UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Fiscal Year ended December 31, 2008

OR

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Transition Period From to

Commission file number 0-3338

MILLENNIUM BIOTECHNOLOGIES GROUP, INC.

(Exact Name of Registrant as Specified in its Charter)

| | Delaware | 22-1558317 | |

| | (State or other Jurisdiction of | (IR..S Employer | |

| | Incorporation or Organization) | Identification No.) | |

| | | | |

| | 665 Martinsville Road, Suite 219 Basking Ridge, NJ | 07920 | |

| | (Address of Principal Executive Offices) | (Zip Code) | |

(908) 604-2500

(Registrant’s telephone number including area code)

Securities registered pursuant to Section 12(b) of the Act: None

| Title of each class | | Name of each exchange on which registered |

| | | |

| None | | |

| | | |

| | | |

Securities registered pursuant to Section 12(g) of the Act:

(Title of class)

Common Stock, $.001 par value

| Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. | o Yes o No |

| Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. | o Yes o No |

Note - Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Exchange Act from their obligations under those Sections.

| Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. | x Yes o No |

| Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T(§229.405 of this chapter) during the preceeding 12 months (or for such shorter period that the registrant was required to submit and post such files). | o Yes o No |

| Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. | o |

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer o | Accelerated filer o |

| | |

Non-accelerated filer o (Do not check if a smaller reporting company) | Smaller reporting company x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). o Yes x No

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant's most recently completed second fiscal quarter.

The Registrant’s revenues for the fiscal year ended December 31, 2008, were $1,492,262.

Common stock, par value $.001 per share (“Common Stock”), was the only class of voting stock of the Registrant outstanding on March 31, 2008. Based on the closing price of the Common Stock on the OTC Electronic Bulletin Board as reported on March 31, 2009, ($0.01), the aggregate market value of the 16,546,901 shares of the Common Stock held by persons other than officers, directors and persons known to the Registrant to be the beneficial owners (as the term is defined under the rules of the Securities and Exchange Commission) of more than five percent of the Common Stock on March 31, 2009, was approximately $165,469. By the foregoing statements, the Registrant does not intend to imply that any of the officers, directors, or beneficial owners are affiliates of the registrant or that the aggregate market value, as computed pursuant to rules of the Securities and Exchange Commission, is in any way indicative of the amount which could be obtained for such shares of Common Stock.

As of March 31, 2009, 257,062,363 shares of Common Stock, $0.001 par value, 65,141 shares of Series B Convertible Preferred Stock, $1.00 par value, and 64,763 shares of Series C Cumulative Preferred Stock, $1.00 par value, were outstanding.

Note - If determination as to weather a particular person or entity is an affiliate cannot be made without involving unreasonable effort and expense, the aggregated market value of the common stock held by non-affiliates may be calculated on the basis of assumptions reasonable under the circumstance, provided that the assumptions are set forth in this Form.

DOCUMENTS INCORPORATED BY REFERENCE: SEE EXHIBIT INDEX

Transitional Small Business Disclosure Format: Yes ¨ No x

MILLENNIUM BIOTECHNOLOGIES GROUP, INC.

CONTENTS

| | | Page |

| | | |

| PART I. | | |

| | | |

| Item 1. | Business | 2 |

| | | |

| Item 1.A. | Risk Factors | 20 |

| | | |

| Item 2. | Properties | 24 |

| | | |

| Item 3. | Legal Proceedings | 24 |

| | | |

| Item 4. | Submission of Matters to a Vote of Security Holders | 24 |

| | | |

| PART II. | | |

| | | |

| Item 5. | Market for Registrant's Common Equity and Related Stockholder Matters | 25 |

| | | |

| Item 6. | Selected Financial Data | 27 |

| | | |

| Item 7. | Management’s' Discussion and Analysis of Financial Condition | |

| | and Results of Operations | 28 |

| | | |

| Item 7.A. | Quantitative and Qualitative Disclosures about Market Risks | 29 |

| | | |

| Item 8. | Financial Statements | 29 |

| | | |

| Item 9. | Changes in and Disagreements with Accountants on Accounting and | |

| | Financial Disclosure | 29 |

| | | |

| Item 9.A. | Controls and Procedures | 29 |

| | | |

| Item 9.B. | Other Information | 30 |

| | | |

| PART III. | | |

| | | |

| Item 10. | Directors, Executive Officers, Promoters and Control Persons; | |

| | Compliance with Section 16(a) of the Exchange Act | 31 |

| | | |

| Item 11. | Executive Compensation | 34 |

| | | |

| Item 12. | Security Ownership of Certain Beneficial Owners and Management | |

| | and Related Stockholder Matters | 35 |

| | | |

| Item 13. | Certain Relationships and Related Transactions | 36 |

| | | |

| Item 14. | Principal Accountant Fees and Services | 37 |

| | | |

| PART IV. | | |

| | | |

| Item 15. | Exhibits | 38 |

| | | |

| | Signatures | 39 |

| | | |

| | Exhibit Index | 38 |

CAUTIONARY STATEMENT PURSUANT TO "SAFE HARBOR" PROVISIONS OF SECTION 21E OF THE SECURITIES EXCHANGE ACT OF 1934

Except for historical information, the Company's reports to the Securities and Exchange Commission on Form 10-KSB and Form 10-Q and 10-QSB and periodic press releases, as well as other public documents and statements, contain "forward-looking statements" within the meaning of Section 21E of the Securities Exchange Act of 1934. Forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from those expressed or implied by the statements. These risks and uncertainties include general economic and business conditions, development and market acceptance of the Company’s products, current dependence on the willingness of investors to continue to fund operations of the Company and other risks and uncertainties identified in the Company's reports to the Securities and Exchange Commission, periodic press releases, or other public documents or statements.

Readers are cautioned not to place undue reliance on forward-looking statements. The Company undertakes no obligation to republish or revise forward-looking statements to reflect events or circumstances after the date hereof or to reflect the occurrences of unanticipated events.

PART I

The Company

Millennium Biotechnologies Group, Inc. (the Company or “Millennium Group”), formerly Regent Group, Inc., is a holding company for its subsidiary Millennium Biotechnologies, Inc. (“Millennium”).

Millennium was incorporated in the State of Delaware on November 9, 2000, and is located in New Jersey. Millennium is a research based bio-nutraceutical corporation involved in the field of nutritional science. Millennium's principal source of revenue is from sales of its nutraceutical supplements.

The Company acquired Millennium on July 27, 2001, when it completed a merger with Millennium. During the year prior to the merger, the Company had no material operations. For more information on the Company's operations prior to the merger and the general terms of the merger we refer to the Company’s report on Form 10-KSB for the period ended July 31, 2001, and related filings with the Securities and Exchange Commission. In the merger, new Convertible Preferred Series D stock was issued in exchange for all the outstanding stock of Millennium. Such preferred shares were subsequently converted into approximately 96% of the outstanding common stock of the Company. For accounting purposes, the merger has been treated as an acquisition of Millennium Group by Millennium, and a re-capitalization of Millennium. The historical financial statements prior to July 27, 2001, are those of Millennium. Subsequent to July 27, 2001, the financial statements are those of the Company and its wholly-owned subsidiary Millennium, on a consolidated basis.

Narrative Description of Business

Introduction

Millennium Biotechnologies Group, Inc. (“Millennium” or “the Company”) engages in the research, development, and marketing of specialized nutritional supplements as an adjunct to medical treatments for select medical conditions, as well as for athletes seeking improved recovery and advanced performance. The Company’s currently marketed products are targeted toward immuno-compromised individuals undergoing medical treatment for diseases, such as cancer, as well as individuals living with Human Immunodeficiency Virus (HIV)/Acquired Immune Deficiency Syndrome (AIDS) and wound healing and post-surgical healing and geriatric among other conditions. Millennium also is currently marketing the Surgex™ product line to elite athletes. Millennium currently manufactures and markets five proprietary product lines and 21 SKU’s to 7 separate target markets. Millennium is headquartered in Basking Ridge, New Jersey, and trades on the Over-the-Counter (OTC) market under the symbol “MBTG.OB.”

Three product lines form the Company’s Resurgex® Continuum of Care, include Resurgex Select®, Resurgex®, andResurgex Plus®. Resurgex Select® is a whole foods-based, calorically dense, high-protein nutritional formula developed for cancer patients undergoing chemotherapy or radiation treatments. Resurgex® and Resurgex Plus® are specialized, anabolic nutritional supplements rich in antioxidants that provide nutritional support post-treatment. Resurgex Essential™ and Resurgex Essential Plus™ represent Millennium’s Ready-To-Drink product line are currently being sold into the Long-Term Care-Geriatric markets. In November of 2007 Millennium obtained a 5 Year $20,000,000 exclusive purchase agreement from Provider Services, Inc., Ohio’s second largest nursing home network.

