Essential to care Q4FY2008 and FY2009E Investor/Analyst Call August 7, 2008 Exhibit 99.3 |

2 Forward-looking statements and GAAP reconciliation This presentation contains forward-looking statements addressing expectations, prospects, estimates and other matters that are dependent upon future events or developments. These matters are subject to risks and uncertainties that could cause actual results to differ materially from those projected, anticipated or implied. The most significant of these uncertainties are described in Cardinal Health's Form 10-K, Form 10-Q and Form 8-K reports (including all amendments to those reports) and exhibits to those reports, and include (but are not limited to) the following: uncertainties regarding the decision to explore the separation of the company’s clinical and medical products businesses and the impacts of such decision if the separation is accomplished; competitive pressures in Cardinal Health's various lines of business; the loss of one or more key customer or supplier relationships or changes to the terms of those relationships; uncertainties relating to the timing of generic or branded pharmaceutical introductions and the frequency or rate of branded pharmaceutical price appreciation or generic pharmaceutical price deflation; changes in the distribution patterns or reimbursement rates for healthcare products and/or services; the results, consequences, effects or timing of any inquiry or investigation by any regulatory authority or any legal or administrative proceedings; future actions of regulatory bodies or government authorities relating to Cardinal Health's manufacturing or sale of products and other costs or claims that could arise from its manufacturing, compounding or repackaging operations or from its other services; difficulties, delays or additional costs in implementing the restructuring program announced on July 8, 2008; the costs, difficulties and uncertainties related to the integration of acquired businesses; conditions in the pharmaceutical market and general economic and market conditions. This presentation reflects management’s views as of August 7, 2008. Except to the extent required by applicable law, Cardinal Health undertakes no obligation to update or revise any forward-looking statement. In addition, this presentation includes non-GAAP financial measures. Cardinal Health provides definitions and reconciling information at the end of this presentation and on its investor relations page at www.cardinalhealth.com. A transcript of the conference call will be available on the investor relations page at www.cardinalhealth.com. |

3 Agenda Opening remarks Kerry Clark Chairman and Chief Executive Officer Financial overview Jeff Henderson Chief Financial Officer HSCS Comments George Barrett Vice Chairman and CEO Healthcare Supply Chain Services CMP Comments Dave Schlotterbeck Vice Chairman and CEO Clinical and Medical Products Q&A |

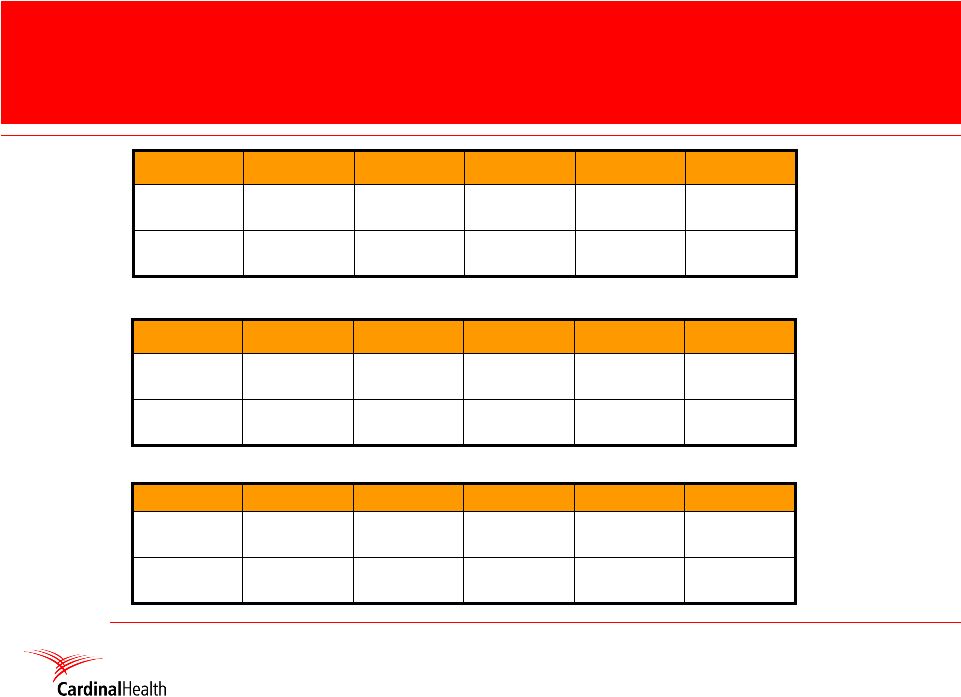

4 Q4 and YEFY08 Results * * * * * * |

5 Q4 FY2008 Financial Review $22,926 $543 $330 $0.92 $247 17% ($M) 3% 29% 39% 51% % Change 1 GAAP Basis $568 $348 $0.97 18% ($M) 6% 1% 9% % Change 1 Non-GAAP Basis 1 % change over prior year quarter Revenue Operating earnings Earnings from continuing ops Diluted EPS from continuing ops Operating cash flow Return on equity |

6 Operating Earnings/(Loss) ($M) Diluted EPS from Continuing Operations Operating Earnings/(Loss) ($M) Diluted EPS from Continuing Operations GAAP Consolidated $543 $0.92 $421 $0.61 Special Items $35 $0.06 $118 $0.28 Impairment Charges & Other ($10) ($0.01) ($1) -- Non-GAAP Consolidated $568 $0.97 $538 $0.89 Q4 FY 2008 Q4 FY 2007 Q4 FY2008 Operating Earnings and EPS |

