UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

Amendment No. 1

Annual report pursuant to section 13 or 15(d) of the Securities Exchange Act of 1934

for the fiscal year ended December 31, 2016

Commission file number 1-10254

TOTAL SYSTEM SERVICES, INC.

(Exact name of registrant as specified in its charter)

Georgia | | 58-1493818 |

(State or other jurisdiction of | | (I.R.S. Employer Identification No.) |

incorporation or organization) | | |

| | |

One TSYS Way | | |

Columbus, Georgia | | 31901 |

(Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (706) 644-6081

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | | Name of each exchange on which registered |

Common Stock, $.10 Par Value | | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: NONE

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months, and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer [X] | Accelerated Filer [ ] | Non-accelerated filer [ ] | Smaller reporting company [ ] |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

As of June 30, 2016, the aggregate market value of the registrant’s common stock held by non-affiliates of the registrant was approximately $9,575,381,000 based on the closing sale price as reported on the New York Stock Exchange.

As of February 17, 2017, there were 183,354,641 shares of the registrant’s common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Incorporated Documents | | Form 10-K Reference Locations |

Portions of the Annual Report to Shareholders for the year ended December 31, 2016 (“Annual Report”) | | Parts I, II, III and IV |

| | |

Portions of the 2017 Proxy Statement for the Annual Meeting of Shareholders to be held April 27, 2017 (“Proxy Statement”) | | Part III |

EXPLANATORY NOTE

Total System Services, Inc. is filing this Amendment No. 1 on Form 10-K/A for the sole purpose of amending Item 5 of its Annual Report on Form 10-K for the year ended December 31, 2016, as filed with the Securities and Exchange Commission on February 24, 2017 (the “Original Filing”), to amend Item 5 to furnish the performance graph as set forth below. The Company had in its possession a copy of the performance graph at the time of the Original Filing; however, the performance graph was inadvertently omitted from the Original Filing due to an error in the filing process. This Amendment No. 1 does not otherwise update information in the Original Filing to reflect facts or events occurring subsequent to the original filing date.

PART II

| |

Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

TSYS’ common stock trades on the New York Stock Exchange (NYSE) under the symbol “TSS.” Price and volume information appears under the abbreviation “TotlSysSvc” in NYSE daily stock quotation listings. As of February 17, 2017, there were 18,854 holders of record of TSYS common stock, some of whom are holders in nominee name for the benefit of different shareholders.

The 2016 fourth quarter dividend of $0.10 per share was declared on December 2, 2016, and was paid January 3, 2017, to shareholders of record on December 15, 2016. The 2015 fourth quarter dividend of $0.10 per share was declared on December 2, 2015, and was paid January 4, 2016, to shareholders of record on December 17, 2015. Total dividends declared in 2016 and in 2015 amounted to $73.5 million and $73.7 million, respectively. It is the present intention of the Board of Directors of TSYS to continue to pay cash dividends on its common stock.

Presented here is a summary of the unaudited quarterly financial data for the years ended December 31, 2016 and 2015.

| | | | | | | | | | |

(in thousands, except per share data) | | First

Quarter | | Second

Quarter | | Third

Quarter | | Fourth

Quarter | |

| | | | | | | | | | |

2016 Revenues | | $ | 739,378 | | 1,151,587 | | 1,146,889 | | 1,132,224 | |

Cost of services | | | 484,507 | | 841,923 | | 840,301 | | 826,331 | |

Operating income | | | 151,687 | | 135,821 | | 155,327 | | 130,547 | |

Net income attributable to TSYS common shareholders | | | 90,628 | | 69,707 | | 85,352 | | 73,950 | |

Basic earnings per share (EPS) attributable to TSYS common shareholders | | | 0.49 | | 0.38 | | 0.46 | | 0.40 | |

Diluted EPS attributable to TSYS common shareholders | | | 0.49 | | 0.38 | | 0.46 | | 0.40 | |

Cash dividends declared | | | 0.10 | | 0.10 | | 0.10 | | 0.10 | |

Stock prices: | | | | | | | | | | |

High | | | 48.55 | | 54.81 | | 56.43 | | 51.61 | |

Low | | | 37.96 | | 47.90 | | 46.58 | | 46.77 | |

Close | | | 47.58 | | 48.50 | | 47.15 | | 49.03 | |

2015 Revenues | | $ | 662,156 | | 692,652 | | 707,890 | | 716,843 | |

Cost of services | | | 449,715 | | 459,961 | | 456,465 | | 489,039 | |

Operating income | | | 122,496 | | 130,602 | | 163,104 | | 117,905 | |

Net income attributable to TSYS common shareholders | | | 77,755 | | 82,839 | | 120,622 | | 82,828 | |

