High-Graded Assets

Focused Exploration

Expanding Production

Monetizing Stranded Natural Gas

Transitioning to a Cash Generator

Noble Energy, Inc.

Acquisition of

Patina Oil & Gas Corporation

December 16, 2004

Forward-looking Statement

This communication contains statements that constitute forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995. These statements are based on

Noble Energy’s and Patina Oil & Gas’ current expectations and beliefs and are subject to a number

of risks, uncertainties and assumptions that could cause actual results to differ materially from

those described in the forward-looking statements. Risks, uncertainties and assumptions include

1) the possibility that the companies may be unable to obtain stockholder or regulatory approvals

required for the acquisition; 2) the possibility that problems may arise in successfully integrating

the businesses of the two companies; 3) the possibility that the acquisition may involve

unexpected costs; 4) the possibility that the combined company may be unable to achieve cost-

cutting synergies; 5) the possibility that the businesses may suffer as a result of uncertainty

surrounding the acquisition; 6) the possibility that the industry may be subject to future regulatory

or legislative actions; 7) the volatility in commodity prices for oil and gas; 8) the presence or

recoverability of estimated reserves; 9) the ability to replace reserves; 10) environmental risks; 11)

drilling and operating risks; 12) exploration and development risks; 13) competition; 14) the ability

of management to execute its plans to meet its goals and other risks that are described in SEC

reports filed by Noble Energy and Patina Oil & Gas. Because forward-looking statements involve

risks and uncertainties, actual results and events may differ materially from results and events

currently expected by Noble Energy and Patina Oil & Gas. Noble Energy and Patina Oil & Gas

assume no obligation and expressly disclaim any duty to update the information contained herein

except as required by law.

Additional Information About The Merger

And Where To Find It

In connection with the proposed acquisition by Noble Energy of Patina Oil & Gas, Noble Energy and Patina Oil &

Gas will file relevant materials with the SEC, including one or more registration statement(s) that contain a

prospectus and a joint proxy statement. Investors and security holders of Noble Energy and Patina Oil & Gas are

urged to read these documents (if and when they become available) and any other relevant documents filed with

the SEC, as well as any amendments or supplements to those documents, because they will contain important

information about Noble Energy, Patina Oil & Gas and the acquisition. Investors and security holders may obtain

these documents (and any other documents filed by Noble Energy or Patina Oil & Gas with the SEC) free of charge

at the SEC’s website at www.sec.gov. In addition, the documents filed with the SEC by Noble Energy may be

obtained free of charge from Noble Energy’s website at www.nobleenergyinc.com. The documents filed with the

SEC by Patina Oil & Gas may be obtained free of charge from Patina Oil & Gas’ website at www.patinaoil.com.

Investors and security holders are urged to read the joint proxy statement/prospectus and the other relevant

materials when they become available before making any voting or investment decision with respect to the

proposed acquisition.

Noble Energy, Patina Oil & Gas and their respective executive officers and directors may be deemed to be

participants in the solicitation of proxies from the stockholders of Noble Energy and Patina Oil & Gas in favor of

the acquisition. Information about the executive officers and directors of Noble Energy and their ownership of

Noble Energy common stock is set forth in the proxy statement for Noble Energy’s 2004 Annual Meeting of

Stockholders, which was filed with the SEC on March 24, 2004. Information about the executive officers and

directors of Patina Oil & Gas and their ownership of Patina Oil & Gas common stock is set forth in the proxy

statement for Patina Oil & Gas’ 2004 Annual Meeting of Stockholders, which was filed with the SEC on April 16,

2004. Investors and security holders may obtain more detailed information regarding the direct and indirect

interests of Noble Energy, Patina Oil & Gas and their respective executive officers and directors in the acquisition

by reading the joint proxy statement/prospectus regarding the acquisition when it becomes available.

These materials do not constitute an offer to sell or solicitation of an offer to buy any security and shall not

constitute an offer, solicitation or sale in any jurisdiction in which such offering would be unlawful.

Transaction Summary

An Accretive Acquisition Benefiting All Parties

Transaction Value – $3.4 Billion

$1.8 Billion Equity

$1.1 Billion Debt

$0.5 Billion Assumed Debt

60 Percent Stock / 40 Percent Cash

New NBL Shares Issued – 27 Million

Immediately Accretive to EPS and DCFPS

Pro Forma Ownership

68 Percent NBL

32 Percent POG

Board of Directors

Five Current NBL Directors

Two POG Directors

Transaction Summary

Key Terms and Conditions

March/April 2005

Estimated Closing:

NBL Shareholder Approval

POG Shareholder Approval

Hart Scott Rodino Approval

Conditions:

$100MM

Termination Fee:

POG Shareholders Can, Subject to Proration, Elect:

Cash or NBL Common Stock, in Either Case

Having a Value Equal to $14.80, plus

Value of 0.3751 NBL Shared During Specified

Period Prior to Closing

In Total, POG Shareholders Will Receive

Consideration Comprised of 60 Percent of NBL

Common Stock and 40 Percent Cash

Consideration:

