Essential to care Q4FY2009 and FY2010E Investor/Analyst Call August 18, 2009 Exhibit 99.3 |

2 2 Forward-looking statements and GAAP reconciliation This presentation contains forward-looking statements addressing expectations, prospects, estimates and other matters that are dependent upon future events or developments. These matters are subject to risks and uncertainties that could cause actual results to differ materially from those projected, anticipated or implied. These risks and uncertainties include (but are not limited to) uncertainties related to the deferral in hospital capital spending affecting Cardinal Health’s Clinical and Medical Products businesses and difficulties in forecasting the exact duration and potential long-term changes in hospital spending patterns; uncertainties and risks regarding the spinoff, including the costs associated with the spinoff and the impact of the spinoff on Cardinal Health, CareFusion and the potential market for their respective securities; competitive pressures in Cardinal Health’s various lines of business; the loss of one or more key customer or supplier relationships or changes to the terms of those relationships; uncertainties relating to timing of generic and branded pharmaceutical introductions and the frequency or rate of branded pharmaceutical price appreciation or generic pharmaceutical price deflation; changes in the distribution patterns or reimbursement rates for health care products and/or services; the results, consequences, effects or timing of any inquiry or investigation by any regulatory authority or any legal or administrative proceedings; future actions of regulatory bodies or government authorities relating to Cardinal Health’s manufacturing or sale of products and other costs or claims that could arise from its manufacturing, compounding or repackaging operations or from its other services; the effects, timing or success of restructuring programs or plans; the costs, difficulties and uncertainties related to the integration of acquired businesses; uncertainties related to disruptions in the financial markets, including uncertainties related to the availability and/or cost of credit and the impact of financial market disruptions on Cardinal Health’s customers and vendors; uncertainties regarding the ultimate features of government health care reform initiatives and their enactment and implementation; and conditions in the pharmaceutical market and general economic and market conditions. In addition, Cardinal Health, CareFusion and the spinoff are subject to additional risks and uncertainties described in Cardinal Health’s Form 10-K, Form 10-Q and Form 8-K reports and CareFusion’s Form 10 registration statement (including all amendments to those reports and registration statement) and exhibits to those reports and registration statement. This presentation reflects management’s views as of August 18, 2009. Except to the extent required by applicable law, neither Cardinal Health nor CareFusion undertakes an obligation to update or revise any forward-looking statement. In addition, this presentation includes non-GAAP financial measures. Cardinal Health provides definitions and reconciling information at the end of this presentation and on its investor relations page at www.cardinalhealth.com. A reconciliation of non-GAAP adjusted financial measures is provided in Exhibit 99.4 to Cardinal Health’s Form 8-K filed on August 18, 2009. A transcript of the conference call will be available on the investor relations page at www.cardinalhealth.com. |

3 3 Agenda Consolidated CAH FY09 financial results Jeff Henderson, Chief Financial Officer New Cardinal Health George Barrett, Post-spinoff: Chairman and CEO nCAH historical adjusted financials and FY10 outlook Jeff Henderson, Chief Financial Officer nCAH Q&A CareFusion Dave Schlotterbeck, Chairman and CEO CFN historical pro forma financials and FY10 outlook Ed Borkowski, Chief Financial Officer CFN Q&A |

4 Q4 and YE FY2009 CAH Results |

5 5 Q4 FY2009 Financial Review $25,199 $436 $268 $0.74 $828M 12.7% ($M) 10% (17%) (15%) (16%) % Change¹ GAAP Basis $25,199 $509 $311 $0.86 14.8% ($M) 10% (9%) (9%) (10%) % Change¹ Non-GAAP Basis 1 % change over prior year quarter Revenue Operating earnings Earnings from continuing ops Diluted EPS from continuing ops Operating cash flow Return on equity |

6 6 Q4 FY2009 Operating Earnings and EPS Note: Costs associated with the spinoff are as follows: 1 Non-GAAP consolidated diluted EPS from continuing operations for Q4 FY2009 and Q4 FY2008 includes a dilutive impact of $0.01 and $0.02, respectively, from the classification of the company’s UK-based Martindale injectable manufacturing business as discontinued operations. Operating Earnings ($M) Diluted EPS from Continuing Operations 1 Operating Earnings ($M) Diluted EPS from Continuing Operations 1 GAAP consolidated $436 $0.74 $527 $0.88 Special items (Note) $54 $0.11 $42 $0.09 Impairments, (gain)/loss on sale of assets and other, net (Note) $12 - ($10) ($0.01) Spinoff costs not included in special items or impairments, (gain)/loss on sale of assets and other, net (Note) $8 $0.01 - - Non-GAAP consolidated $509 $0.86 $560 $0.96 Spinoff costs included in special items or impairments, (gain)/loss on sale of assets and other, net $46 Spinoff costs not included in special items or impairments, (gain)/loss on sale of assets and other, net $8 Total spinoff costs $54 Q4 FY 2008 Q4 FY 2009 |

7 7 FY2009 Financial Review $99,512 $1,886 $1,143 $3.16 $1.6B 14.1% ($M) 9% (10%) (12%) (11%) % Change¹ GAAP Basis $99,512 $2,098 $1,256 $3.48 15.4% ($M) 9% (4%) (8%) (7%) % Change¹ Non-GAAP Basis 1 % change over prior year Revenue Operating earnings Earnings from continuing ops Diluted EPS from continuing ops Operating cash flow Return on equity |

