SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

o | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as Permitted by Rule 14a-6(e)(2)) |

x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Solicitation Material Pursuant to Rule 14a-11(c) or rule 14a-12 |

Millennium Biotechnologies Group, Inc.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | 1) | Title of each class of securities to which transaction applies: |

| | 2) | Aggregate number of securities to which transaction applies: |

| | 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11: |

| | 4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

MILLENNIUM BIOTECHNOLOGIES GROUP, INC.

205 Robin Road

Paramus, NJ 07652

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

TO BE HELD ON MARCH 12, 2010

To the Stockholders of Millennium Biotechnologies Group, Inc.:

You are cordially invited to attend the Special Meeting of Stockholders of Millennium Biotechnologies Group, Inc. (the “Company”), a Delaware corporation, to be held at 205 Robin Road, Paramus, NJ 07652, on Friday, March 12, 2010, at 9:00 a.m. local time, for the following purposes:

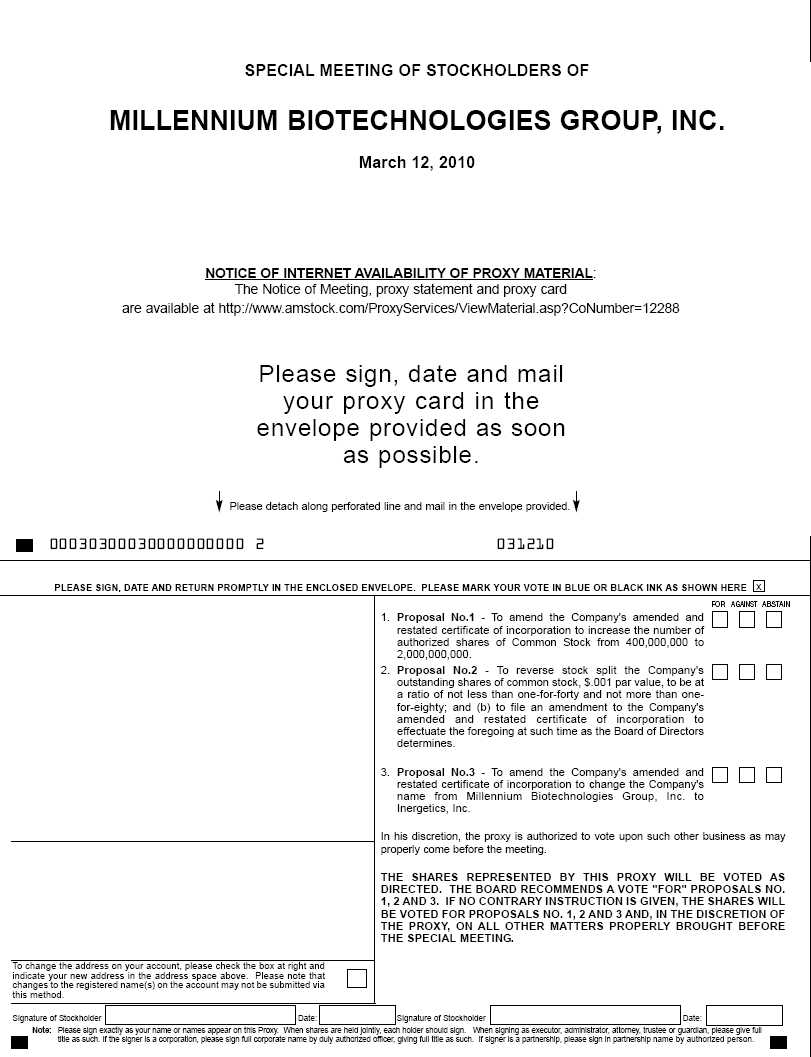

| | 1. | To amend the Company’s certificate of incorporation to increase the number of authorized shares of Common Stock from 400,000,000 to two billion (“Proposal No. 1”); |

| | 2. | To approve: (a) a possible reverse stock split of our outstanding shares of Common Stock, $.001 par value, in an amount which our Board of Directors deems appropriate, to be at a ratio of not less than one-for-forty and not more than one-for-eighty; and (B) the filing of an Amendment to our Certificate of Incorporation effectuating the foregoing at such time as Board of Directors determines (“Proposal No. 2”); |

| | 3. | To amend the Company’s certificate of incorporation to change the Company’s name from Millennium Biotechnologies Group, Inc. to Inergetics, Inc. (“Proposal No. 3”); and |

| | 4. | To transact such other matters as may properly come before the meeting or any adjournment thereof. |

Only stockholders of record at the close of business on February 1, 2010 are entitled to notice of and to vote at the meeting.