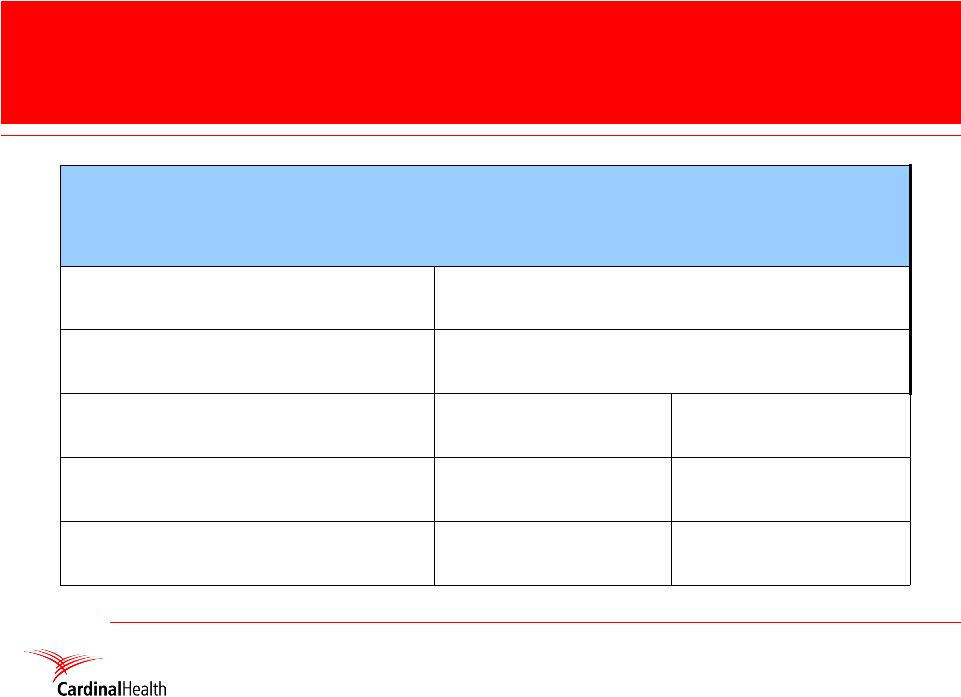

7 Healthcare Supply Chain Services Analysis Revenue Segment Profit Q4 FY08 ($M) 19,556 303 Q4 FY07 ($M) 1% (15%) % Change Revenue Segment Profit 1,929 83 8% (3)% Pharmaceutical Medical/Surgical 19,819 258 2,082 81 FY08 ($M) 76,573 1,300 FY07 ($M) 4% (14%) % Change 79,284 1,122 Q4 FY08 ($M) Q4 FY07 ($M) % Change FY08 ($M) FY07 ($M) % Change 7,514 318 8% (5%) 8,084 303 |

8 Clinical and Medical Products Analysis Revenue Segment Profit 500 58 46% 63% MPT CTS Revenue Segment Profit 756 144 3% 8% 727 95 780 156 Q4 FY08 ($M) Q4 FY07 ($M) % Change Q4 FY08 ($M) Q4 FY07 ($M) % Change FY08 ($M) FY07 ($M) % Change 2,687 386 8% 29% 2,890 497 FY08 ($M) 2,696 300 FY07 ($M) 1,836 198 % Change 47% 52% |

9 Full Year FY08 Financial Review $91,091 $2,129 $1,325 $3.64 $1,559 18% ($M) 5% 55% 58% 76% % Change 1 GAAP Basis $2,219 $1,385 $3.80 19% ($M) 3% -- 11% % Change 1 Non-GAAP Basis 1 % change over prior year quarter Revenue Operating earnings Earnings from continuing ops Diluted EPS from continuing ops Operating cash flow Return on equity |

10 Operating Earnings/(Loss) ($M) Diluted EPS from Continuing Operations Operating Earnings/(Loss) ($M) Diluted EPS from Continuing Operations GAAP Consolidated $2,129 $3.64 $1,374 $2.07 Special Items $123 $0.21 $772 $1.31 Impairment Charges & Other ($32) ($0.05) $17 $0.04 Non-GAAP Consolidated $2,219 $3.80 $2,163 $3.42 FY 2008 FY 2007 Full Year FY08 Operating Earnings and EPS |

11 Key Financial Value Drivers FY2008 Balance sheet management – Days of inventory declined from 28 to 25 days Q4FY07 vs. Q4FY08 – FY08 non-GAAP ROIC of 8.1% Capital deployment – Repurchased $1.1B in FY08 – Increased dividend by 17% to $0.14 per quarter in June 2008 Capital structure – Debt to total capital increased from 32% in Q4 FY07 to 33% in Q4 FY08 – Net debt to capital 1 increased from 22% in Q4FY07 to 25% in Q4FY08 FY08 non-GAAP return on equity of approximately 19% 1 Non-GAAP financial measure |

12 FY2009 Estimates / Assumptions * * * * * * |

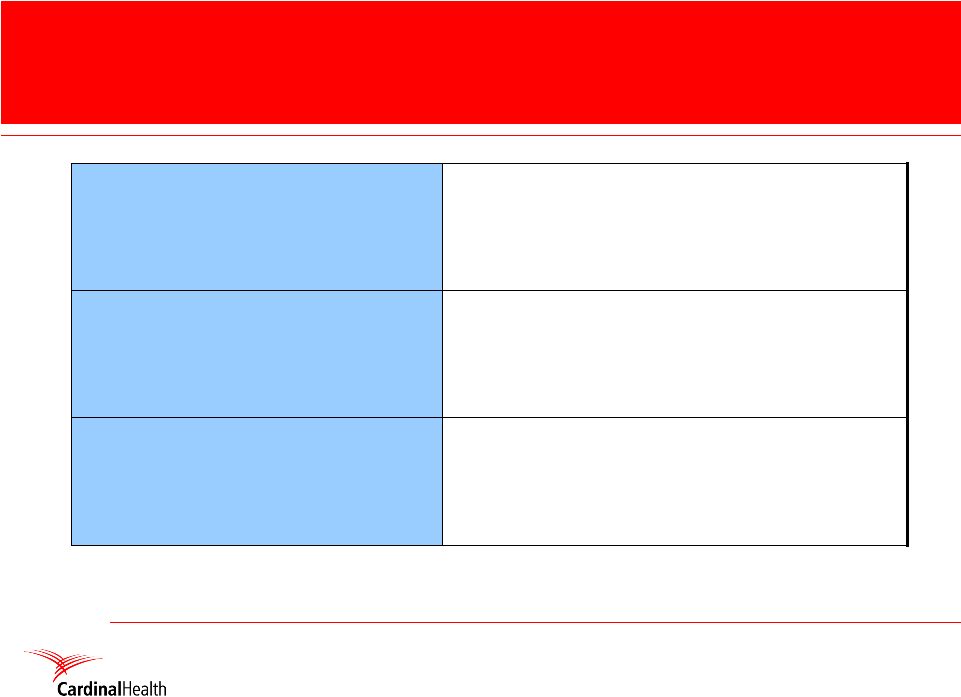

13 FY09 Financial Goals >20% >10% Clinical and Medical Products (CMP) Flat to (5%) >6% Healthcare Supply Chain Services (HSCS) Profit Growth Revenue Growth Segment $3.80 - $3.95 Non-GAAP EPS¹: 6-7% Total revenue growth: August 7, 2008 1 Non-GAAP diluted earnings per share from continuing operations |

14 FY09 Total Corporate Assumptions August 7, 2008 361M – 362M Diluted weighted average shares outstanding Approximately 34% Non-GAAP effective tax rate $180M - $190M Interest and other NOTE: This outlook assumes that the potential separation of the Company’s clinical and medical products businesses does not occur during fiscal 2009 and excludes any charges or significant expenses associated with the potential separation. |

15 FY09 Segment-Related Assumptions August 7, 2008 Healthcare Supply Chain Services Bulk revenue growth likely to exceed non-bulk Nuclear: assumes generic event; participation as distributor, not as manufacturer DEA settlement discussions ongoing in H1 Risk-adjusted “basket” of generic launches Expect recent pharma margin erosion to moderate Borschow accretive IT investments |

