EXHIBIT 99.1

Nobel Learning Communities, Inc.

George H. Bernstein – President and CEO

Tom Frank – Chief Financial Officer

Nobel Learning Communities, Inc.

The following presentation contains forward-looking statements, within the meaning of the Private Securities Litigation Reform Act of 1995, about such things as the Company’s business, projected revenues, expenditures and operating and capital requirements. Statements that are not historical facts are forward-looking statements, and are subject to certain risks, uncertainties and assumptions, such as factors that could cause actual results to vary materially. Among the factors that could impact our ability to achieve our stated goals are competitive conditions in the pre-elementary and elementary school education and services industry, including advertising and tuition price sensitivity; various factors affecting occupancy levels, including, but not limited to, the reduction in or changes to the general labor force that would reduce the need or demand for private schools; the establishment of governmentally mandated universal pre-K programs that do not allow for participation by for-profit operators; our inability successfully to defend against or counter negative publicity associated with claims involving alleged incidents at our schools; and the acceptance of our newly developed schools and businesses and performance of recently acquired businesses. Forward-looking statements should not be relied upon except as statements of our present intentions and expectations that may or may not occur.

Company Presentation Q2, 2005

© 2005 Nobel Learning Communities, Inc.

2

NLCI Presentation Agenda

Company History

Management Team and Board of Directors Education Industry Overview Company Vision and Strategy School Portfolio Marketing Programs Financial Review

Company Presentation Q2, 2005 2005 Nobel Learning Communities, Inc.

3

NLCI Company History

Founded in 1982 as Rocking Horse Child Care Centers of America. Over the past ten years transitioned to an operator of non-sectarian private schools and provider of educational services A leading for-profit operator of schools in the Pre-K-8th Grade market Operates 150 schools in 13 states New management team and majority of Board of Directors brought in during FY 2004

Company Presentation Q2, 2005 2005 Nobel Learning Communities, Inc.

4

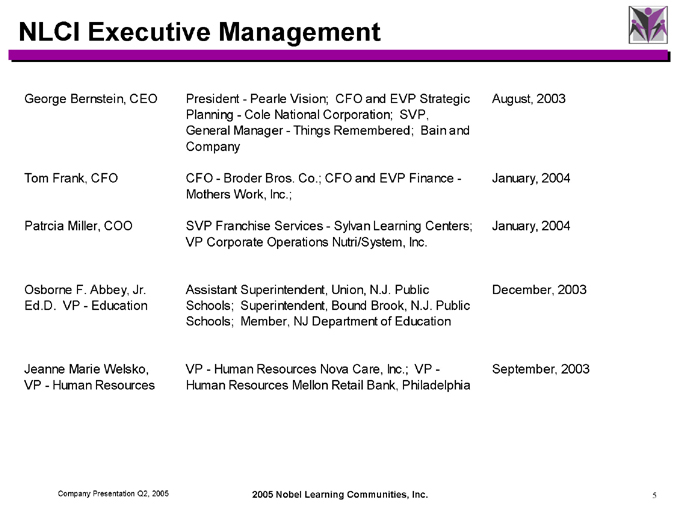

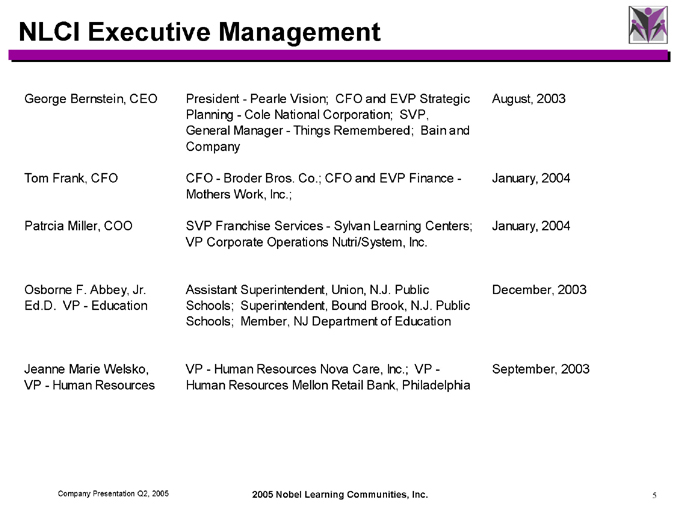

NLCI Executive Management

George Bernstein, CEO President—Pearle Vision; CFO and EVP Strategic Planning—Cole National Corporation; SVP, General Manager—Things Remembered; Bain and Company August, 2003

Tom Frank, CFO CFO—Broder Bros. Co.; CFO and EVP Finance—Mothers Work, Inc.; January, 2004

Patrcia Miller, COO SVP Franchise Services—Sylvan Learning Centers; VP Corporate Operations Nutri/System, Inc. January, 2004

Osborne F. Abbey, Jr. Assistant Superintendent, Union, N.J. Public December, 2003

Ed.D. VP—Education Schools; Superintendent, Bound Brook, N.J. Public Schools; Member, NJ Department of Education

Jeanne Marie Welsko, VP—Human Resources Nova Care, Inc.; VP—September, 2003

VP—Human Resources Human Resources Mellon Retail Bank, Philadelphia

Company Presentation Q2, 2005 2005 Nobel Learning Communities, Inc.

5

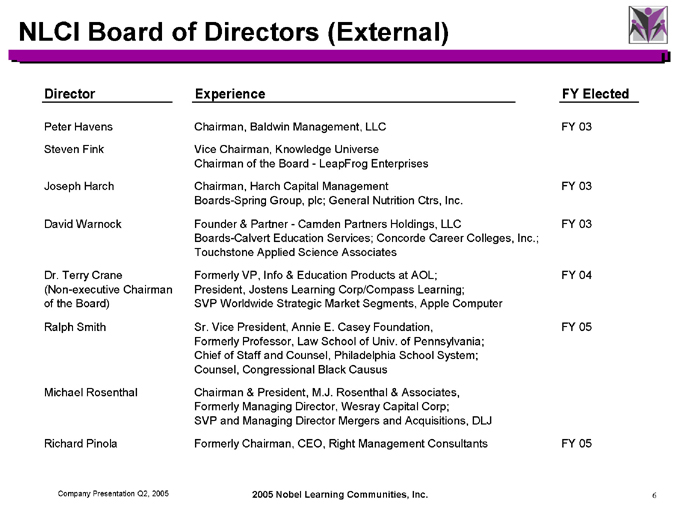

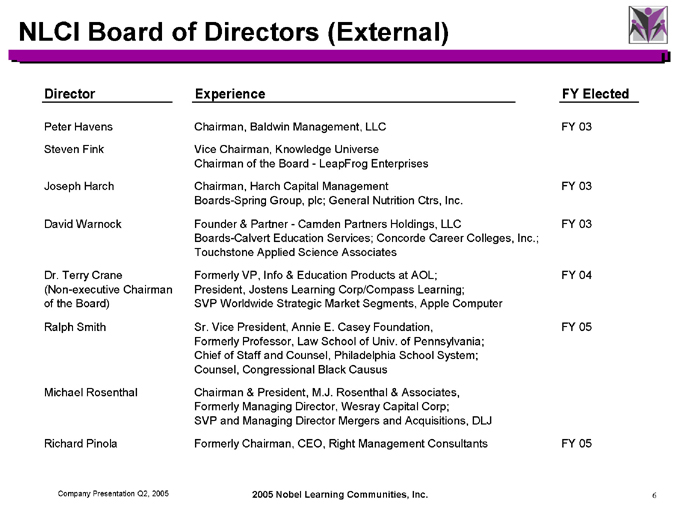

NLCI Board of Directors (External)

Director Experience FY Elected

Peter Havens Chairman, Baldwin Management, LLC FY 03

Steven Fink Vice Chairman, Knowledge Universe Chairman of the Board—LeapFrog Enterprises

Joseph Harch Chairman, Harch Capital Management Boards-Spring Group, plc; General Nutrition Ctrs, Inc. FY 03

David Warnock Founder & Partner—Camden Partners Holdings, LLC Boards-Calvert Education Services; Concorde Career Colleges, Inc.; Touchstone Applied Science Associates FY 03

Dr. Terry Crane (Non-executive Chairman of the Board) Formerly VP, Info & Education Products at AOL; President, Jostens Learning Corp/Compass Learning; SVP Worldwide Strategic Market Segments, Apple Computer FY 04

Ralph Smith Sr. Vice President, Annie E. Casey Foundation, Formerly Professor, Law School of Univ. of Pennsylvania; Chief of Staff and Counsel, Philadelphia School System; Counsel, Congressional Black Causus FY 05

Michael Rosenthal Chairman & President, M.J. Rosenthal & Associates, Formerly Managing Director, Wesray Capital Corp; SVP and Managing Director Mergers and Acquisitions, DLJ

Richard Pinola Formerly Chairman, CEO, Right Management Consultants FY 05

Company Presentation Q2, 2005 2005 Nobel Learning Communities, Inc.

