Essential to care Q3FY2009 Investor/Analyst Call April 30, 2009 Exhibit 99.3 |

2 Forward-looking statements and GAAP reconciliation This presentation contains forward-looking statements addressing expectations, prospects, estimates and other matters that are dependent upon future events or developments. These matters are subject to risks and uncertainties that could cause actual results to differ materially from those projected, anticipated or implied. The most significant of these uncertainties are described in Cardinal Health’s Form 10-K, Form 10-Q and Form 8-K reports and CareFusion’s Form 10 registration statement (including all amendments to those reports and registration statement) and exhibits to those reports and registration statement, and include (but are not limited to) the following: uncertainties related to the deferral in hospital capital spending affecting Cardinal Health’s Clinical and Medical Products segment and difficulties in forecasting the exact duration and potential long-term changes in hospital spending patterns; uncertainties regarding the planned spinoff of CareFusion as a new standalone entity, including the timing and terms of any such spinoff and whether such spinoff will be completed as it is subject to a number of conditions, and uncertainties regarding the impact of the planned spinoff on Cardinal Health, CareFusion and the potential market for their respective securities; competitive pressures in Cardinal Health’s various lines of business; the loss of one or more key customer or supplier relationships or changes to the terms of those relationships; uncertainties relating to timing of generic and branded pharmaceutical introductions and the frequency or rate of branded pharmaceutical price appreciation or generic pharmaceutical price deflation; changes in the distribution patterns or reimbursement rates for health care products and/or services; the results, consequences, effects or timing of any inquiry or investigation by any regulatory authority or any legal or administrative proceedings; future actions of regulatory bodies or government authorities relating to Cardinal Health’s manufacturing or sale of products and other costs or claims that could arise from its manufacturing, compounding or repackaging operations or from its other services, including uncertainties and costs relating to complying with the amended consent decree entered into with the FDA and implementing the corrective action plan submitted to the FDA pursuant to the amended consent decree; the effects, timing or success of restructuring programs or plans; the costs, difficulties and uncertainties related to the integration of acquired businesses; uncertainties related to the recent disruptions in the financial markets, including uncertainties related to the availability and/or cost of credit and the impact of the financial market disruptions on Cardinal Health’s customers and vendors; uncertainties regarding the ultimate features of government health care reform initiatives and their enactment and implementation; and conditions in the pharmaceutical market and general economic and market conditions. This presentation reflects management’s views as of April 30, 2009. Except to the extent required by applicable law, Cardinal Health undertakes no obligation to update or revise any forward-looking statement. In addition, this presentation includes non-GAAP financial measures. Cardinal Health provides definitions and reconciling information at the end of this presentation and on its investor relations page at www.cardinalhealth.com. A transcript of the conference call will be available on the investor relations page at www.cardinalhealth.com. |

3 Agenda Opening remarks Kerry Clark Chairman and Chief Executive Officer Financial overview Jeff Henderson Chief Financial Officer HSCS comments George Barrett Vice Chairman and CEO Healthcare Supply Chain Services CMP comments Dave Schlotterbeck Clinical and Medical Products Q&A Vice Chairman and CEO |

5 Q3 FY2009 Financial Review $24,939 $496 $314 $0.87 $821 15.1% ($M) 9% (14%) (14%) (15%) % Change GAAP Basis $24,939 $553 $350 $0.97 16.9% ($M) 9% (10%) (10%) (10%) % Change Non-GAAP Basis 1 % change over prior year quarter Revenue Operating earnings Earnings from continuing ops Diluted EPS from continuing ops Operating cash flow Return on equity 1 1 |