8 8 Operating Earnings ($M) Diluted EPS from Continuing Operations¹ Operating Earnings ($M) Diluted EPS from Continuing Operations¹ GAAP consolidated $1,886 $3.16 $2,092 $3.56 Special items (Note) $177 $0.35 $130 $0.24 Impairments, (gain)/loss on sale of assets and other, net (Note) $25 ($0.05) ($32) ($0.05) Spinoff costs not included in special items or impairments, (gain)/loss on sale of assets and other, net (Note) $10 $0.02 - - Non-GAAP consolidated $2,098 $3.48 $2,190 $3.75 Spinoff costs included in special items or impairments, (gain)/loss on sale of assets and other, net $97 Spinoff costs not included in special items or impairments, (gain)/loss on sale of assets and other, net $10 Total spinoff costs $107 FY 2009 FY 2008 FY2009 Operating Earnings and EPS Note: Costs associated with the spinoff are as follows: 1 Non-GAAP consolidated diluted EPS from continuing operations for FY2009 and FY2008 includes a dilutive impact of $0.03 and $0.05, respectively, from the classification of the company’s UK-based Martindale injectable manufacturing business as discontinued operations. |

9 Cardinal Health Business Analysis Revenue Segment Profit Q4 FY09 ($M) 21,832 316 Q4 FY08 ($M) 11% 8% % Change Revenue Segment Profit 1,270 229 (12%) (32%) Healthcare Supply Chain Services Clinical and Medical Products 24,318 341 1,119 157 FY09 ($M) 87,110 1,333 FY08 ($M) 10% 0% % Change 95,718 1,339 Q4 FY09 ($M) Q4 FY08 ($M) % Change FY09 ($M) FY08 ($M) % Change 4,606 735 (0%) (9%) 4,588 670 |

10 New Cardinal Health Improving the cost-effectiveness of healthcare |

11 FY09 Accomplishments Laying the foundation for New Cardinal Health – Invested to improve the customer experience and strengthen core business – Focused the portfolio – Disciplined management of operating expenses and capital; rationalized infrastructure to prepare for post-spin – Stabilized our chain customer base – Progress in driving non-bulk revenue growth to improve mix; improved generics performance – Enhanced our regulatory compliance systems and processes – Effectively grew nuclear business and re-positioned for future – Positioned medical businesses for sustained growth – Revised capital deployment strategy; increased dividend pay-out – Improved business processes to optimize performance |

12 New Cardinal Health (nCAH) FY 2010 outlook |

13 nCAH FY 2010 Financial Expectations August 18, 2009 FY10 outlook FY09 adjusted base financials Total revenue growth: Low single digits $96B Non-GAAP EPS : $1.90 - $2.00 $2.26 1 Non-GAAP diluted earnings per share from continuing operations 1 |

14 nCAH Pharmaceutical Segment FY2010 Business Trends and Expectations August 18, 2009 – Market factors: – Modest revenue growth – YoY decline in generic launches – Incorporates customer contract repricings – Key strategic moves benefiting the longer-term: – Portfolio repositioning to focus (divestitures) and optimize existing platforms (MSI) – Pfizer DSA transition timing – Sourcing model changes (generics) – Transformational investments: – Investments in customer-facing systems – Incorporates some risk adjustment for the nuclear supply chain – Strong working capital management continues |

15 – Market factors: – Modest revenue growth – Positive impact from decreases in raw materials/COGS – Transformational investments: – Medical Transformation accelerating – Progress in ambulatory care channel – investments continue – Improvement in Presource performance – Lean/operational excellence initiatives improving supply chain and working capital nCAH Medical Segment FY10 Business Trends and Expectations August 18, 2009 |

16 nCAH FY10 Overall Expectations August 18, 2009 FY10 outlook FY09 adjusted base financials Non-GAAP effective tax rate ~ 36-37% 37% Diluted weighted average shares outstanding ~ 362M ~361.5M Interest and other $120M - $130M $128M Capital expenditures $200M - $250M $419M |

17 17 nCAH: Our Focus in FY 2010 – Continue investing to improve the customer experience and strengthen the core – Drive margin improvement – Optimize customer, pricing and supplier processes – Relentlessly manage expenses and capital – Sustained commitment to building upon FY09 regulatory compliance successes – Institutionalize performance culture; consistently measure and improve our performance – Take actions to deliver sustainable profit growth over the longer-term |

20 20 New Cardinal Health Historical adjusted financials Unaudited adjusted results reflect the estimated impact of the removal of the CareFusion businesses from the historical financial results of Cardinal Health. These adjusted financial results have been derived from Cardinal Health’s historical consolidated financial statements and do not necessarily reflect the financial results that will be presented within Cardinal Health’s consolidated financial statements subsequent to the completion of the spinoff of CareFusion. In addition, they do not reflect what the financial results would have been if Cardinal Health had actually operated without the CareFusion businesses during the periods shown nor are they necessarily indicative of Cardinal Health’s future results. The assumptions and estimates used and adjustments derived from such assumptions are based on currently available information, and Cardinal Health management believes such assumptions and estimates are reasonable under the circumstances. See Cardinal Health unaudited adjusted financial statements filed with the Form 8-K dated Aug. 18, 2009 for further explanation of the adjusted presentation. |

