UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-03785

Fidelity Advisor Series I

(Exact name of registrant as specified in charter)

245 Summer St., Boston, MA 02210

(Address of principal executive offices) (Zip code)

Margaret Carey, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code:

617-563-7000

Date of fiscal year end: | August 31 |

Date of reporting period: | February 28, 2023 |

Item 1.

Reports to Stockholders

Contents

Top Holdings (% of Fund's net assets) | ||

| Microsoft Corp. | 4.1 | |

| Apple, Inc. | 3.7 | |

| Amazon.com, Inc. | 1.8 | |

| NVIDIA Corp. | 1.4 | |

| Exxon Mobil Corp. | 1.3 | |

| Alphabet, Inc. Class A | 1.2 | |

| UnitedHealth Group, Inc. | 1.2 | |

| Meta Platforms, Inc. Class A | 1.1 | |

| Visa, Inc. Class A | 1.0 | |

| Tesla, Inc. | 0.9 | |

| 17.7 | ||

| Top Bond Issuers (% of Fund's net assets) | ||

(with maturities greater than one year) | ||

| U.S. Treasury Obligations | 15.3 | |

| Fannie Mae | 2.2 | |

| Freddie Mac | 2.0 | |

| Uniform Mortgage Backed Securities | 1.6 | |

| Ginnie Mae | 1.1 | |

| JPMorgan Chase & Co. | 0.7 | |

| Morgan Stanley | 0.5 | |

| Bank of America Corp. | 0.5 | |

| Citigroup, Inc. | 0.5 | |

| Petroleos Mexicanos | 0.4 | |

| 24.8 | ||

| Market Sectors (% of Fund's net assets) | ||

| Information Technology | 16.9 | |

| Financials | 12.6 | |

| Health Care | 9.7 | |

| Consumer Discretionary | 6.7 | |

| Communication Services | 6.1 | |

| Industrials | 5.5 | |

| Consumer Staples | 4.8 | |

| Energy | 4.4 | |

| Real Estate | 2.7 | |

| Utilities | 2.2 | |

| Materials | 1.8 | |

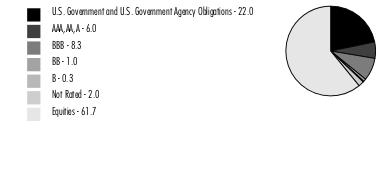

Quality Diversification (% of Fund's net assets) |

|

Short-Term Investments and Net Other Assets (Liabilities) - (1.3)%* |

*Short-term investments and Net Other Assets (Liabilities) are not available in the pie chart. |

| We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes. |

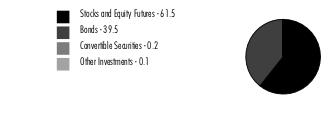

Asset Allocation (% of Fund's net assets) |

|

Short-Term Investments and Net Other Assets (Liabilities) - (1.3)%* |

Foreign investments - 9.2% |

Short-Term Investments and Net Other Assets (Liabilities) are not available in the pie chart. |

