UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-03785

Fidelity Advisor Series I

(Exact name of registrant as specified in charter)

245 Summer St., Boston, Massachusetts 02210

(Address of principal executive offices) (Zip code)

Nicole Macarchuk, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code:

617-563-7000

Date of fiscal year end: | October 31 |

Date of reporting period: | October 31, 2024 |

Item 1.

Reports to Stockholders

ANNUAL SHAREHOLDER REPORT | AS OF OCTOBER 31, 2024 | This report describes changes to the Fund that occurred during the reporting period. | |

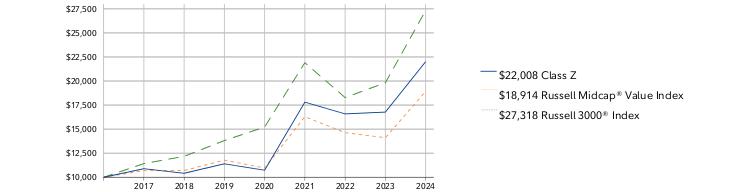

| | Fidelity Advisor® Value Fund Fidelity Advisor® Value Fund Class Z : FVLZX | |

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | ||

| Class Z | $ 87 | 0.75% |

Class Z | $10,000 | $10,891 | $10,416 | $11,400 | $10,734 | $17,805 | $16,584 | $16,773 |

Russell Midcap® Value Index | $10,000 | $10,684 | $10,701 | $11,780 | $10,963 | $16,290 | $14,633 | $14,111 |

Russell 3000® Index | $10,000 | $11,422 | $12,175 | $13,818 | $15,220 | $21,902 | $18,284 | $19,816 |

| 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

|

| 1 Year | 5 Year | Life of Fund A | |

| Class Z | 31.21% | 14.06% | 10.71% |

| Russell Midcap® Value Index | 34.03% | 9.93% | 8.57% |

| Russell 3000® Index | 37.86% | 14.60% | 13.84% |

Visit institutional.fidelity.com for more recent performance information. |

The Fund's past performance is not a good predictor of the Fund's future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

KEY FACTS | ||

| Fund Size | $380,025,415 | |

| Number of Holdings | 268 | |

| Total Advisory Fee | $2,906,123 | |

| Portfolio Turnover | 80% |

(as of October 31, 2024)

MARKET SECTORS (% of Fund's net assets) | ||

| Industrials | 19.2 | |

| Financials | 16.7 | |

| Consumer Discretionary | 10.3 | |

| Materials | 10.3 | |

| Energy | 9.2 | |

| Health Care | 8.8 | |

| Utilities | 6.9 | |

| Real Estate | 5.3 | |

| Consumer Staples | 5.2 | |

| Information Technology | 4.3 | |

| Communication Services | 2.8 | |

| Common Stocks | 99.0 |

| Short-Term Investments and Net Other Assets (Liabilities) | 1.0 |

ASSET ALLOCATION (% of Fund's net assets) |

|

| United States | 86.3 |

| Canada | 6.0 |

| United Kingdom | 1.2 |

| Germany | 1.1 |

| Puerto Rico | 0.6 |

| Belgium | 0.6 |

| Zambia | 0.6 |

| India | 0.5 |

| France | 0.5 |

| Others | 2.6 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

TOP HOLDINGS (% of Fund's net assets) | ||

| PG&E Corp | 1.2 | |

| Vistra Corp | 1.2 | |

| Ventas Inc | 1.0 | |

| Global Payments Inc | 1.0 | |

| Molina Healthcare Inc | 0.9 | |

| Smurfit WestRock PLC | 0.9 | |

| Lithia Motors Inc Class A | 0.9 | |

| Lumentum Holdings Inc | 0.8 | |

| International Paper Co | 0.8 | |

| Lamb Weston Holdings Inc | 0.8 | |

| 9.5 |

The fund's transfer agent and pricing & bookkeeping fees were changed to a fixed rate effective December 1, 2023, through February 29, 2024, in anticipation of the transition to a new management fee structure. Effective March 1, 2024, the fund's management contract was amended to incorporate administrative services previously covered under separate services agreements (transfer agent and pricing & bookkeeping). The amended contract incorporates a basic fee rate that may vary by class (subject to a performance adjustment). The Adviser or an affiliate pays certain expenses of managing and operating the fund out of each class's management fee. |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. | ||

| For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9913929.100 2890-TSRA-1224 | |

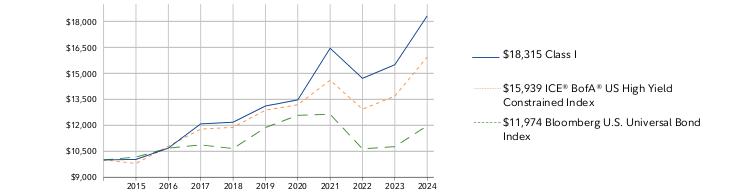

ANNUAL SHAREHOLDER REPORT | AS OF OCTOBER 31, 2024 | This report describes changes to the Fund that occurred during the reporting period. | |

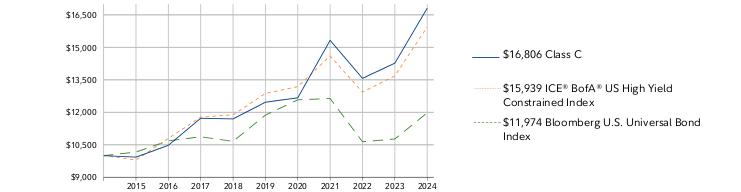

| | Fidelity Advisor® High Income Advantage Fund Fidelity Advisor® High Income Advantage Fund Class C : FAHEX | |

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | ||

| Class C | $ 187 | 1.72% |

Class C | $10,000 | $9,930 | $10,477 | $11,725 | $11,694 | $12,466 | $12,669 | $15,323 | $13,568 | $14,269 | $16,806 |

ICE® BofA® US High Yield Constrained Index | $10,000 | $9,797 | $10,795 | $11,781 | $11,883 | $12,872 | $13,187 | $14,602 | $12,932 | $13,683 | $15,939 |

Bloomberg U.S. Universal Bond Index | $10,000 | $10,167 | $10,682 | $10,870 | $10,658 | $11,869 | $12,576 | $12,636 | $10,641 | $10,768 | $11,974 |

| 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

|

| 1 Year | 5 Year | 10 Year | |

| Class C (incl. contingent deferred sales charge) | 16.04% | 5.84% | 5.33% |

| Class C | 17.04% | 5.84% | 5.33% |

| ICE® BofA® US High Yield Constrained Index | 16.49% | 4.37% | 4.77% |

| Bloomberg U.S. Universal Bond Index | 11.20% | 0.18% | 1.82% |

Visit institutional.fidelity.com for more recent performance information. |

The Fund's past performance is not a good predictor of the Fund's future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

KEY FACTS | ||

| Fund Size | $2,310,946,691 | |

| Number of Holdings | 717 | |

| Total Advisory Fee | $13,652,978 | |

| Portfolio Turnover | 29% |

(as of October 31, 2024)

