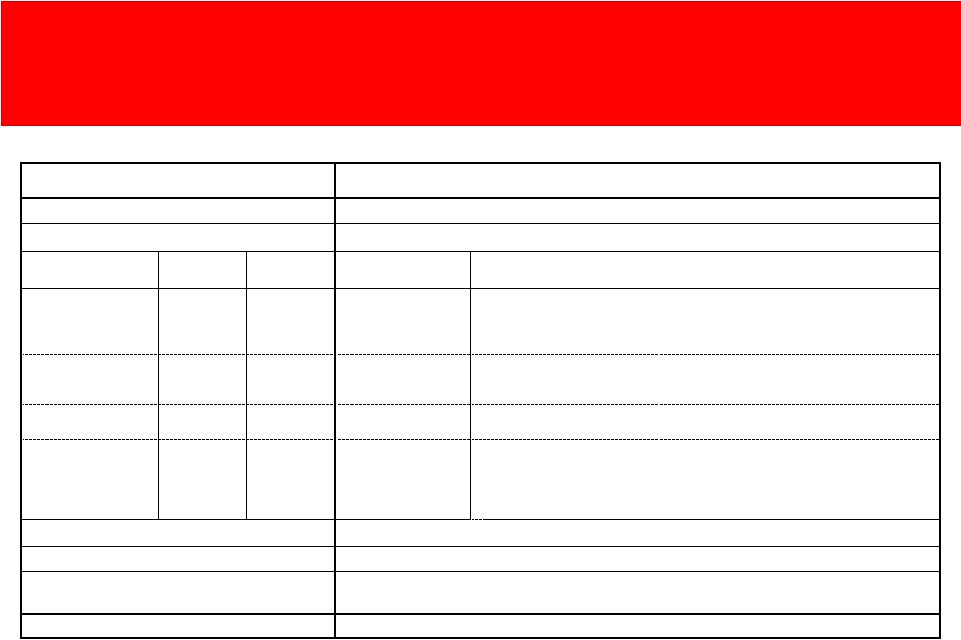

FY 2007 Financial Targets & Goals 1 As of November 30, 2006 Exhibit 99.02 Over FY'07 - FY'09 3 Year Period: Fiscal Year 2007 Revenue: + 8 - 10% At or above the high end of long-term goal EPS 1 : + 12 - 15% 2 $3.25 - $3.40 per share (includes equity compensation expense) Operating FY07 OE 3 growth Segment Revenue Earnings 3 vs. long-term target Drivers HSCS - Pharma + 7 - 10% + 7 - 10% In range * Strong bulk growth; generic launches; cost control; stable to increasing EP margins driven by efficient capital usage; impact of Dohmen acquisition * Sell margin pressure; stable to declining operating margins due to sales mix (driven by lower-margin bulk revenue growth) HSCS - Medical + 4 - 7% + 6 - 9% In range * Strong corporate brand sales growth; cost control; stable to increasing operating margins; stable EP margins * Launch of IPS and customer service consolidations MPM + 6 - 8% + 10 - 12% Above range * New contracts; product innovation; international growth; impact of restructuring and sourcing initiatives; impact of DBI acquisition CTS + 10 - 15% + 15 - 20% Below range * Strong product demand for Alaris and Pyxis products; new product launches; continued impact of operational improvements; international expansion; impact of MedMined acquisition * Increased investment in innovation, quality and service * Current estimate of SE pump fix; impact of Care Fusion acquisition Return on Equity 4 : 15% - 20% In line with long-term goal Operating Cash Flow: > 100% of net earnings In line with long-term goal Cash Returned up to 50% of OCF, via share - Quarterly dividend increased 50% to $0.09 per share to Shareholders : repurchase and dividends 2 - Plan to repurchase $1.5 Billion in FY'07 Credit Rating: Strong investment grade Continued progress from BBB 1 Non-GAAP diluted EPS from continuing operations. 2 Excludes the impact of proceeds from the PTS divestiture. 3 Segment operating earnings growth rates represent organic growth only (except as noted). 4 Non-GAAP return on equity. One Year Targets Long-Term Financial Goals |