| Common Stocks - 61.4% | |||

| Shares | Value ($) (000s) | ||

| COMMUNICATION SERVICES - 5.0% | |||

| Diversified Telecommunication Services - 0.0% | |||

| AT&T, Inc. | 22,800 | 431 | |

| Cellnex Telecom SA (a) | 11,900 | 446 | |

| Liberty Global PLC Class C (b) | 107,269 | 2,279 | |

| 3,156 | |||

| Entertainment - 1.1% | |||

| Activision Blizzard, Inc. | 186,126 | 14,192 | |

| Cinemark Holdings, Inc. (b)(c) | 130,607 | 1,778 | |

| Netflix, Inc. (b) | 83,387 | 26,861 | |

| Sea Ltd. ADR (b) | 74,400 | 4,649 | |

| Take-Two Interactive Software, Inc. (b) | 34,880 | 3,821 | |

| The Walt Disney Co. (b) | 139,325 | 13,878 | |

| Warner Bros Discovery, Inc. (b) | 10,522 | 164 | |

| 65,343 | |||

| Interactive Media & Services - 3.2% | |||

| Alphabet, Inc.: | |||

| Class A (b) | 827,840 | 74,555 | |

| Class C (b) | 494,920 | 44,691 | |

| Epic Games, Inc. (b)(d)(e) | 1,715 | 1,279 | |

| Meta Platforms, Inc. Class A (b) | 384,275 | 67,225 | |

| Snap, Inc. Class A (b) | 492,630 | 5,000 | |

| 192,750 | |||

| Media - 0.5% | |||

| Altice U.S.A., Inc. Class A (b) | 165,802 | 657 | |

| Charter Communications, Inc. Class A (b) | 17,500 | 6,433 | |

| Comcast Corp. Class A | 397,226 | 14,765 | |

| Liberty Broadband Corp.: | |||

| Class A (b) | 63,500 | 5,507 | |

| Class C (b) | 56,200 | 4,871 | |

| 32,233 | |||

| Wireless Telecommunication Services - 0.2% | |||

| T-Mobile U.S., Inc. (b) | 97,595 | 13,876 | |

TOTAL COMMUNICATION SERVICES | 307,358 | ||

| CONSUMER DISCRETIONARY - 6.4% | |||

| Auto Components - 0.1% | |||

| Adient PLC (b) | 115,300 | 4,926 | |

| Automobiles - 1.0% | |||

| Ferrari NV | 19,600 | 5,103 | |

| Tesla, Inc. (b) | 265,200 | 54,554 | |

| 59,657 | |||

| Hotels, Restaurants & Leisure - 1.2% | |||

| Booking Holdings, Inc. (b) | 7,900 | 19,940 | |

| Caesars Entertainment, Inc. (b) | 94,700 | 4,807 | |

| Churchill Downs, Inc. | 37,400 | 9,192 | |

| Domino's Pizza, Inc. | 16,800 | 4,939 | |

| Marriott International, Inc. Class A | 91,900 | 15,553 | |

| McDonald's Corp. | 38,700 | 10,213 | |

| Sweetgreen, Inc. Class A (b) | 11,300 | 99 | |

| Yum! Brands, Inc. | 70,500 | 8,965 | |

| 73,708 | |||

| Household Durables - 0.1% | |||

| D.R. Horton, Inc. | 23,800 | 2,201 | |

| Mohawk Industries, Inc. (b) | 29,800 | 3,065 | |

| 5,266 | |||

| Internet & Direct Marketing Retail - 2.1% | |||

| Amazon.com, Inc. (b) | 1,145,600 | 107,950 | |

| Cazoo Group Ltd. (b)(d) | 53,300 | 6 | |

| eBay, Inc. | 224,900 | 10,323 | |

| Uber Technologies, Inc. (b) | 269,704 | 8,970 | |

| 127,249 | |||

| Multiline Retail - 0.3% | |||

| Dollar General Corp. | 68,000 | 14,708 | |

| Ollie's Bargain Outlet Holdings, Inc. (b) | 14,600 | 840 | |

| Target Corp. | 19,700 | 3,319 | |

| 18,867 | |||

| Specialty Retail - 1.2% | |||

| Fast Retailing Co. Ltd. | 13,500 | 2,667 | |

| Lowe's Companies, Inc. | 133,900 | 27,550 | |

| The Home Depot, Inc. | 61,009 | 18,092 | |

| TJX Companies, Inc. | 330,230 | 25,296 | |

| 73,605 | |||

| Textiles, Apparel & Luxury Goods - 0.4% | |||

| Capri Holdings Ltd. (b) | 40,700 | 2,017 | |

| LVMH Moet Hennessy Louis Vuitton SE | 4,000 | 3,325 | |

| NIKE, Inc. Class B | 81,264 | 9,653 | |

| PVH Corp. | 49,800 | 3,996 | |

| Tapestry, Inc. | 150,500 | 6,548 | |

| 25,539 | |||

TOTAL CONSUMER DISCRETIONARY | 388,817 | ||

| CONSUMER STAPLES - 4.2% | |||

| Beverages - 1.6% | |||

| Boston Beer Co., Inc. Class A (b) | 5,800 | 1,878 | |

| Celsius Holdings, Inc. (b) | 24,100 | 2,188 | |

| Constellation Brands, Inc. Class A (sub. vtg.) | 60,400 | 13,511 | |

| Duckhorn Portfolio, Inc. (b) | 51,500 | 785 | |

| Keurig Dr. Pepper, Inc. | 155,800 | 5,383 | |

| Monster Beverage Corp. (b) | 110,075 | 11,201 | |

| PepsiCo, Inc. | 160,900 | 27,921 | |

| Pernod Ricard SA | 16,100 | 3,367 | |

| The Coca-Cola Co. | 529,100 | 31,487 | |

| 97,721 | |||

| Food & Staples Retailing - 1.1% | |||

| Albertsons Companies, Inc. | 108,300 | 2,153 | |

| Alimentation Couche-Tard, Inc. Class A (multi-vtg.) | 81,400 | 3,819 | |

| Cake Box Holdings PLC | 49,900 | 79 | |

| Costco Wholesale Corp. | 56,800 | 27,501 | |

| U.S. Foods Holding Corp. (b) | 196,072 | 7,359 | |

| Walmart, Inc. | 193,300 | 27,474 | |

| 68,385 | |||

| Food Products - 0.6% | |||

| Freshpet, Inc. (b) | 56,500 | 3,513 | |

| Hotel Chocolat Group Ltd. (b)(c) | 12,100 | 30 | |

| Lamb Weston Holdings, Inc. | 32,000 | 3,220 | |

| McCormick & Co., Inc. (non-vtg.) | 59,300 | 4,407 | |

| Mondelez International, Inc. | 217,800 | 14,196 | |

| Sovos Brands, Inc. (b) | 73,800 | 965 | |

| The Hershey Co. | 27,700 | 6,601 | |

| TreeHouse Foods, Inc. (b) | 27,100 | 1,322 | |

| 34,254 | |||

| Household Products - 0.7% | |||

| Procter & Gamble Co. | 335,400 | 46,138 | |

| Personal Products - 0.2% | |||

| Estee Lauder Companies, Inc. Class A | 36,800 | 8,944 | |

| Olaplex Holdings, Inc. (b) | 158,500 | 780 | |

| 9,724 | |||

TOTAL CONSUMER STAPLES | 256,222 | ||

| ENERGY - 3.2% | |||

| Energy Equipment & Services - 0.4% | |||

| Expro Group Holdings NV (b) | 263,800 | 5,996 | |

| Schlumberger Ltd. | 234,800 | 12,494 | |

| Weatherford International PLC (b) | 89,700 | 5,976 | |

| 24,466 | |||

| Oil, Gas & Consumable Fuels - 2.8% | |||

| Africa Oil Corp. | 749,400 | 1,532 | |

| Canadian Natural Resources Ltd. | 195,600 | 11,054 | |

| Eco Atlantic Oil & Gas Ltd. (b) | 968,500 | 263 | |

| Exxon Mobil Corp. | 707,091 | 77,716 | |

| Hess Corp. | 142,000 | 19,127 | |

| Imperial Oil Ltd. | 262,985 | 13,008 | |

| Kosmos Energy Ltd. (b) | 835,000 | 6,571 | |

| MEG Energy Corp. (b) | 915,500 | 14,466 | |

| Phillips 66 Co. | 116,374 | 11,935 | |

| Tourmaline Oil Corp. | 49,500 | 2,169 | |

| Valero Energy Corp. | 83,000 | 10,934 | |

| 168,775 | |||

TOTAL ENERGY | 193,241 | ||

| FINANCIALS - 7.1% | |||

| Banks - 3.5% | |||

| AIB Group PLC | 330,100 | 1,413 | |

| Bank of America Corp. | 1,572,234 | 53,928 | |

| BankUnited, Inc. (c) | 24,482 | 867 | |

| BNP Paribas SA | 64,040 | 4,477 | |

| Citigroup, Inc. | 177,100 | 8,977 | |

| Citizens Financial Group, Inc. | 112,231 | 4,687 | |

| Comerica, Inc. | 81,482 | 5,712 | |

| DNB Bank ASA | 142,800 | 2,850 | |

| Eurobank Ergasias Services and Holdings SA (b) | 3,273,384 | 5,027 | |

| JPMorgan Chase & Co. | 173,731 | 24,904 | |

| KBC Group NV | 48,300 | 3,612 | |

| M&T Bank Corp. | 39,031 | 6,061 | |

| NatWest Group PLC | 1,298,576 | 4,562 | |

| Piraeus Financial Holdings SA (b) | 879,271 | 2,233 | |

| PNC Financial Services Group, Inc. | 18,360 | 2,899 | |

| Signature Bank | 24,886 | 2,863 | |

| Societe Generale Series A | 60,206 | 1,735 | |

| Starling Bank Ltd. Series D (b)(d)(e) | 659,301 | 2,680 | |

| Sumitomo Mitsui Financial Group, Inc. | 86,100 | 3,760 | |

| U.S. Bancorp | 223,882 | 10,686 | |

| UniCredit SpA | 310,244 | 6,347 | |

| Wells Fargo & Co. | 1,149,810 | 53,777 | |

