2007 April 26, 2007 Third Quarter Earnings Exhibit 99.03 |

2 Forward-Looking Statements and GAAP Reconciliation Except for historical information, all other information in this presentation consists of forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, as amended. These forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from those projected, anticipated or implied. The most significant of these uncertainties are described in Cardinal Health's Form 10-K, Form 10-Q and Form 8-K reports (including all amendments to those reports) and exhibits to those reports, and include (but are not limited to) the following: competitive pressures in its various lines of businesses; the loss of one or more key customer or supplier relationships or changes to the terms of those relationships; changes in the distribution patterns or reimbursement rates for health-care products and/or services; the results, consequences, effects or timing of any inquiry or investigation by any regulatory authority or any legal and administrative proceedings, or settlement discussions with regulatory authorities or plaintiffs in any action against the company; uncertainties related to completing a settlement of the class-action securities litigation or, if completed, obtaining court approval of the settlement, uncertainties regarding whether the amount reserved associated with the class-action securities litigation will be sufficient, and uncertainties regarding the timing or final terms of any settlement; the costs, difficulties and uncertainties related the integration of acquired businesses; with respect to future dividends, the decision by the board of directors to declare such dividends, which is expected to consider Cardinal Health’s surplus, earnings, cash flows, financial condition and prospects at the time any such action is considered; with respect to future share repurchases, the approval of the board of directors, which is expected to consider Cardinal Health’s then-current stock price, earnings, cash flows, financial condition and prospects as well as alternatives available to Cardinal Health at the time any such action is considered; and general economic and market conditions. Except to the extent required by applicable law, Cardinal Health undertakes no obligation to update or revise any forward-looking statement. In addition, this presentation includes non-GAAP financial measures. Cardinal Health provides definitions and a reconciliation between GAAP and non- GAAP financial information at the end of this presentation and on its investor relations page at www.cardinalhealth.com. |

3 Today’s Agenda Opening remarks Kerry Clark Chief Executive Officer Financial overview Jeff Henderson Chief Financial Officer Q&A |

4 Financial Overview • FY 2007 Q3 Results – Consolidated • FY 2007 Q3 Results – Business Segments • Progress Against Key Value Drivers • FY 2007 Financial Targets and Goals • Other Items |

5 Revenue Operating earnings/(loss) Earnings/(loss) from continuing operations Diluted EPS from continuing operations Operating cash flow Return on equity Q3 FY 2007 Recap $ M % Change 1 $21,867 8% $ (10) N.M. $ (5) N.M. $ (0.01) N.M. $ 676 0.9% $ M % Change 1 $ 606 9% $ 390 10% $ 0.96 16% 19.7% GAAP Basis Note: 1 % change over prior year quarter Non-GAAP Basis |

6 Q3 Operating Earnings and EPS 6 Operating Earnings/(Loss) ($M) Diluted EPS from Continuing Operations Operating Earnings/(Loss) ($M) Diluted EPS from Continuing Operations GAAP Consolidated ($10) ($0.01) $535 $0.80 Special Items $612 $0.96 $13 $0.02 Impairment Charges & Other $4 $0.01 $5 $0.01 Non-GAAP Consolidated $606 $0.96 $553 $0.83 Non-Recurring & Other Items ($2) ($0.01) Q3 FY 2007 Q3 FY 2006 |

7 Cardinal Health Business Analysis Healthcare Supply Chain Services - Pharmaceutical Q3 FY ‘07 Q3 FY ‘06 $ M $ M % change Revenue $ 19,246 $ 17,785 8% Segment profit $ 380 $ 329 15% Non-recurring and other items $ (2) Note: 1 Non-GAAP financial measure Highlights: • Direct-store-door (DSD) pharmaceutical and bulk customer sales grew 11% each over prior year • Segment profit leverage driven by strength in brand price inflation and generic launches • Recorded $15.8M in DSA fees above contract minimums that were earned CY 2006 • Strong earnings growth from nuclear pharmacy services • Continue progress on improving capital efficiency; days of inventory declined by 2 days vs. Q3 ’06 • Economic profit margin¹ increased 14 basis points to 1.04% vs. prior year • Q3’ 07 equity compensation expense of $11.1 million vs. $13.6 million in prior year |

8 Cardinal Health Business Analysis Healthcare Supply Chain Services - Medical Q3 FY ��07 Q3 FY ‘06 $ M $ M % change Revenue $ 1,907 $ 1,829 4% Segment profit $ 89 $ 93 (5%) Note: 1 Non-GAAP financial measure Highlights: • Strong revenue growth in laboratory and Canadian operations partially offset by sales weakness in Presource and acute • Product mix and increased SG&A expenses associated with bad debt write-offs and customer service investments driving segment profit declines • Customer service improving; wins beginning to offset losses; margins beginning to stabilize in acute • Appointed new leader and exploring opportunities to accelerate HSCS integration • Economic profit margin¹ declined 44 basis points to 1.37% vs. prior year • Q3 ’07 equity compensation expense of $6.6 million vs. $8.9 million in prior year |

9 Cardinal Health Business Analysis Clinical Technologies and Services Q3 FY ‘07 Q3 FY ‘06 $ M $ M % change Revenue $ 674 $ 603 12% Segment profit $ 98 $ 88 12% Highlights: • Strong sales of Pyxis and Alaris products; committed contracts up significantly over prior year • Demonstrated “All Meds Solution” offering to help hospitals reduce medication errors at the point-of- care • Continued investments to support future growth (e.g., R&D, international, and acquisitions) driving higher SG&A growth • Excluding Q3 ‘06 bad debt reduction of $8M, segment profit growth would have been 11 pp higher • Q3 ‘07 equity compensation expense of $8.7 million vs. $11.1 million in prior year |