6

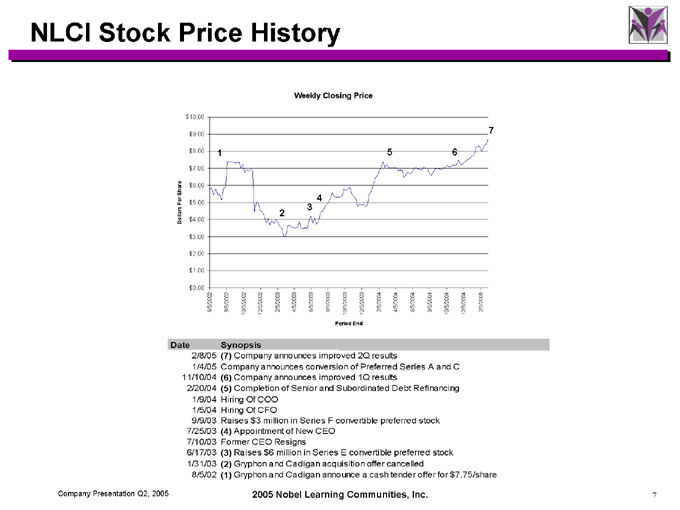

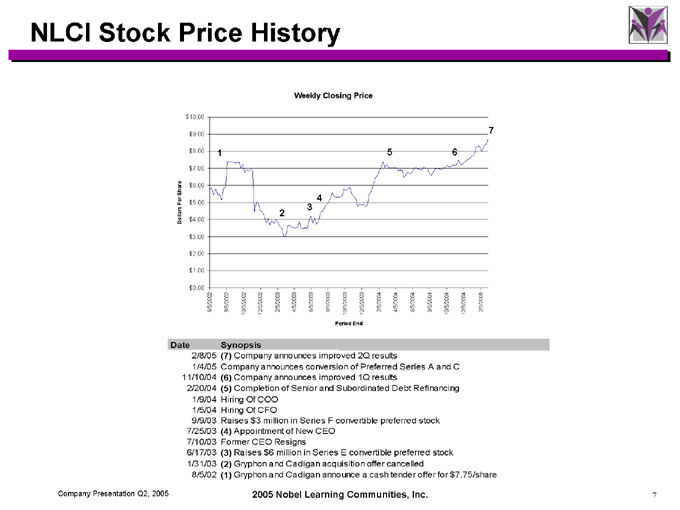

NLCI Stock Price History

Weekly Closing Price

Dollars Per Share $0.00 $10.00 $9.00 $8.00 $7.00 $6.00 $5.00 $4.00 $3.00 $2.00 $1.00

6/3/2002

8/3/2002 10/3/2002 12/3/2002 2/3/2003 4/3/2003 6/3/2003 8/3/2003 10/3/2003 12/3/2003 2/3/2004 4/3/2004 6/3/2004 8/3/2004 10/3/2004 12/3/2004 2/3/2005

Period End

Date Synopsis

2/8/05 (7) Company announces improved 2Q results

1/4/05 Company announces conversion of Preferred Series A and C

11/10/04 (6) Company announces improved 1Q results

2/20/04 (5) Completion of Senior and Subordinated Debt Refinancing

1/9/04 Hiring Of COO

1/5/04 Hiring Of CFO

9/9/03 Raises $3 million in Series F convertible preferred stock

7/25/03 (4) Appointment of New CEO

7/10/03 Former CEO Resigns

6/17/03 (3) Raises $6 million in Series E convertible preferred stock

1/31/03 (2) Gryphon and Cadigan acquisition offer cancelled

8/5/02 (1) Gryphon and Cadigan announce a cash tender offer for $7.75/share

Company Presentation Q2, 2005 2005 Nobel Learning Communities, Inc.

7

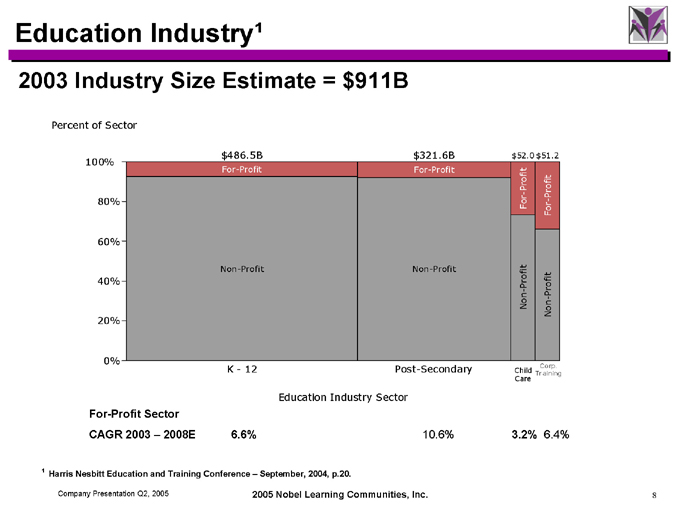

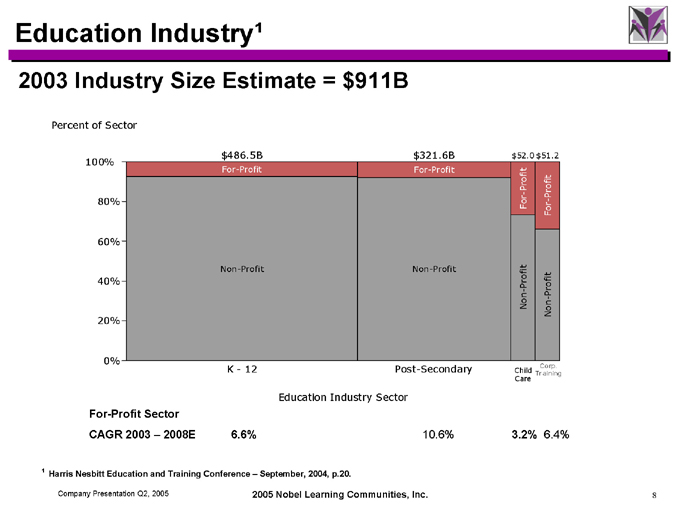

Education Industry1

2003 Industry Size Estimate = $911B

Percent of Sector

100% 80% 60% 40% 20% 0% $486.5B $321.6B $52.0 $51.2

K—12

Post-Secondary

Child Care

Corp. Training

Non-Profit

Non-Profit

Non-Profit

Non-Profit

For-Profit

For-Profit

For-Profit

For-Profit

Education Industry Sector

For-Profit Sector

CAGR 2003 – 2008E 6.6% 10.6% 3.2% 6.4%

¹ Harris Nesbitt Education and Training Conference – September, 2004, p.20.

Company Presentation Q2, 2005 2005 Nobel Learning Communities, Inc.

8

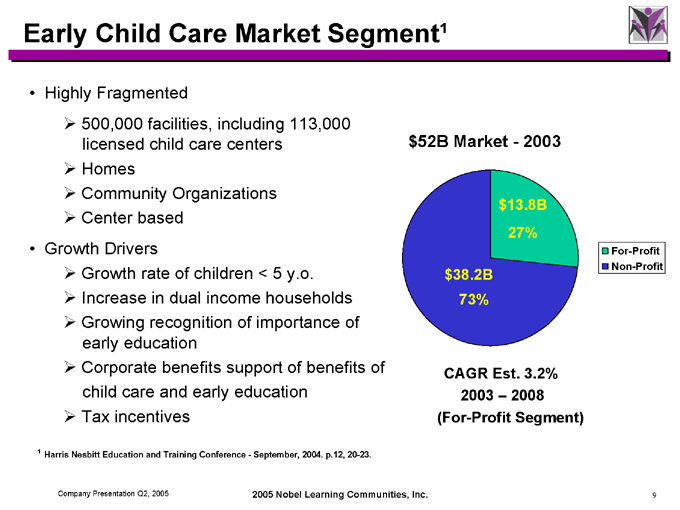

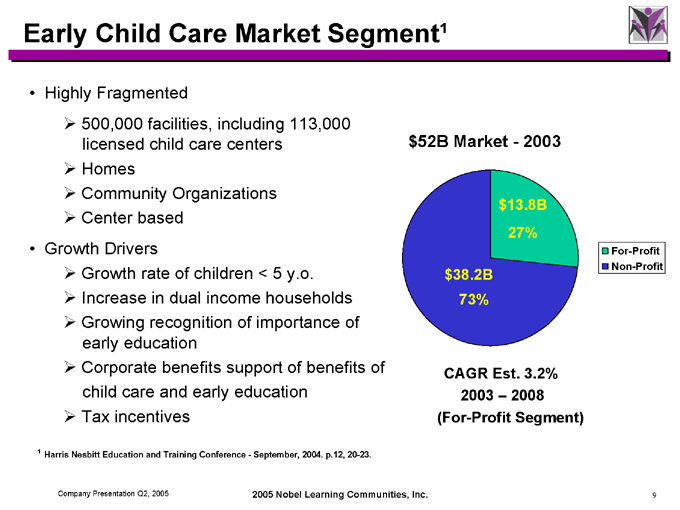

Early Child Care Market Segment1

Highly Fragmented

500,000 facilities, including 113,000 licensed child care centers Homes Community Organizations Center based

Growth Drivers

Growth rate of children < 5 y.o. Increase in dual income households Growing recognition of importance of early education Corporate benefits support of benefits of child care and early education Tax incentives $52B Market—2003 $38.2B

73% $13.8B

27%

For-Profit

Non-Profit

CAGR Est. 3.2% 2003 – 2008

(For-Profit Segment)

¹ Harris Nesbitt Education and Training Conference—September, 2004. p.12, 20-23.

Company Presentation Q2, 2005 2005 Nobel Learning Communities, Inc.

9

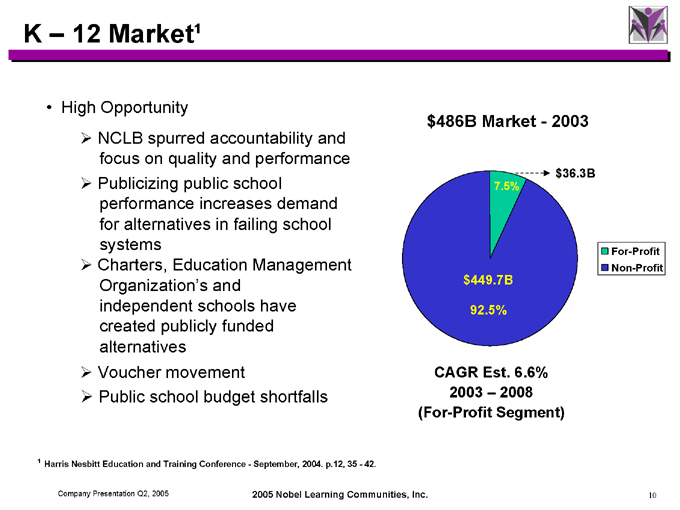

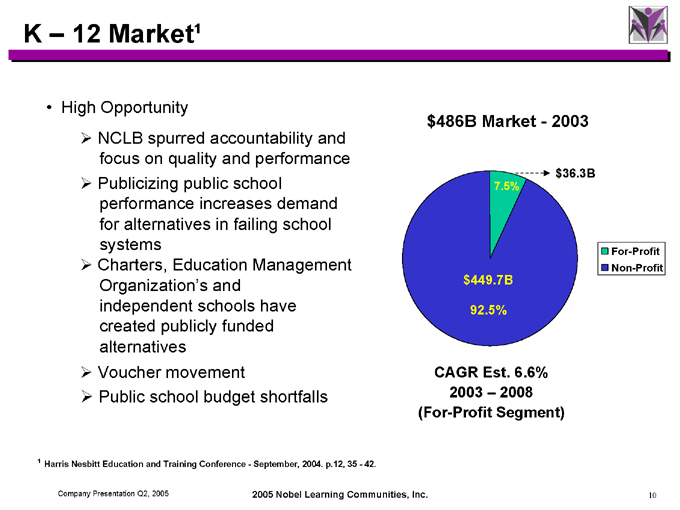

K – 12 Market¹

High Opportunity

NCLB spurred accountability and focus on quality and performance Publicizing public school performance increases demand for alternatives in failing school systems Charters, Education Management Organization’s and independent schools have created publicly funded alternatives Voucher movement Public school budget shortfalls $486B Market—2003 $36.3B

7.5% $449.7B

92.5%

For-Profit

Non-Profit

CAGR Est. 6.6% 2003 – 2008

(For-Profit Segment)

¹ Harris Nesbitt Education and Training Conference—September, 2004. p.12, 35—42.