6 Operating Earnings ($M) Diluted EPS from Continuing Operations Operating Earnings ($M) Diluted EPS from Continuing Operations GAAP consolidated $496 $0.87 $577 $1.02 Special items (Note) $52 $0.11 $36 $0.06 Impairments, (gain)/loss on sale of assets and other, net (Note) $3 ($0.01) $1 - Spinoff costs not included in special items or impairments, (gain)/loss on sale of assets and other, net (Note) $2 - - - Non-GAAP consolidated $553 $0.97 $613 $1.08 Spinoff costs included in special items or impairments, (gain)/loss on sale of assets and other, net $37 Spinoff costs not included in special items or impairments, (gain)/loss on sale of assets and other, net $2 Total spinoff costs $39 Q3 FY 2009 Q3 FY 2008 Q3 FY2009 Operating Earnings and EPS Note: Costs associated with the spinoff are as follows: |

7 Healthcare Supply Chain Services Business Analysis Highlights: • Revenue up 9% on growth in pharma supply chain business • Revenue from bulk pharmaceutical customers up 19%, primarily due to increased volumes from existing customers • Revenue from non-bulk pharmaceutical customers up 3%, driven by organic growth and the Borschow acquisition, partially offset by the previously reported shift in volume from non-bulk to bulk from a large customer • Segment profit up 2%, driven by revenue growth, disciplined cost controls and nuclear pharmacy, partially offset by the impact of customer mix and an increase in bad debt reserves Revenue Segment Profit 23,958 384 Q3 FY09 ($M) 21,923 377 Q3 FY08 ($M) 9% 2% % Change 1 Bulk pharmaceutical customers consist of Healthcare Supply Chain Services customers to which the segment distributes pharmaceutical, radiopharmaceutical and over-the-counter health care products to the customers’ centralized warehouse operations and mail order businesses 2 Non-bulk pharmaceutical customers consist of Healthcare Supply Chain Services customers to which the segment distributes pharmaceutical, radiopharmaceutical and over-the-counter health care products other than bulk pharmaceutical customers 3 Three regional chain customers declared bankruptcy during the quarter 1 2 3 |

8 Clinical and Medical Products Business Analysis Highlights: • Segment revenue down 6% over prior year due to the previously reported deferral in hospital capital spending and negative impact of foreign exchange (~4 pps), partially offset by the Enturia acquisition • Segment profit down 22% due to the deferral in hospital capital spending, a reserve associated with the remediation efforts for certain Alaris products and the impact from the ship-hold as well as the negative impact of foreign exchange (~8 pps), partially offset by the Enturia acquisition • Enturia continues to perform well-above expectations Revenue Segment Profit 1,100 148 Q3 FY09 ($M) 1,170 190 Q3 FY08 ($M) (6%) (22%) % Change |

9 HSCS Update • Pharmaceutical – Strong revenue growth – Momentum with DSD customers – Strong nuclear pharmacy quarter • Medical – Solid profit growth – Signs of softness in hospital admissions and physicians visits – Continued focus on efficiency and category management • Disciplined management of operating expenses |

10 CMP Update • FY09(E) segment profit down 7-11% – Alaris remediation reserve and ship-hold impact – Continued hospital deferral in capital spending – Reduction in workforce, stringent cost controls to primarily impact FY10 and beyond – Disposables are steady, recurring stream • Progress made towards requirements of the amended consent decree – Corrective Action Plan submitted to FDA • Future growth drivers – Continued investment in R&D with pipeline of innovative, clinically differentiated products, focus on patient safety – Working diligently to standup CareFusion Corporation as separate publicly traded entity |

12 FY 2009 Priorities • Investing judiciously to enhance key quality and regulatory systems • Return HSCS to steady growth • Continue to invest (R&D) in CMP growth • Complete integrations (VIASYS ® , Enturia, Borschow) • Prepare organization for and execute spinoff of CareFusion Corporation |