10 Cardinal Health Business Analysis Medical Products Manufacturing Q3 FY ‘07 Q3 FY ‘06 $ M $ M % change Revenue $ 458 $ 413 11% Segment profit $ 47 $ 45 4% Highlights: • Solid top-line growth across the segment driven by special procedures products, gloves and other infection prevention products • Strong demand for new products within gloves, respiratory, and surgical instruments businesses • Seeing cost benefits from operational excellence initiatives and network restructuring; recently announced intention to close the Denver Biomedical facility • Lower segment profit growth driven by unusual charges and continued investment in international and R&D; expecting return to solid bottom-line performance in Q4 • Q3 ’07 equity compensation expense of $6.3 million vs. $8.2 million in prior year |

11 Progress Against Key Value Drivers Drive Top-line Growth and Gross Margin Expansion • Strong customer demand and successful new offerings from CTS and MPM • Improved generics customer compliance and sourcing Improve Operating Efficiency • Increased SG&A leverage year-to-date; 12 bps improvement as a % of sales • Improved cost via One Cardinal Health, operational excellence, facility rationalization, and sourcing Focused Operating Growth Balance Sheet Management Disciplined Capital Deployment Optimize Portfolio • Divested non-strategic Pharmaceutical Technologies and Services segment Improve Capital Efficiency • Inventory levels continue to decline; days on hand declined 3 days from Q3 last year • Non-GAAP return on invested capital has improved substantially year to date Return Capital to Shareholders • ~50% of operating cash flow; PTS proceeds to be used for incremental repurchases • Accelerated repurchase plan in advance of PTS close — ~$2.4B executed YTD Invest for Organic Growth and Tuck-in Acquisitions • Investing to drive growth: increased R&D, international, and customer service • Successful acquisition history since transitioning to an integrated operating company |

12 Acquisition Scorecard Acquisition Date Results Specialty Scripts (HSCS-P) January ’07 (+) Care Fusion (CTS) October ’06 (+) MedMined (CTS) July ’06 (+) Dohmen (HSCS-P) June ’06 (+) Denver Biomedical (MPM) May ’06 (+) Parmed (HSCS-P) March ’06 (+) Source Medical (HSCS-M) November ’05 (+) Geodax (HSCS-P) July ’04 (+) Alaris (CTS) June ’04 (+) Snowden Pencer (MPM) March ’04 (–) Added since last update |

13 Outlook • Full year EPS guidance remains in $3.25 – $3.40 range¹ • Upside from use of PTS proceeds to be offset by CAH Foundation contribution of approximately $30M in Q4 • HSCS-P: Strong performance to date driven by: improved buy-side margins and generic launches • HSCS-P: Expect overall strong FY07 but difficult Q4 comparison vs. last year—brand price increase timings, SPD sale, and recent retail contract re-pricings • HSCS-M: Expecting Q4 improvement, but work still to be done • CTS: 1st half performance impacted by SE recall and launch delays in Alaris and Pyxis; expecting strong 2nd half • MPM: Good 1st half driven by strong sales and improved operational efficiency • CTS & MPM: Anticipating strong Q4 performance, reflecting impact of recent investments Overall Healthcare Supply Chain Services Clinical and Medical Products Note: 1 Non-GAAP diluted EPS from continuing operations |

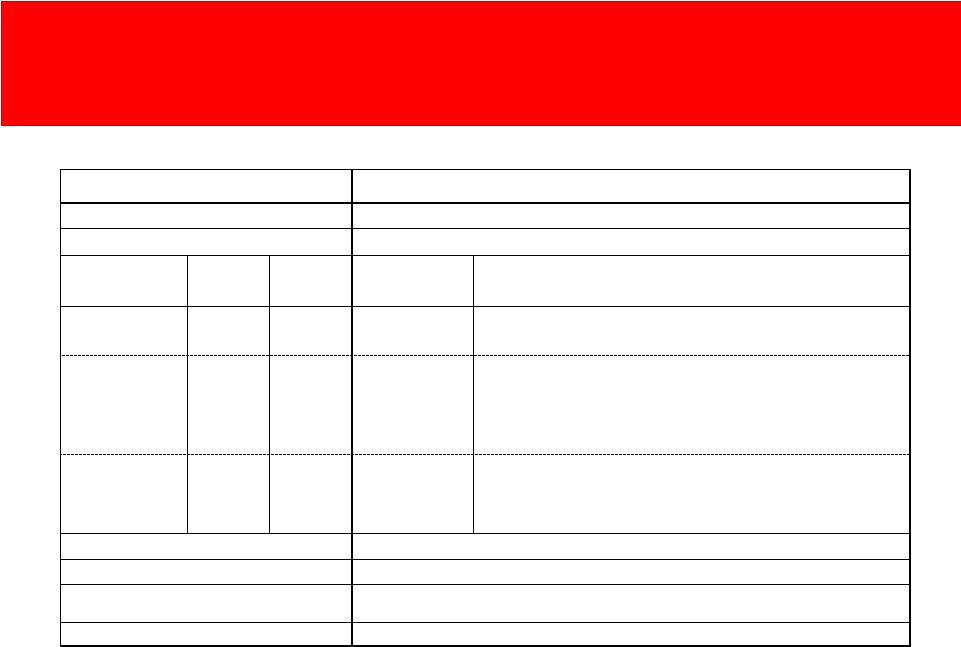

FY 2007 Financial Targets & Goals 14 As of April 26, 2007 Over FY'07 - FY'09 3 Year Period: Fiscal Year 2007 Revenue: + 8 - 10% In upper half of range EPS ¹: + 12 - 15% $3.25 - $3.40 per share (includes equity compensation expense) Segment Revenue Drivers HSCS - Pharma + 7 - 10% + 7 - 10% In range * Strong bulk growth; generic launches; cost control; stable to increasing EP margins driven by efficient capital usage; impact of Dohmen acquisition * Impact of major contract repricings; stable segment profit margins HSCS - Medical + 4 - 7% + 6 - 9% Below range * Strong revenue growth in laboratory and Canadian operations * Customer service consolidations impacting acute sales * Mix changes affecting gross margin; investments in customer service impacting segment profit margin MPM + 6 - 8% + 10 - 12% Above range * New contracts; product innovation; international growth; impact of restructuring and sourcing initiatives; impact of DBI acquisition CTS + 10 - 15% + 15 - 20% Below range * Strong product sales for Alaris and Pyxis products; new product launches; continued impact of operational improvements; international expansion; impact of MedMined acquisition * Increased investment in innovation, quality and service * Estimate of SE pump fix; impact of Care Fusion acquisition Return on Equity³ : 15% - 20% In line with long-term goal Operating Cash Flow: > 100% of net earnings In line with long-term goal Cash Returned up to 50% of OCF, via share - Quarterly dividend $0.09 per share to Shareholders: repurchase and dividends - PTS net proceeds to be utilized for incremental share repurchase Credit Rating: Strong investment grade Continued progress from BBB 1 Non-GAAP diluted EPS from continuing operations. 2 Segment profit growth rates represent organic growth only (except as noted), and exclude the impact of equity compensation. 3 Non-GAAP return on equity. One Year Targets Long-Term Financial Goals FY07 Segment Profit2 growth vs. long-term target Segment Profit2 |

