Dollars based on currency exchange rates prevailing on the respective dates of such transactions. Net realized and unrealized gain (loss) on foreign currency transactions represent: (1) foreign exchange gains and losses from the sale and holdings of foreign currencies; (2) gains and losses between trade date and settlement date on investment securities transactions and foreign currency exchange contracts; and (3) gains and losses from the difference between amounts of interest and dividends recorded and the amounts actually received.

The Fund does not isolate the net realized and unrealized gain or loss resulting from changes in exchange rates from the fluctuations in market prices of securities held. Such fluctuations are included with the net realized and unrealized gain or loss on investments.

2. AGREEMENTS AND TRANSACTIONS WITH AFFILIATES

The Trust has entered into an investment advisory agreement under which the Investment Manager, a subsidiary and the U.S. wealth platform of Affiliated Managers Group, Inc. (“AMG”), serves as investment manager to the Fund and is responsible for the Fund’s overall administration and operations. The Investment Manager selects and recommends, subject to the approval of the Board and, in certain circumstances, shareholders, the subadviser for the Fund and monitors the subadviser’s investment performance, security holdings and investment strategies. The Fund’s investment portfolio is managed by Veritas Asset Management LLP (“Veritas”) who serves as subadviser pursuant to a subadvisory agreement with the Investment Manager. AMG indirectly owns a majority interest in Veritas.

Investment management fees are paid directly by the Fund to the Investment Manager based on average daily net assets. For the six months ended June 30, 2024, the Fund paid an investment management fee at the annual rate of 0.71% of the average daily net assets of the Fund.

The fee paid to Veritas for its services as subadviser is paid out of the fee the Investment Manager receives from the Fund and does not increase the expenses of the Fund.

The Investment Manager has contractually agreed, through at least May 1, 2025, to waive management fees and/or pay or reimburse fund expenses in order to limit total annual Fund operating expenses after fee waiver and expense reimbursements (exclusive of taxes, interest (including interest incurred in connection with bank and custody overdrafts, and in connection with securities sold short), shareholder servicing fees, distribution and service (12b-1) fees, brokerage commissions and other transaction costs, dividends payable with respect to securities sold short, acquired fund fees and expenses and extraordinary expenses) to the annual rate of 0.93% of the Fund’s average daily net assets (this annual rate or such other annual rate that may be in effect from time

13

| | |

| | | Notes to Financial Statements (continued) |

| | | |

| | | |

to time, the “Expense Cap”), subject to later reimbursement by the Fund in certain circumstances.

In general, for a period of up to 36 months after the date any amounts are paid, waived or reimbursed by the Investment Manager, the Investment Manager may recover such amounts from the Fund, provided that such repayment would not cause the Fund’s total annual operating expenses after fee waiver and expense reimbursements (exclusive of the items noted in the parenthetical above) to exceed either (i) the Expense Cap in effect at the time such amounts were paid, waived or reimbursed, or (ii) the Expense Cap in effect at the time of such repayment by the Fund.

The contractual expense limitation may only be terminated in the event the Investment Manager or a successor ceases to be the investment manager of the Fund or a successor fund, by mutual agreement between the Investment Manager and the Board, or in the event of the Fund’s liquidation unless the Fund is reorganized or is a party to a merger in which the surviving entity is successor to the accounting and performance information of the Fund.

For the six months ended June 30, 2024, the Investment Manager reimbursed the Fund $71,564, and did not recoup any previously reimbursed expenses. At June 30, 2024, the Fund’s expiration of reimbursements subject to recoupment is as follows:

| | | | |

Expiration Period | | | |

| |

Less than 1 year | | $ | 153,233 | |

| |

1-2 years | | | 125,055 | |

| |

2-3 years | | | 134,406 | |

| | | | |

| |

Total | | $ | 412,694 | |

| | | | |

The Trust, on behalf of the Fund, has entered into an amended and restated Administration Agreement under which the Investment Manager serves as the Fund’s administrator (the “Administrator”) and is responsible for certain aspects of managing the Fund’s operations, including administration and shareholder services to the Fund. The Fund pays a fee to the Administrator at the rate of 0.15% per annum of the Fund’s average daily net assets for this service.