16 FY09 Segment-Related Assumptions August 7, 2008 Clinical and Medical Products Enturia accretive Fully reserved for Alaris remediation, resolved by CalYE08 Viasys synergy goals ahead of schedule R&D investments |

17 FY09(E) Revenue Product Information HSCS CMP ALL OTHER • Distribution of pharmaceutical, radiopharmaceutical & OTC products • Distribution of medical, surgical and laboratory products & medical procedure kits • Bulk v. non-bulk • Intravenous medication safety & infusion delivery systems • Medication & medical supply dispensing systems • Respiratory care products • Infection prevention products • Medical specialty products • Clinical intelligence solutions • Franchising and operating apothecary-style retail pharmacies • Pharmacy services • Medical access & specialty products |

18 Healthcare Supply Chain Services (HSCS) * * * * * * |

19 HSCS: Turnaround Plan • Focus on execution • More effectively segment our business to target the right opportunities • Improve and simplify our generic programs and better integrate them into overall offerings • Re-invigorate our value proposition |

20 HSCS: Deep Customer Segmentation Aligning offerings Suppliers Customers Retail Ind. • Pharmaceutical/ Distribution services • Pharmacy brands • Rx Purchasing Programs • FirstScript – Customized Autoshipment to stock new Brand or Generic items fast • Front-end Purchasing & Merchandising • Managed Care Programs • Ordering / Inventory Management Chains/ Warehousing & Non • Distribute / operational excellence • Ordering / inventory management • Purchasing Solutions • SOURCE generics (primary and back-up formulary) • Home Health Care, packaging, FirstScript • Managed Care Hospital • Patient Safety/ Clinical Solutions • Pharma Distribution. • Medication Packaging • Cardinal Assist • Ready Scan • Pharmacy Automation (Pyxis) Generic • Market share • Launch speed • Contract mgt • Efficient reach to every COT • AR / returns mgt • Centralized shipping • Data reporting Branded • Inventory mgt • Data reporting • High service levels • Contract mgt • AR / returns mgt • Special handling • Centralized shipping • Efficient reach to every COT |

21 Clinical and Medical Products (CMP) * * * * * * * |

22 22 CMP: Competitive Advantages • Global leader in medication safety and infusion systems • Largest U.S. hospital footprint in dispensing systems • Largest acute-care respiratory company worldwide • Leading provider of disposables used in surgical suite • Industry’s only enterprise-wide medication management solution • Leader in hospital-acquired infection prevention • Leader in positive patient identification |

23 23 CMP: Winning Vision Improve Medication Management Enhance Infection Prevention • Integrating our offers and knowledge to manage all medications • Uniquely positioned to improve safety & productivity Minimize risk and cost of procedures Aligning with top hospital concerns to be a leading provider of products and services for hospital safety & productivity Help hospitals identify patients at risk • Established role and presence in the surgical suite • Expansion into the large respiratory market • Focus on protocol compliance and clinically differentiated products • Expanding our capability with high impact procedures • Tackling our customers latest concerns • Leading market offering in infection detection • Building our data to address top hospital concerns |

25 FY 2009 Priorities • Resolve outstanding regulatory issues • Continue to invest in enhancing quality and regulatory systems • Return HSCS to steady growth • Continue to invest in CMP growth • Complete integrations (Viasys, Enturia, Borschow) Mission: to make healthcare safer and more productive Mission: to make healthcare safer and more productive |

28 Q4FY08 Trailing Five Quarters * * * * * * |

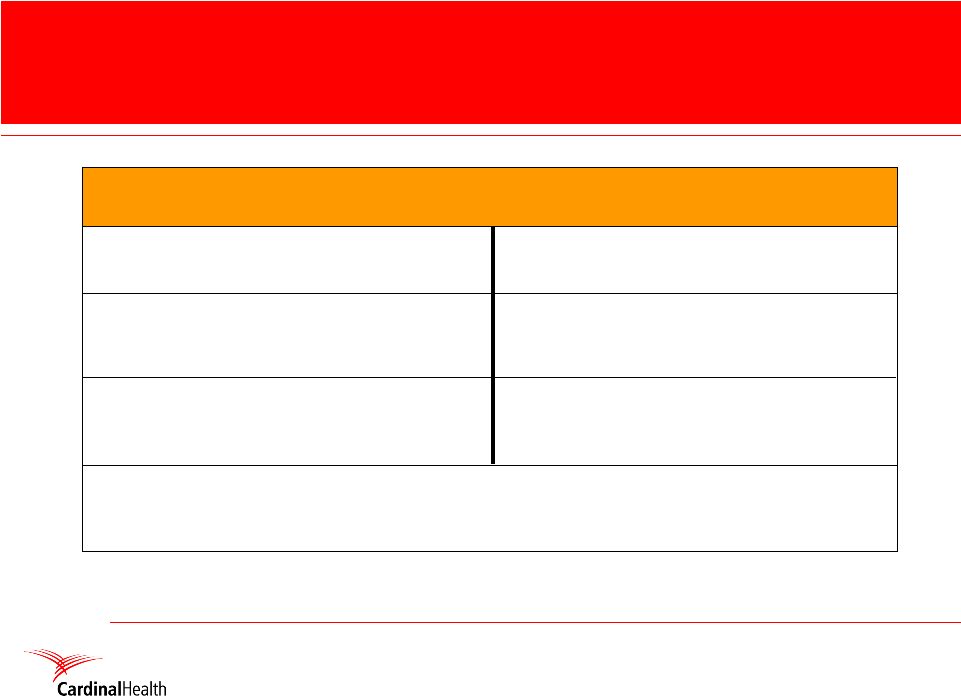

29 Healthcare Supply Chain Services Analysis: Q4FY08 $258 $19,819 Q4FY08 $300 $19,894 Q3FY08 $258 $20,351 Q2FY08 (15)% 1% Q4FY08/ Q4FY07 % change $305 $303 Segment Profit ($M) 19,221 $19,556 Revenue ($M) Q1FY08 Q4FY07 Healthcare Supply Chain Services – Pharmaceutical $81 $2,082 Q4FY08 $93 $2,066 Q3FY08 $72 $2,015 Q2FY08 (3)% 8% Q4FY08/ Q4FY07 % change $58 $83 Segment Profit ($M) $1,921 $1,929 Revenue ($M) Q1FY08 Q4FY07 Healthcare Supply Chain Services – Medical |

30 Clinical and Medical Products Analysis: Q4FY08 $95 $727 Q4FY08 $80 $679 Q3FY08 $69 $667 Q2FY08 63% 46% Q4FY08/ Q4FY07 % change $57 $58 Segment Profit ($M) $623 $500 Revenue ($M) Q1FY08 Q4FY07 Medical Products and Technologies $156 $780 Q4FY08 $127 $747 Q3FY08 $116 $715 Q2FY08 8% 3% Q4FY08/ Q4FY07 % change $98 $144 Segment Profit ($M) $649 $756 Revenue ($M) Q1FY08 Q4FY07 Clinical Technologies and Services |