21 21 Adjusted nCAH Financial Review Non-GAAP Adjusted Financials Fiscal 2009 ($M) Fiscal 2008 ($M) Revenue $95,992 $87,408 Operating Earnings $1,419 $1,437 Earnings from continuing ops $816 $890 Diluted EPS from continuing ops $2.26 $2.45 |

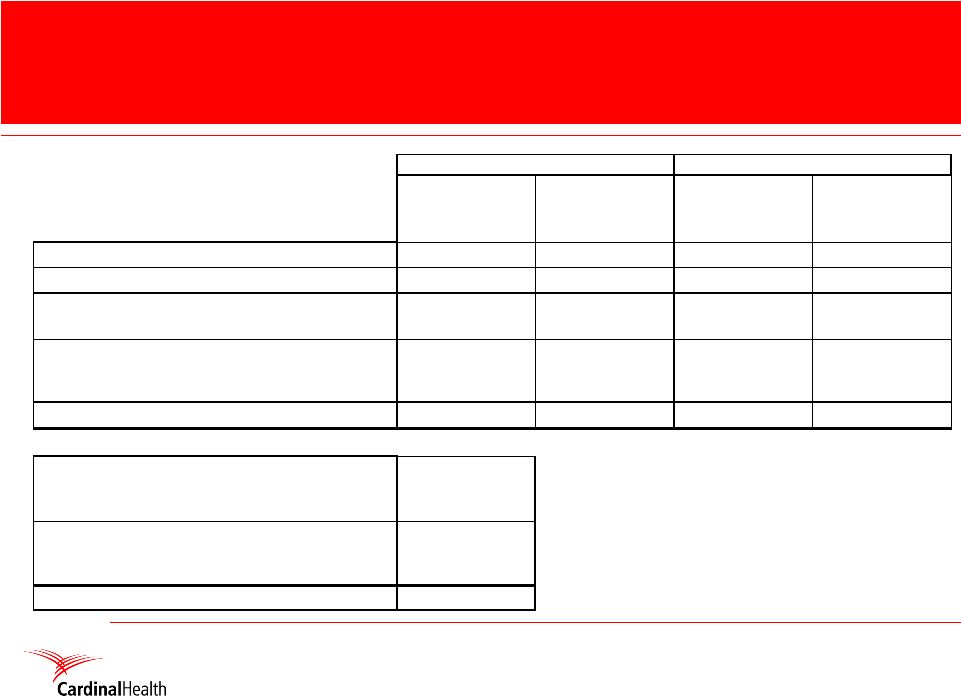

22 Pharmaceutical segment adjusted financials Quarterly analysis: FY08 - 09 Q1FY08 Q2FY08 Q3FY08 Q4FY08 FY08 Revenue ($M) 19,277 20,409 19,952 19,861 79,498 Segment Profit ($M) 280 238 280 224 1,022 Q1FY09 Q2FY09 Q3FY09 Q4FY09 FY09 Revenue ($M) 21,404 22,079 22,118 22,263 87,863 Segment Profit ($M) 213 262 286 273 1,036 |

23 Medical Segment adjusted financials Quarterly analysis: FY08 - 09 Q1FY08 Q2FY08 Q3FY08 Q4FY08 FY08 Revenue ($M) 1,883 1,973 2,026 2,035 7,917 Segment Profit ($M) 76 98 127 110 411 Q1FY09 Q2FY09 Q3FY09 Q4FY09 FY09 Revenue ($M) 2,037 2,057 1,976 2,090 8,159 Segment Profit ($M) 98 75 129 83 384 |

24 24 GAAP to Non-GAAP Reconciliation Statements |

CARDINAL HEALTH, INC. AND SUBSIDIARIES

GAAP / NON-GAAP RECONCILIATION

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Fourth Quarter 2009 | | | Fiscal Year 2009 | |

(in millions, except per Common Share amounts) | | GAAP | | | Special Items | | Other Spin-Off

Costs | | Impairments,

(Gain)/Loss on

Sale of Assets

and Other, Net | | | Non-GAAP | | | GAAP | | | Special Items | | Other Spin-Off

Costs | | Impairments,

(Gain)/Loss on

Sale of Assets

and Other, Net | | | Non-GAAP | |

Operating Earnings | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Amount | | $ | 436 | | | $ | 54 | | $ | 8 | | $ | 12 | | | $ | 509 | | | $ | 1,886 | | | $ | 177 | | $ | 10 | | $ | 25 | | | $ | 2,098 | |

Growth Rate | | | (17 | )% | | | | | | | | | | | | | (9 | )% | | | (10 | )% | | | | | | | | | | | | | (4 | )% |

| | | | | | | | | | |

Provision for Income Taxes | | $ | 134 | | | $ | 15 | | $ | 3 | | $ | 12 | | | $ | 164 | | | $ | 524 | | | $ | 52 | | $ | 4 | | $ | 44 | | | $ | 623 | |

| | | | | | | | | | |

Earnings from Continuing Operations | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Amount | | $ | 268 | | | $ | 39 | | $ | 5 | | $ | — | | | $ | 311 | | | $ | 1,143 | | | $ | 126 | | $ | 7 | | $ | (19 | ) | | $ | 1,256 | |

