Exhibit 99.4

SNAPSHOT OF QUÉBEC'S ECONOMIC

AND FINANCIAL SITUATION

Section A

Overview

Section B

Actions to Manage the Public Health Crisis

Section C

The Québec Economy:

Recent Developments and Outlook

for 2020 and 2021

Section D

Québec's Financial Situation

Section E

Preparing Québec's Economic Recovery

Section A

OVERVIEW

| Message from the Minister | A.3 |

| | |

| 1. Overview | A.5 |

A1

MESSAGE FROM THE MINISTER

On March 11, the World Health Organization declared a global pandemic. On March 13, the Québec government declared a public health emergency and swiftly introduced measures to control the spread of COVID-19.

The subsequent confinement period halted 40% of economic activity for eight weeks. The pause on entire sectors of the economy called for the implementation of unparalleled financial support measures.

Québec thus took prompt action and showed leadership to support Quebecers and Québec businesses. At the outset of the public health crisis, the government established the Concerted Action Program for Job Retention (PACME), the Concerted Temporary Action Program for Businesses (PACTE) and the Incentive Program to Retain Essential Workers (PIRTE), as well as suspended income tax payments and QST remittances.

More targeted measures were subsequently introduced to support the hardest hit sectors of our economy, such as tourism, culture and public transit, and assist those that will be dealing with the impacts of the crisis for several more months.

It is important to note that close cooperation with the federal government helped broaden financial support. The federal contribution was crucial to providing income support, especially thanks to the Canada Emergency Response Benefit (CERB).

The pandemic, the global recession and all of the steps taken in response to the public health crisis are having a major impact on public finances. The time has come to provide Quebecers with a snapshot not only of the substantial efforts made by the government to mitigate the impact, but also of Québec's economic outlook and financial situation.

Despite the high uncertainty still surrounding developments in economic activity, I remain convinced that Québec's strong economy and sound public finances will enable it to weather any new disruptions that might occur. I am also convinced that our economy will return to growth rapidly. Before being hard hit by the pandemic, the Québec economy was performing remarkably well.

We will continue to help Quebecers and Québec businesses get through this crisis. We will stimulate growth by ensuring health security and rebuilding the climate of confidence needed for consumption and private investment to resume.

The public health crisis must not serve as a reason to forego our goals of increasing Québec's economic potential, creating wealth for all Quebecers, investing in health and education and fighting climate change.

Minister of Finances,

Eric Girard

Québec, June 2020.

1. OVERVIEW

❏ An unprecedented health and economic crisis

In the last few months, the world has experienced a public health crisis never seen in modern history.1

Québec has had to face two major challenges in a context of high uncertainty, namely:

— issue unprecedented public health directives to protect the general population;

— take important steps to support an economy forced into a slowdown, and even suddenly paused so as to contain the outbreak.

Since March, the government has had to make a number of difficult, but critical, decisions to contain the spread of COVID-19 within the population.

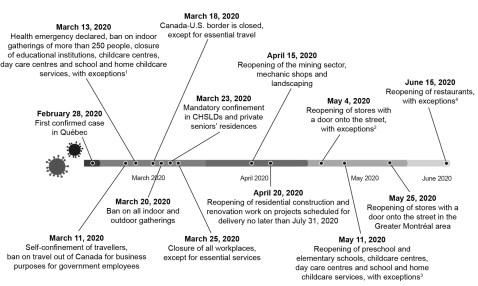

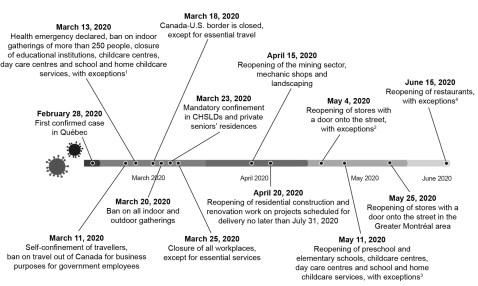

ILLUSTRATION A.1

Chronology of events |

|

(1) Services have to be organized and provided to children with at least one parent who works in a health and social services institution or is a police officer, firefighter, ambulance attendant, correctional services officer or special constable. (2) Except in the Greater Montréal area. (3) Except in the territory of the Communauté métropolitaine de Montréal, the regional county municipality of Joliette and the city of L'Épiphanie. These institutions remain closed to students until the end of August 2020. (4) Except in the territory of the Communauté métropolitaine de Montréal, the regional county municipality of Joliette and the city of L'Épiphanie. These restaurants will be allowed to reopen on June 22, 2020. |

______________________________

1 Unless otherwise indicated, this document is based on data available as at June 9, 2020. For the document as a whole, the budgetary data for 2019-2020 and 2020-2021 are estimates based on preliminary and partial information.

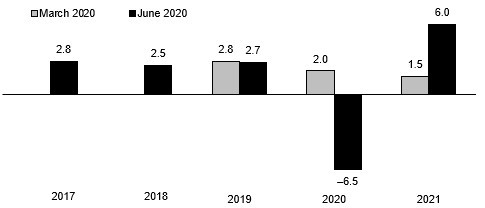

❏ An unparalleled shock to the global economy

The rapid spread of COVID-19 around the globe called for immediate and concerted action to protect the public. Many countries introduced measures to slow the spread of the pandemic.

The public health measures paralyzed the global economy, triggering a simultaneous supply and demand shock.

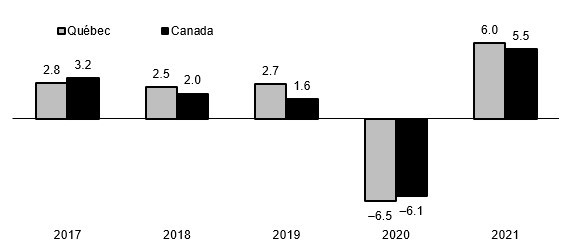

As a result, the economic outlook for 2020 has dimmed rapidly since March, in Québec and elsewhere in the world. In fact, the pandemic has caused a global recession that will affect almost all countries.

— Global real gross domestic product (GDP) is projected to shrink by 3.5% in 2020. During the most recent economic crisis, in 2009, global real GDP fell by 0.1%.

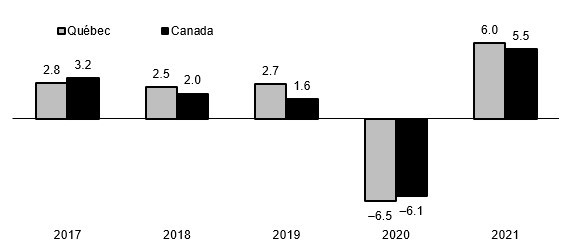

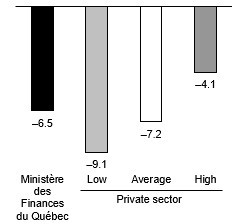

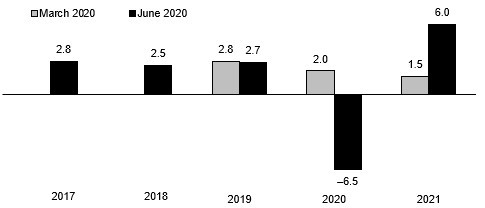

— In Québec, real GDP is projected to contract by 6.5% in 2020.

Furthermore, the gradual reopening of economies as well as the actions taken by governments and central banks around the world will reduce the extent of the decline in output by supporting households and businesses and will boost the economic recovery.

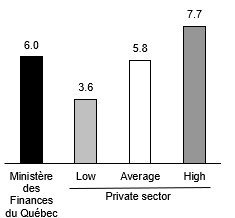

— Global real GDP is projected to expand by 5.0% in 2021.

— In Québec, economic growth is expected to reach 6.0%.

However, a very high degree of uncertainty is weighing on economic forecasts. The impact of the health crisis on economic activity and the speed of recovery are hard to assess with certainty.

TABLE A.1

Economic growth

(real GDP, percentage change) |

| 2019 | 2020 | 2021 |

Québec | 2.7 | -6.5 | 6.0 |

Budget 2020-2021 | 2.8 | 2.0 | 1.5 |

Canada | 1.7 | -6.1 | 5.5 |

Budget 2020-2021 | 1.6 | 1.7 | 1.7 |

United States | 2.3 | -6.0 | 6.2 |

Budget 2020-2021 | 2.3 | 1.8 | 2.0 |

World | 2.9 | -3.5 | 5.0 |

Budget 2020-2021 | 2.9 | 3.1 | 3.3 |

Sources: Institut de la statistique du Québec, Statistics Canada, International Monetary Fund, IHS Markit, Datastream, Eurostat and Ministère des Finances du Québec. |

| Snapshot of Québec’s Economic |

| A.6 | and Financial Situation |

❏ Québec's economy hit hard

In March, Québec was hit hard by the public health measures, which forced the shutdown of nearly 40% of the economy. The pause, albeit temporary, has had an unparalleled economic impact.

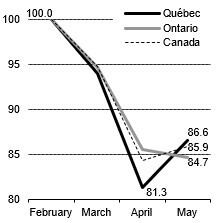

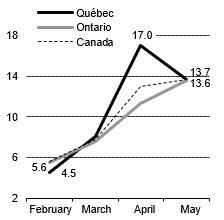

— Between February and April, 820 500 jobs were lost (−18.7%). The unemployment rate rose from 4.5% in February to 17.0% in April.

Québec's economy will pick up gradually in the coming months as economic activities slowly resume.

— The reopening of the mining, construction and manufacturing sectors added 230 900 jobs in May (+6.5%). In just one month, the unemployment rate dropped to 13.7%.

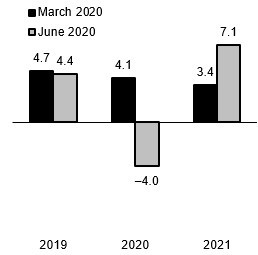

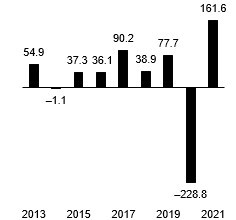

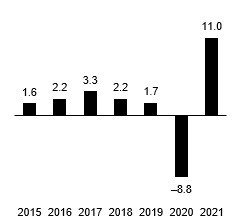

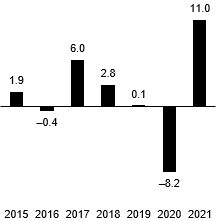

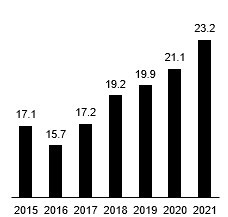

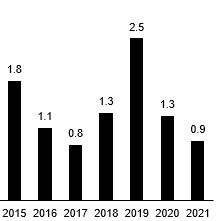

CHART A.1

Economic growth |

(real GDP, percentage change) |

|

Sources: Institut de la statistique du Québec, Statistics Canada and Ministère des Finances du Québec. |

❏ Decisive action by the government

In the space of a few weeks, governments undertook financial support equal to that provided in 24 months during the financial crisis of 2008-2009.