| 214,057 | |||

| Capital Markets - 0.9% | |||

| Bank of New York Mellon Corp. | 298,640 | 15,195 | |

| BlackRock, Inc. Class A | 16,507 | 11,380 | |

| Cboe Global Markets, Inc. | 17,734 | 2,237 | |

| Goldman Sachs Group, Inc. | 6,244 | 2,196 | |

| Intercontinental Exchange, Inc. | 76,737 | 7,812 | |

| State Street Corp. | 139,586 | 12,378 | |

| StepStone Group, Inc. Class A | 88,781 | 2,539 | |

| Virtu Financial, Inc. Class A | 123,655 | 2,273 | |

| 56,010 | |||

| Consumer Finance - 0.4% | |||

| American Express Co. | 57,327 | 9,974 | |

| Capital One Financial Corp. | 87,025 | 9,493 | |

| OneMain Holdings, Inc. | 91,296 | 3,934 | |

| Shriram Transport Finance Co. Ltd. | 84,655 | 1,233 | |

| 24,634 | |||

| Diversified Financial Services - 0.4% | |||

| Ant International Co. Ltd. Class C (b)(d)(e) | 682,677 | 1,031 | |

| Apollo Global Management, Inc. | 115,800 | 8,210 | |

| Berkshire Hathaway, Inc.: | |||

| Class A (b) | 11 | 5,099 | |

| Class B (b) | 36,052 | 11,002 | |

| Jumo World Ltd. (b)(e) | 162 | 169 | |

| Sunrisemezz Ltd. (b) | 131,182 | 18 | |

| 25,529 | |||

| Insurance - 1.9% | |||

| Arthur J. Gallagher & Co. | 37,518 | 7,029 | |

| Assurant, Inc. | 4,698 | 598 | |

| Chubb Ltd. | 100,782 | 21,267 | |

| Direct Line Insurance Group PLC | 1,068,276 | 2,317 | |

| Fairfax Financial Holdings Ltd. (sub. vtg.) | 7,900 | 5,523 | |

| Globe Life, Inc. | 58,310 | 7,096 | |

| Hartford Financial Services Group, Inc. | 162,322 | 12,707 | |

| Marsh & McLennan Companies, Inc. | 70,002 | 11,350 | |

| Progressive Corp. | 84,000 | 12,056 | |

| Prudential PLC | 125,589 | 1,919 | |

| The Travelers Companies, Inc. | 180,729 | 33,457 | |

| 115,319 | |||

| Thrifts & Mortgage Finance - 0.0% | |||

| UWM Holdings Corp. Class A (c) | 106,768 | 455 | |

TOTAL FINANCIALS | 436,004 | ||

| HEALTH CARE - 8.9% | |||

| Biotechnology - 1.6% | |||

| BeiGene Ltd. ADR (b) | 4,215 | 947 | |

| Biogen, Inc. (b) | 13,461 | 3,633 | |

| Gilead Sciences, Inc. | 421,900 | 33,976 | |

| Legend Biotech Corp. ADR (b) | 127,660 | 5,895 | |

| Regeneron Pharmaceuticals, Inc. (b) | 22,611 | 17,194 | |

| Sarepta Therapeutics, Inc. (b) | 18,826 | 2,299 | |

| Vertex Pharmaceuticals, Inc. (b) | 107,093 | 31,088 | |

| 95,032 | |||

| Health Care Equipment & Supplies - 1.8% | |||

| Abbott Laboratories | 210,787 | 21,441 | |

| Boston Scientific Corp. (b) | 879,962 | 41,112 | |

| Intuitive Surgical, Inc. (b) | 39,400 | 9,038 | |

| Masimo Corp. (b) | 46,371 | 7,758 | |

| ResMed, Inc. | 43,139 | 9,189 | |

| Stryker Corp. | 91,300 | 24,001 | |

| 112,539 | |||

| Health Care Providers & Services - 2.5% | |||

| agilon health, Inc. (b) | 351,170 | 7,448 | |

| AmerisourceBergen Corp. | 178,868 | 27,825 | |

| Humana, Inc. | 36,446 | 18,041 | |

| Option Care Health, Inc. (b) | 366,657 | 11,245 | |

| Surgery Partners, Inc. (b) | 477,405 | 15,969 | |

| UnitedHealth Group, Inc. | 150,554 | 71,655 | |

| 152,183 | |||

| Life Sciences Tools & Services - 1.0% | |||

| IQVIA Holdings, Inc. (b) | 70,066 | 14,607 | |

| Thermo Fisher Scientific, Inc. | 88,932 | 48,180 | |

| 62,787 | |||

| Pharmaceuticals - 2.0% | |||

| AstraZeneca PLC sponsored ADR | 336,368 | 21,924 | |

| Bristol-Myers Squibb Co. | 38,692 | 2,668 | |

| Eli Lilly & Co. | 161,156 | 50,155 | |

| Merck & Co., Inc. | 190,821 | 20,273 | |

| Roche Holding AG (participation certificate) | 13,319 | 3,840 | |

| Royalty Pharma PLC | 607,310 | 21,772 | |

| 120,632 | |||

TOTAL HEALTH CARE | 543,173 | ||

| INDUSTRIALS - 5.2% | |||

| Aerospace & Defense - 1.3% | |||

| Howmet Aerospace, Inc. | 157,000 | 6,622 | |

| Lockheed Martin Corp. | 51,230 | 24,296 | |

| Northrop Grumman Corp. | 18,346 | 8,515 | |

| Raytheon Technologies Corp. | 62,452 | 6,126 | |

| Space Exploration Technologies Corp. Class A (b)(d)(e) | 16,000 | 1,232 | |

| The Boeing Co. (b) | 104,182 | 20,998 | |

| TransDigm Group, Inc. | 12,100 | 9,001 | |

| 76,790 | |||

| Air Freight & Logistics - 0.1% | |||

| United Parcel Service, Inc. Class B | 29,642 | 5,409 | |

| Airlines - 0.1% | |||

| Delta Air Lines, Inc. (b) | 173,700 | 6,660 | |

| Building Products - 0.4% | |||

| Trane Technologies PLC | 129,381 | 23,932 | |

| Electrical Equipment - 0.5% | |||

| AMETEK, Inc. | 168,832 | 23,900 | |

| Eaton Corp. PLC | 51,500 | 9,009 | |

| 32,909 | |||

| Industrial Conglomerates - 0.5% | |||

| General Electric Co. | 232,298 | 19,678 | |

| Honeywell International, Inc. | 52,168 | 9,989 | |

| 29,667 | |||

| Machinery - 1.8% | |||

| Caterpillar, Inc. | 68,713 | 16,460 | |

| Deere & Co. | 24,500 | 10,271 | |

| Dover Corp. | 131,000 | 19,637 | |

| Fortive Corp. | 349,431 | 23,293 | |

| Ingersoll Rand, Inc. | 290,700 | 16,881 | |

| Parker Hannifin Corp. | 67,737 | 23,833 | |

| 110,375 | |||

| Professional Services - 0.0% | |||

| Dun & Bradstreet Holdings, Inc. | 182,692 | 2,194 | |

| Road & Rail - 0.5% | |||

| CSX Corp. | 513,350 | 15,652 | |

| Old Dominion Freight Lines, Inc. | 48,100 | 16,318 | |

| 31,970 | |||

TOTAL INDUSTRIALS | 319,906 | ||

| INFORMATION TECHNOLOGY - 16.3% | |||

| Electronic Equipment & Components - 0.2% | |||

| Amphenol Corp. Class A | 158,800 | 12,310 | |

| IT Services - 2.3% | |||

| Accenture PLC Class A | 34,200 | 9,082 | |

| Block, Inc. Class A (b) | 156,470 | 12,006 | |

| Capgemini SA | 43,600 | 8,202 | |

| Cognizant Technology Solutions Corp. Class A | 18,900 | 1,184 | |

| Dlocal Ltd. (b) | 242,100 | 3,617 | |

| EPAM Systems, Inc. (b) | 20,600 | 6,338 | |

| Fiserv, Inc. (b) | 11,530 | 1,327 | |

| MasterCard, Inc. Class A | 30,000 | 10,659 | |

| MongoDB, Inc. Class A (b) | 36,700 | 7,689 | |

| Snowflake, Inc. (b) | 25,000 | 3,860 | |

| Twilio, Inc. Class A (b) | 70,700 | 4,752 | |

| Visa, Inc. Class A | 275,550 | 60,604 | |

| Wix.com Ltd. (b) | 52,900 | 4,789 | |

| Worldline SA (a)(b) | 89,237 | 3,717 | |

| 137,826 | |||

| Semiconductors & Semiconductor Equipment - 3.7% | |||

| Advanced Micro Devices, Inc. (b) | 107,300 | 8,432 | |

| ASML Holding NV (Netherlands) | 13,600 | 8,382 | |

| Lam Research Corp. | 37,000 | 17,982 | |

| Marvell Technology, Inc. | 195,600 | 8,831 | |

| MediaTek, Inc. | 209,000 | 4,916 | |

| Microchip Technology, Inc. | 162,100 | 13,135 | |

| Micron Technology, Inc. | 352,587 | 20,387 | |

| NVIDIA Corp. | 374,700 | 86,990 | |

| NXP Semiconductors NV | 70,797 | 12,636 | |

| Renesas Electronics Corp. (b) | 1,085,200 | 14,018 | |

| Silergy Corp. | 156,000 | 2,954 | |

| SolarEdge Technologies, Inc. (b) | 32,400 | 10,301 | |

| Taiwan Semiconductor Manufacturing Co. Ltd. | 1,081,000 | 17,727 | |

| 226,691 | |||

| Software - 6.4% | |||

| Adobe, Inc. (b) | 93,600 | 30,322 | |

| Autodesk, Inc. (b) | 66,900 | 13,292 | |

| Black Knight, Inc. (b) | 19,313 | 1,151 | |

| CCC Intelligent Solutions Holdings, Inc. (b)(d) | 34,443 | 308 | |