A proxy statement and proxy are enclosed. If you are unable to attend the meeting in person you are urged to sign, date and return the enclosed proxy promptly in the self addressed stamped envelope provided. If you attend the meeting in person, you may withdraw your proxy and vote your shares.

| By Order of the Board of Directors |

| |

| Frank Guarino, Secretary |

Paramus, New Jersey

February 16, 2010

YOUR VOTE IS IMPORTANT We urge you to promptly vote your shares by completing, signing, dating and returning your proxy card in the enclosed envelope. |

PROXY STATEMENT

MILLENNIUM BIOTECHNOLOGIES GROUP, INC.

205 Robin Road

Paramus, NJ 07652

INTRODUCTION

This proxy statement is furnished in connection with the solicitation of proxies for use at the Special Meeting of stockholders of Millennium Biotechnologies Group, Inc. (the “Company,” “We” or “Us”) to be held on Friday, March 12, 2010, and at any adjournments. The accompanying proxy is solicited by the Board of Directors of the Company and is revocable by the stockholder by notifying the Company’s Corporate Secretary at any time before it is voted, or by voting in person at the Special Meeting. This proxy statement and accompanying proxy are being distributed to stockholders beginning on February 16, 2010. The principal executive offices of the Company are located at 205 Robin Road, Paramus, NJ 07652, telephone (908) 604-2500.

Important Notice Regarding the Availability of Proxy Materials for

the Special Meeting of Stockholders To Be Held on March 12, 2010

This proxy statement is available electronically at http://www.amstock.com/ProxyServices/ViewMaterial.asp?CoNumber=12288.

RECORD DATE; OUTSTANDING SHARES, PROXY AND VOTES REQUIRED

Only stockholders of record at the close of business on February 1, 2010, the record date, are entitled to receive notice of, and vote at the Special Meeting.

As of the record date, the number and classes of stock outstanding and entitled to vote at the meeting were as follows:

399,928,830 shares of Common Stock, par value $.001 per share. Each share of Common Stock is entitled to one vote on all matters.

49,544.3348 shares of Series E Convertible Preferred Stock (“E Preferred”), par value $1.00 per share. Each share of E Preferred is entitled to 10,000 votes (the number of votes equal to the number of whole shares of Common Stock into which a share of E Preferred is convertible assuming a sufficient number of shares of Common Stock were then authorized and available for issuance). Except as provided by law, holders of E Preferred vote together with the holders of Common Stock as a single class.

4,741.838 shares of Series F Convertible Preferred Stock (“F Preferred”), par value $1.00 per share. Each share of F Preferred is entitled to 120,000 votes (the number of votes equal to the number of whole shares of Common Stock into which a share of F Preferred is convertible assuming a sufficient number of shares of Common Stock were then authorized and available for issuance). Except as provided by law, holders of F Preferred vote together with the holders of Common Stock as a single class.

No other class of securities will be entitled to vote at the meeting. There are no cumulative voting rights.

By submitting your proxy, you authorize Mark C. Mirken to represent you and vote your shares at the meeting in accordance with your instructions. Mr. Mirken may also vote your shares to adjourn the meeting from time to time and will be authorized to vote your shares at any adjournment or postponement of the meeting.

A majority of the votes that are entitled to be cast by the holders of our Common Stock, E Preferred and F Preferred entitled to vote at the meeting at which a quorum is present is necessary for approval of Proposals No. 1, 2 and 3. In addition, approval of Proposal No. 1 requires the affirmative vote of at least a majority of the outstanding shares of Common Stock entitled to vote, as a separate class.

REVOCABILITY OF PROXIES

If you attend the meeting, you may vote in person, regardless of whether you have submitted a proxy. Any person giving a proxy in the form accompanying this proxy statement has the power to revoke it at any time before it is voted. It may be revoked by filing, with our corporate secretary at our principal offices, 205 Robin Road, Paramus, NJ 07652, a written notice of revocation or a duly executed proxy bearing a later date, or it may be revoked by attending the meeting and voting in person.

SOLICITATION

We have borne the cost of preparing, assembling and mailing this proxy solicitation material. We may reimburse brokerage firms and other persons representing beneficial owners of shares for their expenses in forwarding soliciting materials to beneficial owners. Proxies may be solicited by certain of our directors, officers and employees, without additional compensation, personally, by telephone or by facsimile.