Growth Rate | | | (15 | )% | | | | | | | | | | | | | (9 | )% | | | (12 | )% | | | | | | | | | | | | | (8 | )% |

| | | | | | | | | | |

Diluted EPS from Continuing Operations | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Amount | | $ | 0.74 | | | $ | 0.11 | | $ | 0.01 | | $ | — | | | $ | 0.86 | | | $ | 3.16 | | | $ | 0.35 | | $ | 0.02 | | $ | (0.05 | ) | | $ | 3.48 | |

Growth Rate | | | (16 | )% | | | | | | | | | | | | | (10 | )% | | | (11 | )% | | | | | | | | | | | | | (7 | )% |

| | |

| | | Fourth Quarter 2008 | | | Fiscal Year 2008 | |

| | | GAAP | | | Special Items | | Other Spin-Off

Costs | | Impairments,

(Gain)/Loss on

Sale of Assets

and Other, Net | | | Non-GAAP | | | GAAP | | | Special Items | | Other Spin-Off

Costs | | Impairments,

(Gain)/Loss on

Sale of Assets

and Other, Net | | | Non-GAAP | |

Operating Earnings | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Amount | | $ | 527 | | | $ | 42 | | $ | — | | $ | (10 | ) | | $ | 560 | | | $ | 2,092 | | | $ | 130 | | $ | — | | $ | (32 | ) | | $ | 2,190 | |

Growth Rate | | | 27 | % | | | | | | | | | | | | | 5 | % | | | 55 | % | | | | | | | | | | | | | 3 | % |

| | | | | | | | | | |

Provision for Income Taxes | | $ | 164 | | | $ | 12 | | $ | — | | $ | (6 | ) | | $ | 170 | | | $ | 626 | | | $ | 44 | | $ | — | | $ | (14 | ) | | $ | 655 | |

| | | | | | | | | | |

Earnings from Continuing Operations | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Amount | | $ | 316 | | | $ | 30 | | $ | — | | $ | (4 | ) | | $ | 342 | | | $ | 1,296 | | | $ | 86 | | $ | — | | $ | (18 | ) | | $ | 1,365 | |

Growth Rate | | | 36 | % | | | | | | | | | | | | | 1 | % | | | 58 | % | | | | | | | | | | | | | — | % |

| | | | | | | | | | |

Diluted EPS from Continuing Operations | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Amount | | $ | 0.88 | | | $ | 0.09 | | $ | — | | $ | (0.01 | ) | | $ | 0.96 | | | $ | 3.56 | | | $ | 0.24 | | $ | — | | $ | (0.05 | ) | | $ | 3.75 | |

Growth Rate | | | 47 | % | | | | | | | | | | | | | 9 | % | | | 75 | % | | | | | | | | | | | | | 11 | % |

The sum of the components may not equal the total due to rounding.

CARDINAL HEALTH, INC. AND SUBSIDIARIES

GAAP / NON-GAAP RECONCILIATION

| | | | | | | | | | | | | | | | |

| | | Fourth Quarter | | | Fiscal Year | |

| (in millions) | | 2009 | | | 2008 | | | 2009 | | | 2008 | |

GAAP Return on Equity | | | 12.7 | % | | | 16.8 | % | | | 14.1 | % | | | 17.7 | % |

| | | | |

Non-GAAP Return on Equity | | | | | | | | | | | | | | | | |

Net earnings | | $ | 273.2 | | | $ | 318.0 | | | $ | 1,151.6 | | | $ | 1,300.6 | |

Special items, net of tax, in continuing operations | | | 38.6 | | | | 30.4 | | | | 125.8 | | | | 86.3 | |

Other spin-off costs, net of tax | | | 5.3 | | | | — | | | | 6.5 | | | | — | |

Impairments, (gain)/loss on sale of assets and other, net, net of tax, in continuing operations | | | (0.3 | ) | | | (4.0 | ) | | | (18.5 | ) | | | (17.6 | ) |

Gain on sale of PTS, net of tax, in discontinued operations | | | — | | | | — | | | | — | | | | 7.6 | |

| | | | | | | | | | | | | | | | |

Adjusted net earnings | | $ | 316.8 | | | $ | 344.4 | | | $ | 1,265.4 | | | $ | 1,376.9 | |

| | | | |

Annualized | | $ | 1,267.2 | | | $ | 1,377.6 | | | $ | 1,265.4 | | | $ | 1,376.9 | |

| | | | |

Divided by average shareholders’ equity1 | | $ | 8,579.6 | | | $ | 7,570.4 | | | $ | 8,190.5 | | | $ | 7,338.8 | |

| | | | |

Non-GAAP return on equity | | | 14.8 | % | | | 18.2 | % | | | 15.4 | % | | | 18.8 | % |

| | |

| | | Fourth Quarter | | | Fiscal Year | |

| | | 2009 | | | 2008 | | | 2009 | | | 2008 | |

GAAP Return on Invested Capital | | | 5.97 | % | | | 7.35 | % | | | 6.63 | % | | | 7.55 | % |

| | | | |

Non-GAAP Return on Invested Capital | | | | | | | | | | | | | | | | |

Net earnings | | $ | 273.2 | | | $ | 318.0 | | | $ | 1,151.6 | | | $ | 1,300.6 | |

Special items, net of tax, in continuing operations | | | 38.6 | | | | 30.4 | | | | 125.8 | | | | 86.3 | |