Company Presentation Q2, 2005 2005 Nobel Learning Communities, Inc.

10

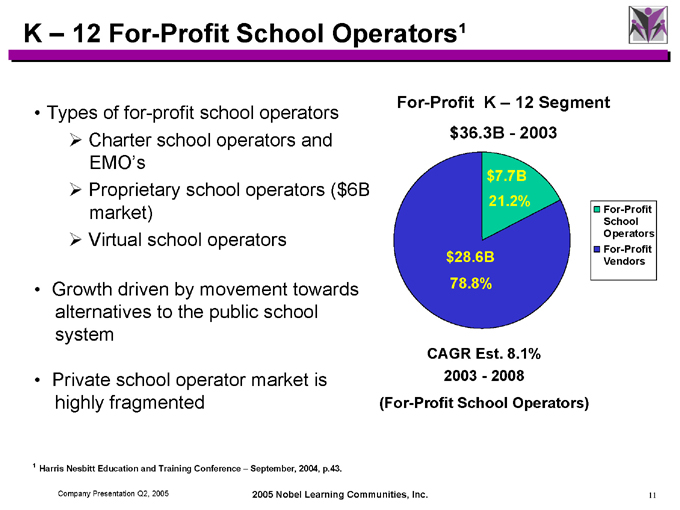

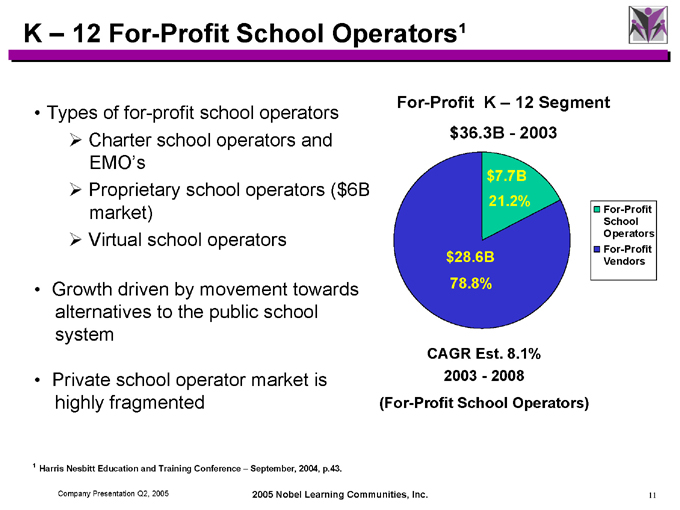

K – 12 For-Profit School Operators1

Types of for-profit school operators

Charter school operators and EMO’s Proprietary school operators ($6B market) Virtual school operators

Growth driven by movement towards alternatives to the public school system

Private school operator market is highly fragmented

For-Profit K – 12 Segment $36.3B—2003 $7.7B

21.2% $28.6B

78.8%

CAGR Est. 8.1%

2003—2008

(For-Profit School Operators)

For-Profit School Operators

For-Profit Vendors

¹ Harris Nesbitt Education and Training Conference – September, 2004, p.43.

Company Presentation Q2, 2005 2005 Nobel Learning Communities, Inc.

11

NLCI Vision

To be the leading provider of infant to 8th grade private education through

learning communities that support the educational, enrichment and wellness

needs of students and their families.

Company Presentation Q2, 2005 2005 Nobel Learning Communities, Inc.

12

NLCI Differentiation

Delivery of curriculum based education programs for infant to eighth grade:

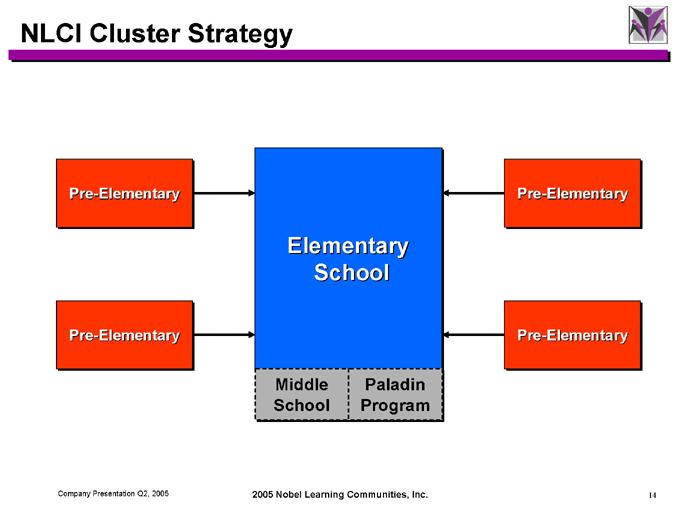

In safe, nurturing and non-sectarian learning communities with small classes and well trained teachers; Through clusters of pre-elementary schools, elementary schools and learning support programs;

Integrating non-cognitive skills needed to succeed in the 21st century work-force; Which offer exceptional value in terms of price to educational outcomes; And offer enrichment programs to meet the lifestyle needs of families before school, after school and throughout the summer.

Company Presentation Q2, 2005 2005 Nobel Learning Communities, Inc.

13

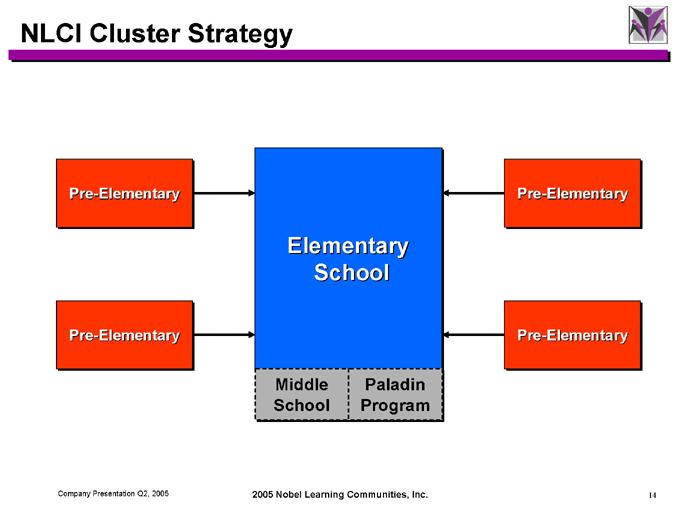

NLCI Cluster Strategy

Pre-Elementary

Pre-Elementary

Elementary School

Middle School

Paladin Program

Pre-Elementary

Pre-Elementary

Company Presentation Q2, 2005 2005 Nobel Learning Communities, Inc.

14

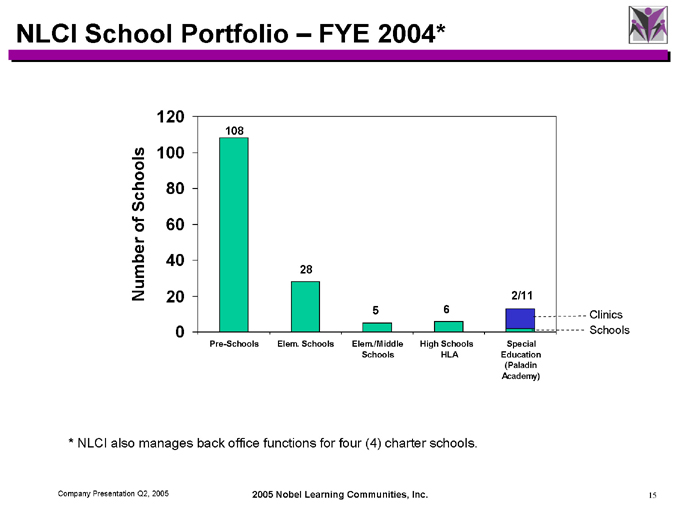

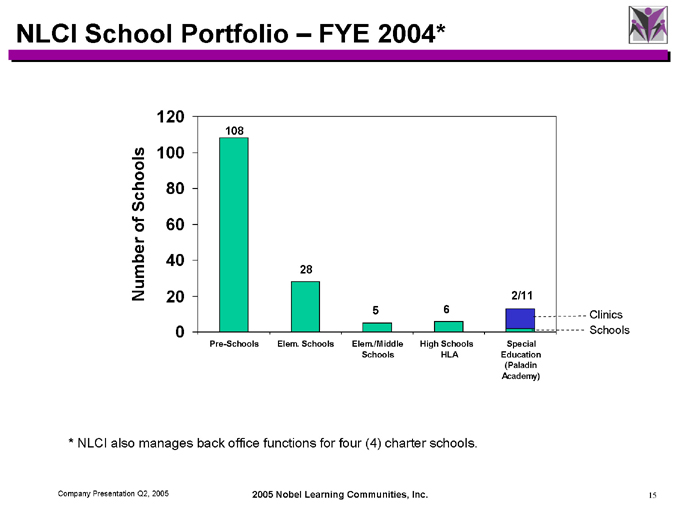

NLCI School Portfolio – FYE 2004*

Number of Schools

120 100 80 60 40 20 0

Pre-Schools

Elem. Schools

Elem./Middle Schools

High Schools HLA

Special Education (Paladin Academy)

108

28

5

6

2/11

Clinics

Schools

* NLCI also manages back office functions for four (4) charter schools.

