QuickLinks -- Click here to rapidly navigate through this document

EXHIBIT 1

DESCRIPTION

This description of Québec is dated as of October 31, 2003 and appears as Exhibit 1 to Québec's Annual Report on Form 18-K to the U.S. Securities and Exchange Commission for the fiscal year ended March 31, 2003.

The delivery of this document at any time does not imply that the information is correct as of any time subsequent to its date. This document (other than as part of a prospectus contained in a registration statement filed under the U.S. Securities Act of 1933) does not constitute an offer to sell or the solicitation of an offer to buy any securities of Québec.

Table of Contents

| | Page

|

|---|

| Foreign Exchange | | 2 |

| Summary | | 3 |

| Québec | | 5 |

| | Overview | | 5 |

| | Constitutional Framework | | 5 |

| | Government | | 6 |

| Economy | | 7 |

| | Economic Developments in 2002 | | 7 |

| | Economic Structure | | 9 |

| Government Finances | | 13 |

| | Financial Administration | | 13 |

| | 2002-2003 Preliminary Results | | 15 |

| | 2003-2004 Revised Forecasts | | 15 |

| | Consolidated Budgetary Revenue | | 17 |

| | Consolidated Budgetary Expenditure | | 19 |

| | Consolidated Non-Budgetary Transactions | | 21 |

| Government Enterprises and Agencies | | 24 |

| | Enterprises included in the Government's reporting entity | | 26 |

| | Agencies whose reporting entity is included in the Government's reporting entity | | 29 |

| | Agencies which conduct fiduciary transactions that are not included in the Government's reporting entity | | 30 |

| Public Sector Debt | | 31 |

| | Government Debt | | 32 |

| | Guaranteed Debt | | 34 |

| | Funded Debt of the Municipal Sector and Other Institutions | | 35 |

| | Government's Commitments | | 36 |

| Where You Can Find More Information | | 37 |

| Forward Looking Statements | | 38 |

| Supplementary Information | | 39 |

Foreign Exchange

Canada maintains a floating exchange rate for the Canadian dollar in order to permit the rate to be determined by market forces without intervention except as required to maintain orderly conditions. Annual average noon spot exchange rates for the major foreign currencies in which debt of Québec is denominated, expressed in Canadian dollars, are shown below.

Foreign Currency

| | 1999

| | 2000

| | 2001

| | 2002

| | 2003(1)

| |

|---|

| United States Dollar | | $ | 1.4858 | | $ | 1.4852 | | $ | 1.5484 | | $ | 1.5704 | | $ | 1.4294 | |

| Japanese Yen | | | 0.0131 | | | 0.0138 | | | 0.0128 | | | 0.0126 | | | 0.0121 | |

| Swiss Franc | | | 0.9901 | | | 0.8793 | | | 0.9184 | | | 1.0112 | | | 1.0525 | |

| Deutsche Mark | | | 0.8102 | | | 0.7007 | | | 0.7091 | | | N/A | (2) | | N/A | (2) |

| French Franc | | | 0.2416 | | | 0.2089 | | | 0.2114 | | | N/A | (2) | | N/A | (2) |

| Pound Sterling | | | 2.4038 | | | 2.2499 | | | 2.2298 | | | 2.3582 | | | 2.3016 | |

| Australian Dollar | | | 0.9589 | | | 0.8633 | | | 0.8008 | | | 0.8535 | | | 0.9000 | |

| Netherlands Guilder | | | 0.7191 | | | 0.6219 | | | 0.6293 | | | N/A | (2) | | N/A | (2) |

| Euro | | | 1.5847 | | | 1.3704 | | | 1.3868 | | | 1.4832 | | | 1.5874 | |

- (1)

- Monthly average through the end of September 2003.

- (2)

- On January 1, 2002, Euro notes and coins replaced the national currencies of these and other members of the European Union.

Source: Bank of Canada.

In this document, unless otherwise specified or the context otherwise requires, all dollar amounts are expressed in Canadian dollars. The fiscal year of Québec ends March 31. "Fiscal 2003" and "2002-2003" refer to the fiscal year ended March 31, 2003, and, unless otherwise indicated, "2002" means the calendar year ended December 31, 2002. Other fiscal and calendar years are referred to in a corresponding manner. Any discrepancies between the amounts listed and their totals in the tables included in this document are due to rounding.

2

Summary

The information below is qualified in its entirety by the detailed information provided elsewhere in this document.

Economy

| | 1998

| | 1999

| | 2000

| | 2001

| | 2002

| |

|---|

| | (dollar amounts in millions)

| |

|---|

| GDP at current market prices | | $ | 196,258 | | $ | 210,166 | | $ | 224,165 | | $ | 229,617 | | $ | 242,914 | |

| % change — GDP at market prices (1997 prices)(1) | | | 3.2 | % | | 5.9 | % | | 4.7 | % | | 1.1 | % | | 4.3 | % |

| Personal income | | $ | 167,432 | | $ | 174,636 | | $ | 187,038 | | $ | 194,417 | | $ | 201,359 | |

| Capital expenditures | | $ | 32,087 | | $ | 33,681 | | $ | 34,683 | | $ | 36,193 | | $ | 38,970 | |

| International exports of goods | | $ | 57,564 | | $ | 62,063 | | $ | 74,120 | | $ | 70,819 | | $ | 68,246 | |

| Population at July 1 (in thousands) | | | 7,324 | | | 7,351 | | | 7,382 | | | 7,418 | | | 7,455 | |

| Unemployment rate | | | 10.3 | % | | 9.3 | % | | 8.4 | % | | 8.7 | % | | 8.6 | % |

| Consumer Price Index — % change | | | 1.4 | % | | 1.5 | % | | 2.4 | % | | 2.4 | % | | 2.0 | % |

| Average exchange rate (US$ per C$) | | | 0.67 | | | 0.67 | | | 0.67 | | | 0.65 | | | 0.64 | |

Consolidated Financial Transactions(2)

| | Fiscal year ending March 31

| |

|---|

| | 2000

| | 2001

| | 2002

| | Preliminary

Results

2003

| | Revised

Forecasts

2004

| |

|---|

| | (dollar amounts in millions)

| |

|---|

| Own-Source Revenue | | $ | 41,076 | | $ | 42,904 | | $ | 41,004 | | $ | 43,573 | | $ | 45,228 | |

| Government of Canada Transfers | | | 6,334 | | | 8,145 | | | 9,305 | | | 9,307 | | | 9,584 | |

| | |

| |

| |

| |

| |

| |

| Total Budgetary Revenue | | | 47,410 | | | 51,049 | | | 50,309 | | | 52,880 | | | 54,812 | |

| Operating Expenditure | | | (40,031 | ) | | (42,066 | ) | | (43,976 | ) | | (46,016 | ) | | (47,437 | ) |

| Debt Service | | | (7,372 | ) | | (7,606 | ) | | (7,261 | ) | | (7,085 | ) | | (7,512 | ) |

| | |

| |

| |

| |

| |

| |

| Total Budgetary Expenditure | | | (47,403 | ) | | (49,672 | ) | | (51,237 | ) | | (53,101 | ) | | (54,949 | ) |

| | |

| |

| |

| |

| |

| |

| Budgetary reserve(3) | | | — | | | (950 | ) | | 950 | | | — | | | — | |

| Shortfall to make up during the fiscal year | | | — | | | — | | | — | | | — | | | 137 | |

| Surplus (deficit) after reserve | | | 7 | | | 427 | | | 22 | | | (221 | ) | | — | |

| Non-Budgetary Transactions | | | 703 | | | (943 | ) | | (637 | ) | | (1,364 | ) | | (1,823 | ) |

| | |

| |

| |

| |

| |

| |

| Net Financial Surplus (Requirements) | | $ | 710 | | $ | (516 | ) | $ | (615 | ) | $ | (1,585 | ) | $ | (1,823 | ) |

| | |

| |

| |

| |

| |

| |

Funded Debt of Public Sector

| | As of March 31

|

|---|

| | 1999

| | 2000

| | 2001

| | 2002

| | Preliminary Results 2003

|

|---|

| | (dollar amounts in millions)

|

|---|

| Government Funded Debt | | | | | | | | | | | | | | | |

| | Borrowings — Government | | $ | 59,711 | | $ | 59,365 | | $ | 62,901 | | $ | 65,466 | | $ | 71,078 |

| | Borrowings — to finance Government Enterprises | | | 4,772 | | | 5,367 | | | 4,981 | | | 5,034 | | | 3,968 |

| | Borrowings — to finance Municipal Bodies | | | 2,674 | | | 2,904 | | | 2,732 | | | 2,918 | | | 2,874 |

| Government Guaranteed Debt(4) | | | 38,429 | | | 38,148 | | | 40,680 | | | 40,697 | | | 40,680 |

| Municipal Sector Debt | | | 13,954 | | | 13,892 | | | 13,464 | | | 13,598 | | | 13,463 |

| Other Institutions | | | 6,685 | | | 6,087 | | | 5,635 | | | 5,312 | | | 5,399 |

| | |

| |

| |

| |

| |

|

| Public Sector Funded Debt(5) | | $ | 126,225 | | $ | 125,763 | | $ | 130,393 | | $ | 133,025 | | $ | 137,462 |

| | |

| |

| |

| |

| |

|

| Per capita ($) | | $ | 17,234 | | $ | 17,108 | | $ | 17,664 | | $ | 17,933 | | $ | 18,439 |

| As a percentage of(6) | | | | | | | | | | | | | | | |

| | GDP | | | 64.3% | | | 59.8% | | | 58.2% | | | 57.9% | | | 56.6% |

| | Personal income | | | 75.4% | | | 72.0% | | | 69.7% | | | 68.4% | | | 68.3% |

- (1)

- Percentage change for Gross Domestic Product ("GDP") adjusted for inflation; referred to herein as "real GDP".