The Company’s products are unique in that they deliver healthy, whole food calories and do not contain high-fructose corn syrup or corn oil, which are not healthy or suitable forms of calories for Millennium’s targeted markets. These ingredients have also been shown to correlate with an increase in obesity, a promotion of insulin resistance, and are implicated in inflammation and cancer. Additionally, the use of high levels of Omega-6 fats (corn oil) has been shown to promote tumor growth in animal models. In contrast, Millennium’s nutritional products deliver 15 nutraceutical ingredients that specifically address the needs of chronically ill patients.

Millennium additionally developed Surgex™ (www.surgexsports.com) sports nutritional formula in late 2007. Surgex™ is clinically proven in two double-blind placebo controlled clinical trials conducted on the Division 1A Football and Soccer players at Rutgers University. Surgex™ was proven to address the nutritional concerns of both professional and amateur elite athletes. These athletes often experience similar symptoms post-workout to those battling immuno-compromised conditions, such as fatigue, loss of lean muscle, oxidative stress, and reduced immune function.

The Products

Since the initial launch of Resurgex® in September 2001, the Product lines have expanded to include 5 separate product lines and 21 SKU’s. Each of the Company’s specialized nutritional products—Resurgex Select®, Resurgex®, and Resurgex Plus®, the newly developed Ready-To-Drink Resurgex Essentiial™ and Essential Plus® form the Company’s Continuum of Care. The Surgex™ sports nutritional formula was created to open up new business outside of the medical market in which the Company’s Continuum of Care products are currently sold and marketed.

Resurgex Select®

Resurgex Select® is a whole foods-based nutritional product that is designed to be used throughout the course of cancer treatment (chemotherapy, radiation, etc.), as many times patients lose weight and cannot consume adequate nutrition. This product combines dietary fiber (3 g), low sugar (5 g), and high protein (15 g) with no added antioxidants to be a high-calorie (350 calorie) supplement. The omission of antioxidants is important because many oncologists prefer to avoid the risk that antioxidants may pose during their patient’s treatments. With this nutritional formula (which may be administered orally or fed through a gastrointestinal [GI] tube), the right balance of nutritional support can be provided in one drink. It is available in three flavors (Vanilla Bean, Chocolate Fudge, and Fruit Smoothie) and each can be mixed with water, milk, juices, or in soft cold foods such as yogurt, apple sauce, or pudding.

Resurgex Plus®

Resurgex Plus® is a high-protein (21 g), high-calorie (400 calorie), antioxidant-rich, enteral nutritional formula providing multiple comprehensive nutritional regimens into one drink. This product (which is available in Chocolate Cream and Vanilla Cream) may serve as a meal replacement or as a sole source of nutrition when directed by a physician following a patient’s treatment. Concentrated calories are derived from high-quality food sources rather than corn oil, sucrose, and corn syrup, which are commonly found in more well-known nutritional supplements.

Resurgex®

Resurgex® is a high-protein (12 g), low-sugar (5 g), low-calorie (90 calorie), antioxidant-rich, nutritional formula, which may be administered orally or fed through a GI tube. This drink, which is available in two flavors (Vanilla Supreme and Fruit Blast), is commonly used as a nutritional supplement to meals and is intended to promote wellness. It can also be mixed with water, milk, juices, or in soft cold foods such as yogurt, apple sauce, or pudding.

Surgex™

While Resurgex® andResurgex Plus® are the first multi-component nutritional supplements to address the various dietary needs of immuno-compromised individuals, Surgex™ (www.surgexsports.com), a nutritional support formula that aims to address the concerns of many elite athletes who suffer from like symptoms (fatigue, lean muscle loss, lactic acid buildup, oxidative stress, and stressed immune systems). This formula includes many of the benefits of the Resurgex® products and is designed to improve recovery parameters in efforts to enhance the performance of professional and collegiate athletes.

While Resurgex® or Resurgex Plus® can be effective when taken by athletes, the National Collegiate Athletic Association (NCAA) has specific rules about the use of certain amino acids, or anabolic agents. In fact, colleges and universities are prohibited from purchasing any product that contains amino acids or anabolic agents for athletes. This led to the development of the Surgex™ nutritional support formula.

Millennium has successfully tested its sports nutrition formula products at Rutgers University in New Jersey, among both the Men’s Division I Soccer Team and the Men’s Division I Football Team in two separate double-blind placebo-controlled studies. Both studies illustrated the product’s beneficial effects as a post-workout recovery aid, assisting the athlete in maximizing training responses and optimal recovery and improving performance. In addition, each batch of Surgex™ is certified by the Banned Substance Control Group (BSCG) to not contain any banned substances.

Resurgex Essential™

Millennium exited Research and Development on the Company’s first Ready-to-Drink Product line Resurgex Essential™ in July 2008. The Essential™ line is a ready to drink alternative to Ensure® and Boost® designed to be marketed into the long-term care channel. Millennium will fill approximately 50% of the existing $20 million dollar 5-year exclusive purchase commitment from Provider Services, Inc. (“PSI”) with this new product line. The remaining 50% of the purchase order from PSI requires Millennium to develop a tube feeding version and diabetic version of the Essential™ product line. Millennium plans to raise the capital to fund this research and development project in 2009. The Resurgex Essential™ has 250 whole food calories containing no corn syrup or corn oil. The product also contains fruit and vegetable extracts, and FOS Fiber to provide superior quality calories and taste when compared to the competition. Resurgex Essential Plus™ contains the same high quality ingredients with a higher caloric value of 450 calories per 8 oz serving.

Product Functionality Overview

Several health concerns must be addressed when it comes to effectively providing nutritional support for any major disease or immuno-compromised condition. While other “single magic bullet” products on the market largely only focus on one area while potentially neglecting others, Millennium’s products have been developed to address the major dietary concerns that may be influenced by nutritional support, when incorporated as an adjunct to a patient’s medical care. Thus, rather than providing significant amounts of calories from corn oil, low-quality proteins, sucrose, and corn syrup combined with an inexpensive multivitamin blend, Millennium’s Resurgex Select®, Resurgex®, Resurgex Plus® and Resurgex Essential™ have been developed to provide a comprehensive and complex array of nutrients, which fulfill necessary requirements in the health and well being of patients.

Mitochondrial (Energy) Support

Found within all human cells, mitochondria are tiny organelles that act as the cell’s “power plants,” producing energy (Adenosine Tri-Phosphate [ATP]) and involved in protein and fat processing. Damage to the mitochondria is typically attributed to the buildup of free radicals and other noxious byproducts, such as lactic acid, that accumulate during and after strenuous activity. Free radicals are highly reactive compounds created in the body during normal metabolic functions or introduced from the environment. Free radicals are inherently unstable, since they contain “extra” energy. To reduce their energy load, free radicals react with certain chemicals in the body, and in the process, interfere with the cells’ ability to function normally.

Factors that may influence the manner in which mitochondria function effectively include age, the presence of infections or certain diseases, strenuous activity, and select medications. Such changes or mutations may damage the mitochondria (known as mitochondrial toxicity) and either disrupt the normal function or cause function to stop completely. Millennium’s patented blend of ingredients, described below, is intended to support the function of the mitochondria and assist in producing energy within a cell.

| § | Co-Enzyme Q10 (CoQ10). CoQ10 is a vital component of cellular energy production and respiration. Participating in the mitochondrial electron transport system, which supplies ATP for a variety of physiological functions, muscle mitochondria lack adequate CoQ10 due to several chronic conditions. |

| § | L-Carnitine. L-Carnitine functions primarily to regulate fat metabolism. It is also a carrier of fatty acids into the mitochondria, where they are oxidized and then converted into ATP. It is believed that serum carnitine deficiency is common in select conditions. Furthermore, it is thought that several medications can be linked to mitochondrial destruction. |

| § | Ribose. Ribose is a key carbohydrate used by cells to form the body’s primary source of all energy, ATP. It further plays a central part in generating and recovering ATP. Ribose can offer powerful complimentary support to other nutrients addressing energy depletion by assisting in the production of normal ATP. |

| § | Nucleotides. Nucleotides are any group of molecules that, when linked together, form the building blocks of deoxyribonucleic acid (DNA) and ribonucleic acid (RNA). Nucleotides are a dietary source required to promote optimal tissue growth. |

Reduce Oxidative Stress

Oxygen consumption greatly increases during exercise, which leads to increased free radical production. Free radical formation within the muscle during exercise can easily damage muscle tissue, thereby inhibiting performance by inducing fatigue. Oxidative stress in the body is caused by an imbalance or overload of oxidants (such as free radicals from air, food, metabolism, medications, stress and disease). Prolonged oxidative stress causes disruption of the cell structure and defenses, which can lead to damage or death to the cell and play a part in the pathophysiology of a host of diseases.

