1 NOBEL LEARNING COMMUNITIES, INC. June 2008 Exhibit 99.1 |

2 NOBEL LEARNING COMMUNITIES, INC. The following presentation contains forward-looking statements, within the meaning of the Private Securities Litigation Reform Act of 1995, about such things as the Company’s business, projected revenues, expenditures and operating and capital requirements. Statements that are not historical facts are forward-looking statements, and are subject to certain risks, uncertainties and assumptions, such as factors that could cause actual results to vary materially. Among the factors that could impact our ability to achieve our stated goals are competitive conditions in the pre-elementary and elementary school education and services industry, including advertising and tuition price sensitivity; various factors affecting occupancy levels, including, but not limited to, the reduction in or changes to the general labor force that would reduce the need or demand for private schools; the establishment of governmentally mandated universal pre-K programs that do not allow for participation by for-profit operators; our inability to successfully defend against or counter negative publicity associated with claims involving alleged incidents at our schools; and the acceptance of our newly developed schools and businesses and performance of recently acquired businesses. Forward- looking statements should not be relied upon except as statements of our present intentions and expectations that may or may not occur. |

3 NLCI BUSINESS SUMMARY • Premier operator in the for-profit private preschool, elementary/middle school and specialty school market – Largest K-8 and # 4 preschool operator – Predominantly private pay • Education market expected to grow at 6.4% per year – Fragmented: provides rollup growth opportunity – Tuition increases of 3% to 5% per year • Excellent target market characteristics: – Dual income, high HH income families; professional and technical employment – Existing portfolio in high growth markets • 3 year Net Income CAGR of > 30% |

4 NLCI BUSINESS MODEL PRINCIPLES • Focus on three growing trends faced by families – Dual income and single parent households – Frustration with public schools – Assure child’s success in the “21 st Century Economy” • Curriculum-based with standardized testing providing excellent value for educational outcomes • “Cluster” School Model – Feeder preschools support K-8 occupancy – Operating and marketing economies • Programs to meet family after school, summer needs |

5 Our preschool curriculum connects parents to what their child is learning in our schools |

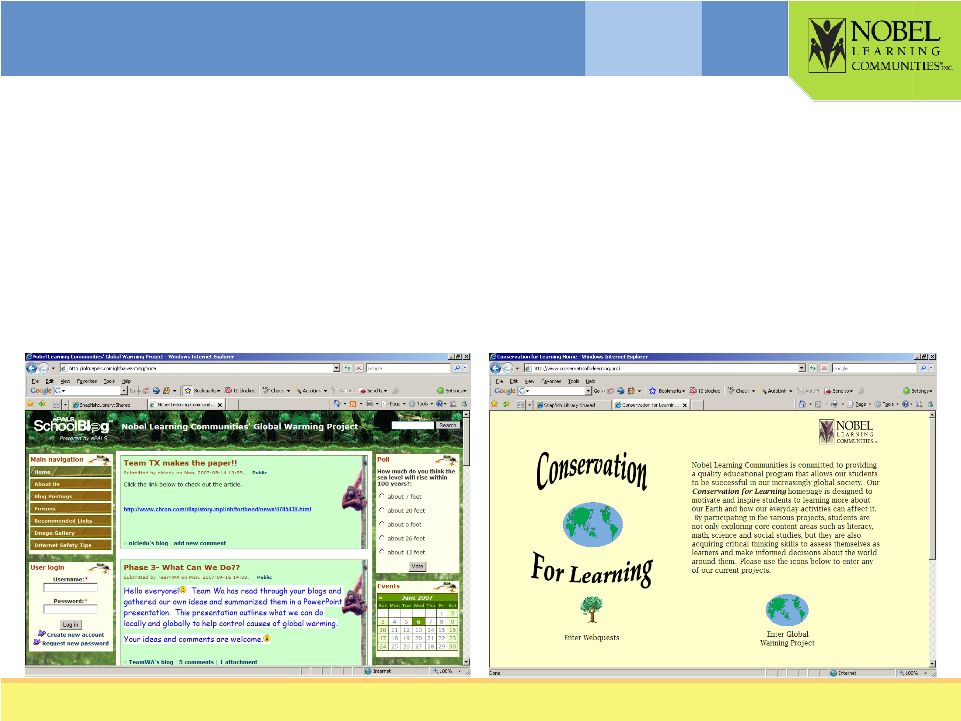

6 Our K-8 Schools are Differentiated Through Our Curriculum Delivery Model • Utilize national network of schools to create extraordinary "distance" learning experiences and student interactions • Develop advanced skills to succeed in 21st century economy |