| Coupa Software, Inc. (b) | 42,000 | 3,402 | |

| Cvent Holding Corp. (b)(d) | 122,436 | 889 | |

| Elastic NV (b) | 63,896 | 3,771 | |

| Five9, Inc. (b) | 59,700 | 3,940 | |

| HubSpot, Inc. (b) | 28,300 | 10,948 | |

| Intuit, Inc. | 54,700 | 22,273 | |

| Microsoft Corp. | 1,019,400 | 254,262 | |

| Salesforce.com, Inc. (b) | 181,189 | 29,644 | |

| Stripe, Inc. Class B (b)(d)(e) | 15,600 | 338 | |

| Synopsys, Inc. (b) | 32,200 | 11,713 | |

| Workday, Inc. Class A (b) | 42,700 | 7,920 | |

| 394,173 | |||

| Technology Hardware, Storage & Peripherals - 3.7% | |||

| Apple, Inc. | 1,550,820 | 228,606 | |

TOTAL INFORMATION TECHNOLOGY | 999,606 | ||

| MATERIALS - 1.8% | |||

| Chemicals - 1.2% | |||

| Air Products & Chemicals, Inc. | 33,027 | 9,445 | |

| Cabot Corp. | 24,390 | 1,940 | |

| Celanese Corp. Class A | 33,450 | 3,888 | |

| CF Industries Holdings, Inc. | 43,310 | 3,720 | |

| Chemtrade Logistics Income Fund | 198,290 | 1,334 | |

| Corteva, Inc. | 115,920 | 7,221 | |

| DuPont de Nemours, Inc. | 66,622 | 4,865 | |

| Linde PLC | 67,973 | 23,680 | |

| LyondellBasell Industries NV Class A | 61,110 | 5,866 | |

| Olin Corp. | 40,782 | 2,355 | |

| The Chemours Co. LLC | 77,050 | 2,634 | |

| Tronox Holdings PLC | 158,460 | 2,472 | |

| Valvoline, Inc. | 150,300 | 5,291 | |

| Westlake Corp. | 10,680 | 1,272 | |

| 75,983 | |||

| Construction Materials - 0.1% | |||

| Martin Marietta Materials, Inc. | 7,947 | 2,860 | |

| Vulcan Materials Co. | 17,030 | 3,081 | |

| 5,941 | |||

| Containers & Packaging - 0.1% | |||

| Aptargroup, Inc. | 16,850 | 1,967 | |

| Greif, Inc. Class A | 27,620 | 1,962 | |

| Sealed Air Corp. | 21,680 | 1,054 | |

| 4,983 | |||

| Metals & Mining - 0.4% | |||

| Alcoa Corp. | 25,780 | 1,262 | |

| First Quantum Minerals Ltd. | 263,410 | 5,755 | |

| Freeport-McMoRan, Inc. | 243,518 | 9,977 | |

| Glencore PLC | 338,080 | 2,016 | |

| Reliance Steel & Aluminum Co. | 13,085 | 3,243 | |

| 22,253 | |||

TOTAL MATERIALS | 109,160 | ||

| REAL ESTATE - 1.6% | |||

| Equity Real Estate Investment Trusts (REITs) - 1.6% | |||

| Alexandria Real Estate Equities, Inc. | 2,800 | 419 | |

| American Tower Corp. | 56,300 | 11,148 | |

| Corporate Office Properties Trust (SBI) | 84,600 | 2,151 | |

| Crown Castle International Corp. | 53,900 | 7,047 | |

| CubeSmart | 11,800 | 554 | |

| Elme Communities (SBI) | 56,100 | 1,044 | |

| Equinix, Inc. | 16,300 | 11,219 | |

| Equity Lifestyle Properties, Inc. | 114,000 | 7,810 | |

| Essex Property Trust, Inc. | 27,600 | 6,294 | |

| Host Hotels & Resorts, Inc. | 413,900 | 6,954 | |

| Invitation Homes, Inc. | 176,300 | 5,511 | |

| Life Storage, Inc. | 1,800 | 217 | |

| Mid-America Apartment Communities, Inc. | 27,300 | 4,371 | |

| Prologis (REIT), Inc. | 122,600 | 15,129 | |

| Simon Property Group, Inc. | 16,400 | 2,002 | |

| Ventas, Inc. | 112,100 | 5,454 | |

| Welltower, Inc. | 104,800 | 7,768 | |

| 95,092 | |||

| Real Estate Management & Development - 0.0% | |||

| Cushman & Wakefield PLC (b) | 106,000 | 1,372 | |

| WeWork, Inc. (b) | 98,000 | 114 | |

| 1,486 | |||

TOTAL REAL ESTATE | 96,578 | ||

| UTILITIES - 1.7% | |||

| Electric Utilities - 1.3% | |||

| Constellation Energy Corp. | 110,625 | 8,285 | |

| Edison International | 74,900 | 4,959 | |

| Exelon Corp. | 194,276 | 7,847 | |

| FirstEnergy Corp. | 171,400 | 6,777 | |

| NextEra Energy, Inc. | 282,400 | 20,059 | |

| PG&E Corp. (b) | 675,662 | 10,554 | |

| PPL Corp. | 193,200 | 5,230 | |

| Southern Co. | 240,400 | 15,160 | |

| 78,871 | |||

| Multi-Utilities - 0.4% | |||

| Dominion Energy, Inc. | 154,245 | 8,579 | |

| NiSource, Inc. | 152,500 | 4,183 | |

| Public Service Enterprise Group, Inc. | 31,300 | 1,891 | |

| Sempra Energy | 73,524 | 11,026 | |

| 25,679 | |||

TOTAL UTILITIES | 104,550 | ||

| TOTAL COMMON STOCKS (Cost $2,875,995) | 3,754,615 | ||

| Preferred Stocks - 0.3% | |||

| Shares | Value ($) (000s) | ||

| Convertible Preferred Stocks - 0.2% | |||

| COMMUNICATION SERVICES - 0.1% | |||

| Interactive Media & Services - 0.1% | |||

| ByteDance Ltd. Series E1 (b)(d)(e) | 18,992 | 3,775 | |

| CONSUMER DISCRETIONARY - 0.0% | |||

| Internet & Direct Marketing Retail - 0.0% | |||

| Circle Internet Financial Ltd. Series F (d)(e) | 38,272 | 1,281 | |

| INDUSTRIALS - 0.0% | |||

| Aerospace & Defense - 0.0% | |||

| ABL Space Systems: | |||

| Series B(b)(d)(e) | 16,809 | 619 | |

| Series B2(b)(d)(e) | 8,427 | 306 | |

| 925 | |||

| Construction & Engineering - 0.0% | |||

| Beta Technologies, Inc. Series A (b)(d)(e) | 6,703 | 510 | |

TOTAL INDUSTRIALS | 1,435 | ||

| INFORMATION TECHNOLOGY - 0.1% | |||

| Communications Equipment - 0.0% | |||

| Astranis Space Technologies Corp. Series C (b)(d)(e) | 56,066 | 918 | |

| Semiconductors & Semiconductor Equipment - 0.0% | |||

| Astera Labs, Inc. Series C (b)(d)(e) | 140,700 | 1,251 | |

| GaN Systems, Inc.: | |||

| Series F1(b)(d)(e) | 15,161 | 170 | |

| Series F2(b)(d)(e) | 8,006 | 90 | |

| Xsight Labs Ltd. Series D (b)(d)(e) | 60,136 | 437 | |

| 1,948 | |||

| Software - 0.1% | |||

| Algolia, Inc. Series D (b)(d)(e) | 28,657 | 509 | |

| Bolt Technology OU Series E (b)(d)(e) | 6,388 | 799 | |

| Databricks, Inc.: | |||

| Series G(b)(d)(e) | 4,077 | 217 | |

| Series H(b)(d)(e) | 19,485 | 1,036 | |

| Skyryse, Inc. Series B (b)(d)(e) | 50,800 | 1,021 | |

| Stripe, Inc. Series H (b)(d)(e) | 6,300 | 137 | |

| 3,719 | |||

TOTAL INFORMATION TECHNOLOGY | 6,585 | ||

| TOTAL CONVERTIBLE PREFERRED STOCKS | 13,076 | ||

| Nonconvertible Preferred Stocks - 0.1% | |||

| CONSUMER DISCRETIONARY - 0.0% | |||

| Internet & Direct Marketing Retail - 0.0% | |||

| Circle Internet Financial Ltd. Series E (d)(e) | 62,279 | 2,085 | |

| INFORMATION TECHNOLOGY - 0.1% | |||

| IT Services - 0.1% | |||

| Checkr, Inc. Series E (b)(e) | 91,236 | 1,198 | |

| Gupshup, Inc. (b)(d)(e) | 58,730 | 973 | |

| 2,171 | |||

| TOTAL NONCONVERTIBLE PREFERRED STOCKS | 4,256 | ||

| TOTAL PREFERRED STOCKS (Cost $17,569) | 17,332 | ||

| U.S. Treasury Obligations - 0.1% | |||

Principal Amount (f) (000s) | Value ($) (000s) | ||

U.S. Treasury Bills, yield at date of purchase 4.24% to 4.61% 3/2/23 to 4/20/23 (g) (Cost $2,615) | 2,630 | 2,615 | |

| Preferred Securities - 0.0% | |||

Principal Amount (f) (000s) | Value ($) (000s) | ||

| INFORMATION TECHNOLOGY - 0.0% | |||

| Semiconductors & Semiconductor Equipment - 0.0% | |||

GaN Systems, Inc. 0% (d)(e)(h) (Cost $355) | 355 | 442 | |

| Fixed-Income Funds - 37.4% | |||

| Shares | Value ($) (000s) | ||

Fidelity Investment Grade Bond Central Fund (i) (Cost $2,623,038) | 23,578,915 | 2,288,334 | |

| Money Market Funds - 1.0% | |||

| Shares | Value ($) (000s) | ||

| Fidelity Cash Central Fund 4.63% (j) | 57,335,320 | 57,347 | |

| Fidelity Securities Lending Cash Central Fund 4.63% (j)(k) | 3,060,114 | 3,060 | |