- (2)

- The data have been adjusted, for purposes of comparison, on the basis of the 2003-2004 budgetary and financial structure.

- (3)

- The Finance Minister announced in the 2001-2002 Budget the creation of a reserve of $950 million out of budgetary surpluses posted in Fiscal 2001. Of this amount, $280 million was used to finance new spending and $670 million to maintain a balanced budget in Fiscal 2002.

- (4)

- Represents mainly debt of Hydro-Québec.

- (5)

- Canadian dollar equivalent on the dates indicated for loans in foreign currencies after currency swap agreements.

- (6)

- Percentages are based upon the prior calendar year's GDP and Personal Income.

3

4

Québec

Overview

Québec is the largest by area of the ten provinces in Canada (1,541,000 square kilometers or 594,860 square miles, representing 15.4% of the geographical area of Canada) and the second largest by population (7.5 million, representing 23.7% of the population of Canada, as of April 2003).

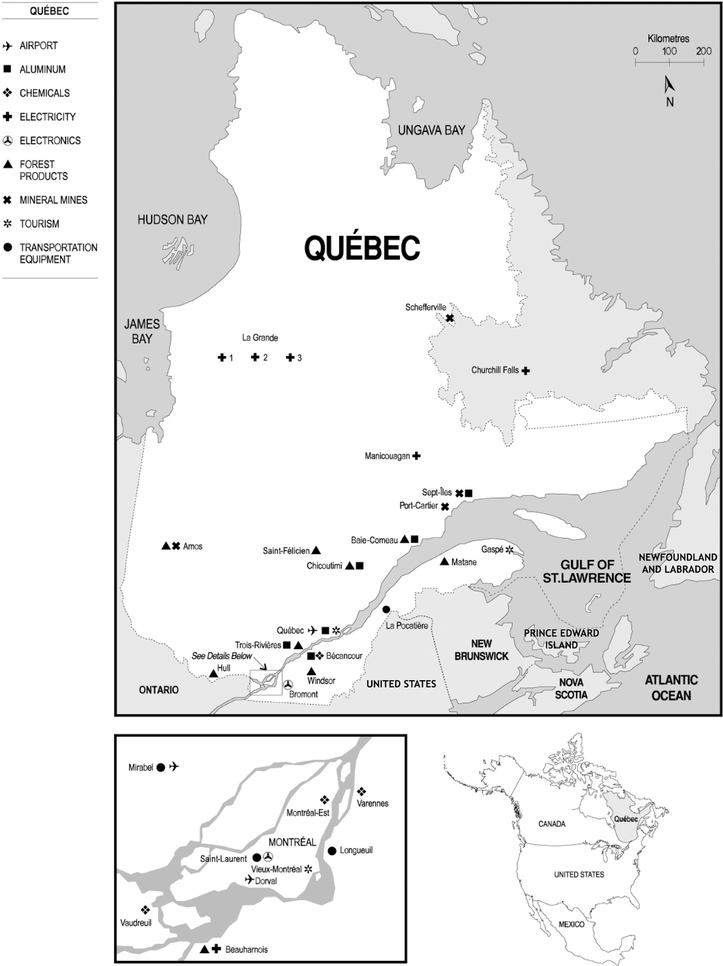

Québec has a modern, developed economy, in which the service sector contributed 70.8%, the manufacturing industry 21.7%, the construction industry 5.0% and the primary sector 2.5% of real GDP at basic prices in 2002. The leading manufacturing industries in Québec are transportation equipment (including aircraft and motor vehicles and associated parts), food products, primary metals (including aluminum smelting and copper refining industries), paper products, chemical products (notably pharmaceuticals) and wood products. Québec also has significant hydroelectric resources, generating approximately one-third of the electricity produced in Canada.

Montréal and Ville de Québec, the capital of Québec, are the centers of economic activity. Montréal is one of the main industrial, commercial and financial centers of North America and is Canada's second largest urban area as measured by population. Montréal is also Canada's largest port, situated on the St. Lawrence River, which provides access to both the Atlantic Ocean and the inland navigation system of the Great Lakes.

French is the official language of Québec and is spoken by approximately 94% of its population.

Constitutional Framework

Canada is a federation of ten provinces and three federal territories, with a constitutional division of responsibilities between the federal and provincial governments as set out in The Constitution Acts, 1867 to 1982 (the "Constitution").

Under the Constitution, each provincial government has exclusive authority to raise revenue through direct taxation within its territorial limits. Each provincial government also has exclusive authority to regulate education, health, social services, property and civil rights, natural resources, municipal institutions and, generally, to regulate all other matters of a purely local or private nature in its province, and to regulate and raise revenue from the exploration, development, conservation and management of natural resources.

The federal parliament is empowered to raise revenue by any method or system of taxation and generally has authority over matters or subjects not assigned exclusively to the provinces. It has exclusive authority over the regulation of trade and commerce, currency and coinage, banks and banking, national defense, naturalization and aliens, postal services, navigation and shipping, and bills of exchange, interest and bankruptcy.

The Constitution Act, 1982 (the "Constitution Act"), enacted by the parliament of the United��Kingdom, provides, among other things, that amendments to the Constitution be effected in Canada according to an amending formula. The Constitution Act also includes various modifications to the Constitution. The Constitution Act came into effect in 1982 notwithstanding the opposition of the National Assembly of Québec (the "National Assembly") and the government of Québec (the "Government") to certain clauses relating to provincial jurisdiction and the terms of the amending formula.

Since 1982, the federal and provincial governments have attempted to remedy this situation by signing two constitutional accords, neither of which was ratified. The first, signed in 1987 but not ratified by the legislative assemblies of two provinces, included a proposal to recognize Québec as a distinct society within Canada. The second, dated 1992, which was also signed by the federal territories and the national associations of native peoples, was rejected by a majority of voters in six provinces, including Québec.

5

On September 7, 1995, the Government, then formed by the Parti Québécois which has as one of its principal objectives the sovereignty of Québec, presented a Bill entitled An Act respecting the future of Québec (the "Act") in the National Assembly. The Act included, among other things, provisions authorizing the National Assembly to proclaim the sovereignty of Québec following a formal offer to the Government of Canada of a treaty of economic and political partnership. The Act was to be enacted only after a favorable vote in a referendum. Such a referendum was held on October 30, 1995. The result was 49.4% in favor of the Act and 50.6% against.

In 1996, the federal government, by way of a reference to the Supreme Court of Canada (the "Supreme Court"), asked the court to determine the legality, both under Canadian constitutional law and public international law, of a unilateral secession of Québec from Canada. The reference before the Supreme Court was heard without Québec's participation in the hearing. On August 20, 1998, the Supreme Court decided, among other things, that under the Constitution, Québec may not secede unilaterally from Canada without negotiation with the other participants in the Canadian Confederation within the existing constitutional framework; Québec does not have the right under international law to secede unilaterally from Canada; nonetheless, the clear repudiation by the people of Québec of the existing constitutional order and the clear expression of the desire to pursue secession would confer legitimacy on demands for secession, and place an obligation on the other provinces and the federal government to acknowledge and respect that expression of democratic will by entering into negotiations and conducting these negotiations in accordance with constitutional principles, including federalism, democracy, constitutionalism, the rule of law, and the protection of minorities; and Québec would have to negotiate in accordance with these constitutional principles. The Supreme Court recognized however that should Québec, having negotiated in conformity with constitutional principles and values, face unreasonable intransigence on the part of other participants at the federal or provincial level, Québec would be more likely to be recognized than if it did not itself act according to constitutional principles in the negotiation process.

The Parti Québécois formed the Government from September 1994 until its reelection in November 1998 and then until the dissolution of the National Assembly for the general election of April 14, 2003. The Québec Liberal Party, a federalist party, won that election and now forms the Government. With regard to the constitutional issue, the Québec Liberal Party pursues a policy which emphasizes the values of Canadian federalism. In particular, its platform is focused on strengthening Québec's place within the federation, on forming new alliances with the other provinces, and on promoting intergovernmental cooperation.

Government

Legislative power in Québec is exercised by the Parliament of Québec, which is comprised of the Lieutenant-Governor, who is appointed by the Governor General in Council of Canada, and the National Assembly. The National Assembly consists of 125 members elected by popular vote from single member districts. According to constitutional practice, the leader of the party with the largest number of elected members becomes Prime Minister and forms the Government.

Executive power in Québec is vested in the Lieutenant-Governor acting with, or on the recommendation of, the Conseil exécutif, which consists of the Prime Minister and the Cabinet (Conseil des ministres). The Conseil exécutif is accountable to the National Assembly.

The current National Assembly consists of 76 members of the Québec Liberal Party, 45 members of the Parti Québécois and four members of the Action Démocratique du Québec. Members are elected for a term of five years, subject to earlier dissolution of the National Assembly by the Lieutenant-Governor at the request of the Prime Minister. The mandate of the current Government extends through the next election which must be called no later than April 2008.

6

Economy

Economic Developments in 2002

Canada. Gross domestic product ("GDP") adjusted for inflation ("real GDP") increased at a rate of 3.3% in 2002 compared with a rate of 1.9% in 2001. This acceleration was mainly attributable to an increase in inventories and strong growth in residential investment. Final domestic demand increased by 2.9% in 2002, compared to 3.2% in 2001. Exports decreased by 0.1% in 2002 compared to a decrease of 3.1% in 2001, while imports increased by 0.6% in 2002 compared to a decrease of 5.0% in 2001. For the second consecutive year, machinery and equipment imports decreased in 2002.

Real consumer spending growth accelerated to 3.4% in 2002, compared to a 2.6% increase in 2001. Non-residential investment decreased by 6.0% in 2002, due in particular to a 10.4% decrease in non-residential construction. Residential investment increased by 14.2%, due to a 26.0% increase in housing starts. Government investment increased by 11.8%. Government expenditure on goods and services increased by 3.0%.