7 WE OPERATE UNDER MULTIPLE BRANDS East West Specialized Individual Market Brands |

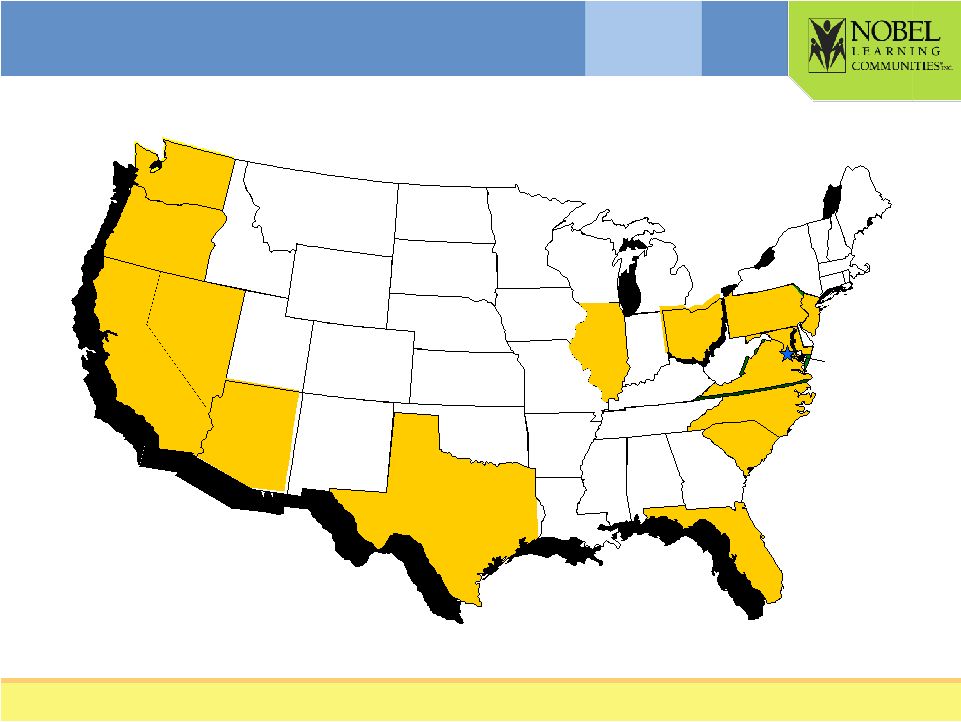

8 1 1 5 3 1 SCHOOL LOCATIONS BY STATE 1 8 9 38 2 6 14 7 2 16 19 19 25 |

9 NLCI GROWTH STRATEGY |

10 Growth Source 2006 2007 2008 YTD Comparable Schools Tuition Increase 3.8% 3.8% Enrollment Increase 0.6% 0.4% Total 1.5% 4.4% 4.2% New Schools 1 2 4 Acquisitions - Completed Preschools 0 7 17 Before and After Programs 0 0 7 Elementary 0 1 2 NLCI GROWTH STRATEGY - EXECUTION On pace to top $200mm in revenues for 1 st time in Company history |

11 NOBEL LEARNING COMMUNITIES, INC. Financial Results |

12 Revenue Growth • Sources of growth – tuition, enrollment, new facilities, acquisitions • Strong recurring revenues – high student retention rate Margin and Earnings Leverage Opportunity • Margin expansion from comparable revenue growth • $175,000 pretax income = $0.01 EPS Attractive Cash Flow • Generate cash before services delivered • Modest capital requirements – real estate leased, not owned Capital Structure Strength • One class of common stock - 10,392,000 shares outstanding • Dry powder - $75,000,000 revolving credit facility KEY BUSINESS CHARACTERISTICS |