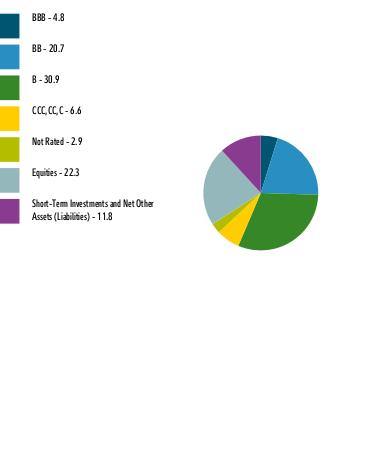

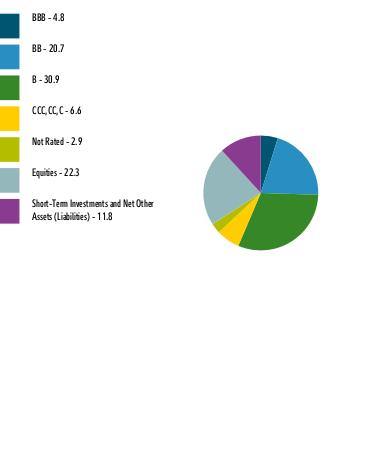

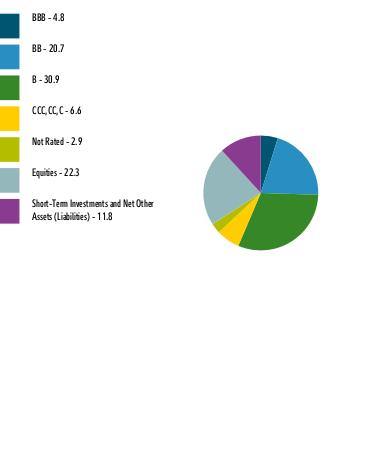

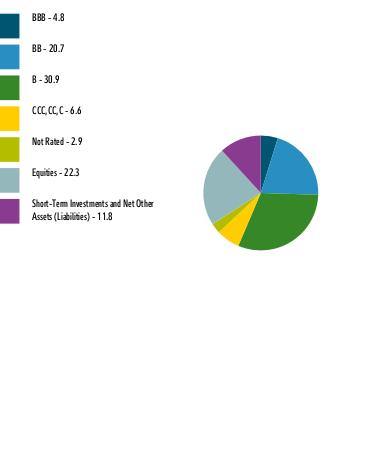

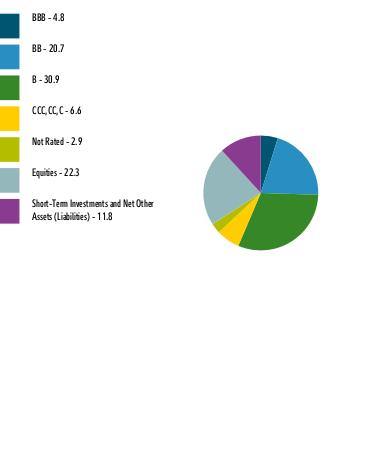

| BBB | 4.8 |

| BB | 20.7 |

| B | 30.9 |

| CCC,CC,C | 6.6 |

| Not Rated | 2.9 |

| Equities | 22.3 |

| Short-Term Investments and Net Other Assets (Liabilities) | 11.8 |

QUALITY DIVERSIFICATION (% of Fund's net assets) |

|

| We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes. |

| Corporate Bonds | 51.5 |

| Common Stocks | 20.1 |

| Bank Loan Obligations | 10.1 |

| Preferred Securities | 4.1 |

| Alternative Funds | 2.2 |

| Asset-Backed Securities | 0.2 |

| Short-Term Investments and Net Other Assets (Liabilities) | 11.8 |

ASSET ALLOCATION (% of Fund's net assets) |

|

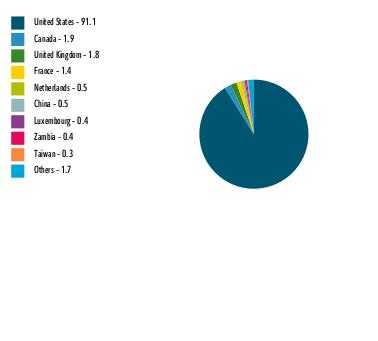

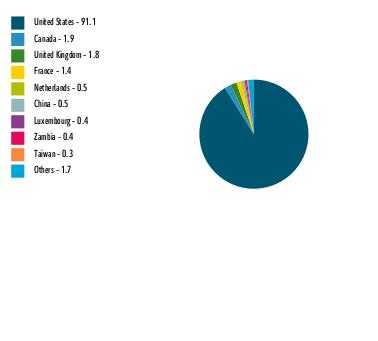

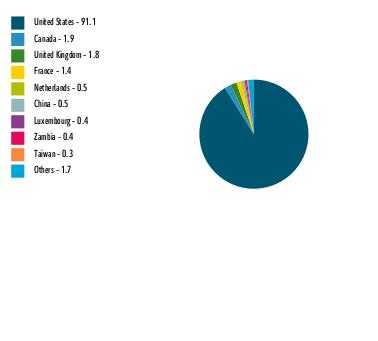

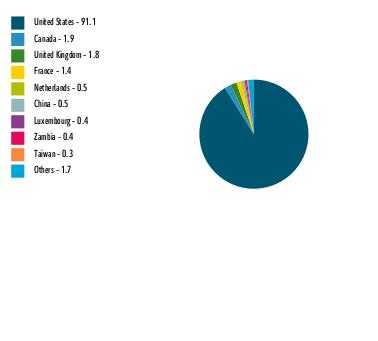

| United States | 91.1 |

| Canada | 1.9 |

| United Kingdom | 1.8 |

| France | 1.4 |

| Netherlands | 0.5 |

| China | 0.5 |

| Luxembourg | 0.4 |

| Zambia | 0.4 |

| Taiwan | 0.3 |

| Others | 1.7 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

TOP HOLDINGS (% of Fund's net assets) | ||

| TransDigm Inc | 2.6 | |

| Fidelity Private Credit Company LLC | 2.2 | |

| Energy Transfer LP | 2.1 | |

| NVIDIA Corp | 1.4 | |

| Tenet Healthcare Corp | 1.4 | |

| LBM Acquisition LLC | 1.2 | |

| Altice France SA | 1.1 | |

| eG Global Finance PLC | 1.1 | |

| Carnival Corp | 1.1 | |

| Meta Platforms Inc Class A | 1.1 | |

| 15.3 |

The fund's transfer agent and pricing and bookkeeping fees were changed to a fixed rate effective December 1, 2023, through February 29, 2024, in anticipation of the transition to a new management fee structure. Effective March 1, 2024, the fund's management contract was amended to incorporate administrative services previously covered under separate services agreements (transfer agent and pricing and bookkeeping). The amended contract incorporates a management fee rate that may vary by class. The Adviser or an affiliate pays certain expenses of managing and operating the fund out of each class's management fee. |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. | ||

| For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9913816.100 521-TSRA-1224 | |

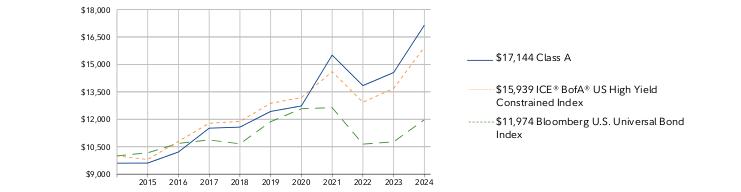

ANNUAL SHAREHOLDER REPORT | AS OF OCTOBER 31, 2024 | This report describes changes to the Fund that occurred during the reporting period. | |

| | Fidelity Advisor® High Income Advantage Fund Fidelity Advisor® High Income Advantage Fund Class A : FAHDX | |

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | ||

| Class A | $ 105 | 0.97% |

Class A | $9,600 | $9,606 | $10,211 | $11,513 | $11,571 | $12,428 | $12,728 | $15,509 | $13,841 | $14,555 | $17,144 |

ICE® BofA® US High Yield Constrained Index | $10,000 | $9,797 | $10,795 | $11,781 | $11,883 | $12,872 | $13,187 | $14,602 | $12,932 | $13,683 | $15,939 |

Bloomberg U.S. Universal Bond Index | $10,000 | $10,167 | $10,682 | $10,870 | $10,658 | $11,869 | $12,576 | $12,636 | $10,641 | $10,768 | $11,974 |

| 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

|

| 1 Year | 5 Year | 10 Year | |

| Class A (incl. 4.00% sales charge) | 13.07% | 5.78% | 5.54% |

| Class A (without 4.00% sales charge) | 17.78% | 6.64% | 5.97% |

| ICE® BofA® US High Yield Constrained Index | 16.49% | 4.37% | 4.77% |

| Bloomberg U.S. Universal Bond Index | 11.20% | 0.18% | 1.82% |

Visit institutional.fidelity.com for more recent performance information. |

The Fund's past performance is not a good predictor of the Fund's future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

KEY FACTS | ||

| Fund Size | $2,310,946,691 | |

| Number of Holdings | 717 | |

| Total Advisory Fee | $13,652,978 | |

| Portfolio Turnover | 29% |

(as of October 31, 2024)

| BBB | 4.8 |

| BB | 20.7 |

| B | 30.9 |

| CCC,CC,C | 6.6 |

| Not Rated | 2.9 |

| Equities | 22.3 |

| Short-Term Investments and Net Other Assets (Liabilities) | 11.8 |

QUALITY DIVERSIFICATION (% of Fund's net assets) |

|

| We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes. |

| Corporate Bonds | 51.5 |

| Common Stocks | 20.1 |

| Bank Loan Obligations | 10.1 |

| Preferred Securities | 4.1 |

| Alternative Funds | 2.2 |

| Asset-Backed Securities | 0.2 |

| Short-Term Investments and Net Other Assets (Liabilities) | 11.8 |

ASSET ALLOCATION (% of Fund's net assets) |

|

| United States | 91.1 |

| Canada | 1.9 |

| United Kingdom | 1.8 |

| France | 1.4 |

| Netherlands | 0.5 |

| China | 0.5 |

| Luxembourg | 0.4 |

| Zambia | 0.4 |

| Taiwan | 0.3 |

| Others | 1.7 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

TOP HOLDINGS (% of Fund's net assets) | ||

| TransDigm Inc | 2.6 | |

| Fidelity Private Credit Company LLC | 2.2 | |

| Energy Transfer LP | 2.1 | |

| NVIDIA Corp | 1.4 | |

| Tenet Healthcare Corp | 1.4 | |

| LBM Acquisition LLC | 1.2 | |

| Altice France SA | 1.1 | |

| eG Global Finance PLC | 1.1 | |

| Carnival Corp | 1.1 | |

| Meta Platforms Inc Class A | 1.1 | |

| 15.3 |

The fund's transfer agent and pricing and bookkeeping fees were changed to a fixed rate effective December 1, 2023, through February 29, 2024, in anticipation of the transition to a new management fee structure. Effective March 1, 2024, the fund's management contract was amended to incorporate administrative services previously covered under separate services agreements (transfer agent and pricing and bookkeeping). The amended contract incorporates a management fee rate that may vary by class. The Adviser or an affiliate pays certain expenses of managing and operating the fund out of each class's management fee. |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. | ||

| For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9913814.100 258-TSRA-1224 | |

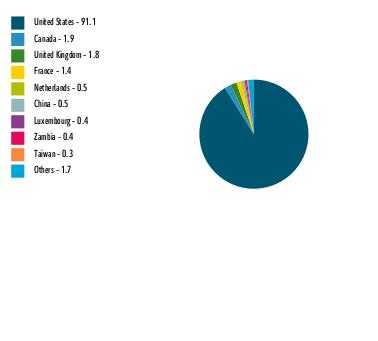

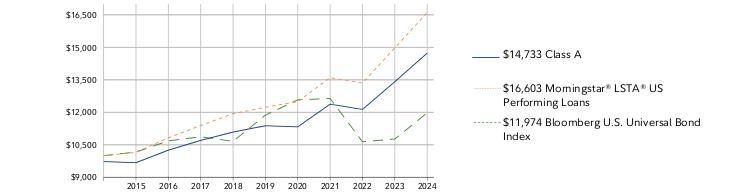

ANNUAL SHAREHOLDER REPORT | AS OF OCTOBER 31, 2024 | This report describes changes to the Fund that occurred during the reporting period. | |

| | Fidelity Advisor® Floating Rate High Income Fund Fidelity® Floating Rate High Income Fund : FFRHX | |

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | ||

| Fidelity® Floating Rate High Income Fund | $ 70 | 0.66% |

Fidelity® Floating Rate High Income Fund | $10,000 | $9,964 | $10,590 | $11,088 | $11,533 | $11,870 | $11,853 | $12,988 | $12,756 | $14,158 | $15,597 |

Morningstar® LSTA® US Performing Loans | $10,000 | $10,151 | $10,824 | $11,392 | $11,936 | $12,235 | $12,491 | $13,602 | $13,349 | $14,977 | $16,603 |

Bloomberg U.S. Universal Bond Index | $10,000 | $10,167 | $10,682 | $10,870 | $10,658 | $11,869 | $12,576 | $12,636 | $10,641 | $10,768 | $11,974 |

| 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

|

| 1 Year | 5 Year | 10 Year | |

| Fidelity® Floating Rate High Income Fund | 10.16% | 5.61% | 4.54% |

| Morningstar® LSTA® US Performing Loans | 10.86% | 6.29% | 5.20% |

| Bloomberg U.S. Universal Bond Index | 11.20% | 0.18% | 1.82% |

Visit www.fidelity.com for more recent performance information. |

The Fund's past performance is not a good predictor of the Fund's future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

KEY FACTS | ||

| Fund Size | $14,682,141,753 | |

| Number of Holdings | 623 | |

| Total Advisory Fee | $84,188,738 | |

| Portfolio Turnover | 41% |

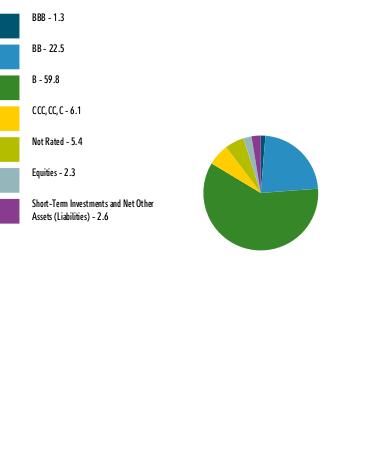

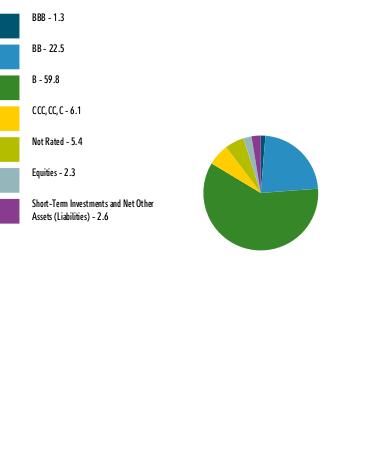

(as of October 31, 2024)

