UNANIMOUS CONSENT ACTION

OF THE INDEPENDENT DIRECTORS OF

NOBILITY HOMES, INC.,

A FLORIDA CORPORATION

The undersigned, as the sole Independent Director of Nobility Homes, Inc., a Florida corporation (the “Corporation”), unanimously agree, adopt, consent to, and order the following corporate actions:

1. The undersigned waive all formal requirements, including the necessity of holding a formal or informal meeting and any requirement that notice of such meeting be given.

2. The undersigned adopt the following corporate actions:

WHEREAS, the Corporation has been approached with an offer to purchase its 63.97% ownership in Nobility Parks I, LLC, a Florida limited liability company, (“NPI”) for $1,510,000; and

WHEREAS, the sole Independent Director has been asked to evaluate the fairness of the offer on behalf of the Corporation since all other directors may or do have a conflict with respect to the transaction; and

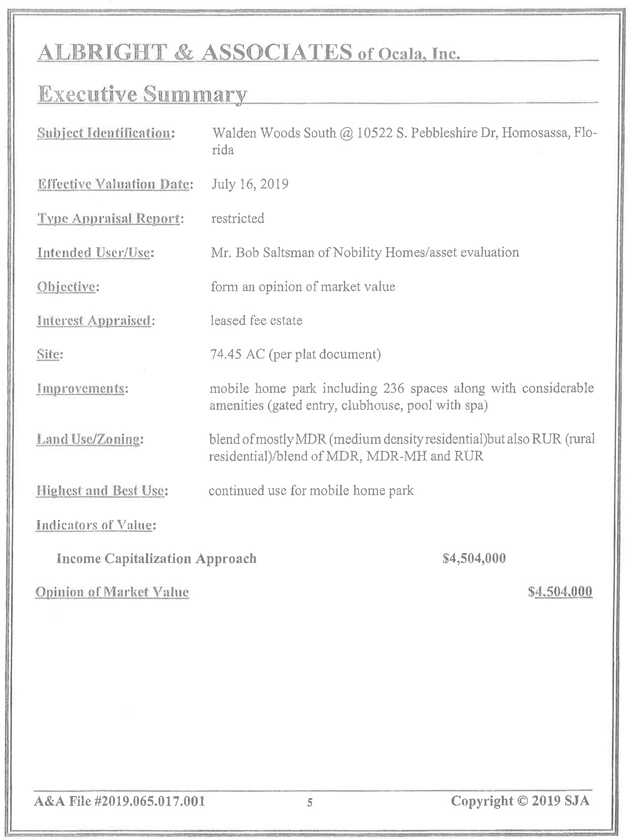

WHEREAS, NPI owns a 49% interest in Walden Wood South, LLC (“Walden”) and Walden’s sole asset is a Manufactured Home Community in Homosassa, Florida; and

