QuickLinks -- Click here to rapidly navigate through this documentExhibit (99.7)

PUBLIC ACCOUNTS 2002-2003

VOLUME 1

CONSOLIDATED FINANCIAL STATEMENTS OF THE

GOUVERNEMENT DU QUÉBEC

Fiscal year ended March 31, 2003

Published in accordance with section 86 of the Financial

Administration Act (R.S.Q., c. A-6.001)

ISSN 0706-2869

ISBN 2-550-41717-8

Legal deposit — 1st quarter 2004

Bibliothèque nationale du Québec

II

To Her Excellency the Honourable Lise Thibault

Lieutenant-Governor of Québec

Parliament Building

Québec

Your Excellency,

The undersigned has the honour of presenting to Your Excellency the Public Accounts of the Gouvernement du Québec for the fiscal year ended March 31, 2003.

Yves Séguin

Minister of Finance

Québec, March 2004

III

(This page has been left blank intentionally.)

IV

To the Minister of Finance

Yves Séguin

Parliament Building

Québec

Dear Sir,

In accordance with the commission entrusted to me, I have the honour of presenting the Public Accounts of the Gouvernement du Québec for the fiscal year ended March 31, 2003. These accounts have been prepared under section 86 of the Financial Administration Act (R.S.Q., c. A-6.001), in accordance with the Government's accounting policies.

Respectfully yours,

Nathalie Tremblay, CA

Comptroller of Finance

Québec, March 2004

V

(This page has been left blank intentionally.)

VI

TABLE OF CONTENTS

|

| |

| |

|

|---|

| INTRODUCTION | | IX |

SUMMARY OF CONSOLIDATED FINANCIAL TRANSACTIONS |

|

|

Consolidated summary of operations |

|

XIII |

| Consolidated revenue | | XV |

| Consolidated expenditure | | XVI |

| Consolidated financial position | | XVIII |

| Reconciliation of revenue, expenditure and annual deficit | | XIX |

| Balanced Budget Act | | XX |

| Financial statistics | | XXI |

CONSOLIDATED FINANCIAL STATEMENTS |

|

|

Statement of responsibility |

|

3 |

| Auditor General's report | | 4 |

| Consolidated statement of operations | | 7 |

| Consolidated statement of accumulated deficit | | 8 |

| Consolidated statement of financial position | | 9 |

| Consolidated statement of financial requirements and financing | | 10 |

| Notes to financial statements | | 13 |

Appendices |

|

|

|

1 |

|

Government departments and agencies whose financial transactions were conducted within the Consolidated Revenue Fund and included in the Government's reporting entity |

|

35 |

| | 2 | | Agencies and special funds whose reporting entity is included in the Government's reporting entity | | 38 |

| | 3 | | Enterprises included in the Government's reporting entity | | 41 |

| | 4 | | Agencies and funds which conduct fiduciary transactions that are not included in the Government's reporting entity | | 42 |

| | 5 | | Breakdown of revenue | | 43 |

| | 6 | | Breakdown of expenditure | | 44 |

| | 7 | | Short-term investments | | 45 |

| | 8 | | Accounts receivable | | 46 |

VII

|

| |

| |

|

|---|

| | 9 | | Investment in Government enterprises | | 47 |

| | 10 | | Long-term investments | | 53 |

| | 11 | | Bank overdraft | | 55 |

| | 12 | | Accounts payable and accrued expenses | | 56 |

| | 13 | | Debts | | 58 |

| | 14 | | Net debt | | 63 |

| | 15 | | Fixed assets | | 64 |

| | 16 | | Commitments and contingencies | | 65 |

| | 17 | | Summary of fiduciary transactions conducted by Government agencies and funds | | 71 |

| | 18 | | Reserve fund | | 73 |

VIII

Introduction

Each year the Ministère des Finances publishes documents on the financial position of the Gouvernement du Québec and the results of its financial transactions.

The Quarterly Presentation of Financial Transactions was published at the close of the second and third quarters of 2002 to account for changes in the financial transactions and facilitate comparison with the projections contained in the 2002-2003 Budget of March 19, 2002.

The 2002-2003 Public Accounts complete the information relating to the actual results for fiscal 2002-2003, whose main data formed part of the second Quarterly Presentation for 2003-2004.

The Public Accounts for the fiscal year ended March 31, 2003 have been prepared by the Comptroller of Finance for the Minister of Finance in accordance with the accounting policies established by the Conseil du trésor and pursuant to the provisions of section 86 of the Financial Administration Act (R.S.Q., c. A-6.001). They are published in two volumes.

Volume 1 — Consolidated Financial Statements of the Gouvernement du Québec

Volume 1 presents summary data on the consolidated financial transactions and the consolidated financial statements of the Gouvernement du Québec for the fiscal year ended March 31, 2003, accompanied by the Auditor General's report.

Volume 2 — Revenue, Appropriations, Expenditure and Investments of the Consolidated Revenue Fund and Financial Information on the Special Funds of the Gouvernement du Québec

Volume 2 is divided into three sections. The first two sections report on the operations of entities whose revenue is cashed into the Consolidated Revenue Fund or the Health Services Fund and entities whose operating activities are paid for out of these funds using appropriations allotted by Parliament. Such entities include Government departments, budgetary agencies, the National Assembly and persons designated by it, and other portfolios. The third section presents summary financial information on the special funds.

IX

(This page has been left blank intentionally.)

X

SUMMARY

OF CONSOLIDATED

FINANCIAL TRANSACTIONS

XI

(This page has been left blank intentionally.)

XII

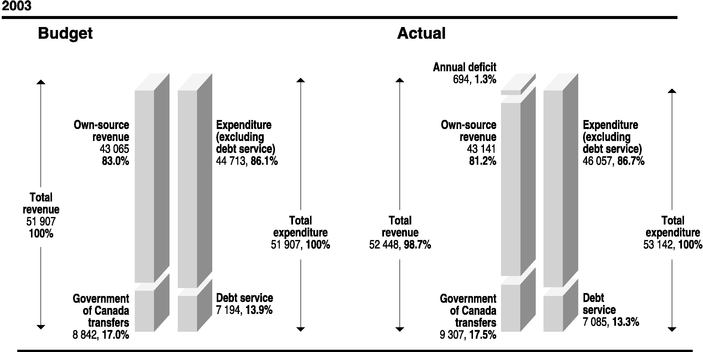

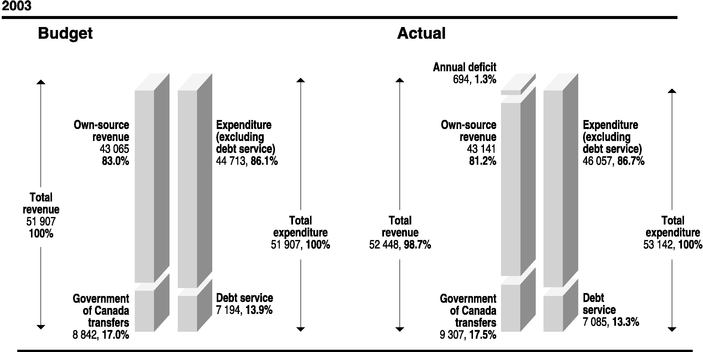

Consolidated summary of operations

FISCAL YEAR ENDED MARCH 31, 2003

(in millions of dollars)

| | 2003

| | 2002(1)

| |

|---|

| | Budget*

| | Actual results

| | Actual results

| |

|---|

| Own-source revenue | | 43 065 | | 43 141 | | 41 011 | |

| Government of Canada transfers | | 8 842 | | 9 307 | | 9 305 | |

| | |

| |

| |

| |

| Total revenue | | 51 907 | | 52 448 | | 50 316 | |

| | |

| |

| |

| |

| Expenditure (excluding debt service) | | 44 713 | | 46 057 | | 43 983 | |

| Debt service | | 7 194 | | 7 085 | | 7 261 | |

| | |

| |

| |

| |

| Total expenditure | | 51 907 | | 53 142 | | 51 244 | |

| | |

| |

| |

| |

| ANNUAL DEFICIT | | — | | (694 | ) | (928 | ) |

| | |

| |

| |

| |

| * On the basis of the revenue and expenditure forecasts showed in the 2002-2003 Budget of March 19, 2002. | |

Under the Act to establish a budgetary surplus reserve fund (R.S.Q., c. R-25.1), the government created a reserve fund to finance certain expenditures and maintain a balanced budget. |

|

|

|

|

|

|

|

The changes in the reserve fund are shown in Appendix 18. |

|

|

|

|

|

|

|

Annual deficit |

|

— |

|

(694 |

) |

(928 |

) |

| Transfer to reserve fund | | — | | — | | — | |

| Use of reserve fund | | — | | — | | 950 | |

| | |

| |

| |

| |

| Excess of annual deficit over reserve fund | | — | | (694 | ) | 22 | |

| | |

| |

| |

| |

- (1)

- Certain revenue and expenditure figures for 2002 were reclassified for consistency with the presentation adopted in 2003.

XIII

Consolidated summary of operations (cont'd)

FISCAL YEAR ENDED MARCH 31, 2003

(in millions of dollars)

Revenue for fiscal 2002-2003 is $541 million higher than forecast in the 2002-2003 Budget of March 19, 2002. The $76-million increase in own-source revenue is due to additional revenue from consumption taxes and Government enterprises. It is largely offset by lower corporate tax revenue and an adjustment to the allocation of remittances by employers, which attributes more revenue to the Régie des rentes du Québec, a fiduciary organization of the Government, and reduces the revenue of the Consolidated Revenue Fund accordingly. As for the $465-million upward adjustment in federal transfers, it can be explained mainly by an increase in revenue from the Canada Health and Social Transfer.

Expenditure for fiscal 2002-2003, excluding debt service, is $1 344 million higher than anticipated in the 2002-2003 Budget. This increase reflects the impact of the additional resources allocated mainly to the health and social services sector, as well as the lower-than-expected decrease in the number of households receiving employment assistance.

Lastly, debt service is $109 million less than projected in the Budget. This change is due primarily to a decline in interest on pension plans.