Transaction Summary

Substantial Financial and Operating Benefits

Reserves and Production Increase Over 50 Percent

Lengthen Domestic Reserve Life

Reserves Per Share Increase 12 Percent

Establishes New Core Areas in Long-lived Basins

Domestic Onshore Reserves Increase to 45 Percent of Total

Onshore Tight Gas Expertise Enhanced

Reduces Domestic Risk and Costs

Less Reliance on Exploration

More Exploitation/Development

Multi-year Project Inventory

Immediately Accretive to EPS and DCFPS*

Increased Free Cash Flow Generation Capacity

Hedging Program Protects Cash Flows from Operations

* See Appendix

Benefits to POG’s Shareholders

Immediate Exposure to High Impact Projects Overseas

and in the Deep Water Gulf of Mexico

Combined Companies Have Outstanding Portfolio

Diversification

55% Domestic Reserves, 45% International Reserves

Transaction Structure Allows POG’s Shareholders to

Continue to Participate in the Growth of POG’s Assets

While Gaining Exposure to Exploration Projects with

Significant Potential

Additional Financial Flexibility with Investment Grade

Rating

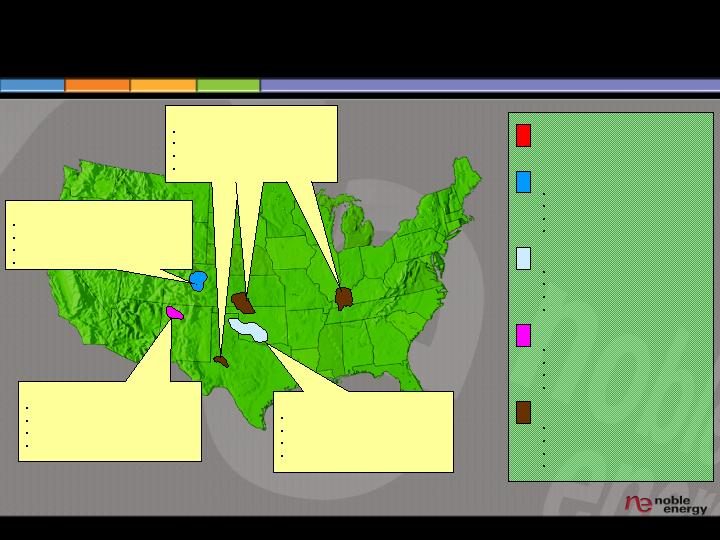

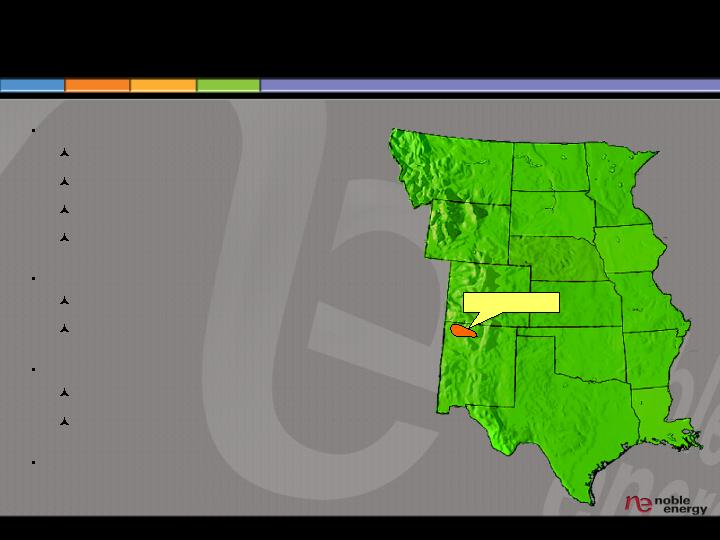

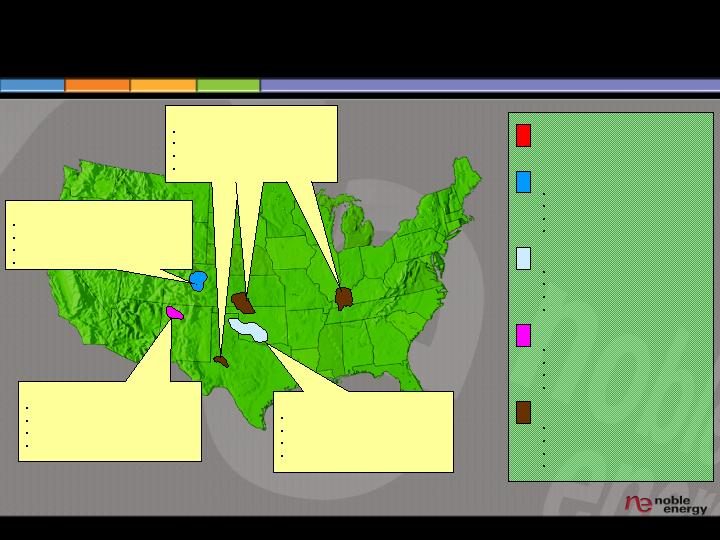

An Outstanding Combination of Assets

Equatorial Guinea*

Reserves 203 MMBoe

Production 17 MBoepd

Argentina*

Reserves 10 MMBoe

Production 3 MBoepd

Ecuador*

Reserves 13 MMBoe

Production 3 MBoepd

Israel*

Reserves 75 MMBoe

Production 7 MBoepd

North Sea*

Reserves 11 MMBoe

Production 9 MBoepd

China*

Reserves 10 MMBoe

Production 4 MBoepd

Onshore US Pro Forma*

Reserves 320 MMBoe

Production 78 MBoepd

Gulf of Mexico*

Reserves 68 MMBoe

Production 39 MBoepd