15 Other Items PTS Divestiture 8-K Updating Historical Financials – Reflects new reportable segments – PTS in discontinued operations – Allocation of equity compensation to segments |

CARDINAL HEALTH, INC. AND SUBSIDIARIES

GAAP / NON-GAAP RECONCILIATION

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Third Quarter 2007 | | | Year-to-Date 2007 | |

(in millions, except per Common Share

amounts) | | GAAP | | | Special Items | | Impairment Charges and Other | | Non-GAAP | | | GAAP | | | Special Items | | Impairment Charges and Other | | Non-GAAP | |

| Operating Earnings / (Loss) | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Amount | | $ | (10 | ) | | $ | 612 | | $ | 4 | | $ | 606 | | | $ | 953 | | | $ | 654 | | $ | 18 | | $ | 1,625 | |

Growth Rate | | | (102 | )% | | | | | | | | | 9 | % | | | (30 | )% | | | | | | | | | 15 | % |

| | | | | | | | |

| Provision for Income Taxes | | $ | (37 | ) | | $ | 220 | | $ | 2 | | $ | 184 | | | $ | 249 | | | $ | 233 | | $ | 2 | | $ | 483 | |

| | | | | | | | |

| Earnings / (Loss) from Continuing Operations | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Amount | | $ | (5 | ) | | $ | 392 | | $ | 2 | | $ | 390 | | | $ | 602 | | | $ | 421 | | $ | 16 | | $ | 1,039 | |

Growth Rate | | | (101 | )% | | | | | | | | | 10 | % | | | (30 | )% | | | | | | | | | 16 | % |

| | | | | | | | |

| Diluted EPS from Continuing Operations1 | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Amount | | $ | (0.01 | ) | | $ | 0.96 | | $ | 0.01 | | $ | 0.96 | | | $ | 1.47 | | | $ | 1.03 | | $ | 0.04 | | $ | 2.54 | |

Growth Rate | | | (101 | )% | | | | | | | | | 16 | % | | | (27 | )% | | | | | | | | | 22 | % |

| | |

| | | Third Quarter 2006 | | | Year-to-Date 2006 | |

| | | GAAP | | | Special Items | | Impairment

Charges and

Other | | Non-GAAP | | | GAAP | | | Special Items | | Impairment

Charges and

Other | | Non-GAAP | |

Operating Earnings | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Amount | | $ | 535 | | | $ | 13 | | $ | 5 | | $ | 553 | | | $ | 1,358 | | | $ | 48 | | $ | 5 | | $ | 1,410 | |

Growth Rate | | | (3 | )% | | | | | | | | | (8 | )% | | | 6 | % | | | | | | | | | 1 | % |

| | | | | | | | |

Provision for Income Taxes | | $ | 168 | | | $ | 4 | | $ | 2 | | $ | 174 | | | $ | 421 | | | $ | 13 | | $ | 2 | | $ | 436 | |

| | | | | | | | |

| Earnings from Continuing Operations | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Amount | | $ | 340 | | | $ | 9 | | $ | 4 | | $ | 353 | | | $ | 860 | | | $ | 35 | | $ | 3 | | $ | 897 | |

Growth Rate | | | (2 | )% | | | | | | | | | (7 | )% | | | 8 | % | | | | | | | | | 2 | % |

| | | | | | | | |

| Diluted EPS from Continuing Operations | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Amount | | $ | 0.80 | | | $ | 0.02 | | $ | 0.01 | | $ | 0.83 | | | $ | 2.00 | | | $ | 0.08 | | $ | 0.01 | | $ | 2.09 | |

The sum of the components may not equal the total due to rounding

1 | The weighted average number of shares used in the non-GAAP calculation includes the dilutive potential Common Shares as there is income from continuing operations on a non-GAAP basis. |

CARDINAL HEALTH, INC. AND SUBSIDIARIES

GAAP / NON-GAAP RECONCILIATION

| | | | | | | | | | | | | | | | |

| | | Third Quarter | | | Year-to-Date | |

| (in millions) | | 2007 | | | 2006 | | | 2007 | | | 2006 | |

GAAPreturn on equity | | | 0.9 | % | | | 6.8 | % | | | 16.3 | % | | | 10.4 | % |

| | | | |

Non-GAAP Return on Equity | | | | | | | | | | | | | | | | |

Net earnings | | $ | 19.0 | | | $ | 146.8 | | | $ | 1,028.9 | | | $ | 679.1 | |

Special items, net of tax, in continuing operations | | | 392.3 | | | | 9.4 | | | | 421.1 | | | | 34.9 | |

Special items, net of tax, in discontinued operations | | | 1.3 | | | | 6.0 | | | | 4.4 | | | | 12.0 | |