XIV

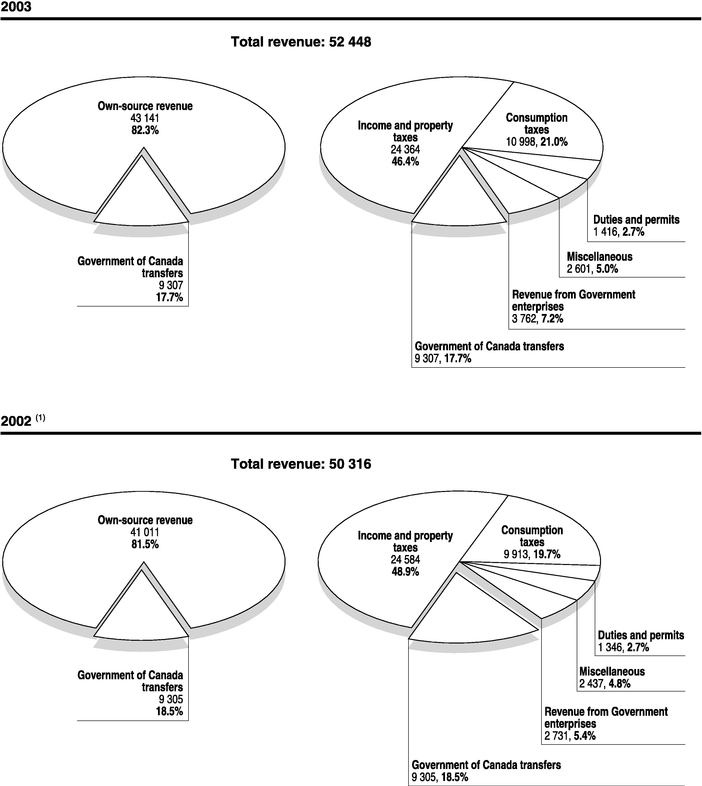

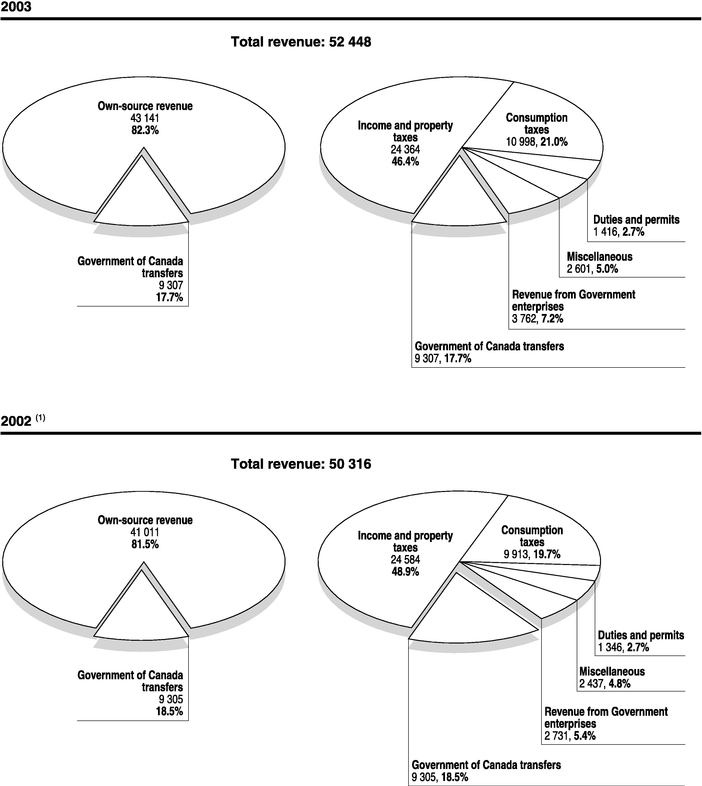

Consolidated revenue

FISCAL YEAR ENDED MARCH 31, 2003

(in millions of dollars)

- (1)

- Certain 2002 figures were reclassified for consistency with the presentation adopted in 2003.

XV

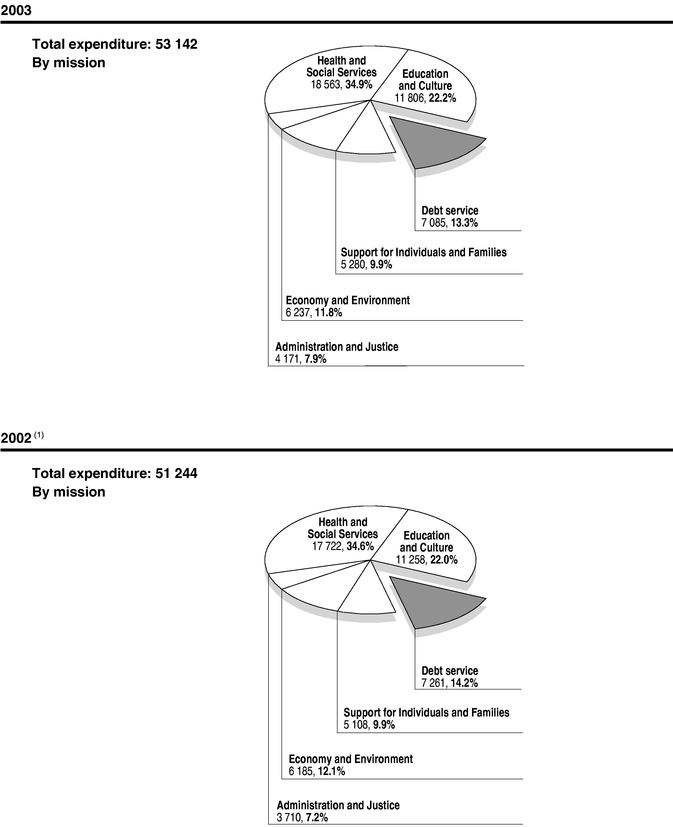

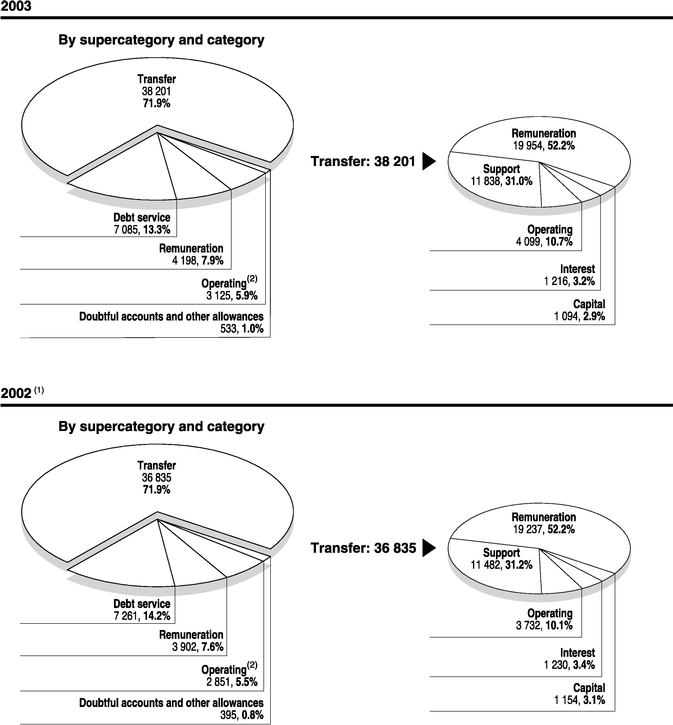

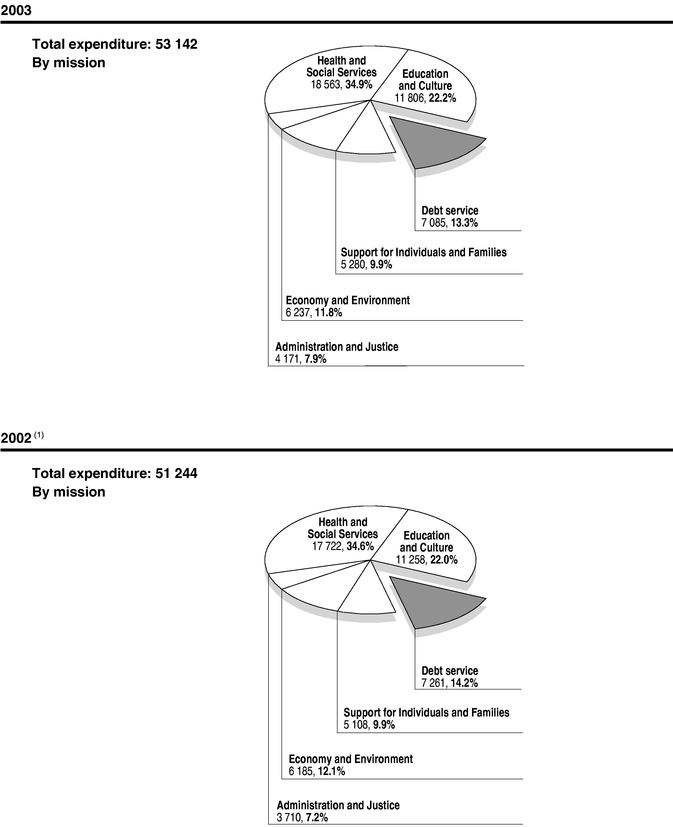

Consolidated expenditure

FISCAL YEAR ENDED MARCH 31, 2003

(in millions of dollars)

- (1)

- Certain 2002 figures were reclassified for consistency with the presentation adopted in 2003.

XVI

- (1)

- Certain 2002 figures were reclassified for consistency with the presentation adopted in 2003.

- (2)

- Including $783 million in 2002-2003 ($622 million in 2001-2002) for the depreciation of fixed assets.