* Reserves As Of 12/31/03

Production As Of YTD 9/04

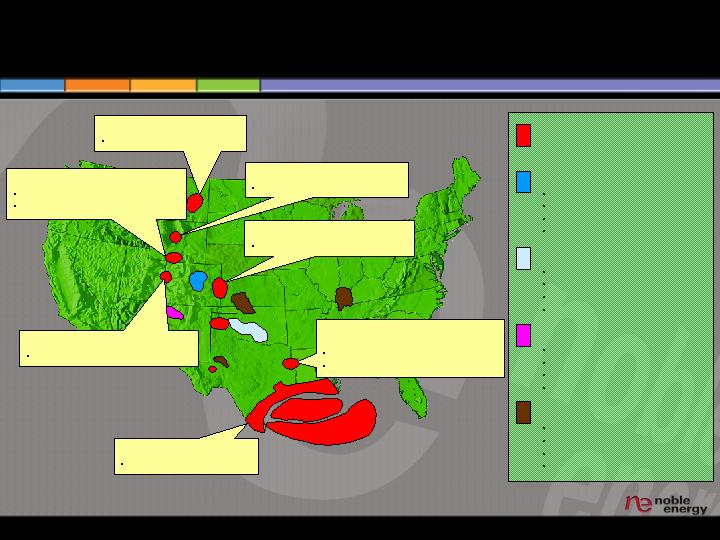

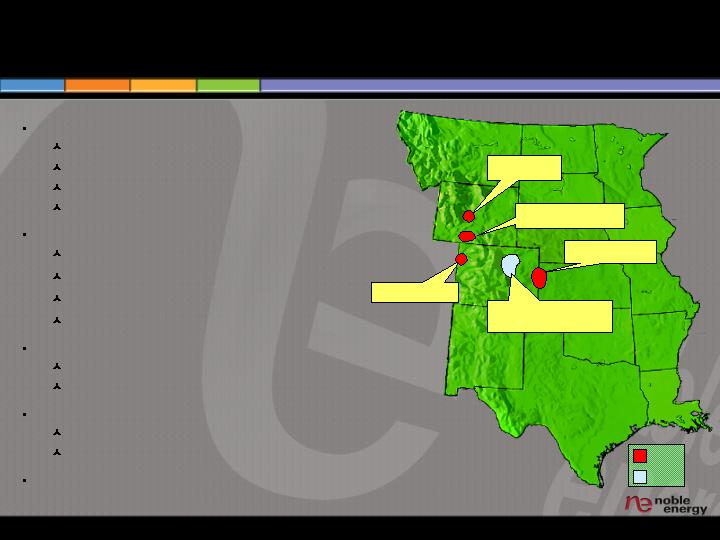

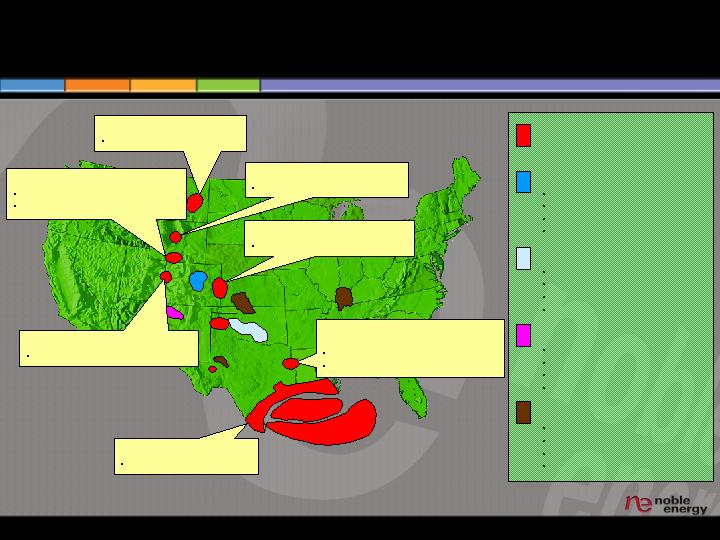

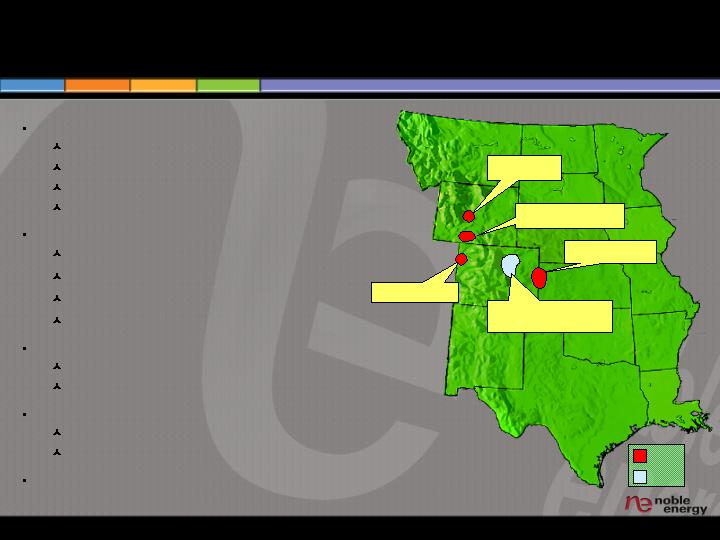

POG Adds Significant Assets in Key Growth Basins

San Juan

16 MMBoe Proved (2004E)

97% Gas

22 MMBoe Probable & Possible

500+ Projects

Wattenberg

152 MMBoe Proved (2004E)

68% Gas

120 MMBoe Probable & Possible

8,700+ Projects

Mid-Continent

80 MMBoe Proved (2004E)

70% Gas

35 MMBoe Probable & Possible

800+ Projects

Central

15 MMBoe Proved (2004E)

11% Gas

4 MMBoe Probable & Possible

300 Projects

NBL

POG – Wattenberg

152 MMBoe Proved (2004E)

68% Gas

120 MMBoe Probable & Possible

8,700+ Projects

POG – Mid-Continent

80 MMBoe Proved (2004E)

70% Gas

35 MMBoe Probable & Possible

800+ Projects

POG – San Juan

16 MMBoe Proved (2004E)

97% Gas

22 MMBoe Probable & Possible

500+ Projects

POG – Central

15 MMBoe Proved (2004E)

11% Gas

4 MMBoe Probable & Possible

300 Projects

NBL

POG – Wattenberg

152 MMBoe Proved (2004E)

68% Gas

120 MMBoe Probable & Possible

8,700+ Projects

POG – Mid-Continent

80 MMBoe Proved (2004E)

70% Gas

35 MMBoe Probable & Possible

800+ Projects

POG – San Juan

16 MMBoe Proved (2004E)

97% Gas

22 MMBoe Probable & Possible

500+ Projects

POG – Central

15 MMBoe Proved (2004E)

11% Gas

4 MMBoe Probable & Possible

300 Projects

POG Adds Significant Assets in Key Growth Basins

Siberia Ridge Field

8 – 10 Well Drilling Program

Additional Infill Drilling Potential

Bowdoin Field

25 Well Drilling Program

Niobrara Trend

235 Well Infill Drilling Program

Caspiana Field

(Hosston / Cotton Valley)