Income tax benefit related to PTS discontinued operations | | | — | | | | — | | | | (425.0 | ) | | | — | |

| | | | | | | | | | | | | | | | |

Adjusted net earnings | | $ | 412.6 | | | $ | 162.2 | | | $ | 1,029.4 | | | $ | 726.0 | |

| | | | |

Annualized | | | 1,650.4 | | | | 648.8 | | | | 1,372.5 | | | | 968.0 | |

| | | | |

Divided by average shareholders’ equity1 | | $ | 8,388.6 | | | $ | 8,668.9 | | | $ | 8,422.3 | | | $ | 8,702.4 | |

| | | | |

Non-GAAP return on equity | | | 19.7 | % | | | 7.5 | % | | | 16.3 | % | | | 11.1 | % |

| | |

| | | Third Quarter | | | Year-to-Date | |

| (in millions) | | 2007 | | | 2006 | | | 2007 | | | 2006 | |

GAAP return on invested capital | | | 0.36 | % | | | 2.76 | % | | | 6.49 | % | | | 4.28 | % |

| | | | |

Non-GAAP Return on Invested Capital | | | | | | | | | | | | | | | | |

Net earnings | | $ | 19.0 | | | $ | 146.8 | | | $ | 1,028.9 | | | $ | 679.1 | |

Special items, net of tax, in continuing operations | | | 392.3 | | | | 9.4 | | | | 421.1 | | | | 34.9 | |

Special items, net of tax, in discontinued operations | | | 1.3 | | | | 6.0 | | | | 4.4 | | | | 12.0 | |

Interest expense and other, net of tax | | | 20.6 | | | | 16.5 | | | | 65.4 | | | | 47.9 | |

Income tax benefit related to PTS discontinued operations | | | — | | | | — | | | | (425.0 | ) | | | — | |

| | | | | | | | | | | | | | | | |

Adjusted net earnings | | $ | 433.2 | | | $ | 178.7 | | | $ | 1,094.8 | | | $ | 773.9 | |

| | | | |

Annualized | | | 1,732.8 | | | | 714.8 | | | | 1,459.7 | | | | 1,031.9 | |

| | | | |

Divided by average total invested capital2 | | $ | 21,206.0 | | | $ | 21,292.2 | | | $ | 21,128.5 | | | $ | 21,173.5 | |

| | | | |

Non-GAAP return on invested capital | | | 8.17 | % | | | 3.35 | % | | | 6.91 | % | | | 4.87 | % |

1 | The average shareholders’ equity shown above is calculated using the average of the prior and current quarters except for year-to-date which is calculated as the average of the prior years’ fourth quarter plus each of the current year quarters. |

2 | The average total invested capital shown above is calculated using the average of the prior and current quarters except for year-to-date which is calculated as the average of the prior year fourth quarter plus each of the current year quarters. Total invested capital is calculated as the sum of the current portion of long-term obligations and other short-term borrowings, long-term obligations, current portion of long-term obligations and other short-term borrowings in discontinued operations, long-term obligations in discontinued operations, total shareholders’ equity and unrecorded goodwill. Unrecorded goodwill is $9.7 billion for all periods presented. Current portion of long-term obligations and other short-term borrowings in discontinued operations, and long-term obligations in discontinued operations were $59.2 million, $46.6 million, $41.3 million and $12.3 million at June 30, 2006, September 30, 2006, December 31, 2006 and March 31, 2007, respectively, and $81.1 million, $84.7 million, $79.2 million and $86.6 million at June 30, 2005, September 30, 2005, December 31, 2005 and March 31, 2006, respectively. |

CARDINAL HEALTH, INC. AND SUBSIDIARIES

GAAP / NON-GAAP RECONCILIATION

| | | | | | | | | | | | | | | | |

| | | Third Quarter | | | Year-to-Date | |

| (in millions) | | 2007 | | | 2006 | | | 2007 | | | 2006 | |

GAAP effective tax rate from continuing operations | | | 88.2 | % | | | 33.1 | % | | | 29.3 | % | | | 32.9 | % |

| | | | |

Non-GAAP Effective Tax Rate from Continuing Operations | | | | | | | | | | | | | | | | |

Earnings / (loss) before income taxes and discontinued operations | | $ | (42.0 | ) | | $ | 508.7 | | | $ | 850.9 | | | $ | 1,280.8 | |

Special items | | | 612.0 | | | | 13.3 | | | | 653.8 | | | | 47.8 | |

| | | | | | | | | | | | | | | | |

Adjusted earnings before income taxes and discontinued operations | | $ | 570.0 | | | $ | 522.0 | | | $ | 1,504.7 | | | $ | 1,328.6 | |

| | | | |

Provision for income taxes | | $ | (37.1 | ) | | $ | 168.4 | | | $ | 248.9 | | | $ | 421.3 | |

Special items tax benefit | | | 219.7 | | | | 3.9 | | | | 232.7 | | | | 12.9 | |

| | | | | | | | | | | | | | | | |

Adjusted provision for income taxes | | $ | 182.6 | | | $ | 172.3 | | | $ | 481.6 | | | $ | 434.2 | |

| | | | |

Non-GAAP effective tax rate from continuing operations | | | 32.0 | % | | | 33.0 | % | | | 32.0 | % | | | 32.7 | % |

| | | |

| | | Third Quarter | | | | | | | |

| | | 2007 | | | 2006 | | | | | | | |

Debt to total capital | | | 29 | % | | | 24 | % | | | | | | | | |

| | | | |

Net Debt to Capital | | | | | | | | | | | | | | | | |

Current portion of long-term obligations and other short-term borrowings | | $ | 296.9 | | | $ | 214.0 | | | | | | | | | |

Long-term obligations, less current portion and other short-term borrowings | | | 2,899.0 | | | | 2,535.7 | | | | | | | | | |

| | | | | | | | | | | | | | | | |

Debt | | $ | 3,195.9 | | | $ | 2,749.7 | | | | | | | | | |

Cash and equivalents | | | (866.5 | ) | | | (1,566.8 | ) | | | | | | | | |

Short-term investments available for sale | | | (300.0 | ) | | | (499.2 | ) | | | | | | | | |

| | | | | | | | | | | | | | | | |

Net debt | | $ | 2,029.4 | | | $ | 683.7 | | | | | | | | | |

Total shareholders’ equity | | $ | 7,869.5 | | | $ | 8,586.8 | | | | | | | | | |

Capital | | $ | 9,898.9 | | | $ | 9,270.5 | | | | | | | | | |

Net debt to capital | | | 21 | % | | | 7 | % | | | | | | | | |

Forward-Looking Non-GAAP Financial Measures

The Company presents non-GAAP diluted EPS from continuing operations and growth rate and non-GAAP return on equity on a forward-looking basis. The Company is unable to provide a quantitative reconciliation of these forward-looking non-GAAP measures to the most comparable forward-looking GAAP measures because the Company cannot reliably forecast special items and impairment charges and other, which are difficult to predict and estimate and are primarily dependent on future events. Please note that the unavailable reconciling items could significantly impact the Company’s future earnings.