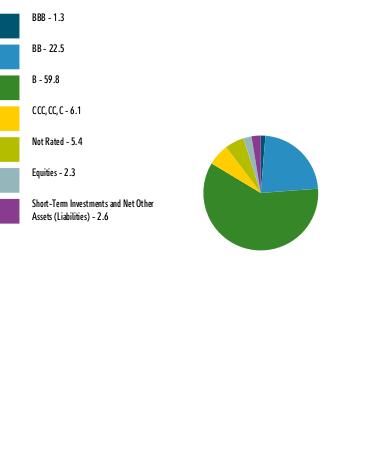

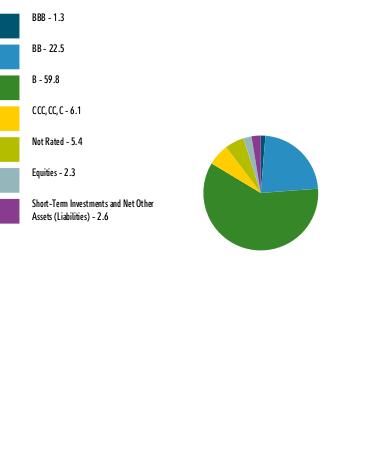

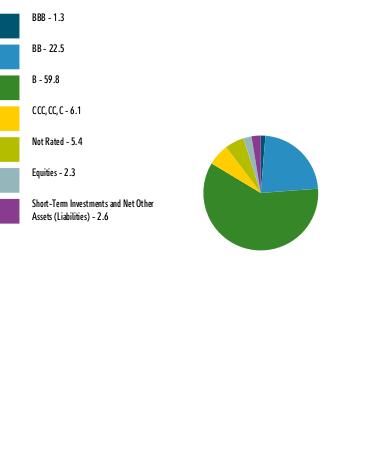

| BBB | 1.3 |

| BB | 22.5 |

| B | 59.8 |

| CCC,CC,C | 6.1 |

| Not Rated | 5.4 |

| Equities | 2.3 |

| Short-Term Investments and Net Other Assets (Liabilities) | 2.6 |

QUALITY DIVERSIFICATION (% of Fund's net assets) |

|

| We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes. |

| Bank Loan Obligations | 90.1 |

| Corporate Bonds | 4.5 |

| Common Stocks | 1.5 |

| Alternative Funds | 0.8 |

| Preferred Securities | 0.3 |

| Asset-Backed Securities | 0.2 |

| Short-Term Investments and Net Other Assets (Liabilities) | 2.6 |

ASSET ALLOCATION (% of Fund's net assets) |

|

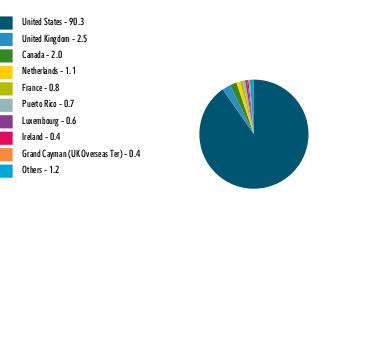

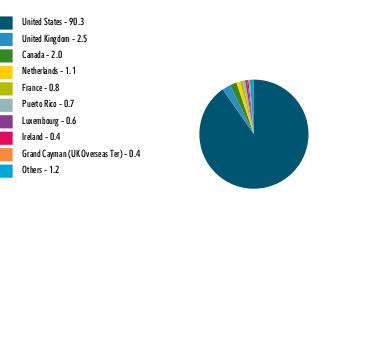

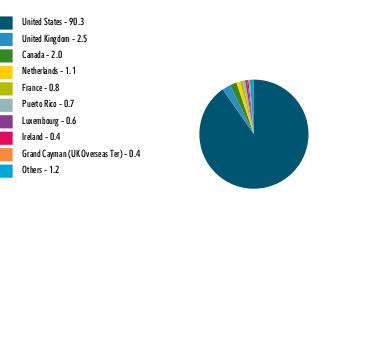

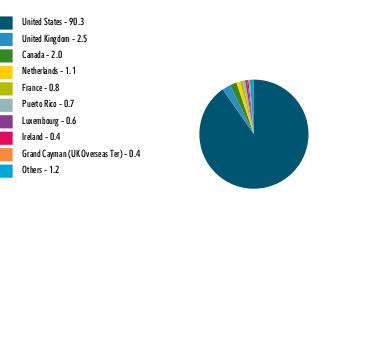

| United States | 90.3 |

| United Kingdom | 2.5 |

| Canada | 2.0 |

| Netherlands | 1.1 |

| France | 0.8 |

| Puerto Rico | 0.7 |

| Luxembourg | 0.6 |

| Ireland | 0.4 |

| Grand Cayman (UK Overseas Ter) | 0.4 |

| Others | 1.2 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

TOP HOLDINGS (% of Fund's net assets) | ||

| Asurion LLC | 2.2 | |

| Great Outdoors Group LLC | 2.2 | |

| Fertitta Entertainment LLC/NV | 1.2 | |

| Acrisure LLC | 1.2 | |

| Caesars Entertainment Inc | 1.2 | |

| Polaris Newco LLC | 1.0 | |

| MH Sub I LLC | 1.0 | |

| TransDigm Inc | 1.0 | |

| Medline Borrower LP | 0.9 | |

| UKG Inc | 0.9 | |

| 12.8 |

The fund's transfer agent and pricing & bookkeeping fees were changed to a fixed rate effective December 1, 2023, through February 29, 2024, in anticipation of the transition to a new management fee structure. Effective March 1, 2024, the fund's management contract was amended to incorporate administrative services previously covered under separate services agreements (transfer agent and pricing & bookkeeping). The amended contract incorporates a management fee rate that may vary by class. The Adviser or an affiliate pays certain expenses of managing and operating the fund out of each class's management fee. |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. | ||

| For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9913809.100 814-TSRA-1224 | |

ANNUAL SHAREHOLDER REPORT | AS OF OCTOBER 31, 2024 | This report describes changes to the Fund that occurred during the reporting period. | |

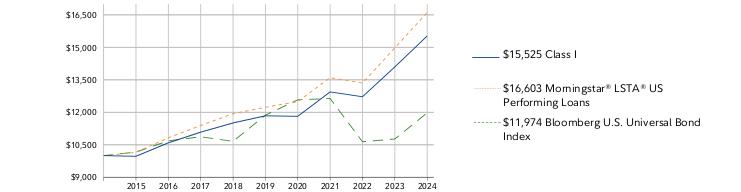

| | Fidelity Advisor® Floating Rate High Income Fund Fidelity Advisor® Floating Rate High Income Fund Class I : FFRIX | |

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | ||

| Class I | $ 72 | 0.68% |

Class I | $10,000 | $9,970 | $10,591 | $11,083 | $11,508 | $11,839 | $11,816 | $12,942 | $12,718 | $14,097 | $15,525 |

Morningstar® LSTA® US Performing Loans | $10,000 | $10,151 | $10,824 | $11,392 | $11,936 | $12,235 | $12,491 | $13,602 | $13,349 | $14,977 | $16,603 |

Bloomberg U.S. Universal Bond Index | $10,000 | $10,167 | $10,682 | $10,870 | $10,658 | $11,869 | $12,576 | $12,636 | $10,641 | $10,768 | $11,974 |

| 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

|

| 1 Year | 5 Year | 10 Year | |

| Class I | 10.13% | 5.57% | 4.50% |

| Morningstar® LSTA® US Performing Loans | 10.86% | 6.29% | 5.20% |

| Bloomberg U.S. Universal Bond Index | 11.20% | 0.18% | 1.82% |

Visit institutional.fidelity.com for more recent performance information. |

The Fund's past performance is not a good predictor of the Fund's future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

KEY FACTS | ||

| Fund Size | $14,682,141,753 | |

| Number of Holdings | 623 | |

| Total Advisory Fee | $84,188,738 | |

| Portfolio Turnover | 41% |

(as of October 31, 2024)

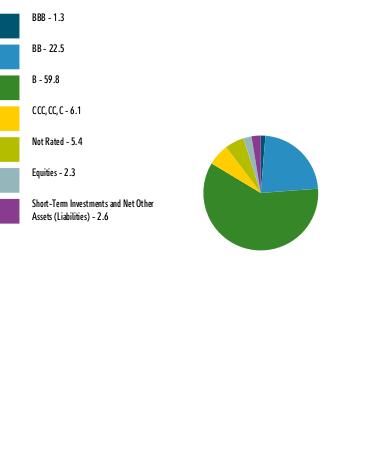

| BBB | 1.3 |

| BB | 22.5 |

| B | 59.8 |

| CCC,CC,C | 6.1 |

| Not Rated | 5.4 |

| Equities | 2.3 |

| Short-Term Investments and Net Other Assets (Liabilities) | 2.6 |

QUALITY DIVERSIFICATION (% of Fund's net assets) |

|

| We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes. |

| Bank Loan Obligations | 90.1 |

| Corporate Bonds | 4.5 |

| Common Stocks | 1.5 |

| Alternative Funds | 0.8 |

| Preferred Securities | 0.3 |

| Asset-Backed Securities | 0.2 |

| Short-Term Investments and Net Other Assets (Liabilities) | 2.6 |

ASSET ALLOCATION (% of Fund's net assets) |

|

| United States | 90.3 |

| United Kingdom | 2.5 |

| Canada | 2.0 |

| Netherlands | 1.1 |

| France | 0.8 |

| Puerto Rico | 0.7 |

| Luxembourg | 0.6 |

| Ireland | 0.4 |

| Grand Cayman (UK Overseas Ter) | 0.4 |

| Others | 1.2 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

TOP HOLDINGS (% of Fund's net assets) | ||

| Asurion LLC | 2.2 | |

| Great Outdoors Group LLC | 2.2 | |

| Fertitta Entertainment LLC/NV | 1.2 | |

| Acrisure LLC | 1.2 | |

| Caesars Entertainment Inc | 1.2 | |

| Polaris Newco LLC | 1.0 | |

| MH Sub I LLC | 1.0 | |

| TransDigm Inc | 1.0 | |

| Medline Borrower LP | 0.9 | |

| UKG Inc | 0.9 | |

| 12.8 |

The fund's transfer agent and pricing & bookkeeping fees were changed to a fixed rate effective December 1, 2023, through February 29, 2024, in anticipation of the transition to a new management fee structure. Effective March 1, 2024, the fund's management contract was amended to incorporate administrative services previously covered under separate services agreements (transfer agent and pricing & bookkeeping). The amended contract incorporates a management fee rate that may vary by class. The Adviser or an affiliate pays certain expenses of managing and operating the fund out of each class's management fee. |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. | ||

| For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9913807.100 279-TSRA-1224 | |

ANNUAL SHAREHOLDER REPORT | AS OF OCTOBER 31, 2024 | This report describes changes to the Fund that occurred during the reporting period. | |