XVII

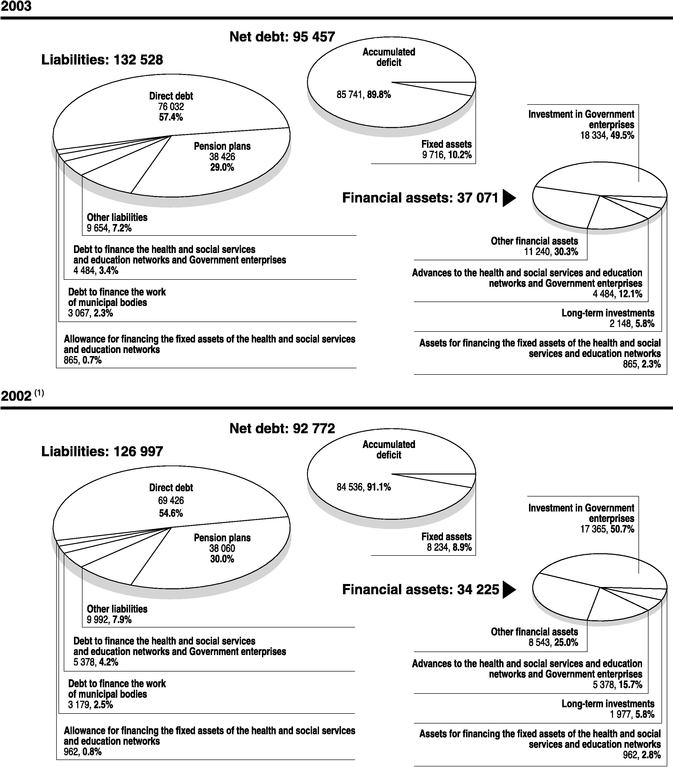

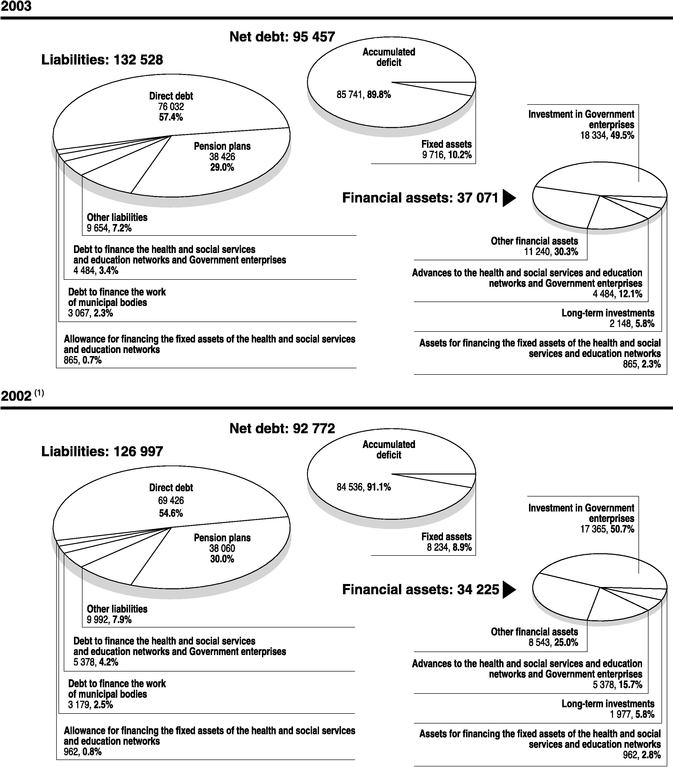

Consolidated financial position

AS AT MARCH 31, 2003

(in millions of dollars)

- (1)

- Certain 2002 figures were reclassified for consistency with the presentation adopted in 2003.

XVIII

Reconciliation of revenue, expenditure and annual deficit

FISCAL YEAR ENDED MARCH 31, 2003

(in millions of dollars)

| | 2003

| | 2002

| |

|---|

| |

| | (reclassified)

| |

|---|

| REVENUE | | | | | |

| Consolidated Revenue Fund excluding | | | | | |

| | Government enterprises | | 46 152 | | 45 209 | |

| Government enterprises | | 3 762 | | 2 731 | |

| Government agencies and special funds | | 15 011 | | 12 834 | |

| | |

| |

| |

| | | 64 925 | | 60 774 | |

| Elimination of inter-entity transactions | | (12 477 | ) | (10 458 | ) |

| | |

| |

| |

| | | 52 448 | | 50 316 | |

| | �� |

| |

| |

EXPENDITURE |

|

|

|

|

|

| Consolidated Revenue Fund | | 50 975 | | 49 190 | |

| Government agencies and special funds | | 14 644 | | 12 512 | |

| | |

| |

| |

| | | 65 619 | | 61 702 | |

| Elimination of inter-entity transactions | | (12 477 | ) | (10 458 | ) |

| | |

| |

| |

| | | 53 142 | | 51 244 | |

| | |

| |

| |

| ANNUAL DEFICIT | | (694 | ) | (928 | ) |

| | |

| |

| |

Under the Act to establish a budgetary surplus reserve fund (R.S.Q., c. R-25.1), the government created a reserve fund to finance certain expenditures and maintain a balanced budget.

The changes in the reserve fund are shown in Appendix 18.

| Annual deficit | | (694 | ) | (928 | ) |

| Transfer to reserve fund | | — | | — | |

| Use of reserve fund | | — | | 950 | |

| | |

| |

| |

| Excess of annual deficit over reserve fund | | (694 | ) | 22 | |

| | |

| |

| |

XIX

Balanced Budget Act

In accordance with the provisions of the Balanced Budget Act (R.S.Q., c. E-12.001), the Minister of Finance must report to the National Assembly on the surplus or overruns registered during the fiscal year in relation to the objectives set by the Act.

Pursuant to the Balanced Budget Act, the accumulated surplus at the end of fiscal 2002-2003 breaks down as follows:

Accumulated surplus pursuant to the Balanced Budget Act

| | 2003

| | 2002

|

|---|

| | Budget

| | Actual results(1)

| | Actual results

|

|---|

| | (in millions of dollars)

|

|---|

| Accumulated surplus, beginning of year | | 1 871 | | 1 871 | | 1 849 |

| Surplus (overruns) reported for the year | | — | | (694 | ) | 22 |

| | |

| |

| |

|

| Accumulated surplus, end of year | | 1 871 | | 1 177 | | 1 871 |

| | |

| |

| |

|

- (1)

- The accounting changes described in Note 2 did not have any effect in fiscal 2002-2003 on financial results for the year.

XX

Financial statistics

FISCAL YEAR ENDED MARCH 31, 2003

(in millions of dollars)

Fiscal year

| | Revenue*

| | Expenditure*

| | (Deficit)

or surplus

| | Net debt(1)

| | Fixed

assets

| | Accumulated

deficit

|

|---|

| 2002-2003 | | 52 448 | | 53 142 | | (694 | ) | 95 457 | (6) | 9 716 | | 85 741 |

| 2001-2002 | | 50 316 | | 51 244 | | (928 | ) | 92 772 | (5) | 8 234 | | 84 538 |

| 2000-2001 | | 51 040 | | 49 663 | | 1 377 | | 88 208 | (4) | 7 166 | | 81 042 |

| 1999-2000 | | 47 410 | | 47 403 | | 7 | | 89 162 | (3) | 6 693 | | 82 469 |

| 1998-1999 | | 46 720 | | 46 594 | | 126 | | 88 810 | (2) | 6 233 | | 82 577 |

- *

- Certain figures were reclassified for consistency with the presentation adopted in 2002-2003.

($M: millions of dollars)

- (1)

- Net debt represents total liabilities minus financial assets, recorded in the statement of financial position.

- (2)

- The net debt was increased by $339 M, including $217 M for the recording of fixed assets, $25 M for the recording of accounts payable and accrued expenses and $97 M for adjustments to other accounts.

- (3)

- The net debt was increased by $359 M for the recording of fixed assets.

- (4)

- The net debt was increased by $423 M, including $473 M for the recording of fixed assets, $12 M for sick leave and vacations and a decrease of $62 M for investments in Government enterprises.

- (5)

- The net debt was increased by $1 386 M, including $1 068 M for the recording of fixed assets, –$88 M for the recording of the Government's share of the foreign exchange gains or losses of enterprises, $215 M for the correction of the error made by the Canada Customs and Revenue Agency, $65 M for the change in the accounting policy for certain recoveries, $126 M for the recording of employer contributions in respect of obligations relating to sick leave and vacations, for the change in the status of a Government enterprise and for costs related to the improvement of premises. In addition, accounting changes made by Government enterprises increased the net debt by $2 250 M, including $1 338 M for the recording of foreign currency translation and $912 M for the introduction of a provision for deviations in the real rate of return.

- (6)

- The net debt was increased by $1 604 M, including $1 482 M for the recording of fixed assets and $122 M for the recording of the Government's share of translation adjustments of enterprises. In addition, accounting changes made by Government enterprises increased the net debt by $387 M, including $363 M relating to the capping mechanism used in calculating deferred gains and losses on basis on the real rate of return assumption.

XXI

XXII

CONSOLIDATED FINANCIAL

STATEMENTS

(This page has been left blank intentionally.)

2

Statement of responsibility

The Government is responsible for the integrity and objectivity of the consolidated financial statements prepared by the Comptroller of Finance for the Minister of Finance in accordance with the Financial Administration Act (R.S.Q., c. A-6.001, s. 86). These statements are prepared in accordance with the accounting policies disclosed in Note 1 of the financial statements.

To fulfil its accounting and financial reporting responsibilities, the Government maintains systems of financial management and internal control designed to provide reasonable assurance that transactions are duly authorized by Parliament and properly executed and recorded.

The Comptroller of Finance takes care of Government accounting and obtains all the information needed to meet its accounting requirements from Government departments, agencies, enterprises and funds.

The Government submits its consolidated financial statements for audit assurance to the Auditor General who, in his report to the National Assembly, states the nature and scope of his audit as well as his opinion.

The financial statements are part of the Public Accounts tabled annually in the National Assembly by the Minister of Finance.

On behalf of the Gouvernement du Québec,

| |

Gilles Godbout

Deputy Minister of Finance | Nathalie Tremblay, CA

Comptroller of Finance |

| | |

| Québec, March 16, 2004 | |

3

Auditor General's report

To the National Assembly,

I have audited the following consolidated financial statements of the Government of Québec for the fiscal year ended March 31, 2003:

- •

- operating results;

- •

- accumulated deficits;

- •

- financial position;

- •

- financial requirements and financing.

The Minister of Finance is responsible for the preparation of these financial statements. My responsibility is to express an opinion on these financial statements based on my audit.

I conducted my audit in accordance with Canadian generally accepted auditing standards. Those standards require that the audit be planned and performed to obtain reasonable assurance whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting policies used and significant estimates made by the management of government departments and agencies included in the government reporting entity, as well as evaluating the overall financial statement presentation.

Commitments for the Government and Public Employees Retirement Plan (RREGOP), the Pension Plan of Management Personnel (PPMP) and the Pension Plan of Peace Officers in Correctional Services (PPPOCS)

The liabilities recorded under "Pension plans" as at March 31, 2003 for the regular service of the RREGOP, the PPMP, excluding that of senior administration, and for the PPPOCS total $24,063 million (March 31, 2002: $22,166 million). These three plans are of the shared-cost type, namely their respective cost, i.e. the ensuing annual contribution, is shared in predetermined proportions between the employer and the participants. This sharing of the annual contribution creates a commitment for the government with respect to the financing of these plans, a commitment whose value corresponds to the fund that the government would have accumulated, had it paid its contributions on the same bases as those which were used to determine the participants' fund. In the case of the RREGOP and the PPMP, the market value of this fund was estimated at $32,677 million as at December 31, 2002 (December 31, 2001: $36,282 million). As for the PPPOCS, for which the employees' contributions were paid into the Consolidated Revenue Fund, the book value of the fund that the employees and the government would have accumulated was evaluated at $713 million as at that same date (December 31, 2001: $767 million).