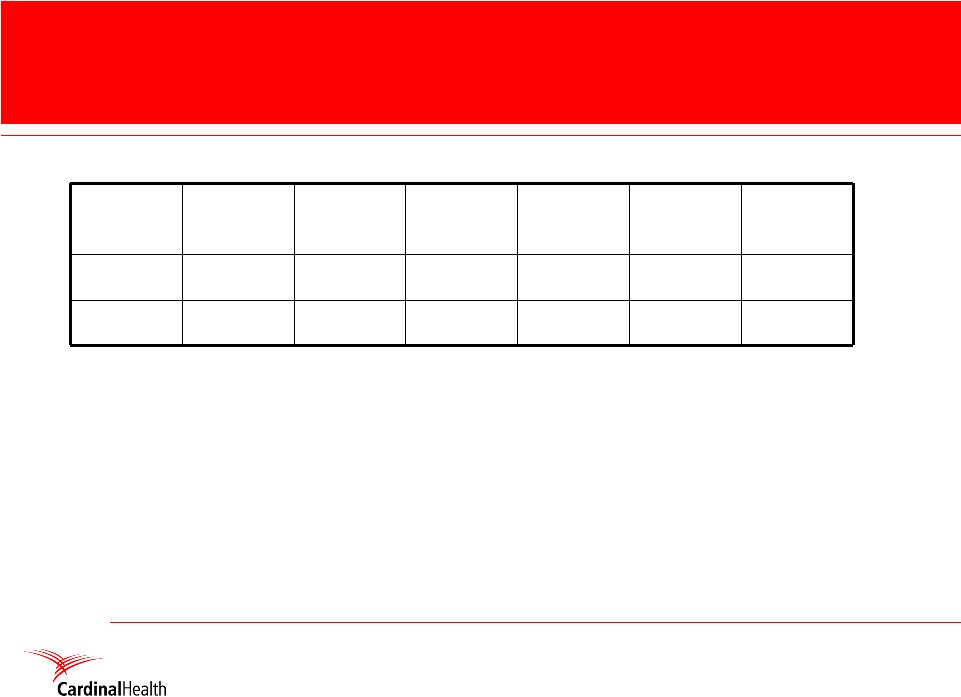

15 Q3FY09 Trailing Five Quarters |

16 Segment Analysis: Q3FY09 Q3FY08 Q4FY08 Q1FY09 Q2FY09 Q3FY09 Q3FY09/ Q3FY08 % change Revenue ($M) $21,923 $21,863 $23,418 $24,096 $ 23,958 9% Segment Profit ($M) $377 $324 $292 $333 $384 2% Healthcare Supply Chain Services Q3FY08 Q4FY08 Q1FY09 Q2FY09 Q3FY09 Q3FY09/ Q3FY08 % change Revenue ($M) $1,170 $1,270 $1,155 $1,215 $1,100 (6%) Segment Profit ($M) $190 $229 $167 $198 $148 (22%) Clinical and Medical Products |

17 Segment Analysis: Q3FY09 Q3FY08 Q4FY08 Q1FY09 Q2FY09 Q3FY09 Q3FY09/ Q3FY08 % change Revenue ($M) $308 $288 $273 $265 $246 (20%) Segment Profit ($M) $27 $27 $24 $31 $23 (12%) All Other Segment |

18 GAAP to Non-GAAP Reconciliation Statements |

CARDINAL HEALTH, INC. AND SUBSIDIARIES

GAAP / NON-GAAP RECONCILIATION

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Third Quarter 2009 | | | Year-to-Date 2009 | |

| (in millions, except per Common Share amounts) | | GAAP | | | Special

Items | | Other

Spin-Off

Costs | | Impairments,

(Gain)/Loss

on Sale of

Assets and

Other, Net | | | Non-GAAP | | | GAAP | | | Special

Items | | Other

Spin-Off

Costs | | Impairments,

(Gain)/Loss

on Sale of

Assets and

Other, Net | | | Non-GAAP | |

Operating Earnings | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Amount | | $ | 496 | | | $ | 52 | | $ | 2 | | $ | 3 | | | $ | 553 | | | $ | 1,461 | | | $ | 124 | | $ | 2 | | $ | 14 | | | $ | 1,600 | |