ADJOURNED MEETING

The meeting may be adjourned from time to time to reconvene at the same or some other time, date and place. Notice need not be given of any such adjournment meeting if the time, date and place thereof are announced at the meeting at which the adjournment is taken. If the time, date and place of the adjournment meeting are not announced at the meeting which the adjournment is taken, then our Secretary shall give written notice of the time, date and place of the adjournment meeting not less than ten (10) days prior to the date of the adjournment meeting. Notice of the adjournment meeting also shall be given if the meeting is adjourned to a date more than 30 days after the original date fixed for the meeting or if a new record date for the adjourned meeting is fixed.

TABULATION OF VOTES

The votes will be tabulated and certified by our transfer agent.

VOTING BY STREET NAME HOLDERS

If you are the beneficial owner of shares held in “street name” by a broker, the broker, as the record holder of the shares, is required to vote those shares in accordance with your instructions. If you do not give instructions to the broker, the broker will nevertheless be entitled to vote the shares with respect to “discretionary” items but will not be permitted to vote the shares with respect to “non-discretionary” items (in which case, the shares will be treated as “broker non-votes”).

QUORUM; ABSTENTIONS; BROKER NON-VOTES

The required quorum for the transaction of business at the Special Meeting is a majority of the capital stock entitled to vote at the Special Meeting, in person or by proxy. Shares that are voted "FOR," "AGAINST" or "WITHHELD FROM" a matter are treated as being present at the meeting for purposes of establishing a quorum and are also treated as shares represented and voting the votes cast at the Special Meeting with respect to such matter.

Proxies marked “abstain” will be counted as shares present for the purpose of determining the presence of a quorum. For purposes of determining the outcome of a proposal, abstentions will have the same effect as a vote against the proposal.

Broker “non-votes” occur when a nominee holding shares for a beneficial owner does not vote on a particular proposal because the nominee does not have discretionary voting power for that particular item and has not received voting instructions from the beneficial owner. Broker “non-votes” will be counted as shares present for purposes of determining the presence of a quorum. However, broker “non-votes” will not be counted for purposes of determining the number of votes cast with respect to the particular proposal on which the broker has expressly not voted. Where a proposal requires the vote of a majority of the shares entitled to vote rather than a majority of the votes present and voting at a meeting, the general effect of a broker “non-vote” is a vote against the proposal.

PROPOSAL TO STOCKHOLDERS

PROPOSAL NO. 1

APPROVAL OF THE PROPOSAL TO AMEND OUR

CERTIFICATE OF INCORPORATION TO INCREASE THE NUMBER

OF AUTHORIZED SHARES OF COMMON STOCK

Our Board of Directors is proposing the approval and adoption of an amendment to our Amended and Restated Certificate of Incorporation, which increases the number of shares of Common Stock authorized for issuance. The complete text of the proposed Amendment to the Amended and Restated Certificate of Incorporation is attached as Appendix A to this Proxy Statement.

Our Amended and Restated Certificate of Incorporation currently authorizes the issuance of 400,000,000 shares of Common Stock, $.001 par value per share and 500,000 shares of preferred stock, $1.00 par value per share. In January 2010, the Board of Directors adopted a resolution proposing that the Certificate of Incorporation be amended to increase the authorized number of shares of Common Stock to two billion, subject to stockholder approval of such amendment (the “Amendment”). The Board of Directors has determined that adoption of the Amendment is in our best interest and unanimously recommends approval by the stockholders.

As of the record date, we had 399,928,830 shares of Common Stock outstanding and no shares of Common Stock available and unreserved for future issuances.

The Board of Directors has proposed the increase in authorized shares of Common Stock as required to permit conversion of our E and F Convertible Preferred Stock (see “Private Placement and Debt Restructuring” below). In addition, the Board believes that the increase will benefit us by providing flexibility to issue shares of Common Stock for general and corporate purposes, including a variety of business and financial objectives in the future without the necessity of delaying such activities for further stockholder approval, except as may be required in particular cases by our charter documents, applicable law or the rules of any stock exchange or national securities association trading system on which our securities may be listed or quoted. In addition, our Board of Directors could issue large blocks of shares of Common Stock to fend off unwanted tender offers or hostile takeovers without further stockholder approval.

Private Placement and Debt Restructuring

As is evident in all of our filings with the Securities and Exchange Commission, we have been in dire financial distress for many years now. During the last half of 2009, in an attempt to turn the company around, we converted a significant amount of our debt into equity and raised some funds in a private placement.

Private Placement

In a private placement (the “Private Placement”) that ended on December 15, 2009, we raised $1,472,050 from the sale of 14.72050 units (the “Units”), each Unit consisting of a Senior Secured 12% thirty month $100,000 Note and 100 shares of our F Preferred. We also converted a total of approximately $3,220,000 of outstanding debt into an aggregate of approximately 32.2 Units.