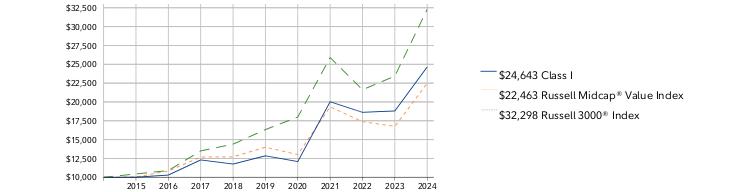

| | Fidelity Advisor® Value Fund Fidelity Advisor® Value Fund Class I : FVIFX | |

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | ||

| Class I | $ 104 | 0.90% |

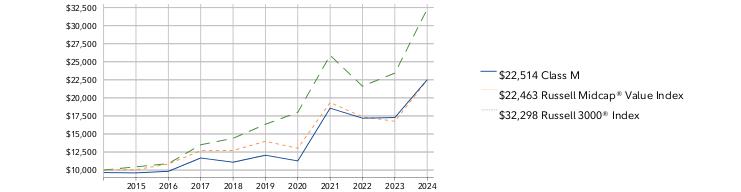

Class I | $10,000 | $10,013 | $10,295 | $12,307 | $11,755 | $12,852 | $12,087 | $20,026 | $18,626 | $18,806 | $24,643 |

Russell Midcap® Value Index | $10,000 | $10,047 | $10,834 | $12,689 | $12,710 | $13,990 | $13,020 | $19,347 | $17,379 | $16,759 | $22,463 |

Russell 3000® Index | $10,000 | $10,449 | $10,892 | $13,504 | $14,395 | $16,337 | $17,995 | $25,894 | $21,617 | $23,429 | $32,298 |

| 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

|

| 1 Year | 5 Year | 10 Year | |

| Class I | 31.04% | 13.90% | 9.44% |

| Russell Midcap® Value Index | 34.03% | 9.93% | 8.43% |

| Russell 3000® Index | 37.86% | 14.60% | 12.44% |

Visit institutional.fidelity.com for more recent performance information. |

The Fund's past performance is not a good predictor of the Fund's future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

KEY FACTS | ||

| Fund Size | $380,025,415 | |

| Number of Holdings | 268 | |

| Total Advisory Fee | $2,906,123 | |

| Portfolio Turnover | 80% |

(as of October 31, 2024)

MARKET SECTORS (% of Fund's net assets) | ||

| Industrials | 19.2 | |

| Financials | 16.7 | |

| Consumer Discretionary | 10.3 | |

| Materials | 10.3 | |

| Energy | 9.2 | |

| Health Care | 8.8 | |

| Utilities | 6.9 | |

| Real Estate | 5.3 | |

| Consumer Staples | 5.2 | |

| Information Technology | 4.3 | |

| Communication Services | 2.8 | |

| Common Stocks | 99.0 |

| Short-Term Investments and Net Other Assets (Liabilities) | 1.0 |

ASSET ALLOCATION (% of Fund's net assets) |

|

| United States | 86.3 |

| Canada | 6.0 |

| United Kingdom | 1.2 |

| Germany | 1.1 |

| Puerto Rico | 0.6 |

| Belgium | 0.6 |

| Zambia | 0.6 |

| India | 0.5 |

| France | 0.5 |

| Others | 2.6 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

TOP HOLDINGS (% of Fund's net assets) | ||

| PG&E Corp | 1.2 | |

| Vistra Corp | 1.2 | |

| Ventas Inc | 1.0 | |

| Global Payments Inc | 1.0 | |

| Molina Healthcare Inc | 0.9 | |

| Smurfit WestRock PLC | 0.9 | |

| Lithia Motors Inc Class A | 0.9 | |

| Lumentum Holdings Inc | 0.8 | |

| International Paper Co | 0.8 | |

| Lamb Weston Holdings Inc | 0.8 | |

| 9.5 |

The fund's transfer agent and pricing & bookkeeping fees were changed to a fixed rate effective December 1, 2023, through February 29, 2024, in anticipation of the transition to a new management fee structure. Effective March 1, 2024, the fund's management contract was amended to incorporate administrative services previously covered under separate services agreements (transfer agent and pricing & bookkeeping). The amended contract incorporates a basic fee rate that may vary by class (subject to a performance adjustment). The Adviser or an affiliate pays certain expenses of managing and operating the fund out of each class's management fee. |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. | ||

| For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9913928.100 1320-TSRA-1224 | |

ANNUAL SHAREHOLDER REPORT | AS OF OCTOBER 31, 2024 | This report describes changes to the Fund that occurred during the reporting period. | |

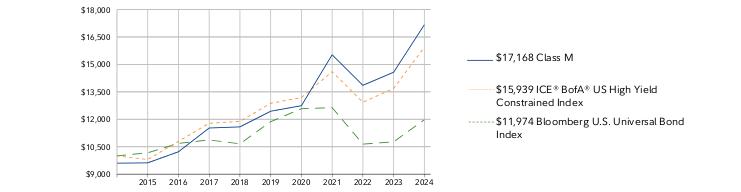

| | Fidelity Advisor® High Income Advantage Fund Fidelity Advisor® High Income Advantage Fund Class M : FAHYX | |

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | ||

| Class M | $ 104 | 0.96% |

Class M | $9,600 | $9,617 | $10,223 | $11,523 | $11,584 | $12,440 | $12,742 | $15,525 | $13,856 | $14,572 | $17,168 |

ICE® BofA® US High Yield Constrained Index | $10,000 | $9,797 | $10,795 | $11,781 | $11,883 | $12,872 | $13,187 | $14,602 | $12,932 | $13,683 | $15,939 |

Bloomberg U.S. Universal Bond Index | $10,000 | $10,167 | $10,682 | $10,870 | $10,658 | $11,869 | $12,576 | $12,636 | $10,641 | $10,768 | $11,974 |

| 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

|

| 1 Year | 5 Year | 10 Year | |

| Class M (incl. 4.00% sales charge) | 13.10% | 5.79% | 5.55% |

| Class M (without 4.00% sales charge) | 17.82% | 6.65% | 5.98% |

| ICE® BofA® US High Yield Constrained Index | 16.49% | 4.37% | 4.77% |

| Bloomberg U.S. Universal Bond Index | 11.20% | 0.18% | 1.82% |

Visit institutional.fidelity.com for more recent performance information. |

The Fund's past performance is not a good predictor of the Fund's future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

KEY FACTS | ||

| Fund Size | $2,310,946,691 | |

| Number of Holdings | 717 | |

| Total Advisory Fee | $13,652,978 | |

| Portfolio Turnover | 29% |

(as of October 31, 2024)

| BBB | 4.8 |

| BB | 20.7 |

| B | 30.9 |

| CCC,CC,C | 6.6 |

| Not Rated | 2.9 |

| Equities | 22.3 |

| Short-Term Investments and Net Other Assets (Liabilities) | 11.8 |

QUALITY DIVERSIFICATION (% of Fund's net assets) |

|

| We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes. |

| Corporate Bonds | 51.5 |

| Common Stocks | 20.1 |

| Bank Loan Obligations | 10.1 |

| Preferred Securities | 4.1 |

| Alternative Funds | 2.2 |

| Asset-Backed Securities | 0.2 |

| Short-Term Investments and Net Other Assets (Liabilities) | 11.8 |

ASSET ALLOCATION (% of Fund's net assets) |

|

| United States | 91.1 |

| Canada | 1.9 |

| United Kingdom | 1.8 |

| France | 1.4 |

| Netherlands | 0.5 |

| China | 0.5 |

| Luxembourg | 0.4 |

| Zambia | 0.4 |

| Taiwan | 0.3 |

| Others | 1.7 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

TOP HOLDINGS (% of Fund's net assets) | ||

| TransDigm Inc | 2.6 | |

| Fidelity Private Credit Company LLC | 2.2 | |

| Energy Transfer LP | 2.1 | |

| NVIDIA Corp | 1.4 | |

| Tenet Healthcare Corp | 1.4 | |

| LBM Acquisition LLC | 1.2 | |

| Altice France SA | 1.1 | |

| eG Global Finance PLC | 1.1 | |

| Carnival Corp | 1.1 | |

| Meta Platforms Inc Class A | 1.1 | |

| 15.3 |

The fund's transfer agent and pricing and bookkeeping fees were changed to a fixed rate effective December 1, 2023, through February 29, 2024, in anticipation of the transition to a new management fee structure. Effective March 1, 2024, the fund's management contract was amended to incorporate administrative services previously covered under separate services agreements (transfer agent and pricing and bookkeeping). The amended contract incorporates a management fee rate that may vary by class. The Adviser or an affiliate pays certain expenses of managing and operating the fund out of each class's management fee. |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. | ||

| For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9913813.100 218-TSRA-1224 | |

ANNUAL SHAREHOLDER REPORT | AS OF OCTOBER 31, 2024 | This report describes changes to the Fund that occurred during the reporting period. | |

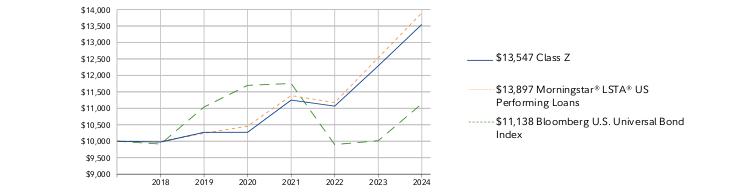

| | Fidelity Advisor® Floating Rate High Income Fund Fidelity Advisor® Floating Rate High Income Fund Class Z : FIQSX | |

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | ||

| Class Z | $ 61 | 0.58% |

Class Z | $10,000 | $9,974 | $10,271 | $10,272 | $11,249 | $11,066 | $12,289 |

Morningstar® LSTA® US Performing Loans | $10,000 | $9,991 | $10,242 | $10,456 | $11,386 | $11,174 | $12,536 |

Bloomberg U.S. Universal Bond Index | $10,000 | $9,913 | $11,039 | $11,697 | $11,754 | $9,898 | $10,016 |

| 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

|

| 1 Year | 5 Year | Life of Fund A | |

| Class Z | 10.24% | 5.69% | 5.12% |

| Morningstar® LSTA® US Performing Loans | 10.86% | 6.29% | 5.56% |

| Bloomberg U.S. Universal Bond Index | 11.20% | 0.18% | 1.79% |

Visit institutional.fidelity.com for more recent performance information. |

The Fund's past performance is not a good predictor of the Fund's future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