13 DOUBLE-DIGIT REVENUE GROWTH Revenue should be reviewed in conjunction with the Financial Statements and Notes thereto filed with the SEC. Comparable School Revenue Growth 3.7% 1.5% 4.4% 4.9% 4.2% 2.8% 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% Revenue Growth 5.8% 3.9% 2.5% 13.0% 12.9% 11.4% 39 weeks 2007 2008 39 weeks 2007 2008 Net Revenue $152 $158 $162 $183 $134 $149 $- $50 $100 $150 $200 |

14 STRONG GROSS PROFIT AND NET INCOME GROWTH Gross Profit and Net Income should be reviewed in conjunction with the Financial Statements, Notes and M,D&A filed with the SEC. Net Income results for 2007 and 2005 are adjusted to remove non-recurring items in those respective fiscal periods. Gross Profit / Gross Margin $20.4 $22.0 $23.0 $27.5 $18.9 $21.0 $- $5.0 $10.0 $15.0 $20.0 $25.0 $30.0 Net Income $3.4 $4.5 $5.8 $3.1 $4.3 $- $1.4 $2.8 $4.3 $5.7 Gross Margin 13.5% 14.0% 14.2% 15.0% 14.1% 14.1% CAGR 30.6% 39 weeks 2007 2008 39 weeks 2007 2008 |

15 Our execution provides leverage even with current economic conditions Comparable Schools March 29, 2008 March 31, 2007 Increase (Decrease) Percent Increase (Decrease) Thirteen Weeks Revenue 50,043 $ 48,792 $ 1,251 $ 2.6% Personnel Costs 23,724 23,264 460 2.0 School Operating Costs 5,995 5,941 54 0.9 Rent and Other 11,629 11,188 441 3.9 Gross Profit 8,695 $ 8,399 $ 296 $ 3.5% Thirty-nine Weeks Revenue 132,750 $ 127,361 $ 5,389 $ 4.2% Personnel Costs 63,781 61,685 2,096 3.4 School Operating Costs 17,746 17,623 123 0.7 Rent and Other 31,640 30,405 1,235 4.1 Gross Profit 19,583 $ 17,648 $ 1,935 $ 11.0% |

16 Fiscal Quarter - EPS $(0.18) $(0.11) $(0.10) $(0.03) $0.10 $0.12 $0.15 $0.20 $0.15 $0.18 $0.21 $0.24 $0.20 $0.22 $0.25 $(0.20) $(0.10) $- $0.10 $0.20 $0.30 2005 2006 2007 2008 Fiscal Year Q1 Q2 Q3 Q4 STRONG EARNINGS TRENDS Fiscal Year - EPS $0.35 $0.44 $0.55 $- $0.10 $0.20 $0.30 $0.40 $0.50 $0.60 2005 2006 2007 Fiscal Year Fiscal Year – July through June CAGR 25.4% EPS should be reviewed in conjunction with the Financial Statements, Notes and M,D&A filed with the SEC. EPS results for 2007 and 2005 are adjusted to remove non-recurring items in those respective fiscal periods. |

17 Free Cash Flow = cash from operations less capital expenditures LOW DEBT AND INCREASING CASH FLOW Total Debt $35.5 $25.3 $15.5 $13.2 $0.0 $17.3 $- $10.0 $20.0 $30.0 $40.0 2003 2004 2005 2006 2007 Free Cash Flow $8.3 $7.9 $3.1 $5.3 $11.5 $- $2.0 $4.0 $6.0 $8.0 $10.0 $12.0 CAGR 38.2% 3Q 08 |

18 • Education is a Growth Market • Only Public Company in Preschool and K-8 Space • Our Growth Produces Double-Digit Revenue and Earnings Growth • Margin and Earnings Leverage • Attractive Cash Flow • Growth through Acquisitions • Strong Capital Structure – Dry Powder INVESTMENT HIGHLIGHTS |

19 NOBEL LEARNING COMMUNITIES, INC. |