Each share of F Preferred is convertible, at the option of the holder, into 120,000 shares of our Common Stock (the “Conversion Rate”) if and when our Certificate of Incorporation is amended to increase the number of authorized shares of Common Stock so that there is a sufficient number of authorized, but unissued and unreserved shares of Common Stock to permit the conversion of all F Preferred and all E Preferred (discussed below) into Common Stock. Each share of F Preferred will automatically be converted into Common Stock at the Conversion Rate after the Amendment is effected: (i) upon the written consent of the holders of a majority of the outstanding F Preferred; or (ii) at such time as we have achieved annual EBITDA of at least $10,000,000 for any fiscal year. “EBITDA” means, for any period, our net income or loss (on a consolidated basis with our wholly-owned operating subsidiary, Millennium Biotechnologies, Inc.) before income or loss from discontinued operations for such period, determined on a consolidated basis, plus: (i) to the extent deducted in computing such consolidated net income or loss, without duplication, an amount equal to the sum of: (1) income tax expense, plus (2) interest expense, plus (3) depreciation and amortization expense, plus (4) non-cash extraordinary or nonrecurring losses or non-recurring expenses; minus (ii) to the extent added in computing such consolidated net income or loss, without duplication, an amount equal to the sum of: (1) extraordinary or non-recurring income or gains, plus (2) non-cash interest income. F Preferred has no liquidation preference and no right to receive dividends. F Preferred votes along with the holders of our Common Stock on an “as if” converted basis on any matters on which the holders of our Common Stock are entitled to vote. However, until such time as we have achieved annual EBITDA of at least $10,000,000, the consent of a the holders of a majority of the outstanding shares of F Preferred, voting as a separate class, is required to approve: (i) any offer, sale, designation or issuance of any security senior to or pari passu with F Preferred; (ii) the repurchase or redemption of our capital stock (except from employees at cost upon termination); (iii) any increase or decrease in the number of authorized shares of our Common Stock or F Preferred (other than in connection with the Amendment); (iv) any amendment to our Certificate of Incorporation or other governing documents with the exception of the Amendment, a reverse split of outstanding shares of Common Stock or a name change; (v) any alteration or change to the rights, preferences or privileges of F Preferred, by merger, consolidation or otherwise; (vi) the entry into: (1) the sale or exclusive license of all or substantially all of our assets, (2) mergers, (3) consolidations, (4) other business combinations, (5) recapitalizations and (6) liquidations; (vii) any acquisition of the stock or assets of any other entity; (viii) any dividends or distributions on our capital stock; or (ix) the expansion into any new businesses. The foregoing will apply to any subsidiary or controlled affiliate of the Company. In addition, F Preferred will be subject to anti-dilution protection, providing for adjustments to the Conversion Rate upon certain events, including: (i) subdivision or combination of Common Stock; (ii) dividends or distributions of Common Stock; (iii) reclassification of the Common Stock into a security other than the Common Stock; or (iv) consolidation or merger of our Company with or into another corporation.

Debt Restructuring

In addition to the private placement, through December 15, 2009, we converted approximately $7,366,936 of our debt into an aggregate of approximately 21,048,3925 shares of our E Preferred, which will convert into 210,483,925 common shares, as discussed below. Thereafter, through the record date, we converted an additional $414,028 of our debt into an aggregate of approximately 1,198.4571 shares of our E Preferred, which will convert into 11,984,571 common shares.

Each share of E Preferred automatically will convert into 10,000 shares of our Common Stock if and when the Amendment is effected. E Preferred has no liquidation preference, no right to receive dividends and votes along with the holders of our Common Stock on an “as if” converted basis on any matters on which the holders of our Common Stock are entitled to vote. In addition, E Preferred will be subject to anti-dilution protection providing for adjustments to the conversion rate upon certain events relating to us, including: (i) subdivision or combination of Common Stock; (ii) dividends or distributions of Common Stock; (iii) reclassification of the Common Stock into a security other than the Common Stock; or (iv) consolidation or merger of our Company with or into another corporation.