5 – 7 Well Drilling Program

Additional Infill Drilling Potential

Gulf Coast Region

38 Drilling Well Program

Wind River

Testing 27,000 Acre Position

Piceance

Drilling 32 Wells on 6,500 Acres

International

70%

Domestic

30%

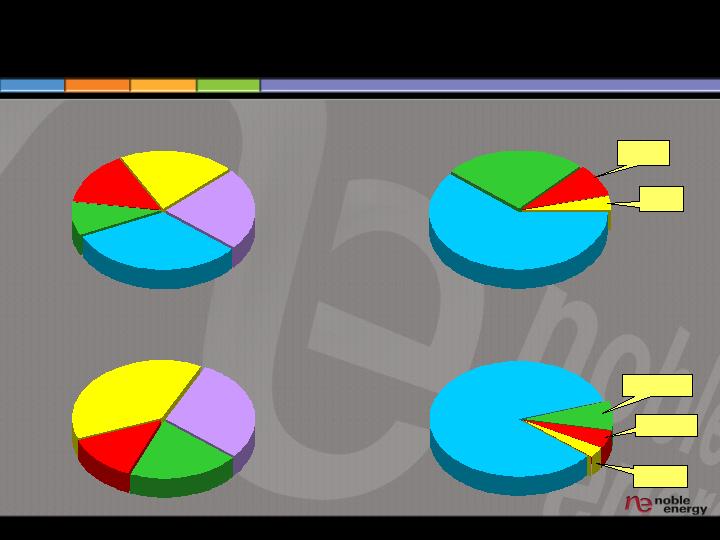

Rebalance Reserve Mix

Domestic Weighting Increases Significantly

International

45%

Domestic

55%

Total Reserves:

710 MMBoe

Pro Forma

NBL YE 2003

Total Reserves:

457 MMBoe

Increased Domestic Onshore Contribution

More Stable, Longer-lived Production

GOM

37%

North Sea

7%

Domestic

Onshore

20%

Other Int’l

9%

Israel

12%

EG

15%

GOM

24%

North Sea

5%

Domestic

Onshore

47%

Other Int’l

6%

Israel

8%

EG

10%

107 MBoepd

160 MBoepd

NBL Production

3Q04

Pro Forma

3Q04

Why Patina Oil & Gas?

Grow Domestic Position in Key Basins

Long-lived Onshore

Deepwater

Complement International Production

Growth

Balance Risk From Exploration

Generate Competitive Risk-weighted

Returns

Reduce Dependence on Gulf of Mexico

Shelf

High-quality, Multi-year, Low-risk Inventory

Balances Risk Profile of Reserve Base

Increases Domestic Onshore Reserves to

45 Percent of Total Reserves From 15

Percent

Increases Domestic Exploitation

Extends Domestic Reserve Life

Taps into One of the Stronger Near-term

Organic Growth Profiles in the Sector

Establishes New Core Areas with Platform

for Further Regional Consolidation

Allows Application of POG’s Technological

Expertise to NBL’s Existing Onshore Tight

Gas Operations

Provides NBL with an Opportunity to

Further High Grade Asset Base

NBL’s Articulated

Strategic Objectives

A Combination with POG Would

Address Many of These Objectives

Establish

Organic Growth

Platform

Strategic

Acquisitions

Major International Developments Online, Driving

Visible Production Growth Through 2008

Recent Deepwater Discoveries and Associated

Development Opportunities Anchor U.S. Growth

Reduced Run-rate Unit Cash Costs by 5 Percent

From 1H03 to 1H04

Five Non-core/Higher Operating Cost Asset

Packages Identified and Sold

Total Debt/Book Capitalization Declined to

38 Percent

Net Debt/Book Capitalization at 35 Percent

Announced Acquisition of Patina Oil & Gas

Adding Long-lived Domestic Natural Gas

NBL’s Long-term Corporate Objectives

Achievements

Growth

Cost

Reductions

Reduce

Financial

Leverage

Significant Progress Towards Long-term Goals

POG Has A Strong Record Of Growth

Production (MBoepd)

Proven Reserves (MMBoe)