Other spin-off costs, net of tax | | | 5.3 | | | | — | | | | 6.5 | | | | — | |

Impairments, (gain)/loss on sale of assets and other, net, net of tax, in continuing operations | | | (0.3 | ) | | | (4.0 | ) | | | (18.5 | ) | | | (17.6 | ) |

Interest expense and other, net of tax | | | 21.9 | | | | 30.0 | | | | 139.3 | | | | 108.4 | |

Gain on sale of PTS, net of tax, in discontinued operations | | | — | | | | — | | | | — | | | | 7.6 | |

| | | | | | | | | | | | | | | | |

Adjusted net earnings | | $ | 338.7 | | | $ | 374.4 | | | $ | 1,404.7 | | | $ | 1,485.3 | |

| | | | |

Annualized | | $ | 1,354.8 | | | $ | 1,497.6 | | | $ | 1,404.7 | | | $ | 1,485.3 | |

| | | | |

Divided by average total invested capital2 | | $ | 19,778.3 | | | $ | 18,935.7 | | | $ | 19,487.0 | | | $ | 18,664.2 | |

| | | | |

Non-GAAP return on invested capital | | | 6.85 | % | | | 7.91 | % | | | 7.21 | % | | | 7.96 | % |

| 1 | The average shareholders’ equity shown above is calculated using the average of the prior and current quarters except for year-to-date which is calculated as the average of shareholders’ equity at the end of the prior years’ fourth quarter plus each of the current year quarters. |

| 2 | Total invested capital is calculated as the sum of the current portion of long-term obligations and other short-term borrowings, long-term obligations, total shareholders’ equity and unrecorded goodwill. The average total invested capital is calculated using the average of total invested capital at the end of the prior and current quarters except for year-to-date which is calculated as the average of the prior years’ fourth quarter plus each of the current year quarters. Unrecorded goodwill is $7.5 billion for all periods presented. |

CARDINAL HEALTH, INC. AND SUBSIDIARIES

GAAP / NON-GAAP RECONCILIATION

| | | | | | | | | | | | | | | | |

(in millions) | | Fourth Quarter | | | Fiscal Year | |

| | 2009 | | | 2008 | | | 2009 | | | 2008 | |

GAAP Effective Tax Rate from Continuing Operations | | | 33.3 | % | | | 34.2 | % | | | 31.4 | % | | | 32.6 | % |

| | | | |

Non-GAAP Effective Tax Rate from Continuing Operations | | | | | | | | | | | | | | | | |

Earnings before income taxes and discontinued operations | | $ | 401.2 | | | $ | 480.3 | | | $ | 1,667.0 | | | $ | 1,922.1 | |

Special items | | | 53.8 | | | | 42.4 | | | | 177.4 | | | | 130.1 | |

Other spin-off costs | | | 8.4 | | | | — | | | | 10.4 | | | | — | |

Impairments, (gain)/loss on sale of assets and other, net | | | 11.5 | | | | (10.0 | ) | | | 25.0 | | | | (32.0 | ) |

| | | | | | | | | | | | | | | | |

Adjusted earnings before income taxes and discontinued operations | | $ | 474.9 | | | $ | 512.7 | | | $ | 1,879.8 | | | $ | 2,020.2 | |

| | | | |

Provision for income taxes | | $ | 133.7 | | | $ | 164.4 | | | $ | 524.2 | | | $ | 626.1 | |

Special items tax benefit | | | 15.2 | | | | 12.0 | | | | 51.6 | | | | 43.8 | |

Other spin-off costs tax benefit | | | 3.1 | | | | — | | | | 3.9 | | | | — | |

Impairments, (gain)/loss on sale of assets and other, net, tax impact | | | 11.8 | | | | (6.0 | ) | | | 43.5 | | | | (14.4 | ) |

| | | | | | | | | | | | | | | | |

Adjusted provision for income taxes | | $ | 163.8 | | | $ | 170.4 | | | $ | 623.2 | | | $ | 655.5 | |

| | | | |

Non-GAAP effective tax rate from continuing operations | | | 34.5 | % | | | 33.2 | % | | | 33.2 | % | | | 32.4 | % |

| | | |

| | | Fourth Quarter | | | | | | | |

| | | 2009 | | | 2008 | | | | | | | |

Debt to Total Capital | | | 29 | % | | | 33 | % | | | | | | | | |

| | | | |

Net Debt to Capital | | | | | | | | | | | | | | | | |

Current portion of long-term obligations and other short-term borrowings | | $ | 367.3 | | | $ | 159.0 | | | | | | | | | |

Long-term obligations, less current portion and other short-term borrowings | | | 3,280.0 | | | | 3,687.4 | | | | | | | | | |

| | | | | | | | | | | | | | | | |

Debt | | $ | 3,647.3 | | | $ | 3,846.4 | | | | | | | | | |

Cash and equivalents | | | (1,847.5 | ) | | | (1,291.3 | ) | | | | | | | | |

| | | | | | | | | | | | | | | | |

Net debt | | $ | 1,799.8 | | | $ | 2,555.1 | | | | | | | | | |

Total shareholders’ equity | | $ | 8,724.7 | | | $ | 7,747.5 | | | | | | | | | |

Capital | | $ | 10,524.5 | | | $ | 10,302.6 | | | | | | | | | |

Net debt to capital | | | 17 | % | | | 25 | % | | | | | | | | |

Forward-Looking Non-GAAP Financial Measures

The Company presents non-GAAP earnings from continuing operations and non-GAAP effective tax rate from continuing operations (and presentations derived from these financial measures) on a forward-looking basis. The most directly comparable forward-looking GAAP measures are earnings from continuing operations and effective tax rate from continuing operations. The Company is unable to provide a quantitative reconciliation of these forward-looking non-GAAP measures to the most comparable forward-looking GAAP measures because the Company cannot reliably forecast special items, impairments, (gain)/loss on sale of assets and other, net and other spin-off costs, which are difficult to predict and estimate and are primarily dependent on future events. Please note that the unavailable reconciling items could significantly impact the Company’s future financial results.