Growth Rate | | | (14 | )% | | | | | | | | | | | | | (10 | )% | | | (8 | )% | | | | | | | | | | | | | (3 | )% |

| | | | | | | | | | |

Provision for Income Taxes | | $ | 122 | | | $ | 12 | | $ | 1 | | $ | 8 | | | $ | 143 | | | $ | 393 | | | $ | 37 | | $ | 1 | | $ | 32 | | | $ | 462 | |

| | | | | | | | | | |

Earnings from Continuing Operations | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Amount | | $ | 314 | | | $ | 40 | | $ | 1 | | $ | (5 | ) | | $ | 350 | | | $ | 882 | | | $ | 88 | | $ | 1 | | $ | (18 | ) | | $ | 953 | |

Growth Rate | | | (14 | )% | | | | | | | | | | | | | (10 | )% | | | (11 | )% | | | | | | | | | | | | | (8 | )% |

| | | | | | | | | | |

Diluted EPS from Continuing Operations | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Amount | | $ | 0.87 | | | $ | 0.11 | | $ | — | | $ | (0.01 | ) | | $ | 0.97 | | | $ | 2.44 | | | $ | 0.24 | | $ | — | | $ | (0.04 | ) | | $ | 2.64 | |

Growth Rate | | | (15 | )% | | | | | | | | | | | | | (10 | )% | | | (10 | )% | | | | | | | | | | | | | (7 | )% |

| | |

| | | Third Quarter 2008 | | | Year-to-Date 2008 | |

| | | GAAP | | | Special

Items | | Other

Spin-Off

Costs | | Impairments,

(Gain)/Loss

on Sale of

Assets and

Other, Net | | | Non-GAAP | | | GAAP | | | Special

Items | | Other

Spin-Off

Costs | | Impairments,

(Gain)/Loss

on Sale of

Assets and

Other, Net | | | Non-GAAP | |

Operating Earnings | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Amount | | $ | 577 | | | $ | 36 | | $ | — | | $ | 1 | | | $ | 613 | | | $ | 1,586 | | | $ | 88 | | $ | — | | $ | (22 | ) | | $ | 1,651 | |

Growth Rate | | | N.M. | | | | | | | | | | | | | | 1 | % | | | 66 | % | | | | | | | | | | | | | 2 | % |

| | | | | | | | | | |

Provision for Income Taxes | | $ | 180 | | | $ | 13 | | $ | — | | $ | — | | | $ | 192 | | | $ | 467 | | | $ | 32 | | $ | — | | $ | (9 | ) | | $ | 491 | |

| | | | | | | | | | |

Earnings from Continuing Operations | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Amount | | $ | 366 | | | $ | 23 | | $ | — | | $ | 1 | | | $ | 390 | | | $ | 994 | | | $ | 56 | | $ | — | | $ | (14 | ) | | $ | 1,037 | |

Growth Rate | | | N.M. | | | | | | | | | | | | | | — | % | | | 65 | % | | | | | | | | | | | | | — | % |

| | | | | | | | | | |

Diluted EPS from Continuing Operations | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Amount | | $ | 1.02 | | | $ | 0.06 | | $ | — | | $ | — | | | $ | 1.08 | | | $ | 2.72 | | | $ | 0.15 | | $ | — | | $ | (0.04 | ) | | $ | 2.83 | |

Growth Rate | | | N.M. | | | | | | | | | | | | | | 13 | % | | | 85 | % | | | | | | | | | | | | | 11 | % |

The sum of the components may not equal the total due to rounding.