The Consumer Price Index ("CPI") increased by 2.2% in 2002. Overall employment rose 2.2%, while the unemployment rate increased to 7.7% from 7.2% in 2001.

Québec. Real GDP growth accelerated to 4.3% in 2002, compared to a 1.1% increase in 2001. Final domestic demand increased by 3.6% in real terms, compared with 1.5% in 2001. Real consumer spending increased by 2.8%, compared with 2.3% in 2001. The value of non-residential investment increased by 0.3%, with a 28.0% increase in the public sector offsetting an 11.5% decrease in the private sector. The value of residential investment increased by 28.5%. In 2002, international exports of goods decreased by 2.2% in volume and by 3.6% in value, compared with decreases of 6.9% and 4.5% respectively in 2001.

The CPI increased by 2.0% in 2002. Overall employment rose 3.4%, while the unemployment rate decreased to 8.6% from 8.7% in 2001.

7

Table 1

Main Economic Indicators of Québec(1)

| | 1998

| | 1999

| | 2000

| | 2001

| | 2002

| | Annual Compound Rate of Growth 1997-2002

| |

|---|

| | (dollar amounts in millions, except for per capita amounts)

| |

| |

|---|

| GDP | | | | | | | | | | | | | | | | | | |

| | At current market prices | | $ | 196,258 | | $ | 210,166 | | $ | 224,165 | | $ | 229,617 | | $ | 242,914 | | 5.2 | % |

| | | | 4.2 | % | | 7.1 | % | | 6.7 | % | | 2.4 | % | | 5.8 | % | | |

| |

At market prices (1997 prices) |

|

$ |

194,414 |

|

$ |

205,856 |

|

$ |

215,499 |

|

$ |

217,935 |

|

$ |

227,263 |

|

3.8 |

|

| | | | 3.2 | % | | 5.9 | % | | 4.7 | % | | 1.1 | % | | 4.3 | % | | |

| |

Per capita at 1997 prices |

|

$ |

26,546 |

|

$ |

28,003 |

|

$ |

29,193 |

|

$ |

29,380 |

|

$ |

30,484 |

|

3.4 |

|

| | | | 2.9 | % | | 5.5 | % | | 4.3 | % | | 0.6 | % | | 3.8 | % | | |

Personal income |

|

$ |

167,432 |

|

$ |

174,636 |

|

$ |

187,038 |

|

$ |

194,417 |

|

$ |

201,359 |

|

4.5 |

|

| | | | 3.7 | % | | 4.3 | % | | 7.1 | % | | 3.9 | % | | 3.6 | % | | |

| |

Per capita |

|

$ |

22,862 |

|

$ |

23,756 |

|

$ |

25,338 |

|

$ |

26,210 |

|

$ |

27,009 |

|

4.1 |

|

| | | | 3.4 | % | | 3.9 | % | | 6.7 | % | | 3.4 | % | | 3.1 | % | | |

Capital expenditures |

|

$ |

32,087 |

|

$ |

33,681 |

|

$ |

34,683 |

|

$ |

36,193 |

|

$ |

38,970 |

|

4.9 |

|

| | | | 4.6 | % | | 5.0 | % | | 3.0 | % | | 4.4 | % | | 7.7 | % | | |

Value of manufacturers' shipments |

|

$ |

104,480 |

|

$ |

112,429 |

|

$ |

127,650 |

|

$ |

120,949 |

|

$ |

122,059 |

|

3.9 |

|

| | | | 3.4 | % | | 7.6 | % | | 13.5 | % | | -5.2 | % | | 0.9 | % | | |

Retail trade |

|

$ |

57,162 |

|

$ |

60,778 |

|

$ |

63,481 |

|

$ |

66,036 |

|

$ |

69,910 |

|

4.6 |

|

| | | | 2.3 | % | | 6.3 | % | | 4.4 | % | | 4.0 | % | | 5.9 | % | | |

|

|

(in thousands of persons)

|

|

|

|

|---|

| Population (at July 1) | | | 7,324 | | | 7,351 | | | 7,382 | | | 7,418 | | | 7,455 | | 0.4 | |

| | | | 0.3 | % | | 0.4 | % | | 0.4 | % | | 0.5 | % | | 0.5 | % | | |

Labor force |

|

|

3,660 |

|

|

3,702 |

|

|

3,753 |

|

|

3,807 |

|

|

3,930 |

|

1.7 |

|

| | | | 1.5 | % | | 1.1 | % | | 1.4 | % | | 1.4 | % | | 3.2 | % | | |

Employment |

|

|

3,282 |

|

|

3,357 |

|

|

3,438 |

|

|

3,475 |

|

|

3,593 |

|

2.4 |

|

| | | | 2.7 | % | | 2.3 | % | | 2.4 | % | | 1.1 | % | | 3.4 | % | | |

Unemployment rate (level in percentage) |

|

|

10.3 |

% |

|

9.3 |

% |

|

8.4 |

% |

|

8.7 |

% |

|

8.6 |

% |

N/A |

|

|

|

(1992 = 100)

|

|

|

|

|---|

| CPI | | | 106.4 | | | 108.0 | | | 110.6 | | | 113.2 | | | 115.5 | | 1.9 | |

| | | | 1.4 | % | | 1.5 | % | | 2.4 | % | | 2.4 | % | | 2.0 | % | | |

- (1)

- Unless otherwise indicated, percentages are percentage changes from the previous year.

Source: Statistics Canada.

8

Economic Structure

In 2002, Québec accounted for 21.5% of Canada's real GDP at basic prices (1997 prices). The service sector accounted for 70.8% of Québec's real GDP at basic prices, compared with 26.7% for the secondary sector and 2.5% for the primary sector. Québec's economy is influenced by developments in the economies of its major trading partners, especially the United States, which is Québec's largest export market. In 2002, Québec exported 57% of its goods and services to other Canadian provinces and the rest of the world.

The following table shows the contribution of each sector to real GDP at basic prices which includes net taxes (taxes less subsidies) paid on factors of production. GDP is a measure of value added (the total value of goods delivered and services rendered less the cost of materials and supplies, fuel and electricity).

Table 2

Real Gross Domestic Product by Sector at 1997 Prices(1)

| |

| |

| |

| |

| |

| | % of Total 2002

| |

|---|

| | 1998

| | 1999

| | 2000

| | 2001

| | 2002

| | Québec

| | Canada

| |

|---|

| | (dollar amounts in millions)

| |

| |

| |

|---|

| Primary Sector: | | | | | | | | | | | | | | | | | | | | |

| | Agriculture, forestry, fishing and hunting | | $ | 3,499 | | $ | 3,826 | | $ | 3,706 | | $ | 3,786 | | $ | 3,708 | | 1.8 | % | 2.1 | % |

| | Mining and oil and gas extraction | | | 1,470 | | | 1,481 | | | 1,507 | | | 1,552 | | | 1,585 | | 0.7 | | 3.7 | |

| | |

| |

| |

| |

| |

| |

| |

| |

| | | | 4,969 | | | 5,307 | | | 5,213 | | | 5,338 | | | 5,293 | | 2.5 | | 5.8 | |

| | |

| |

| |

| |

| |

| |

| |

| |

| Secondary Sector: | | | | | | | | | | | | | | | | | | | | |

| | Manufacturing | | | 39,250 | | | 42,716 | | | 46,278 | | | 44,826 | | | 45,677 | | 21.7 | | 16.9 | |

| | Construction | | | 8,836 | | | 8,675 | | | 9,549 | | | 9,794 | | | 10,462 | | 5.0 | | 5.2 | |

| | |

| |

| |

| |

| |

| |

| |

| |

| | | | 48,086 | | | 51,391 | | | 55,827 | | | 54,620 | | | 56,139 | | 26.7 | | 22.1 | |

| | |

| |

| |

| |

| |

| |

| |

| |

| Service Sector: | | | | | | | | | | | | | | | | | | | | |

| | Community, business and personal services | | | 42,289 | | | 44,013 | | | 45,107 | | | 46,045 | | | 47,710 | | 22.7 | | 23.7 | |

| | Finance, insurance and real estate | | | 31,112 | | | 32,986 | | | 33,866 | | | 34,899 | | | 36,519 | | 17.3 | | 19.2 | |

| | Wholesale and retail trade | | | 19,559 | | | 20,411 | | | 21,136 | | | 21,995 | | | 23,662 | | 11.2 | | 11.6 | |

| | Transportation and warehousing, and information and cultural services | | | 15,374 | | | 16,664 | | | 18,385 | | | 19,070 | | | 19,951 | | 9.5 | | 9.2 | |

| | Governmental services | | | 11,708 | | | 11,993 | | | 12,213 | | | 12,614 | | | 13,072 | | 6.2 | | 5.6 | |

| | Other utility services | | | 7,587 | | | 7,977 | | | 8,466 | | | 8,047 | | | 8,276 | | 3.9 | | 2.8 | |

| | |

| |

| |

| |

| |

| |

| |

| |

| | | | 127,629 | | | 134,044 | | | 139,173 | | | 142,670 | | | 149,190 | | 70.8 | | 72.1 | |

| | |

| |

| |

| |

| |

| |

| |

| |

| Real GDP | | $ | 180,684 | | $ | 190,742 | | $ | 200,213 | | $ | 202,628 | | $ | 210,622 | | 100.0 | % | 100.0 | % |

| | |

| |

| |

| |

| |

| |

| |

| |

- (1)

- North American Industrial Classification System (NAICS).

Source: Institut de la statistique du Québec and Statistics Canada.