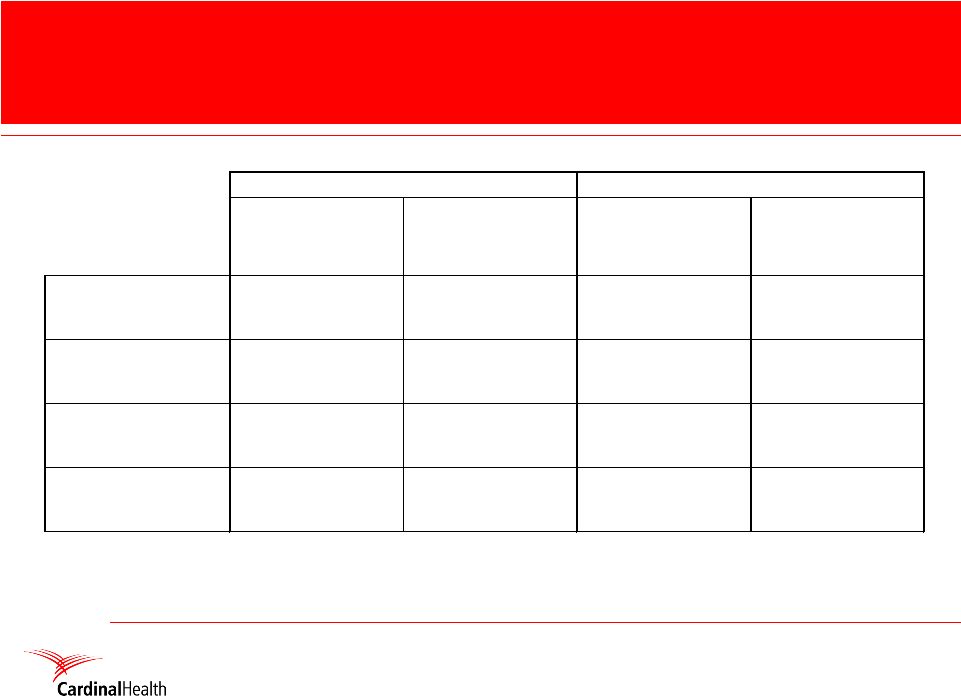

31 3-Year, Quarterly, Historical Financial Data Recast in Current, Revised Structure The following slides contain historical segment information that reflect a change in the Company’s reportable segments effective July 1, 2008. Certain costs held at corporate have been allocated to the segments under the new segment structure. Further information regarding the new segments will be included in the Company’s Form 10-Q for the quarter ending September 30, 2008 and subsequent periods. * * * * |

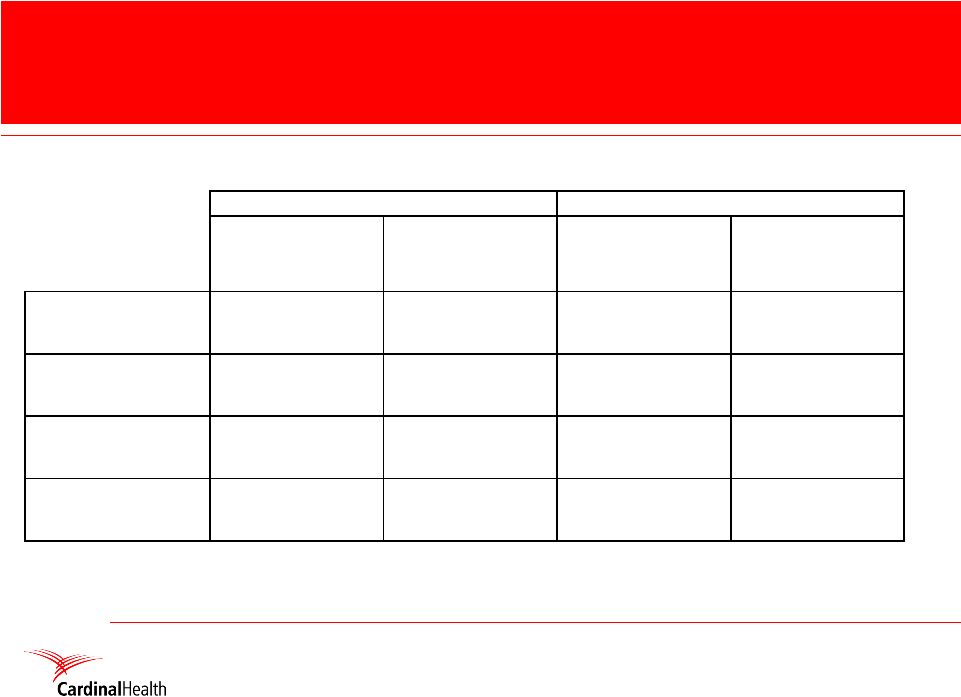

32 Healthcare Supply Chain Services Segment Analysis: FY06 - 08 $1,392 $77,108 FY06 $382 $20,555 Q4FY06 $407 $329 $273 Segment Profit ($M) $19,579 $18,713 $18,260 Revenue ($M) Q3FY06 Q2FY06 Q1FY06 $1,548 $83,948 FY07 $366 $21,444 Q4FY07 $452 $394 $335 Segment Profit ($M) $21,120 $21,079 $20,305 Revenue ($M) Q3FY07 Q2FY07 Q1FY07 $1,363 $87,226 FY08 $324 $21,863 Q4FY08 $377 $315 $347 Segment Profit ($M) $21,923 $22,346 $21,093 Revenue ($M) Q3FY08 Q2FY08 Q1FY08 |

33 Clinical and Medical Products Segment Analysis: FY06 - 08 $429 $3,102 FY06 $126 $850 Q4FY06 $116 $108 $79 Segment Profit ($M) $769 $756 $726 Revenue ($M) Q3FY06 Q2FY06 Q1FY06 $535 $3,542 FY07 $191 $1,017 Q4FY07 $132 $127 $86 Segment Profit ($M) $883 $862 $779 Revenue ($M) Q3FY07 Q2FY07 Q1FY07 $735 $4,606 FY08 $229 $1,270 Q4FY08 $190 $171 $145 Segment Profit ($M) $1,170 $1,133 $1,032 Revenue ($M) Q3FY08 Q2FY08 Q1FY08 |

34 All Other Segment Analysis: FY06 - 08 $110 $1,138 FY06 $26 $282 Q4FY06 $28 $28 $28 Segment Profit ($M) $291 $288 $278 Revenue ($M) Q3FY06 Q2FY06 Q1FY06 $107 $1,151 FY07 $25 $286 Q4FY07 $26 $27 $28 Segment Profit ($M) $290 $295 $280 Revenue ($M) Q3FY07 Q2FY07 Q1FY07 $101 $1,190 FY08 $27 $288 Q4FY08 $26 $25 $22 Segment Profit ($M) $308 $301 $294 Revenue ($M) Q3FY08 Q2FY08 Q1FY08 |

