Exhibit 3.3

TERRA INDUSTRIES INC.

ARTICLES OF RESTATEMENT

TERRA INDUSTRIES INC., a Maryland corporation (the “Corporation”) having its principal office in the State of Maryland c/o United States Corporation Company, 1123 North Eutaw Street, Baltimore, Maryland 21201, hereby certifies to the State Department of Assessments and Taxation of the State of Maryland that:

FIRST: The Corporation desires to and does restate its charter as currently in effect pursuant to Section 2-608 of the Maryland General Corporation Law (the “MGCL”).

SECOND: The following provisions are all the provisions of the charter of the Corporation currently in effect, as restated herein:

FIRST: We, the incorporators, R. Douglas McPheters, Linwood G. Lawrence, III, and George M. Williams, Jr., all of whose post office address is 53 Wall Street, New York, New York 10005, and all being of full legal age, do under and by virtue of the General Laws of the State of Maryland, authorizing the formation of corporations, associate ourselves with the intention of forming a corporation.

SECOND: The name of the corporation (which is hereinafter called the “Corporation”) is TERRA INDUSTRIES INC.

THIRD: The purposes for which and any of which the Corporation is formed and the business and objects to be carried on and promoted by it are:

(1) To engage in any lawful act or activity for which corporations may be organized under the General Corporation Law of the State of Maryland.

(2) To engage in any one or more businesses or transactions, or to acquire all or any portion of the securities of any entity engaged in any one or more businesses or transactions which the Board of Directors of the Corporation may from time to time authorize or approve, whether or not related to the business described elsewhere in this Article THIRD or to any other business at the time or theretofore engaged in by the Corporation.

(3) To purchase, lease, hire or otherwise acquire, hold, own, construct, develop, erect, improve, manage, operate and in any manner dispose of, and to aid and subscribe toward the acquisition, construction or improvement of, buildings, machinery, equipment and facilities, and any other property or appliances which may appertain to or be useful in the conduct of any of the businesses of the Corporation, its subsidiaries, affiliates or any other entity in which the Corporation may have an interest; and to contact for, for terms of years or otherwise, procure or make use of, personal services of officers, employees, agents or contractors, and of services of any firm, association or corporation.

(4) To acquire the whole or any part of the good will, rights, property, franchise and business of any corporation, joint stock company, syndicate, association, firm, trust, partnership, joint venture or person heretofore or hereafter engaged in any business; and to hold, utilize, enjoy and in any manner dispose of, the whole or any part of the good will, rights, property, franchise and business so acquired, and to assume in connection therewith any liabilities of any such corporation, joint stock company, syndicate, association, firm, trust, partnership, joint venture or person.

(5) To acquire by purchase, subscription or otherwise, and to receive, hold, own, guarantee, sell, assign, exchange, transfer, mortgage, pledge or otherwise dispose of or deal in and with any of the shares of capital stock, or any voting trust certificates or depository receipts in respect of the shares of capital stock, scrip, warrants, rights, options, bonds, debentures, notes, trust receipts, and other securities, obligations, choses in action and evidences of indebtedness or other rights in or interests issued or created by any corporation, joint stock company, syndicate, association, firm, trust, partnership, joint venture or person, public or private, or by the government of the United States of America, or by any foreign government, or by any state, territory, province, municipality or other political subdivision, or by any governmental agency, or by any other entity, and to issue in exchange therefore or in payment thereof its own capital stock, bonds or other obligations or securities, or otherwise pay therefor in money or other property; to possess and exercise as owner thereof all the rights, powers and privileges of ownership including the right to execute consents and vote thereon, and to do any and all acts and things necessary or advisable for the preservation, protection, improvement and enhancement in value thereof.

(6) To cause to be organized, under the laws of the United States of America, or any foreign government, or any state, territory, province, municipality or other political entity, a corporation, joint stock company, syndicate, association, firm, trust, partnership, or joint venture, for the purpose of accomplishing any or all of the objects and purposes of the Corporation and to dissolve, wind up, liquidate, merge or consolidate any such corporation, joint stock company, syndicate, association, firm, trust, partnership, or joint venture or cause the same to be dissolved, terminated, wound up, liquidated, merged or consolidated.

2

(7) To carry out all or any part of the foregoing objects as principal, or otherwise, either alone or through or in conjunction with, as partner, joint venturer or otherwise, any corporation, joint stock company, syndicate, association, firm, trust, partnership, joint venture or person; and, in carrying on its business and for the purpose of attaining or furthering any of its objects and purposes, to make and perform any contracts and do any acts and things, and to exercise any powers suitable, convenient or proper for the accomplishment of any of the objects and purposes herein enumerated or incidental to the powers herein specified, or which at any time appear conducive to or expedient for the accomplishment of any such objects and purposes.

(8) To purchase or otherwise acquire, and to hold, sell or otherwise dispose of, and to retire and reissue, shares of its own stock of any class and any other securities issued by it in any manner now or hereafter authorized or permitted by law.

(9) To make contracts and guarantees, incur liabilities and borrow money; to sell, mortgage, lease, pledge, exchange, convey, transfer and otherwise dispose of all or any part of the property and assets of the Corporation; and to issue bonds, notes and other obligations and secure the same by mortgage or deed of trust of all or any part of the property, franchises and income of the Corporation.

(10) To aid in any manner any corporation, joint stock company, syndicate, association, firm, trust, partnership, joint venture or person of which the shares of capital stock, or voting trust certificates or depository receipts in respect of the shares of capital stock, scrip, warrants, rights, options, bonds, debentures, notes, trust receipts, and other securities, obligations, choses in action and evidences of indebtedness or other rights in or interests issued or created by are held by or for the corporation, or in the welfare of which the Corporation shall have any interest, direct or indirect; and to do any acts or things designed to protect, preserve, improve and enhance the value of any such property or interest, or any other property of the Corporation.

(11) To guarantee the payment of dividends or distributions upon any shares of capital stock, interests in or other securities of, or the performance of any contract by, any other corporation, joint stock company, syndicate, association, firm, trust, partnership, joint venture or person in which, or in the welfare of which, the Corporation has any interest, direct or indirect; and to endorse or otherwise guarantee the payment of the principal and interest, or either, on any bonds, debentures, notes or other securities, obligations and evidences of indebtedness created or issued by any of the same.

(12) To carry out all or any part of the objects and purposes of the Corporation and to conduct its business in all or any of its branches, in any or all states, territories, districts and possessions of the United States of America and in foreign countries; and to maintain offices and agencies in any or all states, territories, districts and possessions of the United States of America and in foreign countries.

3

The foregoing enumerated purposes and objects shall be in no way limited or restricted by reference to, or inference from, the terms of any other clause of this or any other Article of the charter of the Corporation, and each shall be regarded as independent; and they are intended to be and shall be construed as powers as well as purposes and objects of the Corporation and shall be in addition to and not in limitation of the general powers of the corporation under the General Laws of the State of Maryland.

FOURTH: The post office address of the principal office of the Corporation in the State of Maryland is 1123 North Eutaw Street, Baltimore, Maryland 21201.

FIFTH: The resident agent of the Corporation in the State of Maryland is the United States Corporation Company, a corporation of the State of Maryland, whose post office address is 1123 North Eutaw Street, Baltimore, Maryland 21201.

SIXTH: The total number of shares of all classes of stock which the Corporation has authority to issue is 133,500,000 shares of capital stock, without par value, of which 133,380,000 shares are hereby classified as “Common Shares” and 120,000 are hereby classified as “4.25% Series A Cumulative Convertible Perpetual Preferred Shares” (the “Series A Shares”). The Board of Directors of the Corporation may from time to time classify or reclassify any unissued stock of any class by setting or changing the preferences, conversion or other rights, voting powers, restrictions, limitations as to dividends, qualifications, or terms or conditions of redemption of the stock.

A description of each class of stock of the Corporation with the preferences, conversion and other rights, voting powers, restrictions, limitations as to dividends, qualifications and terms and conditions of each class is as follows:

(1) Common Shares

(a) Each Common Share shall have one vote and the holders of the outstanding Common Shares shall vote together as a single class and shall not be entitled to any class voting power or rights.