| TOTAL MONEY MARKET FUNDS (Cost $60,406) | 60,407 | ||

| TOTAL INVESTMENT IN SECURITIES - 100.2% (Cost $5,579,978) | 6,123,745 |

NET OTHER ASSETS (LIABILITIES) - (0.2)% | (11,406) |

| NET ASSETS - 100.0% | 6,112,339 |

| Futures Contracts | |||||

Number of contracts | Expiration Date | Notional Amount ($) (000s) | Value ($) (000s) | Unrealized Appreciation/ (Depreciation) ($) (000s) | |

| Purchased | |||||

| Equity Index Contracts | |||||

| CME E-mini S&P 500 Index Contracts (United States) | 72 | Mar 2023 | 14,312 | 24 | 24 |

| The notional amount of futures purchased as a percentage of Net Assets is 0.2% | |||||

| (a) | Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At the end of the period, the value of these securities amounted to $4,163,000 or 0.1% of net assets. |

| (b) | Non-income producing |

| (c) | Security or a portion of the security is on loan at period end. |

| (d) | Restricted securities (including private placements) - Investment in securities not registered under the Securities Act of 1933 (excluding 144A issues). At the end of the period, the value of restricted securities (excluding 144A issues) amounted to $24,339,000 or 0.4% of net assets. |

| (e) | Level 3 security |

| (f) | Amount is stated in United States dollars unless otherwise noted. |

| (g) | Security or a portion of the security was pledged to cover margin requirements for futures contracts. At period end, the value of securities pledged amounted to $809,000. |

| (h) | Security is perpetual in nature with no stated maturity date. |

| (i) | Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. A complete unaudited schedule of portfolio holdings for each Fidelity Central Fund is filed with the SEC for the first and third quarters of each fiscal year on Form N-PORT and is available upon request or at the SEC's website at www.sec.gov. An unaudited holdings listing for the Fund, which presents direct holdings as well as the pro-rata share of securities and other investments held indirectly through its investment in underlying non-money market Fidelity Central Funds, is available at fidelity.com and/or institutional.fidelity.com, as applicable. In addition, each Fidelity Central Fund's financial statements are available on the SEC's website or upon request. |

| (j) | Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements are available on the SEC's website or upon request. |

| (k) | Investment made with cash collateral received from securities on loan. |

| Additional information on each restricted holding is as follows: | ||

| Security | Acquisition Date | Acquisition Cost ($) (000s) |

| ABL Space Systems Series B | 3/24/21 | 757 |

| ABL Space Systems Series B2 | 10/22/21 | 573 |

| Algolia, Inc. Series D | 7/23/21 | 838 |

| Ant International Co. Ltd. Class C | 5/16/18 | 2,602 |

| Astera Labs, Inc. Series C | 8/24/21 | 473 |

| Astranis Space Technologies Corp. Series C | 3/19/21 | 1,229 |

| Beta Technologies, Inc. Series A | 4/09/21 | 491 |

| Bolt Technology OU Series E | 1/03/22 | 1,660 |

| ByteDance Ltd. Series E1 | 11/18/20 | 2,081 |

| Cazoo Group Ltd. | 3/28/21 | 533 |

| CCC Intelligent Solutions Holdings, Inc. | 2/02/21 | 344 |

| Circle Internet Financial Ltd. Series E | 5/11/21 | 1,011 |

| Circle Internet Financial Ltd. Series F | 5/09/22 | 1,613 |

| Cvent Holding Corp. | 7/23/21 | 1,224 |

| Databricks, Inc. Series G | 2/01/21 | 241 |

| Databricks, Inc. Series H | 8/31/21 | 1,432 |

| Epic Games, Inc. | 3/29/21 | 1,518 |

| GaN Systems, Inc. Series F1 | 11/30/21 | 129 |

| GaN Systems, Inc. Series F2 | 11/30/21 | 68 |

| GaN Systems, Inc. 0% | 11/30/21 | 355 |

| Gupshup, Inc. | 6/08/21 | 1,343 |

| Skyryse, Inc. Series B | 10/21/21 | 1,254 |

| Space Exploration Technologies Corp. Class A | 2/16/21 | 672 |

| Starling Bank Ltd. Series D | 6/18/21 | 1,179 |

| Stripe, Inc. Class B | 5/18/21 | 626 |

| Stripe, Inc. Series H | 3/15/21 | 253 |

| Xsight Labs Ltd. Series D | 2/16/21 | 481 |

| Affiliate (Amounts in thousands) | Value, beginning of period ($) | Purchases ($) | Sales Proceeds ($) | Dividend Income ($) | Realized Gain (loss) ($) | Change in Unrealized appreciation (depreciation) ($) | Value, end of period ($) | % ownership, end of period |

| Fidelity Cash Central Fund 4.63% | 57,511 | 763,976 | 764,140 | 1,010 | - | - | 57,347 | 0.1% |

| Fidelity Investment Grade Bond Central Fund | 2,025,195 | 335,091 | - | 36,593 | - | (71,952) | 2,288,334 | 6.4% |

| Fidelity Securities Lending Cash Central Fund 4.63% | 12,253 | 39,910 | 49,103 | 20 | - | - | 3,060 | 0.0% |

| Total | 2,094,959 | 1,138,977 | 813,243 | 37,623 | - | (71,952) | 2,348,741 | |

| Valuation Inputs at Reporting Date: | ||||

Description (Amounts in thousands) | Total ($) | Level 1 ($) | Level 2 ($) | Level 3 ($) |

Investments in Securities: | ||||

| Equities: | ||||

Communication Services | 311,133 | 305,633 | 446 | 5,054 |

Consumer Discretionary | 392,183 | 385,492 | 3,325 | 3,366 |

Consumer Staples | 256,222 | 256,222 | - | - |

Energy | 193,241 | 193,241 | - | - |

Financials | 436,004 | 406,474 | 25,650 | 3,880 |

Health Care | 543,173 | 539,333 | 3,840 | - |

Industrials | 321,341 | 318,674 | - | 2,667 |

Information Technology | 1,008,362 | 955,424 | 43,844 | 9,094 |

Materials | 109,160 | 107,144 | 2,016 | - |

Real Estate | 96,578 | 96,578 | - | - |

Utilities | 104,550 | 104,550 | - | - |

| U.S. Government and Government Agency Obligations | 2,615 | - | 2,615 | - |

| Preferred Securities | 442 | - | - | 442 |

| Fixed-Income Funds | 2,288,334 | 2,288,334 | - | - |

| Money Market Funds | 60,407 | 60,407 | - | - |

| Total Investments in Securities: | 6,123,745 | 6,017,506 | 81,736 | 24,503 |

Derivative Instruments: | ||||

| Assets | ||||

Futures Contracts | 24 | 24 | - | - |

| Total Assets | 24 | 24 | - | - |

| Total Derivative Instruments: | 24 | 24 | - | - |

| Net Unrealized Depreciation on Unfunded Commitments | (111) | - | - | (111) |

| Total | (111) | - | - | (111) |

Primary Risk Exposure / Derivative Type | Value | |

| (Amounts in thousands) | Asset ($) | Liability ($) |

| Equity Risk | ||

Futures Contracts (a) | 24 | 0 |

| Total Equity Risk | 24 | 0 |

| Total Value of Derivatives | 24 | 0 |

| Statement of Assets and Liabilities | ||||

| Amounts in thousands (except per-share amounts) | February 28, 2023 (Unaudited) | |||

| Assets | ||||

| Investment in securities, at value (including securities loaned of $2,941) - See accompanying schedule: | ||||