The action taken by the Québec government since the onset of the public health crisis has made more than $28 billion available to Quebecers and Québec businesses, an amount equal to 6.2% of the economy. The action has taken various forms, including management of the health crisis, subsidies, loans, the extension of individual and corporate income tax deadlines and acceleration of infrastructure projects.

Substantial measures totalling $6.6 billion have been introduced to address the health crisis. First and foremost, they have made it possible to reconfigure the health care system in order to deal with the crisis. Significant financial support has also been provided to individuals and businesses to help them cope with the economic impacts of the crisis:

— $3.7 billion to strengthen our health care system to address the public health crisis;

— $1.0 billion to support workers and individuals;

— $2.0 billion to mitigate the economic impact of the pandemic.

These measures are in addition to the crucial steps taken by the federal government to help individuals, workers and businesses during the state of emergency.2

— The government introduced the Canada Emergency Response Benefit (CERB) grants workers who lost their job due to the pandemic $2 000 a month to ensure they have enough income to weather the crisis.

— In addition, significant measures were adopted to make liquidity available to businesses affected by the pandemic; for example, the Canada Emergency Wage Subsidy (CEWS), the Business Credit Availability Program (BCAP) and Canada Emergency Commercial Rent Assistance (CECRA).

TABLE A.2

Financial impact of the actions to manage the public health crisis and support the economy

(millions of dollars) |

| Financial impact | Injections into

the economy |

| 2019-2020 | 2020-2021 | Total |

Strengthening our health care system

to address the public health crisis | -166 | -3 522 | -3 688 | 3 688 |

Supporting workers and individuals | -71 | -910 | -981 | 5 820 |

Mitigating the economic impact

of the pandemic | -70 | -1 904 | -1 974 | 18 770 |

TOTAL | -307 | -6 336 | -6 643 | 28 277 |

Note: Totals may not add due to rounding. |

______________________________

2 The federal government estimates the total financial support for Canadians at $60 billion for the CERB and $45 billion for the CEWS.

| Snapshot of Québec’s Economic |

| A.8 | and Financial Situation |

Pursuing the government objective of increasing

Québec's economic potential |

The government has made it its goal to create wealth and increase Québec's economic potential. Although the public health crisis has been a major shock to the economy and public finances in Québec, the government must not deviate from the goals it set itself. To turn the economic recovery into sustainable growth, the government needs to set clear economic objectives: — in the short term, return to the pre-crisis GDP level by December 2021; — in the medium term, raise Québec's potential GDP growth to 2%. Its strong economy will enable Québec to overcome these disruptions In the last ten years, economic growth in Québec was driven by an improvement in the employment rate. In 2019, the trend changed. — Québec saw further expansion in economic growth thanks to productivity gains. — As a result, the standard of living rose by 1.6% in Québec in 2019. In 2020, the global economy will experience a crisis unlike any other seen in modern history. — Given its favourable position prior to the crisis, the Québec economy will turn around quickly and return to a period of economic expansion in 2022. The economic recovery, wealth creation and enhancement of economic potential must continue to be underpinned by strong productivity growth. Contribution of economic growth factors in Québec

(average annual percentage change and contribution in percentage points) |

| 2009-2018 | 2019 | 2020 | 2021 | 2022 |

Real GDP | 1.5 | 2.7 | -6.5 | 6.0 | 2.4 |

Pool of potential workers(1) | 0.2 | 0.2 | 0.1 | -0.1 | -0.1 |

Employment rate(2) | 0.7 | 1.6 | -5.4 | 4.1 | 1.2 |

Productivity(3) | 0.5 | 0.9 | -1.3 | 2.0 | 1.3 |

STANDARD OF LIVING(4) | 0.7 | 1.6 | -7.1 | 5.3 | 1.7 |

Note: Totals may not add due to rounding. (1) Population aged 15-64. (2) The employment rate corresponds to the total number of workers over the population aged 15-64. (3) Productivity as measured by real GDP per job. (4) Standard of living as measured by real GDP per capita. Sources: Institut de la statistique du Québec, Statistics Canada and Ministère des Finances du Québec. |

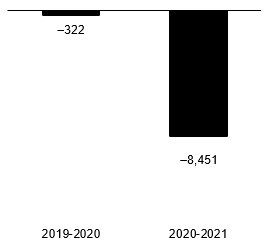

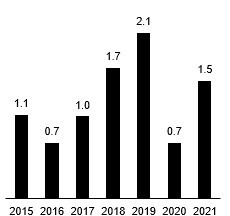

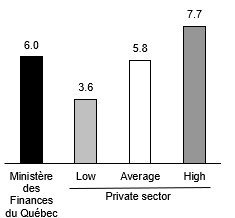

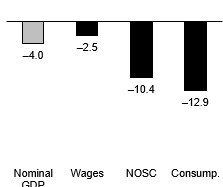

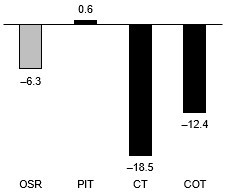

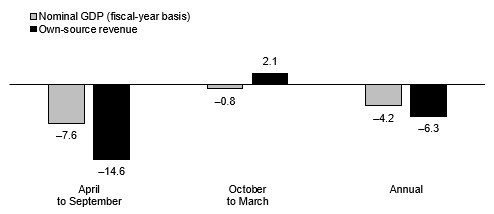

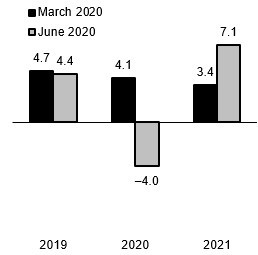

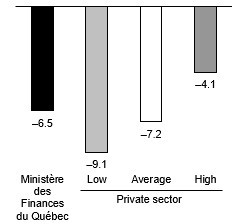

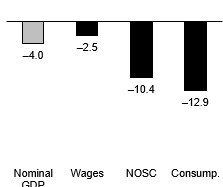

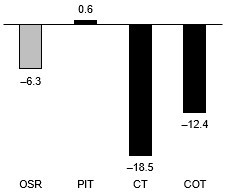

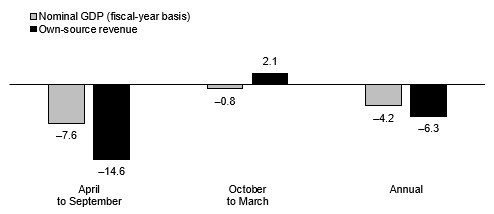

❏ A significant decrease in government revenues

A sharp contraction in Québec's economic growth is forecast for 2020.

— Nominal GDP is projected to contract by 4.0%, a decrease of 8.1 percentage points from the forecast in March 2020.

The effects of the economic contraction on the different tax bases, coupled with the measures introduced to support workers, individuals and businesses, result in a significant decrease in the government's own-source revenue,3 especially in 2020-2021.

Relative to the forecast in Budget 2020-2021, tabled on March 10, revenue has been adjusted downward by:

— $0.3 billion in 2019-2020;

— $8.5 billion in 2020-2021, a 9% decrease in the government's own-source revenue.

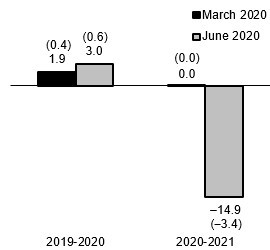

CHART A.2

Adjustment to nominal

GDP growth | | CHART A.3

Adjustment to own-source revenue

since March 2020 |

(percentage change) | (millions of dollars) |

|

|

Sources: Institut de la statistique du Québec, Statistics Canada and Ministère des Finances du Québec. | Source: Ministère des Finances du Québec. |

______________________________

3 Own-source revenue excluding revenue from government enterprises.

| Snapshot of Québec’s Economic |

| A.10 | and Financial Situation |

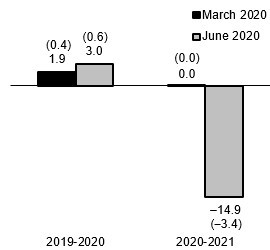

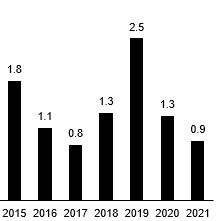

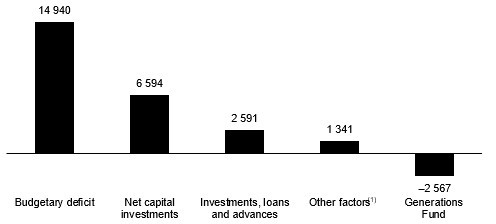

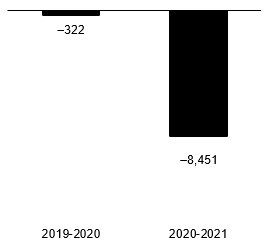

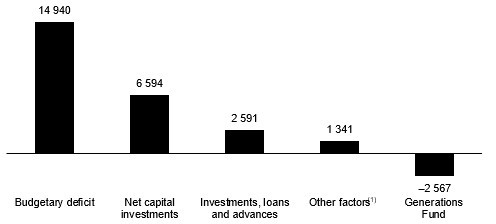

�� Major impact on Québec's financial situation

The current public health crisis is having major impacts on Québec's financial situation. Whereas Budget 2020-2021 forecast a surplus of $1.9 billion in 2019-2020 and a balanced budget thereafter, the budgetary balance will instead be:

— $3.0 billion in 2019-2020, an increase of $1.1 billion;

— The upward adjustments of $1.1 billion since March 2020 are primarily attributable to a still-favourable budgetary situation prior to the public health emergency declared in the second half of March.

— $−14.9 billion in 2020-2021, before accounting for the stabilization reserve.