(b) Subject to the provisions of any applicable law, the holders of Common Shares shall be entitled to receive such dividends as from time to time may be declared by the Board of Directors of the Corporation.

(c) The holders of the outstanding Common Shares shall not have any rights to covert such shares into or exchange such shares for shares of any other class or classes of capital stock (or any other security) of the Corporation.

4

(2) The Series A Shares have the preferences, rights, voting powers, restrictions, limitations, qualifications, terms and conditions of redemption and other terms and conditions set forth onExhibit I attached hereto and incorporated herein by reference.

SEVENTH: The following provisions are hereby adopted for the purpose of defining, limiting and regulating the powers of the Corporation and of the directors and stockholders:

(1) The Board of Directors of the Corporation is hereby empowered to authorize the issuance from time to time of shares of its stock of any class, whether now or hereafter authorized, or securities convertible into shares of its stock of any class or classes, whether now or hereafter authorized, for such consideration as may be deemed advisable by the Board of Directors and without any action by the stockholders.

(2) No holder of any stock or any other securities of the Corporation, whether now or hereafter authorized, shall have any preemptive right to subscribe for or purchase or receive any stock or any other securities of the Corporation other than such, if any, as the Board of Directors, in its sole discretion, may determine and at such price or prices and upon such other terms as the Board of Directors, in its sole discretion, may fix; and any stock or other securities which the Board of Directors may determine to offer for subscription may, as the Board of Directors in its sole discretion shall determine, be offered to the holders of any class, series or type of stock or other securities at the time outstanding to the exclusion of the holders of any or all other classes, series or types of stock or other securities at the time outstanding.

(3) The Board of Directors of the Corporation shall have power from time to time and in its sole discretion to determine in accordance with sound accounting practice, what constitutes annual or other net profits, earnings, surplus, or net assets in excess of capital; to fix and vary from time to time the amount to be reserved as working capital, or determine that retained earning or surplus shall remain in the hands of the Corporation; to set apart out of any funds of the Corporation such reserve or reserves in such amount or amounts and for such proper purposes or purposes as it shall determine and to abolish any such reserve or any part thereof; to distribute and pay distributions or dividends in stock, cash or other securities or property, out of surplus or any other funds or amounts legally available therefor, at such times and to the stockholders of record on such dates as it may, from time to time, determine; and to determine whether and to what extent and to what times and places and under what conditions and regulations the books, accounts and documents of the Corporation, or any of them shall be open to the inspection of stockholders, except as otherwise provided by statute or by the By-Laws, and, except as so provided, no stockholder shall have any right to inspect any book, account or document of the Corporation unless authorized so to do by resolution of the Board of Directors.

5

(4) A contract or other transaction between the Corporation and any of its directors or between the Corporation and any other corporation, firm or other entity in which any of the Corporation’s directors is a director of has a material financial interest is not void or voidable solely because of any one or more of the following: the common directorship or interest; the presence of the director at the meeting of the Board of Directors which authorizes, approves, or ratifies the contract or transaction; or the counting of the vote of the director for the authorization, approval, or ratification of the contract or transaction. This Section applies if:

(a) the fact of the common directorship or interest is disclosed or known to: the Board of Directors and the Board authorizes, approves, or ratifies the contract or transaction by the affirmative vote of a majority of disinterested directors, even if the disinterested directors constitute less than a quorum; or the stockholders entitled to vote, and the contract or transaction is authorized, approved, or ratified by a majority of the votes cast by the stockholders entitled to vote other than the votes of shares owned of record or beneficially by the interested director or corporation, firm or other entity; or

(b) the contract or transaction is fair and reasonable to the Corporation.

Common or interested directors or the stock owned by them or by an interested corporation, firm, or other entity may be counted in determining the presence of a quorum at a meeting of the Board of Directors or at a meeting of the stockholders, as the case may be, at which the contract or transaction is authorized, approved, or ratified. If a contract or transaction is not authorized, approved, or ratified in one of the ways provided for in clause (a) of the second sentence of this Section, the person asserting the validity of the contract or transaction bears the burden of proving that the contract or transaction was fair and reasonable to the Corporation at the time it was authorized, approved, or ratified. The procedures in this Section do not apply to the fixing by the Board of Directors of reasonable compensation for a director, whether as a director or in any other capacity.

(5) Except for contracts, transactions, or acts required to be approved under the provisions of Section (4) of this Article SEVENTH, any contract, transaction, or act of the Corporation or of the Board of Directors which shall be ratified by a majority of a quorum of the stockholders having voting powers at any annual meeting, or at any special meeting called for such purpose, shall so far as permitted by law be as valid and as binding as though ratified by every stockholder of the Corporation.

(6) Unless the By-Laws otherwise provide, any officer or employee of the Corporation (other than a director) may be removed at any time with or without cause by the Board of Directors or by any committee or superior officer upon whom such power of removal may be conferred by the By-Laws or by authority of the Board of Directors.

6

(7) Notwithstanding any provision of law requiring the authorization of any action by a greater proportion than a majority of the total number of shares of all classes of capital stock or of the total number of shares of any class of capital stock, such action shall be valid and effective if authorized by the affirmative vote of the holders of a majority of the total number of shares of all classes outstanding and entitled to vote thereon, except as otherwise provided in the charter.

(8) The Corporation shall indemnify (a) its directors to the full extent provided by the general laws of the State of Maryland now or hereafter in force, including the advance of expenses under the procedures provided by such laws; (b) its officers to the same extent it shall indemnify its directors; and (c) its officers who are not directors to such further extent as shall be authorized by the Board of Directors and be consistent with law. The foregoing shall not limit the authority of the Corporation to indemnify other employees and agents consistent with law.

(9) To the fullest extent permitted by Maryland statutory or decisional law, as amended or interpreted, no director or officer of the Corporation shall be personally liable to the Corporation or its stockholders for money damages. No amendment of the charter of the Corporation or repeal of any of its provisions shall limit or eliminate the benefits provided to directors and officers under this provision with respect to any act or omission that occurred prior to such amendment or repeal.

(10) The Corporation reserves the right from time to time to make any amendments of its charter which may now or hereafter be authorized by law, including any amendments changing the terms or contract rights, as expressly set forth in its charter, of any of its outstanding stock by classification, reclassification or otherwise but no such amendment which changes such terms or contract rights of any of its outstanding stock shall be valid unless such amendment shall have been authorized by not less than a majority of the aggregate number of the votes entitled to be cast thereon, by a vote at a meeting or in writing with or without a meeting.

(11) The Board of Directors of the Corporation shall have power, if the By-Laws so provide, to hold their meetings either within or without the State of Maryland; and the Corporation may have one or more offices in addition to the principal office in Maryland, and keep its books (subject to the provisions of the statutes) outside of the State of Maryland at such places as may from time to time be designated by the Board of Directors.

(12) Pursuant to Title 3, Subtitle 8 of the Maryland General Corporation Law (the “MGCL”), the Board of Directors of the Corporation, at a duly called

7

meeting held on February 16, 2005, adopted resolutions to provide that the Corporation elects to be subject to the provisions of Sections 3-803, 3-804 and 3-805 of the MGCL.

The enumeration and definition of particular powers of the Board of Directors included in the foregoing shall in no way be limited or restricted by reference to or inference from the terms of any other clause of this or any other Article of the charter of the Corporation, or construed as or deemed by inference or otherwise in any manner to exclude or limit any powers conferred upon the Board of Directors under the General Laws of the State of Maryland now or hereafter in force.

EIGHTH: The duration of the Corporation shall be perpetual.

THIRD: These Articles of Restatement do not amend the charter of the Corporation.