35 GAAP to Non-GAAP Reconciliation Statements * * * * * * * |

CARDINAL HEALTH, INC. AND SUBSIDIARIES

GAAP / NON-GAAP RECONCILIATION

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Fourth Quarter 2008 | | | Fiscal Year 2008 | |

| (in millions, except per Common Share amounts) | | GAAP | | | Special

Items | | Impairment

Charges

and Other | | | Non-GAAP | | | GAAP | | | Special

Items | | Impairment

Charges

and Other | | | Non-GAAP | |

Operating Earnings | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Amount | | $ | 543 | | | $ | 35 | | $ | (10 | ) | | $ | 568 | | | $ | 2,129 | | | $ | 123 | | $ | (32 | ) | | $ | 2,219 | |

Growth Rate | | | 29 | % | | | | | | | | | | 6 | % | | | 55 | % | | | | | | | | | | 3 | % |

| | | | | | | | |

Provision for Income Taxes | | $ | 166 | | | $ | 13 | | $ | (6 | ) | | $ | 173 | | | $ | 633 | | | $ | 45 | | $ | (14 | ) | | $ | 663 | |

| | | | | | | | |

Earnings from Continuing Operations | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Amount | | $ | 330 | | | $ | 22 | | $ | (4 | ) | | $ | 348 | | | $ | 1,324 | | | $ | 78 | | $ | (18 | ) | | $ | 1,385 | |

Growth Rate | | | 39 | % | | | | | | | | | | 1 | % | | | 58 | % | | | | | | | | | | — | |

| | | | | | | | |

Diluted EPS from Continuing Operations | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Amount | | $ | 0.92 | | | $ | 0.06 | | $ | (0.01 | ) | | $ | 0.97 | | | $ | 3.64 | | | $ | 0.21 | | $ | (0.05 | ) | | $ | 3.80 | |

Growth Rate | | | 51 | % | | | | | | | | | | 9 | % | | | 76 | % | | | | | | | | | | 11 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Fourth Quarter 2007 | | | Fiscal Year 2007 | |

| | | GAAP | | | Special

Items | | Impairment

Charges

and Other | | | Non-GAAP | | | GAAP | | | Special

Items | | Impairment

Charges

and Other | | Non-GAAP | |

Operating Earnings | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Amount | | $ | 421 | | | $ | 118 | | $ | (1 | ) | | $ | 538 | | | $ | 1,374 | | | $ | 772 | | $ | 17 | | $ | 2,163 | |

Growth Rate | | | (14 | )% | | | | | | | | | | 3 | % | | | (26 | )% | | | | | | | | | 12 | % |

| | | | | | | | |

Provision for Income Taxes | | $ | 164 | | | $ | 10 | | | — | | | $ | 174 | | | $ | 413 | | | $ | 243 | | $ | 2 | | $ | 657 | |

| | | | | | | | |

Earnings from Continuing Operations | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Amount | | $ | 238 | | | $ | 108 | | | — | | | $ | 345 | | | $ | 840 | | | $ | 529 | | $ | 16 | | $ | 1,384 | |

Growth Rate | | | (22 | )% | | | | | | | | | | 5 | % | | | (28 | )% | | | | | | | | | 13 | % |

| | | | | | | | |

Diluted EPS from Continuing Operations | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Amount | | $ | 0.61 | | | $ | 0.28 | | | — | | | $ | 0.89 | | | $ | 2.07 | | | $ | 1.31 | | $ | 0.04 | | $ | 3.42 | |

Growth Rate | | | (15 | )% | | | | | | | | | | 14 | % | | | (24 | )% | | | | | | | | | 20 | % |

The sum of the components may not equal the total due to rounding

CARDINAL HEALTH, INC. AND SUBSIDIARIES

GAAP / NON-GAAP RECONCILIATION

| | | | | | | | | | | | | | | | |

| | | Fourth Quarter | | | Fiscal Year | |

| (in millions) | | 2008 | | | 2007 | | | 2008 | | | 2007 | |

GAAP Return on Equity | | | 17.3 | % | | | 47.3 | % | | | 17.8 | % | | | 23.5 | % |

| | | | |

Non-GAAP Return on Equity | | | | | | | | | | | | | | | | |

Net earnings | | $ | 326.6 | | | $ | 902.2 | | | $ | 1,309.2 | | | $ | 1,931.1 | |

Special items, net of tax, in continuing operations | | | 21.8 | | | | 107.8 | | | | 77.7 | | | | 528.9 | |

Special items, net of tax, in discontinued operations | | | — | | | | — | | | | — | | | | 4.4 | |

(Gain)/loss on sale of PTS, net of tax, in discontinued operations | | | — | | | | (679.5 | ) | | | 7.6 | | | | (1,072.4 | ) |

| | | | | | | | | | | | | | | | |

Adjusted net earnings | | $ | 348.4 | | | $ | 330.5 | | | $ | 1,394.5 | | | $ | 1,392.0 | |

| | | | |

Annualized | | $ | 1,393.6 | | | $ | 1,322.0 | | | $ | 1,394.5 | | | $ | 1,392.0 | |

| | | | |

Divided by average shareholders’ equity1 | | $ | 7,574.7 | | | $ | 7,623.2 | | | $ | 7,340.5 | | | $ | 8,213.2 | |

| | | | |

Non-GAAP return on equity | | | 18.4 | % | | | 17.3 | % | | | 19.0 | % | | | 16.9 | % |

| | |

| | | Fourth Quarter | | | Fiscal Year | |

| (in millions) | | 2008 | | | 2007 | | | 2008 | | | 2007 | |

GAAP Return on Invested Capital | | | 6.90 | % | | | 18.43 | % | | | 7.01 | % | | | 9.38 | % |

| | | | |

Non-GAAP Return on Invested Capital | | | | | | | | | | | | | | | | |

Net earnings | | $ | 326.6 | | | $ | 902.2 | | | $ | 1,309.2 | | | $ | 1,931.1 | |

Special items, net of tax, in continuing operations | | | 21.8 | | | | 107.8 | | | | 77.7 | | | | 528.9 | |

Special items, net of tax, in discontinued operations | | | — | | | | — | | | | — | | | | 4.4 | |

Interest expense and other, net of tax | | | 30.4 | | | | 12.2 | | | | 109.7 | | | | 77.7 | |