Unaffiliated issuers (cost $2,896,534) | $ | 3,775,004 | ||

Fidelity Central Funds (cost $2,683,444) | 2,348,741 | |||

| Total Investment in Securities (cost $5,579,978) | $ | 6,123,745 | ||

| Cash | 23 | |||

| Receivable for investments sold | 18,953 | |||

| Receivable for fund shares sold | 4,044 | |||

| Dividends receivable | 4,813 | |||

| Distributions receivable from Fidelity Central Funds | 216 | |||

| Prepaid expenses | 5 | |||

| Other receivables | 20 | |||

Total assets | 6,151,819 | |||

| Liabilities | ||||

| Payable for investments purchased | $ | 25,331 | ||

| Unrealized depreciation on unfunded commitments | 111 | |||

| Payable for fund shares redeemed | 6,237 | |||

| Accrued management fee | 1,960 | |||

| Distribution and service plan fees payable | 1,717 | |||

| Payable for daily variation margin on futures contracts | 45 | |||

| Other affiliated payables | 881 | |||

| Other payables and accrued expenses | 138 | |||

| Collateral on securities loaned | 3,060 | |||

| Total Liabilities | 39,480 | |||

| Net Assets | $ | 6,112,339 | ||

| Net Assets consist of: | ||||

| Paid in capital | $ | 5,653,916 | ||

| Total accumulated earnings (loss) | 458,423 | |||

| Net Assets | $ | 6,112,339 | ||

| Net Asset Value and Maximum Offering Price | ||||

| Class A : | ||||

Net Asset Value and redemption price per share ($1,604,280 ÷ 69,877 shares) (a) | $ | 22.96 | ||

| Maximum offering price per share (100/94.25 of $22.96) | $ | 24.36 | ||

| Class M : | ||||

Net Asset Value and redemption price per share ($1,401,206 ÷ 60,085 shares) (a) | $ | 23.32 | ||

| Maximum offering price per share (100/96.50 of $23.32) | $ | 24.17 | ||

| Class C : | ||||

Net Asset Value and offering price per share ($909,679 ÷ 40,085 shares) (a) | $ | 22.69 | ||

| Class I : | ||||

Net Asset Value , offering price and redemption price per share ($1,479,572 ÷ 62,800 shares) | $ | 23.56 | ||

| Class Z : | ||||

Net Asset Value , offering price and redemption price per share ($717,602 ÷ 30,448 shares) | $ | 23.57 | ||

(a)Redemption price per share is equal to net asset value less any applicable contingent deferred sales charge. | ||||

| Statement of Operations | ||||

| Amounts in thousands | Six months ended February 28, 2023 (Unaudited) | |||

| Investment Income | ||||

| Dividends | $ | 25,330 | ||

| Interest | 47 | |||

| Income from Fidelity Central Funds (including $20 from security lending) | 37,623 | |||

| Total Income | 63,000 | |||

| Expenses | ||||

| Management fee | $ | 11,501 | ||

| Transfer agent fees | 4,621 | |||

| Distribution and service plan fees | 10,064 | |||

| Accounting fees | 671 | |||

| Custodian fees and expenses | 62 | |||

| Independent trustees' fees and expenses | 11 | |||

| Registration fees | 123 | |||

| Audit | 78 | |||

| Legal | 24 | |||

| Interest | 11 | |||

| Miscellaneous | 13 | |||

| Total expenses before reductions | 27,179 | |||

| Expense reductions | (116) | |||

| Total expenses after reductions | 27,063 | |||

| Net Investment income (loss) | 35,937 | |||

| Realized and Unrealized Gain (Loss) | ||||

| Net realized gain (loss) on: | ||||

| Investment Securities: | ||||

| Unaffiliated issuers (net of foreign taxes of $3) | (3,923) | |||

| Foreign currency transactions | (2) | |||

| Futures contracts | 1,944 | |||

| Total net realized gain (loss) | (1,981) | |||

| Change in net unrealized appreciation (depreciation) on: | ||||

| Investment Securities: | ||||

| Unaffiliated issuers (net of decrease in deferred foreign taxes of $26) | 71,144 | |||

| Fidelity Central Funds | (71,952) | |||

| Unfunded commitments | (12) | |||

| Assets and liabilities in foreign currencies | 13 | |||

| Futures contracts | (428) | |||

| Total change in net unrealized appreciation (depreciation) | (1,235) | |||

| Net gain (loss) | (3,216) | |||

| Net increase (decrease) in net assets resulting from operations | $ | 32,721 | ||

| Statement of Changes in Net Assets | ||||

| Amount in thousands | Six months ended February 28, 2023 (Unaudited) | Year ended August 31, 2022 | ||

| Increase (Decrease) in Net Assets | ||||

| Operations | ||||

| Net investment income (loss) | $ | 35,937 | $ | 45,974 |

| Net realized gain (loss) | (1,981) | 245,935 | ||

| Change in net unrealized appreciation (depreciation) | (1,235) | (1,296,129) | ||

| Net increase (decrease) in net assets resulting from operations | 32,721 | (1,004,220) | ||

| Distributions to shareholders | (283,922) | (489,272) | ||

| Share transactions - net increase (decrease) | (11,867) | 703,097 | ||

| Total increase (decrease) in net assets | (263,068) | (790,395) | ||

| Net Assets | ||||

| Beginning of period | 6,375,407 | 7,165,802 | ||

| End of period | $ | 6,112,339 | $ | 6,375,407 |

| Fidelity Advisor® Balanced Fund Class A |

Six months ended (Unaudited) February 28, 2023 | Years ended August 31, 2022 | 2021 | 2020 | 2019 | 2018 | |||||||

Selected Per-Share Data | ||||||||||||

| Net asset value, beginning of period | $ | 23.98 | $ | 29.67 | $ | 24.87 | $ | 21.14 | $ | 22.22 | $ | 21.09 |

| Income from Investment Operations | ||||||||||||

Net investment income (loss) A,B | .14 | .19 | .17 | .27 | .30 | .25 | ||||||

| Net realized and unrealized gain (loss) | (.06) | (3.87) | 5.67 | 4.10 | .08 | 2.22 | ||||||

| Total from investment operations | .08 | (3.68) | 5.84 | 4.37 | .38 | 2.47 | ||||||

| Distributions from net investment income | (.16) | (.17) | (.17) | (.29) | (.29) | (.25) | ||||||

| Distributions from net realized gain | (.95) | (1.84) | (.88) | (.35) | (1.18) | (1.09) | ||||||

| Total distributions | (1.10) C | (2.01) | (1.04) C | (.64) | (1.46) C | (1.34) | ||||||

| Net asset value, end of period | $ | 22.96 | $ | 23.98 | $ | 29.67 | $ | 24.87 | $ | 21.14 | $ | 22.22 |

Total Return D,E,F | .77% | (13.19)% | 24.38% | 21.16% | 2.15% | 12.26% | ||||||

Ratios to Average Net Assets B,G,H | ||||||||||||

| Expenses before reductions | .83% I | .81% | .83% | .85% | .86% | .87% | ||||||

| Expenses net of fee waivers, if any | .82% I | .81% | .83% | .85% | .86% | .87% | ||||||

| Expenses net of all reductions | .82% I | .81% | .82% | .84% | .86% | .86% | ||||||

| Net investment income (loss) | 1.24% I | .72% | .63% | 1.21% | 1.46% | 1.18% | ||||||

| Supplemental Data | ||||||||||||

| Net assets, end of period (in millions) | $ | 1,604 | $ | 1,621 | $ | 1,723 | $ | 1,080 | $ | 818 | $ | 681 |

Portfolio turnover rate J | 28% I | 35% | 37% | 92% | 57% | 62% K |

| Fidelity Advisor® Balanced Fund Class M |

Six months ended (Unaudited) February 28, 2023 | Years ended August 31, 2022 | 2021 | 2020 | 2019 | 2018 | |||||||

Selected Per-Share Data | ||||||||||||

| Net asset value, beginning of period | $ | 24.34 | $ | 30.08 | $ | 25.19 | $ | 21.40 | $ | 22.47 | $ | 21.31 |

| Income from Investment Operations | ||||||||||||

Net investment income (loss) A,B | .12 | .13 | .10 | .22 | .25 | .20 | ||||||

| Net realized and unrealized gain (loss) | (.07) | (3.94) | 5.76 | 4.15 | .09 | 2.24 | ||||||

| Total from investment operations | .05 | (3.81) | 5.86 | 4.37 | .34 | 2.44 | ||||||

| Distributions from net investment income | (.12) | (.09) | (.10) | (.23) | (.23) | (.19) | ||||||

| Distributions from net realized gain | (.95) | (1.84) | (.88) | (.35) | (1.18) | (1.09) | ||||||

| Total distributions | (1.07) | (1.93) | (.97) C | (.58) | (1.41) | (1.28) | ||||||

| Net asset value, end of period | $ | 23.32 | $ | 24.34 | $ | 30.08 | $ | 25.19 | $ | 21.40 | $ | 22.47 |