4

Auditor General's report (cont'd)

In note 5 of its financial statements, the government does not clearly recognize that it has contracted commitments for the financing of these plans. Indeed, it does not indicate that the commitments to which reference is made ensue from the sharing of the annual contribution established according to the legislative provisions of these plans and the collective agreements that the government has negotiated since the creation of the plans. With respect to total commitments of $33,390 million (December 31, 2001: $37,049 million), $24,063 million (March 31, 2002: $22,166 million) are already recorded as liabilities as at March 31, 2003.

Although these commitments have no effect on the liabilities, the net debt, the accumulated deficits and the deficit of the fiscal year ended March 31, 2003, this information must be disclosed appropriately to enable readers of the financial statements to better evaluate the government's financial situation.

Reporting entity

The government reporting entity, which is described in note 1 of its financial statements, does not include the entities of the education network and those of the health and social services network. In accordance with the recommendations of the Canadian Institute of Chartered Accountants, these entities should be included in the government reporting entity as they meet the criteria for inclusion in that entity.

Given the fact that the government did not compile the necessary information, I was unable to determine the effects of the non-inclusion of the entities of the education network and of the health and social services network in the financial statements. However, based on the information that I do have, the inclusion of these entities in the government's consolidated financial statements would have a significant impact on the financial information presented in those statements.

Provision for losses on guaranteed financial initiatives

Investissement Québec establishes the provision for losses on its financial initiatives guaranteed by the government according to the credit risks and the initiatives in progress. The government records a different provision for the same initiatives according to its own assessment of the credit risks and on the basis of the authorized interventions rather than of those in progress. In my opinion, the provision established by Investissement Québec is appropriate because it is evaluated on the basis of the accrual accounting method and a meticulous analysis of the credit risks. Hence, the government should have recorded in its books, the provision calculated by Investissement Québec. The effect of not having entered an appropriate provision is to overstate the deficit of the fiscal year ended on

5

Auditor General's report (cont'd)

March 31, 2003 by $82.3 million (March 31, 2002: $50.1 million), and to overstate the provision for losses on guaranteed financial initiatives, the net debt and the accumulated deficits by $260.7 million at that date (March 31, 2002: $178.4 million).

In my opinion, except for the inappropriate disclosure by the government of its commitments concerning the financing of the RREGOP, the PPMP and the PPPOCS, the undetermined effects of the non-inclusion of the entities of the education network and those of the health and social services network, as well as the effects of the inappropriate recording of the provision for losses on guaranteed financial initiatives, these consolidated financial statements present fairly, in all material respects, the financial position of the Government of Québec as at March 31, 2003, as well as the results of its operations and the changes in its financial position for the fiscal year then ended, in accordance with the accounting policies set forth in note 1. As required by the Auditor General Act, I report that, in my opinion, these accounting policies have been applied on a basis consistent with that of the preceding fiscal year.

Another important question

Comparative financial data

The government applied a retroactive treatment to the recovery of the equalization payments by the Government of Canada for the 2001-2002 fiscal year in relation to the error of the Canada Customs and Revenue Agency. The government included in the net debt at the start of 2001-2002 the recovery of the $215 million attributable to that fiscal year, whereas it should have recorded said amount as a reduction of revenue for that fiscal year. The transfer income from the Government of Canada for 2001-2002 presented for comparison in the government's consolidated statement of operations for 2002-2003 should have been reduced by $215 million. Moreover, the deficit for 2001-2002 remained at $928 million, whereas it should have been increased to $1,143 million.

Acting Auditor General,

Doris Paradis, FCA

Québec, March 16, 2004

6

Consolidated statement of operations

FISCAL YEAR ENDED MARCH 31, 2003

(in millions of dollars)

| |

| | 2003

| | 2002

| |

|---|

Appendix

| |

| | Budget*

| | Actual

results

| | Actual

results

| |

|---|

| |

| |

| |

| | (Notes 2 and 11)

| |

|---|

| 5 | | REVENUE (Note 3) | | | | | | | |

| | | Income and property taxes | | 25 703 | | 24 364 | | 24 584 | |

| | | Consumption taxes | | 10 435 | | 10 998 | | 9 913 | |

| | | Duties and permits | | 1 390 | | 1 416 | | 1 346 | |

| | | Miscellaneous | | 2 322 | | 2 601 | | 2 437 | |

| 9 | | Revenue from Government enterprises | | 3 215 | | 3 762 | | 2 731 | |

| | | | |

| |

| |

| |

| | | Own-source revenue | | 43 065 | | 43 141 | | 41 011 | |

| | | Government of Canada transfers | | 8 842 | | 9 307 | | 9 305 | |

| | | | |

| |

| |

| |

| | �� | Total revenue | | 51 907 | | 52 448 | | 50 316 | |

| | | | |

| |

| |

| |

| 6 | | EXPENDITURE | | | | | | | |

| | | Health and Social Services | | 17 992 | | 18 563 | | 17 722 | |

| | | Education and Culture | | 11 785 | | 11 806 | | 11 258 | |

| | | Economy and Environment | | 6 029 | | 6 237 | | 6 185 | |

| | | Support for Individuals and Families | | 5 060 | | 5 280 | | 5 108 | |

| | | Administration and Justice | | 3 847 | | 4 171 | | 3 710 | |

| | | | |

| |

| |

| |

| | | Sub-total | | 44 713 | | 46 057 | | 43 983 | |

| | | Debt service | | 7 194 | | 7 085 | | 7 261 | |

| | | | |

| |

| |

| |

| | | Total expenditure | | 51 907 | | 53 142 | | 51 244 | |

| | | | |

| |

| |

| |

| | | ANNUAL DEFICIT | | — | | (694 | ) | (928 | ) |

| | | | |

| |

| |

| |

* On the basis of the revenue and expenditure forecasts showed in the 2002-2003 Budget of March 19, 2002. |

|

|

|

Under the Act to establish a budgetary surplus reserve fund (R.S.Q., R-25.1), the government created a reserve fund to finance certain expenditures and maintain a balanced budget. |

|

|

|

|

|

|

|

|

|

The changes in the reserve fund are shown in Appendix 18. |

|

|

|

|

|

|

|

| | | Annual deficit | | — | | (694 | ) | (928 | ) |

| | | Transfer to reserve fund | | — | | — | | — | |

| | | Use of reserve fund | | — | | — | | 950 | |

| | | | |

| |

| |

| |

| | | Excess of annual deficit over reserve fund | | — | | (694 | ) | 22 | |

| | | | |

| |

| |

| |

7

Consolidated statement of accumulated deficit

FISCAL YEAR ENDED MARCH 31, 2003

(in millions of dollars)

| | 2003

| | 2002

| |

|---|

| | Budget*

| | Actual

| | Actual

| |

|---|

| PREVIOUSLY ESTABLISHED ACCUMULATED DEFICIT, BEGINNING OF YEAR | | (81 992 | ) | (84 100 | ) | (83 260 | ) |

| Restatements (Note 2) | | | | (406 | ) | (406 | ) |

| Government's share of restatements made by Government enterprises, April 1st, 2001 (Appendix 9) | | | | (32 | ) | (32 | ) |

| | |

| |

| |

| |

| | | (81 992 | ) | (84 538 | ) | (83 698 | ) |

| Government's share of restatements made by Government enterprises, April 1st, 2002 (Appendix 9) | | | | (387 | ) | | |

| | |

| |

| |

| |

| Restated balance | | (81 992 | ) | (84 925 | ) | (83 698 | ) |

| Government's share of translation adjustments of Government enterprises | | — | | (122 | ) | 88 | |

| Annual deficit | | — | | (694 | ) | (928 | ) |

| | |

| |

| |

| |

| ACCUMULATED DEFICIT, END OF YEAR | | (81 992 | ) | (85 741 | ) | (84 538 | ) |

| | |

| |

| |

| |

- *

- On the basis of the revenue and expenditure forecasts showed in the 2002-2003 Budget of March 19, 2002.

8

Consolidated statement of financial position

AS AT MARCH 31, 2003

(in millions of dollars)

Appendix

| |

| | 2003

| | 2002

| |

|---|

| |

| |

| | (Note 2)

| |

|---|

| | | FINANCIAL ASSETS | | | | | |

| 7 | | Short-term investments | | 4 488 | | 1 445 | |

| 8 | | Accounts receivable | | 6 262 | | 7 003 | |

| 9 | | Investment in Government enterprises | | 18 334 | | 17 365 | |

| 10 | | Long-term investments | | 2 148 | | 1 977 | |

| | | Deferred expenses related to debts | | 490 | | 95 | |

| | | Advances to the health and social services and education networks and Government enterprises (Note 7) | | 4 484 | | 5 378 | |

| | | Assets for financing the fixed assets of the health and social services and education networks (Note 8) | | 865 | | 962 | |

| | | | |

| |

| |

| | | TOTAL FINANCIAL ASSETS | | 37 071 | | 34 225 | |

| | | | |

| |

| |

| | | LIABILITIES | | | | | |

| 11 | | Bank overdraft | | 368 | | 882 | |

| 12 | | Accounts payable and accrued expenses | | 8 978 | | 8 579 | |

| | | Deferred revenue | | 308 | | 531 | |

| | | Pension plans (Note 5) | | 38 426 | | 38 060 | |

| 13 | | Direct debt (Notes 6 and 7) | | 76 032 | | 69 426 | |

| 13 | | Debt to finance the health and social services and education networks and Government enterprises (Notes 6 and 7) | | 4 484 | | 5 378 | |

| 13 | | Debt to finance the work of municipal bodies (Notes 6 and 7) | | 3 067 | | 3 179 | |

| | | Allowance for financing the fixed assets of the health and social services and education networks (Note 8) | | 865 | | 962 | |