Company Presentation Q2, 2005 2005 Nobel Learning Communities, Inc.

15

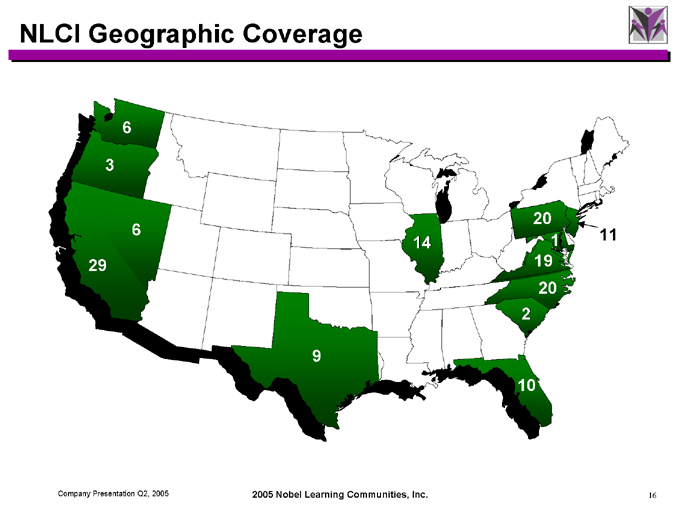

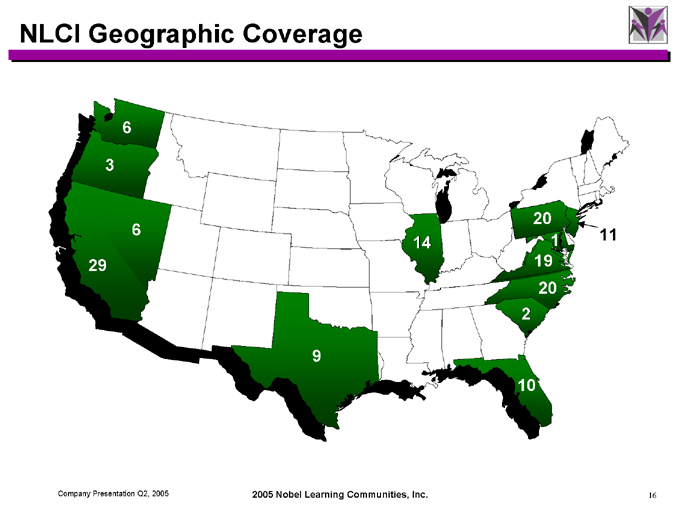

NLCI Geographic Coverage

6

3

29

6

9

14

20

1

11

19

20

2

10

Company Presentation Q2, 2005 2005 Nobel Learning Communities, Inc.

16

NLCI Elementary School

Company Presentation Q2, 2005 2005 Nobel Learning Communities, Inc.

17

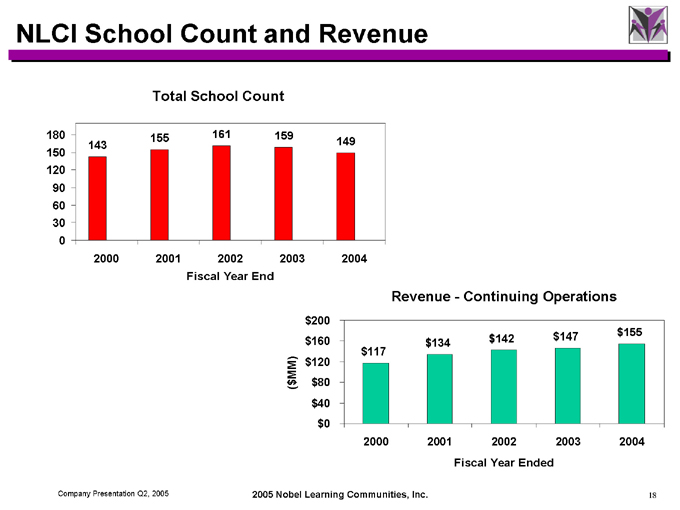

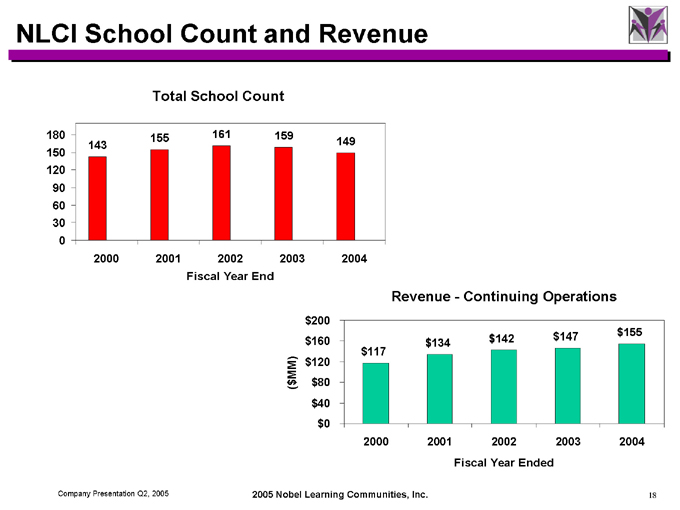

NLCI School Count and Revenue

Total School Count

180 150 120 90 60 30 0

143

155

161

159

149

2000 2001 2002 2003 2004

Fiscal Year End

Revenue—Continuing Operations

($ MM) $200 $160 $120 $80 $40 $0 $117 $134 $142 $147 $155

2000 2001 2002 2003 2004

Fiscal Year Ended

Company Presentation Q2, 2005 2005 Nobel Learning Communities, Inc.

18

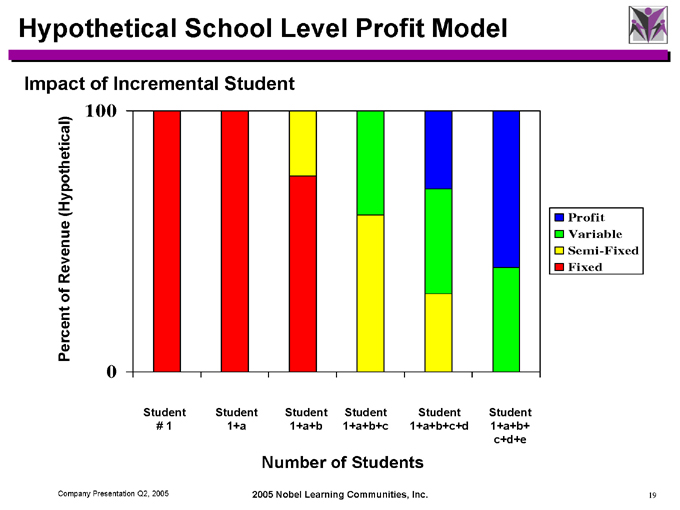

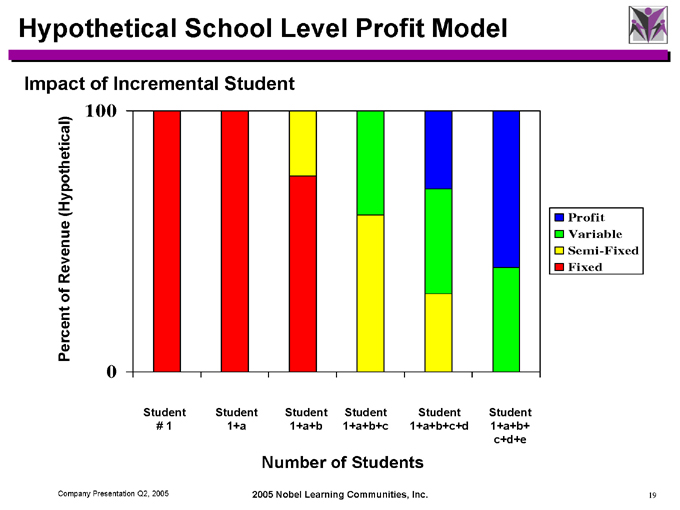

Hypothetical School Level Profit Model

Impact of Incremental Student

Percent of Revenue (Hypothetical)

100

0

Student # 1

Student 1+a

Student 1+a+b

Student 1+a+b+c

Student 1+a+b+c+d

Student 1+a+b+ c+d+e

Profit

Variable

Semi-Fixed

Fixed

Number of Students

Company Presentation Q2, 2005 2005 Nobel Learning Communities, Inc.

19

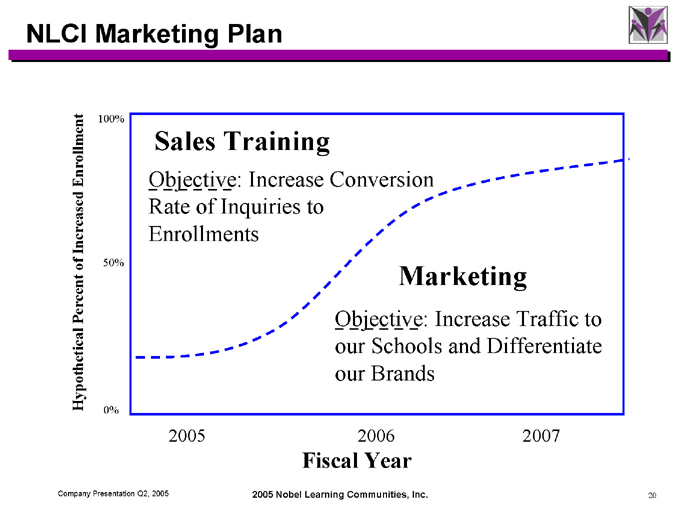

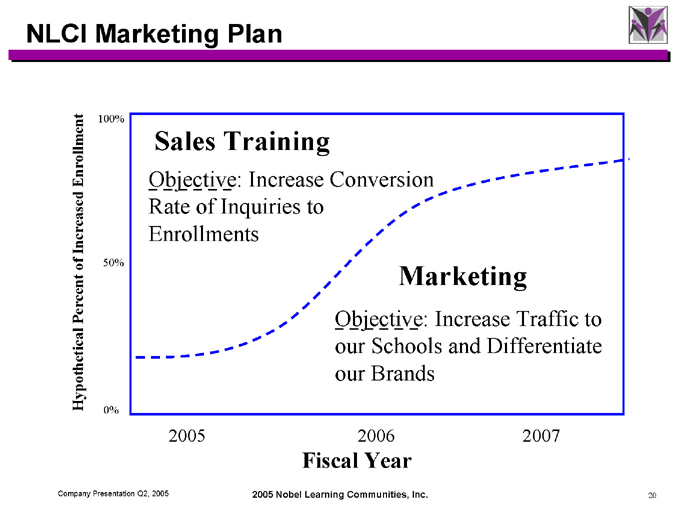

NLCI Marketing Plan

Hypothetical Percent of Increased Enrollment

100%

50%

0%

Sales Training

Objective: Increase Conversion

Rate of Inquiries to Enrollments

Marketing

Objective: Increase Traffic to our Schools and Differentiate our Brands

2005

2006

2007

Fiscal Year

Company Presentation Q2, 2005 2005 Nobel Learning Communities, Inc.