In addition, a provision of $4.0 billion is being included in the financial framework to mitigate potential economic risks, cover additional health spending and fund additional support and recovery measures. The provision will give the government the leeway it needs to respond quickly should there be a second wave of COVID-19.

— This amount, which represents roughly 3% of the government's budget, is enough to cover additional health costs should the public health emergency continue and to offset another shock to the economy in the event of a second wave.

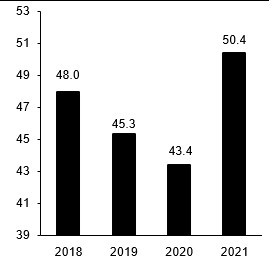

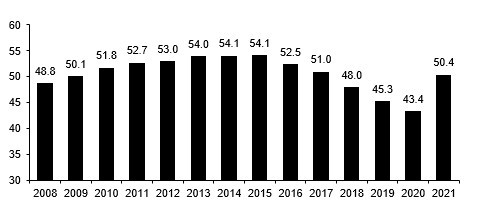

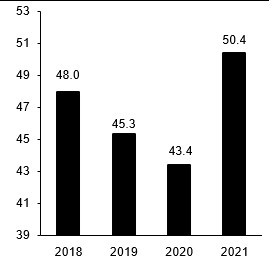

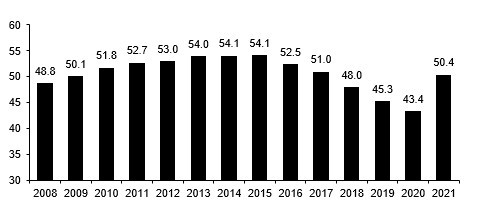

The forecast deficit in 2020-2021 raises the gross debt to 50.4% of GDP as at March 31, 2021. Note that Québec's credit rating is evaluated by six credit rating agencies. These six agencies have assigned a stable outlook to Québec's credit rating.

CHART A.4

Budgetary balance -

2019-2020 and 2020-2021 | | CHART A.5

Québec's gross debt as at March 31 |

(billions of dollars and percentage of GDP) | (percentage of GDP) |

|

|

Source: Ministère des Finances du Québec. | Source: Ministère des Finances du Québec. |

Section B

ACTIONS TO MANAGE THE PUBLIC HEALTH CRISIS

| Introduction | B.3 |

| | |

| 1. Strengthening our health care system to address the public health crisis | B.5 |

| | |

| 1.1 Acknowledging the extra efforts of health workers | B.6 |

| | |

| 1.2 Ensuring the necessary supply of equipment to tackle the crisis | B.9 |

| | |

| 1.3 Other support measures in the health and social services sector | B.10 |

| | |

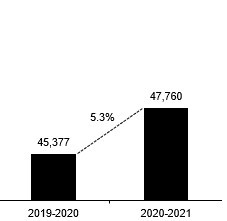

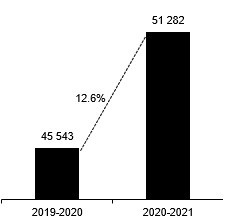

| 1.4 $51.3 billion in health and social service spending in 2020—2021 | B.11 |

| | |

| 2. Supporting workers and individuals | B.15 |

| | |

| 2.1 Supporting Quebecers | B.16 |

| | |

| 2.2 Fostering the retention of workers | B.18 |

| | |

| 3. Mitigating the economic impact of the pandemic | B.21 |

| | |

| 3.1 Accelerating infrastructure investments | B.22 |

| | |

| 3.2 Providing businesses with financial support | B.23 |

| | |

| 3.3 Offering support adapted to certain sectors | B.28 |

| | |

| 3.4 Supporting municipalities | B.31 |

B.1

INTRODUCTION

The Québec government acted swiftly in adopting measures to limit the spread of the COVID—19 pandemic, protect Quebecers and support the economy.

Through these measures, the government has injected over $28 billion into Québec's economy, or 6.2% of the GDP, to support individuals and businesses affected by the public health crisis.

The government's actions represent a total financial impact of more than $6.6 billion over two years:

— $3.7 billion to strengthen our health care system to address the public health crisis;

— $1.0 billion to support workers and individuals;

— $2.0 billion to mitigate the economic impact of the pandemic through various measures to support businesses and municipalities.

TABLE B.1

Financial impact of the actions to manage the public health crisis and support the economy

(millions of dollars) |

| Financial impact | Injections into the economy |

| 2019—2020 | 2020—2021 | Total |

Strengthening our health care system to address the public health crisis | —165.8 | —3 522.4 | —3 688.2 | 3 688 |

| | | | | |

Supporting workers and individuals | —70.8 | —909.7 | —980.5 | 5 820 |

| | | | | |

Mitigating the economic impact of the pandemic | —70.2 | —1 903.5 | —1 973.7 | 18 770 |

| | | | | |

TOTAL | —306.9 | —6 335.6 | —6 642.5 | 28 277 |

Note: Totals may not add due to rounding. |

| Actions to Manage the | |

| Public Health Crisis | B.3 |

1. STRENGTHENING OUR HEALTH CARE SYSTEM TO ADDRESS THE PUBLIC HEALTH CRISIS

The significant strain on health workers and the need to provide them with the necessary protective equipment called for prompt action by the government.

The Québec government is investing nearly $3.7 billion to strengthen the health care system in order to deal with the health crisis.

Substantial measures have been introduced to that end, in particular:

— $878 million to acknowledge the extra efforts of health workers;

— $2 382 million to ensure the necessary supply of equipment to tackle the crisis;

— $428 million for other measures, including support for individuals experiencing distress and mental health problems.

TABLE B.2

Financial impact of the measures to strengthen our health care system to address the public health crisis

(millions of dollars) |

| Financial impact | Injections into the economy |

| 2019—2020 | 2020—2021 | Total |

| | | | | |

Acknowledging the extra efforts of health workers | —77.3 | —801.1 | —878.4 | 878 |

| | | | | |

Ensuring the necessary supply of equipment to tackle the crisis | —15.0 | —2 366.8 | —2 381.8 | 2 382 |

| | | | | |

Other support measures in the health and social services sector | —73.6 | —354.4 | —428.0 | 428 |

| | | | | |

TOTAL | —165.8 | —3 522.4 | —3 688.2 | 3 688 |

Note: Totals may not add due to rounding. |

1.1 Acknowledging the extra efforts of health workers

The government acknowledges the challenges faced by the health and social services sector, particularly in recruiting workers in various fields.

A number of temporary wage increases, totalling $878 million, have been announced for people employed in the health and social services sector.

Bonuses and wage increases have been granted to several categories of workers, including patient—care attendants, nurses, nursing assistants and other job categories (housekeeping attendants, laboratory technicians, etc.) in public and private health and social services institutions. They include:

— a wage increase for patient—care attendants working in private facilities;

— an 8% bonus for employees in the health and social services network who are in permanent contact with COVID—19 patients and a 4% bonus for all other employees in the network;

— temporary lump sum payments to encourage full—time work and labour mobility:

— an additional amount of up to $1 000 per month for clinical staff in the health and social services network working full—time in CHSLDs or in designated hospital centres, as well as for staff working in private residential facilities;

— an additional amount of up to $2 000 per month for employees in the health and social services network who agree to go work in regions considered "hot zones" (Laval, Montréal and Montérégie).

In addition, on June 2 the government announced a campaign to recruit 10 000 more patient—care attendants in CHSLDs to ensure greater availability of staff and provide better care and services to residents.

TABLE B.3

Financial impact of the measures to acknowledge the extra efforts of health workers

(millions of dollars) |

| Financial impact | Injections into the economy |

| 2019—2020 | 2020—2021 | Total |

Wage increase for patient—care attendants working in private facilities | —14.7 | —108.2 | —122.9 | 123 |

| | | | | |

8% bonus for employees in the health network and 4% bonus for all other employees | —38.8 | —168.2 | —207.0 | 207 |

| | | | | |

Lump sum payments to encourage full—time work and labour mobility | — | —62.6 | —62.6 | 63 |

| | | | | |

Training and remuneration of new patient—care attendants | — | —337.0 | —337.0 | 337 |

| | | | | |

Other tailored support measures | —23.8 | —125.2 | —149.0 | 149 |

| | | | | |

TOTAL | —77.3 | —801.1 | —878.4 | 878 |

Note: Totals may not add due to rounding. |

| Further support for seniors and caregivers |

The last two budgets announced further investments to help seniors and caregivers, totalling more than $3 billion over six years, that is, between 2019—2020 and 2024—2025. These investments raise the total annual funding for supporting the autonomy of seniors to $7 billion.1 Enhancing services for seniors The government has announced a number of enhancements to services for seniors, particularly with the aim of: — improving home care; — increasing the lodging supply and improving the quality of food served; — rolling out respite services for caregivers; — developing clinical prevention and reinforcing healthy lifestyles to help Quebecers age well. Funding has been earmarked to ensure that seniors and people living with disabilities can enjoy a better quality of life. In the last two years, the government has announced that additional resources will be hired to enable more hours of in—home care and services. The government also pledged to build 48 seniors' homes, which provide a more humane living environment offering quality care and services, and to add nearly 2 000 more residential beds and spaces. |

1 This amount includes transfers to service recipients, expenditures made through the tax system and the contribution from users lodged in a care facility.

Further support for seniors and caregivers (cont.) |

Double the assistance for caregivers The new refundable tax credit for caregivers replaces the refundable tax credit for informal caregivers of persons of full age. As of 2020, the new tax credit will double the maximum tax assistance granted to caregivers of an adult who has a severe and prolonged impairment, raising it from $1 225 to $2 500. In addition, the tax assistance has been extended to caregivers of spouses of any age and caregivers having no family relationship with the carereceiver. This means that over 112 000 people will now receive tax assistance in recognition of the care they provide. This is 30 000 more people than under the old tax credit. Greater financial support for seniors The tax assistance for caregivers is in addition to the various actions to provide greater financial support to seniors that have been taken since the December 2018 Update on Québec's Economic and Financial Situation, namely: — introduction of the senior assistance amount, which grants low—income seniors aged 70 or older up to $206 in financial assistance, in the case of a senior living alone, and $412, in the case of a senior couple, in 2020; — enhancement of the tax credit for career extension, which represents tax savings of up to $1 650 in 2020 for workers aged 60 or older. |

1.2 Ensuring the necessary supply of equipment to tackle the crisis

The government moved swiftly to support health and social services workers on the front lines of the fight against COVID—19 and provide them with the necessary protective equipment.