KEY FACTS | ||

| Fund Size | $14,682,141,753 | |

| Number of Holdings | 623 | |

| Total Advisory Fee | $84,188,738 | |

| Portfolio Turnover | 41% |

(as of October 31, 2024)

| BBB | 1.3 |

| BB | 22.5 |

| B | 59.8 |

| CCC,CC,C | 6.1 |

| Not Rated | 5.4 |

| Equities | 2.3 |

| Short-Term Investments and Net Other Assets (Liabilities) | 2.6 |

QUALITY DIVERSIFICATION (% of Fund's net assets) |

|

| We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes. |

| Bank Loan Obligations | 90.1 |

| Corporate Bonds | 4.5 |

| Common Stocks | 1.5 |

| Alternative Funds | 0.8 |

| Preferred Securities | 0.3 |

| Asset-Backed Securities | 0.2 |

| Short-Term Investments and Net Other Assets (Liabilities) | 2.6 |

ASSET ALLOCATION (% of Fund's net assets) |

|

| United States | 90.3 |

| United Kingdom | 2.5 |

| Canada | 2.0 |

| Netherlands | 1.1 |

| France | 0.8 |

| Puerto Rico | 0.7 |

| Luxembourg | 0.6 |

| Ireland | 0.4 |

| Grand Cayman (UK Overseas Ter) | 0.4 |

| Others | 1.2 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

TOP HOLDINGS (% of Fund's net assets) | ||

| Asurion LLC | 2.2 | |

| Great Outdoors Group LLC | 2.2 | |

| Fertitta Entertainment LLC/NV | 1.2 | |

| Acrisure LLC | 1.2 | |

| Caesars Entertainment Inc | 1.2 | |

| Polaris Newco LLC | 1.0 | |

| MH Sub I LLC | 1.0 | |

| TransDigm Inc | 1.0 | |

| Medline Borrower LP | 0.9 | |

| UKG Inc | 0.9 | |

| 12.8 |

The fund's transfer agent and pricing & bookkeeping fees were changed to a fixed rate effective December 1, 2023, through February 29, 2024, in anticipation of the transition to a new management fee structure. Effective March 1, 2024, the fund's management contract was amended to incorporate administrative services previously covered under separate services agreements (transfer agent and pricing & bookkeeping). The amended contract incorporates a management fee rate that may vary by class. The Adviser or an affiliate pays certain expenses of managing and operating the fund out of each class's management fee. |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. | ||

| For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9913808.100 3277-TSRA-1224 | |

ANNUAL SHAREHOLDER REPORT | AS OF OCTOBER 31, 2024 | This report describes changes to the Fund that occurred during the reporting period. | |

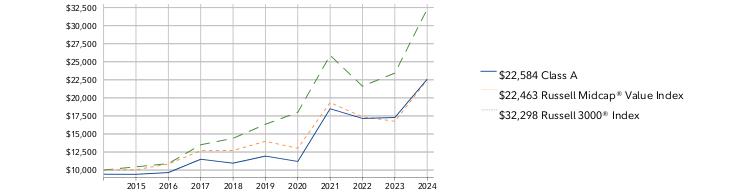

| | Fidelity Advisor® Value Fund Fidelity Advisor® Value Fund Class A : FAVFX | |

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | ||

| Class A | $ 133 | 1.15% |

Class A | $9,425 | $9,414 | $9,652 | $11,497 | $10,953 | $11,939 | $11,194 | $18,493 | $17,152 | $17,277 | $22,584 |

Russell Midcap® Value Index | $10,000 | $10,047 | $10,834 | $12,689 | $12,710 | $13,990 | $13,020 | $19,347 | $17,379 | $16,759 | $22,463 |

Russell 3000® Index | $10,000 | $10,449 | $10,892 | $13,504 | $14,395 | $16,337 | $17,995 | $25,894 | $21,617 | $23,429 | $32,298 |

| 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

|

| 1 Year | 5 Year | 10 Year | |

| Class A (incl. 5.75% sales charge) | 23.20% | 12.26% | 8.49% |

| Class A (without 5.75% sales charge) | 30.72% | 13.60% | 9.13% |

| Russell Midcap® Value Index | 34.03% | 9.93% | 8.43% |

| Russell 3000® Index | 37.86% | 14.60% | 12.44% |

Visit institutional.fidelity.com for more recent performance information. |

The Fund's past performance is not a good predictor of the Fund's future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

KEY FACTS | ||

| Fund Size | $380,025,415 | |

| Number of Holdings | 268 | |

| Total Advisory Fee | $2,906,123 | |

| Portfolio Turnover | 80% |

(as of October 31, 2024)

MARKET SECTORS (% of Fund's net assets) | ||

| Industrials | 19.2 | |

| Financials | 16.7 | |

| Consumer Discretionary | 10.3 | |

| Materials | 10.3 | |

| Energy | 9.2 | |

| Health Care | 8.8 | |

| Utilities | 6.9 | |

| Real Estate | 5.3 | |

| Consumer Staples | 5.2 | |

| Information Technology | 4.3 | |

| Communication Services | 2.8 | |

| Common Stocks | 99.0 |

| Short-Term Investments and Net Other Assets (Liabilities) | 1.0 |

ASSET ALLOCATION (% of Fund's net assets) |

|

| United States | 86.3 |

| Canada | 6.0 |

| United Kingdom | 1.2 |

| Germany | 1.1 |

| Puerto Rico | 0.6 |

| Belgium | 0.6 |

| Zambia | 0.6 |

| India | 0.5 |

| France | 0.5 |

| Others | 2.6 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

TOP HOLDINGS (% of Fund's net assets) | ||

| PG&E Corp | 1.2 | |

| Vistra Corp | 1.2 | |

| Ventas Inc | 1.0 | |

| Global Payments Inc | 1.0 | |

| Molina Healthcare Inc | 0.9 | |

| Smurfit WestRock PLC | 0.9 | |

| Lithia Motors Inc Class A | 0.9 | |

| Lumentum Holdings Inc | 0.8 | |

| International Paper Co | 0.8 | |

| Lamb Weston Holdings Inc | 0.8 | |

| 9.5 |

The fund's transfer agent and pricing & bookkeeping fees were changed to a fixed rate effective December 1, 2023, through February 29, 2024, in anticipation of the transition to a new management fee structure. Effective March 1, 2024, the fund's management contract was amended to incorporate administrative services previously covered under separate services agreements (transfer agent and pricing & bookkeeping). The amended contract incorporates a basic fee rate that may vary by class (subject to a performance adjustment). The Adviser or an affiliate pays certain expenses of managing and operating the fund out of each class's management fee. |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. | ||

| For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9913925.100 1316-TSRA-1224 | |

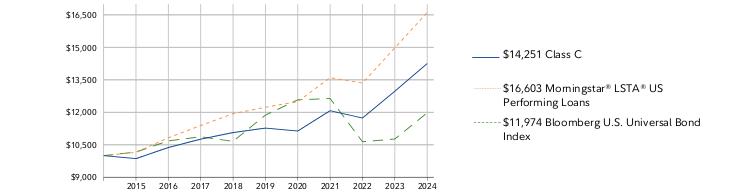

ANNUAL SHAREHOLDER REPORT | AS OF OCTOBER 31, 2024 | This report describes changes to the Fund that occurred during the reporting period. | |

| | Fidelity Advisor® Value Fund Fidelity Advisor® Value Fund Class C : FCVFX | |

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | ||

| Class C | $ 218 | 1.90% |

Class C | $10,000 | $9,911 | $10,082 | $11,917 | $11,256 | $12,171 | $11,317 | $18,557 | $17,084 | $17,208 | $22,494 |

Russell Midcap® Value Index | $10,000 | $10,047 | $10,834 | $12,689 | $12,710 | $13,990 | $13,020 | $19,347 | $17,379 | $16,759 | $22,463 |

Russell 3000® Index | $10,000 | $10,449 | $10,892 | $13,504 | $14,395 | $16,337 | $17,995 | $25,894 | $21,617 | $23,429 | $32,298 |

| 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

|

| 1 Year | 5 Year | 10 Year | |

| Class C (incl. contingent deferred sales charge) | 28.70% | 12.73% | 8.44% |

| Class C | 29.70% | 12.73% | 8.44% |

| Russell Midcap® Value Index | 34.03% | 9.93% | 8.43% |

| Russell 3000® Index | 37.86% | 14.60% | 12.44% |

Visit institutional.fidelity.com for more recent performance information. |

The Fund's past performance is not a good predictor of the Fund's future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

KEY FACTS | ||

| Fund Size | $380,025,415 | |

| Number of Holdings | 268 | |

| Total Advisory Fee | $2,906,123 | |

| Portfolio Turnover | 80% |

(as of October 31, 2024)

MARKET SECTORS (% of Fund's net assets) | ||

| Industrials | 19.2 | |

| Financials | 16.7 | |

| Consumer Discretionary | 10.3 | |

| Materials | 10.3 | |

| Energy | 9.2 | |

| Health Care | 8.8 | |

| Utilities | 6.9 | |

| Real Estate | 5.3 | |

| Consumer Staples | 5.2 | |

| Information Technology | 4.3 | |

| Communication Services | 2.8 | |

| Common Stocks | 99.0 |

| Short-Term Investments and Net Other Assets (Liabilities) | 1.0 |

ASSET ALLOCATION (% of Fund's net assets) |

|

| United States | 86.3 |

| Canada | 6.0 |

| United Kingdom | 1.2 |

| Germany | 1.1 |

| Puerto Rico | 0.6 |

| Belgium | 0.6 |

| Zambia | 0.6 |

| India | 0.5 |

| France | 0.5 |

| Others | 2.6 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

TOP HOLDINGS (% of Fund's net assets) | ||

| PG&E Corp | 1.2 | |

| Vistra Corp | 1.2 | |

| Ventas Inc | 1.0 | |

| Global Payments Inc | 1.0 | |

| Molina Healthcare Inc | 0.9 | |

| Smurfit WestRock PLC | 0.9 | |

| Lithia Motors Inc Class A | 0.9 | |

| Lumentum Holdings Inc | 0.8 | |

| International Paper Co | 0.8 | |

| Lamb Weston Holdings Inc | 0.8 | |

| 9.5 |

The fund's transfer agent and pricing & bookkeeping fees were changed to a fixed rate effective December 1, 2023, through February 29, 2024, in anticipation of the transition to a new management fee structure. Effective March 1, 2024, the fund's management contract was amended to incorporate administrative services previously covered under separate services agreements (transfer agent and pricing & bookkeeping). The amended contract incorporates a basic fee rate that may vary by class (subject to a performance adjustment). The Adviser or an affiliate pays certain expenses of managing and operating the fund out of each class's management fee. |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. | ||

| For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9913926.100 1318-TSRA-1224 | |

ANNUAL SHAREHOLDER REPORT | AS OF OCTOBER 31, 2024 | This report describes changes to the Fund that occurred during the reporting period. | |

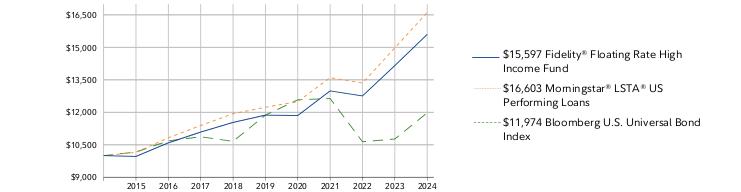

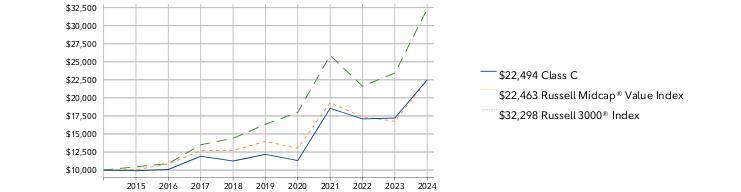

| | Fidelity Advisor® Floating Rate High Income Fund Fidelity Advisor® Floating Rate High Income Fund Class A : FFRAX | |