FOURTH: Under Section 2-608(c) of the MGCL, upon any restatement of the charter of the Corporation, the Corporation may omit from such restatement all provisions thereof that relate solely to a class of stock if, at the time, there are no shares of the class outstanding and the Corporation has no authority to issue any shares of such class. There are no shares of the Corporation’s Class A Shares, Trust Shares or Series B Cumulative Redeemable Preferred Shares outstanding and the Corporation has no authority to issue any of the Class A Shares, Trust Shares or Series B Cumulative Redeemable Preferred Shares. All provisions in the charter of the Corporation that relate solely to the Corporation’s Class A Shares, Trust Shares and Series B Cumulative Redeemable Preferred Shares have been omitted from the foregoing restatement of the charter of the Corporation.

FIFTH: The foregoing restatement of the charter of the Corporation has been approved by a majority of the entire Board of Directors.

8

SIXTH: The current address of the principal office of the Corporation is as set forth in ArticleFOURTH of the foregoing restatement of the charter of the Corporation.

SEVENTH: The name and address of the Corporation’s current resident agent is as set forth in ArticleFIFTH of the foregoing restatement of the charter of the Corporation

EIGHTH: The number of directors of the Corporation is six, which number may be increased or decreased pursuant to the By-Laws of the Corporation, but shall never be less than the minimum number permitted by the General Laws of the State of Maryland, and the names of the directors currently in office are: Henry R. Slack, Michael L. Bennett, David E. Fisher, Dod A. Fraser, Martha O. Hesse and Peter S. Janson.

NINTH: The undersigned President acknowledges these Articles of Restatement to be the corporate act of the Corporation and, as to all matters or facts required to be verified under oath, the undersigned President acknowledges that to the best of his knowledge, information and belief, these matters and facts are true in all material respects and that this statement is made under penalty of perjury.

[SIGNATURE PAGE FOLLOWS]

9

IN WITNESS WHEREOF, Terra Industries Inc. has caused these Articles of Restatement to be signed in its name and on its behalf by its President and attested to by its Secretary on August 3, 2005.

TERRA INDUSTRIES INC. | ||

By: | /s/ Michael L. Bennett | |

Michael L. Bennett, President | ||

ATTEST: |

/s/ Mark A. Kalafut |

Mark A. Kalafut, Corporate Secretary |

S-1

EXHIBIT I

TERRA INDUSTRIES INC.

4.25% SERIES A CUMULATIVE CONVERTIBLE PERPETUAL PREFERRED SHARES

The number of shares, designation, preferences, rights, voting powers, restrictions, limitations, qualifications, terms and conditions of redemption and other terms and conditions of the separate series of capital stock of Terra Industries Inc. (the “Corporation”) designated as the 4.25% Series A Cumulative Convertible Perpetual Preferred Shares are as follows (collectively, the “Series A Terms”):

1.Designation and Number. A series of Preferred Shares, designated as “4.25% Series A Cumulative Convertible Perpetual Preferred Shares” (the “Series A Preferred Shares”), is hereby established. The number of Series A Preferred Shares shall be 120,000.

2.Definitions. For purposes of the Series A Terms, the following terms shall have the meanings indicated:

“Additional Common Shares” shall have the meaning assigned to it in Section 7(m)(i) hereof.

“Additional Dividends” shall have the meaning assigned to it in Section 4(h) hereof.

“Affiliate” of any Person means any other Person directly or indirectly controlling or controlled by or under direct or indirect common control with such Person. For the purposes of this definition, “control” when used with respect to any Person means the power to direct the management and policies of such Person, directly or indirectly, whether through the ownership of voting securities, by contract or otherwise; and the terms “controlling” and “controlled” have meanings correlative to the foregoing.

“Agent Members” shall have the meaning assigned to it in Section 16(a) hereof.

“Board of Directors” means either the board of directors of the Corporation or any duly authorized committee of such board.

“Business Day” means any day other than a Saturday, Sunday or a day on which state or U.S. federally chartered banking institutions in New York, New York are not required to be open.

“Capital Stock” of any Person means any and all shares, interests, participations or other equivalents however designated of corporate stock or other equity participations, including partnership interests, whether general or limited, of such Person and any rights (other than debt securities convertible or exchangeable into an equity interest), warrants or options to acquire an equity interest in such Person.

“Closing Sale Price” of the Common Shares or other Capital Stock or similar equity interests on any date means the closing sale price per share (or, if no closing sale price is

I-1

reported, the average of the closing bid and ask prices or, if more than one in either case, the average of the average closing bid and the average closing ask prices) on such date as reported on the principal United States securities exchange on which Common Shares or such other Capital Stock or similar equity interests are traded or, if the Common Shares or such other Capital Stock or similar equity interests are not listed on a United States national or regional securities exchange, as reported by Nasdaq or by the National Quotation Bureau Incorporated. In the absence of such quotations, the Board of Directors of the Corporation shall be entitled to determine the Closing Sale Price on the basis it considers appropriate, which determination shall be conclusive. The Closing Sale Price shall be determined without reference to any extended or after hours trading.

“Common Share Legend” shall have the meaning assigned to it in Section 17(e).

“Common Shares” means any shares of any class of the Corporation that has no preference in respect of dividends or of amounts payable in the event of any voluntary or involuntary liquidation, dissolution or winding up of the Corporation and that is not subject to redemption by the Corporation. Subject to the provisions of Section 10, however, shares issuable on conversion of the Series A Preferred Shares shall include only shares of the class designated as Common Shares of the Corporation as of October 14, 2004 or shares of any class or classes resulting from any reclassification or reclassifications thereof and that have no preference in respect of dividends or of amounts payable in the event of any voluntary or involuntary liquidation, dissolution or winding up of the Corporation and which are not subject to redemption by the Corporation; provided that if at any time there shall be more than one such resulting class, the shares of each such class then so issuable on conversion shall be substantially in the proportion that the total number of shares of such class resulting from all such reclassifications bears to the total number of shares of all such classes resulting from all such reclassifications.

“Conversion Agent” shall have the meaning assigned to it in Section 18(a) hereof.

“Conversion Date” shall have the meaning assigned to it in Section 6(b) hereof.

“Conversion Price” per Series A Preferred Share means, on any date, the Liquidation Preference divided by the Conversion Rate in effect on such date.

“Conversion Rate” per Series A Preferred Share means 100.4016 Common Shares, subject to adjustment pursuant to Section 7 hereof.

“Convertible Subordinated Debentures” shall have the meaning assigned to it in Section 9(a) hereof.

“Corporation” means Terra Industries Inc., a Maryland corporation, and shall include any successor to such Corporation.

“Depositary” means DTC or its successor depositary.

I-2

“Dividend Payment Date” means March 15, June 15, September 15 and December 15 of each year, commencing March 15, 2005, or if any such date is not a Business Day, on the next succeeding Business Day.

“Dividend Period” shall mean the period beginning on, and including, a Dividend Payment Date (or, in the case of the first Dividend Period, the first date of original issuance of the Series A Preferred Shares) and ending on, and excluding, the immediately succeeding Dividend Payment Date.

“Dividend Rate” shall have the meaning assigned to it in Section 4(a) hereof.

“DTC” shall mean The Depository Trust Company, New York, New York.

“Effective Date” shall have the meaning assigned to it in Section 7(m)(i) hereof.

“Exchange” shall have the meaning assigned to it in Section 9(a) hereof.

“Exchange Act” shall mean the Securities Exchange Act of 1934, as amended.

“Exchange Date” shall have the meaning assigned to it in Section 9(b) hereof.

“Exchange Right” shall have the meaning assigned to it in Section 9(a) hereof.

“Expiration Time” shall have the meaning assigned to it in Section 7(e) hereof.

“Fundamental Change” shall have the meaning assigned to it in Section 12(b) hereof.

“Fundamental Change Notice” shall have the meaning assigned to it in Section 12(c) hereof.

“Fundamental Change Purchase Date” shall have the meaning assigned to it in Section 12(a) hereof.

“Fundamental Change Purchase Notice” shall have the meaning assigned to it in Section 12(d) hereof.

“Fundamental Change Purchase Price” shall have the meaning assigned to it in Section 12(a) hereof.

“Global Preferred Shares” shall have the meaning assigned to it in Section 16(a) hereof.

“Global Shares Legend” shall have the meaning assigned to it in Section 16(a) hereof.