Primary Sector. In 2002, the primary sector, which includes agriculture, forestry, fishing and hunting, and mining and oil and gas extraction, contributed 2.5% of real GDP at basic prices and accounted for 2.9% of employment in Québec. Québec's forests, covering 1,140,000 square kilometers or 440,000 square miles, are among its most important natural resources. Québec's logging operations were estimated to have produced approximately 1.4 billion cubic feet of timber in 2002, generating revenue of $2.5 billion from sales to domestic and foreign customers.

In mining and oil and gas extraction, which represented 29.9% of the primary sector in 2002, production is concentrated mainly in gold, iron ore, copper and zinc. In 2002, the value of mineral production amounted to $3.7 billion.

Secondary Sector. In 2002, the secondary sector, which consists of the manufacturing and construction industries, contributed 26.7% of real GDP at basic prices and accounted for 22.6% of employment in Québec. In terms of real GDP at basic prices, the construction industry recorded a 6.8% increase in 2002 over 2001. Real GDP at basic prices in manufacturing increased by 1.9% as strong consumer demand compensated for weakening export markets during 2002. The total value of manufacturers' shipments increased by 0.9% to $122.1 billion in 2002, representing 23.5% of total Canadian shipments. Shipments of computer and electronic products (including telecommunications products) decreased by 18.1% in 2002 as a result of a significant decline in world demand.

Durable goods accounted for 57.7% of manufacturing real GDP at basic prices and 51.2% of manufacturing employment. The leading manufacturing industries in Québec are transportation equipment (including aircraft and motor vehicles and associated parts), food products, primary metals (including aluminum smelting and copper refining industries), paper products, chemical products (notably pharmaceuticals) and wood products. As a result of its competitive advantage in low cost electricity production, Québec is one of the world's leading producers of aluminum.

9

Table 3

Value of Manufacturers' Shipments(1)

| | 1998

| | 1999

| | 2000

| | 2001

| | 2002

| | % of Total 2002

| |

|---|

| | (dollar amounts in millions)

| |

| |

|---|

| Transportation equipment | | $ | 11,217 | | $ | 12,760 | | $ | 15,202 | | $ | 15,194 | | $ | 14,134 | | 11.6 | % |

| Food | | | 11,692 | | | 11,909 | | | 12,671 | | | 13,388 | | | 13,573 | | 11.1 | |

| Primary metal | | | 10,633 | | | 10,942 | | | 11,802 | | | 11,787 | | | 12,712 | | 10.4 | |

| Paper | | | 10,389 | | | 10,560 | | | 11,964 | | | 12,049 | | | 11,729 | | 9.6 | |

| Chemicals | | | 6,526 | | | 6,633 | | | 7,119 | | | 8,159 | | | 8,711 | | 7.1 | |

| Wood products | | | 6,674 | | | 6,906 | | | 6,806 | | | 6,828 | | | 7,637 | | 6.3 | |

| Petroleum and coal products | | | 3,407 | | | 4,175 | | | 7,236 | | | 6,413 | | | 6,845 | | 5.6 | |

| Computer and electronic products | | | 8,509 | | | 10,108 | | | 15,068 | | | 8,043 | | | 6,588 | | 5.4 | |

| Fabricated metal products | | | 4,584 | | | 5,065 | | | 5,398 | | | 5,236 | | | 5,329 | | 4.4 | |

| Plastics and rubber products | | | 4,037 | | | 4,280 | | | 4,480 | | | 4,706 | | | 5,208 | | 4.3 | |

| Machinery | | | 4,342 | | | 4,504 | | | 4,723 | | | 4,578 | | | 4,587 | | 3.8 | |

| Beverage and tobacco products | | | 3,283 | | | 3,678 | | | 3,664 | | | 3,872 | | | 4,093 | | 3.4 | |

| Other | | | 19,188 | | | 20,908 | | | 21,519 | | | 20,697 | | | 20,914 | | 17.1 | |

| | |

| |

| |

| |

| |

| |

| |

| | | $ | 104,480 | | $ | 112,429 | | $ | 127,650 | | $ | 120,949 | | $ | 122,059 | | 100.0 | % |

| | |

| |

| |

| |

| |

| |

| |

- (1)

- North American Industrial Classification System (NAICS).

Source: Statistics Canada.

Service Sector. The service sector includes a wide range of activities such as community, business and personal services, finance, insurance and real estate, wholesale and retail trade, transportation and warehousing, and information and cultural services, governmental services, and other utility services. In 2002, the service sector contributed 70.8% of real GDP at basic prices and accounted for 74.5% of employment in Québec.

In terms of real GDP at basic prices, increases in the service sector in 2002 occurred in wholesale and retail trade (7.6%), transportation and warehousing, and information and cultural services (4.6%), finance, insurance and real estate (4.6%), community, business and personal services (3.6%), governmental services (3.6%) and other utility services (2.8%).

Due to Québec's large territory, transportation facilities are essential to the development of its economy. Water transportation is provided mainly through the St. Lawrence River and Seaway. Approximately 25% of all international tonnage handled in Canadian ports in 2001 (the last year for which information is available) passed through Québec's shipping facilities. Highway, rail and air transportation systems service the populated areas, with higher concentrations in the metropolitan areas of Montréal and Ville de Québec.

The financial sector includes large Canadian and foreign financial institutions, Québec's cooperative institutions and Government financial intermediary enterprises and fiduciary agencies (particularly the Caisse de dépôt et placement du Québec).

Capital Expenditures. In 2002, the value of capital expenditures by the private and public sectors increased by 7.7% in Québec. Total capital expenditures increased as a result of a 28.5% increase in residential investment while non-residential investment increased by only 0.3%.

A 28.0% increase in the public sector completely offset an 11.5% decrease in non-residential investment in the private sector. The decline in non-residential investment resulted in major part from decreases in mining and oil and gas extraction (-34.1%), manufacturing (-18.3%) and finance, insurance and real estate operators (-13.8%). These decreases were partially offset by increases in governmental, educational, health and social services (24.1%), construction (18.7%) and information, cultural and other utilities (8.7%).

10

Table 4

Private and Public Sectors Capital Expenditures in Québec(1)

| | 1998

| | 1999

| | 2000

| | 2001

| | 2002(2)

| | % of Total 2002

| |

|---|

| | (dollar amounts in millions)

| |

| |

|---|

| Non-residential Investment: | | | | | | | | | | | | | | | | | | |

| | Governmental, educational, health and social services | | $ | 4,654 | | $ | 4,779 | | $ | 4,876 | | $ | 5,409 | | $ | 6,711 | | 17.2 | % |

| | Information, cultural and other utilities | | | 4,456 | | | 4,134 | | | 4,086 | | | 4,245 | | | 4,616 | | 11.9 | |

| | Manufacturing | | | 4,933 | | | 5,750 | | | 6,375 | | | 5,022 | | | 4,105 | | 10.5 | |

| | Finance, insurance and real estate operators | | | 3,777 | | | 4,142 | | | 3,999 | | | 4,396 | | | 3,791 | | 9.7 | |

| | Wholesale and retail trade | | | 1,577 | | | 1,604 | | | 1,601 | | | 1,917 | | | 1,958 | | 5.0 | |

| | Business services, accommodation and other services | | | 1,833 | | | 1,670 | | | 1,868 | | | 1,831 | | | 1,838 | | 4.7 | |

| | Transportation and warehousing | | | 1,846 | | | 1,674 | | | 1,439 | | | 1,697 | | | 1,727 | | 4.4 | |

| | Construction | | | 618 | | | 580 | | | 646 | | | 706 | | | 839 | | 2.2 | |

| | Agriculture, forestry, fishing and hunting | | | 673 | | | 816 | | | 804 | | | 721 | | | 727 | | 1.9 | |

| | Mining and oil and gas extraction | | | 671 | | | 1,077 | | | 1,190 | | | 819 | | | 540 | | 1.4 | |

| | |

| |

| |

| |

| |

| |

| |

| | | $ | 25,037 | | $ | 26,225 | | $ | 26,884 | | $ | 26,764 | | $ | 26,851 | | 68.9 | % |

| Residential Investment | | | 7,051 | | | 7,456 | | | 7,800 | | | 9,429 | | | 12,119 | | 31.1 | |

| | |

| |

| |

| |

| |

| |

| |

| | | $ | 32,087 | | $ | 33,681 | | $ | 34,683 | | $ | 36,193 | | $ | 38,970 | | 100.0 | % |

| | |

| |

| |

| |

| |

| |

| |

| Private sector | | $ | 24,985 | | $ | 26,936 | | $ | 27,546 | | $ | 28,189 | | $ | 28,725 | | 73.7 | % |

| Public sector | | | 7,102 | | | 6,746 | | | 7,137 | | | 8,005 | | | 10,245 | | 26.3 | |

| | |

| |

| |

| |

| |

| |

| |

| | | $ | 32,087 | | $ | 33,681 | | $ | 34,683 | | $ | 36,193 | | $ | 38,970 | | 100.0 | % |

| | |

| |

| |

| |

| |

| |

| |

- (1)

- North American Industrial Classification System (NAICS).

- (2)

- Preliminary estimates.

Source: Statistics Canada.

International Exports. International exports of goods originating from Québec, computed by the Institut de la statistique du Québec from data on Canada's total exports of goods, were $68.2 billion for 2002, compared with $70.8 billion for 2001, representing a decrease of 3.6%. Declines occurred in 2002 in the value of exports of electronic products (-30.5%), newsprint and printing paper (-16.0%), lumber and wood products (-4.0%), aircraft and associated parts (-4.0%), machinery (-3.6%) and chemical products (-0.1%). The decrease in exports of electronic products is the result of a significant decline in world demand for these products in 2001 and 2002 following a period of strong growth in 2000. These declines were partially offset by gains in the value of exports of tools and other equipment (5.0%), clothing and apparel (3.6%), paperboard and other paper (2.8%), motor vehicles and associated parts (2.0%) and aluminum and alloys (1.9%).