CARDINAL HEALTH, INC. AND SUBSIDIARIES

GAAP / NON-GAAP RECONCILIATION

| | | | | | | | | | | | | | | | |

| | | Third Quarter | | | Year-to-Date | |

| (in millions) | | 2009 | | | 2008 | | | 2009 | | | 2008 | |

GAAP Return on Equity | | | 15.1 | % | | | 19.6 | % | | | 14.5 | % | | | 18.1 | % |

| | | | |

Non-GAAP Return on Equity | | | | | | | | | | | | | | | | |

Net earnings | | $ | 312.9 | | | $ | 356.0 | | | $ | 878.4 | | | $ | 982.6 | |

Special items, net of tax, in continuing operations | | | 40.0 | | | | 22.7 | | | | 87.8 | | | | 55.9 | |

Other spin-off costs, net of tax | | | 1.0 | | | | — | | | | 1.3 | | | | — | |

Impairments, (gain)/loss on sale of assets and other, net, net of tax, in continuing operations | | | (4.5 | ) | | | 0.8 | | | | (18.3 | ) | | | (13.5 | ) |

(Gain)/loss on sale of PTS, net of tax, in discontinued operations | | | — | | | | 7.6 | | | | — | | | | 7.6 | |

| | | | | | | | | | | | | | | | |

Adjusted net earnings | | $ | 349.4 | | | $ | 387.1 | | | $ | 949.2 | | | $ | 1,032.6 | |

| | | | |

Annualized | | $ | 1,397.6 | | | $ | 1,548.4 | | | $ | 1,265.6 | | | $ | 1,376.8 | |

| | | | |

Divided by average shareholders’ equity1 | | $ | 8,281.2 | | | $ | 7,250.7 | | | $ | 8,057.0 | | | $ | 7,236.6 | |

| | | | |

Non-GAAP return on equity | | | 16.9 | % | | | 21.4 | % | | | 15.7 | % | | | 19.0 | % |

| | |

| | | Third Quarter | | | Year-to-Date | |

| | | 2009 | | | 2008 | | | 2009 | | | 2008 | |

GAAP Return on Invested Capital | | | 7.18 | % | | | 8.03 | % | | | 6.86 | % | | | 7.63 | % |

| | | | |

Non-GAAP Return on Invested Capital | | | | | | | | | | | | | | | | |

Net earnings | | $ | 312.9 | | | $ | 356.0 | | | $ | 878.4 | | | $ | 982.6 | |

Special items, net of tax, in continuing operations | | | 40.0 | | | | 22.7 | | | | 87.8 | | | | 55.9 | |

Other spin-off costs, net of tax | | | 1.0 | | | | — | | | | 1.3 | | | | — | |

Impairments, (gain)/loss on sale of assets and other, net, net of tax, in continuing operations | | | (4.5 | ) | | | 0.8 | | | | (18.3 | ) | | | (13.5 | ) |

Interest expense and other, net of tax | | | 38.6 | | | | 19.9 | | | | 118.3 | | | | 79.4 | |

(Gain)/loss on sale of PTS, net of tax, in discontinued operations | | | — | | | | 7.6 | | | | — | | | | 7.6 | |

| | | | | | | | | | | | | | | | |

Adjusted net earnings | | $ | 388.0 | | | $ | 407.0 | | | $ | 1,067.5 | | | $ | 1,112.0 | |

| | | | |

Annualized | | $ | 1,552.0 | | | $ | 1,628.0 | | | $ | 1,423.3 | | | $ | 1,482.7 | |

| | | | |

Divided by average total invested capital2 | | $ | 19,584.5 | | | $ | 18,727.9 | | | $ | 19,380.9 | | | $ | 18,546.9 | |

| | | | |

Non-GAAP return on invested capital | | | 7.92 | % | | | 8.70 | % | | | 7.34 | % | | | 7.99 | % |

1 | The average shareholders’ equity shown above is calculated using the average of the prior and current quarters except for year-to-date which is calculated as the average of shareholders’ equity at the end of the prior years’ fourth quarter plus each of the current year quarters. |