Proper antioxidant defense is essential for recovery from disease. While there are many important antioxidants, vitamin C, vitamin E, zinc, selenium, polyphenols, and carotenoids, the most important is the cell’s master antioxidant defense enzyme, called superoxide dismutase (SOD). Millennium has developed a blend of ingredients, described below, to help support the cell’s ability to defend against oxidative stress.

| § | SOD/Gliadin. SOD/Gliadin has been shown to reduce oxidative stress in humans by reducing a cell’s genetic damage and reducing isoprostanes. In particular, SOD has been shown to lower oxidative stress, and is the master cellular defense enzyme of the cell. It further serves as significant support for the immune system, countering the harmful effects of free radicals and reducing their negative effects within the body. SOD may consequently support immune function, and reduce oxidative stress. The clinical relevancy of SOD has been demonstrated in numerous scientific studies in cardiology, immunology, oncology, inflammatory conditions, asthma, vision, and liver support. |

| § | Undenatured Whey Protein. A well-known source of protein for building and retaining lean muscle mass, undenatured whey has become a nutritional staple for immuno-compromised patients. Undenatured whey has also been shown to assist in cellular defense by increasing available glutathione, another important cellular antioxidant required by the body to ward off the effects of oxidative stress. |

| § | Beta Glucans. Beta glucans are sugar molecules bound together as a sugar/protein complex. Beta glucans spur macrophages (a type of white blood cell that surrounds and kills microorganisms, removes dead cells, and stimulates the action of other immune system cells) into action. Increased macrophage activity triggers a cascade of immune events that boost immune response and stimulate the production of immune cells. |

| § | Multi-Vitamin/Mineral Mix, Polyphenols. Polyphenols are a class of phytochemicals that have been associated with preventing heart disease and cancer. This mix also provides essential vitamins required by the body to provide a nutritional balance. |

Maintain Lean Muscle

Lean muscle loss or wasting is a common problem as people age and among many chronic degenerative or immuno-compromised conditions. Also known as cachexia, this problem can diminish a person’s quality of life and aggravate an existing illness. Some of the common issues that are associated with muscle loss from illness and aging consist of inadequate caloric intake, problems with metabolism, elevations of inflammatory compounds that break down muscle (some cytokines), or malabsorption.

Nutritional supplementation is important for boosting caloric intake. However, there are a variety of conditions where increasing calories may not be an effective solution. Millennium’s products contain ingredients that are designed to help maintain lean tissue by providing high-quality protein and compounds that assist in building muscle and preventing its breakdown. Some of the ingredients incorporated into Millennium’s products that help maintain lean muscle mass are bulleted below.

| § | Undenatured Whey A well-known source of protein for building and retaining lean muscle mass, undenatured whey has become a nutritional staple for immuno-compromised patients. Undenatured whey has also been shown to assist in cellular defense by increasing available glutathione, another important cellular antioxidant required by the body to ward off the effects of oxidative stress. |

| § | Ornithine Alpha-ketoglutarate (OKG). OKG affects wasting through three primary mechanisms: (1) as an anabolic agent (buildup of muscle tissue); (2) as an anti-catabolic agent (prevents breakdown of muscle tissue); and (3) as an inducer of protein synthesis. Each of these mechanisms contributes to muscular development and enhanced recovery. OKG also spares the loss of glutamine in muscle. This is vital for recovery and repair. |

| § | Branched Chain Amino Acids (BCAAs). BCAAs play an important role in muscle recovery, muscle growth, and energy maintenance. Each must be present in the muscle cells to promote protein synthesis. There is scientific evidence that BCAAs may help build and retain lean muscle mass. |

| § | Nucleotides. Nucleotides are any group of molecules that, when linked together, form the building blocks of deoxyribonucleic acid (DNA) and ribonucleic acid (RNA). Nucleotides are a dietary source required to promote optimal tissue growth. |

Support Immune Function

Good dietary support supplying essential macronutrients and micronutrients is critically important for maintaining a proper immune system. Nevertheless, if the cells of the immune system cannot produce energy efficiently (mitochondrial dysfunction), have poor antioxidant defenses (oxidative stress), and the body is losing important lean muscle, immune support cannot effectively be achieved. Millennium’s products contain a blend of ingredients, listed below, that can support the immune system while protecting against mitochondrial dysfunction, oxidative stress, and lean muscle loss.

| § | SOD/Gliadin, Beta Glucans, Nucleotides, OKG, CoQ10 and L-Carnitine. |

| § | Undenatured Whey High in Immunoglobulins. |

| § | Fruit and Vegetable Extract Blend. This blend has the phytonutrients equivalent to one to two servings of fruits and vegetables per day. The phytonutrients found in fruits and vegetables directly contribute to a healthy immune system. |

Principal Market

Size of the Market

The nutritional supplement market is expected to increase to over $6 billion by 2011 from approximately $4.7 billion at year-end 2006, according to Nutritional Supplements in the U.S., a report from Packaged Facts published in November 2006. This growth is likely to be attributed to several factors, including increased awareness of the value of adequate nutrition in helping to recover from illness or injury, the advancement and further understanding of nutritional science, the availability of newer and more sophisticated nutritional formulas, and pressure from many managed care organizations to reduce overall healthcare costs.

Target Markets

Millennium’s products are intended to benefit patients with chronic debilitating diseases, such as cancer, as well as patients needing homecare for HIV/AIDS and those undergoing wound healing or post-surgical healing, among other conditions. Surgex™ has been clinically proven to address sports recovery needs for amateur and professional elite athletes. Greater details on these markets are provided below.

Cancer

Cancer is a class of diseases or disorders characterized by uncontrolled division of cells and the ability of these cells to spread, either by direct growth into adjacent tissue through invasion, or by implantation into distant sites by metastasis (where cancer cells are transported through the bloodstream or lymphatic system). Cancer may affect people at all ages, but risk tends to increase with age and is one of the principal causes of death in developed countries. There are many types of cancer, all of which require specific treatments such as surgery, chemotherapy, and radiation. These treatments, as well as the disease itself, often have a direct impact on a person’s nutritional health.

Millennium has recognized the need for a product that is specific to people receiving cancer treatment. For that reason, the Company has formulated its Resurgex Select®, designed to be utilized during cancer treatment.

Nutrition in Cancer

Cancer patients have specific nutritional needs in order to fight the disease and maintain their energy and quality of life. According to the Canadian Cancer Journal Clin. 2005;55:319-321, some of the requirements of cancer patients include protein from high biological value sources, specific amino acids (BCAAs), “good fats” (Medium Chain Triglycerides [MCTs], Omega-3 fatty acids, low in Omega-6 fats), healthy fruits and vegetables, and highly soluble fiber (oat fiber, fructooligosaccharide [FOS], etc.). Enteral nutritional support during cancer treatment or recovery can help to restore normal body protein levels, restore immune function, and promote weight gain.

Diet is an important part of cancer treatment since malnutrition is a common problem in cancer patients due to side effects, such as anorexia, nausea, vomiting, diarrhea, constipation, mouth sores, trouble with swallowing, and pain, which make it difficult for cancer patients to eat well (where up to 85% of cancer patients experience malnutrition during their treatments). Malnutrition may also cause the patient to be weak, tired, and unable to resist infections or withstand some cancer therapies. Inadequate nutrition may further play an important role in adverse outcomes for patients, such as increased morbidity and mortality, as well as a decreased quality of life.