“Indenture” shall have the meaning assigned to it in Section 9(a) hereof.

“Initial Purchaser” shall have the meaning assigned to it in the Purchase Agreement.

“Junior Shares” shall have the meaning assigned to it in Section 3(a) hereof.

I-3

“Liquidation Preference” means $1,000 per Series A Preferred Share.

“Mandatory Conversion Date” shall have the meaning assigned to it in Section 8(b) hereof.

“Market Price” shall mean the average of the Closing Sale Prices of the Common Shares for the twenty Trading Day period ending on the third Business Day prior to the Fundamental Change Repurchase Date.

“Officer” means the Chairman of the Board, a Vice Chairman of the Board, the President, any Vice President, the Treasurer, any Assistant Treasurer, the Controller, any Assistant Controller, the Secretary or any Assistant Secretary of the Corporation.

“Outstanding” means, when used with respect to Series A Preferred Shares, as of any date of determination, all Series A Preferred Shares outstanding as of such date; provided, however, that, in determining whether the holders of Series A Preferred Shares have given any request, demand, authorization, direction, notice, consent or waiver or taken any other action hereunder, Series A Preferred Shares owned by the Corporation or its Affiliates shall be deemed not to be Outstanding, except that, in determining whether the Registrar shall be protected in relying upon any such request, demand, authorization, direction, notice, consent, waiver or other action, only Series A Preferred Shares which the Registrar has actual knowledge of being so owned shall be deemed not to be Outstanding.

“Parity Shares” shall have the meaning assigned to it in Section 3(b) hereof.

“Paying Agent” shall have the meaning assigned to it in Section 18(a) hereof.

“Person” means an individual, a corporation, a partnership, a limited liability company, an association, a trust or any other entity or organization, including a government or political subdivision or an agency or instrumentality thereof.

“Public Acquiror Change of Control” shall have the meaning assigned to it in Section 7(n)(ii) hereof.

“Public Acquiror Common Stock” shall have the meaning assigned to it in Section 7(n)(ii) hereof.

“Publicly Traded Securities” shall have the meaning assigned to it in Section 12(a)(ii) hereof.

“Purchase Agreement” means the Purchase Agreement, dated as of October 7, 2004, among the Corporation and the Initial Purchasers relating to the Series A Preferred Shares.

“Record Date” means (i) with respect to the dividends payable on March 15, June 15, September 15 and December 15 of each year, March 1, June 1, September 1 and December 1 of each year, respectively, or such other record date, not more than 60 days and not less than 10 days preceding the applicable Dividend Payment Date, as shall be fixed by the Board of Directors and (ii) solely for the purpose of adjustments to the Conversion Rate pursuant to

I-4

Section 7, with respect to any dividend, distribution or other transaction or event in which the holders of Common Shares have the right to receive any cash, securities or other property or in which the Common Shares (or other applicable security) is exchanged for or converted into any combination of cash, securities or other property, the date fixed for determination of shareholders entitled to receive such cash, securities or other property (whether such date is fixed by the Board of Directors or by statute, contract or otherwise).

“Registrar” shall have the meaning assigned to it in Section 14 hereof.

“Registration Default Dividends” shall have the meaning assigned to it in the Registration Rights Agreement.

“Registration Rights Agreement” means the Registration Rights Agreement, dated as of October 7, 2004, among the Corporation and the Initial Purchasers relating to the Series A Preferred Shares.

“Restricted Shares Legend” shall have the meaning assigned to it in Section 16(a).

“Restricted Subsidiaries” shall have the meaning assigned thereto in the indentures relating to the Corporation’s and its Subsidiaries’ indebtedness.

“Rights” shall have the meaning assigned to it in Section 11 hereof.

“Rights Plan” shall have the meaning assigned to it in Section 11 hereof.

“Securities Act” means the Securities Act of 1933, as amended.

“Senior Shares” shall have the meaning assigned to it in Section 3(c) hereof.

“Series A Preferred Share Director” shall have the meaning assigned to it in Section 13(c) hereof.

“Shelf Registration Statement” shall have the meaning assigned to it in the Registration Rights Agreement.

“Spin-off” shall have the meaning assigned to it in Section 7(c) hereof.

“Stock Price” shall have the meaning assigned to it in Section 7(m)(i) hereof.

“Subsidiary” means (a) a corporation, a majority of whose Capital Stock with voting power, under ordinary circumstances, to elect directors is, at the date of determination, directly or indirectly owned by the Corporation, by one or more Subsidiaries of the Corporation or by the Corporation and one or more Subsidiaries of the Corporation, (b) a partnership in which the Corporation or a Subsidiary of the Corporation holds a majority interest in the equity capital or profits of such partnership, or (c) any other Person (other than a corporation) in which the Corporation, a Subsidiary of the Corporation or the Corporation and one or more Subsidiaries of the Corporation, directly or indirectly, at the date of determination, has (i) at least a majority ownership interest or (ii) the power to elect or direct the election of a majority of the directors or other governing body of such person.

I-5

“Trading Day” means a day during which trading in securities generally occurs on the New York Stock Exchange or, if the applicable security is not listed on the New York Stock Exchange, on the principal other national or regional securities exchange on which the applicable security is then listed or, if the applicable security is not listed on a national or regional securities exchange, on Nasdaq or, if the applicable security is not quoted on Nasdaq, on the principal other market on which the applicable security is then traded (provided that no day on which trading of the applicable security is suspended on such exchange or other trading market will count as a Trading Day).

“Transfer Agent” shall have the meaning assigned to it in Section 14 hereof.

“Trust Indenture Act” shall mean the Trust Indenture Act of 1939 as amended.

“Voting Stock” shall have the meaning assigned to it in Section 12(b)(i) hereof.

3.Ranking. The Series A Preferred Shares shall, with respect to dividend rights and rights upon liquidation, winding-up or dissolution, rank:

(a) senior to the Common Shares and any other class or series of Capital Stock of the Corporation, the terms of which do not expressly provide that such class or series ranks senior to or on a parity with the Series A Preferred Shares as to dividend rights and rights on liquidation, winding-up and dissolution of the Corporation (collectively, together with any warrants, rights, calls or options exercisable for or convertible into such Capital Stock, the “Junior Shares”);

(b) on a parity with any other class or series of Capital Stock of the Corporation, the terms of which expressly provide that such class or series ranks on a parity with the Series A Preferred Shares as to dividend rights and rights on liquidation, winding-up and dissolution of the Corporation (collectively, together with any warrants, rights, calls or options exercisable for or convertible into such Capital Stock, the “Parity Shares”); and

(c) junior to all existing and future indebtedness of the Corporation and to each class or series of Capital Stock of the Corporation, the terms of which expressly provide that such class or series ranks senior to the Series A Preferred Shares as to dividend rights and rights on liquidation, winding-up and dissolution of the Corporation (collectively, together with any warrants, rights, calls or options exercisable for or convertible into such Capital Stock, the “Senior Shares”).

4.Dividends. (a) Holders of Series A Preferred Shares shall be entitled to receive, when, as and if, declared by the Board of Directors, out of funds legally available for the payment of dividends, dividends on each Series A Preferred Share at the annual rate (the “Dividend Rate”) of 4.25% of the Liquidation Preference per share. Such dividends shall be payable in arrears in equal amounts quarterly on each Dividend Payment Date, beginning March 15, 2005, in preference to and in priority over dividends on any Junior Shares but subject to the rights of any holders of Senior Shares or Parity Shares. All references in these Series A

I-6

Terms to dividends or to a Dividend Rate shall be deemed to include Additional Dividends or to reflect any adjustment to the Dividend Rate applicable to the Series A Preferred Shares pursuant to Section 4(h) hereof, as the case may be, if such Additional Dividends are then payable as described in Section 4(h).

(b) Dividends shall be cumulative from the initial date of issuance or the last Dividend Payment Date for which accumulated dividends were paid, whichever is later, whether or not funds of the Corporation are legally available for the payment of such dividends. Each such dividend shall be payable to the holders of record of the Series A Preferred Shares, as they appear on the Corporation’s stock register at the close of business on a Record Date. Accumulated but unpaid dividends on the Series A Preferred Shares will not bear interest.