As part of the debt restructuring, we granted management 15,500 shares of E Preferred (the “Performance Shares”), which represented such number of E Preferred that are convertible into common stock equal to 10% of the fully diluted common shares following December 15, 2009, the final closing date (the “Final Closing Date”) of the Private Placement. In the event that the gross revenue of our subsidiary, Millennium Biotechnologies, Inc., for the 13 month period immediately following the Final Closing Date (the “Target Period”) is less than $15 million (the “Target Revenue”), the number of Performance Shares shall be reduced by 10% for each $1 million under the Target Revenue and such number of reduced Performance Shares shall be issue to the purchasers of the Units in the Private Placement based upon the percentage of Units purchased by each such purchaser. The Target Period shall commence when we and/or our subsidiary have received at least $1,000,000 in working capital from any sources including from the net proceeds of the Private Placement. The right to so reduce and reallocate any portion of the Performance Shares is dependent on the Target Period commencing within 60 days of the Final Closing Date. Notwithstanding any of the foregoing, the Performance Shares shall not be reduced by more than 50% of the total Performance Shares issued.

Anticipated Plans for Issuance of Common Stock

We anticipate that, in the future, in addition to the issuance of Common Stock upon conversion of E Preferred and F Preferred, we most likely will (i) attempt to raise capital through the sale of shares of our Common Stock or securities convertible into or exercisable for shares of our Common Stock, (ii) acquire additional assets with our Common Stock, and/or (iii) facilitate an agreement with a potential partner regarding the marketing, distribution or manufacturing of our products in part through the issuance of our Common Stock. However, we have no current plans to issue any of the shares that would be authorized should this proposal no. 1 be approved by our stockholders for any of these or other purposes other than upon conversion of E Preferred and F Preferred.

Substantial Dilution upon Conversion of Preferred Stock

If and when the Amendment is effected and the E and F Preferred are converted, there will be substantial dilution to the holders of our Common Stock. As of the record date, there are 399,928,830 shares of Common Stock, 49,544.3348 shares of E Preferred Stock and 4,741,838 shares of F Preferred Stock issued and outstanding. The foregoing issued and out shares of E and F Preferred Stock are convertible into approximately 1,064,463,908 shares of our Common Stock before any reverse stock split sought in Proposal No. 2.

THE BOARD OF DIRECTORS DEEMS PROPOSAL NO. 1 TO BE IN THE BEST INTERESTS OF OUR COMPANY AND OUR STOCKHOLDERS AND RECOMMENDS A VOTE "FOR" APPROVAL THEREOF.

PROPOSAL 2

APPROVAL OF: (A) A POSSIBLE REVERSE STOCK SPLIT OF OUR OUTSTANDING SHARES OF COMMON STOCK IN AN AMOUNT WHICH OUR BOARD OF DIRECTORS DEEMS APPROPRIATE TO BE AT A RATIO OF NOT LESS THAN ONE-FOR-FORTY AND NOT MORE THAN ONE-FOR-EIGHTY; AND (B) THE FILING OF AN AMENDMENT TO OUR CERTIFICATE OF INCORPORATION EFFECTUATING THE FOREGOING, AT SUCH TIME AS OUR BOARD OF DIRECTORS DETERMINES.

General

Our Board of Directors has approved and is recommending to our stockholders a proposal to empower the Board of Directors to effect a reverse stock split of all outstanding shares of our Common Stock to be at a ratio of not less than one-for-forty and not more than one-for-eighty (the “Reverse Stock Split”). We will not issue fractional shares in connection with the Reverse Stock Split. Any fractional shares that result from the Reverse Stock Split will be rounded up to the next whole share. However, if the Board determines that effecting the Reverse Stock Split would not be in the best interests of our stockholders, the Board can determine not to effect it.

The Reverse Stock Split, if authorized by the stockholders at the Meeting and if subsequently implemented by our Board of Directors, will be effected by the filing of an amendment to our Amended and Restated Certificate of Incorporation. Your attention is directed to the section “Exchange of Stock Certificates” below. The complete text of the proposed Amendment to the Amended and Restated Certificate of Incorporation is attached as Appendix B to this Proxy Statement.

Background and Reasons for the Reverse Stock Split

The Board believes that, as a result of the number of shares of Common Stock already issued and outstanding, as well as the number of such shares that will be outstanding after conversion of E Preferred and F Preferred, it is in the best interest of our stockholders to reduce the number of outstanding shares of Common Stock by reverse splitting the issued and outstanding shares of Common Stock. The Board of Directors believes that the Reverse Stock Split will be beneficial for, inter alia, the following reasons, as discussed in greater detail below: (1) to increase the marketability of our Common Stock, (2) to create earnings per share visibility if and when we starts generating profits, (3) to reduce stockholder transaction costs and (4) to possibly eventually list our Common Stock on a National Securities Exchange if and when it meets the listing criteria.