20

NLCI New Marketing Programs

Parent centered sales approach School marketing materials Development of customer database Internet marketing and lead generation Targeted direct mail programs Customer loyalty program (in test) Local Cluster marketing plan (in test)

Company Presentation Q2, 2005 2005 Nobel Learning Communities, Inc.

21

NLCI Marketing

Loyalty Program – FREd™ (Funds Re-invested in Education)

Chesterbrook Academy®’s College Savings Plan

Company Presentation Q2, 2005 2005 Nobel Learning Communities, Inc.

22

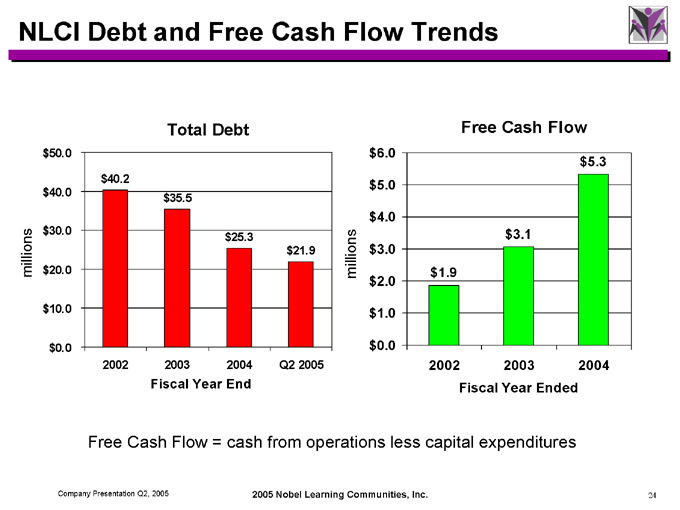

NLCI Financial Review

Enrollment stabilized

Substantial Balance Sheet Improvement in FY 2004

Reduced debt by over $10MM

No borrowings under revolving credit facilities

Debt reduced an additional $3.4MM through Q2 2005

Operating Performance Improvement in FY 2004

FY 2004 School Operating Profit improved to 12.8% of revenue from 12.5% of revenue in FY 2003

Free Cash Flow increased over 70% to $5.3MM

Cash flow improvement and school operating profit improvement have continued through Q2 2005

Progress in simplifying capital structure

Company Presentation Q2, 2005 2005 Nobel Learning Communities, Inc.

23

NLCI Debt and Free Cash Flow Trends

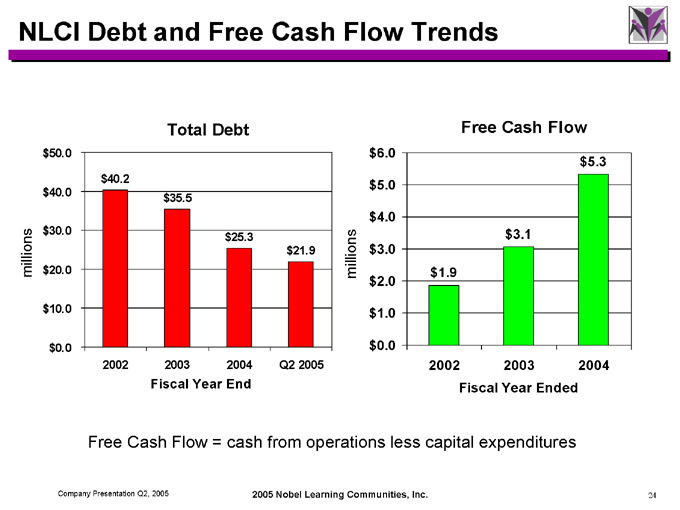

Total Debt millions $50.0 $40.0 $30.0 $20.0 $10.0 $0.0

2002 2003 2004 Q2 2005 $40.2 $35.5 $25.3 $21.9

Fiscal Year End

Free Cash Flow millions $6.0 $5.0 $4.0 $3.0 $2.0 $1.0 $0.0

2002 2003 2004

Fiscal Year Ended $1.9 $3.1 $5.3

Free Cash Flow = cash from operations less capital expenditures

Company Presentation Q2, 2005 2005 Nobel Learning Communities, Inc.

24

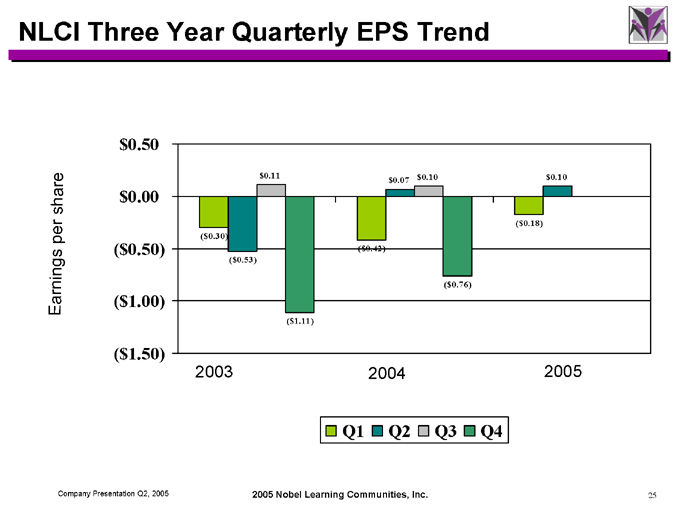

NLCI Three Year Quarterly EPS Trend

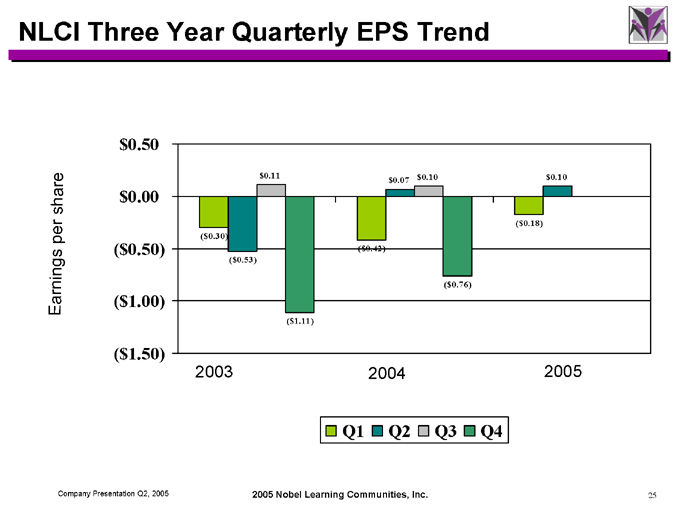

Earnings per share

$0.50

$0.00

($ 0.50)

($ 1.00)

($ 1.50)

2003 2004 2005

($ 0.30)

($ 0.53) $0.11

($ 1.11)

($ 0.42) $0.07 $0.10

($ 0.76)

($ 0.18) $0.10

Q1

Q2

Q3

Q4

Company Presentation Q2, 2005 2005 Nobel Learning Communities, Inc.

25

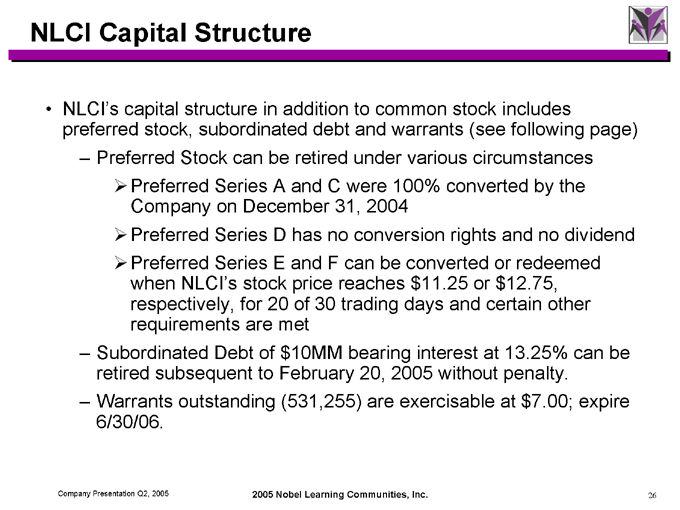

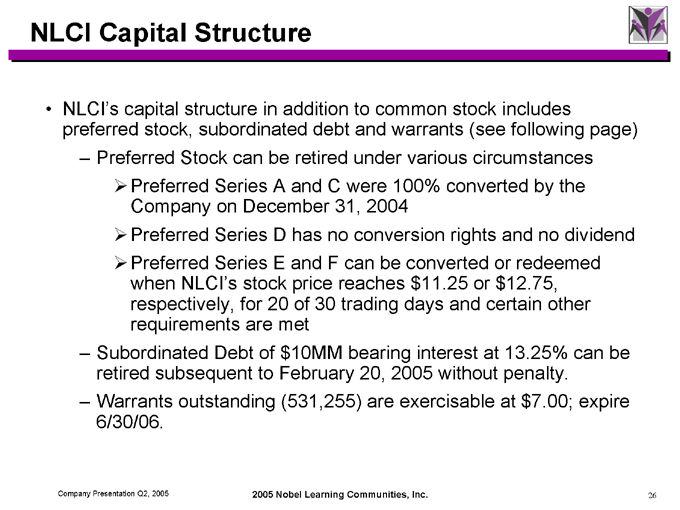

NLCI Capital Structure

NLCI’s capital structure in addition to common stock includes preferred stock, subordinated debt and warrants (see following page)

Preferred Stock can be retired under various circumstances

Preferred Series A and C were 100% converted by the Company on December 31, 2004 Preferred Series D has no conversion rights and no dividend Preferred Series E and F can be converted or redeemed when NLCI’s stock price reaches $11.25 or $12.75, respectively, for 20 of 30 trading days and certain other requirements are met

Subordinated Debt of $10MM bearing interest at 13.25% can be retired subsequent to February 20, 2005 without penalty. Warrants outstanding (531,255) are exercisable at $7.00; expire 6/30/06.