| | | | |

| |

| |

| | | TOTAL LIABILITIES | | 132 528 | | 126 997 | |

| | | | |

| |

| |

| 14 | | NET DEBT | | (95 457 | ) | (92 772 | ) |

| 15 | | FIXED ASSETS (Note 4) | | 9 716 | | 8 234 | |

| | | | |

| |

| |

| | | ACCUMULATED DEFICIT | | (85 741 | ) | (84 538 | ) |

| | | | |

| |

| |

| 16 | | Commitments and contingencies (Note 9) | | | | | |

| | | Subsequent events (Note 12) | | | | | |

| 17 | | Fiduciary transactions conducted by Government agencies and funds | | | | | |

| 18 | | Reserve fund | | | | | |

9

Consolidated statement of financial requirements and financing

FISCAL YEAR ENDED MARCH 31, 2003

(in millions of dollars)

| | 2003

| | 2002

| |

|---|

| |

| |

| | (Note 11)

| |

|---|

| OPERATING ACTIVITIES | | | | | | | | | |

| Annual deficit | | | | (694 | ) | | | (928 | ) |

| Items not affecting liquid assets: | | | | | | | | | |

| | Doubtful accounts and other allowances | | 533 | | | | 395 | | | |

| | Sick leave and vacations | | 55 | | | | 75 | | | |

| | Depreciation of fixed assets | | 783 | | | | 622 | | | |

| | Amortization of deferred expenses related to debts | | 37 | | | | 72 | | | |

| | Amortization of deferred foreign exchange loss | | 129 | | | | 153 | | | |

| | Amortization of discounts and premiums | | 48 | | 1 585 | | 61 | | 1 378 | |

| | |

| |

| |

| |

| |

| | | | | 891 | | | | 450 | |

| Specific purpose accounts (Appendix 12) | | | | | | | | | |

| | Payments and other debits | | (510 | ) | | | (527 | ) | | |

| | Receipts and other credits | | 496 | | (14 | ) | 567 | | 40 | |

| | |

| | | |

| | | |

| Changes in financial assets and liabilities related to operations | | | | (484 | ) | | | (345 | ) |

| | | | |

| | | |

| |

| | | | | 393 | | | | 145 | |

| | | | |

| | | |

| |

Activities related to pension plans |

|

|

|

|

|

|

|

|

|

| | Pension costs (Note 5) | | 1 451 | | | | 1 395 | | | |

| | Interest charges relating to pension plans (Note 5) | | 3 389 | | 4 840 | | 3 322 | | 4 717 | |

| | |

| | | |

| | | |

| | Benefits and other payments | | (2 913 | ) | | | (2 720 | ) | | |

| | Employee and independent employer contributions | | 80 | | (2 833 | ) | 92 | | (2 628 | ) |

| | |

| |

| |

| |

| |

| | | | | 2 007 | | | | 2 089 | |

| | | | |

| | | |

| |

| Liquid assets provided by operating activities | | | | 2 400 | | | | 2 234 | |

| | | | |

| | | |

| |

INVESTMENT ACTIVITIES |

|

|

|

|

|

|

|

|

|

| Changes in investment in Government enterprises | | | | | | | | | |

| | Investments made | | (340 | ) | | | (648 | ) | | |

| | Share in the results of enterprises entered as revenue less declared dividends | | (1 138 | ) | (1 478 | ) | (371 | ) | (1 019 | ) |

| | |

| | | |

| | | |

| Changes in long-term investments | | | | | | | | | |

| | Investments made | | (545 | ) | | | (426 | ) | | |

| | Investments realized | | 310 | | (235 | ) | 213 | | (213 | ) |

| | |

| | | |

| | | |

| Fixed assets | | | | | | | | | |

| | Acquisition | | (2 270 | ) | | | (1 626 | ) | | |

| | Disposal | | 5 | | (2 265 | ) | 9 | | (1 617 | ) |

| | |

| |

| |

| |

| |

| Liquid assets used for investment activities | | | | (3 978 | ) | | | (2 849 | ) |

| | | | |

| | | |

| |

| NET FINANCIAL REQUIREMENTS | | | | (1 578 | ) | | | (615 | ) |

| | | | |

| | | |

| |

10

Consolidated statement of financial requirements and financing (cont'd)

FISCAL YEAR ENDED MARCH 31, 2003

(in millions of dollars)

| | 2003

| | 2002

| |

|---|

| |

| |

| | (Note 11)

| |

|---|

| FINANCING ACTIVITIES | | | | | | | | | |

| Changes in debts | | | | | | | | | |

| | | Borrowings made | | 11 430 | | | | 9 011 | | | |

| | | Borrowings repaid | | (5 121 | ) | 6 309 | | (5 492 | ) | 3 519 | |

| | |

| | | |

| | | |

Activities related to pension plans |

|

|

|

|

|

|

|

|

|

| Changes in the Retirement Plans | | | | | | | | | |

| | Sinking Fund | | | | | | | | | |

| | | Payments | | (900 | ) | | | (2 535 | ) | | |

| | | Reinvestment of Fund investment income | | (741 | ) | (1 641 | ) | (605 | ) | (3 140 | ) |

| | | | |

| | | |

| |

| Liquid assets provided by operating activities | | | | 4 668 | | | | 379 | |

| Changes in liquid assets(1) | | | | (3 090 | ) | | | 236 | |

| | | | |

| | | |

| |

| NET FINANCING | | | | 1 578 | | | | 615 | |

| | | | |

| | | |

| |

- (1)

- Liquid assets include cash in bank (Appendix 11) and short-term investments (Appendix 7).

11

(This page has been left blank intentionally.)

12

Notes to financial statements

1. Significant accounting policies

The Gouvernement du Québec accounts for its financial transactions in accordance with the accounting policies disclosed below. When necessary, the information included in the consolidated financial statements is based on best estimates and judgments.

Reporting entity

The Government's reporting entity encompasses departments, agencies, enterprises and special funds which must account for the management of their financial transactions and resources to a Minister or directly to the National Assembly and which are part of the Government or under its control. They are listed in an appendix to the financial statements.

Fiduciary transactions conducted by certain agencies and funds are not included in the Government's reporting entity. These agencies and funds are listed in an appendix to the financial statements.

Consolidation method

The accounts of the Consolidated Revenue Fund and the other entities included in the Government's reporting entity, with the exception of Government enterprises, have been standardized and combined line by line in accordance with the accounting policies disclosed below. Inter-entity transactions and balances have been eliminated.

Investment in Government enterprises is accounted for using the modified equity method. Therefore, investment in these enterprises is recorded at cost, which is adjusted annually by the Government's share in the results of these enterprises with an offsetting entry to revenue, and reduced by the portion of dividends that are paid or reported by an enterprise and that accrue to the Government. A Government enterprise has all of the following characteristics:

- a)

- it is a separate legal entity that has the authority to enter into contracts in its own name and to go before a court;

- b)

- it is vested with the financial and administrative power to carry out commercial activities;

- c)

- its main activity is the sale of goods or the delivery of services to individuals or to organizations not included in the Government's reporting entity;

- d)

- it may, during the normal course of its operations, pursue its activities and settle its debts using revenue from sources not included in the Government's reporting entity.

13

Revenue

Revenue from income and property taxes, consumption taxes, duties, permits, fines and forfeitures is recorded in the fiscal year during which it is received, after deducting reimbursements and other amounts deductible under the applicable legislation. Assessments and amounts billed before the end of the fiscal year are entered as revenue.

Revenue from Government of Canada transfers is recorded in the fiscal year during which it is received. However, claims issued and estimates of revenue from transfers related to shared-cost programs without fiscal compensation are recorded in the fiscal year during which the related expenditures are made.

Other revenue is recorded on the accrual basis. Interest income ceases to be recorded when there is no reasonable assurance that the principal or interest will be recovered.

Expenditure

Transfers are recorded in the fiscal year during which the events that give rise to them occur, insofar as the transfers have been authorized and once beneficiaries have met the eligibility criteria.

Expenditure includes the cost of goods and services acquired during the fiscal year, with the exception of fixed assets for which an annual depreciation is recorded.

Debt service interest charges resulting from transactions in foreign currency are translated into Canadian dollars at the rates in effect at the time of the transactions.

Financial assets

Short-term investments are recorded at cost and accounts receivable, loans and advances are recorded initially at cost and then brought down to their net recoverable value through valuation allowances.

Investment in Government enterprises is recorded using the modified equity method.

Other long-term investments are entered at cost and reduced by any durable loss in value. The loss in value is charged to operations for the fiscal year during which it is known.

14

Liabilities

Accounts payable and accrued expenses

Specific purpose accounts

The Financial Administration Act (R.S.Q., c. A-6.001) provides for the creation of specific purpose accounts in which amounts received in respect of a contract or an agreement calling for the allocation of funds to a specific purpose may be deposited. Consequently, certain amounts receivable or payable under shared-cost programs without fiscal compensation or as a result of third-party compensation are recorded in specific purpose accounts.

Sick leave and vacations

Obligations relating to sick leave and vacations owed to Government employees are recorded as liabilities. The annual change in this account is posted to expenditure.

Allowance for losses on guaranteed financial initiatives

Obligations resulting from borrowings and other guaranteed financial initiatives are recorded as liabilities when a loss is probable. The annual change in this allowance is posted to expenditure.

The allowance for probable losses is evaluated using a rate based on past experience regarding losses on each of the guarantee programs. Special guarantees are grouped according to risk level.

Pension plans

Government pension plans are defined benefit pension plans. Within the context of preparing the Government's financial statements, obligations relating to vested benefits are evaluated using the actuarial projected benefit method prorated on service, according to the most probable assumptions set by the Government with regard, notably, to inflation, interest and employee remuneration. This method has been adjusted, however, to reflect the way in which benefits are earned by employees.

Total cost of plans

The annual cost of vested benefits for all pension plans, including the cost of changes to the plans, and the amortization of adjustments to estimates based on actuarial gains or losses are charged to expenditure, with an offsetting entry in the retirement plans account, i.e. pension plan liability. Changes to actuarial assumptions are included in the adjustments to estimates based on actuarial gains or losses.

15

In the case of the Government and Public Employees Retirement Plan (RREGOP), the Pension Plan of Management Personnel (PPMP), the Civil Service Superannuation Plan (CSSP), the Teachers Pension Plan (TPP), the Pension Plan of Certain Teachers (PPCT) and transfers from the TPP and the CSSP to RREGOP and the PPMP, adjustments to estimates based on actuarial gains or losses are amortized using the straight-line method over a period corresponding to the estimated average remaining years of service of participants in these plans as a whole. However, adjustments to estimates based on actuarial gains or losses for the other pension plans are amortized over a period corresponding to the estimated average remaining years of service of participants in each plan.