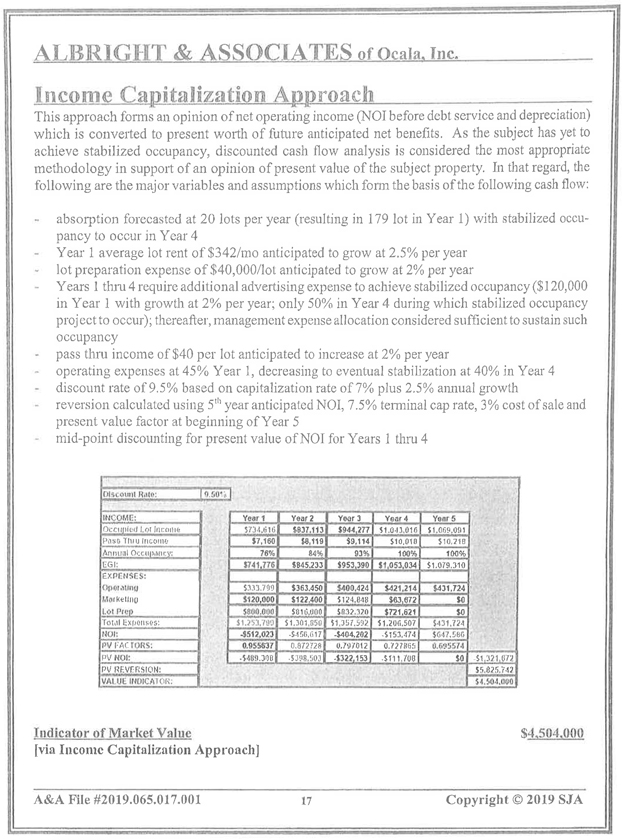

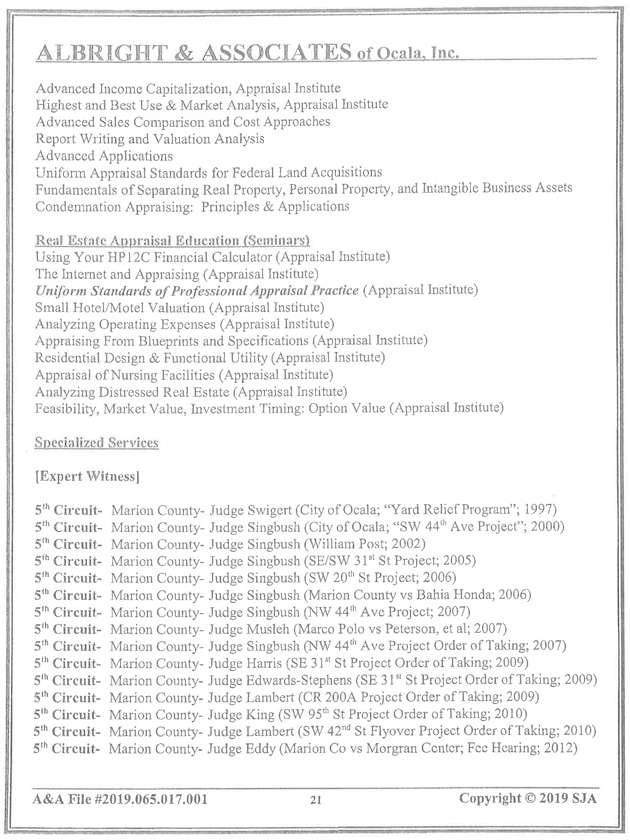

WHEREAS, Albright and Associates of Ocala, Inc. has completed an appraisal of Walden, attached hereafter as Exhibit A, which concludes a gross value of $4,504,000 for Walden’s asset without consideration of any discount associated with anon-controlling minor interest in Walden; and

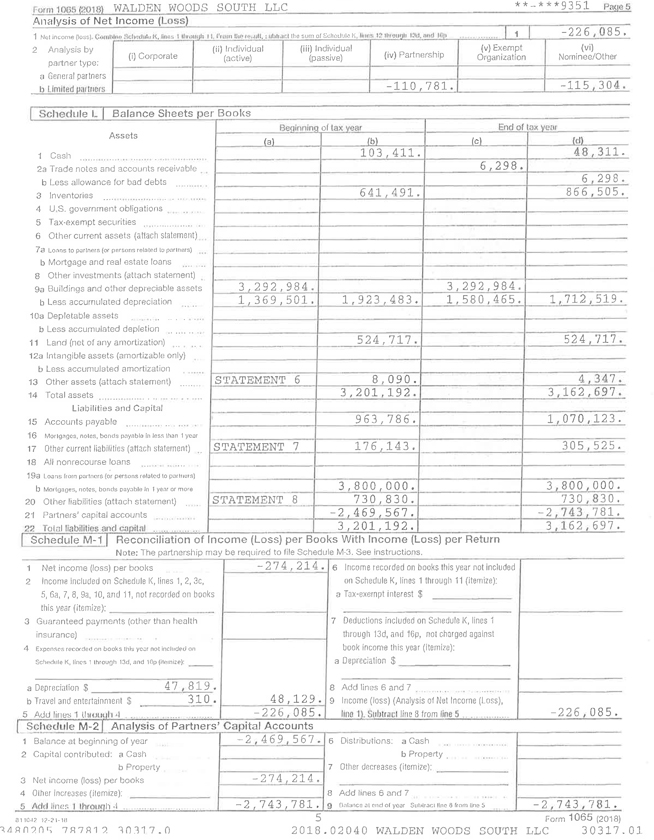

WHEREAS, an examination of the financial statement, attached as Exhibit B, shows two material liabilities: (1) a $3,800,000 note and mortgage to Terry E. Trexler related to the original purchase by him, and (2) $700,000 owed to Stoneridge Landing, Ltd. and Lake Harris Landing, Ltd.; and

WHEREAS, based on the appraisal and existing liabilities, the existing net equity of Walden is approximately zero, so based on these facts, the purchase price of $1,510,000 is well in excess of fair value; and

WHEREAS, the price offered is the original amount invested by the Corporation, representing an overall ownership of 31.35% (63.97% times 49%) of Walden.

RESOLVED, that the Independent Director hereby concludes that based on the above facts, the purchase price of $1,510,000 in the above offer is a fair value for the Corporation’s ownership in NPI.

Page 1 of 2