(Gain)/loss on sale of PTS, net of tax, in discontinued operations | | | — | | | | (679.5 | ) | | | 7.6 | | | | (1,072.4 | ) |

| | | | | | | | | | | | | | | | |

Adjusted net earnings | | $ | 378.8 | | | $ | 342.7 | | | $ | 1,504.2 | | | $ | 1,469.7 | |

| | | | |

Annualized | | $ | 1,515.2 | | | $ | 1,370.8 | | | $ | 1,504.2 | | | $ | 1,469.7 | |

| | | | |

Divided by average total invested capital2 | | $ | 18,940.1 | | | $ | 19,583.8 | | | $ | 18,665.9 | | | $ | 20,580.7 | |

| | | | |

Non-GAAP return on invested capital | | | 8.00 | % | | | 7.00 | % | | | 8.06 | % | | | 7.14 | % |

1 | The average shareholders’ equity shown above is calculated using the average of the prior and current quarters except for fiscal year which is calculated as the average of shareholders’ equity at the end of the prior years’ fourth quarter plus each of the current year quarters. |

2 | Total invested capital is calculated as the sum of the current portion of long-term obligations and other short-term borrowings, long-term obligations, current portion of long-term obligations and other short-term borrowings in discontinued operations, long-term obligations in discontinued operations, total shareholders’ equity and unrecorded goodwill. The average total invested capital is calculated using the average of total invested capital at the end of the prior and current quarters except for year-to-date which is calculated as the average of the prior years’ fourth quarter plus each of the current year quarters. Unrecorded goodwill is $7.5 billion for all periods presented. Current portion of long-term obligations and other short-term borrowings in discontinued operations, and long-term obligations in discontinued operations were $59.2 million, $46.6 million, $41.3 million and $12.3 million at June 30, 2006, September 30, 2006, December 31, 2006 and March 31, 2007, respectively. |

CARDINAL HEALTH, INC. AND SUBSIDIARIES

GAAP / NON-GAAP RECONCILIATION

| | | | | | | | | | | | | | | | |

| | | Fourth Quarter | | | Fiscal Year | |

| (in millions) | | 2008 | | | 2007 | | | 2008 | | | 2007 | |

GAAP Effective Tax Rate from Continuing Operations | | | 33.4 | % | | | 40.8 | % | | | 32.3 | % | | | 33.0 | % |

| | | | |

Non-GAAP Effective Tax Rate from Continuing Operations | | | | | | | | | | | | | | | | |

Earnings before income taxes and discontinued operations | | $ | 495.8 | | | $ | 401.4 | | | $ | 1,957.3 | | | $ | 1,252.3 | |

Special items | | | 34.9 | | | | 118.2 | | | | 122.6 | | | | 772.0 | |

| | | | | | | | | | | | | | | | |

Adjusted earnings before income taxes and discontinued operations | | $ | 530.7 | | | $ | 519.6 | | | $ | 2,079.9 | | | $ | 2,024.3 | |

| | | | |

Provision for income taxes | | $ | 165.6 | | | $ | 163.7 | | | $ | 632.8 | | | $ | 412.6 | |

Special items tax benefit | | | 13.1 | | | | 10.4 | | | | 44.9 | | | | 243.1 | |

| | | | | | | | | | | | | | | | |

Adjusted provision for income taxes | | $ | 178.7 | | | $ | 174.1 | | | $ | 677.7 | | | $ | 655.7 | |

| | | | |

Non-GAAP effective tax rate from continuing operations | | | 33.7 | % | | | 33.5 | % | | | 32.6 | % | | | 32.4 | % |

| | | |

| | | Fourth Quarter | | | | | | | |

| | | 2008 | | | 2007 | | | | | | | |

Debt to Total Capital | | | 33 | % | | | 32 | % | | | | | | | | |

| | | | |

Net Debt to Capital | | | | | | | | | | | | | | | | |

Current portion of long-term obligations and other short-term borrowings | | $ | 159.0 | | | $ | 16.0 | | | | | | | | | |

Long-term obligations, less current portion and other short-term borrowings | | | 3,687.4 | | | | 3,457.3 | | | | | | | | | |

| | | | | | | | | | | | | | | | |

Debt | | $ | 3,846.4 | | | $ | 3,473.3 | | | | | | | | | |

Cash and equivalents | | | (1,291.3 | ) | | | (1,308.8 | ) | | | | | | | | |

Short-term investments available for sale | | | — | | | | (132.0 | ) | | | | | | | | |

| | | | | | | | | | | | | | | | |

Net debt | | $ | 2,555.1 | | | $ | 2,032.5 | | | | | | | | | |

Total shareholders’ equity | | $ | 7,756.1 | | | $ | 7,376.9 | | | | | | | | | |

Capital | | $ | 10,311.2 | | | $ | 9,409.4 | | | | | | | | | |

Net debt to capital | | | 25 | % | | | 22 | % | | | | | | | | |

Forward-Looking Non-GAAP Financial Measures

The Company presents non-GAAP earnings from continuing operations and non-GAAP effective tax rate from continuing operations (and presentations derived from these financial measures) on a forward-looking basis. The most directly comparable forward-looking GAAP measures are earnings from continuing operations and effective tax rate from continuing operations. The Company is unable to provide a quantitative reconciliation of these forward-looking non-GAAP measures to the most comparable forward-looking GAAP measures because the Company cannot reliably forecast special items and impairment charges and other, which are difficult to predict and estimate and are primarily dependent on future events. Please note that the unavailable reconciling items could significantly impact the Company’s future financial results.

CARDINAL HEALTH, INC. AND SUBSIDIARIES

GAAP / NON-GAAP RECONCILIATION

| | | | | | | | |

| | | Fourth Quarter | |

| (in millions) | | 2008 | | | 2007 | |

Clinical Technologies and Services revenue growth | | | 3 | % | | | | |

| | |

Clinical Technologies and Services revenue | | $ | 779.8 | | | $ | 755.8 | |

Less: Pharmacy Services business unit revenue | | | (194.8 | ) | | | (218.7 | ) |

| | | | | | | | |

Clinical Technologies and Services revenue excluding Pharmacy Services business unit revenue | | $ | 585.0 | | | $ | 537.1 | |

| | |

Clinical Technologies and Services revenue growth excluding Pharmacy Services business unit revenue | | | 9 | % | | | | |