The total cost of the pension plans also includes interest charges on obligations relating to vested benefits, with an offsetting entry to liabilities in the retirement plans account.

Retirement Plans Sinking Fund (RPSF)

Under the Financial Administration Act (R.S.Q., c. A-6.001, s. 8), the Minister of Finance may make long-term investments, by way of a deposit with the Caisse de dépôt et placement du Québec, using part of the Consolidated Revenue Fund up to an amount equal to the sums recorded as the pension plans liability, in order to create a sinking fund to provide for the payment of all or part of the benefits awarded under these plans. The RPSF's assets are recorded at a value based on their market value. The RPSF's annual investment income is calculated by applying the nominal interest rate used in the most recent actuarial valuation to the RPSF's balance at the end of the previous fiscal year.

During the actuarial valuations conducted every three years, discrepancies that can be attributed to differences between revenue recorded since the most recent actuarial valuations and investment income valuated at its market value at the end of the fiscal year are amortized using the straight-line method over a period corresponding to the estimated average remaining years of service of participants, i.e. the period applicable to estimates based on actuarial gains or losses.

The RPSF's investment income and the amortization of discrepancies observed in the course of actuarial valuations are subtracted in calculating interest charges on obligations relating to vested benefits.

Debts

Borrowings are recorded at the amount received at the time of issue, adjusted by the premium or discount amortization to obtain the amount of principal repayable at maturity. The amortization is calculated using the effective rate for each borrowing.

16

Issue expenses related to debts are deferred and amortized over the term of each borrowing using the straight-line method. The unamortized balance is included in deferred expenses related to debts.

Borrowings in foreign currency are translated into Canadian dollars at the rates in effect on March 31.

Foreign exchange gains or losses resulting from the translation of borrowings are deferred and amortized over the remaining term of each borrowing using the straight-line method.

Derivative instruments

The Government uses derivative instruments to manage foreign exchange and interest rate risks related to debts. These instruments are recorded at cost.

Derivative instruments used to manage the foreign exchange risk associated with the repayment of interest and principal on borrowings and with the cash management transactions such risk management entails, including currency swap contracts and foreign exchange forward contracts, are translated into Canadian dollars at the rates in effect on March 31. The components of these instruments, namely, financial assets and liabilities, are offset against one another and shown as "Debts" items.

Interest rate exchanges stemming from interest rate swap contracts used to change exposure to interest rate risk over the long term are reconciled with interest charges for the borrowings with which these swap contracts are associated.

Gains or losses on derivative instruments are deferred and amortized over the term of each contract. However, foreign exchange gains or losses on short-term contracts aimed at modifying the foreign exchange risk associated with long-term borrowings are amortized over the remaining term of the borrowing portfolio in the currency concerned using the straight-line method.

Debt Sinking Fund

Securities held by the sinking fund are recorded at the amount paid at the time of purchase, adjusted by the premium or discount amortization to obtain the amount of principal receivable at maturity. The amortization is calculated on the basis of the effective rate for each security.

The difference between the book value of a security and the amount received at the time of its disposal is charged to results.

17

Fixed assets

Fixed assets consist of acquired, built, developed or improved non-financial assets, whose useful life extends beyond the fiscal year and which are intended to be used on an ongoing basis for producing goods or delivering services.

They include land, buildings, facilities such as parks and outdoor recreational areas, complex networks such as dams, canals, roads and bridges, equipment such as vehicles and furniture, and the development of data processing systems.

Fixed assets are recorded at cost and depreciated — except for land, which is not depreciated — using a logical, systematic method over a period corresponding to their useful life. They are a component of net debt. Their cost includes financing charges capitalized during their construction, improvement or development.

The cost of fixed assets held under capital leases is equal to the present value of payments due. Works of art and historic property are not recorded as fixed assets but are mentioned in a note to the financial statements, and their cost is charged to expenditure for the fiscal year during which they are acquired.

Fixed assets acquired through donation or for a nominal fee are recorded at their fair value at the time of acquisition with an offsetting entry to deferred revenue liabilities, which are gradually transferred to operating results using the same term and method of amortization as for the fixed assets concerned. However, land is recorded at its nominal value.

Sums received from agencies not included in the Government's reporting entity for the purchase of fixed assets are recorded as deferred revenue liabilities and gradually transferred to operating results using the same term and method of amortization as for the fixed assets concerned. However, contributions received for the purchase of land are deducted from the latter's cost.

2. Restatements

The Government made the following restatements:

Since certain recoveries are hard to estimate before they are received, the Government had to change the accounting application method for this revenue and record it on a cash basis rather than an accrual basis, in accordance with the rules of the Canadian Institute of Chartered Accountants.

18

From 1972 to 1999, Canada Customs and Revenue Agency (CCRA) made overpayments of more than $3.4 billion to four provinces in particular (Ontario, Manitoba, British Columbia and Alberta) in regard to personal income tax. The federal government announced, as part of a solution to the error, a change in equalization formula, which increased Québec's relative fiscal capacity and thus reduced its equalization entitlements. The negative impact of the federal solution to CCRA's error on Québec's equalization entitlements obliged the government to correct its financial results of the previous years by $215 million.

Employer contributions in respect of obligations relating to sick leave and vacations owed to employees, estimated at $177 million, are now recorded as liabilities under "Sick leave and vacations" whereas previously they were recorded when employees used their holidays.

Certain costs related to the improvement of premises are now capitalized and amortized under "Buildings" whereas previously they were charged to operations.

The Centre de recherche industrielle du Québec (CRIQ) has not achieved the financial autonomy initially sought by the Government. Therefore, CRIQ has been consolidated line by line whereas previously it was considered a Government enterprise and its operations were accounted for using the modified equity method.

The retroactive application of these restatements as a whole increased (decreased) the following financial statement items:

| | 2003

| | 2002

| |

|---|

| | (in millions of dollars)

| |

|---|

| Revenue | | 12 | | 16 | |

| Expenditure | | 12 | | 16 | |

| Investment in Government enterprises | | (24 | ) | (24 | ) |

| Long-term investments | | 10 | | 10 | |

| Accounts receivable | | (61 | ) | (61 | ) |

| Bank overdraft | | 12 | | 7 | |

| Accounts payable and accrued expenses | | 392 | | 397 | |

| Fixed assets | | 73 | | 73 | |

| Accumulated deficit | | 406 | | 406 | |

19

3. Revenue

According to applicable legislation, revenue is shown after deduction of the following items:

| | 2003

| | 2002

| |

|---|

| | (in millions of dollars)

| |

|---|

| |

| | (Note 11)

| |

|---|

| Personal income tax | | | | | |

| | Refundable tax credits: | | | | | |

| | | Sales tax | | 456 | | 693 | |

| | | Day care expenses | | 200 | | 211 | |

| | | Other | | 113 | | 96 | |

| | Property tax refunds | | 230 | | 243 | |

| | Family assistance allowances | | 3 | | (2 | ) |

| | |

| |

| |

| | | 1 002 | | 1 241 | |

| | |

| |

| |

| Corporate taxes | | | | | |

| | Refundable tax credits: | | | | | |

| | | Scientific research and experimental development | | 547 | | 349 | |

| | | Cinematrographic productions | | 110 | | 97 | |

| | | Tax credits relating to the reporting of tips | | 49 | | 40 | |

| | | Other | | 398 | | 231 | |

| | |

| |

| |

| | | 1 104 | | 717 | |

| | |

| |

| |

| Duties and permits | | | | | |

| | Silvicultural work and other forest management activities | | 230 | | 198 | |

| | Highway carrier monitoring | | 48 | | 48 | |

| | Refundable mining duties credits for losses pertaining to exploration and capital expenditures and other | | 5 | | 3 | |

| | |

| |

| |

| | | 283 | | 249 | |

| | |

| |

| |

| | | 2 389 | | 2 207 | |

| | |

| |

| |

20

4. Fixed assets

Fixed assets are recorded at cost and shown in net debt. They are depreciated over their useful life using the following methods:

Category

| | Depreciation method

| | Useful life

|

|---|

| Buildings | | Straight-line and annuity | | 10 to 50 years |

| Facilities | | Straight-line | | 5 to 10 years |

| Complex networks | | Straight-line | | 10 to 40 years |

| Equipment | | Straight-line | | 3 to 20 years |

| Development of data processing systems | | Straight-line | | 5 to 10 years |

Works of art and historic property consist mainly of paintings, sculptures, drawings, prints, photographs, installations, films and videos and their cost is charged to expenditures for the fiscal year in which they are acquired.

21

5. Pension plans

The Gouvernement du Québec contributes to several pension plans for its employees. Employees of the public and parapublic sectors, the Members of the National Assembly and the judges of the Court of Québec participate in these plans.

Pension Plans

| | Estimated

number of

participants as at

December 31,

2002

| | Number of

beneficiaries

as at

December 31,

2002

| |

|---|

| Government and Public Employees Retirement Plan (RREGOP) | | 465 000 | | 110 436 | |

| Pension Plan of Management Personnel (PPMP) | | 24 200 | | 12 591 | |

| Teachers Pension Plan and Pension Plan of Certain Teachers (TPP and PPCT) | | 5 925 | * | 46 182 | * |

| Civil Service Superannuation Plan (CSSP) | | 2 900 | * | 24 798 | * |

| Superannuation Plan for the Members of the Sûreté du Québec (SPMSQ) | | 5 000 | | 3 677 | |

| Pension Plan of Peace Officers in Correctional Services (PPPOCS) | | 2 900 | | 969 | |

| Pension Plan of the Judges of the Court of Québec (PPJCQ) | | 260 | | 295 | |

| Pension Plan for Federal Employees Transferred to Employment with the Gouvernement du Québec (PPFETQ) | | 275 | | 71 | |

| Pension Plan of the Members of the National Assembly (PPMNA) | | 122 | | 264 | |

| | |

| |

| |

| | | 506 582 | | 199 283 | |

| | |

| |

| |

- *

- These plans have not admitted any new participants since July 1, 1973.

These plans are "defined benefit" pension plans, which means that they guarantee participants a set income upon retirement, calculated on the basis of participants' average income for the best paid years, generally five, and their number of years of service. The portion of benefits accrued prior to July 1, 1982 is usually indexed to the cost of living, while those accrued after that date are partially indexed.

| There are two types of pension plans: | | cost-sharing pension plans; |

| | | cost-balance pension plans. |

22

Cost-sharing pension plans

In the case of RREGOP and the PPMP, the Government covers costs at a rate of 50% for years of service since July 1, 1982 and 58.33% (7/12) for years of service prior to July 1, 1982. The contributions of participants and independent employers are paid into the Caisse de dépôt et placement du Québec.