To that end, an additional $2.4 billion in spending was made available to health and social services institutions.

The government purchased N95 masks, surgical masks, gowns, gloves, visors, personal protective equipment and hand sanitizer to protect health and social services workers so that they can safely provide care.

The supplies purchased to date should be enough to cover most of the current year.

The situation is being monitored on an ongoing basis to ensure sufficient supplies in the foreseeable future.

TABLE B.4

Financial impact of the measures to ensure the necessary supply of equipment to tackle the crisis

(millions of dollars) |

| Financial impact | Injections into the economy |

| 2019—2020 | 2020—2021 | Total |

| | | | | |

Provision of equipment (gowns, masks, etc.) | — | —2 296.0 | —2 296.0 | 2 296 |

| | | | | |

Protective and safety measures for health workers | —15.0 | —64.8 | —79.8 | 80 |

| | | | | |

Equipment for the Greater Montréal public transit system | — | —6.0 | —6.0 | 6 |

| | | | | |

TOTAL | —15.0 | —2 366.8 | —2 381.8 | 2 382 |

1.3 Other support measures in the health and social services sector

The COVID—19 pandemic and confinement have led to an increase in psychological distress and mental health problems in the general population as well as physical and mental exhaustion among people working in health and social services institutions.

Additional spending of $428 million has been earmarked to provide more services to the public and to health and social services institutions, including:

— more than 500 000 COVID—19 screening tests to date, involving $25.7 million in spending. With the current target set at 20 000 tests a day, the government projects that spending could reach $200 million by the end of the current fiscal year;

— psychosocial and mental health services for the general population;

— help for people employed in the health and social services sector, under the Employee Assistance Program;

— support for community organizations so that they can help people;

— assistance for women who are victims of domestic violence.

TABLE B.5

Financial impact of the other support measures in the health and social services sector

(millions of dollars) |

| Financial impact | Injections into the economy |

| 2019—2020 | 2020—2021 | Total |

| | | | | |

Increase in the daily screening capacity | — | —200.0 | —200.0 | 200 |

| | | | | |

Greater mental health supports for the general population | — | —31.1 | —31.1 | 31 |

| | | | | |

Addition of beds for alternative care services | — | —27.0 | —27.0 | 27 |

| | | | | |

Employee Assistance Program | — | —14.0 | —14.0 | 14 |

| | | | | |

Support for community organizations | — | —20.0 | —20.0 | 20 |

| | | | | |

Assistance for women who are victims of domestic violence | —2.5 | — | —2.5 | 3 |

| | | | | |

Support for community or private addiction treatment facilities | — | —3.0 | —3.0 | 3 |

| | | | | |

Further support for the Tel—jeunes teen support line | — | —0.5 | —0.5 | 1 |

| | | | | |

Other measures | —71.1 | —58.8 | —129.9 | 130 |

| | | | | |

TOTAL | —73.6 | —354.4 | —428.0 | 428 |

Note: Totals may not add due to rounding. |

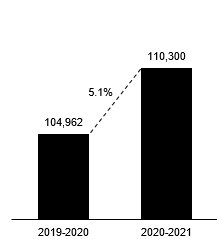

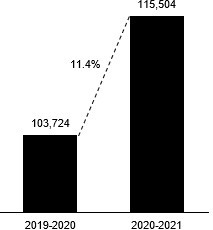

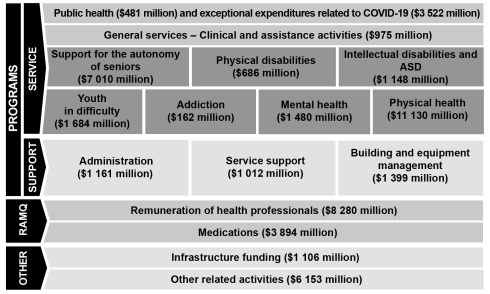

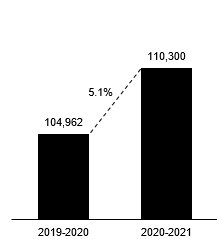

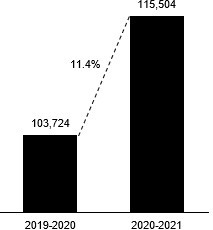

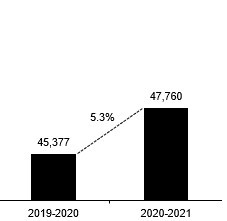

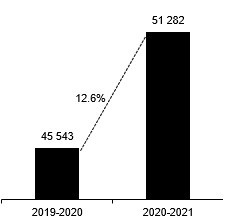

1.4 $51.3 billion in health and social service spending in 2020—2021

Initially forecast at $47.8 billion in the last budget, spending on health and social services now stands at $51.3 billion in 2020—2021. This spending category can be broken down into three main areas of intervention:

— services provided to the public through direct service or support programs;

— programs under the responsibility of the Régie de l'assurance maladie du Québec (RAMQ);

— infrastructure funding and other related activities.

The majority of services are delivered or administered by:

— health and social services institutions, which are responsible for delivering all services to the public and ensuring equitable distribution of resources among the various programs;

— the RAMQ, which serves nearly 8 million people covered by the Québec Health Insurance Plan. Of that number, approximately 3.7 million people are also registered for the Public Prescription Drug Insurance Plan.

Health and social service spending is largely funded by general and income taxes, but also by external contributions, in particular from the federal government and users, by way of transfers to service providers or direct assistance to recipients through the tax system.

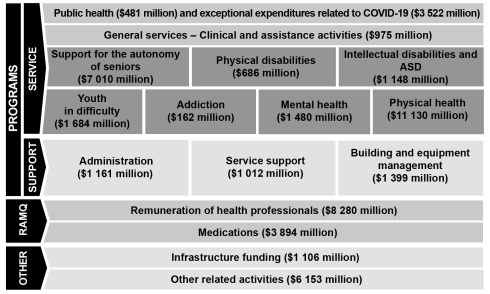

CHART B.1

Breakdown of total spending on health and social services |

|

Source: Ministère des Finances du Québec calculation based on 2020—2021 Expenditure Budget data. |

Existing health and social services programs |

Public health The purpose of the Public Health Program is to enhance the health and well—being of the general population through action taken mainly before problems related to health and well—being occur. — Exceptionally in 2020—2021, public health spending is up by $3.5 billion, that is, the amount injected into the health care system to fight the COVID—19 pandemic. General services — Clinical and assistance activities This program includes local services that can be accessed through an institution, a physician's office or a family medicine group, as well as individual services for one—off or acute problems. Support for the autonomy of seniors This program includes all services provided in an institution, at home or elsewhere for people suffering from problems related to loss of autonomy, such as diminishing functional autonomy, cognitive problems (e.g. Alzheimer's disease) or chronic illnesses, and for the person's family. Home support services amount to $2.6 billion in 2020—2021, including expenditures in respect of the tax credit for home—support services for seniors (forecast at $637 million in Budget 2020—2021). — Services to provide individuals with lodging in the various types of facilities amount to $4.4 billion, including the financial contribution paid by users lodged in a facility (forecast at $1.1 billion in Budget 2020—2021). Physical disabilities This program provides services to people with physical disabilities with the aim of developing and maintaining the person's functional autonomy, compensating for the disability and supporting the person's full social participation. Intellectual disabilities and autism spectrum disorder The services provided under this program are designed to mitigate the effects of the disability, compensate for the impairments and support the person's social inclusion. Youth in difficulty This program includes services for young people and the families of young people who have development or behaviour problems, social adjustment problems (delinquency, violence, suicidal thoughts, etc.) or who need appropriate help to ensure their safety and development. Addiction This program aims to meet the needs of people with at—risk behaviour or problems associated with the use of psychoactive substances or gambling. |

Existing health and social services programs (cont.) |

Mental health This program is intended to meet the needs of people experiencing mental health problems, as well as the needs of their families. Physical health This program is intended for people with an illness, a symptom or an injury requiring specialized and super—specialized care and treatment, including emergency care, acute care episodes, specialized and super—specialized out—patient care visits, as well as specialized home visits. Administration This program includes administrative activities, such as general institution management, technical services administration and computer technology integration. Service support This program delivers services to users of health and social services institutions, including coordination of user services, nursing and assistance care, education, user admission and registration activities, and food and laundry services. Building and equipment management This program includes activities closely related to the physical environment of institutions, including the operation, maintenance and repair of facilities, housekeeping, biomedical waste management and safety. Remuneration of health professionals The remuneration of nearly 52 000 health professionals, other service providers and prescribers. Health professionals are paid by the RAMQ pursuant to agreements entered into between the medical federations or professional associations and the Minister of Health and Social Services. Medications The Public Prescription Drug Insurance Plan and other public drug expenditures under the administration of the RAMQ. Infrastructure funding and other related activities Expenditures associated with related activities include, in particular, long—term funding of infrastructure projects, Héma—Québec and pre—hospital emergency services. |

2. SUPPORTING WORKERS AND INDIVIDUALS

To help Quebecers, the government introduced a number of measures to address the new labour market reality, the lack of income suffered by many people and specific situations caused by the COVID—19 crisis.

The government acted on two fronts by:

— taking significant steps to support all Quebecers by injecting money into the economy and supporting people in vulnerable situations;

— granting wage increases to certain essential workers and workers who have been particularly affected by the crisis.

Through these measures, the Québec government has invested nearly $1 billion to support workers and individuals.

TABLE B.6

Financial impact of the measures to support workers and individuals

(millions of dollars) |

| Financial impact | Injections into the economy |

| 2019—2020 | 2020—2021 | Total |

| | | | | |

Supporting Quebecers | —46.6 | —399.5 | —446.1 | 5 249 |

| | | | | |

Fostering the retention of workers | —24.2 | —510.2 | —534.4 | 570 |

| | | | | |

TOTAL | —70.8 | —909.7 | —980.5 | 5 820 |

Note: Totals may not add due to rounding. |

2.1 Supporting Quebecers

Since the onset of the public health crisis, the government has put various measures in place to support all Quebecers. More specifically, it extended the deadlines for filing personal income tax returns and paying income tax balances and contributions.

— This measure, which helps two million Quebecers, allowed for a $4.5—billion government intervention in Québec's economy.