CARDINAL HEALTH, INC. AND SUBSIDIARIES

GAAP / NON-GAAP RECONCILIATION

(in millions)

HEALTHCARE SUPPLY CHAIN SERVICES

Pharmaceutical

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | First Quarter Fiscal 2007 | | | Second Quarter Fiscal 2007 | | | Third Quarter Fiscal 2007 | | | 2007 | |

| | | July | | August | | September | | Total | | | October | | November | | December | | Total | | | January | | February | | March | | Total | | | YTD | |

Economic Profit Margin | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Segment profit | | | | | | | | | | | $ | 288.7 | | | | | | | | | | | | $ | 328.0 | | | | | | | | | | | | $ | 379.7 | | | $ | 996.4 | |

Effective tax rate from continuing operations | | | | | | | | | | | | 36.2 | % | | | | | | | | | | | | 36.2 | % | | | | | | | | | | | | 36.2 | % | | | 36.2 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net operating earnings, after-tax (NOPAT) | | | | | | | | | | | $ | 184.2 | | | | | | | | | | | | $ | 209.3 | | | | | | | | | | | | $ | 242.3 | | | $ | 635.8 | |

Total assets | | $ | 11,549.8 | | $ | 12,206.9 | | $ | 11,620.0 | | | | | | $ | 11,781.8 | | $ | 11,624.6 | | $ | 11,663.1 | | | | | | $ | 11,423.2 | | $ | 11,681.7 | | $ | 12,031.9 | | | | | | | | |

Less: assets from discontinued operations | | | 107.5 | | | 109.4 | | | — | | | | | | | — | | | — | | | — | | | | | | | — | | | — | | | — | | | | | | | | |

Less: accounts payable | | | 6,644.9 | | | 7,115.6 | | | 6,979.1 | | | | | | | 6,897.3 | | | 6,836.3 | | | 6,912.9 | | | | | | | 6,906.3 | | | 7,252.4 | | | 7,513.2 | | | | | | | | |

Less: other accrued liabilities | | | 1,069.5 | | | 1,088.6 | | | 1,016.3 | | | | | | | 1,092.8 | | | 1,100.2 | | | 1,036.3 | | | | | | | 1,078.3 | | | 1,059.3 | | | 1,154.0 | | | | | | | | |

Less: liabilities from businesses held for sale | | | — | | | — | | | — | | | | | | | — | | | — | | | — | | | | | | | — | | | — | | | — | | | | | | | | |

Less: deferred income taxes and other liabilities | | | 82.1 | | | 82.1 | | | 71.0 | | | | | | | 89.3 | | | 89.7 | | | 71.6 | | | | | | | 90.3 | | | 90.3 | | | 69.6 | | | | | | | | |

Less: goodwill and other intangibles, net | | | 1,354.5 | | | 1,361.8 | | | 1,332.4 | | | | | | | 1,328.7 | | | 1,335.0 | | | 1,335.7 | | | | | | | 1,339.6 | | | 1,348.9 | | | 1,349.4 | | | | | | | | |

Less: cash and equivalents | | | 42.2 | | | 57.4 | | | 75.0 | | | | | | | 91.3 | | | 102.7 | | | 113.6 | | | | | | | 115.5 | | | 113.0 | | | 135.3 | | | | | | | | |

Less: short-term investments available for sale | | | — | | | — | | | — | | | | | | | — | | | — | | | — | | | | | | | — | | | — | | | — | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Tangible capital | | $ | 2,249.1 | | $ | 2,392.0 | | $ | 2,146.2 | | $ | 2,262.4 | | | $ | 2,282.4 | | $ | 2,160.7 | | $ | 2,193.0 | | $ | 2,212.0 | | | $ | 1,893.2 | | $ | 1,817.8 | | $ | 1,810.4 | | $ | 1,840.5 | | | $ | 2,105.0 | |

Multiplied by weighted average cost of capital | | | | | | | | | | | | 2.3 | % | | | | | | | | | | | | 2.3 | % | | | | | | | | | | | | 2.3 | % | | | 2.3 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Capital charge | | | | | | | | | | | $ | 52.0 | | | | | | | | | | | | $ | 50.9 | | | | | | | | | | | | $ | 42.3 | | | $ | 48.4 | |

Economic profit | | | | | | | | | | | $ | 132.2 | | | | | | | | | | | | $ | 158.4 | | | | | | | | | | | | $ | 200.0 | | | $ | 587.4 | |

Revenue | | | | | | | | | | | $ | 18,532.8 | | | | | | | | | | | | $ | 19,237.6 | | | | | | | | | | | | $ | 19,246.4 | | | $ | 57,016.8 | |

Economic profit margin | | | | | | | | | | | | 0.71 | % | | | | | | | | | | | | 0.82 | % | | | | | | | | | | | | 1.04 | % | | | 1.03 | % |

(1) | Tangible Capital is a quarterly average calculated as total assets allocated to the segment less (total liabilities allocated to the segment, goodwill and intangibles, cash and equivalents and short term investments available for sale) |

(2) | The sum of the components may not equal due to rounding |

CARDINAL HEALTH, INC. AND SUBSIDIARIES

GAAP / NON-GAAP RECONCILIATION

(in million)

HEALTHCARE SUPPLY CHAIN SERVICES

Medical

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | First Quarter Fiscal 2007 | | | Second Quarter Fiscal 2007 | | | Third Quarter Fiscal 2007 | | | 2007 | |

| | | July | | August | | September | | Total | | | October | | November | | December | | Total | | | January | | February | | March | | Total | | | YTD | |