Company Presentation Q2, 2005 2005 Nobel Learning Communities, Inc.

26

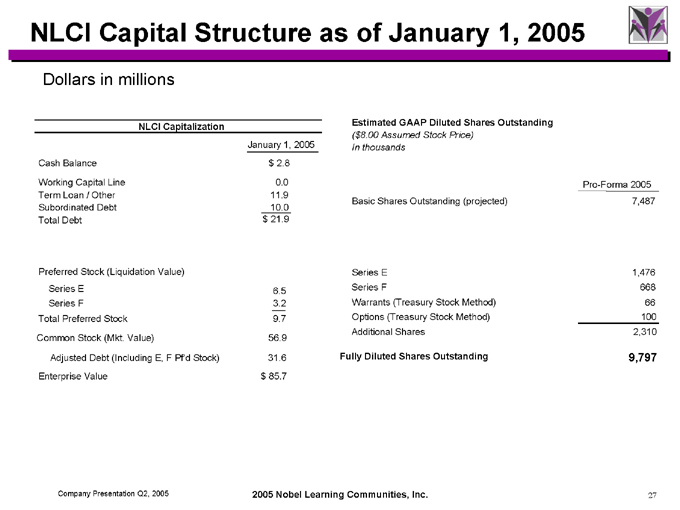

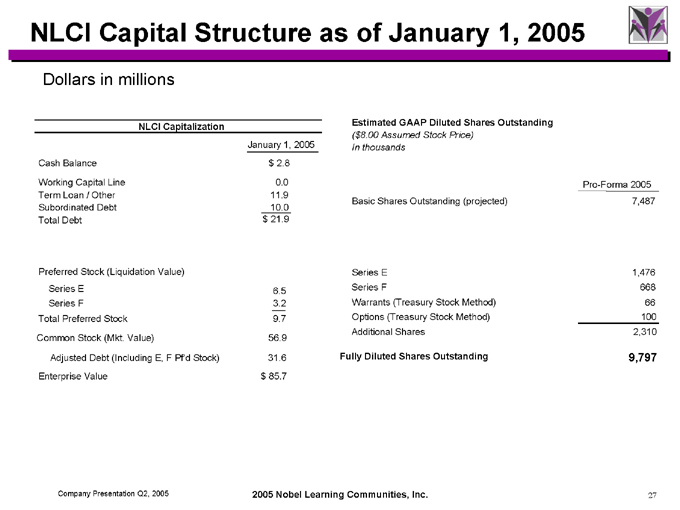

NLCI Capital Structure as of January 1, 2005

Dollars in millions

NLCI Capitalization

January 1, 2005

Cash Balance $ 2.8

Working Capital Line 0.0

Term Loan / Other 11.9

Subordinated Debt 10.0

Total Debt $ 21.9

Preferred Stock (Liquidation Value)

Series E 6.5

Series F 3.2

Total Preferred Stock 9.7

Common Stock (Mkt. Value) 56.9

Adjusted Debt (Including E, F Pf’d Stock) 31.6

Enterprise Value $ 85.7

Estimated GAAP Diluted Shares Outstanding

($8.00 Assumed Stock Price) In thousands

Pro-Forma 2005

Basic Shares Outstanding (projected) 7,487

Series E 1,476

Series F 668

Warrants (Treasury Stock Method) 66

Options (Treasury Stock Method) 100

Additional Shares 2,310

Fully Diluted Shares Outstanding 9,797

Company Presentation Q2, 2005 2005 Nobel Learning Communities, Inc.

27

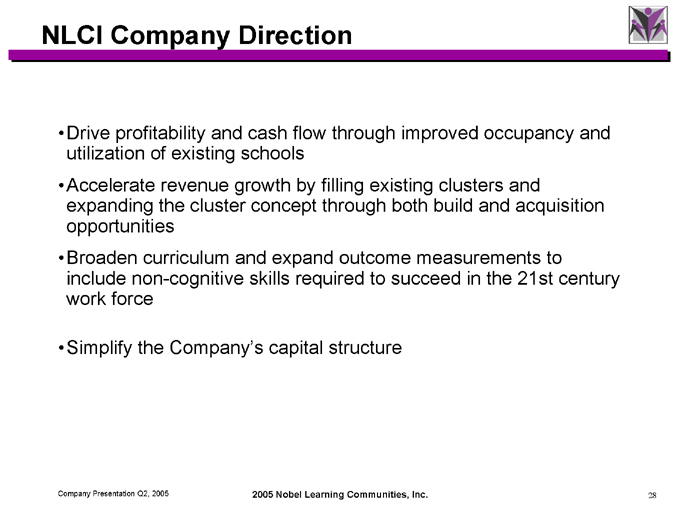

NLCI Company Direction

Drive profitability and cash flow through improved occupancy and utilization of existing schools Accelerate revenue growth by filling existing clusters and expanding the cluster concept through both build and acquisition opportunities Broaden curriculum and expand outcome measurements to include non-cognitive skills required to succeed in the 21st century work force

Simplify the Company’s capital structure

Company Presentation Q2, 2005 2005 Nobel Learning Communities, Inc.

28

Appendix

Summary Financial Statements

Company Presentation Q2, 2005 2005 Nobel Learning Communities, Inc.

29

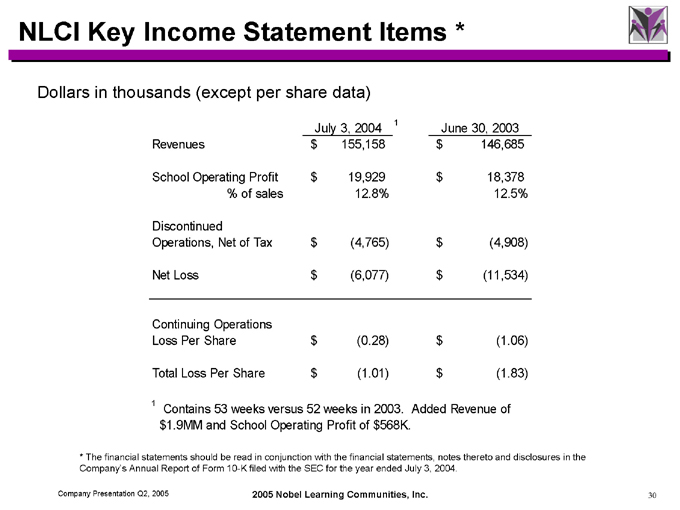

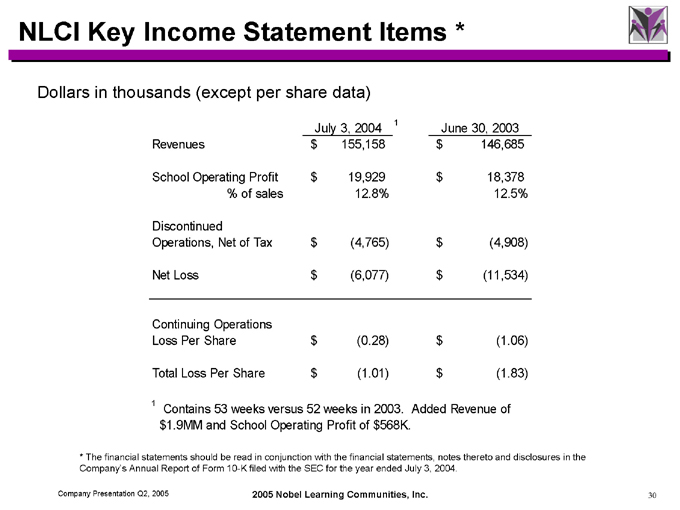

NLCI Key Income Statement Items *

Dollars in thousands (except per share data)

July 3, 2004 1 June 30, 2003

Revenues $ 155,158 $ 146,685

School Operating Profit $ 19,929 $ 18,378

% of sales 12.8% 12.5%

Discontinued

Operations, Net of Tax $ (4,765) $ (4,908)

Net Loss $ (6,077) $ (11,534)

Continuing Operations

Loss Per Share $ (0.28) $ (1.06)

Total Loss Per Share $ (1.01) $ (1.83)

1 Contains 53 weeks versus 52 weeks in 2003. Added Revenue of $1.9MM and School Operating Profit of $568K.

* The financial statements should be read in conjunction with the financial statements, notes thereto and disclosures in the Company’s Annual Report of Form 10-K filed with the SEC for the year ended July 3, 2004.

Company Presentation Q2, 2005 2005 Nobel Learning Communities, Inc.