Furthermore, the government is delivering on its promise to implement a single school tax rate based on the lowest effective rate in Québec ahead of schedule, and is even implementing it sooner. A single school tax rate will give individuals and businesses more financial leeway.

A single rate will also eliminate rate inequities between regions and finish streamlining tax administration while ensuring that the needs of the public school system continue to be adequately funded.

— Nearly $173 million in additional funding will be earmarked for that purpose in 2020—2021. All told, the decrease announced last year and the ones announced this year represent $622 million in annual savings for taxpayers.

In addition, the government has announced over $273 million in additional measures to provide Quebecers with the money they need and help people in vulnerable situations weather the health crisis, including:

— $36.0 million for the moratorium on student loan repayments for 300 000 Quebecers;

— $116.9 million for the 25% reduction in the mandatory minimum withdrawal from a registered retirement income fund (RRIF) for 700 000 seniors;

— $82.6 million for the implementation of a loan program, a financial support program for households awaiting their residence and for the allocation of 1 800 new units under the Emergency Rent Supplement program;

— $16.7 million for implementation of the Temporary Aid for Workers Program (PATT) to provide financial assistance to nearly 14 600 people who lost work income as a result of the pandemic.

TABLE B.7

Financial impact of the measures to support Quebecers

(millions of dollars) |

| Financial impact | Injections into the economy |

| 2019—2020 | 2020—2021 | Total |

| | | | | |

Extension of filing deadline for personal income tax returns | — | — | — | 4 500 |

| | | | | |

Implementation of a single school tax rate as of July 1, 2020 | — | —172.9 | —172.9 | 226 |

| | | | | |

Moratorium on student loan repayments — Harmonization with the Government of Canada measure | — | —36.0 | —36.0 | 198 |

| | | | | |

Reduction of 25% in the mandatory minimum withdrawal from a registered retirement income fund (RRIF) | —29.9 | —87.0 | —116.9 | — |

| | | | | |

Financial support for households awaiting their residence | — | —50.0 | —50.0 | 50 |

| | | | | |

Support measures to help low—income tenants pay their rent | — | —20.1 | —20.1 | 225 |

| | | | | |

Allocation of 1 800 new units under the Emergency Rent Supplement program | — | —12.5 | —12.5 | 13 |

| | | | | |

Temporary Aid for Workers Program (PATT) | —16.7 | — | —16.7 | 17 |

| | | | | |

Further support for volunteering | — | —10.0 | —10.0 | 10 |

| | | | | |

Assistance for day camps | — | —11.0 | —11.0 | 11 |

| | | | | |

TOTAL | —46.6 | —399.5 | —446.1 | 5 249 |

Note: Totals may not add due to rounding. |

Temporary relief measures regarding retirement plans and savers |

In April 2020, the government announced temporary relief measures to facilitate the administration of pension plans and give Quebecers easier access to their retirement savings: — 3-month extension of deadlines for filing administrative documents with no penalty, including actuarial valuations of pension plans; — adjustment of the payments to retiring employees based on the most up—to—date information on the pension plan, thereby avoiding penalizing participants and retirees who stay in the pension plan; — increase in the maximum amount that can be withdrawn from locked—in retirement accounts and life income funds in 2020. |

2.2 Fostering the retention of workers

The government introduced measures totalling over $534 million to ensure the continuity of priority sectors of activity and foster the retention of low—income workers in those sectors.

More specifically, the government announced:

— $407 million to set up the Incentive Program to Retain Essential Workers (PIRTE), which provides financial assistance to 300 000 people;1

— $82.4 million to support childcare services and ensure the continued supply of childcare spaces and provide free childcare to 9 500 children of essential workers;

— $45 million to, in particular, pay an extra $100 a week above regular wages as an incentive to recruit 16 500 seasonal farm workers and offer training to give them the skills to work in Québec agricultural enterprises.

TABLE B.8

Financial impact of the measures to foster the retention of workers

(millions of dollars) |

| Financial impact | Injections into the economy |

| 2019—2020 | 2020—2021 | Total |

| | | | | |

Incentive Program to Retain Essential Workers (PIRTE) | — | —407.0 | —407.0 | 443 |

| | | | | |

Support for childcare services | —24.2 | —58.2 | —82.4 | 82 |

| | | | | |

Recruitment of farm workers | — | —45.0 | —45.0 | 45 |

| | | | | |

TOTAL | —24.2 | —510.2 | —534.4 | 570 |

Note: Totals may not add due to rounding. |

________________________________

1 The projected $890—million impact of the PIRTE as well as the anticipated 600 000 participants have been revised downward to account for the actual participation rate.

Main federal government measures |

The federal government has introduced various measures in addition to those of the Québec government to help individuals, workers and businesses weather the pandemic. To support individuals during the public health crisis, the federal government has announced, among other measures: — the Canada Emergency Response Benefit (CERB), which provides $2 000 a month for up to 16 weeks; — a one—time payment of the GST credit amount; — an increase of $300 per child in the Canada child benefit; — extension of the filing deadline for income tax returns to June 1, 2020 and of the tax payment deadline to September 1, 2020; — the Canada Emergency Student Benefit, which provides $1 250 per month and an additional $750 per month for students with permanent disabilities and students with dependents; — a one—time payment of $300 for seniors eligible for the Old Age Security pension and an additional $200 for seniors eligible for the Guaranteed Income Supplement; — a one—time payment of up to $600 for people with disabilities.1 To support businesses, the federal government has introduced: — the Canada Emergency Wage Subsidy; — access to credit through such measures as the Canada Business Emergency Account (CEBA), the Business Credit Availability Program (BCAP) and the Large Employer Emergency Financing Facility (LEEFF); — Canada Emergency Commercial Rent Assistance (CECRA) for small businesses, which provides relief in partnership with the Canadian provinces; — deferred tax levies; — one—time support to specific sectors, such as culture, agriculture, fisheries and tourism. In addition, the federal government and the Bank of Canada have taken a number of steps to ensure stability in the Canadian financial market. |

1 This payment is subject to passage of Bill C—17. |

3. MITIGATING THE ECONOMIC IMPACT OF THE PANDEMIC

To mitigate the impact of the pandemic on Québec's economy, the government acted rapidly and introduced a series of measures totalling nearly $19 billion over two years. This funding, which is intended to support the economy and foster the recovery, is making it possible to:

— accelerate infrastructure investments by injecting, ahead of schedule, $2.9 billion in 2020—2021 into the 2020—2030 Québec Infrastructure Plan (QIP);

— provide businesses with financial support;

— offer support adapted to certain sectors;

— support municipalities.

All told, these measures represent a financial impact of nearly $2 billion.

TABLE B.9

Financial impact of the measures to mitigate the economic impact of the pandemic

(millions of dollars) |

| Financial impact | Injections into the economy |

| 2019—2020 | 2020—2021 | Total |

| | | | | |

Accelerating infrastructure investments | — | —73.0 | —73.0 | 2 901 |

| | | | | |

Providing businesses with financial support | — | —1 174.0 | —1 174.0 | 13 587 |

| | | | | |

Offering support adapted to certain sectors | —70.2 | —256.5 | —326.7 | 1 545 |

| | | | | |

Supporting municipalities | — | —400.0 | —400.0 | 737 |

| | | | | |

TOTAL | —70.2 | —1 903.5 | —1 973.7 | 18 770 |

3.1 Accelerating infrastructure investments

The government has announced that several of the investments planned under the 2020—2030 Québec Infrastructure Plan (QIP) will be made ahead of schedule in order to accelerate Québec's economic recovery.

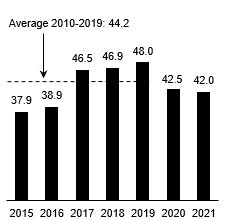

The plan now provides for investments of up to $13.9 billion for 2020—2021 instead of $11.0 billion as originally planned.

— This amounts to nearly $3 billion in additional funding that will become available in the current fiscal year and that will have a positive impact of 0.3% on Québec's real GDP.

These investments will enable several infrastructure projects to be carried out, mainly in the health, education, higher education, road transport and public transit sectors. They will have positive effects on the economy and employment in all regions of Québec.

TABLE B.10

Financial impact of the measures to accelerate infrastructure investments

(millions of dollars) |

| Financial impact | Injections into the economy |

| 2019—2020 | 2020—2021 | Total |

| | | | | |

$2.9 billion in QIP investments made ahead of schedule in 2020—2021 | — | —73.0 | —73.0 | 2 901 |

3.2 Providing businesses with financial support

The repercussions of the pandemic are putting significant pressure on the liquidity of many businesses that have had to reduce or cease their activities. Despite declining sales, these businesses must continue to cover certain expenses, which is exerting additional pressure on their finances.

To address this situation, the government has taken significant steps to support businesses through measures totalling $13.6 billion:

— financial assistance to support the working capital of businesses, in particular:

— the Concerted Temporary Action Program for Businesses (PACTE) and the Emergency Assistance Program for Small and Medium—Sized Businesses (PAUPME), amounting to support of $2.5 billion and $250 million, respectively;

— financial contribution of the Québec government to the Canada Emergency Commercial Rent Assistance (CECRA) program, representing support of $822 million for tenants of commercial property;

— introduction of the Concerted Action Program for Job Retention (PACME) to offer training to workers in businesses whose activities have been reduced, for an intervention totalling $165 million;

— accelerated payment of tax credits to businesses, representing total liquidity of nearly $1.0 billion;

— deferral and reduction of tax levies on businesses, for amounts totalling $8.9 billion, including:

— suspension of the payment of tax instalments and taxes due;

— deferral of QST remittances;

— introduction of a tax credit in respect of contributions to the Health Services Fund for employees on paid leave.

All told, these measures represent a financial impact of over $1.0 billion.