According to the NIH, the cancer and cancer treatments described below may cause nutrition-related side effects.

| § | Surgery. Depending on the procedure, surgery can cause mechanical or physiologic barriers to adequate nutrition, such as a short gut, which results in malabsorption after bowel resection. In addition, surgery frequently imposes an immediate metabolic response that increases the energy needs and changes the nutritional requirements necessary for wound healing and recovery at a time when baseline needs and requirements are often not being met. A well-balanced diet that contains the recommended amounts of essential nutrients and calories may help promote wound healing. |

| § | Chemotherapy. Chemotherapy is a systemic treatment that affects the whole body and causes potentially more side effects than surgery or radiation therapy. The most commonly experienced nutrition-related side effects are anorexia, taste changes, early satiety, nausea, vomiting, mucositis/esophagitis, diarrhea, and constipation. Such side effects in combination with the cancer can greatly affect a patient’s nutritional status. Nutritional support or high-calorie/high-protein liquid supplements may be used in an effort to maintain adequate calorie and nutrient intake. |

| § | Radiation. Radiation therapy can produce changes in normal physiologic function of healthy tissue that may ultimately diminish a patient’s nutritional status by interfering with ingestion, digestion, or absorption of nutrients. Side effects of radiation therapy depend on the area irradiated, total dose, fractionation, duration, and volume irradiated. Adequate calories and protein can help maintain patient strength and prevent body tissues from further catabolism. Individuals who do not consume adequate calories and protein make use of stored nutrients as an energy source, which leads to protein wasting and further weight loss. |

| | o | Many patients who are undergoing radiation therapy can benefit from nutritional supplements between meals. Aggressive nutritional support is indicated when oral intake alone fails to maintain an individual’s weight. Tube feedings, which are used more frequently than parenteral nutrition (primarily to preserve GI function), are usually well tolerated, pose less risk to the patient than parenteral feedings, and are more cost effective. Although Millennium is not yet addressing the tube-feeding market, the Company is in the process of developing a formula and could enter this market by third quarter of 2009. |

It is noteworthy that the use of antioxidants to promote healing during cancer treatments has been highly debated. According to the American Cancer Society, some recently published studies state that antioxidant supplementation may cause new disease or interference with treatment in some cancer patients. Thus, based on conflicting information as to the benefits and harms of antioxidants on patients undergoing treatment, Millennium has developed Resurgex Select® to support a cancer patient’s nutritional needs without containing antioxidants.

Protein-Calorie Malnutrition (PCM)

Protein-calorie malnutrition (PCM) is one of the most common secondary diagnoses in individuals with cancer. This condition stems from the inadequate intake of carbohydrate, protein, and fat to meet metabolic requirements or the reduced absorption of macronutrients. PCM in cancer may result from multiple factors, most often associated with anorexia, cachexia, and the early satiety sensation frequently experienced by individuals with cancer. These factors range from loss of taste or change in taste to a physical inability to digest food—both leading to inadequate nutrient intake. Furthermore, cancer-induced abnormalities may further increase the incidence of PCM. Such abnormalities could lead to glucose intolerance and insulin resistance, increased lipolysis, and increased whole-body protein turnover.

Good nutritional practices can help cancer patients maintain weight and the body’s nutrition stores, as well as aid the body in keeping its immune system strong so that it is able to fight off infection or disease following cancer treatment. Major concerns in the oncology patient that can be influenced by proper nutritional support include the following:

| § | Mitochondrial Dysfunction. Mitochondrial function is depressed in liver, kidney, colon, breast, gastric, esophageal, and lung carcinomas; |

| § | Oxidative Stress. Oxidative stress is involved in the pathophysiology of most cancers. Additionally, low levels of SOD, CAT, etc. and elevated free radicals have been found in the plasma of certain cancer patients; and |

| § | Wasting. Elevated inflammatory cytokines are strongly associated with muscle wasting and cancer cachexia. |

Each of these conditions, described in greater detail on pages 6-7, can be addressed with Millennium’s Resurgex Select®.

Product Distribution in Oncology Markets

Many hospitals and pharmacies already prescribe Millennium’s products for support during oncology treatments or for recovery.

Treatment of HIV/AIDS and Other Immuno-Compromised Conditions

According to Kalorama Information (www.kaloramainformation.com), the U.S. market for homecare products and equipment continues to increase, primarily as a result of the aging population and increasing shifts of chronic care patients from hospitals to home. In 2004, an estimated 16 million people received homecare in the U.S. Through 2009, the numbers of homecare patients are expected to continue to grow as patient life spans are extended with more sophisticated medical care and new technologies, and homecare becomes an increasingly important and accepted means to contain healthcare costs for managed care providers.

Homecare represents a wide range of community-based services to support someone that is recuperating from an acute situation, such as a hip fracture, or services needed by people with ongoing chronic conditions, such as cancer or HIV/AIDS. Homecare is often preferred to hospital stays by patients as it makes it possible for care recipients to remain in a safe, comfortable, familiar environment, and possibly have more independence than they would in a hospital or clinical setting. Furthermore, hospitals are discharging patients earlier to long-term care or homecare situations in order to cut costs.

HIV/AIDS

People living with HIV/AIDS often experience a loss of lean muscle (wasting), nutrient depletion, immune deficiencies, mitochondrial dysfunction (energy loss), and oxidative stress (free radical damage). The Company’s two patented nutritional formulas, Resurgex® and Resurgex Plus®, address the nutritional needs of patients with HIV/AIDS, whose immune systems have been compromised as a result of chronic and acute viral-based infections and who are receiving medical care. These products and their use in HIV/AIDS patients was the impetus behind the Company’s expansion into oncology.

Nutrition in HIV/AIDS

Antiretroviral medications (ARVs) are used to treat HIV/AIDS. Although ARVs do not completely destroy HIV, they significantly reduce the replication of the virus in the blood, which slows down the progression of the disease to AIDS. Many of the ARVs on the market today, however, can impair the body’s ability to use sugar. Additionally, side effects of medication, such as taste changes, loss of appetite (i.e., anorexia), nausea, bloating, heartburn, constipation, vomiting, and diarrhea, indirectly affect nutritional status by causing a reduction in food intake or nutrient absorption. Reduced food intake and poor nutrient absorption can lead to weight loss and continued impairment of the immune system, which, in turn, allows HIV to more quickly progress to AIDS.

Some side effects of medications can be similar to select AIDS-related symptoms and call for similar dietary management. Dietary management of these side effects can help maintain food intake, compensate for nutrient losses, and prevent weight loss.

Major concerns in the HIV/AIDS patient that can be influenced by nutritional support include the following:

| § | Energy Loss (Mitochondrial Dysfunction). Highly Active Antiretroviral Therapy (HAART) causes damage to the cell’s mitochondria; |

| § | Oxidative Stress. People with AIDS are under chronic stress as demonstrated by low levels of superoxide dismutase (SOD); and |

| § | Wasting (Muscle Loss). Wasting is not necessarily due to lack of fat and sugar. Patients infected with HIV lose lean body mass, even on HAART and with adequate dietary intake, due to excessive production of inflammatory compounds. |

Resurgex® Metabolic/Virological: Quality of Life Study

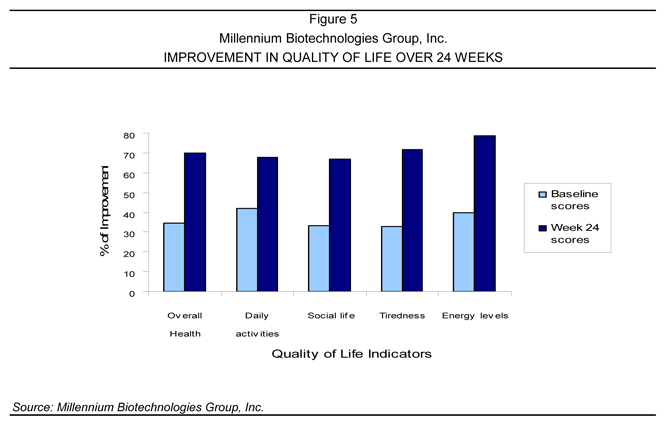

A six-month study of 26 HIV-1-infected patients on HAART was conducted at the Center for Family Health at the University of Medicine and Dentistry of New Jersey (UMDNJ)/St. Mary’s Hospital (Hoboken, New Jersey). In the study, patients were given Resurgex® twice daily. A standardized quality of life questionnaire, approved by the Investigational Review Board (IRB), was completed at baseline and follow-up visits. The results of this questionnaire are summarized in figure 5. This Study was displayed as a poster presentation at the Annual International Conference on HIV/AIDS in Brazil.