The United States is Québec's principal international export market, accounting for 84.0% of the international exports of goods in 2002.

Table 5

Québec's International Exports of Goods

| | 1998

| | 1999

| | 2000

| | 2001

| | 2002

| | % of Total 2002

| |

|---|

| | (dollar amounts in millions)

| |

| |

|---|

| Aircraft and associated parts | | $ | 5,793 | | $ | 6,403 | | $ | 8,043 | | $ | 10,858 | | $ | 10,428 | | 15.3 | % |

| Aluminum and alloys | | | 4,355 | | | 4,199 | | | 4,630 | | | 5,168 | | | 5,266 | | 7.7 | |

| Electronic products | | | 7,008 | | | 8,084 | | | 13,283 | | | 6,678 | | | 4,639 | | 6.8 | |

| Newsprint and printing paper | | | 4,286 | | | 4,077 | | | 4,604 | | | 4,734 | | | 3,975 | | 5.8 | |

| Lumber and wood products | | | 3,481 | | | 4,005 | | | 3,744 | | | 3,618 | | | 3,474 | | 5.1 | |

| Motor vehicles and associated parts | | | 3,040 | | | 3,101 | | | 3,544 | | | 2,908 | | | 2,965 | | 4.3 | |

| Tools and other equipment | | | 1,713 | | | 2,060 | | | 2,370 | | | 2,313 | | | 2,429 | | 3.6 | |

| Chemical products | | | 1,764 | | | 1,551 | | | 1,813 | | | 2,048 | | | 2,045 | | 3.0 | |

| Machinery | | | 1,896 | | | 1,912 | | | 2,004 | | | 2,064 | | | 1,990 | | 2.9 | |

| Clothing and apparel | | | 1,339 | | | 1,515 | | | 1,664 | | | 1,699 | | | 1,760 | | 2.6 | |

| Paperboard and other paper | | | 1,170 | | | 1,349 | | | 1,449 | | | 1,486 | | | 1,528 | | 2.2 | |

| Other goods | | | 21,718 | | | 23,808 | | | 26,972 | | | 27,244 | | | 27,747 | | 40.7 | |

| | |

| |

| |

| |

| |

| |

| |

| Total | | $ | 57,564 | | $ | 62,063 | | $ | 74,120 | | $ | 70,819 | | $ | 68,246 | | 100.0 | % |

| | |

| |

| |

| |

| |

| |

| |

Source: Institut de la statistique du Québec.

11

Canada is a member of the World Trade Organization ("WTO") and has also signed other trade agreements in order to promote commerce with economic partners. In 1989, the United States and Canada entered into a free trade agreement ("FTA") which has led to the gradual elimination of tariffs on goods and services between the two countries and to the liberalization of trade in several sectors including the energy sector. The FTA provides for a binding binational review of domestic determinations in antidumping and countervailing duty cases and for binational arbitration of disputes between Canada and the United States as to either's compliance with the FTA or with the rules of the WTO. In 1994, Canada, the United States and Mexico signed a similar free trade agreement, the North American Free Trade Agreement ("NAFTA"), which provides, with a few exceptions, for the gradual elimination by 2003 of tariffs on goods and services among Canada, the United States and Mexico. In April 1998, negotiations were undertaken between countries of the Americas (North, Central and South) to reach a new trade agreement by 2005 (Free Trade Area of the Americas).

On April 23, 2001, in response to a petition filed with the U.S. Department of Commerce ("DoC") and the U.S. International Trade Commission ("ITC") by a coalition of American lumber producers and various labor unions, the DoC instituted countervailing duty and antidumping investigations with respect to softwood lumber imports from Canada that were allegedly subsidized by the federal and provincial governments. Meanwhile, the ITC proceeded with its own investigations and issued on May 18, 2001 a preliminary determination that there was a reasonable indication that an industry in the United States was threatened with material injury by reason of imports of softwood lumber from Canada. As a result, both investigations were allowed to continue to final determinations. On March 22, 2002, the DoC issued its final decision establishing countervailing duties ("CVD") of 18.79% and antidumping duties ("AD") of 8.43%. On May 2, 2002, the ITC also determined under a final decision that there existed a threat of injury to the U.S. industry and, therefore, permanent combined duties of 27.22% were levied by American customs as of May 22, 2002. However, the ITC's final decision also concluded that, up to the time of the decision, the U.S. industry had not been injured by softwood lumber imports from Canada. As a consequence, the U.S. government was required to release bonds posted prior to May 16, 2002 by Canadian companies to cover interim duties imposed in 2001 and to refund all cash deposits paid prior to that date, resulting in an estimated saving by Canadian lumber producers of $760 million. The Government and the federal government have consistently denied the allegations. The federal government and the Canadian lumber industry are challenging the U.S. measures under NAFTA and WTO agreements. Two similar challenges before the WTO were previously resolved in Canada's favor. In 2003, a NAFTA panel and a WTO panel each issued preliminary rulings concluding that the ITC's method of calculating CVD and AD should be reviewed. Representatives of the federal and provincial governments are negotiating with representatives of the DoC to find alternative ways of resolving the dispute. The American and Canadian lumber industries are also involved in these discussions.

Labor Force. In 2002, the labor force was estimated at 3.9 million persons, an increase of 3.2% from 2001. The labor force participation rate for 2002 was estimated at 65.1% in Québec, compared with 66.9% in Canada. Total employment increased by 3.4% in 2002 in Québec, compared with an increase of 2.2% in Canada. The unemployment rate decreased from 8.7% in 2001 to 8.6% in 2002 in Québec, compared with an increase from 7.2% to 7.7% in Canada for the same period.

Energy. Of the total energy consumed in Québec in 2001 (the last year for which information is available), energy derived from electricity accounted for 43.0%, oil for 42.2%, natural gas for 13.5% and coal for 1.3%. Québec generates approximately one-third of all electricity produced in Canada and is one of the largest producers of hydroelectricity in the world. In 2002, approximately 96% of all electricity produced in Québec was from hydroelectric installations. More than 41,000 megawatts ("MW") of hydroelectric capacity (including the capacity of independent producers and the firm capacity currently available from Churchill Falls (Labrador) Corporation Limited) have been or are in the process of being developed. Of the total electricity produced in Québec in 2002, 12.2% was exported to the United States and to other Canadian provinces, compared with 11.0% in 2001.

12

Government Finances

Financial Administration

The Minister of Finance is responsible for the general administration of the Government's finances. The Financial Administration Act, the Balanced Budget Act and the Act to establish a budgetary surplus reserve fund govern the management of public monies of Québec and the Public Administration Act governs the management of financial, human, physical and information resources of the Administration. The Conseil exécutif issues Orders in Council which authorize the Minister of Finance to enter into financial contracts, including those related to borrowings by the Government. The Conseil du trésor determines the accounting policies. The accounts of the Government are kept on a modified accrual basis. The fiscal year of the Government ends March 31. The Auditor General is responsible for auditing the consolidated financial statements of the Government and reporting annually to the National Assembly.

All revenues and monies over which the Parliament has power of appropriation form the Consolidated Revenue Fund of Québec. The Budget and appropriations from the Consolidated Revenue Fund and consolidated organizations are published at the beginning of each fiscal year. Interim financial statements and revisions to the Budget forecast are published quarterly.

Transactions are classified as "budgetary", "non-budgetary" or "financing":

- •

- budgetary transactions are those related to the Government's revenue and expenditure:

- •

- revenue is derived from taxes, duties, permits, revenues from Government enterprises and consolidated organizations, transfers from the federal government and miscellaneous sources; and

- •

- expenditure consists of operating expenditures for goods and services which include, among other things, transfer payments, remuneration, and debt service;

- •

- non-budgetary transactions include changes in the balances of investments, loans and advances made by the Government, particularly to its own enterprises, changes in net capital investments made by the Government, changes in the accumulated provision for retirement plans administered by the Government and changes in other accounts; and

- •

- financing transactions include changes in cash position and in financial liabilities.

The Balanced Budget Act is designed to ensure that over time and on a cumulative basis the Government maintains budgetary balance. Any sum lacking for meeting the budgetary balance or surplus objectives determined by the Act (an "overrun") of less than $1 billion in a fiscal year must be offset by the Government in the next fiscal year. If an overrun exceeding $1 billion stems from any of the exceptional circumstances defined in the Act, the Government may exceed the deficit objective for more than one year, but must offset the overrun over a maximum period of five years. If the Government achieves a surplus in its budgetary objectives for a fiscal year, it may then incur overruns in subsequent fiscal years up to the amount of that surplus. However, if the Government is operating under an offsetting financial plan, it must apply any surplus to offset any already recorded or anticipated overruns.

Under the Act to establish a budgetary surplus reserve fund, a surplus may be appropriated to a budgetary reserve fund which may be used for capital projects or projects of defined duration or for the maintenance of a budgetary balance when circumstances mentioned in the Act arise. The amounts paid into the reserve remain under full Government control.

A balanced budget was achieved in Fiscal 2000. In Fiscal 2001, a surplus of $427 million was achieved after the creation of a reserve of $950 million. In Fiscal 2002, a surplus of $22 million was achieved through the use of the budgetary reserve of $950 million created in Fiscal 2001. On June 12, 2003, the Government presented the 2003-2004 Budget Speech and on September 30, 2003, released the Quarterly Presentation of Financial Transactions as at June 30, 2003. The preliminary results for the year ended March 31, 2003, as revised indicates a budget deficit of $221 million. Notwithstanding the overrun in Fiscal 2003, the Government remains in compliance with the Balanced Budget Act as a result of the accumulated surpluses achieved as at the end of Fiscal 2002.

13

The following table summarizes the consolidated financial transactions of the Government for the three years ended March 31, 2002, the preliminary results for Fiscal 2003 and the revised forecasts for Fiscal 2004.