Large POG Resource Base

Provides Stability and Upside

Over 250 MMBoe of Proved Reserves Provides Stable Production Base

Low-cost, High Operating Margins

High Free Cash Flow Generation

Significant Inventory of High Rate of Return Projects

Over 200 MMBoe of Probable and Possible Resources

Seven-plus Year Project Inventory

Low-risk Exploitation and Development

More Than 10,000 Total Identified Projects

Operating Control of Reserves, Production and Upside

95 Percent of Value

Focused Asset Base

Over 85 Percent of Value and Upside Concentrated in Two Core Areas

Technical, Operating and Acquisition Expertise Highly Transferable

3Q04 Average Daily Production – 54 MBoepd

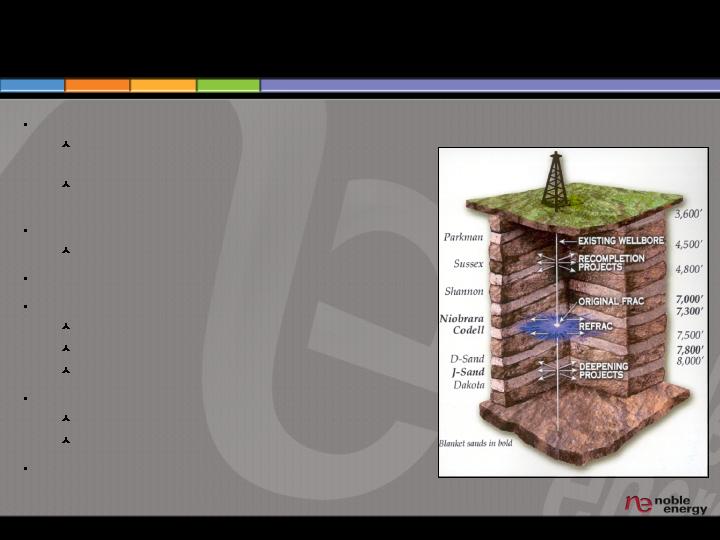

D-J Basin – The Wattenberg Field

A New Core Area with Running Room

Wattenberg Field

One of Ten Largest Gas Fields in US

Over 500 MMBoe of Cumulative Production

POG Currently Largest Operator in Field

Stable, Predictable, Long-lived Production

Resources – 2004E

152 MMBoe of Proven Reserves

73 Percent Developed

120 MMBoe Probable/Possible

68 Percent Natural Gas

Production – 3Q04

33 MBoepd

13 Year Reserve Life

Control

Average WI of 94 Percent

99 Percent Operated

Leasehold – 220,000 Net Acres

D-J Basin

Wattenberg Field

Siberia Ridge Field

Wind River

Piceance

Niobrara Trend

NBL

POG

Wattenberg Field

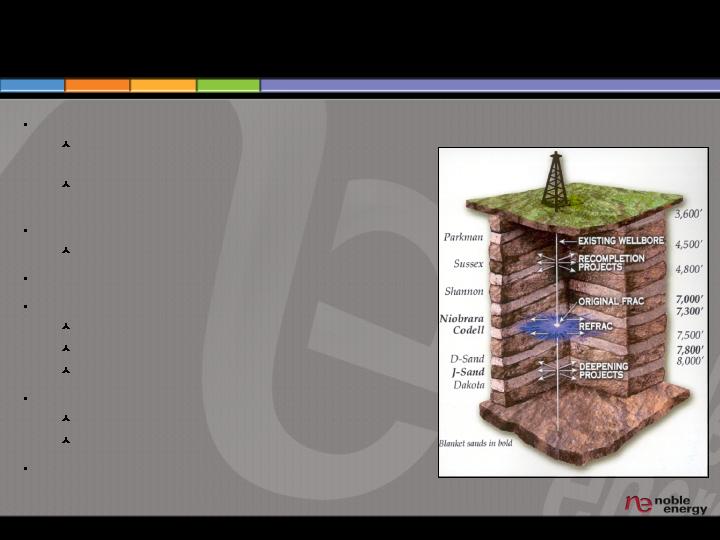

A Large Inventory of Exploitation and Growth Opportunities

Multiple Zones

Up to Eight Productive Formations in

4500’-Thick Section

All Zones Can Be Drilled, Commingled and

Produced From Single Wellbore

Low Risk Development Opportunities

Over 98 Percent Historical Success Rate

Over 8,700 Identified High-return Projects

Major Proven Development Programs

Codell Drilling, Refracs and Trifracs

Niobrara Recompletions / Refracs

J-Sand Drilling and Deepenings

Further Exploitation Potential

Dakota

Shallow Sands (Sussex, Shannon, Parkman)