CareFusion presents the non-GAAP measure “adjusted diluted earnings per share” on a forward-looking basis. The most directly comparable forward-looking GAAP measure for CareFusion is diluted earnings per share. CareFusion is unable to provide a quantitative reconciliation of this forward-looking non-GAAP measure to the most directly comparable forward-looking GAAP measure, because CareFusion cannot reliably forecast merger integration and restructuring costs and acquired in-process research and development costs. Please note that the unavailable reconciling items could significantly impact CareFusion’s future financial results.

CARDINAL HEALTH, INC. AND SUBSIDIARIES

DEFINITIONS

GAAP

Debt:long-term obligations plus short-term borrowings

Debt to Total Capital:debt divided by (debt plus total shareholders’ equity)

Diluted EPS from Continuing Operations: earnings from continuing operations divided by diluted weighted average shares outstanding

Effective Tax Rate from Continuing Operations:provision for income taxes divided by earnings before income taxes and discontinued operations

Operating Cash Flow: net cash provided by / (used in) operating activities from continuing operations

Other Spin-Off Costs:costs incurred in connection with the Company’s plans to spin off its clinical and medical products businesses that are not included in special items or impairments, (gain)/loss on sale of assets and other, net

Segment Profit:segment revenue minus (segment cost of products sold and segment selling, general and administrative expenses)

Segment Profit Margin:segment profit divided by segment revenue

Segment Profit Mix: segment profit divided by total segment profit for all segments

Return on Equity:annualized net earnings divided by average shareholders’ equity

Return on Invested Capital: annualized net earnings plus interest expense and other divided by (average total shareholders’ equity plus debt plus unrecorded goodwill)

Revenue Mix:segment revenue divided by total segment revenue for all segments

NON-GAAP

Net Debt to Capital: net debt divided by (net debt plus total shareholders’ equity)

Net Debt:debt minus (cash and equivalents and short-term investments available for sale)

Non-GAAP Diluted EPS from Continuing Operations: non-GAAP earnings from continuing operations divided by diluted weighted average shares outstanding

Non-GAAP Diluted EPS from Continuing Operations Growth Rate: (current period non-GAAP diluted EPS from continuing operations minus prior period non-GAAP diluted EPS from continuing operations) divided by prior period non-GAAP diluted EPS from continuing operations

Non-GAAP Earnings from Continuing Operations:earnings from continuing operations excluding (1) special items, (2) impairments, (gain)/loss on sale of assets and other, net and (3) Other Spin-Off Costs, each net of tax

Non-GAAP Earnings from Continuing Operations Growth Rate: (current period non-GAAP earnings from continuing operations minus prior period non-GAAP earnings from continuing operations) divided by prior period non-GAAP earnings from continuing operations

Non-GAAP Effective Tax Rate from Continuing Operations:(provision for income taxes adjusted for (1) special items, (2) impairments, (gain)/loss on sale of assets and other, net and (3) Other Spin-Off Costs) divided by (earnings before income taxes and discontinued operations adjusted for (1) special items, (2) impairments, (gain)/loss on sale of assets and other, net and (3) Other Spin-Off Costs)

Non-GAAP Operating Earnings: operating earnings excluding (1) special items, (2) impairments, (gain)/loss on sale of assets and other, net and (3) Other Spin-Off Costs

Non-GAAP Operating Earnings Growth Rate:(current period non-GAAP operating earnings minus prior period non-GAAP operating earnings) divided by prior period non-GAAP operating earnings

Non-GAAP Return on Equity:(annualized current period net earnings excluding (1) special items, (2) impairments, (gain)/loss on sale of assets and other, net and (3) Other Spin-Off Costs, each net of tax) divided by average shareholders’ equity1

Non-GAAP Return on Invested Capital: (annualized net earnings excluding (1) special items, (2) impairments, (gain)/loss on sale of assets and other, net, (3) Other Spin-Off Costs and (4) interest expense and other, each net of tax) divided by (average total shareholders’ equity plus debt plus unrecorded goodwill)1

| 1 | For the fiscal year ended June 30, 2008, the numerator in calculating these non-GAAP measures also excludes the $7.6 loss, net of tax, on the sale of PTS recorded in discontinued operations. |

© 2009 CareFusion Corporation or one of its subsidiaries. All rights reserved. August 18, 2009 FY2009 and FY2010E Investor/Analyst Call |