CARDINAL HEALTH, INC. AND SUBSIDIARIES

GAAP / NON-GAAP RECONCILIATION

| | | | | | | | | | | | | | |

| | | Fourth Quarter | | Fiscal Year |

| (in millions) | | 2008 | | | 2007 | | 2008 | | | 2007 |

HEALTHCARE SUPPLY CHAIN SERVICES | | | | | | | | | | | | | | |

| | | | |

Revenue | | | | | | | | | | | | | | |

Pharmaceutical | | $ | 19,819 | | | $ | 19,556 | | $ | 79,284 | | | $ | 76,573 |

Medical | | | 2,082 | | | | 1,929 | | | 8,084 | | | | 7,514 |

| | | | | | | | | | | | | | |

Total Sector Revenue | | $ | 21,901 | | | $ | 21,485 | | $ | 87,368 | | | $ | 84,087 |

| | | | |

Sector Growth Rate | | | 2 | % | | | | | | 4 | % | | | |

| | | | |

Segment Profit | | | | | | | | | | | | | | |

Pharmaceutical | | $ | 258 | | | $ | 303 | | $ | 1,122 | | | $ | 1,300 |

Medical | | | 81 | | | | 83 | | | 303 | | | | 318 |

| | | | | | | | | | | | | | |

Total Sector Profit | | $ | 339 | | | $ | 386 | | $ | 1,425 | | | $ | 1,618 |

| | | | |

Sector Growth Rate | | | (12 | )% | | | | | | (12 | )% | | | |

| | |

| | | Fourth Quarter | | Fiscal Year |

| (in millions) | | 2008 | | | 2007 | | 2008 | | | 2007 |

CLINICAL AND MEDICAL PRODUCTS | | | | | | | | | | | | | | |

| | | | |

Revenue | | | | | | | | | | | | | | |

Clinical Technologies and Services | | $ | 780 | | | $ | 756 | | $ | 2,890 | | | $ | 2,687 |

Medical Products and Technologies | | | 727 | | | | 500 | | | 2,696 | | | | 1,836 |

| | | | | | | | | | | | | | |

Total Sector Revenue | | $ | 1,507 | | | $ | 1,256 | | $ | 5,586 | | | $ | 4,523 |

| | | | |

Sector Growth Rate | | | 20 | % | | | | | | 24 | % | | | |

| | | | |

Segment Profit | | | | | | | | | | | | | | |

Clinical Technologies and Services | | $ | 156 | | | $ | 144 | | $ | 497 | | | $ | 386 |

Medical Products and Technologies | | | 95 | | | | 58 | | | 300 | | | | 198 |

| | | | | | | | | | | | | | |

Total Sector Profit | | $ | 251 | | | $ | 202 | | $ | 797 | | | $ | 584 |

| | | | |

Sector Growth Rate | | | 24 | % | | | | | | 36 | % | | | |

The results above are reported under the Company’s segment reporting structure as it existed at June 30, 2008

CARDINAL HEALTH, INC. AND SUBSIDIARIES

GAAP / NON-GAAP RECONCILIATION

(in millions)

HEALTHCARE SUPPLY CHAIN SERVICES

Pharmaceutical

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Fourth Quarter Fiscal 2008 | | | | | | Fourth Quarter Fiscal 2007 | | | | |

| | | April | | May | | June | | Total | | | Fiscal

2008 | | | April | | May | | June | | Total | | | Fiscal

2007 | |

Economic Profit Margin | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Segment profit | | | | | | | | | | | $ | 258.4 | | | $ | 1,121.6 | | | | | | | | | | | | $ | 303.4 | | | $ | 1,299.8 | |

Effective tax rate from continuing operations | | | | | | | | | | | | 36.7 | % | | | 36.7 | % | | | | | | | | | | | | 35.1 | % | | | 35.1 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net operating earnings, after-tax (NOPAT) | | | | | | | | | | | $ | 163.6 | | | $ | 710.2 | | | | | | | | | | | | $ | 197.0 | | | $ | 844.1 | |

| | | | | | | | | | |

Total assets | | $ | 11,675.5 | | $ | 11,586.4 | | $ | 11,038.5 | | | | | | | | | | $ | 11,494.8 | | $ | 11,849.6 | | $ | 11,705.2 | | | | | | | | |

Less: assets from discontinued operations | | | — | | | — | | | — | | | | | | | | | | | — | | | — | | | — | | | | | | | | |

Less: accounts payable | | | 7,696.3 | | | 8,004.8 | | | 7,470.4 | | | | | | | | | | | 7,805.4 | | | 7,921.3 | | | 8,412.5 | | | | | | | | |

Less: other accrued liabilities | | | 1,134.4 | | | 1,057.4 | | | 1,074.4 | | | | | | | | | | | 1,082.4 | | | 1,202.4 | | | 1,160.2 | | | | | | | | |

Less: liabilities from businesses held for sale | | | — | | | — | | | — | | | | | | | | | | | — | | | — | | | — | | | | | | | | |

Less: deferred income taxes and other liabilities | | | 85.0 | | | 68.2 | | | 44.3 | | | | | | | | | | | 87.7 | | | 88.0 | | | 36.1 | | | | | | | | |

Less: goodwill and other intangibles, net | | | 1,358.1 | | | 1,356.8 | | | 1,346.1 | | | | | | | | | | | 1,351.9 | | | 1,351.3 | | | 1,345.6 | | | | | | | | |

Less: cash and equivalents | | | 42.6 | | | 38.9 | | | 12.3 | | | | | | | | | | | 127.7 | | | 67.9 | | | 32.8 | | | | | | | | |

Less: short-term investments available for sale | | | — | | | — | | | — | | | | | | | | | | | — | | | — | | | — | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Tangible capital | | $ | 1,359.1 | | $ | 1,060.3 | | $ | 1,091.0 | | $ | 1,170.1 | | | $ | 1,167.0 | | | $ | 1,039.7 | | $ | 1,218.7 | | $ | 718.0 | | $ | 992.1 | | | $ | 1,221.7 | |

Multiplied by weighted average cost of capital | | | | | | | | | | | | 2.3 | % | | | 9.0 | % | | | | | | | | | | | | 2.3 | % | | | 9.0 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Capital charge | | | | | | | | | | | $ | 26.9 | | | $ | 105.0 | | | | | | | | | | | | $ | 22.8 | | | $ | 110.0 | |

| | | | | | | | | | |

Economic profit | | | | | | | | | | | $ | 136.7 | | | $ | 605.2 | | | | | | | | | | | | $ | 174.2 | | | $ | 734.1 | |

| | | | | | | | | | |

Revenue | | | | | | | | | | | $ | 19,818.8 | | | $ | 79,284.2 | | | | | | | | | | | | $ | 19,556.0 | | | $ | 76,572.8 | |

| | | | | | | | | | |

Economic profit margin | | | | | | | | | | | | 0.69 | % | | | 0.76 | % | | | | | | | | | | | | 0.89 | % | | | 0.96 | % |

| | | | | | | | | | |

HEALTHCARE SUPPLY CHAIN SERVICES Medical | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | |

| | | Fourth Quarter Fiscal 2008 | | | | | | Fourth Quarter Fiscal 2007 | | | | |

| | | April | | May | | June | | Total | | | Fiscal

2008 | | | April | | May | | June | | Total | | | Fiscal

2007 | |

Economic Profit Margin | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Segment profit | | | | | | | | | | | $ | 80.9 | | | $ | 303.0 | | | | | | | | | | | | $ | 83.3 | | | $ | 318.1 | |