Potential for Field Consolidation

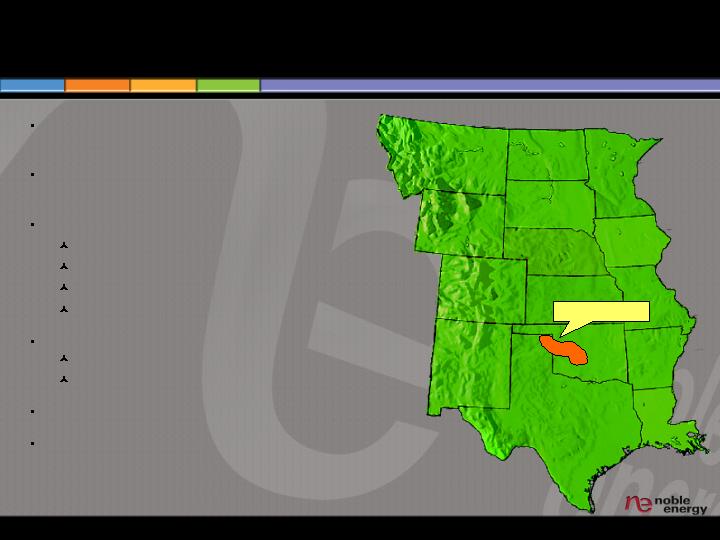

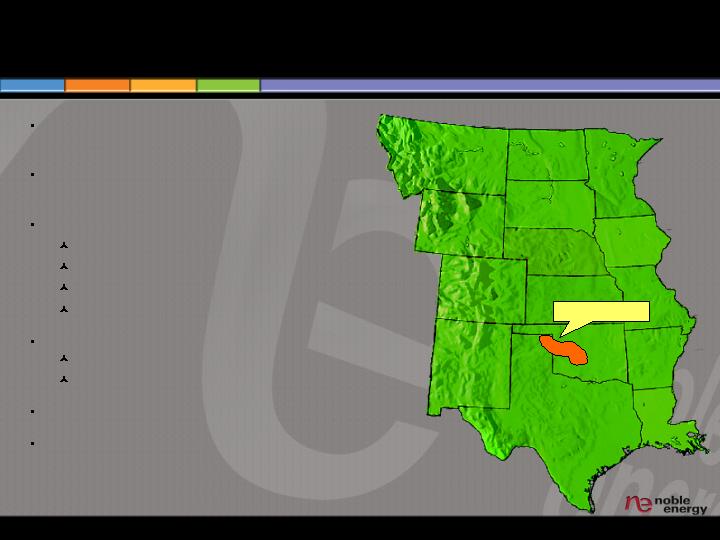

Mid-Continent Area

A Platform for Substantial Growth

Growing Natural Gas Position in

Anadarko Basin

Stable Oil Production in Ardmore-Marietta

Basin

Resources – 2004E

80 MMBoe of Proven Reserves

71 Percent Developed

35 MMBoe Probable/Possible

70 Percent Natural Gas

Production – 3Q04

15 MBoepd

15 Year Reserve Life

87 Percent Operated

Leasehold – 180,000 Net Acres

Mid-Continent

Mid-Continent

A Large Number of Low-risk Growth Opportunities

Buffalo Wallow – 20 Acre

Down-spacing Approved

Granite Wash – 200

Potential Locations

Billy Rose – Developing

10,000 Net Acres

Western Oklahoma –

Developing Red Fork Play

Southern Oklahoma

Expand Waterfloods

Test Deeper Horizons

Over 800 Identified Projects

Hemphill

St. Claire

Buffalo Wallow

Billy Rose

South Thomas

Elm Grove

Eakley Weatherford

Wildcat Jim

SW Davis

East Cumberland

Franklin Unit

Santa Fe

Milroy Deese

Loco

Cottonwood Creek

Texas

Oklahoma

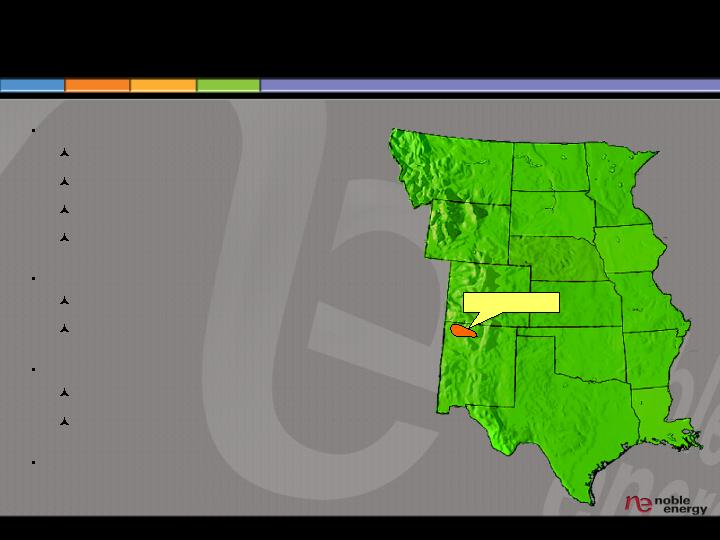

San Juan Basin

Establishing A Platform for Growth

Resources – 2004E

16 MMBoe of Proven Reserves

70 Percent Developed

22 MMBoe Probable/Possible

97 Percent Natural Gas

Production – 3Q04

2 MBoepd

26 Year Reserve Life

Control

Average WI of 78 Percent

98 Percent Operated

Leasehold – 20,700 Net Acres

San Juan Basin

Central Region

Stable Oil Production

Primarily Illinois and Kansas Basins

Resources – 2004E

15 MMBoe of Proven Reserves

89 Percent Developed

4 MMBoe Probable/Possible

11 Percent Natural Gas

Production – 3Q04

4 MBoepd

10 Year Reserve Life

93 Percent Operated

Leasehold – 70,000 Net Acres

New Ventures

Leasing Acreage in Three Areas Targeting Shale

Formations

Utilize POG’s Tight Reservoir Completion Expertise

More Than 70,000 Net Acres Acquired To Date

Drilling Expected to Begin in 1Q05

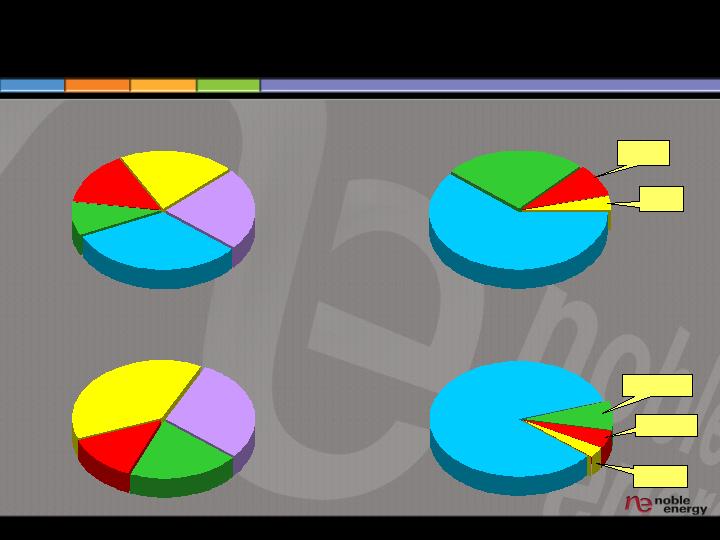

Mid

Continent

26%

San Juan

9%

Wattenberg

61%

Central

4%

Mid Continent

8%

San Juan

5%

Central

3%

Wattenberg

84%

PDNP

9%

Possible

23%

PUD

15%

PDP

32%

Probable

21%

POG’s Deep Project Inventory Provides Future Growth

Resources by Category

Total: 477 MMBoe

Resources by Area

Total: 477 MMBoe

Projects by Category

Total: 10,400

Projects by Area

Total: 10,400

PDNP

20%

PUD

13%

Possible

29%

Probable

38%

A Significantly Enhanced Domestic Business

Combination Drives Further Cost Improvements

Year-to-Date 9/30/04, $/Boe

Domestic

Pro Forma

Domestic

NBL

POG

Percent

Change

LOE

4.36

3.51

3.97

Production Tax

0.78

2.36

1.50

SG&A [1]