Table 6

Summary of Consolidated Financial Transactions

| | Year ending March 31

| |

|---|

| | 2000

| | 2001

| | 2002

| | Preliminary Results 2003(1)

| | Revised Forecasts 2004(1)

| |

|---|

| | (dollar amounts in millions)

| |

|---|

| Budgetary transactions: | | | | | | | | | | | | | | | | |

| | Own-source revenue | | $ | 41,076 | | $ | 42,904 | | $ | 41,004 | | $ | 43,573 | | $ | 45,228 | |

| | Federal transfers | | | 6,334 | | | 8,145 | | | 9,305 | | | 9,307 | | | 9,584 | |

| | |

| |

| |

| |

| |

| |

| | Total revenue | | | 47,410 | | | 51,049 | | | 50,309 | | | 52,880 | | | 54,812 | |

| | |

| |

| |

| |

| |

| |

| | Operating expenditure | | | (40,031 | ) | | (42,066 | ) | | (43,976 | ) | | (46,016 | ) | | (47,437 | ) |

| | Debt service | | | (7,372 | ) | | (7,606 | ) | | (7,261 | ) | | (7,085 | ) | | (7,512 | ) |

| | |

| |

| |

| |

| |

| |

| | Total expenditure | | | (47,403 | ) | | (49,672 | ) | | (51,237 | ) | | (53,101 | ) | | (54,949 | ) |

| | |

| |

| |

| |

| |

| |

| Budgetary reserve: | | | | | | | | | | | | | | | | |

| | Funds allocated to the reserve | | | — | | | (950 | ) | | — | | | — | | | — | |

| | Use of funds allocated to the reserve to finance spending and maintain a balanced budget | | | — | | | — | | | 950 | | | — | | | — | |

| Shortfall to make up during the fiscal year | | | — | | | — | | | — | | | — | | | 137 | |

| | |

| |

| |

| |

| |

| |

| Budgetary surplus (deficit) | | | 7 | | | 427 | | | 22 | | | (221 | ) | | — | |

| | |

| |

| |

| |

| |

| |

| Non-budgetary transactions: | | | | | | | | | | | | | | | | |

| | Investments, loans and advances | | | (2,006 | ) | | (1,632 | ) | | (1,142 | ) | | (1,795 | ) | | (1,677 | ) |

| | Fixed assets | | | (359 | ) | | (473 | ) | | (995 | ) | | (1,525 | ) | | (1,334 | ) |

| | Retirement plans | | | 1,740 | | | 1,793 | | | 2,089 | | | 2,007 | | | 2,041 | |

| | Other accounts(2) | | | 1,328 | | | (631 | ) | | (589 | ) | | (51 | ) | | (853 | ) |

| | |

| |

| |

| |

| |

| |

| | | | 703 | | | (943 | ) | | (637 | ) | | (1,364 | ) | | (1,823 | ) |

| | |

| |

| |

| |

| |

| |

| Net financial surplus (requirements) | | $ | 710 | | $ | (516 | ) | $ | (615 | ) | $ | (1,585 | ) | $ | (1,823 | ) |

| | |

| |

| |

| |

| |

| |

| Financing transactions: | | | | | | | | | | | | | | | | |

| | Change in cash position | | | 2,253 | | | (473 | ) | | 132 | | | (2,225 | ) | | 4,454 | |

| | Change in direct debt(3) | | | (132 | ) | | 3,008 | | | 3,623 | | | 5,451 | | | (278 | ) |

| | Retirement plans sinking fund(4) | | | (2,831 | ) | | (2,019 | ) | | (3,140 | ) | | (1,641 | ) | | (2,353 | ) |

| | |

| |

| |

| |

| |

| |

| Total financing of transactions | | $ | (710 | ) | $ | 516 | | $ | 615 | | $ | 1,585 | | $ | 1,823 | |

| | |

| |

| |

| |

| |

| |

- (1)

- As revised on September 30, 2003.

- (2)

- Reflects year-to-year changes in accounts payable and receivable, cash on hand and outstanding bank deposits and checks.

- (3)

- Represents mainly new borrowings of $6,080 million, $8,594 million, $9,011 million, $10,572 million, and $4,918 million for each of Fiscal 2000 through 2004, respectively, less repayment of borrowings.

- (4)

- Reflects the proceeds of Government debt issues used to partially fund the Government's obligations in respect of its retirement plans (see "Consolidated Non-Budgetary Transactions Relating to Retirement Plans").

14

2002-2003 Preliminary Results

Preliminary results for the Government's financial transactions in Fiscal 2003 indicate a budgetary deficit of $221 million.

Consolidated budgetary revenue for Fiscal 2003 is expected to be $973 million higher than forecasted in the Supplement to the 2002-2003 Budget presented on March 19, 2002. Provincial own-source revenue is expected to be $508 million higher than originally budgeted. These adjustments arise due to the increase of the tobacco tax rate announced on June 17, 2002 providing $165 million, and to higher than originally budgeted revenue from consumption taxes, consolidated organizations and government enterprises and are partly offset by lower revenue from other sources, particularly personal and corporate taxes. Federal transfers are expected to be $465 million higher than budgeted. Revenue from other programs was adjusted upward by $280 million owing to the refund, at the beginning of 2003-2004 rather than at the end of 2002-2003, of part of the federal tax transfer for youth allowances. In addition, revenue from the Canada Health and Social Transfer ("CHST") was revised upward by $193 million reflecting a decrease of the fiscal transfer value, which increases the cash transfer to Québec.

Consolidated budgetary expenditure was adjusted upward by $1,194 million to $53,101 million. Operating expenditure was revised upward by $1,303 million. This increase resulted mainly from additional expenditures of $381 million in the health and social services sector, $146 million caused by a lower-than-anticipated decrease in the number of households on employment assistance and $124 million of provisions for uncollectable tax receipts. Additionally, the spending in consolidated organizations was adjusted upward by $226 million. Finally, total debt service was adjusted downward by $109 million.

Fiscal 2003 provincial own-source revenue included a non-cash entry of $739 million, reflecting elimination of the accumulated deficit in a government agency, the Commission de la santé et de la sécurité au travail ("CSST"), the functions of which were transferred to a trust fund. Own-source revenue includes profits of CSST for Fiscal 2000 in the amount of $787 million and, for Fiscal 2001, $443 million, and losses in Fiscal 2002 and Fiscal 2003 of $33 million and $58 million, respectively. These profits were not distributed as dividends to the Government but rather were applied against the accumulated deficit of the CSST accounted for in the Government's financial statements. Effective January 2003, the CSST was removed from the Government's reporting entity.

2003-2004 Revised Forecasts

The Government has confirmed the objective of a balanced budget for Fiscal 2004. Results for Société générale de financement du Québec for Fiscal 2004 are expected to be $137 million less than originally budgeted. Nevertheless, the Minister of Finance has indicated that this shortfall will be offset in other areas during the remainder of Fiscal 2004. The Government expects consolidated net financial requirements of $1,823 million in 2003-2004. The net financial requirements of consolidated organizations amount to $1,523 million while the net financial requirements of the Consolidated Revenue Fund is budgeted to be $300 million.

In 2003-2004, total budgetary revenue is forecast to be $54,812 million, an increase of 3.7% compared with the preliminary results for 2002-2003. Own-source revenue is budgeted at $45,228 million, an increase of 3.8% compared with 2002-2003, due to expected growth of the economy, resulting in increases in personal, corporate and consumption taxes revenue. Nearly 83% of total budgetary revenue comes from own-source revenue. Federal transfers are expected to increase by 3.0% ($9,584 million) reflecting the increase in funds received by Québec following the federal government's February 2003 announcement supporting health care. Without this announcement, federal transfers would have fallen by 14.7% which would have been mainly attributable to a decline in equalization resulting from Québec's good economic performance in 2002. This federal announcement includes a $10 billion increase in transfers to the provinces over the next three years. Furthermore, an additional $2 billion will be paid to the provinces in 2003-2004 if the federal surplus reaches $5 billion. For Québec, the federal announcement represents additional revenues of $2.8 billion over the next three years, of which $1.6 billion is included in Fiscal 2003-2004. This amount includes $472 million as Québec's share of the additional $2 billion in 2003-2004.

The method used to calculate consumption-tax revenue from agents will be improved starting Fiscal 2004 in order to take into consideration all of the remittances on sales made before March 31 of each year, which will result in a one-time gain of $300 million in 2003-2004.

The Youth Allowance Refund Schedule will be changed to coincide, as of 2004-2005, with the year in which refunds become payable to the federal government. This measure will result in a one-time gain of $305 million in 2003-2004.

15

In agreement with Hydro-Québec, Loto-Québec and Société des alcools du Québec, Québec revised the objectives of their respective net profit targets for Fiscal 2004, to $2,130 million for Hydro-Québec, $1,464 million for Loto-Québec and $570 million for Société des alcools du Québec. This represents an aggregate budgeted profit increase of $431 million, relative to the actual results for Fiscal 2003.

The Government's budgetary expenditure is expected to total $54,949 million in 2003-2004, 3.5% higher than the preliminary results of 2002-2003. Program spending (excluding the operating expenditures of consolidated organizations) will increase by 3.8% in 2003-2004 to $45,800 million. More than 85% of program spending growth is related to the health and social services sector. The ratio of the Government's program spending to GDP is budgeted to decrease to 17.9% in 2003-2004. Total debt service is expected to increase by 6.0% to $7,512 million.

The portion of budgetary revenue allocated to total debt service is budgeted to represent 13.7% in 2003-2004, a decline from 15.5% in 1999-2000.