30

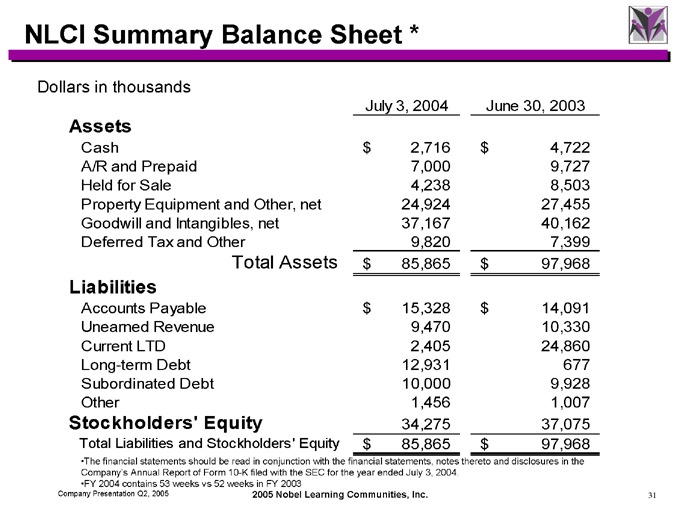

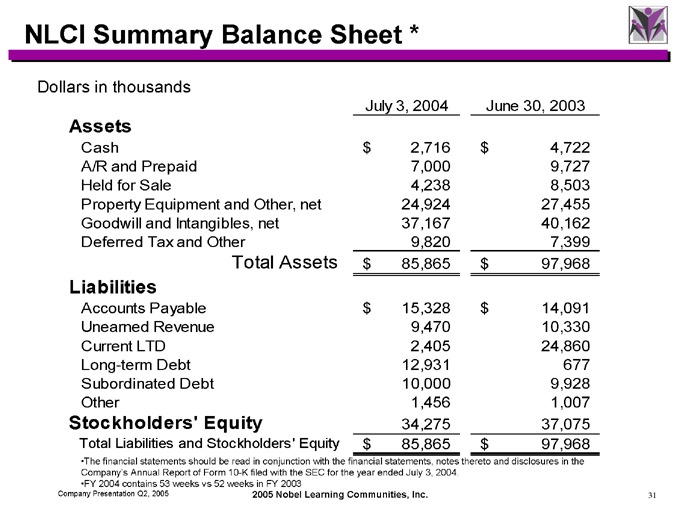

NLCI Summary Balance Sheet *

Dollars in thousands

July 3, 2004 June 30, 2003

Assets

Cash $ 2,716 $ 4,722

A/R and Prepaid 7,000 9,727

Held for Sale 4,238 8,503

Property Equipment and Other, net 24,924 27,455

Goodwill and Intangibles, net 37,167 40,162

Deferred Tax and Other 9,820 7,399

Total Assets $ 85,865 $ 97,968

Liabilities

Accounts Payable $ 15,328 $ 14,091

Unearned Revenue 9,470 10,330

Current LTD 2,405 24,860

Long-term Debt 12,931 677

Subordinated Debt 10,000 9,928

Other 1,456 1,007

Stockholders’ Equity 34,275 37,075

Total Liabilities and Stockholders’ Equity $ 85,865 $ 97,968

The financial statements should be read in conjunction with the financial statements, notes thereto and disclosures in the Company’s Annual Report of Form 10-K filed with the SEC for the year ended July 3, 2004.

FY 2004 contains 53 weeks vs 52 weeks in FY 2003

Company Presentation Q2, 2005 2005 Nobel Learning Communities, Inc.

31

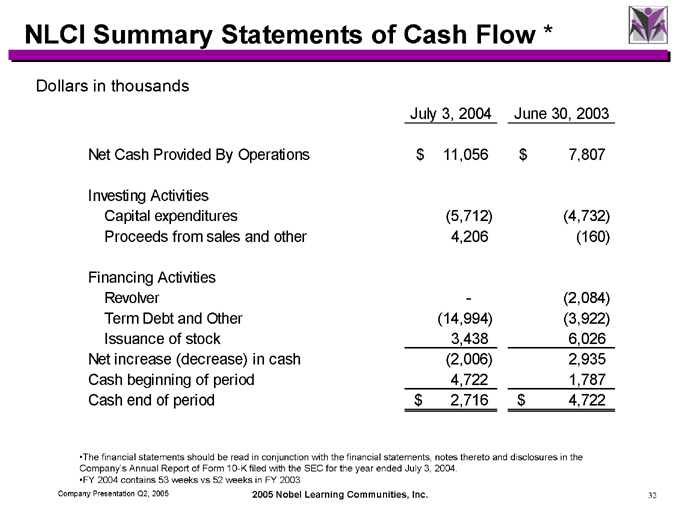

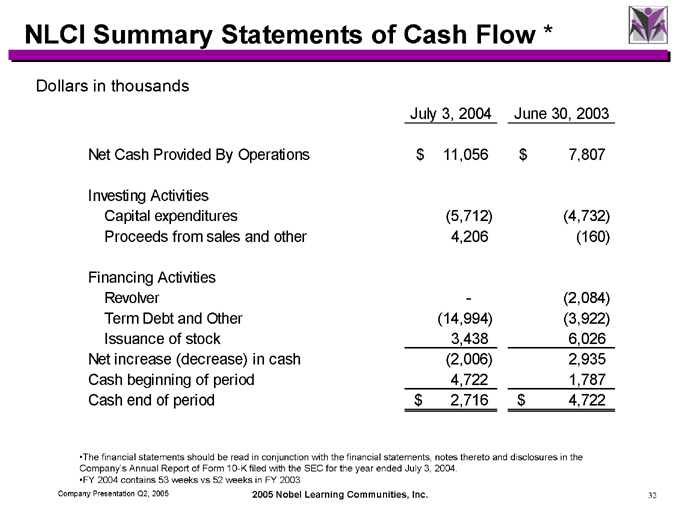

NLCI Summary Statements of Cash Flow *

Dollars in thousands

July 3, 2004 June 30, 2003

Net Cash Provided By Operations $ 11,056 $ 7,807

Investing Activities

Capital expenditures (5,712) (4,732)

Proceeds from sales and other 4,206 (160)

Financing Activities

Revolver—(2,084)

Term Debt and Other (14,994) (3,922)

Issuance of stock 3,438 6,026

Net increase (decrease) in cash (2,006) 2,935

Cash beginning of period 4,722 1,787

Cash end of period $ 2,716 $ 4,722

The financial statements should be read in conjunction with the financial statements, notes thereto and disclosures in the Company’s Annual Report of Form 10-K filed with the SEC for the year ended July 3, 2004.

FY 2004 contains 53 weeks vs 52 weeks in FY 2003

Company Presentation Q2, 2005 2005 Nobel Learning Communities, Inc.

32

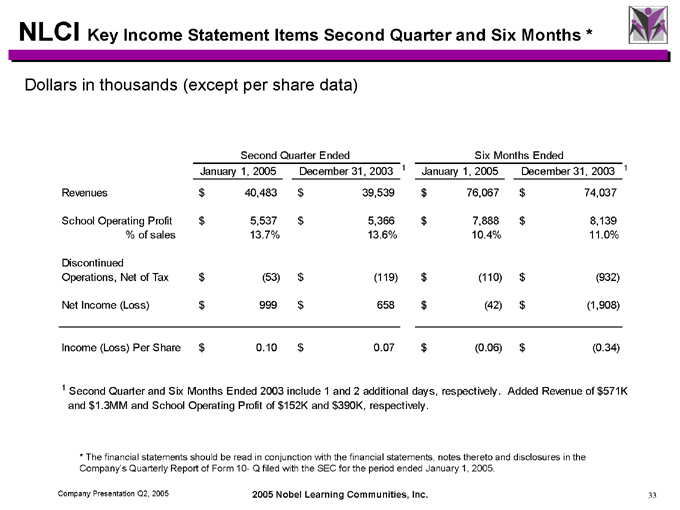

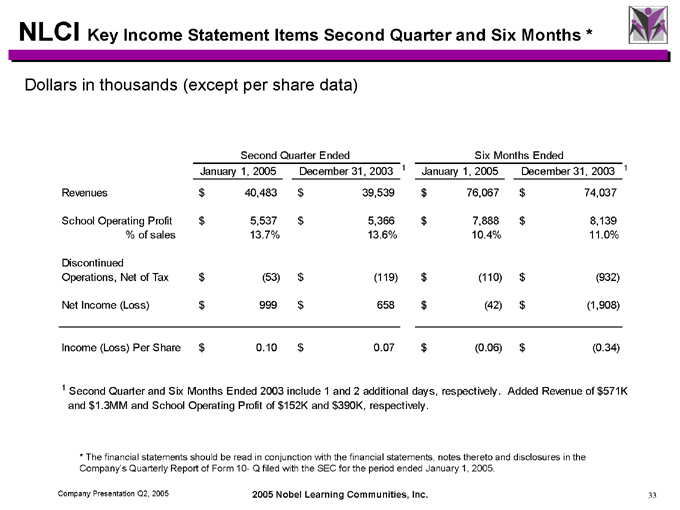

NLCI Key Income Statement Items Second Quarter and Six Months *

Dollars in thousands (except per share data)

Second Quarter Ended Six Months Ended

January 1, 2005 December 31, 20031 January 1, 2005 December 31, 20031

Revenues $ 40,483 $ 39,539 $ 76,067 $ 74,037

School Operating Profit $ 5,537 $ 5,366 $ 7,888 $ 8,139

% of sales 13.7% 13.6% 10.4% 11.0%

Discontinued

Operations, Net of Tax $ (53) $ (119) $ (110) $ (932)

Net Income (Loss) $ 999 $ 658 $ (42) $ (1,908)

Income (Loss) Per Share $ 0.10 $ 0.07 $ (0.06) $ (0.34)

1 Second Quarter and Six Months Ended 2003 include 1 and 2 additional days, respectively. Added Revenue of $571K and $1.3MM and School Operating Profit of $152K and $390K, respectively.

* The financial statements should be read in conjunction with the financial statements, notes thereto and disclosures in the Company’s Quarterly Report of Form 10- Q filed with the SEC for the period ended January 1, 2005.

Company Presentation Q2, 2005 2005 Nobel Learning Communities, Inc.