2 | Total invested capital is calculated as the sum of the current portion of long-term obligations and other short-term borrowings, long-term obligations, total shareholders’ equity and unrecorded goodwill. The average total invested capital is calculated using the average of total invested capital at the end of the prior and current quarters except for year-to-date which is calculated as the average of the prior years’ fourth quarter plus each of the current year quarters. Unrecorded goodwill is $7.5 billion for all periods presented. |

CARDINAL HEALTH, INC. AND SUBSIDIARIES

GAAP / NON-GAAP RECONCILIATION

| | | | | | | | | | | | | | | | |

| | | Third Quarter | | | Year-to-Date | |

| (in millions) | | 2009 | | | 2008 | | | 2009 | | | 2008 | |

GAAP Effective Tax Rate from Continuing Operations | | | 28.1 | % | | | 32.9 | % | | | 30.8 | % | | | 32.0 | % |

| | | | |

Non-GAAP Effective Tax Rate from Continuing Operations | | | | | | | | | | | | | | | | |

Earnings before income taxes and discontinued operations | | $ | 435.9 | | | $ | 545.4 | | | $ | 1,275.2 | | | $ | 1,461.5 | |

Special items | | | 52.2 | | | | 35.6 | | | | 124.4 | | | | 87.7 | |

Other spin-off costs | | | 1.6 | | | | — | | | | 2.0 | | | | — | |

Impairments, (gain)/loss on sale of assets and other, net | | | 3.0 | | | | 1.2 | | | | 13.5 | | | | (22.0 | ) |

| | | | | | | | | | | | | | | | |

Adjusted earnings before income taxes and discontinued operations | | $ | 492.7 | | | $ | 582.2 | | | $ | 1,415.1 | | | $ | 1,527.2 | |

| | | | |

Provision for income taxes | | $ | 122.4 | | | $ | 179.5 | | | $ | 393.1 | | | $ | 467.2 | |

Special items tax benefit | | | 12.2 | | | | 12.9 | | | | 36.6 | | | | 31.8 | |

Other spin-off costs tax benefit | | | 0.6 | | | | — | | | | 0.7 | | | | — | |

Impairments, (gain)/loss on sale of assets and other, net, tax impact | | | 7.5 | | | | 0.4 | | | | 31.8 | | | | (8.5 | ) |

| | | | | | | | | | | | | | | | |

Adjusted provision for income taxes | | $ | 142.7 | | | $ | 192.8 | | | $ | 462.2 | | | $ | 490.5 | |

| | | | |

Non-GAAP effective tax rate from continuing operations | | | 29.0 | % | | | 33.1 | % | | | 32.7 | % | | | 32.1 | % |

| | | | | | | | |

| | | Third Quarter | |

| | | 2009 | | | 2008 | |

Debt to Total Capital | | | 30 | % | | | 34 | % |

| | |

Net Debt to Capital | | | | | | | | |

Current portion of long-term obligations and other short-term borrowings | | $ | 368.0 | | | $ | 355.3 | |

Long-term obligations, less current portion and other short-term borrowings | | | 3,303.1 | | | | 3,450.1 | |

| | | | | | | | |

Debt | | $ | 3,671.1 | | | $ | 3,805.4 | |

Cash and equivalents | | | (1,366.0 | ) | | | (1,529.0 | ) |

| | | | | | | | |

Net debt | | $ | 2,305.1 | | | $ | 2,276.4 | |

Total shareholders’ equity | | $ | 8,434.5 | | | $ | 7,393.2 | |

Capital | | $ | 10,739.6 | | | $ | 9,669.6 | |

Net debt to capital | | | 21 | % | | | 24 | % |

Forward-Looking Non-GAAP Financial Measures

The Company presents non-GAAP earnings from continuing operations and non-GAAP effective tax rate from continuing operations (and presentations derived from these financial measures) on a forward-looking basis. The most directly comparable forward-looking GAAP measures are earnings from continuing operations and effective tax rate from continuing operations. The Company is unable to provide a quantitative reconciliation of these forward-looking non-GAAP measures to the most comparable forward-looking GAAP measures because the Company cannot reliably forecast special items, impairments, (gain)/loss on sale of assets and other, net and other spin-off costs, which are difficult to predict and estimate and are primarily dependent on future events. Please note that the unavailable reconciling items could significantly impact the Company’s future financial results.