| | · | Increased, more attractive share price. The anticipated stock price resulting from the Reverse Stock Split could bring our stock price to a level more attractive to investors who generally will not invest in a stock below a certain price threshold. |

| | · | Increased earnings per share visibility. If and when we generate earnings, a decrease in our outstanding shares would result in increased visibility for our earnings per share. For example, after conversion of our E Preferred and F Preferred, if our weighted average number of shares outstanding was 1,500,000,000, each $15 million of net income would result in $0.01 of earnings per share and net income of less than $7.5 million would result in no earnings per share as a result of rounding. If we implemented the Reverse Stock Split and reduced the weighted average number of shares outstanding to 28,125,000 each $281,250 of net income would result in $0.01 earnings per share, making it easier to reflect changes in our quarterly and annual results of operations, whether up or down, in our earnings per share calculations. |

| | · | Reduced stockholder transaction costs. Many investors pay commissions based on the number of shares traded when they buy or sell our Common Stock. If our stock price was higher, such investors would pay lower commissions to trade a fixed dollar amount of our stock. |

| | · | Possible Eventual Listing on a National Securities Exchange. We believe that a listing on a national securities exchange such as the NYSE: Amex, should our common stock ever meet the listing criteria, is advisable because it could increase the class of investors who purchase our stock and increase our visibility in financial markets. |

The Board believes that the ratio and timing of the Reverse Stock Split will depend on future market conditions. Accordingly, instead of asking stockholders to authorize a Reverse Stock Split in a specified amount and for us to implement the change at the current time, the Board is seeking stockholder approval of a proposal to authorize a Reverse Stock Split in an amount which our Board of Directors deems appropriate, if and when required. As discussed above, such amount would not be less than one-for-forty and not more than one-for-eighty.

While the Board believes that the Reverse Stock Split will cause our shares of Common Stock to trade at higher prices than those which have prevailed in recent fiscal quarters, the actual effect of the Reverse Stock Split upon the market price for our Common Stock cannot be predicted. There are numerous factors and contingencies that could adversely affect the value of the Common Stock, including prevailing economic or market conditions, and our reported results of operations in future fiscal periods. There is no assurance that:

| · | the trading price per share of our Common Stock after the Reverse Stock Split will rise in proportion to the reduction in the number of pre-split shares of Common Stock outstanding before the Reverse Stock Split; |

| · | the total market capitalization of our Common Stock (the aggregate of the then market price) after the proposed Reverse Stock Split will be equal to or greater than the total market capitalization before the proposed split; or |

| · | the market price of our Common Stock will also be based on our performance and other factors, some of which are unrelated to the number of shares outstanding. |

Material Effects of the Proposed Reverse Stock Split

If the Board elects to effect the Reverse Stock Split following stockholder approval, the number of issued and outstanding shares of Common Stock would be reduced by a ratio of not less than one-for-forty and not more than one-for-eighty as determined by our Board of Directors. Except for adjustments that may result from the treatment of fractional shares as described below, each stockholder will hold the same percentage of the outstanding Common Stock immediately following the Reverse Stock Split as such stockholder held immediately prior to the Reverse Stock Split. Voting rights and other rights and preferences of the holders of Common Stock will not be affected by the Reverse Stock Split. Notwithstanding the foregoing, conversion of E and F Preferred will have a material effect on holders of our Common Stock (see “Substantial Dilution upon Conversion of Preferred Stock” above in Proposal No. 1).

The following table contains approximate information relating to the effect on outstanding shares of Common Stock under the proposed amendment based on share information as of the record date assuming the smallest and the largest ratio for the Reverse Stock Split:

| | | Pre-Reverse Split | | | Post-Reverse Split | | | | |

| | | | | | | | | | |

| | | | | | One-for-Forty basis | | | One-for-Eighty basis | |

| | | | | | | | | | |

| Outstanding | | | 399,928,830 | | | | 9,998,221 | | | | 4,999,110 | |

| | | | | | | | | | | | | |

| Reserved for future issuance upon conversion of outstanding E and F Preferred Stock | | | 1,064,463,908 | | | | 26,611,598 | | | | 13,305,799 | |

| Reserved for future issuance pursuant to outstanding Options, Warrants and Convertible Debt | | | 75,475,176 | | | | 1,886,879 | | | | 943,440 | |

| Total | | | 1,539,867,914 | | | | 38,496,698 | | | | 19,248,349 | |

Fractional Shares

No fractional certificates will be issued as a result of the Reverse Stock Split. Instead, all fractional shares resulting from the Reverse Stock Split will be rounded up to the next whole share.