Effective tax rate from continuing operations | | | | | | | | | | | | 28.5 | % | | | 28.5 | % | | | | | | | | | | | | 29.8 | % | | | 29.8 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net operating earnings, after-tax (NOPAT) | | | | | | | | | | | $ | 57.8 | | | $ | 216.5 | | | | | | | | | | | | $ | 58.5 | | | $ | 223.2 | |

| | | | | | | | | | |

Total assets | | $ | 2,482.9 | | $ | 2,511.2 | | $ | 2,499.5 | | | | | | | | | | $ | 2,480.4 | | $ | 2,396.8 | | $ | 2,472.9 | | | | | | | | |

Less: assets from discontinued operations | | | — | | | — | | | — | | | | | | | | | | | — | | | — | | | — | | | | | | | | |

Less: accounts payable | | | 609.0 | | | 574.5 | | | 572.5 | | | | | | | | | | | 532.3 | | | 523.2 | | | 558.0 | | | | | | | | |

Less: other accrued liabilities | | | 62.1 | | | 58.2 | | | 53.0 | | | | | | | | | | | 48.7 | | | 76.5 | | | 35.8 | | | | | | | | |

Less: liabilities from businesses held for sale | | | — | | | — | | | — | | | | | | | | | | | — | | | — | | | — | | | | | | | | |

Less: deferred income taxes and other liabilities | | | 55.9 | | | 71.9 | | | 71.9 | | | | | | | | | | | 63.6 | | | 56.6 | | | 59.8 | | | | | | | | |

Less: goodwill and other intangibles, net | | | 387.5 | | | 394.2 | | | 393.0 | | | | | | | | | | | 379.6 | | | 381.2 | | | 385.1 | | | | | | | | |

Less: cash and equivalents | | | 16.4 | | | 10.2 | | | 10.7 | | | | | | | | | | | 16.5 | | | 3.5 | | | 25.3 | | | | | | | | |

Less: short-term investments available for sale | | | — | | | — | | | — | | | | | | | | | | | — | | | — | | | — | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Tangible capital | | $ | 1,352.0 | | $ | 1,402.2 | | $ | 1,398.4 | | $ | 1,384.2 | | | $ | 1,441.7 | | | $ | 1,439.7 | | $ | 1,355.8 | | $ | 1,408.9 | | $ | 1,401.5 | | | $ | 1,460.8 | |

Multiplied by weighted average cost of capital | | | | | | | | | | | | 2.3 | % | | | 9.0 | % | | | | | | | | | | | | 2.3 | % | | | 9.0 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Capital charge | | | | | | | | | | | $ | 31.8 | | | $ | 129.8 | | | | | | | | | | | | $ | 32.2 | | | $ | 131.5 | |

| | | | | | | | | | |

Economic profit | | | | | | | | | | | $ | 26.0 | | | $ | 86.7 | | | | | | | | | | | | $ | 26.3 | | | $ | 91.7 | |

| | | | | | | | | | |

Revenue | | | | | | | | | | | $ | 2,082.1 | | | $ | 8,083.6 | | | | | | | | | | | | $ | 1,928.5 | | | $ | 7,513.9 | |

| | | | | | | | | | |

Economic profit margin | | | | | | | | | | | | 1.25 | % | | | 1.07 | % | | | | | | | | | | | | 1.36 | % | | | 1.22 | % |

(1) | Tangible Capital is a quarterly average calculated as total assets allocated to the segment less (total liabilities allocated to the segment, goodwill and intangibles, cash and equivalents and short term investments available for sale) |

(2) | The sum of the components may not equal the total due to rounding |

(3) | Healthcare Supply Chain Services—Pharmaceutical Tangible Capital calculated for both current and prior fiscal year includes an allocation of payables previously held at Corporate to more accurately reflect the payable balance of the segment. |

CARDINAL HEALTH, INC. AND SUBSIDIARIES

DEFINITIONS

GAAP

Debt: long-term obligations plus short-term borrowings

Debt to Total Capital: debt divided by (debt plus total shareholders’ equity)

Diluted EPS from Continuing Operations: earnings from continuing operations divided by diluted weighted average shares outstanding

Effective Tax Rate from Continuing Operations: provision for income taxes divided by earnings before income taxes and discontinued operations

Operating Cash Flow: net cash provided by / (used in) operating activities from continuing operations

Segment Profit: segment revenue minus (segment cost of products sold and segment selling, general and administrative expenses)

Segment Profit Margin: segment profit divided by segment revenue

Segment Profit Mix: segment profit divided by total segment profit for all segments

Return on Equity:annualized net earnings divided by average shareholders’ equity

Return on Invested Capital: annualized net earnings divided by (average total shareholders’ equity plus debt plus unrecorded goodwill)

Revenue Mix:segment revenue divided by total segment revenue for all segments

NON-GAAP

Net Debt to Capital: net debt divided by (net debt plus total shareholders’ equity)

Net Debt:debt minus (cash and equivalents and short-term investments available for sale)

Non-GAAP Diluted EPS from Continuing Operations: non-GAAP earnings from continuing operations divided by diluted weighted average shares outstanding

Non-GAAP Diluted EPS from Continuing Operations Growth Rate: (current period non-GAAP diluted EPS from continuing operations minus prior period non-GAAP diluted EPS from continuing operations) divided by prior period non-GAAP diluted EPS from continuing operations

Non-GAAP Earnings from Continuing Operations:earnings from continuing operations excluding special items and impairment charges and other, both net of tax

Non-GAAP Earnings from Continuing Operations Growth Rate: (current period non-GAAP earnings from continuing operations minus prior period non-GAAP earnings from continuing operations) divided by prior period non-GAAP earnings from continuing operations

Non-GAAP Effective Tax Rate from Continuing Operations: (provision for income taxes adjusted for special items) divided by (earnings before income taxes and discontinued operations adjusted for special items)

Non-GAAP Operating Earnings: operating earnings excluding special items and impairment charges and other

Non-GAAP Operating Earnings Growth Rate:(current period non-GAAP operating earnings minus prior period non-GAAP operating earnings) divided by prior period non-GAAP operating earnings

Non-GAAP Return on Equity:(annualized current period net earnings plus special items minus special items tax benefit) divided by average shareholders’ equity1

Non-GAAP Return on Invested Capital: (annualized net earnings plus special items minus special items tax benefit plus interest expense and other) divided by (average total shareholders’ equity plus debt plus unrecorded goodwill)1

| 1 | For the three months ended June 30, 2007, the numerator in calculating this non-GAAP financial measure also excludes the $679.5 million gain, net of tax, on the sale of PTS recorded in discontinued operations in the fourth quarter of fiscal 2007. For the fiscal year ended June 30, 2008 and 2007 the numerator in calculating this non-GAAP financial measure also excludes the respective $7.6 million and $(1,072.4) million (gain) / loss, net of tax, on the sale of PTS recorded in discontinued operations. |