(c) If the Corporation fails to pay or to set apart funds to pay dividends on the Series A Preferred Shares for any Dividend Period, then holders of Series A Preferred Shares shall be entitled to receive, when, as and if, declared by the Board of Directors, out of funds legally available therefor, dividends at a Dividend Rate per annum equal to:

4.25% + (N * (4.25%2) * 0.25

where:

| N | = the number of Dividend Periods for which the Corporation has failed to pay or to set apart funds to pay dividends on the Series A Preferred Shares, |

for each subsequent Dividend Period until the Corporation has paid or provided for the payment of all dividends on the Series A Preferred Shares for all Dividend Periods up to and including the Dividend Payment Date on which the accumulated and unpaid dividends are paid in full (such accumulated and unpaid dividends for each prior Dividend Period to be paid at a Dividend Rate calculated based on the formula set forth above, where N will be equal to the number of Dividend Periods for which the Corporation has failed to pay or to set apart funds to pay dividends on the Series A Preferred Shares determined as of, and for, each prior Dividend Period).

(d) The amount of dividends payable for each full Dividend Period for the Series A Preferred Shares shall be computed by dividing the Dividend Rate by four. The amount of dividends payable for the initial Dividend Period, or any other period shorter than a full Dividend Period, on the Series A Preferred Shares shall be computed on the basis of a 360-day year consisting of twelve 30-day months.

(e) No dividend will be declared or paid upon, or any sum set apart for the payment of dividends upon, any Outstanding Series A Preferred Share with respect to any Dividend Period unless all dividends for all preceding Dividend Periods have been declared and a sufficient sum set apart for the payment of such dividend, upon all Outstanding Series A Preferred Shares.

(f) No dividend or other distribution (other than a dividend or distribution payable solely in shares of a like or junior ranking or cash in lieu of fractional shares) may be declared, made or paid, or set apart for the payment, upon any Parity Shares or Junior Shares, nor

I-7

shall any Parity Shares or Junior Shares be redeemed, purchased or otherwise acquired for any consideration (or any money paid to or made available for a sinking fund for the redemption of any Parity Shares or Junior Shares) by or on behalf of the Corporation (except by conversion into or exchange for shares of a like or junior ranking), unless all accumulated and unpaid dividends, shall have been or contemporaneously are declared and paid, or are declared and a sum sufficient for payment thereof is set apart for such payment, on the Series A Preferred Shares and any Parity Shares for all Dividend Periods terminating on or prior to the date of such declaration, payment, redemption, purchase or acquisition. Notwithstanding the foregoing, if full dividends have not been paid on the Series A Preferred Shares and any Parity Shares, dividends may be declared and paid on the Series A Preferred Shares and such Parity Shares so long as the dividends are declared and paid pro rata so that amounts of dividends declared per share on the Series A Preferred Shares and such Parity Shares will in all cases bear to each other the same ratio that accumulated and unpaid dividends per Series A Preferred Share and such other Parity Share bear to each other.

(g) (i) The Corporation may pay dividends, at its option, in cash, Common Shares or any combination thereof. Common Shares delivered to the Transfer Agent on behalf of the holders of the Series A Preferred Shares will be sold automatically on the holders’ behalf for cash. By purchasing the Series A Preferred Shares, holders are deemed to appoint the Transfer Agent as their agent for any such sale and the Transfer Agent will serve as the designated agent of the holders of the Series A Preferred Shares in making any such sales. If the Corporation pays dividends by delivering Common Shares to the Transfer Agent, the Corporation must deliver to the Transfer Agent a number of Common Shares which, when sold by the Transfer Agent on the holders’ behalf, will result in net cash proceeds to be distributed to the holders in an amount equal to the cash dividends otherwise payable.

(ii) If the Corporation pays dividends in Common Shares by delivering them to the Transfer Agent, those shares will be owned beneficially by the holders of the Series A Preferred Shares upon delivery to the Transfer Agent, and the Transfer Agent will hold those shares and the net cash proceeds from the sale of those shares for the exclusive benefit of the holders until the Dividend Payment Date at which time a proportion of the net cash proceeds equal to the non-cash component of the declared dividend will be distributed to the holders entitled thereto with any remainder to continue to be held by the Transfer Agent for the exclusive benefit of the holders and pooled with the net cash proceeds from future sales of Common Shares delivered to the Transfer Agent pursuant to this subsection (g). If a registered holder as of a particular Record Date provides an irrevocable notice to the Transfer Agent at least 30 days prior to the applicable Dividend Payment Date not to sell Common Shares held on behalf of that holder, to the extent the Corporation elects to pay such dividends by delivering Common Shares to provide cash to pay all or a portion of the dividends payable to such holder, the Transfer Agent will deliver to or for the account of the holder promptly after their receipt by the Transfer Agent, Common Shares having the value of the dividend payment calculated based on an aggregate average Closing Sale Price over the five Trading Day period ending on the third Business Day prior to the applicable Dividend Payment Date. Common Shares paid as dividends by delivery to or for the account of the holder, as described above, will

I-8

(A) be treated as restricted securities, (B) bear a legend to that effect, (C) will be issued in physical certificated form and will not be eligible for receipt in global form through the facilities of the Depositary and (D) not be transferable by the recipient thereof except pursuant to an effective registration statement or pursuant to an exemption from the registration requirements of the Securities Act. No fractional Common Shares will be issued to pay dividends. Instead of issuing fractional shares, the Corporation will pay a cash adjustment in respect of any fractional interest in an amount equal to the fractional interest multiplied by the Closing Sale Price of the Common Shares on the Trading Day preceding the date Common Shares are issued to pay dividends.

(iii) In order to pay dividends on any Dividend Payment Date in Common Shares, (A) the Common Shares delivered to the Transfer Agent shall have been duly authorized, (B) the Corporation shall have provided to the Transfer Agent an effective registration statement under the Securities Act permitting the immediate sale of the Common Shares in the public market, (C) the Common Shares, once purchased by the purchasers thereof, shall be validly issued, fully paid and nonassessable and (D) such shares shall have been registered under the Exchange Act, if required, and shall be listed or admitted for trading on each United States securities exchange or market on which the Common Shares are then listed.

(h) The Dividend Rate on the Series A Preferred Shares for the relevant period will be increased by the amount of Registration Default Dividends (the “Additional Dividends”), if any, in accordance with the Registration Rights Agreement. Following the cure of all registration defaults, the accumulation of Additional Dividends with respect to the Series A Preferred Shares shall cease in accordance with the terms of the Registration Rights Agreement. Additional Dividends payable by the Corporation, shall be payable to the record holders of Series A Preferred Shares on each Dividend Payment Date in the manner provided for the payment of regular dividends.

5.Liquidation Preference. (a) Upon any voluntary or involuntary liquidation, dissolution or winding up of the Corporation resulting in a distribution of assets to holders of any class or series of Capital Stock, each holder of Series A Preferred Shares shall be entitled to payment out of the assets of the Corporation available for distribution of an amount equal to the aggregate Liquidation Preference attributable to the shares held by such holder, plus an amount equal to all accumulated and unpaid dividends on those shares from, and including, the immediately preceding Dividend Payment Date to, but excluding, the date of liquidation, dissolution or winding up, before any distribution is made on any Junior Shares, including Common Shares. After payment in full of the aggregate Liquidation Preference and an amount equal to all accumulated and unpaid dividends to which holders of Series A Preferred Shares are entitled, such holders shall not be entitled to any further participation in any distribution of the assets of the Corporation. If, upon any voluntary or involuntary liquidation, dissolution or winding up of the Corporation, the amounts payable with respect to the Series A Preferred Shares and all other Parity Shares are not paid in full, the holders of shares of Series A Preferred Shares and all other Parity Shares shall share equally and ratably in any distribution of assets of the Corporation in proportion to the liquidation preference and an amount equal to all accumulated and unpaid dividends, if any, to which each such holder is entitled.