© 2009 CareFusion Corporation or one of its subsidiaries. All rights reserved. 26 Forward-Looking Statements and GAAP Reconciliation Forward-Looking Statements and GAAP Reconciliation “Safe Harbor” Statement under the Private Securities Litigation Reform Act of 1995: This presentation contains forward-looking statements addressing expectations, prospects, estimates and other matters that are dependent upon future events or developments. These matters are subject to risks and uncertainties that could cause actual results to differ materially from those projected, anticipated or implied. The most significant of these uncertainties are described in our Form 10 and Cardinal Health’s Form 10-K, Form 10-Q and Form 8-K reports (including all amendments to those reports) and exhibits to those reports, and include (but are not limited to) those described in the last slide of this presentation. This presentation reflects management’s views as of August 18, 2009. Except to the extent required by applicable law, we undertake no obligation to update or revise any forward-looking statement. Pro Forma and Non-GAAP Financial Measures: This presentation includes pro forma financial information for CareFusion Corporation as a standalone company. The unaudited pro forma results included in this presentation are derived from Cardinal Health’s historical consolidated financial statements to reflect CareFusion's results as if the spinoff and certain related transactions had occurred as of the beginning of the fiscal year. These financial results do not necessarily reflect what CareFusion's financial results would have been if it had operated as an independent, publicly traded company during this fiscal period. In addition, these financial results are not necessarily indicative of CareFusion's future results. The assumptions and estimates used and pro forma adjustments derived from such assumptions are based on currently available information, and CareFusion management believes such assumptions are reasonable under the circumstances. For more information, see the CareFusion unaudited pro forma condensed combined financial statements included as Exhibit 99.5 to Cardinal Health's Form 8-K filed on August 18, 2009. The financial information included in this presentation includes non-GAAP financial measures. Reconciliations can be found on slide 7 of this presentation. In addition, definitions and reconciling information can be found on CareFusion’s website at www.carefusion.com under the SEC Filings link of the Investor Relations tab. |

© 2009 CareFusion Corporation or one of its subsidiaries. All rights reserved. 27 Today’s Speakers Today’s Speakers Dave Schlotterbeck Chairman and Chief Executive Officer Ed Borkowski Chief Financial Officer |

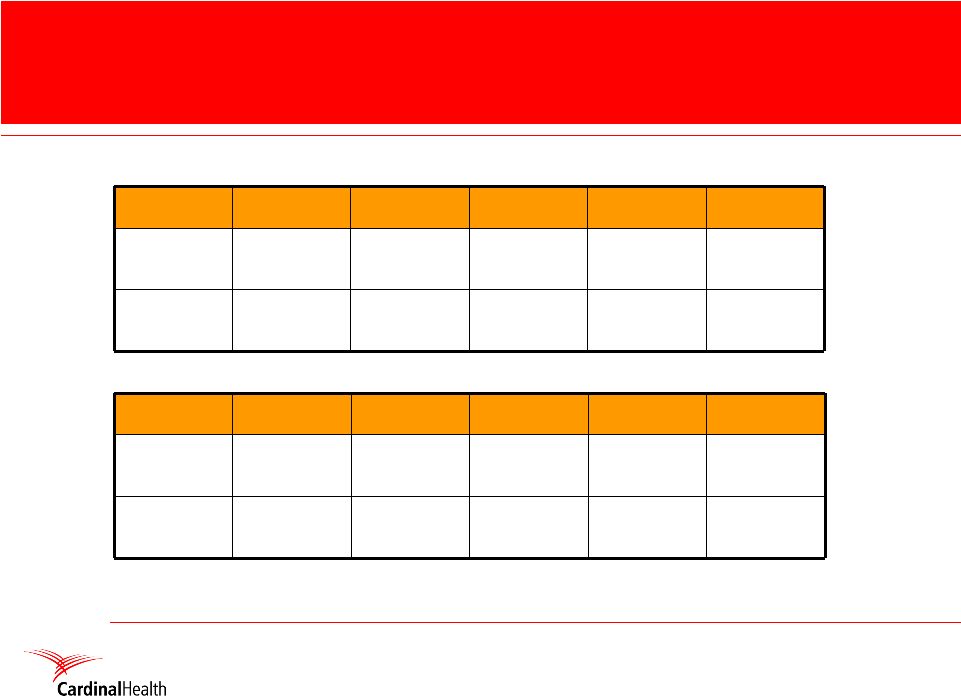

© 2009 CareFusion Corporation or one of its subsidiaries. All rights reserved. Fiscal 2010 Financial Guidance Fiscal 2010 Financial Guidance FY10 Outlook FY09 Pro Forma Financials¹ Total Revenue Growth Mid single digits Flat at $3,707 M Operating Expenses 34% of total revenue 33% of total revenue One-time Items ~$120-$130M $72M Adjusted Diluted EPS $1.10 - $1.20 $1.54 28 1 Unaudited pro forma results are derived from Cardinal’s historical consolidated financial statements to reflect CareFusion's results as if the spinoff and certain related transactions had occurred as of the beginning of the fiscal year. 2 Includes $100 - $110M incremental operating expenses over pro forma FY09 related to “Public Company” costs, incentive compensation and R&D spend. 3 One-time expenditures related to merger integration, restructuring and spinoff costs. 4 Adjusted diluted earnings per share is a Non-GAAP measure that excludes one-time items related to merger integration, restructuring and spinoff costs. 5 See reconciliation on slide 7. 3 4 2 5 |