Sports Recovery

Competitive athletes often suffer from similar symptoms to those battling cancer or immuno-compromised diseases, such as fatigue, oxidative stress, muscle wasting, and possibly lack of immune support due to the demands they put on their bodies daily. In order to compete effectively, these athletes need a solution to address some of the key concerns they face, described below.

| § | Fatigue and Mitochondrial Dysfunction. Damage done to the mitochondria is typically attributed to the buildup of free radicals and other noxious byproducts, such as lactic acid that accumulates during and after strenuous activity. |

| § | Oxidative Stress. Oxygen consumption greatly increases during exercise, which leads to increased free radical production. Also, free radical formation within the muscle during exercise can easily damage muscle tissue and inhibit performance by the induction of fatigue. |

| § | Muscle Wasting. A common problem during strenuous activity is lean muscle loss or wasting as muscle tends to breakdown after vigorous activity. This problem can have a serious impact on performance and recovery. |

| § | Immune Support. Exercise has also been shown to have a positive effect on the immune system if one does not overtrain. Signs and signals of overtraining are a constant feeling of fatigue, loss of strength or endurance, and although still exercising, a feeling of burnout. Additionally, excessive exercise or periods of very heavy conditioning could lead to suppression of immunity for several hours to a week or longer, creating a brief period of vulnerability when the risk of upper respiratory tract infections is increased. |

Effect of Banned Nutritionals

In recent years, professional athletes have come under considerable scrutiny for taking different substances or performance enhancers. Whether it is the Olympics, Tour de France, baseball, or other professional sports, organizations constantly test athletes for chemicals within their body that would indicate they have taken an illegal substance to boost their performance. Millennium’s Surgex™ sports nutritional formula product is devoid of any banned substances.

Each batch of the Company’s product is tested for a list of substances by the Banned Substance Control Group (BSCG) that are outlawed by organizations such as the International Olympic Committee (IOC), the World Anti-Doping Agency (WADA), the U.S. Anti-Doping Agency (USADA), the NCAA, and the National Football League (NFL). All of the Surgex™ products receive a seal from the BSCG, a WADA-approved laboratory. Therefore, athletes need not worry about consuming any substance that could disqualify them from competition by using the Company’s products. The product also meets all NCAA guidelines for Nutritional Supplements.

Rutgers Studies: Demonstrating the Effect of Surgex™ Sports Nutrition Formula vs. Placebo

Millennium has conducted two clinical trials at Rutgers University among the Men’s Division I Soccer and Football teams, demonstrating the effect of the Surgex™ sports nutrition formula versus a placebo. Both studies showed the product’s beneficial effects as post-workout recovery aid, assisting the athlete in maximizing training responses and aiding in optimal recovery.

Division I Men’s Soccer Team-Results of the Trial-Accepted for Publication in The Journal for Strength and Conditioning Research

Millennium conducted its first clinical trial among the Rutgers University Men’s Division I Soccer team during their preseason training regimen. The clinical trial was accepted for publication in The Journal for Strength and Conditioning Research (“JSCR”). The JCSR is the official research journal of the National Strength and Conditioning Association, (``NSCA''). This journal is recognized as the preeminent publication for strength and conditioning coaches worldwide. These thought leaders rely on this journal for the future of leading edge science as applied to their profession.

Preseason training often places a high demand on athletes, and requires them to engage in frequent, high-intensity workouts with limited time devoted to recovery. Soccer players spend a considerable portion of a match at an intensity close to 75% of VO2 max (the maximum amount of oxygen in milliliters that one can use in one minute per kilogram of body weight) and rely on anaerobic metabolism and power during brief bursts of sprinting, kicking, and jumping. These players must be able to perform near maximal capacity for extended periods, which may result in increased oxidative stress. With outside supplementation of protective nutraceuticals, it may be possible to reduce acute and chronic oxidative stress, as well as capitalize on gains from intense preseason training.

The purpose of this study was to examine changes in performance and oxidative stress in collegiate soccer players over the course of preseason preparation, and to determine the impact of a supplemental proprietary nutraceutical blend proposed to reduce oxidative stress and enhance recovery.

Results

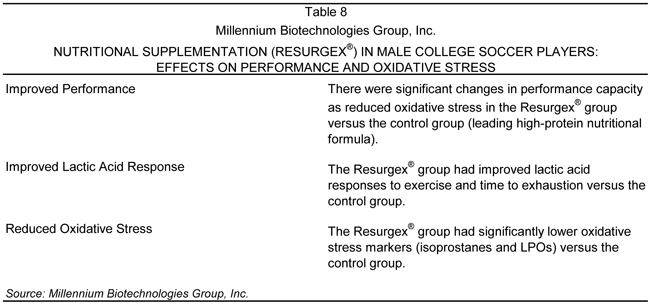

A summary of the findings of the soccer trial is provided in Table 8.

This double-blind, placebo-controlled trial found that the Company’s Surgex™ sports nutrition formula enhanced performance parameters and reduced oxidative stress levels (free radical damage caused by exercise) in players. Oxidative stress in the body is caused by imbalance or overload of oxidants (free radicals from air, food, metabolism, medications, stress, disease, etc.). Sustained oxidative stress disrupts the cells’ defenses, resulting in damage that contributes to the development of many diseases.

Results indicated a beneficial effect of the Surgex™ sports nutrition formula, including improvements in performance capacity, time to exhaustion, lactic acid response, and reduced oxidative stress. This data suggests an important role for Resurgex® in the sports fitness field in addition to its proven benefits for cancer and immuno-compromised medical patients. The fact that this trial is approved for publication in the JSCR confirms the results of this clinical trial have been reviewed and approved by an independent and accredited third party.

Rutgers’ Division I Football Team

The Company also conducted a second clinical trial on the Rutgers University Division I Football team versus a placebo group. The study tested the recovery time, strength, and body composition of the players versus a placebo (a leading competitor sports formula). The results concluded that the Surgex™ sports nutrition formula significantly enhanced recovery parameters, strength, and body composition in the football players.

Results

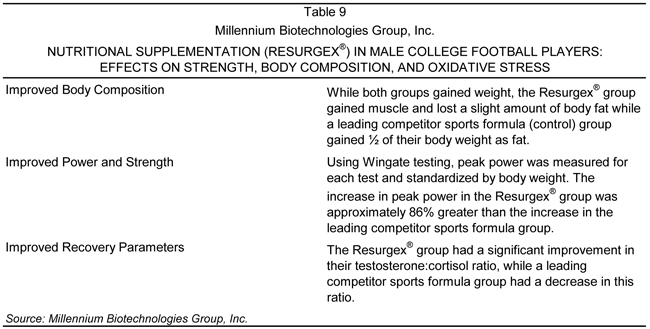

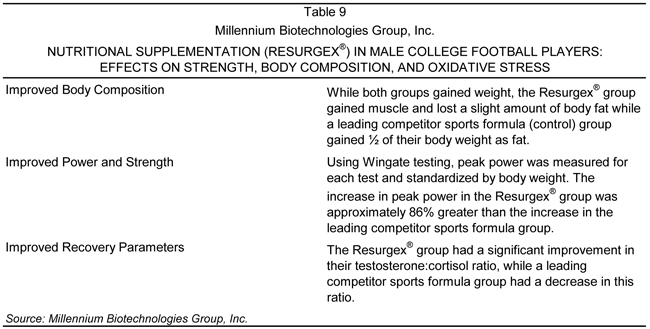

Those receiving the Surgex™ sports nutrition formula showed significant increases in their peak power, as measured by Wingate testing (assessment for peak anaerobic power, anaerobic fatigue, and total anaerobic capacity through a combination of running, vertical jumping, and resistance training), better muscle to fat weight gains, and an improved testosterone:cortisol ratio, as well as reduction of interleukin 6 (IL6), creatine kinase, and isoprostanes versus the control group.

Testosterone and cortisol are the two hormones affected by training. The cortisol levels typically elevate and break down lean muscle. Testosterone, in contrast, which is the supporter of lean muscle, decreases, therefore causing lean muscle breakdown in the body after strenuous exercise. In this study, the Resurgex® group had significantly improved testosterone to cortisol ratios versus the control group. A summary of the findings of this study is provided in Table 9.

The practical application emerging from the study demonstrates the beneficial application of the Surgex™ sports nutrition formula as a post-workout recovery aid, assisting the athlete in maximizing training responses by helping to buffer the acute and chronic biochemical challenges to optimal recovery. The product also has the ability to reduce inflammatory and oxidative stress markers, as well as compounds that can break down muscle. Millennium believes that these findings can help the Company position the Surgex™ sports nutrition formula as an aid to help athletes increase their performance by improving recovery, strength, and energy parameters.

Intellectual Property

Millennium owns all rights to the formulations of Resurgex Select®, Resurgex®, Resurgex Plus®, Resurgex Essential™ and Surgex™, and has filed compositional patent applications with respect to these formulations. Resurgex®, Resurgex Plus®, Resurgex Select®, and Surgex™ are registered trademarks filed with the U.S. Patent and Trademark Office (USPTO). Additionally, the Company has patents pending for all product lines in 57 countries worldwide.