Basic EPS attributable to TSYS common shareholders | | | 0.42 | | 0.45 | | 0.66 | | 0.45 | |

Diluted EPS attributable to TSYS common shareholders | | | 0.42 | | 0.45 | | 0.65 | | 0.45 | |

Cash dividends declared | | | 0.10 | | 0.10 | | 0.10 | | 0.10 | |

Stock prices: | | | | | | | | | | |

High | | | 39.02 | | 42.72 | | 48.64 | | 56.37 | |

Low | | | 33.27 | | 37.89 | | 41.52 | | 45.82 | |

Close | | | 38.15 | | 41.77 | | 45.43 | | 49.80 | |

| | | | | | | | | | |

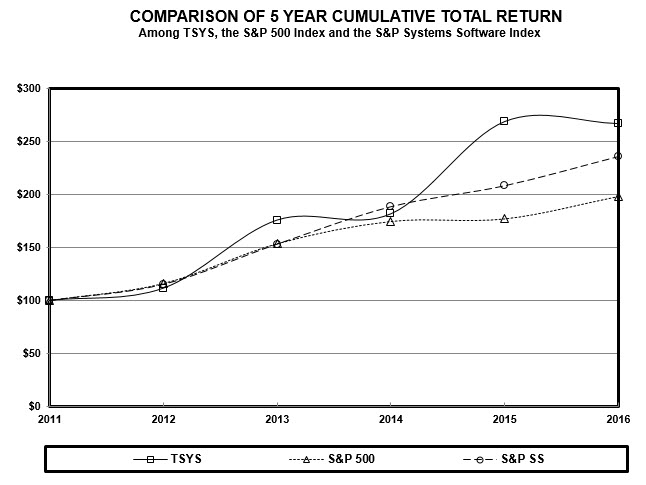

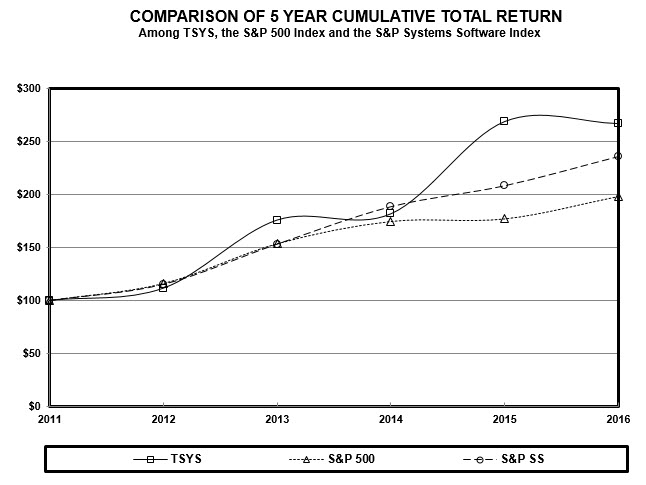

STOCK PERFORMANCE GRAPH

The following graph compares the yearly percentage change in cumulative shareholder return on TSYS stock with the cumulative total return of the Standard & Poor’s 500 Index and the Standard & Poor’s Systems Software Index for the last five fiscal years (assuming a $100 investment on December 31, 2011 and reinvestment of all dividends).

| | | | | | | | | | | | | | | | | | | |

| | 2011 | | 2012 | | 2013 | | 2014 | | 2015 | | 2016 | |

TSYS | | $ | 100.00 | | $ | 111.41 | | $ | 175.72 | | $ | 181.62 | | $ | 268.71 | | $ | 266.74 | |

S&P 500 | | $ | 100.00 | | $ | 116.00 | | $ | 153.58 | | $ | 174.60 | | $ | 177.01 | | $ | 198.18 | |

S&P SS | | $ | 100.00 | | $ | 115.23 | | $ | 153.13 | | $ | 188.36 | | $ | 208.08 | | $ | 235.62 | |

| | | | | | | | | | | | | | | | | | | |

PART IV

| |

Item 15. | Exhibits, Financial Statement Schedules |

Exhibit

NumberDescription

| |

31.1* | Certification of Chief Executive Officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 |

| |

31.2* | Certification of Chief Financial Officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 |

| |

| |

* Filed Herewith |

SIGNATURES

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, as amended, Total System Services, Inc. has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

| TOTAL SYSTEM SERVICES, INC. |

| |

February 28, 2017 | By: | /s/ M. Troy Woods | |

| M. Troy Woods, |

| Chairman and Chief Executive Officer |

| (Principal Executive Officer) |