© 2009 CareFusion Corporation or one of its subsidiaries. All rights reserved. Fiscal 2010 Corporate Assumptions Fiscal 2010 Corporate Assumptions FY10 Outlook FY09 Pro Forma Financials Adjusted Tax Rate ~25% 16.5% Diluted weighted average shares outstanding ~228M 226M Capital Expenditures $180M $130M 29 1 Unaudited pro forma results are derived from Cardinal’s historical consolidated financial statements to reflect CareFusion's results as if the spinoff and certain related transactions had occurred as of the beginning of the fiscal year. 1 |

© 2009 CareFusion Corporation or one of its subsidiaries. All rights reserved. 30 FY10 Segment-related Assumptions FY10 Segment-related Assumptions Critical Care Technologies assumptions: – Segment revenue grows in mid single digits – Slowdown in hospital capital spending continues to impact segment – Infusion: Resumption of shipping the Alaris ® System drives infusion business – Respiratory: Launch of EnVe™ palmtop, CDC order of 4,500 ventilators and ramp up for Swine Flu drive respiratory business – Dispensing: expected to be flat year-over-year Medical Technologies and Services assumptions: – Segment revenue grows in mid single digits – ChloraPrep ® continues to grow double digits |

© 2009 CareFusion Corporation or one of its subsidiaries. All rights reserved. Non-GAAP Reconciliations Non-GAAP Reconciliations FY09 Pro Forma¹ One-Time Items² FY09 Adjusted Pro Forma³ Operating earnings $448 $72M $520M Provision for income taxes $47 $22M $69M Net earnings from continuing operations $298 $50M $348M Diluted EPS from continuing operations $1.32 $0.22 $1.54 31 1 Unaudited pro forma results are derived from Cardinal’s historical consolidated financial statements to reflect CareFusion's results as if the spinoff and certain related transactions had occurred as of the beginning of the fiscal year. 2 One-time items related to merger integration, restructuring and spinoff costs. 3 Pro forma results adjusted on a non-GAAP basis to exclude one-time items related to merger integration, restructuring and spinoff costs. Note: A full GAAP pro forma to non-GAAP pro forma reconciliation can be found on CareFusion’s website at www.carefusion.com under the SEC Filings link of the Investor Relations tab |

Q&A Q&A © 2009 CareFusion Corporation or one of its subsidiaries. All rights reserved. 32 |

© 2009 CareFusion Corporation or one of its subsidiaries. All rights reserved. 33 Forward Looking Statements Forward Looking Statements This presentation contains forward-looking statements addressing expectations, prospects, estimates and other matters that are dependent upon future events or developments. These matters are subject to risks and uncertainties that could cause actual results to differ materially from those projected, anticipated or implied. The most significant of these uncertainties are described in our Form 10 and Cardinal Health’s Form 10-K, Form 10-Q and Form 8-K reports (including all amendments to those reports) and exhibits to those reports, and include (but are not limited to) the following: uncertainties regarding our planned spinoff as a new stand-alone entity, including the timing and terms of any such spinoff and whether such spinoff will be completed as it is subject to a number of conditions, and uncertainties regarding the impact of the planned spinoff on us and the potential market for our securities; uncertainties regarding the divestiture of any of our stock retained by Cardinal Health after the spinoff; difficulties or delays in the development, production, manufacturing and marketing of new or existing products and services, including difficulties or delays associated with obtaining requisite regulatory approvals or clearances associated with those activities; changes in laws and regulations or in the interpretation or application of laws or regulations, as well as possible failures to comply with applicable laws or regulations as a result of possible misinterpretations or misapplications; cost-containment efforts of our customers, purchasing groups, third-party payers and governmental organizations; the continued financial viability and success of our customers and suppliers and the potential impact on our customers and suppliers of declining economic conditions, which could impact our results of operations and financial condition; uncertainties related to the deferral in hospital capital spending and difficulties in forecasting the exact duration and potential long-term changes in hospital spending patterns; costs associated with protecting our trade secrets and enforcing our patent, copyright and trademark rights, and successful challenges to the validity of our patents, copyrights or trademarks; actions of regulatory bodies and other government authorities, including the FDA and foreign counterparts, that could delay, limit or suspend product development, manufacturing or sales or result in recalls, seizures, consent decrees, injunctions and monetary sanctions; costs or claims resulting from potential errors or defects in our manufacturing that may injure persons or damage property or operations, including costs from remediation efforts or recalls; the results, consequences, effects or timing of any commercial disputes, patent infringement claims or other legal proceedings or any government investigations; disruption or damage to or failure of our information systems; interruption in our ability to manufacture our products or an inability to obtain key components or raw materials or increased costs in such key components or raw materials; the costs, difficulties and uncertainties related to the integration of acquired businesses, including liabilities relating to the operations or activities of such businesses prior to their acquisition; uncertainties in our industry due to government healthcare reform; uncertainties related to the availability of additional financing to us in the future and the terms of such financing; risks associated with international operations, including fluctuations in currency exchange rates; the effects of our strategies to run our business in a tax-efficient manner; competitive pressures in the markets in which we operate; the loss of, or default by, one or more key customers or suppliers; unfavorable changes to the terms of key customer or supplier relationships; and general economic and market conditions. This presentation reflects management’s views as of August 18, 2009. Except to the extent required by applicable law, we undertake no obligation to update or revise any forward-looking statement. |