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | ||

| Class A | $ 99 | 0.94% |

Class A | $9,725 | $9,674 | $10,252 | $10,703 | $11,089 | $11,380 | $11,329 | $12,376 | $12,133 | $13,413 | $14,733 |

Morningstar® LSTA® US Performing Loans | $10,000 | $10,151 | $10,824 | $11,392 | $11,936 | $12,235 | $12,491 | $13,602 | $13,349 | $14,977 | $16,603 |

Bloomberg U.S. Universal Bond Index | $10,000 | $10,167 | $10,682 | $10,870 | $10,658 | $11,869 | $12,576 | $12,636 | $10,641 | $10,768 | $11,974 |

| 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

|

| 1 Year | 5 Year | 10 Year | |

| Class A (incl. 2.75% sales charge) | 6.82% | 4.72% | 3.95% |

| Class A (without 2.75% sales charge) | 9.85% | 5.30% | 4.24% |

| Morningstar® LSTA® US Performing Loans | 10.86% | 6.29% | 5.20% |

| Bloomberg U.S. Universal Bond Index | 11.20% | 0.18% | 1.82% |

Visit institutional.fidelity.com for more recent performance information. |

The Fund's past performance is not a good predictor of the Fund's future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

KEY FACTS | ||

| Fund Size | $14,682,141,753 | |

| Number of Holdings | 623 | |

| Total Advisory Fee | $84,188,738 | |

| Portfolio Turnover | 41% |

(as of October 31, 2024)

| BBB | 1.3 |

| BB | 22.5 |

| B | 59.8 |

| CCC,CC,C | 6.1 |

| Not Rated | 5.4 |

| Equities | 2.3 |

| Short-Term Investments and Net Other Assets (Liabilities) | 2.6 |

QUALITY DIVERSIFICATION (% of Fund's net assets) |

|

| We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes. |

| Bank Loan Obligations | 90.1 |

| Corporate Bonds | 4.5 |

| Common Stocks | 1.5 |

| Alternative Funds | 0.8 |

| Preferred Securities | 0.3 |

| Asset-Backed Securities | 0.2 |

| Short-Term Investments and Net Other Assets (Liabilities) | 2.6 |

ASSET ALLOCATION (% of Fund's net assets) |

|

| United States | 90.3 |

| United Kingdom | 2.5 |

| Canada | 2.0 |

| Netherlands | 1.1 |

| France | 0.8 |

| Puerto Rico | 0.7 |

| Luxembourg | 0.6 |

| Ireland | 0.4 |

| Grand Cayman (UK Overseas Ter) | 0.4 |

| Others | 1.2 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

TOP HOLDINGS (% of Fund's net assets) | ||

| Asurion LLC | 2.2 | |

| Great Outdoors Group LLC | 2.2 | |

| Fertitta Entertainment LLC/NV | 1.2 | |

| Acrisure LLC | 1.2 | |

| Caesars Entertainment Inc | 1.2 | |

| Polaris Newco LLC | 1.0 | |

| MH Sub I LLC | 1.0 | |

| TransDigm Inc | 1.0 | |

| Medline Borrower LP | 0.9 | |

| UKG Inc | 0.9 | |

| 12.8 |

The fund's transfer agent and pricing & bookkeeping fees were changed to a fixed rate effective December 1, 2023, through February 29, 2024, in anticipation of the transition to a new management fee structure. Effective March 1, 2024, the fund's management contract was amended to incorporate administrative services previously covered under separate services agreements (transfer agent and pricing & bookkeeping). The amended contract incorporates a management fee rate that may vary by class. The Adviser or an affiliate pays certain expenses of managing and operating the fund out of each class's management fee. |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. | ||

| For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9913810.100 861-TSRA-1224 | |

ANNUAL SHAREHOLDER REPORT | AS OF OCTOBER 31, 2024 | This report describes changes to the Fund that occurred during the reporting period. | |

| | Fidelity Advisor® High Income Advantage Fund Fidelity Advisor® High Income Advantage Fund Class I : FAHCX | |

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | ||

| Class I | $ 80 | 0.73% |

Class I | $10,000 | $10,031 | $10,686 | $12,082 | $12,178 | $13,113 | $13,466 | $16,447 | $14,710 | $15,497 | $18,315 |

ICE® BofA® US High Yield Constrained Index | $10,000 | $9,797 | $10,795 | $11,781 | $11,883 | $12,872 | $13,187 | $14,602 | $12,932 | $13,683 | $15,939 |

Bloomberg U.S. Universal Bond Index | $10,000 | $10,167 | $10,682 | $10,870 | $10,658 | $11,869 | $12,576 | $12,636 | $10,641 | $10,768 | $11,974 |

| 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

|

| 1 Year | 5 Year | 10 Year | |

| Class I | 18.18% | 6.91% | 6.24% |

| ICE® BofA® US High Yield Constrained Index | 16.49% | 4.37% | 4.77% |

| Bloomberg U.S. Universal Bond Index | 11.20% | 0.18% | 1.82% |

Visit institutional.fidelity.com for more recent performance information. |

The Fund's past performance is not a good predictor of the Fund's future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

KEY FACTS | ||

| Fund Size | $2,310,946,691 | |

| Number of Holdings | 717 | |

| Total Advisory Fee | $13,652,978 | |

| Portfolio Turnover | 29% |

(as of October 31, 2024)

| BBB | 4.8 |

| BB | 20.7 |

| B | 30.9 |

| CCC,CC,C | 6.6 |

| Not Rated | 2.9 |

| Equities | 22.3 |

| Short-Term Investments and Net Other Assets (Liabilities) | 11.8 |

QUALITY DIVERSIFICATION (% of Fund's net assets) |

|

| We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes. |

| Corporate Bonds | 51.5 |

| Common Stocks | 20.1 |

| Bank Loan Obligations | 10.1 |

| Preferred Securities | 4.1 |

| Alternative Funds | 2.2 |

| Asset-Backed Securities | 0.2 |

| Short-Term Investments and Net Other Assets (Liabilities) | 11.8 |

ASSET ALLOCATION (% of Fund's net assets) |

|

| United States | 91.1 |

| Canada | 1.9 |

| United Kingdom | 1.8 |

| France | 1.4 |

| Netherlands | 0.5 |

| China | 0.5 |

| Luxembourg | 0.4 |

| Zambia | 0.4 |

| Taiwan | 0.3 |

| Others | 1.7 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

TOP HOLDINGS (% of Fund's net assets) | ||

| TransDigm Inc | 2.6 | |

| Fidelity Private Credit Company LLC | 2.2 | |

| Energy Transfer LP | 2.1 | |

| NVIDIA Corp | 1.4 | |

| Tenet Healthcare Corp | 1.4 | |

| LBM Acquisition LLC | 1.2 | |

| Altice France SA | 1.1 | |

| eG Global Finance PLC | 1.1 | |

| Carnival Corp | 1.1 | |

| Meta Platforms Inc Class A | 1.1 | |

| 15.3 |

The fund's transfer agent and pricing and bookkeeping fees were changed to a fixed rate effective December 1, 2023, through February 29, 2024, in anticipation of the transition to a new management fee structure. Effective March 1, 2024, the fund's management contract was amended to incorporate administrative services previously covered under separate services agreements (transfer agent and pricing and bookkeeping). The amended contract incorporates a management fee rate that may vary by class. The Adviser or an affiliate pays certain expenses of managing and operating the fund out of each class's management fee. |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. | ||

| For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9913817.100 644-TSRA-1224 | |

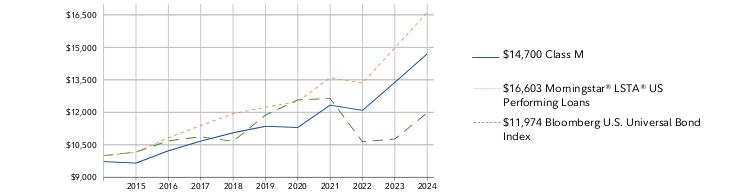

ANNUAL SHAREHOLDER REPORT | AS OF OCTOBER 31, 2024 | This report describes changes to the Fund that occurred during the reporting period. | |

| | Fidelity Advisor® Floating Rate High Income Fund Fidelity Advisor® Floating Rate High Income Fund Class M : FFRTX | |

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | ||

| Class M | $ 97 | 0.93% |

Class M | $9,725 | $9,655 | $10,223 | $10,670 | $11,053 | $11,354 | $11,301 | $12,332 | $12,089 | $13,381 | $14,700 |

Morningstar® LSTA® US Performing Loans | $10,000 | $10,151 | $10,824 | $11,392 | $11,936 | $12,235 | $12,491 | $13,602 | $13,349 | $14,977 | $16,603 |

Bloomberg U.S. Universal Bond Index | $10,000 | $10,167 | $10,682 | $10,870 | $10,658 | $11,869 | $12,576 | $12,636 | $10,641 | $10,768 | $11,974 |

| 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

|

| 1 Year | 5 Year | 10 Year | |

| Class M (incl. 2.75% sales charge) | 6.84% | 4.72% | 3.93% |

| Class M (without 2.75% sales charge) | 9.86% | 5.30% | 4.22% |

| Morningstar® LSTA® US Performing Loans | 10.86% | 6.29% | 5.20% |

| Bloomberg U.S. Universal Bond Index | 11.20% | 0.18% | 1.82% |

Visit institutional.fidelity.com for more recent performance information. |

The Fund's past performance is not a good predictor of the Fund's future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