TABLE B.11

Financial impact of the measures to provide businesses with financial support

(millions of dollars) |

| Financial impact | Injections into the economy |

| 2019—2020 | 2020—2021 | Total |

| | | | | |

Concerted Temporary Action Program for Businesses (PACTE) | — | —625.0 | —625.0 | 2 500 |

| | | | | |

Emergency Assistance Program for Small and Medium—Sized Businesses (PAUPME) | — | —125.0 | —125.0 | 250 |

| | | | | |

Commercial rent assistance | — | —274.0 | —274.0 | 822 |

| | | | | |

Concerted Action Program for Job Retention (PACME) | — | —65.0 | —65.0 | 165 |

| | | | | |

Accelerated payment of tax credits to businesses(1) | — | — | — | 961 |

| | | | | |

Deferral and reduction of tax levies on businesses | | | | |

| | | | | |

— Suspension of the payment of tax instalments and taxes due(1) | — | — | — | 2 828 |

| | | | | |

— Deferral of QST remittances(1) | — | — | — | 5 787 |

| | | | | |

— Introduction of a tax credit in respect of employer contributions to the Health Services Fund for employees on paid leave | — | —85.0 | —85.0 | 85 |

| | | | | |

— Postponement of the payment of annual registration fees to the Registraire des entreprises du Québec | — | — | — | 25 |

| | | | | |

— Postponement of the payment of registration fees for commercial vehicles and taxis | — | — | — | 165 |

| | | | | |

TOTAL | — | —1 174.0 | —1 174.0 | 13 587 |

Note: Totals may not add due to rounding. (1) The financial impact of this measure, which affects the government's financial requirements, is included in debt service. |

Main steps taken by government enterprises to mitigate

the economic impact of the pandemic |

Maintenance of donations and sponsorships Hydro—Québec, Loto—Québec and the Société des alcools du Québec (SAQ) have maintained their donations and sponsorships programs, even in cases where events have been cancelled. Suspension of fees, penalties and service interruptions by Hydro—Québec Hydro—Québec has, generally speaking, suspended the application of fees and penalties for bills not paid by its customers. In addition, Hydro—Québec is suspending electricity service interruptions for its residential and business customers. Moratorium on the repayment of loans from Investissement Québec Investissement Québec has introduced a moratorium of up to six months on the repayment of the principal on loans granted to support businesses that are under significant financial pressure on account of the current situation. Accordingly, it is only interest that must be paid during this period and businesses will see the term of their loans extended. Support measures by the SAQ for restaurant owners The SAQ has introduced measures to support restaurant owners, particularly with regard to payment terms and the supply and return of products. |

|

❏ Tax measures announced in Budget 2020—2021 to enhance business productivity and competitiveness

In addition to the measures to mitigate the economic impact of the pandemic, several tax initiatives introduced in Budget 2020—2021 are benefiting Québec businesses.

These initiatives, which will total nearly $600 million by 2024—2025, are fostering the productivity and competitiveness of businesses by encouraging them to modernize their operations.

— They are designed to spur business investment and foster innovation and its commercialization.

◼ Spurring business investment

To spur business investment, the government has:

— implemented the investment and innovation tax credit (C3i), which encourages businesses from all sectors of activity to acquire manufacturing and processing equipment, computer hardware and management software packages through tax assistance of up to 20% of eligible investments;

— extended by four years the eligibility period for the tax holiday for large investment projects, which contributes to the carrying out of large projects in Québec by allowing eligible businesses to claim tax relief of up to 15% of their investments;

— announced the implementation of the synergy capital tax credit, which encourages established businesses to invest in young, innovative businesses with high growth potential and promotes the establishment of ties between them.

These initiatives have been added to the significant accelerated depreciation measures announced in the fall 2018 Update on Québec's Economic and Financial Situation.

▘ Fostering innovation and its commercialization

To foster innovation and its commercialization, the government has:

— introduced the incentive deduction for the commercialization of innovations (IDCI), which encourages businesses from all sectors of the economy to commercialize Québec innovations in Québec by offering them the most competitive tax rate in North America;

— enhanced the three R&D tax credits fostering collaboration among innovation players by removing the applicable expenditure thresholds, which further supports research projects carried out with universities, or through private partnerships or research consortia;

— streamlined administrative procedures related to tax holidays for foreign researchers and experts in order to help businesses recruit the best talent in the world.

TABLE B.12

Financial impact of the tax measures announced in Budget 2020—2021 to enhance business productivity and competitiveness

(millions of dollars) |

| 2020—2021 | 2021—2022 | 2022—2023 | 2023—2024 | 2024—2025 | Total |

| | | | | | | |

Spurring business investment | | | | | | |

| | | | | | | |

Implementing the investment and innovation tax credit (C3i) | —6.7 | —42.9 | —101.7 | —137.0 | —165.7 | —454.0 |

| | | | | | | |

Extending the tax holiday for large investment projects(1) | — | — | — | — | — | — |

| | | | | | | |

Implementing the synergy capital tax credit | — | —6.0 | —8.0 | —8.0 | —8.0 | —30.0 |

| | | | | | | |

Fostering innovation and its commercialization | | | | | | |

| | | | | | | |

Introducing the incentive deduction for the commercialization of innovations (IDCI)(2) | — | —2.6 | —12.7 | —23.7 | —47.7 | —86.7 |

| | | | | | | |

Enhancing the R&D tax credits fostering collaboration | —0.4 | —1.6 | —2.6 | —2.8 | —2.8 | —10.2 |

| | | | | | | |

Streamlining administrative procedures related to tax holidays for foreign researchers and experts | —0.2 | —0.2 | —0.2 | —0.2 | —0.2 | —1.0 |

| | | | | | | |

TOTAL | —7.3 | —53.3 | —125.2 | —171.7 | —224.4 | —581.9 |

(1) Due to the 60—month period during which businesses can carry out their investment projects, the financial impact of this measure will be felt beyond the period 2024—2025. (2) As of January 1, 2021, the incentive deduction for the commercialization of innovations (IDCI) will replace the deduction for innovative corporations (DIC). |

3.3 Offering support adapted to certain sectors

Businesses in certain economic sectors face specific challenges because of the pandemic.

To support these sectors, the government has implemented measures totalling more than $1.5 billion over two years for:

— the agri—food sector, by easing certain loan repayment procedures and practices of the Financière agricole du Québec, for a total of over $110 million;

— the cultural sector, particularly through the implementation by the Société de développement des entreprises culturelles (SODEC) of a temporary support program for the working capital of cultural enterprises, for total support of $400 million;

— the tourism sector, with $753 million for its recovery plan and more than $18 million to support festivals and events, representing total support of $771 million;

— the mining and forestry sectors, particularly through the postponement of the payment of mining taxes as well as the payment of volumes of timber harvested in public forests, for total liquidity of more than $220 million;

— the transportation sector, to ensure the supply of essential air services for remote regions during the health emergency, for a total of $40 million.

All told, these initiatives represent a financial impact of $327 million.

TABLE B.13

Financial impact of the measures to offer support adapted to certain sectors

(millions of dollars) |

| Financial impact | Injections into the economy |

| 2019—2020 | 2020—2021 | Total |

| | | | | |

Measures for the agri—food sector | | | | |

| | | | | |

— Easing the terms and conditions of La Financière agricole du Québec programs(1) | — | — | — | 104 |

| | | | | |

— Accelerating the payment of sums owed to farmers(1) | — | — | — | 6 |

| | | | | |

Measures for culture and the media | | | | |

| | | | | |

— Economic recovery plan for the culture and communications sector | — | —110.0 | —110.0 | 240 |

| | | | | |

— Acceleration of financial assistance for cultural organizations | —60.0 | — | —60.0 | 60 |

| | | | | |

— SODEC program — Temporary support for the working capital of cultural enterprises(2) | — | —20.0 | —20.0 | 100 |

| | | | | |

Measures for tourism | | | | |

| | | | | |

— Support for investment in tourism | — | —52.8 | —52.8 | 248 |

| | | | | |

— Addition of a tourism component to PACTE | — | —37.1 | —37.1 | 446 |

| | | | | |

— Offering direct support to hotel owners and bed and breakfasts in Québec that collect the tax on lodging | — | —3.8 | —3.8 | 14 |

| | | | | |

— Support for festivals and events | — | — | — | 18 |

| | | | | |

— Enhancement of regional tourism partnership agreements(3) | — | — | — | 25 |

| | | | | |

— Fostering the consumption of tourism products | — | — | — | 20 |

| | | | | |

Measures for the mining sector | | | �� | |

| | | | | |

— 12—month suspension of the validity period for mining claims | — | —3.0 | —3.0 | 3 |

| | | | | |

— Postponement of the payment of mining taxes(3) | — | — | — | 112 |

|

TABLE B.13

Financial impact of the measures to offer support adapted to certain sectors (cont.)

(millions of dollars) |

| Financial impact | Injections into the economy |

| 2019—2020 | 2020—2021 | Total |

| | | | | |

Measures for the forestry sector | | | | |

| | | | | |

— Postponement of invoicing for harvested volumes of timber | — | — | — | 60 |

| | | | | |

— Compensation of worker safety costs | — | — | — | 20 |

| | | | | |

— Acceleration of payments under the reimbursement program for the cost of multi—use roads (PRCM) | — | — | — | 29 |

| | | | | |

Measures for the transportation sector | | | | |

| | | | | |

— Assistance Program for Maintaining Essential Regional Air Services in Times of Health Emergencies | —10.2 | —29.8 | —40.0 | 40 |

| | | | | |

TOTAL | —70.2 | —256.5 | —326.7 | 1 545 |

(1) Since certain data for calculating the liquidity of the La Financière agricole du Québec measures are not available, the amount could be higher. (2) The financial impact of raising the intervention envelope of this program from $50 million to $100 million is included in the economic recovery plan for the culture and communications sector. (3) The financial impact of this measure, which affects the government's financial requirements, is included in debt service. |

3.4 Supporting municipalities

Municipalities are responsible for providing citizens with certain priority services such as public transit and public security.

On account of the health crisis, public transit ridership fell sharply, entailing significant losses in fare revenues in spring 2020. Therefore, transit authorities are going to require additional financial support in the coming months to maintain this essential service.

To that end, the government has announced an immediate and concrete measure to support municipalities by offering them assistance of $400 million for transit authorities. One half of this amount could come from recently announced federal assistance.

— This assistance will enable municipalities to continue offering this essential service to the public.

In addition, several municipalities have seen their liquidity decrease due to the COVID—19 pandemic. Accordingly, to provide financial support to its municipal partners, the government has allowed payment for Sûreté du Québec services to be postponed in order to give municipalities greater flexibility in their financial management. This will provide total liquidity of more than $337 million.

Furthermore, the government will continue to monitor the situation closely with its municipal partners and will take stock of the municipalities' financial situation in fall 2020.