Economic Profit Margin | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Segment profit | | | | | | | | | | | $ | 64.1 | | | | | | | | | | | | $ | 81.9 | | | | | | | | | | | | $ | 88.7 | | | $ | 234.8 | |

Effective tax rate from continuing operations | | | | | | | | | | | | 31.0 | % | | | | | | | | | | | | 31.0 | % | | | | | | | | | | | | 31.0 | % | | | 31.0 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net operating earnings, after-tax (NOPAT) | | | | | | | | | | | $ | 44.2 | | | | | | | | | | | | $ | 56.5 | | | | | | | | | | | | $ | 61.2 | | | $ | 162.0 | |

Total assets | | $ | 2,442.1 | | $ | 2,437.6 | | $ | 2,456.6 | | | | | | $ | 2,492.0 | | $ | 2,525.1 | | $ | 2,505.1 | | | | | | $ | 2,562.1 | | $ | 2,521.4 | | $ | 2,476.4 | | | | | | | | |

Less: assets from discontinued operations | | | — | | | — | | | — | | | | | | | — | | | — | | | — | | | | | | | — | | | — | | | — | | | | | | | | |

Less: accounts payable | | | 534.8 | | | 478.7 | | | 510.4 | | | | | | | 510.6 | | | 524.1 | | | 544.4 | | | | | | | 505.2 | | | 522.0 | | | 528.5 | | | | | | | | |

Less: other accrued liabilities | | | 71.1 | | | 78.1 | | | 49.4 | | | | | | | 77.4 | | | 61.6 | | | 20.9 | | | | | | | 52.1 | | | 52.3 | | | 16.2 | | | | | | | | |

Less: liabilities from businesses held for sale | | | — | | | — | | | — | | | | | | | — | | | — | | | — | | | | | | | — | | | — | | | — | | | | | | | | |

Less: deferred income taxes and other liabilities | | | 58.2 | | | 58.1 | | | 53.0 | | | | | | | 57.2 | | | 55.4 | | | 44.4 | | | | | | | 48.3 | | | 48.4 | | | 58.5 | | | | | | | | |

Less: goodwill and other intangibles, net | | | 378.8 | | | 377.8 | | | 377.7 | | | | | | | 385.3 | | | 384.7 | | | 378.3 | | | | | | | 377.2 | | | 378.1 | | | 378.0 | | | | | | | | |

Less: cash and equivalents | | | 2.9 | | | 3.0 | | | 4.1 | | | | | | | 4.2 | | | 9.8 | | | 7.4 | | | | | | | 6.7 | | | 2.9 | | | 17.0 | | | | | | | | |

Less: short-term investments available for sale | | | — | | | — | | | — | | | | | | | — | | | — | | | — | | | | | | | — | | | — | | | — | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Tangible capital | | $ | 1,396.3 | | $ | 1,441.9 | | $ | 1,462.0 | | $ | 1,433.4 | | | $ | 1,457.3 | | $ | 1,489.5 | | $ | 1,509.7 | | $ | 1,485.5 | | | $ | 1,572.6 | | $ | 1,517.7 | | $ | 1,478.2 | | $ | 1,522.8 | | | $ | 1,480.6 | |

Multiplied by weighted average cost of capital | | | | | | | | | | | | 2.3 | % | | | | | | | | | | | | 2.3 | % | | | | | | | | | | | | 2.3 | % | | | 2.3 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Capital charge | | | | | | | | | | | $ | 33.0 | | | | | | | | | | | | $ | 34.2 | | | | | | | | | | | | $ | 35.0 | | | $ | 34.1 | |

Economic profit | | | | | | | | | | | $ | 11.2 | | | | | | | | | | | | $ | 22.3 | | | | | | | | | | | | $ | 26.2 | | | $ | 127.9 | |

Revenue | | | | | | | | | | | $ | 1,806.1 | | | | | | | | | | | | $ | 1,872.5 | | | | | | | | | | | | $ | 1,906.9 | | | $ | 5,585.4 | |

Economic profit margin | | | | | | | | | | | | 0.62 | % | | | | | | | | | | | | 1.19 | % | | | | | | | | | | | | 1.37 | % | | | 2.29 | % |

(1) | Tangible Capital is a quarterly average calculated as total assets allocated to the segment less (total liabilities allocated to the segment, goodwill and intangibles, cash and equivalents and short term investments available for sale) |

(2) | The sum of the components may not equal due to rounding |

CARDINAL HEALTH, INC. AND SUBSIDIARIES

GAAP / NON-GAAP RECONCILIATION

(in millions)

HEALTHCARE SUPPLY CHAIN SERVICES

Pharmaceutical

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | First Quarter Fiscal 2006 | | | Second Quarter Fiscal 2006 | | | Third Quarter Fiscal 2006 | | | Fiscal 2006 | |

| | | July | | August | | September | | Total | | | October | | November | | December | | Total | | | January | | February | | March | | Total | | | YTD | |

Economic Profit Margin | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Segment profit | | | | | | | | | | | $ | 225.1 | | | | | | | | | | | | $ | 276.0 | | | | | | | | | | | | $ | 329.5 | | | $ | 830.5 | |

Effective tax rate from continuing operations | | | | | | | | | | | | 36.8 | % | | | | | | | | | | | | 36.8 | % | | | | | | | | | | | | 36.8 | % | | | 36.8 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net operating earnings, after-tax (NOPAT) | | | | | | | | | | | $ | 142.3 | | | | | | | | | | | | $ | 174.4 | | | | | | | | | | | | $ | 208.2 | | | $ | 524.9 | |

Total assets | | $ | 10,521.1 | | $ | 10,384.3 | | $ | 11,050.2 | | | | | | $ | 10,499.1 | | $ | 10,379.0 | | $ | 10,760.7 | | | | | | $ | 10,770.0 | | $ | 10,896.3 | | $ | 11,748.0 | | | | | | | | |

Less: assets from discontinued operations | | | 173.1 | | | 188.3 | | | 191.0 | | | | | | | 197.3 | | | 190.6 | | | 178.1 | | | | | | | 179.0 | | | 188.2 | | | 102.0 | | | | | | | | |