Exchange of Stock Certificates

If approved by our stockholders, the Reverse Stock Split would become effective on any date selected by our Board of Directors (the “Effective Date”). As soon as practicable after the Effective Date, our stockholders will be notified that the Reverse Stock Split has been effected. Our transfer agent, American Stock Transfer & Trust Company, will act as exchange agent for purposes of implementing the exchange of physical stock certificates. Such person is referred to as the “exchange agent.” Holders of certificates of pre-reverse split shares will be asked to surrender to the exchange agent their certificates in exchange for certificates representing post-reverse split shares in accordance with the procedures to be set forth in a letter of transmittal to be sent by the exchange agent. No new certificates will be issued to a stockholder until such stockholder has surrendered such stockholder’s outstanding certificate(s) together with the properly completed and executed letter of transmittal to the exchange agent. As soon as practicable after the surrender to the exchange agent of any certificate which prior to the Reverse Stock Split represented shares of Common Stock, together with a duly executed transmittal letter and any other documents the exchange agent may specify, the exchange agent shall deliver to the person in whose name such certificate had been issued certificates registered in the name of such person representing the number of full shares of Common Stock into which the shares of Common Stock previously represented by the surrendered certificate shall have been reclassified, with any resulting fractional share being rounded up to the next whole share. Until surrendered as contemplated herein, each certificate which immediately prior to the Effective Date represented any shares of Common Stock shall be deemed at and after the Effective Date to represent the number of full shares of Common Stock contemplated by the preceding sentence. Each certificate representing shares of Common Stock issued in connection with the Reverse Stock Split will continue to bear any legends restricting the transfer of such shares that were borne by the surrendered certificates representing the shares of Common Stock. Stockholders should not destroy any stock certificate and should not submit any certificates until requested to do so and until they receive a transmittal form from the exchange agent.

Shares held in “street name” (e.g., through an account at a brokerage firm, bank, dealer or other similar organization) will automatically be adjusted to reflect the Reverse Stock Split.

Dissenters’ Right of Appraisal

Under the Delaware General Corporation Law, our stockholders are not entitled to dissenter’s rights with respect to the Reverse Stock Split and we will not independently provide the stockholders with any such right.

THE BOARD OF DIRECTORS DEEMS PROPOSAL NO. 2 TO BE IN THE BEST INTERESTS OF THE COMPANY AND ITS STOCKHOLDERS AND RECOMMENDS A VOTE “FOR” APPROVAL THEREOF.

PROPOSAL NO. 3

APPROVAL OF THE PROPOSAL TO AMEND OUR

CERTIFICATE OF INCORPORATION TO CHANGE OUR NAME

FROM MILLENNIUM BIOTECHNOLOGIES GROUP, INC.

TO INERGETICS, INC.

Our Board of Directors is proposing the approval and adoption of an amendment to our Amended and Restated Certificate of Incorporation to change the name of our company from Millennium Biotechnologies Group, Inc. to Inergetics, Inc. Our Board believes that this name change will more clearly reflect our current and future product lines. The complete text of the proposed Amendment to the Certificate of Incorporation is attached as Appendix A to this Proxy Statement.

Unless contrary instructions are indicated on the proxy, all shares of Common Stock, E Preferred and F Preferred represented by valid proxies received pursuant to this solicitation (and not revoked before they are voted) will be voted FOR Proposals No. 1, 2 and 3.

The Board of Directors knows of no business other than that set forth above to be transacted at the meeting, but if other matters requiring a vote of the stockholders arise, the persons designated as proxies will vote the shares of Common Stock, E Preferred and F Preferred represented by the proxies in accordance with their judgment on such matters. If a stockholder specifies a different choice on the proxy, his or her shares of stock will be voted in accordance with the specification so made.

IT IS IMPORTANT THAT PROXIES BE RETURNED PROMPTLY. WE URGE YOU TO FILL IN, SIGN AND RETURN THE ACCOMPANYING FORM OF PROXY IN THE PREPAID ENVELOPE PROVIDED, NO MATTER HOW LARGE OR SMALL YOUR HOLDINGS MAY BE.

| By Order of the Board of Directors, |

| |

| Frank Guarino, Secretary |

APPENDIX A

CERTIFICATE OF AMENDMENT

TO THE

AMENDED AND RESTATED

CERTIFICATE OF INCORPORATION

OF

MILLENNIUM BIOTECHNOLOGIES GROUP, INC.

The above corporation organized and existing under and by virtue of the General Corporation Law of the State of Delaware does hereby certify:

FIRST: That the Board of Directors of Millennium Biotechnologies Group, Inc. (the “Corporation”) has duly adopted resolutions, pursuant to Section 242 of the General Corporation Law of the State of Delaware, setting forth amendments to the Amended and Restated Certificate of Incorporation of this Corporation and declaring said amendments to be advisable.