TABLE B.14

Financial impact of the measures to support municipalities

(millions of dollars) |

| Financial impact | Injections into the economy |

| 2019—2020 | 2020—2021 | Total |

| | | | | |

Maintaining public transit services | — | —400.0 | —400.0 | 400 |

| | | | | |

Postponement of municipal payments for Sûreté du Québec services(1) | — | — | — | 337 |

| | | | | |

TOTAL | — | —400.0 | —400.0 | 737 |

(1) The financial impact of this measure, which affects the government's financial requirements, is included in debt service. |

Section C

THE QUÉBEC ECONOMY:

RECENT DEVELOPMENTS AND OUTLOOK

FOR 2020 AND 2021

| 1. Québec's economy | C.3 |

| | |

| 1.1 Impact of the health crisis on the economic situation | C.3 |

| | |

| 1.2 Revised economic situation | C.7 |

C.1

1. QUÉBEC'S ECONOMY

1.1 Impact of the health crisis on the economic situation

❏ The global economy disrupted by COVID—19

In December 2019, there was an outbreak of a novel coronavirus in China that was causing an atypical pneumonia. Even though the Chinese authorities introduced public health measures to stop the virus from spreading, similar outbreaks rapidly emerged around the world. With the number of cases surging, the Director—General of the World Health Organization (WHO) declared the coronavirus infectious disease (COVID—19) a pandemic on March 11, 2020.

The situation required immediate and concerted global action to protect the public. Many countries introduced measures to slow the spread of the pandemic, such as prohibiting gatherings, closing borders, confining people to their homes and halting non—essential economic activities.

The public health measures paralyzed economies, triggering a simultaneous supply and demand shock.

— The interruption of economic activities led to a contraction in output. Production shutdowns as well as supply chain disruptions drove a sharp decline in world trade.

— The public health measures also reduced global demand, particularly for certain commodities such as oil. In addition, the shutdown of economies led to substantial job losses and a subsequent drop in household income.

As a result, the economic outlook has worsened over the past few months. The pandemic will cause a global recession that will affect almost all countries.

— Global real gross domestic product (GDP) is projected to shrink by 3.5% in 2020. This is a sharper decrease than during the global financial crisis of 2008—2009, when global real GDP fell by 0.1% in 2009.

— U.S. real GDP is forecast to contract by 6.0% in 2020.

— Certain sectors of activity, such as air transportation, retail trade and accommodation and food services, have been hit hard by the public health measures and the measures may have a more lasting impact on these industries.

Several governments announced strong measures to help households and businesses during these turbulent economic times.

— Budgetary and fiscal policies have provided individuals and businesses with financial assistance as well as preserved economies' production capacity to prevent the temporary shutdown from becoming a permanent shock.

— In addition, central banks have adopted monetary measures to support credit and ensure the smooth functioning of financial markets.

❏ Québec and Canada have not been spared by the health crisis

The Québec government acted swiftly to protect the public, including by ordering, as early as March 13, the closure of schools, the suspension of non—essential economic activities and the banning of gatherings and inter—regional travel.

The economic outlook for both Québec and Canada has dimmed rapidly.

— In 2020, real GDP is projected to contract by 6.5% in Québec and 6.1% in Canada.

— The measures to prevent the spread of COVID—19 were stronger in Québec than the rest of Canada. Consequently, the downturn in economic activity will likely be slightly bigger in Québec, even though the drop in oil prices will affect an important part of the Canadian economy.

The actions taken by the governments and the Bank of Canada to support the economy will help reduce the extent of the decline in output and employment in 2020 as well as support the recovery in 2021.

— In 2021, economic growth is expected to rebound to 6.0% in Québec and 5.5% in Canada. The recovery should thus be stronger in Québec.

However, a very high degree of uncertainty is weighing on economic forecasts. The impact of the health crisis on economic activity and the pace of recovery are hard to assess with certainty. Furthermore, there could be a second wave of infections by the end of the year.

TABLE C.1

Economic growth

(real GDP, percentage change) |

| 2019 | 2020 | 2021 |

| | | | |

Québec | 2.7 | −6.5 | 6.0 |

| | | | |

Budget 2020—2021 | 2.8 | 2.0 | 1.5 |

| | | | |

Canada | 1.7 | −6.1 | 5.5 |

| | | | |

Budget 2020—2021 | 1.6 | 1.7 | 1.7 |

| | | | |

United States | 2.3 | −6.0 | 6.2 |

| | | | |

Budget 2020—2021 | 2.3 | 1.8 | 2.0 |

| | | | |

World | 2.9 | −3.5 | 5.0 |

| | | | |

Budget 2020—2021 | 2.9 | 3.1 | 3.3 |

Sources: Institut de la statistique du Québec, Statistics Canada, International Monetary Fund, IHS Markit, Datastream, Eurostat and Ministère des Finances du Québec. |

| | Snapshot of Québec’s Economic |

| C.4 | and Financial Situation |

Response from central banks: concerted efforts

Central banks have made unprecedented efforts in recent months to combat the economic fallout from the pandemic and ensure that financial markets function properly.

— The U.S. Federal Reserve cut its key interest rate by 150 basis points to a target range of 0.0%—0.25%, launched new public and private bond purchase programs and set up credit facilities to help banks, SMBs and local governments. In June, it reiterated its commitment to continue supporting the U.S. economy.

— The Bank of Canada lowered its policy interest rate by 150 basis points to the effective lower bound of 0.25%. It also introduced programs to purchase federal, provincial and corporate bonds, along with various measures to ensure the smooth functioning of markets.

In the current context of high uncertainty about the speed of economic recovery, the Ministère des Finances du Québec expects U.S. and Canadian key interest rates to remain unchanged until at least 2022.

Persistent weakness in bond yields

The COVID—19 crisis has triggered a steep drop in bond yields in advanced economies. The yield on Government of Canada 10—year bonds fell from 1.4% in mid-February to just 0.6% at the beginning of June.

— The drop is attributable to increased safe—haven demand due to heightened volatility in financial markets since March, as well as to a dimmer outlook for global economic growth.

— Exceptional monetary easing around the world has also put downward pressure on long—term interest rates.

Bond yields will remain at historically low levels in the years ahead. However, expectations of an economic recovery and a bigger appetite for risk should spark a modest increase in yields.

TABLE C.2

Canadian financial markets

(average annual percentage rate, unless otherwise indicated, end—of—year data in brackets) |

| 2019 | 2020 | 2021 |

| | | | |

Overnight rate target | 1.8 (1.8) | 0.5 (0.3) | 0.3 (0.3) |

| | | | |

3—month Treasury bills | 1.7 (1.7) | 0.5 (0.3) | 0.4 (0.5) |

| | | | |

10—year bonds | 1.6 (1.6) | 0.8 (0.8) | 1.1 (1.3) |

| | | | |

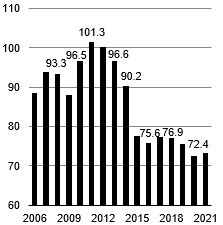

Canadian dollar (in U.S. cents) | 75.6 (77.0) | 72.4 (72.2) | 73.1 (74.3) |

| | | | |

U.S. dollar (in Canadian dollars) | 1.32 (1.30) | 1.38 (1.39) | 1.37 (1.35) |

Sources: Statistics Canada, Bloomberg and Ministère des Finances du Québec. |

Plunge in oil prices

Oil prices have also been influenced by the pandemic and have plunged. The price of Brent crude oil fell from an average of US$64 a barrel in January to US$27 a barrel in April, the lowest level since 2003. However, prices rose in May and June.

— The price drop is due primarily to the collapse of global oil demand, but also to the oil price war between Saudi Arabia and Russia following tough negotiations to continue production cuts by the Organization of the Petroleum Exporting Countries (OPEC) and its partners.

Oil prices are projected to rise at a moderate pace over the coming quarters, fuelled by lower production by OPEC and its partners.

— Higher global demand as economic activity gradually picks up in several countries should also boost oil prices.

Sharp depreciation in the Canadian dollar

In March, the Canadian dollar fell sharply against the U.S. dollar due to a rise in risk aversion, the oil price collapse and the U.S. dollar's broad—based appreciation.

— The Canadian currency subsequently rose, standing at over 74 U.S. cents at the beginning of June.

The Canadian dollar is expected to remain relatively weak in the short term. In the medium term, though, it should be supported by an improvement in confidence and the anticipated rise in oil prices.

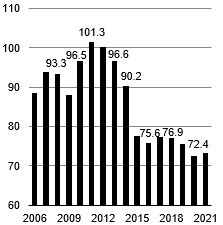

CHART C.1

Oil price trends | | CHART C.2

Canadian dollar exchange rate |

(U.S. dollars per barrel) | (annual average in U.S. cents) |

|

|

Sources: Bloomberg and Ministère des Finances du Québec. | Sources: Bloomberg and Ministère des Finances du Québec. |

1.2 Revised economic situation

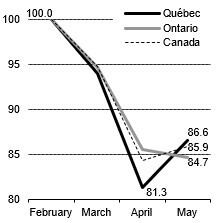

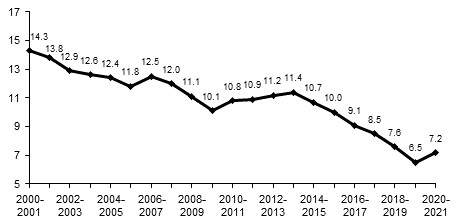

❏ Québec's economy hit hard

Prior to the pandemic, the Québec economy was going full throttle. The labour market was booming. Productivity and the standard of living in Québec were rising rapidly, with wages increasing faster than inflation.

In March, Québec was hit hard by the public health measures, which forced the shutdown of nearly 40% of the economy. The sudden decline in production is expected to cause a 6.5% decrease in economic activity in 2020, the biggest downturn since compilation of economic accounts' statistics began in 1981.

— This is a downward adjustment of 8.5 percentage points relative to Budget 2020—2021, which forecast 2.0% growth in real GDP.

Québec's economy will slowly pick up as economic activities gradually recover.

— However, certain sectors, including air transportation, retail trade and accommodation and food services, which were hit hard, will feel the impacts for longer.

Furthermore, the support measures adopted by the governments and Bank of Canada will help households and businesses through this economic downturn and underpin the recovery.

Real GDP growth is thus forecast at 6.0% for 2021. The strong economy and sound public finances will also enable Québec to overcome these disruptions.