Total Return D,E,F | .61% | (13.41)% | 24.11% | 20.85% | 1.91% | 11.99% | ||||||

Ratios to Average Net Assets B,G,H | ||||||||||||

| Expenses before reductions | 1.07% I | 1.06% | 1.07% | 1.10% | 1.11% | 1.12% | ||||||

| Expenses net of fee waivers, if any | 1.07% I | 1.06% | 1.07% | 1.10% | 1.11% | 1.11% | ||||||

| Expenses net of all reductions | 1.07% I | 1.06% | 1.07% | 1.09% | 1.11% | 1.11% | ||||||

| Net investment income (loss) | 1.00% I | .47% | .38% | .97% | 1.21% | .94% | ||||||

| Supplemental Data | ||||||||||||

| Net assets, end of period (in millions) | $ | 1,401 | $ | 1,427 | $ | 1,744 | $ | 1,455 | $ | 1,273 | $ | 1,257 |

Portfolio turnover rate J | 28% I | 35% | 37% | 92% | 57% | 62% K |

| Fidelity Advisor® Balanced Fund Class C |

Six months ended (Unaudited) February 28, 2023 | Years ended August 31, 2022 | 2021 | 2020 | 2019 | 2018 | |||||||

Selected Per-Share Data | ||||||||||||

| Net asset value, beginning of period | $ | 23.71 | $ | 29.37 | $ | 24.67 | $ | 20.97 | $ | 22.05 | $ | 20.93 |

| Income from Investment Operations | ||||||||||||

Net investment income (loss) A,B | .06 | (.01) | (.03) | .10 | .14 | .09 | ||||||

| Net realized and unrealized gain (loss) | (.07) | (3.82) | 5.62 | 4.07 | .09 | 2.20 | ||||||

| Total from investment operations | (.01) | (3.83) | 5.59 | 4.17 | .23 | 2.29 | ||||||

| Distributions from net investment income | (.06) | (.01) | (.02) | (.13) | (.13) | (.08) | ||||||

| Distributions from net realized gain | (.95) | (1.82) | (.87) | (.35) | (1.18) | (1.09) | ||||||

| Total distributions | (1.01) | (1.83) | (.89) | (.47) C | (1.31) | (1.17) | ||||||

| Net asset value, end of period | $ | 22.69 | $ | 23.71 | $ | 29.37 | $ | 24.67 | $ | 20.97 | $ | 22.05 |

Total Return D,E,F | .34% | (13.82)% | 23.43% | 20.25% | 1.40% | 11.41% | ||||||

Ratios to Average Net Assets B,G,H | ||||||||||||

| Expenses before reductions | 1.58% I | 1.57% | 1.58% | 1.60% | 1.62% | 1.62% | ||||||

| Expenses net of fee waivers, if any | 1.58% I | 1.57% | 1.58% | 1.60% | 1.62% | 1.62% | ||||||

| Expenses net of all reductions | 1.58% I | 1.57% | 1.58% | 1.60% | 1.62% | 1.62% | ||||||

| Net investment income (loss) | .49% I | (.04)% | (.13)% | .46% | .70% | .43% | ||||||

| Supplemental Data | ||||||||||||

| Net assets, end of period (in millions) | $ | 910 | $ | 980 | $ | 1,118 | $ | 769 | $ | 635 | $ | 620 |

Portfolio turnover rate J | 28% I | 35% | 37% | 92% | 57% | 62% K |

| Fidelity Advisor® Balanced Fund Class I |

Six months ended (Unaudited) February 28, 2023 | Years ended August 31, 2022 | 2021 | 2020 | 2019 | 2018 | |||||||

Selected Per-Share Data | ||||||||||||

| Net asset value, beginning of period | $ | 24.58 | $ | 30.36 | $ | 25.42 | $ | 21.59 | $ | 22.66 | $ | 21.48 |

| Income from Investment Operations | ||||||||||||

Net investment income (loss) A,B | .17 | .26 | .24 | .33 | .36 | .31 | ||||||

| Net realized and unrealized gain (loss) | (.06) | (3.97) | 5.81 | 4.19 | .08 | 2.26 | ||||||

| Total from investment operations | .11 | (3.71) | 6.05 | 4.52 | .44 | 2.57 | ||||||

| Distributions from net investment income | (.19) | (.23) | (.23) | (.34) | (.34) | (.30) | ||||||

| Distributions from net realized gain | (.95) | (1.84) | (.88) | (.35) | (1.18) | (1.09) | ||||||

| Total distributions | (1.13) C | (2.07) | (1.11) | (.69) | (1.51) C | (1.39) | ||||||

| Net asset value, end of period | $ | 23.56 | $ | 24.58 | $ | 30.36 | $ | 25.42 | $ | 21.59 | $ | 22.66 |

Total Return D,E | .88% | (12.98)% | 24.68% | 21.48% | 2.41% | 12.56% | ||||||

Ratios to Average Net Assets B,F,G | ||||||||||||

| Expenses before reductions | .58% H | .56% | .57% | .59% | .61% | .61% | ||||||

| Expenses net of fee waivers, if any | .57% H | .56% | .57% | .59% | .61% | .61% | ||||||

| Expenses net of all reductions | .57% H | .56% | .57% | .58% | .60% | .61% | ||||||

| Net investment income (loss) | 1.49% H | .97% | .88% | 1.47% | 1.71% | 1.44% | ||||||

| Supplemental Data | ||||||||||||

| Net assets, end of period (in millions) | $ | 1,480 | $ | 1,621 | $ | 1,831 | $ | 1,070 | $ | 785 | $ | 621 |

Portfolio turnover rate I | 28% H | 35% | 37% | 92% | 57% | 62% J |

| Fidelity Advisor® Balanced Fund Class Z |

Six months ended (Unaudited) February 28, 2023 | Years ended August 31, 2022 | 2021 | 2020 | 2019 | 2018 | |||||||

Selected Per-Share Data | ||||||||||||

| Net asset value, beginning of period | $ | 24.59 | $ | 30.37 | $ | 25.43 | $ | 21.60 | $ | 22.66 | $ | 21.48 |

| Income from Investment Operations | ||||||||||||

Net investment income (loss) A,B | .19 | .30 | .28 | .36 | .38 | .34 | ||||||

| Net realized and unrealized gain (loss) | (.06) | (3.98) | 5.80 | 4.19 | .10 | 2.26 | ||||||

| Total from investment operations | .13 | (3.68) | 6.08 | 4.55 | .48 | 2.60 | ||||||

| Distributions from net investment income | (.20) | (.27) | (.26) | (.37) | (.36) | (.33) | ||||||

| Distributions from net realized gain | (.95) | (1.84) | (.88) | (.35) | (1.18) | (1.09) | ||||||

| Total distributions | (1.15) | (2.10) C | (1.14) | (.72) | (1.54) | (1.42) | ||||||

| Net asset value, end of period | $ | 23.57 | $ | 24.59 | $ | 30.37 | $ | 25.43 | $ | 21.60 | $ | 22.66 |

Total Return D,E | .95% | (12.87)% | 24.82% | 21.62% | 2.57% | 12.70% | ||||||

Ratios to Average Net Assets A,F,G | ||||||||||||

| Expenses before reductions | .45% H | .45% | .45% | .47% | .48% | .49% | ||||||

| Expenses net of fee waivers, if any | .45% H | .44% | .45% | .47% | .48% | .49% | ||||||

| Expenses net of all reductions | .45% H | .44% | .45% | .46% | .48% | .48% | ||||||

| Net investment income (loss) | 1.62% H | 1.09% | 1.00% | 1.59% | 1.84% | 1.56% | ||||||

| Supplemental Data | ||||||||||||

| Net assets, end of period (in millions) | $ | 718 | $ | 726 | $ | 749 | $ | 388 | $ | 280 | $ | 224 |