I-9

(b) Neither the voluntary sale, conveyance, exchange or transfer, for cash, shares of stock, securities or other consideration, of all or substantially all of the Corporation’s property or assets, nor the consolidation, merger or amalgamation of the Corporation with or into any corporation or the consolidation, merger or amalgamation of any corporation with or into the Corporation shall be deemed to be a voluntary or involuntary liquidation, dissolution or winding up of the Corporation.

In determining whether a distribution (other than upon voluntary or involuntary liquidation) by dividend, redemption or other acquisition of shares of stock of the Corporation or otherwise is permitted under the MGCL, no effect shall be given to amounts that would be needed if the Corporation would be dissolved at the time of the dissolution, to satisfy the preferential rights upon dissolution of holders of shares of stock of the Corporation whose preferential rights upon dissolution are superior to those receiving the distribution.

6.Conversion. (a) Right to Convert. Each Series A Preferred Share shall be convertible, at any time, in accordance with, and subject to, this Section 6 into a number of fully paid and non-assessable Common Shares equal to the Conversion Rate in effect at such time.

(b)Conversion Procedures. (i) Conversion of the Series A Preferred Shares may be effected by any holder thereof upon the surrender to the Corporation, at the principal office of the Corporation or at the office of the Transfer Agent, as may be designated by the Board of Directors, of the certificate or certificates for such Series A Preferred Shares to be converted accompanied by a complete and manually signed Notice of Conversion (as set forth in the form of Series A Preferred Shares certificate attached hereto as Exhibit A) along with (A) appropriate endorsements and transfer documents as required by the Registrar or Transfer Agent and (B) if required pursuant to Section 6(c), funds equal to the dividend payable on the next Dividend Payment Date. In case such Notice of Conversion shall specify a name or names other than that of such holder, such notice shall be accompanied by payment of all transfer taxes payable upon the issuance of Common Shares in such name or names. Other than such taxes, the Corporation shall pay any documentary, stamp or similar issue or transfer taxes that may be payable in respect of any issuance or delivery of Common Shares upon conversion of the Series A Preferred Shares pursuant hereto. The conversion of the Series A Preferred Shares will be deemed to have been made as of the close of business on the date (the “Conversion Date”) such certificate or certificates have been surrendered and the receipt of such Notice of Conversion. As promptly as practicable after the Conversion Date and payment of all required transfer taxes, if any (or the demonstration to the satisfaction of the Corporation that such taxes have been paid), the Corporation shall deliver or cause to be delivered (1) certificates representing the number of validly issued, fully paid and nonassessable full Common Shares to which the holder of the Series A Preferred Shares being converted (or such holder’s transferee) shall be entitled, and (2) if less than the full number of the Series A Preferred Shares evidenced by the surrendered certificate or certificates is being converted, a new certificate or certificates, of like tenor, for the number of shares evidenced by such surrendered certificate or certificates less the number of shares being converted. As of the close of business on the Conversion Date, the rights of the holder of the Series A Preferred Shares as to the shares being converted shall cease except for the right to receive Common Shares and the Person entitled to receive the Common Shares shall be treated for all purposes as having become the record holder of such Common Shares at such time.

I-10

(ii) Anything herein to the contrary notwithstanding, in the case of Global Preferred Shares, Notices of Conversion may be delivered to, and the Series A Preferred Shares representing beneficial interests in respect of such Global Preferred Shares may be surrendered for conversion in accordance with the applicable procedures of, the Depositary as in effect from time to time.

(c)Dividend and Other Payments Upon Conversion. (i) If a holder of Series A Preferred Shares exercises conversion rights, such shares will cease to accumulate dividends as of the end of the day immediately preceding the Conversion Date. Holders of Series A Preferred Shares who convert their shares into Common Shares will not be entitled to, nor will the Conversion Rate be adjusted for, any accumulated and unpaid dividends. Instead, accumulated dividends, if any, will be canceled. Series A Preferred Shares surrendered for conversion during the period between the close of business on any Record Date for the payment of dividends declared and before the opening of business on the corresponding Dividend Payment Date must be accompanied by a payment to the Corporation in cash of an amount equal to the dividend payable in respect of those shares on such Dividend Payment Date. A holder of the Series A Preferred Shares on a Record Date who converts such shares into Common Shares on the corresponding Dividend Payment Date shall be entitled to receive the dividend payable on the Series A Preferred Shares on such Dividend Payment Date, and such holder need not include payment to the Corporation of the amount of such dividend upon surrender of the Series A Preferred Shares for conversion. Except as provided in this clause with respect to a voluntary conversion, the Corporation will make no payment or allowance for unpaid dividends, whether or not in arrears, on converted shares or for dividends on Common Shares issued upon conversion.

(ii) Notwithstanding the foregoing, if the Series A Preferred Shares are converted during the period between the close of business on any Record Date and the opening of business on the corresponding Dividend Payment Date and the Corporation has designated a Fundamental Change Purchase Date during such period, then any holder who tenders such shares for conversion shall receive the dividend payable on such Dividend Payment Date and need not include payment of the amount of such dividend upon surrender of the Series A Preferred Shares for conversion.

(d)Fractional Shares. In connection with the conversion of any Series A Preferred Shares, no fractions of Common Shares shall be issued, but the Corporation shall pay a cash adjustment in respect of any fractional interest in an amount equal to the fractional interest multiplied by the Closing Sale Price of the Common Shares on the Trading Day preceding the Conversion Date, rounded to the nearest whole cent.

(e)Total Shares. If more than one Series A Preferred Share shall be surrendered for conversion by the same holder at the same time, the number of full Common Shares issuable on conversion of those shares shall be computed on the basis of the total number of the Series A Preferred Shares so surrendered.

I-11

(f)Reservation of Shares; Shares to be Fully Paid; Compliance with Governmental Requirements; Listing of Common Shares. The Corporation shall:

(i) at all times reserve and keep available, free from preemptive rights, for issuance upon the conversion of the Series A Preferred Shares such number of its authorized but unissued Common Shares as shall from time to time be sufficient to permit the conversion of all Outstanding Series A Preferred Shares;

(ii) prior to the delivery of any securities that the Corporation shall be obligated to deliver upon conversion of the Series A Preferred Shares, comply with all applicable federal and state laws and regulations that require action to be taken by the Corporation (including, without limitation, the registration or approval, if required, of any Common Shares to be provided for the purpose of conversion of the Series A Preferred Shares hereunder); and

(iii) ensure that all Common Shares delivered upon conversion of the Series A Preferred Shares will, upon delivery, be duly and validly issued and fully paid and nonassessable, free of all liens and charges and not subject to any preemptive rights.

7.Conversion Rate Adjustments. The Conversion Rate (and each of the Stock Prices set forth in the table in Section 7(m)(ii) used to determine the number of Additional Common Shares issuable to a holder of Series A Preferred Shares upon conversion of Series A Preferred Shares in connection with a transaction described in clause (iv) of the definition of Fundamental Change in Section 12(b), if applicable) shall be adjusted from time to time by the Corporation as follows:

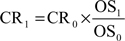

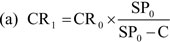

(a) If Common Shares are issued as a dividend or distribution on Common Shares, or if a share split or share combination is effected, the Conversion Rate will be adjusted based on the following formula:

where,

| CR0 | = | the Conversion Rate in effect immediately prior to such event | ||

| CR1 | = | the Conversion Rate in effect immediately after such event | ||

| OS0 | = | the number of Common Shares outstanding immediately prior to such event | ||

| OS1 | = | the number of Common Shares outstanding immediately after such event | ||

An adjustment made pursuant to this subsection 0 shall become effective on the date immediately after (x) the date fixed for the determination of shareholders entitled to receive such dividend or other distribution or (y) the date on which such split or combination becomes effective, as applicable. If any dividend or distribution described in this subsection 0 is declared but not so paid or made, the Conversion Rate shall again be adjusted to the Conversion Rate that would then be in effect if such dividend or distribution had not been declared.