The Fund is distributed by AMG Distributors, Inc. (the “Distributor”), a wholly-owned subsidiary of the Investment Manager. The Distributor serves as the distributor and underwriter for the Fund and is a registered broker-dealer and member of the Financial Industry Regulatory Authority, Inc. (“FINRA”). Shares of the Fund will be continuously offered and will be sold directly to prospective purchasers and through brokers, dealers or other financial intermediaries who have executed selling agreements with the Distributor. Generally, the Distributor bears all or a portion of the expenses of providing services pursuant to the distribution agreement, including the payment of the expenses relating to the distribution of prospectuses for sales purposes and any advertising or sales literature.

For Class N shares, the Board has approved reimbursement payments to the Investment Manager for shareholder servicing expenses (“shareholder servicing fees”) incurred. Shareholder servicing fees include payments to financial intermediaries, such as broker-dealers (including fund supermarket platforms), banks, and trust companies who provide shareholder recordkeeping, account servicing and other services. The Class N shares may reimburse the Investment Manager for the actual amount incurred up to a maximum annual rate of the Class’s average daily net assets as shown in the table below.

The impact on the annualized expense ratios for the six months ended June 30, 2024, was as follows:

| | | | | | | | |

| | | Maximum Annual

Amount

Approved | | | Actual Amount Incurred | |

| | |

Class N | | | 0.25% | | | | 0.24% | |

The Board provides supervision of the affairs of the Trust and other trusts within the AMG Funds Family. The Trustees of the Trust who are not affiliated with the Investment Manager receive an annual retainer and per meeting fees for regular, special and telephonic meetings, and they are reimbursed for out-of-pocket expenses incurred while carrying out their duties as Board members. The Chairman of the Board and the Audit Committee Chair receive additional annual retainers. Certain Trustees and Officers of the Fund are Officers and/or Directors of the Investment Manager, AMG and/or the Distributor.

The Securities and Exchange Commission (the “SEC”) granted an exemptive order that permits certain eligible funds in the AMG Funds Family to lend and borrow money for certain temporary purposes directly to and from other eligible funds in the AMG Funds Family. Participation in this interfund lending program is voluntary for both the borrowing and lending funds, and an interfund loan is only made if it benefits each participating fund. The Administrator manages the program according to procedures approved by the Board, and the Board monitors the operation of the program. An interfund loan must comply with certain conditions set out in the exemptive order, which are designed to assure fairness and protect all participating funds. The interest earned and interest paid on interfund loans are included on the Statement of Operations as interest income and interest expense, respectively. At June 30, 2024, the Fund had no interfund loans outstanding. The Fund did not borrow during the six months ended June 30, 2024.

The Fund utilized the interfund loan program during the six months ended June 30, 2024 as follows:

| | | | | | | | | | | | | | |

Average

Lent | | Number

of Days | | | | Interest

Earned | | | | | Average Interest Rate | |

| | | | | |

$2,872,084 | | 5 | | | | | $2,451 | | | | | | 6.230% | |

3. PURCHASES AND SALES OF SECURITIES

Purchases and sales of securities (excluding short-term securities and U.S. Government Obligations) for the six months ended June 30, 2024, were $32,632,596 and $37,049,670, respectively.

The Fund had no purchases or sales of U.S. Government Obligations during the six months ended June 30, 2024.