1.42

1.20

1.16 [2]

Exploration

3.92

0.09

2.18

Interest [1]

1.35

0.64

1.64 [3]

Subtotal

11.83

7.80

10.45

(12%)

DD&A

10.59

6.25

10.72 [4]

Total

22.42

14.05

21.17

(6%)

Production (MMBoe)

17.4

14.5

31.9

[1]

Average Total NBL Rates

[2]

Includes Acquisition Synergies

[3]

Includes Additional Borrowings

[4]

Includes Purchase Price Allocation

2005 Guidance

Pro Forma

NBL

Production Growth (%)

10

10 – 11

(175 – 180 MBoepd)

LOE ($/Boe)

3.70 – 3.90

3.50 – 3.75

SG&A ($/Boe)

1.45 – 1.65

1.15 – 1.35

DD&A ($/Boe)

7.00 – 7.50

8.25 – 8.75

Exploration ($MM)

140 – 160

140 – 165

Capital Spending ($MM)

735

995

Effective Tax Rate (%)

42

40

% Deferred

20 – 30

25 – 35

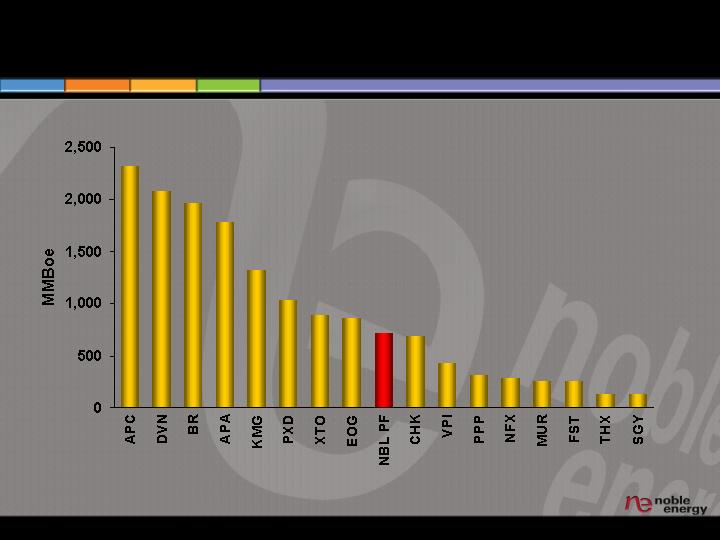

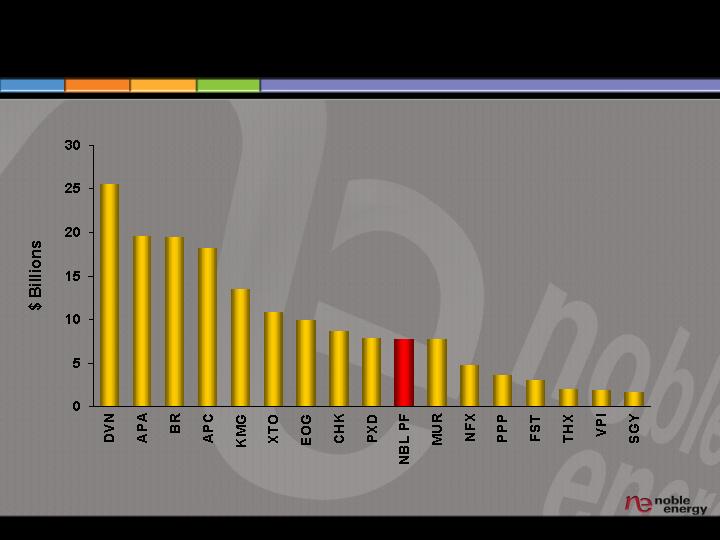

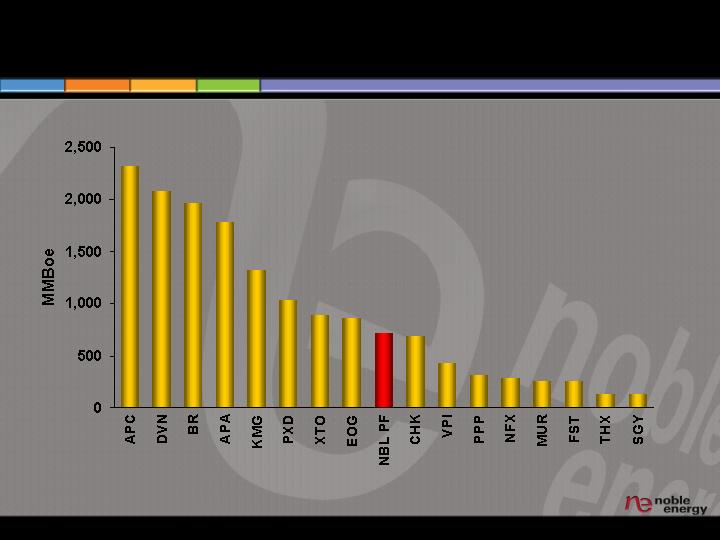

2003 Proved Reserves

Note: 2003 Reserve Figures Adjusted for Announced Asset Acquisitions and Divestitures