I-12

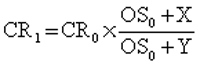

(b) If any rights, warrants or options are issued to all or substantially all holders of Common Shares entitling them for a period of not more than 60 days to subscribe for or purchase Common Shares, or securities convertible into Common Shares, in either case at a price per share or a conversion price per share less than the Closing Sale Price of Common Shares on the Trading Day immediately preceding the day on which such issuance is announced, the Conversion Rate will be adjusted based on the following formula (provided that the Conversion Rate will be readjusted to the extent that such rights, warrants or options are not exercised prior to their expiration):

where,

| CR0 | = | the Conversion Rate in effect immediately prior to such event | ||

| CR1 | = | the Conversion Rate in effect immediately after such event | ||

| OS0 | = | the number of Common Shares outstanding immediately prior to such event | ||

| X | = | the total number of Common Shares issuable pursuant to such rights, warrants or options | ||

| Y | = | the number of Common Shares equal to the aggregate price payable to exercise such rights divided by the average of the Closing Sale Prices of Common Shares for the ten consecutive Trading Days prior to the Trading Day immediately preceding the record date for the issuance of such rights, warrants or options | ||

An adjustment made pursuant to this subsection 0 shall be made successively whenever such rights, warrants or options are issued, and shall become effective on the day following the date of announcement of such issuance. If at the end of the period during which such rights, warrants or options are exercisable, not all rights, warrants or options have been exercised, the adjusted Conversion Rate shall be immediately readjusted to what it would have been based upon the number of additional Common Shares actually issued (or the number of Common Shares issuable upon conversion of convertible securities actually issued).

In determining whether such rights, warrants or options entitle the holder to subscribe for or purchase Common Shares at less than the average Closing Sale Price, and in determining the aggregate offering price of such Common Shares, there shall be taken into account any consideration received by the Corporation for such rights or warrants and any amount payable on exercise or conversion thereof, the value of such consideration, if other than cash, to be determined by the Board of Directors.

(c) If shares of the Corporation’s Capital Stock, evidences of the Corporation’s indebtedness or other assets or property of the Corporation is distributed to all or substantially all holders of Common Shares, excluding:

(i) dividends, distributions and rights, warrants, options or securities referred to in clause 0 or 0 above; and

I-13

(ii) dividends or distributions in cash referred to in clause 0 below;

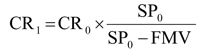

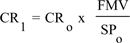

then the Conversion Rate will be adjusted based on the following formula:

where,

| CR0 | = | the Conversion Rate in effect immediately prior to such distribution | ||

| CR1 | = | the Conversion Rate in effect immediately after such distribution | ||

| SP0 | = | the average of the Closing Sale Prices of Common Shares for the ten consecutive Trading Days prior to the Trading Day immediately preceding the ex dividend date for such distribution | ||

| FMV | = | the fair market value (as determined by the Board of Directors) of the shares of Capital Stock, evidences of indebtedness, assets or property distributed with respect to each outstanding Common Share on the ex dividend date for such distribution | ||

An adjustment made pursuant to the above paragraph shall be made successively whenever any such distribution is made and shall become effective on the day immediately after the date fixed for the determination of shareholders entitled to receive such distribution.

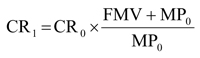

With respect to an adjustment pursuant to this clause (c) where there has been a payment of a dividend or other distribution on Common Shares of shares of the Corporation’s Capital Stock of any class or series, or similar equity interest, of or relating to a Subsidiary of the Corporation or other business unit (a “Spin-off”), the Conversion Rate in effect immediately before the close of business on the record date fixed for determination of shareholders entitled to receive the distribution will be increased based on the following formula:

where,

| CR0 | = | the Conversion Rate in effect immediately prior to such distribution | ||

| CR1 | = | the Conversion Rate in effect immediately after such distribution | ||

| FMV | = | the average of the Closing Sale Prices of the Corporation’s Capital Stock or similar equity interest distributed to holders of Common Shares applicable to one Common Share over the first 10 Trading Days after the effective date of the Spin-off | ||

I-14

| MP0 | = | the average of the Closing Sale Prices of Common Shares over the first 10 consecutive Trading Days after the effective date of the Spin-off |

(d) If any cash dividend or distribution is made to all or substantially all holders of Common Shares, the Conversion Rate will be adjusted based on the following formula:

where,

| CR0 | = | the Conversion Rate in effect immediately prior to the record date for such distribution | ||

| CR1 | = | the Conversion Rate in effect immediately after the ex dividend date for such distribution | ||

| SP0 | = | the average of the Closing Sale Prices of Common Shares for the ten consecutive Trading Days prior to the Trading Day immediately preceding the ex-dividend date of such distribution | ||

| C | = | the amount in cash per share the Corporation distributes to holders of Common Shares | ||

An adjustment made pursuant to this subsection 0 shall become effective on the date immediately after the record date for the determination of shareholders entitled to receive such dividend or distribution. If any dividend or distribution described in this subsection 0 is declared but not so paid or made, the Conversion Rate shall again be adjusted to the Conversion Rate that would then be in effect if such dividend or distribution had not been declared.

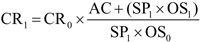

(e) The Conversion Rate will be increased if the Corporation or any of its Subsidiaries purchases Common Shares pursuant to a tender offer or exchange offer which involves an aggregate consideration that exceeds the Closing Sale Price of Common Shares on the Trading Day immediately after the last date on which tenders or exchanges may be made pursuant to the tender offer or exchange offer (the “Expiration Time”). The Conversion Rate will be increased based on the following formula:

where,

| CR0 | = | the Conversion Rate in effect on the date such tender offer or exchange offer expires |

I-15

| CR1 | = | the Conversion Rate in effect on the day immediately after the date such tender offer or exchange offer expires | ||

| AC | = | the aggregate value of all cash and any other consideration (as determined by the Board of Directors) paid or payable for all Common Shares that the Corporation or one of its Subsidiaries purchases in the tender offer or exchange offer | ||

| OS0 | = | the number of Common Shares outstanding immediately prior to the date such tender offer or exchange offer expires | ||

| OS1 | = | the number of Common Shares outstanding immediately after the date such tender offer or exchange offer expires | ||

| SP1 | = | the average of the Closing Sale Prices of Common Shares for the ten consecutive Trading Days commencing on the Trading Day immediately after the date such tender offer or exchange offer expires | ||

If, however, the application of the foregoing formula would result in a decrease in the Conversion Rate, no adjustment to the Conversion Rate will be made. Any adjustment made pursuant to this subsection 0 shall become effective on the date immediately following the Expiration Time. If the company is obligated to purchase shares pursuant to any such tender or exchange offer, but the Corporation is permanently prevented by applicable law from effecting any such purchases or all such purchases are rescinded, the Conversion Rate shall again be adjusted to be the Conversion Rate that would be in effect if such tender or exchange offer had not been made.

(f) Notwithstanding the foregoing provisions of this Section 7, in the event of an adjustment to the Conversion Rate pursuant to clause (d) or (e) above, in no event shall the Conversion Rate exceed 120.4819, subject to adjustment pursuant to clauses (a), (b) and (c) above.

(g) Notwithstanding the foregoing provisions of this Section 7, no adjustment shall be made to the Conversion Rate, nor shall an adjustment be made to the ability of a holder of Series A Preferred Shares to convert, for any distribution therein, if the holders of Series A Preferred Shares will otherwise participate in the distribution without conversion solely as a holder of Series A Preferred Shares.

(h) Except as stated in this Section 7, no adjustment to the Conversion Rate will be made for the issuance of Common Shares or any securities convertible into or exchangeable for Common Shares or the right to purchase Common Shares or such convertible or exchangeable securities, including:

(i) upon the issuance of any Common Shares pursuant to any present or future plan providing for the reinvestment of dividends or interest payable on securities of the Corporation and the investment of additional optional amounts in Common Shares under any plan;

I-16

(ii) upon the issuance of any Common Shares or options or rights to purchase those shares pursuant to any present or future employee, director or consultant benefit plan or program of or assumed by the Corporation or any of its Subsidiaries;

(iii) upon the issuance of any Common Shares pursuant to any option, warrant, right, or exercisable, exchangeable or convertible security not described in (ii) above and outstanding as of the date the Series A Preferred Shares were first issued;

(iv) for a change in the par value of the Common Shares; or

(v) for accrued and unpaid dividends.