On January 7, 2003, Resurgex® was issued a use and composition patent (U.S. Patent 6,503,506, Nutrient therapy for immuno-compromised patients). Millennium was granted a composition patent for Resurgex Select® in December of 2006. In addition, the Surgex™ line of products is patent pending in the United States and 57 countries worldwide. The Company relies on trade secrets and unpatented proprietary technology in addition to their patented technologies.

On March 20, 2006, Millennium received the Healthcare Common Procedure Coding System (HCPCS) code for Resurgex Select®. HCPCS is one of the formats in which nutritional formulas may be coded for Medicare reimbursement and is specifically required for Medicaid reimbursement in many states. The Resurgex® and Resurgex Plus® product lines have also received Federal HCPCS Codes.

Regulatory Environment

The manufacturing, processing, formulation, packaging, labeling and advertising of all of Millennium’s product lines are subject to regulation by federal agencies, including the Food and Drug Administration (the "FDA"), the Federal Trade Commission, the Consumer Product Safety Commission, the United States Department of Agriculture, the United States Postal Service and the United States Environmental Protection Agency. These activities are also subject to regulation by various agencies of the states and localities in which the Company sells and plans to sell its products.

The Dietary Supplement Health and Education Act of 1994 (the "Dietary Supplement Law") broadly regulates nutritional labeling, claims and manufacturing requirements for dietary supplements. The Dietary Supplement Law provides for regulation of Statements of Nutritional Support ("Statements"). These Statements may be made if they are truthful and not misleading and if "adequate" substantiation for the claims is available. Statements can describe claims of enhanced well-being from use of the dietary supplement or product statements that relate to affecting a structure or function of the body. However, statements cannot claim to diagnose, treat, cure, or prevent any disease, regardless of the possible existence of scientific reports substantiating such claims.

Statements appearing in dietary supplement labeling must be accompanied by disclaimer stating that the FDA has not evaluated the Statements. Notification to the FDA of these Statements is not considered approval of the Statements. If the FDA determines in possible future proceedings that dietary supplement Statements fail to meet the requirements of the Dietary Supplement Law, a product may be subject to regulation as a drug. The FDA retains all enforcement means available to it (i.e. seizure, civil or criminal penalties, etc.), when investigating or enforcing labeling claims.

The Federal Trade Commission ("FTC") regulates advertising of dietary supplements which includes all of Millennium’s products. The Federal Trade Commission Act prohibits unfair or deceptive trade practices and false or misleading advertising. The FTC has recently been very active in its enforcement of advertising against manufacturers and distributors of nutritional dietary supplements having instituted several enforcement actions resulting in signed agreements and payment of large fines. Although the Company has not been the target of a FTC investigation, there can be no assurance that the FTC will not investigate the Company's advertising in the future.

The Company is unable to predict the nature of any future laws, regulations, interpretations, or applications, nor can it predict what effect additional governmental regulations or administrative orders, when and if promulgated, would have on its business in the future. They could, however, require the reformulation of certain products not possible to be reformulated, imposition of additional record keeping requirements, and expanded documentation of the properties of certain products, expanded or different labeling and scientific substantiation regarding product ingredients, safety or usefulness. Any or all such requirements could have a material adverse effect on the Company's results of operations and financial condition.

Medicaid Reimbursement

Medicare/Medicaid

Millennium has received federal government approval to have its nutritional product lines (Resurgex®, Resurgex Plus® and Resurgex Select®) covered by Medicare. After receiving Medicare approval by the federal government, Millennium started lobbying state governments for Medicaid approval, which would allow the Company to have its products distributed or retailed in HIV clinics, oncology centers, long term care facilities and pharmacies throughout each state. Currently, Millennium has received Medicaid and Medicare approval for the Resurgex® line products in several states including New York, New Jersey, Connecticut and Nevada.

Growth Strategy and Distribution

Millennium has implemented a variety of strategies and formed partnerships that are intended to penetrate the various specialized markets for nutritional products, which are targeted by the Company (oncology patients, immuno-compromised individuals, and athletes seeking effective sports recovery). Currently, products can be purchased through the Company’s websites, www.surgexsports.com www.milbiotech.com and www.resurgex.com, also through the website www.caring4cancer.com, or ordered by phone (877) RESURGX. Additionally, in select areas, Medicaid-associated pharmacies distribute the Company’s products. Furthermore, select international distribution agreements are in place (as described below), which are intended to expand the Company beyond U.S. markets. Each of the Company’s growth strategies in terms of product distribution are detailed below.

Oncology Market Distribution

Canadian Distribution

In March 2007, Millennium signed a Letter of Intent with Ferring Pharmaceutical the Canadian subsidiary of an international pharmaceutical company currently producing gross revenue in excess of $1,000,000,000 USD. Subsequently in March 2008 Millennium entered into a definitive distribution agreement where Millennium granted exclusive marketing rights to this pharmaceutical company to distribute and market its line of Resurgex® products for cancer patients in Canada.

Under the proposed terms of the agreement Millennium would profit from the manufacturing and royalty of all product sold in Canada. This agreement was finalized in March 2008.

Greek Distribution

In April 2007, the Company entered into an international distribution partnership with Nutrimedica, a Greek distributor of nutritional products with knowledge of the local market and regulations in Greece. Under this agreement, Nutrimedica is to import and distribute the Resurgex® products to hospitals, pharmacies, and directly to patients. Nutrimedica has initiated introduction of the Resurgex® products to the market, and sales have significantly increased over the past year. The distribution agreement with Nutrimedica produced annual average revenue of $22,000 for the years 2006 and 2007. Millennium recorded revenue totaling $313,000 in 2008 from Nutrimedica in Greece.

On a percentage basis the revenue received in 2008 as compared to average revenue received from Nutrimedica in Greece in the years 2006 and 2007 increased 1,323%. Furthermore Millennium received a purchase order in the first quarter of 2009 totaling $478,000 form Nutrimedica in Greece. Management anticipates the exponential revenue growth in Greece to continue based on the positive reports and exponentially large increases in orders from Greece which are continuing into 2009.

Sports Nutrition Market Product Distribution

In order to penetrate the sports nutrition market, the Company directly targeted the strength/conditioning coaches of professional sports teams. During the National Basketball Association (NBA) 2006-2007 and 2007-2008 seasons, several NBA organizations that purchased and used Surgex™, and had players using the products before and after practices and games. Importantly, since many of the NBA coaches have come from the NCAA, many coaches at the collegiate level are aware of the Surgex® line of products. However, due to NCAA rules of fairness, no university may offer or distribute supplements containing amino acids or anabolic agents to its athletes. For that reason, Millennium has developed an NCAA-compliant Surgex™ sports nutrition formula, devoid of amino acids or anabolic agents, which is fully compliant with the NCAA rules and could therefore be used by universities. In addition, each batch of Surgex™ is certified by the BSCG to not contain any banned substances.

Research and Development

During 2008 and 2007 the Company spent $476,806 and $97,171, respectively, on research and development of its products. The increased research and development expenses incurred in 2008 are directly related to the development of the Resurgex Essential™ ready-to-drink product line. Millennium received other income totaling $400,000 during the fourth quarter of 2007 pursuant to the terms of the research and development contract between Millennium and Provider Services, Inc. The funds received from PSI helped subsidize the cash requirement related to the development of the Resurgex Essential™ Ready-to-Drink product lines.

Competition

Millennium’s products target the nutritional supplement market, specifically the ready-to-drink beverage market, as an adjunct or meal replacement. The products that most directly compete with Millennium’s Resurgex® Continuum of Care in the adult nutrition market are produced by mainstream manufacturers—Boost® by Novartis AG, Ensure® by the Ross Product Division of Abbott Laboratories Inc., and Carnation® Instant Breakfast® by Nestlé—as well as generic (store branded) products that are marketed head-to-head against these products.