Portfolio turnover rate I | 28% H | 35% | 37% | 92% | 57% | 62% J |

| Fidelity Central Fund | Investment Manager | Investment Objective | Investment Practices | Expense Ratio A |

| Fidelity Investment Grade Bond Central Fund | Fidelity Management & Research Company LLC (FMR) | Seeks a high level of income by normally investing in investment-grade debt securities. | Delayed Delivery & When Issued Securities Futures Restricted Securities Swaps | Less than .005% |

| Fidelity Money Market Central Funds | Fidelity Management & Research Company LLC (FMR) | Each fund seeks to obtain a high level of current income consistent with the preservation of capital and liquidity. | Short-term Investments | Less than .005% |

| Fidelity Advisor Balanced Fund | $5 |

| Gross unrealized appreciation | $1,118,061 |

| Gross unrealized depreciation | (584,079) |

| Net unrealized appreciation (depreciation) | $533,982 |

| Tax cost | $5,589,787 |

| Investment to be Acquired | Commitment Amount | Unrealized Appreciation (Depreciation) | |

| Fidelity Advisor Balanced Fund | Stripe, Inc. | $491 | $(111) |

| Equity Risk | Equity risk relates to the fluctuations in the value of financial instruments as a result of changes in market prices (other than those arising from interest rate risk or foreign exchange risk), whether caused by factors specific to an individual investment, its issuer, or all factors affecting all instruments traded in a market or market segment. |

| Purchases ($) | Sales ($) | |

| Fidelity Advisor Balanced Fund | 853,683 | 1,101,344 |

| Distribution Fee | Service Fee | Total Fees | Retained by FDC | |

| Class A | - % | .25% | $1,968 | $94 |

| Class M | .25% | .25% | 3,464 | 47 |

| Class C | .75% | .25% | 4,632 | 706 |

| $10,064 | $847 |

| Retained by FDC | |

| Class A | $284 |

| Class M | 20 |

Class C A | 5 |

| $309 |

| Amount | % of Class-Level Average Net Assets A | |

| Class A | $1,303 | .17 |

| Class M | 1,133 | .16 |

| Class C | 785 | .17 |

| Class I | 1,252 | .17 |

| Class Z | 148 | .04 |

| $4,621 |

| % of Average Net Assets | |

| Fidelity Advisor Balanced Fund | .02 |

| Amount | |

| Fidelity Advisor Balanced Fund | $14 |

| Borrower or Lender | Average Loan Balance | Weighted Average Interest Rate | Interest Expense | |

| Fidelity Advisor Balanced Fund | Borrower | $17,341 | 4.57% | $11 |

| Purchases ($) | Sales ($) | Realized Gain (Loss) ($) | |

| Fidelity Advisor Balanced Fund | 18,724 | 66,394 | 237 |

| Amount ($) | |

| Fidelity Advisor Balanced Fund | 18 |

| Amount | |

| Fidelity Advisor Balanced Fund | $6 |

| Total Security Lending Fees Paid to NFS | Security Lending Income From Securities Loaned to NFS | Value of Securities Loaned to NFS at Period End | |

| Fidelity Advisor Balanced Fund | $2 | $- A | $19 |

Six months ended February 28, 2023 | Year ended August 31, 2022 | |

| Fidelity Advisor Balanced Fund | ||

| Distributions to shareholders | ||

| Class A | $74,365 | $120,162 |

| Class M | 62,468 | 112,328 |

| Class C | 41,002 | 71,160 |

| Class I | 72,248 | 129,619 |

| Class Z | 33,839 | 56,003 |

Total | $283,922 | $489,272 |

| Shares | Shares | Dollars | Dollars | |

Six months ended February 28, 2023 | Year ended August 31, 2022 | Six months ended February 28, 2023 | Year ended August 31, 2022 | |

| Fidelity Advisor Balanced Fund | ||||

| Class A | ||||

| Shares sold | 7,531 | 18,286 | $171,341 | $490,465 |

| Reinvestment of distributions | 3,397 | 4,208 | 71,653 | 115,013 |

| Shares redeemed | (8,658) | (12,953) | (195,976) | (340,320) |

| Net increase (decrease) | 2,270 | 9,541 | $47,018 | $265,158 |

| Class M | ||||

| Shares sold | 4,473 | 8,730 | $103,361 | $236,401 |

| Reinvestment of distributions | 2,879 | 3,990 | 61,663 | 110,866 |

| Shares redeemed | (5,917) | (12,055) | (136,840) | (324,972) |

| Net increase (decrease) | 1,435 | 665 | $28,184 | $22,295 |

| Class C | ||||

| Shares sold | 2,705 | 9,262 | $60,676 | $248,978 |

| Reinvestment of distributions | 1,862 | 2,484 | 38,794 | 67,522 |

| Shares redeemed | (5,812) | (8,475) | (129,975) | (220,083) |

| Net increase (decrease) | (1,245) | 3,271 | $(30,505) | $96,417 |

| Class I | ||||

| Shares sold | 8,242 | 20,463 | $191,664 | $566,761 |

| Reinvestment of distributions | 2,945 | 4,109 | 63,731 | 114,965 |

| Shares redeemed | (14,310) | (18,968) | (331,706) | (505,109) |

| Net increase (decrease) | (3,123) | 5,604 | $(76,311) | $176,617 |

| Class Z | ||||

| Shares sold | 4,091 | 12,178 | $95,399 | $336,638 |

| Reinvestment of distributions | 1,421 | 1,794 | 30,779 | 50,155 |

| Shares redeemed | (4,584) | (9,125) | (106,431) | (244,183) |

| Net increase (decrease) | 928 | 4,847 | $19,747 | $142,610 |

| The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (September 1, 2022 to February 28, 2023). |

Annualized Expense Ratio- A | Beginning Account Value September 1, 2022 | Ending Account Value February 28, 2023 | Expenses Paid During Period- C September 1, 2022 to February 28, 2023 | |||||||

| Fidelity Advisor® Balanced Fund | ||||||||||

| Class A | .82% | |||||||||

| Actual | $ 1,000 | $ 1,007.70 | $ 4.08 | |||||||

Hypothetical- B | $ 1,000 | $ 1,020.73 | $ 4.11 | |||||||

| Class M | 1.07% | |||||||||

| Actual | $ 1,000 | $ 1,006.10 | $ 5.32 | |||||||

Hypothetical- B | $ 1,000 | $ 1,019.49 | $ 5.36 | |||||||

| Class C | 1.58% | |||||||||

| Actual | $ 1,000 | $ 1,003.40 | $ 7.85 | |||||||

Hypothetical- B | $ 1,000 | $ 1,016.96 | $ 7.90 | |||||||

| Class I | .57% | |||||||||

| Actual | $ 1,000 | $ 1,008.80 | $ 2.84 | |||||||

Hypothetical- B | $ 1,000 | $ 1,021.97 | $ 2.86 | |||||||

| Class Z | .45% | |||||||||

| Actual | $ 1,000 | $ 1,009.50 | $ 2.24 | |||||||

Hypothetical- B | $ 1,000 | $ 1,022.56 | $ 2.26 | |||||||

- Highly liquid investments - cash or convertible to cash within three business days or less

- Moderately liquid investments - convertible to cash in three to seven calendar days

- Less liquid investments - can be sold or disposed of, but not settled, within seven calendar days

- Illiquid investments - cannot be sold or disposed of within seven calendar days

|

Item 2.

Code of Ethics

Not applicable.

Item 3.

Audit Committee Financial Expert

Not applicable.

Item 4.

Principal Accountant Fees and Services

Not applicable.

Item 5.

Audit Committee of Listed Registrants

Not applicable.

Item 6.

Investments

(a)

Not applicable.

(b)

Not applicable

Item 7.

Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies

Not applicable.

Item 8.

Portfolio Managers of Closed-End Management Investment Companies

Not applicable.

Item 9.

Purchase of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers

Not applicable.

Item 10.

Submission of Matters to a Vote of Security Holders

There were no material changes to the procedures by which shareholders may recommend nominees to the Fidelity Advisor Series I’s Board of Trustees.

Item 11.

Controls and Procedures

(a)(i) The President and Treasurer and the Chief Financial Officer have concluded that the Fidelity Advisor Series I’s (the “Trust”) disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act) provide reasonable assurances that material information relating to the Trust is made known to them by the appropriate persons, based on their evaluation of these controls and procedures as of a date within 90 days of the filing date of this report.

(a)(ii) There was no change in the Trust’s internal control over financial reporting (as defined in Rule 30a-3(d) under the Investment Company Act) that occurred during the period covered by this report that has materially affected, or is reasonably likely to materially affect, the Trust’s internal control over financial reporting.

Item 12.

Disclosure of Securities Lending Activities for Closed-End Management

Investment Companies

Not applicable.

Item 13.

Exhibits

(a) | (1) | Not applicable. |

(a) | (2) | |

(a) | (3) | Not applicable. |

(b) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Fidelity Advisor Series I

By: | /s/Stacie M. Smith |

Stacie M. Smith | |

President and Treasurer | |

Date: | April 20, 2023 |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

By: | /s/Stacie M. Smith |

Stacie M. Smith | |

President and Treasurer | |

Date: | April 20, 2023 |

By: | /s/John J. Burke III |

John J. Burke III | |

Chief Financial Officer | |

Date: | April 20, 2023 |