33

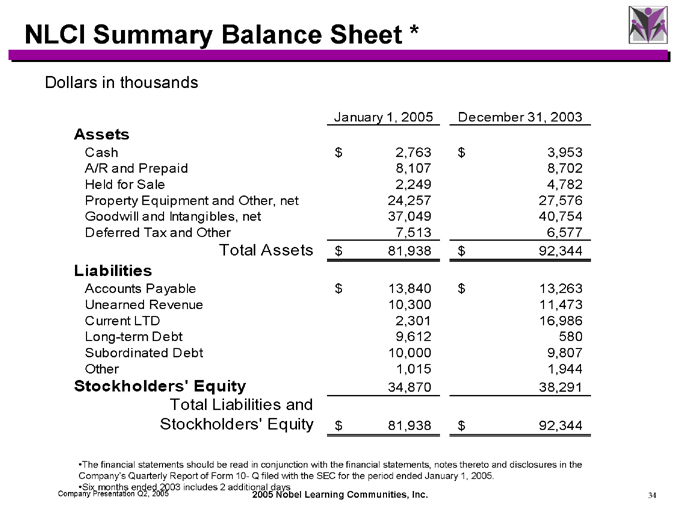

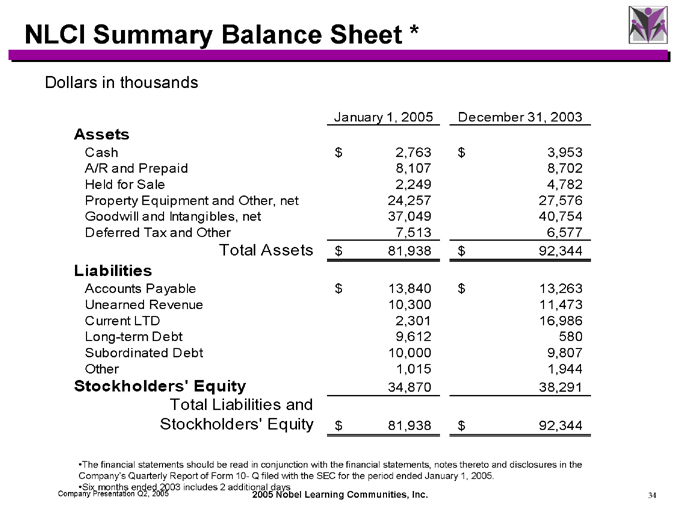

NLCI Summary Balance Sheet *

Dollars in thousands

January 1, 2005 December 31, 2003

Assets

Cash $ 2,763 $ 3,953

A/R and Prepaid 8,107 8,702

Held for Sale 2,249 4,782

Property Equipment and Other, net 24,257 27,576

Goodwill and Intangibles, net 37,049 40,754

Deferred Tax and Other 7,513 6,577

Total Assets $ 81,938 $ 92,344

Liabilities

Accounts Payable $ 13,840 $ 13,263

Unearned Revenue 10,300 11,473

Current LTD 2,301 16,986

Long-term Debt 9,612 580

Subordinated Debt 10,000 9,807

Other 1,015 1,944

Stockholders’ Equity 34,870 38,291

Total Liabilities and

Stockholders’ Equity $ 81,938 $ 92,344

The financial statements should be read in conjunction with the financial statements, notes thereto and disclosures in the Company’s Quarterly Report of Form 10- Q filed with the SEC for the period ended January 1, 2005. Six months ended 2003 includes 2 additional days

Company Presentation Q2, 2005 2005 Nobel Learning Communities, Inc.

34

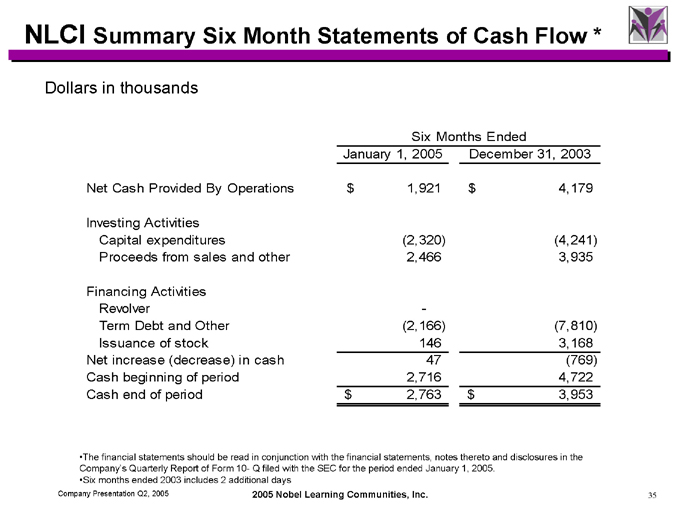

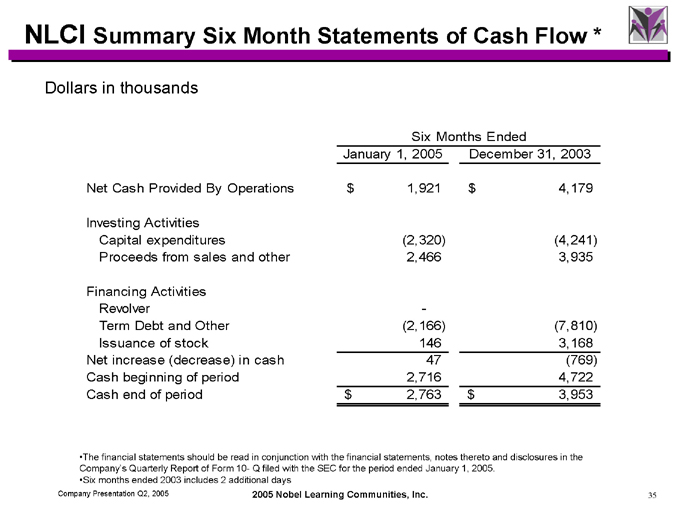

NLCI Summary Six Month Statements of Cash Flow *

Dollars in thousands

Six Months Ended

January 1, 2005 December 31, 2003

Net Cash Provided By Operations $ 1,921 $ 4,179

Investing Activities

Capital expenditures (2,320) (4,241)

Proceeds from sales and other 2,466 3,935

Financing Activities

Revolver—

Term Debt and Other (2,166) (7,810)

Issuance of stock 146 3,168

Net increase (decrease) in cash 47 (769)

Cash beginning of period 2,716 4,722

Cash end of period $ 2,763 $ 3,953

The financial statements should be read in conjunction with the financial statements, notes thereto and disclosures in the Company’s Quarterly Report of Form 10- Q filed with the SEC for the period ended January 1, 2005. Six months ended 2003 includes 2 additional days

Company Presentation Q2, 2005 2005 Nobel Learning Communities, Inc.

35

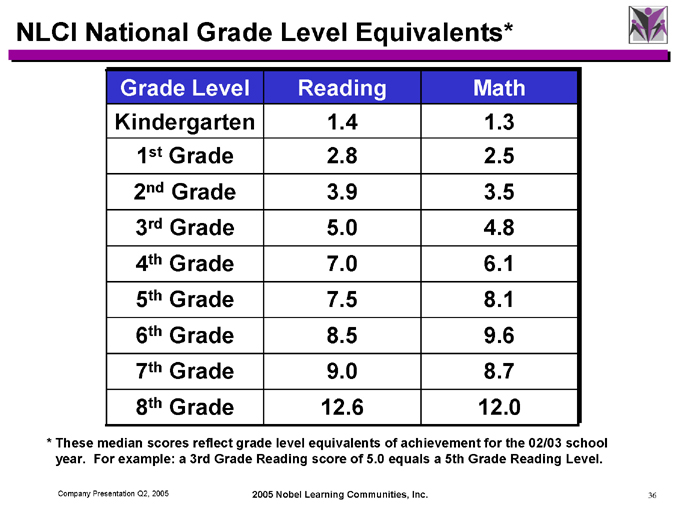

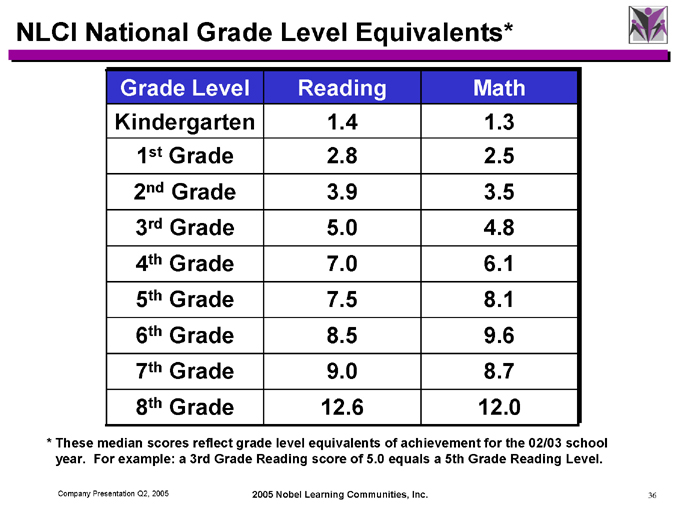

NLCI National Grade Level Equivalents*

Grade Level Reading Math

Kindergarten 1.4 1.3

1st Grade 2.8 2.5

2nd Grade 3.9 3.5

3rd Grade 5.0 4.8

4th Grade 7.0 6.1

5th Grade 7.5 8.1

6th Grade 8.5 9.6

7th Grade 9.0 8.7

8th Grade 12.6 12.0

* These median scores reflect grade level equivalents of achievement for the 02/03 school year. For example: a 3rd Grade Reading score of 5.0 equals a 5th Grade Reading Level.

Company Presentation Q2, 2005 2005 Nobel Learning Communities, Inc.

36

NLCI Marketing

ELEMENTARY

Brochures and Mailers

Inspiration…

Motivation…

EducationTM

Inspiration…

Motivation…

EducationTM

Inspiration…

Motivation…

EducationTM

PRESCHOOL

Company Presentation Q2, 2005 2005 Nobel Learning Communities, Inc.

37

NLCI Marketing

Our Preschool Approach

School Posters

Our Promise

Our Elementary Approach

Our Advantage

Company Presentation Q2, 2005 2005 Nobel Learning Communities, Inc.

38

NLCI Marketing

Pre-School Developmental Guidelines

Biginner Program

Infant Program

Intermediate Program

Toddler Program

Pre Elementary Program

Company Presentation Q2, 2005 2005 Nobel Learning Communities, Inc.

39

NLCI Marketing

Company Presentation Q2, 2005 2005 Nobel Learning Communities, Inc.

40