SECOND: That the stockholders of the Corporation have duly approved said amendments by the required vote of such stockholders, such required vote being a majority of the outstanding shares of the Corporation’s Common Stock voting as a group and a majority of the votes that are entitled to be cast by the holders of the Corporation’s Common Stock, Series E Preferred Stock and Series F Preferred Stock, adopted at a special meeting of the stockholders of the Corporation duly called and held in accordance with the requirements of Section 222 of the General Corporation Law of the State of Delaware, such approval being in accordance with Section 242 of the General Corporation Law of the State of Delaware.

THIRD: That Article FIRST of the Corporation’s Amended and Restated Certificate of Incorporation is hereby amended and, as amended, reads as follows:

“The name of the Corporation (hereinafter called the “Corporation” or the “Company”) is ‘Inergetics, Inc.’.”

FOURTH: That paragraph B of Article FOURTH of the Corporation's Amended and Restated Certificate of Incorporation, is hereby amended and, as amended, reads as follows:

“Upon the filing of this Amendment to the Amended and Restated Certificate of Incorporation, the aggregate number of shares of all classes of capital stock which the Corporation shall have authority to issue shall be Two Billion Five Hundred Thousand (2,000,500,000) shares, consisting of:

(1) Five Hundred Thousand (500,000) shares of preferred stock, par value $1.00 per share ("Preferred Stock"); and

(2) Two Billion (2,000, 000, 000) shares of common stock, par value $0.001 per share.”

IN WITNESS WHEREOF, the Corporation has caused this certificate to be signed this __ day of 2010.

| By: | | |

| | Mark C. Mirken, Chief Executive Officer | |

APPENDIX B

CERTIFICATE OF AMENDMENT

TO THE

AMENDED AND RESTATED

CERTIFICATE OF INCORPORATION

OF

MILLENNIUM BIOTECHNOLOGIES GROUP, INC.

The above corporation organized and existing under and by virtue of the General Corporation Law of the State of Delaware does hereby certify:

FIRST: That the Board of Directors of Millennium Biotechnologies Group, Inc. (the “Corporation”) has duly adopted a resolution, pursuant to Section 242 of the General Corporation Law of the State of Delaware, setting forth an amendment to the Amended and Restated Certificate of Incorporation of this Corporation and declaring said amendment to be advisable.

SECOND: That the stockholders of the Corporation have duly approved said amendment by the required vote of such stockholders, such required vote being a majority of the votes that are entitled to be cast by the holders of the Corporation’s Common Stock, Series E Preferred Stock and Series F Preferred Stock, adopted at a special meeting of the stockholders of the Corporation duly called and held in accordance with the requirements of Section 222 of the General Corporation Law of the State of Delaware, such approval being in accordance with Section 242 of the General Corporation Law of the State of Delaware.

THIRD: That Paragraph A of Article FOURTH of the Corporation's Amended and Restated Certificate of Incorporation be amended and, as amended, read as follows:

“As of 12:01 A.M. (Eastern Time) on _______ __, 2010 (the “Effective Time”), each issued and outstanding share of the Corporation’s Common Stock (the “Pre-Split Common Stock”) shall automatically and without any action on the part of the holder thereof be consolidated, combined and reclassified to one-_____________ (1/_____________) of a share of Common Stock (such consolidation of shares designated as the “Reverse Stock Split”). The par value of the Corporation’s Common Stock following the Reverse Stock Split shall remain at $0.001 par value per share. Each holder of a certificate or certificates of Pre-Split Common Stock shall be entitled to receive, upon surrender of such certificates to the Corporation’s transfer agent for cancellation, a new certificate or certificates for a number of shares equal to such holder’s Pre-Split Common Stock multiplied by 1/_____________, with any fraction resulting from such multiplication rounded up to the nearest whole number (in each case, such fraction, if any, being a “Fractional Share”). No Fractional Shares will be issued for Pre-Split Common Stock in connection with the Reverse Stock Split.”

FOURTH: This Certificate of Amendment to the Amended and Restated Certificate of Incorporation shall be effective as of 12:01 A.M. (Eastern Time) on _____________ __, 2010 in accordance with the provisions of Section 103(d) of the General Corporation Law of the State of Delaware.

IN WITNESS WHEREOF, the Corporation has caused this certificate to be signed this __ day of _____________ 2010.

| By: | | |

| | Mark C. Mirken, Chief Executive Officer | |