710

Source: J.P. Morgan Chase

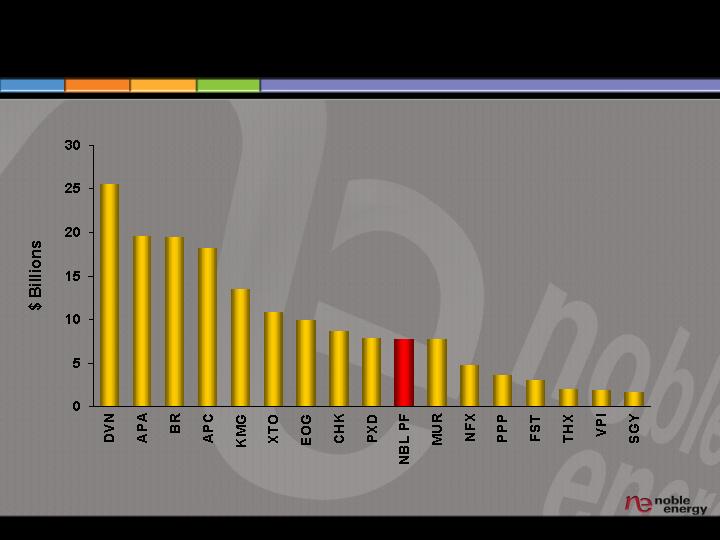

Enterprise Value

$7.7

Source: J.P. Morgan Chase

Capitalization

Current NBL

12/31/04E

(Millions)

Pro Forma

12/31/04

(Millions)

Amount

Percent

Amount

Percent

Credit Facility

$85

4%

$447

8%

Current Term Loan

150

6%

150

3%

Acquisition Loan

-

-

1,300

23%

Sr. Unsecured Notes

644

28%

644

11%

Total Debt

$879

38%

$2,541

45%

Total Equity

1,443

62%

3,146

55%

Total Capitalization

$2,322

100%

$5,687

100%

Financial Flexibility

Five-year Financing Provides Repayment Flexibility

Combined Company Generates Substantial Free

Cash Flow

Available for Expanded Capital Projects

Debt Reduced to Pre-acquisition Levels Within

Three Years

Hedges Ensure Free Cash Flow to Meet Goals

Hedging Strategy

Protects Cash Flow from Operations for Capital Needs

and Debt Reduction

New Production Hedges Through 2008

Natural Gas: 80 MMcfpd

Crude Oil: 7,000 Boepd

Layered into NBL’s Existing Production

Treated as Hedges

Fixed Rate Swaps

NBL and POG

Accelerating Progress Towards Strategic Objectives

Stronger and More Balanced Company

Reserves and Production Increase Over 50 Percent

Domestic Onshore Significantly Enhanced

Domestic Growth Less Dependent on Exploration

A Larger Base to Support Major Projects

Increased Inventory of Exploitation Projects

NBL’s Current Portfolio to Benefit with Added Expertise

from POG

Domestic Cost Structure Improves Further

Accretive to Earnings and Discretionary Cash Flow* Immediately

Significant Combined Free Cash Flow to Accommodate New

Opportunities and Debt Reduction

* See Appendix

Appendix

Disclosure & Reconciliation of Non-GAAP Measures

Discretionary Cash Flow

A – 1

YTD

09/04 2003

($MM) ($MM)

Net Income

$241.3

78.0

DD&A

234.4

288.7

Power Project DD&A

15.4

27.1

Crude Oil and Natural Gas Exploration

82.1

148.8

Interest Capitalized

(9.7)

(14.1)

Undistributed (Earnings)/Loss From Unconsol. Subs.

(44.0)

(40.6)

Distribution from Unconsol. Subs.

50.0

46.1

DD&A – Discontinued Operations

-

28.8

Impairment of Operating Assets

-

31.9

Change in Accounting Principle, Net of Tax

-

5.8

Deferred Income Tax Provision (Benefit)

43.9

(34.9)

Accretion of Asset Retirement Obligation

7.1

9.3

Other

(4.5)

63.9

Discretionary Cash Flow (1)

$615.9

$638.9

Adjustments to Reconcile:

Working Capital

(34.1)

(26.1)

Israel – Take or Pay Payment

(51.8)

Cash Exploration Costs

(29.1)

14.1

Capitalized Interest

9.7

2.9

Deferred Tax, Misc. Credits and Other

(38.3)

-

Net Cash Provided By Operating Activities

$524.0

$578.0

(1) Discretionary cash flow is a forward-looking non-GAAP financial measure. The GAAP

measure most comparable to discretionary cash flow is net cash provided by operating activities

(net operating cash). Net operating cash is not accessible on a forward-looking basis and

reconciling information is not available without unreasonable effort. The reconciling information

that is unavailable would include a forward-looking balance sheet prepared in accordance with

GAAP. The probable significance of having a forward-looking GAAP balance sheet is estimated

to be a variance of plus or minus 10 percent of the forward-looking discretionary cash flow in

this presentation.

The table above reconciles cash flow to net cash flow provided by operating activities. While

discretionary cash flow is not a GAAP measure of financial performance, management believes it

is a good tool for internal use and the investment community in evaluating the company’s overall

financial performance. Among management, professional research analysts, portfolio managers

and investors following the crude oil and natural gas industry, discretionary cash flow is broadly

used as an indicator of a company’s ability to fund exploration and production activities and

meet financial obligations. Discretionary cash flow is also commonly used as a basis to value

and compare companies in the crude oil and natural gas industry.

Disclosure & Reconciliation of Non-GAAP Measures

Discretionary Cash Flow

A - 2