Less: accounts payable | | | 5,506.3 | | | 5,692.3 | | | 6,238.9 | | | | | | | 5,626.8 | | | 5,867.5 | | | 6,167.7 | | | | | | | 6,086.9 | | | 6,336.7 | | | 7,243.7 | | | | | | | | |

Less: other accrued liabilities | | | 970.8 | | | 912.7 | | | 890.1 | | | | | | | 929.7 | | | 899.0 | | | 847.0 | | | | | | | 908.9 | | | 887.9 | | | 987.3 | | | | | | | | |

Less: liabilities from businesses held for sale | | | 222.9 | | | 222.9 | | | 222.9 | | | | | | | 186.3 | | | 186.3 | | | 186.3 | | | | | | | 67.6 | | | 67.6 | | | 67.6 | | | | | | | | |

Less: deferred income taxes and other liabilities | | | 109.1 | | | 106.4 | | | 44.5 | | | | | | | 107.6 | | | 107.7 | | | 43.6 | | | | | | | 107.2 | | | 107.1 | | | 62.9 | | | | | | | | |

Less: goodwill and other intangibles, net | | | 962.4 | | | 958.6 | | | 1,168.0 | | | | | | | 959.5 | | | 958.1 | | | 1,157.3 | | | | | | | 1,162.6 | | | 1,183.6 | | | 1,210.2 | | | | | | | | |

Less: cash and equivalents | | | 59.2 | | | 66.6 | | | 70.3 | | | | | | | 80.3 | | | 88.9 | | | 108.2 | | | | | | | 73.4 | | | 74.0 | | | 88.3 | | | | | | | | |

Less: short-term investments available for sale | | | — | | | — | | | — | | | | | | | — | | | — | | | — | | | | | | | — | | | — | | | — | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Tangible capital | | $ | 2,517.3 | | $ | 2,236.5 | | $ | 2,224.5 | | $ | 2,326.1 | | | $ | 2,411.6 | | $ | 2,080.9 | | $ | 2,072.5 | | $ | 2,188.3 | | | $ | 2,184.4 | | $ | 2,051.2 | | $ | 1,986.0 | | $ | 2,073.9 | | | $ | 2,196.1 | |

Multiplied by weighted average cost of capital | | | | | | | | | | | | 2.3 | % | | | | | | | | | | | | 2.3 | % | | | | | | | | | | | | 2.3 | % | | | 2.3 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Capital charge | | | | | | | | | | | $ | 53.5 | | | | | | | | | | | | $ | 50.3 | | | | | | | | | | | | $ | 47.7 | | | $ | 50.5 | |

Economic profit | | | | | | | | | | | $ | 88.8 | | | | | | | | | | | | $ | 124.1 | | | | | | | | | | | | $ | 160.5 | | | $ | 474.4 | |

Revenue | | | | | | | | | | | $ | 16,532.8 | | | | | | | | | | | | $ | 16,977.2 | | | | | | | | | | | | $ | 17,784.6 | | | $ | 51,294.6 | |

Economic profit margin | | | | | | | | | | | | 0.54 | % | | | | | | | | | | | | 0.73 | % | | | | | | | | | | | | 0.90 | % | | | 0.92 | % |

(1) | Tangible Capital is a quarterly average calculated as total assets allocated to the segment less (total liabilities allocated to the segment, goodwill and intangibles, cash and equivalents and short term investments available for sale) |

(2) | The sum of the components may not equal due to rounding |

CARDINAL HEALTH, INC. AND SUBSIDIARIES

GAAP / NON-GAAP RECONCILIATION

(in millions)

HEALTHCARE SUPPLY CHAIN SERVICES

Medical

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | First Quarter Fiscal 2006 | | | Second Quarter Fiscal 2006 | | | Third Quarter Fiscal 2006 | | | Fiscal 2006 | |

| | | July | | August | | September | | Total | | | October | | November | | December | | Total | | | January | | February | | March | | Total | | | YTD | |

Economic Profit Margin | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Segment profit | | | | | | | | | | | $ | 64.5 | | | | | | | | | | | | $ | 71.4 | | | | | | | | | | | | $ | 93.5 | | | $ | 229.4 | |

Effective tax rate from continuing operations | | | | | | | | | | | | 30.1 | % | | | | | | | | | | | | 30.1 | % | | | | | | | | | | | | 30.1 | % | | | 30.1 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net operating earnings, after-tax (NOPAT) | | | | | | | | | | | $ | 45.1 | | | | | | | | | | | | $ | 49.9 | | | | | | | | | | | | $ | 65.4 | | | $ | 160.4 | |

Total assets | | $ | 2,267.1 | | $ | 2,204.7 | | $ | 2,260.7 | | | | | | $ | 2,362.1 | | $ | 2,414.5 | | $ | 2,436.0 | | | | | | $ | 2,491.0 | | $ | 2,436.4 | | $ | 2,385.5 | | | | | | | | |

Less: assets from discontinued operations | | | — | | | — | | | — | | | | | | | — | | | — | | | — | | | | | | | — | | | — | | | — | | | | | | | | |

Less: accounts payable | | | 496.2 | | | 439.0 | | | 534.4 | | | | | | | 530.4 | | | 481.4 | | | 498.2 | | | | | | | 513.2 | | | 498.0 | | | 480.3 | | | | | | | | |

Less: other accrued liabilities | | | 127.3 | | | 124.4 | | | 85.2 | | | | | | | 109.4 | | | 114.4 | | | 79.6 | | | | | | | 100.9 | | | 100.4 | | | 39.7 | | | | | | | | |

Less: liabilities from businesses held for sale | | | — | | | — | | | — | | | | | | | — | | | — | | | — | | | | | | | — | | | — | | | — | | | | | | | | |

Less: deferred income taxes and other liabilities | | | 66.9 | | | 67.7 | | | 62.2 | | | | | | | 68.3 | | | 51.2 | | | 46.7 | | | | | | | 52.8 | | | 52.4 | | | 86.3 | | | | | | | | |