In the case of the PPPOCS, the Government covers 46% of costs, while employees cover 54%. Employee contributions are paid into the Consolidated Revenue Fund.

Cost-balance pension plans

Cost-balance pension plans are plans for which employers cover the difference between the cost of plans and the contributions paid by participants. All Government plans except RREGOP, the PPMP and the PPPOCS fall into this category. The contributions of participants and independent employers to these cost-balance plans are paid into the Consolidated Revenue Fund. The Government covers the difference between the cost of each plan and the contributions paid by participants and independent employers.

Value of actuarial obligations relating to vested benefits for the pension plans as a whole

The value of actuarial obligations relating to vested benefits for the pension plans as a whole for service rendered as at a given date is determined by actuaries of the Commission administrative des régimes de retraite et d'assurances (CARRA). For this purpose, they use the actuarial projected benefit method prorated on service and take into account, among other things, the most probable long-term economic assumptions.

| Long-term economic assumptions: | | |

| — Yield, net of inflation | | 4.85% |

| — Inflation rate | | 3.00% |

| — Salary escalation rate, net of inflation | | 1.10% |

Government's liability with regard to the pension plans

The Government's liability with regard to the pension plans is recorded in conformity with the recommendations of the Canadian Institute of Chartered Accountants for public sector pension plans.

The liability recorded with respect to the pension plans is established on the basis of the value of actuarial obligations relating to vested benefits for the pension plans as a whole, taking into account certain adjustments stemming from actuarial gains or losses noted during the actuarial valuations prepared every three years. These gains or losses are amortized using the accounting policy established for this purpose. The Government's liability with regard to the pension plans also includes interest charges calculated on the basis of the value of the actuarial obligations relating to vested benefits as at a given date for the pension plans as a whole.

23

As shown by the following table concerning the main pension plans, the Government's liability with regard to the pension plans as a whole is estimated at $50 266 million as at March 31, 2003, including $27 331 million for RREGOP and the PPMP.

PENSION PLANS LIABILITY

| | Actuarial

obligations

relating to

vested benefits

| | Adjustments

| | Pension plans liability as at March 31, 2003

| | Pension plans liability as at March 31, 2002

| |

|---|

| | (in millions of dollars)

| |

|---|

| RREGOP | | | | | | | | | |

| — regular service | | 21 346 | | (1 093 | ) | 20 253 | | 18 609 | |

| — transferred service | | 2 487 | | (219 | ) | 2 268 | | 2 259 | |

| PPMP | | | | | | | | | |

| — regular service | | 4 013 | | (284 | ) | 3 729 | | 3 396 | |

| — transferred service | | 1 179 | | (98 | ) | 1 081 | | 1 043 | |

| TPP and PPCT | | 15 246 | | (944 | ) | 14 302 | | 14 364 | |

| CSSP | | 5 271 | | (254 | ) | 5 017 | | 5 067 | |

| Other | | 3 617 | | (1 | ) | 3 616 | | 3 521 | |

| | |

| |

| |

| |

| |

| | | 53 159 | | (2 893 | ) | 50 266 | | 48 259 | |

| | Sinking fund(1) | | (9 240 | )(2) | (2 600 | ) | (11 840 | ) | (10 199 | ) |

| | |

| |

| |

| |

| |

| | | 43 919 | | (5 493 | ) | 38 426 | | 38 060 | |

| | |

| |

| |

| |

| |

- (1)

- During fiscal 2002-2003 the Minister of Finance made investments of $900 million in the Retirement Plans Sinking Fund ($2 535 million in 2001-2002). At March 31, 2003, $741 million in investment income ($605 million in 2002) was reinvested in the sinking fund, and was taken into account in calculating the interest charges relating to pension plans.

- (2)

- This amount corresponds to the fair value of investments with the Caisse de dépôt et placement du Québec as at March 31, 2003.

Actuarial valuations and subsequent estimates

The most recent estimates, which were filed and issued in 2003, were determined on the basis of actuarial valuations as at December 31, 2001 for the PPMNA and the PPPOCS; as at December 31, 2000 for the PPCT, the PPJCQ, the SPMSQ, the PPFETQ, the PPMP (RRAS) and service transferred from the TPP and the CSSP to RREGOP and the PPMP; as at December 31, 1999 for the CSSP, the TPP, RREGOP and the PPMP, other than service transferred from the TPP and the CSSP to RREGOP and the PPMP, and for the PPMP (RRAS).

24

Total Cost of Pension Plans

| | 2003

| | 2002

| |

|---|

| | (in millions of dollars)

| |

|---|

| Pension costs | | | | | |

| | Cost of vested benefits excluding interest charges | | 1 303 | | 1 253 | |

| | Employee contributions | | (76 | ) | (88 | ) |

| | Independant employer contributions | | (4 | ) | (4 | ) |

| | |

| |

| |

| | | 1 223 | | 1 161 | |

| | Cost of changes | | 3 | (1) | 28 | |

| | Amortization of adjustments to estimates based on actuarial gains or losses | | 225 | | 206 | |

| | |

| |

| |

| | | 1 451 | | 1 395 | |

| Interest charges relating to the pension plans | | 2 648 | (2) | 2 717 | (2) |

| | |

| |

| |

| Total | | 4 099 | | 4 112 | |

| | |

| |

| |

- (1)

- Under the Act to amend the pension plans of the public and parapublic sectors (2002, c, 30) assented to on June 14, 2002, changes with an impact of $3 million as at March 31, 2003 were made to the PPPOCS.

- (2)

- After deducting Retirement Plans Sinking Fund investment income of $741 million in 2002-2003 ($605 million in 2001-2002).

Funding of pension plans

Actuarial valuations for funding purposes for regular service under "cost-sharing" pension plans (RREGOP, PPMP AND PPPOCS)

By law, CARRA actuaries are required to prepare, every three years, an actuarial valuation for funding purposes for each of the pension plans in order to determine the rates of contribution for these plans. To that end, the actuaries take legislative provisions and collective agreements into account using the valuation method agreed upon by the parties concerned and economic assumptions that are more conservative than those used to prepare valuations for accounting purposes.

According to these valuations, Government commitments for funding purposes are calculated as the fund that the Government would have amassed had it been required to pay contributions since 1973 on the same bases as those used to determine the rate of contribution of participants. In the case of RREGOP and the PPMP, this fund was estimated at $32 677 million at fair value and $39 800 million at cost as at December 31, 2002 ($36 282 million at fair value and $41 147 million at cost as at December 31, 2001). In the case of the PPPOCS, for which employee contributions were paid into the Consolidated Revenue Fund, the value of the fund that would have been amassed by employees and the Government was $713 million at cost as at December 31, 2002 ($767 million as at December 31, 2001).

25

The difference between these amounts and the liability recorded for these three plans represents a non-payable amount that does not have to be recorded as a liability of the Government. The difference may be attributed to the use of different economic assumptions and methods.

6. Risk management and derivative instruments

To meet the financial requirements arising from its operations for repaying maturing loans and for maintaining the desired level of liquid assets, the Government has provided itself with an annual financing and debt-management program targeting Canadian and international financial markets.

Participation in these markets involves various types of risk. Therefore, the Government devises risk-management strategies by using the different derivative instruments at its disposal.

Foreign exchange risk

Foreign exchange risk is the risk that the cash flows needed to repay the interest and principal on loans in foreign currency will vary according to market fluctuations. To manage this risk, the Government uses derivative instruments such as currency swap contracts and foreign exchange forward contracts. The purpose of such contracts is to exchange cash flows from one currency to another. These contracts mature at various dates until 2013.

After taking into account derivative instruments used to manage foreign exchange risk, the structure of the debt as at March 31, 2003 was 83% in Canadian dollars, 4% in U.S. dollars, 10% in yen and 3% in Swiss francs (as at March 31, 2002: 81% in Canadian dollars, 7% in U.S. dollars and 12% in yen).

Interest rate risk

Interest rate risk is the risk that debt service will vary unfavourably according to interest rate fluctuations. To reduce its exposure to interest rate risk, the Government uses interest rate swap contracts or short-term derivative products. Interest rate swap contracts make it possible to exchange payments of interest at fixed rates for payments of interest at variable rates or vice versa on the basis of a reference par value.

After taking into account derivative instruments used to manage interest rate risk, the structure of the debt as at March 31, 2003 was 71% at fixed rates and 29% at variable rates (as at March 31, 2002: 71.5% at fixed rates and 28.5% at variable rates).

26

Credit risk

Credit risk is the risk that a counterparty will default on his contractual obligations, an event that could entail financial losses for the Government. To protect itself from such a risk within the scope of derivative instrument transactions, the Government has adopted a credit risk management policy that limits potential losses by counterparties.

A credit limit is set for each counterparty based mainly on his credit rating. When this limit is exceeded, a process is implemented to ensure that the amounts owed by the counterparty concerned fall within the limits set.

The Government deals with major financial institutions whose credit rating is equal to or higher than its own. As at March 31, 2003, over 95% of its derivative instrument portfolio was associated with counterparties that had a double "A" or better rating. All of the Government's counterparties had at least an "A" rating with a recognized credit rating agency.

Liquidity risk

Liquidity risk is the risk that the Government will not be able to meet its financial commitments over the short term. To offset this risk, the Government has obtained lines of credit totalling C$1 165 million from various Canadian banking institutions.

In addition, the Government has concluded credit agreements for U.S. $3 500 million with a Canadian and international banking syndicate.

As at March 31, 2003, none of these credit lines or agreements had been drawn upon.