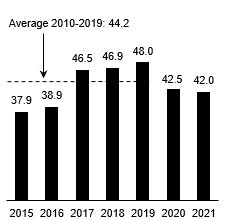

CHART C.3

Economic growth in Québec |

(real GDP, percentage change) |

|

Sources: Institut de la statistique du Québec, Statistics Canada and Ministère des Finances du Québec. |

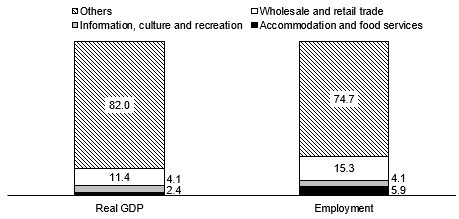

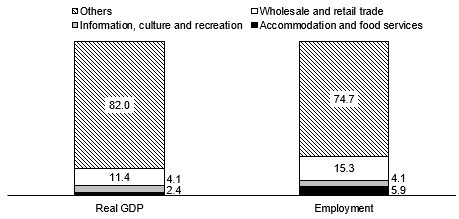

Sectors hit hard by the crisis |

The shutdown of non—essential sectors on March 25 sent a shockwave through Québec's economy. Certain sectors were hit harder than others by the sudden economic paralysis. — This was especially the case for the manufacturing (−115 000 jobs), construction (−110 100) and wholesale and retail trade (−131 900) sectors, which suffered massive job losses between February and April. In May, the gradual reopening of the economy led to strong employment growth in the construction (+57 900 jobs), manufacturing (+56 100) and trade (+53 600) sectors. In the coming months, as more sectors of the economy gradually open, the pace of rehiring will be marked by renewed household confidence and consumer demand. — The decline in household income, the uncertainties faced by households, the restrictions on tourism and the social distancing measures still in effect will continue to have a heavier impact on certain industries. Thus, activities in the accommodation and food services, information, culture and recreation, and wholesale and retail trade industries will be slow to fully recover. — In 2019, these three industries accounted for the equivalent of 25% of jobs in Québec, whereas they represented just 18% of output. Consequently, these labour—intensive sectors will take longer to return to normal, which will curtail job creation and prevent the unemployment rate from returning to its pre—pandemic level in the short term. |

Share of output and employment in Québec, select industries, 2019 |

(percentage of total output and employment) |

|

Note: Totals may not add due to rounding. Sources: Institut de la statistique du Québec, Statistics Canada and Ministère des Finances du Québec. |

Recent indicators confirm the downturn in economic activity |

Since economic statistics are released after a certain time lag, the consequences of "pausing" the Québec economy are only now starting to show in the data. In particular, between February and May: — 589 600 jobs were lost (−13.4%); — the unemployment rate rose by 9.2 percentage points and stood at 13.7% in May, after reaching a historic monthly high in April (17.0%). However, the gradual deconfinement initiated in early May signals a rebound in real GDP growth. In addition, governments have introduced a number of budgetary and fiscal measures to help businesses and households weather the crisis. — Even with the rebound, however, real GDP will not return to its pre—pandemic level by year—end. A 6.5% contraction in Québec's real GDP is thus forecast for 2020. Given its strong position before the onset of the pandemic and the stimulus measures put in place, the Québec economy should rebound rapidly and see 6.0% growth in 2021. Recent economic indicators in Québec

(percentage change relative to the previous period, unless otherwise indicated)

|

Feb. March April May 2019 2020(1) Jobs (thousands) 20.0 −264.0 −556.5 230.9 77.7 −274.6 Unemployment rate (per cent) 4.5 8.1 17.0 13.7 5.1 9.5 Retail sales (in nominal terms) −0.4 −15.7 NA NA 1.9 −3.3 Consumer price index 2.3(2) 1.1(2) 0.2(2) NA 2.1 1.6 Housing starts (thousands) 51.5 45.7 0.0(3) 60.9 48.0 47.6 Home resales (thousands) 109.9 95.2 34.6 NA 96.6 87.4 International exports of goods

(in real terms)(4) 1.1 −5.4 NA NA 0.5 0.9 Consumer confidence

(points, 2014 = 100) 167.9 136.7 77.4 91.1 163.3 129.3 Small business confidence index

(points) 68.3 38.0 28.2 36.1 66.0 46.8 Manufacturing shipments

(in nominal terms) −4.3 −4.1 NA NA 3.4 −3.1 |

(1) Cumulative for the available periods compared to the same period the previous year. (2) Change from the previous year. (3) The construction industry was "paused" on March 16, 2020. Residential construction work was allowed

to resume on April 20, after the Canada Mortgage and Housing Corporation (CMHC) survey for April. Consequently, the CMHC has no Québec data for April. (4) International exports of goods in real terms (on a customs basis). Sources:Institut de la statistique du Québec, Statistics Canada, Canada Mortgage and Housing Corporation, Quebec Professional Association of Real Estate Brokers, Conference Board of Canada and Canadian Federation of Independent Business. |

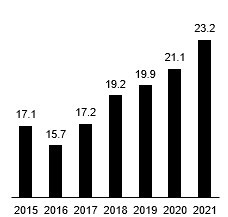

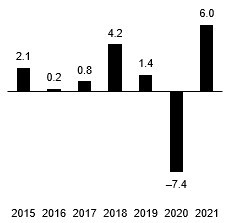

❏ Public administrations' significant contribution will cushion the economic shock

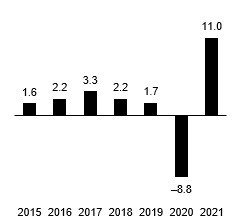

After increasing by 2.2% in 2019, domestic demand will decline by 6.5% in 2020, an unprecedented downturn.

— The massive job losses and significant erosion of consumer confidence will put a drag on household spending as well as residential investment.

— The temporary shutdown of activities and the uncertainty surrounding the recovery will lead to a significant downturn in non—residential business investment.

— Furthermore, the anticipated drop in domestic demand will be mitigated by an increase in total government spending. The severity of the shock called for a robust response from authorities. Governments announced extensive programs to support households and businesses during the downturn.

The impact of the health crisis on foreign demand for goods and services and on supply chains will cause exports to fall. Imports will also decline, particularly as a result of weaker domestic demand.

— With imports set to decrease more than exports, the external sector will contribute 0.7 percentage point to economic growth in 2020.

TABLE C.3

Real GDP and its major components in Québec

(percentage change and, in brackets, contribution in percentage points) |

| 2019 | 2020 | 2021 |

| | | | |

Domestic demand | 2.2 (2.3) | −6.5 (−6.7) | 8.3 (8.6) |

| | | | |

— Household consumption | 1.7 (1.0) | −8.8 (−5.2) | 11.0 (6.3) |

| | | | |

— Residential investment | 3.9 (0.3) | −8.5 (−0.6) | 5.2 (0.4) |

| | | | |

— Non—residential business investment | 1.6 (0.1) | −15.4 (−1.2) | 10.3 (0.7) |

| | | | |

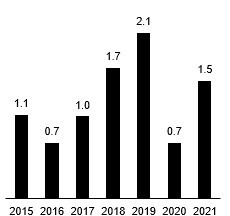

— Government spending and investment | 2.8 (0.8) | 1.1 (0.3) | 3.8 (1.1) |

| | | | |

External sector | (0.6) | (0.7) | (−2.6) |

| | | | |

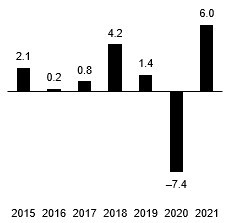

— Exports | 1.4 (0.7) | −7.4 (−3.4) | 6.0 (2.7) |

| | | | |

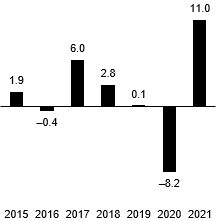

— Imports | 0.1 (−0.1) | −8.2 (4.0) | 11.0 (−5.3) |

| | | | |

Inventories | (−0.1) | (−0.3) | (−0.1) |

| | | | |

REAL GDP | 2.7 | −6.5 | 6.0 |

Note: Totals may not add due to rounding. Sources: Institut de la statistique du Québec, Statistics Canada and Ministère des Finances du Québec. |

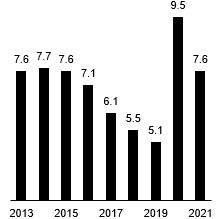

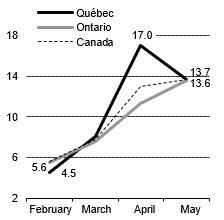

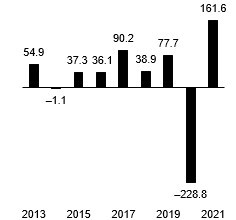

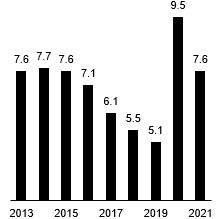

❏ Sudden but temporary deterioration of the labour market

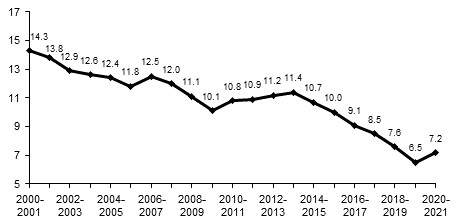

Québec's labour market remained robust in 2019. Substantial job creation in recent years contributed to a rapid drop in the unemployment rate, which fell to 5.1% in 2019, the lowest annual rate ever seen.

— In February 2020, the unemployment rate was down to 4.5%, a historic monthly low.

Then in March, the temporary shutdown of several industries resulted in massive layoffs. Between February and April, 820 500 jobs were lost (−18.7%). In April, the unemployment rate reached 17.0%, the highest rate seen since Statistics Canada began its Labour Force Survey in 1976.

In May, businesses gradually resumed their activities and Quebecers slowly went back to work, resulting in a gain of 230 900 jobs compared to April. The unemployment rate fell to 13.7%. Despite the rebound, Québec will still record a historic decline in employment for the full year 2020.

— On an annual average, 228 800 jobs will be shed (−5.3%). The unemployment rate is expected to be 9.5%, the highest rate since 1998 (10.3%). However, it will still be lower than the rates recorded during other major slowdowns, such as in 1983 (14.2%) and 1993 (13.2%).