KEY FACTS | ||

| Fund Size | $14,682,141,753 | |

| Number of Holdings | 623 | |

| Total Advisory Fee | $84,188,738 | |

| Portfolio Turnover | 41% |

(as of October 31, 2024)

| BBB | 1.3 |

| BB | 22.5 |

| B | 59.8 |

| CCC,CC,C | 6.1 |

| Not Rated | 5.4 |

| Equities | 2.3 |

| Short-Term Investments and Net Other Assets (Liabilities) | 2.6 |

QUALITY DIVERSIFICATION (% of Fund's net assets) |

|

| We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes. |

| Bank Loan Obligations | 90.1 |

| Corporate Bonds | 4.5 |

| Common Stocks | 1.5 |

| Alternative Funds | 0.8 |

| Preferred Securities | 0.3 |

| Asset-Backed Securities | 0.2 |

| Short-Term Investments and Net Other Assets (Liabilities) | 2.6 |

ASSET ALLOCATION (% of Fund's net assets) |

|

| United States | 90.3 |

| United Kingdom | 2.5 |

| Canada | 2.0 |

| Netherlands | 1.1 |

| France | 0.8 |

| Puerto Rico | 0.7 |

| Luxembourg | 0.6 |

| Ireland | 0.4 |

| Grand Cayman (UK Overseas Ter) | 0.4 |

| Others | 1.2 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

TOP HOLDINGS (% of Fund's net assets) | ||

| Asurion LLC | 2.2 | |

| Great Outdoors Group LLC | 2.2 | |

| Fertitta Entertainment LLC/NV | 1.2 | |

| Acrisure LLC | 1.2 | |

| Caesars Entertainment Inc | 1.2 | |

| Polaris Newco LLC | 1.0 | |

| MH Sub I LLC | 1.0 | |

| TransDigm Inc | 1.0 | |

| Medline Borrower LP | 0.9 | |

| UKG Inc | 0.9 | |

| 12.8 |

The fund's transfer agent and pricing & bookkeeping fees were changed to a fixed rate effective December 1, 2023, through February 29, 2024, in anticipation of the transition to a new management fee structure. Effective March 1, 2024, the fund's management contract was amended to incorporate administrative services previously covered under separate services agreements (transfer agent and pricing & bookkeeping). The amended contract incorporates a management fee rate that may vary by class. The Adviser or an affiliate pays certain expenses of managing and operating the fund out of each class's management fee. |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. | ||

| For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9913812.100 872-TSRA-1224 | |

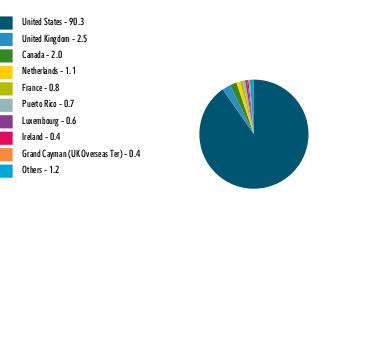

ANNUAL SHAREHOLDER REPORT | AS OF OCTOBER 31, 2024 | This report describes changes to the Fund that occurred during the reporting period. | |

| | Fidelity Advisor® Floating Rate High Income Fund Fidelity Advisor® Floating Rate High Income Fund Class C : FFRCX | |

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | ||

| Class C | $ 177 | 1.69% |

Class C | $10,000 | $9,862 | $10,374 | $10,761 | $11,065 | $11,271 | $11,137 | $12,075 | $11,736 | $12,974 | $14,251 |

Morningstar® LSTA® US Performing Loans | $10,000 | $10,151 | $10,824 | $11,392 | $11,936 | $12,235 | $12,491 | $13,602 | $13,349 | $14,977 | $16,603 |

Bloomberg U.S. Universal Bond Index | $10,000 | $10,167 | $10,682 | $10,870 | $10,658 | $11,869 | $12,576 | $12,636 | $10,641 | $10,768 | $11,974 |

| 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

|

| 1 Year | 5 Year | 10 Year | |

| Class C (incl. contingent deferred sales charge) | 8.03% | 4.51% | 3.61% |

| Class C | 9.03% | 4.51% | 3.61% |

| Morningstar® LSTA® US Performing Loans | 10.86% | 6.29% | 5.20% |

| Bloomberg U.S. Universal Bond Index | 11.20% | 0.18% | 1.82% |

Visit institutional.fidelity.com for more recent performance information. |

The Fund's past performance is not a good predictor of the Fund's future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

KEY FACTS | ||

| Fund Size | $14,682,141,753 | |

| Number of Holdings | 623 | |

| Total Advisory Fee | $84,188,738 | |

| Portfolio Turnover | 41% |

(as of October 31, 2024)

| BBB | 1.3 |

| BB | 22.5 |

| B | 59.8 |

| CCC,CC,C | 6.1 |

| Not Rated | 5.4 |

| Equities | 2.3 |

| Short-Term Investments and Net Other Assets (Liabilities) | 2.6 |

QUALITY DIVERSIFICATION (% of Fund's net assets) |

|

| We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes. |

| Bank Loan Obligations | 90.1 |

| Corporate Bonds | 4.5 |

| Common Stocks | 1.5 |

| Alternative Funds | 0.8 |

| Preferred Securities | 0.3 |

| Asset-Backed Securities | 0.2 |

| Short-Term Investments and Net Other Assets (Liabilities) | 2.6 |

ASSET ALLOCATION (% of Fund's net assets) |

|

| United States | 90.3 |

| United Kingdom | 2.5 |

| Canada | 2.0 |

| Netherlands | 1.1 |

| France | 0.8 |

| Puerto Rico | 0.7 |

| Luxembourg | 0.6 |

| Ireland | 0.4 |

| Grand Cayman (UK Overseas Ter) | 0.4 |

| Others | 1.2 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

TOP HOLDINGS (% of Fund's net assets) | ||

| Asurion LLC | 2.2 | |

| Great Outdoors Group LLC | 2.2 | |

| Fertitta Entertainment LLC/NV | 1.2 | |

| Acrisure LLC | 1.2 | |

| Caesars Entertainment Inc | 1.2 | |

| Polaris Newco LLC | 1.0 | |

| MH Sub I LLC | 1.0 | |

| TransDigm Inc | 1.0 | |

| Medline Borrower LP | 0.9 | |

| UKG Inc | 0.9 | |

| 12.8 |

The fund's transfer agent and pricing & bookkeeping fees were changed to a fixed rate effective December 1, 2023, through February 29, 2024, in anticipation of the transition to a new management fee structure. Effective March 1, 2024, the fund's management contract was amended to incorporate administrative services previously covered under separate services agreements (transfer agent and pricing & bookkeeping). The amended contract incorporates a management fee rate that may vary by class. The Adviser or an affiliate pays certain expenses of managing and operating the fund out of each class's management fee. |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. | ||

| For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9913811.100 871-TSRA-1224 | |

ANNUAL SHAREHOLDER REPORT | AS OF OCTOBER 31, 2024 | This report describes changes to the Fund that occurred during the reporting period. | |

| | Fidelity Advisor® Value Fund Fidelity Advisor® Value Fund Class M : FTVFX | |

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | ||

| Class M | $ 161 | 1.40% |

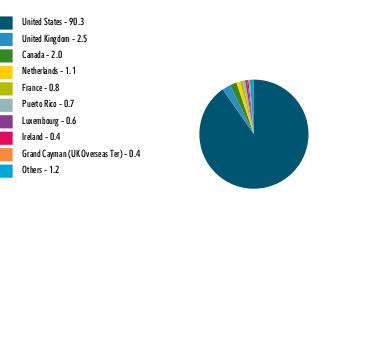

Class M | $9,650 | $9,608 | $9,827 | $11,673 | $11,088 | $12,058 | $11,268 | $18,571 | $17,186 | $17,271 | $22,514 |

Russell Midcap® Value Index | $10,000 | $10,047 | $10,834 | $12,689 | $12,710 | $13,990 | $13,020 | $19,347 | $17,379 | $16,759 | $22,463 |

Russell 3000® Index | $10,000 | $10,449 | $10,892 | $13,504 | $14,395 | $16,337 | $17,995 | $25,894 | $21,617 | $23,429 | $32,298 |

| 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

|

| 1 Year | 5 Year | 10 Year | |

| Class M (incl. 3.50% sales charge) | 25.80% | 12.50% | 8.45% |

| Class M (without 3.50% sales charge) | 30.36% | 13.30% | 8.84% |

| Russell Midcap® Value Index | 34.03% | 9.93% | 8.43% |

| Russell 3000® Index | 37.86% | 14.60% | 12.44% |

Visit institutional.fidelity.com for more recent performance information. |

The Fund's past performance is not a good predictor of the Fund's future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

KEY FACTS | ||

| Fund Size | $380,025,415 | |

| Number of Holdings | 268 | |

| Total Advisory Fee | $2,906,123 | |

| Portfolio Turnover | 80% |

(as of October 31, 2024)

MARKET SECTORS (% of Fund's net assets) | ||

| Industrials | 19.2 | |

| Financials | 16.7 | |

| Consumer Discretionary | 10.3 | |

| Materials | 10.3 | |

| Energy | 9.2 | |

| Health Care | 8.8 | |

| Utilities | 6.9 | |

| Real Estate | 5.3 | |

| Consumer Staples | 5.2 | |

| Information Technology | 4.3 | |

| Communication Services | 2.8 | |

| Common Stocks | 99.0 |

| Short-Term Investments and Net Other Assets (Liabilities) | 1.0 |

ASSET ALLOCATION (% of Fund's net assets) |

|

| United States | 86.3 |

| Canada | 6.0 |

| United Kingdom | 1.2 |

| Germany | 1.1 |

| Puerto Rico | 0.6 |

| Belgium | 0.6 |

| Zambia | 0.6 |

| India | 0.5 |

| France | 0.5 |

| Others | 2.6 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

TOP HOLDINGS (% of Fund's net assets) | ||

| PG&E Corp | 1.2 | |

| Vistra Corp | 1.2 | |

| Ventas Inc | 1.0 | |

| Global Payments Inc | 1.0 | |

| Molina Healthcare Inc | 0.9 | |

| Smurfit WestRock PLC | 0.9 | |

| Lithia Motors Inc Class A | 0.9 | |

| Lumentum Holdings Inc | 0.8 | |

| International Paper Co | 0.8 | |

| Lamb Weston Holdings Inc | 0.8 | |

| 9.5 |

The fund's transfer agent and pricing & bookkeeping fees were changed to a fixed rate effective December 1, 2023, through February 29, 2024, in anticipation of the transition to a new management fee structure. Effective March 1, 2024, the fund's management contract was amended to incorporate administrative services previously covered under separate services agreements (transfer agent and pricing & bookkeeping). The amended contract incorporates a basic fee rate that may vary by class (subject to a performance adjustment). The Adviser or an affiliate pays certain expenses of managing and operating the fund out of each class's management fee. |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. | ||

| For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9913927.100 1319-TSRA-1224 | |

ANNUAL SHAREHOLDER REPORT | AS OF OCTOBER 31, 2024 | This report describes changes to the Fund that occurred during the reporting period. | |

| | Fidelity Advisor® High Income Advantage Fund Fidelity Advisor® High Income Advantage Fund Class Z : FIQTX | |

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | ||

| Class Z | $ 69 | 0.63% |

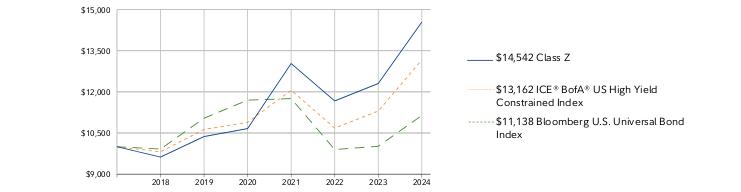

Class Z | $10,000 | $9,622 | $10,371 | $10,661 | $13,032 | $11,668 | $12,304 |

ICE® BofA® US High Yield Constrained Index | $10,000 | $9,813 | $10,630 | $10,890 | $12,058 | $10,679 | $11,299 |