27

7. Debts

| | 2003

|

|---|

| | Direct

| | Health and social services and education networks and Government enterprises(1)

|

|---|

Currency

| | In millions of monetary units

| | Total in Canadian equivalent

| | In millions of monetary units

| | Total in Canadian equivalent

|

|---|

| |

| | (in millions of dollars)

| |

| | (in millions of dollars)

|

|---|

| In Canadian dollars | | 44 925 | | 44 925 | (3) | 4 523 | | 4 523 |

| In U.S. dollars | | 11 948 | | 17 571 | | 3 | | 4 |

| In yen | | 537 601 | | 6 690 | | | | |

| In euros | | 5 724 | | 9 170 | | | | |

| In Swiss francs | | 508 | | 552 | | | | |

| Other currencies(4) | | | | 903 | | | | |

| Less: | | | | | | | | |

| | Derivative instruments — net | | | | (669 | ) | | | 1 |

| | Sinking fund | | | | 3 552 | | | | 42 |

| | | | |

| | | |

|

| Debts before deferred foreing exchange loss | | | | 76 928 | | | | 4 484 |

| | Deferred foreign exchange loss | | | | 896 | | | | |

| | | | |

| | | |

|

| | | | | 76 032 | | | | 4 484 |

| | | | |

| | | |

|

| | 2002

|

|---|

| | Direct

| | Health and social services and education networks and Government enterprises(1)

|

|---|

Currency

| | In millions of monetary units

| | Total in Canadian equivalent

| | In millions of monetary units

| | Total in Canadian equivalent

|

|---|

| |

| | (in millions of dollars)

| |

| | (in millions of dollars)

|

|---|

| In Canadian dollars | | 38 339 | | 38 339 | (3) | 5 025 | | 5 025 |

| In U.S. dollars | | 12 718 | | 20 262 | | 224 | | 358 |

| In yen | | 547 816 | | 6 583 | | 7 004 | | 84 |

| In euros | | 5 053 | | 7 015 | | | | |

| In Swiss francs | | 10 | | 9 | | | | |

| Other currencies(4) | | | | 1 539 | | | | |

| Less: | | | | | | | | |

| | Derivative instruments — net | | | | 327 | | | | 55 |

| | Sinking fund | | | | 3 151 | | | | 34 |

| | | | |

| | | |

|

| Debts before deferred foreing exchange loss | | | | 70 269 | | | | 5 378 |

| | Deferred foreign exchange loss | | | | 843 | | | | |

| | | | |

| | | |

|

| | | | | 69 426 | | | | 5 378 |

| | | | |

| | | |

|

- (See Notes 1, 2, 3 and 4 on page 30)

28

2003

|

|---|

Work of municipal bodies(2)

| | Total

| |

| |

|

|---|

In millions of

monetary units

| | Total in

Canadian

equivalent

| | In millions of

monetary units

| | Total in Canadian equivalent

| | Derivative instruments — net

| | Total after impact of derivative instruments

|

|---|

| | (in millions of dollars)

| |

| | (in millions of dollars)

| | (in millions of dollars)

| | (in millions of dollars)

|

|---|

| 2 045 | | 2 045 | | 51 493 | | 51 493 | | 22 350 | | 73 843 |

| | 315 | | 463 | | 12 266 | | 18 038 | | (14 704 | ) | 3 334 |

| 5 000 | | 62 | | 542 601 | | 6 752 | | 1 637 | | 8 389 |

| | 284 | | 455 | | 6 008 | | 9 625 | | (9 625 | ) | |

| | | | | 508 | | 552 | | 1 955 | | 2 507 |

| | | | | | | 903 | | (903 | ) | |

| | | (42 | ) | | | (710 | ) | 710 | | |

| | | | | | | 3 594 | | | | 3 594 |

| | |

| | | |

| |

| |

|

| | | 3 067 | | | | 84 479 | | | | 84 479 |

| | | | | | | 896 | | | | 896 |

| | |

| | | |

| |

| |

|

| | | 3 067 | | | | 83 583 | | | | 83 583 |

| | |

| | | |

| |

| |

|

2002

|

|---|

Work of municipal bodies(2)

| | Total

| |

| |

|

|---|

In millions of

monetary units

| | Total in

Canadian

equivalent

| | In millions of

monetary units

| | Total in Canadian equivalent

| | Derivative instruments — net

| | Total after impact of derivative instruments

|

|---|

| | (in millions of dollars)

| |

| | (in millions of dollars)

| | (in millions of dollars)

| | (in millions of dollars)

|

|---|

| 2 382 | | 2 382 | | 45 746 | | 45 746 | | 20 783 | | 66 529 |

| | 172 | | 274 | | 13 114 | | 20 894 | | (15 199 | ) | 5 695 |

| 5 000 | | 60 | | 559 820 | | 6 727 | | 3 051 | | 9 778 |

| | 284 | | 393 | | 5 337 | | 7 408 | | (7 408 | ) | |

| | | | | 10 | | 9 | | | | 9 |

| | | | | | | 1 539 | | (1 539 | ) | |

| | | (70 | ) | | | 312 | | (312 | ) | |

| | | | | | | 3 185 | | | | 3 185 |

| | |

| | | |

| |

| |

|

| | | 3 179 | | | | 78 826 | | | | 78 826 |

| | | | | | | 843 | | | | 843 |

| | |

| | | |

| |

| |

|

| | | 3 179 | | | | 77 983 | | | | 77 983 |

| | |

| | | |

| |

| |

|

29

Weighted average interest rate(5)

| |

| |

| | Health and social services and education networks and Government enterprises

| |

| |

| |

|---|

| |

| |

| | Work of municipal bodies

| |

|---|

| | Direct

| |

|---|

Currency

| |

|---|

| | 2003

| | 2002

| | 2003

| | 2002

| | 2003

| | 2002

| |

|---|

| |

| | (Note 11)

| |

| |

| |

| |

| |

|---|

| In Canadian dollars | | 6.36 | % | 6.73 | % | 6.48 | % | 6.54 | % | 6.33 | % | 7.11 | % |

| In U.S. dollars | | 6.68 | | 6.54 | | 1.41 | | 4.73 | | 7.28 | | 8.53 | |

| In yen | | 3.63 | | 3.61 | | | | 0.72 | | 9.89 | | 9.89 | |

| In euros | | 5.37 | | 5.73 | | | | | | 8.37 | | 8.37 | |

| In Swiss francs | | 3.16 | | 3.16 | | | | | | | | | |

| Weighted average rate | | 6.07 | % | 6.30 | % | 6.48 | % | 6.33 | % | 6.96 | % | 7.51 | % |

- (1)

- To offset this debt, advances to the health and social services and education networks and to Government enterprises are granted on the same conditions as these borrowings and recorded as financial assets.

- (2)

- Under the water treatment program, the Government is committed, in accordance with an agreement with the municipalities and the Société québécoise d'assainissement des eaux (SQAE), to contributing to the financing of work costs by repaying, based on date of maturity, the principal and interest on borrowings contracted by the SQAE.

- (3)

- The Government held $282 million worth of its securities as at March 31, 2003 ($400 million in 2002).

- (4)

- In 2002 and 2003, other currencies included the pound sterling, the Australian dollar and the Swedish krona. A detailed table by type of currency and debt is presented in Appendix 13.

- (5)

- The weighted average interest rate corresponds to the effective rate of borrowings.

Debt schedules after impact of derivative instruments

Direct

Maturing on March 31(6)

| | In Canadian dollars(9)

| | In U.S. dollars(9)

| | In yen

| | In euros

| | In Swiss francs

| | Other

| | Total

|

|---|

| |

| |

| |

| |

| |

| |

| | (in millions of dollars)

|

|---|

| 2004 | | 12 171 | | (5 638 | ) | 3 236 | | (244 | ) | 896 | | (112 | ) | 10 309 |

| 2005 | | 5 187 | | 32 | | 38 | | | | | | | | 5 257 |

| 2006 | | 6 127 | | 70 | | 12 | | 5 | | | | | | 6 214 |

| 2007 | | 4 875 | | 42 | | 19 | | | | | | | | 4 936 |

| 2008 | | 5 168 | | 29 | | 46 | | 110 | | | | | | 5 353 |

| | |

| |

| |

| |

| |

| |

| |

|

| | | 33 528 | | (5 465 | ) | 3 351 | | (129 | ) | 896 | | (112 | ) | 32 069 |

| 2009-2013 | | 17 176 | | 1 330 | | 2 188 | | 13 | | 1 611 | | (4 | ) | 22 314 |

| 2014-2018 | | 1 315 | | 514 | | 2 580 | | 81 | | | | | | 4 490 |

| 2019-2023 | | 1 962 | | 514 | | 21 | | 35 | | | | 116 | | 2 648 |

| 2024-2028 | | 2 808 | | 3 572 | | 249 | | | | | | | | 6 629 |

| 2029 and thereafter | | 6 349 | | 2 429 | | | | | | | | | | 8 778 |

| | |

| |

| |

| |

| |

| |

| |

|

| | | 63 138 | | 2 894 | | 8 389 | | — | | 2 507 | | — | | 76 928 |

| | |

| |

| |

| |

| |

| |

| |

|

30

Health and social services and education networks and Government enterprises

Maturing on March 31(7)

| | In Canadian dollars(9)

| | In U.S. dollars(9)

| | In yen

| | In euros

| | In Swiss francs

| | Other

| | Total

|

|---|

| |

| |

| |

| |

| |

| |

| | (in millions of dollars)

|

|---|

| 2004 | | 1 366 | | | | | | | | | | | | 1 366 |

| 2005 | | 76 | | | | | | | | | | | | 76 |

| 2006 | | 885 | | | | | | | | | | | | 885 |

| 2007 | | 12 | | | | | | | | | | | | 12 |

| 2008 | | 653 | | | | | | | | | | | | 653 |

| | |

| |

| |

| |

| |

| |

| |

|

| | | 2 992 | | | | | | | | | | | | 2 992 |

| 2009-2013 | | 760 | | | | | | | | | | | | 760 |

| 2014-2018 | | 27 | | | | | | | | | | | | 27 |

| 2019-2023 | | 345 | | | | | | | | | | | | 345 |

| 2024-2028 | | 6 | | | | | | | | | | | | 6 |

| 2029 and thereafter | | 354 | | | | | | | | | | | | 354 |

| | |

| |

| |

| |

| |

| |

| |

|

| | | 4 484 | | | | | | | | | | | | 4 484 |

| | |

| |

| |

| |

| |

| |

| |

|

Work of municipal bodies

Maturing on March 31(7)

| | In Canadian dollars(9)

| | In U.S. dollars(9)

| | In yen

| | In euros

| | In Swiss francs

| | Other

| | Total

|

|---|

| |

| |

| |

| |

| |

| |

| | (in millions of dollars)

|

|---|

| 2004 | | 832 | | | | | | | | | | | | 832 |

| 2005 | | 270 | | | | | | | | | | | | 270 |

| 2006 | | 382 | | | | | | | | | | | | 382 |

| 2007 | | 402 | | | | | | | | | | | | 402 |

| 2008 | | 205 | | | | | | | | | | | | 205 |

| | |

| |

| |

| |

| |

| |

| |

|

| | | 2 091 | | | | | | | | | | | | 2 091 |