Millennium has chosen to target the medical community, vis-à-vis a pharmaceutical sales approach and distribution model for its currently marketed products, which is unique from that of its competitors, as the Company believes that this approach provides credibility and legitimacy that competitive brands on the market may lack. Additional factors that Millennium believes distinguish it from other competitively marketed nutritional products are listed below.

| § | Resurgex®, Resurgex Plus®, Resurgex Select® and Resurgex Essential™ address multiple issues that cause diminished fatigue and quality of life in immuno-compromised individuals. To the Company’s knowledge, no other product on the market can make this claim. These include the following: |

| | o | Mitochondrial support (energy); |

| | o | Reducing oxidative stress; |

| | o | Providing healthy, whole food calories. |

| § | Many of the mass-market competitors manufacture their products using the least expensive ingredients, which ensures low retail price and high profitability. This means diminished bioavailability and low biological value, as well as less benefit to the end user. |

| § | Resurgex®, Resurgex Plus®, Resurgex Select® and Resurgex Essential™ were developed with the ingredients necessary in order to deliver optimal performance. |

| § | Resurgex® and Resurgex Plus® deliver over 15 nutraceutical ingredients that specifically address the needs of the chronically ill. Other products generally contain only one highlighted ingredient. |

| § | Resurgex®, Resurgex Plus®, Resurgex Select® and Resurgex Essential™ deliver therapeutic levels of active ingredients based on the scientific research. |

| § | Millennium has a use and composition patent for the existing formulas. Ensure® and Boost® are composed of mostly corn syrup and provide “empty calories,” which could do more harm than good, especially in glucose-sensitive individuals. |

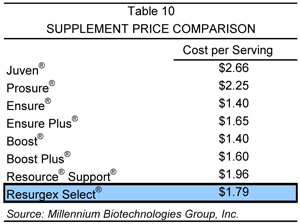

While the majority of other companies in this market sell the bulk of their product through the mass market, these formulations may not transfer well into the highly critical medical market, which Millennium’s products target. Additionally, many of these products have been slow to update their formulas and incorporate the latest nutritional ingredients. Descriptions of the products which Millennium believes could be considered competitors to its own product line are provided in the accompanying section, along with a price summary of each of these products, relative to Resurgex Select®, which is provided in Table 10.

Boost® and Boost Plus®

Boost® is marketed as an energy beverage for healthy adults, providing a balance of essential vitamins and minerals to promote physical and mental health. As a meal replacement or between-meal snack alternative, Boost® is a nutritional drink with 25 vitamins and minerals, carbohydrates, and protein. The product additionally contains antioxidants, such as beta-carotene, selenium, and vitamins C and E, as well as natural milk calcium. Boost Plus® is marketed as a high-protein, high-calorie, nutritionally complete drink for people on fluid- or volume-restricted diets, people with HIV suffering from weight

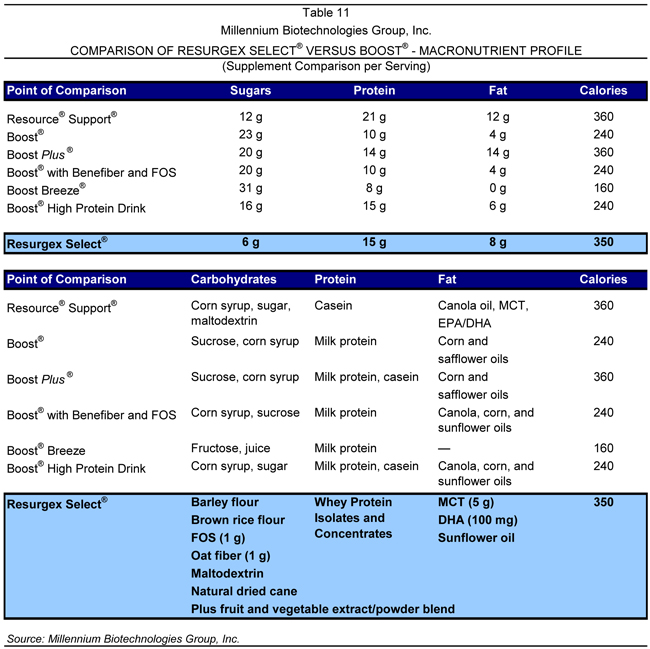

loss, or for general weight gain. A comparison between Resurgex Select® and Boost® from a macronutrient perspective is provided in Table 11.

Ensure® and Ensure Plus®

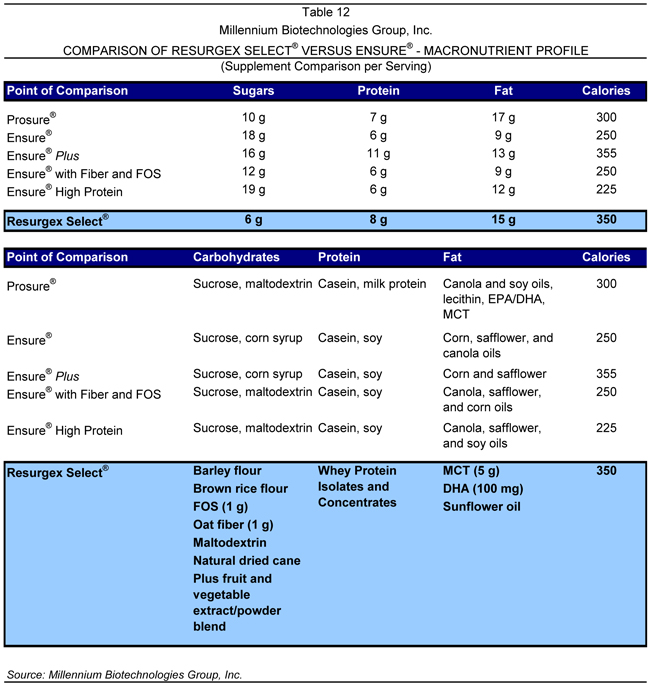

Ensure® was developed to provide a source of complete, balanced nutrition for supplemental use between or with meals and for interim sole-source feeding. Ensure® is marketed as a benefit to people who are at nutrition risk, experiencing involuntary weight loss, recovering from illness or surgery, or on modified or low-residue diets. Ensure Plus® is marketed as a source of complete, balanced nutrition that provides concentrated calories and protein to help patients gain or maintain healthy weight. It can be used with or between meals or as a meal replacement. A comparison between Resurgex Select® and Ensure® from a macronutrient perspective is provided in Table 12.

Sports Nutrition Market

Millennium is currently seeking sales, marketing and distribution partner which will assist in distribution Surgex™ to the sports nutrition market. Millennium’s management feels a partner is necessary for the mass market distribution launch of Surgex into the retail sports nutrition marketplace. Management is pursuing this alternative because Millennium’s shareholders would benefit from the anti-dilutive capital which would be allocated to the marketing expense of a mass market product launch. Millennium would also benefit from the marketing expertise and capabilities of their distribution partner. Based on historical acceptance by 10 NBA teams, PGA golfers, and NFL players with little or no marketing budget, management expects to exponentially improve results with proper marketing and distribution strategies which cater to the mass market of sports nutrition consumers.

Products such as those listed below, as well as many other “high protein” drinks, are marketed as sports nutrition supplements and may be considered competitive products to the Company’s Surgex™ sports nutrition formula. It is important to note that as the high-protein drink market is expansive, these competitive products are not an exhaustive list of competitors. Rather, these products are representative of some of the high-protein drink products on the market today that may compete with Surgex™ sports nutrition formula. Surgex™ sports nutrition formula will likely provide athletes with the important calories they need while being competitively priced with other products.

| § | BSN Syntha-6™ Extended Release Protein Blend by BSN Inc. |

| § | Muscle Milk® by CytoSport Inc. |

| § | FRS, an antioxidant health drink, by New Sun Nutrition, Inc. |

| § | Gatorade® Performance Series |

Employees

As of December 31, 2008, the Company employed 6 persons, of whom one is primarily engaged in research and development and product support activities, two are primarily engaged in overall managerial functions associated with operations, capital raising, distribution partnerships and sales and marketing, one is primarily engaged in day to day managerial operations and two are engaged in general administrative and wholesale/direct to consumer sales functions. The Company has no collective bargaining agreements with its employees.

RISK FACTORS

The following cautionary statements identify important factors that could cause our actual result to differ materially from those projected in the forward-looking statements made in this report.

We have operated at a loss and cannot assure that we will be able to attain profitable operations.

Although we are generating revenues, we continue to operate at a loss. During the year ended December 31, 2008, we generated revenues of $1,492,262 from sales of our six products. However, during this period we realized net losses of $11,361,216, of which $6,517,142 were non-cash items primarily related to issuance of shares and warrants for compensation, services, and associated with financing transactions during the period. We expect to continue incurring operating losses until we are able to derive meaningful revenues from marketing our three products and other products we intend to bring to market. We cannot assure that we will be able to attain profitable operations.