(i) The Corporation may make such increases in the Conversion Rate in addition to those required by this Section 7 as the Board of Directors considers to be advisable to avoid or diminish any income tax to holders of Common Shares resulting from any dividend or distribution of shares (or rights to acquire shares) or from any event treated as such for income tax purposes. To the extent permitted by applicable law, the Corporation from time to time may increase the Conversion Rate by any amount for any period of at least 20 days. Whenever the Conversion Rate is increased pursuant to the preceding sentence, the Corporation shall mail to each holder of the Series A Preferred Shares at the address of such holder as it appears in the stock register a notice of the increase at least 15 days prior to the date the increased Conversion Rate takes effect, and such notice shall state the increased Conversion Rate and the period during which it will be in effect.

(j) No adjustment in the Conversion Rate shall be required unless such adjustment would require a change of at least one percent (1%) in the Conversion Rate then in effect; provided, however, that any adjustments that by reason of this Section 7(j) are not required to be made shall be carried forward and taken into account in any subsequent adjustment and the Corporation shall make such carried forward adjustments, regardless of whether the aggregate adjustment is less than one percent (1%), within one year of the first such adjustment carried forward or if the Corporation has called the Series A Preferred Shares for mandatory conversion. All calculations under this Section 7 shall be made by the Corporation and shall be made to the nearest cent or to the nearest one-ten thousandth (1/10,000) of a share, as the case may be.

(k) Whenever the Conversion Rate is adjusted as herein provided, the Corporation shall promptly file with the Transfer Agent an Officer’s certificate setting forth the Conversion Rate after such adjustment and setting forth a brief statement of the facts requiring such adjustment. Unless and until a responsible officer of the Transfer Agent shall have received such Officer’s certificate, the Transfer Agent shall not be deemed to have knowledge of any adjustment of the Conversion Rate and may assume that the last Conversion Rate of which it has knowledge is still in effect. Promptly after delivery of such certificate, the Corporation shall prepare a notice of such adjustment of the Conversion Rate setting forth the adjusted Conversion Rate and the date on which each adjustment becomes effective and shall mail such notice of such adjustment of the Conversion Rate to each holder of Series A Preferred Shares at its last address appearing in the stock register within 20 days after execution thereof. Failure to deliver such notice shall not affect the legality or validity of any such adjustment.

I-17

(l) For purposes of this Section 7, the number of Common Shares at any time outstanding shall not include shares held in the treasury of the Corporation, unless such treasury shares participate in any distribution or dividend that requires an adjustment pursuant to this Section 7.

(m)Adjustment to Conversion Rate upon Certain Fundamental Changes. (i) If and only to the extent that a holder of Series A Preferred Shares elects to convert their Series A Preferred Shares in connection with a transaction described in clause (iv) of the definition of Fundamental Change in Section 12(b) pursuant to which 10% or more of the consideration for the Common Shares (other than cash payments for fractional shares and cash payments made in respect of a dissenters’ appraisal rights) in such Fundamental Change transaction consists of cash, securities or other property that are not traded or scheduled to be traded immediately following such transaction on a U.S. national securities exchange or the Nasdaq National Market, the Corporation will increase the Conversion Rate by a number of additional Common Shares (the “Additional Common Shares”) as set forth in this subsection (m). A holder of Series A Preferred Shares may only elect to convert their Series A Preferred Shares in connection with such a Fundamental Change transaction at any time, from and after the date which is 15 days prior to the anticipated effective date of such Fundamental Change transaction until and including the date which is 15 days after the Effective Date of such Fundamental Change transaction (or, if such transaction also results in a holder having the right to require the Corporation to repurchase their Series A Preferred Shares, until the Fundamental Change Purchase Date). The number of Additional Common Shares will be determined by reference to the table set forth in subsection (m)(ii) below, based on the date on which such Fundamental Change transaction becomes effective (the “Effective Date”) and the price (the “Stock Price”) paid per Common Share in such Fundamental Change transaction. If holders of Common Shares receive only cash in such Fundamental Change transaction, the Stock Price shall be the cash amount paid per share. Otherwise, the Stock Price shall be the average of the Closing Sale Price of the Common Shares on the five Trading Days prior to but not including the Effective Date of such Fundamental Change transaction. The Stock Prices set forth in the table below will be adjusted as of any date on which the Conversion Rate is adjusted. On such date the Stock Prices shall be adjusted by multiplying the Stock Prices applicable immediately prior to such Conversion Rate adjustment, by a fraction, the numerator of which shall be the Conversion Rate immediately prior to the adjustment giving rise to the Stock Price adjustment, and the denominator of which is the Conversion Rate so adjusted.

(ii) The following table sets forth the hypothetical Stock Price and number of Additional Common Shares issuable per Series A Preferred Share:

Effective Date of Fundamental Change | Stock Price | |||||||||||||||||||||||

| $8.30 | $9.00 | $10.00 | $12.50 | $15.00 | $17.50 | $20.00 | $25.00 | $30.00 | $50.00 | $100.00 | $200.00 | |||||||||||||

October 15, 2004 | 28.4354 | 23.6365 | 19.8691 | 13.7204 | 10.2892 | 8.2190 | 6.8547 | 5.1412 | 4.0714 | 1.9826 | 0.4468 | 0.0000 | ||||||||||||

October 15, 2005 | 26.3382 | 22.8967 | 18.9357 | 12.5064 | 9.0552 | 7.0916 | 5.8649 | 4.3893 | 3.4858 | 1.7235 | 0.4150 | 0.0000 | ||||||||||||

October 15, 2006 | 25.8716 | 22.2526 | 18.0358 | 11.1568 | 7.6139 | 5.7627 | 4.7017 | 3.5093 | 2.7964 | 1.4027 | 0.3615 | 0.0000 | ||||||||||||

October 15, 2007 | 25.5667 | 21.7744 | 17.2569 | 9.6888 | 5.9115 | 4.1810 | 3.3340 | 2.4862 | 1.9899 | 1.0116 | 0.2785 | 0.0000 | ||||||||||||

October 15, 2008 | 25.3514 | 21.4739 | 16.7058 | 8.1246 | 3.8494 | 2.2719 | 1.7368 | 1.3061 | 1.0501 | 0.5396 | 0.1567 | 0.0000 | ||||||||||||

October 15, 2009 | 25.2674 | 21.3848 | 16.5836 | 7.1388 | 0.9996 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | ||||||||||||

October 15, 2010 | 25.2663 | 21.3838 | 16.5829 | 7.1352 | 0.5665 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | ||||||||||||

October 15, 2011 | 25.2663 | 21.3838 | 16.5829 | 7.1352 | 0.5665 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | ||||||||||||

October 15, 2012 | 25.2663 | 21.3838 | 16.5829 | 7.1352 | 0.5665 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | ||||||||||||

October 15, 2013 | 25.2663 | 21.3838 | 16.5829 | 7.1352 | 0.5665 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | ||||||||||||

October 15, 2014 | 25.2663 | 21.3838 | 16.5829 | 7.1352 | 0.5665 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | ||||||||||||

I-18

(iii) The Stock Prices and Additional Common Shares set forth above are based upon a Common Share price of $8.30 at October 7, 2004 and an initial Conversion Price of $9.96. The exact Stock Price and Effective Date may not be set forth on the table above, in which case if the Stock Price is:

(A) between two Stock Price amounts on the table or the Effective Date is between two dates on the table, the number of Additional Common Shares will be determined by straight-line interpolation between the number of Additional Common Shares set forth for the higher and lower Stock Price amounts and the two dates, as applicable, based on a 365-day year;

(B) in excess of $200.00 per share (subject to adjustment), no Additional Common Shares will be issued upon conversion; or

(C) less than $8.30 per share (subject to adjustment), no Additional Common Shares will be issued upon conversion.