The projections in the 2003-2004 Budget reflect the following assumptions regarding the economy of Québec for 2003:

Table 7

Economic Assumptions included in the 2003-2004 Budget

| | Percentage Change

| |

|---|

| GDP: | | | |

| | At current market prices | | 5.2 | % |

| | At market prices (1997 prices) | | 2.5 | |

| Personal income | | 4.0 | |

| Business residential capital expenditures | | 4.1 | |

| Consumer expenditures | | 4.7 | |

| Labor force | | 1.8 | |

| Employment | | 1.7 | |

|

|

Average Rate

|

|

| Unemployment rate | | 8.6 | % |

Source: Ministère des Finances du Québec.

16

Consolidated Budgetary Revenue

Table 8

Consolidated Budgetary Revenue

| | Year ending March 31

| |

|---|

| | 2000

| | 2001

| | 2002

| | Preliminary Results 2003

| | Revised Forecasts 2004(1)

| | % of Total 2004(1)

| |

|---|

| | (dollar amounts in millions)

| |

| |

|---|

| Own-source revenue: | | | | | | | | | | | | | | | | | | |

| Income and property taxes: | | | | | | | | | | | | | | | | | | |

| | Personal income tax | | $ | 16,074 | | $ | 17,116 | | $ | 15,923 | | $ | 16,403 | | $ | 16,891 | | 30.8 | % |

| | Contributions to Health Services Fund | | | 4,291 | | | 4,488 | | | 4,291 | | | 4,108 | | | 4,640 | | 8.5 | |

| | Corporate taxes | | | 3,643 | | | 4,217 | | | 4,029 | | | 3,735 | | | 3,926 | | 7.2 | |

| | |

| |

| |

| |

| |

| |

| |

| | | | 24,008 | | | 25,821 | | | 24,243 | | | 24,246 | | | 25,457 | | 46.5 | |

| | |

| |

| |

| |

| |

| |

| |

| Consumption taxes: | | | | | | | | | | | | | | | | | | |

| | Sales | | | 6,761 | | | 7,374 | | | 7,557 | | | 8,331 | | | 9,014 | | 16.4 | |

| | Fuel | | | 1,560 | | | 1,536 | | | 1,536 | | | 1,645 | | | 1,638 | | 3.0 | |

| | Tobacco | | | 498 | | | 483 | | | 652 | | | 867 | | | 915 | | 1.7 | |

| | |

| |

| |

| |

| |

| |

| |

| | | | 8,819 | | | 9,393 | | | 9,745 | | | 10,843 | | | 11,567 | | 21.1 | |

| | |

| |

| |

| |

| |

| |

| |

| Duties and permits: | | | | | | | | | | | | | | | | | | |

| | Motor vehicles | | | 667 | | | 646 | | | 662 | | | 690 | | | 695 | | 1.3 | |

| | Natural resources | | | 354 | | | 265 | | | 188 | | | 201 | | | 128 | | 0.2 | |

| | Alcoholic beverages | | | 139 | | | 146 | | | 140 | | | 155 | | | 158 | | 0.3 | |

| | Other | | | 182 | | | 180 | | | 177 | | | 178 | | | 178 | | 0.3 | |

| | |

| |

| |

| |

| |

| |

| |

| | | | 1,342 | | | 1,237 | | | 1,167 | | | 1,224 | | | 1,159 | | 2.1 | |

| | |

| |

| |

| |

| |

| |

| |

| Miscellaneous: | | | | | | | | | | | | | | | | | | |

| | Sales of goods and services | | | 422 | | | 406 | | | 412 | | | 440 | | | 467 | | 0.9 | |

| | Fines, forfeitures and recoveries | | | 345 | | | 310 | | | 371 | | | 417 | | | 386 | | 0.7 | |

| | Interest | | | 363 | | | 390 | | | 395 | | | 321 | | | 352 | | 0.6 | |

| | |

| |

| |

| |

| |

| |

| |

| | | | 1,130 | | | 1,106 | | | 1,178 | | | 1,178 | | | 1,205 | | 2.2 | |

| | |

| |

| |

| |

| |

| |

| |

| Revenue from Government enterprises(2): | | | | | | | | | | | | | | | | | | |

| | Hydro-Québec | | | 1,090 | | | 1,160 | | | 1,041 | | | 1,840 | | | 2,130 | | 3.9 | |

| | Loto-Québec | | | 1,289 | | | 1,358 | | | 1,352 | | | 1,353 | | | 1,464 | | 2.7 | |

| | Société des alcools du Québec | | | 442 | | | 471 | | | 489 | | | 540 | | | 570 | | 1.0 | |

| | Other | | | 1,106 | | | 507 | | | (151 | ) | | 189 | | | (359 | ) | (0.7 | ) |

| | |

| |

| |

| |

| |

| |

| |

| | | | 3,927 | | | 3,496 | | | 2,731 | | | 3,922 | | | 3,805 | | 6.9 | |

| Consolidated organizations | | | 1,850 | | | 1,851 | | | 1,940 | | | 2,160 | | | 2,035 | | 3.7 | |

| | |

| |

| |

| |

| |

| |

| |

| Total own-source revenue | | | 41,076 | | | 42,904 | | | 41,004 | | | 43,573 | | | 45,228 | | 82.5 | |

| | |

| |

| |

| |

| |

| |

| |

| Federal transfers: | | | | | | | | | | | | | | | | | | |

| | Equalization | | | 4,387 | | | 5,650 | | | 5,336 | | | 5,315 | | | 4,145 | | 7.6 | |

| | Canada Health and Social Transfer | | | 1,120 | | | 1,597 | | | 2,958 | | | 2,648 | | | 4,133 | | 7.5 | |

| | Contributions to welfare programs | | | 11 | | | — | | | — | | | — | | | — | | — | |

| | Other transfers related to fiscal arrangements | | | 11 | | | 30 | | | 27 | | | 34 | | | 15 | | — | |

| | Other programs | | | 535 | | | 618 | | | 564 | | | 935 | | | 895 | | 1.7 | |

| | Consolidated organizations | | | 270 | | | 250 | | | 420 | | | 375 | | | 396 | | 0.7 | |

| | |

| |

| |

| |

| |

| |

| |

| Total federal transfers | | | 6,334 | | | 8,145 | | | 9,305 | | | 9,307 | | | 9,584 | | 17.5 | |

| | |

| |

| |

| |

| |

| |

| |

| Total budgetary revenue | | $ | 47,410 | | $ | 51,049 | | $ | 50,309 | | $ | 52,880 | | $ | 54,812 | | 100.0 | % |

| | |

| |

| |

| |

| |

| |

| |

- (1)

- As revised on September 30, 2003.

- (2)

- Includes the dividends declared and the changes in surpluses or deficits accumulated by Government enterprises, which are consolidated with a corresponding revaluation of the investment held by the Government. The declared dividends were $2,145 million, $2,339 million, $2,360 million and $2,624 million for each of Fiscal 2000 through 2003, respectively, and are budgeted to be $2,939 million for Fiscal 2004.

17

Taxes. The Government and the federal government share the power to levy personal income taxes in Québec. The Government levies and collects its own personal income tax at rates ranging, for 2003, from 16% to 24% in three brackets.

Québec corporations are subject to taxation at the provincial level on profits, capital and wages. A provincial tax rate of 8.9% is applied on active business income of corporations and a rate of 16.25% is applied on non-active business income and other income of corporations.

The corporate tax on capital was reduced from 0.64% to 0.6% in 2003. Furthermore, an exemption on paid-up capital of $250,000 is granted since January 1, 2003. The exemption will be raised to $600,000 in January 1, 2004. Thus, as of January 2004, 70% of businesses will no longer pay tax on capital.

The tax rate on wages (contribution to the Health Services Fund) is 4.26%. As part of the corporate tax reform initiated on July 1, 1999, the tax rate applicable to wages was reduced for small and medium-sized businesses ("SMEs") to 2.70% effective January 1, 2001.

Québec's corporate tax system provides incentives for the development of the new economy (tax credits in research and development), encourages investment (partial tax holiday: five-year for new corporations, ten-year for manufacturing SMEs in remote resource regions) and supports secondary and tertiary processing activities in resource regions (including Abitibi-Témiscamingue, Bas-Saint-Laurent, Côte-Nord, Gaspésie-Îles-de-la-Madeleine, Mauricie, Nord-du-Québec and Saguenay-Lac-Saint-Jean).

Starting June 12, 2003, the 2003-2004 Budget imposed measures reducing many tax incentives for businesses and other specific fiscal advantages granted to high-income earners.

The Québec Sales Tax ("QST") is a multi-stage value-added tax which applies uniformly at each stage of the production and marketing of goods and services. A mechanism provides refunds of the tax paid on inputs at various stages of production in order to avoid double taxation. Refunds of QST are not allowed on energy (unless used to produce movable property), telecommunications, road vehicles, fuel and meals and entertainment for large businesses. The QST rate is 7.5%.

On June 30, 2003, the Grand Chief of the Assembly of First Nations of Québec and Labrador, filed a motion in the Québec Superior Court for authorization to file a class action on behalf of all status Indians (except for James Bay Crees) who have paid Québec fuel tax since July 1, 1973 (the date on which this tax came into force) on purchases of fuel on a reserve in Québec. Québec fuel tax legislation requires status Indians to pay the fuel tax embedded in the price of fuel at the pump but allows them to claim a rebate of the tax paid from the Québec Ministry of Revenue. The proposed class action alleges that many status Indians failed to file a rebate claim for the fuel tax they paid and that the rebate system is not valid as the tax should not have been paid in the first place in view of the federal Indian Act which exempts from taxes the property of a status Indian when it is located on a reserve. The amounts the proposed class action could potentially involve have not yet been ascertained. The motion has not yet been heard and both the claimant, the Grand chief of the Assembly of First Nations of Québec and Labrador, and the Minister responsible for Aboriginal Affairs have publicly indicated their preference for a negotiated settlement of this issue.