Less: goodwill and other intangibles, net | | | 396.5 | | | 397.6 | | | 396.8 | | | | | | | 396.8 | | | 415.9 | | | 416.2 | | | | | | | 418.2 | | | 374.7 | | | 374.7 | | | | | | | | |

Less: cash and equivalents | | | 8.4 | | | 8.0 | | | 8.5 | | | | | | | 8.4 | | | 9.1 | | | 10.0 | | | | | | | 4.4 | | | 4.8 | | | 5.0 | | | | | | | | |

Less: short-term investments available for sale | | | — | | | — | | | — | | | | | | | — | | | — | | | — | | | | | | | — | | | — | | | — | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Tangible capital | | $ | 1,171.8 | | $ | 1,168.0 | | $ | 1,173.6 | | $ | 1,171.1 | | | $ | 1,248.8 | | $ | 1,342.5 | | $ | 1,385.3 | | $ | 1,325.5 | | | $ | 1,401.5 | | $ | 1,406.1 | | $ | 1,399.5 | | $ | 1,402.4 | | | $ | 1,299.7 | |

Multiplied by weighted average cost of capital | | | | | | | | | | | | 2.3 | % | | | | | | | | | | | | 2.3 | % | | | | | | | | | | | | 2.3 | % | | | 2.3 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Capital charge | | | | | | | | | | | $ | 26.9 | | | | | | | | | | | | $ | 30.5 | | | | | | | | | | | | $ | 32.3 | | | $ | 29.9 | |

Economic profit | | | | | | | | | | | $ | 18.2 | | | | | | | | | | | | $ | 19.4 | | | | | | | | | | | | $ | 33.1 | | | $ | 130.5 | |

Revenue | | | | | | | | | | | $ | 1,762.6 | | | | | | | | | | | | $ | 1,770.2 | | | | | | | | | | | | $ | 1,828.6 | | | $ | 5,361.4 | |

Economic profit margin | | | | | | | | | | | | 1.03 | % | | | | | | | | | | | | 1.10 | % | | | | | | | | | | | | 1.81 | % | | | 2.43 | % |

(1) | Tangible Capital is a quarterly average calculated as total assets allocated to the segment less (total liabilities allocated to the segment, goodwill and intangibles, cash and equivalents and short term investments available for sale) |

(2) | The sum of the components may not equal due to rounding |

CARDINAL HEALTH, INC. AND SUBSIDIARIES

GAAP / NON-GAAP RECONCILIATION

| | | | |

| (in millions) | | Third Quarter

2007 | |

GAAP operating margin | | | (0.04 | )% |

| |

Non-GAAP Operating Margin | | | | |

Operating earnings / (loss) | | $ | (9.8 | ) |

Special items | | | 612.0 | |

Impairment charges and other | | | 3.6 | |

| | | | |

Non-GAAP operating earnings | | $ | 605.8 | |

| |

Revenue | | $ | 21,867.1 | |

| |

Non-GAAP operating margin | | | 2.77 | % |

CARDINAL HEALTH, INC. AND SUBSIDIARIES

DEFINITIONS

GAAP

Debt: long-term obligations plus short-term borrowings

Debt to Total Capital: debt divided by (debt plus total shareholders’ equity)

Diluted EPS from Continuing Operations: earnings / (loss) from continuing operations divided by diluted weighted average shares outstanding

Effective Tax Rate from Continuing Operations: provision for income taxes divided by earnings / (loss) before income taxes and discontinued operations

Operating Cash Flow: net cash provided by / (used in) operating activities from continuing operations

Segment Profit: segment revenue minus (segment cost of products sold and segment selling, general and administrative expenses)

Segment Profit Margin: segment profit divided by revenue

Segment Profit Mix: segment profit divided by total segment profit for all operating segments

Return on Equity:annualized net earnings divided by average shareholders’ equity

Return on Invested Capital: annualized net earnings divided by (average total shareholders’ equity plus debt plus unrecorded goodwill)

Revenue Mix:segment revenue divided by total revenue for all segments

NON-GAAP

Economic Profit:segment net operating earnings, after-tax minus (tangible capital multiplied by weighted average cost of capital);

Tangible Capital: is the quarterly average calculated as total assets allocated to the segment less (total liabilities allocated to the segment less (total liabilities allocated to the segment, goodwill and intangibles, cash and equivalents and short term investments available for sale)

Economic Profit Margin:economic profit divided by revenue

Net Debt to Capital: net debt divided by (net debt plus total shareholders’ equity)

Net Debt:debt minus (cash and equivalents and short-term investments available for sale)

Non-GAAP Diluted EPS from Continuing Operations: non-GAAP earnings from continuing operations divided by diluted weighted average shares outstanding

Non-GAAP Earnings from Continuing Operations:earnings / (loss) from continuing operations excluding special items and impairment charges and other, both net of tax

Non-GAAP Earnings from Continuing Operations Growth Rate: (current period non-GAAP earnings from continuing operations minus prior period non-GAAP earnings from continuing operations) divided by prior period non-GAAP earnings from continuing operations

Non-GAAP Effective Tax Rate from Continuing Operations:(provision for income taxes adjusted for special items) divided by (earnings / (loss) before income taxes and discontinued operations adjusted for special items)

Non-GAAP Operating Earnings: operating earnings / (loss) excluding special items and impairment charges and other

Non-GAAP Operating Earnings Growth Rate:(current period non-GAAP operating earnings minus prior period non-GAAP operating earnings) divided by prior period non-GAAP operating earnings

Non-GAAP Operating Margin:non-GAAP operating earnings divided by revenue

Non-GAAP Return on Equity:(annualized current period net earnings plus special items minus special items tax benefit) divided by average shareholders’ equity1

Non-GAAP Return on Invested Capital: (annualized net earnings plus special items minus special items tax benefit plus interest expense and other) divided by (average total shareholders’ equity plus debt plus unrecorded goodwill)1

1 | For the nine months ended March 31, 2007, the denominator in calculating this non-GAAP financial measure also excludes a $425 million net of tax benefit associated with the PTS sale that was recorded in discontinued operations for the second quarter of fiscal 2007. |