We require additional funding to maintain our operations and to further develop our business. Our inability to obtain additional financing would have an adverse effect on our business.

Our success depends on our ability to develop a market for our three products and other nutraceutical supplements we intend to bring to market. This means having an adequate advertising and marketing budget and adequate funds to continue to promote our products. Although our revenues have increased, our operating expenses are significantly greater than our revenues. During 2008, the Company obtained new capital in the form of equity that supplied a major portion of the funds that were needed to finance operations during the reporting period. Such new investments resulted in the receipt by the Company of $575,000. In addition, the Company obtained $2,302,925 from borrowings, net of debt repayments, through issuance of promissory notes (see Note 7 to our audited Financial Statements below). These funds in conjunction with on going operating revenues provided adequate capital for our operating needs for 2009. We need to continue to raise funds to cover working capital requirements until we are able to raise revenues to a point of positive cash flow. We plan to do this, as before, through additional equity or debt financings. We may not be able to raise such funds on terms acceptable to us or at all. Financings may be on terms that are dilutive or potentially dilutive to our stockholders. If sources of financing are insufficient or unavailable, we will be required to modify our operating plans to the extent of available funding or curtail or suspend operations.

Our year end audited financial statements contain a “going concern” explanatory paragraph. Our inability to continue as a going concern would require a restatement of assets and liabilities on a liquidation basis, which would differ materially and adversely from the going concern basis on which our financial statements included in this report have been prepared.

Our consolidated financial statements for the year ended December 31, 2008 included herein have been prepared on the basis of accounting principles applicable to a going concern. Our auditors’ report on the consolidated financial statements contained herein includes an additional explanatory paragraph following the opinion paragraph on our ability to continue as a going concern. A note to these consolidated financial statements describes the reasons why there is substantial doubt about our ability to continue as a going concern and our plans to address this issue. Our December 31, 2008 and 2007 consolidated financial statements do not include any adjustments that might result from the outcome of this uncertainty. Our inability to continue as a going concern would require a restatement of assets and liabilities on a liquidation basis, which would differ materially and adversely from the going concern basis on which our consolidated financial statements have been prepared. See, “Part II. Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations; Liquidity and Capital Resources.”

We are subject to significant government regulation.

The packaging, labeling, advertising, promotion, distribution and sale of Resurgex®, Resurgex Plus® Resurgex Select®, Surgex™, Resurgex Essential™ and Resurgex Essential Plus™ and other products we plan to produce and market are subject to regulation by numerous governmental agencies, the most active of which is the U.S. Food and Drug Administration (the "FDA"), which regulates our products under the Federal Food, Drug and Cosmetic Act (the "FDCA") and regulations promulgated there under. Our products are also subject to regulation by, among other regulatory entities, the Consumer Product Safety Commission (the "CPSC"), the U.S. Department of Agriculture (the "USDA") and the Environmental Protection Agency (the "EPA"). Advertising and other forms of promotion and methods of marketing of our products are subject to regulation by the U.S. Federal Trade Commission (the "FTC"), which regulates these activities under the Federal Trade Commission Act (the "FTCA"). The manufacture, labeling and advertising of our products are also regulated by various state and local agencies. Failure to comply with applicable regulatory requirements may result in, among other things, injunctions, product withdrawals, recalls, product seizures, and fines.

Our involvement in defending product liability claims could have a detrimental effect on our operations.

Like other retailers and distributors of products designed for human consumption, we face an inherent risk of exposure to product liability claims in the event that the use of our products results in injury. We may be subjected to various product liability claims, including, among others, that our products include inadequate instructions for use or inadequate warnings concerning possible side effects and interactions with other substances. We carry $10,000,000 of product liability insurance. Thus, any product liabilities exceeding our coverage relating to our products could have a material adverse effect on our business, financial condition and results of operations.

We face significant competition.

The biotechnology and nutraceutical supplement industries are highly competitive and subject to significant and rapid technological change. Developments by our competitors may render our products obsolete or noncompetitive. Numerous companies compete in our market, many of which have greater size and financial, personnel, distribution and other resources greater than ours. Our principal competition in the distribution channels where we are marketing our current products and where we intend to market other products comes from a limited number of large nationally known manufacturers and many smaller manufacturers of nutraceutical supplements. In addition, large pharmaceutical companies compete with us on a limited basis in the nutraceutical supplement market. Increased competition from such companies could have a material adverse effect on us because such companies have greater financial and other resources available to them and possess distribution and marketing capabilities far greater than ours. We also face competition in mass market distribution channels from private label nutraceutical supplements offered by health and natural food store chains and drugstore chains. We cannot assure that we will be able to compete.

If we are unable to protect our intellectual property or we infringe on intellectual property of others, our business and financial condition may be materially and adversely affected.

We own all rights to the formulation of Resurgex®, Resurgex Plus®, Resurgex Select®, Surgex™ Resurgex Essential™ and Resurgex Essential Plus™ and have a use and compositional patent with respect to Resurgex® (which covers Resurgex Plus®), and Resurgex Select®. Surgex™ is patent pending. We also have registered trademarks for the names "Resurgex", “Resurgex Plus” and “Resurgex Select”. “Surgex” has preliminary Trade mark reservation status. We have filed patent applications internationally with regards to all patents and patents pending. No assurance can be given that patents will be issued from pending applications or that there right, if issued and the rights from our existing patents and registered name will afford us adequate protections. In addition, we rely on trade secrets and unpatented proprietary technology. There is no assurance that others may not independently develop the same or similar technology or produce products which provide the same benefits as the current product lines.

Although we will seek to ensure that our products do not infringe the intellectual property rights of others, there can be no assurance that third parties will not assert intellectual property infringement claims against us. Any infringement claims by third parties against us may have a material adverse effect on our business, financial condition and results of operations.

Because our Board can issue common stock without stockholder approval, you could experience substantial dilution.

Our Board of Directors has the authority to issue up to 400,000,000 shares of common stock and to issue options and warrants to purchase shares of our common stock without stockholder approval. As of March 31, 2009, 314,465,510 shares are issued and outstanding or reserved for issuance on a fully-diluted basis. Future issuance of our additional shares of common stock could be at values substantially below the current market price of our common stock and, therefore, could represent substantial dilution to investors in this offering. In addition, our Board could issue large blocks of our common stock to fend off unwanted tender offers or hostile takeovers without further stockholder approval.

Anti-takeover provisions of the Delaware General Corporation Law could discourage a merger or other type of corporate reorganization or a change in control even if they could be favorable to the interests of our stockholders.

The Delaware General Corporation Law contains provisions which may enable our management to retain control and resist a takeover of us. These provisions generally prevent us from engaging in a broad range of business combinations with an owner of 15% or more of our outstanding voting stock for a period of three years from the date that this person acquires his stock. Accordingly, these provisions could discourage or make more difficult a change in control or a merger or other type of corporate reorganization even if they could be favorable to the interests of our stockholders.

We do not intend to pay cash dividends in the foreseeable future.

We have never declared or paid cash dividends on our capital stock. We currently intend to retain all of our earnings, if any, for use in its business and do not anticipate paying any cash dividends in the foreseeable future. The payment of any future dividends will be at the discretion of our Board of Directors and will depend upon a number of factors, including future earnings, the success of our business activities, our general financial condition and future prospects, general business conditions and such other factors as the Board of Directors may deem relevant. In addition, no cash dividends may be declared or paid on our Common Stock if, and as long as, the Series B Preferred Stock is outstanding or there are unpaid dividends on outstanding shares of Series C Preferred Stock. No dividends may be declared on the Series C Preferred Stock if, and as long as, the Series B Preferred Stock is outstanding. Accordingly, it is unlikely that we will declare any cash dividends in the foreseeable future.

We cannot assure that there will be a sustained public market for our common stock.

At present, our common stock is quoted on the OTC Bulletin Board and tradable in the over-the-counter market. Our common stock is not traded on a sustained basis or with significant volume. In addition, we currently do not meet the requirements for listing our common stock on NASDAQ or a national securities exchange and we cannot assure if or when our common stock will be listed on such an exchange. For the foregoing reasons, we cannot assure that there will be a significant and sustained public market for the sale of our common stock. Accordingly, if you purchase our common stock, you may be unable to resell it. In the absence of any readily available secondary market for our common stock, you may experience great difficulty in selling your shares at or near the price that you originally paid.

The market price of our common stock may be volatile.

The market price of our common stock may fluctuate significantly in response to the following factors:

| | · | variations in quarterly operating results; |

| | · | our announcements of significant contracts, milestones, acquisitions; |