Bloomberg U.S. Universal Bond Index | $10,000 | $9,913 | $11,039 | $11,697 | $11,754 | $9,898 | $10,016 |

| 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

|

| 1 Year | 5 Year | Life of Fund A | |

| Class Z | 18.20% | 6.99% | 6.35% |

| ICE® BofA® US High Yield Constrained Index | 16.49% | 4.37% | 4.62% |

| Bloomberg U.S. Universal Bond Index | 11.20% | 0.18% | 1.79% |

Visit institutional.fidelity.com for more recent performance information. |

The Fund's past performance is not a good predictor of the Fund's future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

KEY FACTS | ||

| Fund Size | $2,310,946,691 | |

| Number of Holdings | 717 | |

| Total Advisory Fee | $13,652,978 | |

| Portfolio Turnover | 29% |

(as of October 31, 2024)

| BBB | 4.8 |

| BB | 20.7 |

| B | 30.9 |

| CCC,CC,C | 6.6 |

| Not Rated | 2.9 |

| Equities | 22.3 |

| Short-Term Investments and Net Other Assets (Liabilities) | 11.8 |

QUALITY DIVERSIFICATION (% of Fund's net assets) |

|

| We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes. |

| Corporate Bonds | 51.5 |

| Common Stocks | 20.1 |

| Bank Loan Obligations | 10.1 |

| Preferred Securities | 4.1 |

| Alternative Funds | 2.2 |

| Asset-Backed Securities | 0.2 |

| Short-Term Investments and Net Other Assets (Liabilities) | 11.8 |

ASSET ALLOCATION (% of Fund's net assets) |

|

| United States | 91.1 |

| Canada | 1.9 |

| United Kingdom | 1.8 |

| France | 1.4 |

| Netherlands | 0.5 |

| China | 0.5 |

| Luxembourg | 0.4 |

| Zambia | 0.4 |

| Taiwan | 0.3 |

| Others | 1.7 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

TOP HOLDINGS (% of Fund's net assets) | ||

| TransDigm Inc | 2.6 | |

| Fidelity Private Credit Company LLC | 2.2 | |

| Energy Transfer LP | 2.1 | |

| NVIDIA Corp | 1.4 | |

| Tenet Healthcare Corp | 1.4 | |

| LBM Acquisition LLC | 1.2 | |

| Altice France SA | 1.1 | |

| eG Global Finance PLC | 1.1 | |

| Carnival Corp | 1.1 | |

| Meta Platforms Inc Class A | 1.1 | |

| 15.3 |

The fund's transfer agent and pricing and bookkeeping fees were changed to a fixed rate effective December 1, 2023, through February 29, 2024, in anticipation of the transition to a new management fee structure. Effective March 1, 2024, the fund's management contract was amended to incorporate administrative services previously covered under separate services agreements (transfer agent and pricing and bookkeeping). The amended contract incorporates a management fee rate that may vary by class. The Adviser or an affiliate pays certain expenses of managing and operating the fund out of each class's management fee. |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. | ||

| For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9913815.100 3278-TSRA-1224 | |

Item 2.

Code of Ethics

As of the end of the period, October 31, 2024, Fidelity Advisor Series I (the trust) has adopted a code of ethics, as defined in Item 2 of Form N-CSR, that applies to its President and Treasurer and its Chief Financial Officer. A copy of the code of ethics is filed as an exhibit to this Form N-CSR.

Item 3.

Audit Committee Financial Expert

The Board of Trustees of the trust has determined that Donald F. Donahue is an audit committee financial expert, as defined in Item 3 of Form N-CSR. Mr. Donahue is independent for purposes of Item 3 of Form N-CSR.

Item 4.

Principal Accountant Fees and Services

Fees and Services

The following table presents fees billed by Deloitte & Touche LLP, the member firms of Deloitte Touche Tohmatsu, and their respective affiliates (collectively, “Deloitte Entities”) in each of the last two fiscal years for services rendered to Fidelity Advisor Floating Rate High Income Fund, Fidelity Advisor High Income Advantage Fund and Fidelity Advisor Value Fund (the “Fund(s)”):

Services Billed by Deloitte Entities

October 31, 2024 FeesA

Audit Fees | Audit-Related Fees | Tax Fees | All Other Fees | |

Fidelity Advisor Floating Rate High Income Fund | $78,000 | $- | $9,700 | $1,700 |

Fidelity Advisor High Income Advantage Fund | $65,800 | $- | $9,700 | $1,500 |

Fidelity Advisor Value Fund | $42,500 | $- | $11,200 | $1,000 |

October 31, 2023 FeesA

Audit Fees | Audit-Related Fees | Tax Fees | All Other Fees | |

Fidelity Advisor Floating Rate High Income Fund | $78,200 | $- | $9,700 | $1,900 |

Fidelity Advisor High Income Advantage Fund | $66,100 | $- | $9,700 | $1,600 |

Fidelity Advisor Value Fund | $42,700 | $- | $11,400 | $1,100 |

A Amounts may reflect rounding.

The following table(s) present(s) fees billed by Deloitte Entities that were required to be approved by the Audit Committee for services that relate directly to the operations and financial reporting of the Fund(s) and that are rendered on behalf of Fidelity Management & Research Company LLC ("FMR") and entities controlling, controlled by, or under common control with FMR (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser) that provide ongoing services to the Fund(s) (“Fund Service Providers”):

Services Billed by Deloitte Entities

October 31, 2024A | October 31, 2023A | |

Audit-Related Fees | $125,000 | $75,000 |

Tax Fees | $- | $- |

All Other Fees | $2,929,500 | $- |

A Amounts may reflect rounding.

“Audit-Related Fees” represent fees billed for assurance and related services that are reasonably related to the performance of the fund audit or the review of the fund's financial statements and that are not reported under Audit Fees.

“Tax Fees” represent fees billed for tax compliance, tax advice or tax planning that relate directly to the operations and financial reporting of the fund.

“All Other Fees” represent fees billed for services provided to the fund or Fund Service Provider, a significant portion of which are assurance related, that relate directly to the operations and financial reporting of the fund, excluding those services that are reported under Audit Fees, Audit-Related Fees or Tax Fees.

Assurance services must be performed by an independent public accountant.

* * *

The aggregate non-audit fees billed by Deloitte Entities for services rendered to the Fund(s), FMR (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser), and any Fund Service Provider for each of the last two fiscal years of the Fund(s) are as follows:

Billed By | October 31, 2024A | October 31, 2023A |

Deloitte Entities | $3,383,800 | $5,842,500 |

A Amounts may reflect rounding.

The trust's Audit Committee has considered non-audit services that were not pre-approved that were provided by Deloitte Entities to Fund Service Providers to be compatible with maintaining the independence of Deloitte Entities in its(their) audit of the Fund(s), taking into account representations from Deloitte Entities, in accordance with Public Company Accounting Oversight Board rules, regarding its independence from the Fund(s) and its(their) related entities and FMR’s review of the appropriateness and permissibility under applicable law of such non-audit services prior to their provision to the Fund(s) Service Providers.

Audit Committee Pre-Approval Policies and Procedures

The trust’s Audit Committee must pre-approve all audit and non-audit services provided by a fund’s independent registered public accounting firm relating to the operations or financial reporting of the fund. Prior to the commencement of any audit or non-audit services to a fund, the Audit Committee reviews the services to determine whether they are appropriate and permissible under applicable law.

The Audit Committee has adopted policies and procedures to, among other purposes, provide a framework for the Committee’s consideration of non-audit services by the audit firms that audit the Fidelity funds. The policies and procedures require that any non-audit service provided by a fund audit firm to a Fidelity fund and any non-audit service provided by a fund auditor to a Fund Service Provider that relates directly to the operations and financial reporting of a Fidelity fund (“Covered Service”) are subject to approval by the Audit Committee before such service is provided.

All Covered Services must be approved in advance of provision of the service either: (i) by formal resolution of the Audit Committee, or (ii) by oral or written approval of the service by the Chair of the Audit Committee (or if the Chair is unavailable, such other member of the Audit Committee as may be designated by the Chair to act in the Chair’s absence). The approval contemplated by (ii) above is permitted where the Treasurer determines that action on such an engagement is necessary before the next meeting of the Audit Committee.

Non-audit services provided by a fund audit firm to a Fund Service Provider that do not relate directly to the operations and financial reporting of a Fidelity fund are reported to the Audit Committee periodically.

Non-Audit Services Approved Pursuant to Rule 2-01(c)(7)(i)(C) and (ii) of Regulation S-X (“De Minimis Exception”)

There were no non-audit services approved or required to be approved by the Audit Committee pursuant to the De Minimis Exception during the Fund’s(s’) last two fiscal years relating to services provided to (i) the Fund(s) or (ii) any Fund Service Provider that relate directly to the operations and financial reporting of the Fund(s).

The Registrant has not retained, for the preparation of the audit report on the financial statements included in the Form N-CSR, a registered public accounting firm that has a branch or office that is located in a foreign jurisdiction and that the Public Company Accounting Oversight Board (the “PCAOB”) has determined that the PCAOB is unable to inspect or investigate completely because of a position taken by an authority in the foreign jurisdiction.

The Registrant is not a “foreign issuer,” as defined in 17 CFR 240.3b-4.

Item 5.

Audit Committee of Listed Registrants

Not applicable.

Item 6.

Investments

(a)

Not applicable.

(b)

Not applicable.

Item 7.

Financial Statements and Financial Highlights for Open-End Management Investment Companies

Contents

| Common Stocks - 99.0% | |||

| Shares | Value ($) | ||

| COMMUNICATION SERVICES - 2.8% | |||

| Diversified Telecommunication Services - 0.5% | |||

| Cellnex Telecom SA (a) | 40,260 | 1,475,818 | |

| Liberty Latin America Ltd. Class C (b) | 51,900 | 502,392 | |

| 1,978,210 | |||

| Entertainment - 0.1% | |||

| Ubisoft Entertainment SA (b) | 34,320 | 517,188 | |

| Interactive Media & Services - 0.6% | |||

| Zoominfo Technologies, Inc. (b) | 190,573 | 2,105,832 | |

| Media - 1.6% | |||

| Grupo Televisa SA de CV (CPO) sponsored ADR | 403,909 | 1,009,773 | |

| Nexstar Media Group, Inc. | 9,906 | 1,742,664 | |

| Thryv Holdings, Inc. (b) | 111,351 | 1,601,227 | |

| WPP PLC | 145,711 | 1,531,557 | |

| 5,885,221 | |||

TOTAL COMMUNICATION SERVICES | 10,486,451 | ||

| CONSUMER DISCRETIONARY - 10.4% | |||

| Automobile Components - 0.9% | |||

| Aptiv PLC (b) | 37,581 | 2,135,728 | |

| Autoliv, Inc. | 14,290 | 1,327,255 | |

| 3,462,983 | |||

| Automobiles - 0.4% | |||

| Harley-Davidson, Inc. | 53,792 | 1,718,654 | |

| Broadline Retail - 0.3% | |||

| Kohl's Corp. | 53,801 | 994,242 | |

| Distributors - 0.4% | |||

| LKQ Corp. | 45,178 | 1,662,099 | |