4. PORTFOLIO SECURITIES LOANED

The Fund participates in the Securities Lending Program providing for the lending of securities to qualified borrowers. Securities lending income includes earnings of such temporary cash investments, plus or minus any rebate to a borrower. These earnings (after any rebate) are then divided between BNYM, as a fee for its services under the Securities Lending Program, and the Fund, according to agreed-upon rates. Collateral on all securities loaned is accepted in cash, U.S. Treasury Obligations or U.S. Government Agency Obligations. Collateral is maintained at a minimum level of 102% (105% in the case of certain foreign securities) of the market value, plus interest, if applicable, of investments on loan. It is the Fund’s policy to obtain additional collateral from or return excess collateral

14

| | |

| | | Notes to Financial Statements (continued) |

| | | |

| | | |

to the borrower by the end of the next business day, following the valuation date of the securities loaned. Therefore, the value of the collateral held may be temporarily less than the value of the securities on loan. Lending securities entails a risk of loss to the Fund if and to the extent that the market value of the securities loaned were to increase and the borrower did not increase the collateral accordingly, and the borrower fails to return the securities. Under the terms of the Securities Lending Program, the Fund is indemnified for such losses by BNYM. Cash collateral is held in separate omnibus accounts managed by BNYM, who is authorized to exclusively enter into joint repurchase agreements for that cash collateral. Securities collateral is held in separate omnibus accounts managed by BNYM and cannot be sold or pledged. BNYM bears the risk of any deficiency in the amount of the cash collateral available for return to the borrower due to any loss on the collateral invested. Loans of securities are terminable at any time and the borrower, after notice, is required to return borrowed securities as soon as practical, which is normally within three business days.

The value of securities loaned on positions held, cash collateral and securities collateral received at June 30, 2024, was as follows:

| | | | | | | | |

Securities Loaned | | Cash Collateral Received | | Securities Collateral Received | | | Total Collateral Received |

| | | |

$2,212,056 | | $951,184 | | | $1,312,310 | | | $2,263,494 |

The following table summarizes the securities received as collateral for securities lending at June 30, 2024:

| | | | | | |

Collateral Type | | Coupon

Range | | Maturity Date Range |

| | |

U.S. Treasury Obligations | | 0.000%-5.456% | | | 07/15/24-08/15/53 | |

5. FUND RISKS

In the normal course of business, the Fund invests in securities or other instruments and may enter into certain transactions, and such activities subject the Fund to various risks. The value of securities or other instruments may also be affected by various factors, including, without limitation: (i) the general economy; (ii) the overall market as well as local, regional or global political and/or social instability; or (iii) currency and price fluctuations. Please refer to the Fund’s current prospectus for additional information about the Fund’s principal risks.

Market Risk: Market prices of investments held by the Fund may fall rapidly or unpredictably due to a variety of factors, including economic, political, or market conditions, or other factors including terrorism, war, natural disasters and the spread of infectious illness or other public health issues, including epidemics or pandemics, or in response to events that affect particular industries or companies.

Management Risk: Because the Fund is an actively managed investment portfolio, security selection or focus on securities in a particular style, market sector or group of companies may cause the Fund to incur losses or underperform relative to its benchmarks or other funds with a similar investment objective. There can be no guarantee that the Subadviser’s investment techniques and risk analysis will produce the desired result.

Non-Diversified Fund Risk: The Fund is non-diversified and therefore a greater percentage of holdings may be focused in a small number of issuers or a single issuer, which can place the Fund at greater risk. Notwithstanding the Fund’s status as a “non-diversified” investment company under the 1940 Act, the Fund intends to qualify as a regulated investment company accorded favorable tax treatment

under the Code, which imposes its own diversification requirements that are less restrictive than the requirements applicable to “diversified” investment companies under the 1940 Act. The Fund’s intention to qualify as a regulated investment company may limit its pursuit of its investment strategy and its investment strategy could limit its ability to so qualify.

Focused Investment Risk: To the extent the Fund invests a substantial portion of its assets in a relatively small number of securities or a particular market, industry, group of industries, country, region, group of countries, asset class or sector, it generally will be subject to greater risk than a fund that invests in a more diverse investment portfolio. In addition, the value of the Fund would be more susceptible to any single economic, market, political or regulatory occurrence affecting, for example, that particular market, industry, region or sector.

Sector Risk: Issuers and companies that are in similar industry sectors may be similarly affected by particular economic or market events; to the extent the Fund has substantial holdings within a particular sector, the risks associated with that sector increase.