Federal Government Transfers. A major category of federal transfers is equalization. Equalization is designed to enable provincial governments to offer reasonably comparable levels of public services without having to impose unduly high taxation. The equalization program was renewed in March 1999 for a period of five years.

The federal government contributes to the financing of provincial health, post-secondary education and income security programs by means of the CHST. There are two types of transfers under the CHST: tax transfers and cash transfers. Total entitlements per province are first established, from which tax transfers are deducted to arrive at cash transfers. Tax transfers represent a portion of the federal personal income and corporate income tax collected in the provinces. Cash transfers fluctuate based on total entitlements and the value of taxes transferred in a given year.

Until 2000-2001, total entitlements were distributed to reflect 1995-1996 Established Program Financing (EPF) and Canada Assistance Plan (CAP) shares, adjusted to reflect demographic growth and each province's share of Canada's total population. Since 2001-2002, the distribution of total entitlements reflects each province's share of the population. Other federal transfers generally represent cost-sharing agreements for education, regional economic development and the labor market.

18

Consolidated Budgetary Expenditure

Table 9

Consolidated Budgetary Expenditure

| | Year ending March 31

| |

|---|

| | 2000

| | 2001

| | 2002

| | Preliminary Results 2003

| | Revised Forecasts 2004(1)

| | % of Total 2004(1)

| |

|---|

| | (dollar amounts in millions)

| |

| |

|---|

| Economy and environment: | | | | | | | | | | | | | | | | | | |

| | Transportation | | $ | 1,578 | | $ | 1,507 | | $ | 1,412 | | $ | 1,434 | | $ | 1,496 | | 2.7 | % |

| | Employment | | | 934 | | | 977 | | | 964 | | | 971 | | | 935 | | 1.7 | |

| | Agriculture, fisheries and food | | | 513 | | | 714 | | | 651 | | | 641 | | | 633 | | 1.2 | |

| | Environment | | | 658 | | | 554 | | | 776 | | | 752 | | | 757 | | 1.4 | |

| | Other | | | 1,971 | | | 2,174 | | | 1,948 | | | 2,032 | | | 1,780 | | 3.2 | |

| | |

| |

| |

| |

| |

| |

| |

| | | | 5,654 | | | 5,926 | | | 5,751 | | | 5,830 | | | 5,601 | | 10.2 | |

| | |

| |

| |

| |

| |

| |

| |

| Education and culture: | | | | | | | | | | | | | | | | | | |

| | Educational institutions(2) | | | 9,355 | | | 9,610 | | | 9,982 | | | 10,518 | | | 10,838 | | 19.7 | |

| | Culture and communications | | | 484 | | | 530 | | | 484 | | | 490 | | | 498 | | 0.9 | |

| | Teachers pension plan(2) | | | 471 | | | 520 | | | 566 | | | 587 | | | 647 | | 1.2 | |

| | Other | | | 156 | | | 162 | | | 198 | | | 188 | | | 188 | | 0.3 | |

| | |

| |

| |

| |

| |

| |

| |

| | | | 10,466 | | | 10,822 | | | 11,230 | | | 11,783 | | | 12,171 | | 22.1 | |

| | |

| |

| |

| |

| |

| |

| |

| Health and social services: | | | | | | | | | | | | | | | | | | |

| | Health and social services(2) | | | 11,189 | | | 12,162 | | | 12,901 | | | 13,321 | | | 14,220 | | 25.9 | |

| | Régie de l'assurance-maladie du Québec(3) | | | 3,642 | | | 3,939 | | | 4,295 | | | 4,511 | | | 4,895 | | 8.9 | |

| | |

| |

| |

| |

| |

| |

| |

| | | | 14,831 | | | 16,101 | | | 17,196 | | | 17,832 | | | 19,115 | | 34.8 | |

| | |

| |

| |

| |

| |

| |

| |

| Support for individuals and families: | | | | | | | | | | | | | | | | | | |

| | Income security | | | 3,123 | | | 3,111 | | | 3,102 | | | 3,184 | | | 2,971 | | 5.4 | |

| | Other | | | 1,682 | | | 1,720 | | | 1,868 | | | 1,979 | | | 2,110 | | 3.9 | |

| | |

| |

| |

| |

| |

| |

| |

| | | | 4,805 | | | 4,831 | | | 4,970 | | | 5,163 | | | 5,081 | | 9.3 | |

| | |

| |

| |

| |

| |

| |

| |

| Administration and justice: | | | | | | | | | | | | | | | | | | |

| | Public security | | | 701 | | | 744 | | | 800 | | | 871 | | | 832 | | 1.5 | |

| | Revenue(3) | | | 721 | | | 715 | | | 613 | | | 779 | | | 630 | | 1.1 | |

| | Municipal affairs | | | 335 | | | 516 | | | 628 | | | 619 | | | 568 | | 1.0 | |

| | Justice | | | 317 | | | 319 | | | 341 | | | 364 | | | 379 | | 0.7 | |

| | Retirement and insurance plans(2) | | | 191 | | | 270 | | | 312 | | | 315 | | | 295 | | 0.5 | |

| | Other | | | 710 | | | 639 | | | 671 | | | 744 | | | 1,128 | | 2.1 | |

| | |

| |

| |

| |

| |

| |

| |

| | | | 2,975 | | | 3,203 | | | 3,365 | | | 3,692 | | | 3,832 | | 6.9 | |

| | |

| |

| |

| |

| |

| |

| |

| Program spending | | | 38,731 | | | 40,883 | | | 42,512 | | | 44,300 | | | 45,800 | | 83.3 | |

| Consolidated organizations | | | 1,300 | | | 1,183 | | | 1,464 | | | 1,716 | | | 1,637 | | 3.0 | |

| | |

| |

| |

| |

| |

| |

| |

| Total operating expenditure | | | 40,031 | | | 42,066 | | | 43,976 | | | 46,016 | | | 47,437 | | 86.3 | |

| | |

| |

| |

| |

| |

| |

| |

| Debt service: | | | | | | | | | | | | | | | | | | |

| | Direct debt service | | | 4,119 | | | 4,378 | | | 3,970 | | | 3,888 | | | 4,177 | | 7.6 | |

| | Interest on retirement plans | | | 2,632 | | | 2,594 | | | 2,717 | | | 2,648 | | | 2,685 | | 4.9 | |

| | Consolidated organizations | | | 621 | | | 634 | | | 574 | | | 549 | | | 650 | | 1.2 | |

| | |

| |

| |

| |

| |

| |

| |

| | | | 7,372 | | | 7,606 | | | 7,261 | | | 7,085 | | | 7,512 | | 13.7 | |

| | |

| |

| |

| |

| |

| |

| |

| Total budgetary expenditure | | $ | 47,403 | | $ | 49,672 | | $ | 51,237 | | $ | 53,101 | | $ | 54,949 | | 100.0 | % |

| | |

| |

| |

| |

| |

| |

| |

- (1)

- As revised on September 30, 2003.

- (2)

- Includes provisions for the cost of vested benefits due from the Government for retirement plans.

- (3)

- Québec's health insurance plan.

- (4)

- Ministry responsible for the administration of most of Québec's tax laws and tax collection.

19

In Fiscal 2003, expenditures for salaries and wages allocated to all programs under budgetary expenditure covered the equivalent of 381,057 full-time employees who are either civil servants or school or hospital employees (of which 6% are not subject to collective bargaining agreements). All of the collective agreements of the Government's employees as well as the contracts with its non-unionized employees were to expire on June 30, 2002.

Pursuant to interim agreements reached in April and May 2002, the Government agreed with certain major unions, representing approximately 84% of all unionized Government employees, to extend the terms of their collective agreements until June 30, 2003 and to provide for a salary increase of 2%, effective April 1, 2003 plus a lump sum payment representing 0.5% of the relevant base salary as of March 31, 2003. Employees not covered by the interim agreements continue to be governed by the terms of the collective agreements which expired on June 30, 2002 or their respective contracts.

The Government and the unions representing employees of the Government and the public sector will enter into negotiations for the renewal of the collective agreements. While no schedule has been set for their negotiations, the Government has appointed a spokesman to negotiate all the major compensation issues (such as remuneration and social benefits). Until new collective agreements are signed, the terms of the interim agreements and the collective agreements which expired on June 30, 2002 remain in effect. In addition, the Government and union representatives are negotiating further adjustments to the pay relativity program within the public sector, which seeks to achieve greater parity in compensation between public and private sector employees and between male and female employees.

Economy and Environment. Expenditures are budgeted to decrease by 3.9% in Fiscal 2004 from the preceding fiscal year. Transportation expenditures include payments to public transportation agencies, primarily in the form of support for the Montréal subway system, and expenditures for highway maintenance.

The Agriculture, Fisheries and Food program includes expenditures in the agricultural sector to assist farm production.

Expenditures categorized as "Environment" include mainly debt service for the water purification program and all expenditures related to sustainable development of the environment, environmental protection, conservation and development of wildlife and natural heritage.

A significant portion of the remaining economic programs is intended to promote and create employment. The Government's fiscal policies with respect to job creation involve various measures, including investment tax credits designed to increase research and development in Québec and thereby indirectly create new jobs.

Education and Culture. Expenditures are budgeted to increase by 3.3% in Fiscal 2004 from the preceding fiscal year. This increase reflects the impact of additional expenditures for educational institutions to maintain and improve the quality of education services. Expenditures in Fiscal 2004 for preschool, primary and secondary education, for college education and for university education are budgeted at $6,827 million, $1,486 million and $1,984 million, respectively.

Health and Social Services. Expenditures are budgeted to increase by 7.2% in Fiscal 2004 from the preceding fiscal year. The Government is granting additional resources to this sector, mainly because of higher costs relating to increases in wages and consumption and the growing costs of the prescription drug insurance program.