CARDINAL HEALTH, INC. AND SUBSIDIARIES

DEFINITIONS

GAAP

Debt: long-term obligations plus short-term borrowings

Debt to Total Capital: debt divided by (debt plus total shareholders’ equity)

Diluted EPS from Continuing Operations: earnings from continuing operations divided by diluted weighted average shares outstanding

Effective Tax Rate from Continuing Operations: provision for income taxes divided by earnings before income taxes and discontinued operations

Operating Cash Flow: net cash provided by / (used in) operating activities from continuing operations

Other Spin-Off Costs: costs incurred in connection with the Company’s plans to spin off its clinical and medical products businesses that are not included in special items or impairments, (gain)/loss on sale of assets and other, net

Segment Profit: segment revenue minus (segment cost of products sold and segment selling, general and administrative expenses)

Segment Profit Margin: segment profit divided by segment revenue

Segment Profit Mix: segment profit divided by total segment profit for all segments

Return on Equity: annualized net earnings divided by average shareholders’ equity

Return on Invested Capital: annualized net earnings plus interest expense and other divided by (average total shareholders’ equity plus debt plus unrecorded goodwill)

Revenue Mix: segment revenue divided by total segment revenue for all segments

NON-GAAP

Net Debt to Capital: net debt divided by (net debt plus total shareholders’ equity)

Net Debt: debt minus (cash and equivalents and short-term investments available for sale)

Non-GAAP Diluted EPS from Continuing Operations: non-GAAP earnings from continuing operations divided by diluted weighted average shares outstanding

Non-GAAP Diluted EPS from Continuing Operations Growth Rate: (current period non-GAAP diluted EPS from continuing operations minus prior period non-GAAP diluted EPS from continuing operations) divided by prior period non-GAAP diluted EPS from continuing operations

Non-GAAP Earnings from Continuing Operations: earnings from continuing operations excluding (1) special items, (2) impairments, (gain)/loss on sale of assets and other, net and (3) Other Spin-Off Costs, each net of tax

Non-GAAP Earnings from Continuing Operations Growth Rate: (current period non-GAAP earnings from continuing operations minus prior period non-GAAP earnings from continuing operations) divided by prior period non-GAAP earnings from continuing operations

Non-GAAP Effective Tax Rate from Continuing Operations: (provision for income taxes adjusted for (1) special items, (2) impairments, (gain)/loss on sale of assets and other, net and (3) Other Spin-Off Costs) divided by (earnings before income taxes and discontinued operations adjusted for (1) special items, (2) impairments, (gain)/loss on sale of assets and other, net and (3) Other Spin-Off Costs)

Non-GAAP Operating Earnings: operating earnings excluding (1) special items, (2) impairments, (gain)/loss on sale of assets and other, net and (3) Other Spin-Off Costs

Non-GAAP Operating Earnings Growth Rate: (current period non-GAAP operating earnings minus prior period non-GAAP operating earnings) divided by prior period non-GAAP operating earnings

Non-GAAP Return on Equity: (annualized current period net earnings excluding (1) special items, (2) impairments, (gain)/loss on sale of assets and other, net and (3) Other Spin-Off Costs, each net of tax) divided by average shareholders’ equity

Non-GAAP Return on Invested Capital: (annualized net earnings excluding (1) special items, (2) impairments, (gain)/loss on sale of assets and other, net, (3) Other Spin-Off Costs and (4) interest expense and other, each net of tax) divided by (average total shareholders’ equity plus debt plus unrecorded goodwill)